Queens, knights and “TowerCos”: Telecom chess

Staying ahead in the game

Executive Summary

Picture a chess game. Your moves in the game have put you “in check”. You are at serious risk and pressured from all sides. You must react now.

Something similar is occurring with mobile network operators (MNOs). Financial fundamentals are declining, and maintaining cost-intensive, passive fixed assets is draining their pockets. At the same time, the “5G ecosystem” technological wave is just around the corner, requiring a ramp-up in MNOs’ investments in their future networks. The game is tough and a strategic move is required now.

In this context, MNOs have engaged in different strategies. The most relevant of these is asset monetization (mainly of tower sites), which allows them to focus on their core business operations, outsource management of cost-intensive assets and raise valuable financial muscle.

Now is the moment for MNOs to define their real “core” business areas. They have an excellent opportunity to leverage the current momentum of the tower market and grow valuable financial muscle for future network deployments.

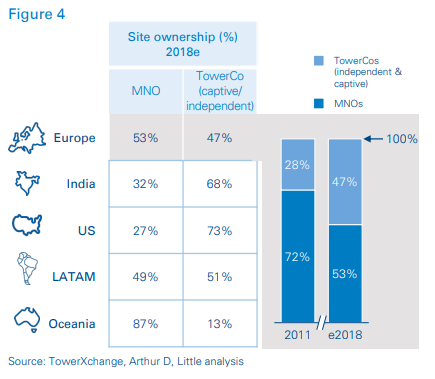

As site ownership has been progressively moving from MNOs to TowerCos, new players have gained relevance, transforming the nature of deals. Private equities’ presence in sites under independent TowerCo management has more than doubled since 2011 (reaching approximately 50 percent)1 . Overall, prices of tower deals have increased, and deals are moving from a “one-size-fitsall” approach to more ad hoc operations.

To stay ahead, both TowerCos and MNOs have a game to play. For TowerCos all around the globe, there is an untapped site base holding opportunities for several attractive deals. For example, Europe holds a 477,000-site base, the MENA region has around 240,000 sites, India’s site count has risen to approximately 460,000, there are roughly 410,000 in SE Asia, and approximately 170,000 sites are placed in LATAM. Leveraging and combining different players’ assets (large MNOs, local players, private equities) becomes critical to unlocking such deals. Additionally, other infrastructure growth levers, such as fiber, data centers and small cells, are waiting to be explored.

As we can see, opportunities are waiting ahead, but for now, it is essential to make the right move.

The telecom playing field

MNOs at a tipping point

Stress levels among MNOs are high. Over the past years, their fundamentals have been deteriorating. At an aggregated level, MNOs1 have seen EBITDA margins fall six percentage points over the past 12 years, from 38 to 32 percent. Similarly, operating free cash flow margin has almost halved, from 22 percent in 2005 to 12 percent in 2017. Furthermore, MNOs have seen their debt levels rise, reaching an average ratio of 2.7 times, versus 2.0 times in 2006.

Compared with other industries globally, such as pharma, banking, and even utilities, which have generated considerable value for their shareholders (five-year total shareholder return of 24.2 percent, 13.8 percent and 10.9 percent, respectively)2 , MNOs have managed to score a mere 9.9 percent. They come just before metals, oil and mining (the worst performers).

In addition, further pressure and strain lies on MNOs’ accounts, driven by their CAPEX needs. MNOs estimate that managing their fixed assets takes up to 80 percent of their total CAPEX.

Ultimately, MNOs are at a tipping point, requiring urgent action in CAPEX financing

Added technological pressure to support “data boom”

As if MNOs did not have enough to manage with their current scenario, the boom in traffic demand, increased number of connected devices, and higher performance needs are hatching a game changer

This game changer is “5G”, or rather, the “5G ecosystem”, and involves a completely new set of assets and added CAPEX. Apart from new radiating active equipment at existing macro sites, 5G will also require network evolution, including small cells, fiber backhaul, tower reinforcement, edge computing and hyper-scale data centers, among other things.

