With sustainability commitments on the horizon, how can industrial companies reach their targets cost-effectively?

Large industrial and commercial companies face increasingly challenging energy management decisions due to sustainability ambitions and concerns for energy costs. As executives make commitments for the long term, procurement and operations executives must justify the cost and prove the feasibility of energy-saving measures. While many energy supply and efficiency solutions are available, energy service companies and energy suppliers can provide their own offerings under business models such as energy-as-a-service (EaaS). In this Viewpoint, we explore how organizations can ensure these solutions are a win-win in the convergence domain between the energy and industrial/commercial sectors.

Energy is an increasingly strategic executive-level purchase decision

From concerns …

Energy sustainability is often high on the agenda of industrials and large commercial companies. In a recent Arthur D. Little survey among industry leaders about energy management priorities, 87% of energy executives rated sustainability as a “high or very high” concern for their company (see figure below). They reported this concern to be further stimulated by stakeholder pressure, as well as from employees, investors, and customers. The next-highest concerns organizations reported fall under rising energy cost, including commodity prices, taxes, and grid charges. In response to this concern, organizations often launch ambitious sustainability goals and commitments, along with considering investment decisions such as distributed generation assets.

… to actions

In recent years, an increasing number of industry leaders have taken the first steps toward carbon neutrality, while simultaneously optimizing their energy bill costs. Few, however, are well advanced in their promises and actions. One such initiative involving global corporations in renewable energy, electric vehicles, and energy productivity efforts is led by The Climate Group (the RE100, EV100, and EP100). With these programs, many industry leaders have committed to running fully electric fleets, or having zero carbon assets in operation by 2050, 2030, or as early as 2025 (see figure overleaf). Numerous organizations have made pledges, but the efforts required are huge in scope and reach, and practical challenges for implementation are substantial.

Aside from well-known front-runners (e.g., IKEA, Unilever), many procurement and operations executives still have admitted to being ill-prepared to address the practical challenges ahead. They either struggle to scope the full breadth of available methods for their energy management ambitions, or lack company backing to realize the required investments. Those challenges raise the need for executives to have some guidance to gain a full understanding of energy management options to consider as well as how to make things happen within the regular business and investment constraints.

Reducing carbon footprints and saving on utility costs

Companies must think broadly to decrease their emissions. A solid energy management portfolio considers all means between power plant and plug — and plug and product. In recent years, the rapidly evolving energy transition has opened up various new methods, business models, assets, and opportunities (see figure below).

Energy purchasing

With awareness and usage of green certificate trading, and green power and gas contracts already well matured, there has been an increased interest in corporate power purchase agreements (CPPAs). This is evident from Arthur D. Little’s survey, where nearly half of respondents reported using CPPAs, with another third actively investigating them. Interestingly, companies don’t shift to CPPAs only to stabilize and control their price and cost levels, but also to increase their direct sustainability impact by financing renewable energy development. In fact, some industrials prefer insourcing risk management completely and setting up internal trading desks (including emission certificate trading, which has been increasing due to rising prices/shortage of certificates); in some cases, these become a source of new revenue and a real pillar of the company’s business. However, these are more the exception than the rule.

