15 min read

GROWTH IN A NET ZERO WORLD

The need to decarbonize has now moved center stage for us all. By the end of COP26, over 200 countries had announced decarbonization commitments and plans, along with a range of pledges around funding clean technology, decreasing reliance on coal, phasing out fuel subsidies and stopping deforestation.

Government action, at both a national and international level, has therefore set the playing field for companies, in many cases radically transforming the landscape they currently operate in.

The onus is now on companies, particularly in asset-intensive industries such as energy, oil & gas, chemicals, industrials, construction, steel and cement, to transform their business models and operations if every country’s Net Zero pledges are to be delivered on. For example:

-

The UK is focusing on sector-specific policies, and emphasizes the role of business in delivering its targets.

-

Germany will need to significantly restructure its industrial economy while ensuring that its citizens don’t have to bear the economic cost of transition.

-

The French government has announced plans to expand nuclear power to support its Net Zero targets.

-

Japan’s Net Zero ambition has decarbonization of the power sector and electrification of other industries at its core, as well as commitments to hydrogen and ammonia to build on its automotive sector strengths.

Major oil companies, from Shell and ENI to BP and Equinor, have made significant decarbonization commitments. Total Energies has committed to reaching Net Zero by 2050 in its operations (Scope 1 & 2) and decreasing the greenhouse gas (GHG) intensity of its products (Scope 1, 2 and 3) by 60%, while also setting several intermediate key milestones.

Many may be cynical and view these commitments as greenwashing that will not have a lasting impact. However, shareholders, stakeholders, citizens and regulators will be carefully watching to ensure real progress against these lofty commitments. They will hold companies to account. Company CEOs and management teams need to demonstrate a real commitment to the cause, and have well- thought-through plans to ensure they are able to deliver on their promises. They need to do it now, fast.

Collaboration will be essential, between a complex ecosystem of governments, regulators, civil society, and the private sector. Achieving Net Zero ambitions will require companies from across industries to work together, converging to deliver innovative and scalable solutions to decarbonization issues.

On one hand, in a rapidly changing world, Net Zero represents a new paradigm for companies, bringing both threats and opportunities. They need to work to shape this new reality, rather than reacting to it. Timing is key and first-mover advantage may prove to be vital in order to avoid being left behind. However, company CEOs are charged by shareholders and boards to deliver short- and long-term value-building growth. How can companies balance these two potentially conflicting targets? What new business opportunities are there alongside simply driving down emissions associated with the current core business? What sort of transformation is needed for business models, operations, supply chains and customer value propositions? What role should technology play? How can all the key stakeholders be engaged on the journey?

This article sets out a framework approach to help address these questions and create sustainable value for all stakeholders.

IS PROGRESS POSSIBLE?

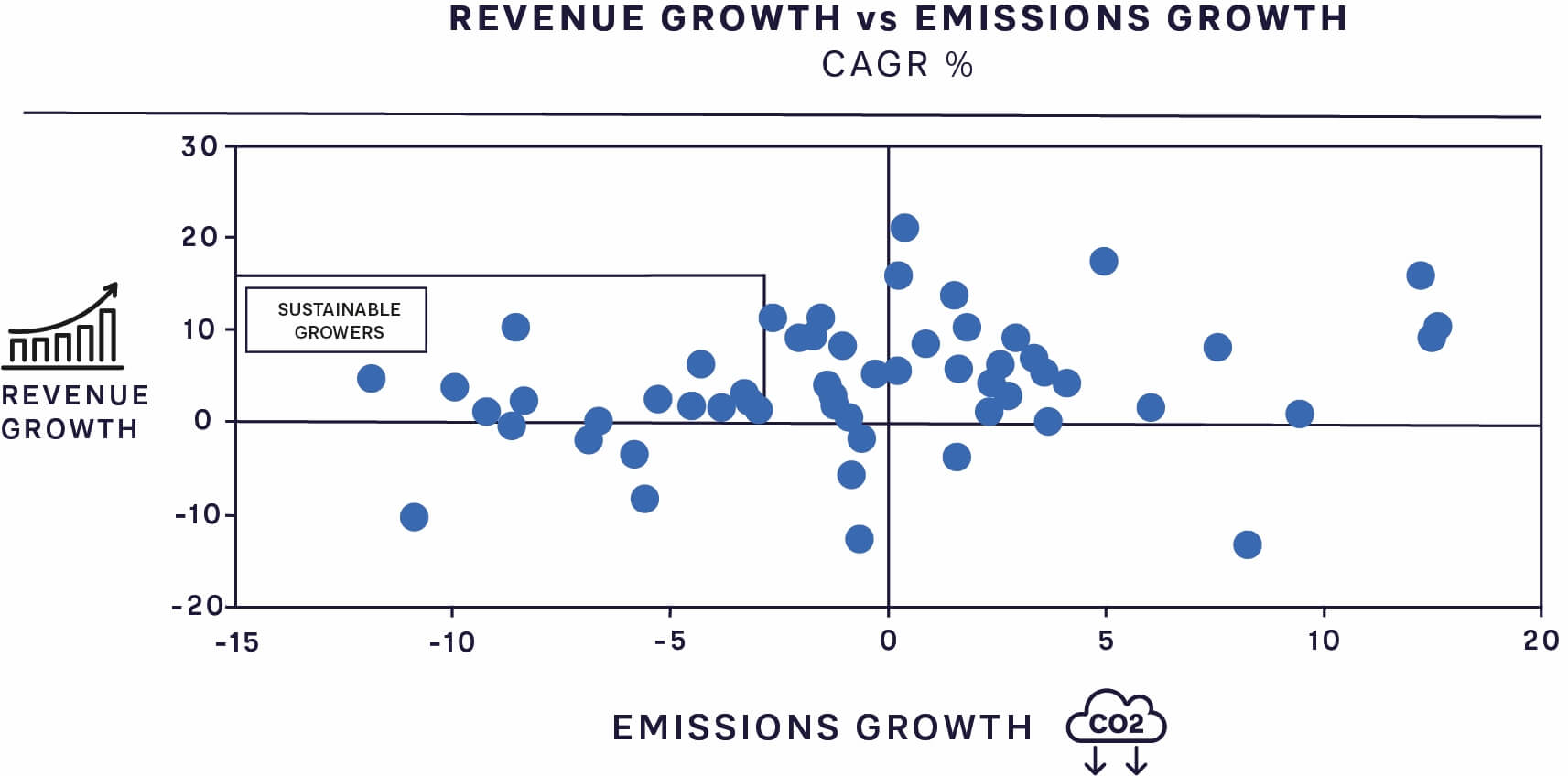

Research into the performance of companies confirms that delivering growth while reducing emissions is certainly achievable. We looked at the performance of selected listed companies from asset- intensive sectors (such as chemicals, oil & gas, energy, industrials, construction, steel, and cement) by comparing revenue growth rates and emissions reduction rates for the same duration (where both results were publicly available pre-COVID-19).

