DOWNLOAD

DATE

Contact

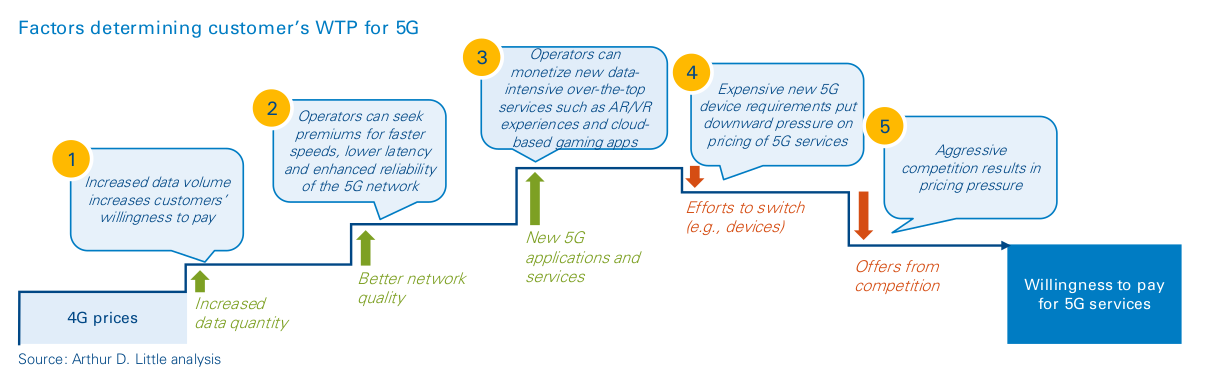

Leading telcos have switched on their 5G networks and launched commercial offers to acquire early adopters. With the scale of investments required for 5G, the consumer pricing strategy becomes a critical lever for recouping these investments. In this viewpoint we aim to provide a framework for increasing customers’ willingness-to-pay for 5G services and B2C 5G pricing guidelines, in order to achieve optimal monetization. In summary, operators must leverage the key benefits of 5G, i.e., data generosity, quality of service, and new applications and services, to increase customers’ willingness to pay for 5G services and aim for price premiums. In parallel, they must address the downward pricing pressure from 5G device costs, market competition, and initial coverage and quality glitches.

5G is now a reality

Every month, more operators are announcing commercial launches of their 5G services. Countries such as South Korea, the US, the UK, Finland, and Austria have taken big steps in bringing the 5G experience to their consumers. South Korea reached 1 million subscribers within 69 days of the 5G commercial launch, compared to 58 days for 4G in 2011. Other countries have launched multiple pilots and will start commercialization soon.

In parallel, a new set of consumer applications are emerging, fuelled by 5G and built on technologies such as augmented reality, virtual reality, artificial intelligence, and cloud gaming.

The 5G ecosystem is heating up

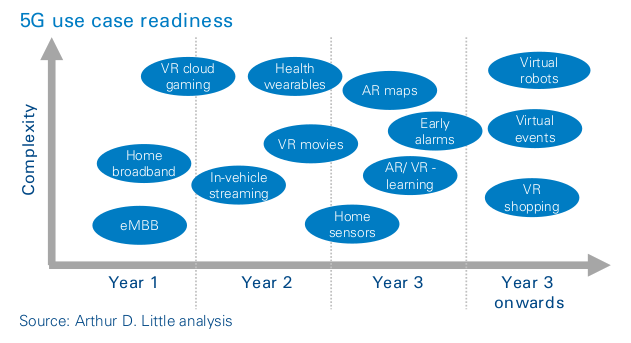

We expect most 5G consumer use cases to go mainstream within two to three years of 5G’s launch, as operators finish deployment, 5G handsets hit the market, and new services achieve maturity. 5G use cases can be categorized based on their time-to-market and complexity in development/adoption (see figure). As anticipated, enhanced-mobile-broadband (eMBB) will be the first 5G commercial use case, followed by applications such as enhanced in-vehicle “infotainment”, real-time traffic alerts, real-time video streaming, and 3D gaming. In two years, we can expect to see use cases such as virtual-reality movies, games, learning, and wearables that require low latency and high throughput. In three to five years, use cases such as AR maps, VR shopping and virtual event experiences are expected to materialize.

