Metaverse and Web3 are often used as umbrella terms for the next generation of the Internet, and the transformation they signify presents both a challenge and an opportunity for India. While some remain skeptical, we believe Metaverse and Web3 will lead the frontiers of the next wave of digital adoption for Indian industries. This Viewpoint explores the market potential of this next version of the Internet across different industries in India and gives an overview of the early use cases tested by industries in India and across the globe.

UNDERSTANDING BEYOND THE HYPE

For many, the term “Metaverse” first entered their consciousness when Facebook changed its name to Meta in late 2021. At the time, many people assumed it was merely a passing trend focused on gamers and younger audiences, with little or no relevance to them or their businesses. In fact, Web3 and Metaverse now are poised to transform industries and the way of working of the Internet, providing new opportunities across telecom, media, and other sectors as well as threats to companies that fail to adapt.

Future of the Internet

While the Metaverse and Web3 are often mentioned in the same breath and they are closely connected, they do not mean the same thing. Arthur D. Little (ADL) defines the Metaverse as “the future version of the Internet, blending the frontiers between reality and virtuality, at the convergence of immersive spaces, social and collaborative experiences, and the creator economy” (see ADL’s Blue Shift Report “The Metaverse, Beyond Fantasy,” which comprehensively covers the Metaverse’s structure, technology, and use cases).

