40 min read • Automotive

Unlocking India’s electric mobility potential

Comprehensive report on the future of EVs in India

FOREWORD

Electric vehicles (EVs) have emerged at the forefront of driving the shift in mobility away from traditional internal combustion engine (ICE) vehicles to a more sustainable option across geographies. Given this global shift, will India be able to shape its own path to e-mobility or merely remain a slow adopter of solutions developed abroad? To that end, this Report aims to provide a realistic picture of India’s EV journey to date and explores the reasons behind heightened optimism regarding the Indian EV industry. It also provides forecasts and several challenges that must be overcome for India to unlock its full potential.

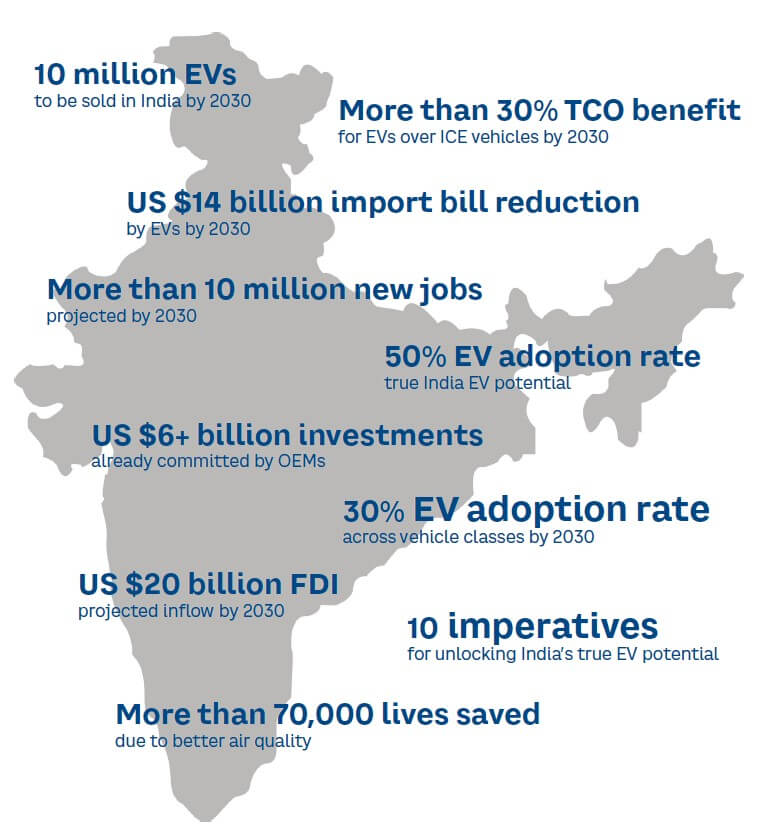

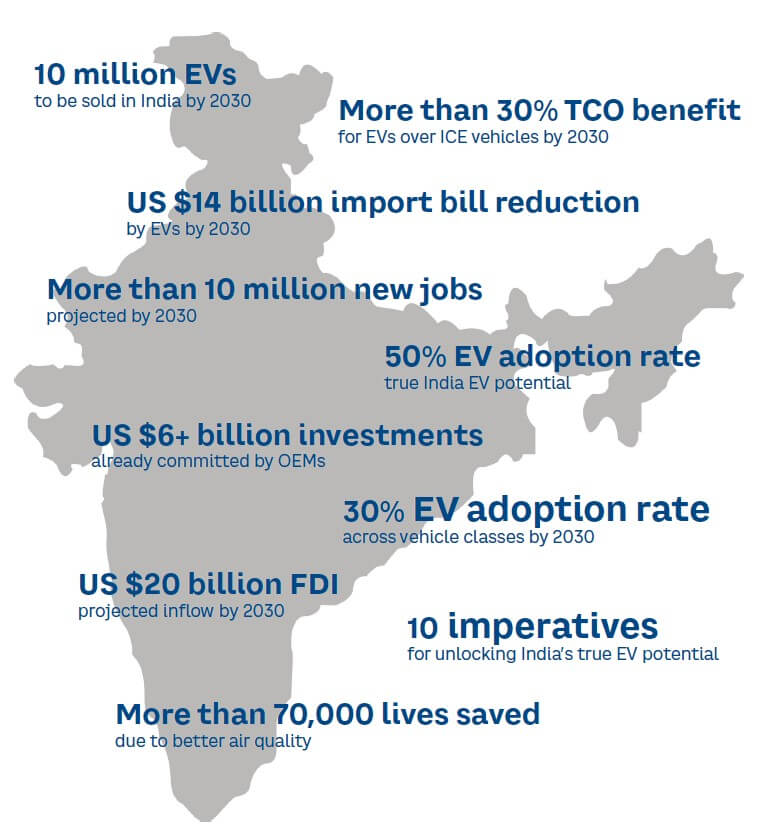

India currently has a low EV adoption rate of about 2%, largely due to the huge price differential with traditional engine counterparts and the absence of an adequate EV infrastructure. Recent steps undertaken by the Indian Government, OEMs, and other stakeholders have rejuvenated investor and consumer confidence. While three- and two-wheelers spearhead current EV adoption in India, attractive offerings are now entering the passenger car and commercial vehicle segment. As per our analysis, India will likely see sales of more than 10 million units of EVs by 2030, largely driven by the two-wheeler category. This suggests the possibility for India to become a global EV powerhouse.

With its flagship Faster Adoption and Manufacturing of Electric Vehicles (FAME) policy, the Indian Government is rigorously pushing for electrification of automobiles with an ambitious target of 30% EV penetration for passenger cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030. This Report seeks to analyze and discuss whether the government will be able to achieve these targets set across different classes of vehicles. The Report also seeks to inform various stakeholders about current and potential challenges that will impact the adoption of EVs in India and suggest suitable measures to help India unlock its true EV potential, which already appears to have started on the right footing.

Given current geopolitical tensions, global supply chain disruptions, and the government’s policy of making India self-reliant (referred to as “AatmaNirbhar Bharat”), it is important that India creates its own indigenous solutions and a supporting domestic value chain. In this spirit, the Report seeks to provide a platform for diverse opinions and ideas as a starting point of dialogue among key stakeholders that will help shape India’s EV industry going forward. Steps we take today, and the bets we place, will help determine if, how, and when India will become a global EV manufacturing powerhouse in the near future.

— Rajan Wadhera, Former President, Mahindra, automotive sector; Former President, Society of Indian Automobile Manufacturers (SIAM)

EXECUTIVE SUMMARY

Recent Arthur D. Little (ADL) analysis of the dynamic EV industry affirms that the use of electric vehicles in India and the attendant growth of this industry can skyrocket, and the government’s intention to support this trend is clear.

We believe India’s EV industry will cross sales of 10 million units by 2030, with an overall adoption rate of more than 30% across different vehicle classes. Furthermore, more than a third of all two-wheelers sold by 2030 will be electric. EV adoption for passenger cars, however, is likely to be a mere 10% by that time, amounting to just 5% of total EV sales. Given the achievable volumes we expect, India will likely be among the top 10 EV markets globally by 2030.

The current low rate of passenger EV adoption is due to many barriers. We believe, however, that India can lift its EV game and unlock its true potential if private players and the government work together to remove these barriers. An adoption rate of about 50%, with more than 17 million units of EVs sold by 2030, is possible through collaborative stakeholder action.

India is one of the largest EV markets in Asia, behind only China and, surprisingly, ahead of Japan. India can build on this position by supporting R&D, building a reliable charging infrastructure, and providing subsidies such as direct subsidies and further tax incentives to buyers and companies in the areas of battery R&D, among other actions.

These are exciting times for the automotive and mobility industry. The world is in the midst of a key transition away from fossil fuel vehicles, a shift that has already arrived in India, where EV use is ready to move beyond the nascent stage. India has also been listed in ADL’s 2022 Global Electronic Mobility Readiness Index (GEMRIX), which assesses transformations made by major countries in EV mobility, securing the 11th position among different countries studied. This is largely due to strategic bets placed by different stakeholders — the government, OEMs, suppliers, and investors, among others — toward setting up a robust EV ecosystem in the country.

The electric vehicle has emerged as one of the foremost avenues of innovation in this space. The Indian Government’s goal of 30% EV penetration for passenger cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030 through its flagship FAME Phase II policy will greatly boost EV adoption. Nevertheless, as of now, India lags well behind developed countries in terms of EV adoption. According to our analysis, while India should achieve its target in the three-wheeler category, it will definitely miss the mark across all other vehicle segments. Only through concerted industry-wide action and value unlocking will India be able to stay reasonably close to planned targets.

The government’s intent is clear and points in only one direction — growth of the EV industry. The signs of growing EV acceptance are bright, with the industry increasingly seeing more partnerships, joint ventures, and M&As. Startups are gaining a lot more funding from private equity/venture capital (PE/VC) funds. We see EV adoption rates picking up in the major cities in the short run, although this trend is not yet visible in Tier-2/Tier-3 cities.

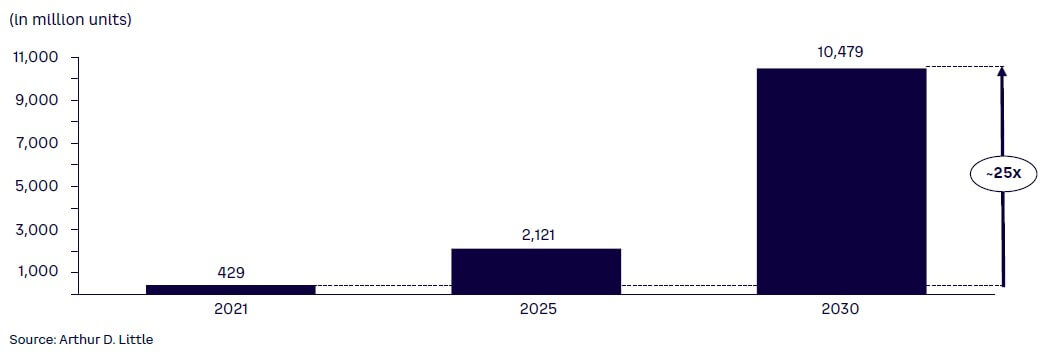

The projected sales of more than 10 million EVs, with more than 100 million units expected to be sold worldwide by 2030, means India’s share will be around 10% of the global EV industry.

CRITICAL FACTORS HAMPERING EV ADOPTION

Multiple factors are behind India’s low EV adoption rates. Fundamental pressures include higher up-front prices of EVs compared to ICE vehicles, the dearth of a charging infrastructure (e.g., charging stations, battery swapping centers, chargers, and the entire EV supporting ecosystem), a lack of vehicle options, and low consumer confidence. Recently, macroeconomic factors such as the semi-conductor shortage and the COVID-19 pandemic have also hampered growth in the EV industry.

Setting up an effective EV ecosystem remains one of the immediate, fundamental challenges the industry faces. The absence of this ecosystem prevents manufacturers from scaling up, which adds further pressure on prices, making EVs significantly more expensive than their ICE counterparts. Such price differentials and the absence of adequate infrastructure drive value-conscious customers away, thus perpetuating a vicious cycle.

EV sales are also hindered by a lack of appealing options, customer anxiety about battery range (i.e., charge lasting long enough to reach the destination), and safety concerns, given the current state of technology. India can outperform even the projected EV sales by 2030 by resolving these issues and thus get closer to its government’s aspiration.

JOINING HANDS TO LIFT INDIA’S EV GAME

India’s EV market holds great potential. Early steps taken, however small, can be built upon to expand the market and kickstart growth through the following concerted actions by all EV industry stakeholders — vehicle manufacturers, component suppliers, power generation and distribution companies, the government, and, above all, customers. To this end, we recommend the following 10 imperatives for India to truly unlock its potential:

- Product innovation. OEMs can either opt for a bespoke or a shared architecture/platform across different powertrain variants.

