High medicine prices impose a burden on national healthcare systems, where pharmaceuticals account for a significant share of spending, especially for countries in the early stages of maturity in the pharma sector. Competition authorities have expressed concerns that access to affordable, innovative drugs may be at risk due to high prices, market withdrawals or other business strategies, along with national governments’ limited bargaining power against pharma companies. This Viewpoint discusses competition in the pharma sector and presents an integrated framework for authorities to strengthen pharma competition.

Access to affordable and innovative drugs

Average government spend on pharmaceuticals is about 57 percent across OECD countries. Most private spending comes directly from households’ pockets, which reflects both high costsharing requirements and the extent of OTC self-consumption. Moreover, drug prices vary greatly across countries. Recent data from Medbelle shows that, for generic drugs, the UAE pays over 10 times more, while Egypt pays about 95 percent less than the median. For branded drugs, the US pays five times more than the median, while Indonesia pays about 90 percent less. These differences result from multiple factors, such as production and other operating costs and price regulation.

Effective competition from generics/biosimilars represents a vital source of price competition and significantly decreases price. In fact, when pharmaceuticals register patents to branded drugs, the registration is only valid for a certain period, after which other companies can produce generic versions. This not only makes older treatments more accessible, but also allows savings to be redirected to newer medicines. However, to mitigate the impact of generic entry, which greatly reduces revenues, originator pharma manufacturers often use strategies to extend the commercial life of patented drugs. Some even resort to anticompetitive behaviors to prevent entry of a generic that may threaten revenues and market share. Consequently, competition authorities have investigated and sanctioned practices that lead to higher prices and involve anticompetitive behaviors. These authorities have expressed concerns that access to affordable, innovative drugs may be at risk. There are limits to competition law; thus, continuous efforts by stakeholders must meet the challenge of sustainable access to affordable, innovative drugs, especially in countries where the pharma sector is in early stages of development.

Competition overview in the pharma sector

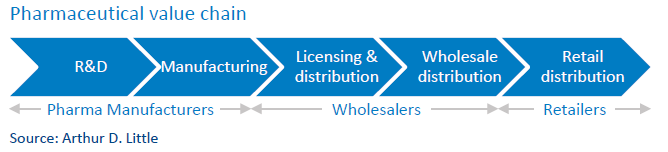

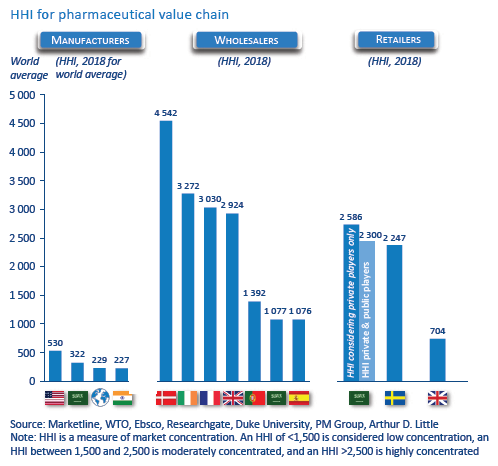

Market concentration and competition differ across the pharma value chain activities (see figure below) and product category groups, and are dependent on regulation within countries:

- Pharma manufacturers: For many stakeholders, the Herfindahl-Hirschman Index (HHI) for pharma manufacturing indicates a low-concentration industry). However, concentration at the level of industry might not be the best indicator, as patents protect certain categories. Thus, the branded-drugs market is more concentrated than generics. This high market power is also due to competitive R&D and the merging of smaller firms with larger branded firms. The result: no significant change in ranking of leading branded-drugs manufacturers since 2011, indicating serious competition concerns and continuing price increases.

- Wholesalers: The wholesale market is characterized by low- and high-concentration markets, depending on regulations and distributing power. Most countries have mixtures of national and regional wholesalers, with national wholesalers providing the full range of medicines and regional providing full and partial ranges. Some countries have many wholesalers with less than half of market share (low concentration), while others have fewer than four wholesalers with more than 85 percent market share (high concentration)

- Retailers: Market concentration in retail is low to medium due to legacy government monopoly pharmacies and regulation. This corresponds to low concentration in markets with strict regulations and medium concentration in markets recently liberalized, or where market positions of previously government-owned pharmacies are still strong or big chains prevail.

Competition concerns in the pharma sector

- Anticompetitive mergers, which can appear as price increases or lack of merger control.