FIGURE 1: REVENUE GROWTH VERSUS EMISSIONS GROWTH IN CAGR (%)

Our analysis shows that there are many companies that have been able to grow their revenue while reducing emissions by at least 3 percent CAGR. What stood out with these “sustainable growers” was that they took the issue of emissions reduction seriously, made it a core part of their corporate objectives, focused on activities to reduce emissions, and invested in key technology and innovations. They used their existing capabilities, such as scale and ability to manage large capital-intensive projects, to diversify successfully.

However, this in itself may not be enough. It remains to be seen whether these rates of emissions reduction will be sufficient to deliver on future Net Zero objectives.

While some leaders have been able to improve both metrics, the majority (i.e., over 78 percent of companies) have not. Some companies pursuing organic growth seem to have lost sight of the emissions implications of increasing production and sales of their (emission-intensive) products. These companies have not allocated sufficient Capex to more sustainable projects to balance their strategies. Others have simply sold off “bad assets”, leading to emissions reduction (for them) but lower growth.

Pursuing M&A growth strategies without understanding the full implication for a company’s emissions profile is another area to watch out for. Businesses must apply a sustainability-led lens to the target’s product mix (see ADL’s Viewpoint on sustainable portfolio steering), assess the risk of future stranded assets, and make “emissions diligence” a core part of the investment process.

Going forward, post-pandemic, companies will need to double down on delivering both growth objectives and Net Zero commitments.

DELIVERING NET ZERO GROWTH

Many companies are still at early stages of their Net Zero journey and trying to figure out how to “move the dial” quickly. While companies may have made public commitments to Net Zero, it often doesn’t receive the same level of priority at investor presentations where, for example, the CEO talks about performance, growth, and finance, and delegates emissions and decarbonization details to others (such as the Chief Strategy Officer or Chief Sustainability Officer). There is often little alignment between financial and sustainability performance metrics, demonstrating a lack of parity between objectives.

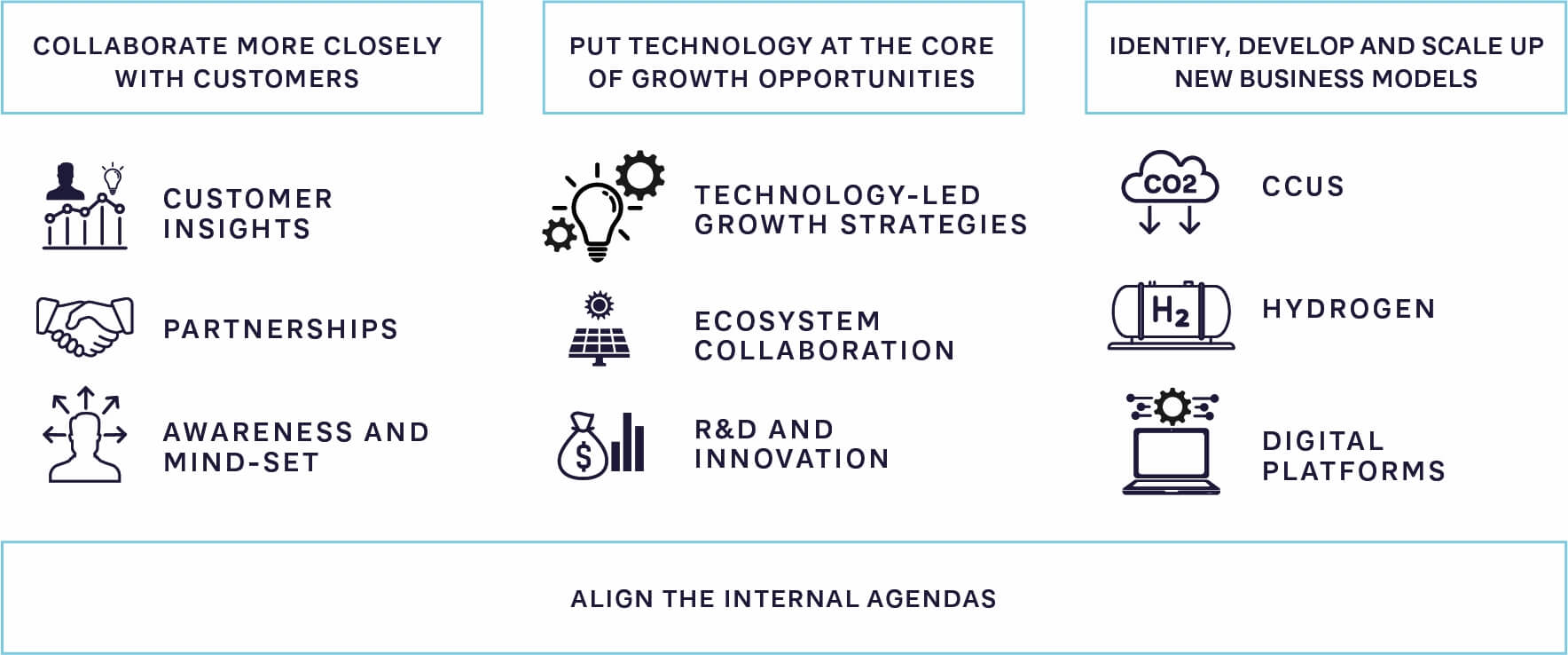

Achieving the dual objectives of growth and emissions reduction in asset-intensive sectors requires corporate leaders to focus on four key areas, as shown in Figure 2.

