As the world’s desire to achieve decarbonization intensifies, an innovative solution is emerging. Electric vehicle (EV) conversion (converting existing internal combustion engine [ICE] vehicles into EVs) offers a practical, cost-effective way to electrify the transport sector, enabling emerging economies to accelerate their sustainability journey. This Viewpoint looks at how EV conversion can drive decarbonization, especially in emerging markets such as Southeast Asia (SEA).

DECARBONIZATION & THE TRANSPORT SECTOR

Carbon-neutral fuels and EVs are both viable ways to combat pollution from the transport sector. However, carbon-neutral fuels are expensive, require a lot of energy to produce, and have near-term scalability issues, while EV adoption does not solve the problem of pollution from existing ICE vehicles. The focus of this Viewpoint, EV conversion, offers a more practical solution for decarbonizing the transport sector, particularly in emerging markets like SEA.

EV conversion and retrofit kits[1] offer a way to convert traditional ICE powertrains into electric ones, significantly reducing carbon emissions from ICE vehicles. EV conversion kits can:

-

Accelerate EV adoption by making them more accessible and affordable.

-

Create a circular economy by extending the lifecycle of ICE vehicles.

-

Tackle the root cause of emissions by targeting the existing base of ICE vehicles.

Global & regional transport emission goals

Climate change, enhancing air quality, and reducing fossil fuel dependency are being addressed at a global level through initiatives like the Paris Agreement and the Conference of the Parties (COP) summits. Based on current climate projections, achieving global net-zero emissions by 2050 and limiting global warming to 1.5 degrees Celsius above preindustrial levels are critical.

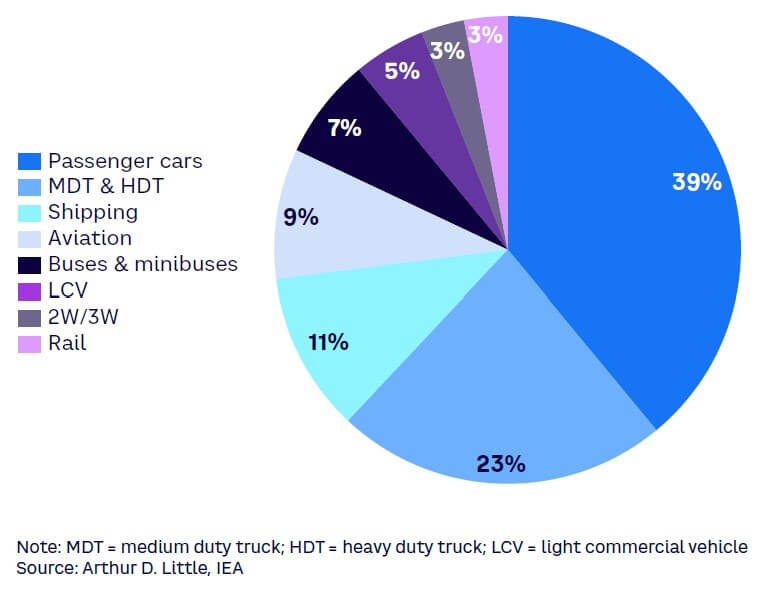

Based on data from the International Energy Agency (IEA), the transport sector is responsible for nearly 37% of global CO2 emissions (from end-use sectors in 2021), so addressing vehicle emissions must be a top priority. More specifically, the sector is responsible for 15%-35% of total CO2 emissions in the US, India, and China, according to ADL analysis. As shown in Figure 1, passenger and commercial vehicles are the largest emissions sources, underscoring the importance of electrifying them.

