DOWNLOAD

DATE

Contact

With inflation rates rising, telcos are facing increasing costs and slowing market growth rates, leading to shrinking margins. To overcome this challenging cycle, operators are adopting distinctive strategies as a way to effectively respond to inflation and become more resilient, with mixed results. In this Viewpoint, we evaluate the strengths and weaknesses of each approach — and present an assessment of what strategies hold the most promise. We utilize these lessons to argue that the current inflationary context represents an opportunity for operators to properly manage pricing strategies and avoid negative market position changes, while becoming resilient to future shocks.

A GLOBAL ISSUE

Inflationary pressures could reduce EBITDA margins

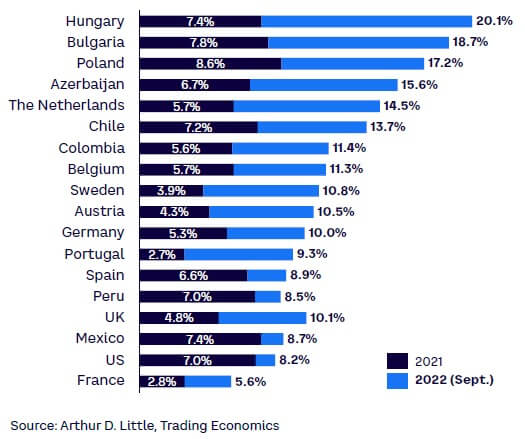

As a result of numerous geopolitical and macroeconomic factors, inflation has risen sharply worldwide over the course of 2022 (see Figure 1) and is forecasted to remain above target levels during the 2023–2026 time frame, albeit slowly declining. Seeking to drive spending across economies after the COVID-19 pandemic, central banks across the globe cut their interest rates — spurring spending across all sectors and pushing the observed growth in inflation. Further factors have also contributed to inflation, as has been the case in Europe, where rising energy prices directly link to the Russia-Ukraine war, along with the consequent stifling of natural gas supply. Moreover, some high- and mid-income countries, such as the US, Germany, and France, where inflation rates have been historically stable, have been impacted by the global effect of inflation as well and are being threatened by the highest inflation rates witnessed during the past few decades.

Certain sectors, such as utilities, consumer staples, and energy, are especially resistant to inflation due to the inelastic nature of their demand, as consumers will continue to demand these goods even if prices change. As such, companies in these sectors have the ability to pass higher costs directly to consumers, which most do through price increases in accordance with inflation. Other sectors, like consumer discretionary and IT, however, are less resistant, leading companies in these areas to be more hesitant to raise prices, as consumers may choose to stop acquiring goods or seek substitutes depending on price changes.

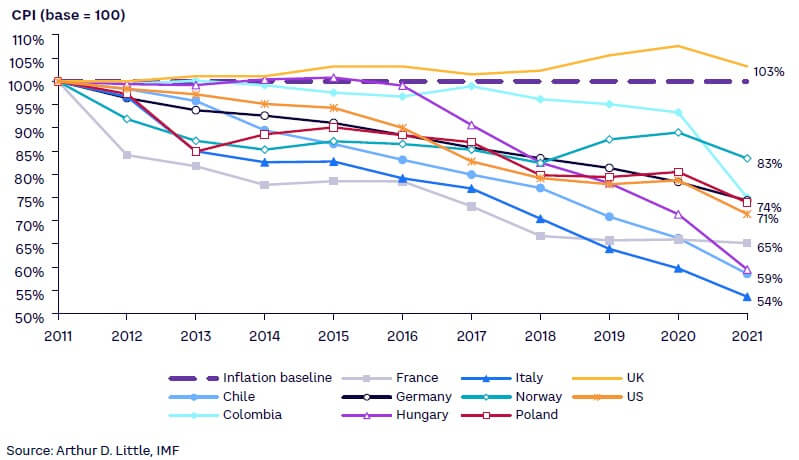

The telecommunications sector, however, is positioned in the middle ground between more and less resilient sectors. Consumers recognize the essential services telcos provide but may choose to pursue substitutes (in terms of competitors and/or technologies) in cases where price changes are substantial. Moreover, in many countries, arbitrary price increases are prohibited by country- and sector-specific regulations, making telco inflation resilience more difficult. This is exemplified by Figure 2, where pricing for communications services, which includes telecom, has grown notably below inflation rates with very few exceptions.