FIGURE 2: A FRAMEWORK FOR GROWTH UNDER NET ZERO

1. COLLABORATE MORE CLOSELY WITH CUSTOMERS

Companies need to build deeper relationships with customers. They will have to leverage their extensive, long-established understanding of their customers and supply chains, and work jointly to solve their emissions issues.

Leverage customer insights

Many companies have been following a well-trodden path of investing heavily to capture, analyze, and generate deep, privileged insights about customer needs and requirements. Such capabilities have helped to strengthen competitive advantage. During the pandemic, many companies also started to invest into end-to-end supply chain transparency.

Now is the time to find synergies between customer and supply chain insights and use these to develop new technology solutions for the customer that will also help reduce emissions. For example, by investigating up and down the supply chain to evaluate emissions created by its own products, Honeywell realized a significant opportunity in the refrigerants, propellants, and solvents space. Through a new line of low global warming products, Honeywell is helping its customers to reduce their carbon footprint and increase energy efficiency without sacrificing product performance. As a result of this, Honeywell estimates that its customers have potentially avoided over 263 million metric tons of carbon dioxide.

Partner to solve customers’ problems

Traditional approaches of finding the optimal “go to market” strategies for products and services will not be sufficient, and will require a rethink and revamp. Leading companies are already starting to find ways to partner with their key customers and develop solutions (often jointly) to help them reduce their emissions. For example, new growth partnership models are emerging in the area of sustainable air fuel, in which companies are teaming up to find alternatives to jet fuel – such as Johnson Matthey’s partnership with United Airlines and PETRONAS’ downstream retail business (PDB) partnership with Malaysia Airlines and Neste. Delta Airlines is going even further – helping its suppliers and corporate customers decarbonize by introducing sustainable aviation fuels and selling them to business-travel clients such as Nike.

Increase awareness, influence mind-set

Companies will not succeed unless there is increased, widespread demand for their new products. The key question is how quickly customers will change their buying behavior in favor of more sustainable products and services. While legislation is expected to play a role in driving both consumer and customer demand, a “wait and see” approach risks companies falling behind. Rather than holding off until regulations are in place, companies should work swiftly to educate their customers, in order to influence their mind-sets and collaborate to generate demand early on.

Siemens has made an aggressive commitment – to be the first global industrial company to be Net Zero in its operations by 2030 and have a Net Zero supply chain by 2050. By leveraging its industrial know- how, customer and supply chain understanding, and decentralized technology, it has launched a collaborative solutions platform for its customers, thus creating growth opportunities for the business. From its position as a global industrial company, Siemens is now pursuing its journey as a focused technology company.

2. PUT TECHNOLOGY AT THE CORE OF GROWTH OPPORTUNITIES

Companies will also need to increase their focus on the role of technology, not just as an enabler for pursuing growth strategies and reducing emissions, but also as a driver at the core of future growth platforms.

Identify technology-led growth strategies

When exploring the question of “where to play”, company strategists and corporate planners typically look for attractive market segments. Technology is often an afterthought or considered solely an enabler. Many companies have developed their own marginal cost curves to decide on optimal technologies that can reduce emissions.

These only go so far. Companies now need to shift the lens on technology by making it central to uncovering growth opportunities. They need to look beyond mere cost and extend their time frames to identify where technologies can drive business growth and new opportunities. With low-carbon/negative-carbon technologies now at various stages of maturity and development, companies need to explore, understand, and assess them for future growth and value creation potential. In a fast-moving market, it is essential to have all opportunities on your radar and be prepared to accelerate those that demonstrate the greatest potential.

Collaborate in an ecosystem

In their search for technology solutions, companies will need to collaborate more intensively and comprehensively across sectors and beyond. This is beginning now. For example, the World Economic Forum’s Low-Carbon Emitting Technologies Initiative has brought together 10 global chemicals companies, with the joint aim of accelerating the development and upscaling of low-carbon emitting technologies for chemical production.

BASF has committed to Net Zero (Scope 1 and 2) by 2050 and plans $4 billion of Capex investment by 2030. At the same time, it is committed to growth, for example, in opening a new site in South China. In order to achieve both objectives it is implementing continuous improvement processes for the short term, while exploring new technologies (e.g., its CO2-free, electrically heated steam cracker) for chemicals production and use of renewable energy for its electricity needs for the long term.

Reset the technology R&D and innovation portfolio for growth

Now is also the time to review the company’s portfolio of R&D and innovation projects with razor-sharp clarity around its strategic relevance and potential to create future distinctive capabilities in light of Net Zero and time to profit. There can be hidden gems from the past that did not make it to successful commercialization for many reasons (such as customers not being ready or the product not being cost competitive); these can potentially be accelerated in a Net Zero world.

Boral, a leading Australian building and construction company, used innovative technology to develop cement products, which resulted in over 40 percent lower carbon emissions for concrete, while providing excellent performance benefits and finishing properties. This technology-led innovation has allowed Boral to partner with its customer, Lend Lease, to work on specific projects (e.g., primary schools) and help Lend Lease achieve its aim of securing carbon neutrality certification.

3. IDENTIFY, DEVELOP AND SCALE UP NEW BUSINESS MODELS

In the Net Zero world of the future, new business models will open up new growth opportunities. This includes providing sustainability/ Net Zero “as a service” to customers. Three examples of this are in Carbon Capture Utilization and Storage (CCUS), hydrogen and Net Zero platforms.

Carbon Capture Utilization and Storage

CCUS is a critical enabler of reduced emissions. A paradigm shift will be to look at CCUS from a business growth-opportunity perspective, in which companies take ownership of the infrastructure and provide carbon-related services (i.e., CCUS-as-a-Service).

For example, the concept of a CCUS hub is gaining traction. This captures CO2 from different sources and provides shared CO2 transport and storage infrastructure for multiple sectors. An example of this approach is the Northern Lights/Longship CCUS hub in Norway, an offshore facility with the capacity to store 1.5 million tons of CO2 from cement, biomass, steel, waste incineration, and steel plants across Europe.