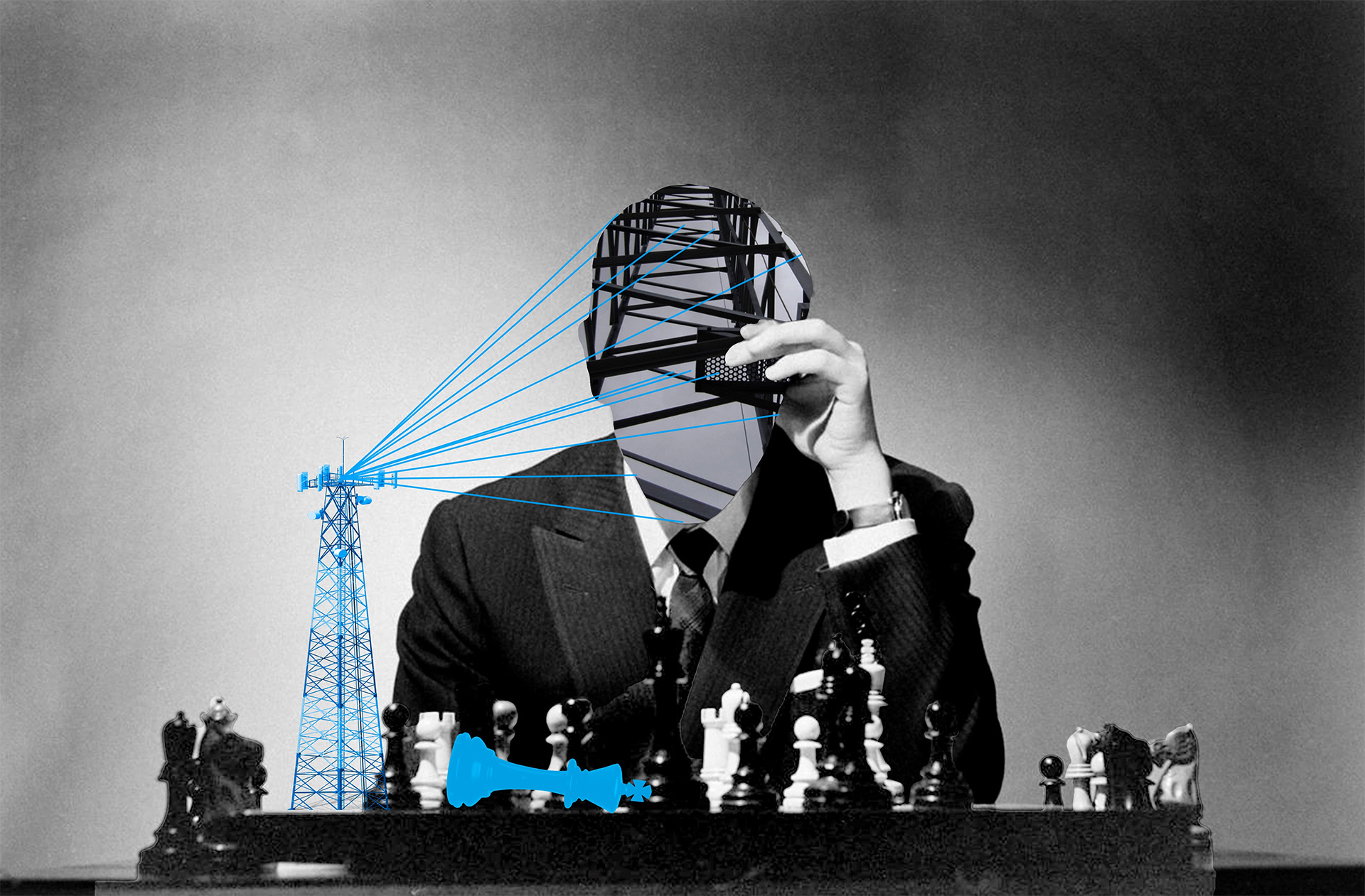

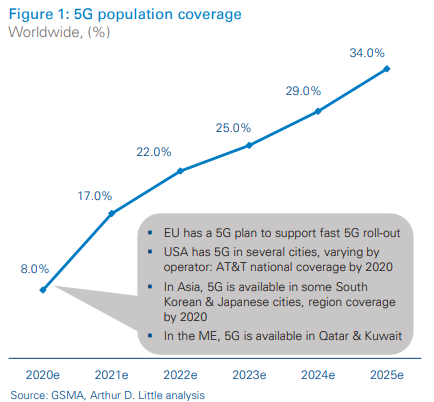

Although there is still uncertainty concerning 5G’s readiness and deployment, there is consensus that global coverage is likely to reach around 22 percent by 2022. Authorities have 5G roll-out guidelines, and different countries are encouraging trial-test roll-outs. MNOs must begin to prepare for full-scale roll-out with progressive investments.