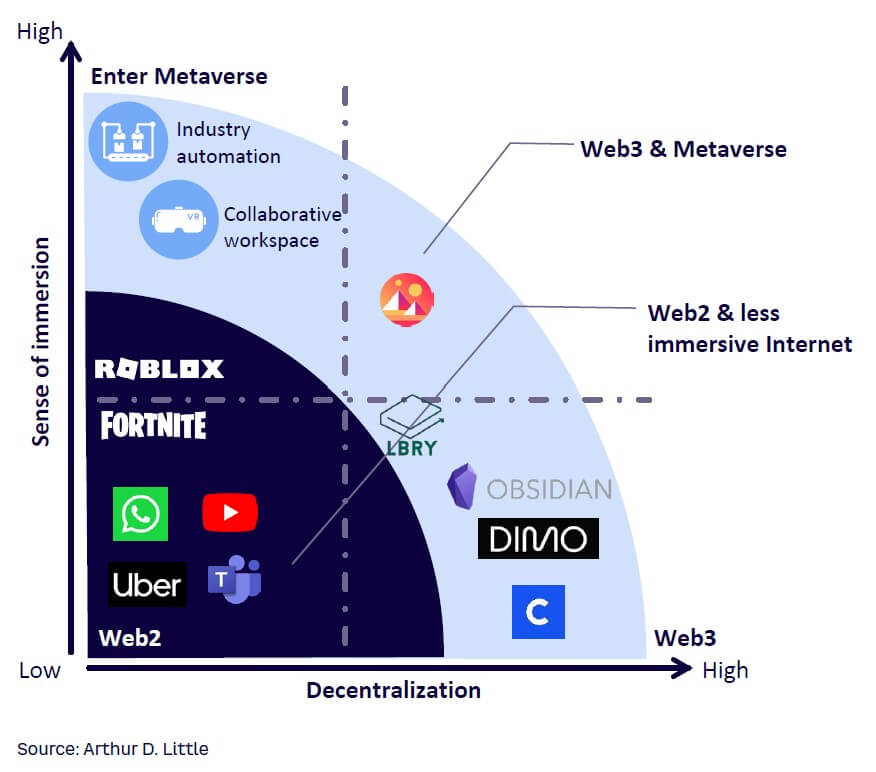

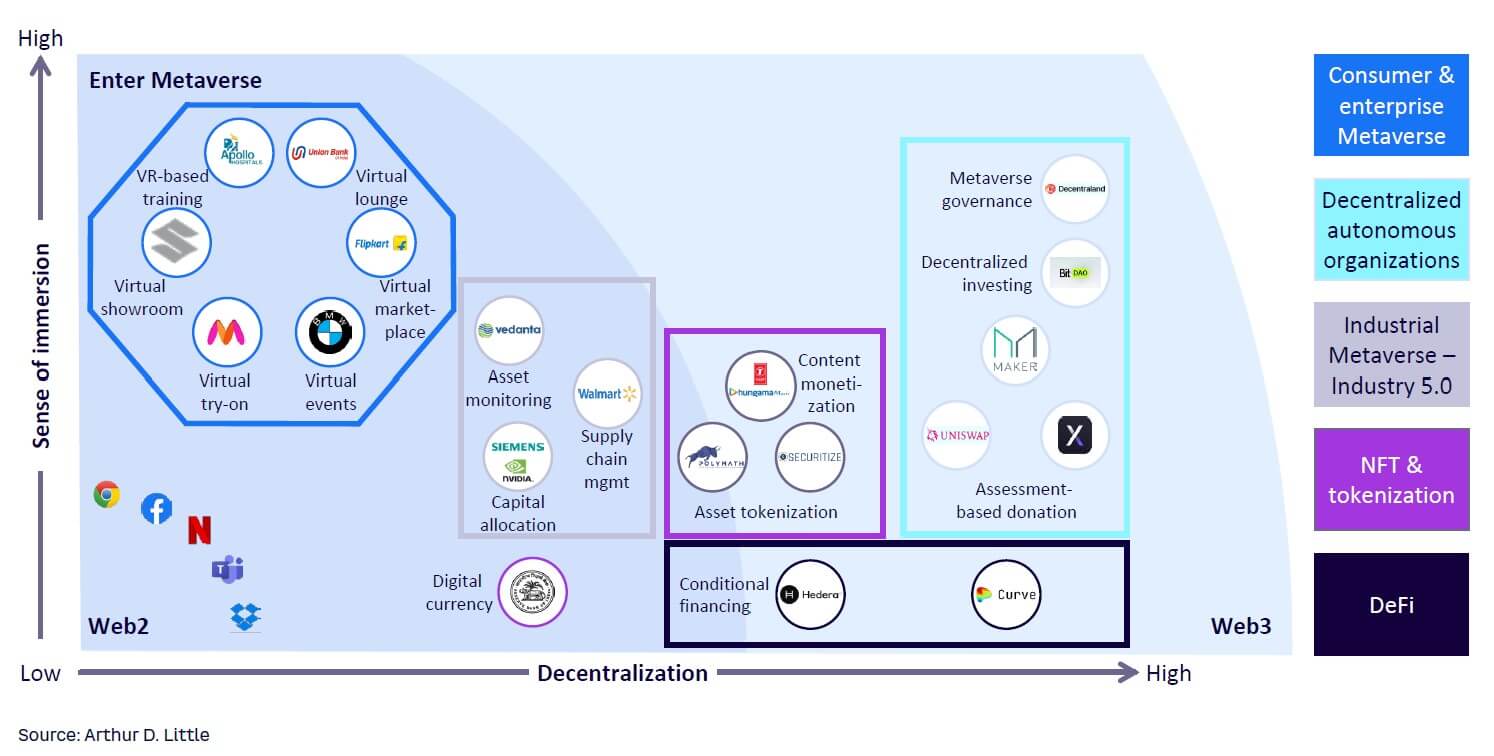

For its part, Web3 is the umbrella term for the next generation of the Internet, underpinned by decentralization and token-based economics. Alongside the Metaverse, the operation of which it partly enables, Web3 will transform the Internet’s power structure and way of working (see “Web3 Basics for Telecoms & Media”). Figure 1 illustrates a future version of the Internet that is more immersive and decentralized, while showing how the new decentralized and immersive element will coexist with the way we see the Internet today.