The hydrogen economy

The hydrogen economy, which is expected to see 500 to 800 million tons of hydrogen produced per year by 2050 (based on the Energy Transition Commissions estimate), is another fertile area for new business models. For this economy to materialize, new global ecosystems need to be created across generation, transport, and utilization in both end-user applications (such as transport) and industry. Our recent Viewpoint, “Paving the way for green hydrogen”, explains how a global green hydrogen ecosystem is likely to develop.

Digital platforms

Converging sustainability with digital will create opportunities for sustain-tech- or green-tech-type platform business models. Companies can explore creating digital platforms that bring together an ecosystem of buyers and sellers of Net Zero-related products and services, and through the network effect, continue to create and capture future value. Taking the valuation of tech and sustainability companies as a guide, launching such platforms has the potential to unlock substantial untapped shareholder value in the long run.

To embrace these (and many other) new opportunities, companies will need to shift their models and not be bound by existing value chain-/ industry-specific thinking. They will need to go beyond traditional business boundaries and bring a convergence-type mind-set to imagine, create, and take their share of future value pools.

In addition, CEOs will need to get used to running “two speed companies” – one that is tied to the core/legacy business and one that is much more agile, constantly innovating, and bringing out new-generation products and services (just as current digital/tech companies do). This requires “ambidextrous” operating models, as described in a previous Prism article, which allow CEOs to drive structural and emissions-related opportunities in the core business while developing and delivering innovative Net Zero services for customers.

4. ALIGN INTERNAL PRIORITIES

In order to succeed, Net Zero should be at the heart of the company’s business. This requires deep cultural transformation, particularly in traditional, asset-intensive organizations. ADL recently conducted a global sustainability survey across multiple sectors. One of the findings from that survey was that while 80 percent of companies had a sustainability strategy, just 29 percent believed its impact was clear to all employees. For more detail on the survey, read Walking the talk on corporate sustainability in this issue of Prism.

Achieving success starts by aligning priorities across the board, management and employees, which requires action on multiple fronts:

-

Start with compelling strategic logic, with the board, CEO and management team clearly embracing the decarbonization mega- trend and understanding that their strategic initiatives and actions will strengthen the company’s competitive advantage and open up new avenues for growth.

-

Armed with this strategic conviction, the CEO and senior management need to work hard to communicate and increase awareness of the new objectives across the organization. This should aim to remove skepticism, boost engagement, and ensure everyone is pushing in the same direction.

-

Companies will then need to think through and act to set the type and time horizon of incentives and ensure that all employee objectives fit with company Net Zero aims.

A leading global electrical equipment manufacturer is currently developing a new business and growth strategy, based around carbon neutrality. Building on its existing lithium-ion (Li-ion) battery-based energy storage business line, the company identified a distributed energy resource management system (DERMS) as an attractive future growth opportunity. Developing the overall growth strategy required a deep understanding of the technology landscape (the second pillar of the framework), the associated strategic choices, the customers, and their needs, as well as a new Energy-as-a-Service (EaaS)-type revenue model (the third pillar of the framework).

One of Asia’s largest gas utility operators needed to balance its growth strategy and Net Zero commitments. The company set its commitment to Net Zero by 2050 and outlined a series of initiatives, including increased use of renewable energy, use of CCUS technologies, and development of decarbonization technologies. The company identified carbon-neutral methane as a new growth direction and developed a strategic roadmap (the second pillar of the framework). The company is now exploring a feasibility study in collaboration with its strategic partners to establish a supply chain of carbon- neutral methane (produced using green hydrogen and carbon dioxide) to its end destination.

INSIGHTS FOR THE EXECUTIVE

In successfully pursuing Net Zero growth under this four-pillar framework, there are some good practices that leading companies have found to be effective:

1. Set an ambition for the core business versus a new business mix. Set a clear ambition on what mix of new businesses makes strategic sense (and by when), fits within the acceptable “risk appetite”, and meets all key company objectives (e.g., sustainable cash flow, returns, and science-based Net Zero targets).

Divesting “carbon-challenged” businesses is a common approach, but it only passes the buck to others to deal with, and doesn’t reduce emissions. Therefore, make the structural change/decline happen yourself, such as by retiring coal assets. Alternatively, if you have to divest part of your portfolio, ensure it goes to a new owner that will be able to reduce emissions through synergies with its own operations.

2. Embrace carbon pricing. If there are no carbon-pricing mechanisms yet available or implemented in your geography, use an internal value for business case assessment and making resource allocation decisions. Expect that the EU and others will move the world to applying a de facto carbon price by implementing taxes on imports that have not been subject to carbon pricing in their country of production.

3. Explore innovative funding models. Funding for “carbon- challenged” businesses is getting increasingly difficult – limiting options and raising funding costs. To unlock funding, such businesses need to have a concrete transition and decarbonization plan in place, and demonstrate real progress. Explore innovative funding models to support portfolio reshaping and the growth of new sustainable businesses. (See our Prism article, “Green Gambit”, on new sources of funding). There is also a major role for financial institutions to fund sustainability, as detailed in the Actively shaping the future – The new imperative for financial services article within this issue.

4. Integrate Net Zero into strategic planning. The company’s Net Zero program should not be under the custody of the Health, Safety & Environment (HS&E) team. These are strategic imperatives and should be part of the overall growth strategy development and strategic planning process led by the CEO. If there is sufficient scale across all decarbonization activities, consider creating a focused Net Zero unit reporting directly to the CEO.

5. Adopt effective Net Zero KPIs. Commit to and cascade the right KPIs. Make Net Zero everyone’s business, not just the focus of senior management. Apply the same razor-sharp focus on measuring and reducing carbon as you would for revenue, costs and profits.

6. Rethink your partner ecosystem. In seeking to collaborate more intensively, take a fresh look at your partner ecosystem and think beyond traditional industry boundaries. As well as suppliers, customers, industry peers, research organizations and government, consider start-ups, specialist service providers, adjacent industry sectors and tech/digital innovators.

