24 min read • Travel & transportation

Energy: New business pillar for transport infrastructure operators

How the energy transition can evolve from regulatory constraint to business opportunity

FOREWORD

“It’s not my core business” ... “I lack the right skills.”

Holding onto such beliefs would have prevented Amazon from creating its lucrative Amazon Web Services (AWS) or kept Apple from developing the smartphone. Likewise, transport infrastructure operators (TIOs) would not have diversified their business portfolio without looking beyond their initial role of developing, operating, and maintaining transportation networks and facilities. Engaging in new ventures like retail and real estate has been successful and profitable and can give rise to future endeavors to increase revenue while improving the sector’s sustainability.

Certainly, the transportation industry’s paradigm shift toward achieving net zero before 2050 poses a plausible threat to the business model of TIOs due to the potential limitation of mobility demand, driven by increasing costs of green energy or potential regulatory constraints. Despite challenges, however, opportunities exist for TIOs to increase their value proposition while monetizing their lands and assets to develop green energy production. The concept of a “green energy hub” (or “green power hub”) has been subject to public debate for years and widely discussed as part of the strategic vision of airports, ports, and rail companies. Now is the time for a breakthrough: a move from concept to concrete business actions. As we explore in this Report, TIOs have the advantage of major assets to facilitate the process of turning a regulatory constraint into a business opportunity. The case of airports is particularly convincing.

Anticipating new client needs; mastering recent technologies; innovating in operational, business, and partnership models; and transforming organization, regulation, and shareholder perspectives will be key to achieving a successful outcome. This Report illustrates the insights and elements that TIOs should examine to help them act quickly and take command of this opportunity.

We hope you find this Report inspiring — let’s accelerate on this journey together!

Mathieu Blondel

Partner, Arthur D. Little

EXECUTIVE SUMMARY

ONCE-IN-A-LIFETIME OPPORTUNITY

Today, most TIOs adhere to a three-pillar business model:

-

The first pillar is the original core business: connecting flows of vehicles, passengers, and goods, and moving them to where they need or want to be.

-

The second pillar emerged between 2000 and 2020; operators gradually grew into major retail hubs, creating significant additional revenue and profit streams by harvesting wait time of passenger clients.

-

The third pillar, real estate, grew in parallel to the second; operators exploited their strategic location and harvested their available land by making direct investments.

Over the next decade, TIOs could create a fourth pillar: energy.

Between now and 2035, the paradigm shift toward green energy will provide TIOs with a new opportunity to increase their value proposition and tap into a new profit pool. TIOs have a strong imperative for this: greening transportation to reach net zero before 2050 is their “license to operate.” In other words, they need to show they are taking serious steps to address climate change and maintain a positive public image as an industry that values and seeks sustainability. Otherwise, they and their clients might cease operation. Still, sustainability through decarbonization and clean energy is a wide and deep galaxy to navigate.

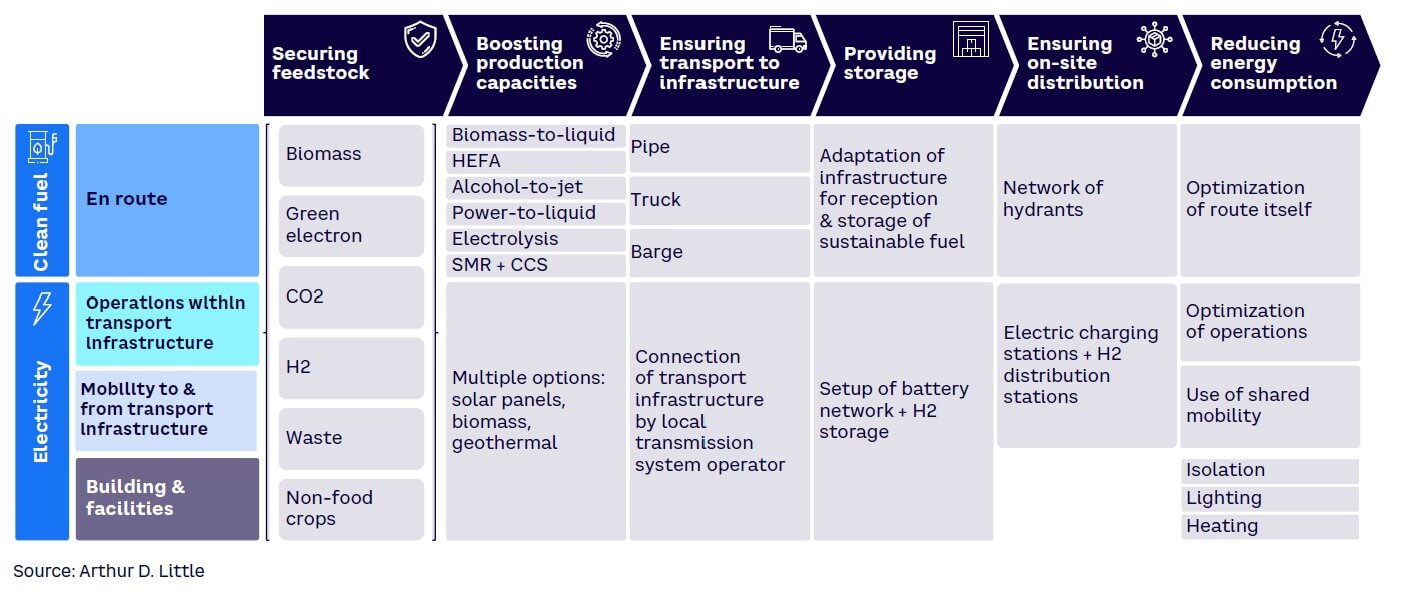

Indeed, TIOs could take charge by engaging into green energy within the domains of:

-

Buildings and facilities located on the site and in the surrounding area

-

Mobility within, to, and from the premises

-

Fostering the transition to clean energy vectors for heavy mobility, including electrification, sustainable drop-in fuels, and hydrogen (H2) for large transport equipment

In each of these three domains, TIOs can consider dozens of strategic options.Assessing each of these options requires: (1) an appraisal of its impact on net-zero ambitions (which scope? what level of avoidance or reduction of CO2e emissions?), (2) a consideration of technological and operational risks, and (3) an understanding of the relevant economics (CAPEX, OPEX, expected ROI). Finally, (4) this process also requires careful consideration of potential partners from the energy ecosystem as well as the value and risk-sharing strategy that TIOs should pursue.

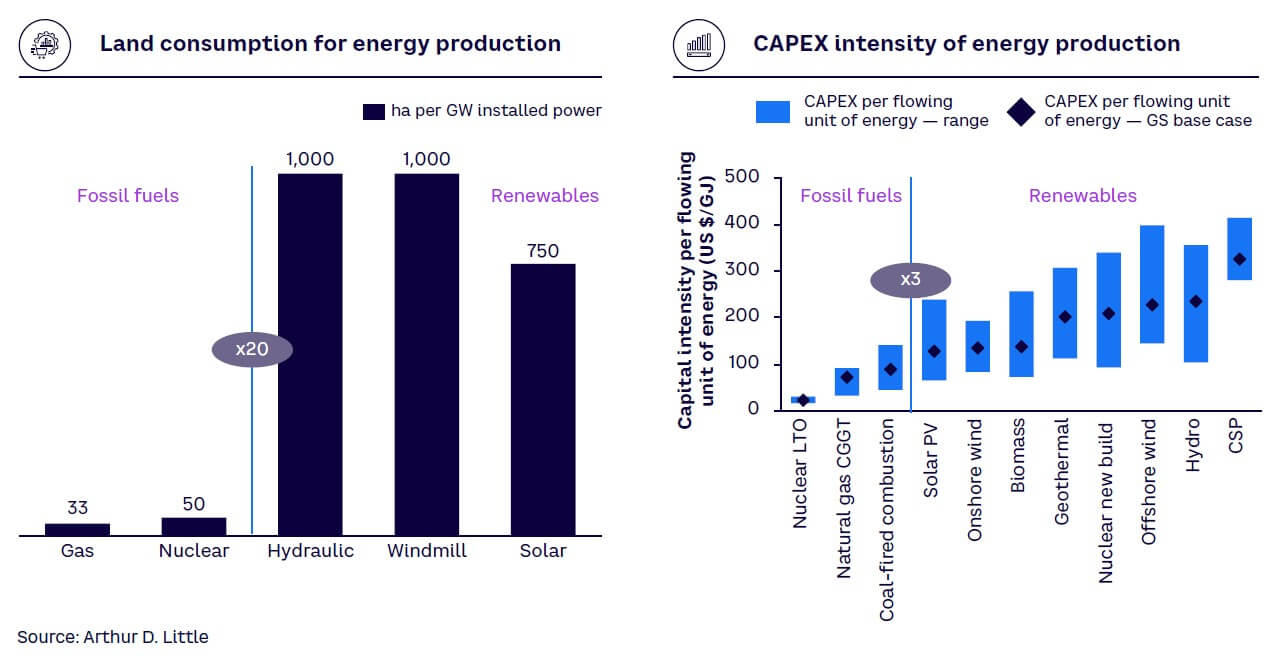

While having to face such a complex decision-making process, TIOs possess two scarce resources they can leverage as the industry transitions to renewable or sustainable energy: (1) in a context where renewable energy is extremely land-consuming and more capital-intensive compared to fossil energy, TIOs own large amounts of available land close to energy-consumption areas (e.g., cities); and (2) a fit-for-purpose, long-term, return-oriented, and CAPEX-driven business model.

This Report relies on examples from airports and ports in the aviation and maritime industries to illustrate an instrumental strategic approach to making a breakthrough — and emerging as an energy hub by:

-

Clearly mapping decarbonization options, from Scope 1 to Scope 3

-

Understanding the technicalities and economics of each option

-

Validating strategic positioning of owners, operators, facilitators, and so on, for each option

-

Defining a clear roadmap to deploy the target industrial, economic, and regulatory models

1

NET-ZERO TRANSITION IS A MUST

TRANSPORTATION MUST ACT TO KEEP “LICENSE TO OPERATE”

Transportation is responsible for approximatively 24% of total global CO2 emissions, which gives it a leading role as the urgency to fight climate change intensifies. The transportation industry (and long-distance transport in particular) finds itself under pressure from clients and regulators to decarbonize and achieve net-zero emissions by 2050. Reaching this net-zero target in the prescribed time span is not optional. For the maritime industry, and even more for aviation, it is their license to operate.

The aviation industry, for example, can activate three main levers to reduce its impact on climate:

-

Improve technologies to enact the potential to reduce 15%-25% of CO2 emissions by 2050.

-

Make operational improvements for a reduction of 4%-8% in CO2 emissions.

-

Change the energy vector, which has the greatest potential to eliminate 70%-90% of CO2e emissions by 2050.

If the above steps are insufficient or not deployed fast enough, governments could put constraints on capacity and demand levels of the sector. Given the positioning of airports and ports, they could play a key role in materializing operational improvements as well as the transition toward cleaner energy sources.

SILVER BULLET DOESN’T EXIST (YET): AVIATION EXAMPLE

Hydrogen could be the endgame solution for clean commercial aviation, cutting emissions by 98% if production of affordable green H2 at scale is considered and if the industry can achieve a tremendous transformation of the supply chain on the ground and at airports, with subsequent CAPEX at stake. However, the transition from 100% jet fuel to 100% H2 fuel-powered aviation will not happen before 2060, as it will take 25 years minimum starting from 2035 to fully renew the world’s fleet. The positive effect of preventing tons of CO2 into the atmosphere will come too late. A fully H2 aviation ecosystem is certainly attainable, but the industry and the planet cannot wait for it.

Beyond massively investing in H2-fueled regional, midrange, and long-range aircraft, commercial aviation should pursue three immediate priorities:

-

Avoid consuming fossil energy as much as possible by:

-

Implementing all possible operational improvements by 2025. Actions at the forefront include facilitating a fully electric airport and enforcing eco-friendly flying practices supported by air navigation service providers (ANSPs) and pilot training.

-

Accelerating R&D on more fuel-efficient aircrafts and engine design, with full electrification of non-propulsive aircraft systems.

-

Developing new body, wing, and engine architecture to enable higher fuel efficiency.

-

-

Succeed in regional and general aviation electrification:

-

By 2024–2025, a first wave of full electric or hybrid general aviation aircrafts will be certified. Regional aircrafts (19-70 seaters) should come by 2030. The ability of regional airports to host and handle those aircrafts is critical to accelerating their rollout.

-

Demonstrate to the public that aviation is delivering on its promises and moving fast enough toward decarbonization, even though the impact on total emissions from electric aircrafts will be extremely low.

-

-

Implement sustainable aviation fuel (SAF) at large scale, starting now:

-

A focus on synthetic fuel (synfuel) should occur as soon as possible to complement biofuels. The emissions-reduction potential of synfuel is higher than biofuels (~80%-90% CO2e emissions for synfuels compared to ~70%-80% for biofuels). Synfuel also does not compete with other land uses.

