DOWNLOAD

DATE

Contact

As the communications-platform-as-a-service (CPaaS) hype fades, questions arise over where the industry will find future value. Two trends are coming to the fore. First, enterprise customers are starting to request features beyond application-to-person (A2P) and “best effort” legacy solutions to enable future omnichannel and 5G-based use cases like the metaverse. Second, classic CPaaS services are finding a new market for an ever-increasing savvy mid-market. Both trends are allowing operators to stamp their mark on the CPaaS industry.

CPAAS PLAYERS MOVE BEYOND SMS & VOICE SERVICES

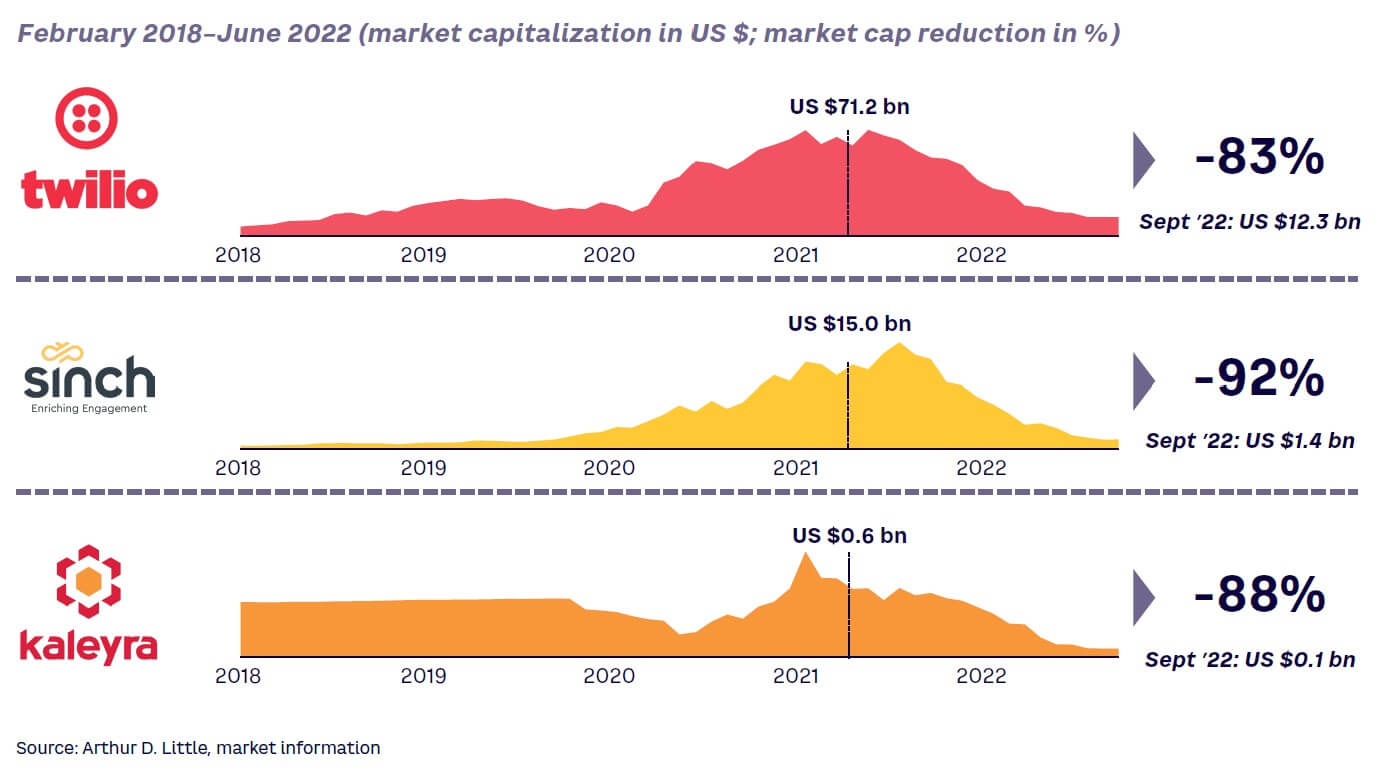

Investors appear to be moving on from the CPaaS hype and adopting more realistic views on its future. Thus, CPaaS players must evolve from mainly messaging/SMS platforms to embed voice and other capabilities. As shown in Figure 1, three main CPaaS players have witnessed their market capitalization erode in the past year:

- Twilio — from about US $71.2 billion market cap in February 2021 to about US $12.3 billion today.