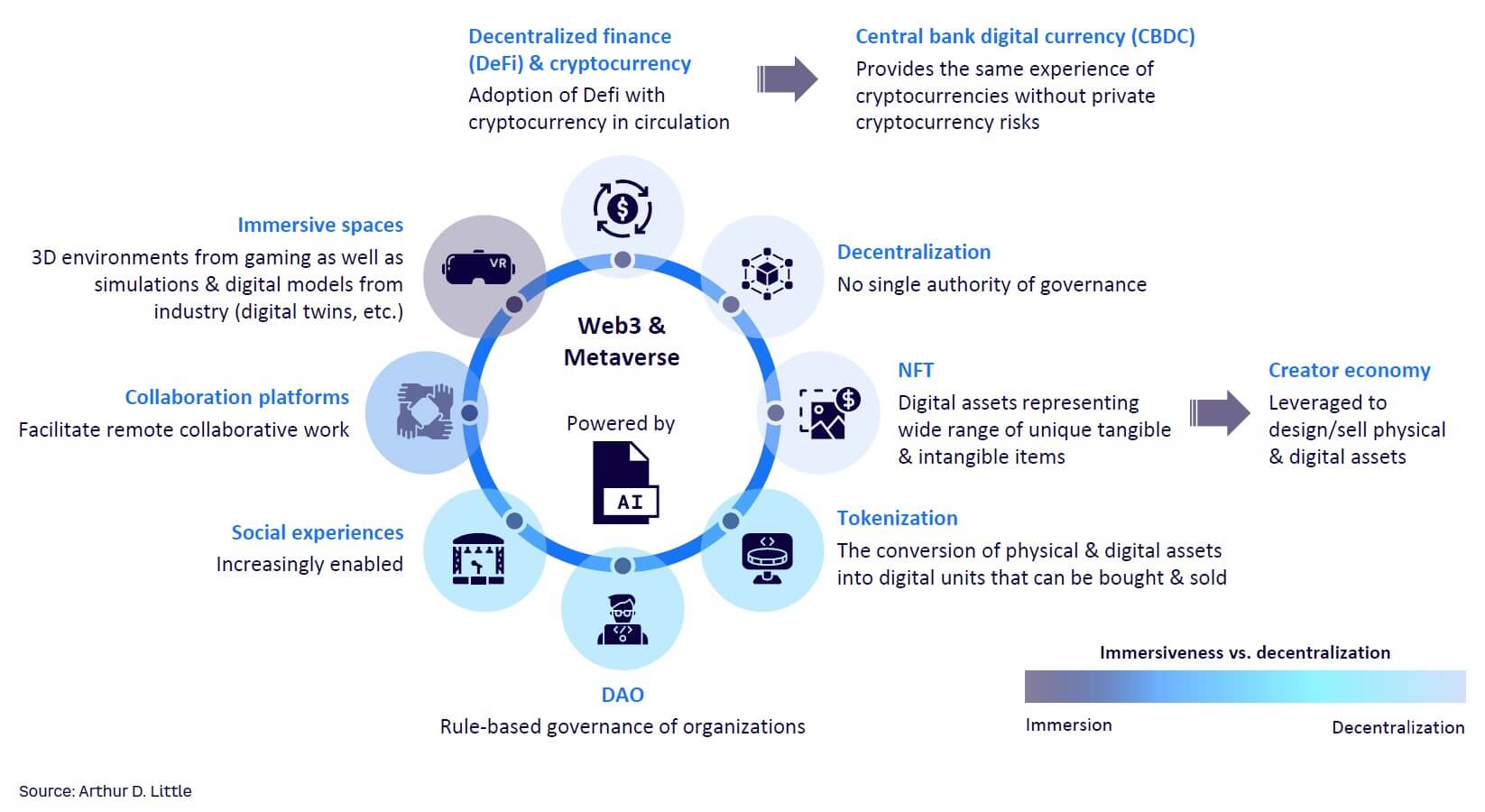

Defining characteristics & underlying technology

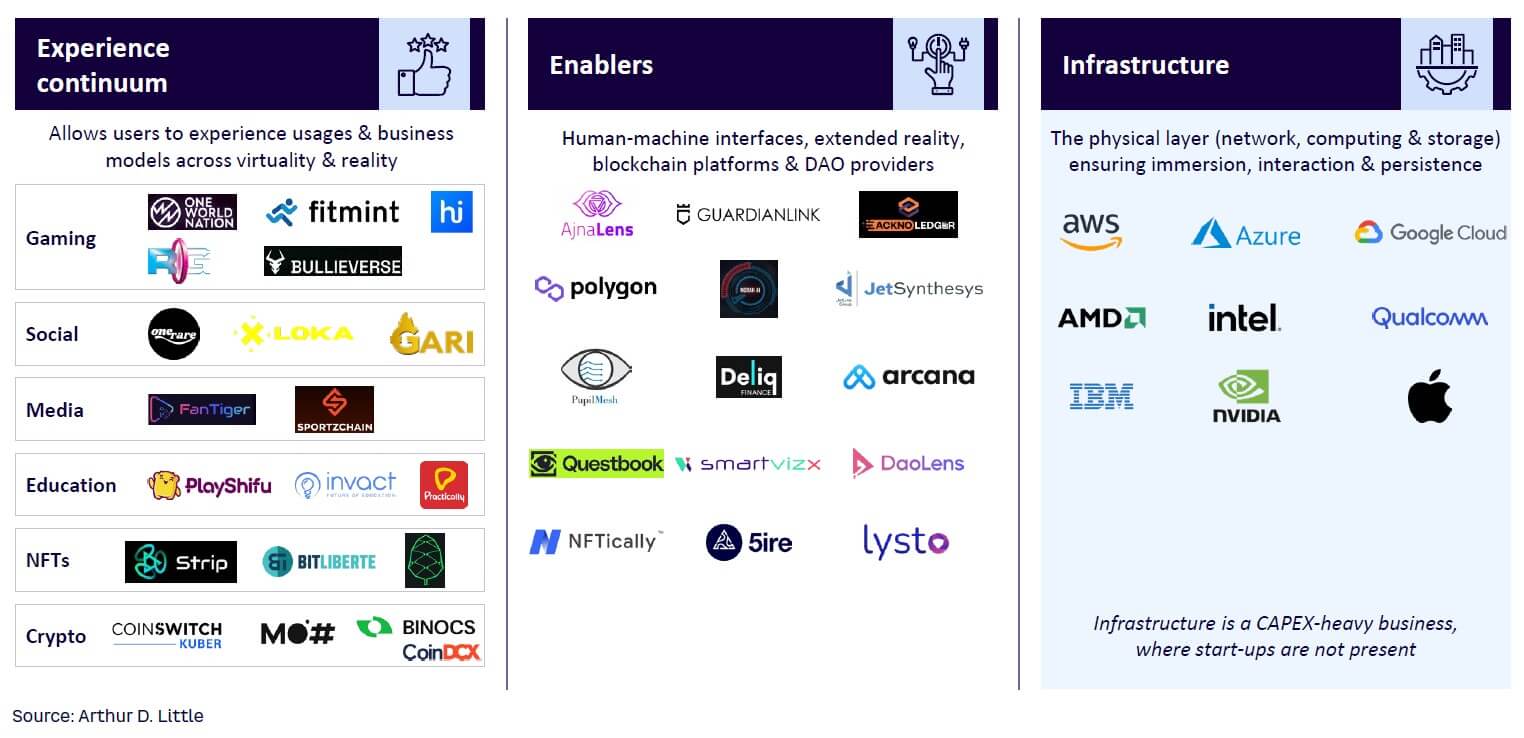

The Blue Shift Report (“The Metaverse, Beyond Fantasy”) defined a six-layer Metaverse framework. Figure 2 illustrates the underlying technologies that will build the future of Web3 and Metaverse on the experience continuum. We have described this framework in detail in other Viewpoints (see “Once Upon a Time in Hollywood” and “The Metaverse: What’s in It for Telcos?”). For the purposes of this Viewpoint, we examine the applications and use cases that have been built on these principles and adopted by multiple companies and start-ups.

Indian use cases

Particularly in the media sectors, prominent use cases are driving the faster adoption of Web3 and Metaverse. Content creators are looking to Web3 to monetize directly from the user, bypassing the aggregators. As an example, music-label company T-Series has partnered with Hungama, a digital media entertainment firm, launching HeftyVerse to facilitate the sales of newly released music as well as snapshots from movies and art as non-fungible token (NFT) collectibles.

We defined the evolution of the Internet around the sense of immersion found in the Metaverse and the extent of decentralization of Web3 in Figure 1. Similarly, we map the prominent Indian/global players and the use cases in Figure 3. By their nature, Web3 applications are decentralized and are accessible from anywhere around the globe. As a result, players like 3D virtual world marketplace Decentraland (which is not from India) are also included in Figure 3.

For example, Apollo Hospitals is using the Metaverse for patient consultations pre- and post-operation, as well as for training its staff. Maruti Suzuki has launched EXPOVerse during Auto Expo 2023 in India for remote users to experience their cars. And Union Bank has launched Uni-Verse, a virtual lounge used to interact with their customers digitally and provide them information about their financial products.