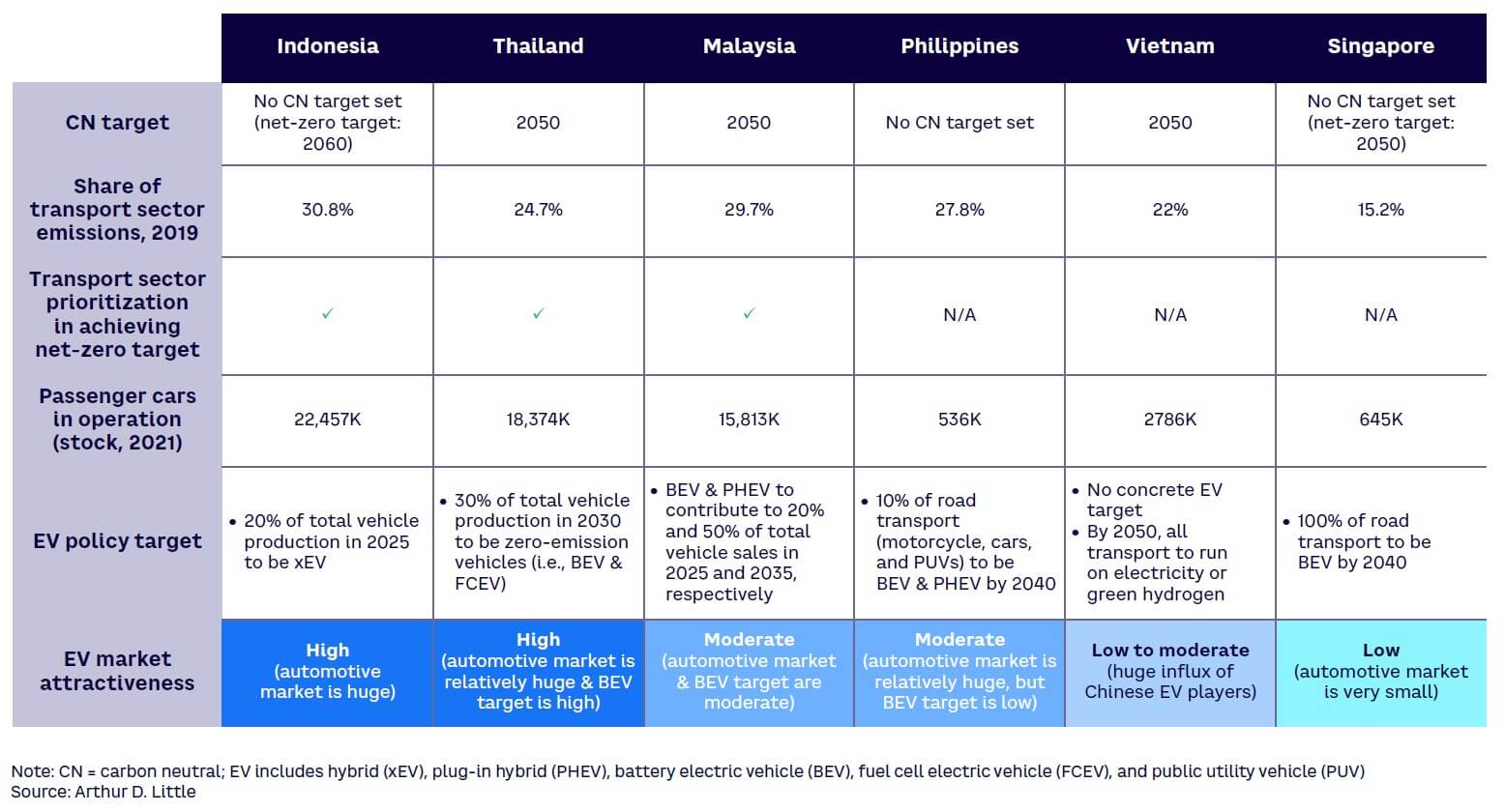

Countries around the world have announced targets centered around reducing emissions from the transport sector. For example, the EU aims to reduce transport emissions by at least 90% by 2050 compared to 1990 levels. China wants EVs to represent 50% of new car sales by 2035. The US aims to have zero-emission vehicles constitute 50% of all new passenger vehicles sold by 2030 with a strong push for local production via policies like the Inflation Reduction Act. Norway and the Netherlands have declared plans to ban the sale of new ICE vehicles by 2025 and 2030, respectively. Most major SEA countries have announced ambitious electrification targets to stay in line with global trends (see Figure 2).

