DOWNLOAD

DATE

Contact

With tightening market conditions and ambitious competitive plans, the fiber to the home (FTTH) market seems poised for consolidation. In this Viewpoint, we argue that consolidation presents value creation potential for both players and investors — by limiting overbuild in highly competitive markets, accelerating growth inorganically in nascent ones, and achieving efficiency gains via economies of scale. Efficient and effective post-merger integration (PMI) will be key to durable synergy creation.

AMBITIOUS TARGETS & MARKET CHALLENGES

The era of easy money has ended

Thanks to rapidly tightening monetary policy and recessionary fears sparked by inflation, 2023 saw a significant slowdown in investment activity across sectors. Digital infrastructure, and fiber in particular, was no exception, with a declining number of deals. The spotlight has now shifted from raising funding for growth to optimizing operations and harnessing efficiencies, especially in highly competitive European markets like Germany and the UK (see the Viewpoint “Next-Stage Fiber: A Guide to FTTH Refinancing”). Beyond optimizing efficiency, players can pursue market consolidation to significantly improve performance against the backdrop of those markets. In more nascent ones, where competition in fiber is still low, consolidation presents an opportunity to inorganically accelerate rollout and do “land grabs” in optimal areas.

A looming imperative for consolidation in Europe

Several factors point to consolidation in the European market. These include not only pure financial considerations but a blend of technical and social elements, which limits the extent of growth targets being realized organically:

-

Economic thresholds of infrastructure utilization. Penetration is among the key determinants of return on fiber infrastructure investments; for example, we estimate that a penetration of 40% is needed to achieve an attractive return in a developed market with average revenue per unit (ARPU) and rollout CAPEX per home.

-

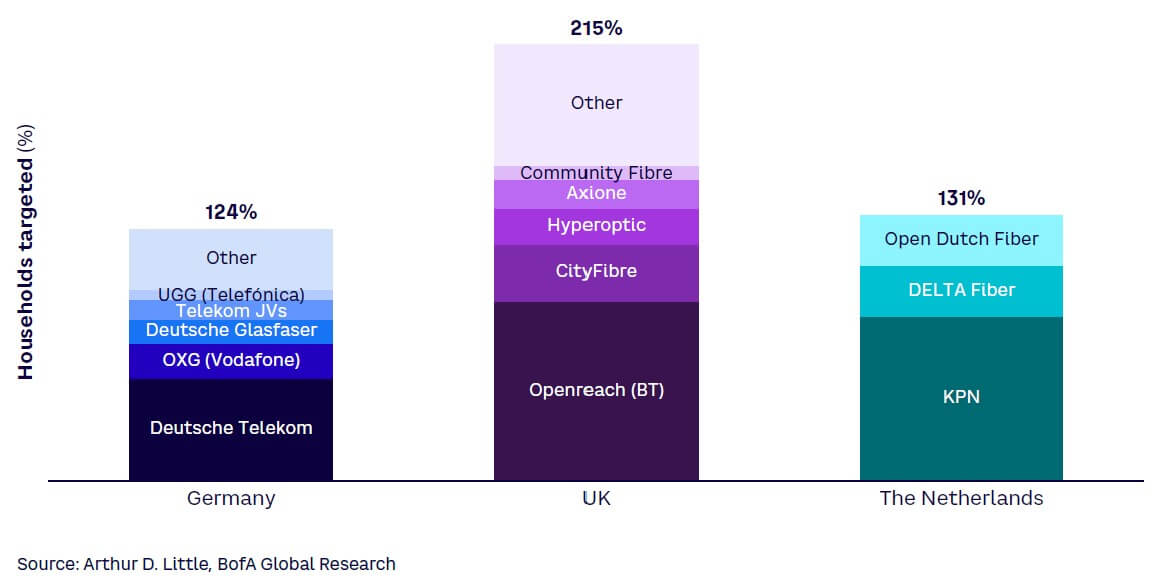

Ambitious growth targets. An aggregation of growth commitments from key fiber players across Germany, the UK, and the Netherlands confirms anecdotal indications from those markets: if all players realize growth ambitions individually, a significant overbuild of 100%+ would result (see Figure 1).

