DOWNLOAD

11 min read

Automotive: Accelerating disruption through creative destruction

How automotive sales and after-sales need to prepare for the post-COVID-19 era now

Thanks to the rise of electric vehicles, digital and new ownership models, the automotive market was already facing unprecedented disruption. As this article explains, the impact of COVID-19 on newcar sales accelerates the need for radical change – now is the time to turbocharge transformation efforts and seize opportunities to thrive in a post-ICE era.

Manufacturers (OEMs) had to react immediately to secure their financial liquidity, their operations, the health of their employees, and the value of basic capital assets to guarantee their immediate survival. As the broader crisis stabilizes, they face the pressing question of how to stay competitive and successful during and after the recovery, against the backdrop of a transforming market.

Unlike in previous recoveries, when buyers start returning to the market in greater numbers in two to three years, ongoing industry disruption will have advanced sufficiently to change their buying behavior. This confluence of factors creates opportunities for those in the industry who set the right course now. Therefore, we suggest making bold – and perhaps counterintuitive – strategic decisions, focusing scarcer resources on future automotive technologies such as electrified powertrains, xEVs and digitalization to accelerate the modernization of products and sales structures, even if it means losing volume in traditional business areas and internal combustion engine (ICE) vehicles.

How will COVID-19 ultimately affect the industry?