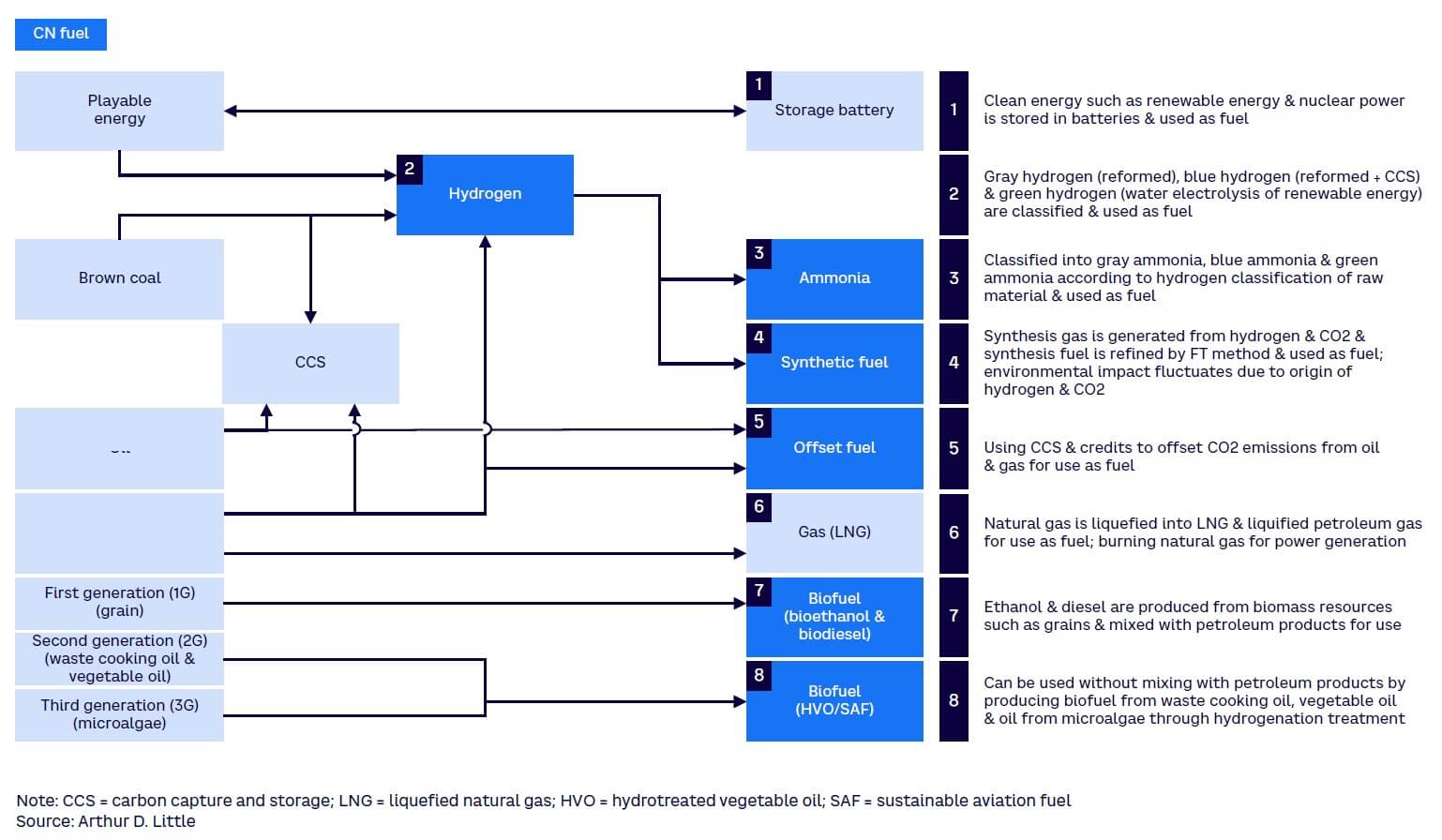

Carbon-neutral fuels

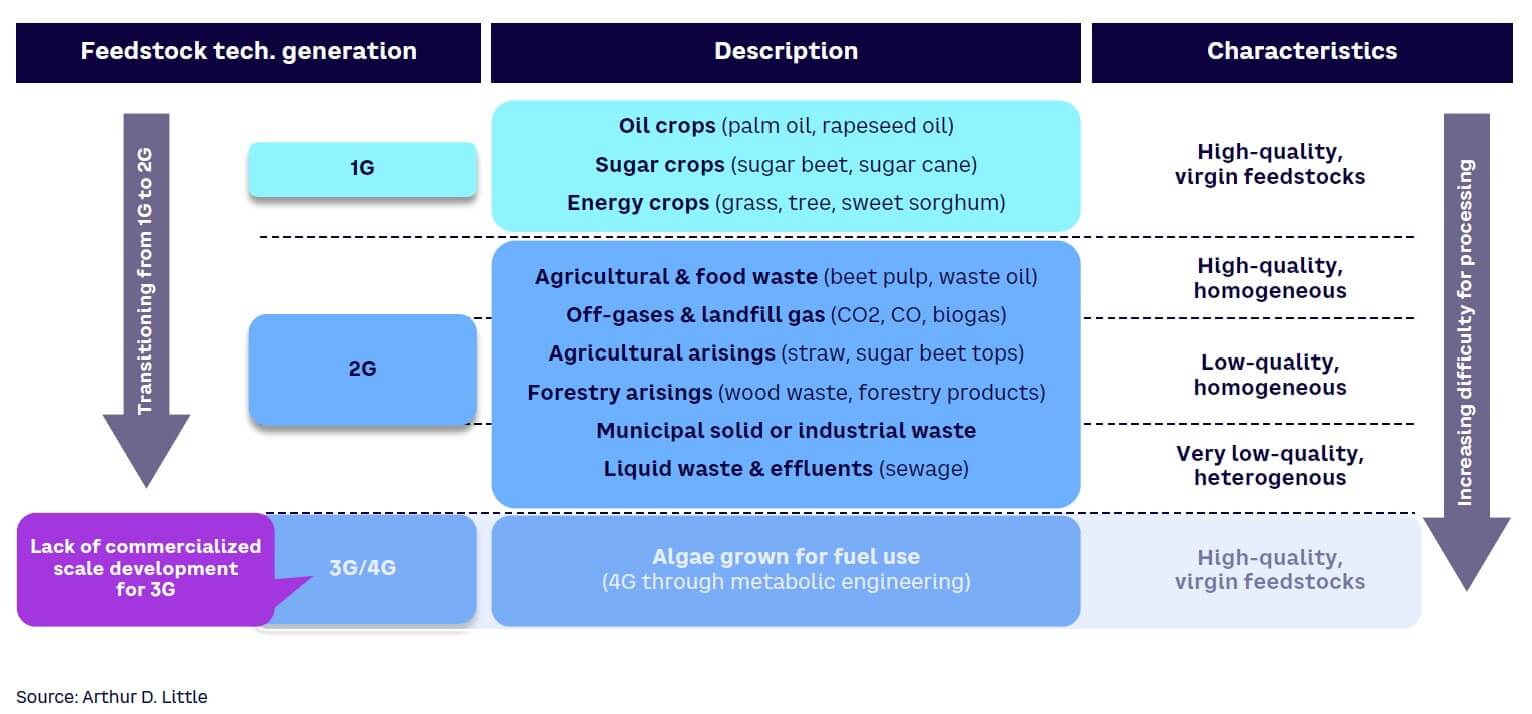

Carbon-neutral fuels do not generate net CO2 emissions when burned or used, and they use sustainable production methods to reduce or offset carbon emissions throughout their lifecycle. Synthetic fuel, hydrogen, ammonia, offset fuel, and biofuel are examples of carbon-neutral fuels (see Figure 3). Biofuels have received considerable attention as a potential solution for decarbonizing the transport sector, but there are several challenges to its widespread adoption (see Figure 4).

Technologies like bioenergy with carbon capture and storage (BECCS) (a third-generation biofuel) and cellulosic ethanol production (a second-generation biofuel) are CAPEX-intensive and require capture facilities and transport pipelines. Their underground storage sites necessitate intricate engineering, geologic assessments, and compliance with safety and environmental regulations. Establishing biomass feedstock supply chains, conversion facilities, and refining facilities are also CAPEX-intensive. This is why second- and third-generation biofuels cost 1.7-2.3 times more than fossil fuels, making them commercially unviable.