Success of 5G in the near-term hinges on successful adoption of the initial use cases. This requires robust 5G rollout (to meet the speed and capacity needs of these new applications) and well-priced commercial offerings.

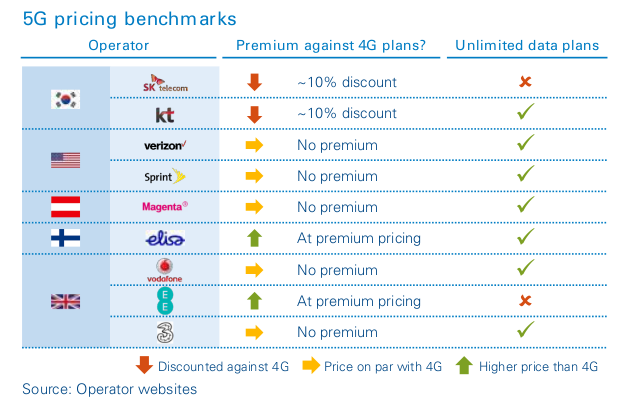

Current 5G pricing varies drastically across operators

Operators worldwide are experimenting with pricing and structuring of 5G tariff plans. Based on recently launched 5G tariff plans, we have observed various models across markets – while a few operators have slashed their price-per-gigabyte (PPGB) compared to 4G, others are charging a premium. However, most have set 5G pricing at similar levels to those of 4G.

The discounters and no-changers hope to make money from increased 5G data usage (instead of higher unit prices) and 5G applications adoption

So, how do operators price 5G for optimal monetization?

We have identified a set of levers that operators can use to increase customers’ willingness-to-pay (WTP) for 5G services, and price them in a manner that will result in optimal monetization.

1. Increase data allowances

5G networks will be able to transmit greater amounts of data without bottlenecks by making use of higher-frequency bands, and 5G use cases will naturally consume more data for better experiences. Average usage of 200GB/month is realistic if we assume current mobile cellular data usage and add to it the consumption required for one hour of 360-degree video, one hour of VR on the move, one hour using AR maps, and four hours of video streaming in 4K per month. In South Korea, 5G customers are already using three times more data per customer than 4G customers over the same time period.

The data generosity in 5G tariff plans will increase customers’ WTP (effectively the ARPU), as it will meet their usage requirements and at lower PPGBs.

In initial months of launch, introducing 5G exclusively on new tariff plans with large or unlimited data allowance, priced at a premium (versus existing smaller plans) would generate an uplift as and when early 5G adopters migrate from smaller, cheaper plans. For operators already offering unlimited or large 4G data plans, introducing 5G exclusively on those plans will also enable upselling to customers on basic plans. However, for customers already on these large data plans, there is limited room for an uplift.

2. Differentiate on superior network quality

As per claims from vendors, 5G is expected to offer 1-10 Gbps peak data rate, 99.999% reliability and less than 1 ms latency. This differentiated network quality is another lever which increases customers’ WTP for 5G services. To monetize optimally in 5G era, operators must structure their offerings based on tiers of network quality parameters, such as speed, latency and reliability, as volume-based tiering becomes meaningless in markets with high penetration of large or unlimited data plans. For example, gamers will be happy to pay a price premium for a low-latency plan, professionals for a high-reliability plan, and AR/VR enthusiasts for a high-speed plan. Finland-based operator Elisa has introduced two new speed-tiered 5G tariffs: 1Gbps for €50 ($56) per month and 600Mbps for €40 ($45) per month. On similar lines, AT&T has also indicated potential pricing of 5G tariff plans based on data speeds.

