DOWNLOAD

DATE

Contact

The Metaverse is a megatrend, presenting both a challenge and an opportunity for the telco industry. While some have dismissed it as a passing fad, we believe the Metaverse: (1) necessitates structural changes to the telecom industry on an infrastructure level and (2) offers valuable economic and strategic benefits for those telcos that actively participate in it. This Viewpoint explores the multifold benefits for telcos, from leveraging infrastructure to building new business models to capturing downstream value through active participation in the Metaverse as a “single point of service.”

THE METAVERSE: MORE THAN JUST INFRASTRUCTURE

The Metaverse means more than just infrastructure for telcos. While it heralds structural changes for infrastructure that must be addressed, it also offers economic and strategic benefits for those telcos that actively participate in it. Speed is imperative in capturing this opportunity, and telcos must learn from the past to adopt carefully calibrated downstream monetization models to avoid investing in infrastructure solely to derive commodity (data) revenues.

Three related forces drive the imperative for telcos to be proactive in their Metaverse strategies and tactics. First, the demand is likely to be too large to ignore. While early estimates of the size of the Metaverse opportunity range enormously from US $750 million to $13 trillion by 2030 depending on different assumptions and definitions of what is and is not included, it seems clear that the Metaverse represents a major new market for telcos. For example, Ericsson estimates the opportunity presented by 5G fixed wireless access at $5 billion in 2022, growing to $21 billion in 2025 and $53 billion by 2030.

Second, the risk of failure or non-participation could be existential: hyperscalers such as Amazon Web Services (AWS) and Microsoft Azure will be close on the heels of those telco players that fail to guarantee the infrastructure the Metaverse necessitates. Both local and global players will need to continuously develop new use cases to build and launch novel services for the Metaverse market.

Third, consumer behavior, particularly from Gen Z, shows that demand for Metaverse products is already well into the mainstream. For example, according to a recent study by Obsess, 75% of Gen Z virtual shoppers have already purchased a digital product within a video game. To connect with this generation of consumers, telcos must invest in Metaverse offerings and capabilities.

Given these three factors, telcos should explore how they can benefit from the Metaverse’s rise, both with infrastructure and through direct participation. By engaging effectively with this new market, benefits for telcos include growth from increased revenues and retention and new efficiency gains along multiple axes, including carbon usage and workforce outsourcing.