-

Intricacies of greenfield rollout. Deploying fiber quickly and cost-efficiently outside the existing footprint embodies a labyrinth of challenges, including slow acquisition of building permit acquisition; limited subcontractor capacities; material shortages; and a challenging, complex vendor landscape to manage.

So why act now? Here are some critical reasons:

-

First-mover advantage. Engaging in strategic investments and PMI now can provide companies with a competitive edge, positioning them as leaders, rather than followers, in the next phase of the industry’s evolution.

-

Capitalizing on market inefficiencies. In the current transitional phase, market inefficiencies and undervalued assets partially exist or are about to emerge (timing is still to be determined). Astute investors and companies can capitalize on these opportunities before the market reaches a new equilibrium.

-

Risk mitigation. Proactively engaging in consolidation and PMI unlocks new growth avenues and can serve as a defensive strategy via operational improvements. For example, an increased footprint makes wholesale business more attractive, while scale in rollout volumes allows for a better position in negotiating long-term subcontracting conditions.

Although market conditions in Europe are the most supportive of consolidation currently, we see attractive consolidation scenarios across global markets. For example, the concept is gaining momentum in the US. In 2023, Cox Communications, a major US provider of cable TV, telecommunications, and home automation, acquired commercial fiber provider Unite Private Networks. Several other mergers between local players further demonstrate the increase in traction. The consolidation trend is likely to accelerate in the coming years, highlighting the importance of post-merger value creation in the US market.

3 FUNDAMENTAL INTEGRATION OPTIONS

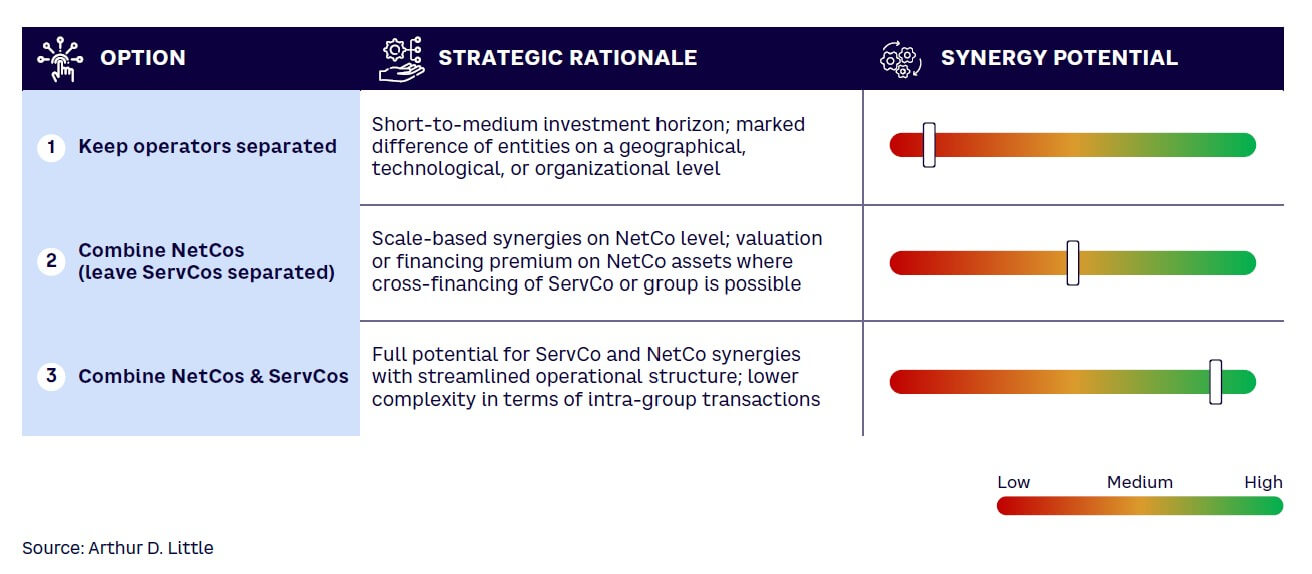

Creating value in transactions should be driven by both network and commercial operations. On the network side, combining infrastructure can deliver added value through direct technological benefits (e.g., increased redundancy and reliability) and tangible synergistic effects. On the commercial side, integrating the corresponding core functions can magnify the synergies on the whole-company level, leading to increased value creation. Depending on the degree of integration, there are various options, which can be further refined depending on the exact operational and business profiles (see Figure 2). These options include:

-

Option 1 — unintegrated core operations. The simplest option is to forgo integrating core network and commercial operations and potentially merge only corporate functions, such as HR and finance. One strategic rationale behind this decision might be locking in an investment in the short to medium horizon, which allows less time for synergies to be realized. In fact, synergy creation in this case extends primarily to efficiency gains in centralized functions, leading to possible double-digit OPEX savings in the long run but offset in the short term by one-off items (e.g., transfer costs and renumeration harmonization). The move could also be justified if both the acquired and original entities have vastly different operational models or are geographically distant from one another.