1. Two or three “lost” years for car sales are ahead, with much lower sales volumes

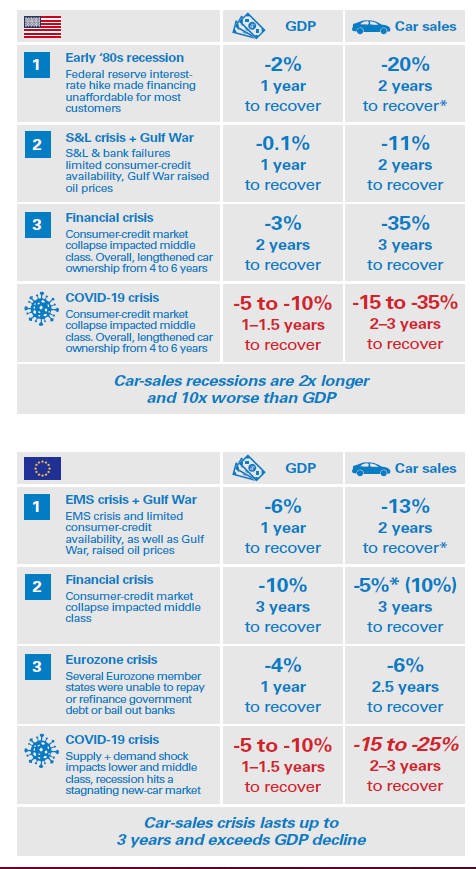

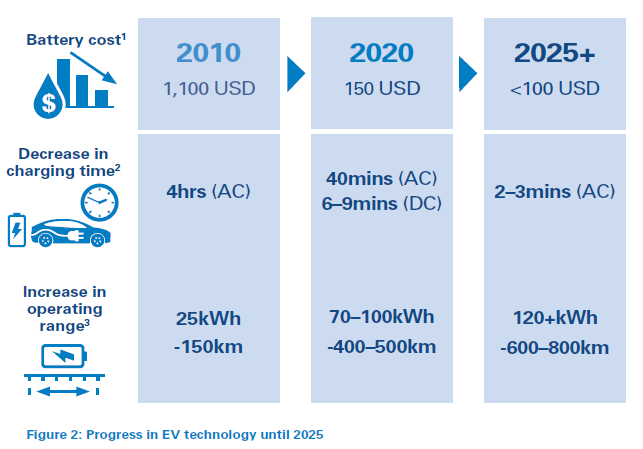

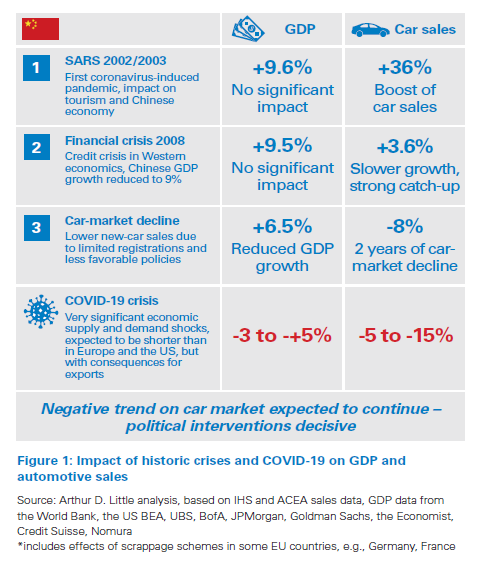

Although the current crisis is different to previous events, studying their impact on vehicle markets can give some indications on how to develop post-COVID-19 recovery scenarios. In the past, car markets in Europe and the US decreased more than the overall economy (GDP) and took longer to recover to pre-crisis levels. As a rule of thumb, passenger-car markets are likely to recover only one or two years after overall GDP, which points to two to three lost years in terms of sales volumes in the current crisis.

2. The crisis will lead to “creative destruction” and accelerated consolidation

Another consequence of economic crises is the market exit of the least innovative and competitive market players, products and technologies. This creates opportunities for new entrants and ideas, rewards entrepreneurial risks and accelerates structural changes. We expect the COVID-19 crisis to have this effect on the automotive industry, particularly as it accelerates existing transformation, although policy makers and car buyers will have great influence on where this “creative destruction” leads.

3. The impact of COVID-19 on automotive markets will differ from region to region

The United States

In the US, the speed and magnitude of the economic contraction has already eclipsed the 2008 recession and is expected to briefly reach levels of GDP decline and unemployment not seen since the Great Depression of the 1930s. Job losses, general uncertainty, and logistical challenges caused by lockdowns have already had major impact on the automotive market:

- Car sales slowed rapidly, dropping by over 35 percent in March, with the vast majority of the fall in the second half of the month. April sales were down by 50 percent.

- Supply chains were cut and production capacity reduced by 93 percent from late March to the end of May.

- Looking forward, consumer sentiment has dropped to a six-year low and is expected to continue a downward trend.

- COVID-19’s nature of limiting human contact will continue to have an outsized impact on services industries, disproportionally affecting the middle class and leading to large numbers of postponed or cancelled car purchases.

- “Millennials” (approximately 22–38 years old) are especially vulnerable, as they are being hit by a second “once in a generation” recession during their prime earning years – all while already struggling to manage higher levels of household debt – which makes large expenditure on new cars unlikely.

These weaknesses could lead to an unprecedented reduction in car sales over the next two to three years.

Europe

Across the continent, the automotive industry directly or indirectly employs 6.1 percent of the total workforce, and six weeks of production lockdowns and supply-chain disruption have had a growing impact on this significant portion of the economy:

- Currently, an EU recession for 2020 with a GDP contraction of 8 percent is the consensus estimate, with the Economic Sentiment Indicator (ESI) and Employment Expectation Indicator (EEI) close to the historic lows reached in 2009.

- Lower GDP and ESI/EEI rankings will lead to reduced long-term car sales. The greatest impact falls on markets such as Italy, Spain, and France, which had barely recovered from previous crises and were hit most severely in medical terms. Car demand contracted by 85 percent in Italy, 72 percent in Spain, and almost 70 percent in France during March.

- In some European markets, however, social-welfare systems and state intervention in key industries will stabilize economies, preventing large-scale layoffs and the impoverishment of the middle class, which could help raise sales.

China

The first global market hit by the COVID-19 crisis, China experienced its first quarter with a contracting GDP (down 6.8 percent compared to Q1/2019) since numbers were first published in 1992. Across 2020, GDP growth of only 2 percent is expected – compared to 2019 growth of 6 percent:

- China faced the most severe hit to car sales of all regions in Q1, with a 50 percent drop compared to Q1 2019.

- Sales had already dropped in 2018 and 2019, with the current crisis leading to further sales declines of up to 10 percent in 2020.

- However, recovery is expected to be quicker than in the rest of the world, with sales already returning to 2019 levels in Q2.

From previous experiences, China’s car market is expected to react primarily to state intervention, which means whether historic sales peaks can be reached again, and when, will depend on political measures. For example, the Chinese government has just announced that it will continue new energy vehicle (NEV) sales incentives – at a reduced level – until the end of 2022, as well as especially support domestic manufacturers during the recovery.