A MULTIBILLION-DOLLAR OPPORTUNITY

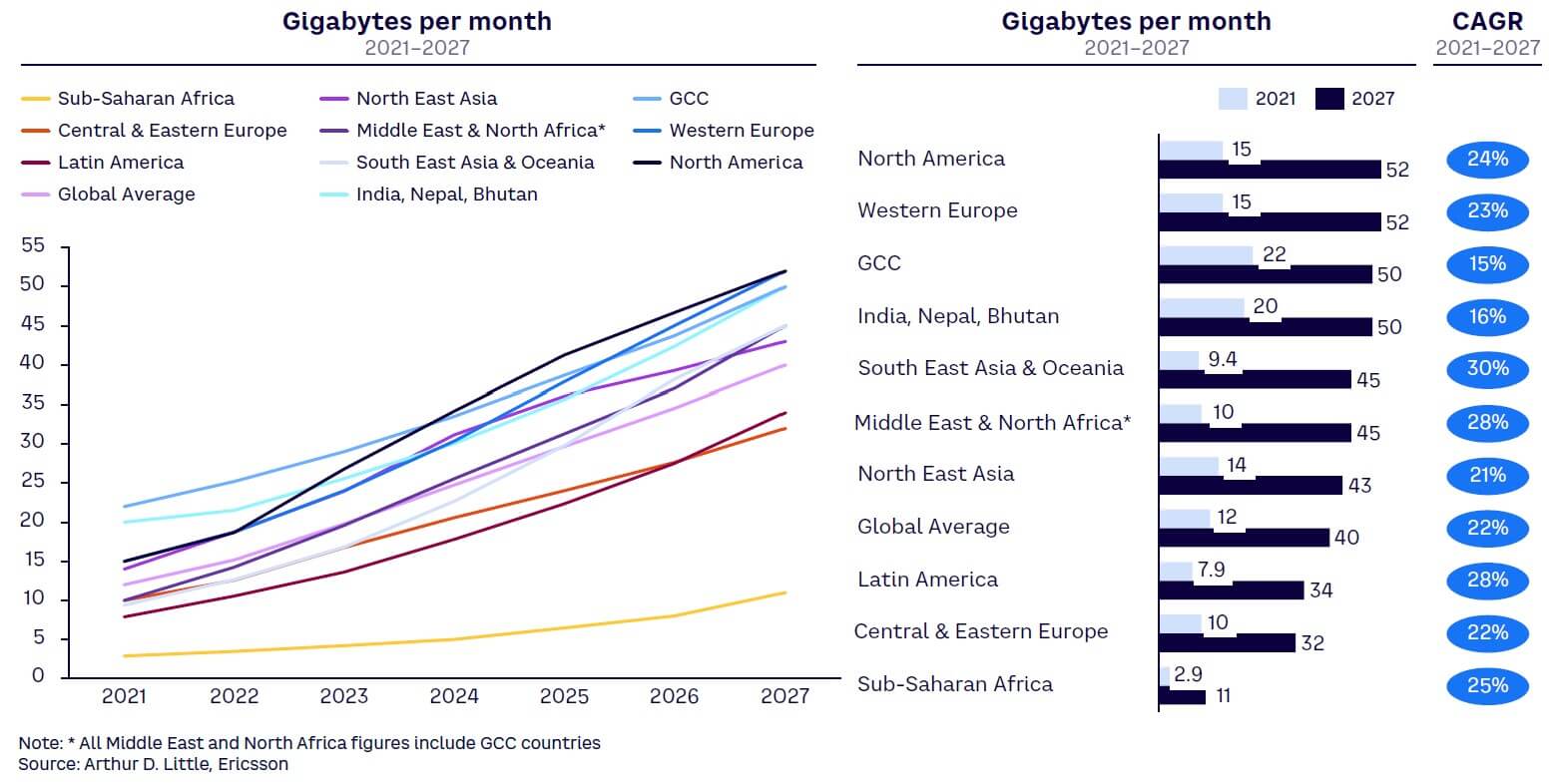

The Metaverse will see demand for data, and thus revenues, increase rapidly (see Figure 1). Depending on quality, the average virtual reality (VR) Metaverse user requires five to 40 times more bitrate than it takes to stream an HD video. In addition to the challenge of ultra-low-latency requirements, global network infrastructure requires overhauling to bring the Metaverse into consumers’ homes. Telcos are already spending heavily on such initiatives, and mobile carriers may be expected to invest as much as $720 billion globally on network upgrades between 2022–2025, according to GSMA Intelligence, of which $527 billion will be spent on 5G networks. Meanwhile, Arthur D. Little (ADL) estimates that $88 billion will be spent on fiber upgrades in the European Union alone from 2022–2030. Note that these estimated investments offer only a snapshot of a dynamic environment and do not consider every possible use case.

ADL estimates the total addressable market will grow at a 33% CAGR from 2022–2025 (excluding infrastructure and enabling technologies). 5G fixed wireless alone is expected to grow at a CAGR of 34% from 2022–2025, per analysis by Ericsson. While estimates by analysts vary due to differing definitions of what constitutes the Metaverse and the nascent nature of the market, the consensus holds that the opportunity is enormous and growing.

Beyond data-attributable revenues, according to Ericsson, proactive telcos could earn more than $130 billion cumulatively in direct revenues from 5G-enabled digital services and use cases globally over the decade. Though some might see this as high-risk and peripheral to telcos’ core business, we anticipate that the most innovative firms will find ways to tap this market via joint ventures, partnerships, and, in some cases, independent development of products and services.

To support an immersive Metaverse experience of the quality currently envisaged, telcos must make a major shift in their capabilities to deliver latency reduction, symmetrical bandwidth advancement, and overall network-speed acceleration. Local compute, ultra-low-latency communications and cloud computing will be key to achieving this.

METAVERSE REQUIRES ENABLING TECHNOLOGIES

Telcos will need to develop key enabling technologies — from infrastructure to artificial intelligence (AI) and analytics — to fully participate in the Metaverse, including the following.

