DOWNLOAD

DATE

Contact

Sustainability has become increasingly important to telco business strategy and operations. Although individual 5G equipment is more energy-efficient than its predecessors, the need for more extensive, denser networks will increase overall direct energy consumption. Amid rising energy prices, how can telcos achieve their sustainability goals, while enabling broader decarbonization? In this Viewpoint, we provide frameworks and strategies telcos can use to improve sustainability.

THE TRENDS DRIVING TELCO SUSTAINABILITY

Like all businesses, telcos face short-term challenges around rising energy prices, driven by the phasing out of fossil fuels and higher gas prices resulting from the conflict between Russia and Ukraine.

Telcos have long understood the need to position themselves around long-term sustainability trends. In February 2019, the board of the Global System for Mobile Communications Association (GSMA) illustrated its commitment to sustainability by seeking to transform the mobile industry and reach net-zero greenhouse gas (GHG) emissions by 2050. However, as highlighted in “Mobile Net Zero: State of the Industry on Climate Action 2022,” GSMA found that 34% of total global mobile connections are currently provided by operators that make no disclosures of their climate impact. Sixty-six percent of operators only measure Scope 1 (emissions from sources an organization owns or directly controls) and Scope 2 (emissions from the production of energy it purchases and uses). However, the majority (56%) do not measure Scope 3 (emissions they cannot control but result from their overall value chain). This significant gap requires additional complicated data gathering and processing, as well as further work on standards, reporting, and coordination across supply chains.

Meeting ESG challenges

The telco sector is experiencing an increasing focus on ESG from stakeholders, including investors and regulators. In particular, investors are closely monitoring the sustainable financial business efforts and environmental, social, and governance (ESG) initiatives of asset-intensive telco companies such as tower operators (TowerCos) and network operators (NetCos). The growing emphasis on ESG manifests greater demand for due diligence and includes sustainability assessments into commercial transactions, which requires ESG to become an integral part of corporate strategy.

Multiple stakeholders are also putting pressure on businesses to become more sustainable and adopt a triple bottom line approach. This concept expands the traditional view of financial performance by monitoring three categories of impact. The focus on profit as the bottom line now incorporates people and planet; how a company addresses its social and environmental responsibilities is measured and evaluated. The broad overview created by this framework is having a profound impact on the information and communication technologies (ICT) industry, which can enable other industries to operate more sustainably while concurrently helping to accelerate progress toward meeting the United Nation’s (UN) 17 Sustainable Development Goals (SDGs).

Some key assets in the telecommunications industry (e.g., towers, optical fiber networks, and data centers) have the potential to accelerate the move to greater sustainability. Combining infrastructure with new business models can create an ecosystem that delivers:

-

Smaller environmental impacts through sharing infrastructure, improving energy efficiency, generating power on-site from renewable energy sources, and applying circular approaches to recycling electronic equipment.

-

Improvements for society by reducing impact through enabling digitalization and optimizing asset distribution.

