DOWNLOAD

DATE

Contact

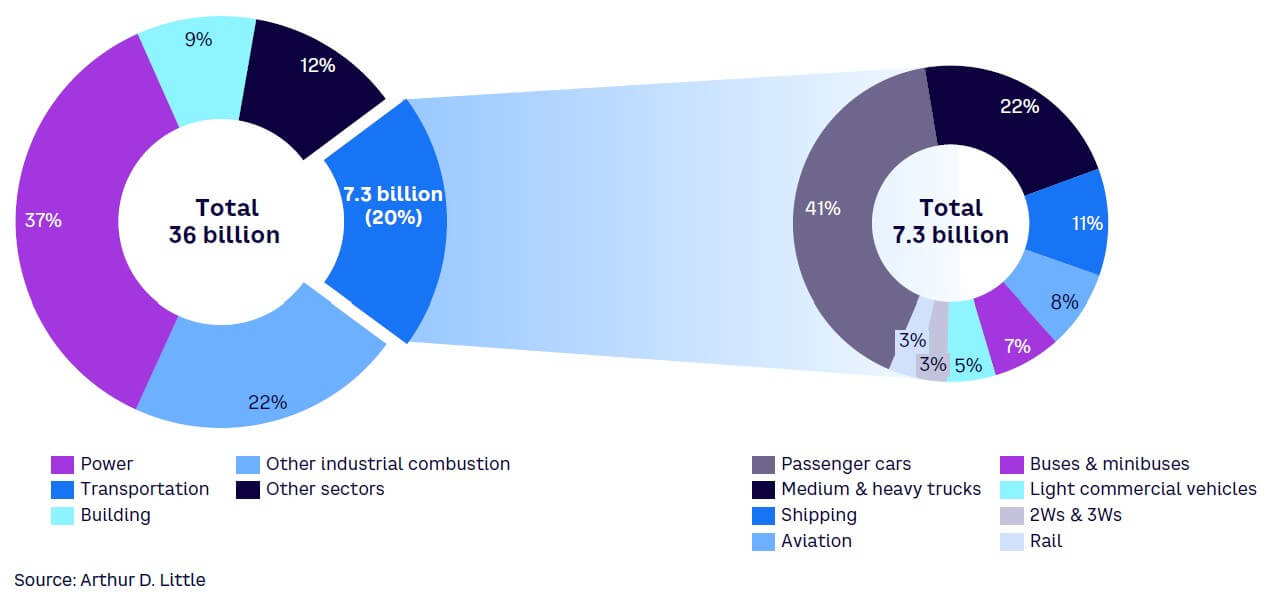

The transportation sector is responsible for 20% of global emissions and faces increasingly stringent regulations and intense pressure to change. Adopting alternative fuels has the potential to drive decarbonization, especially in aircraft, ships, and heavy-duty vehicles. Thanks to their mature sustainability certification standards, the EU and US currently lead alternative fuel ecosystems. In this Viewpoint, we focus on how Southeast Asia (SEA) can replicate that success for the emerging class of alternative fuels.

ALTERNATIVE FUELS: DRIVING A CLEANER FUTURE

More than half of the 7.3 billion tons of global CO2 emissions generated by the transport sector are in hard-to-abate applications, such as aircraft, ships, trucks, and buses (see Figure 1). This fact is driving the rapid development of policies, accelerated technology adoption, and innovative business models around low-carbon alternative fuels. These nontraditional energy sources can replace or supplement fossil fuels.

With the potential to offer a lifecycle emissions reduction as high as 100%, alternative fuels provide an opportunity to significantly decarbonize the transportation sector and dramatically lower emissions. Alternative fuels include established biofuels (e.g., UCOME [used cooking oil methyl ester], biodiesel, bioethanol) and the emerging class of e-fuels gaining market share (e.g., green methanol, e-ammonia, other green hydrogen-derived fuels).