- Sinch — from about US $15 billion market cap peak in September 2021 to about US $1.4 billion today.

- Kaleyra — a reduction of about US $0.4 billion between February 2021 and September 2022.

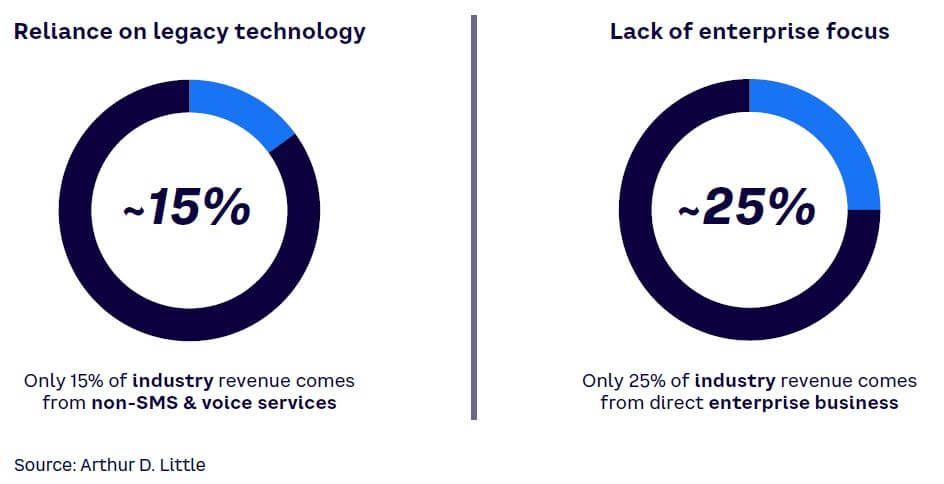

ADL’s estimations find that about 20%-25% relate to the general economic downturn following the COVID-19 pandemic, with the remaining reduction still above approximately 50%, compared to their respective peak market capitalizations. Two structural issues are driving this downturn: (1) increasing demand for new technologies away from legacy systems (i.e., SMS) and (2) change in customer mix moving toward an enterprise focus — see Figure 2.

The current CPaaS market focuses on legacy use cases mainly built on SMS and voice with respective revenues combined estimated to range from about 80%-95% of the total market. Rich communication services (RCS), Apple Business Chat (ABC), and over-the-top (OTT) messaging were expected to be major market drivers; however, pick-up rates are low (e.g., RCS about 1.2 billion subscribers in 2022).

Current revenues are driven by wholesale providers, either directly through operators or indirectly through independent software vendor (ISVs) and system integrators (SIs), looking for simplistic SMS and voice use cases. However, the broader enterprise market is catching up, demanding the above-mentioned technologies for their wider use cases. Yet, most CPaaS players are not ready to offer services in a consumable manner for this growing segment though self sign-up (SSU)/portal sales channels.

