The Middle Eastern (ME) banking sector is significantly reshaped thanks to technological advancements, regulatory shifts, and evolving consumer expectations. While focusing on key business drivers, banks have spent less attention on employee experience (EX). Yet, employees are a crucial piece of the puzzle to every bank’s future; prioritizing EX is no longer optional. In this Viewpoint, we examine the state of EX in ME banks and explore how they are harnessing it to cultivate a culture of continuous improvement, innovation, and resilience.

“Our employees — who we call partners — are at the heart of the Starbucks experience. We are committed to making our partners proud and investing in their health, well-being, and success and to creating a culture of belonging where everyone is welcome.”

Howard Schultz, former CEO of Starbucks

THE POWER OF EX

In today’s hypercompetitive banking landscape, the key to sustainable success lies in something often overlooked — employee experience. Technology, strategy, and innovation all play vital roles, but it’s the people behind these initiatives that drive growth, creativity, and long-term resilience. With new generations entering the labor market and employee expectations shifting, financial institutions must realize that the experiences they create for their employees directly influence their overall performance, customer satisfaction, and, ultimately, the bottom line.

EX encompasses every interaction an employee has with the organization, from initial application/recruitment to everyday work life, professional growth and development, and departure or retirement. EX is not simply about job satisfaction; it’s about creating a culture that aligns with the personal and professional aspirations of the people who make the organization thrive.

Since the human factor underpins every organization’s success or failure, prioritizing EX generates benefits like stronger engagement, increased productivity, higher retention levels, improved financial performance, better customer service, easier recruitment, greater adaptability, and increased innovation.

According to research from the Josh Bersin Company, organizations that embrace EX as a strategic priority are:

- 2.2x more likely to surpass financial targets.

- 2.4x more likely to exceed customer expectations.

- 5.1x more likely to foster a strong sense of belonging, crucial for maintaining morale and reducing turnover.

- 5.2x more likely to be recognized as a great place to work, making it easier to attract top talent.

- 5.1x more likely to have engaged employees and retain them.

- 3.7x more likely to adapt smoothly to change, a critical ability in today’s fast-paced business environment.

- 4.3x more likely to drive innovation (a satisfied workforce is the engine behind new ideas).

Moreover, surveys conducted across workplaces globally highlight the need to prioritize employee wellness:

- 92% of employees value working for organizations that prioritize their emotional well-being.

- 35% of employees want opportunities to learn and develop skills.

- 89% of employees with access to wellness programs are more engaged and happier with their job.

- 56% of employees report that stress and anxiety harm their job performance.

- Two out of three employees have experienced at least mild symptoms of anxiety and depression.

Crafting a positive EX is complex, especially in the Middle East, where the region’s diverse workforce and fast-changing economic landscape present unique challenges, but there are also significant opportunities. For instance, banks that prioritize employee well-being and development are better placed to attract, nurture, and retain the top talent they need to create a workforce that’s adaptable, resilient, and innovative — critical in a competitive global market.

By embedding employee well-being and development into strategic objectives, financial institutions can unlock higher levels of engagement, productivity, and innovation. This holistic approach strengthens organizational performance and positions the institution as a leader in shaping a dynamic, resilient, forward-thinking financial sector.

EX TRENDS IN THE MIDDLE EAST

Increasingly, employee experience in the Middle East focuses on enhancing engagement, promoting gender equality, and integrating technology-driven solutions. Leading banks have implemented comprehensive EX programs that empower employees through career development, recognition, and well-being initiatives. Flexible work environments, enhanced communications tools, and secure whistleblowing policies are becoming standard practice. There is also a strong emphasis on gender diversity, with banks increasing female representation and supporting employees with disabilities. Continuous feedback mechanisms, such as engagement surveys, are used to refine employee-centric strategies, ensuring alignment with evolving expectations.

Initiatives to provide training and career development opportunities reflect a broader trend toward nurturing local talent in line with national objectives like Saudi Vision 2030. These efforts aim to create workplaces that prioritize employee satisfaction, well-being, and inclusivity while fostering innovation and growth.

Ongoing digital transformation is another important trend shaping EX in the ME banking sector. Smart onboarding processes, contactless payment solutions, and digital credit cards are decreasing administrative burden and increasing staff productivity and job satisfaction. More digital transactions result in less manual work, help avoid repetitive tasks, and can allow employees to concentrate on more significant duties.

For millennial and Gen Z employees, a good work-life balance is nonnegotiable, so hybrid work models with high flexibility are a key incentive. Similarly, professional development opportunities are a key driver of staff retention. Continuous learning, particularly in new technologies like generative AI, keeps employees motivated in their roles and confident about their career prospects.

