The current COVID-19 crisis is unprecedented, and the impact on demand across all industry sectors has been brutal. But if companies are to survive and even thrive in this situation, they must develop sales strategies for both the short- and medium-term – however grim the current outlook might be. It is vital to plan for tomorrow and the future. In this viewpoint, we outline the different ways in which pricing and offering can help companies to unlock demand even in a time of social and economic crisis. We also look at how customer preferences may have shifted and the right way to communicate with your target markets.

The COVID-19 crisis and the effects it has already had on the global economy are unique in modern history, with business suffering the consequences of a self-imposed recession. Right now, it is impossible to tell what the shape of the recovery will be, but it is likely that return to growth will be relatively slow. With companies worldwide feeling the pain of reduced demand, many firms are reaching for a quick-fix solution to stimulate growth in the short-term, with pricing being an obvious choice.

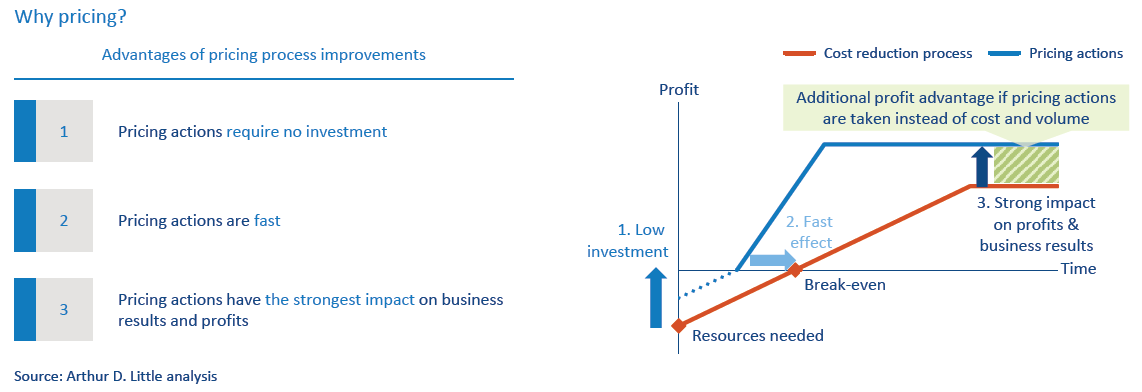

Pricing has a number of advantages in shoring up a company’s order book. For a start, pricing adjustments do not require any additional investment and can be implemented quickly. Pricing actions have also been shown to have the most beneficial impact on profits compared to actions such as cost or volume reduction.

However, although pricing can quickly have a positive effect on the bottom line, it is important that it is implemented correctly – because if it is not, it could seriously backfire and damage your business in the future. By way of illustration, there are numerous examples of companies that overreacted during the financial crisis of 2008, slashing prices across the board in a way that was ultimately unsustainable and difficult to come back from. As such, it is vital that companies understand both the short- and long-term implications of pricing actions, and always retain full control of them.

If done correctly, it is possible to not only ride out the crisis period, but also to unlock new demand, improve customer loyalty and attract new clients. There are seven key steps that companies can take to maximize the power of pricing and offering at this time:

1. Understand what the current crisis means to your industry

Before undertaking any actions, a company needs to assess the exact situation it is in, as the crisis has affected industries in different ways. For instance, the travel industry has been hit hard by the decision to lock citizens down in their homes and towns, with international travel and tourism practically non-existent. On the other hand, certain segments of the retail industry – food, in particular – have seen temporary spikes in demand as people have stocked up on supplies.

In some ways, this reflects what happened during the financial crisis of 2008, but what is unprecedented about the current situation is the way in which governments themselves have imposed restrictions on the supply side. Nevertheless, many companies will have passed through, or still be in the grip of, the same stages of panic, paralysis and pessimism that were experienced in the previous crisis. Yet, the intransigency and indecision of one company could be to its competitor’s advantage, particularly as this crisis is one in which governments have much greater control over when companies are allowed to resume business and demand is generated once more.

To be winners in this crisis, companies need to figure out how their businesses will be affected in both the short- and mediumterm, understand what market scenarios they should base their planning on, and revise the levels and hierarchies of their goals – for example, establishing the relative importance of market share, sales and profit.

2. Think in terms of value-based segments

Ideally, a company should already have a good idea of how its customer base is segmented by demand. In other words, what are the different value drivers and reasons for customers to buy the company’s products or services? For example, some customers may be primarily driven by quality, while for others, speed of delivery may be more important – similarly, some customers may highly value ongoing support, while for others, the decision to buy may be driven purely by price point.

If a company does not already have this level of insight, it is vital to now acquire it, because changes in pricing and offering should be based on this information. There is little point in offering a discount to those customers who value quality over all other factors – while they will no doubt be grateful for the price reduction, it’s not the reason they’ll continue doing business with you, and so the discount is effectively wasted on them. Customer segmentation studies can be done via internal expert workshops and focus groups, with external research experts appointed as necessary, to establish those customers who would be most responsive to pricing and offering changes.

3. Understand your customers’ changed needs during the crisis

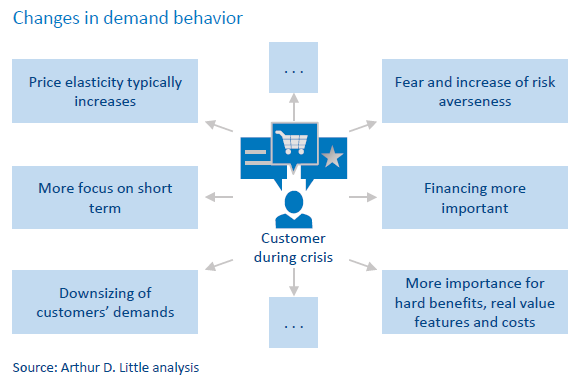

While customer segmentation is important to establish an overall picture of baseline behavior, it is inevitable that the current crisis will have affected their outlook and actions. In many ways, they will have reacted in line with the general mood of business, with concerns over cash flow and a tendency to be more risk averse. Focusing on the short-term, their needs and demands may have been reined in, and they are more likely to examine the value of the products and services that they do continue to buy.