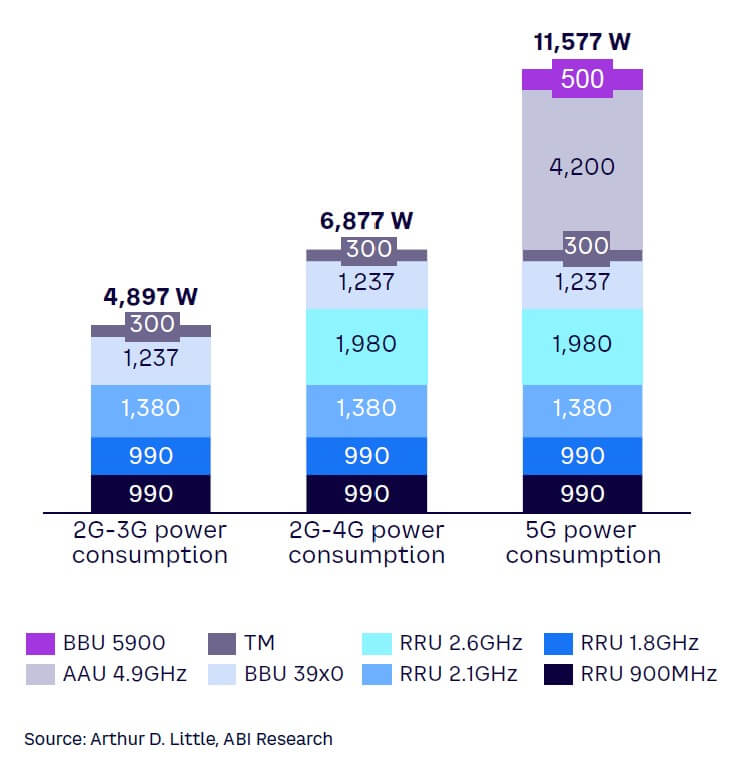

The impact of 5G on energy consumption

While the power consumption per unit of network traffic, measured in watts per bit, has decreased during the last 10 years, 5G networks will reverse this by requiring significantly more energy than their 4G predecessors (see Figure 1). This rise is anticipated despite the fact that individual 5G equipment components are notably more efficient than previous technologies and other equipment has been already optimized. For example, rectifiers have already achieved 98% energy efficiency.

Two factors influence this increase:

-

5G sites will typically be configured with multiple bands, meaning that the maximum power installed per site will exceed 10 kW or even 20 kW. the number of sites providing more than five bands is estimated to be 45% of the total, whereas in 2016 the figure was just 3%.

-

5G networks will need to be denser, with a greater number of sites being deployed to provide more robust coverage.

Greater regulatory demands

Regulatory demands around sustainability and sustainability reporting are accelerating, at both the regional and industry level:

-

The European Green Deal is a collection of deeply transformative policies aiming to transform the EU into a fair and prosperous society, with a modern, resource-efficient, and competitive economy that eliminates GHG emissions by 2050.

-

The new EU Sustainable Finance Disclosure Regulation (SFDR) requires financial market participants, such as banks, to rate loans based on ESG criteria, while the EU Taxonomy is a classification system that sets new standards for assessing green investments. It aims to focus and accelerate investment by private and institutional funds to drive the green transition.

-

The International Telecommunication Union (ITU) is taking an active role in promoting and addressing the UN SDGs through ICT. Its Connect 2030 Agenda envisages “an information society, empowered by the interconnected world, where ICT enables and accelerates social, economic, and environmentally sustainable growth.”

-

The EU Corporate Sustainability Reporting Directive (CSRD) further details and expands existing sustainability reporting rules and will take effect in 2024. The rules will apply to almost 50,000 companies across the European Economic Area, including non-EU companies with EU revenues of €150 million or more.

The regulatory pressure on ESG transparency and performance requires businesses to rapidly change the way they operate and align with these new requirements. The challenges are pivotal and require drastic improvements. However, according to survey highlights outlined in Arthur D. Little (ADL’s) Report “Overcoming the Challenges to Sustainability,” these commitments to ESG do not seem to have the same urgency as other business objectives. Just 24% of respondents have developed structured plans and roadmaps to achieve their ESG goals.

New opportunities for telcos

Energy consumption and prices are growing in tandem with the focus on sustainability. Therefore, telcos need to become more efficient in the short term and more sustainable in the mid to long term.

Telecom networks generate about 20% of the ICT sector’s total emissions, which are predicted to grow at an annual rate of about 4%-5%. Projected future GHG emissions from the ICT sector vary; some research expects emissions to remain stable, while others predict that ICT sector emissions could increase to 14% of global emissions by 2030, if unmitigated, according to the European Commission’s “Supporting the Green Transition: Shaping Europe’s Digital Future” report.

Industry initiatives are aiming to make the sector greener. For example, the Next Generation Mobile Networks (NGMN) Alliance has launched the Green Future Networks project to set and achieve common targets around sustainability and mitigating climate change across the entire telco supply chain. The project aims to increase energy efficiency, reduce CO2 emissions, and expand the use of recycling.

The NGMN Alliance plans to analyze the entire equipment lifecycle, from design to disposal, aspiring to save energy and recycle components through a shared approach between operators and suppliers.