The deployment of such a “5G ecosystem” will involve great investment efforts in the coming years.

According to Timotheus Höttges, CEO of Deutsche Telekom, “deploying 5G across Europe could require €300 to €500 billion”, which is 1.5 to 2.5 times the total investment for 4G roll-out.

These CAPEX requirements, added to network virtualization movements and topped off with regulatory push, will result in greater sharing initiatives between operators. Sharing will extend from active to passive equipment, and, where allowed by regulators, even spectrum.

The coming “5G ecosystem” deployment represents a market game changer

MNOs’ moves

In order to improve their financial fundamentals, prepare for a technological game changer and stay ahead of the game, while focusing on their core businesses, MNOs have been engaging in different initiatives, such as added infrastructure sharing and asset monetization.

Through the latter, MNOs are selling capital-intensive, passive fixed infrastructure assets, which are no longer a strategic priority for them. Such passive assets have limited influence in offerings and service levels that they offer to their customers. For example, in 2017 alone, there were eight deals in Asia, five in Europe and nine in LATAM.

Although price range paid per site in such deals is very broad, European deals are of a consistently higher value than those generated in the Middle East & Asia. A selection of recent transactions by region can be found in the following table.

MNOs are engaged in fixed-asset monetization Through monetizing

Through monetizing their fixed assets (especially telecom sites), MNOs can grow financial muscle for further technological investment requirements. At the same time, they retain core elements for “future networks”, including user experience, “softwarization” and quality of service.

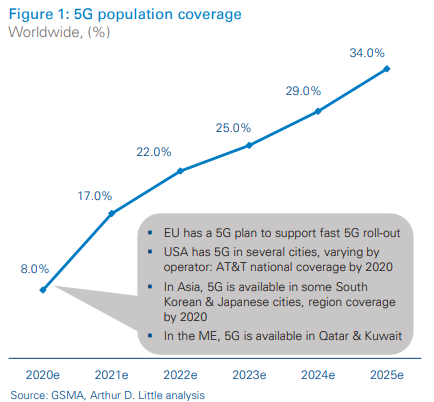

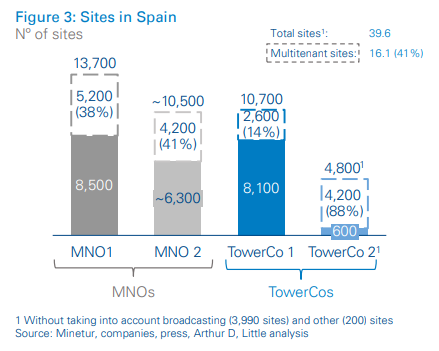

As mentioned previously, MNOs are also moving towards asset sharing to rationalize OPEX. In Spain in particular, out of the total of around 40,000 telecom sites in the market, over 41 percent are already multitenant, having engaged in passive sharing (colocation).

This figure has been rising over the past years, and is due to continue growing as MNOs outsource their presence on TowerCos.

TowerCos’ strategies

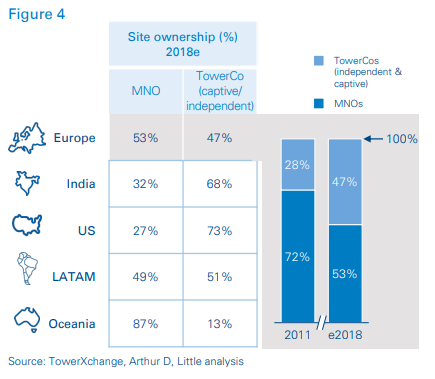

Globally, tower sites’ ownership has progressively moved from MNOs to independent TowerCos and captive TowerCos (of which MNOs retain ownership).