Another prominent global Metaverse and Web3 use case that is applicable for India is in Industry 5.0, where digital twins of large physical assets are built and controlled remotely. Some digital twins can be viewed in an immersive world, while others can be viewed on existing screens. In such cases, workers on-site can leverage augmented reality (AR) for their work on the ground, while basic monitoring and diagnosis can be done with precision remotely. As a global example, Siemens has collaborated with Nvidia to create digital twins of wind farms across the country that can be monitored remotely. The companies also used additional artificial intelligence (AI)-based simulations to further improve the operations. Such adoption of digital twins will disrupt power plant operations, transmission lines, gas pipelines, and other infrastructure assets located in the most remote parts of the country.

E-commerce marketplace Flipkart, is testing a marketplace for more immersive interaction between consumers and brands through its Flipverse. It displayed the products of 13 brands in Flipverse and during the virtual interaction, users earn Supercoins — virtual coins that can be redeemed for discounts.

A lot of brands globally have built their presence across Metaverse spaces to engage their consumers in more immersive experiences. In the next generation of the Internet, the Metaverse will evolve to become what websites are today.

Barriers to adoption

The key barriers in India to the adoption of highly immersive interactive environments are low Internet speed, network unreliability that causes lags and packet loss, and the high cost of AR/virtual reality (VR) devices. Despite these barriers, ecosystem players must push for wider adoption by building use cases and applications for a more immersive user experience.

In the future, AR will replace screens at a cost similar to screens today (across devices like TVs, laptops, smartphones, etc.). With the right talent and maturity, companies will build high-quality virtual worlds, just as they build websites today. The Metaverse will become critical for each industry, business, and government — just as websites are today. We will see adoption from workspaces, educational institutes, healthcare operations, government, and media. In preparation, industries should focus on building real tangible business on Metaverses to avoid what happened with the dot-com crash.