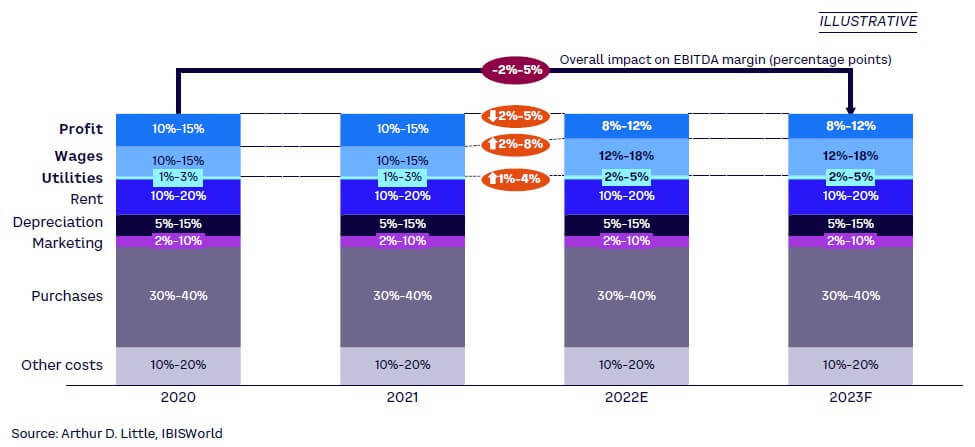

Thus, inflationary pressures represent a significant threat for the telecom sector. If left unchecked, Arthur D. Little (ADL) estimates inflation could shave two to five percentage points off telco EBITDA margins, mostly by way of increasing wage pressures and energy prices, as shown in Figure 3. This pressure is further compounded given that the sector is currently at a crossroads, with other factors, including those highlighted below, necessitating telcos to quickly transform their business models:

-

The sector has grown rapidly since an increasing number of people have become connected or have integrated digital means further into their everyday lives.

-

The impending adoption of 5G worldwide places additional growth expectations on the sector and, in certain high-income countries where the technology has already been deployed, has further compounded observed growth rates, driving them up.

-

Rising interest rates have resulted in more limited access to funding related to CAPEX, customer experience/digital transformation, and investment needs for telcos.

-

With the increasing commoditization of data comes an elevated need for telcos to find different avenues to capture value within digital ecosystems.

-

The accelerating investment of private equity firms in the sector, with a significant number having acquired telecom assets in the past few years, has also further enhanced the need for telcos to transform their business models.

In sum, the telecom sector will need to face future threats to make its economic model sustainable in the medium to long term. On one hand, market growth is slowing down while non-telco players are becoming more active in the value chain; on the other hand, there is more pressure on telcos due to higher CAPEX investment needs to update technology capacity and offer customers what they demand. Thus, it is necessary for telcos to ponder how to address the current situation and become more resilient given the inflationary context.

TELCO RESPONSE

Telcos utilize price increases as main tool to combat inflation

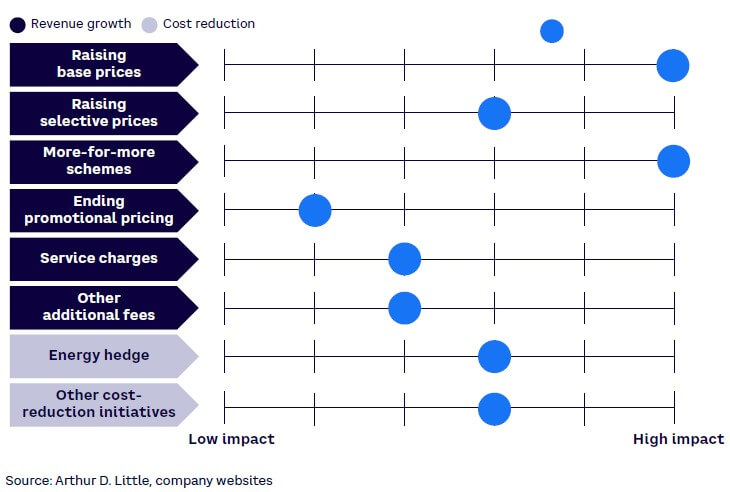

The accelerating downward pressure on margins has put telcos under duress, forcing them to adapt quickly by adopting several measures and initiatives to address both limited revenue growth and rising costs (see Figure 4). Recognizing inflationary economies as an opportunity to capture additional revenue if managed properly, some operators have chosen to increase base prices for services, implementing additional fees and/or enhancing the elements of current packages, albeit at higher prices (denominated “more-for-more” schemes or upselling into higher-tier mixes).