In Europe, 47 percent of sites are owned by TowerCos today, versus just 28 percent in 2011, while the figure rises to approximately 68 percent in India and 70 percent in the US and Canada. Other regions are still behind, with MNOs owning a greater share of sites. MNOs own approximately 50% In LATAM, 66% in southeast Asia, and still a whopping 99 percent in the MENA region

Key TowerCos playing prominent roles in this change include Cellnex in the European context, with over 28,000 sites; American Tower, with 170,000 sites focusing on the US, LATAM and India; and Crown Castle, with a portfolio of 40,000 sites, mainly in the US.

Tower deals are changing

These changes in terms of site ownership, as well as the increasing number of transactions, are leading to a change of paradigm in the nature of site transactions.

In this sense, two main changes have been identified:

- Transaction prices are increasing substantially (from approximately 10.3 times EBITDA in 2014 to 15.1 times today)

- Transaction structure has evolved significantly

– From traditional “sale and lease-back” deals with purely financial rationale

– To more complex and “industrially sound” deals, adding operational and strategic elements such as build-to-suit, joint-venture TowerCos….

MNOs have also adapted their approach towards site transactions from traditional leases, site commercialization and third-party site management.

MNOs adopting a conservative approach have moved to setting up joint ventures with competitors. While very successful at reducing OPEX (15–50 percent), this option reduces competitive differentiation, and partner misalignments often hinder the JV’s success. MNOs willing to engage in more value-adding initiatives have moved to TowerCos to either manage or completely outsource their tower bases. This approach not only provides MNOs with financial muscle, but also adds significant value through eliminating duplicities in areas such as operation & maintenance, network management and support functions, among others.

Recognizing the changing nature of tower transactions is an essential first step in allowing both MNOs & TowerCos to stay ahead in the game.

Private equities are stepping ahead

The changes identified above can be traced back to a common cause. Although not the only driver, the entrance of private equities (PEs) into tower transactions has greatly influenced deals’ structure.

PEs have gained significant presence, in both independent and captive TowerCos. As an example, out of the approximately 77,000 sites under independent TowerCo management in Europe, PEs have presence in over 50 percent, compared to roughly 24 percent in 2011 (generally as minority shareholders, with some exceptions). Since 2012, there have been over 13 independent TowerCo PE deals, with an average perimeter of 2,100 sites (approximately 260 sites in the smallest deal, up to 7,000 sites in the largest deal).

PEs are also beginning to explore opportunities in the area of captive players. For instance, KKR acquired a minority stake of approximately 40 percent in Telxius in 2017 and a site base of 10,200 from Altice in France. (The MNOs for these had very high debt levels.) Such movements have led PEs to move from null presence in European captive TowerCos in 2014 to approximately 16 percent of the total 146,000 sites in 2018.

The tower market is as dynamic as ever, with active PEs and a changing deals nature

Staying ahead of the game

The TowerCos’ game

Opportunities in towers

The market has plenty of further growth opportunities for TowerCos. However, given the increasing competition, those wanting to achieve a competitive edge in the market must stay on top of it, scouting for unexpected and interesting opportunities.

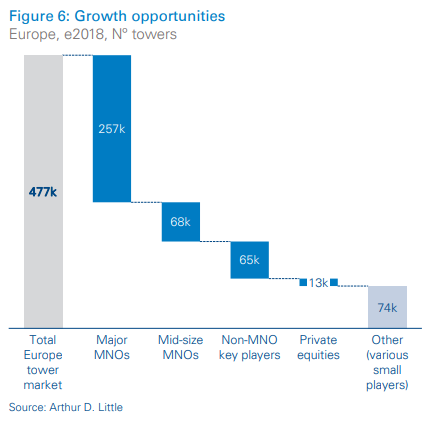

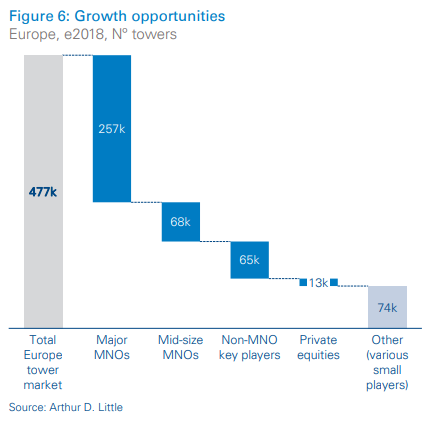

By regions, MENA has around 240,000 sites posing growth opportunities, India has approximately 460,000, southeast Asia has around 410,000, and LATAM has roughly 170,000. Finally, Europe has a tower base of 477,000 sites to be analyzed by TowerCos. The breakdown of this site base by owner can be seen in the figure below.