A THRIVING START-UP ECOSYSTEM

In India, start-ups have been at the forefront of innovation when it comes to building digital use cases and business models.

Across the key levers of the Metaverse and Web3, incumbents control the CAPEX and asset-heavy infrastructure of Web2, and they will continue to provide infrastructure for Web3 and Metaverse adoption. The top layer of the framework — the experience continuum — drives Metaverse usage for corporates, consumers, and industries. As Metaverse adoption and virtual use cases increase and more digital interactions become VR-based, the boundaries of virtuality and reality will continue to blur.

Start-ups are building in the experience continuum layer and in the enabler segment, which helps foster the ecosystem and includes blockchain platforms and decentralized autonomous organizations (DAOs). Figure 4 shares a broader landscape of Indian start-ups across the experience layer and enabler segments, where start-ups are making virtual games, developing social media apps, developing platforms in the education sector, building blockchain infrastructure, and more.

Similar to the global outlook, adoption of Web3 and Metaverse in India is driven by gaming, social media, and decentralized finance (DeFi) players. The crypto crash of 2022 forced the ecosystem to reconsider DeFi’s viability. The final nail on the coffin for DeFi came with the FTX crash, when millions of dollars were written off by FTX’s institutional investors. The cryptocurrency crash will shift the focus away from DeFi, but overall Web3 has a lot to offer besides cryptocurrencies.

Rising investor confidence

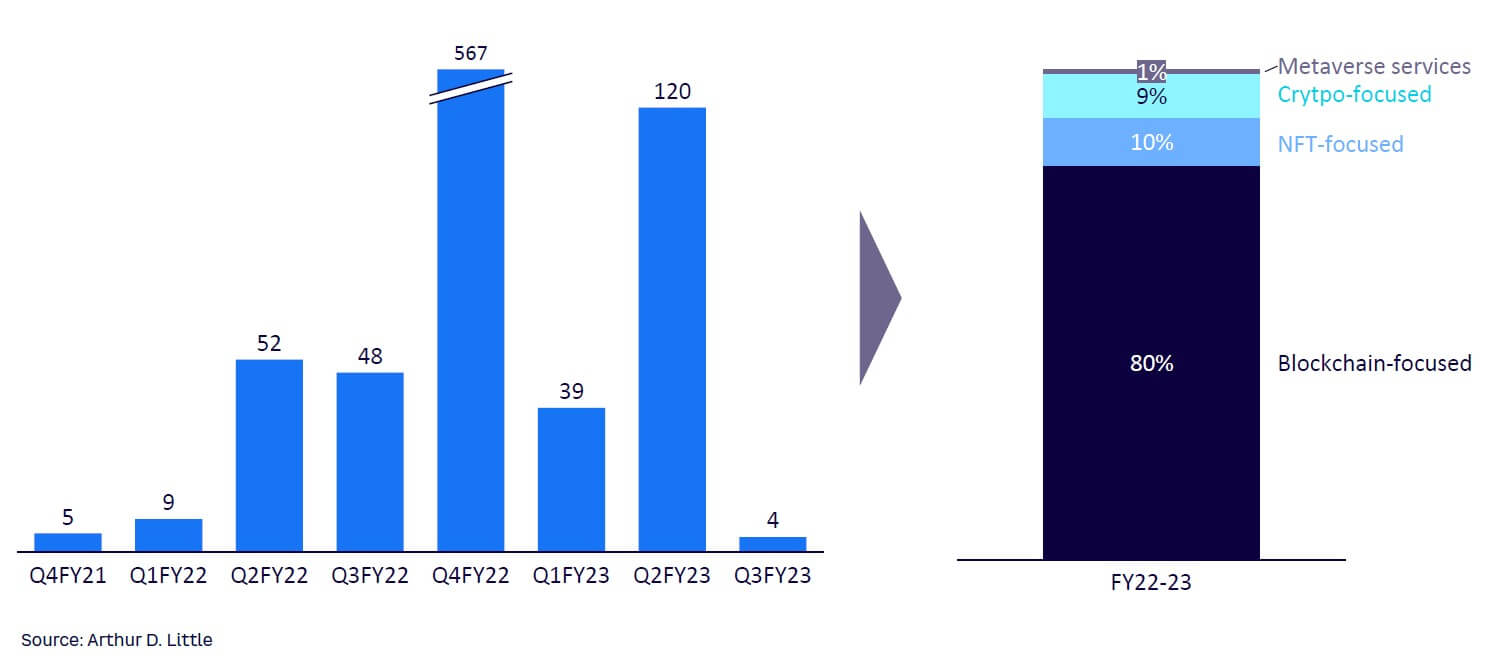

The recent investments outlook in the Indian Web3 and Metaverse space is robust. According to our research, ~US $840 million of investor money was invested in this sector across the last eight quarters ending December 2022 (see Figure 5). The investment trend is in line with the global economic outlook, where cost of capital increased and investments dried up globally. Given the potential in India and its relatively stable inflation, we expect the investment outlook to improve in 2023, with more investments happening in this sector.