-

Option 2 — integrated infra operations. A further step is to integrate the entities’ infrastructure into one NetCo while keeping their commercial operations in separate ServCos. The rationale is to establish scale-related (mostly OPEX- and CAPEX-driven) synergies. The ServCos may benefit from a strong brand and local presence, which are excellent reasons to not consolidate them. With a much more focused asset base, the NetCo becomes an attractive target for a much broader group of investors (e.g., infrastructure funds) and can become a funding engine, used to raise additional equity or debt, pay down or refinance liabilities on a group level, or refinance liabilities for the ServCo.

-

Option 3 — integrated core operations. Lastly, it is possible to integrate both the commercial and infrastructure layers of the two entities. Should both be separated, the consolidation would result in two entities — one ServCo and one NetCo — which allows the full potential synergies to be realized. This assumes that the merged commercial entities are in the same market because cross-border synergies are fewer in number and more difficult to establish. The setup reduces the complexity of intra-group transactions since service-level agreements must be struck only between the entities. In addition to a cleaner structure, this feature also facilitates cash-flow balancing, as the optimization problem is reduced to two dimensions: one ServCo and one NetCo.

Beyond defining the integration depth in terms of the “merger principle,” there must be refinements regarding demarcation lines on operational and strategic levels — where exactly is the strategic separation line drawn between the ServCo and the NetCo? For example, who owns the active equipment or the in-house infrastructure on the customer premises? If FTTH architectures and vendor stacks differ, how can short-term migration and long-term preferred targets be managed?

A further complication may arise if the business profile of the combined infrastructure entities extends beyond that of a pure, wholesale-driven InfraCo and includes retail activities. Several players also offer services unrelated to fixed broadband offerings, like various IT or system integration solutions. In these cases, the reconfiguration options increase significantly in complexity.

Fundamentally, picking the right integration option specifically for the entities in question and their shareholder goals largely defines the probability of a successful merger and the size of the resulting value creation. Alleviating pressure from shareholders over their profit expectations is one of the main reasons telecom operators reconfigure or carve out assets. Companies can manage these expectations better by further concentrating the scope of the entities and increasing the synergy potential through an effective PMI.

