DOWNLOAD

DATE

Contact

With CPaaS market consolidation on the horizon, players must move from messaging toward AI and higher-value services

Communications-platform-as-a-service (CPaaS) markets have evolved rapidly over recent years. Initially, players succeeded by providing efficient messaging services. Today, these solutions are quickly being commoditized and market consolidation is underway. Tomorrow’s CPaaS winners will need to provide a more comprehensive portfolio of client-centric business solutions to sustain value creation. Artificial intelligence (AI)–based platform automation, video applications, as well as contact center and campaign management solutions will play a central role. This study builds on our previous Viewpoint, “Closing in: The development of CPaaS towards a cohesive market structure,” published earlier this year.

CPaaS messaging under pressure

CPaaS allows businesses to manage an extensive selection of client communications features without needing to develop and maintain the infrastructure on the back end of the service.

In recent years, there has been wide proliferation and major advancements in the CPaaS market:

- Initial CPaaS adoption came from an array of digital companies such as on-demand economy players (e.g., Lyft, Uber, and Airbnb), over-the-top (OTT) messaging players (e.g., Snapchat, Twitter, and WhatsApp), and dominant cloud companies (e.g., Amazon, Microsoft, and Google).

- This was followed by a large number of traditional enterprises adopting CPaaS to digitally enrich their client-facing business processes, including Daimler Group, Goldman Sachs, and Nike among others.

- The most recent wave of adoption (potentially the widest) has been sparked by small and medium-sized enterprises (SMEs) across developed markets since they have been forced to accelerate toward digital to survive the impact of COVID-19. CPaaS has thus found universal adoption and a plethora of use cases.

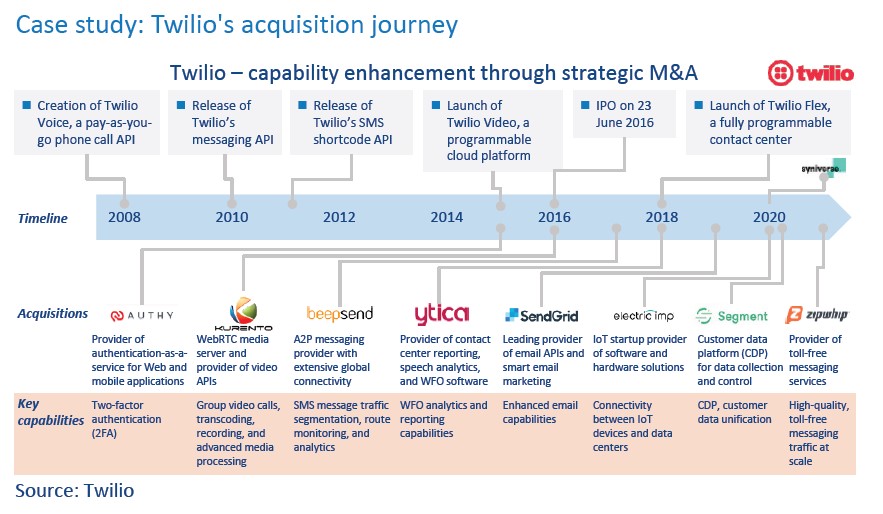

Consequently, a wave of activities and consolidation has marked a race for CPaaS dominance. This wave has been fueled fundamentally by the need to grow volumes and derive economies of scale. As an example, consider Twilio’s pursuit for growth through strategic acquisitions in recent years (see figure below). Through various acquisitions and scale build-out, Twilio has grown its market cap from US $2.2 billion in 2016 to $51.3 billion in 2021, and its valuation multiple went from 9.9 to 20.6 over the same period.

As the market consolidates, commoditization has hit the thus-far established CPaaS value propositions. Now players and investors in the CPaaS space must understand where the industry is headed beyond commoditization so that they can help identify future winners.