- Component manufacturing. Key EV components, such as electric motors, batteries, chargers, and so forth, can either be manufactured by OEMs or sourced from suppliers.

- Secondary offerings. In addition to EVs, OEMs can provide charging infrastructure and swapping solutions.

- After-sales service. Training of sales personnel is essential to ensure quality customer service.

- Supplier capabilities. Building capability is an important area of consideration for component manufacturers.

- Charging infrastructure. Building the charging infrastructure and enabling the grid to manage the higher load is crucial to ensure a successful transition to EVs. Power companies should also develop smart charging solutions at home and depots to provide a seamless solution to customers.

- Incentives. The primary responsibility of the government is to activate and incentivize the EV market, which is currently at an embryonic stage. Incentives offered by the government can either be monetary or nonmonetary.

- Policy adoption. The government needs to draft and regulate policies in conjunction with industry players to ensure standardization.

- Pollution targets. Air quality targets and license plate regulations are other areas where the government can provide incentives for EV operators.

- Customer awareness. A key stakeholder in the entire EV ecosystem is the end consumer, who will prefer an affordable product that effectively meets their mobility needs with minimal impact on the environment.

Electric mobility is the fast-approaching future of transport. We believe India is well positioned to make this transition. The solutions are evident, and the environment is conducive. Indeed, our study reflects more than 30% EV penetration in India by 2030, given current visibility into plans and initiatives.

Yet, if India were to truly unlock its full potential, an adoption rate of 50% is feasible, with the sale of more than 17 million EVs by 2030. This reflects the “true potential” of the Indian EV industry if all stakeholders come together and put a concerted effort in setting up a robust ecosystem in India. With such much-needed impetus, India can achieve its aspiration of becoming one of the global leaders in e-mobility and a manufacturing powerhouse for EVs globally.

— Barnik Chitran Maitra, Managing Partner, Arthur D. Little, India & South Asia

1

INDIA’S EV STORY: MARRED BY LOW ADOPTION

SLOW STEPS

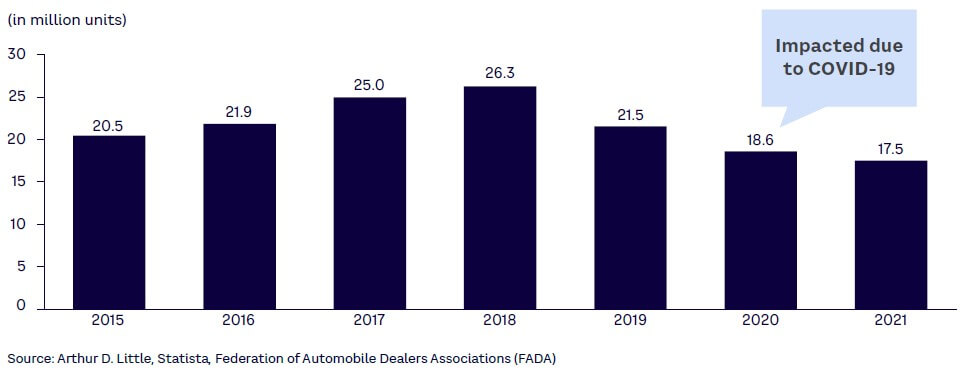

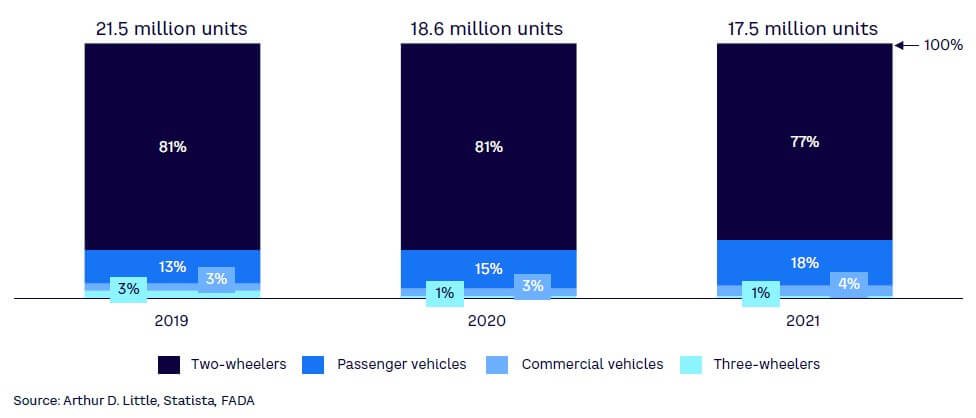

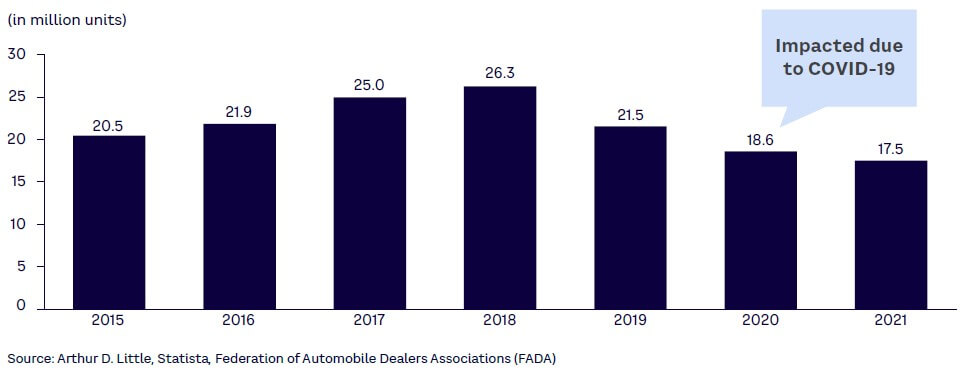

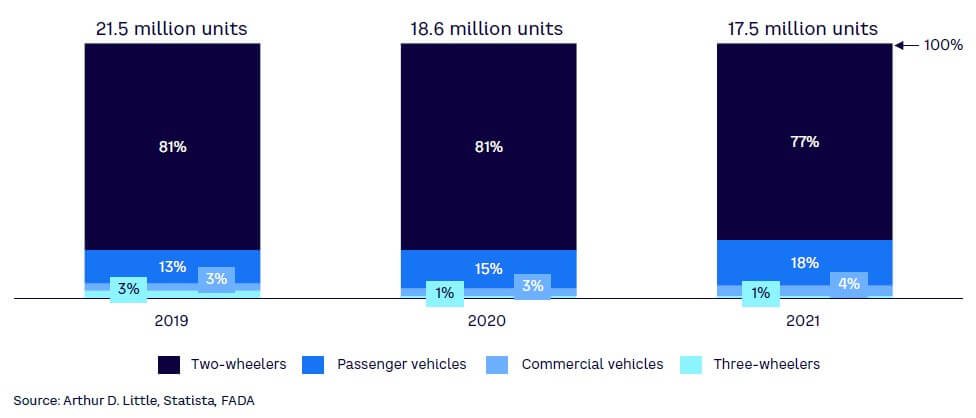

India is one of the largest automotive markets in the world, with more than 17 million units sold in 2021 (see Figure 1). The market, however, is dominated by two-wheelers, with a market share of 77%, followed by passenger cars (18%), commercial vehicles (4%), and three-wheelers (1%) — see Figure 2. Automotive is expected to be one of India’s fastest-growing sectors, as demand for personal and shared mobility continues to rise, against the backdrop of a growing urban population and a rising GDP per capita, coupled with increasing traffic congestion, climate change concerns, and the government’s push toward clean and renewable energy. Thus, EVs have emerged as front-runners in driving a shift in consumer demand, with the government pushing for electrification of motor vehicles through FAME-II and a plan to achieve 30% EV penetration for passenger cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030.

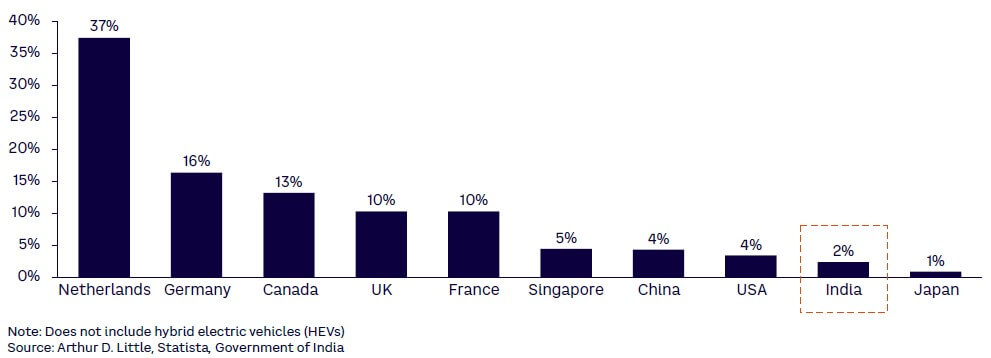

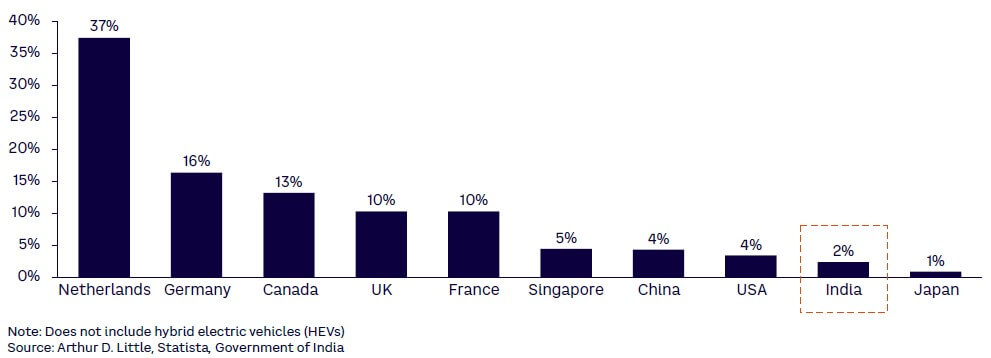

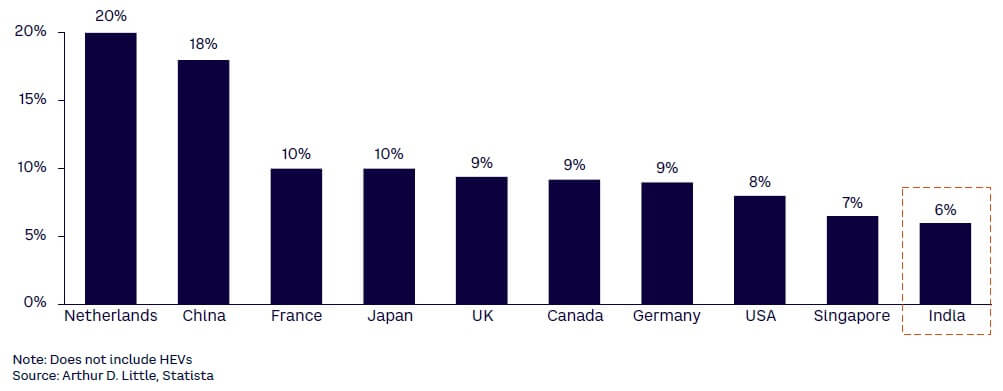

Despite steps in the right direction, India currently lags far behind European countries, where EV adoption is increasing at a much more rapid pace (see Figure 3). There is heightened skepticism in the minds of the Indian consumer about the adequacy of the country’s EV charging and transport infrastructure, and about the current state of the EV ecosystem in general. Consequently, the EV adoption rate in India, by the end of 2021, stood at merely 2%, compared to several European countries where adoption exceeded 10%. India also lags large automotive markets like the US and China, which are witnessing high EV adoption rates.

