DOWNLOAD

DATE

Contact

Seabed mining offers a unique US $20 trillion opportunity to extract critical minerals that are essential for batteries, electric vehicles (EVs), and other green technologies. This Viewpoint explores the economic potential and environmental impact of seabed mining as an alternative to traditional land-based mining, which faces challenges due to declining ore grades, stricter environmental regulations, and rising production costs.

By accessing higher-grade deposits with potentially lower environmental impacts, companies like The Metals Company (TMC), Global Sea Mineral Resources (GSR), and Deep Sea Mining Finance (DSMF) could diversify their resource portfolios and secure a stable supply of critical materials essential for the energy transition. Moreover, developing new subsea exploration and extraction technologies is vital for seabed mining. Remotely operated vehicles (ROVs), autonomous underwater vehicles (AUVs), subsea mining vehicles (SMVs), and pipeline lifting systems are just some of the technologies involved.

While seabed mining could provide significant opportunities, there are concerns about potential environmental impact, which is why many are urging caution. The International Seabed Authority (ISA) will play a central role in ensuring that a sufficiently robust regulatory framework is in place to establish and maintain responsible and sustainable seabed mining practices.

ABUNDANCE BENEATH

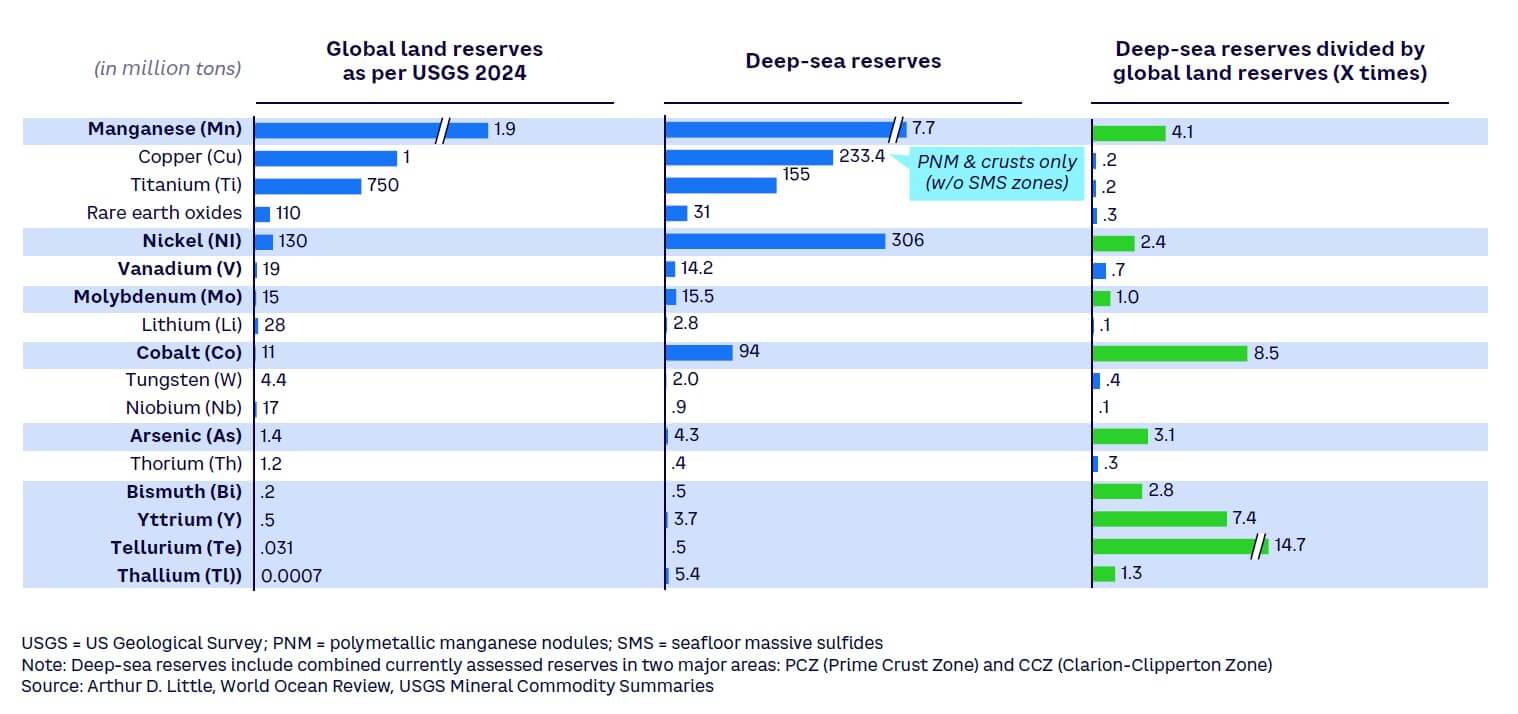

While traditional land-based mining is increasingly constrained by diminishing ore grades, stricter environmental regulations, and rising production costs, seabed deposits are staggeringly abundant and generally higher quality. Comparisons between global land reserves and known seabed reserves show that seabed deposits often exceed terrestrial ones (see Figure 1).

There are three types of deep-sea resources:

-

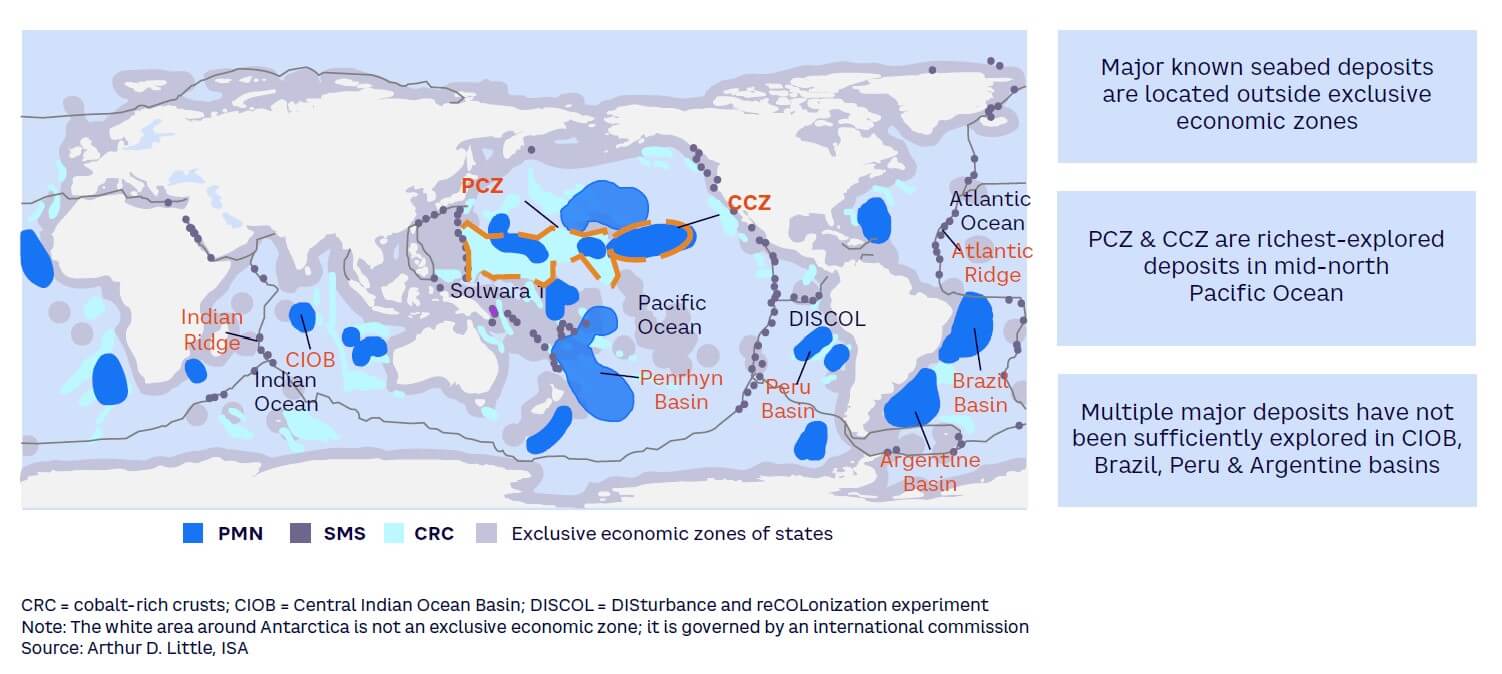

Polymetallic manganese nodules (PMN) — found 4-6 km down in the abyssal zone, in concentrations between 11 and 15 kg per square meter on the seabed. Ranging in size from a few millimeters to the size of small potatoes, their exact composition varies, but typically each nodule might contain manganese (31.2%), nickel (1.4%), copper (1.14%), and cobalt (0.2%). These nodules potentially contain more of these four minerals than all global terrestrial reserves combined. One of the richest areas for polymetallic nodules is the Clarion-Clipperton Zone (CCZ), a vast abyssal plain of ~4.5 million square km between Hawaii and Mexico. The CCZ is estimated to contain up to 30 billion metric tons of nodules with an estimated value of ~$18.4 trillion.

-

Seafloor massive sulfides (SMS) — found at hydrothermal vents along mid-ocean ridges, between 1,500 and 3,000 meters down. Rich in valuable metals like copper, zinc, silver, and gold, they are prime targets for mining. Currently, there are ~550 of these vent sites with an estimated resource volume of 7.5 billion metric tons.

-

Cobalt and manganese-rich crusts (CRC) — found in shallower waters, between 800 and 2,400 meters down. These crusts also contain copper and nickel, with trace amounts of lithium, thallium, tellurium, yttrium, bismuth, and rare earth elements like niobium and tungsten. CRCs form very slowly on bare rock surfaces of “seamounts,” which are undersea hills and mountains that can be several thousand meters high. Figure 2 shows the location of the Prime Crust Zone (PCZ), where these deposits are concentrated; the oldest seamounts can have crusts between 10 and 20 cm thick.

TECHNOLOGICAL ADVANCES IN SEABED MINING

Recent innovations are making seabed mining increasingly feasible. Echo-sounding bathymetry, for example, uses sonar to enable detailed mapping and sampling of the seabed, providing high-resolution images for identifying resource-rich areas.

