DOWNLOAD

DATE

Related Industries

Contact

Due to fierce competition, stagnating revenues, and decreasing margins, differentiation is more vital than ever for telecommunications operators. To optimally achieve this goal, tapping into the insurance market presents an attractive opportunity: it’s sizable, profitable, and currently immersed in a huge transformation process that telcos can leverage. To fully take advantage of this opportunity, telcos must carefully assess and choose the right model. Arthur D. Little (ADL) has designed such a model (“telcoassurance”) with lessons learned from bancassurance. Our model goes a step further by integrating the unique capabilities of telecommunications operators. After carrying out telcoassurance assignments in multiple regions, we have developed and iteratively refined a proven methodology to build this model from scratch.

THE INSURANCE OPPORTUNITY

Protecting telco customers, increasing EBITDA 5%-10%

In context with stagnating revenues and decreasing margins, telecommunications operators all around the globe are looking for ways to differentiate themselves and generate competitive advantages that make them succeed within this difficult environment.

Tapping the insurance market is an attractive opportunity for reaching these goals, since it has the following qualities, according to ADL analysis:

- A sizable market (e.g., in European countries, it is two to three times the size of a telco with 5%-10% GDP).

- Profitable both for insurers (5%-10% PBT over sales) and distributors.

- Anticyclical and has proven to be a lever to increase customer loyalty (churn in banks, for example, is down 20%-30%).

Years ago, having already identified this relevant opportunity, banks began to take advantage of it by partnering with insurers to create a new diversification initiative: bancassurance. These joint business models are currently enjoying the fastest growth and profitability rates within the insurance industry (both for insurers and banks).

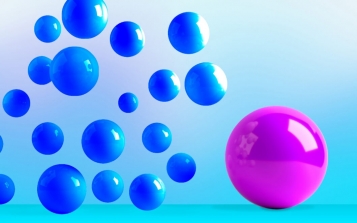

Now telcos can also take advantage of the insurance opportunity, as they are becoming the perfect math for insurers. Insurers are now in a huge transformative process (see Figure 1): customers are demanding more digital, transparent, and personalized products; distributors are also pushing for digital end-to-end sales and servicing processes; and new competitors (insurtechs) are receiving billions of dollars to disrupt the insurance market. Telecommunication operators’ capabilities are, as stated, a perfect match for insurance needs: they have millions of customers already using telco digital services and channels, are able to customize service offering based on customer data and events, and can build ecosystems such as digital homes or digital small- and medium-sized enterprises (SMEs), where insurance can integrate their offering.

However, although an attractive opportunity, due to their limited knowledge of the insurance market and overall business trends, telecommunications operators might struggle to identify the best way to take advantage of this high-potential opportunity.

ADL, based on its experience and knowledge of both the insurance and telecommunications industry, has designed an optimal model to embark on this journey: telcoassurance. Our model takes lessons learned from the successful experience of bancassurers and improves that already-optimized model by integrating the unique teleco capabilities that can generate competitive advantages within the insurance business.

Learnings from bancassurance include the relevance of “aiming big.” For example, banks such as Spain’s CaixaBank are consistently getting above 25% of their total results from their bancassurance units. This leads to the creation of convenient and competitive value offerings for customers, such as cheaper mortgages bundled with home and life insurance, while building long-term relationships with insurers. Thus, banks have incentives to invest in the new business model and can reach an appropriate return on those investments (e.g., building a new insurance product can take up to nine to 12 months with investments greater than US $500,000).

Like banks seeking new opportunities, telcos can take insurance distribution to the next level by leveraging customer knowledge in various ways. For instance, through adjustments of the timing of an insurance offer (e.g., an SME insurance offer when a customer buys a B2B telco product), selection of the most profitable customers (by using telco data to predict customer profitability), personalization of prices without reducing profitability (e.g., more than 20% expected price reduction in certain insurance products), and simplification of purchasing experience (e.g., from more than 35 questions about buying auto insurance to only one, thanks to existing customer data). Such details of customer knowledge, together with remarkable digital reach (typically more than 20% of customers use telco digital channels monthly), and the massive number of potential customers (all B2C and SME telco customers) set the foundations for a very interesting diversification effort. As a result, this optimized model can generate a 5%-10% EBITDA gain on telcos through distribution commissions and involvement in insurance business profitability.