15 min read

GROWTH IN A NET ZERO WORLD

The need to decarbonize has now moved center stage for us all. By the end of COP26, over 200 countries had announced decarbonization commitments and plans, along with a range of pledges around funding clean technology, decreasing reliance on coal, phasing out fuel subsidies and stopping deforestation.

DATE

Government action, at both a national and international level, has therefore set the playing field for companies, in many cases radically transforming the landscape they currently operate in.

The onus is now on companies, particularly in asset-intensive industries such as energy, oil & gas, chemicals, industrials, construction, steel and cement, to transform their business models and operations if every country’s Net Zero pledges are to be delivered on. For example:

-

The UK is focusing on sector-specific policies, and emphasizes the role of business in delivering its targets.

-

Germany will need to significantly restructure its industrial economy while ensuring that its citizens don’t have to bear the economic cost of transition.

-

The French government has announced plans to expand nuclear power to support its Net Zero targets.

-

Japan’s Net Zero ambition has decarbonization of the power sector and electrification of other industries at its core, as well as commitments to hydrogen and ammonia to build on its automotive sector strengths.

Major oil companies, from Shell and ENI to BP and Equinor, have made significant decarbonization commitments. Total Energies has committed to reaching Net Zero by 2050 in its operations (Scope 1 & 2) and decreasing the greenhouse gas (GHG) intensity of its products (Scope 1, 2 and 3) by 60%, while also setting several intermediate key milestones.

Many may be cynical and view these commitments as greenwashing that will not have a lasting impact. However, shareholders, stakeholders, citizens and regulators will be carefully watching to ensure real progress against these lofty commitments. They will hold companies to account. Company CEOs and management teams need to demonstrate a real commitment to the cause, and have well- thought-through plans to ensure they are able to deliver on their promises. They need to do it now, fast.

Collaboration will be essential, between a complex ecosystem of governments, regulators, civil society, and the private sector. Achieving Net Zero ambitions will require companies from across industries to work together, converging to deliver innovative and scalable solutions to decarbonization issues.

On one hand, in a rapidly changing world, Net Zero represents a new paradigm for companies, bringing both threats and opportunities. They need to work to shape this new reality, rather than reacting to it. Timing is key and first-mover advantage may prove to be vital in order to avoid being left behind. However, company CEOs are charged by shareholders and boards to deliver short- and long-term value-building growth. How can companies balance these two potentially conflicting targets? What new business opportunities are there alongside simply driving down emissions associated with the current core business? What sort of transformation is needed for business models, operations, supply chains and customer value propositions? What role should technology play? How can all the key stakeholders be engaged on the journey?

This article sets out a framework approach to help address these questions and create sustainable value for all stakeholders.

IS PROGRESS POSSIBLE?

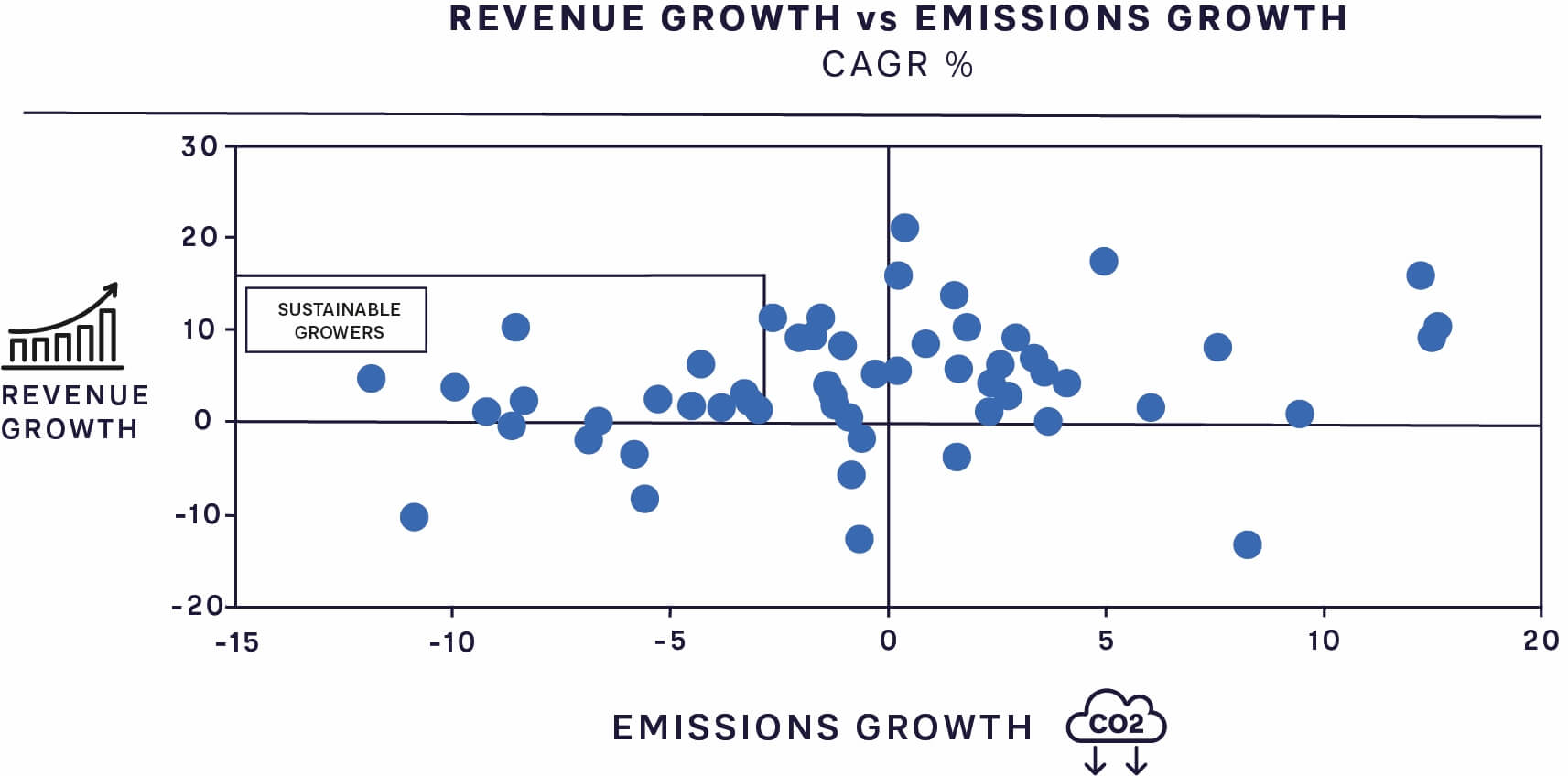

Research into the performance of companies confirms that delivering growth while reducing emissions is certainly achievable. We looked at the performance of selected listed companies from asset- intensive sectors (such as chemicals, oil & gas, energy, industrials, construction, steel, and cement) by comparing revenue growth rates and emissions reduction rates for the same duration (where both results were publicly available pre-COVID-19).