In addition, some operators have focused efforts on cost efficiencies, especially in Europe, minimizing the effect of higher energy costs on telco operations. While several cost-related measures are available to telcos to mitigate the impact of the detrimental economic environment (e.g., delaying IT/network CAPEX, energy hedging/power purchase agreements, reducing OPEX, digitalization), here we focus on pricing/top-line measures that may result in a greater positive impact for operators and telcos.

A key element for managing inflation in a consistent fashion is via Consumer Price Index (CPI)–linked contracts, which establish fees that go up according to yearly inflation rates. These are the norm in many European markets like the UK and Sweden, as well as others like Brazil. Although the current inflationary context may lead to high dissatisfaction for consumers with CPI-linked contracts due to current inflation rates at double or high single digits, this mechanism effectively allows operators to pass rising costs directly to consumers and is a key instrument for operator resilience given the context. However, these contracts are the exception worldwide rather than the norm and are difficult to implement due to regulatory policy or competitive pressures, making it necessary for telcos to seek other methods to effectively manage the impact of inflation.

In the US, operators such as AT&T and Verizon have raised their base prices across the board without necessarily enhancing packages. AT&T CFO Pascal Desroches has reportedly warned that further increases may take place in the upcoming quarters if pressures continue. Moreover, Verizon has upped its prices for customers without unlimited plans and has implemented additional administrative charges for each voice line. In Europe, in countries such as Slovakia, Belgium, and the Netherlands, operators Orange and Liberty Global have raised prices quite extraordinarily. Deutsche Telekom, however, has addressed the issue by maintaining current base prices but ending promotional pricing. Other operators, in Latin America, for example, have raised base prices in key markets or are toying with the implementation of more-for-more schemes, considering higher prices for both new and existing customers that would be compensated by significant increases in data and voice allowance.

For most European operators, higher inflation has led to rising costs mainly through increasing energy prices and growing wage pressures. Consequently, operators have focused on measures that limit these impacts by elevating prices and addressing rising costs. Orange, Telia, and Vodafone, for example, have hedged energy in the range of 50%-85% between 2022 and 2023, while others, such as BT Group and Liberty Global, have implemented energy rolling hedge programs throughout 12-month periods.

As BT CEO Philip Jansen recently stated, “Given the high inflationary environment, including significantly increased energy prices, we need to take additional action on our costs to maintain the cash flow needed to support our network investments.” In terms of growing wage pressures, European operators that have not been able to offset growing costs through price increases have moved towards accelerating automatization, cost savings, and digitalization initiatives. However, cost-reduction initiatives have currently taken a back seat to price increases, which operators are utilizing as their main tool to combat inflation.

SUCCESSFUL STRATEGIES

Lessons from Asian & Latin American markets

Although the steady wave of inflation has impacted telco margins globally, operators in some Asian countries (such as Turkey, Azerbaijan, and Pakistan) and Latin American countries (like Argentina and Venezuela and, to a lesser degree, Mexico and Brazil, where inflation has been consistently high spanning back decades) have demonstrated applicable lessons to smoothly ride out the current wave.

ADL interviewed representatives of several main telcos, former executives, and experts from the aforementioned countries, seeking to understand how operators have managed to be resilient given the inflationary context, what strategies they have adopted, and what lessons may be applicable for other operators across the globe. In general, a common conclusion surfaced: under the current context, prices must go up without hesitation.

Experts also elaborated on the how and when for price increases, with three strategies leading the way as best practices in their respective markets: (1) more-for-more schemes, (2) phased price hikes, and (3) monitoring and anticipating the response of direct competitors, especially challengers. Price increases would effectively offset rising margin pressures or cost growth and are a widely applicable solution throughout multiple market contexts. Costs, however, are highly context-specific; thus, operators should address them on a case-by-case basis (consider Europe, for example, where cost increases are mostly due to energy costs and increasing wage pressures). These strategies are, however, highly dependent on local circumstances and must be carefully synthesized to guarantee success:

-

More-for-more schemes are widely utilized in markets with high inflation. They consist of plan price increases accompanied by enhanced data/voice allowance possibilities. Given that inflation is a consistent issue, prices are updated on a yearly basis or even more frequently, which creates customer dissatisfaction. The utility of more-for-more schemes has reduced dissatisfaction, since enhanced elements of plans compensate for consistent and significant price increases. Importantly, experts and operators are adamant that a degree of churn should be expected with this strategy, but this would consist mainly of low-to-no value customers, leaving the main client base untouched. In Turkey and Azerbaijan, this practice is commonplace and has allowed operators to keep up with inflation rates, while also sending a positive message to customers.