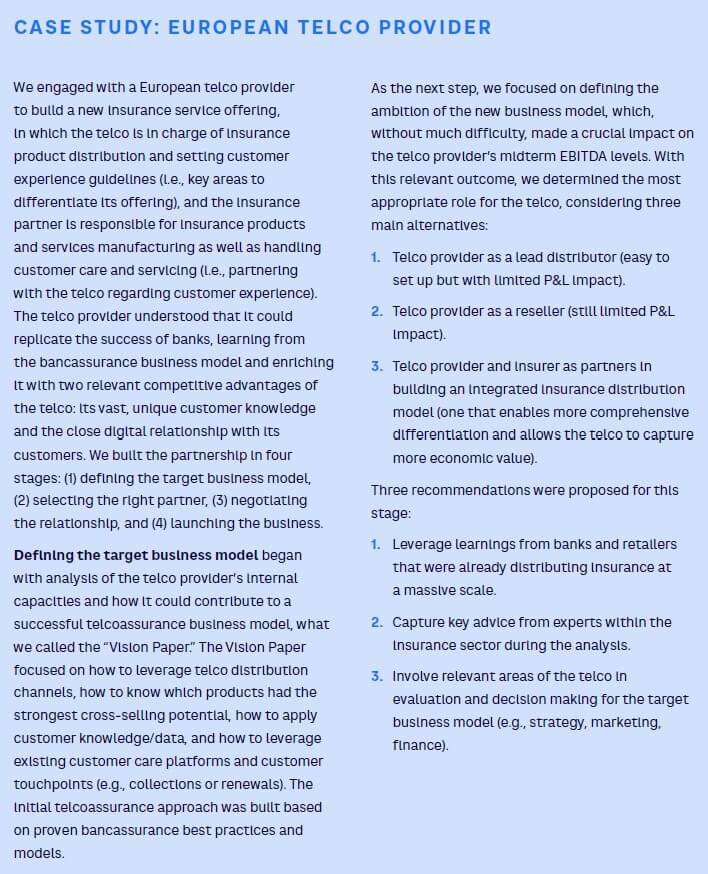

The aim of this Viewpoint is to present the fundamentals of telcoassurance: beginning with the vision (i.e., ambition and key value levers), continuing with what encompasses its basic structure (i.e., customer as an asset and partnership agreements), outlining a solution, and concluding with an examination of market development. We also outline a case study from our experience in building a pioneering telcoassurance model for a European telco provider.

THE VISION

Protecting all customers, from all risks, in all channels

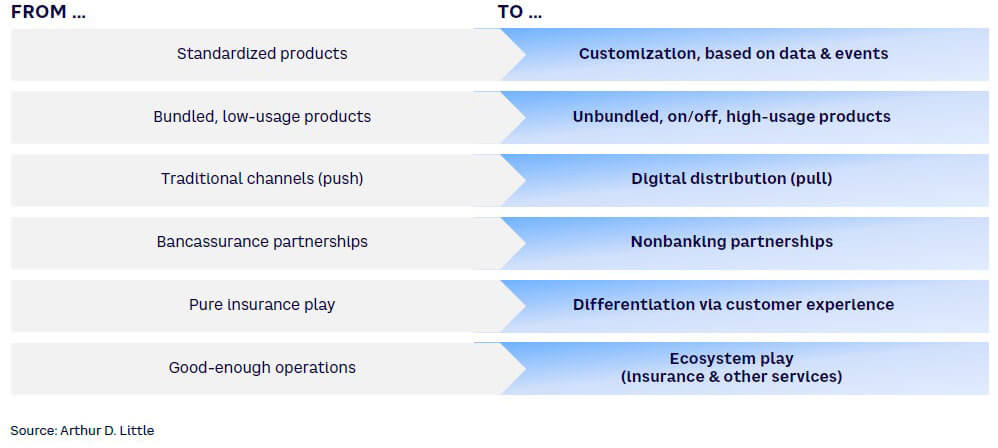

Telcoassurance is an ambitious model with the aim of allowing telecommunications operators to take full advantage of the insurance opportunity (see Figure 2). Most of the operators have already started the journey offering handset insurance to retail customers and, in some cases, cybersecurity insurance to SME customers. These steps are a good starting point, but offer limited potential in terms of EBITDA and customer relevance. The vision in a mature telcoassurance player is bolder, aiming to protect all customer segments and becoming customers’ preferred insurance distributor for all their risks.

