Managing wealth for private clients is a profitable, competitive, and growing business — and currently dominated by traditional players with proven skills in holistic wealth management and personal client service. Meaningful change is not happening, partly due to the players’ ongoing success. But previous strategies and offerings likely will not satisfy the next generation. In this Viewpoint, we outline three dimensions to drive growth for the wealth managers of the future.

IS CONTINUOUS CHANGE IN SYSTEM ENOUGH?

Most organizations have been working on impressive project portfolios and improvement programs for years. With these efforts, banks and management consultancies focus on well-known levers where the actors themselves already have deep knowledge and expertise. The continuous improvement and expansion of product ranges, including ETFs, alternative investments, real estate, and crypto, provide the most visible examples. Sales efficiency and cost management have improved; market penetration and segment processing with clients such as ultra-high-net-worth individuals (UHNWI) and entrepreneurs have been upgraded. A lot is happening, but there is still much to do, and the effort will be worth it.

Digitization projects and the need to comply with new and evolving regulatory requirements require space and investment. However, real progress for clients and employees in terms of convenience or efficiency is often hardly noticeable. On the contrary, making progress becomes more complicated and runs the risk of frustrating and alienating clients due to, for example, increased regulations, which would hurt both sides of the client-bank relationship.

Employees often ask, “Why can’t we be like a fintech?” In fact, there is limited priority in efforts to inspire staff for the development of a real future model and a new vision. And these are necessary to succeed with the next generation of clients and employees.

3 DIMENSIONS OF THE FUTURE MODEL

Should renovations be carried out on a moving train, or should the entire vehicle be replaced? When and how should decision makers examine a problem and take action to solve it?

Real changes, both in behavior and technology, toward a newly configured business model are only possible with positive motivation and inspiration and require behavioral shifts and technological advancement. Consider what Steve Jobs might say if he examined the wealth management industry. How would he invent a new wealth manager?

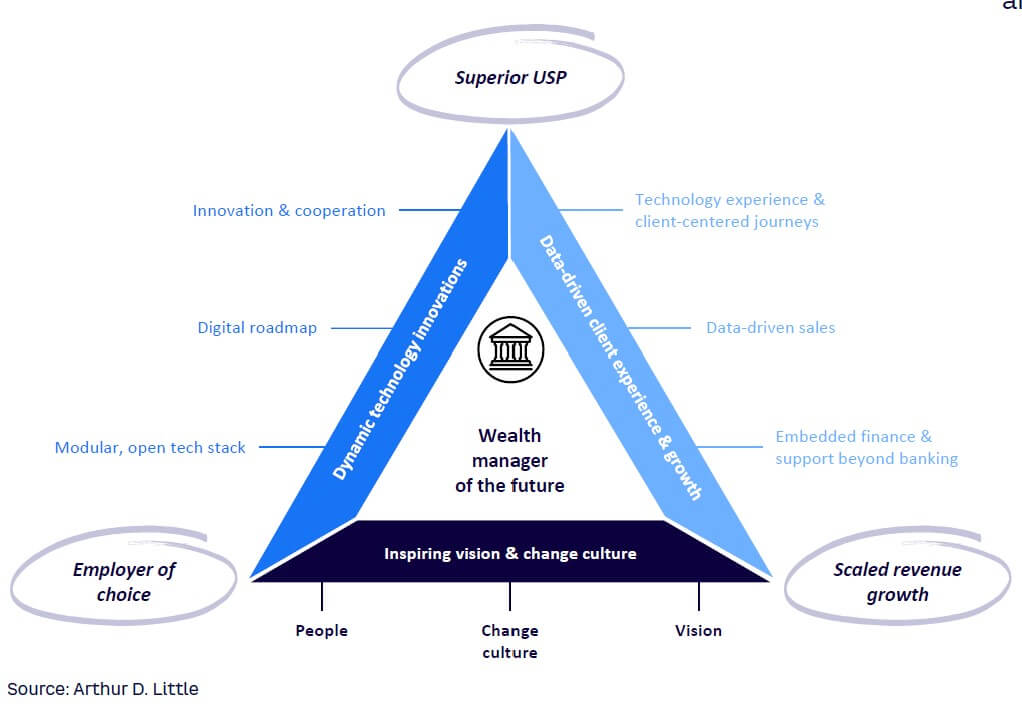

In our view, the emergence and success of modern wealth managers are decided along three dimensions that must be developed methodically and concurrently, as shown in Figure 1:

-

Create and promote inspiring strategy that addresses culture changes and transformation.