-

Phased price hikes refer to the practice of updating/raising prices in plans for new customers and eventually transitioning these prices to existing clients when they are forced to update their plans as their contracts expire. The benefits of a phased price hike are twofold: first, it allows for an immediate price increase by way of new customers; second, it presents operators the opportunity to measure the response and sensitivity of a portion of the client base to price raises and rollback, if necessary. This strategy is also a key element to consistently minimize churn and dissatisfaction among the customer base.

-

Finally, operators and experts in high-inflation countries feel strongly that the role competitors play in the success of any price-raising strategy is crucial. When facing potential higher prices by their industry peers, direct competitors may choose to either follow their peers in raising their own prices or implement a price lock, leaving prices untouched, such as T-Mobile in the US and Free in France. The argument for competitors’ increasing prices is strong because if all competitors raise prices, then the general discontent among customers will be minimized. Moreover, by following along with higher prices, competing operators will minimize the impact of inflation on their revenues. As such, if all operators in a given market hike their prices simultaneously, it is a win-win situation. However, if a competitor does not follow with this strategy, the detracting competitor would likely absorb dissatisfied customers of other companies in the short term and impact the effectivity of other operators raising prices, by way of increasing churn. Thus, operators considering price raises should be wary of competition and monitor competitors closely before determining next steps.

CALL TO ACTION

Carefully plan price hikes

For operators to remain resilient in a high-inflation context, planned price raises remain a crucial instrument. While the introduction of CPI-linked contracts is ideal, as mentioned, these are difficult to implement in many countries due to regulatory limits and competition. As such, many operators are limited to the action of extraordinary price raises, which bring their own challenges, mostly in terms of product strategy: how to raise prices and when to raise prices.

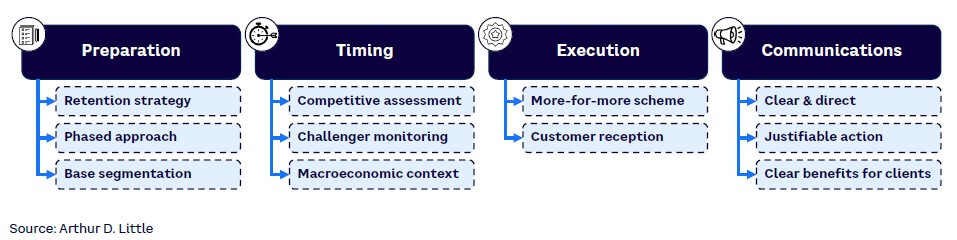

To address the first question — how to raise prices — operators should consider several factors, most notably strategies related to preparation, communications, and product strategy. In terms of preparation, telcos should have a clear retention strategy before increasing prices, especially for more price-sensitive customers. They should gear this strategy toward highlighting benefits of their more expensive plans with a positive message that seeks to minimize churn. Additionally, drawing from successful strategies in several markets, experts recommend preparing a phased approach. Telcos should transition new customers first, followed by renewing current clients, and finally pushing for the entire customer base. This allows for operators to measure response to price hikes and consider rollbacks, if necessary. Other alternatives of a phased approach include transitioning low- or medium-risk clients (as determined by their probable sensitivity to price increases) first and to then follow with more price-sensitive, risky clients. It is possible that the more price-sensitive customer segment will increase as purchasing power continues to decline; thus, telcos should continue fine-tuning their definition of distinct customer segments or even reconsider their overall strategy (e.g., using low-end brands, up-tiering mechanisms, focusing on retention).

When it comes to communications, experts suggest operators must do everything possible to avoid making customers feel cheated and, therefore, recommend price increases be clear, transparent, and explicit — directly stating how much prices will go up and the reasoning behind it. Given the high-inflation context across the economy, customers already will have observed price increases across many essential and day-to-day products and thus may have grown accustomed to higher prices, reducing eventual blowback. Therefore, it is key that operators directly relate their higher prices to the current inflationary context as reasonable justification.

Finally, in terms of product strategy, and following guidance from experts and telcos, a more-for-more approach is crucial. Such an approach hikes prices for plans while simultaneously enhancing them in terms of data and voice allowance. As suggested earlier, these schemes minimize potential dissatisfaction by compensating price increases through better plan benefits, sending a positive message to customers. The implementation of more-for-more schemes also implies the advancement of grid updates, giving operators the opportunity to simplify pricing grids and renew legacy plans as well.

Other possible alternatives include amendments to main services, implementing service charges or after-sales services, implementing administrative changes, migrating invoicing and payment charges, or reducing tariff validity. These options offer attaching additional charges to base prices; however, the client base may perceive them negatively due to already high inflation. Thus, it’s important to assess these strategies further to determine if it is the correct way to implement given the context.