-

Most investment in synfuel production, namely green electricity and electrolyzers, can be reused for production of H2 at scale when considering the entire value chain.

-

Arthur D. Little’s (ADL’s) forecast shows that all efforts toward net zero may nevertheless not enable fully CO2-free aviation by 2050 without considering carbon capture. However, it will foster a massive performance transformation with unit emissions per passenger being decreased by approximately 80% (this does not consider a decrease in travel because of higher travel costs).

MARITIME also SHIFTING TOWARD BLUE ECONOMY

The “blue economy” is an emerging concept that encourages the sustainable use of “blue” resources for economic growth, improved livelihoods, and jobs while preserving the health of the planet’s ecosystem. The goal is to simultaneously conserve sea and freshwater ecosystems and sustainably use them to produce resources and economic growth. Within the blue economy framework, major world economies have defined deeply focused guidelines for operators to ensure they prioritize energy and emissions.

Maritime transport is already the most carbon- efficient mode of transport when considering CO2 emissions per distance and weight carried (i.e., from 1-5 gCO2/ton-km for bulk carriers ocean to 20-45 gCO2/ton-km for container ships coastal, compared to 70-90 gCO2/ton-km for heavy-duty trucks or 25-60 gCO2/ton-km for diesel freight trains). However, shipping nonetheless accounts for 10% of total transport emissions.

Due to expected world economy growth, associated transport demand from world trade — and thus GHG emissions from shipping — might grow if measures will not be implemented, regarding the improvement of energy efficiency of ships and the shift to alternative fuels.

The first zero-emissions vessels should come to market by 2030. The EU and the US have defined incentives for the deployment of renewable and low-carbon fuels (e.g., H2) and the feeding of onshore power supply with renewable energy:

-

The US government has initiated the Ocean Climate Action Plan, which directs funds toward ocean-based climate action and identifies near-term actions toward increasing offshore wind and marine energy (e.g., deploying 30 gigawatts (GW) of power from offshore wind by 2030 and 15 GW from floating offshore wind platforms by 2035), decarbonizing the maritime shipping sector, and greening nation ports by upgrading, modernizing, and decarbonizing infrastructure and operations — thanks to increased production capacity of green electricity to feed machinery at ports or e-fuel production plants.

-

The 2020 Communication of European Commission on a Sustainable and Smart Mobility Strategy incentivizes the deployment of renewable and low-carbon fuels (e.g., by using H2), the feeding of onshore power supply with renewable energy, and emerging and innovative sectors of marine renewable energy (i.e., ocean energy, floating solar energy, and offshore H2 generation).

Ports will play a pivotal role in energy and decarbonization within this blue economy framework. Because ports facilitate a complex cross section of industries, the potential for significantly reducing greenhouse gas emissions and aiding the transition to clean energy are substantial. Alongside standard port activities such as cargo, logistics, and supporting the shipping industry, the larger ports can also support energy intensive industries (e.g., chemicals, cement, and manufacturing) and the energy industry itself in the form of energy generation, import and export, and energy grids. All these industry “clusters” present a range of pathways toward decarbonization, and the transition to clean energy and ports can act as a coordinator and provide assets to support this transition.

A coordinated strategy involving port authorities, port operators, and all stakeholders within ports is necessary to maximize the intake of carbon-neutral technologies:

-

Ship-electrification support solutions. These can range from portable energy-storage solution supplies to long-life modular battery systems, which can be tailored to power small and medium-sized marine transport, to innovative high-power and efficiency submerged electric motor systems for propeller-driven watercrafts, to ultracapacitors that can store energy and discharge when needed.

-

Using green fuels to power vessels. Shipping companies are currently exploring several potential green fuels (e.g., biodiesel, e-methanol, bio-methanol, ammonia, H2, liquefied natural gas, and nuclear). Hydrogen is expected to be a key player in the future low-carbon economy. However, current storage and delivery of H2 in its gaseous state are challenging and hazardous and should be carefully studied, balancing both environmental and safety considerations. A similar discourse can be applied to ammonia.

-

Decarbonizing logistics within ports. Direct and indirect emissions are generated by logistics activities from diesel-powered shore-side infrastructure to the use of nonrenewable electricity by buildings, lighting, and machinery to other indirect emissions from vehicles delivering cargo and warehouses. Many opportunities exist to decarbonize these activities, considering a combination of electrification (with renewable energy sources), higher efficiency, smart technologies to support freight delivery, and providing shore-side electricity for docked ships.

-

Decarbonizing port-based carbon-intensive industries. These include ship building, oil and gas, chemicals, food, construction, and fish processing. Similar to the logistics case, a combination of renewable-sourced heat can be used to run industrial processes, improve energy efficiency within existing processes, electrify with renewable energy sources and green H2 as a feedstock, conduct waste-heat reuse, and apply circular production models.

-

Producing renewable energy in ports. Ports can become pivotal in producing and providing clean energy to nearby residential, commercial, and industrial areas. They can function on strong grid networks to connect large electricity consumers and serve as ideal landing points for planned capacity of offshore wind. Ports are also potential sites for developing the large-scale electricity storage facilities needed to balance fluctuating supply and demand, as well as facilitating green H2 transportation.

-

Decarbonizing maintenance and construction activities. Activities within these areas include a combination of portable off-grid power supplies, off-grid storage to power tools (e.g., dredging equipment used for port maintenance), and a switch from diesel-powered machinery to electrified options.

A RACE AGAINST TIME THAT STARTED YESTERDAY

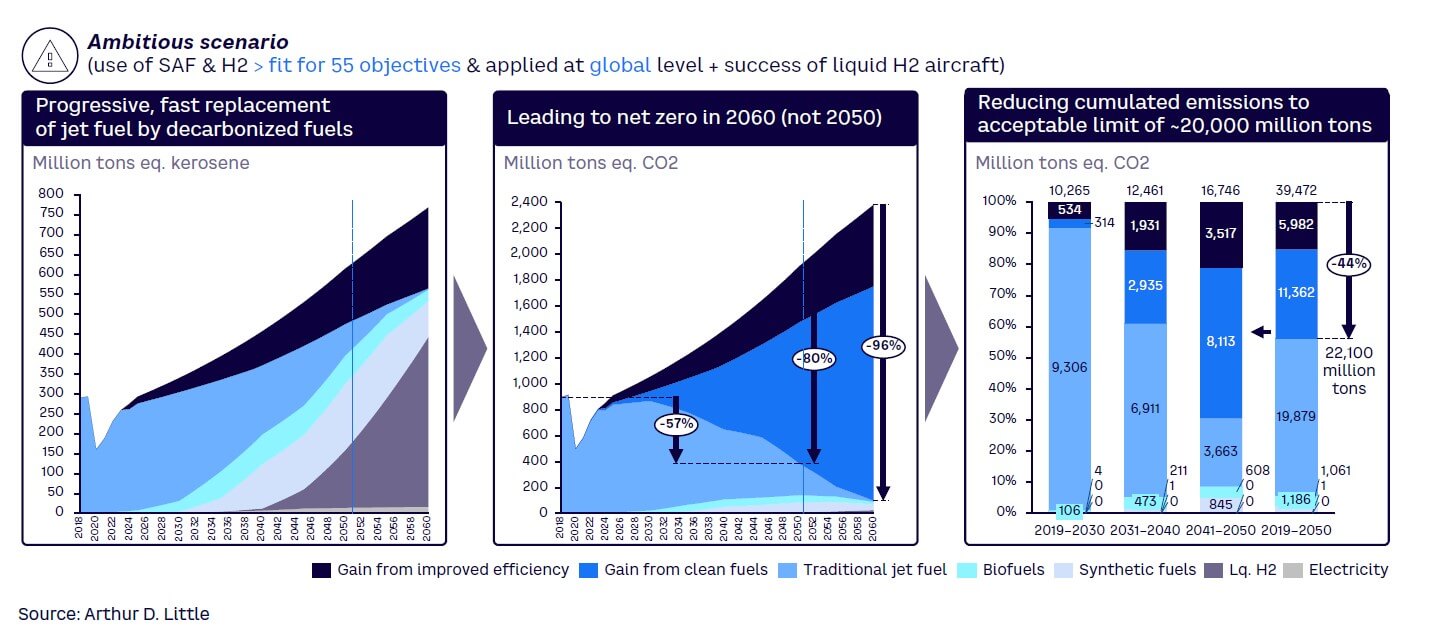

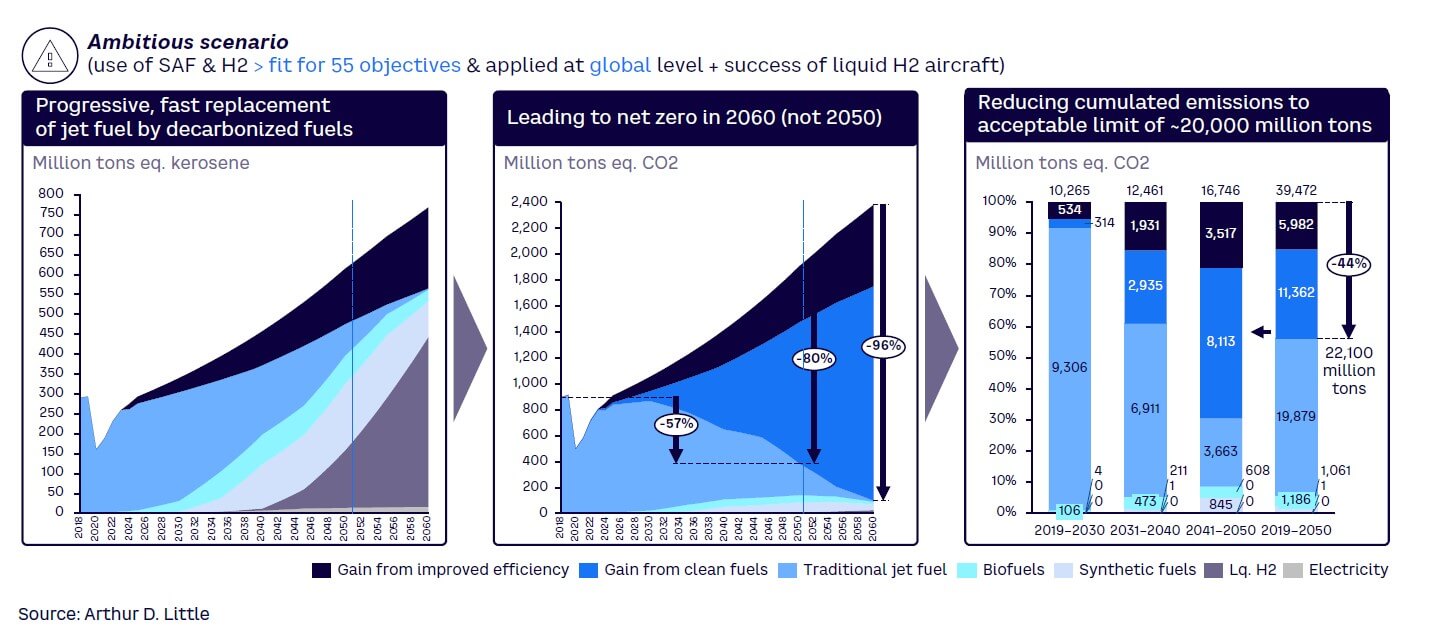

In transport industries, establishing clean transportation is a three-phase endeavor, as the example of aviation below shows:

-

Phase 1 — operational improvements that result in vehicles with fuel-efficient designs and technologies, better asset utilization, and thoughtful infrastructures

-

Phase 2 — a sharp and rapid ramp-up phase of clean fuels for airlines, with electric and/or hybrid aviation and SAF defining the period between 2025–2040 and beyond

-

Phase 3 — a possible shift toward full H2 in the 2040–2060 period

However, the race against time is tough, and the example of aviation is particularly striking (see Figure 1). Because biofuel enables only a 65%-75% emission reduction and because biofuel feedstock would be limited, the full effect on emission reduction is going to become material only when synfuels and H2 reach a critical mass. Also, ramped-up production capacity for biofuels, synfuel, and liquid H2 is a major factor when targeting net zero. Based on the anticipation of a future “fuel mix” that considers an optimistic perspective on liquid H2 as a drop-in aviation fuel and assumes a strong effort starting before 2025, over 70% of emission gain related to clean fuels will not happen before 2041–2050! Although 2050 seems far, it is remarkably close. Aviation must start to boost SAF usage now.