What is next? – Increased commoditization

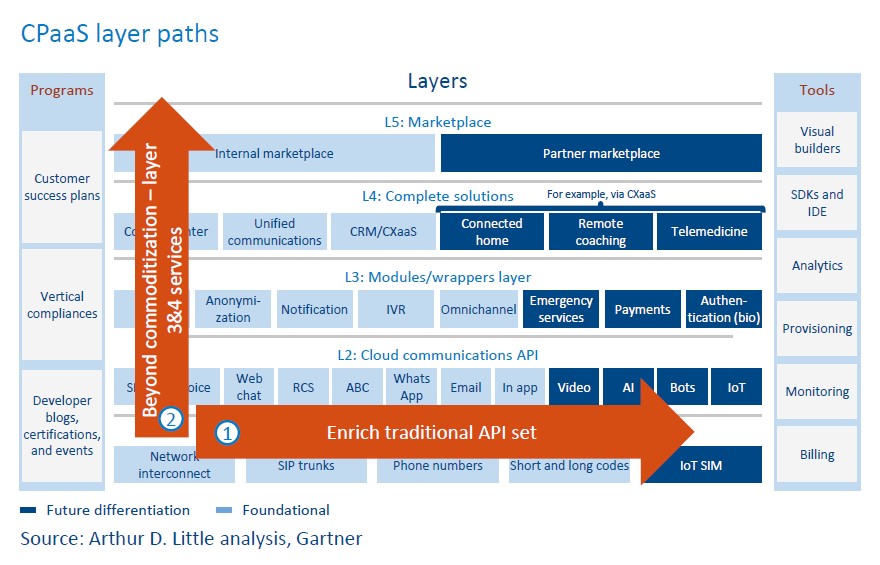

Understanding commoditization fully requires a better grasp of the CPaaS value-creation model. The widely accepted industry standard view is to consider CPaaS offerings across various layers (see figure below). Layer 1 represents the basic network infrastructure that CPaaS providers typically procure in bulk (from telcos or intermediaries). These are usually not customer offerings of CPaaS players, except for some specialized solutions/use cases. Layer 2 represents cloud communications APIs, where CPaaS players have built targeted solutions aggregating Layer 1 infrastructure capabilities.