The financial possibilities of sustainability

The benefits of becoming more sustainable go far beyond reducing energy costs or meeting regulatory demands. Implementing sustainable business practices offers the added potential of additional revenue. For example, a growing volume of investment capital is available for sustainability-centered initiatives. Global ESG assets are predicted to exceed US $50 trillion by 2025, up from $30.6 trillion in 2018, according to Bloomberg Intelligence. Attracting new capital requires organizations to demonstrate and communicate their sustainable credentials and their progress toward achieving their ESG commitments.

However, ADL’s aforementioned sustainability survey found that company reporting on sustainability performance remains the inferior counterpart to financial reporting. Just 17% of organizations surveyed believe the two areas share the same rigor, while only 13% integrate sustainability and financial reporting into the same report. Often, this lack of rigor comes from companies being reactive rather than proactive. These organizations begin with the tactical goal of creating a sustainability report, as opposed to starting with the bigger objective of setting a strategy and governance to effectively steer sustainability within the organization.

Because of their reactive responses, these companies fail to articulate their strategies or develop the necessary confidence around their sustainability initiatives, which are essential in discussions with investors. Consequently, 30% of respondents said they do not discuss sustainability with investors at all, and only 22% are using their performance metrics to attract green investors. Essentially, 78% of the organizations surveyed are not fully exploiting the growing availability of green investment and the better terms it offers.

Additionally, post-pandemic government recovery funds prioritize green transition and digitalization, providing opportunities for telcos to tap additional funding:

-

In Europe, funding instruments, including the Digital Europe Programme (DIGITAL), Recovery and Resilience Facility (RRF), and Invest EU, aim to drive digital transformation. The Connecting Europe Facility (CEF) sets out an enormous range of investments to support the telco industry in developing gigabit broadband and 5G networks, while increasing infrastructure capacity and resilience.

-

In the US, the Inflation Reduction Act of 2022 will unlock $369 billion in federal funding from 2022 to 2031 to promote investment toward climate action and energy security. The incentives come in the form of tax credits, which can support telcos and help them achieve their decarbonization goals ahead of schedule and under budget.