4. Recovery within two to three years: Why the current crisis accelerates industry disruption

“The US auto-market recovery will probably take two to three years, depending on different scenarios. We have witnessed the peak of ICE vehicles sales, and we will very likely see an accelerated trend towards electrification. This trend has already started pre-COVID.”

Daniel Weissland, President of Audi of America

Daniel Weissland, the President of Audi of America, points out: “Today there is a major difference from the recoveries of 2009, 2002, and earlier. The automotive industry is currently undergoing a huge transformation in all global markets. However, at this point manufacturers and dealers have only just started to reposition for this new era”:

- Powertrain electrification: Demand and supply are shifting towards electric and electrified vehicles with increasing speed.

- Digitalization of automotive sales and services: Connected and smart devices are changing the way consumers buy and drive cars and use mobility.

- Shift in ownership models: More flexible models of use, financing, and subscriptions of cars and mobility are gaining ground, which is also impacting automotive after-sales.

The current crisis will not bring this disruption to a halt. On the contrary, we expect it to become a catalyst for the transformation and to support a wave of “creative destruction” hitting the automotive sector. This view is supported by industry top managers in major markets, as well as four key observations:

xEV value propositions will improve, and diesel/gasoline car sales will never again reach previous peaks

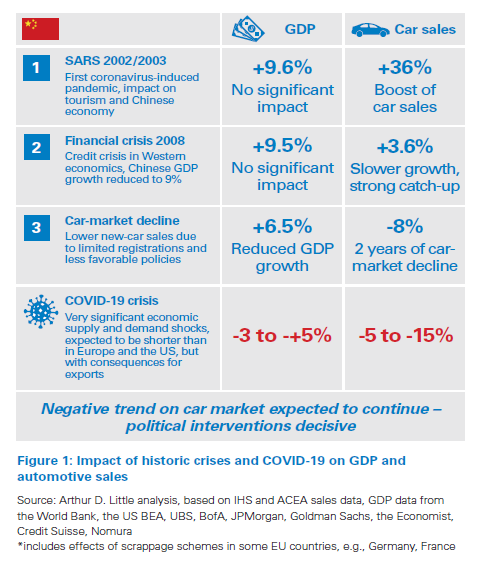

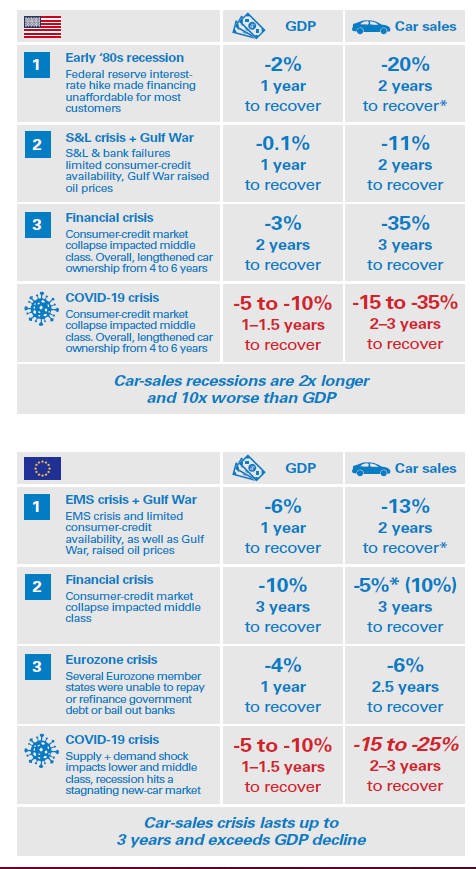

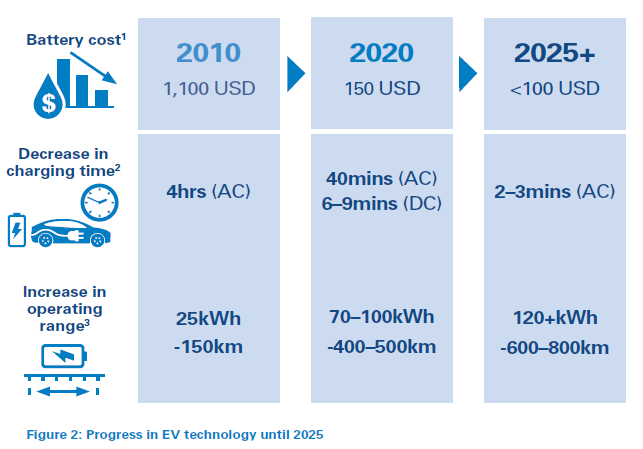

The next two to three years will be “lost years” for sales of ICE vehicles on traditional technology platforms. Demand will be sluggish due to economic conditions, and when it returns in 2023/2024, customers will be focused on state-of-theart technology with electrified powertrains. The ADL study “Future of automotive mobility” has identified price and TCO, charging times, range anxiety and the absence of attractive vehicles as today’s major customer concerns regarding xEVs. However, all these issues are likely to rapidly reduce:

- OEMs are increasing xEV lineups by more than 400 new models by 2024, while cutting back on traditional-engine offerings. Huge investments in xEVs have already been made all along the value chain – they will pay off with customer demand for up-to-date powertrain technology in and after the market rebound.

- Technology progress, such as in batteries, highperformance charging and ramped-up production volume, will further reduce manufacturing costs for xEVs, improve the total cost of ownership and range, and make them more attractive for the mass market, as low oil prices will also bring down costs for electricity.

- Charging infrastructure development will continue and improve the practicality of xEVs for a wider group of users – public and private investments into charging infrastructure will increase network density, and charging/ battery technology improvements will bring down charging times.

- Regulation and politics will continue to push for lowemission vehicles and the scrapping of current ICE fleets. CO2 limits and purchase and tax incentives will make it unattractive to offer or buy ICEs.

Digitalization of sales and services will receive a boost