- Abuse of dominance, which usually appears in five forms:

- Excessive pricing: Prices set significantly above competitive levels due to monopoly or market power

- Denigration: Competitors criticized in derogatory manner to minimize competitive potential.

- Kickbacks: Stakeholders offer negotiated bribery tactics in exchange for anticompetitive disadvantage to briber.

- Patent misuse: Stakeholders extend patents over products set to expire to limit generic competition (“evergreening”) or introduce modified versions to switch patients from older versions without facing imminent risk of generic substitution (“product hopping”).

- Restrictive horizontal agreements often appear in three forms:

- Price fixing: Rival companies come to illicit agreement not to sell goods or services below a certain price.

- Generic-delay agreements: Brand manufacturers negotiate with generic manufacturers to delay entry of substitutes and avoid threat to sales of more expensive branded products.

- Collusion: Rival companies cooperate for mutual benefit, but decision to collude impacts market as a whole.

- Vertical agreements mainly take the form of contracts, which constrain competition.

In mergers, market definition of existing products typically considers overlaps and market shares of the merging firms’ products within a set of therapeutic substitutes; hence, large firms may have hundreds of separate markets to be assessed. Typically, mergers are approved subject only to divestment of products for which there is significant overlap between merging firms. There is less clarity about how to treat R&D in mergers. Pharma firms often have clear pipelines of future products due to clinical trial needs, making it predictable which products will be available in a few years. There is, however, debate about whether earlier “research capability” should be considered a potentially lost competition area in an “innovation market.”

In both abuse-of-dominance and horizontal collusion cases, competition authorities have recognized the importance of regulation, and generally respond with competition law only when regulation has failed. Arguably, litigation or regulation within the patent system should be enough to prevent abuses but evergreening and product hopping plus misrepresentation of rival products have all been considered abuse of dominance. Competition authorities can only take action when the criteria for a competition case have been met. In such a regulated sector, if a competition authority finds itself repeatedly taking action against infringements, it is likely a sign something is wrong with the regulatory system and reform might provide a better solution. The highly regulated nature of the sector makes other forms of breach-of-competition law less prevalent.

Strengthening competition in the pharma sector

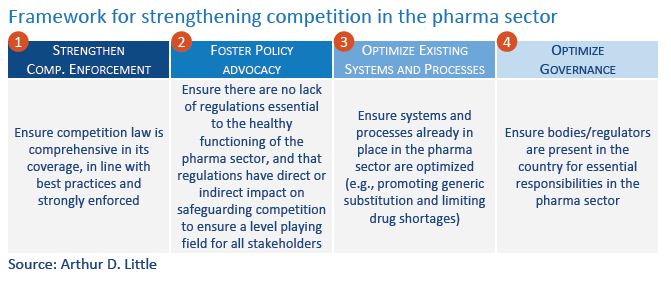

Competition authorities aiming to strengthen competition should look toward collaboration with country-wide stakeholders. We have developed a framework with four key recommendations (see figure below):

1. Strengthen competition enforcement: Problems often stem from combinations of evolving regulations and lack of enforcement. Competition law must remain comprehensive in its coverage, follow best practices and be strongly enforced. Substantive provisions regarding abuse of dominance, collusion and merger control should be held to high standards. The law should embody an excessive reliance on formal, rigid rules. Competition authorities must also be vigilant about stakeholders that abuse their dominant position, especially in cases protected by patents and non-regulated OTC drugs.

2. Foster policy advocacy: Competition authorities should ensure there is no lack of regulations essential to the healthy functioning of the pharma sector, and that regulations have direct/indirect impact on safeguarding competition. Policy advocacy can relate to various policies, dependent on the development of a country’s pharma sector. For those markets in early phases, policy advocacy can relate to the following:

- Strengthening public procurement processes: Provide an adequate degree of transparency in procurement cycle to promote fair, equitable treatment of potential pharma suppliers. To avoid any tendering decision-making challenges between a country’s central public procurement entity of drugs and bidders, define a clear procedure for opening tenders and advocate for close cooperation. Moreover, advocate for procurement entity to procure multiple medicines for different therapeutic categories from more than one manufacturer and/or increase frequency of tendering. To improve competition, the entity should consider allowing diversification of public formularies, as well as procurement of two to three alternatives under each treatment category. This allows accommodation of multiple therapeutic cases and treatment requirements for different patients, as well as more competition in tendering process. Another option: more frequent tenders instead of current practice, which is once every two years. Alternatively, follow a reimbursement negotiation model rather than a traditional procurement approach Finally, secure mechanisms to prevent risks to integrity (protect procurement officials from undue influence, which is more prevalent in early-stage sectors). Develop risk maps that identify the most vulnerable officials as well for risk activities. Also look towards separation of duties within the public procurement entity via multiple-level review and approval. In this setup, different specialized resources would handle various parts of the procurement cycle.