The need for an integrated sustainability framework

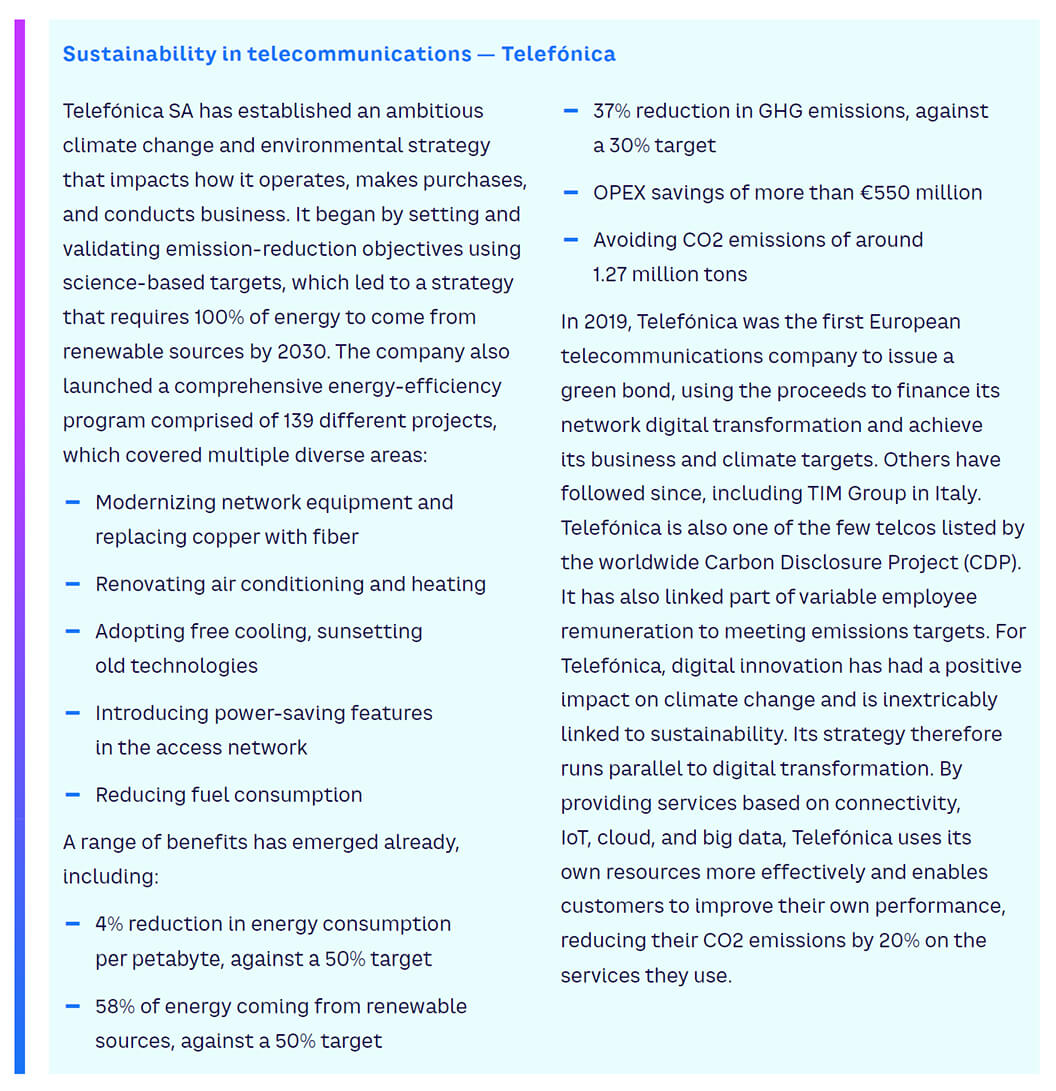

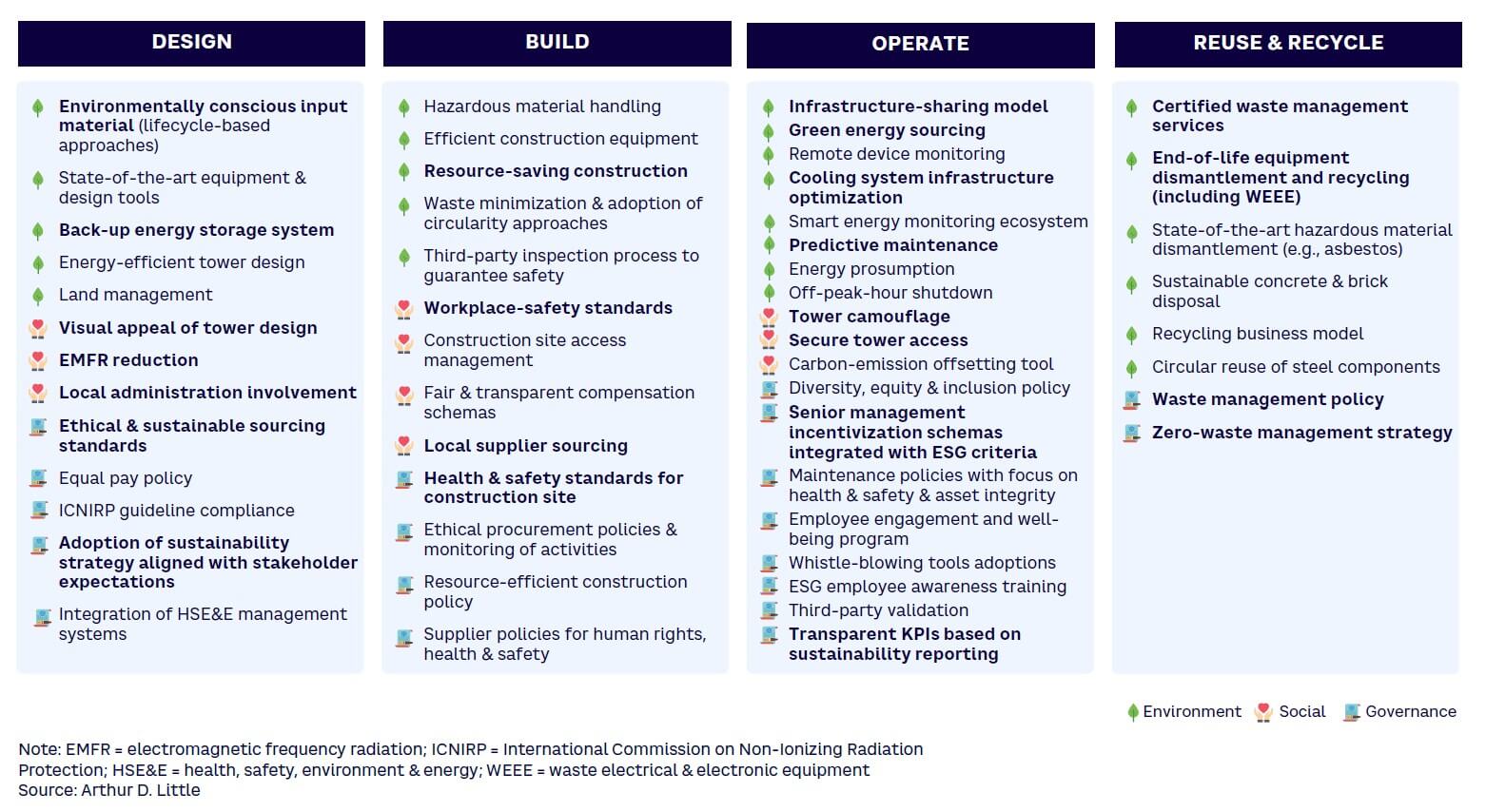

ADL has accumulated more than 30 years’ experience with sustainability strategy, using it to inform the development of an integrated sustainability lever framework specific to the telco sector (see Figure 2). Using the framework’s structure can assist organizations in identifying and assessing the levers that will boost sustainability across the telco asset lifecycle. Recent projects have focused on areas such as the social ROI impact assessment of Internet of Things (IoT) use cases, ESG due diligence, and supporting initiatives to increase energy efficiency and reduce decarbonization.

The lifecycle of a telco asset is typically organized into four phases: (1) design, (2) build, (3) operate, and (4) reuse and recycle. These phases can be applied to every key component category within the overall asset, such as the individual servers operating within a data center. Identifying all the key component categories makes it possible to define which ones have the most relevant ESG impacts within the different phases of the lifecycle. In Figure 2, the framework is applied to a company managing telco towers, with the most relevant ESG impacts indicated by bold text.

Based on our recent experience, the most relevant overall ESG impacts relate to energy procurement, energy savings and ensuring that short- and long-term decarbonization targets are achievable. The ADL framework can be deployed by considering both the lifecycle of key industry assets (e.g., towers, optical fiber networks, and/or data centers) and the three categories of sustainability impacts addressed by ESG (i.e., environmental, social, and governance).