Underwater vehicles, designed to efficiently collect minerals while navigating obstacles on the seabed, are central to the economic development of any deposits. They require complex engineering, as they operate in deep-sea environments at depths around 6,000 meters, where pressures can be up to 60 MPa. There are three main types:

-

AUVs operate independently on preprogrammed missions. They use onboard batteries and advanced sensors for navigation, making them ideal for extensive mapping/surveying and collecting geological, biological, and chemical data over large distances without direct human intervention. AUVs are particularly suited for long-duration missions in remote or hazardous environments but are limited by battery life and lack of complex manipulative capabilities. They are best for broad, autonomous data collection.

-

In contrast, ROVs are tethered to a surface vessel and controlled in real time. This setup allows ROVs to perform precise tasks with robotic arms and tools, essential for underwater inspections, maintenance, and repairs. Continuous power from the tether enables extended operations (crucial for industries like oil and gas, marine construction, and search and rescue). However, the tether restricts mobility, and ROV operations require a support vessel and team, increasing costs. Nautilus Mineral’s ROV mines SMS deposits at ~1,600 meters deep. It is equipped with imaging systems and high-precision drills to map and extract minerals with minimal disruption.

-

SMVs, such as the GSR-developed Patania II, operate at depths over 4,500 meters and combine the autonomy of AUVs with the real-time control of ROVs. Designed specifically for seabed mining, they autonomously navigate the seafloor using sensors and AI to identify resource-rich areas and adapt operations in real time to collect material. Operators can take control for precise tasks (e.g., extracting polymetallic nodules or SMS deposits. SMVs are built to withstand extreme deep-sea pressures and incorporate environmental management systems to minimize ecological impact.

