DOWNLOAD

DATE

Contact

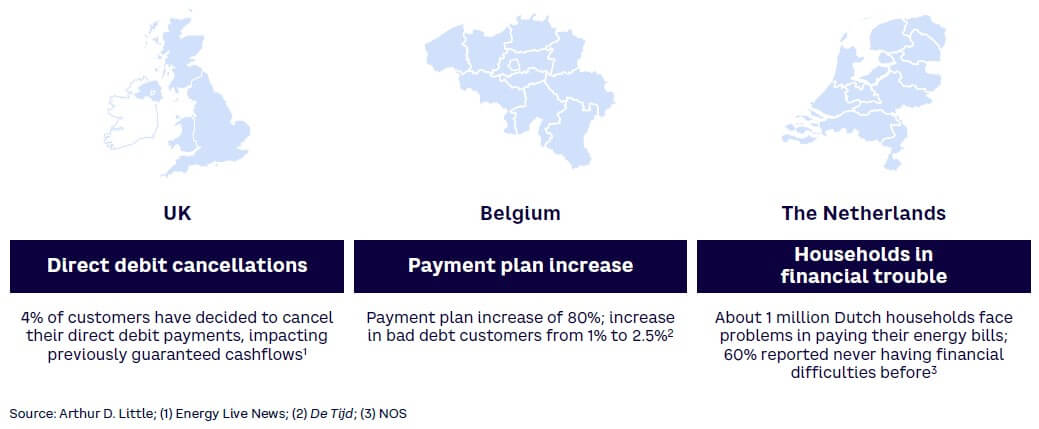

Energy retailers have been facing unfavorable market evolutions for multiple consecutive years, triggering a first wave of bankruptcies in the industry and preventing important innovations to exploit new healthy revenue streams, among which are the required investments to accelerate the energy transition. With the current energy crisis, even major players are alarmed due to skyrocketing prices and customers faulting on their energy bills.

Although the energy value chain from production to end consumers entails multiple different market parties, retailers are the main players taking the full blow, as they cannot pass through all extra costs and act as the first-line interface toward an increasingly unhappy and highly protected defaulting mass market. If countries want to maintain a healthy, long-term, liberalized energy market with room for highly needed innovation, the impact of the energy crisis should become a shared responsibility across the value chain.

SUCCESSIVE CRISES HIGHLIGHT WEAKNESSES OF RETAIL MODEL

While the COVID-19 pandemic resulted in a short-term crisis on the energy markets due to soaring global energy demand combined with impacted supply chains, the ongoing energy crisis is expected to extend over the long term and has exposed the risks of the European energy supply strategy based on cheap gas from Russia.

The phaseout of conventional supply generation assets, such as coal and nuclear, in combination with the shortage of the Russian gas supply due to the Ukraine/Russia conflict has led to record energy prices across Europe. The current consequences on the energy market are severe, and the effects of a long-term escalation will be dramatic, both for consumers and retailers.

Skyrocketing energy prices leave end consumers unable to pay their bills, resulting in an increase in bad debt and unpredictable cashflow (see Figure 1). This current situation combined with unforeseen changing demand patterns (e.g., due to a reduction in churn) leave retailers with higher portfolio imbalances that need to be settled on the spot market at very expensive prices. These additional costs cannot immediately be passed through to the end consumer due to fixed-price contracts in their portfolio and the response time required to adapt advance payments.