4-STAGE PROCESS FOR TELCO SUSTAINABILITY

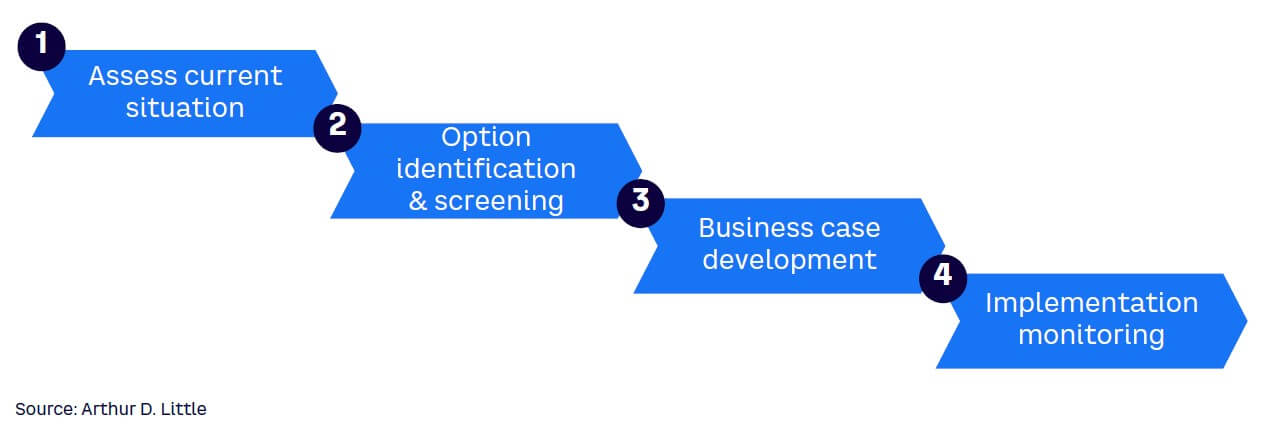

Our recent experience collaborating with telcos showed us that energy management is a key element for improving sustainability performance. Our work informed the creation of an energy strategy framework to provide telcos with a structured approach to reducing energy consumption (see Figure 3). Rather than adopting one-off cost-cutting measures, telcos should set clear targets and define an actionable strategy based on these four steps:

-

Assess the current situation to build a picture of the sourcing strategy (e.g., market, energy providers, contracts) and efficiency profile (e.g., assets, energy profile and mix, “do nothing” scenario estimations, constraints).

-

Identify, evaluate, and select potential options in accordance with the ADL sustainability lever framework.

-

Produce detailed options and related financial analysis (e.g., cost/benefit analysis, including reputational aspects), impact analysis (e.g., MWh and the resulting cost savings and CO2 benefits), scenario modeling and risk/benefit analysis, a detailed vulnerability/risk assessment analysis, and prioritization against defined criteria.

-

Monitor progress and the achievement of targets across the implementation phase.

ADL has developed and used this framework globally to implement a range of initiatives to lower operating costs and increase sustainability by reducing energy consumption and emissions.