COLLECTION METHODS

There are two primary methods of resource collection: mechanical collection uses specialized tools to rake up deposits, while hydraulic systems use powerful water jets to break up the deposits. Hydraulic systems are particularly effective where minerals are embedded in softer substrates (e.g., SMS deposits around hydrothermal vents).

Getting material from extreme depths to the surface remains a challenge. Pipeline lifting systems, consisting of riser pipes extending from the seafloor to a surface vessel, through which powerful pumps suck up material, are considered best. However, maintaining efficient flow rates when the pressure at 6,000 meters is over 0.6 tons per square cm is no simple task.

Ensuring the durability of equipment under high-pressure conditions is another critical issue. Innovations like corrosion-resistant alloys, high-strength composites, and real-time monitoring systems enhance the reliability and efficiency of these collection methods. Stronger, lighter materials, more efficient pumps, and improved sediment management techniques are essential for balancing economic gains with environmental protection.

The deployment of mechanical and hydraulic collection technologies includes strategies to mitigate environmental impact, such as sediment containment systems to minimize the dispersion of disturbed sediments, and precise, targeted extraction techniques to avoid unnecessary damage to surrounding habitats.

Inevitably, the scale and technical complexity of working in extreme deep-sea environments means the cost of such technology remains a significant barrier to widespread commercial adoption.

THE COSTS OF EXPLORATION

Collection vehicles cost $10-$20 million each. There are also major offshore expenditures; the support vessels needed to house equipment and personnel come in between $400-$600 million. On top of this, the riser and lifting systems needed to carry collected materials from seabed to surface cost an additional $200-$300 million.

Onshore costs are equally significant. Constructing a processing plant (greenfield) with the capacity to handle seabed materials can cost between $3-$4 billion. Investment in other advanced technologies needed for material preparation, high-temperature pretreatment, leaching, and metal separation can add $300-$500 million to the overall CAPEX.

Handling the unique demands of massive-scale bulk material movement of extracted materials to processing facilities is also expensive. Currently, intermediary storage facilities are being considered on Clipperton Island in the CCZ as an interim containment point. This would reduce the need for continuous long-distance transport directly from the seabed to land, making the process more efficient and cost-effective. However, specialized bulk carriers and support vessels equipped with advanced handling technologies would still be needed.

Consequently, the economic viability of seabed mining projects like TMC’s NORI-D and DSMF’s Solwara 1 hinges on balancing CAPEX, OPEX, and potential revenue streams, which are inherently complex due to the volatile nature of gross metal value. Unsurprisingly, business models often require innovative financial strategies involving a combination of equity, debt, and strategic partnerships to accommodate fluctuating metal prices and market demands.

GROWING COMMERCIAL INTEREST

Thanks to technological innovation, strategic partnerships, and sustainable practices, the seabed mining industry is becoming increasingly commercially viable (see Figure 3). Governments around the world are beginning to explore its potential:

-

In January 2021, Norway became the first country to approve mineral exploration and exploitation on its continental shelf.

-

Japan is investing heavily in seabed mining technology and exploration, focusing on hydrothermal deposits in the Okinawa Trough. China has also emerged as a key player.

-

The Norwegian University of Science and Technology (NTNU) is working on AUVs in partnership with various organizations.

-

Chinese companies have secured multiple exploration licenses in the CCZ and the Indian Ocean; the China Ocean Mineral Resources Research and Development Association (COMRA) has conducted extensive economic viability studies.

LOCAL IMPACT

By fostering innovation and forming strategic partnerships, the seabed mining industry is positioning itself as a key player in meeting the growing demand for essential minerals, while striving to balance economic gains with environmental protection. The Japan Oil, Gas and Metals National Corporation (JOGMEC), for example, is exploring the hydrothermal vent systems of the Okinawa Trough in partnership with Indonesia, the Philippines, and other Southeast Asian countries. These partnerships include profit-sharing agreements, investment in sustainable development projects, and commitments to environmental-monitoring efforts.