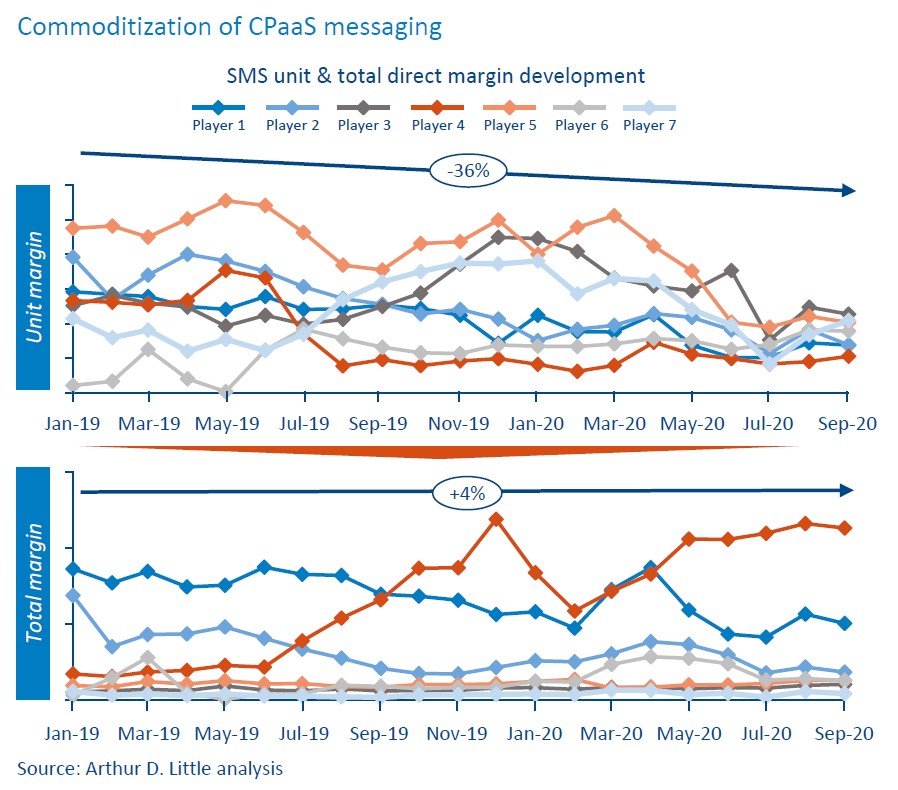

In Layer 1, the race for scale has accelerated; leading CPaaS players are looking to acquire strong infrastructure capabilities to drive economies of scale (e.g., the acquisition of Syniverse by Twilio in 2020). Layer 2 is where commoditization is currently the most observable and impactful, primarily in legacy SMS/voice. While growth in e-commerce and the digital lifestyle (boosted by COVID-19) have led to sharp increases in volumes, overall direct margins have declined significantly over the past years. The figure below shows how direct unit margins for SMS have declined by 36% for a major CPaaS player over the past year.

We anticipate that the commoditization of messaging is likely to continue. To compensate for commoditization and create more value, CPaaS players have typically found two paths (see “CPaaS layer paths” figure above):

- Enrich traditional API set – add additional channels and scale.

- Beyond commoditization – Move up the value stack and differentiate on Layer 3 and 4 services.

Alessandro Adriani, Director of Indirect Sales at BT, on how BT is tackling the dynamic CPaaS market space:

“The CPaaS segment has been growing steadily and it continues to show significant further growth opportunities. Working as a team with several CPaaS players at different latitudes, BT is focused on co-creating solutions to address their and our end-customers needs.”

Path 1: Enrich traditional API set

To counteract the increasing commoditization in Layer 2 services, CPaaS players are enriching their API sets through voice, video, OTT, email, and others. These incremental channels still allow for higher transaction margins compared to messaging and provide a more potent platform to add future value-added services to increase customer penetration and margin profiles. For example, having a simple built-in video API can differentiate a CPaaS portfolio, enabling richer engagement with end customers. Typical video-enabling applications gaining traction are customer support, telehealth, insurance claim processing, and authentication. We anticipate CPaaS players to increasingly compete through enriching API sets while scaling up on traditional messaging and voice.

Path 2: Beyond commoditization – Layer 3 and 4 services

CPaaS revenue streams historically have been concentrated in messaging channels. Going forward, revenues and, more importantly, margins in CPaaS are likely to be driven by value-added services – Layer 3 and 4 offerings. We observe three emerging use cases as likely to be the biggest drivers of growth:

- Authentication – move from one-time password (OTP) to “active” identification of solutions (based on a combination of data sets to identify customer activity) and biomarkers.

- Contact-center-as-a-service (CCaaS) – move from on-premises solutions to CCaaS suite (selected feature set rather than bulky portfolio of solutions).

- Customer-experience-as-a-service (CXaaS) – digital customer engagement solutions that can support enterprises to shift more sales online.

