There’s an old joke that we may have all heard at one time or another: “My doctor asked me if I had ever had a stress test. Sure … it’s called life!” Today, and for some time to come, the COVID-19 pandemic has become part of our daily lives and is providing the biggest stress test of our lifetime.

For the business world, the likes of such a stress test most recently came from the Global Financial Crisis of 2007–2008, when about US $2 trillion was wiped out from the global economy, leading to widespread adoption of stress testing for financial institutions. In that particular type of stress test, the robustness of the institution is tested against a range of extreme but plausible scenarios. Consequently, after that debilitating economic crash, many companies beefed up their crisis management systems; indeed, a global pandemic was often one of the scenarios used as a test. However, for most companies, the severity, velocity, and uncertainty of the actual pandemic crisis transcended anything in which they had planned. (For more on this, see “Leading businesses through the COVID-19 crisis” from an Arthur D. Little [ADL] Prism Special Report.) Today’s pandemic has impacted everything a business touches, including supply, operations, and demand.

As we enter the third year of the crisis — and with forecasters such as the Organisation for Economic Co-operation and Development having predicted GDP growth of more than 5.6% in 2021 and 4.5% in 2022 as the economy recovers — we can now begin to look more closely at how companies have responded to the pandemic’s stress test. Overall, the impact has varied dramatically across different sectors, causing near collapse in some industries like tourism and hospitality and rapid expansion in others like e-commerce and logistics. Companies have adapted in a plethora of ways, by scaling down, scaling up, and even changing their business models, operating models, and products/services.

What can we learn from those companies that fared well and fared badly? Were there some particular strategies or approaches especially effective that could be transferable to other companies?

To shed some light on these questions, we have examined how some peer companies performed in different sectors (e.g., pharmaceuticals and automotive). Based on the peer comparisons and our experience in working with companies in disruptive environments, this Viewpoint seeks to uncover some transferable learnings.

PFIZER WINS THE VACCINE RACE

About two years ago, if asked the question, “Which pharmaceutical company would be best placed to develop a vaccine quickly in the case of a pandemic?” most would have suggested the established global vaccine powerhouses — Pfizer, Merck, GlaxoSmithKline (GSK), or Sanofi. With the benefit of hindsight, we now know that only one of the four could actually deliver on that promise, by going with an unproven technology in a new partnership.

Of course, that major vaccine player is Pfizer, which delivered the first highly effective mRNA vaccine to battle the pandemic. The other three major vaccine makers decided to stick with proven methods involving much longer timelines — and failed to get the same results. Merck abandoned its trials, while GSK and Sanofi only announced their intention to submit data from their booster and Phase 3 trials in February 2022. Incidentally, GSK rebooted its partnership with CureVac, which in February 2022 dosed its first patient in a Phase 1 study for the seasonal influenza vaccine, based on the mRNA backbone it developed together.

So what did Pfizer do differently to leave its competitors behind and put itself in a prime position to reap the benefits for years to come, not only in the vaccine field but also as a major player in mRNA technology through its partnership with BioNTech?

- First, Pfizer acted decisively in mobilizing its resources toward developing an mRNA vaccine. It bet on an unproven technology and an untested partnership with BioNTech. As Pfizer CEO Albert Bourla explained in Harvard Business Review (HBR) last year, to speed up the process, the partnership began on a handshake and the contracts followed later — highly unusual in drug development. Merck, on the other hand, decided to go with its proven methodology, and its CEO declared early on that the timelines of less than a year were unrealistic. (Note, however, in drug development, the methodology used is only one of many factors affecting the outcome.)

- Second, Pfizer elected not to take direct government funding, allowing it to operate at a faster pace. The company did, however, sign numerous sales agreements with the US and other governments; in effect, underwriting part of the development and scaling effort.

- Third, Pfizer recognized quickly that the global need and urgency changed the environment, with risk and short-term return becoming less important. As a result, it went “all in” on the “moon shot challenge” of a six-month vaccine development timeline, according to Bourla. It was imperative to him to push for success — playing the new circumstances well and taking full advantage of regulatory flexibility — while also “doing the right thing” (helping the efforts of fighting the pandemic).

- Fourth, Pfizer leveraged its partnership with BioNTech optimally. Although, it must be noted that BioNTech is also a big winner in this story — not just Pfizer.

In addition to Pfizer, we should also mention Moderna and AstraZeneca as winners. Moderna managed to accelerate its strategy by three to four years — and was close on the heels of Pfizer with a highly effective vaccine. Its share price multiplied by seven at the time of FDA approval (incidentally, Merck was a large shareholder in Moderna and cashed in that stake).