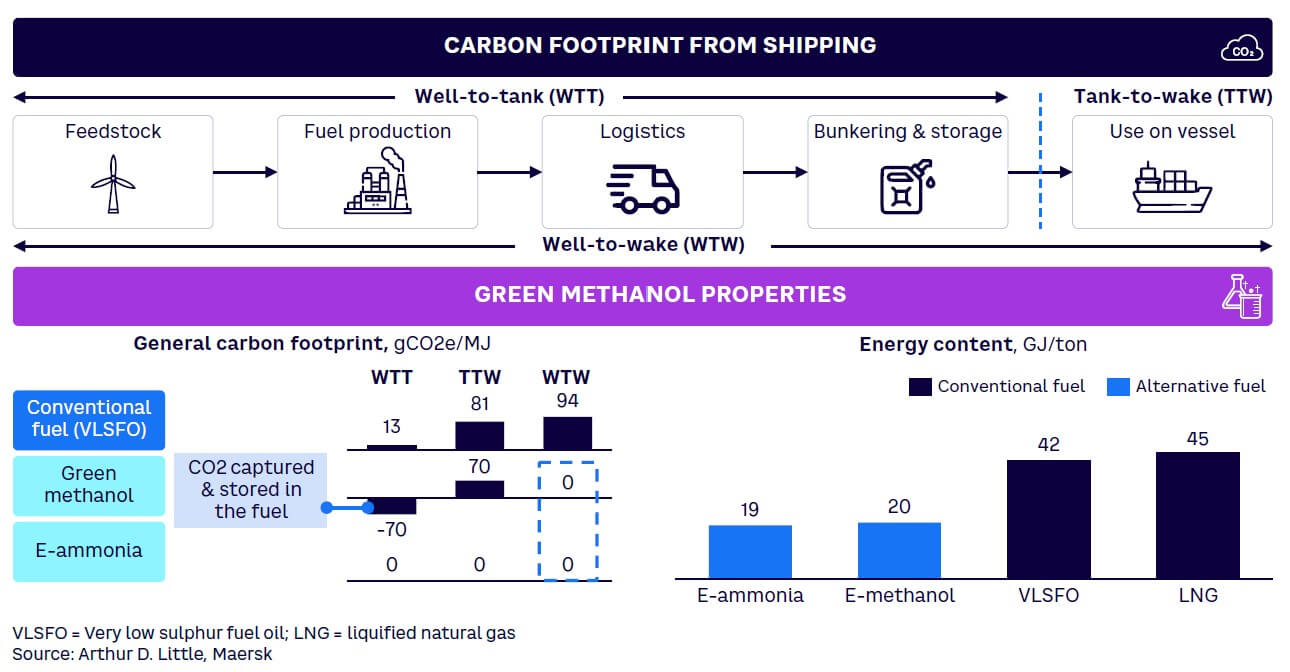

Figure 2 shows potential applications for alternative fuels in shipping. It is based on the full lifecycle carbon footprint of a fuel — well-to-wake (WTW) emissions. This figure illustrates the combination of emissions from the extraction, production, and supply chain (well-to-tank [WTT] emissions) with emissions from final utilization of a fuel (tank-to-wake [TTW] emissions) and demonstrates that alternative fuels like green methanol and e-ammonia have a significantly lower carbon footprint, despite having a lower energy content than conventional fuels.