Hydrogen fuel scalability is hindered by the energy-intensive and costly nature of electrolysis (the primary method of production). Scalability is further hindered by the low availability of renewable energy sources required for sustainable hydrogen production. Similarly, biofuel production — which involves complex, energy-intensive processes like Fischer-Tropsch synthesis and pyrolysis — requires substantial investments in equipment, infrastructure, and feedstock.

Given the challenges associated with carbon-neutral fuels, electrification of the transport sector has emerged as the preferred pathway to decarbonization.

EV adoption

EV penetration across all transport modes (excluding two-wheelers [2Ws]/three-wheelers [3Ws]) is projected to reach only 145 million vehicles, accounting for 7% of the road vehicle fleet by 2030, according to forecasts by IEA. There are three main reasons. First, higher up-front costs compared to ICE vehicles discourage adoption, despite EVs having lower total cost of ownership. Second, the underdeveloped charging infrastructure, with a scarcity of charging points and slow charging speeds, creates range anxiety and inconvenience for EV owners. This is a classic “chicken and egg” dilemma: charging infrastructure providers are hesitant to invest in the market until EVs reach critical mass, and consumers are reluctant to embrace EVs without a well-established, widespread charging infrastructure. Third, limited availability of EV models compared to ICE vehicles restricts consumer choice and affordability. Globally, the ratio of ICE:EV models is 13:1. Even in China, which has made huge strides in EV adoption, the ratio stands at 2.2:1, and emerging economies like Thailand have a ratio of 9.7:1.

Wood Mackenzie forecasts global EV stock to reach 323 million by 2040. When compared to the approximately 1.4 billion ICE vehicles operating worldwide in 2022 (according to Hedges & Company), the urgent need for an innovative solution to effectively reduce greenhouse gas (GHG) emissions from existing vehicle stock becomes clear.

BENEFITS OF EV CONVERSION

EV conversion has the potential to swiftly decarbonize the transport sector by transforming conventional ICE powertrains into electric ones. In this section, we explore the advantages and opportunities offered by EV conversion.