Local compute for a truly immersive experience

The Metaverse aims to allow users to become fully immersed in a virtual world. If the Metaverse is to become fully participatory, it will require simultaneous audiovisual information flows between large numbers of users and the virtual world at any one time. Such an immersive experience requires significant local compute. Local compute will require an improvement in performance by orders of magnitude. The Metaverse will require computational efficiency 1,000 times greater than what is typically provided today, with edge data centers at almost every node of a telco’s network. The Metaverse will require not only vast amounts of computing power but also real-time rendering and AI computing capabilities.

Ultra-low-latency communications for a lag-free experience

The Metaverse requires complete, instantaneous, and multilateral information flows between users. New, low-latency (one to five milliseconds), near-instantaneous communications methods will need to be developed to enable a realistic, lag-free experience that allows users to fully engage in the Metaverse. Beyond this, 5G ultra-low-latency communications will be required to support true immersion. As we have seen with Meta struggling to deploy certain use cases due to inadequately low latency, this presents a major challenge.

Networks, including their Internet backbones, will require significantly increased throughput to handle new data streams. This can be achieved not only through multi-gigabit networks delivered by fiber and 5G, but also 5G “slicing” and innovative technologies that optimize for latency.

Enhanced cloud computing for interactions on a mass scale

The Metaverse will continue to exist and develop internally as users sign in and sign out. This may even extend to the real world — think Pokémon Go. Cloud compute server farms will need to ensure the world is always “on.” Currently, multiplayer online games have populations limited to the hundreds as a maximum and hence are still manageable. The performance of cloud computing needs to improve by orders of magnitude to enable a truly global Metaverse. To achieve this, telcos must invest in persistent cloud compute capacity, along with persistent data transfer.

Analytics & AI capabilities to facilitate telcos’ activities

As the functional area of analytics and AI converges with the Metaverse, telcos will also need to pay attention to identity, billing, and transaction management. In addition to a concern for customer data management and ownership in the Metaverse, it will also demand safe transactions (payments). Telcos will likely play an important part beyond infrastructure enablement in creating new avenues for revenues and monetization, supported by the creation of an analytics and AI layer to support both data management and the payments capabilities required.

Privacy & trust infrastructure to tame the regulatory “Wild West”

Given telcos’ positioning as a “trusted party” guaranteeing privacy, identity authentication, and data management outside of the Metaverse, this will likely become another important aspect of telcos’ role in the Metaverse as virtual worlds become more sophisticated.

PARTNERSHIPS & “GOING IT ALONE”: POSSIBILITIES FOR TELCOS

Navigating hype and opportunity, telcos have charted varying courses in exploiting the Metaverse’s potential. While infrastructure provisioning is a clear opportunity, some telcos have explored and exploited the more innovative, and risky, layers of the Metaverse stack (see Figure 2 , adapted from “The Metaverse: Beyond fantasy”), as we explore in this Viewpoint. It remains to be seen how telco participation will evolve, but in such a dynamic area, further use cases are likely to arise.

Infrastructure

Why is infrastructure relevant for telcos?

The primary layer of telco participation within the Metaverse will be infrastructure. The provisioning and improvement of bandwidth, latency, local compute, and cloud compute already sit within telcos’ competency, and they are likely to exploit the growth of this area. The challenge will be the increasing importance to consumers of bandwidth and latency with the rise of the Metaverse, as well as telcos’ ability to respond to this demand rapidly with high-bandwidth, low-latency infrastructure. They must also prepare for the threat hyperscalers (e.g., Amazon and SpaceX) pose if telcos do not act quickly and effectively. The availability of 3GPP releases 17 and 18, respectively, should also continue the evolution of the 5G standards supporting the case for telcos reacting quickly to invest.

Case studies: What are others doing?

Developing a potentially innovative business model, Verizon partnered with Meta to develop advanced Metaverse capabilities on its 5G fixed and mobile connectivity. The venture will see VR and augmented reality (AR) apps developed by Meta and delivered by Verizon, and will likely be tied to a connectivity subscription model, with a potential revenue share model incorporated as well.

What could others do in the future?

Partnerships and close working relationships between telcos and over-the-top (OTT) content providers and hyperscale cloud platform players will be key to success. The Metaverse will require significant investment in infrastructure, presenting two critical problems:

- Telcos will not be able to manage that investment on their own.

- If they attempt to carry out such investment alone, they could not generate adequate returns on their investment (unless this can be leveraged to capture further layers of the Metaverse).