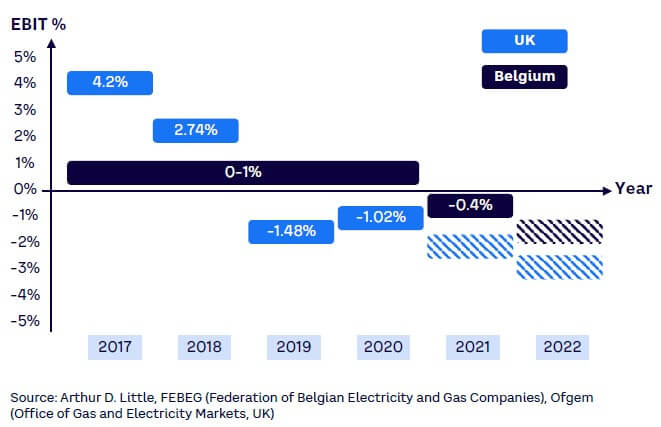

The effect of the energy crisis is being reflected in the annual statements of Belgian and other European energy suppliers with average EBIT margins close to zero — and even negative (see Figure 2). While it is often believed that energy retailers have a profitable return, these margins have been low during the last five years (and even negative for many players in 2021). The profound result has caused suppliers to fault on their core activities; for example:

- Iberdrola has informed thousands of French customers that their contract will be terminated, requesting them to look for another supplier.

- Centrica has stopped selling power and natural gas to its biggest business customers, as surging wholesale energy costs erode profit margins at the UK utility.

- Wien Energie GmbH, Austria’s largest energy supplier, has announced insolvency, requiring a €1.7 billion bailout. This is the second major Western European energy supplier in trouble, leaving 2 million customers at risk of falling without an energy supplier.

- There have been several bankruptcies across Europe; more will come as the Ukraine/Russia conflict continues, resulting in oligopoly scenarios in certain countries where only international and vertically integrated energy suppliers will survive.

NOT NEW; FUNDAMENTALS OFF FOR A WHILE

Regulatory & market model changes hamper opportunities to innovate

Although there is a critical need to reform the regulatory playing field to enable the energy transition and energy market of tomorrow, reforms have often been at the cost of retailers having to focus on safeguarding their licence to operate, limiting their capability in (1) investing in the right IT basics and (2) focusing on new product development and offerings to diversify their nonprofitable commodity offerings. Examples include increased restrictions on dunning processes in Wallonia and Brussels, major market model redesigns (e.g., MIG6), no sleeping contracts, expansion of social tariffs, and so forth.

The new MIG6 market model redesign — intended to simplify and centralize market messaging and the uptake of smart meters — actually has caused increased complexity to correctly generate energy bills toward the end consumers, driving delayed cashflow, a decrease in the net promotor score, and extra required resources to manually process bills and handle complaints. Although these market redesigns were meant to reduce overall system costs and unlock new opportunities, these changes led to higher costs and complexity for the retailers without benefiting from promised upsides, at least not yet.

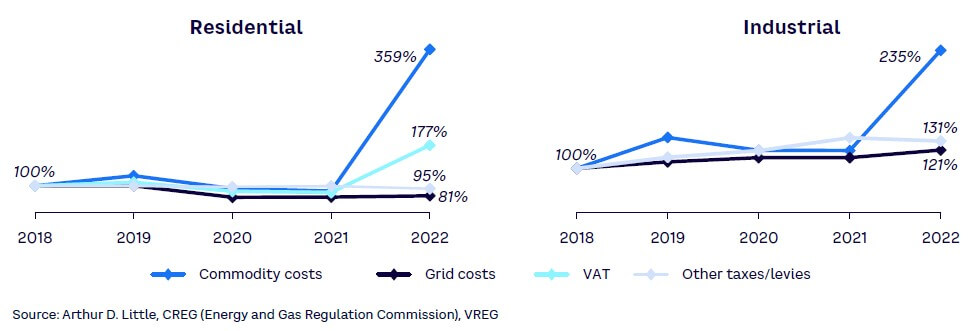

Retailers take bulk of blame

Increasing bills frequently makes headlines, often pointing at rising commodity prices. While this has certainly been the major driver for skyrocketing prices, it is worthwhile to consider other components comprising the energy bill. In the Belgian industrial segment, grid costs have been steadily increasing over the last five years, with an increase in grid costs of ~20% since 2018 (see Figure 3).