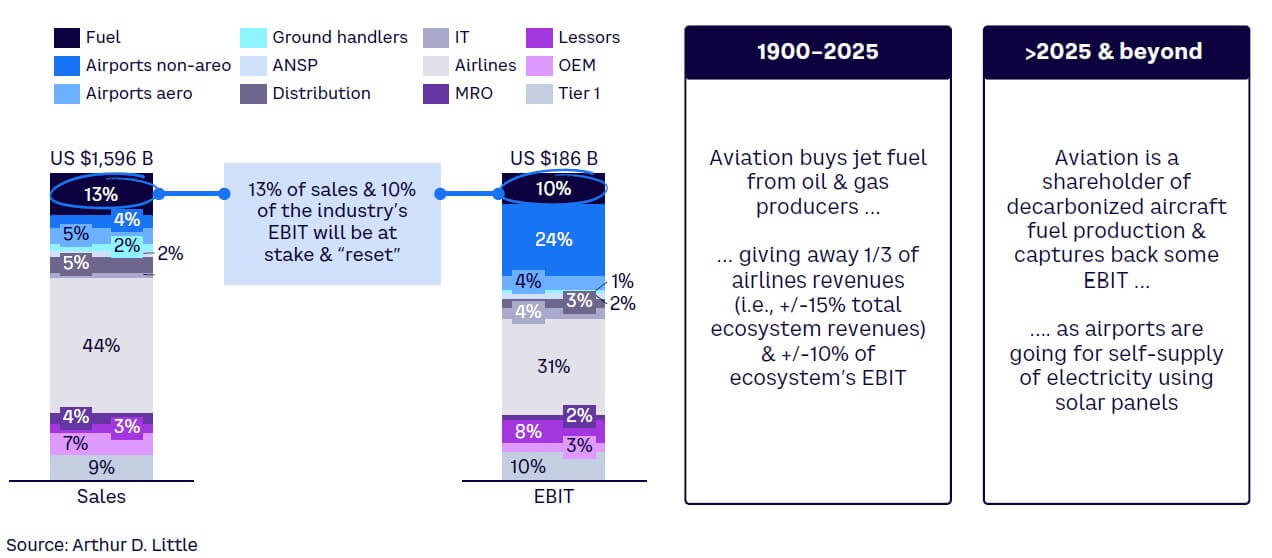

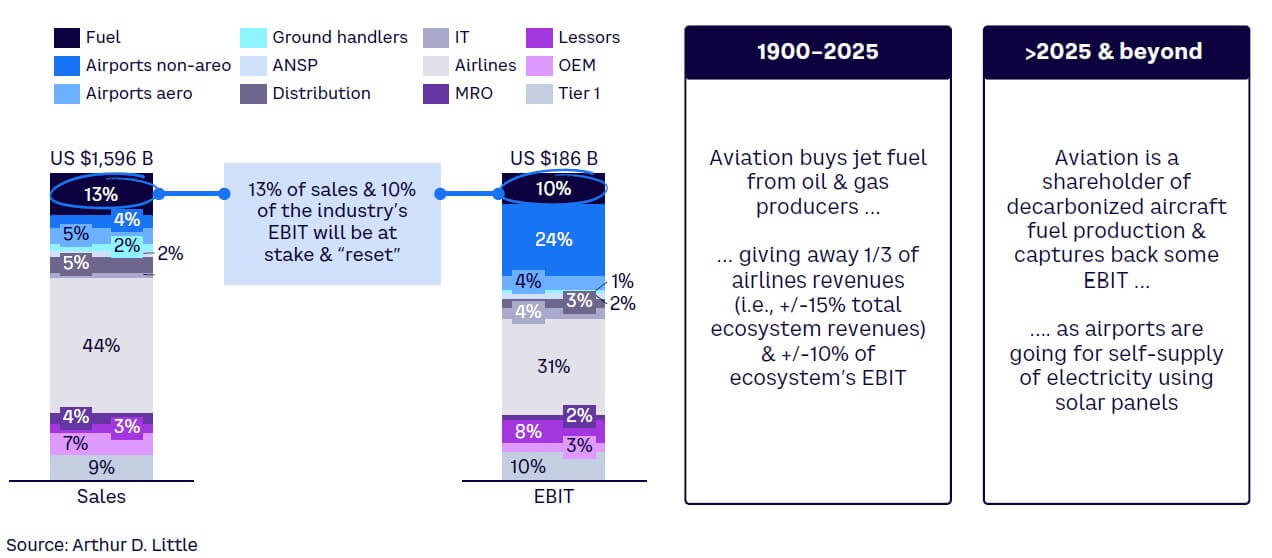

TIOs SHOULD GRAB SIGNIFICANT PART OF DECARBONIZATION’S VALUE

The net-zero transition is a singular moment for daring and capable investors to tap into the profit pool of energy supply (see Figure 2). Looking at the current share of total EBIT captured by OEMs, airlines, and airports reveals a strong opportunity. In the aviation industry, end-to-end CAPEX requirements to reach net zero are substantial. Participating in this investment means regaining approximately 10% of annual EBIT captured by outside energy suppliers. Investing in self-supply provides an additional clear opportunity to better manage the volatility of energy costs for aviation players.

Over the next 10-20 years, we see a paradigm in aviation: a substantial portion of the ecosystem EBIT becoming available to all heavy-duty or long-distance transportation segments. In these segments, energy represents less than 20% of transportation companies’ operating costs; the energy sector is also preparing to change to match net-zero ambitions. These changes will be primarily for road transport, maritime, and aviation, while rail should see a limited deployment of H2-powered trains.

Questions arise: Who will invest and become a shareholder in this new energy value chain? Who will tap associated profit pool? How will profit sharing occur among:

-

Incumbent energy supplier — namely, oil and gas companies?

-

New feedstock or energy technology providers and producers?

-

Players within the transportation ecosystem, including transportation companies, infrastructure operators, and OEMs?

-

Other external parties?

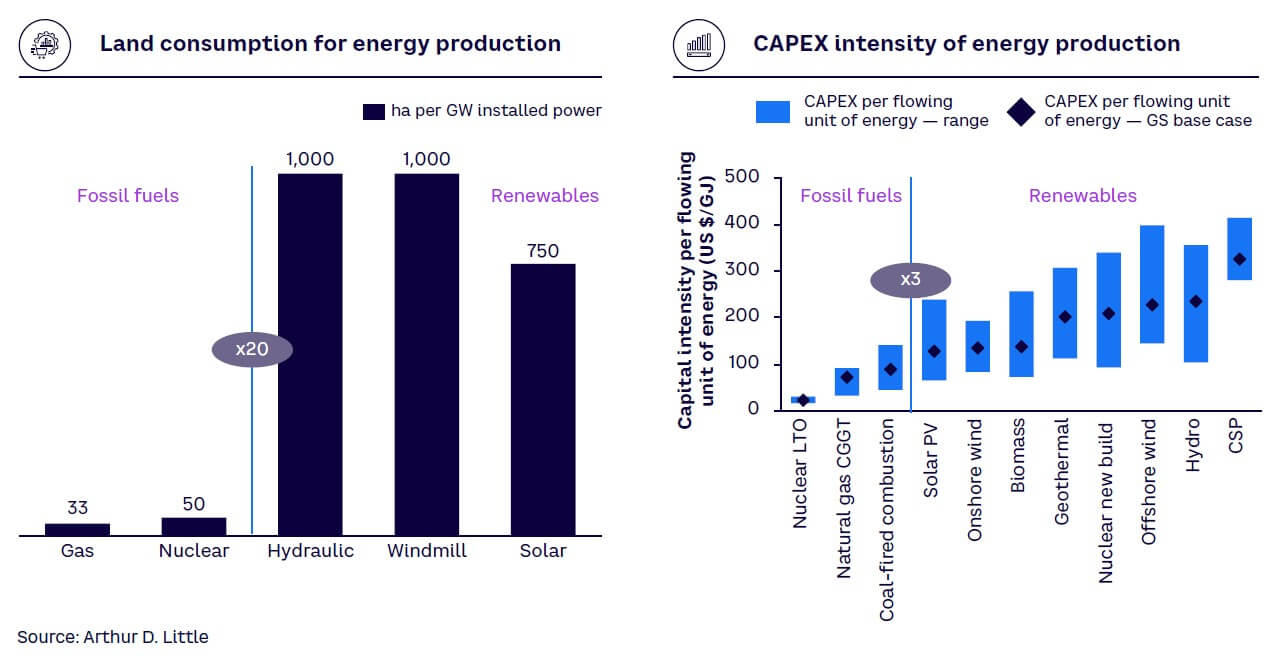

TIOs possess significant assets they should leverage to capture energy-transition value pool:

-

Ample land assets — critical to renewable electricity production, as windmills and solar farms consume roughly 20x more land than fossil fuel producers. Setting up electrolyzers for hydrogen is also very land-consuming.

-

CAPEX-oriented business model — aligns with high CAPEX requirement of energy production, as renewables are 3x more CAPEX-intensive than fossil fuel infrastructure development.

TIOs also have motivation to foster growth of new clean energy production, beyond need to gain approval from stakeholders. If they can guarantee access to clean fuels to transportation clients, they will attract more volume to their sites and gain a competitive advantage against competing hubs. Figure 3 shows factors affecting energy production.

2

TIOs MUST ARBITRATE BETWEEN (TOO?) MANY OPTIONS FOR DECARBONIZING TRANSPORT

CHALLENGES ARISE FOR TIOs WHEN LOOKING AT ENERGY

Even though TIOs are well positioned to support the net-zero transition, they must navigate four challenges:

-

Assessing a very wide variety of options covering both core and non-core activities to help decarbonize transport, some of them far beyond their usual core business

-

Choosing an investment strategy for each energy-related initiative, from pure facilitator to active involvement through investment and/or operational responsibility

-

Recognizing the need to view from an HR perspective (airports do not have “energy-transition experts” yet and need to acquire/develop this competence)

-

Navigating the unknowns of energy sector regulation, since it differs from core infrastructure safety, technical, or economic regulation that TIOs are accustomed to

TIOs MUST EVALUATE PRIORITIES

TIOs have options for taking action to reduce emissions in their sector. They can improve the energy efficiency of their facilities by using self-supplied green electricity or installing LED lighting. However, the impact of these actions is minimal. In aviation, for example, airports and building facilities emit less than 1% of the entire sector’s CO2.

Mobility is another lever TIOs can act upon by establishing electric charging stations for passenger and employee parking areas; promoting “soft” mobility when possible; and imposing the use of green employee vehicles, taxis, shuttles, and buses. Again, the impact of these changes is limited. In aviation, mobility accounts for less than 3% of CO2 emissions, although it represents almost 50% of ground emissions.

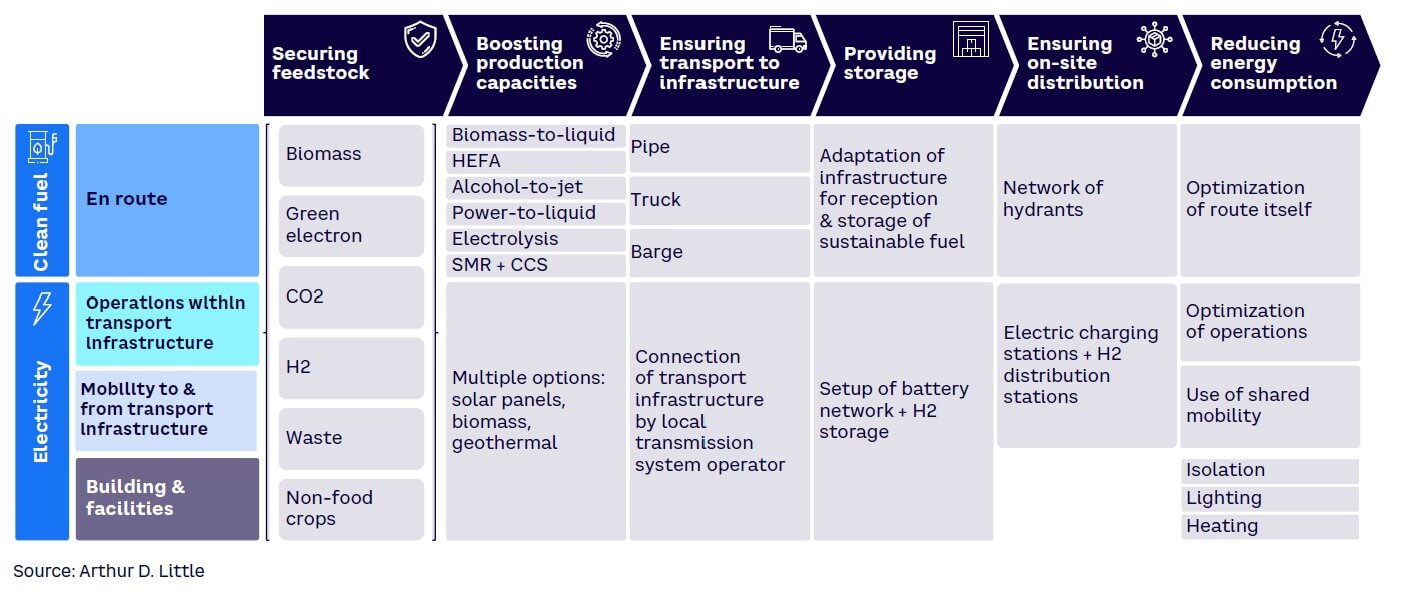

Despite the minimal benefits from the above changes, TIOs at least have control over them. They have no control over factors like the fuel burn of transportation vehicles. In the aviation sector, fuel burn represents more than 90% of CO2 emissions, both on airside ops (i.e., green taxiing, electrified ground support equipment (GSE), and buses and electrification of aircraft stands) and en route (i.e., optimized takeoff and landing trajectories and carbon-neutral aircraft fuels).