REASONS WHY

Several factors have contributed to India’s poor EV adoption rate at the start of 2022. Below, we highlight the most critical ones:

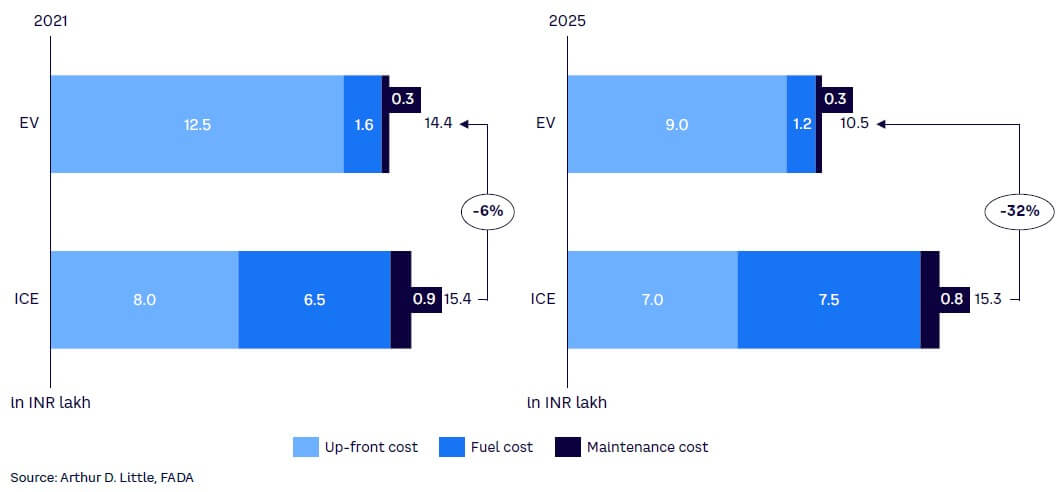

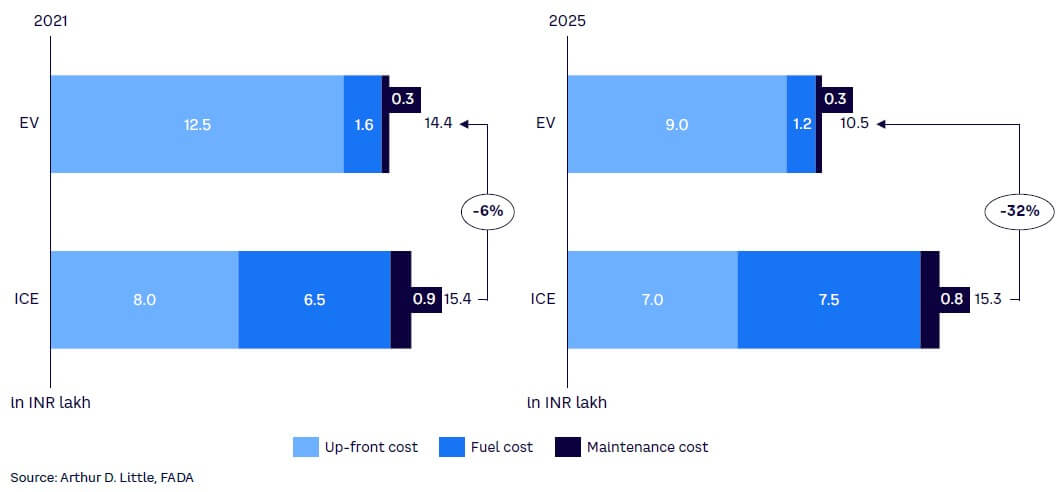

- Premium pricing. EVs are currently priced at a premium compared to their ICE counterparts. For instance, the EV variant of the highly popular Tata Tigor five-seater passenger sedan costs INR 12.5 lakh (ex-showroom), while its ICE variant starts at less than half that price tag, at INR 6 lakh (ex-showroom). The rising cost of batteries has contributed to such steep price differentials, despite government subsidies. This premium pricing has driven consumers away, given the availability of cheaper alternatives with a more pervasive infrastructure.

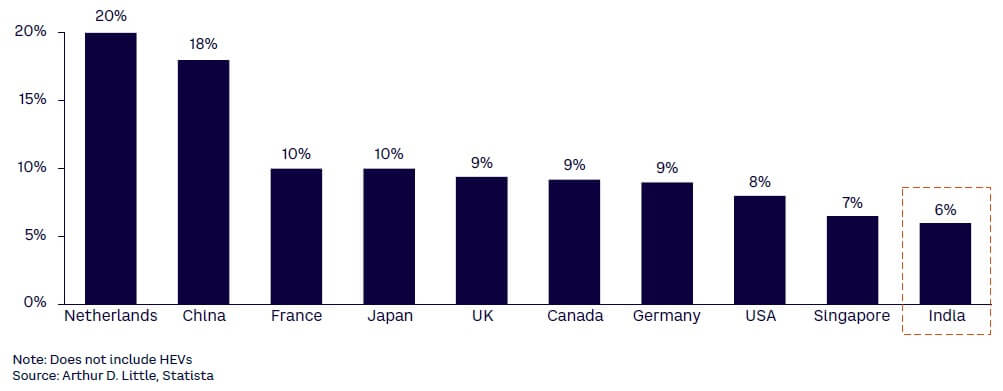

- Lack of charging infrastructure. India’s public EV charging infrastructure is still in its infancy, lagging far behind its Asian peers like China and Japan (see Figure 4), which took significant steps to set up a strong EV ecosystem in their countries. Given recent policy steps announced by the government (e.g., the draft battery swapping policy) and partnerships announced by OEMs (e.g., Hyundai Motors with Tata Power), the growth of the charging infrastructure is expected to pick up pace soon.

- Limited availability of EV models. As of April 2022, there are limited EV options available, with just 17 car models and 25 two-wheeler models in the market, compared to more than 200 ICE models available of both cars and two-wheelers. Given the lack of EV penetration across income segments, consumers have been reluctant to purchase an EV as their primary mode of private transport, mostly opting for EVs as their second or third vehicle.

- Lack of product innovation. Most passenger EVs available in India have not been designed to keep the “value-conscious” Indian consumer in mind. Also, current EVs are not adequately suited for Indian roads and traffic conditions, an intrinsic limitation of current EV design. Despite the premium charged, sustainable performance is not guaranteed with a satisfactory driving range suitable for intercity travel. Hence, most EVs available in the market are two- and three-wheelers, which are barely used for intercity travel.

- Safety concerns. Recent reports of battery explosions in several parts of India have alarmed consumers. Ola, Okinawa, and Pure EV have recalled more than 7,000 electric scooters voluntarily in the wake of dozens of incidents of electric two-wheelers catching fire. Reported cases of explosions of EV batteries, which were charging overnight, have also made consumers wary.

- Macro factors. COVID-19 and the global semiconductor chip shortage are among several macro factors that have further slowed the pace of EV adoption in India. On the demand side, we have the recent inflationary pressures and reduced purchasing power due to the short-term economic impact of the pandemic. On the supply side, the global semi-conductor chip shortage has been a major constraint for OEMs, inhibiting their ability to roll out innovative EV models designed for the Indian market.

Given all these factors, adoption of EVs in India has not reached a significant pace. However, recent developments undertaken by the government and other key stakeholders have provided much-needed optimism, which will likely act as a catalyst to turn India’s EV story on its head in the next few years.

2

SOURCE OF OPTIMISM: RECENT EV DEVELOPMENTS IN INDIA

Several recent key developments in India’s EV space have provided a source of optimism for an increased pace of EV adoption in the country. For instance, the central government’s think tank NITI Aayog proposed a draft battery-swapping policy in April 2022. Moreover, a month later, Tata Power and Hyundai Motors announced a partnership to boost the EV charging infrastructure in the country. Developments such as these and much more have encouraged consumer confidence. In this chapter, we look at some critical initiatives undertaken by several key stakeholders.

GOVERNMENT INITIATIVES

A strong government push to make EVs affordable and accessible will be the most significant driver fueling the growth of EVs in India. The government has taken numerous steps, both for consumers as well as manufacturers, to ease the adoption of EVs. The main motivation is the already poor and further declining air quality index (AQI) in India’s top metropolitan cities, like Delhi and Mumbai, besides India’s climate change commitments.

The government first launched its FAME policy in April 2015 to discourage the use of petrol and diesel vehicles. Phase I of that policy — with a major focus on demand creation, technology developments, pilot projects, and development of the charging infrastructure — utilized a fund of US $68 million over a period of four years.

In March 2019, FAME Phase II launched, with a focus on subsidizing more than 7,000 e-buses, 500,000 electric three-wheelers, and more than a million electric four-wheelers, with a total budget outlay of US $1.36 billion over the next five-year period. Given the dedicated demand-centric initiatives under this latest scheme, we are optimistic that the high up-front cost of EVs will be reduced by 10%-20%.

Another welcome step taken under the National Electric Mobility Mission Plan (NEMMP) 2020 was a reduction of goods and service tax (GST) rates for EVs from 12% to 5%. GST rates on chargers or charging stations have also been reduced from 18% to 5%.

In the Union Budget for 2021-2022, Union Minister for Road Transport and Highways Shri Nitin Gadkari announced the highly anticipated Vehicle Scrappage Policy, under which ICE vehicles more than 20 years old will have to take a “fitness test” per guidelines of the Motors Vehicles Act, 1989, and vehicles deemed unfit would be scrapped. The initiative targets the replacement of old vehicles with new, eco-friendly ones to reduce both pollution and oil imports, in turn boosting the adoption of green mobility (EVs, in particular). It is expected that the recycling of vehicles will reduce raw material costs and help the government in tax collection of US $4-$5 billion, which will be invested in EV infrastructure development.

A policy trend we observed that is working in favor of EV adoption is that each year, the government touches upon a new aspect of the EV support ecosystem, with the most recent initiative being the formulation of a battery-swapping policy.