COST SYNERGIES POTENTIAL IS HIGH

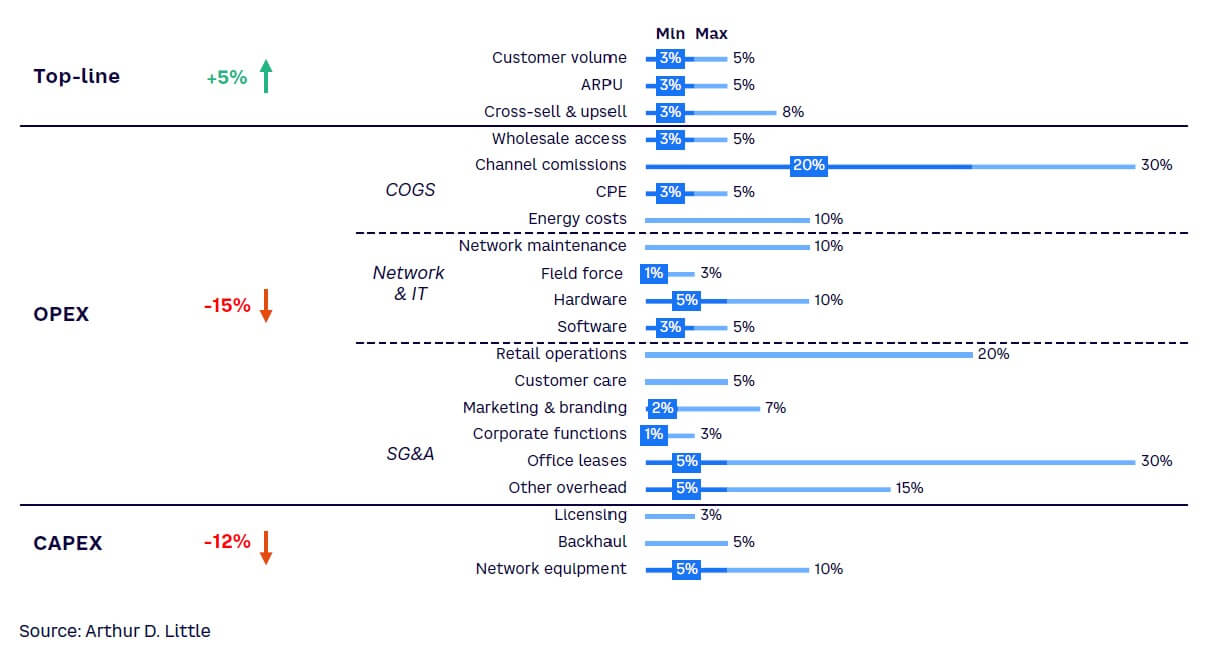

In recent transactions, we have seen positive effects at top-line, OPEX, and CAPEX levels (see Figure 3). In a “combined NetCo” integration option (see previous section), the impact is naturally predominantly visible in reduced network OPEX and COGS (i.e., better procurement of network access and components and efficiency in maintenance) and better network-building CAPEX (i.e., due to improved scale). A full merger additionally offers top-line synergies (i.e., potentially improved pricing position and cross-selling and upselling opportunities) and significant SG&A savings potential, assuming an absence of remedies.

Variables determining synergy potential

Various drivers affect the total monetary potential of the different synergy levers, which can be inherently technical, commercial, or operational. Primary drivers include those that are business-critical and therefore prerequisites for realizing the synergies. These include the existence of appropriate IT systems (e.g., moving from two software stacks to one). (We have worked with companies whose goal was to avoid running parallel systems [e.g., moving provisioning into one system within seven days of closure]).

Also, the integration with wholesale access platforms, operational support systems (OSSs), and business support systems (BSSs) can vary greatly between entities, resulting in very different levels of complexity required to achieve the potential IT synergies.

The maturity of the merging organizations also has substantial ramifications for the synergies. A large delta between the overall maturity of the organizations (e.g., efficiency and effectiveness of business and operating models) typically results in higher optimization potential after merging. For example, if FiberCo A has significantly better supplier conditions than FiberCo B, switching to those suppliers would result in immediate improvement.

Secondary drivers are commercial in nature and facilitate operational efficiency. For example, the respective footprint and customer base of the merging entities will largely govern the short-term strategic ambitions for network savings and upsell potential. To leverage synergy potential, it is important to have an aligned view of the first steps in the value chain, such as area selection, area development, and demand aggregation. In addition, changes in the sales channel mix or commissions may directly impact synergy potential.

In case of network overbuild between two merging entities, the network OPEX reduction is imperative, as parts of the network can be potentially decommissioned; in case of vastly different customer bases and non-fixed products (e.g., mobile), the upsell and cross-sell potentials are significantly increased. A view of the products and services of one another and the ability to support them are important and require clear mapping.

Network architecture and network vendors provide another example. The choice of network architecture (e.g., GPON versus P2P), deployment method (digging versus aerial versus passive access to other providers’ ducts), and equipment vendors and procurement agreements for active network equipment CPE greatly determine the degree to which the two networks can merge and yield better operational efficiency. Additional drivers may include more qualitative variables (e.g., cultural differences between the entities) or other function-specific factors (e.g., degree of centralization in network equipment warehousing or physical proximity of office buildings).

Integrating the operating models of the companies — the networks, organizations, systems, and processes — naturally results in economies of scale that yield savings in operational costs (lower OPEX, better EBITDA) and improves the rollout profile (less CAPEX per home, faster rollout, access to more construction companies).