Telcos should therefore actively engage OTTs and other companies to encourage coinvestment in infrastructure. As the providers of essential infrastructure to the Metaverse, telcos have leverage in negotiating such relationships.

What do telcos need to consider before entering this space?

The importance of the infrastructure layer raises the question of how telcos can leverage their critical role to generate revenues. Following the traditional B2C model of data sales, we expect revenues to pick up with Metaverse users’ increased demand for data. The Metaverse also gives rise to the possibility of business model innovations. One route for telcos to consider is through partnerships with the downstream players that rely heavily on high-quality infrastructure to enable their services. We believe both B2B2x and downstream revenue-sharing agreements will feature heavily in the future. Telcos may also find an opportunity in offering infrastructure-based wholesale services to other Metaverse players. Products could include pricing quality of service (e.g., via 5G slicing) and demand services to ensure bandwidth, latency, and reliability for high-volume customers.

World engine

Why is the world engine relevant for telcos?

As the software layer generating the Metaverse’s digital simulation, we anticipate global oligopolies such as Meta, Google, and Baidu will lead development. Despite this primary trend, space exists for local telcos like SK Telecom to leverage their large existing customer bases and strong brands to build local Metaverse platforms alone or in partnership. Such partnerships may see telcos leverage the software engineering expertise of third-party firms, and agreements could involve other layers of the Metaverse framework, for instance by guaranteeing partner Metaverses bandwidth via 5G slicing.

Case studies: What are others doing?

South Korean operator SK Telecom has become an early Metaverse player in the world engine layer through its dedicated subsidiary, Ifland. SK channels its existing customer case to its Metaverse platform with digital products, including virtual real estate and intellectual property, in the form of music and video experiences. SK has taken the long view on partnerships, too, opening its platform to B2B collaboration, with initial success in the education sector.

What could others do in the future?

We observe two primary revenue stream potentials from the world engine for telcos:

- Developing and selling required middleware technology.

- Acting as distributors.

The first opportunity requires deep expertise and capabilities that other firms, such as Big Tech, are better placed to provide, and is not an approach well suited to telcos. However, there may be potential in telcos’ role as distributors. The Metaverse and purchasable products within it will be highly complex and multifold. If telcos can act as “bundlers” when selling data packages, they could develop a single point of service offering for users’ Metaverse experiences. Telcos will face significant competition in attempting to secure this unifying role, but the winner in this space stands to profit significantly.

What do telcos need to consider before entering this space?

We recommend that telcos act to find the right world engine partners for distribution. In this diverse ecosystem, telcos should establish multiple partnerships to become the point of call for users looking to purchase a Metaverse “package.”

Extended reality

Why is XR relevant for telcos?

We view extended reality (XR) to be the least relevant layer in the Metaverse for telcos. While crucial to the Metaverse itself, this segment will require significant capital expenditure blended with deep expertise that telcos do not typically have. Better-positioned industries such as gaming, Big Tech, and start-up disruptors are poised to win this space, and any telco participation will be achieved via partnerships.

Case studies: What are others doing?

Turkcell, Turkey’s leading mobile provider, announced the establishment of a virtual Metaverse store offering both physical and virtual products, leveraging the experience continuum. It will allow customers to experience products by engaging in the Metaverse. Furthermore, the company has started to develop platform capabilities that extend into internal processes. Sitting within the Experience Continuum layer, Turkcell is exploring offering job postings, recruitment, and orientation in a virtual environment. The company hopes to improve user experience, and thus satisfaction, with these critical functions. The firm also aims to hold technology summits on the Metaverse.

What could others do in the future?

While the role of telcos in this segment is limited, we foresee two possible revenue streams:

- In-house middleware production. To succeed in the mass market, telcos would need deep computer and software development capabilities, making this a less attractive option.

- Distribution. As with the world engine, there is opportunity for telcos to act as a single point of purchase. That said, chances of success depend on a fractured Metaverse device market, as if there is one universal device to enter the Metaverse, the usefulness to consumers of telcos acting as “unifiers” would diminish.

What do telcos need to consider before entering this space?

To be successful in middleware production, telcos would need not only to reach a mass market but also accumulate needed computer/software skills. Telcos currently do not possess such skills, so we do not recommend this route to capture value.