FIGURE 1: REVENUE GROWTH VERSUS EMISSIONS GROWTH IN CAGR (%)

Our analysis shows that there are many companies that have been able to grow their revenue while reducing emissions by at least 3 percent CAGR. What stood out with these “sustainable growers” was that they took the issue of emissions reduction seriously, made it a core part of their corporate objectives, focused on activities to reduce emissions, and invested in key technology and innovations. They used their existing capabilities, such as scale and ability to manage large capital-intensive projects, to diversify successfully.

However, this in itself may not be enough. It remains to be seen whether these rates of emissions reduction will be sufficient to deliver on future Net Zero objectives.

While some leaders have been able to improve both metrics, the majority (i.e., over 78 percent of companies) have not. Some companies pursuing organic growth seem to have lost sight of the emissions implications of increasing production and sales of their (emission-intensive) products. These companies have not allocated sufficient Capex to more sustainable projects to balance their strategies. Others have simply sold off “bad assets”, leading to emissions reduction (for them) but lower growth.

Pursuing M&A growth strategies without understanding the full implication for a company’s emissions profile is another area to watch out for. Businesses must apply a sustainability-led lens to the target’s product mix (see ADL’s Viewpoint on sustainable portfolio steering), assess the risk of future stranded assets, and make “emissions diligence” a core part of the investment process.

Going forward, post-pandemic, companies will need to double down on delivering both growth objectives and Net Zero commitments.

DELIVERING NET ZERO GROWTH

Many companies are still at early stages of their Net Zero journey and trying to figure out how to “move the dial” quickly. While companies may have made public commitments to Net Zero, it often doesn’t receive the same level of priority at investor presentations where, for example, the CEO talks about performance, growth, and finance, and delegates emissions and decarbonization details to others (such as the Chief Strategy Officer or Chief Sustainability Officer). There is often little alignment between financial and sustainability performance metrics, demonstrating a lack of parity between objectives.

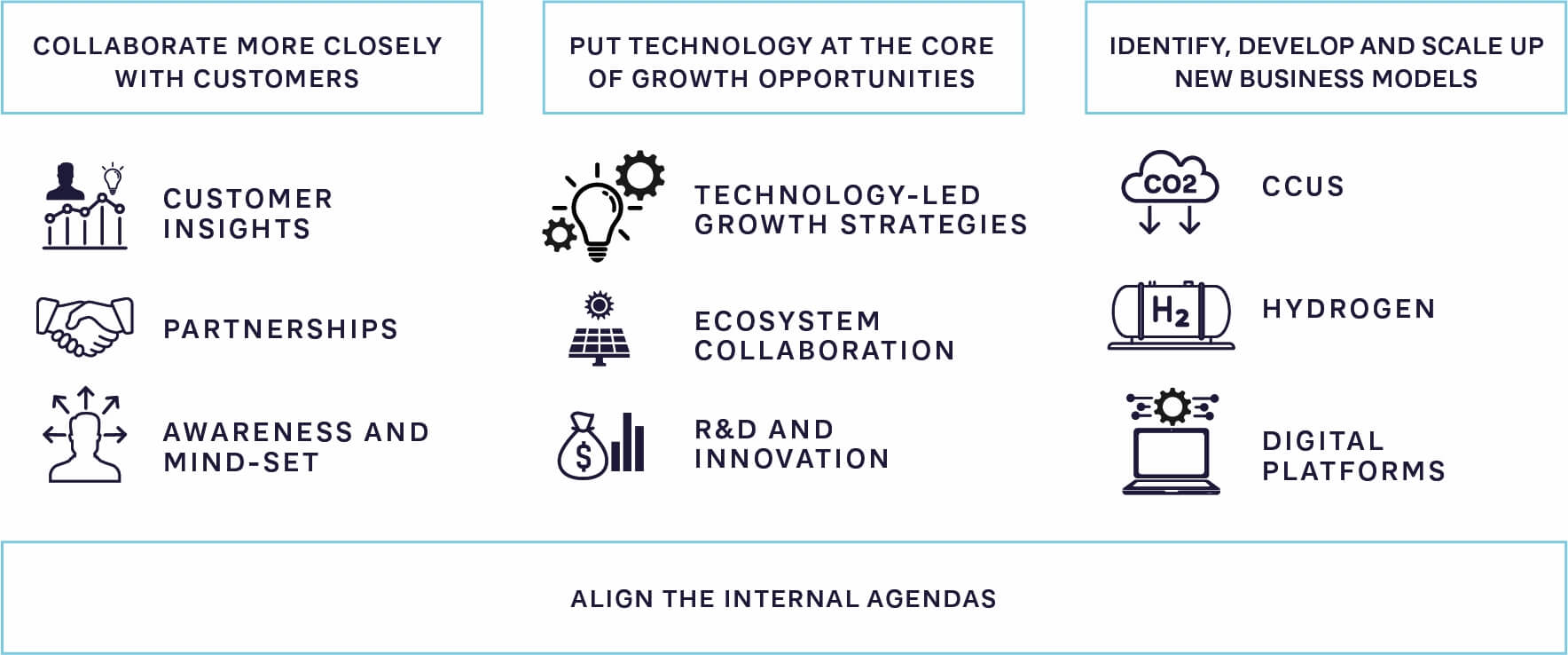

Achieving the dual objectives of growth and emissions reduction in asset-intensive sectors requires corporate leaders to focus on four key areas, as shown in Figure 2.