TIOs can activate multiple options and synergies to address the need to lower emissions generated (see Figure 4). For example, locally produced hydrogen, which supplies industrial vehicle fuel cells, could serve to supply commercial vehicles. Because of so many options, making arbitrages and prioritizing are difficult tasks for TIOs.

ANOTHER KEY DECISION: CHOOSING OPERATING & BUSINESS MODELS

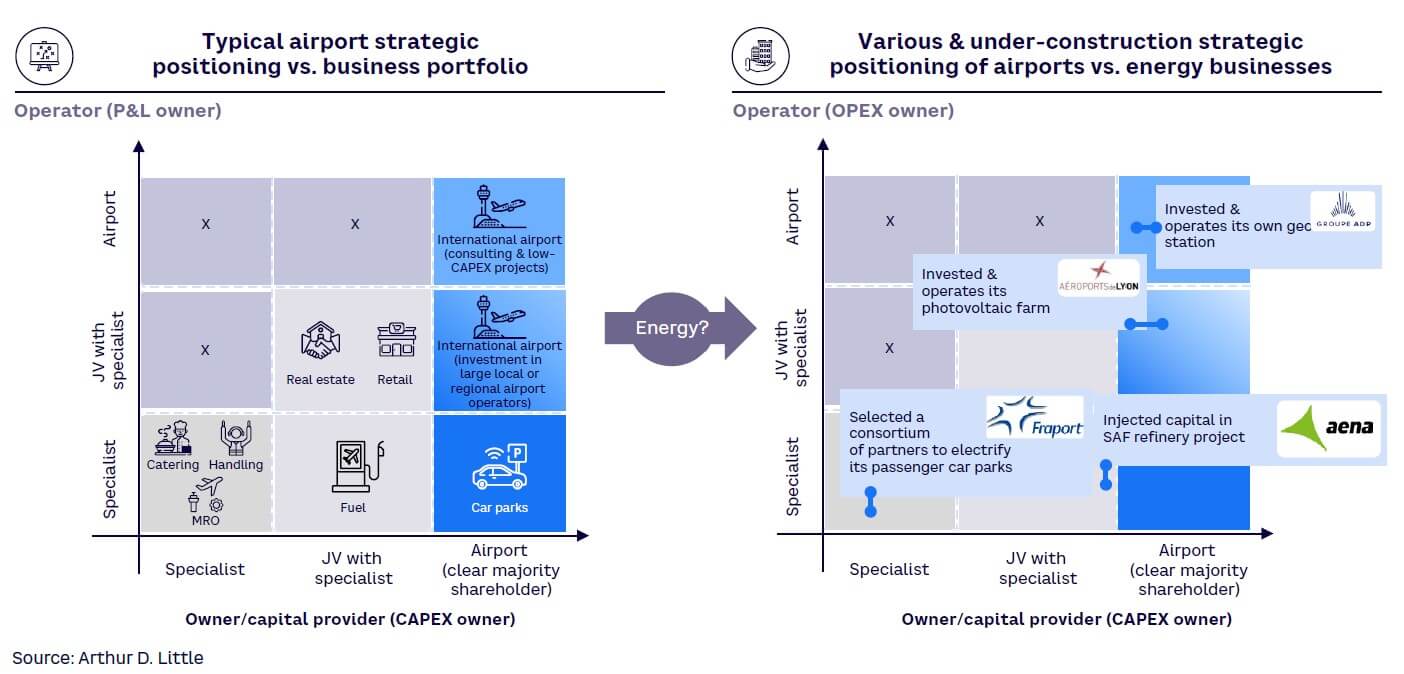

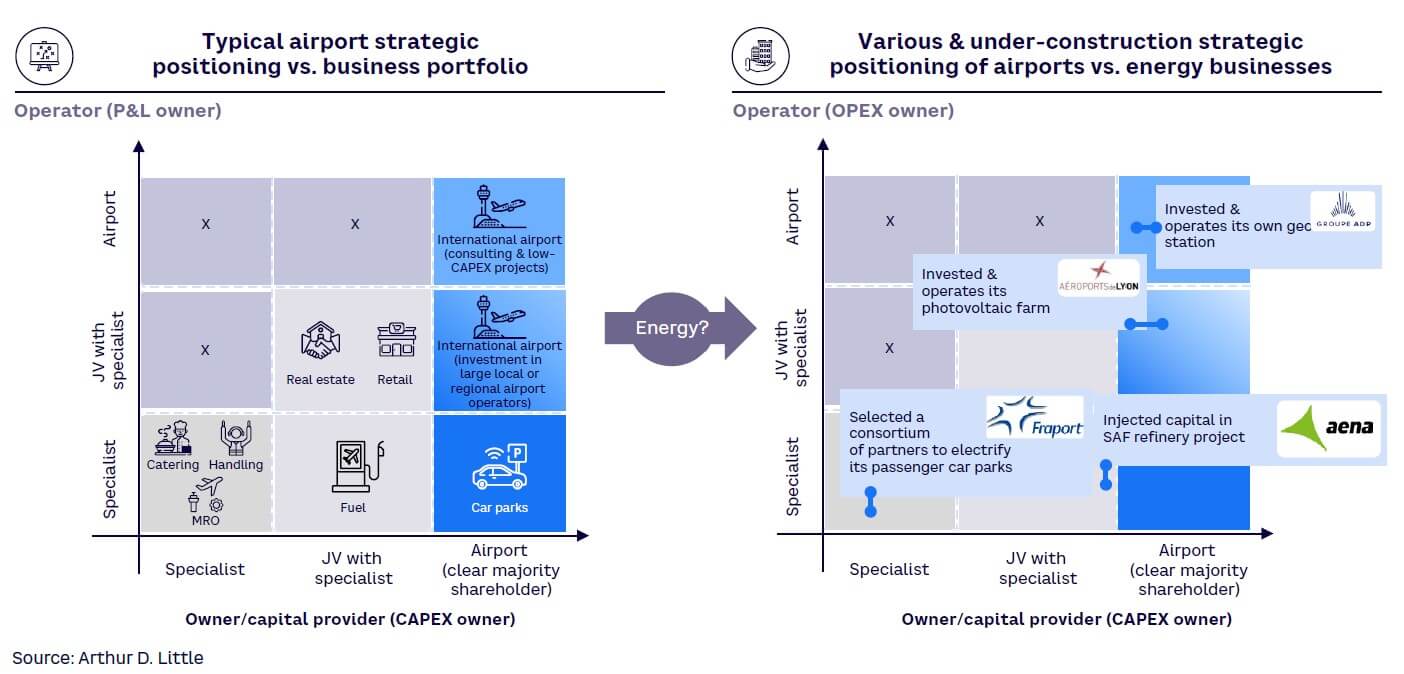

Airports have numerous ways to respond to the question of what they can do to decarbonize their industry; there are also many ways to address how. For every initiative, they need to determine their degree of involvement, which could range from purely facilitating to investing and/or taking operational responsibilities.

As facilitators of energy projects, airports can create partnerships and provide infrastructure support to attract external investments and/or operators (see Figure 5). If a more hands-on role is desired, they can opt for a joint venture (JV) with specialists or take a more proactive approach by investing directly in required assets and getting involved in operational duties.

Airports and rail station operators have already needed to decide their degree of involvement in operations and developing/maintaining the assets needed to manage non-core business. Namely, these businesses include travel retail concessions and real estate investments in logistics, hospitality, or office segments. Energy is a much wider space for TIOs. The right model may differ when EV charging stations, battery storage, photovoltaic electricity, or sustainable fuel production is on the table.

The primary competencies of TIOs are asset management and operations. These skill sets can address local energy-optimization projects such as energy-efficient buildings, green electricity, and LED lighting. However, TIOs lack the necessary expertise and specialized knowledge required to structurally tackle energy transition, thoroughly understand related technologies and industry best practices, and identify the strengths and weaknesses of potential industrial partners. To address these deficits, TIOs should consider bringing in energy experts or creating dedicated roles focused on managing energy-related activities, while leveraging external experts and partnerships.

Finally, the need for attention arises around enforcing regulations on energy-related activities. As an energy provider, accountable for energy transmission, TIOs must respect the multiple operational obligations around infrastructure setup, operations, safety, and technical standards. Moreover, becoming an energy supplier (i.e., the seller of molecules or electrons) confers even more structural regulations, as TIOs would be required to obtain specific licenses and comply with energy-pricing regulations.

WHAT A LOWER RISK PROFILE MEANS FOR THE INDUSTRY

Despite a context with multiple complications, it is time for TIOs to take concrete actions thanks to the decreasing risk profile of decarbonization:

-

The technology is maturing and improving. This growth clarifies investment needs and the order of magnitude of the related business case. The aviation industry is shifting from a what-if perspective to making concrete arbitrages on energy-transition investments. One potential clean aviation fuel, hydroprocessed esters and fatty acids (HEFA), is a mature biofuel that is deployed by oil players reconverting their existing facilities; stakeholders are confident that other technologies, including biomass to liquid, alcohol to jet, and power to liquid (PtL), could reach industrial maturity and deployment by 2030.

-

Demand for clean energy is growing. Many countries around the globe have set sustainable fuel-incorporation mandates (e.g., the European initiative ReFuelEU and Japan’s mandate for clean aviation fuel). Large corporate transportation clients wish to decarbonize their own emissions. Microsoft and JP Morgan are participating in SAF book and claim systems, while LVMH is seeking net-zero transportation.

-

Ecosystems in all industries are eager for green power, but there is no risk of overcapacity; producing green electricity is a “no regret” move. Even if initial first clients are non-transportation-related, the investment in energy from TIOs should see lower risks on their revenue side. For instance, although H2 production for aircrafts may not be at scale before 2035–2040, making investments in green electron production now may still be worthwhile, as those green electrons will easily find clients.

THE BUSINESS CASE FOR STRATEGIC ENERGY INVESTMENT

The overall business case of net-zero transportation nevertheless represents a critical challenge that the industry must prepare for and overcome. Considerations include:

-

The need to use significant CAPEX up front to transform:

-

The existing asset base (building and vehicles), with typically +10%-15% premium.

-

The energy supply chain; for instance, moving toward 100% synfuel would represent a cumulative CAPEX of US $10 trillion over the next 30 years, assuming green electricity production capacity (about 50% of the total), H2 electrolysis capacities (10%), clean fuel production itself (20%), and maintenance CAPEX of the asset base.

-

-

An overall increase in energy-related OPEX; results will vary depending on the players, but:

-

Regional airlines, airports, ground handlers, and shuttle bus operators electing to electrify their operations will see a strong decline of their OPEX, thanks to much lower prices of electric energy versus fossil energy.

-

Commercial airlines, which represent the vast majority of the industry’s energy consumption, will keep paying 3x more at least for SAFs and H2 versus traditional kerosene by 2035, reduced to 1.5-2x more by 2050+.

-

-

Potentially lower revenues for commercial airlines resulting from:

-

Ticket prices impacted by higher fuel costs, with an overall increase estimated between +10% to +25%.[1]

-

Travel demand being hampered to a significant extent by the price elasticity of air travel (between -0.7 and -1.1, according to existing studies across geographies[2]).

