What are oil companies going to look like in the future?

The oil industry is shifting towards NOC hegemony, peak oil is arriving from the demand side, and the energy mix is changing. Oil companies’ profiles are in constant evolution, and they are already adapting their business strategies to the forthcoming era. However, will they know how to leverage their core competences to survive and even benefit from such new challenges?

1. NOCs’ hegemony over global resources

The dynamics of the oil industry have been historically impacted by the key role and the increasing scale and influence of national oil companies (NOCs).

NOCs emerged in developing countries to monetize their access to vast oil resources, leveraged by states’ strong financial muscle and supported by national resources protection policies, self-sufficiency and supply security concerns. In many cases, said NOCs ended up becoming economy engines and foreignpolicy tools to foster strategic relationships with developed countries.

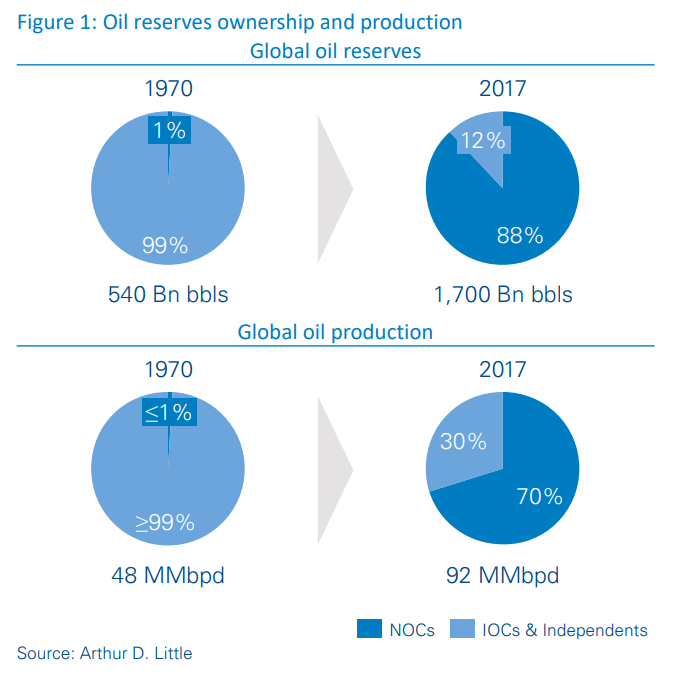

International oil companies (IOCs) have fallen from full access to reserves in the 1970s to 10–15 percent in present times, and access to large prospective resource opportunities has been an increasing challenge.

With 85–90 percent of global proven resources and around 70 percent of total production, NOCs’ expansion has affected the entire industry, which has resulted in a highly concentrated resource base, with the top-five NOCs accounting for more than half of global oil-proven reserves. Such reserves are mostly located in OPEC member countries (72 percent), with Venezuela and Saudi Arabia at the top of the list.

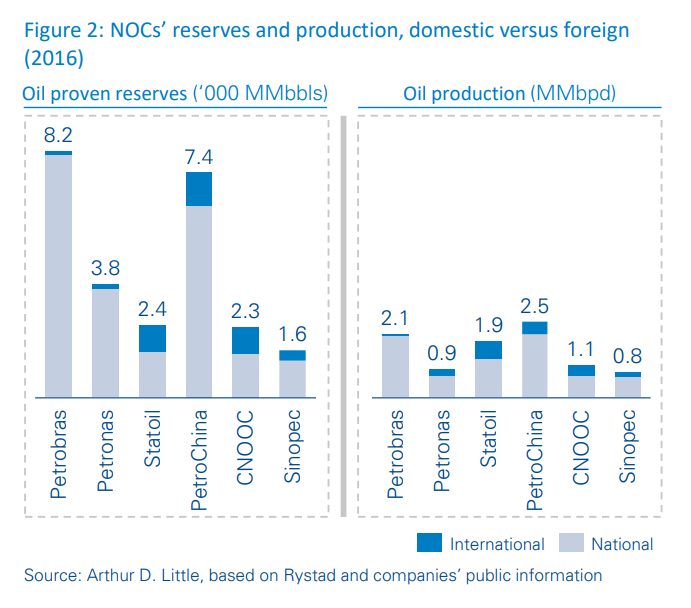

Many national oil companies have expanded their visions and stepped outside their countries, some to ensure energy security for their own nations or take advantage of their financial positions and industry know-how in developing international investments in E&P, thus becoming “international NOCs”

Several cases serve as good examples of internationalization in NOCs:

- The Norwegian company Statoil has been involved in projects in the US, LATAM, Africa and the Middle East.

- Chinese companies CNOOC and CNPC – with approximately one-third of foreign production – driven by oil-supply requirements to cover the vertiginously growing Asian demand, have been implementing overseas strategies since the early 1990s, mainly in Asia and Africa.

- Malaysian Petronas’ internationalization started in 1991 with upstream investments in Vietnam, and it is now present in more than 20 countries.

- From Latin America, Petrobras expanded internationally after the Brazilian oil-sector deregulation in 1997, and now has assets in almost 20 countries, but it has started to refocus its international scope. Colombian Ecopetrol launched its internationalization process after Colombia’s energy reform in 2001, with a more limited expansion today.