Options for telco sustainability

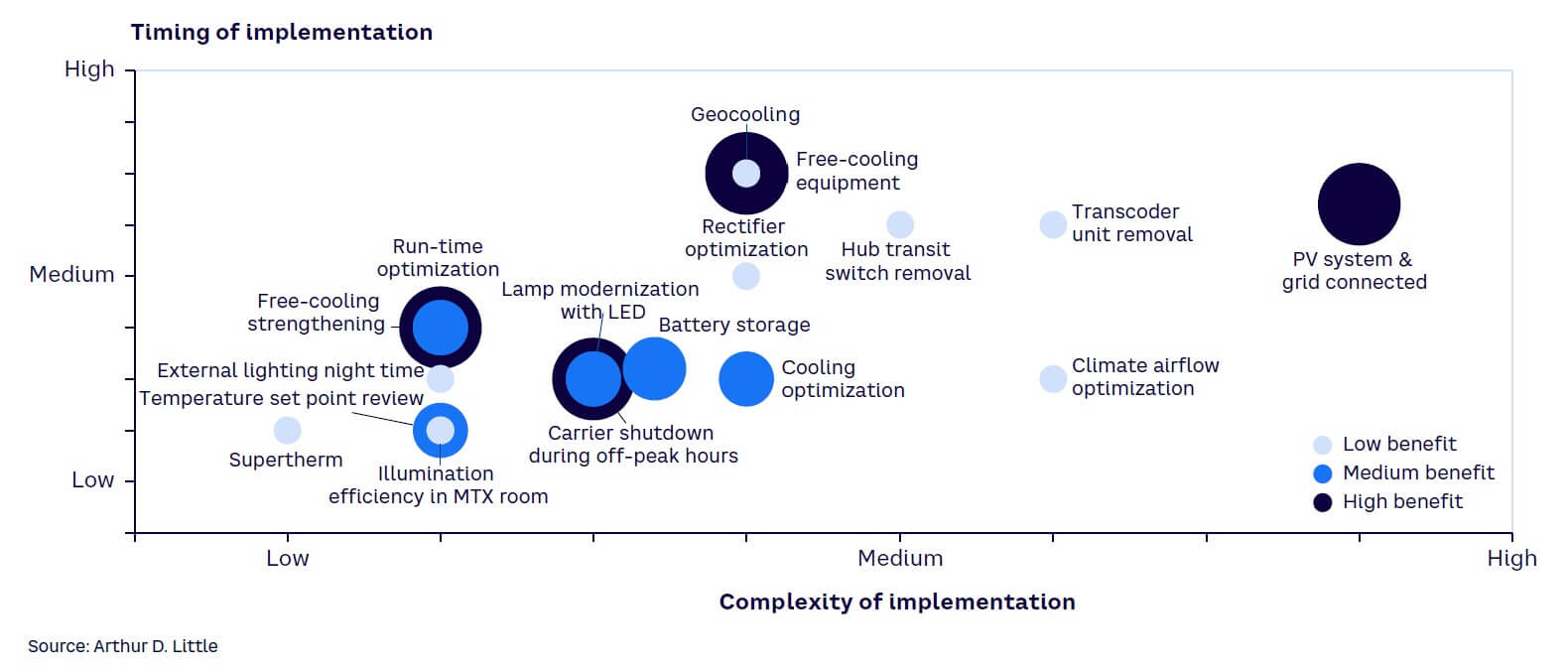

Extracting the previously mentioned main ESG impact areas from the full sustainability framework provides telcos with multiple options for meeting sustainability targets, lowering costs, and improving EBITDA, some of which are set out in Figure 4. We have analyzed and quantified average benefits from energy consumption optimization of these initiatives in our Viewpoint, “Extracting Network Operations Efficiency in the Post-COVID-19 Era.”

Telcos clearly have a lot to do to become frontrunners in the sustainability race, but a range of options are available to support this undertaking. Developing countries, where operators still run networks heavily reliant on diesel generators for power, could substantially improve sustainability with guidance from telcos.

Replacing old diesel generators with new, greener sources of power or connecting directly to the grid provide financial and commercial benefits while reducing air pollution, thus improving air quality.

Classic approaches to lowering energy use and deploying new technologies and strategies can drastically reduce consumption. For example:

-

In Japan, KDDI Corporation, Mitsubishi Heavy Industries, and NEC Networks & System Integration Corporation cooperated to experiment with using liquid cooling, rather than conventional air cooling, for an edge computing data center. By immersing servers in liquid coolant within a container, the project saw an astonishing 43% reduction in energy consumption.

-

Intel and KDDI Corporation are working to lower central processing unit energy consumption, and ultimately CO2 emissions, by using artificial intelligence (AI) to control communication server traffic. Initial results show a claimed power consumption reduction of up to 20%.

-

NTT Group aims to use two measures to reduce GHG emissions by 30% and achieve carbon neutrality: expanding its use of renewable energy and reducing its consumption by installing Innovative Optical and Wireless Network (IOWN) technology. IOWN is a silicon photonics network capable of lowering energy consumption 100x by utilizing light in networks, computing, and terminals and processing 125x more information without delay.