-

The inability of airlines to fully pass fuel price increases over to passengers because of competition or the possibility of limiting travel demand (although different surveys show that clients would agree to pay a premium[3] of 15% or more for green travel, which would almost offset fuel-cost increases). Travel during the 2022 and 2023 summer seasons demonstrates that air-passenger traffic is back despite higher ticket prices.[4]

-

3. HOW CAN TIOs ACHIEVE NET ZERO WHILE CAPTURING FULL BUSINESS POTENTIAL?

DEVELOPING VISION & ROADMAP

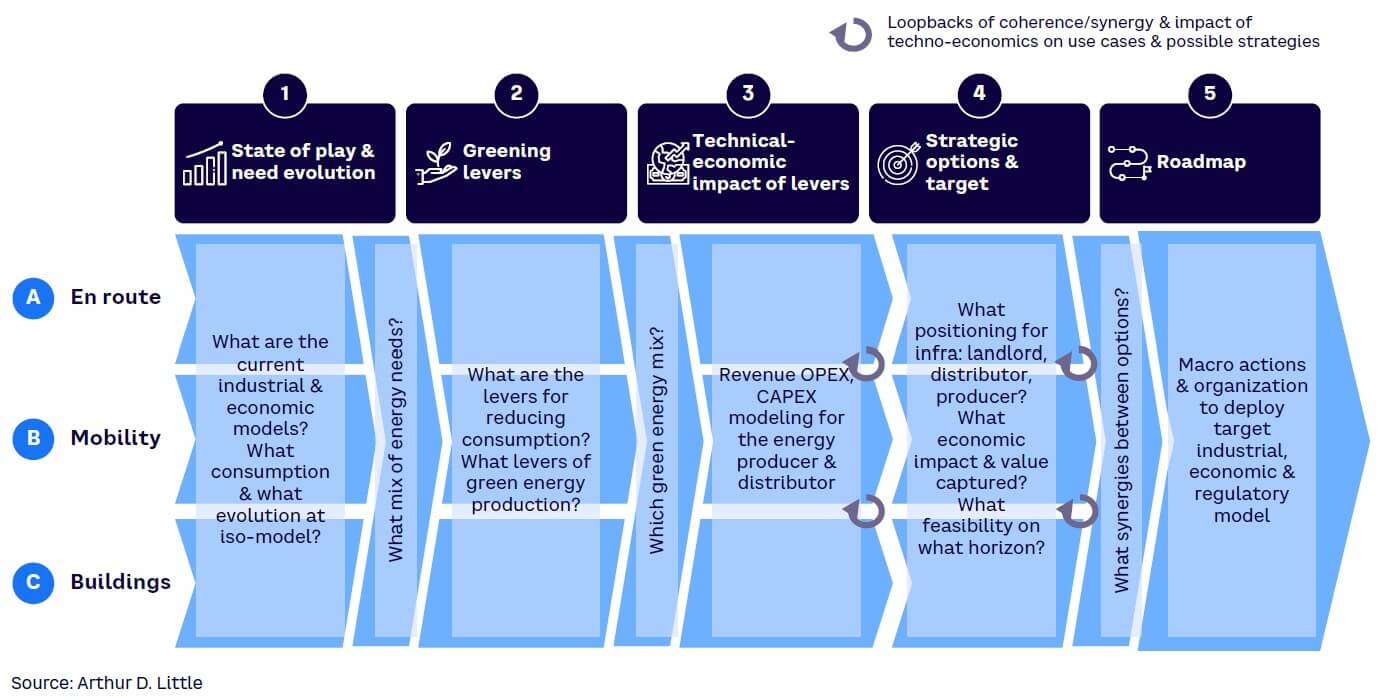

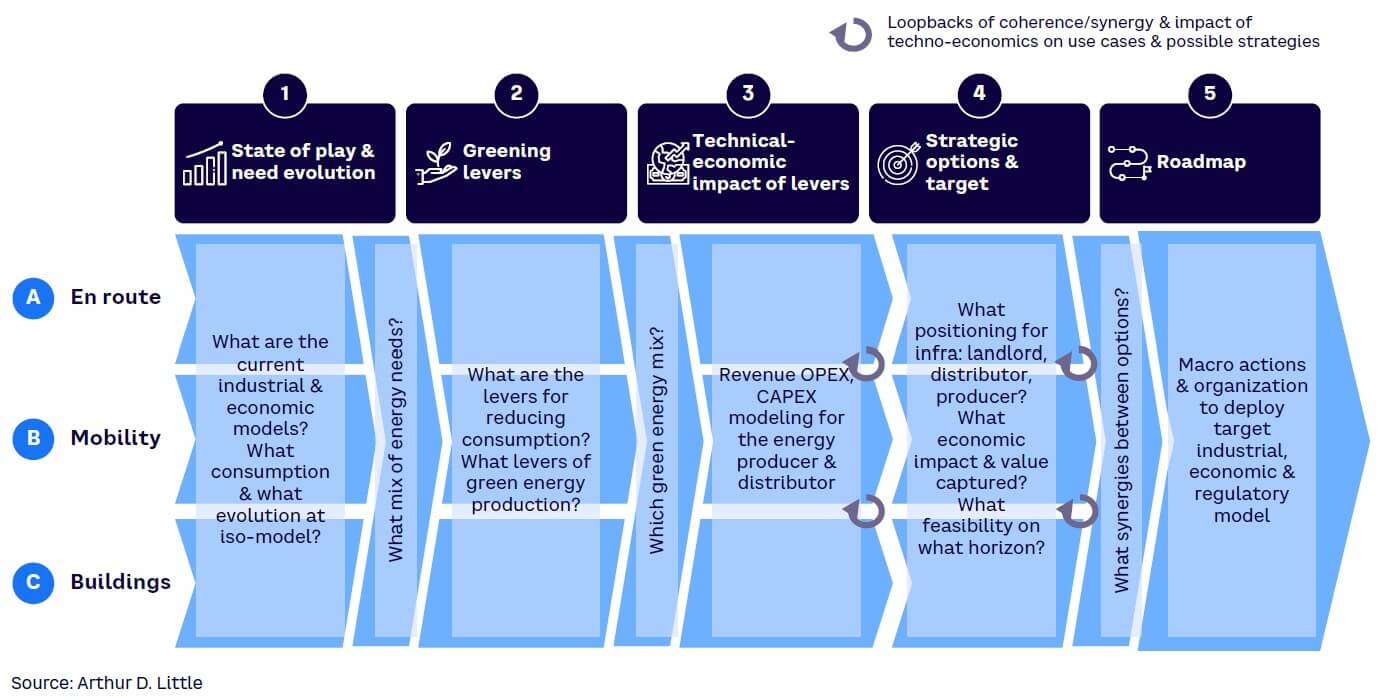

Energy is all but assured to become a significant business pillar for TIOs. Therefore, executives must act beyond current initiatives; define a proper strategic vision; and develop an exhaustive roadmap that addresses technical, regulatory, economic, and financial impacts (see Figure 6). This vision and roadmap should ensure that TIOs make the right trade-offs among different business priorities: impact and speed of decarbonization, ROI, and the sector’s green image. Therefore, the vision and energy roadmaps must answer the following questions:

-

What are the possible scenarios for energy mix in their transportation vertical during the following three periods: 2020–2030, 2030–2040, and 2040–2050?

-

What are the technical prerequisites, challenges, and solutions for deploying production capacities for different key energy options?

-

What are the economics of different energy options, including CAPEX and OPEX, for production, distribution, onsite storage, and distribution?

-

What potential synergies among energy-related activities will ensure duplication of efforts and optimal phasing?

-

What best practices and lessons can be shared by other stakeholders, such as airports, OEMs, and airlines, that have taken initial steps in the carbon-neutral aviation fuel value chain?

-

What are the required competences and ideal governance for smoothly running energy-related activities?

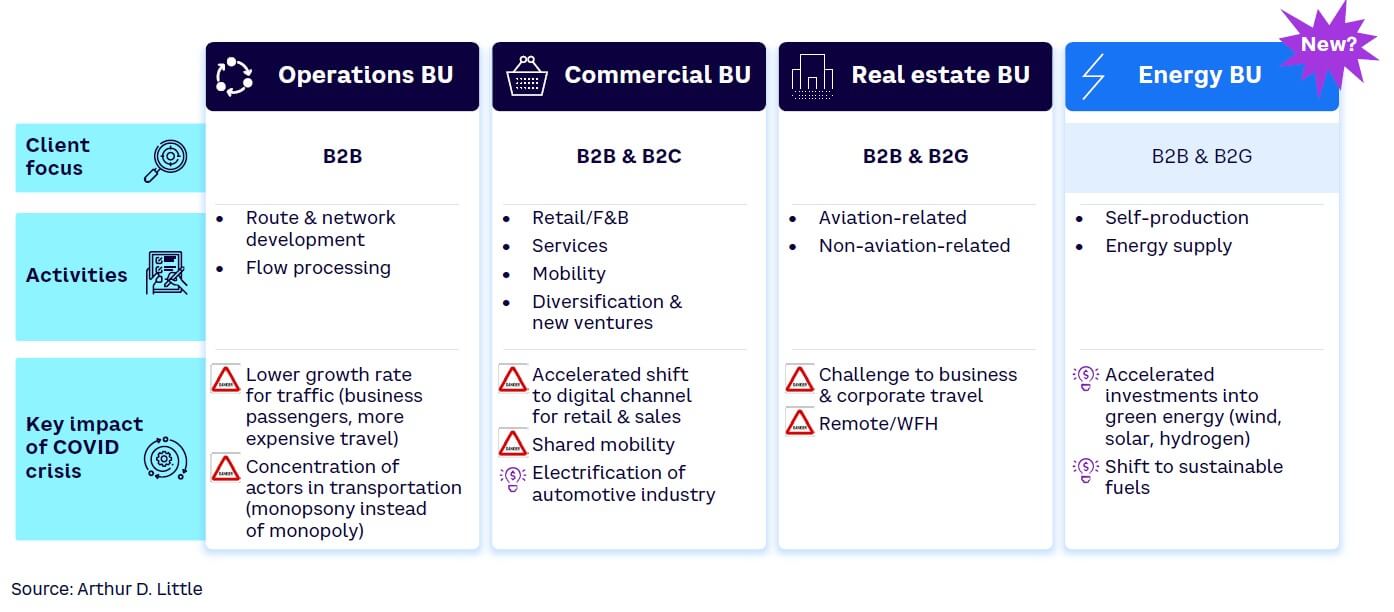

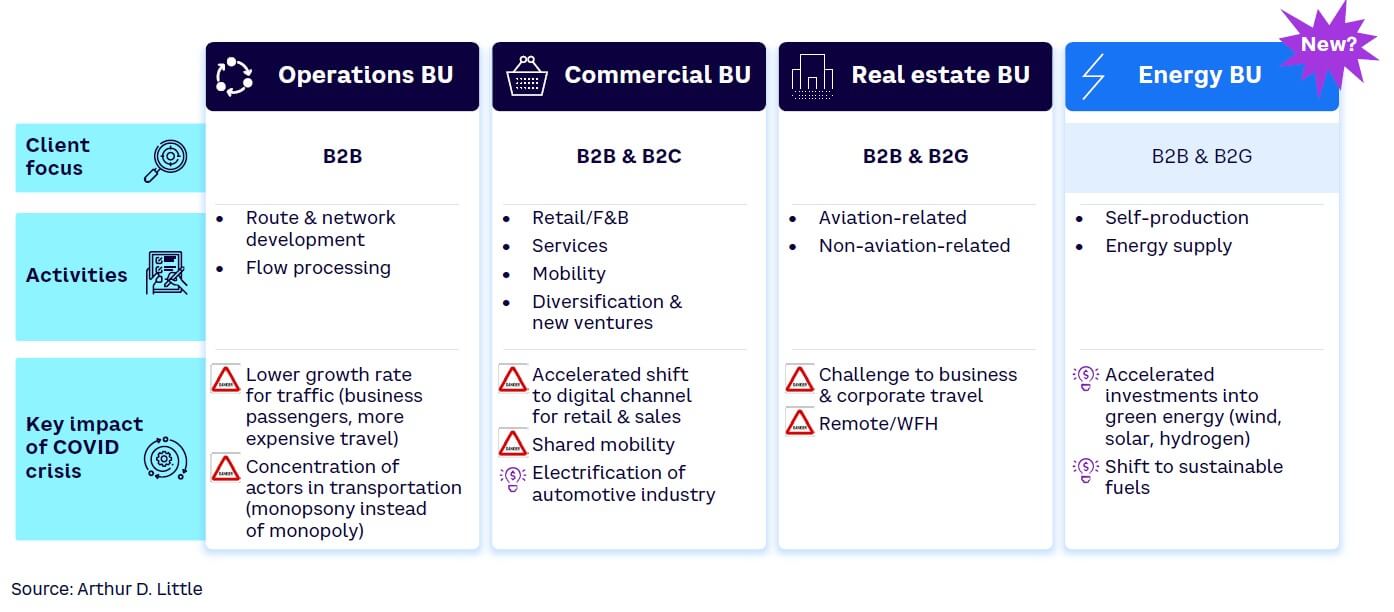

CREATING NEW ENERGY BUSINESS UNIT

We strongly believe that TIOs need to create a new energy-focused business unit adjacent to their traditional business units of core transport, commercial and mobility, and real estate (see Figure 7). Creating this structure will enable them to catch the momentum to adapt their infrastructure for energy transition and tap into new a profit pool. This is because energy-related investments are long-term (fuel and oil installations are typically tendered for 20 or more years), while other activities such as retail or car parks have shorter tendering cycles of typically five to 10 years. Moreover, staffing this business unit will support recruiting and developing new capabilities.

TIOs can evaluate the benefits of creating a new energy business unit by extracting knowledge from other transport players or other industries with experience in setting up new energy-related business units:

-

SNCF, France’s national state-owned railway, recently launched a concession-like business model to produce photovoltaic energy in its car park. In June 2023, the railway operator announced its new subsidiary, SNCF Renewables, that will build solar power plants using available SNCF land and buildings. Its objectives are to produce 15%-20% of its current consumption by 2030 and gain energy independence by 2050.