Case study: National Bank of Kuwait

NBK has effectively merged digital banking with traditional services, serving both conventional and Islamic financial markets. Its focus on digital transformation, combined with a customer-centric approach, led to high adoption rates of its mobile banking app, boosting overall customer satisfaction. A key contributor is NBK’s digital bank, Weyay, which has been instrumental in retaining customers and expanding market share among younger demographics. NBK’s commitment to employee development through targeted training and educational programs results in a skilled workforce that drives the bank’s success.

THE MIDDLE EAST VS. ASIA & GLOBAL BANKS

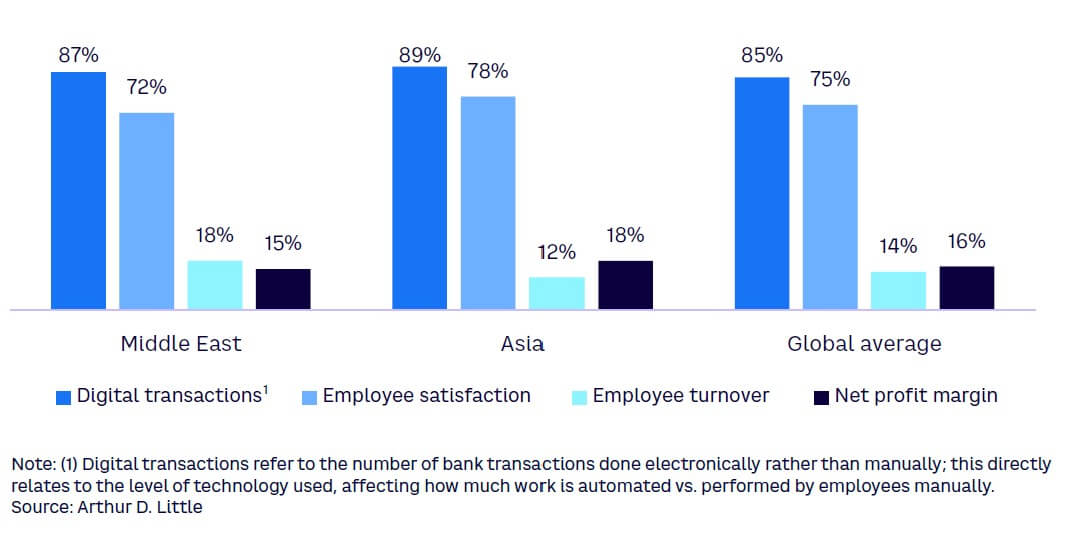

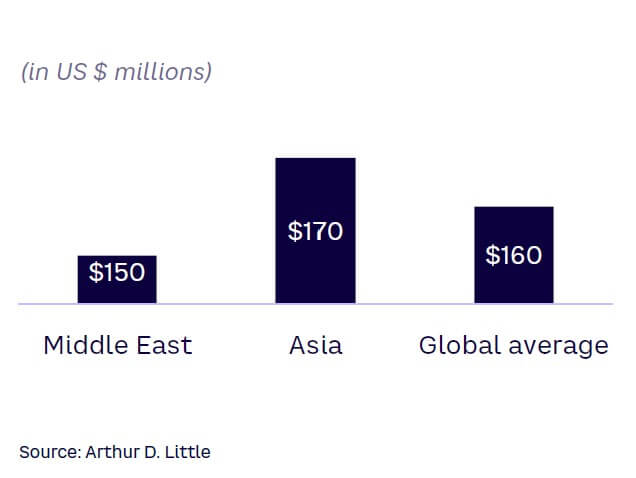

In many respects, ME banks are comparable with those in Asia. For instance, 87% of transactions are conducted digitally in the Middle East, a similar percentage to Asian banks. However, when it comes to HR practices and employee satisfaction, Asian banks, especially in Singapore and Malaysia, perform better, with ME banks more aligned with global averages than with top performers (see Figure 1). For example, DBS Bank in Singapore is partnering with Amazon Web Services (AWS) to train employees in the core concepts of AI/machine learning (ML), significantly enhancing employee development and engagement.

As highlighted in Figure 1, there are notable differences in employee satisfaction and performance between ME and Asian banks. ME banks generally experience higher employee turnover rates and lower engagement levels compared to those in Asia. These differences are due to management practices, organizational culture, and economic factors.