Beyond A2P to omnichannel

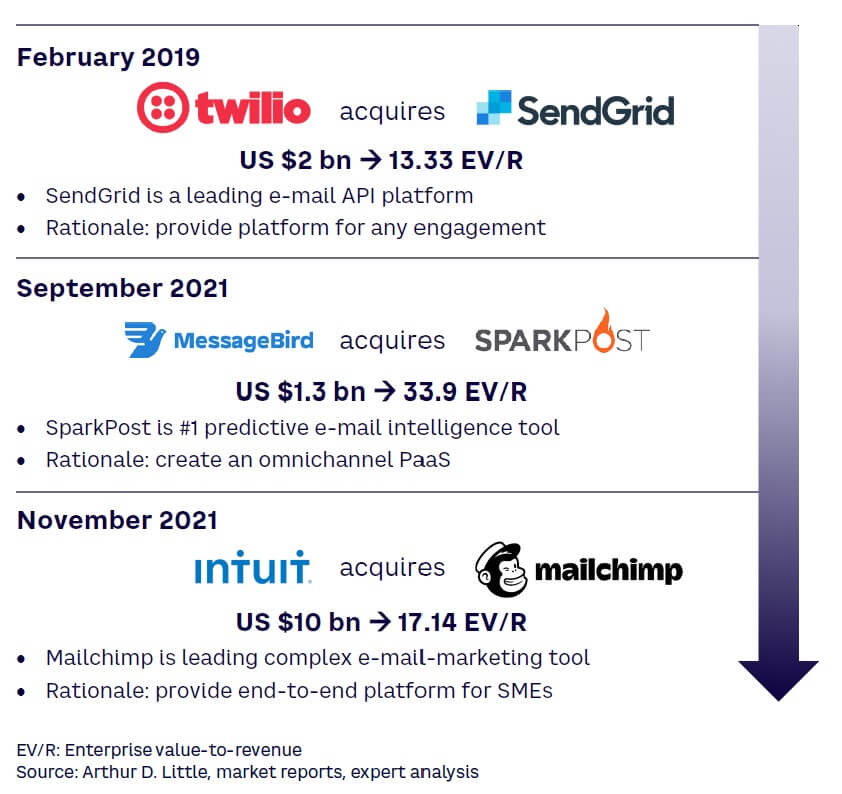

As CPaaS players attempt to move away from the legacy environment, an omnichannel capability has become a key consideration driving acquisition- and strategy-related decisions. As shown in Figure 3, recent transactions include the expansion of the traditional API set with email functionalities. Three major acquisition deals (more than US $1 billion) had the strategic rationale of that capability expansion:

- In February 2019, US-based Twilio acquired leading email API platform SendGrid to provide a platform for any engagement type.

- In September 2021, the Netherlands-based MessageBird acquired market leader email intelligence tool SparkPost to create an omnichannel platform.

- In November 2021, US-based software company Intuit acquired leading complex email marketing tool Mailchimp to leverage its reach to small and medium-sized enterprises (SMEs).

Other platforms are undergoing an organic expansion — listening to their customer needs and proving successful in growing their customer base. WhatsApp Business, for example, is becoming a new channel for applications, generating traffic of more than 2 billion users in 2022.

Potential boost in market capitalization

As CPaaS players evolve, driving further innovation and incorporating contact-center-as-a-service (CCaaS) and unified-communications-as-a-service (UCaaS) capabilities, they most likely will boost their market capitalization. In a mature market environment, value is created for CPaaS players by scaling up existing services through new customer acquisitions and by adding new services. The latest focus has been on incorporating CCaaS and UCaaS applications to chase the omnichannel approach. Sinch acquired voice communications enabler Inteliquent, and LINK Mobility Group secured a variety of players to add to its omnichannel platform (e.g., an AI chatbot company in Italy, MarketingPlatform in Denmark). CPaaS M&A activity is expected to remain prolific in 2022, with other players going for scale across multiple channels (e.g., Vercom acquiring MailerLite, adding email capabilities to their API set). The future complexity will be in integrating these services into one offering, with players succeeding in a streamlined model set to win the race. Indeed, Vonage and Nexmo have proven how complex it is with customers requiring separate logins for each of Vonage’s CPaaS, SSU platform, CCaaS, and support portal services — six years after the acquisition!