-

In February 2023, United Airlines launched its Sustainable Flight Fund with support from other partners, including JP Morgan. The fund invests in companies that develop technologies to boost SAF production. In March 2022, it acquired a $5 million stake in Cemvita, a start-up that uses biotechnology and synthetic biology to address the need for SAF production at scale. The fund committed up to $37.5 million to NEXT Renewable Fuels, a leading start-up in turning recycled organic materials into renewable transportation fuels, provided it hits certain benchmarks. The airline has used a shareholder model to create a de facto energy business unit.

-

Tesla’s supercharger network was originally intended to support its core business growth, but it has rapidly grown into its own significant business segment, generating just under $1 billion in revenue. The network is also used to anchor new adjacent ventures, such as retail.

-

Casino Group launched GreenYellow, originally established to support the group’s energy transition. GreenYellow specializes in renewable energy production and energy-efficient services. Its large client portfolio helped it become a significant business asset, which Casino Group sold to Ardian Infrastructure for a net proceed of €600 million EUR.

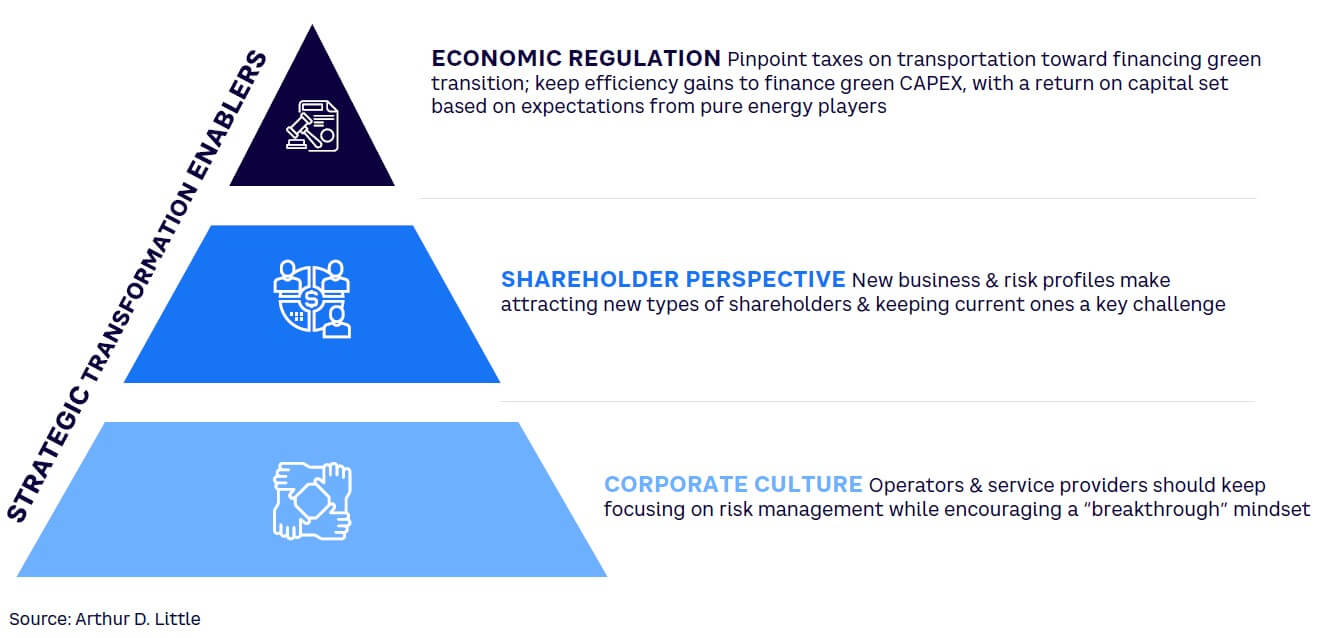

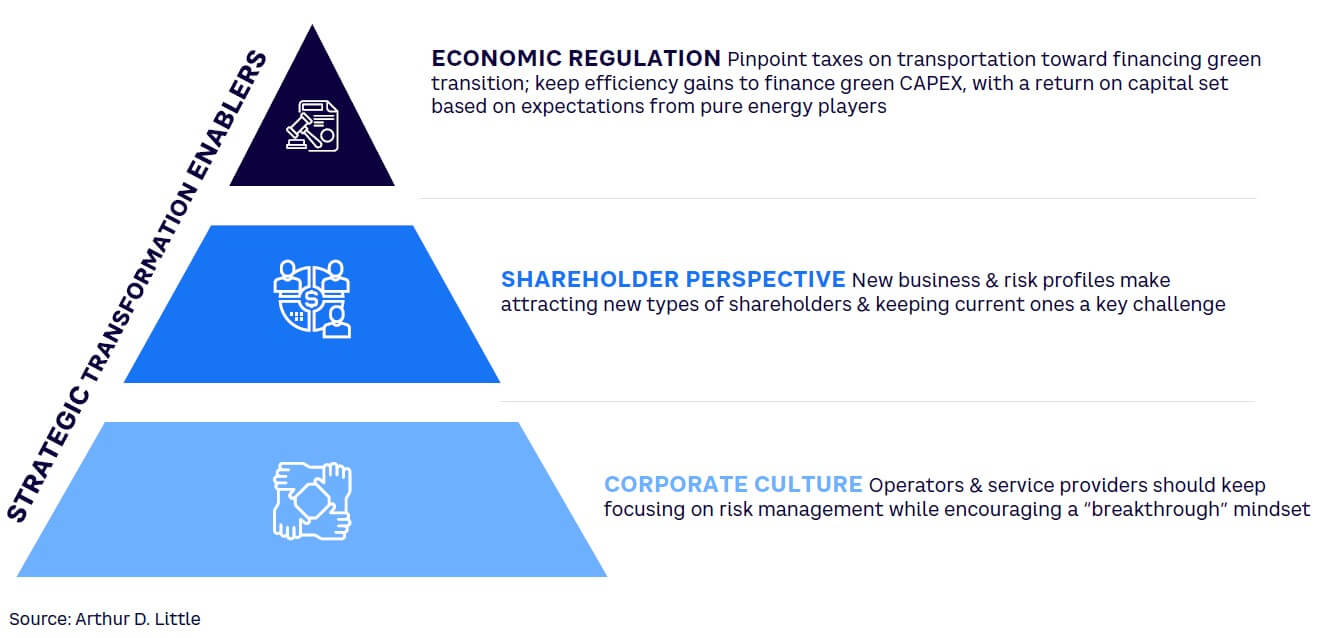

3 COMPLEMENTARY TRANSFORMATIONS

Having a strategic vision, foreseeing the business plan, knowing the risk and value at stake, and shaping a target organization won’t be enough for TIOs to be instrumental in decarbonizing transport. There are three dimensions that play important parts in the quest to achieve net zero: corporate culture, shareholder perspective, and economic regulation (see Figure 8).

First, they need to ensure that their corporate culture will be open to innovative businesses, partnerships, and ecosystems. This challenge cannot be underestimated, as transportation players have historically focused heavily on risk management and leveraging vertically integrated organizations or strict client-supplier relationships, instead of innovating, risk taking, and becoming partnership-oriented. In the case of energy, the latter is shown by the establishment of corporate venture capital funds, JVs, or innovative long-term partnerships with emerging champions (either start-ups or divisions of fossil-born energy players).

Next, the energy strategy of TIOs will potentially modify their business, investments, and risk profile. In this context, aligning with the shareholder vision will be critical. A challenge may be posed by shareholders who use options other than the infrastructure operators themselves to invest in the net-zero transition; hence, the imperative of crafting a strategy demonstrating that the value capture will be equal at a minimum, that future monetization of this investment will be possible, and that investing in the energy strategy of infrastructure operators enables a competitive advantage for the latter in terms of attracting more traffic volumes.

Finally, when considering CAPEX and the need for TIO shareholders to capture a fair value, making most players subject to economic regulations is crucial. An initial obvious move would be pinpointing taxes levied on transport toward financing net-zero goals and the industry’s transition. However, beyond green CAPEX and throughput efficiency, CAPEX may have a specific incentivized status compared to other capacity-expansion CAPEX, which is driven by enlarged infrastructures rather than greener, more efficient assets.

CONCLUSION

ONCE-IN-A-LIFETIME OPPORTUNITY, STRONG STRATEGIC VISION & DETAILED ROADMAP TOWARD ENERGY BUSINESS UNIT

The time is now for TIOs to foster energy hubs. By 2030–2035, many positions in the clean energy value chain will be occupied.

The current conditions are ideal for TIOs to tap into significant additional revenue and profit streams:

-

Technologies are available.

-

The energy regulatory framework is concrete.

-

The demand for decarbonization is solid.

-

The CAPEX-oriented business model can monetize well-positioned available land.

Effectively unlocking this potential requires a strong strategic vision and a detailed roadmap. Moreover, it requires a dedicated business unit to effectively drive and manage energy-related activities, beyond existing initiatives. Answering the right questions can lead to significant steps toward sustainability and decarbonizing the transportation industry — and to significant incremental value creation for TIOs.

Notes

[1] Consider the following: a 2.5x fuel cost for SAFs versus kerosene, ~30% fuel consumption for aircrafts by 2040 (from technological and operational improvements), a relative share of fuel of 25% of airlines OPEX, and a target EBIT margin of 7%.

[2] Estimating Air Travel Demand Elasticities.” InterVISTAS Consulting Inc., 28 December 2007.

[3] Chaire Pégase, 2023.

[4] “Global Outlook for Air Transport: Highly Resilient, Less Robust.” IATA, June 2023.

DOWNLOAD THE FULL REPORT

24 min read • Travel & transportation

Energy: New business pillar for transport infrastructure operators

How the energy transition can evolve from regulatory constraint to business opportunity

DATE

FOREWORD

“It’s not my core business” ... “I lack the right skills.”

Holding onto such beliefs would have prevented Amazon from creating its lucrative Amazon Web Services (AWS) or kept Apple from developing the smartphone. Likewise, transport infrastructure operators (TIOs) would not have diversified their business portfolio without looking beyond their initial role of developing, operating, and maintaining transportation networks and facilities. Engaging in new ventures like retail and real estate has been successful and profitable and can give rise to future endeavors to increase revenue while improving the sector’s sustainability.

Certainly, the transportation industry’s paradigm shift toward achieving net zero before 2050 poses a plausible threat to the business model of TIOs due to the potential limitation of mobility demand, driven by increasing costs of green energy or potential regulatory constraints. Despite challenges, however, opportunities exist for TIOs to increase their value proposition while monetizing their lands and assets to develop green energy production. The concept of a “green energy hub” (or “green power hub”) has been subject to public debate for years and widely discussed as part of the strategic vision of airports, ports, and rail companies. Now is the time for a breakthrough: a move from concept to concrete business actions. As we explore in this Report, TIOs have the advantage of major assets to facilitate the process of turning a regulatory constraint into a business opportunity. The case of airports is particularly convincing.

Anticipating new client needs; mastering recent technologies; innovating in operational, business, and partnership models; and transforming organization, regulation, and shareholder perspectives will be key to achieving a successful outcome. This Report illustrates the insights and elements that TIOs should examine to help them act quickly and take command of this opportunity.

We hope you find this Report inspiring — let’s accelerate on this journey together!

Mathieu Blondel

Partner, Arthur D. Little

EXECUTIVE SUMMARY

ONCE-IN-A-LIFETIME OPPORTUNITY

Today, most TIOs adhere to a three-pillar business model:

-

The first pillar is the original core business: connecting flows of vehicles, passengers, and goods, and moving them to where they need or want to be.

-

The second pillar emerged between 2000 and 2020; operators gradually grew into major retail hubs, creating significant additional revenue and profit streams by harvesting wait time of passenger clients.

-

The third pillar, real estate, grew in parallel to the second; operators exploited their strategic location and harvested their available land by making direct investments.

Over the next decade, TIOs could create a fourth pillar: energy.

Between now and 2035, the paradigm shift toward green energy will provide TIOs with a new opportunity to increase their value proposition and tap into a new profit pool. TIOs have a strong imperative for this: greening transportation to reach net zero before 2050 is their “license to operate.” In other words, they need to show they are taking serious steps to address climate change and maintain a positive public image as an industry that values and seeks sustainability. Otherwise, they and their clients might cease operation. Still, sustainability through decarbonization and clean energy is a wide and deep galaxy to navigate.

Indeed, TIOs could take charge by engaging into green energy within the domains of:

-

Buildings and facilities located on the site and in the surrounding area

-

Mobility within, to, and from the premises

-

Fostering the transition to clean energy vectors for heavy mobility, including electrification, sustainable drop-in fuels, and hydrogen (H2) for large transport equipment

In each of these three domains, TIOs can consider dozens of strategic options.Assessing each of these options requires: (1) an appraisal of its impact on net-zero ambitions (which scope? what level of avoidance or reduction of CO2e emissions?), (2) a consideration of technological and operational risks, and (3) an understanding of the relevant economics (CAPEX, OPEX, expected ROI). Finally, (4) this process also requires careful consideration of potential partners from the energy ecosystem as well as the value and risk-sharing strategy that TIOs should pursue.