-

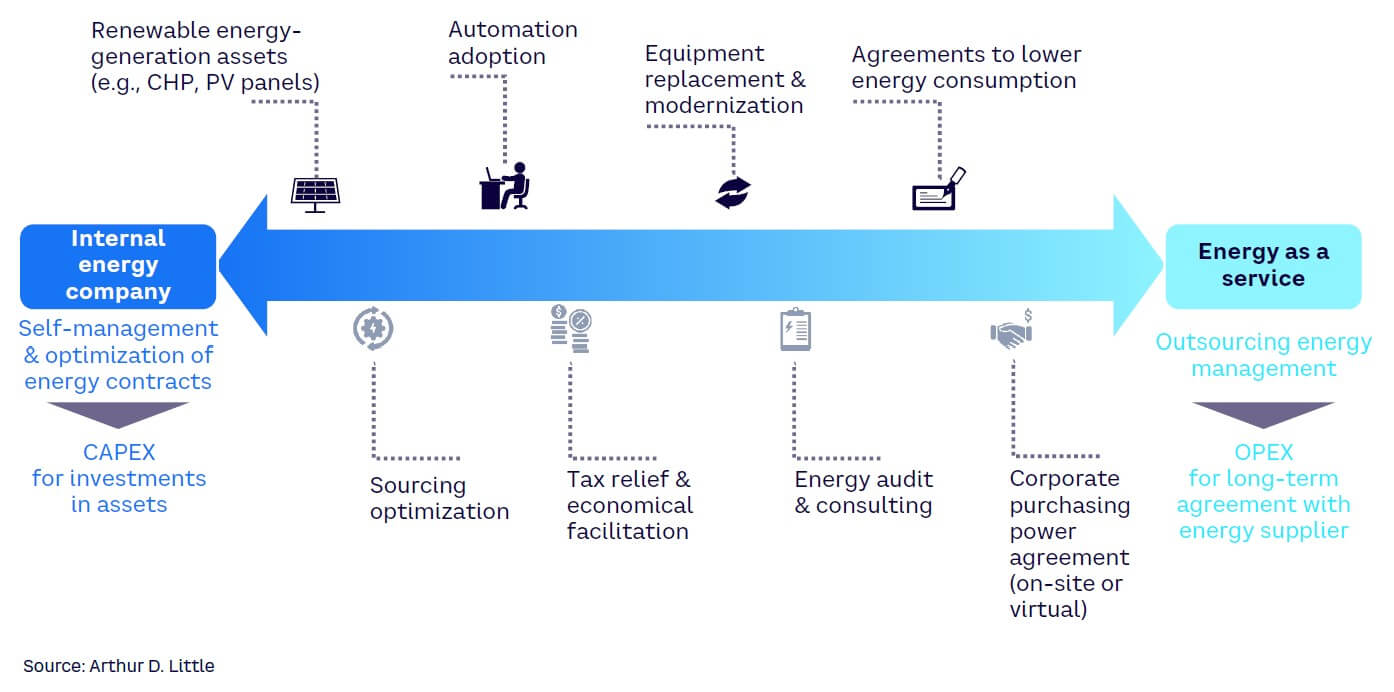

Energy-as-a-service (EaaS) business models, initially viewed as a unique way to supply energy by transferring energy management to specialized players, improves monitoring and reduces consumption, as detailed in Figure 5.

Creating a telco ecosystem to drive sustainability

The telco industry needs to take an ecosystem approach to sustainability by working within its own value chain and driving convergence with other sectors to improve the green performance of these industries.

The sector already has a strong foundation to build upon, as many players have already made significant progress in exploring and monetizing data analysis (see “Telecoms Data Monetization: Reality, not a Mirage”). The present time offers an opportunity to leverage data to construct collaborative ecosystems and support improvement in other industries. Achieving sustainability goals requires a high degree of collaboration between operators, infrastructure vendors, suppliers, and customers. It is crucial to adopt individual energy-efficiency strategies built on best practices. However, strategies to lower consumption and increase sustainability must be part of a holistic approach across the ecosystem. 5G networks will allow telco customers to start and complete their transformation to efficiency and sustainability simultaneously. We have selected three sectors as first movers, where both stakeholders and the environment will see tangible benefits:

-

Manufacturing. Supporting the automation and optimization of processes and enabling predictive maintenance (see “Operations 4.0: The Five Tech Pillars That Will Make or Break Telco Operators in 2022”) through the use of data and AI optimizes energy consumption and reduces CO2 emissions.

-

Transport and logistics. The advent of 5G means that innovative, low-latency applications can support drivers in improving their efficiency through feedback on their driving style or reduce traffic congestion and CO2 emissions by optimizing routes for couriers.

-

Healthcare. 5G-driven telemedicine provides patients with better access to services, increases the quality of diagnoses, optimizes resource usage, and reduces the need to transfer patients from their homes to medical centers, all of which decrease CO2 emissions.

These early examples show where the telco industry can build cross-sector ecosystems, contribute to overall sustainability goals, and monetize its substantial investments in connectivity and innovative technologies.

Conclusion

TELCO SUSTAINABILITY DELIVERS BUSINESS & ECOSYSTEM BENEFITS

Telco operators must make sustainability a central pillar of their strategy so that it impacts all planning and decision-making. Meeting sustainability goals represents an opportunity for telcos to lower operational expenditures, but more importantly, their efforts will drive the green transformation of other industries and achieve ecosystem decarbonization.

More specifically, sustainability is an opportunity to generate revenue by:

- Leading their ecosystems, providing more sustainable services to customers, and enabling wider decarbonization.

- Engaging with investors to tap funding sources, such as green bonds. ESG reporting needs the same attention as financial metrics.

- Creating the right culture by leading from the top with clear incentives and KPIs.

- Deploying the right reporting tools to measure sustainability performance against business metrics.