Through its Solwara 1 project, DSMF, in partnership with Papua New Guinea, targets SMS deposits rich in copper, gold, zinc, and silver in the Bismarck Sea. The Papua New Guinea government will receive royalties based on the value of the extracted minerals. DSMF has also agreed to invest in education and training to build local capacity and develop infrastructure.

ENVIRONMENTAL IMPACT & MANAGEMENT STRATEGIES

While many are enthusiastic about the potential of seabed mining, it remains a contentious and complex issue given its potential impact on the environment. SMS deposits found around hydrothermal vents, for instance, are biologically rich ecosystems consisting of marine species unique to vents’ extreme conditions. Mining could have significant consequences in terms of disturbing the seabed and by creating large sediment plumes and releasing toxic substances from deposits. Similarly, cobalt-rich crusts support diverse marine life, including corals, sponges, and fish.

Life in the dark depths of abyssal plains, like the CCZ, may not be as abundant as in rainforests. However, the discovery of 5,000 new species in the CCZ in 2023 alone underscores the ecological significance of such habitats; even at 4,000-6,000 meters down, there are environmental implications from removing nodules from the seabed. Mining these substrates impacts these habitats by creating sediment plumes that smother marine life, though to a lesser extent than with SMS. Therefore, seabed mining comes with a trade-off between accessing an abundant resource that could usher in a new golden age of renewable energy technology and addressing important environmental considerations.

Volvo, Volkswagen, BMW, Google, Patagonia, Philips, Samsung SDI, and Scania are among the companies that say they will not use deep-sea-mined metals until the environmental risks are “comprehensively understood.” In contrast, Tesla shareholders have voted against a moratorium on sourcing minerals from deep-sea mining.

Thus, seabed mining holds the potential to revolutionize resource extraction, but stringent regulation is essential to prevent unregulated exploitation. For seabed mining to become an accepted mainstream industry, there must be strong emphasis on the ethical management of ecosystems, with controlled mining techniques, sediment disturbance mitigation, and habitat restoration central to all operations.

While individual countries have regulations governing seabed mining within their exclusive economic zone, these national regulations must align with international standards, while addressing local environmental and economic concerns. Consequently, and to ensure inclusive decision-making, governments must engage with local communities, industry stakeholders, and environmental groups through public consultations, environmental impact assessments (EIAs), and stakeholder meetings.

Importantly, indigenous communities, particularly those in coastal and island regions, have significant stakes in seabed mining activities. Regulatory frameworks must respect and consider traditional knowledge and cultural heritage of these communities. Appropriate engagement processes include culturally sensitive consultations to ensure fair compensation and preservation of indigenous rights and lands.

Finally, the results of studies released in mid-2024 show that scientists might have discovered an inherent “true purpose” of nodules acting as a vehicle for oxygen production in the deep sea. Nodule composition acts as a battery, cracking the salt water under high pressure into hydrogen and oxygen. There are still doubts about the quality of this analysis, probing, and other factors and the magnitude and significance on the seabed ecosystem. However, the findings may significantly impact strategies and the breadth of environmental studies to be conducted by contractors to justify the start of mining operations.

REGULATORY FRAMEWORK & GOVERNANCE

The ISA, established under the United Nations Convention on the Law of the Sea (UNCLOS), is the primary body overseeing seabed mining activities in international waters. To ensure sustainable practices, mining firms are mandated to adhere to global and local laws. The ISA plays a pivotal role in establishing a regulatory framework that balances resource extraction and environmental preservation and acts as a central point of engagement for stakeholders by bringing together governments, industry, scientists, environmental nongovernmental organizations, and other parties to contribute to the regulatory process.

The ISA mandates that mining companies carry out detailed EIAs and baseline studies to understand the local ecology and provide a benchmark for ongoing monitoring before beginning operations. It is hoped that collaboration will lead to industry standards and guidelines that promote environmental stewardship for minimizing environmental impacts and ensuring sustainability of mining operations. Collaborative research efforts can lead to a better understanding of deep-sea ecosystems and strategies to protect them.