-

Introduce dynamic technology innovations and platforms.

-

Use data to differentiate client experiences and identify new growth areas.

ENVISIONING CHANGE TO TRANSFORM THE FUTURE

Dimension 1: Create & promote inspiring strategy

Formulating and developing a future vision is the starting point for a company-specific transformation to prepare the organization for the next generation of client advisors. From an external perspective, private banks are perceived often as undifferentiated and staid, while fintechs already appear innovative and attractive, offering, for example, digital onboarding. The ability of wealth managers to manage the cultural change necessary for transformation will be a significant key to success.

To distinguish itself and prioritize its initiatives, an organization’s leadership has to deliberately and thoughtfully develop a narrative to convey its objective and provide a target vision and overall framework for the multitude of ideas. Some institutions have significantly made over their communication practices, which already contributes to a different public perception.

Wealth management is a service people offer to other people. Managers operate on a different level and are often far ahead of the organization and employees in their thoughts. It is vital that managers meet the team where they are to understand and manage change-related needs and blockages to progress. A real strategy and the associated empathetic spark will only arise when everyone understands and embraces implementation; mandatory participatory development makes the difference.

Advisors are the pillars of wealth management. Teams primarily comprise experienced advisors from the baby boomer generation. Their comprehensive experience and long-term client relationships are valuable assets, but they also make change difficult; they are attached to their familiar and hitherto successful behaviors and beliefs. People often fall back on old tried-and-tested routines, which is unsurprising. The example of online skills training, which received a temporary boost during COVID-19 restrictions that receded afterward, revealed people’s preferences for safe and familiar over new and unpredictable.

In a few years, a large advisory gap will arise as baby boomers retire. What will the future working environment look like? Will it bring the talents of the next generation back into the exciting world of banking? Answers to these questions are paramount. Only when one recognizes where one wants to go can one take others along.

NEW TECHNOLOGIES UNLOCK NEW POTENTIALS

Dimension 2: Introduce dynamic technology innovations & platforms

Technology is rapidly advancing and opening new opportunities to achieve much-needed efficiency gains and economies of scale, optimized processes, and improved service quality. Advances in technology are bringing new tools and approaches to support client advisors in their work, which can lead to better relationships with their clients. However, for some organizations, the feeling often persists that nothing has happened, or not enough has happened, even after touching it a thousand times. Despite high investments of money and time, most institutions still rely on older legacy systems in banking operations.

Migrations appear risky and expensive and initially achieve few noticeable external improvements. As a result, institutions adhere to the status quo, which makes it difficult to connect to modern, open systems. Oftentimes, the majority of employees and a large segment of management capacity are non-client-facing. This of course has an impact on the corporate culture, which is largely occupied with addressing back-office tasks and regulatory issues instead of client centricity and innovation.

Digital capability often results in, at best, a “slow follower strategy” of online access and reporting. The resulting gaps and omissions are increasingly being filled by focused offerings from fintechs that develop new services and “experience worlds” that address areas from communications and transparency to product platforms and family offices.

As smart followers, wealth managers have the opportunity to review and redefine their development plans and digital roadmaps with innovative approaches and availability. Optimization can now be gradually carried out from the outside in, by using pre-developed, cloud-based software packages or subscribing to software-as-a-service (SaaS) or banking-as-a-service (BaaS) solutions, all of which enable demand-oriented variability of the cost base. (For more on BaaS, see “Banking as a Service: At the Heart of the Bank of Tomorrow.”)

Innovation management and cooperation should be integral to the strategy to make usable the benefits of an open, shared economy. Making the most of existing and emerging innovations can unlock the potential of new technologies, such as artificial intelligence (AI), which can be applied to support “know your customer” (KYC) procedures or blockchain. Technological innovations around platform approaches, either individual or in partnerships, may increase the reach of one’s own capabilities.