While having to face such a complex decision-making process, TIOs possess two scarce resources they can leverage as the industry transitions to renewable or sustainable energy: (1) in a context where renewable energy is extremely land-consuming and more capital-intensive compared to fossil energy, TIOs own large amounts of available land close to energy-consumption areas (e.g., cities); and (2) a fit-for-purpose, long-term, return-oriented, and CAPEX-driven business model.

This Report relies on examples from airports and ports in the aviation and maritime industries to illustrate an instrumental strategic approach to making a breakthrough — and emerging as an energy hub by:

-

Clearly mapping decarbonization options, from Scope 1 to Scope 3

-

Understanding the technicalities and economics of each option

-

Validating strategic positioning of owners, operators, facilitators, and so on, for each option

-

Defining a clear roadmap to deploy the target industrial, economic, and regulatory models

1

NET-ZERO TRANSITION IS A MUST

TRANSPORTATION MUST ACT TO KEEP “LICENSE TO OPERATE”

Transportation is responsible for approximatively 24% of total global CO2 emissions, which gives it a leading role as the urgency to fight climate change intensifies. The transportation industry (and long-distance transport in particular) finds itself under pressure from clients and regulators to decarbonize and achieve net-zero emissions by 2050. Reaching this net-zero target in the prescribed time span is not optional. For the maritime industry, and even more for aviation, it is their license to operate.

The aviation industry, for example, can activate three main levers to reduce its impact on climate:

-

Improve technologies to enact the potential to reduce 15%-25% of CO2 emissions by 2050.

-

Make operational improvements for a reduction of 4%-8% in CO2 emissions.

-

Change the energy vector, which has the greatest potential to eliminate 70%-90% of CO2e emissions by 2050.

If the above steps are insufficient or not deployed fast enough, governments could put constraints on capacity and demand levels of the sector. Given the positioning of airports and ports, they could play a key role in materializing operational improvements as well as the transition toward cleaner energy sources.

SILVER BULLET DOESN’T EXIST (YET): AVIATION EXAMPLE

Hydrogen could be the endgame solution for clean commercial aviation, cutting emissions by 98% if production of affordable green H2 at scale is considered and if the industry can achieve a tremendous transformation of the supply chain on the ground and at airports, with subsequent CAPEX at stake. However, the transition from 100% jet fuel to 100% H2 fuel-powered aviation will not happen before 2060, as it will take 25 years minimum starting from 2035 to fully renew the world’s fleet. The positive effect of preventing tons of CO2 into the atmosphere will come too late. A fully H2 aviation ecosystem is certainly attainable, but the industry and the planet cannot wait for it.

Beyond massively investing in H2-fueled regional, midrange, and long-range aircraft, commercial aviation should pursue three immediate priorities:

-

Avoid consuming fossil energy as much as possible by:

-

Implementing all possible operational improvements by 2025. Actions at the forefront include facilitating a fully electric airport and enforcing eco-friendly flying practices supported by air navigation service providers (ANSPs) and pilot training.

-

Accelerating R&D on more fuel-efficient aircrafts and engine design, with full electrification of non-propulsive aircraft systems.

-

Developing new body, wing, and engine architecture to enable higher fuel efficiency.

-

-

Succeed in regional and general aviation electrification:

-

By 2024–2025, a first wave of full electric or hybrid general aviation aircrafts will be certified. Regional aircrafts (19-70 seaters) should come by 2030. The ability of regional airports to host and handle those aircrafts is critical to accelerating their rollout.

-

Demonstrate to the public that aviation is delivering on its promises and moving fast enough toward decarbonization, even though the impact on total emissions from electric aircrafts will be extremely low.

-

-

Implement sustainable aviation fuel (SAF) at large scale, starting now:

-

A focus on synthetic fuel (synfuel) should occur as soon as possible to complement biofuels. The emissions-reduction potential of synfuel is higher than biofuels (~80%-90% CO2e emissions for synfuels compared to ~70%-80% for biofuels). Synfuel also does not compete with other land uses.

-

Most investment in synfuel production, namely green electricity and electrolyzers, can be reused for production of H2 at scale when considering the entire value chain.

-

Arthur D. Little’s (ADL’s) forecast shows that all efforts toward net zero may nevertheless not enable fully CO2-free aviation by 2050 without considering carbon capture. However, it will foster a massive performance transformation with unit emissions per passenger being decreased by approximately 80% (this does not consider a decrease in travel because of higher travel costs).

MARITIME also SHIFTING TOWARD BLUE ECONOMY

The “blue economy” is an emerging concept that encourages the sustainable use of “blue” resources for economic growth, improved livelihoods, and jobs while preserving the health of the planet’s ecosystem. The goal is to simultaneously conserve sea and freshwater ecosystems and sustainably use them to produce resources and economic growth. Within the blue economy framework, major world economies have defined deeply focused guidelines for operators to ensure they prioritize energy and emissions.

Maritime transport is already the most carbon- efficient mode of transport when considering CO2 emissions per distance and weight carried (i.e., from 1-5 gCO2/ton-km for bulk carriers ocean to 20-45 gCO2/ton-km for container ships coastal, compared to 70-90 gCO2/ton-km for heavy-duty trucks or 25-60 gCO2/ton-km for diesel freight trains). However, shipping nonetheless accounts for 10% of total transport emissions.

Due to expected world economy growth, associated transport demand from world trade — and thus GHG emissions from shipping — might grow if measures will not be implemented, regarding the improvement of energy efficiency of ships and the shift to alternative fuels.

The first zero-emissions vessels should come to market by 2030. The EU and the US have defined incentives for the deployment of renewable and low-carbon fuels (e.g., H2) and the feeding of onshore power supply with renewable energy:

-

The US government has initiated the Ocean Climate Action Plan, which directs funds toward ocean-based climate action and identifies near-term actions toward increasing offshore wind and marine energy (e.g., deploying 30 gigawatts (GW) of power from offshore wind by 2030 and 15 GW from floating offshore wind platforms by 2035), decarbonizing the maritime shipping sector, and greening nation ports by upgrading, modernizing, and decarbonizing infrastructure and operations — thanks to increased production capacity of green electricity to feed machinery at ports or e-fuel production plants.

-

The 2020 Communication of European Commission on a Sustainable and Smart Mobility Strategy incentivizes the deployment of renewable and low-carbon fuels (e.g., by using H2), the feeding of onshore power supply with renewable energy, and emerging and innovative sectors of marine renewable energy (i.e., ocean energy, floating solar energy, and offshore H2 generation).

Ports will play a pivotal role in energy and decarbonization within this blue economy framework. Because ports facilitate a complex cross section of industries, the potential for significantly reducing greenhouse gas emissions and aiding the transition to clean energy are substantial. Alongside standard port activities such as cargo, logistics, and supporting the shipping industry, the larger ports can also support energy intensive industries (e.g., chemicals, cement, and manufacturing) and the energy industry itself in the form of energy generation, import and export, and energy grids. All these industry “clusters” present a range of pathways toward decarbonization, and the transition to clean energy and ports can act as a coordinator and provide assets to support this transition.

A coordinated strategy involving port authorities, port operators, and all stakeholders within ports is necessary to maximize the intake of carbon-neutral technologies:

-

Ship-electrification support solutions. These can range from portable energy-storage solution supplies to long-life modular battery systems, which can be tailored to power small and medium-sized marine transport, to innovative high-power and efficiency submerged electric motor systems for propeller-driven watercrafts, to ultracapacitors that can store energy and discharge when needed.

-

Using green fuels to power vessels. Shipping companies are currently exploring several potential green fuels (e.g., biodiesel, e-methanol, bio-methanol, ammonia, H2, liquefied natural gas, and nuclear). Hydrogen is expected to be a key player in the future low-carbon economy. However, current storage and delivery of H2 in its gaseous state are challenging and hazardous and should be carefully studied, balancing both environmental and safety considerations. A similar discourse can be applied to ammonia.

-

Decarbonizing logistics within ports. Direct and indirect emissions are generated by logistics activities from diesel-powered shore-side infrastructure to the use of nonrenewable electricity by buildings, lighting, and machinery to other indirect emissions from vehicles delivering cargo and warehouses. Many opportunities exist to decarbonize these activities, considering a combination of electrification (with renewable energy sources), higher efficiency, smart technologies to support freight delivery, and providing shore-side electricity for docked ships.

-

Decarbonizing port-based carbon-intensive industries. These include ship building, oil and gas, chemicals, food, construction, and fish processing. Similar to the logistics case, a combination of renewable-sourced heat can be used to run industrial processes, improve energy efficiency within existing processes, electrify with renewable energy sources and green H2 as a feedstock, conduct waste-heat reuse, and apply circular production models.

-

Producing renewable energy in ports. Ports can become pivotal in producing and providing clean energy to nearby residential, commercial, and industrial areas. They can function on strong grid networks to connect large electricity consumers and serve as ideal landing points for planned capacity of offshore wind. Ports are also potential sites for developing the large-scale electricity storage facilities needed to balance fluctuating supply and demand, as well as facilitating green H2 transportation.

-

Decarbonizing maintenance and construction activities. Activities within these areas include a combination of portable off-grid power supplies, off-grid storage to power tools (e.g., dredging equipment used for port maintenance), and a switch from diesel-powered machinery to electrified options.

A RACE AGAINST TIME THAT STARTED YESTERDAY

In transport industries, establishing clean transportation is a three-phase endeavor, as the example of aviation below shows:

-

Phase 1 — operational improvements that result in vehicles with fuel-efficient designs and technologies, better asset utilization, and thoughtful infrastructures

-

Phase 2 — a sharp and rapid ramp-up phase of clean fuels for airlines, with electric and/or hybrid aviation and SAF defining the period between 2025–2040 and beyond

-

Phase 3 — a possible shift toward full H2 in the 2040–2060 period

However, the race against time is tough, and the example of aviation is particularly striking (see Figure 1). Because biofuel enables only a 65%-75% emission reduction and because biofuel feedstock would be limited, the full effect on emission reduction is going to become material only when synfuels and H2 reach a critical mass. Also, ramped-up production capacity for biofuels, synfuel, and liquid H2 is a major factor when targeting net zero. Based on the anticipation of a future “fuel mix” that considers an optimistic perspective on liquid H2 as a drop-in aviation fuel and assumes a strong effort starting before 2025, over 70% of emission gain related to clean fuels will not happen before 2041–2050! Although 2050 seems far, it is remarkably close. Aviation must start to boost SAF usage now.

TIOs SHOULD GRAB SIGNIFICANT PART OF DECARBONIZATION’S VALUE

The net-zero transition is a singular moment for daring and capable investors to tap into the profit pool of energy supply (see Figure 2). Looking at the current share of total EBIT captured by OEMs, airlines, and airports reveals a strong opportunity. In the aviation industry, end-to-end CAPEX requirements to reach net zero are substantial. Participating in this investment means regaining approximately 10% of annual EBIT captured by outside energy suppliers. Investing in self-supply provides an additional clear opportunity to better manage the volatility of energy costs for aviation players.

Over the next 10-20 years, we see a paradigm in aviation: a substantial portion of the ecosystem EBIT becoming available to all heavy-duty or long-distance transportation segments. In these segments, energy represents less than 20% of transportation companies’ operating costs; the energy sector is also preparing to change to match net-zero ambitions. These changes will be primarily for road transport, maritime, and aviation, while rail should see a limited deployment of H2-powered trains.

Questions arise: Who will invest and become a shareholder in this new energy value chain? Who will tap associated profit pool? How will profit sharing occur among:

-

Incumbent energy supplier — namely, oil and gas companies?

-

New feedstock or energy technology providers and producers?

-

Players within the transportation ecosystem, including transportation companies, infrastructure operators, and OEMs?

-

Other external parties?

TIOs possess significant assets they should leverage to capture energy-transition value pool:

-

Ample land assets — critical to renewable electricity production, as windmills and solar farms consume roughly 20x more land than fossil fuel producers. Setting up electrolyzers for hydrogen is also very land-consuming.

-

CAPEX-oriented business model — aligns with high CAPEX requirement of energy production, as renewables are 3x more CAPEX-intensive than fossil fuel infrastructure development.

TIOs also have motivation to foster growth of new clean energy production, beyond need to gain approval from stakeholders. If they can guarantee access to clean fuels to transportation clients, they will attract more volume to their sites and gain a competitive advantage against competing hubs. Figure 3 shows factors affecting energy production.