NAVIGATING ROADBLOCKS TO ALTERNATIVE FUELS

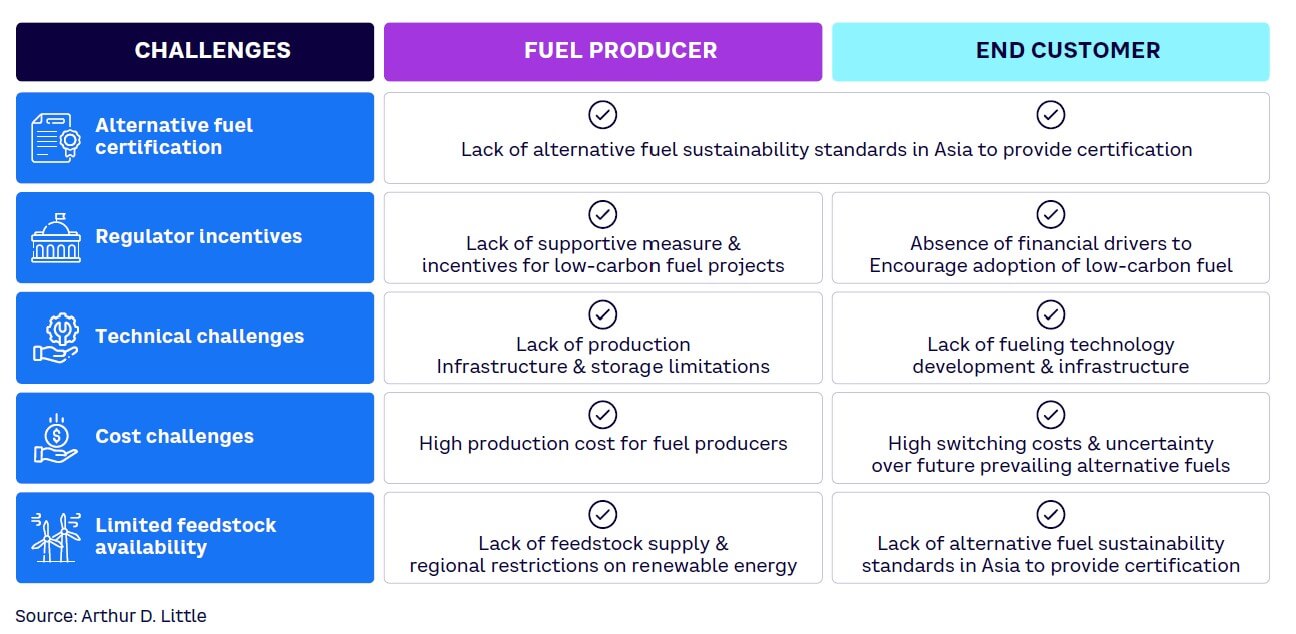

Interest in alternative fuel is accelerating in SEA, but countries in the region face their own unique challenges as they work to develop and adopt alternative fuels, as shown in Figure 3. Some obstacles, such as high costs, technical hurdles, and feedstock availability, are global. However, certification and regulation are specific, pressing local challenges that threaten to hold back the region’s success.

Certification: Primary challenge

Increasing regulations and growing customer demands are motivating the transport sector to decarbonize via alternative fuels. However, meeting requirements related to renewability, carbon footprint, and technical-specification characteristics needs third-party certification to validate sustainability throughout the production chain. Essentially, if alternative fuels are to be adopted en masse, producers need to document their decarbonization credentials.

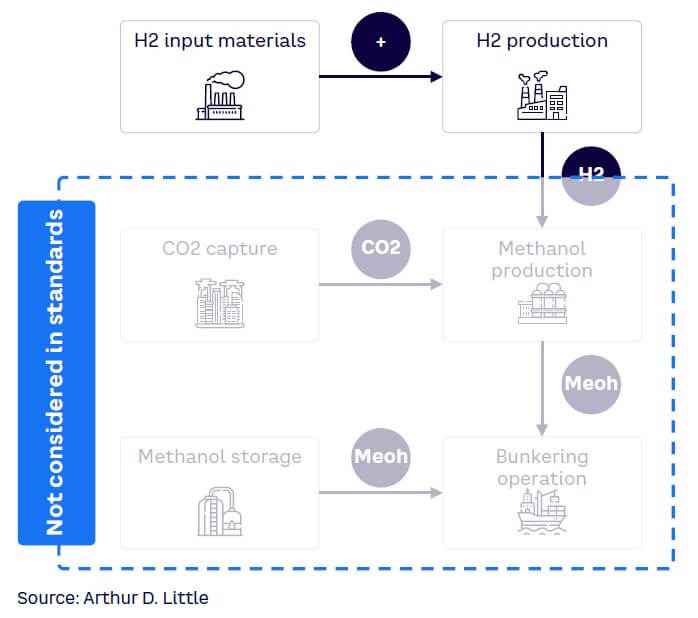

Certification comes from standards, but currently no international standard exists that covers all categories of low-carbon e-fuels (i.e., blue hydrogen derivatives, such as methanol and ammonia), meaning certification plans in this area are not forthcoming. The only standards in place simply cover hydrogen production and not the end-to-end value chain (i.e., derivatives), as shown in Figure 4.

Currently, Asia lacks e-fuel sustainability standards, which hinders local sales and limits exports to regions with existing standards like the EU’s Renewable Energy Directive (RED) II and California’s Low Carbon Fuel Standard (LCFS). Moreover, these existing international standards are limited in scope and jurisdiction, impeding Asian producers.

Overlooked regulatory & financial incentives

Alternative fuel projects require substantial investment thanks to high initial setup and operating costs. Depending on size, an e-fuel plant investment could range between US $100 million and $1 billion. The use of subsidies can reduce costs and incentivize development. The EU Innovation Fund and the US Inflation Reduction Act have stimulated expansion, making these regions global hubs for alternative fuel production.

In the Asia-Pacific (APAC) region, Australia has assigned AUD $2 billion (about US $1.3 billion) from its Hydrogen Headstart program to fund some of the country’s largest green hydrogen projects, bridging the commercial gap between production cost and the current market price of these initial projects. In contrast, some SEA governments have incentives to encourage biofuel production and improvements but have yet to create strong regulatory and financial incentives for any e-fuel or advanced biofuel production.