- Improving local innovation capabilities: Many countries in the early stages of the framework depend on import or international manufacturers. This reliance stems mostly from limited innovation capabilities in local pharma manufacturing. It presents a setback by discouraging dependence on local talent and innovation capabilities. Best-practice countries, on the other hand, have reached advanced stages of manufacturing potential by undertaking and incentivizing a range of initiatives. Competition authorities should advocate to various stakeholders within the country to improve local innovation capabilities.

- Ensuring deregulation of retail activities: Deregulation retail various consumer welfare benefits and positively affects competition.

3. Optimize existing systems and processes: Competition authorities should identify systems/processes to be optimized and then advocate for ensuring such optimization to safeguard competition. Moreover, though many countries have initiatives to promote generic drugs, there are many other initiatives to consider (e.g., strengthen guidelines so physicians dispense medicine based on molecule rather than brand). In addition, the early-stage pharma sector may face drug shortage issuesdespite having several initiatives. Competition authorities should advocate for optimization of initiatives (e.g., enforcing regulation to notify food and drug authorities of drug shortages, stimulate and improve digitalization in supply chain and ensure tendering process takes into consideration the availability of drugs).

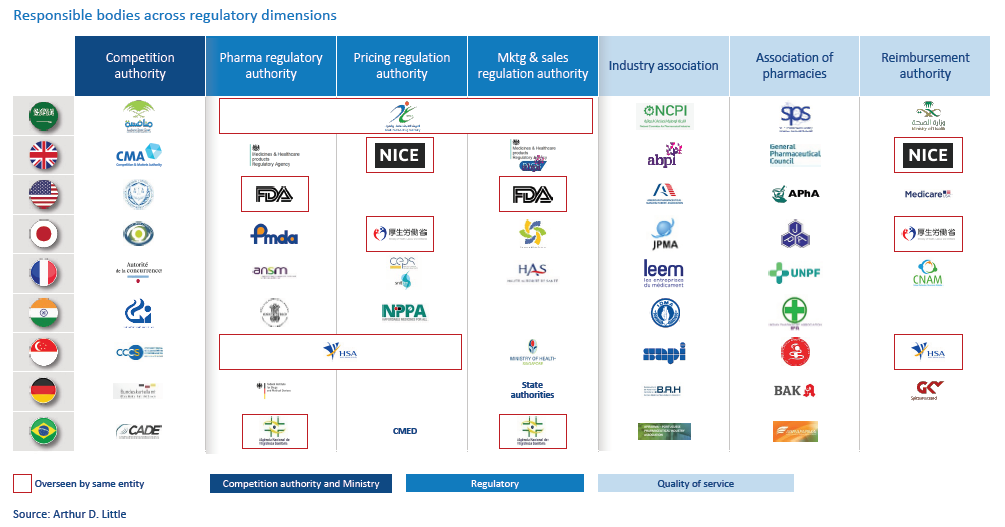

4. Optimize governance: Sometimes, the sector is missing specialized bodies that assume essential responsibilities in regulating the pharma sector, or certain regulations are not strongly enforced. To ensure a fair market, competition authorities should advocate for ensuring the right bodies are in place and regulations within the sector are strongly enforced. The key is diversity of responsible authorities and bodies, each specializing in specific areas of monitoring and regulation (see figure above).

Conclusion

The pharma sector will undergo increased pressure to ensure competition. To create a fair and competitive market where patients have access to affordable and innovative drugs, an integrated framework is required. This allows competition authorities to ensure a level playing field. This framework endorses proper actions for competition authorities to undertake in collaboration with various stakeholders.

Arthur D. Little, facilitating your innovative potential in the healthcare sector

Arthur D. Little is uniquely positioned to support the healthcare sector in:

- Developing and implementing innovation strategies.

- Identifying and implementing health information systems.

- Reorganizing the healthcare sector and healthcare companies.

- Identifying growth plans for new companies or projects.

- Identifying new healthcare business models

We have extensive project experience in linking strategy, innovation and transformation in the healthcare sector. Our internal experts combine extensive healthcare experience with local insight and industry expertise.

Our extensive network of external experts ensures that each client will leverage the best-possible expertise, in line with the challenges and the context the company is facing.