Retail customer needs include protection for their belongings, moving from handset protection to gadget protection (e.g., covering “all screens in the home” to household protection and to car insurance). Telefónica is a good example of this evolution. Retail needs also include family healthcare, with other telcos offering eHealth and traditional offline health insurance services and family protection with life insurance.

The vision of a preferred insurance distributor requires a full omnichannel approach for sales and servicing. Sales activities are orchestrated to match product and channel capabilities (e.g., handset insurance can easily be sold online, but motor protection sometimes requires the face-to-face or remote assistance of a specialized sales agent).

THE STRUCTURE

Recognizing “customer” asset

Telcos have relevant competitive advantages around the customer to enter into the insurance business, including:

- Large customer base (B2B/B2C) with an established, close relationship. Telcoassurance can leverage the telco brand and its position with the customer being top of mind to develop an insurance business around telco core values (e.g., family care, cost efficiency). This marketing approach must align with core values in order to be considered a legitimate offering from the telco.

- Tight and recurrent relationship/touchpoints with the customer, thanks to monthly payments (i.e., bill collection), service usage, and telco app/website activity. Each customer interaction is an opportunity to start a conversation around insurance. Telco commercial strategy needs to select which interactions and insurance products are more suitable for beginning a personalized advisory. Telcos’ relevant digital tools allow for a nonintrusive channel for insurance-related interactions.

- Different customer data sources (e.g., socioeconomics, service usage, or geolocation), which are key for developing models (e.g., pricing, purchasing propensity, next best action [NBA]) to boost efficiency and offer a more personalized experience, such as:

- Improving sales efficiency — adjust insurance offers to customers events and identify up-front target customers based on expected profitability. This allows for offering an unbeatable price for selected customers or making the insurance sales process easier and convenient by reducing the number of questions.

- Offering excellent customer experience — application of specific journeys based on customer profile and activity, smart claims management, or fraud detection.

Telcos, however, face two challenges for building data capabilities:

- Developing a proper legal and compliance data protection framework.

- Implementing technology capabilities (e.g., business intelligence and data analytics).

Global data protection regulations impact how data can be shared and exploited by partners (i.e., telco and insurer). Nevertheless, anonymization techniques (e.g., hashing, k-anonymization, federated learning) make it possible to build, train, and run joint models, while at the same time complying with applicable regulation.

Building long-term partnership with insurer

The telcoassurance business model integrates a full-protection value offer — an omnichannel approach and telco experience — which requires an incremental level of integration with the telco core business and distribution model. Both partners need to be extremely committed and aligned to guarantee success when building and running the joint business.

Although each deal has its own particularities, based on our experience, the needed commitment and alignment is achieved via specific insurer-telco agreements on duration, product, customer experience, or break-up scenarios, which structure the collaboration. The level of commitment between the telco and the insurer will guide insurance business development. The highest level of commitment comes from a mutual-exclusivity agreement, which can translate to an exclusive insurance product portfolio and better economic conditions for the distributor.

From an operational model perspective, the insurer will provide all products required by the telco, and the telco will distribute them. The insurer will provide customer care services (e.g., claims management, billing/collection) under the control and guidance of the telco (e.g., service-level agreements [SLAs], key performance indicators [KPIs], penalties). Moreover, for a successful partnership, an adequate governance model needs to be defined, clearly stating responsibilities between companies. Usually, governance models include meetings between insurer and telco senior directors (similar to board meetings for the telcoassurance business) and tactical meetings to jointly develop new insurance products, manage the distribution channels, co-execute joint projects, and supervise the SLA and customer experience.