However, operators need to invest in upgrading network management and provisioning tools to ensure that such differentiated quality of service is delivered in reality to 5G subscribers.

3. Bundle new breed of 5G applications and services

Just as operators leverage bundling of zero-rated Netflix or Spotify and social media add-ons to generate ARPU uplifts today, 5G will bring opportunities to sell a new breed of digital services. This is expected to increase customers’ WTP and support premium 5G pricing. 5G apps, services and engagement models will mature soon, and so will monetization opportunities. In the short term, operators can monetize new data-intensive over-the-top (OTT) services, such as cloud-based gaming and e-learning applications. For example, SKT has started selling its video app, Oksusu’s zero-rated VR experiences and 4K UHD videos as an add-on service.

Taking learnings from the 4G era, operators need to be part of the overall digital ecosystem, which thrives on the advanced infrastructure built by operators, without restricting themselves to serving as “pipes”. We expect existing OTT monetization and partnership models, such as download, subscription and usage-based commissions, advertising, and geo-analytics services to further increase in the 5G world.

Notably, cost-to-serve per GB of 5G data will be significantly less than 4G data, thanks to enhanced spectral efficiency and traffic capacity of 5G. This will result in a steeper cost elasticity curve than the price-elasticity-of-demand (PED) curve. It will enable operators to price 5G at much lower PPGBs than 4G and thus stimulate data demand. Moreover, operators will be able to increase the PED by offering better network quality and creating more value through added features, which would justify a premium ARPU.

4. Enable migration to 5G handsets

5G requires customers to purchase new devices – from 5G-enabled smartphones to VR wearables. This will require investment from customers, which is a key barrier to technology adoption. Given that 5G handsets were launched only recently, they are priced high - for example, Samsung’s first 5G smartphone, the Galaxy S10 5G, is set at around 1,200 USD. This reduces customers’ WTP for 5G tariff plans and puts downward pressure on 5G price points. On the flip side, due to high device price-points, handset bundling is expected to come back into prominence and result in increased customer stickiness. Several early movers, such as Vodafone/EE in the UK, Verizon in the US, and SK Telecom in Korea have introduced 5G plans bundled with smartphones (in addition to SIM-only plans).

Case study: SK Telecom’s early success in 5G

In April 2019, all three South Korean operators simultaneously switched on their 5G networks. After 2 quarters of 5G journey, market leader SK Telecom stands out, in terms of its success with 5G. Its attractive 5G offers included:

- Tiered plans with higher monthly data allowances of 8/150/200/300 GB monthly data.

- ~10% discount against similar LTE plans.

- Promotions for unlimited monthly 5G data.

This resulted in a notable uplift for SKT in Q3 2019:

- > 1.5 million 5G subscribers, representing a market share of 44% within 7 months of launch.

- 65% increase in average monthly data usage from 20.4GB (in 4G) to 33.7GB (in 5G).

- ARPU uplift of ~1.3% for Q3 and 1.7% since 5G launch in April.

5. Gain advantage before the market becomes competitive

As with 4G, early 5G movers will get a short window of opportunity to project an image of superior network quality versus competition and price 5G on their own terms. However, in competitive markets where operators are pursuing 5G neck and neck, the competition is a key lever that can push consumer 5G pricing downwards. As seen in South Korea, 5G tariff plans are priced at a 10 percent discount versus comparable 4G plans. These operators’ hope is that customers will move to larger, more expensive data bundles, to satiate their increasing 5G data appetites.

Challengers in the consumer mobile market are expected to price 5G at similar levels or at discount versus current 4G prices to gain market share. Pricing 5G similarly to 4G (without charging a premium) initially isn’t a bad move because premium pricing raises customer expectations of network quality, which may not be consistent in the first few months of 5G launch. In the US, Verizon pulled back a $10 increase for 5G in its unlimited plans after receiving customer complaints about spotty coverage and quality.