Digital sales and services have steadily gained ground in the automotive sector. The crisis has accelerated this – as many dealerships closed, potential buyers shifted even more of their car-purchase journeys to digital channels. Initial research and information gathering moved online years ago, and video presentations of the car, online negotiations and online sales now digitize the entire process. The COVID-19 crisis will therefore open the door to a rapid rise in digital sales as both customers and dealers overcome their long-standing resistance and trial new technology.

Increased focus on after-sales business and profits

The drop in new-car purchases means that over the next two to three years the average age of cars on the road will increase, intensifying an ongoing trend and creating additional growth in demand for aftermarket parts and services. ADL calculations indicate that the average car age in the EU will increase from 11.4 to 12.6 years in just three years. For dealers weakened by the loss of sales, the aftermarket will be a growth opportunity and lifeline during the years of the downturn. And given that these are out-of-warranty vehicles with ages of five-plus years, OEMs will have to adapt their offerings if they are to avoid losing out to independent aftermarket players.

Government intervention will shape the pace of and path to market recovery

The market rebound and the post-COVID-19 automotive world will be strongly shaped by regulation. Government interventions cannot yet be fully predicted and will differ across the US, Europe, and China. Therefore, manufacturers need to monitor the regulatory conditions for the rebound and act with strategies that can be adapted for multiple scenarios. Supportive measures on the demand side will likely be put in place, along with short-term support for OEMs on the supply side. We also expect CO2 and climate policy to play a major role in political decision-making, based on statements from Chinese and EU officials. Automotive strategies should be based on scenarios which differentiate by the expected extent of purchase incentives (none to high) and the climate and environmental focus (none to high):

We expect the most likely scenario to be around a push for new-energy and new-technology vehicles in China and the EU. As well as continued xEV subsidies in China, financial incentives for zero or low emission vehicles are being discussed in Europe, and would add to existing schemes. Meanwhile, loosening the CO2 emission and fuel consumption targets for 2030 seems to be against the EU’s political consensus. In this context, higher prices for CO2 emissions, such as by taxation of fuels or emission certificates, could offset the current oil-price lows, which adds uncertainty to the current situation for xEVs. In the US, however, the current administration has reduced CO2 standards and pollution enforcement during the crisis.

Insight for the executive

Although securing cash positions and supply chains are both important to survive the current crisis in the short term, carmakers must start taking action to win in the post- COVID-19 era. With lower revenues and profits during the next few years it is even more important to use limited investment resources wisely:

- Fully embrace transformation mode now: OEMs need to use the momentum of crisis-induced change to prepare their organizations for the era of EVs and digital from top to bottom, i.e., from HQ to dealers. This will free up resources in the mid-term. Although many are already on their transformation journeys, the crisis must accelerate their efforts.