Distribution is a far more attractive option, however. Telcos can leverage their expertise and intimate understanding of their customers to allow them to better sell products and outcompete other players. Telcos should also consider whether to exclusively sell the products of a single manufacturer or offer a wider range of products. There will be space for differentiation via exclusivity agreements, where telcos can build their positioning.

Human-machine interfaces

Why are HMIs relevant for telcos?

Human-machine interfaces (HMIs) and devices will largely be provided by global giants such as Oculus (Meta) and HoloLens (Microsoft), alongside local players responding to niche cases. While not a core segment for telcos, this is still an important space for differentiation. Forward-thinking telcos can bundle Metaverse-enabling software and hardware into existing mobile and fiber packages. Such moves will help to recruit new Metaverse users and lock in those existing participants, helping to drive recurring revenues beyond traditional hardware/handset revenues.

Case studies: What are others doing?

Vodafone has developed a proprietary Metaverse, Vodafone 5G Reality, and is partnering with Nreal to deliver an immersive consumer experience with the help of its AR-enabling Nreal Light glasses. The platform, facilitated by Vodafone’s 5G infrastructure, will enable content generation and social functionality. Users will need to download Vodafone’s proprietary app, Nebula, to participate in this environment and can purchase Nreal Light glasses to enhance the AR experience. Vodafone is expected to monetize the deal via a subscription model for connectivity, via royalties on transactions that take place on its platform, and potentially through its partnership with Nreal.

What could others do in the future?

The most realistic option for telcos in this layer of the Metaverse is distribution. This can take two different forms:

- Partnerships with manufacturers. Fabricators of mass-market devices such as sensors, computing devices, and wearables will require distribution channels with excellent customer feedback loops. Telcos are well positioned to facilitate this through their intimate understanding of their customers and high levels of consumer trust. As such, we expect telcos to forge close relationships with manufacturers to sell to their customers. In so doing, telcos could capture substantial value.

- Unaligned distributors. Telcos could seek to sell wearables without establishing agreements with manufacturers. We do not anticipate this being a major channel for manufacturers of HMIs, and as such the telcos’ bargaining power, and margins, would likely be of minor significance.

What do telcos need to consider before entering this space?

There are two aspects telcos should focus on:

- Finding the right manufacturers to partner with to position themselves as the primary channel for sales of certain HMIs. Making use of customer experience, trust, and proximity are crucial to achieving this.

- Bringing in exclusivity and utilizing customer information will shift the balance of power toward telcos.

Experience continuum: A fragmented market to leverage brand and customer bases

Metaverse evangelists hypothesize a decentralized experience continuum composed of independent and corporate creators alike. In the most fragmented layer, we break the experience continuum into three categories (see Figure 3).

Why is the experience continuum relevant for telcos?

Owing to their strong brands and broad customer bases, telcos have much to win within these segments. Global and local players will succeed in this space based on positioning, go-to-market definition, and customer experience. While content will likely continue to be developed by global oligopolies, including film studios, streaming giants, and broadcasters, there exists opportunity for different-sized companies from multiple industries, including telcos.

Case studies: What are others doing?

Africa’s largest mobile network operator, MTN, is aiming to position itself as a technology player under its “Ambition 2025” strategy, leveraging opportunities from digital trends in African markets. MTN has purchased 144 plots of digital land in the Africarare Metaverse Ubuntuland, looking to build its presence in the experience continuum. The land will be used to demonstrate the best of African art, fashion, sports, and tech.

What could others do in the future?

The experience continuum segment holds great potential for telcos. Potential revenue stems from three main sources:

- Launching existing partner products into the Metaverse utilizing existing products and technology, such as live performances or exhibitions, virtual tourism, or selling digital assets.

- Developing new apps and use cases from the ground up. Telcos may play a partnership role in driving and enabling content creators to benefit from the Metaverse’s network effect. Examples include the likes of T-Mobile’s partnership with Disney Studios, although it remains to be seen how and if telcos will form relationships with the broader community of independent creators that we expect in the Metaverse.

- Extending sales channels for existing products. Though currently vanishingly small, telcos increasingly will need to participate directly in the experience continuum via virtual storefronts. Regardless of the Metaverse’s scale at its end state, its users will expect the services delivered in-store and online by telcos to transition to the Metaverse.

What do telcos need to consider before entering this space?