Rather than using an “all or nothing” binary approach, in which an MNO’s entire site base represents just one opportunity, attractive deals can arise through combining different players’ assets. Specifically, through deals with large MNOs, TowerCos can consolidate their presence in specific geographies, while smaller, local players allow them to boost their expansion, and specific deals with private equities provide “key wins” in strategic locations.

Some MNOs have already explicitly announced their willingness to monetize their tower assets. Recently, Vodafone announced that it was considering selling its tower assets in Europe to reduce its multi-billion-euro debt levels.

Opportunities beyond towers

Although TowerCos are betting heavily on growth through inorganic operations, there are additional untapped growth levers to explore. These include fiber connectivity, edge data centers and small cells.3

Reports suggest the small cell market is due to grow at an annual CAGR of 15–20 percent until 2026. With such projections, some TowerCos, such as Crown Castle, have begun racing for the business, spending over USD 11bn to diversify into small cells and fiber.

The MNOs’ game

Now is the moment for MNOs to define their core business areas. With lagging financial fundamentals and capital-intensive fixed assets draining their pockets, MNOs are in a tough position to engage in further technological investments.

In such a situation, MNOs have an opportunity to leverage the current momentum of the tower market. With different players bidding for MNOs’ passive assets at higher prices, they have the chance to grow valuable financial muscle and open partnerships with industrial rationale.

However, before approaching industrial or financial players, MNOs must decide what criteria carry most weight when deciding on one over the other. For MNOs whose aim is to engage in strategic partnerships that enable their network expansion (securing construction of “build to suit” and fiber backhaul) and allow them to keep part ownership of the sites, industrial partners may be the best choice. On the other hand, for MNOs whose motivation is mainly financial and to externalize tower assets completely (without keeping part ownership), financial partners can fulfill this requirement.

Specifically, MNOs should remain open to approaching private equities that have demonstrated interest in the market. However, they must ensure maximization of their assets’ value through detailed assessment, and first-mover MNOs will increase their possibility of doing so.

It is interesting to note that recently, in addition to tower-sale deals, there has been a move towards externalizing other passive infrastructure assets, especially fiber. MEO in Portugal is in the process of selling a stake of its fiber to the home (FTTH) network business. In a similar deal in 2018, SFR (France) sold a 49.99 percent stake in its FTTH business to a series of investment funds.

The capital raised through these deals will not only allow MNOs to improve their results, but also give them a head start in deploying the 5G ecosystem and associated network developments. In this sense, specific opportunities arise in the fields of edge computing, cloud RAN and spectrum sharing.

Recipe for success

At Arthur D. Little, we support MNOs and TowerCos in developing and implementing asset monetization strategies, as well as in preparing for the opportunities that lie ahead.

In this sense, the main steps to follow for both MNOs and TowerCos include:

- Performing an introspection to define the company’s own “core”:

- Determining which assets are strategic and which are less so (towers, fiber backhaul, data centers, etc.)

- Understanding requirements for the MNO’s future network (number of “build to suit sites”, edge data center expansion, etc.)

- Defining the ideal “asset basket” mix

- Tailoring the best strategy for each company and situation:

- Pursuing deals with industrial or financial partners

- Deciding what sites will be included in such deals (legacy sites, sites with major CAPEX requirements, network extensions, etc.)

- Defining a clear roadmap for moving ahead in the physical asset investment/divestment game. Depending on each company’s needs, strategic orientation, capabilities and desired involvement level, different options can be proposed, such as sales and leasebacks, network management deals, joint ventures and ad hoc deals.

To learn more about how we can help your company, do not hesitate to contact us.

DOWNLOAD THE FULL REPORT

Queens, knights and “TowerCos”: Telecom chess

Staying ahead in the game

DATE

Executive Summary

Picture a chess game. Your moves in the game have put you “in check”. You are at serious risk and pressured from all sides. You must react now.