AstraZeneca was not an established name in vaccines before the pandemic. It quickly established a collaboration with Oxford University, where the other UK giant GSK was a much likelier partner, and delivered an effective vaccine within the year. It promised to deliver at cost, and while it has had some bad luck with side effects and a few unfortunate PR stumbles, it has established itself as a major player in vaccines. On top of that, it pulled off the largest acquisition in the industry in 2020 by announcing it would buy Alexion Pharmaceuticals (AstraZeneca completed the acquisition in July 2021).

Of course, drug development is a long game. It will take some years to assess the ultimate winners and losers, but the stress test of the pandemic has already demonstrated that even pharmaceutical companies can move with great speed and agility if pressed to do so.

VOLVO ANTICIPATES TRENDS

The pandemic hit automotive sales hard, with initial falls of about 15%-30% in many markets in 2020 (see ADL’s Prism article, “Automotive: Accelerating disruption through creative destruction”). Ford was among the major players exposed to a large decline in the mainly internal combustion engine car segment, although it managed to make up its losses with Q1 2021 sales similar to the Q1 2020 in the US (70% of its global market).

However, not all automotive players suffered to the same degree; indeed, a few bucked the trend entirely. One of the most striking examples is Volvo, whose quarterly revenues actually increased by 41% in Q1 2021, relative to the same period in 2020, which was largely pre-pandemic. This is the best quarter in its history. What did Volvo do differently to achieve such a stunning performance during the pandemic?

One of the main factors was certainly Volvo’s early commitment to move toward full electric vehicles. (In the words of its CEO Håkan Samuelsson, “We are determined to be the first premium car maker to move our entire portfolio of vehicles into electrification.”) Volvo is currently the only maker to offer a plug-in hybrid variant on every model in its lineup from the smallest to the largest, and it has declared an aim to accelerate half its sales to fully electric cars by 2025 with the rest as hybrids. In Q1 2020, the share of fully electric or plug-in hybrid powertrain sales in Europe was already 39%. It also more than tripled its numbers of subscriptions sold online through its “Care by Volvo” offer. Meanwhile Ford’s electrified vehicle sales increased nearly 75% to a new record sales start, although starting from a lower share.

What does all this have to do with the pandemic? Well, the pandemic caused not just a fall in automotive sales but also significantly accelerated the disruption in the industry that was already taking place. This includes the move toward electrification, digitalization of automotive sales and services through connected and smart devices, and the shift in ownership models toward subscription and mobility services.

The lesson here is that companies that are faster at recognizing and adapting to long-term trends — and committing clearly to a long-term vision aligned with those trends — are more likely to be resilient to shocks like the pandemic. Something of a revelation to the world has been how the pandemic has accelerated preexisting trends across all sectors, intensifying the difference between those companies with a greater commitment to change versus those slower to adapt.

LESSONS FOR SUCCESS DURING CRISIS

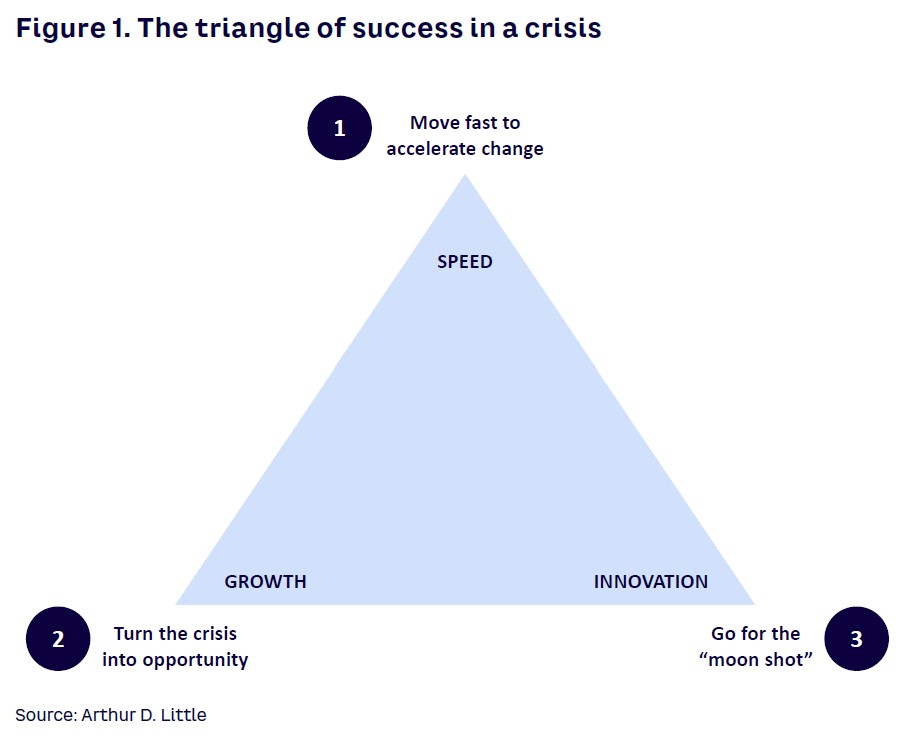

So what can we reasonably infer from these case examples in terms of how to do well in future crises? Figure 1 highlights three complementary strategies for success.