2

TIOs MUST ARBITRATE BETWEEN (TOO?) MANY OPTIONS FOR DECARBONIZING TRANSPORT

CHALLENGES ARISE FOR TIOs WHEN LOOKING AT ENERGY

Even though TIOs are well positioned to support the net-zero transition, they must navigate four challenges:

-

Assessing a very wide variety of options covering both core and non-core activities to help decarbonize transport, some of them far beyond their usual core business

-

Choosing an investment strategy for each energy-related initiative, from pure facilitator to active involvement through investment and/or operational responsibility

-

Recognizing the need to view from an HR perspective (airports do not have “energy-transition experts” yet and need to acquire/develop this competence)

-

Navigating the unknowns of energy sector regulation, since it differs from core infrastructure safety, technical, or economic regulation that TIOs are accustomed to

TIOs MUST EVALUATE PRIORITIES

TIOs have options for taking action to reduce emissions in their sector. They can improve the energy efficiency of their facilities by using self-supplied green electricity or installing LED lighting. However, the impact of these actions is minimal. In aviation, for example, airports and building facilities emit less than 1% of the entire sector’s CO2.

Mobility is another lever TIOs can act upon by establishing electric charging stations for passenger and employee parking areas; promoting “soft” mobility when possible; and imposing the use of green employee vehicles, taxis, shuttles, and buses. Again, the impact of these changes is limited. In aviation, mobility accounts for less than 3% of CO2 emissions, although it represents almost 50% of ground emissions.

Despite the minimal benefits from the above changes, TIOs at least have control over them. They have no control over factors like the fuel burn of transportation vehicles. In the aviation sector, fuel burn represents more than 90% of CO2 emissions, both on airside ops (i.e., green taxiing, electrified ground support equipment (GSE), and buses and electrification of aircraft stands) and en route (i.e., optimized takeoff and landing trajectories and carbon-neutral aircraft fuels).

TIOs can activate multiple options and synergies to address the need to lower emissions generated (see Figure 4). For example, locally produced hydrogen, which supplies industrial vehicle fuel cells, could serve to supply commercial vehicles. Because of so many options, making arbitrages and prioritizing are difficult tasks for TIOs.

ANOTHER KEY DECISION: CHOOSING OPERATING & BUSINESS MODELS

Airports have numerous ways to respond to the question of what they can do to decarbonize their industry; there are also many ways to address how. For every initiative, they need to determine their degree of involvement, which could range from purely facilitating to investing and/or taking operational responsibilities.

As facilitators of energy projects, airports can create partnerships and provide infrastructure support to attract external investments and/or operators (see Figure 5). If a more hands-on role is desired, they can opt for a joint venture (JV) with specialists or take a more proactive approach by investing directly in required assets and getting involved in operational duties.

Airports and rail station operators have already needed to decide their degree of involvement in operations and developing/maintaining the assets needed to manage non-core business. Namely, these businesses include travel retail concessions and real estate investments in logistics, hospitality, or office segments. Energy is a much wider space for TIOs. The right model may differ when EV charging stations, battery storage, photovoltaic electricity, or sustainable fuel production is on the table.

The primary competencies of TIOs are asset management and operations. These skill sets can address local energy-optimization projects such as energy-efficient buildings, green electricity, and LED lighting. However, TIOs lack the necessary expertise and specialized knowledge required to structurally tackle energy transition, thoroughly understand related technologies and industry best practices, and identify the strengths and weaknesses of potential industrial partners. To address these deficits, TIOs should consider bringing in energy experts or creating dedicated roles focused on managing energy-related activities, while leveraging external experts and partnerships.

Finally, the need for attention arises around enforcing regulations on energy-related activities. As an energy provider, accountable for energy transmission, TIOs must respect the multiple operational obligations around infrastructure setup, operations, safety, and technical standards. Moreover, becoming an energy supplier (i.e., the seller of molecules or electrons) confers even more structural regulations, as TIOs would be required to obtain specific licenses and comply with energy-pricing regulations.

WHAT A LOWER RISK PROFILE MEANS FOR THE INDUSTRY

Despite a context with multiple complications, it is time for TIOs to take concrete actions thanks to the decreasing risk profile of decarbonization:

-

The technology is maturing and improving. This growth clarifies investment needs and the order of magnitude of the related business case. The aviation industry is shifting from a what-if perspective to making concrete arbitrages on energy-transition investments. One potential clean aviation fuel, hydroprocessed esters and fatty acids (HEFA), is a mature biofuel that is deployed by oil players reconverting their existing facilities; stakeholders are confident that other technologies, including biomass to liquid, alcohol to jet, and power to liquid (PtL), could reach industrial maturity and deployment by 2030.

-

Demand for clean energy is growing. Many countries around the globe have set sustainable fuel-incorporation mandates (e.g., the European initiative ReFuelEU and Japan’s mandate for clean aviation fuel). Large corporate transportation clients wish to decarbonize their own emissions. Microsoft and JP Morgan are participating in SAF book and claim systems, while LVMH is seeking net-zero transportation.

-

Ecosystems in all industries are eager for green power, but there is no risk of overcapacity; producing green electricity is a “no regret” move. Even if initial first clients are non-transportation-related, the investment in energy from TIOs should see lower risks on their revenue side. For instance, although H2 production for aircrafts may not be at scale before 2035–2040, making investments in green electron production now may still be worthwhile, as those green electrons will easily find clients.

THE BUSINESS CASE FOR STRATEGIC ENERGY INVESTMENT

The overall business case of net-zero transportation nevertheless represents a critical challenge that the industry must prepare for and overcome. Considerations include:

-

The need to use significant CAPEX up front to transform:

-

The existing asset base (building and vehicles), with typically +10%-15% premium.

-

The energy supply chain; for instance, moving toward 100% synfuel would represent a cumulative CAPEX of US $10 trillion over the next 30 years, assuming green electricity production capacity (about 50% of the total), H2 electrolysis capacities (10%), clean fuel production itself (20%), and maintenance CAPEX of the asset base.

-

-

An overall increase in energy-related OPEX; results will vary depending on the players, but:

-

Regional airlines, airports, ground handlers, and shuttle bus operators electing to electrify their operations will see a strong decline of their OPEX, thanks to much lower prices of electric energy versus fossil energy.

-

Commercial airlines, which represent the vast majority of the industry’s energy consumption, will keep paying 3x more at least for SAFs and H2 versus traditional kerosene by 2035, reduced to 1.5-2x more by 2050+.

-

-

Potentially lower revenues for commercial airlines resulting from:

-

Ticket prices impacted by higher fuel costs, with an overall increase estimated between +10% to +25%.[1]

-

Travel demand being hampered to a significant extent by the price elasticity of air travel (between -0.7 and -1.1, according to existing studies across geographies[2]).

-

The inability of airlines to fully pass fuel price increases over to passengers because of competition or the possibility of limiting travel demand (although different surveys show that clients would agree to pay a premium[3] of 15% or more for green travel, which would almost offset fuel-cost increases). Travel during the 2022 and 2023 summer seasons demonstrates that air-passenger traffic is back despite higher ticket prices.[4]

-

3. HOW CAN TIOs ACHIEVE NET ZERO WHILE CAPTURING FULL BUSINESS POTENTIAL?

DEVELOPING VISION & ROADMAP

Energy is all but assured to become a significant business pillar for TIOs. Therefore, executives must act beyond current initiatives; define a proper strategic vision; and develop an exhaustive roadmap that addresses technical, regulatory, economic, and financial impacts (see Figure 6). This vision and roadmap should ensure that TIOs make the right trade-offs among different business priorities: impact and speed of decarbonization, ROI, and the sector’s green image. Therefore, the vision and energy roadmaps must answer the following questions:

-

What are the possible scenarios for energy mix in their transportation vertical during the following three periods: 2020–2030, 2030–2040, and 2040–2050?

-

What are the technical prerequisites, challenges, and solutions for deploying production capacities for different key energy options?

-

What are the economics of different energy options, including CAPEX and OPEX, for production, distribution, onsite storage, and distribution?

-

What potential synergies among energy-related activities will ensure duplication of efforts and optimal phasing?

-

What best practices and lessons can be shared by other stakeholders, such as airports, OEMs, and airlines, that have taken initial steps in the carbon-neutral aviation fuel value chain?

-

What are the required competences and ideal governance for smoothly running energy-related activities?

CREATING NEW ENERGY BUSINESS UNIT

We strongly believe that TIOs need to create a new energy-focused business unit adjacent to their traditional business units of core transport, commercial and mobility, and real estate (see Figure 7). Creating this structure will enable them to catch the momentum to adapt their infrastructure for energy transition and tap into new a profit pool. This is because energy-related investments are long-term (fuel and oil installations are typically tendered for 20 or more years), while other activities such as retail or car parks have shorter tendering cycles of typically five to 10 years. Moreover, staffing this business unit will support recruiting and developing new capabilities.

TIOs can evaluate the benefits of creating a new energy business unit by extracting knowledge from other transport players or other industries with experience in setting up new energy-related business units:

-

SNCF, France’s national state-owned railway, recently launched a concession-like business model to produce photovoltaic energy in its car park. In June 2023, the railway operator announced its new subsidiary, SNCF Renewables, that will build solar power plants using available SNCF land and buildings. Its objectives are to produce 15%-20% of its current consumption by 2030 and gain energy independence by 2050.

-

In February 2023, United Airlines launched its Sustainable Flight Fund with support from other partners, including JP Morgan. The fund invests in companies that develop technologies to boost SAF production. In March 2022, it acquired a $5 million stake in Cemvita, a start-up that uses biotechnology and synthetic biology to address the need for SAF production at scale. The fund committed up to $37.5 million to NEXT Renewable Fuels, a leading start-up in turning recycled organic materials into renewable transportation fuels, provided it hits certain benchmarks. The airline has used a shareholder model to create a de facto energy business unit.

-

Tesla’s supercharger network was originally intended to support its core business growth, but it has rapidly grown into its own significant business segment, generating just under $1 billion in revenue. The network is also used to anchor new adjacent ventures, such as retail.

-

Casino Group launched GreenYellow, originally established to support the group’s energy transition. GreenYellow specializes in renewable energy production and energy-efficient services. Its large client portfolio helped it become a significant business asset, which Casino Group sold to Ardian Infrastructure for a net proceed of €600 million EUR.

3 COMPLEMENTARY TRANSFORMATIONS

Having a strategic vision, foreseeing the business plan, knowing the risk and value at stake, and shaping a target organization won’t be enough for TIOs to be instrumental in decarbonizing transport. There are three dimensions that play important parts in the quest to achieve net zero: corporate culture, shareholder perspective, and economic regulation (see Figure 8).

First, they need to ensure that their corporate culture will be open to innovative businesses, partnerships, and ecosystems. This challenge cannot be underestimated, as transportation players have historically focused heavily on risk management and leveraging vertically integrated organizations or strict client-supplier relationships, instead of innovating, risk taking, and becoming partnership-oriented. In the case of energy, the latter is shown by the establishment of corporate venture capital funds, JVs, or innovative long-term partnerships with emerging champions (either start-ups or divisions of fossil-born energy players).

Next, the energy strategy of TIOs will potentially modify their business, investments, and risk profile. In this context, aligning with the shareholder vision will be critical. A challenge may be posed by shareholders who use options other than the infrastructure operators themselves to invest in the net-zero transition; hence, the imperative of crafting a strategy demonstrating that the value capture will be equal at a minimum, that future monetization of this investment will be possible, and that investing in the energy strategy of infrastructure operators enables a competitive advantage for the latter in terms of attracting more traffic volumes.

Finally, when considering CAPEX and the need for TIO shareholders to capture a fair value, making most players subject to economic regulations is crucial. An initial obvious move would be pinpointing taxes levied on transport toward financing net-zero goals and the industry’s transition. However, beyond green CAPEX and throughput efficiency, CAPEX may have a specific incentivized status compared to other capacity-expansion CAPEX, which is driven by enlarged infrastructures rather than greener, more efficient assets.

CONCLUSION

ONCE-IN-A-LIFETIME OPPORTUNITY, STRONG STRATEGIC VISION & DETAILED ROADMAP TOWARD ENERGY BUSINESS UNIT

The time is now for TIOs to foster energy hubs. By 2030–2035, many positions in the clean energy value chain will be occupied.

The current conditions are ideal for TIOs to tap into significant additional revenue and profit streams:

-

Technologies are available.

-

The energy regulatory framework is concrete.

-

The demand for decarbonization is solid.

-

The CAPEX-oriented business model can monetize well-positioned available land.

Effectively unlocking this potential requires a strong strategic vision and a detailed roadmap. Moreover, it requires a dedicated business unit to effectively drive and manage energy-related activities, beyond existing initiatives. Answering the right questions can lead to significant steps toward sustainability and decarbonizing the transportation industry — and to significant incremental value creation for TIOs.

Notes

[1] Consider the following: a 2.5x fuel cost for SAFs versus kerosene, ~30% fuel consumption for aircrafts by 2040 (from technological and operational improvements), a relative share of fuel of 25% of airlines OPEX, and a target EBIT margin of 7%.

[2] Estimating Air Travel Demand Elasticities.” InterVISTAS Consulting Inc., 28 December 2007.

[3] Chaire Pégase, 2023.

[4] “Global Outlook for Air Transport: Highly Resilient, Less Robust.” IATA, June 2023.

DOWNLOAD THE FULL REPORT