INVESTMENT BY EXISTING PLAYERS

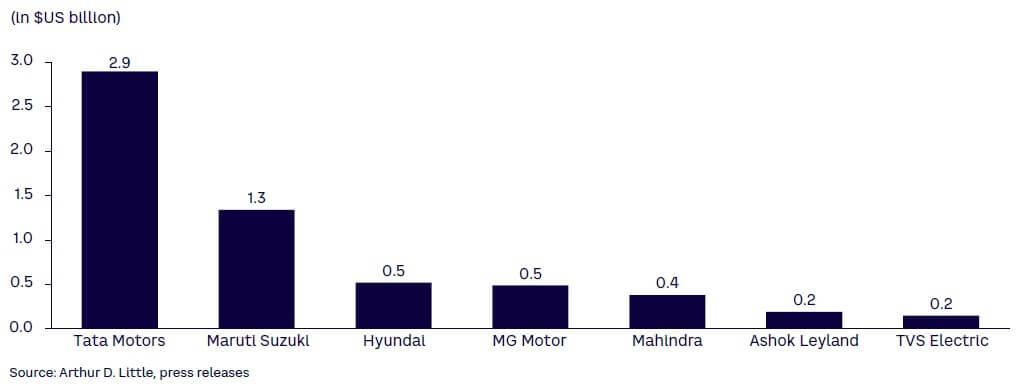

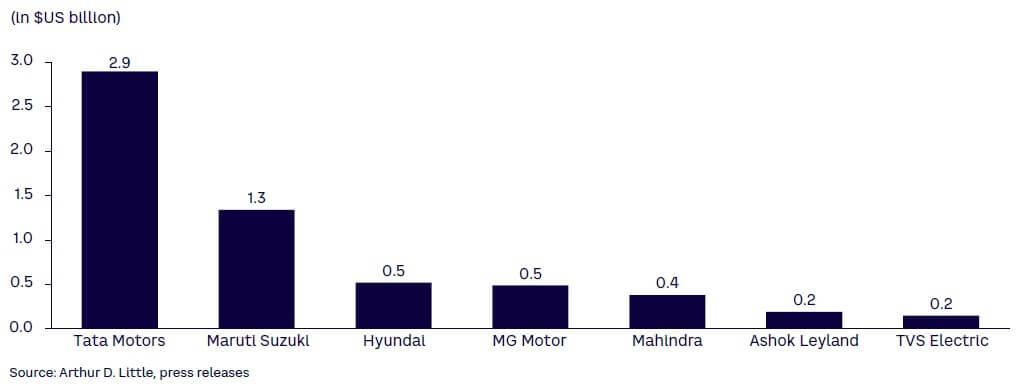

Overall, OEMs have been fairly bullish on India’s EV growth story, despite skepticism about the rate of EV adoption of a few leading automotive players, like Maruti Suzuki. The reservation on the part of Maruti Suzuki, however, largely stems from its Japanese partner’s global strategy of focusing on hybrid electric vehicles (HEVs) rather than pure battery-operated EVs. Despite this, Maruti Suzuki has committed to make investments totaling US $1.3 billion in India’s EV space. Below, we highlight some key steps by OEMs and component manufacturers.

Partnerships

Collaboration among leading OEMs and component manufacturers is a healthy industry-wide phenomenon and will help overcome existing infrastructural gaps in this evolving market. As previously mentioned, India’s leading EV makers — Tata and Hyundai — have recently collaborated to boost India’s charging infrastructure. In March 2022, Hero Electric and SUN Mobility partnered to develop 10,000 electric two-wheelers integrated with SUN Mobility’s smart battery-swapping technology. Mahindra & Mahindra signed a partnership with Volkswagen (VW) to explore the use of MEB components for Mahindra’s New Born Electric Platform. Such collaborations will provide the synergies needed to drive EV industry growth in India.

Stake acquisition

The Indian EV space has also attracted a lot of M&A activity, with large investments. In January 2022, Hero MotoCorp announced an investment of INR 420 crore in Ather Energy, an electric two-wheeler startup. Ola Electric has also made a strategic investment in Israeli battery-technology company, StoreDot. Meanwhile, TVS Motor acquired a 75% stake in Swiss E-Mobility Group (SEMG), at a valuation of US $100 million. Increased transactions in the EV space reflect heightened consumer and investor interest.

Expansion plans

Business, capacity, and product expansions underway reflect optimism among OEMs that EV demand will pick up pace soon. According to our analysis, these investments can be divided into three categories: EV and future mobility (49%), expansion of product line (38%), and debottlenecking of existing plants (14%). Most R&D spending has been around software-related features development, including navigation and automation software packages. Some expansion plans by leading OEMs include Tata Motors incorporating a new subsidiary — Tata Passenger Electric Mobility (TPEML) — for its EV segment at the end of 2021. TPEML will exclusively look into passenger EVs and HEVs. Olectra Greentech, one of India’s major electric bus manufacturers, plans to set up an electric bus factory with a capacity of 10,000 units. JBM Auto has received orders to supply 200 air-conditioned electric buses from Delhi Transport Corporation, while Bajaj Auto plans to introduce electric three-wheelers in 2022. Figure 5 shows more significant investments made by leading OEMs.

Foreign participation

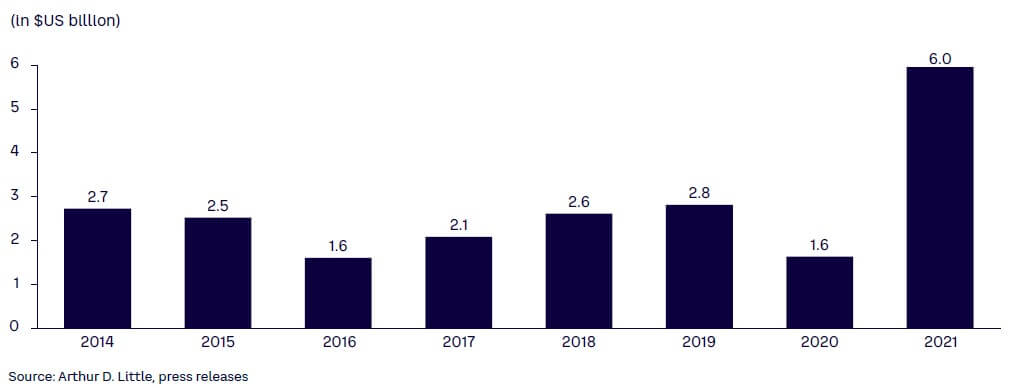

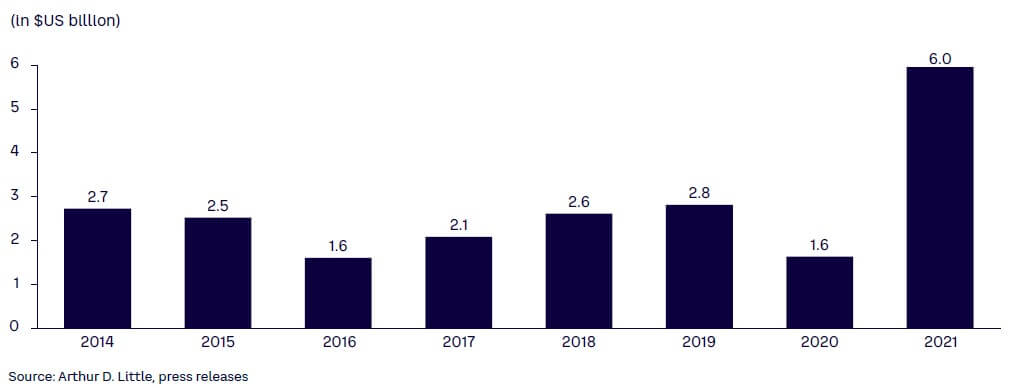

India offers the largest untapped market worldwide for foreign direct investment (FDI), specifically in the electric two-wheeler segment, where 100% FDI is approved, according to our analysis. Some significant investments already undertaken include the acquisition of Indian battery manufacturing startup Pravaig by European renewable energy company Eren Group, the entry of US EV manufacturer Tesla through its subsidiary Tesla India Motors and Energy Pvt. Ltd., and the setting up of EV charging stations in Hyderabad by Finnish company Fortum. Canadian learning solutions company MakerMax has also announced its entry into India and will offer EV production and servicing technical skill development programs. In battery manufacturing, Magnis Energy Technologies is collaborating with the public sector Bharat Heavy Electricals Limited (BHEL) to set up India’s first Lithium-ion (Li-ion) battery giga factory, with a manufacturing capacity ranging from 1-30 GWh (gigawatt hours). Such investments underscore the potential and attractiveness of the Indian EV market to foreign operators, further illustrated by Figure 6.

Rising investor confidence

In the recent past, government support and investments made by incumbents in the EV ecosystem have bolstered PE/VC confidence in India’s EV space. PE funds are supporting domestic EV companies with robust technology and sound plans of action. One of the key drivers for such investments is that the EV sector is the first mass electricity market that extends beyond the home. Therefore, investors ranging from infrastructure funds and PEs to growth equity and early-stage VCs are all showing interest.

Some key PE/VC investments made in the past few years include: a US $2.6 million investment by Bengaluru-based VC firm Inventus Capital India in Delhi-based EV manufacturer Euler Motors, a US $3.9 million investment by US-based VC Rocketship in Bengaluru-based micromobility service provider Yulu, and the fundraising of US $6.6 million by electric ride-hailing platform BluSmart. Other notable investments include Ola Electric (US $253 million), Simple Energy (US $21 million), and Revolt (US $20 million).

An interesting point in our analysis is that investments in India’s EV space were 255% higher in 2021 compared to 2020, showing increasing investor confidence, with more strategic and long-term bets expected in the near future.

THRIVING EV STARTUP ECOSYSTEM

India had 592 startups functioning in the EV industry as of March 2022, according to the investment research firm Tracxn,[1] working in the domains of battery manufacturing, charging infrastructure, and battery recycling, to name a few. Some major startups have even gone down the OEM route and launched their own EVs. Clearly, the startup ecosystem for EVs in India is thriving.

Leading OEM startups such as Ola Electric, Okinawa Autotech, Ather Energy, and Tork Motors all have sound financial backing and are building electric two-wheelers at a substantially lower total cost of ownership (TCO) in the long run than traditional ICE two-wheelers.

BluSmart, backed by incumbents Reliance Industries Ltd. and BP Mobility Ltd., has focused on the ride-sharing element in the electric four-wheelers category. BluSmart is establishing itself as an alternative to taxi/aggregator majors Uber and Ola and plans to add 100,000 electric taxis over the next five years. In June 2022, it placed India’s largest EV fleet order of 10,000 electric cars with Tata Motors, signaling its optimism about India’s EV growth story. Bounce, on the other hand, is delivering on the “battery as a service” model and is offering e-scooters with or without a battery. Bounce also plans to build a battery-swapping ecosystem at more than 3,500 dedicated locations across 20 Indian cities. In another example, Yulu is exploring a unique rental model.

The company offers light e-scooters in large urban areas for people to use, as an alternative to walking, for short trips in congested areas. Volttic is one of the few startups providing exciting home- and wall-charging solutions. Log9 Materials (also working with Volttic) is providing the fastest charging battery for EVs in India, with versatile battery compositions. Finally, Attero Recycling and Ziptrax are prominent startups aiming to recycle used batteries, resulting in less wastage and reduced import of new Li-ion batteries.

With India being home to 21 of the top 30 most polluted cities globally,[2] companies have realized that in the coming years, EVs are not going to remain a choice but will become a necessity. According to ADL analysis, the electric two-wheeler segment grew more than 400% in 2021, a testament to the innovations and investments taking place in the EV startup ecosystem. Such initiatives undertaken by major stakeholders provide a lot of optimism about the EV industry in India skyrocketing in the coming years.