FIGURE 2: A FRAMEWORK FOR GROWTH UNDER NET ZERO

1. COLLABORATE MORE CLOSELY WITH CUSTOMERS

Companies need to build deeper relationships with customers. They will have to leverage their extensive, long-established understanding of their customers and supply chains, and work jointly to solve their emissions issues.

Leverage customer insights

Many companies have been following a well-trodden path of investing heavily to capture, analyze, and generate deep, privileged insights about customer needs and requirements. Such capabilities have helped to strengthen competitive advantage. During the pandemic, many companies also started to invest into end-to-end supply chain transparency.

Now is the time to find synergies between customer and supply chain insights and use these to develop new technology solutions for the customer that will also help reduce emissions. For example, by investigating up and down the supply chain to evaluate emissions created by its own products, Honeywell realized a significant opportunity in the refrigerants, propellants, and solvents space. Through a new line of low global warming products, Honeywell is helping its customers to reduce their carbon footprint and increase energy efficiency without sacrificing product performance. As a result of this, Honeywell estimates that its customers have potentially avoided over 263 million metric tons of carbon dioxide.

Partner to solve customers’ problems

Traditional approaches of finding the optimal “go to market” strategies for products and services will not be sufficient, and will require a rethink and revamp. Leading companies are already starting to find ways to partner with their key customers and develop solutions (often jointly) to help them reduce their emissions. For example, new growth partnership models are emerging in the area of sustainable air fuel, in which companies are teaming up to find alternatives to jet fuel – such as Johnson Matthey’s partnership with United Airlines and PETRONAS’ downstream retail business (PDB) partnership with Malaysia Airlines and Neste. Delta Airlines is going even further – helping its suppliers and corporate customers decarbonize by introducing sustainable aviation fuels and selling them to business-travel clients such as Nike.

Increase awareness, influence mind-set

Companies will not succeed unless there is increased, widespread demand for their new products. The key question is how quickly customers will change their buying behavior in favor of more sustainable products and services. While legislation is expected to play a role in driving both consumer and customer demand, a “wait and see” approach risks companies falling behind. Rather than holding off until regulations are in place, companies should work swiftly to educate their customers, in order to influence their mind-sets and collaborate to generate demand early on.

Siemens has made an aggressive commitment – to be the first global industrial company to be Net Zero in its operations by 2030 and have a Net Zero supply chain by 2050. By leveraging its industrial know- how, customer and supply chain understanding, and decentralized technology, it has launched a collaborative solutions platform for its customers, thus creating growth opportunities for the business. From its position as a global industrial company, Siemens is now pursuing its journey as a focused technology company.

2. PUT TECHNOLOGY AT THE CORE OF GROWTH OPPORTUNITIES

Companies will also need to increase their focus on the role of technology, not just as an enabler for pursuing growth strategies and reducing emissions, but also as a driver at the core of future growth platforms.

Identify technology-led growth strategies

When exploring the question of “where to play”, company strategists and corporate planners typically look for attractive market segments. Technology is often an afterthought or considered solely an enabler. Many companies have developed their own marginal cost curves to decide on optimal technologies that can reduce emissions.

These only go so far. Companies now need to shift the lens on technology by making it central to uncovering growth opportunities. They need to look beyond mere cost and extend their time frames to identify where technologies can drive business growth and new opportunities. With low-carbon/negative-carbon technologies now at various stages of maturity and development, companies need to explore, understand, and assess them for future growth and value creation potential. In a fast-moving market, it is essential to have all opportunities on your radar and be prepared to accelerate those that demonstrate the greatest potential.

Collaborate in an ecosystem

In their search for technology solutions, companies will need to collaborate more intensively and comprehensively across sectors and beyond. This is beginning now. For example, the World Economic Forum’s Low-Carbon Emitting Technologies Initiative has brought together 10 global chemicals companies, with the joint aim of accelerating the development and upscaling of low-carbon emitting technologies for chemical production.

BASF has committed to Net Zero (Scope 1 and 2) by 2050 and plans $4 billion of Capex investment by 2030. At the same time, it is committed to growth, for example, in opening a new site in South China. In order to achieve both objectives it is implementing continuous improvement processes for the short term, while exploring new technologies (e.g., its CO2-free, electrically heated steam cracker) for chemicals production and use of renewable energy for its electricity needs for the long term.

Reset the technology R&D and innovation portfolio for growth

Now is also the time to review the company’s portfolio of R&D and innovation projects with razor-sharp clarity around its strategic relevance and potential to create future distinctive capabilities in light of Net Zero and time to profit. There can be hidden gems from the past that did not make it to successful commercialization for many reasons (such as customers not being ready or the product not being cost competitive); these can potentially be accelerated in a Net Zero world.

Boral, a leading Australian building and construction company, used innovative technology to develop cement products, which resulted in over 40 percent lower carbon emissions for concrete, while providing excellent performance benefits and finishing properties. This technology-led innovation has allowed Boral to partner with its customer, Lend Lease, to work on specific projects (e.g., primary schools) and help Lend Lease achieve its aim of securing carbon neutrality certification.

3. IDENTIFY, DEVELOP AND SCALE UP NEW BUSINESS MODELS

In the Net Zero world of the future, new business models will open up new growth opportunities. This includes providing sustainability/ Net Zero “as a service” to customers. Three examples of this are in Carbon Capture Utilization and Storage (CCUS), hydrogen and Net Zero platforms.

Carbon Capture Utilization and Storage

CCUS is a critical enabler of reduced emissions. A paradigm shift will be to look at CCUS from a business growth-opportunity perspective, in which companies take ownership of the infrastructure and provide carbon-related services (i.e., CCUS-as-a-Service).

For example, the concept of a CCUS hub is gaining traction. This captures CO2 from different sources and provides shared CO2 transport and storage infrastructure for multiple sectors. An example of this approach is the Northern Lights/Longship CCUS hub in Norway, an offshore facility with the capacity to store 1.5 million tons of CO2 from cement, biomass, steel, waste incineration, and steel plants across Europe.