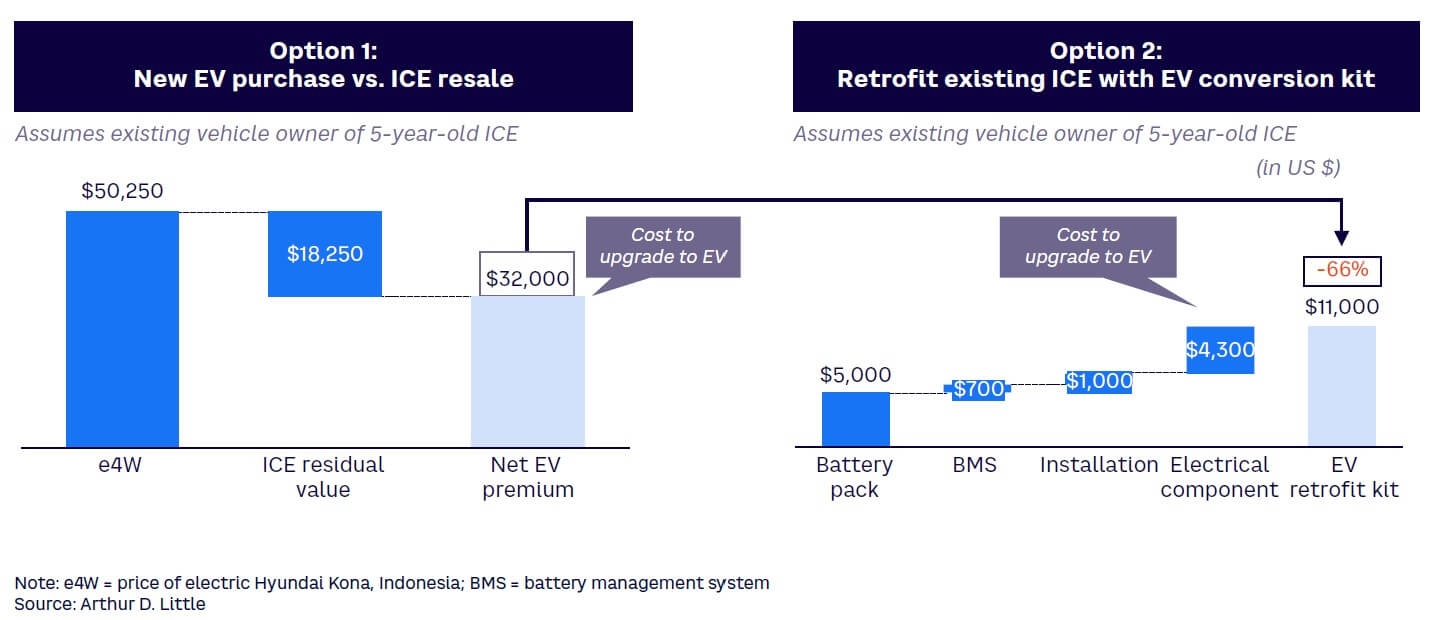

EV conversion is the most cost-effective path to electrification

EV conversion significantly reduces the up-front costs associated with purchasing a new EV (see Figure 5). Mid-range EVs cost between US $40,000-$50,000. An EV conversion kit for a vehicle with a range of 250 kilometers (km) and power capacity of 25-30 kilowatt hours costs around $11,000, a savings of 66%. In places like SEA, where cost considerations play a crucial role in consumer decision-making, EV conversion offers a much more affordable pathway to electric transport.

EV conversion extends the ICE vehicle lifecycle

A midsized ICE vehicle produces approximately 24 tons of CO2 during its lifecycle. Around 5.6 tons of that CO2 comes from the carbon footprint of the production process, with about 75% of that contributed by the steel used in the vehicle’s structure. Steel production is energy-intensive, accounting for around for 8% of global CO2 emissions, according to industry data. Technologies designed to decarbonize steel production (e.g., carbon capture and storage, electric arc furnaces, and hydrogen-based direct-reduced iron) still face significant challenges. In contrast, EV conversion prolongs the lifespan of existing ICE vehicles, resulting in decreased demand for new vehicles and thus carbon-intensive materials like steel. Reduced demand would eliminate a substantial amount of CO2 emissions associated with the vehicle-manufacturing process.

EV conversion caters to the existing ICE base

Government EV targets primarily focus on new vehicle sales, essentially ignoring the existing stock of ICE vehicles, a major source of GHG emissions (refer to Figure 2). To put this in perspective, in 2019, India’s transport sector emitted almost 320 metric tons of CO2, according to IEA. That’s around 15% of the country’s overall carbon emissions, and more than 90% of it is from existing vehicles in the road-transport segment.

The growth of the EV market indicates progress, but most vehicles on the road are still powered by fossil fuels. According to IEA, electric cars accounted for only 4% of the overall car market in 2020, with a projected increase to 7% by 2030, highlighting the significant gap that needs to be bridged to achieve widespread EV adoption. Increased EV conversion would allow countries to reduce emissions before a complete changeover to new EVs. EV conversion would lead to a fast rise in EV penetration and thus high demand for EV charging, reducing the chicken-and-egg dilemma mentioned earlier.