On the other hand, regulatory implications can pose a strong caveat to any top-line synergies, especially if the merger results in monopolistic situations on a given footprint. In this case, wholesale regulations generally define a regulated base price for a base broadband service. This substantial pricing limitation may transfer a sizable portion of the value to competitors or customers, translating to lower profitability for the merged entity. For this reason, regulation should always be a primary consideration when evaluating possible risks in realizing the total synergy potential.

PMI CAN MAKE OR BREAK THE CASE

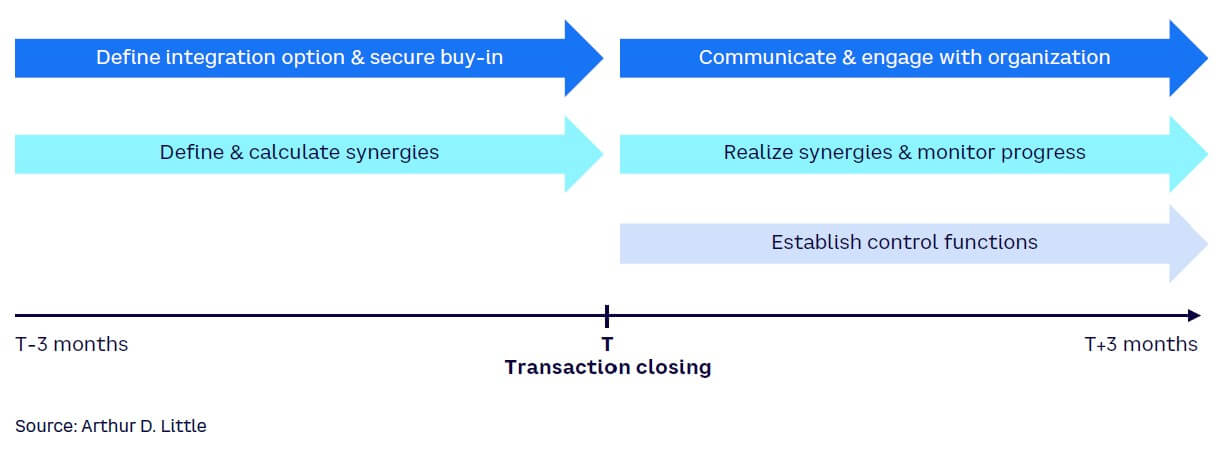

It is crucial to accelerate the PMI process to gain a first-mover market advantage, especially given the importance of scale for wholesale FTTH (see Figure 4). By expediting the integration process and preempting competitors, companies can accelerate synergies, thereby shortening the payback period. However, several FTTH-specific bottlenecks (e.g., technical challenges stemming from differences between the parties) could develop during the PMI process, which may threaten its success. These difficulties may emerge prior to, during, and/or after the transaction, which necessitates full diligence in executing the process:

-

Degree of integration. It’s important to align the integration option with key internal and external stakeholders, like company management or vendors. At this point, some key questions may arise around FTTH architecture and vendor selection, how to combine portfolio and pricing commercially (including non-FTTH products), and which strategy to pursue in wholesale. The degree of integration will serve as a reference point for every stakeholder to set clear milestones until the transformation concludes. This stage of the process sets realistic timelines for the legal transition, which can be overly complex depending on the number of required legal transactions and governing regulation.

-

Synergy measurement. Since the right asset allocation serves as the basis for synergy creation, it is important to devise a pragmatic and impactful synergy measurement. A preliminary calculation of synergies is a crucial step and should occur prior to completing the transaction. This should be an “outside-in view” — allowing for a more objective assessment of potential synergies and helping identify areas for value creation. To ensure accurate backtracking, involved stakeholders must agree on the calculation logic, especially for complex synergy categories such as network and IT CAPEX. Additionally, a synergy owner should be assigned, which can be either a specific subdivision or an individual. This person or group will be responsible for overseeing the synergy-realization process and ensuring achievement of expected benefits. We recommend selecting synergy owners during the completion stage of the transaction, upon performing an in-depth reevaluation of the aggregated synergy impact, which can serve as the basis for future performance tracking of total synergy realization.

-

Control functions. Establishing centralized functions is another essential factor. This consideration is highly influenced by the total synergy potential and the degree of integration for the operating entities; therefore, it should be addressed during or even after completing the transaction. Functions such as HR, legal, logistics, finance, and administration can be centralized, thereby identifying further economies of scale. If such a setup is absent, duplications can occur, resulting in substantial negative synergies. The lack of a consolidated view of operations from financial, commercial, legal, and HR-related perspectives may thwart the integration process.