The hydrogen economy

The hydrogen economy, which is expected to see 500 to 800 million tons of hydrogen produced per year by 2050 (based on the Energy Transition Commissions estimate), is another fertile area for new business models. For this economy to materialize, new global ecosystems need to be created across generation, transport, and utilization in both end-user applications (such as transport) and industry. Our recent Viewpoint, “Paving the way for green hydrogen”, explains how a global green hydrogen ecosystem is likely to develop.

Digital platforms

Converging sustainability with digital will create opportunities for sustain-tech- or green-tech-type platform business models. Companies can explore creating digital platforms that bring together an ecosystem of buyers and sellers of Net Zero-related products and services, and through the network effect, continue to create and capture future value. Taking the valuation of tech and sustainability companies as a guide, launching such platforms has the potential to unlock substantial untapped shareholder value in the long run.

To embrace these (and many other) new opportunities, companies will need to shift their models and not be bound by existing value chain-/ industry-specific thinking. They will need to go beyond traditional business boundaries and bring a convergence-type mind-set to imagine, create, and take their share of future value pools.

In addition, CEOs will need to get used to running “two speed companies” – one that is tied to the core/legacy business and one that is much more agile, constantly innovating, and bringing out new-generation products and services (just as current digital/tech companies do). This requires “ambidextrous” operating models, as described in a previous Prism article, which allow CEOs to drive structural and emissions-related opportunities in the core business while developing and delivering innovative Net Zero services for customers.

4. ALIGN INTERNAL PRIORITIES

In order to succeed, Net Zero should be at the heart of the company’s business. This requires deep cultural transformation, particularly in traditional, asset-intensive organizations. ADL recently conducted a global sustainability survey across multiple sectors. One of the findings from that survey was that while 80 percent of companies had a sustainability strategy, just 29 percent believed its impact was clear to all employees. For more detail on the survey, read Walking the talk on corporate sustainability in this issue of Prism.

Achieving success starts by aligning priorities across the board, management and employees, which requires action on multiple fronts:

-

Start with compelling strategic logic, with the board, CEO and management team clearly embracing the decarbonization mega- trend and understanding that their strategic initiatives and actions will strengthen the company’s competitive advantage and open up new avenues for growth.

-

Armed with this strategic conviction, the CEO and senior management need to work hard to communicate and increase awareness of the new objectives across the organization. This should aim to remove skepticism, boost engagement, and ensure everyone is pushing in the same direction.

-

Companies will then need to think through and act to set the type and time horizon of incentives and ensure that all employee objectives fit with company Net Zero aims.

A leading global electrical equipment manufacturer is currently developing a new business and growth strategy, based around carbon neutrality. Building on its existing lithium-ion (Li-ion) battery-based energy storage business line, the company identified a distributed energy resource management system (DERMS) as an attractive future growth opportunity. Developing the overall growth strategy required a deep understanding of the technology landscape (the second pillar of the framework), the associated strategic choices, the customers, and their needs, as well as a new Energy-as-a-Service (EaaS)-type revenue model (the third pillar of the framework).

One of Asia’s largest gas utility operators needed to balance its growth strategy and Net Zero commitments. The company set its commitment to Net Zero by 2050 and outlined a series of initiatives, including increased use of renewable energy, use of CCUS technologies, and development of decarbonization technologies. The company identified carbon-neutral methane as a new growth direction and developed a strategic roadmap (the second pillar of the framework). The company is now exploring a feasibility study in collaboration with its strategic partners to establish a supply chain of carbon- neutral methane (produced using green hydrogen and carbon dioxide) to its end destination.

INSIGHTS FOR THE EXECUTIVE

In successfully pursuing Net Zero growth under this four-pillar framework, there are some good practices that leading companies have found to be effective:

1. Set an ambition for the core business versus a new business mix. Set a clear ambition on what mix of new businesses makes strategic sense (and by when), fits within the acceptable “risk appetite”, and meets all key company objectives (e.g., sustainable cash flow, returns, and science-based Net Zero targets).

Divesting “carbon-challenged” businesses is a common approach, but it only passes the buck to others to deal with, and doesn’t reduce emissions. Therefore, make the structural change/decline happen yourself, such as by retiring coal assets. Alternatively, if you have to divest part of your portfolio, ensure it goes to a new owner that will be able to reduce emissions through synergies with its own operations.

2. Embrace carbon pricing. If there are no carbon-pricing mechanisms yet available or implemented in your geography, use an internal value for business case assessment and making resource allocation decisions. Expect that the EU and others will move the world to applying a de facto carbon price by implementing taxes on imports that have not been subject to carbon pricing in their country of production.

3. Explore innovative funding models. Funding for “carbon- challenged” businesses is getting increasingly difficult – limiting options and raising funding costs. To unlock funding, such businesses need to have a concrete transition and decarbonization plan in place, and demonstrate real progress. Explore innovative funding models to support portfolio reshaping and the growth of new sustainable businesses. (See our Prism article, “Green Gambit”, on new sources of funding). There is also a major role for financial institutions to fund sustainability, as detailed in the Actively shaping the future – The new imperative for financial services article within this issue.

4. Integrate Net Zero into strategic planning. The company’s Net Zero program should not be under the custody of the Health, Safety & Environment (HS&E) team. These are strategic imperatives and should be part of the overall growth strategy development and strategic planning process led by the CEO. If there is sufficient scale across all decarbonization activities, consider creating a focused Net Zero unit reporting directly to the CEO.

5. Adopt effective Net Zero KPIs. Commit to and cascade the right KPIs. Make Net Zero everyone’s business, not just the focus of senior management. Apply the same razor-sharp focus on measuring and reducing carbon as you would for revenue, costs and profits.

6. Rethink your partner ecosystem. In seeking to collaborate more intensively, take a fresh look at your partner ecosystem and think beyond traditional industry boundaries. As well as suppliers, customers, industry peers, research organizations and government, consider start-ups, specialist service providers, adjacent industry sectors and tech/digital innovators.