Something similar is occurring with mobile network operators (MNOs). Financial fundamentals are declining, and maintaining cost-intensive, passive fixed assets is draining their pockets. At the same time, the “5G ecosystem” technological wave is just around the corner, requiring a ramp-up in MNOs’ investments in their future networks. The game is tough and a strategic move is required now.

In this context, MNOs have engaged in different strategies. The most relevant of these is asset monetization (mainly of tower sites), which allows them to focus on their core business operations, outsource management of cost-intensive assets and raise valuable financial muscle.

Now is the moment for MNOs to define their real “core” business areas. They have an excellent opportunity to leverage the current momentum of the tower market and grow valuable financial muscle for future network deployments.

As site ownership has been progressively moving from MNOs to TowerCos, new players have gained relevance, transforming the nature of deals. Private equities’ presence in sites under independent TowerCo management has more than doubled since 2011 (reaching approximately 50 percent)1 . Overall, prices of tower deals have increased, and deals are moving from a “one-size-fitsall” approach to more ad hoc operations.

To stay ahead, both TowerCos and MNOs have a game to play. For TowerCos all around the globe, there is an untapped site base holding opportunities for several attractive deals. For example, Europe holds a 477,000-site base, the MENA region has around 240,000 sites, India’s site count has risen to approximately 460,000, there are roughly 410,000 in SE Asia, and approximately 170,000 sites are placed in LATAM. Leveraging and combining different players’ assets (large MNOs, local players, private equities) becomes critical to unlocking such deals. Additionally, other infrastructure growth levers, such as fiber, data centers and small cells, are waiting to be explored.

As we can see, opportunities are waiting ahead, but for now, it is essential to make the right move.

The telecom playing field

MNOs at a tipping point

Stress levels among MNOs are high. Over the past years, their fundamentals have been deteriorating. At an aggregated level, MNOs1 have seen EBITDA margins fall six percentage points over the past 12 years, from 38 to 32 percent. Similarly, operating free cash flow margin has almost halved, from 22 percent in 2005 to 12 percent in 2017. Furthermore, MNOs have seen their debt levels rise, reaching an average ratio of 2.7 times, versus 2.0 times in 2006.

Compared with other industries globally, such as pharma, banking, and even utilities, which have generated considerable value for their shareholders (five-year total shareholder return of 24.2 percent, 13.8 percent and 10.9 percent, respectively)2 , MNOs have managed to score a mere 9.9 percent. They come just before metals, oil and mining (the worst performers).

In addition, further pressure and strain lies on MNOs’ accounts, driven by their CAPEX needs. MNOs estimate that managing their fixed assets takes up to 80 percent of their total CAPEX.

Ultimately, MNOs are at a tipping point, requiring urgent action in CAPEX financing

Added technological pressure to support “data boom”

As if MNOs did not have enough to manage with their current scenario, the boom in traffic demand, increased number of connected devices, and higher performance needs are hatching a game changer

This game changer is “5G”, or rather, the “5G ecosystem”, and involves a completely new set of assets and added CAPEX. Apart from new radiating active equipment at existing macro sites, 5G will also require network evolution, including small cells, fiber backhaul, tower reinforcement, edge computing and hyper-scale data centers, among other things.

Although there is still uncertainty concerning 5G’s readiness and deployment, there is consensus that global coverage is likely to reach around 22 percent by 2022. Authorities have 5G roll-out guidelines, and different countries are encouraging trial-test roll-outs. MNOs must begin to prepare for full-scale roll-out with progressive investments.

The deployment of such a “5G ecosystem” will involve great investment efforts in the coming years.

According to Timotheus Höttges, CEO of Deutsche Telekom, “deploying 5G across Europe could require €300 to €500 billion”, which is 1.5 to 2.5 times the total investment for 4G roll-out.

These CAPEX requirements, added to network virtualization movements and topped off with regulatory push, will result in greater sharing initiatives between operators. Sharing will extend from active to passive equipment, and, where allowed by regulators, even spectrum.