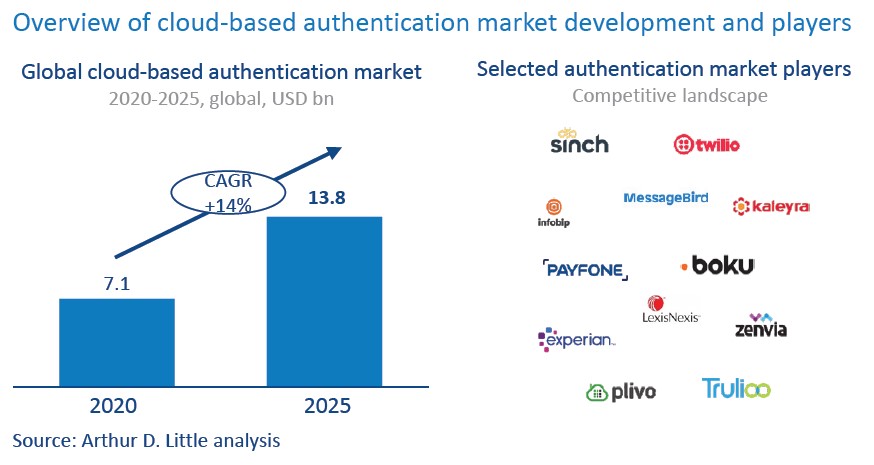

Authentication

Over the past 18 months, there has been a steep increase in CPaaS authentication services. COVID-19, in particular, has forced acceleration of digital services, and customers are becoming more familiar with transactions performed online. This has led to a steep increase in authentication use cases. As the impact of COVID-19 subsides, we expect the trend of online transactions to continue to rise due to significant value creation. Next to established OTP solutions, “active” authentication propositions such as biomarkers will assume a larger role in the market space. The figure below below shows an overview of the current market and selected market players.

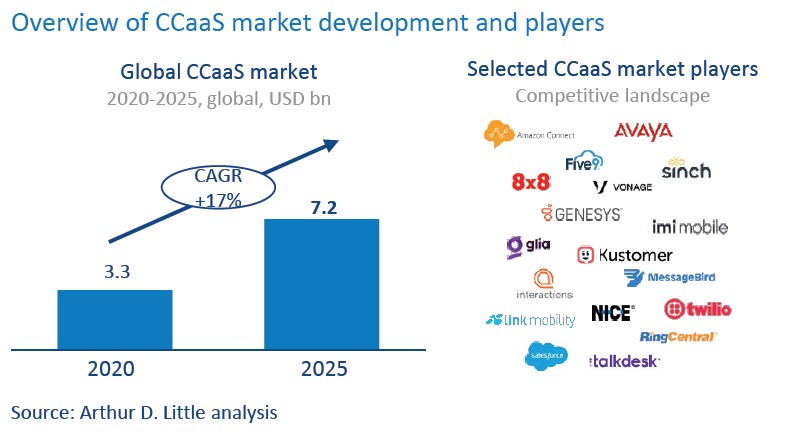

CCaaS

Overall contact center spending has continued to grow over the last few years, and we expect this trend to continue (see figure below). There is a noticeable shift in value from on-premises, full feature set solutions toward cloud-based CCaaS solutions. The tipping point for CCaaS solutions growth is the wide-ranging adoption of such solutions by medium-sized enterprises. This pool of first-time buyers of contact center solutions is likely to drive the upside. For example, a chain of car repair shops that had individuals answering telephone lines for different branches significantly drove up productivity by adopting a CCaaS solution that answers calls and sets up scheduling automatically.

The key question for CPaaS providers entering the CCaaS space is not whether to pursue CCaaS but what feature sets and key differentiation capabilities within Layer 3 and 4 they should invest in.

CXaaS

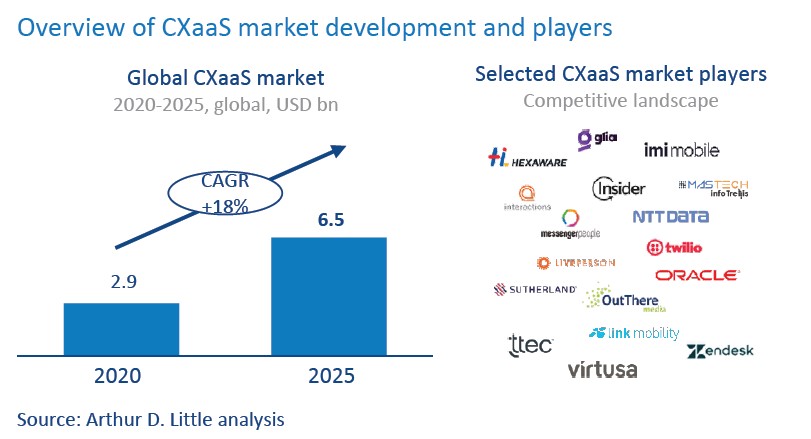

In recent years, the steady growth of digital commerce created a split between online-only (e-commerce) and hybrid (physical experience store plus e-commerce) models. COVID-19 and its accompanying lockdowns, however, shifted the balance toward online-only models with many enterprises being caught unprepared. Consequently, CPaaS solutions that help offline stores offer compelling customer experiences through online channels are going to dominate the CXaaS space. Key use cases for enterprise clients in the CXaaS space center around targeted campaign management, UX design, cross-channel marketing, and customer analytics. Overall, we expect the CXaaS market segment to show high activity over the next years; market consolidation will accelerate in this relatively new field (see figure below).