CLIENTS 4.0: FINDING NEW SOURCES TO INFORM SERVICE, CARE & GROWTH

Dimension 3: Use data to differentiate & identify new growth areas

When used correctly, data analytics and technology enable banks to leverage their understanding of client needs and individualize their service offerings to meet those needs, thus achieving new aha moments of clarity and inspiration which result in additional client-centered journeys.

One example is the use of behavioral finance models to capture clients’ individual information needs, risk perceptions, and biases. (For more on behavioral finance, see “Adopting Behavioral Finance in Investment Management.”). The gamification of content, such as the imparting of knowledge on fundamental topics (e.g., environmental, social, and governance [ESG]; risk management; succession) and target-group-relevant content is another example. Banco Bilbao Vizcaya Argentaria (BBVA) in Spain shows how a bank utilized these levers and the resulting added value. (For more on ESG innovations in finance, see “From Green Finance to Greening Finance.”)

Good private bankers are experts in maintaining client relationships; they understand the different personalities, interests, and needs. The trend toward multichannel and increasingly hybrid advisory models and working methods should not dilute this unique selling proposition of relationship-building and personal connections.

Clients want their interactions with their bank to be easy, practical, and relevant. Bank interactions must also be enjoyable and foster real connections, as younger clients are turning increasingly to the contributions of so-called finfluencers. The impact of finfluencers can be laughed at or viewed with concern over potential manipulation and abuse. In any case, their presence should motivate banks to do better and further integrate themselves to improve people’s lives and information routines.

We sometimes complain about different entities repeatedly asking us for existing data. What about banks? Data is the gold of our time, but how can banks work with that data? Ideally, using relevant data to analyze client behavior can provide insights to continuously improve service, and the appearance and flow of information can be applied to tangibly personalize the client’s experience. Ultimately, new data-driven sales approaches can be developed that use social media platforms and other modern tools.

Oftentimes, the task is perceived as too large; who has an all-encompassing data warehouse or AI like Amazon? But that’s not how start-ups think, and that’s not how established wealth managers should think either. The idea is to cut the task down; one approach is to use shared observation points to conduct a bancassurance initiative from which the organization learns and chooses the next step.

Using data effectively means a changed way of thinking and acting in the client ecosystems that should be targeted and accessed through partnerships. This includes embedded finance offers, such as the types that insurance and telecommunications companies are currently developing. Other industries are moving in that ecosystem direction as well, including retailers, luxury brands, and mobility providers. Thinking with clients means thinking and acting beyond banking and becoming part of platforms, regionally or specifically.

MLP SE or the specialization of apoBank are classic examples. Fintechs have a broader approach to all kinds of needs with their client groups. As an example, a small regional bank in the US built a fully digitalized extension for truckers so they could do their banking from anywhere. This extended its reach beyond the region and increased its visibility throughout the US.

The most important idea comes at the end: think from and with the client, which is almost the raison d’être of every consulting organization. Wealth managers often remain focused on volume differentiation and rough topic clusters. “Next-gen” entrepreneurs or “female finance” are good starting points but not nearly enough to create unique and differentiating client experiences as a basis for a renowned unique selling proposition.

Conclusion

Don’t be a dino — Grow with new possibilities

Wealth managers have all the qualities for future success but getting stuck in old behavior might be the biggest risk. The choice lies in going the “dinosaur path” or embracing the way toward permanent evolution and improvement based on new technological possibilities. Addressing the three dimensions outlined in this Viewpoint through bold steps could guide the way to convert to a learning organization:

-

Create and promote inspiring strategy that addresses culture changes and transformation.

-

Know that long-standing trust and expertise are valuable assets to preserve while integrating new technology.

-

Understand that data can overwhelm in its amount and complexity, but invaluable insights are waiting to be uncovered.

A vision of the future is the starting point to inspire future clients and employees but can and will be vastly different for each institution. Attacking all three dimensions simultaneously might be “mission impossible,” where you end up nowhere, so choose an agile approach that produces results, reduces risks, and creates learning and success step-by-step.