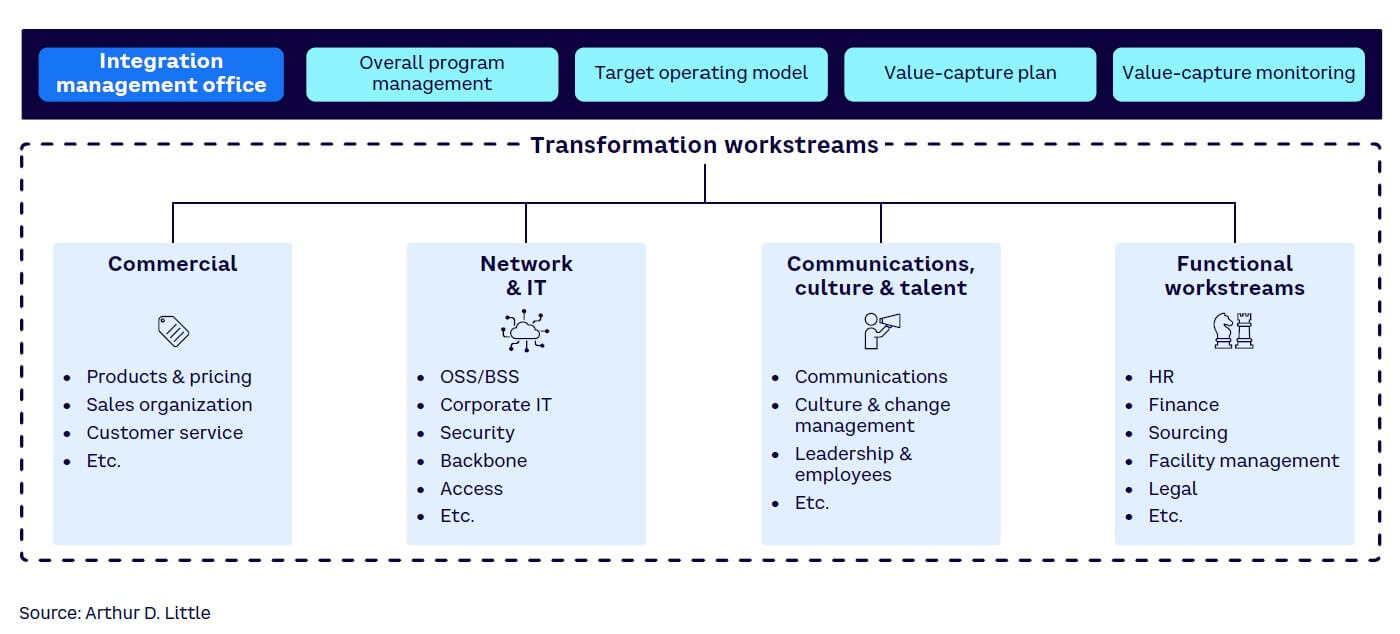

Organizing the PMI office/team and planning for integration is a crucial step to ensure the success of the integration and the degree to which the synergies materialize. We recommend assembling a cross-functional team that has both strategic and operational competence, especially in network and IT; decision-making power is crucial. The case example in Figure 5 shows a centralized office, which is responsible for steering the PMI and coordinating individual streams and their sometimes-diverging interests (e.g., between commercial, technical, and corporate functions).

Conclusion

KEY CONSIDERATIONS BEFORE APPROACHING PMI

An effective PMI will be a key driver for enduring value creation and improved long-term positioning, with the following takeaways to keep in mind:

-

The fiber market is at a strategic inflection point. Consolidation is not merely a trend; in highly competitive markets, it’s a necessity, driven by market dynamics. In some countries, not consolidating could result in an overbuild of 100%+.

-

Multiple integration options exist. Value creation should be driven by the inherent value potential of the network side; synergy impacts can be magnified by structurally separating commercial functions.

-

Significant synergies are possible, post-integration, creating up to 10%-15% OPEX and/or CAPEX savings potential. The key is targeted and pragmatic PMI execution to keep the synergy target in sight while laying the foundation for the newly merged company.