The Indian regulatory environment is propelling start-up founders to set up their bases in Singapore and the Middle East, where government regulations are more lenient. With leading cryptos losing their value in 2022, investments in the space dried up, and investors are losing trust in crypto-based applications. As new technological capabilities emerge to enhance the virtual world, start-ups offering Metaverse services will gain traction in India.

As the funding outlook improves in 2023, investors are keen on funding blockchain tech, which will in turn aid in the adoption of Web3. The majority of funding themes in India are centered around infrastructure enablers. For example, blockchain platform-based Polygon received a total funding of more than $450 million, and 5ire, a blockchain-based network for interoperability and cross-chain transfers, received total funding of $221 million, rather than that funding going toward end applications like NFTs and cryptocurrencies. As a result, investors are promoting start-ups across the experience continuum and enablers cohorts to build infrastructure and create new business models.

A MULTI-BILLION-DOLLAR OPPORTUNITY FOR INDIA

With the rise of use cases and global adoption of Web3 and Metaverse, these technologies will have an enormous impact on the global and Indian economies. In fact, according to ADL analysis, the Metaverse is poised to become a ~$13 trillion opportunity globally by 2030. Based on growth estimates by the World Bank, the global GDP will reach $160 trillion by 2030, with about 8% of that contributed from Web3 and Metaverse. Global forecasts put Indian GDP at $10 trillion by 2035.

There are several factors that point to India’s strong position for Web3 and Metaverse adoption, as outlined below.