Layer 3 and 4 solutions in the CPaaS stack will likely be key drivers of incremental revenues, margins, and market differentiation. These solutions have the added benefit of increased enterprise “stickiness.” It is comparatively easy for enterprises to integrate the lowest-cost messaging platform (Layer 2) compared to replacing, for example, a complete CXaaS solution that provides a bespoke customer experience for end customers. Thus, we observe that CPaaS players will likely race to find differentiated solutions combining Layer 2 channels and Layer 3 and 4 value-added services. The key question emerging, however, is how to succeed in this race.

Conclusion – How to succeed?

We believe that the future winners in the dynamic CPaaS market will have four key characteristics:

- Integrated core service offering combining messaging with voice and video.

- AI/machine learning (ML) layer to orchestrate incremental channels and enable solutions (authentication, CCaaS, CXaaS, etc.).

- Regional and asset-light scale.

- Accelerated onboarding through self-signup (SSU) and out-of-the-box (OOTB) integration APIs

Integrated core service

The demand for a low-price, single-service offering – for example, for messaging (SMS, RCS, OTT, etc.) – is rapidly giving way to clients requesting omnichannel capabilities that combine voice with messaging. We believe that to become future winners, CPaaS players must have a combined core service offering that can seamlessly merge messaging, voice, and video (Web real-time communications-based, asset-light video) for typical core use cases (e.g., notifications, marketing).

AI/ML layer

Future winners in CPaaS will also need a strong foundation in AI/ML and data/analytics capabilities. Thus, it is critical to differentiate between developing AI/ML solutions inhouse versus building on top of existing AI/ML stacks from hyperscalers, such as Google, Microsoft, and Amazon. CPaaS players must have the organizational capability to develop AI/ML solutions that leverage best-in-class stacks from hyperscalers. Similarly, owning customer data may not be as critical as the ability to integrate seamlessly with available sources of data.

Regional and asset-light scale

With increased regulatory oversight of customer data across different countries and regions, it will be crucial for CPaaS players to build safeguards for data protection and privacy, as applicable in regional context. Within this constraint, future winners will likely have the ability to scale up their solutions.

For example, within Europe, the CPaaS solution should be able to seamlessly support client needs across countries, addressing context specificities with respect to language, cultural preferences, regulations, and the like. At the same time, internally on the cost front, the efficient CPaaS player will be able to address this centrally without having local teams in each country.

Accelerated on-boarding via SSU and OOTB integration APIs

The incremental pools of value in CPaaS are likely to come from SMEs adopting CPaaS solutions in large numbers and large enterprises that are first-time buyers of CPaaS (that have traditionally purchased on-premises solutions). To best position themselves to capture this opportunity, it is vital that CPaaS players onboard customers in the shortest time possible with minimal incremental costs.

SSU-based sales where SME clients with limited in-house IT capabilities and budgets can purchase, install, and drive a CPaaS solution are key for CPaaS players’ success. Large enterprises that are first-time buyers of CPaaS prefer solutions with the shortest “time to value delivered.” To enable this, CPaaS solutions should be able to integrate with the standard portfolio of client IT systems (CRM, ERP, etc.).

Therefore, in summary, the CPaaS market will likely grow strongly (~CAGR >15%) over the next five years, creating disruptive growth opportunities to come from Layer 3 and 4 services rather than pure Layer 2 messaging. CPaaS players, investors, and new entrants can capture this growth opportunity by focusing on building out Layer 3 and 4 services rather than continuing to chase scale in Layer 2 at high prices.

We believe that the race to CPaaS dominance will continue, and future winners will be determined by the ability to differentiate – not just in value proposition but also in an AI/MLbased foundation – with regional scale and the ability to rapidly onboard clients.