THE SOLUTION

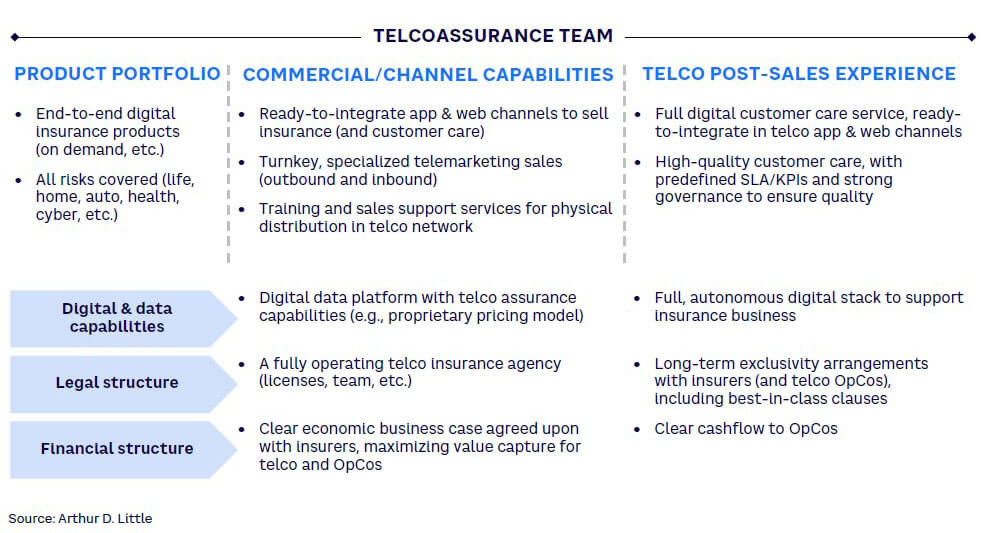

Creating telcoassurance team

Telcoassurance needs its own entity — a telcoassurance team — to ensure coordination between partners and to guarantee that both partners put enough focus on developing the joint business (see Figure 3). We recommend establishing an insurance distributor officer within this entity to mobilize and coordinate the partnership between the telco and the insurer. This person will be in charge of commercial intelligence and customer experience control activities. The telcoassurance team needs to take the form of a legal vehicle to be able to distribute insurance products, which depends on specific national laws and regulations.

MARKET DEVELOPMENT

Spain: Frontrunner in market

Spain is a pioneer in the European telco-insurance market, currently with four major telco providers (Telefónica, Orange, Vodafone, and MásMóvil) offering telcoassurance products. With the introduction of 10 new products since 2020, the Spanish telcoassurance market has seen a considerable rise in the quantity and complexity of products offered. All telcoassurance providers currently offer headset insurance, but leverage different models, while also encompassing a wide range of insurance products in both the life and nonlife areas.

Telefónica, the largest telco provider in Spain, utilizes its own insurance company, Telefónica Seguros, to produce customized insurance products in the areas of cyber insurance for enterprises, mobile, and gadgets. In addition, it builds products in the area of home and health insurance in collaboration with other insurance companies.

Orange, on the other hand, leverages cooperation with external insurance providers. It introduced its gadget insurance back in 2014 and has currently partnered up with a Zurich insurance company to expand its insurance products offerings, which now also include home, life insurance, and SME multi-risk protection insurance.

Vodafone and MásMóvil leverage multiple insurance providers, which differ for each telcoassurance product offered. In the case of Vodafone, besides gadget insurance, it currently also offers “connected insurance” for motorbikes and cars as well as cybersecurity solutions. In 2021, MásMóvil introduced telehealth service and medical insurance, offering packages with special video and chat consultation services or access to hospital networks under exclusive conditions.

The current state of the Spanish telco market shows how telco providers can leverage their positions to offer a wide spectrum of insurance products and successfully dip their toes into the larger insurance business and create an additional revenue stream.

Conclusion

Seizing the opportunity

Insurance provides a relevant opportunity for telcos to increase EBITDA and differentiate from their competitors. But capturing this opportunity requires designing a model that fits with the customer demands, the telco capabilities, and the insurers’ requirements. From our experience, there are three key elements to succeed:

- A bold vision to become the preferred insurance distributor in all key risk of the customers.

- The development of a tailored partnership with the insurer that incentivize them to invest and develop the required capabilities (e.g., products, data capabilities).

- The selection of the right insurance partner, as capturing the insurance opportunity is a multiyear effort that requires a deep strategic alignment between companies.

Banks are living proof of the relevance of insurance opportunity. Many of them consistently achieve above 25% of their total results from their bancassurance units and enjoy a 20% reduction in customer churn as they cross-sell insurance. Telcos should learn from their experience and adapt their proven business model, creating the telcoassurance approach.