Opportunities abound

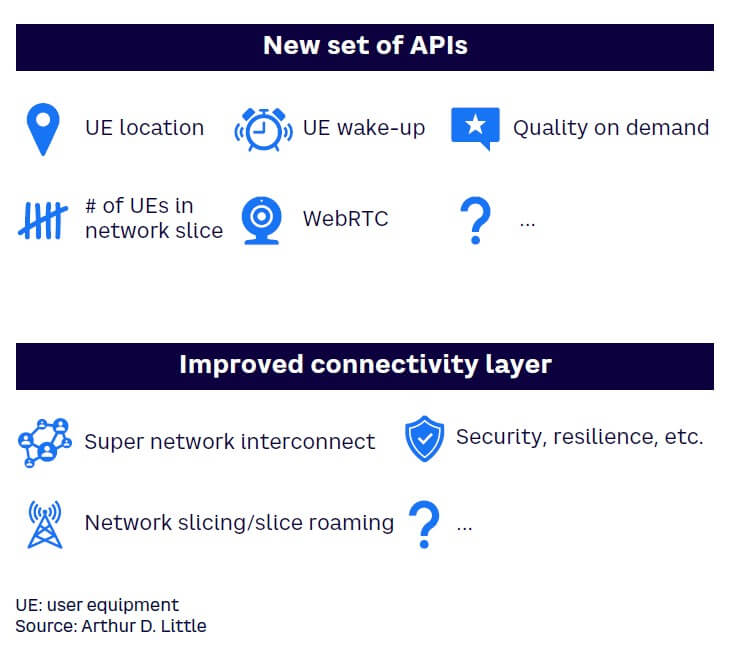

The wider telco ecosystem spots an opportunity within the current landscape and is adding to the competitive pressure by entering the CPaaS market to regain end-user relationships. The ever-changing nature of the industry is incentivizing players to innovate their business models. The advent of 5G, for instance, allows for new use cases. Thus, new vectors are launching use cases relying on location data (e.g., credit card verifications based on traffic routes, marketing platforms activated when entering stores), sensor data (e.g., Internet of Things [IoT] and smart device communication), and artificial intelligence–driven use cases (e.g., Interactive Voice Response [IVR], chatbots). These use cases require going beyond “best effort” connectivity to offer customers a seamless experience. As such, the quality of the features defines a use case’s success. In the dichotomy between operators and hyperscalers, the one that holds the best network control points will come out on top.

In particular, infrastructure vendors are entering the CPaaS space to leverage their position toward enterprises and capture a piece of the shifting landscape. They see the synergies of capturing the end-user relationship by building a service platform on their existing assets. In November 2021, for example, Ericsson acquired Vonage, which offers the company the opportunity to introduce network and API capabilities to a large development community and benefit from the extended 5G application sets, including the rising IoT segment. That same year, Mavenir acquired Telestax to enhance its customer engagement platform with a primary consideration for 5G-related API enablement for IoT, smart cities, automotive, and a wide variety of other verticals. Synergy creation extends also to partnerships. In May 2022, Twilio acquired minority ownership in Syniverse and secured a strategic partnership with a company to monetize the 5G and CPaaS revolutions, as well as to capitalize on the innovations in intelligent connectivity. Figure 4 highlights the move toward Web 3.0 and OTT use cases.