3

INDIA’S EV EVOLUTION: MARKET GROWTH FORECAST

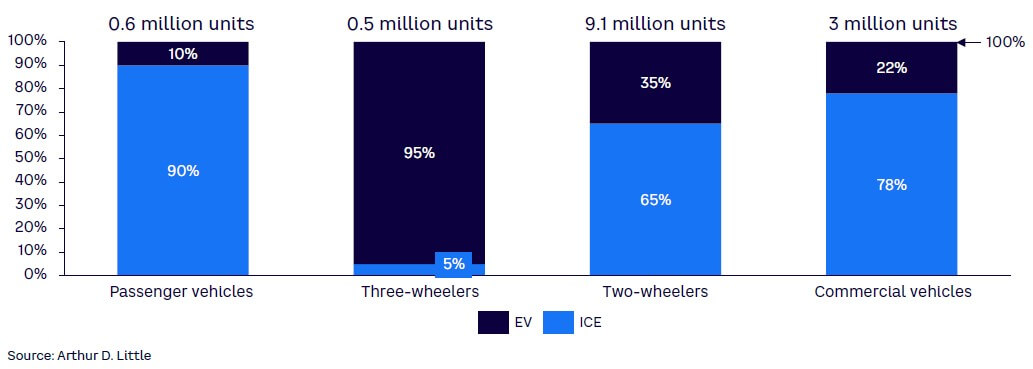

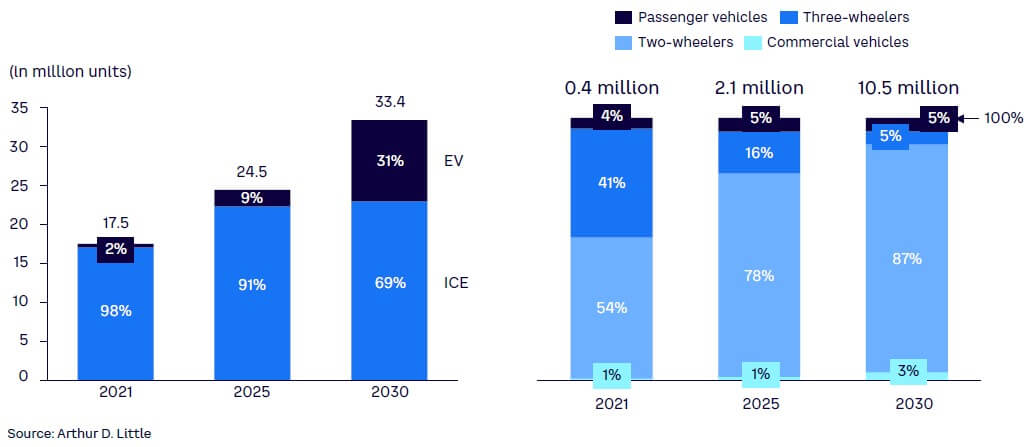

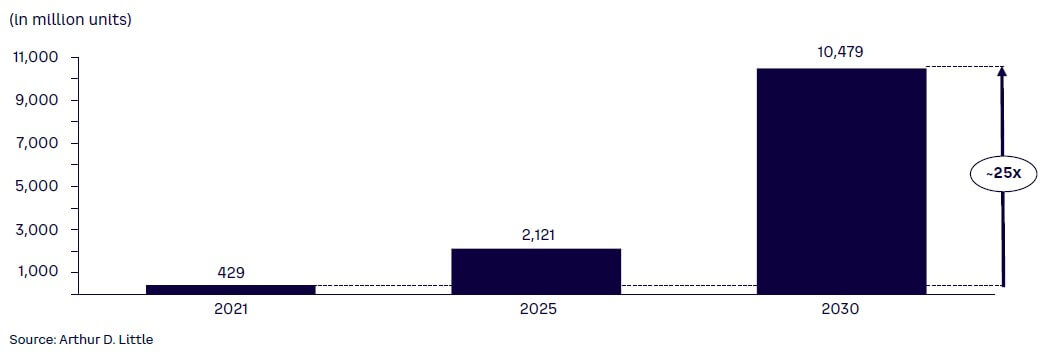

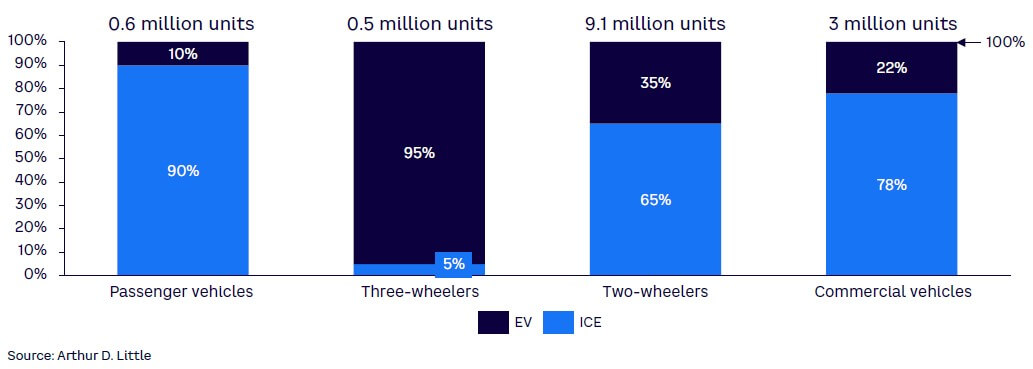

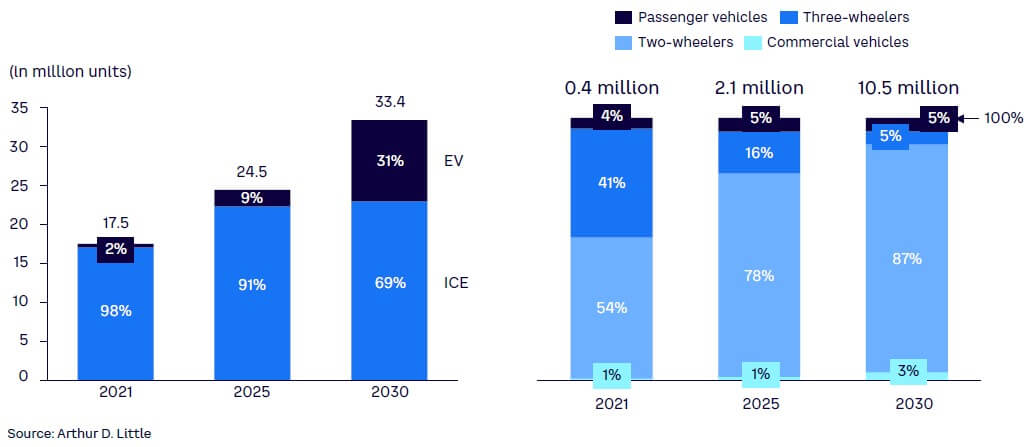

According to our analysis, we expect sales of EVs in India to increase from just over 400,000 units in 2021 to more than 10 million units by 2030, growing almost 25x in the next nine years (see Figure 7). This will mean a blended adoption rate of more than 30% across different categories, per our analysis. While adoption rates for electric three-wheelers, two-wheelers, and commercial vehicles are expected to grow significantly, passenger EVs are expected to face strong resistance from their ICE counterparts, at least until 2030. Our analysis shows EV adoption rates for passenger vehicles to reach 10%, three-wheelers at 95%, two-wheelers at 35%, and commercial vehicles at 22% (see Figure 8).

While the government will achieve its planned penetration targets for three-wheelers, for all other categories it is expected to miss the targets set by FAME Phase II (30% penetration rate for passenger vehicles, 70% for commercial vehicles, and 80% each for two-wheelers and three-wheelers). Electric three-wheelers have already become quite popular in several parts of the country for short-distance commuting, and the trend is expected to further consolidate by 2030, with Bajaj already announcing plans to roll out electric autorickshaws by the second half of 2022.

EV adoption for passenger vehicles is not expected to pick up pace significantly at least until 2030, achieving an adoption rate of merely 10% by that time, due to the factors outlined in Chapter 1. Electric passenger vehicle sales will be confined mainly to the biggest metro cities like Delhi, Bengaluru, and Mumbai, while the rest of the country will continue to primarily use ICE vehicles. As shown in Figure 9, only 5% of the total EV sales in 2030 will be of passenger vehicles, a strikingly small share compared to EV’s projected market share (31%) of automobiles overall.

Our analysis is in stark contrast to a report published by VC fund Blume,[3] which predicts that sales of electric two-wheelers will touch 17 million units by 2030. Electric two-wheelers will be at the forefront of the EV transition but around 9 million units would be sold by 2030, with an adoption rate of about 35%, according to our analysis. Further, our predictions are slightly conservative in comparison to a KPMG survey of auto executives,[4] which predicted an EV adoption rate of 39% across different categories, while our forecasts suggest the adoption rate will remain at 31% until 2030.

Given our understanding of the Indian market, government targets set for 2030 are ambitious and will require a concerted effort from all players across the industry to achieve the desired result.

KEY LONG-TERM DRIVERS OF SUPPLY & DEMAND

We believe growth in EV demand will be fueled by a myriad of reasons, ranging from demographic and geopolitical factors to economic and environmental concerns influencing the decision of the final consumer. We highlight some key long-term drivers of supply and demand, below.

Growing aspirational middle-class population

Despite the economic disruption stemming from the COVID-19 pandemic, India’s medium-to-long-term growth is expected to be steady. In fact, India’s GDP per capita is projected to grow significantly in the next eight years, going from US $2,515 in 2022 to an estimated US $4,404 in 2030.[5] This growth will result in an increase in India’s aspirational middle class (gross national income [GNI] per capita of US $1,000 to $4,000 for lower-middle-income countries), which will account for more than 40% of India’s total population by 2030. This middle-class population will define the success of, and the timeline for, acceptance of EVs, as this group of consumers looks to invest in future-proof mobility solutions. Demand for electric two-wheelers is expected to pick up rapidly, given the current state of India’s road infrastructure, availability of options, and lower investments required in comparison to passenger vehicles.

Our analysis reveals that the growth story of electric two-wheelers has already begun in FY 2022, with sales picking up rapidly, growing almost five times year on year to register a record sale of more than 230,000 units. As disposable income continues to increase in the hands of India’s aspirational middle class, a willingness to pay a slight premium for future-proof EVs will increase.

Rapid urbanization

For the next few years, EV adoption in India will largely be driven by the urban population, before spreading to rural areas, as much of the charging infrastructure will emerge in cities before villages. Further, India is expected to add another 100 million people to its cities between 2022 and 2030.[6] Rapid urbanization will come with its own sets of challenges, such as increased air pollution and traffic congestion. In the medium term, urban boundaries will expand as current urban infrastructure continues to struggle to accommodate additional people. This will drive both government policies and consumer demand for ecofriendly and sustainable mobility solutions like EVs. Increased urbanization will provide both a higher population base that is more persuadable to switch to EVs and the required workforce to bolster the commercial vehicle category.

Cost-effective alternative to ICE vehicles

The TCO for EVs over 1.5 lakh km is already low, in comparison to ICE vehicles today (see Figure 10). This is particularly relevant for commercial vehicles, where operating cost is the most critical factor driving purchase. Hence, cab providers and aggregators are expected to make the switch to EVs faster than passenger vehicles. As technology continues to improve, the up-front cost of an EV is expected to further reduce. This will increase adoption across noncommercial categories as well.

Our analysis shows that TCO will further decline from the current 8% to more than 30% by 2030, as battery manufacturing costs continue to drop with the evolution of technology. As the gap in up-front cost between EV and ICE vehicles lowers, the adoption rate will pick up pace significantly given the availability of an adequate supporting infrastructure.

OEMs, which are heavily dependent on government subsidies, will also be motivated to improve existing margins. In fact, a Massachusetts Institute of Technology (MIT) team calculated the lifetime cost of every car model available in the global market and concluded that electric cars were always significantly cheaper than gas-burning counterparts, largely because of fuel prices.[7]

Given India’s dependence on oil imports and rising fuel prices, the government is further incentivized to make the shift to EVs sooner rather than later. As the long-term cost benefits become more evident to the price-sensitive Indian consumer, the transition from ICE vehicles will become inevitable.

Growing clamor for sustainable mobility solutions

As mentioned previously, 21 of the top 30 most polluted cities in the world are in India.[8] Hence, sustainable mobility is not just a choice, but soon will become a necessity. This presents a unique opportunity for EV manufacturers to highlight their ecofriendly capabilities and align with the mindset of an environment-conscious next generation.

While there is unanimous consent over the environmental benefits of operating an EV over an ICE vehicle, there are still serious environmental concerns over the battery manufacturing process. EVs, however, are much cleaner for the environment over the long term, irrespective of how emission-intensive the battery manufacturing process and energy grid is, according to British power company EDF Energy.[9] As technology advances, this will further change for the better. In fact, an EV’s production emissions can be undone within the first 18 months of use, per a recent study.