One of ISA’s key requirements is that mining companies contribute to a fund supporting marine scientific research and capacity-building initiatives. This ensures conducting resource extraction responsibly, with a focus on environmental sustainability and scientific advancement.

The regulatory framework for seabed mining is continually evolving. The ISA updates its regulations to address new technological advancements and emerging environmental concerns. Future developments may include stricter environmental safeguards, improved monitoring and enforcement mechanisms, and greater transparency in the licensing process.

After a complex and lengthy process, the ISA is expected to finalize a comprehensive framework of mining regulations by 2025. However, if delayed, there are UNCLOS provisions to allow contractors that have received exploration licenses to begin limited mining activities. TMC, for instance, has secured rights to begin operations before the official regulatory framework is in place. As the ISA continues to work toward completing the framework, the actions of early movers like TMC will be closely monitored to ensure operations align with overarching goals of sustainability and responsible resource management.

SEABED MINING: A SHARED OPPORTUNITY

The ISA also seeks to ensure an equitable distribution of revenue from seabed mining, promoting that the benefits of these activities should be shared globally. Its comprehensive licensing system is designed to ensure that countries defined by the UN as developing nations can benefit from seabed mining activities.

Under the ISA’s licensing system, developed countries can explore up to 150,000 square km in specified regions (e.g., CCZ, Indian Ocean, Mid-Atlantic Ridge, and Pacific Ocean). To further support equitable resource distribution, developed countries are required to allocate 75,000 square km of their explored space to the reserved areas. This policy provides access to seabed resources for developing nations and ensures international cooperation and fairness in seabed mining activities.

Reserved areas play a crucial role in the ISA’s mission to promote sustainable and equitable seabed mining. They support economic development and environmental stewardship on a global scale, ensuring that developing nations can participate meaningfully in the extraction and utilization of seabed resources. By meeting specific criteria, developing countries can engage in responsible seabed mining, benefiting from these resources while adhering to high standards of environmental protection and sustainable development.

To use reserved areas, developing countries must meet specific criteria set by the ISA. The country must sponsor and effectively control the entity applying for the mining contract and demonstrate commitment to building the necessary institutional and technical capacities to manage seabed mining activities. Compliance with the ISA’s regulations and international law is also required to ensure that mining activities are conducted responsibly and sustainably.

By setting aside these areas, the ISA promotes fair access and international cooperation in deep-sea mining. This reserved area requirement aligns with the ISA’s goals of sustainable development and environmental protection. It ensures that any mining in these zones adheres to strict environmental standards, safeguarding marine ecosystems. Developed countries retain significant exploration rights while contributing to a system that fosters global equity and sustainability. This policy facilitates access for developing nations and reinforces the collaborative nature of international seabed mining efforts.

To support this equitable approach, the ISA mandates that mining companies contribute to a fund that supports marine scientific research and capacity-building initiatives. This fund helps developing countries build the necessary infrastructure and expertise to engage in seabed mining, fostering economic development and technological advancement.

Revenue sharing and royalty agreements with host countries are critical components of subsea mining models, ensuring mutual benefits from resource extraction. For example, TMC has agreements with island nations in the Pacific, including Nauru, Kiribati, and Tonga, which enable exploration and exploitation in the CCZ and include specific revenue sharing and royalty payments vital for the project’s financial viability.

By promoting a fair distribution of resources and revenues, the ISA’s licensing system aims to create a more inclusive, sustainable seabed mining industry. This approach supports economic growth in resource-rich developing nations and helps build a foundation for long-term environmental stewardship and cooperation in marine resource management.