Strong base of large customers

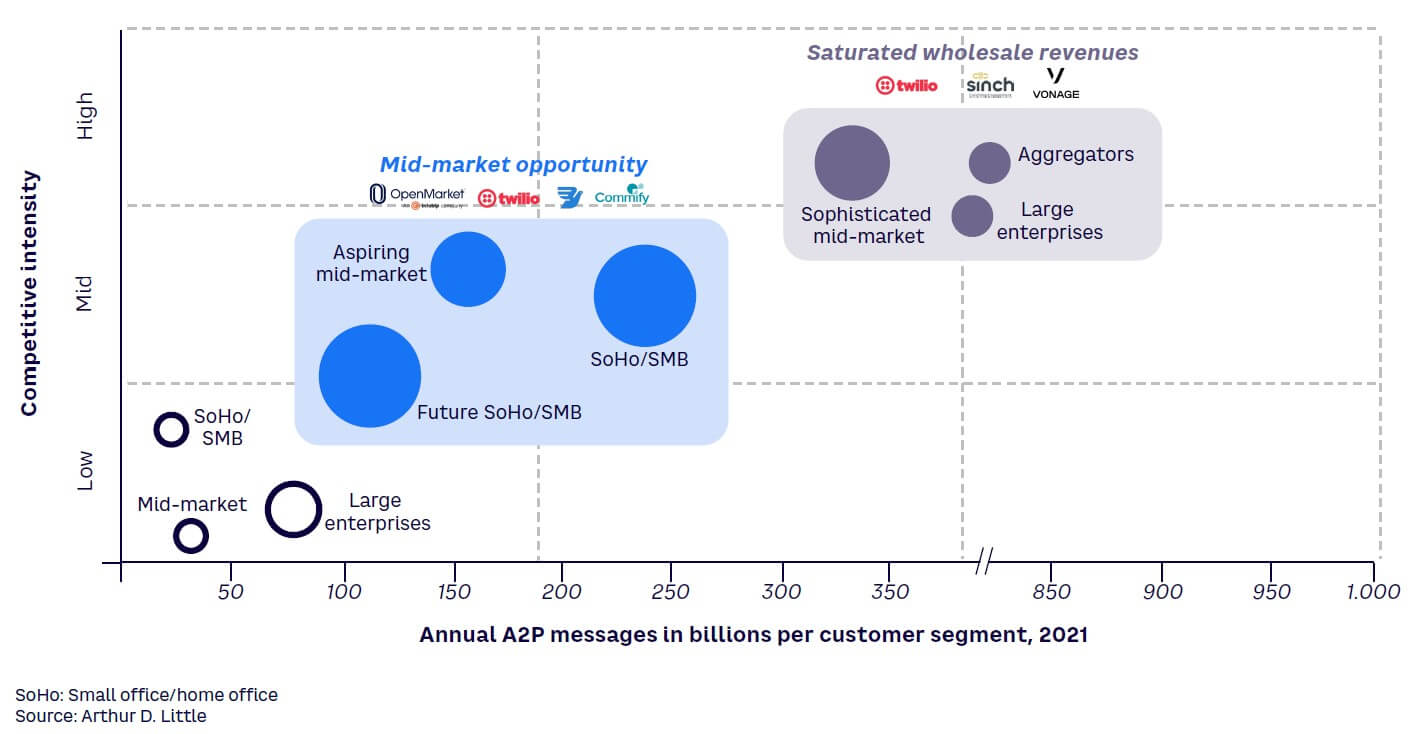

CPaaS players have a strong base with their large customers, which can translate well to an opportunity for operators. Overall, with the market moving away from saturated wholesale revenues to established CPaaS players relying on operators and operators relying on ISVs and SIs, a strong opportunity opens up in the mid-market (see Figure 5). Thus far, CPaaS players have reacted more quickly than operators to capture the largest segments and are aiming to transition to lower market segments. As SME businesses become more tech-savvy in their efforts to remain digitally relevant to their customers, the awareness of use cases increases.

Whereas for the larger corporations, CPaaS players offered a nuts-and-bolts approach through APIs, the mid-market demands full software-as-a-service (SaaS) and plug-and-play solutions. The plug-and-play solutions drive the capture of a larger subset of end users with new use cases. While the technical capabilities are a prerequisite to enter the market, operators are suited to play a role here. They already have the channel capabilities to address this segment. Current operator resources focus on penetrating a large subset of customers and building relationships in both B2C and B2B markets. This is a major advantage compared to CPaaS players. CPaaS players are less equipped than local operators to scale their business due to a lack of a sizeable local sales force and scalable tools (e.g., SSU platforms). Therefore, the current competitive intensity for these segments remains achievable for operators willing to act now before CPaaS players continue to expand their reach.

HOW CAN OPERATORS BEST CAPITALIZE ON THIS TREND?

Operators struggle to acquire capabilities at the right value

With CPaaS players interacting directly with end users for services traditionally considered in the operators’ sphere of influence, operators are losing their monopoly on connectivity with end users. No longer do companies and customers relate mobile interaction to operators, allowing a wider capture of the value chain while the race for B2B2X heats up. CPaaS players are benefiting from offering direct solutions to businesses.