As the clamor for sustainable mobility solutions continues to increase, all categories of EVs will benefit from a higher adoption rate, given the environmental benefits. However, we believe the real opportunity is to further expand the benefits gap. The public and private sectors need to work together to build an infrastructure that is clean from the source, through grid decarbonization. For EVs to truly be a game-changer for the environment, the electricity used to charge these vehicles must be clean, efficient, and from renewable sources.

Geopolitical factors

While COVID-19 was a major setback for the automobile industry, we do not consider it to be a long-term trend. In the short term, the pandemic has influenced people’s thinking about car ownership. For instance, in 2021, nearly half (48%) of all respondents of an ADL global survey reported their belief that owning a car is now more important than it was before the pandemic. While these trends will not shape permanent behavior, they might have a role to play in the overall aggregate demand for automobiles over the next three to five years.

When considering a longer time frame (10-15 years), sophisticated geopolitical factors come into play. Russia’s invasion of Ukraine is a devastating illustration of the complexity of modern-day supply chains and how easily multiple industries can be affected overnight by geopolitical events. With major climatic issues and tensions rising between countries, we expect and advise companies to keep multiple supply channels open, instead of an overdependence on one supply partner. This can be a substantial issue, as seen in the worldwide automotive chaos caused by the semiconductor chip shortage, because of overdependence on one supplier, the Taiwan Semiconductor Manufacturing Company.

Political factors in favor of EV adoption will also drive both demand and supply. Indian Prime Minister Narendra Modi has taken several key steps at the global level regarding climate change and environmental degradation. Hence, pushing EV adoption in the country helps Modi bolster his image as an environment-conscious global leader. Also, employment opportunities presented in this space will push government policies in favor of EV adoption.

Such factors will also aid the growth of EV ancillary industries. For instance, setting up processes to recycle batteries will solve the problem of managing dead battery waste, bring down the cost of batteries, and act as a catalyst for the adoption of EVs. While China focuses on the production and refining of batteries, India can focus on becoming the world’s premier recycling hub for electric batteries over the next decade.

Technological innovation

EVs are currently classified as battery electric vehicles (BEVs), plug-in hybrid EVs (PHEVs), and fuel cell EVs (FCEVs). The last few years have brought significant improvements in all these technologies, in terms of driving range and cost. As technologies continue to evolve and companies gain valuable customer insights, better product design and energy capacity will help bring down costs and provide a more satisfactory experience to consumers than is currently available.

Innovative techniques like battery swapping are already being practiced, overcoming some of the intrinsic limitations of EVs. Also, EVs in the future will be better suited for Indian roads and intercity travel, as domestic OEMs continue to develop newer models. Some recent safety concerns are also expected to improve as continuous innovation takes place in this space.

In 2021, a group of researchers at Harvard University’s School for Engineering and Applied Sciences (SEAS) have already managed to stabilize the lithium-metal battery and figure out a way to charge and discharge them over 10,000 times — at a high current density.[10] This new battery technology could increase the lifespan of an electric vehicle, making it equal to or even greater than that of its ICE counterparts. Commercial feasibility of this breakthrough is still being studied by firms globally, which can reduce EV charging times significantly.

The biggest impact of technological innovation, however, will be to reduce the premium charged for EVs in comparison to ICE vehicles, while retaining similar margins for OEMs after the withdrawal of government subsidies. This will drive adoption across categories, with passenger vehicles being the most impacted. Promoting indigenous industries and investments in R&D will play a pivotal role in driving product innovation in this space in India.

Need for a robust EV ecosystem

One of the most important factors contributing to EV growth is the establishment of a pervasive and robust charging infrastructure, suitable to serve the requirements of a rapidly increasing customer base. Most countries currently experiencing a high EV adoption rate, such as the Netherlands, Germany, and Canada, have already set up robust charging infrastructures. India, too, needs to make large strides in this direction to achieve the targeted numbers.

Given that the charging infrastructure will require significant inflows of investments and technology, the participation of foreign players becomes increasingly important. As mentioned previously, think tank Niti Aayog has already prepared a draft battery-swapping policy aimed at convincing OEMs and investors to make immediate and large investments in this category. In the coming five to eight years, however, we believe the charging infrastructure will primarily be limited to urban areas and highways.

Notably, Hero Electric has announced a partnership with Charzer, a Bengaluru-based EV charging startup, to build 100,000 charging stations across India. Tata Power, Reliance Industries, Magentra, and SUN Mobility are among other companies in this category — all promising signs for the development of a robust EV ecosystem in India.

All these factors will drive EV adoption in the country over the coming few years. However, the industry also faces certain risks and challenges, such as reliance on imports from China for battery and other components, grid overload, high-carbon grid profiles, and safety concerns currently leading to recalls. India needs to reduce dependencies on other countries to establish a robust EV ecosystem and become a global EV manufacturing hub. Hence, the Indian market presents both exciting opportunities and tough challenges for innovators.

4

UNLOCKING INDIA’S EV POTENTIAL

We can see the Indian EV market booming over the next few years with renewable energy becoming more commonplace. The projected growth in the EV sector promises more jobs, investments, cleaner air, better health, and a more resilient economy. Overall, the EV industry is predicted to deliver a much-needed boost to the Indian economy, after the COVID-19 blow.

EMPLOYMENT & GDP GROWTH

Since its inception, India’s automobile industry has been a substantial contributor to macroeconomic growth and employment. The adoption of EVs is expected to create 10 million new jobs in India by 2030.[11] Consequently, there will be increased demand for upskilling and training the existing workforce. The sector is currently facing a massive shift on numerous fronts, including the implementation of rigorous pollution standards and policies with the aim of electrifying public and private transportation. Building a functioning EV ecosystem is critical to achieving this aim. This revolution will also have a considerable influence on other sectors of the economy. To chart the course for the future of e-mobility, development and policymaking should work in close coordination with the automobile industry.

In addition to employment generation, adoption of EVs will have an enormous impact on India’s GDP. According to a study, the contribution of EVs to India’s GDP will cross US $150 billion by 2030.[12] This will be complemented by growth in ancillary industries, such as battery and component manufacturing along with IT services. Thus, the EV industry will continue to play an increasingly significant role in contributing to India’s GDP.

BATTERY MANUFACTURING GROWTH

Li-ion batteries are being lauded as the future of automobiles. These Li-ion cells are the fuel of choice owing to their unique properties — lightweight, high charge-holding capacity, and steady output. The increasing use of EVs in India will raise demand for Li-ion batteries, boosting the manufacturing industry. To attain more than 30% EV adoption, as predicted, India will require approximately 800 GWh of batteries by 2030. To meet this rising demand, India is accelerating plans to manufacture Li-ion cells within the country, anticipating US $2.3 billion in government subsidies and more than US $7.5 billion in investment potential, according to ADL analysis. Li-ion cell manufacturing is expected to evolve in stages, with a concentration on battery pack assembly in the initial phase, and manufacturing becoming more localized eventually. This is a clear indication that India is gradually becoming self-sufficient in battery manufacturing and assembly. In addition, adoption of Li-ion batteries in vehicles will provide scope for additional use cases in other industries. For India to realize its mission of becoming a global EV manufacturing powerhouse will require more than US $10 billion of focused investments in this industry. However, once achieved, it has the potential to generate more than 1 million additional employment opportunities in the country.

COMPONENT MANUFACTURING GROWTH

As the ICE gets replaced by the electric motor, component requirements will alter dramatically, too. There will be new prospects for various electronics and battery-related items, including controllers, capacitors, and so on. Thus, component makers are recognizing the importance of investing in EV component technology and capacity. This is evident from big investment announcements made by leading component players, such as Sundram Fasteners, which announced a phased investment of INR 100 crore over the next five years. Demand for required minerals such as lithium, cobalt, copper, and nickel will increase with changes in component requirements. In fact, per ADL analysis, the demand for aluminum is predicted to increase by a factor of 14. A challenge here is the reliance on a limited geography for the extraction of such metals. To tackle this, the government must form strategic alliances. A scrappage strategy that is successfully implemented will minimize dependency to some level through metal recycling. Companies like Hindustan Copper, Nalco, and Hindalco appear to be the change agents, providing novel alloys like steel-aluminum blends that will lower total costs.

GROWTH IN FOREIGN INVESTMENTS

Another trend associated with the increased demand for EVs is OEM involvement in software and telematics R&D. Our studies suggest a US $300 million investment required by 2025, focusing on many software aspects (e.g., battery level and health monitoring, motor maintenance, nearest charging stations). Furthermore, these linked vehicles will generate a vast amount of data for use in a variety of ways, opening up new business prospects. The formation of the Renault-Nissan Technical & Business Centre, a strategic alliance, and an R&D sharing program for the development of software for efficient battery charging, are two initiatives that will transform the telematics business.

Given FDI inflow of nearly US $6 billion in 2021, it is expected that the EV industry will attract further foreign investments of about US $20 billion by 2030 to fuel India’s economic growth and help achieve required scale in this industry. Technology transfer and alliances formed between local manufacturers and leading global EV companies will be pivotal in this regard.

BETTER AIR QUALITY

EVs will lead to an improvement in air quality over the coming years. Researchers have suggested that this will eventually have a positive impact on the health of citizens. With cleaner air, there will be fewer cardiopulmonary illnesses and deaths, increasing labor productivity and effective person-hours. According to a study from the Indian Institute of Technology Kanpur and the International Council on Clean Transportation,[13] the result could be as many as 70,380 avoided premature deaths by 2040, quantified as a savings of approximately US $80 billion in 2040 alone.

REDUCED IMPORT BILLS

Besides the benefits of a cleaner environment, more investments, jobs, innovations, and health benefits, we estimate India’s import bill could be reduced by almost US $14 billion in 2030 itself, if the target of 30% penetration of EVs is reached. This is largely due to savings on crude oil imports, which form a major chunk of India’s current import bills.

Overall, the EV industry is well positioned to play a pivotal role in India’s mobility solutions going forward. Our analysis suggests that beyond transforming mobility, this industry can contribute significantly to “AtmaNirbhar Bharat” and India’s progress toward net zero and other sustainable goals. The societal impact of ensuring clean air for India’s citizens is another transformational impact of the EV industry.

5

TAKING THE FINAL LEAP

Even though we predict increased EV adoption in India as an inevitable outcome, timelines are a concern. The sooner India adopts EVs, the better for India’s air quality, as well as its import bill. In recent months, EVs are slowly gaining consumer trust and will no longer be constrained to being a second or third vehicle. However, there are several fundamental challenges with large scopes for improvement, which can only be addressed if the government and private players work together cohesively. The following are the three main challenges to increased EV adoption:

- Low distance range. The battery range of EVs currently stands at an average of 140 km for two-wheelers and 300 km for four-wheelers, which is still quite low in comparison to their ICE counterparts, especially given Indian road and traffic conditions. This, combined with the dire lack of EV charging stations, adds to anxiety about EVs’ range, a major bottleneck. Consequently, consumers are less likely to prefer long trips in their EVs. Also, the excess time taken to charge an EV compared to refueling a typical ICE means the country will have many more charging stations compared to gas stations. Hence, most public and private parking places will have to be well equipped with a charging infrastructure. This requires a threefold approach: (1) focusing on increasing battery capacity through robust R&D, (2) standardizing battery and charging equipment to focus on battery swapping, and (3) increasing charging station density through a public-private partnership (PPP) model.

- High on-road prices. The high up-front cost of EVs also needs correction, given the value-conscious Indian consumer. India’s highest-selling four-wheeler passenger EV, TATA Nexon, is priced at INR 18 lakh (on-road), whereas the highest-selling ICE, Maruti Alto, costs up to INR 5.5 lakh (on-road). The primary reason behind the difference is the high cost of advanced Li-ion batteries. However, with improvements in technology and scaling up of operations, costs are expected to come down.