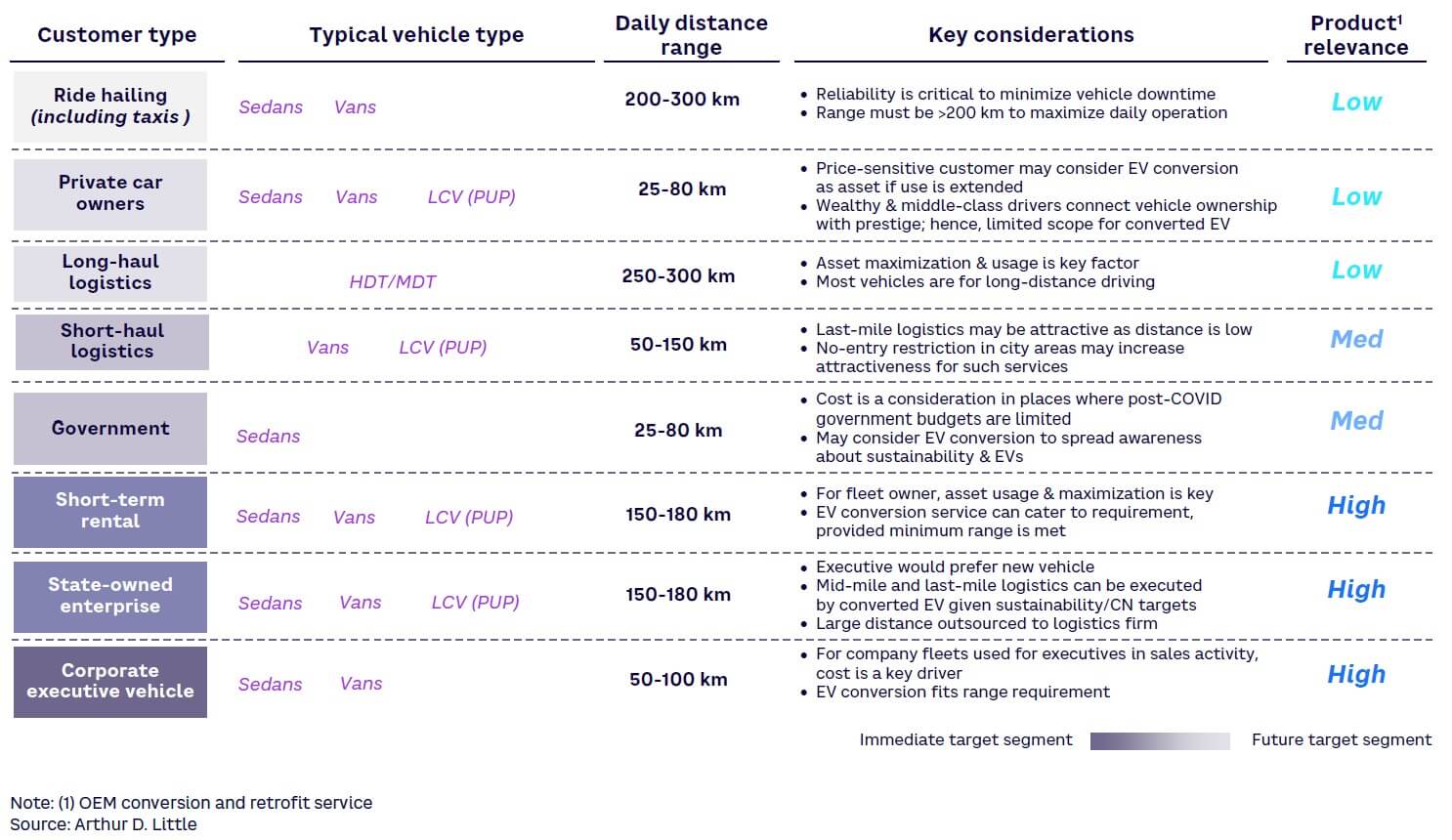

Of course, EV conversion is not suitable in all situations (see Figure 6). For example, ride-hailing service providers must factor reliability and range into their purchasing calculations, which might lead them to purchase new EVs rather than convert older ICE vehicles.

MARKET OVERVIEW & RECOMMENDATIONS

The EV conversion market is in a nascent stage, although it’s poised for significant growth and innovation. This section focuses on the prevailing dynamics of key industry players, the market potential of EV conversion, and the issues hindering widespread adoption.

Key players: OEMs & start-ups

Only a handful of traditional automotive OEMs are experimenting with EV conversion, including Renault, Nissan, Volkswagen, and Toyota. OEMs find it difficult to balance existing product lines, which rely heavily on ICEs, with the investments and resources needed for EV conversion. A focus on EV conversion also involves a fundamental shift in the OEM business model because EV conversion could cannibalize sales of EV and ICE vehicles.

Currently, start-ups dominate the EV conversion industry. They can quickly respond to changes in market dynamics while catering to the customized needs of potential customers. Australia-based SEA Electric is a good example. Founded in 2012, SEA Electric spent five years in R&D before announcing the launch of five EV models. It recently entered the EV conversion space, and this year reached a $700 million deal to convert 8,500 Toyota Hilux and Land Cruiser into EVs for use in mines.