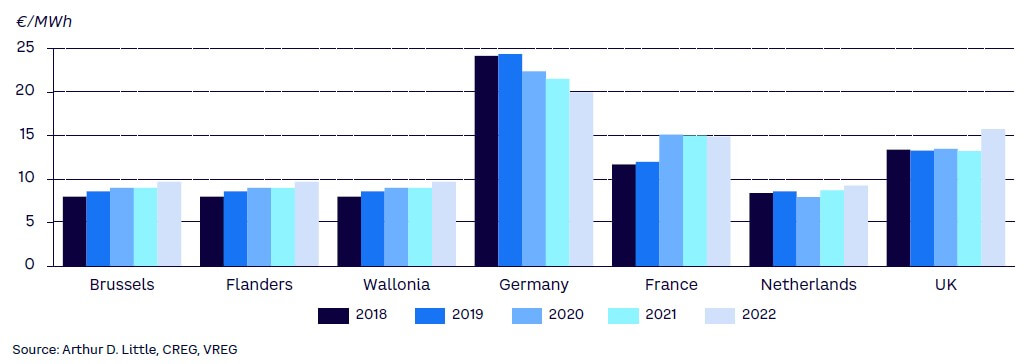

These rising grid costs are not only happening in Belgium. When comparing this to neighbouring countries, we see increasing grid costs per MWh in France, the Netherlands, and the UK over the last five years (see Figure 4). Only Germany has seen decreases due to a reduction on renewable surcharges; however, in absolute terms, the grid cost per MWh is still significantly higher than neighbouring countries and is expected to rise again in the upcoming years.

Energy crisis worsened situation

While energy retailers have been increasingly struggling, the ongoing energy crisis has significantly worsened the situation. High prices for power futures lead to limited capacity for retailers to hedge their future activities, leading to high settlement costs on the expensive spot market. Moreover, rising energy prices have caused a sharp increase in client requests and complaints via call centers, resulting in a higher cost to serve. Also in the B2B segment, clients are becoming increasingly demanding regarding energy management (e.g., lower advance payments, delay of payments).

Furthermore, unprecedented energy prices have led consumers — both residential and industrial — to lower their energy consumption. Recently, big industrials like stainless steel producer Aperam, fertilizer producer Yara, and flooring group Beaulieu have shut down parts of their facilities to lower energy consumption. This causes a temporary loss of income for the retailer as well.

HOW TO DEVELOP A SUSTAINABLE FUTURE FOR RETAILERS

Short-term actions: focus on limiting impact of energy crisis

For the energy landscape as a whole to survive, retailers should not be left alone to flounder. It’s crucial to avoid further constraints on their business model, and measures should focus on sharing the impact across all players in the ecosystem:

- There needs to be a push toward further reduction of energy taxes. Although in Belgium the VAT on electricity and gas has been temporarily decreased from 21% to 6%, the absolute amount of taxes paid is still comparable to the situation prior to the current energy crisis, due to an unprecedented high energy price. Thereby, a further temporary reduction could be considered.

- Alternatively, the surplus in the VAT collected due to high energy prices could be deployed by the government to support households, small and medium-sized enterprises (SMEs), and industrial players in a targeted way. In the UK, for example, households will receive a £400 discount on their energy bill throughout the winter months, with further support up to £1,200 for the most vulnerable householders.

- Next to the VAT, several taxes/levies comprise the energy bill (e.g., energy contributions, excises, energy fund contributions, public service charges) — see Figure 5. Belgium represented 13% of the electricity bill in August 2022, compared to only 3% in the gas bill. Federal and regional governments could consider shifting these levies from electricity to gas consumption — accelerating the electrification and thereby decreasing the reliance on imported gas — or even not charging these levies at all during the coming months.

- Government-backed loans for retailers is another avenue to consider, as they provide greater liquidity. This allows retailers to spread wholesale energy costs in the bills over a longer period of time, decreasing the energy bill in the short term, promoting green electricity, allowing for cogeneration charges, and so on.

- A similar approach could be implemented for grid costs, decreasing grid costs on energy bills in the short term and spreading what is not charged today across the next 10 years, for instance.

- Governments should begin with preparing market reforms to decouple electricity prices from gas prices. The German government, for example, has recently proposed such a reform, while Austria and Belgium are advocating for a similar market reform on a European level.