- Inadequate service infrastructure. The lack of an after-sales service infrastructure is another constraint to the speedy adoption of EVs in India. General maintenance of an EV is cheaper and easier because of fewer moving parts, but service and replacement costs are much higher compared to ICEs due to two major reasons: lack of a skilled workforce and high cost of battery replacement.

ADL’S 10 IMPERATIVES

ADL suggests the following plan of action across key stakeholder groups to address these challenges and unlock India’s EV potential.

- Product innovation. OEMs can either opt for a bespoke or a shared architecture/platform across different powertrain variants. In a bespoke vehicle architecture, a vehicle would be completely design-optimized for the BEV. We believe the trend is toward a bespoke vehicle architecture, providing much larger interior space on the same footprint and less cabin intrusion by things like the prop-shaft or exhaust tunnel. VW ID3 is one such example. Another trend we believe will persist involves sharing components with other vehicle manufacturers, as seen in the case of Ford and Mahindra both using VW’s MEB platform.

- Component manufacturing. Key EV components like electric motors, batteries, chargers, and so forth, can either be manufactured by OEMs or sourced from suppliers. The risk of technology obsolescence is a major concern when sourcing such components from dedicated players, given the capital required. Further, OEMs should partner with suppliers to ensure the security of supplies and develop their own capabilities in the medium-to-long term. Investments in innovative startups are another effective strategy in this regard.

- Secondary offerings. In addition to EVs, OEMs can provide charging infrastructure and swapping solutions. They can set up networks for public charging/swapping of batteries and venture into providing wall boxes for private charging. OEMs should invest in R&D to provide proper insulation of wall boxes and regularly check for safety concerns associated with charging.

- After-sales service. Training of sales personnel is essential to ensure quality customer service. A centralized network of equipment and supplies will be extremely useful in avoiding stockouts. Also, specialized dealerships should be set up to deal with more complex repairs and those that involve trained personnel. This will help in efficiently providing after-sales service to customers.

- Supplier capabilities. Building capability is an important area of consideration for component manufacturers. Localization of components is essential to reduce costs, especially in the initial years when volumes will be low. It’s also essential for suppliers reliant on ICEs to manage the transition to EVs in the next 10 years. Partnerships with international players like Bosch can prove valuable in terms of technology transfer.

- Charging infrastructure. Building the charging infrastructure and enabling the grid to manage the higher load is essential to ensure a successful transition to EVs. A significant challenge in India is to upgrade electricity generation and distribution and manage much higher electricity demand, which may not be evenly distributed during the day. Power companies should also develop smart charging solutions at home and depots to provide a seamless solution to customers.

- Incentives. The primary responsibility of the government is to activate and incentivize the EV market, which is currently at an embryonic stage. Incentives offered by the government can either be monetary or nonmonetary. Monetary incentives can be offered either to the OEM or to the customer. Subsidies have proven to be an effective mechanism in driving EV penetration across geographies. Indirect benefits like road tax and toll rebates have also incentivized customers (B2B, especially) to purchase EVs. Certain nonmonetary incentives like parking privileges can also aid in faster EV adoption. Also, GST rates on ICE vehicles should be progressively increased from 28% to 50% to reduce the existing price differential with ICEs.

- Policy adoption. The government also needs to draft and regulate policies in conjunction with industry players to ensure standardization. The successful implementation of these policies is essential, given the Indian market. Steps like an outright ban on sale of ICE vehicles can also lead to an immediate rise in EV adoption.

- Pollution targets. Air quality targets and license plate regulations are other areas where the government can provide incentives for EV operators. As previously stated, given the reduction in loss of lives and savings involved, the government should make administrations responsible for the level of air quality in their area. The government can set maximum AQI levels for cities to achieve in a given time frame.

- Customer awareness. A key stakeholder in the entire EV ecosystem is the end consumer who will prefer an affordable product that effectively meets their mobility needs with minimal impact on the environment. Growing environmental concerns have made customers more cautious about the impact of their choices on the environment. It is essential for other stakeholders to effectively communicate the benefits of an EV over an ICE. B2B customers can also set corporate social responsibility and electrification targets to further drive demand for EVs. However, it is the duty of other stakeholders to provide such a product to the end consumer.

Eventually, future mobility solutions will transition to EVs. However, a lot of challenges — price differentials, infrastructure challenges, and hot climate conditions — which are particularly pronounced in India, need to be overcome for the country to achieve its dream of being an EV manufacturing hub. We believe India is well positioned to tackle all these challenges and achieve forecasted EV adoption rates across categories. The solutions are evident, and the environment is conducive. All that remains to be seen is how quickly India’s EV story unfolds.

While our study reflects the best estimate for EV penetration to be achieved in the country by 2030, if India were to truly unlock its full potential, an adoption rate of 50% could be feasible with the sale of more than 17 million EVs by 2030. This reflects the true potential of the Indian EV industry if all stakeholders come together and put a concerted effort in setting up a robust ecosystem in the country. Achieving this true potential of the EV industry will make India a global powerhouse in EV.

Notes

[1] “Electric Vehicles Startups in India.” Tracxn, 19 March 2022.

[2] “World’s Most Polluted Cities (Historical Data 2017-2021).” IQAir, accessed July 2022.

[3] Sachdev, Alisha. “Electric Two-Wheeler Sales to Grow 24x to Nearly 18bn Units in 2030: Report.” Mint, 7 April 2022.

[4] “39% of New Vehicles Sold in India Will Be Electric Vehicles by 2030: Report.” The Hindu BusinessLine, 1 December 2021.

[5] “India: Estimated Gross Domestic Product per Capita in Current Prices from 1987 to 2027.” Statista, 2022.

[6] “India’s Urban Population to Stand at 675 Million in 2035, Behind China’s 1 Billion: UN.” The Hindu, 30 June 2022.

[7] Dizikes, Peter. “Study: Low-Emissions Vehicles Are Less Expensive Overall.“ MIT News, 27 September 2016.

[8] “World’s Most Polluted Cities (Historical Data 2017-2021).” IQAir, accessed July 2022.

[9] “Benefits of Electric Cars on the Environment.” EDF Energy, accessed July 2022.

[10] Burrows, Leah. “Battery Breakthrough for Electric Cars.” The Harvard Gazette, 12 May 2021.

[11] “E-Vehicles Industry to Create 10 Million Jobs in Future: Report.” BusinessToday.In, 15 May 2019.

[12] Malik, Bismah. “India’s EV Market to Grow by 90% to Touch $150 Billion by 2030: Report.” BusinessToday.In, 1 December 2021.

[13] “IIT-K and ICCT Study Suggests Adoption of EVs to Improve Air Quality, Health Benefits in Every State by 2040.“ Times of India, 5 October 2021.

DOWNLOAD THE FULL REPORT

40 min read • Automotive

Unlocking India’s electric mobility potential

Comprehensive report on the future of EVs in India

DATE

FOREWORD

Electric vehicles (EVs) have emerged at the forefront of driving the shift in mobility away from traditional internal combustion engine (ICE) vehicles to a more sustainable option across geographies. Given this global shift, will India be able to shape its own path to e-mobility or merely remain a slow adopter of solutions developed abroad? To that end, this Report aims to provide a realistic picture of India’s EV journey to date and explores the reasons behind heightened optimism regarding the Indian EV industry. It also provides forecasts and several challenges that must be overcome for India to unlock its full potential.

India currently has a low EV adoption rate of about 2%, largely due to the huge price differential with traditional engine counterparts and the absence of an adequate EV infrastructure. Recent steps undertaken by the Indian Government, OEMs, and other stakeholders have rejuvenated investor and consumer confidence. While three- and two-wheelers spearhead current EV adoption in India, attractive offerings are now entering the passenger car and commercial vehicle segment. As per our analysis, India will likely see sales of more than 10 million units of EVs by 2030, largely driven by the two-wheeler category. This suggests the possibility for India to become a global EV powerhouse.

With its flagship Faster Adoption and Manufacturing of Electric Vehicles (FAME) policy, the Indian Government is rigorously pushing for electrification of automobiles with an ambitious target of 30% EV penetration for passenger cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030. This Report seeks to analyze and discuss whether the government will be able to achieve these targets set across different classes of vehicles. The Report also seeks to inform various stakeholders about current and potential challenges that will impact the adoption of EVs in India and suggest suitable measures to help India unlock its true EV potential, which already appears to have started on the right footing.

Given current geopolitical tensions, global supply chain disruptions, and the government’s policy of making India self-reliant (referred to as “AatmaNirbhar Bharat”), it is important that India creates its own indigenous solutions and a supporting domestic value chain. In this spirit, the Report seeks to provide a platform for diverse opinions and ideas as a starting point of dialogue among key stakeholders that will help shape India’s EV industry going forward. Steps we take today, and the bets we place, will help determine if, how, and when India will become a global EV manufacturing powerhouse in the near future.

— Rajan Wadhera, Former President, Mahindra, automotive sector; Former President, Society of Indian Automobile Manufacturers (SIAM)

EXECUTIVE SUMMARY

Recent Arthur D. Little (ADL) analysis of the dynamic EV industry affirms that the use of electric vehicles in India and the attendant growth of this industry can skyrocket, and the government’s intention to support this trend is clear.

We believe India’s EV industry will cross sales of 10 million units by 2030, with an overall adoption rate of more than 30% across different vehicle classes. Furthermore, more than a third of all two-wheelers sold by 2030 will be electric. EV adoption for passenger cars, however, is likely to be a mere 10% by that time, amounting to just 5% of total EV sales. Given the achievable volumes we expect, India will likely be among the top 10 EV markets globally by 2030.

The current low rate of passenger EV adoption is due to many barriers. We believe, however, that India can lift its EV game and unlock its true potential if private players and the government work together to remove these barriers. An adoption rate of about 50%, with more than 17 million units of EVs sold by 2030, is possible through collaborative stakeholder action.

India is one of the largest EV markets in Asia, behind only China and, surprisingly, ahead of Japan. India can build on this position by supporting R&D, building a reliable charging infrastructure, and providing subsidies such as direct subsidies and further tax incentives to buyers and companies in the areas of battery R&D, among other actions.

These are exciting times for the automotive and mobility industry. The world is in the midst of a key transition away from fossil fuel vehicles, a shift that has already arrived in India, where EV use is ready to move beyond the nascent stage. India has also been listed in ADL’s 2022 Global Electronic Mobility Readiness Index (GEMRIX), which assesses transformations made by major countries in EV mobility, securing the 11th position among different countries studied. This is largely due to strategic bets placed by different stakeholders — the government, OEMs, suppliers, and investors, among others — toward setting up a robust EV ecosystem in the country.

The electric vehicle has emerged as one of the foremost avenues of innovation in this space. The Indian Government’s goal of 30% EV penetration for passenger cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030 through its flagship FAME Phase II policy will greatly boost EV adoption. Nevertheless, as of now, India lags well behind developed countries in terms of EV adoption. According to our analysis, while India should achieve its target in the three-wheeler category, it will definitely miss the mark across all other vehicle segments. Only through concerted industry-wide action and value unlocking will India be able to stay reasonably close to planned targets.

The government’s intent is clear and points in only one direction — growth of the EV industry. The signs of growing EV acceptance are bright, with the industry increasingly seeing more partnerships, joint ventures, and M&As. Startups are gaining a lot more funding from private equity/venture capital (PE/VC) funds. We see EV adoption rates picking up in the major cities in the short run, although this trend is not yet visible in Tier-2/Tier-3 cities.

The projected sales of more than 10 million EVs, with more than 100 million units expected to be sold worldwide by 2030, means India’s share will be around 10% of the global EV industry.