For 4G, an extreme discounting example was observed in India: Reliance Jio disrupted the market by offering 4G services for free for six months. The zero price tag helped the company acquire a significant market share with over 100m+ customers in record time, and at the same time, customers couldn’t complain about technical glitches because the service was for free. Therefore, delaying monetization to acquire a solid base is a viable strategy, especially for challengers.

Way forward for executives

Operators must leverage data generosity, QoS, and new 5G applications and services to increase customers’ WTP for 5G services and aim for an ARPU uplift. At the same time, they need to address downward pressure due to device costs, market competition, and initial coverage/quality glitches. The right balance between the above factors will help achieve optimal monetization.

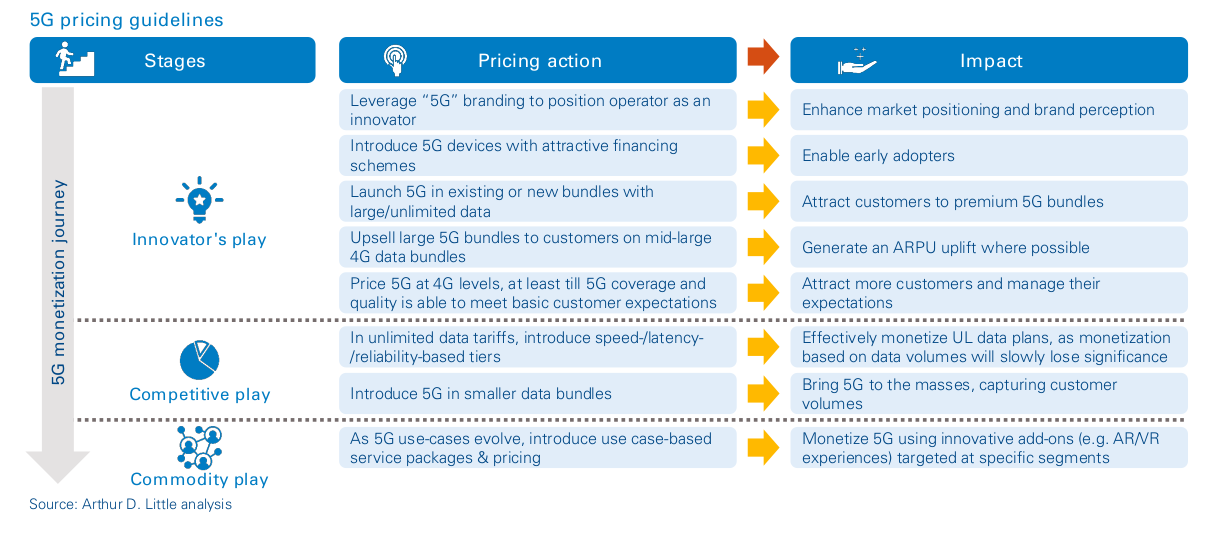

Even though the extent of these individual factors varies, based on market context, operator positioning and strategy, we recommend some common 5G pricing guidelines as operators embark on their 5G monetization journeys (see figure above).

At the 5G commercial launch, an operator could gain first-mover advantage and leverage an “innovator’s play” with strengthened brand positioning founded on 5G, attractive 5G device schemes, and focus on premium large-data-volume tariff plans. This would enable the operator to acquire early 5G adopters and potentially gain an ARPU uplift by upgrading mid-to-large 4G customers to 5G. As the 5G ecosystem gains maturity, the operator should introduce speed-, latency-, and reliability-based tiers in tariff plans (for monetization of unlimited data plans). We expect 5G pricing to eventually enter a “commodity play” in its matured state. The key for gaining pricing advantage then, would be to leverage use case-based service packages. This would allow the operator to stll differentiate and monetize 5G using innovative 5G add-ons. While these guidelines offer valuable actions, how quickly an operator moves from one action to another depends on its market context.

Arthur D. Little is helping leading telecom players globally in defining and implementing their 5G strategy and value propositions. Please reach out for more details.