The coming “5G ecosystem” deployment represents a market game changer

MNOs’ moves

In order to improve their financial fundamentals, prepare for a technological game changer and stay ahead of the game, while focusing on their core businesses, MNOs have been engaging in different initiatives, such as added infrastructure sharing and asset monetization.

Through the latter, MNOs are selling capital-intensive, passive fixed infrastructure assets, which are no longer a strategic priority for them. Such passive assets have limited influence in offerings and service levels that they offer to their customers. For example, in 2017 alone, there were eight deals in Asia, five in Europe and nine in LATAM.

Although price range paid per site in such deals is very broad, European deals are of a consistently higher value than those generated in the Middle East & Asia. A selection of recent transactions by region can be found in the following table.

MNOs are engaged in fixed-asset monetization Through monetizing

Through monetizing their fixed assets (especially telecom sites), MNOs can grow financial muscle for further technological investment requirements. At the same time, they retain core elements for “future networks”, including user experience, “softwarization” and quality of service.

As mentioned previously, MNOs are also moving towards asset sharing to rationalize OPEX. In Spain in particular, out of the total of around 40,000 telecom sites in the market, over 41 percent are already multitenant, having engaged in passive sharing (colocation).

This figure has been rising over the past years, and is due to continue growing as MNOs outsource their presence on TowerCos.

TowerCos’ strategies

Globally, tower sites’ ownership has progressively moved from MNOs to independent TowerCos and captive TowerCos (of which MNOs retain ownership).

In Europe, 47 percent of sites are owned by TowerCos today, versus just 28 percent in 2011, while the figure rises to approximately 68 percent in India and 70 percent in the US and Canada. Other regions are still behind, with MNOs owning a greater share of sites. MNOs own approximately 50% In LATAM, 66% in southeast Asia, and still a whopping 99 percent in the MENA region

Key TowerCos playing prominent roles in this change include Cellnex in the European context, with over 28,000 sites; American Tower, with 170,000 sites focusing on the US, LATAM and India; and Crown Castle, with a portfolio of 40,000 sites, mainly in the US.

Tower deals are changing

These changes in terms of site ownership, as well as the increasing number of transactions, are leading to a change of paradigm in the nature of site transactions.

In this sense, two main changes have been identified:

- Transaction prices are increasing substantially (from approximately 10.3 times EBITDA in 2014 to 15.1 times today)

- Transaction structure has evolved significantly

– From traditional “sale and lease-back” deals with purely financial rationale

– To more complex and “industrially sound” deals, adding operational and strategic elements such as build-to-suit, joint-venture TowerCos….

MNOs have also adapted their approach towards site transactions from traditional leases, site commercialization and third-party site management.

MNOs adopting a conservative approach have moved to setting up joint ventures with competitors. While very successful at reducing OPEX (15–50 percent), this option reduces competitive differentiation, and partner misalignments often hinder the JV’s success. MNOs willing to engage in more value-adding initiatives have moved to TowerCos to either manage or completely outsource their tower bases. This approach not only provides MNOs with financial muscle, but also adds significant value through eliminating duplicities in areas such as operation & maintenance, network management and support functions, among others.

Recognizing the changing nature of tower transactions is an essential first step in allowing both MNOs & TowerCos to stay ahead in the game.

Private equities are stepping ahead

The changes identified above can be traced back to a common cause. Although not the only driver, the entrance of private equities (PEs) into tower transactions has greatly influenced deals’ structure.

PEs have gained significant presence, in both independent and captive TowerCos. As an example, out of the approximately 77,000 sites under independent TowerCo management in Europe, PEs have presence in over 50 percent, compared to roughly 24 percent in 2011 (generally as minority shareholders, with some exceptions). Since 2012, there have been over 13 independent TowerCo PE deals, with an average perimeter of 2,100 sites (approximately 260 sites in the smallest deal, up to 7,000 sites in the largest deal).

PEs are also beginning to explore opportunities in the area of captive players. For instance, KKR acquired a minority stake of approximately 40 percent in Telxius in 2017 and a site base of 10,200 from Altice in France. (The MNOs for these had very high debt levels.) Such movements have led PEs to move from null presence in European captive TowerCos in 2014 to approximately 16 percent of the total 146,000 sites in 2018.