CRITICAL FACTORS HAMPERING EV ADOPTION

Multiple factors are behind India’s low EV adoption rates. Fundamental pressures include higher up-front prices of EVs compared to ICE vehicles, the dearth of a charging infrastructure (e.g., charging stations, battery swapping centers, chargers, and the entire EV supporting ecosystem), a lack of vehicle options, and low consumer confidence. Recently, macroeconomic factors such as the semi-conductor shortage and the COVID-19 pandemic have also hampered growth in the EV industry.

Setting up an effective EV ecosystem remains one of the immediate, fundamental challenges the industry faces. The absence of this ecosystem prevents manufacturers from scaling up, which adds further pressure on prices, making EVs significantly more expensive than their ICE counterparts. Such price differentials and the absence of adequate infrastructure drive value-conscious customers away, thus perpetuating a vicious cycle.

EV sales are also hindered by a lack of appealing options, customer anxiety about battery range (i.e., charge lasting long enough to reach the destination), and safety concerns, given the current state of technology. India can outperform even the projected EV sales by 2030 by resolving these issues and thus get closer to its government’s aspiration.

JOINING HANDS TO LIFT INDIA’S EV GAME

India’s EV market holds great potential. Early steps taken, however small, can be built upon to expand the market and kickstart growth through the following concerted actions by all EV industry stakeholders — vehicle manufacturers, component suppliers, power generation and distribution companies, the government, and, above all, customers. To this end, we recommend the following 10 imperatives for India to truly unlock its potential:

- Product innovation. OEMs can either opt for a bespoke or a shared architecture/platform across different powertrain variants.

- Component manufacturing. Key EV components, such as electric motors, batteries, chargers, and so forth, can either be manufactured by OEMs or sourced from suppliers.

- Secondary offerings. In addition to EVs, OEMs can provide charging infrastructure and swapping solutions.

- After-sales service. Training of sales personnel is essential to ensure quality customer service.

- Supplier capabilities. Building capability is an important area of consideration for component manufacturers.

- Charging infrastructure. Building the charging infrastructure and enabling the grid to manage the higher load is crucial to ensure a successful transition to EVs. Power companies should also develop smart charging solutions at home and depots to provide a seamless solution to customers.

- Incentives. The primary responsibility of the government is to activate and incentivize the EV market, which is currently at an embryonic stage. Incentives offered by the government can either be monetary or nonmonetary.

- Policy adoption. The government needs to draft and regulate policies in conjunction with industry players to ensure standardization.

- Pollution targets. Air quality targets and license plate regulations are other areas where the government can provide incentives for EV operators.

- Customer awareness. A key stakeholder in the entire EV ecosystem is the end consumer, who will prefer an affordable product that effectively meets their mobility needs with minimal impact on the environment.

Electric mobility is the fast-approaching future of transport. We believe India is well positioned to make this transition. The solutions are evident, and the environment is conducive. Indeed, our study reflects more than 30% EV penetration in India by 2030, given current visibility into plans and initiatives.

Yet, if India were to truly unlock its full potential, an adoption rate of 50% is feasible, with the sale of more than 17 million EVs by 2030. This reflects the “true potential” of the Indian EV industry if all stakeholders come together and put a concerted effort in setting up a robust ecosystem in India. With such much-needed impetus, India can achieve its aspiration of becoming one of the global leaders in e-mobility and a manufacturing powerhouse for EVs globally.

— Barnik Chitran Maitra, Managing Partner, Arthur D. Little, India & South Asia

1

INDIA’S EV STORY: MARRED BY LOW ADOPTION

SLOW STEPS

India is one of the largest automotive markets in the world, with more than 17 million units sold in 2021 (see Figure 1). The market, however, is dominated by two-wheelers, with a market share of 77%, followed by passenger cars (18%), commercial vehicles (4%), and three-wheelers (1%) — see Figure 2. Automotive is expected to be one of India’s fastest-growing sectors, as demand for personal and shared mobility continues to rise, against the backdrop of a growing urban population and a rising GDP per capita, coupled with increasing traffic congestion, climate change concerns, and the government’s push toward clean and renewable energy. Thus, EVs have emerged as front-runners in driving a shift in consumer demand, with the government pushing for electrification of motor vehicles through FAME-II and a plan to achieve 30% EV penetration for passenger cars, 70% for commercial vehicles, and 80% for two- and three-wheelers by 2030.

Despite steps in the right direction, India currently lags far behind European countries, where EV adoption is increasing at a much more rapid pace (see Figure 3). There is heightened skepticism in the minds of the Indian consumer about the adequacy of the country’s EV charging and transport infrastructure, and about the current state of the EV ecosystem in general. Consequently, the EV adoption rate in India, by the end of 2021, stood at merely 2%, compared to several European countries where adoption exceeded 10%. India also lags large automotive markets like the US and China, which are witnessing high EV adoption rates.

REASONS WHY

Several factors have contributed to India’s poor EV adoption rate at the start of 2022. Below, we highlight the most critical ones:

- Premium pricing. EVs are currently priced at a premium compared to their ICE counterparts. For instance, the EV variant of the highly popular Tata Tigor five-seater passenger sedan costs INR 12.5 lakh (ex-showroom), while its ICE variant starts at less than half that price tag, at INR 6 lakh (ex-showroom). The rising cost of batteries has contributed to such steep price differentials, despite government subsidies. This premium pricing has driven consumers away, given the availability of cheaper alternatives with a more pervasive infrastructure.

- Lack of charging infrastructure. India’s public EV charging infrastructure is still in its infancy, lagging far behind its Asian peers like China and Japan (see Figure 4), which took significant steps to set up a strong EV ecosystem in their countries. Given recent policy steps announced by the government (e.g., the draft battery swapping policy) and partnerships announced by OEMs (e.g., Hyundai Motors with Tata Power), the growth of the charging infrastructure is expected to pick up pace soon.

- Limited availability of EV models. As of April 2022, there are limited EV options available, with just 17 car models and 25 two-wheeler models in the market, compared to more than 200 ICE models available of both cars and two-wheelers. Given the lack of EV penetration across income segments, consumers have been reluctant to purchase an EV as their primary mode of private transport, mostly opting for EVs as their second or third vehicle.

- Lack of product innovation. Most passenger EVs available in India have not been designed to keep the “value-conscious” Indian consumer in mind. Also, current EVs are not adequately suited for Indian roads and traffic conditions, an intrinsic limitation of current EV design. Despite the premium charged, sustainable performance is not guaranteed with a satisfactory driving range suitable for intercity travel. Hence, most EVs available in the market are two- and three-wheelers, which are barely used for intercity travel.

- Safety concerns. Recent reports of battery explosions in several parts of India have alarmed consumers. Ola, Okinawa, and Pure EV have recalled more than 7,000 electric scooters voluntarily in the wake of dozens of incidents of electric two-wheelers catching fire. Reported cases of explosions of EV batteries, which were charging overnight, have also made consumers wary.

- Macro factors. COVID-19 and the global semiconductor chip shortage are among several macro factors that have further slowed the pace of EV adoption in India. On the demand side, we have the recent inflationary pressures and reduced purchasing power due to the short-term economic impact of the pandemic. On the supply side, the global semi-conductor chip shortage has been a major constraint for OEMs, inhibiting their ability to roll out innovative EV models designed for the Indian market.

Given all these factors, adoption of EVs in India has not reached a significant pace. However, recent developments undertaken by the government and other key stakeholders have provided much-needed optimism, which will likely act as a catalyst to turn India’s EV story on its head in the next few years.

2

SOURCE OF OPTIMISM: RECENT EV DEVELOPMENTS IN INDIA

Several recent key developments in India’s EV space have provided a source of optimism for an increased pace of EV adoption in the country. For instance, the central government’s think tank NITI Aayog proposed a draft battery-swapping policy in April 2022. Moreover, a month later, Tata Power and Hyundai Motors announced a partnership to boost the EV charging infrastructure in the country. Developments such as these and much more have encouraged consumer confidence. In this chapter, we look at some critical initiatives undertaken by several key stakeholders.

GOVERNMENT INITIATIVES

A strong government push to make EVs affordable and accessible will be the most significant driver fueling the growth of EVs in India. The government has taken numerous steps, both for consumers as well as manufacturers, to ease the adoption of EVs. The main motivation is the already poor and further declining air quality index (AQI) in India’s top metropolitan cities, like Delhi and Mumbai, besides India’s climate change commitments.

The government first launched its FAME policy in April 2015 to discourage the use of petrol and diesel vehicles. Phase I of that policy — with a major focus on demand creation, technology developments, pilot projects, and development of the charging infrastructure — utilized a fund of US $68 million over a period of four years.

In March 2019, FAME Phase II launched, with a focus on subsidizing more than 7,000 e-buses, 500,000 electric three-wheelers, and more than a million electric four-wheelers, with a total budget outlay of US $1.36 billion over the next five-year period. Given the dedicated demand-centric initiatives under this latest scheme, we are optimistic that the high up-front cost of EVs will be reduced by 10%-20%.

Another welcome step taken under the National Electric Mobility Mission Plan (NEMMP) 2020 was a reduction of goods and service tax (GST) rates for EVs from 12% to 5%. GST rates on chargers or charging stations have also been reduced from 18% to 5%.

In the Union Budget for 2021-2022, Union Minister for Road Transport and Highways Shri Nitin Gadkari announced the highly anticipated Vehicle Scrappage Policy, under which ICE vehicles more than 20 years old will have to take a “fitness test” per guidelines of the Motors Vehicles Act, 1989, and vehicles deemed unfit would be scrapped. The initiative targets the replacement of old vehicles with new, eco-friendly ones to reduce both pollution and oil imports, in turn boosting the adoption of green mobility (EVs, in particular). It is expected that the recycling of vehicles will reduce raw material costs and help the government in tax collection of US $4-$5 billion, which will be invested in EV infrastructure development.

A policy trend we observed that is working in favor of EV adoption is that each year, the government touches upon a new aspect of the EV support ecosystem, with the most recent initiative being the formulation of a battery-swapping policy.

INVESTMENT BY EXISTING PLAYERS

Overall, OEMs have been fairly bullish on India’s EV growth story, despite skepticism about the rate of EV adoption of a few leading automotive players, like Maruti Suzuki. The reservation on the part of Maruti Suzuki, however, largely stems from its Japanese partner’s global strategy of focusing on hybrid electric vehicles (HEVs) rather than pure battery-operated EVs. Despite this, Maruti Suzuki has committed to make investments totaling US $1.3 billion in India’s EV space. Below, we highlight some key steps by OEMs and component manufacturers.

Partnerships

Collaboration among leading OEMs and component manufacturers is a healthy industry-wide phenomenon and will help overcome existing infrastructural gaps in this evolving market. As previously mentioned, India’s leading EV makers — Tata and Hyundai — have recently collaborated to boost India’s charging infrastructure. In March 2022, Hero Electric and SUN Mobility partnered to develop 10,000 electric two-wheelers integrated with SUN Mobility’s smart battery-swapping technology. Mahindra & Mahindra signed a partnership with Volkswagen (VW) to explore the use of MEB components for Mahindra’s New Born Electric Platform. Such collaborations will provide the synergies needed to drive EV industry growth in India.

Stake acquisition

The Indian EV space has also attracted a lot of M&A activity, with large investments. In January 2022, Hero MotoCorp announced an investment of INR 420 crore in Ather Energy, an electric two-wheeler startup. Ola Electric has also made a strategic investment in Israeli battery-technology company, StoreDot. Meanwhile, TVS Motor acquired a 75% stake in Swiss E-Mobility Group (SEMG), at a valuation of US $100 million. Increased transactions in the EV space reflect heightened consumer and investor interest.

Expansion plans