BEST PRACTICES FOR ENHANCED EX

Arthur D. Little (ADL) has identified several key practices that can help ME banks foster employee engagement and drive long-term success:

- Onboarding is a critical first step and shapes an individual’s connection to a bank’s culture.

- Continuous learning and development improve retention and performance.

- Well-being programs are proven to promote a strong sense of belonging.

- Recognizing employee contributions maximizes engagement and aligns organizational purpose with employee values.

Effective onboarding is critical to help new hires integrate quickly and ensure that they feel well-supported and engaged. To achieve this, banks are increasingly using data-driven, personalized programs that can last several months. For example, Emirates NBD’s onboarding process includes mentorship and interactive digital modules.

Continuous learning and development, along with clear career-progression opportunities, are also essential for a successful employee experience. Banks that invest in upskilling their workforce and offer well-defined career pathways (see Figure 2) tend to have higher retention rates and improved performance. To achieve this, individuals are provided greater role mobility and offered multiple career paths tailored to their needs, including digital skills training to keep pace with technological advancements. The National Bank of Kuwait (NBK), for instance, offers an e-learning platform that lets employees take courses at their own pace to enhance their skills and career prospects.

Addressing employee well-being holistically is equally important. Comprehensive packages, including mental health support, flexible working hours, and wellness programs enhance job satisfaction, prevent burnout, and reduce staff turnover. Mashreq Bank’s wellness program, for example, helps staff maintain a healthy work-life balance by offering flexible hours, access to mental health professionals, and fitness programs.

Creating a supportive work environment also means promoting diversity and inclusion. Abu Dhabi Commercial Bank (ADCB) fosters a culture of respect and belonging through initiatives that emphasize gender equality, cultural inclusivity, and support for employees with disabilities.

Recognizing and rewarding employee contributions is crucial for maintaining a high degree of engagement. Bank Muscat reinforces a culture of appreciation and motivation through an employee recognition program that celebrates achievements with awards and public acknowledgment.

Aligning organizational purpose and culture is essential for driving employee engagement and long-term success. For instance, Emirates Islamic Bank drives employee engagement by articulating a clear, inspiring purpose that resonates with employees and guides their actions.

EX METRICS & KPIs

Surveys measuring job satisfaction, alignment with company values, and morale are essential to understanding EX. For instance, staff turnover rates highlight areas that need retention improvement: high turnover usually signals underlying issues. Tracking participation in professional development programs shows whether employees are upskilling in ways that benefit both them and the organization. Digital adoption rates indicate the success of digital transformation efforts, with lower rates suggesting a need for further training. Well-being scores offer a snapshot of employee happiness, mental health, and work-life balance, helping organizations create a more positive and productive work environment.

Case study: Emirates NBD

Emirates NBD’s robust digital platform integrates HR functions like recruitment, onboarding, performance management, and learning and development. By leveraging AI and ML, Emirates NBD personalizes its EX with tailored learning paths and career development opportunities. The bank also promotes a healthy work-life balance through comprehensive wellness programs, including mental health support, fitness challenges, and flexible working arrangements.

REGULATORY & CULTURAL CONSIDERATIONS

To develop EX strategies, ME banks need to navigate the region’s complex regulatory and cultural environment. For example, flexible work arrangements must comply with local labor laws and align with cultural preferences. EX initiatives must also be inclusive, reflecting and respecting the region’s diverse cultural backgrounds. Balancing these factors is essential to creating a supportive and effective work environment.

NEAR-FUTURE TRENDS

Several trends are set to shape the future of EX in ME banks:

- AI and automation will be central to transforming EX, including personalized learning programs and predictive analytics. A bank could use AI to tailor career development paths, recommending specific upskilling courses or mentorship opportunities. However, to succeed, banks must create human-AI hybrid models that enhance both employee and customer experiences. This will require a shift in job designs — for example, AI might handle routine, allowing employees to focus on higher-level problem-solving. Organizational investment will be crucial to finding a balance between AI efficiency and human strengths.

- Sustainability is becoming a business imperative, and banks are increasingly integrating environmental, social, and governance (ESG) principles into their EX strategies. For example, some banks offer employees paid time off for volunteering in sustainability initiatives or create internal “green teams” that focus on the organization’s ESG goals. Promoting a culture of sustainability helps attract and retain environmentally conscious employees and engages staff by giving them purpose-driven work.

- As demand for enhanced digital experiences grows, especially among young, tech-savvy employees, banks must invest in cutting-edge digital tools. These could include user-friendly, mobile-first HR portals for managing tasks like leave requests or offering immersive onboarding experiences through virtual reality. Advanced collaboration tools and AI-powered chatbots can streamline internal communications, and digital learning platforms let employees upskill at their own pace. These investments ensure that the bank’s technological infrastructure supports a modern, engaging, flexible experience.