- Keep investing in future products while reducing ICE investment: The right product lineup will be key, even if it implies severe cuts to spending on ICE technology in the face of fading sales. OEMs “win with winners” and not all technology and vehicle platforms can be continued.

- Monitor and support the change in the sales landscape: Dealer networks will suffer heavily from the impact of the crisis and might never reach the geographical density of pre-crisis times. Therefore, now is the time to reboot your sales organization and structures to be prepared for a world of digital sales and services.

- Review business models for new profit opportunities and generate higher shares of revenues from subscriptions and the aftermarket: An aging car population, declining new-car sales and the rise of new ownership models require new business models – OEMs need to tap into financial-mobility services, subscriptions and new aftermarket segments, targeting older cars and large fleets.

Before the crisis many automotive manufacturers saw the need for change and had begun the process. However, they now need to turbocharge their efforts. Innovative automotive manufacturers will find healthy ways out of the current crisis, and those that take opportunities now will benefit the most from an accelerated breakthrough to cleaner, more sustainable, and more convenient automotive mobility in the long term. It is a challenge – but achievable for those that grasp the opportunity.

11 min read

Automotive: Accelerating disruption through creative destruction

How automotive sales and after-sales need to prepare for the post-COVID-19 era now

Thanks to the rise of electric vehicles, digital and new ownership models, the automotive market was already facing unprecedented disruption. As this article explains, the impact of COVID-19 on newcar sales accelerates the need for radical change – now is the time to turbocharge transformation efforts and seize opportunities to thrive in a post-ICE era.

Manufacturers (OEMs) had to react immediately to secure their financial liquidity, their operations, the health of their employees, and the value of basic capital assets to guarantee their immediate survival. As the broader crisis stabilizes, they face the pressing question of how to stay competitive and successful during and after the recovery, against the backdrop of a transforming market.

Unlike in previous recoveries, when buyers start returning to the market in greater numbers in two to three years, ongoing industry disruption will have advanced sufficiently to change their buying behavior. This confluence of factors creates opportunities for those in the industry who set the right course now. Therefore, we suggest making bold – and perhaps counterintuitive – strategic decisions, focusing scarcer resources on future automotive technologies such as electrified powertrains, xEVs and digitalization to accelerate the modernization of products and sales structures, even if it means losing volume in traditional business areas and internal combustion engine (ICE) vehicles.

How will COVID-19 ultimately affect the industry?

1. Two or three “lost” years for car sales are ahead, with much lower sales volumes

Although the current crisis is different to previous events, studying their impact on vehicle markets can give some indications on how to develop post-COVID-19 recovery scenarios. In the past, car markets in Europe and the US decreased more than the overall economy (GDP) and took longer to recover to pre-crisis levels. As a rule of thumb, passenger-car markets are likely to recover only one or two years after overall GDP, which points to two to three lost years in terms of sales volumes in the current crisis.

2. The crisis will lead to “creative destruction” and accelerated consolidation

Another consequence of economic crises is the market exit of the least innovative and competitive market players, products and technologies. This creates opportunities for new entrants and ideas, rewards entrepreneurial risks and accelerates structural changes. We expect the COVID-19 crisis to have this effect on the automotive industry, particularly as it accelerates existing transformation, although policy makers and car buyers will have great influence on where this “creative destruction” leads.

3. The impact of COVID-19 on automotive markets will differ from region to region

The United States

In the US, the speed and magnitude of the economic contraction has already eclipsed the 2008 recession and is expected to briefly reach levels of GDP decline and unemployment not seen since the Great Depression of the 1930s. Job losses, general uncertainty, and logistical challenges caused by lockdowns have already had major impact on the automotive market:

- Car sales slowed rapidly, dropping by over 35 percent in March, with the vast majority of the fall in the second half of the month. April sales were down by 50 percent.

- Supply chains were cut and production capacity reduced by 93 percent from late March to the end of May.

- Looking forward, consumer sentiment has dropped to a six-year low and is expected to continue a downward trend.

- COVID-19’s nature of limiting human contact will continue to have an outsized impact on services industries, disproportionally affecting the middle class and leading to large numbers of postponed or cancelled car purchases.