But operators have been slow in stepping into this new opportunity due to their low willingness to invest in wider CPaaS capabilities and their hesitancy to share both the value in selling the service without client interaction (and gaining margin) and maintaining a close relationship with the customer (i.e., end-user relationship). Historically, internal innovation has proven difficult for operators. Current acquisition pricing for CPaaS players is surging through increased demand, making it costly to go for a buy-and-build strategy. Alternatively, operators can rent these capabilities on an “as-a-service” basis. But, as pointed out, operators are hesitant to share both the margin and the end-user relationship. Combining these elements leads to an uncompetitive position of the operators in these capabilities.

Nonetheless, some operators have been dipping their toes in the wider CPaaS market. Operators, such as BICS, have acquired CPaaS players to complement their network capabilities. BICS bought TeleSign in 2017 adding two-factor authentication to its product portfolio and acquired MOBtexting, an Indian CPaaS platform, in 2021, to further accelerate its growth in CPaaS capabilities. Larger operators invested in setting up their own platforms with average success. Airtel, for example, launched its Airtel IQ platform, MTN in Nigeria launched an RCS messaging service in partnership with Google and Dotgo, Telefonica partnered with Infobip for IoT applications, and Vodafone partnered with Infobip and Soprano while developing an IoT platform in this space.

Certainly, operators can build organically on their own infrastructure; however, this alternative has often proved slow, which is a key consideration given the high pace of innovation in the market. Assets can be acquired through transactions, which would allow operators to capture most of the intrinsic value in the immediate to short term but would also result in a high-investment cost outlay.

Lastly, operators can enter into partnerships with industry incumbents, where they can capture both the value and the knowledge generated. The downside is that the operators have to share all resources with an external player at the same time.

Leveraging channels offers advantage

Once the operator acquires the CPaaS capabilities required, the focus shifts to the go-to-market model. Key anchor points for the mid-market and lower end of the market are the SSU approach and the 5G developments. The SSU approach allows businesses to tailor services to their needs via an interactive platform, guiding them through all elements required. For CPaaS players, a fully functioning SSU removes the need to scale their sales teams and spread their investment over both salespeople and sales tools. Operators have limited differentiation potential in designing a competing portal. The operator must reprise its role as first point of contact for businesses related to their connectivity through its existing assets. Generally, operators have a large sales team, flexible support services, existing client relationships, and the customer intimacy to detract from the CPaaS SSU approach.

However, operators will need to adapt their teams to handle this new business opportunity. The customers subject to these services are flexible and result-oriented, looking for an easy-to-implement solution with a high degree of success. Operators must focus their staff on three areas:

- Development of automated messaging portal — drives interaction with large set of smaller customers at cost-efficient level.

- Support staff speaking the “enterprise” language — oriented to solving issues rapidly, focusing on customer satisfaction.

- Agility of the sales staff — readying upsell mindset, capturing new incremental business with current customers.

With 5G, the strength of the operators’ network will allow them to offer more robust services than traditional CPaaS players. In cases where the traditional CPaaS players have already accessed the customers in the market, operators can position themselves as connectivity partners to capture a slice of the new value.

Conclusion

OPPORTUNITIES AWAIT

Many operators have largely missed the chance to tackle the most concentrated local segment in the CPaaS market with two opportunities for operators emerging:

- Legacy technologies are making way for new use cases driven by 5G vectors (e.g., location data, sensor data). The new technologies are key for the largest enterprises looking at building out a more sophisticated offering. For these large customers, legacy technology will not suffice in opening up an opportunity to move beyond the “best effort” CPaaS space. Operators can instead capture this by offering a high-quality network and controlling the necessary control points to guarantee service.

- Besides the new technologies, a new market is growing in the mid-market and lower market, where there is a lower need for highly sophisticated use cases. The sheer volumes of customers are relatively untapped by traditional CPaaS players due to high go-to-market cost. Operators can use their existing assets and relationships to retake control of the connectivity space for businesses.

The immediate next step for operators is to focus on the acquisition of the necessary capabilities to compete in this market. Opting for acquisition, partnering, or renting CPaaS services will be subject to the specific circumstances and market dynamics, but action is needed now before operators miss out on this segment in the CPaaS market.