Indians are becoming digital-savvy

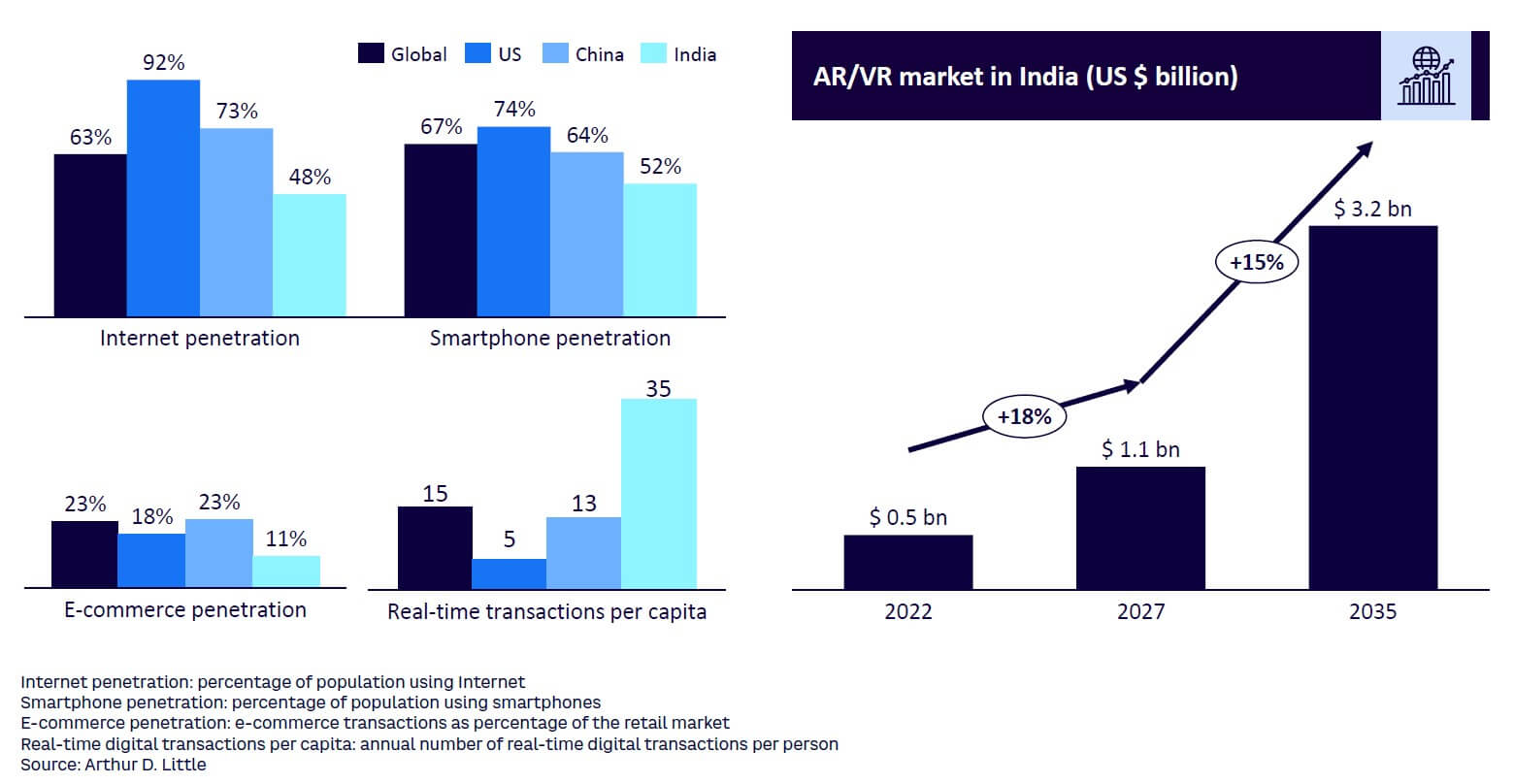

In recent years, smartphone penetration and Internet access in India have increased to cover almost 50% of the population (see Figure 6). In the last five years, multiple Chinese manufacturers have launched products in the $100-$200 category and smartphone usage has penetrated the price-sensitive rural areas of the country. Adoption is driven as well by cheaper voice data rates.

Accessing virtual worlds requires AR/VR devices, the current prices of which will limit India’s Metaverse adoption in the consumer segment. In addition, AR/VR devices currently on the market are bulky and not comfortable for prolonged use. Apple’s foray in this space with a lightweight, easy-to-use device is expected to disrupt the industry much the way iPods disrupted the music industry. Indian consumers are price-sensitive, and cost is a major impetus for adoption of new devices. Thus, the introduction of local and Chinese low-cost consumer electronic players (e.g., Boat, Noise, Xiaomi) in the AR space will allow consumers to access these devices at significantly lower cost, further driving Metaverse adoption.

Indians are paying digitally & shopping online

While the e-commerce penetration in India retail is only 11% (half that of global penetration), with increased disposable income and the expanded offering of products and services by start-ups in Tier 1 and Tier 2 cities (e.g., the Bharat Market), we expect the e-commerce penetration to grow in the future. Globally, India has emerged as an example for digital payments adoption driven by the convenience of a unified payment interface.