- “Millennials” (approximately 22–38 years old) are especially vulnerable, as they are being hit by a second “once in a generation” recession during their prime earning years – all while already struggling to manage higher levels of household debt – which makes large expenditure on new cars unlikely.

These weaknesses could lead to an unprecedented reduction in car sales over the next two to three years.

Europe

Across the continent, the automotive industry directly or indirectly employs 6.1 percent of the total workforce, and six weeks of production lockdowns and supply-chain disruption have had a growing impact on this significant portion of the economy:

- Currently, an EU recession for 2020 with a GDP contraction of 8 percent is the consensus estimate, with the Economic Sentiment Indicator (ESI) and Employment Expectation Indicator (EEI) close to the historic lows reached in 2009.

- Lower GDP and ESI/EEI rankings will lead to reduced long-term car sales. The greatest impact falls on markets such as Italy, Spain, and France, which had barely recovered from previous crises and were hit most severely in medical terms. Car demand contracted by 85 percent in Italy, 72 percent in Spain, and almost 70 percent in France during March.

- In some European markets, however, social-welfare systems and state intervention in key industries will stabilize economies, preventing large-scale layoffs and the impoverishment of the middle class, which could help raise sales.

China

The first global market hit by the COVID-19 crisis, China experienced its first quarter with a contracting GDP (down 6.8 percent compared to Q1/2019) since numbers were first published in 1992. Across 2020, GDP growth of only 2 percent is expected – compared to 2019 growth of 6 percent:

- China faced the most severe hit to car sales of all regions in Q1, with a 50 percent drop compared to Q1 2019.

- Sales had already dropped in 2018 and 2019, with the current crisis leading to further sales declines of up to 10 percent in 2020.

- However, recovery is expected to be quicker than in the rest of the world, with sales already returning to 2019 levels in Q2.

From previous experiences, China’s car market is expected to react primarily to state intervention, which means whether historic sales peaks can be reached again, and when, will depend on political measures. For example, the Chinese government has just announced that it will continue new energy vehicle (NEV) sales incentives – at a reduced level – until the end of 2022, as well as especially support domestic manufacturers during the recovery.

4. Recovery within two to three years: Why the current crisis accelerates industry disruption

“The US auto-market recovery will probably take two to three years, depending on different scenarios. We have witnessed the peak of ICE vehicles sales, and we will very likely see an accelerated trend towards electrification. This trend has already started pre-COVID.”

Daniel Weissland, President of Audi of America

Daniel Weissland, the President of Audi of America, points out: “Today there is a major difference from the recoveries of 2009, 2002, and earlier. The automotive industry is currently undergoing a huge transformation in all global markets. However, at this point manufacturers and dealers have only just started to reposition for this new era”:

- Powertrain electrification: Demand and supply are shifting towards electric and electrified vehicles with increasing speed.

- Digitalization of automotive sales and services: Connected and smart devices are changing the way consumers buy and drive cars and use mobility.

- Shift in ownership models: More flexible models of use, financing, and subscriptions of cars and mobility are gaining ground, which is also impacting automotive after-sales.

The current crisis will not bring this disruption to a halt. On the contrary, we expect it to become a catalyst for the transformation and to support a wave of “creative destruction” hitting the automotive sector. This view is supported by industry top managers in major markets, as well as four key observations:

xEV value propositions will improve, and diesel/gasoline car sales will never again reach previous peaks

The next two to three years will be “lost years” for sales of ICE vehicles on traditional technology platforms. Demand will be sluggish due to economic conditions, and when it returns in 2023/2024, customers will be focused on state-of-theart technology with electrified powertrains. The ADL study “Future of automotive mobility” has identified price and TCO, charging times, range anxiety and the absence of attractive vehicles as today’s major customer concerns regarding xEVs. However, all these issues are likely to rapidly reduce:

- OEMs are increasing xEV lineups by more than 400 new models by 2024, while cutting back on traditional-engine offerings. Huge investments in xEVs have already been made all along the value chain – they will pay off with customer demand for up-to-date powertrain technology in and after the market rebound.

- Technology progress, such as in batteries, highperformance charging and ramped-up production volume, will further reduce manufacturing costs for xEVs, improve the total cost of ownership and range, and make them more attractive for the mass market, as low oil prices will also bring down costs for electricity.