Inadequate technology & infrastructure

Globally, the need for new technologies and infrastructure to accelerate scaling of alternative fuel adoption has created significant obstacles. SEA trails other regions in developing production infrastructure for decarbonization. It lacks both carbon capture, utilization, and storage (CCUS) technology penetration and the connected renewable power grid needed for large-scale production of blue and green hydrogen fuel.

High production costs

In SEA, capital expenditures for producing alternative fuels are significantly higher than in the US and EU. This is due to a current lack of development around:

-

Renewable power sources already available — wind, solar, and hydroelectric power

-

Specialized R&D facilities — pilot and demonstration scale plants

-

Other value chain infrastructure — electrolyzers and CCUS facilities

Building the ecosystem requires a considerable up-front investment. To justify it, producers must secure offtake agreements or guarantees from customers to mitigate the significant market and financial risks of using a nascent technology to develop projects. However, without certification standards, customers are uncertain about the timeline for alternative fuel adoption, making them hesitant to sign long-term supply agreements. This vicious cycle holds back the advancement of the entire ecosystem.

Limited availability of alternative fuel feedstock & renewable power

Alternative fuels are still relatively new technologies and have yet to generate a robust feedstock supply in the region. This is limited by a lack of biogenic-captured CO2 and non-crop-based, centrally collected advanced biomass. Regulatory restrictions or protections on renewable energy, created by countries in the region with ample supply, also hamper availability. For example, until recently, Malaysia had an export ban on its renewable energy, which deprived other SEA countries needing renewable energy of access to green power.

IMPACT OF CERTIFICATION ON EMERGING INDUSTRY

Most of the above challenges are well established, and SEA countries are actively seeking strategies to tackle them. For example:

-

Malaysia lifted its renewable energy ban in early 2023.

-

Singapore released a national hydrogen strategy. It plans to expand its biofuel economy, develop an ammonia supply chain, and implement ammonia bunkering standards.

-

Indonesia’s national oil company Pertamina is collaborating with Chevron and Keppel Corporation to study green hydrogen production using electricity obtained from geothermal power.

Certification would act as the main catalyst to the scale and maturity of SEA’s emerging alternative fuel ecosystem. Robust regulation and certification would provide the required guarantees for both producers and customers to unlock investments and to commit to alternative fuels, thus justifying the necessary price premiums. Certification would also support the development of cross-border supply chains and trade, stimulate demand for alternative fuels in the region, enable local producers to target export markets, and contribute to local and global decarbonization.

Clear advantages of certification

Policy makers must therefore collaborate with certification bodies and industry players to implement a regional standard in SEA that will provide a pathway toward certifying these new alternative fuels and their decarbonization benefits. Certification will deliver multiple advantages:

-

Assuring customers of a fuel’s sustainability, subsequently influencing and driving demand

-

Enabling market transformation to accommodate alternative fuels by increasing competition around obtaining sustainability credentials

-

Scaling the market to promote innovation and greater production efficiency

-

Providing confidence to potential producers and increasing investment and public funding for the necessary infrastructure to support low-carbon transportation fuels

-

Helping countries and companies meet their decarbonization targets, especially with hard-to-abate transport emissions

As a global integrated alternative fuel market evolves, the right certification frameworks must provide:

-

Unified, comprehensive definitions of alternative fuels according to renewability and emissions impact

-

A mutually accepted approach to certifying fuel specification, feedstock origins, and greenhouse gas emissions of diverse transportation fuels and their feedstocks

A COLLABORATIVE EFFORT

Every player, including policy makers, certification bodies, producers, and consumers, has a role in advancing alternative fuel certification and building a sustainable ecosystem, both in SEA and across the globe.

1. Policy makers

Policy makers must build global consensus on the standards required for sustainable transportation fuel production. One potential model is the International Partnership for Hydrogen and Fuel Cells in the Economy (IPHE), which consists of 24 member countries, including the US, Australia, UAE, and China. Within the hydrogen economy, IPHE is aiming to develop agreed-upon standards for certifying feedstock origins, product specifications, and lifecycle-emissions accounting. Participation in this and other international collaborative initiatives will enable countries to have their voices heard and influence the emerging alternative fuel ecosystem.

2. Certification bodies

Existing certification frameworks for sustainable and low-carbon transportation fuels should become more inclusive by expanding their coverage of fuels and regions. This change will provide a solution for stakeholders currently facing the pressing issue caused by lack of certification. Several certification schemes are already broadening their scope. For example, the International Sustainability and Carbon Certification organization has announced a certification plan for sustainable marine fuels, which will uphold both EU-specific standards such as EU RED II, EU Emissions Trading System, and FuelEU Maritime and the global standards of the Science Based Targets initiative (SBTi). However, certification bodies need to understand local and/or fuel-specific contexts. This can be accomplished by working with national and regional agencies and industry stakeholders to develop certification schemes that recognize local regulations and standards.