By embracing these trends, ME banks can build an EX that meets the evolving needs of their employees and drives innovation, sustainability, and growth.

TECHNOLOGY ENABLERS

To provide a superior EX that attracts, engages, and retains talent, banks must develop a flexible architecture that can adapt to changing expectations and facilitate seamless system integration. The goal is to create a unified user experience and efficient data flow by connecting disparate systems through application programming interfaces (APIs) and integration solutions.

Banks should leverage key technology components, such as an HR information system to manage employee data, payroll, benefits, and compliance. Engagement platforms are essential for measuring and enhancing engagement through surveys, feedback, and recognition. Additionally, banks must implement collaboration and communications tools, especially in remote and hybrid work environments, to support effective teamwork and communication.

A learning management system is vital for managing employee training and development, and performance management systems are essential for tracking performance, setting goals, and providing feedback. Wellness and mental health platforms support employee well-being, which is increasingly prioritized in today’s workplace. Employee self-service portals let employees independently manage their personal information and easily access benefits information.

Workforce analytics tools offer insights that can inform HR decision-making. Talent acquisition platforms streamline the hiring process, from job posting to onboarding.

Remote work tools keep employees productive, and recognition systems reward their achievements. Knowledge management systems capture and dispense organizational knowledge, so employees never feel they must “reinvent the wheel.”

When selecting solutions, banks should prioritize an intuitive user experience to encourage widespread adoption, scalability to support growth, and robust security to protect data and ensure regulatory compliance. Customization is essential to meeting the bank’s unique needs.

Case study: Alinma Bank

Alinma Bank focuses on empowering employees by fostering innovation, personal development, and professional growth through mentorship and leadership opportunities. The bank promotes a collaborative workplace culture, values diversity, and prioritizes gender inclusivity, including 22% female representation as of 2023. Alinma invests in employee well-being through medical services, financial well-being programs, and health initiatives. With an emphasis on recognition and rewards, the bank strongly supports its workforce’s achievements and growth. The bank plans to further enhance employee engagement, professional development, and social engagement as it strives to become the employer of choice among Kingdom of Saudi Arabia banks by 2025.

RECOMMENDATIONS FOR ME BANKS

To elevate EX and maintain a competitive edge, ME banks must adopt a bold, forward-thinking approach to enhancing employee satisfaction and performance. Below are six proven strategies that have worked in a variety of settings across multiple countries, including Nordic financial institutions:

- Strategic alignment. The workplace culture must align with the company’s overall strategy, mission, and vision. These might be based on several items such as ESG objectives or Vision 2030 (for Kingdom of Saudi Arabia banks).

- People-centric. Employee engagement and empowerment should be a central theme, with leaders focusing on creating an environment that prioritizes the well-being, engagement, and productivity of all employees.

- Holistic workplace. In addition to a safe, comfortable physical space, leaders should consider digital and psychosocial aspects when designing a workplace strategy.

- Continuity. The company’s EX strategy should be subject to frequent updates and follow-up activities. This includes gathering employee feedback about their daily experiences and areas for improvement. This helps leaders understand workers’ needs and make good decisions about improvements.

- Authenticity. Leaders must be genuine and transparent, earning workers’ trust as they build a positive work culture.

- Change management. Change management is essential to ensuring smooth transitions to new processes and improving adaptability, efficiency, and morale in the workplace.

Conclusion

NEXT STEPS FOR ENHANCED EX

An enhanced EX isn’t just a strategic priority. In a rapidly evolving workforce marketplace, it’s a must-have for banks in the Middle East that want to remain competitive and drive innovation:

- By embracing digital transformation and integrating advanced technologies, banks can streamline workflows, reduce employee stress, and create a more efficient work environment.

- Offering continuous learning opportunities and clear career paths can significantly boost employee satisfaction and engagement, making the workforce more dynamic and motivated.

- Equally important are well-being initiatives, such as flexible work arrangements and mental health support, which help cultivate a healthier, more productive workforce.

- Promoting workforce diversity and inclusion, with a focus on gender equality, cultural inclusivity, and support for differently abled employees, helps ensure that all staff function well and contribute their best work.

- A clearly articulated purpose that embodies an organization’s principles, priorities, and culture will inspire loyalty and foster a sense of belonging. Engaging employees in ESG, in particular, is no longer optional.