- Charging infrastructure development will continue and improve the practicality of xEVs for a wider group of users – public and private investments into charging infrastructure will increase network density, and charging/ battery technology improvements will bring down charging times.

- Regulation and politics will continue to push for lowemission vehicles and the scrapping of current ICE fleets. CO2 limits and purchase and tax incentives will make it unattractive to offer or buy ICEs.

Digitalization of sales and services will receive a boost

Digital sales and services have steadily gained ground in the automotive sector. The crisis has accelerated this – as many dealerships closed, potential buyers shifted even more of their car-purchase journeys to digital channels. Initial research and information gathering moved online years ago, and video presentations of the car, online negotiations and online sales now digitize the entire process. The COVID-19 crisis will therefore open the door to a rapid rise in digital sales as both customers and dealers overcome their long-standing resistance and trial new technology.

Increased focus on after-sales business and profits

The drop in new-car purchases means that over the next two to three years the average age of cars on the road will increase, intensifying an ongoing trend and creating additional growth in demand for aftermarket parts and services. ADL calculations indicate that the average car age in the EU will increase from 11.4 to 12.6 years in just three years. For dealers weakened by the loss of sales, the aftermarket will be a growth opportunity and lifeline during the years of the downturn. And given that these are out-of-warranty vehicles with ages of five-plus years, OEMs will have to adapt their offerings if they are to avoid losing out to independent aftermarket players.

Government intervention will shape the pace of and path to market recovery

The market rebound and the post-COVID-19 automotive world will be strongly shaped by regulation. Government interventions cannot yet be fully predicted and will differ across the US, Europe, and China. Therefore, manufacturers need to monitor the regulatory conditions for the rebound and act with strategies that can be adapted for multiple scenarios. Supportive measures on the demand side will likely be put in place, along with short-term support for OEMs on the supply side. We also expect CO2 and climate policy to play a major role in political decision-making, based on statements from Chinese and EU officials. Automotive strategies should be based on scenarios which differentiate by the expected extent of purchase incentives (none to high) and the climate and environmental focus (none to high):

We expect the most likely scenario to be around a push for new-energy and new-technology vehicles in China and the EU. As well as continued xEV subsidies in China, financial incentives for zero or low emission vehicles are being discussed in Europe, and would add to existing schemes. Meanwhile, loosening the CO2 emission and fuel consumption targets for 2030 seems to be against the EU’s political consensus. In this context, higher prices for CO2 emissions, such as by taxation of fuels or emission certificates, could offset the current oil-price lows, which adds uncertainty to the current situation for xEVs. In the US, however, the current administration has reduced CO2 standards and pollution enforcement during the crisis.

Insight for the executive

Although securing cash positions and supply chains are both important to survive the current crisis in the short term, carmakers must start taking action to win in the post- COVID-19 era. With lower revenues and profits during the next few years it is even more important to use limited investment resources wisely:

- Fully embrace transformation mode now: OEMs need to use the momentum of crisis-induced change to prepare their organizations for the era of EVs and digital from top to bottom, i.e., from HQ to dealers. This will free up resources in the mid-term. Although many are already on their transformation journeys, the crisis must accelerate their efforts.

- Keep investing in future products while reducing ICE investment: The right product lineup will be key, even if it implies severe cuts to spending on ICE technology in the face of fading sales. OEMs “win with winners” and not all technology and vehicle platforms can be continued.

- Monitor and support the change in the sales landscape: Dealer networks will suffer heavily from the impact of the crisis and might never reach the geographical density of pre-crisis times. Therefore, now is the time to reboot your sales organization and structures to be prepared for a world of digital sales and services.

- Review business models for new profit opportunities and generate higher shares of revenues from subscriptions and the aftermarket: An aging car population, declining new-car sales and the rise of new ownership models require new business models – OEMs need to tap into financial-mobility services, subscriptions and new aftermarket segments, targeting older cars and large fleets.

Before the crisis many automotive manufacturers saw the need for change and had begun the process. However, they now need to turbocharge their efforts. Innovative automotive manufacturers will find healthy ways out of the current crisis, and those that take opportunities now will benefit the most from an accelerated breakthrough to cleaner, more sustainable, and more convenient automotive mobility in the long term. It is a challenge – but achievable for those that grasp the opportunity.