Medium-term & long-term actions: make retail business sustainable

We advise developing mechanisms over the medium and long term on a market-wide level, helping both the end consumer and the retailer, enabling them to contribute to the energy transition by investing in other areas than compliancy alone:

- Among these areas is the value creation of the smart meter data potential. Increased electrification of society along with climate targets and European/local legislation is putting high pressure on all levels of the grid while creating opportunities for existing and new market players to develop activities supporting this transition. In addition, end consumers are looking to reduce their energy bill and hoping to valorize opportunities when it comes to their energy efficiency investments, like solar PV, heat pumps, and so on. Although the opportunities for (commercial) energy market players to offer energy services are vast, there is a key barrier preventing fast innovation in Belgium, in particular: large-scale easy access to granular smart meter data. Focusing on this challenge could unlock:

- (Near)-real-time insights to end consumers to act on their energy consumption.

- Commercial market parties to develop new offerings like residential demand-side response, dynamic and personalized pricing, and more frequent invoicing based on actual consumption (avoiding “bill shock” and realizing more accurate cashflow).

- New energy allocation and tariff models that can support the rise of energy communities and peer-to-peer energy-sharing offerings.

We believe that there is an absolute need at regional levels to speed up the deployment of smart meters for every end-user segment.

- Market and regulatory reforms should not be introduced in silos; rather, they should consider overall system impact for all market parties across multiple dimensions; for example:

- Continuous integral planning of market-wide initiatives. This will balance the load for all market parties and ensure stable market operations before introducing new changes (e.g., reconsidering the timing of the capacity tariff in relation to the stable operation of the new MIG6 market model).

- Standardization on the federal level. This will avoid complex and differentiated processes across the regions. For example, the different dunning rules (from high to low complexity: Brussels, Walloon, Flanders) are creating an elevated burden on retailers for multiple reasons: (1) the complexity to terminate a contract of non-payers in Brussels not only results in a significant amount of bad debt, it leads to an almost monopoly-like landscape with retailers avoiding the supply of energy in Brussels; and (2) different and complex rules per region have resulted in significant customizations to the already complex IT systems of retailers, increasing time to market of new IT functionality and requiring extra labor to follow up on the process.

- Balanced impact. Although the end consumer should take a central role in regulatory reforms, this should not go at the cost of negative EBIT margins and the resulting bankruptcy of energy retailers. While retailers have struggled, the introduction of the “Consumentenakkoord” in Flanders (region-specific) triggered increased regulations for the protection of the customer, impacting stable revenue streams. One such example is the customer notification on the silent renewal of their contracts, triggering customers to revise their energy supplier. Squeezing regulations shouldn’t drive retailers toward bankruptcy and should go hand in hand with the rules that open up new revenue streams and innovation, lower costs, or reduce market complexity.

- Another lever for retailers to generate value is to divert away from commodity sales only and focus instead on increasing customer lifetime value by offering adjacent products and services. Given customers’ increased awareness on energy management, we can expect a further increase in the deployment of solar panels and onsite energy storage systems in the next decade, in which retailers can play a role by leveraging existing client relationships. Also, diversification toward energy management platforms and electric vehicle fleet and infrastructure services could be envisaged, as well as further development of energy-efficiency businesses, which will remain a major topic for at least the next 20 years.

Conclusion

From crisis to sustainable energy future

The COVID-19 pandemic and the ongoing energy crisis have shown the vulnerability of the energy retailer business model. Increasing energy prices are leaving consumers unable to pay their bills and are also significantly increasing retailers’ cost to serve. Support mechanisms are frequently targeted at the end consumer, thereby often hurting the retailers — whose margins have been completely eroded over the last years — even more so recently. In the short term, it is vital that all players in the ecosystem share the impact of the energy crisis and that the government provides direct or indirect support to the keep energy bills at a reasonable level. For long-term sustainability of the energy landscape, regulatory mechanisms should focus on laying out the foundation to increase collaboration and develop synergies at the market-wide level.