For smaller countries, seabed mining offers economic opportunities that lead to job creation and infrastructure development. South Korea has entered into strategic partnerships to enhance its seabed mining capabilities. The Korea Institute of Ocean Science and Technology (KIOST) collaborates with international entities to explore and exploit seabed resources. South Korea’s strategic approach includes joint ventures with countries like Tonga and Kiribati, securing access to resource-rich areas in the Pacific Ocean. These partnerships provide South Korea with critical minerals and promote technology transfer and capacity building in partner countries.

Stakeholder engagement is crucial for developing policies that balance economic development with environmental protection and social equity. Here, the ISA is instrumental in organizing workshops and conferences to promote collaboration and the exchange of ideas on sustainable mining strategies between governments, industry players, research institutions, universities, environmental organizations, and scientists. It also works with partners like the US Geological Survey (USGS) on joint initiatives (e.g., Global Marine Mineral Resources program). The EU does something similar with its Blue Mining project.

Alongside this, the Deep Ocean Stewardship Initiative (DOSI) has created a global network of scientists, industry experts, and policymakers doing joint research on sustainable mining practices while the International Marine Minerals Society (IMMS) has developed the Code for Environmental Management of Marine Mining, an internationally recognized framework for managing the environmental impacts of marine mining.

STRATEGIC OPPORTUNITIES FOR STAKEHOLDERS

With land-based mining challenged by declining ore grades, stricter environmental regulations, and rising costs, seabed mining offers a chance to diversify portfolios and access higher-grade deposits of critical materials. For oil and gas companies with offshore operations, their deep-water exploration, drilling, and infrastructure skills are directly applicable to seabed mining. Companies like Shell and Total can leverage their existing offshore technology and expertise to explore seabed mining opportunities.

But time is one constraint on the development of seabed mining. Technology providers need to quickly develop the robotics, remote sensing, and subsea engineering essential for the efficient and sustainable extraction of seabed minerals. Technological innovations make it easier, faster, and cheaper to locate and harvest deep-sea resources, but many technical challenges remain.

TO THE SEABED & BEYOND

Looking further ahead, the advancements for extracting minerals from the ocean floor could be adapted for off-world mining ventures on asteroids, the Moon, and Mars. Techniques such as mechanical and hydraulic collection methods will be crucial for efficient space mining operations, while the ROVs and AUVs used in seabed mining are directly relevant to space exploration. They could easily be adapted to operate in the harsh environment of space, to navigate and extract resources from asteroids or the lunar surface.

Environmental management strategies from seabed mining could equally provide valuable insights into sustainable practices for off-world mining. Partnerships between seabed mining companies, space agencies like NASA and the European Space Agency, and private space exploration firms such as SpaceX and Blue Origin would accelerate the development of off-world mining capabilities, with each sector leveraging the expertise of the others to overcome technical and logistical challenges.

Planetary Resources and Deep Space Industries are two companies already exploring the feasibility of asteroid mining by drawing on technologies developed for seabed mining. With a single asteroid potentially yielding precious metals like platinum, gold, and rare earth elements worth billions of dollars, the economic potential of asteroid mining is immense.

Conclusion

FUTURE PROSPECTS

Thanks to technological advances, seabed mining is becoming commercially viable and may significantly bolster global supplies of materials for multiple green technologies. This creates strategic opportunities for governments, metals/mining companies, and oil/gas companies. But there are important considerations:

-

Financing will only become available when miners can demonstrate their ability to deliver at an industrial scale (i.e., in excess of 500,000 tons per annum).

-

Seabed mining takes an environmental toll and highlights the central paradox in resource management: balancing immediate extraction and long-term sustainability.

-

While seabed mining generally produces fewer CO2 emissions and uses less water than land-based mining, habitat disruption and sediment release persist. Growing apprehension over this has scientists, environmentalists, and governments advocating for a temporary halt to deep-sea mining until its ecological implications are more thoroughly known.

There is no perfect method of extraction, so the focus falls on minimizing impacts through technological innovation, stringent regulation, and genuine commitment to sustainable practices. Moving forward requires consensus about acceptable levels of environmental disruption, especially in the fragile, largely unexplored, and uniquely biodiverse ecosystems of the deep ocean.