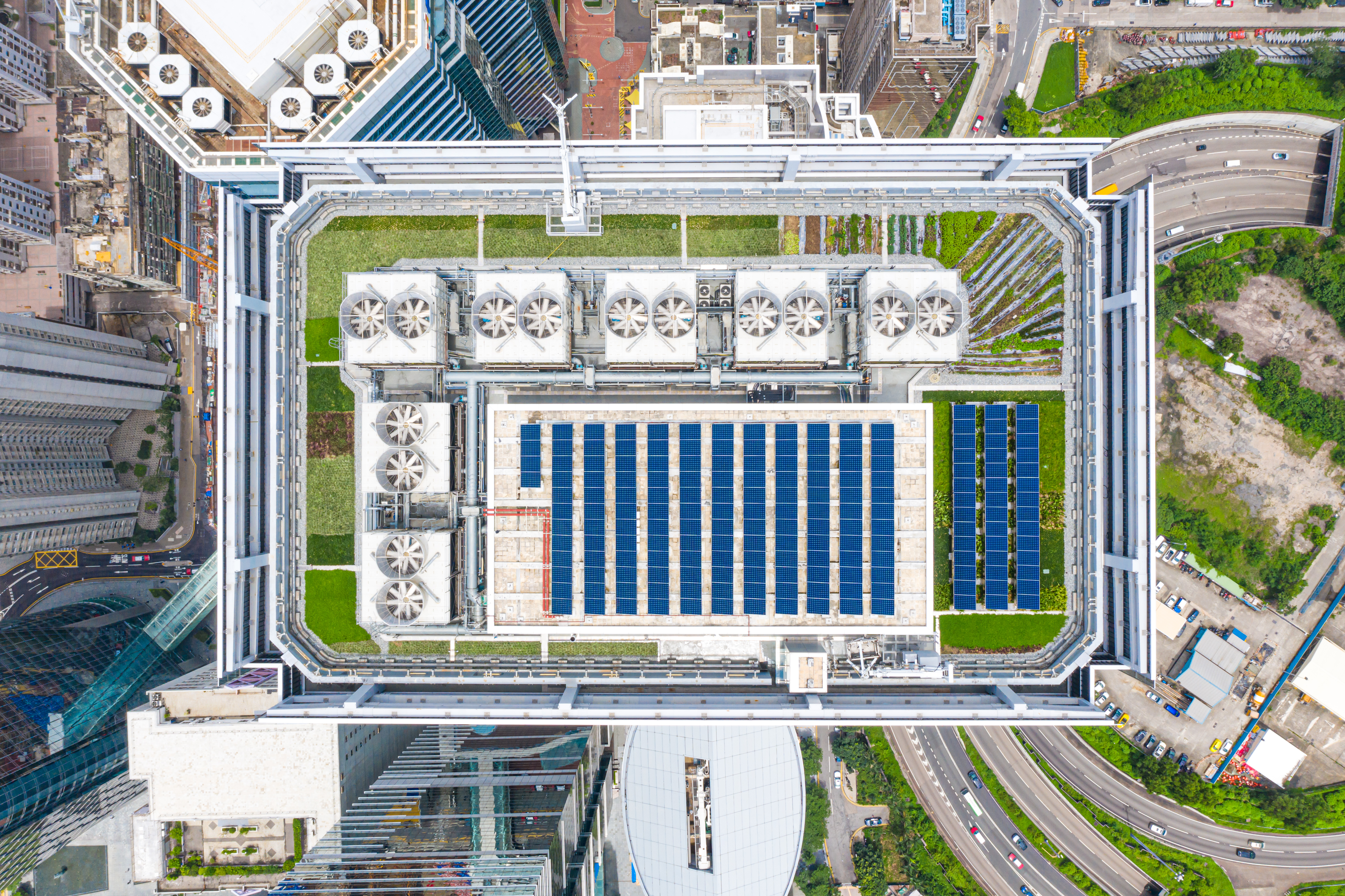

Energy assets & generation

Most survey respondents have already invested in on-site renewable generation (e.g., solar panels and combined heat and power). Although investments in renewable energy generation are well understood by large industrials, the commercial segment still needs convincing. In addition to distributed renewable assets (e.g., micro turbines), a wave of awareness and investigation among industrials nowadays lies in on-site energy storage and electrification of company fleets. A key driver for the uptake of these initiatives is the exponential decrease of the levelized cost of storage, which improves the business case of batteries.

Energy efficiency & optimization

Organizations are also looking at ways to lower their energy consumption rather than merely optimizing supply. Consequently, companies report performing regular energy audits within their facilities to spot and make the case for energy conservation measures. These measures come in many shapes and forms, such as installing LEDs, improving heat and water leak management, installing insulation, recalibrating processes, and exploring technical solutions like replacement of energy efficient manufacturing equipment (e.g., pumps, compressors, and hydraulic units).

Industrial participation in demand side response (DSR) programs and virtual power plants (VPPs) continues to grow as well. This elevated participation has been prompted by the increasing amount of companies with on-site assets and storage and complemented by the consolidation of the aggregator industry (these companies are often acquired by large retailers that leverage DSR/VPP solutions to existing energy client portfolios) as well as advanced experience and knowledge in deploying DSR programs in complex industrial processes. For the solutions described above, different waves and hype cycles dictate industrials’ awareness, investigation, and investment. Many organizations have already deployed easy measures, but there is still work required if companies wish to deliver upon their sustainability commitments beyond quick wins.

Although companies are exploring solutions and educating themselves on all possible options, when it comes to actual investments in energy measures, two major hurdles remain:

- Need for expertise to explore and implement more complex investments (especially when they interfere with advanced industrial core processes).

- Alignment of energy-related investments with company financial expectations for such investments (notably, payback periods, financing requirements, etc.).

Flexible investment models & pragmatic rollout strategies

Industrials have particularly strong requirements associated with the outlay of CAPEX. High internal rates of return, aggressive return on capital employed ambitions, and short payback periods can red-light even the most impactful energy generation or conservation projects. Moreover, especially for certain energy efficiency measures, the business case often does not concur with these tough investment requirements.

This is where business models developed by energy service companies and energy suppliers can provide a solution that fits with these financial requirements. EaaS is a service-based business model whereby the industrial or commercial customer enjoys the benefits of an energy service by paying service fees directly related to the energy provided and saved. With this model, the focus shifts from CAPEX to OPEX — and from insourcing to outsourcing of expertise. The service contract models can shift varying degrees of accountability to the service provider. Successful setups have an incentive for efficiency improvement (i.e., lowering cost to serve) over time. Typically, EaaS makes use of traditional arrangements such as energy performance contracts, energy supply contracts, and power purchase agreements.

There are several benefits to the EaaS model, including simplification of the service offering, increasing cost planning reliability, lowering or eliminating up-front CAPEX, and including a greater range of energy service options (see figure below). EaaS could prove to be a key to unchain the next steps for industrials in their path to cost-effective sustainability.

Nevertheless, to assess the most efficient solutions, global companies must analyze facility specifics, local market design, local regulation, and pay close attention to energy prices. Although some basic measures can be applied across facilities, each market or site will require measures with varying degrees of complexity and investment and may or may not benefit from a favorable market design and regulation.

Key insights for executives

- Translate sustainable and efficiency ambitions into tangible targets and commitments for your company to achieve, using quantifiable and measurable KPIs related to your business.

- Be aware of the full range of options to realize your company’s ambitions, including multiple levers for energy supply, energy assets, and energy efficiency.

- Energy management, financial departments, and board members should recognize that investment limitations should not prevent impactful sustainability projects; there are simple and advanced solutions available to enable the strategic intent.

- One key route is seeking out new ways of financing and implementing these projects through, for example, an EaaS model.

- When rolling out an ambitious energy management strategy across the company, consider a robust decision tree model to account for local specifications, regulations, and market designs, enabling local rollout within corporate guidelines to reach the targeted impact.