To address the next question — when to raise prices — operators must consider a couple key factors: competitive response and the severity of the inflationary environment. First and foremost, operators must anticipate negative competitive responses. While experts and telcos suggest most operators will follow suit after a price hike, the possibility of a challenging operator locking its prices and running aggressive marketing schemes is latent. This case is exemplified by the US market, where market leaders AT&T and Verizon have recently increased mobile prices while T-Mobile, the challenger, has implemented a widely marketed price lock. Meanwhile, Verizon has also implemented a 10-year price lock for its fixed wireless access product seeking to improve its positioning in the fixed market. This strategy is not unique to the US, as French operator Free has also announced it will maintain stable plan prices despite the inflationary environment.

It is too soon to observe the effects of these strategies, but most likely they will affect market leaders negatively. While in these markets only one competitor, the challenger, has implemented a price lock, it is possible for all operators in a given market to maintain base prices after the incumbent raises its own. This is what we call a “nightmare scenario,” which could impact any operator raising prices severely in a negative manner. However, given the benefits of hiking prices for all operators, discussed earlier, in most cases this scenario is very unlikely and may only occur in a situation where a single incumbent operator competes with several challengers in the market. Therefore, given possible competitive responses to a price increase, any operator considering price hikes must be wary of the competitive reaction and monitor competitors closely, especially challengers, which may benefit by detracting from a price raise.

Certain operators may consider the implementation of a price lock as a viable strategy depending on specific market circumstances, such as market positioning, overall sales, go-to-market strength, among other factors. However, in the context of high inflation, the benefits of a price lock may be temporary because it is more likely than not that operators will have to eventually raise prices to maintain their margins in the medium to long term.

Operators must also consider the severity of the inflationary environment before making a decision. As pointed out earlier, high inflation rates correlate with higher prices across various essential and secondary products outside the realm of telecom. However, price increases should stay in line with central bank inflation rates as an argument for justification, which operators could incorporate into their communications strategy.

Figure 5 summarizes the recommended strategies to manage inflation effectively, where extraordinary price increases are the main tool for operators to resist inflation. When implementing such price hikes, operators must prepare beforehand; again, it’s crucial to have a clear retention strategy — communicating to customers in a transparent manner, justifying the reason behind the higher prices, and compensating the increase through greater data/voice allowance. Moreover, the success of this strategy also depends on the competitive response and the macroeconomic environment. As highlighted earlier, operators must be wary of challengers and monitor them closely, choosing the correct time to raise prices for all operators to follow suit. And, again, operators should utilize inflationary contexts to raise prices, justifying any increases with central bank rates and taking advantage of the scenario that most customers have already seen prices go up across the board in their daily lives, making them accustomed to increases.

Overall, while CPI-linked contracts are the ideal instrument for telcos to fight inflation, their implementation may be unrealistic in some markets due to regulatory and legal limitations. While most countries allow for CPI indexation and extraordinary price increases, depending on whether customer contracts include these factors, others prohibit such practices. Moreover, some offer price flexibility for operators but give customers the opportunity to exit contracts without a penalty in case increases are above a certain threshold, such as in the case in the Netherlands. Operators, therefore, must be aware of limits imposed by regulation in their price-increase strategies.

Conclusion

THRIVING IN A HIGH-INFLATIONARY ENVIRONMENT

Inflation worldwide presents a serious risk for telcos’ continued profitability by way of rising costs and slowing market growth. Therefore, it is key to understand what strategies operators in inflation-prone countries have adopted and how they have proved resilient through applying them. To formulate this Viewpoint, ADL conducted various interviews with key telcos, former executives, and experts from these countries to better understand this growing threat, draw key lessons applicable worldwide, and help telcos manage inflation effectively. In doing so, we offer the following action plan:

-

Increase prices. Under the high-inflation context, prices are the main tool in mitigating impact and must be raised without hesitation. Although CPI-based contracts are ideal, they are not feasible in certain countries due to regulatory restrictions or competition.

-

Create an effective roadmap. Telcos must define a viable roadmap for the price increase by setting out a clear retention, communications, and product strategy. Communications must be precise, transparent, and justify the price increase.

-

Opt for more-for-more scheme. When operators raise both plan pricing and content, they can compensate price increases with additional benefits and mitigate potential customer dissatisfaction.

-

Take advantage of inflationary context. Since customers are accustomed to price increases in other areas, blowback may be minimized. In addition, it is essential to monitor competitors, especially challengers and their response to potential price hikes.