The tower market is as dynamic as ever, with active PEs and a changing deals nature

Staying ahead of the game

The TowerCos’ game

Opportunities in towers

The market has plenty of further growth opportunities for TowerCos. However, given the increasing competition, those wanting to achieve a competitive edge in the market must stay on top of it, scouting for unexpected and interesting opportunities.

By regions, MENA has around 240,000 sites posing growth opportunities, India has approximately 460,000, southeast Asia has around 410,000, and LATAM has roughly 170,000. Finally, Europe has a tower base of 477,000 sites to be analyzed by TowerCos. The breakdown of this site base by owner can be seen in the figure below.

Rather than using an “all or nothing” binary approach, in which an MNO’s entire site base represents just one opportunity, attractive deals can arise through combining different players’ assets. Specifically, through deals with large MNOs, TowerCos can consolidate their presence in specific geographies, while smaller, local players allow them to boost their expansion, and specific deals with private equities provide “key wins” in strategic locations.

Some MNOs have already explicitly announced their willingness to monetize their tower assets. Recently, Vodafone announced that it was considering selling its tower assets in Europe to reduce its multi-billion-euro debt levels.

Opportunities beyond towers

Although TowerCos are betting heavily on growth through inorganic operations, there are additional untapped growth levers to explore. These include fiber connectivity, edge data centers and small cells.3

Reports suggest the small cell market is due to grow at an annual CAGR of 15–20 percent until 2026. With such projections, some TowerCos, such as Crown Castle, have begun racing for the business, spending over USD 11bn to diversify into small cells and fiber.

The MNOs’ game

Now is the moment for MNOs to define their core business areas. With lagging financial fundamentals and capital-intensive fixed assets draining their pockets, MNOs are in a tough position to engage in further technological investments.

In such a situation, MNOs have an opportunity to leverage the current momentum of the tower market. With different players bidding for MNOs’ passive assets at higher prices, they have the chance to grow valuable financial muscle and open partnerships with industrial rationale.

However, before approaching industrial or financial players, MNOs must decide what criteria carry most weight when deciding on one over the other. For MNOs whose aim is to engage in strategic partnerships that enable their network expansion (securing construction of “build to suit” and fiber backhaul) and allow them to keep part ownership of the sites, industrial partners may be the best choice. On the other hand, for MNOs whose motivation is mainly financial and to externalize tower assets completely (without keeping part ownership), financial partners can fulfill this requirement.

Specifically, MNOs should remain open to approaching private equities that have demonstrated interest in the market. However, they must ensure maximization of their assets’ value through detailed assessment, and first-mover MNOs will increase their possibility of doing so.

It is interesting to note that recently, in addition to tower-sale deals, there has been a move towards externalizing other passive infrastructure assets, especially fiber. MEO in Portugal is in the process of selling a stake of its fiber to the home (FTTH) network business. In a similar deal in 2018, SFR (France) sold a 49.99 percent stake in its FTTH business to a series of investment funds.

The capital raised through these deals will not only allow MNOs to improve their results, but also give them a head start in deploying the 5G ecosystem and associated network developments. In this sense, specific opportunities arise in the fields of edge computing, cloud RAN and spectrum sharing.

Recipe for success

At Arthur D. Little, we support MNOs and TowerCos in developing and implementing asset monetization strategies, as well as in preparing for the opportunities that lie ahead.

In this sense, the main steps to follow for both MNOs and TowerCos include:

- Performing an introspection to define the company’s own “core”:

- Determining which assets are strategic and which are less so (towers, fiber backhaul, data centers, etc.)

- Understanding requirements for the MNO’s future network (number of “build to suit sites”, edge data center expansion, etc.)

- Defining the ideal “asset basket” mix

- Tailoring the best strategy for each company and situation:

- Pursuing deals with industrial or financial partners

- Deciding what sites will be included in such deals (legacy sites, sites with major CAPEX requirements, network extensions, etc.)

- Defining a clear roadmap for moving ahead in the physical asset investment/divestment game. Depending on each company’s needs, strategic orientation, capabilities and desired involvement level, different options can be proposed, such as sales and leasebacks, network management deals, joint ventures and ad hoc deals.

To learn more about how we can help your company, do not hesitate to contact us.

DOWNLOAD THE FULL REPORT