3. Fuel producers & customers

Certification will take time to develop and implement. Acting now will fill the gap. In the interim, producers and customers should navigate current challenges by choosing one of two options:

-

Identify available certification schemes based on customer requirements. Supplement shortfalls with self-declared documentation, such as an internal lifecycle assessments (LCAs) to obtain fuel-carbon footprints, followed by an audit from an independent third party.

-

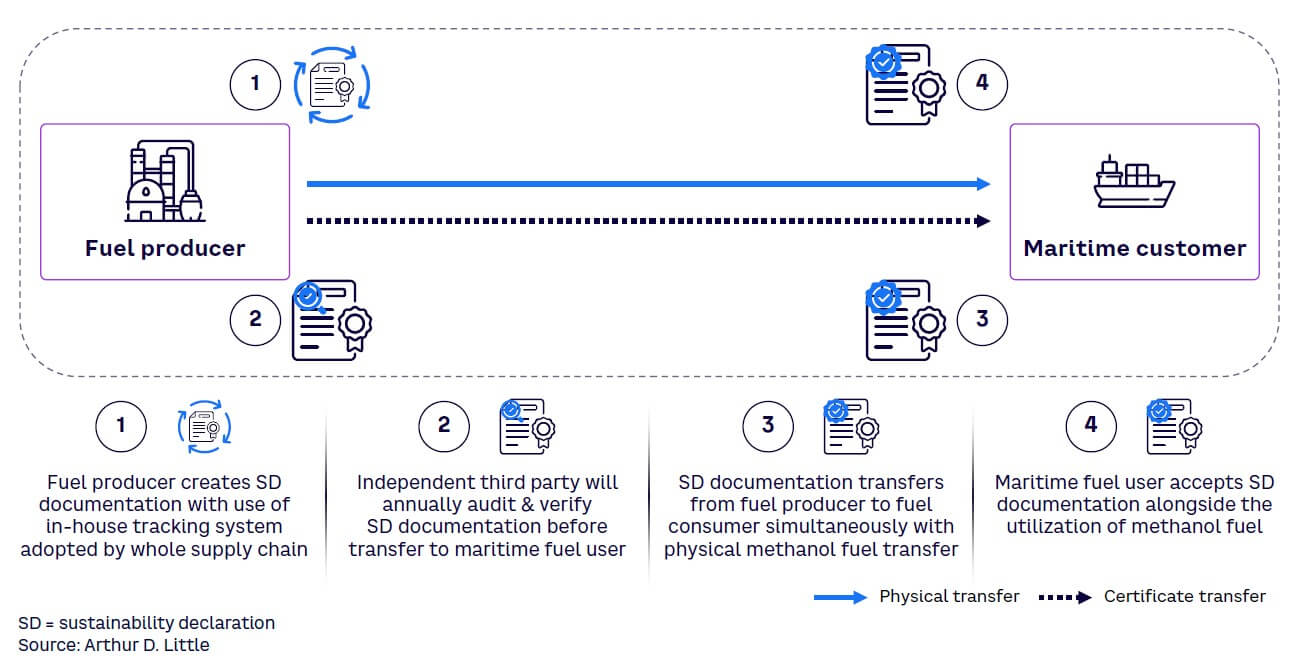

If adopting a certification scheme is not possible, develop an in-house tracking system that leverages data analytics and Smart LCA processes to generate a delivery-documentation system that facilitates end-to-end communication across the supply chain (see Figure 5).

Conclusion

COLLABORATE, CREATE & REPLICATE TO DECARBONIZE TRANSPORT SECTOR

Southeast Asia lags other regions in alternative fuel production and adoption. Policy makers, certification bodies, producers, and customers therefore must act to:

-

Address key issue of sustainability certification and collaborate locally and globally to design relevant standards.

-

Establish the necessary regulatory framework to encourage production and usage of alternative fuels.

-

Create or promote required infrastructure across the supply chain, from feedstock and production to fueling stations.

-

Partner with experts to build relevant, tailored strategies and implementation plans based on industry knowledge and experience.

-

Consider options offered by current certification schemes and develop self-declaration systems for producers and consumers to provide accurate, reliable accounting throughout the supply chain.