India market opportunity for Web3 & Metaverse

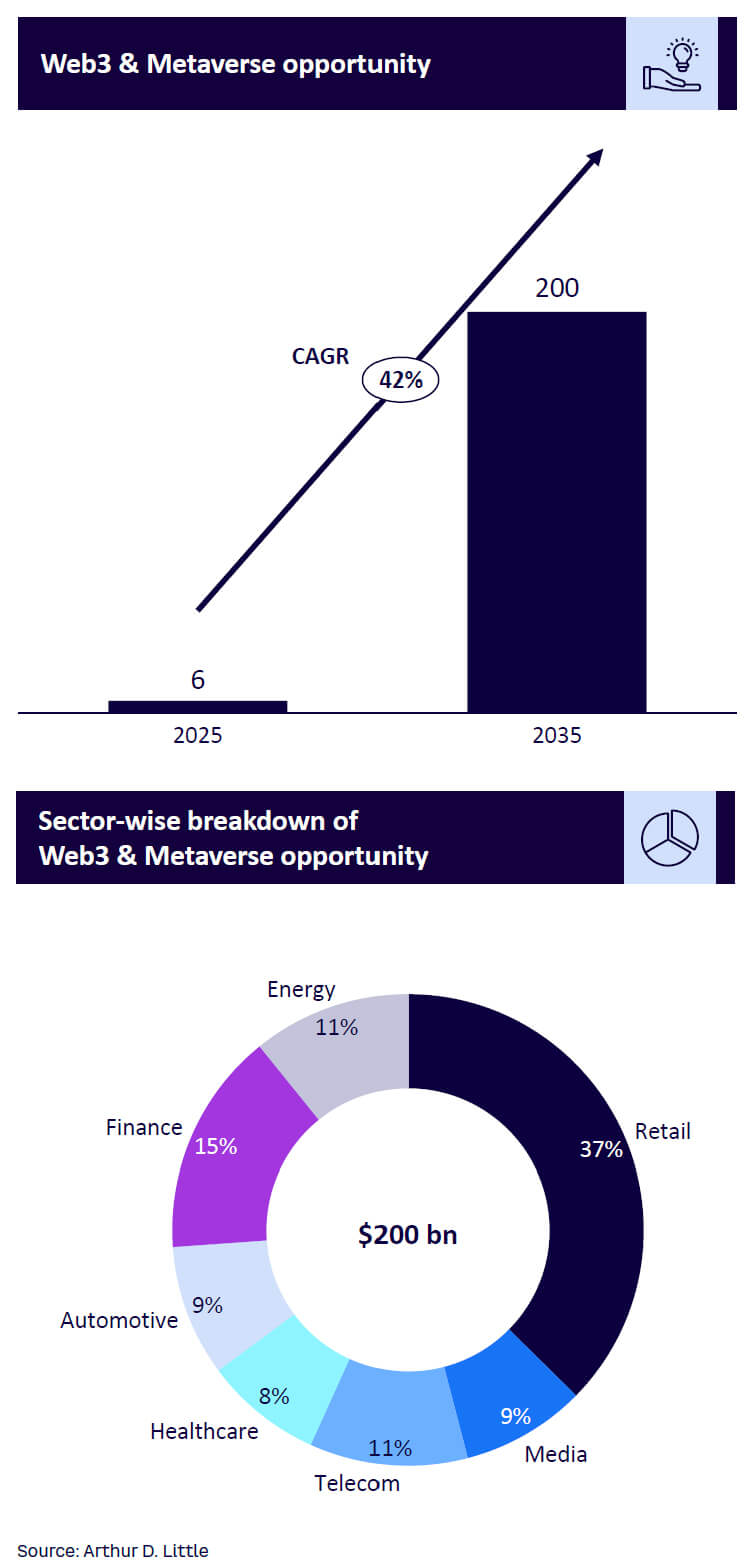

According to ADL analysis, the Web3 and Metaverse market opportunity in India is expected to grow at ~42% CAGR from $6 billion in 2025 to $200 billion by 2035 (see Figure 7). This growth will be driven by several factors, including:

-

Increased awareness and understanding of Web3 and Metaverse among industry leaders

-

Technology advancements

-

Availability of skilled talent

-

Clarity on government regulations

-

Investment by venture capital into start-ups

Conclusion

CAPTURING THE OPPORTUNITY

Although uncertainties and questions around Web3 and the Metaverse remain, companies in India and across the globe have begun to identify and prioritize opportunities. Companies are actively analyzing the Web3 ecosystem across technologies, use cases, and industries to build potential business models and go-to-market strategies for the most attractive opportunities. The technologies will be transformative, and companies should not be caught unprepared. To meet the challenge, we share some imperatives for India to capture Web3 and Metaverse opportunities.

Imperatives for investors

-

Set up dedicated expert teams in Web3 and Metaverse. Develop novel investment themes and provide guidance on business model innovations and opportunities.

-

Establish accelerator programs. Independently or in partnership with leading incumbents, set up accelerator programs to incubate early-stage start-ups.

Imperatives for corporates

-

Launch a sandbox for fostering innovation. Identify and build on the relevant use cases for your core product offering to benefit from Web3 and Metaverse adoption.

-

Form partnership strategy. Support and partner with start-ups and accelerators to solve industry-wide problems and drive efficiencies within your organization.

Imperatives for start-ups

-

Evangelize use cases and benefits to build the ecosystem. Identify and test the niche Web3 and Metaverse use cases among early adopters to lead the ecosystem.

-

Build products for the e-commerce market. The e-commerce Bharat marketplace (beyond Tier 1 and Tier 2 cities) offers huge total addressable market and growth opportunities.

-

Build in India for the globe. Build products with global reach in mind, taking inspiration from the success of Indian IT services and software-as-a-service products.

-

Work with corporates to establish B2B partnerships. Benefit from the financial stability and industry know-how of corporate partners while providing them with access to innovative products and services.

Imperatives for regulators

Globally, countries like South Korea, UAE, and China have invested in the Metaverse with both capital and effort. In India, a governmental vision for the Metaverse that supports the ecosystem and accelerates its adoption focuses on:

-

Enacting proactive regulation. Government could encourage and support ongoing efforts in building the Metaverse and proactively craft regulations to drive standards and policies to ensure the legal basis for safety, privacy, asset ownership, interoperability, competition, and innovation.

-

Incentivizing infrastructure investments. Current capacity planning in the infrastructure layer is insufficient to reap the full benefits of the Metaverse. Infrastructure investments must be controlled and managed to incentivize investments in the infrastructure layer.

-

Providing subsidies for AR/VR devices. Particularly for education and healthcare, the indirect benefits of using the Metaverse are tremendous for society. Government can facilitate faster adoption by subsidizing a portion of the cost.