Market potential

EV conversion has a long way to go before it reaches large-scale acceptance. With a scattered market led by start-ups converting ICE vehicles in small numbers, the EV conversion market is forecasted to be only 2%-3% of the overall automotive market from 2022–2032. The global market for EV conversion was estimated at approximately $60 billion in 2022 and is projected to grow to between $125-$133 billion by 2032. In comparison, the global automotive market is projected to grow to between $6-$7 trillion by 2032.

Conclusion

OBSTACLES TO ACHIEVING LARGE-SCALE EV CONVERSION

Five obstacles must be overcome for EV conversion to reach its full potential:

-

Absence of uniformity in the regulatory environment. There’s a lack of uniform EV conversion regulations across countries. For example, Japan and Indonesia have detailed guidelines requiring certification for EV kits, retrofitting processes, and emissions compliance; China and India have limited regulations; and Malaysia and Thailand are working on developing standards. This creates barriers for companies providing conversion kits and for customers considering EV conversions, as compliance with regulations is too uncertain. Collaboration between EV conversion players and regulators is essential to address this issue. Involvement from traditional OEMs is also necessary — this collaboration should focus on promoting the development of industry-wide standards through regulatory sandboxes.

-

Lack of defined technical standards for ICE-to-EV conversions. Factors like vehicle age, structural integrity, space availability (to accommodate a battery pack, electric motor, and other components without reducing passenger/cargo capacity), and post-conversion use case play a crucial role in determining suitability for conversion. The absence of universally accepted technical standards for ICE-to-EV conversions poses a significant challenge to growth in this industry. Currently, EV players use a variety of conversion methods, leading to safety risks and inconsistent vehicle performance. Addressing these concerns will involve establishing common technical standards that define vehicle-eligibility criteria (in terms of age/km run), guidelines for battery selection, and other integration specifications. Collaboration among EV conversion players, regulatory bodies, and industry experts will be vital to developing these standards.

-

Lack of customer awareness about EV conversion. Most vehicle owners are unaware that their ICE vehicles can be converted to EVs. Awareness campaigns that incorporate strategic advertising methods are needed, along with experiential centers where potential buyers can gain insights into the conversion process and test-drive converted vehicles. EV conversion start-ups should focus on capturing the attention of commercial fleet owners to secure high-volume orders; traditional OEMs could offer EV conversion as an add-on service when cars are brought in for routine maintenance.

-

Warranty concerns. The absence of a comprehensive warranty for EV conversions creates uncertainty among vehicle owners regarding the reliability, durability, and ongoing maintenance of their converted vehicles. Although OEM warranties cover EV batteries and drivetrains, the remaining components and the conversion process lack adequate coverage. By offering a warranty tailored to converted components (e.g., battery motor, controller) and integrating it with services like EV charging infrastructure integration, EV conversion companies can establish a unique competitive advantage while addressing customer concerns.

-

Financing and insurance concerns. In emerging economies, where a significant portion of automotive purchases rely on credit, financing availability can be a decisive factor. In India, most passenger cars (80%) and commercial vehicles (100%) are purchased with credit, according to the Times of India. The availability of affordable insurance products for converted EVs is also a decisive factor for consumers. As they’re developed, regulatory frameworks and technical standards will provide a basis for financial institutions to finance EV conversions and insurers to provide insurance products. EV conversion start-ups will want to forge partnerships with fintechs and insurance companies to offer credit and insurance products, further promoting the adoption of EV conversions.

The benefits of EV conversion, however, outweigh the obstacles. Conversion provides a cost-effective approach to electrification, reduces carbon emissions across the value chain, and targets the ICE vehicle base that generates most CO2 emissions. As OEMs and EV conversion start-ups venture into this space, collaboration, innovation, and strategic partnerships will be essential to address challenges and unlock the full potential of EV conversion. Governments, regulatory bodies, and industry stakeholders should work together to establish favorable policies, harmonize standards, and invest in the necessary infrastructure to support widespread EV conversion adoption. With the right approach, EV conversion can reshape the future of sustainable mobility, making a significant contribution toward achieving global net-zero emissions.

Note

[1] For the purpose of this Viewpoint, EV conversion kits refer to retrofit kits as well.