1. Move fast to accelerate change

The pandemic stress test showed more clearly than ever why the ability of companies to move fast and respond with agility is essential for success. Normal working processes with checks and balances, often using a sequence of steps with intermediate approvals, are not fit-for-purpose in a crisis. The companies that succeeded throughout the pandemic were typically those whose leadership had the courage to deviate from the normal way of doing things and take decisive action with incomplete data, such as Pfizer’s CEO. These winners recognized that, in crisis mode, a rapid but risky decision is much more valuable than a slower but more measured one due to the speed with which the “problem statement” changes and deteriorates.

In such situations, personal relationships with the broader network are especially important. If there’s no time to conduct any checks or go through a formal procurement process, the next best thing is to engage with people whom you personally know and trust. One of the reasons why the UK was able to vaccinate its population so quickly is that an empowered Vaccine Taskforce was set up, comprising leading figures from industry, academia, and government who were well-known to the UK political leadership. Although there were strong media allegations of cronyism at the time, this strategy proved to be a huge success with the benefit of hindsight.

2. Turn the crisis into opportunity

“Be fearful when others are greedy and greedy when others are fearful.” — Warren Buffett

Companies that have prospered during the crisis have had the courage to go against the crowd, be aggressive rather than defensive, and take advantage of low valuations — AstraZeneca’s takeover of Alexion in December 2020 is a good example. Although there was a dip in M&A activity in 2020 as the crisis hit, Q1 2021 saw an increase of 93% on the previous quarter, the second biggest quarter on record, according to data provider Refinitiv.

However, there’s more to this than just opportunism. If we believe, as many do, that the coming decades are going to be increasingly subject to serial disruptions, whether health, climate change, or geopolitical, then it follows that future-oriented companies will be much better positioned to take advantage of sudden trend accelerations, as we have seen during the current pandemic. Volvo, with its strong commitment to electric vehicles, is a good illustration.

3. Go for the “moon shot”

Finally, successful companies under the pandemic stress test have taken the opportunity to set moon shot challenges that, like Pfizer, Moderna, and AstraZeneca, have led to stunning successes. A crisis such as the pandemic can be a unique opportunity for breakthrough innovation. If the downside of “business as usual” is very severe, then suddenly it makes sense to accept much higher levels of risk and uncertainty. For example, when Pfizer CEO Bourla first postulated a six-month vaccine development timeline, he claims his “scientists were incredulous.” (Source: HBR.) However, ultimately, they found a way to make it happen.

The new normal

There are huge learnings from the way companies have been able to respond to challenges that, prior to the pandemic, might have been previously thought to be impossible. A key question is which aspects of the modus operandi adopted during this crisis will become normal practice going forward.

Like any stress test, the pandemic has shone a spotlight on how well — and how badly — businesses are set up to respond to disruption. While various sectors have been affected in very different ways, there are still useful lessons to be learned from how peers in the same sector have performed. The most successful companies during the pandemic are those that have been able to move and adapt with speed, leverage the opportunities for growth, and use the crisis as a unique opportunity to drive breakthrough innovation.

Conclusion

HOW BEST TO RESPOND TO DISRUPTION

The pandemic has accentuated and highlighted companies’ strengths and weaknesses in ways that cannot be ignored. Be wary of writing off the pandemic as a one-off and instead use it to bring about valuable change. Executives should ask themselves:

- What did the pandemic reveal about our agility, and what changes should we make?

- Which new approaches can we integrate into our business processes to speed them up?

- Does our culture encourage risk taking; if not, how can we change this?

- Do we place enough emphasis on understanding future trends and aligning with them?

- Do we have a clear and inspiring vision and sense of purpose?

- Do we have the right organization and culture to be “ambidextrous” — blending scale/productivity with speed/creativity in a balanced way?

- Do we have the right innovation approach for moon shots aligned with our vision and sense of purpose?

As Winston Churchill is reputed to have said in relation to the conditions after World War II that allowed for the formation of the United Nations, “Never let a good crisis go to waste.” Executives should make the most of the valuable learnings that the pandemic stress test has revealed.