In an industry where trust and loyalty play a significant role, telcos must leverage their strong customer brand and trust. Rewriting and selling products they already have in their product line could act as a good starting point and may shift toward new partnerships in which new content is created. Winners can expect loyal, data-intensive customers.

Key enablers

Why are key enablers relevant for telcos?

As a cross-cutting segment, telcos can play a role in financing, and potentially developing, the infrastructure stack’s enabling technology. Though many of the innovations necessary to deliver low-latency, high-bandwidth connections are already present, incremental innovation upon these will still be possible, discoverable, and deliverable via R&D functions.

In an industry with many new players, telcos can also wield the advantage of their strong brands and elevated levels of consumer trust. Opportunity exists for telcos to develop and/or partner to deliver applications such as payment, identity verification, and customer data management in the Metaverse. Particularly pressing in an ecosystem with multiple Metaverses and the potential for poor governance of bad actors across decentralized platforms, telcos can play a key role in enhancing the security layer and providing single sign-on services. Standards for interoperability between the Metaverses will be important, and the new announcement of the Metaverse working group (Metaverse Standards Forum) would make the companies’ nascent digital worlds compatible with each other.

Case studies: What are others doing?

Telefónica, via innovation and accelerator hub Wayra, announced a partnership deal with Meta to launch a “Metaverse Innovation Hub” in Madrid. The program will largely target the infrastructure, key enabler, and experience continuum layers. The partnership includes a 5G laboratory and will serve as a platform for local start-ups and developers to utilize a Metaverse end-to-end test on Meta and Telefónica’s network infrastructure and equipment. Participants will also benefit from Telefónica’s open innovation ecosystem and Meta’s engineering support and tools. Beneficial for all parties, the program positions Telefónica as a leader in the Metaverse with its early collaborations with the potential Metaverse unicorns of tomorrow and by its follow-on investments via its corporate venture capital arm.

What could others do in the future?

Telcos have various options concerning security and authentication. A strong and secure Metaverse is essential for mass uptake, and telcos could use their expertise to deliver this, particularly as it relates to infrastructure. Enabling secure payment rails and inventive means of authentication as the “single point of service” are also options open to telcos.

All layers of the Metaverse will require advanced recommendation engines to fuel sales, offering telcos yet another opportunity. With deep customer understanding, telcos may also be able to sell or build their own recommendation engines to better design sales to consumers.

What do telcos need to consider before entering this space?

Closely interlinking with other sections, telcos must be cognizant of their limited capabilities in software development and inherent disadvantage when compared to other players. As such, partnerships will be crucial to capturing value within this segment. Telcos should act swiftly on the opportunity to gain new customers (and avoid repeating the failed attempts to capture value from 4G/5G).

Conclusion

INVEST, INNOVATE, PARTNER & RETHINK POSITIONING TO SUCCEED

Metaverse prospects may be hyped, but the current acceleration is driven by a real convergence of multiple factors — a situation telecom providers cannot afford to ignore. Regarding the Metaverse, telco executives should consider the following:

- Infrastructure. Significant investment will be required; telcos must partner with OTTs to facilitate investment and capture more value in the Metaverse market.

- World engine. Telcos should act as distributors and leverage their intimate customer understanding to sell a single point of access to the Metaverse, thereby capturing a substantial proportion of the pie.

- Extended reality. Highly dependent on the emergence of a fractured middleware market, telcos will profit most from acting as a single-point-of-access distributor due to their strong brand and consumer trust.

- Human-machine interfaces. Telcos should look to “own” customer relationships to capture margins, forging partnerships with manufacturers but acting as the primary sales channel.

- Experience continuum. Three options exist for telcos to monetize this segment: (1) launch existing partner products into the Metaverse, (2) develop new apps and use cases from the ground up, and (3) extend existing sales channels and products into the Metaverse. Telcos will need to choose wisely based on their capabilities and positioning.

- Key enablers. Telcos should look to capitalize on their hard-won consumer trust to partner with providers of Metaverse-enabling solutions.

With excellent customer understanding and trust alongside a fundamental role in enabling the Metaverse (infrastructure), telcos are well positioned to move through the value chain to capture a greater slice of the pie. To achieve this, telcos will need to: (1) find the right partners, (2) build or grow internal capabilities, (3) extend their traditional scope of business, and (4) act swiftly to not be left out.