As such, customers may be more responsive to special offers and added benefits, such as more generous financing terms. In fact, many customers may expect to see such pricing and offering changes in a time of crisis – but while for some segments, price changes alone may be sufficiently compelling, others will require further incentives.

In addition, bear in mind that while the crisis may have exaggerated existing traits in customer buying habits, it may also have affected their priorities. Again, this is something that needs to be understood before pricing and offering changes are rolled out, particularly if customers’ priorities remain affected over the longer term.

4. Adapt offering and pricing elements

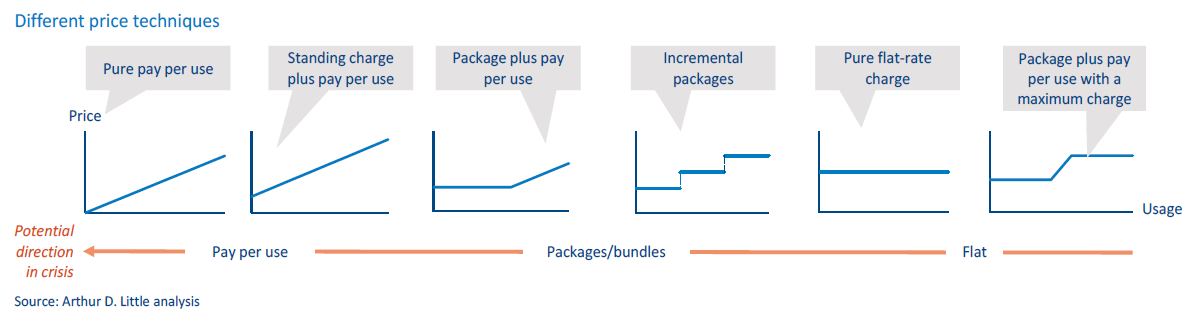

With the company having identified which customers are likely to respond to which stimulus, it is now time to be creative, and to come up with price models and offers that are genuinely compelling. While basic discounts may be effective in driving demand if aimed at the right customers, other pricing innovations may be necessary to reach the broadest-possible spectrum of customers.

Pricing innovations may include:

- Trial periods for products and services – addressing a reluctance to buy when benefits are not immediately tangible.

- Extended warranties and guarantees – addressing increased risk aversion.

- Unbundling pricing elements – enabling customers to pay for just those elements they regard as essential (instead of losing customers’ business altogether).

- Performance-related/pay-by-use models – overcoming customer reservations and addressing increased focus on cost-efficiency and hard benefits.

- Package/bundle pricing – selling more products/services, but at a combined lower price.

- Lower-cost alternatives – retaining business by offering a range of less expensive options.

Companies cannot just assume that the way they charged for products previously will work in a crisis – instead, they need to generate multiple pricing techniques and options to make themselves as attractive as possible to buy from. Any one of these options may be more effective than just slashing prices. While it is easy for a company to focus on merely retaining its existing customer base, opportunities may exist to also grow this base if they respond quicker and more smartly than their competitors.

5. Make intelligent decisions about price levels

If companies are considering lowering prices as an option, it is vital that the mathematics add up. While it is tempting in the short-term to do anything that will generate sales and demand, even if it means the company undercutting itself, this is not a recipe for medium-/long-term success. All pricing actions should be subject to a break-even analysis before being implemented, to understand not only how they impact margins, but also how they might affect different areas of the business – all offers must be sustainable.

It is possible to evaluate the levels at which pricing should be set in a number of ways, such as systematically utilizing expert knowledge within the company to build scenarios, or predicting customers’ reactions to pricing offers via quick and targeted market research. It is important to be as sure as possible that new pricing and offers are likely to be effective before being implemented.

6. Promote and communicate smartly

Once a company is confident that it has the right pricing and offers in place, and understands which customer segments they should be aimed at, additional incentives such as temporary promotions –free giveaways, free delivery, vouchering etc. – should also be considered. Again, the ROI and effectiveness of promotions should be forecast before being implemented, as should the long-term implications for customers and possible actions of competitors – for instance, how long should promotions be offered in order to yield maximum effect without significantly impacting profit?

The way in which pricing, offers and promotions are communicated also makes a big difference to their effectiveness and success. In what order should promotions be shared? Some promotions may achieve the desired effect on sales and should therefore be tried before entering a potential price war with competitors. How can you communicate new pricing and offers in a way that suggests a pragmatic response to an unprecedented situation, and does not damage your brand or undercut your reputation in the longer term?

7. Use the power of pricing psychology

There are numerous sales techniques that use psychological insight into human behavior to boost demand, and many companies will already be utilizing some of them. However, in a crisis, bear in mind that customers may behave in a way that is less rational and more emotional – this may make them more responsive to psychological prompts. For example, “versioning” may be particularly effective, in which three or four product/ service scenarios are offered instead of just one.

Other techniques include “anchoring” products to compare favorably against less or more expensive alternatives and influencing customer choice on a subconscious level via prompts such as “recommended”, “premium”, and “best offer”. Understanding the main principles of psychological pricing and offers and applying them to your business are more important than ever at this time.

For every company, these are difficult and unprecedented times, but it is vital that firms do not fall victim to a short-termist outlook. Instead, there are clear steps that can be taken to not only help businesses survive, but also take advantage of the opportunities that the current crisis period and the eventual recovery offer. Remember that while some customers will double down on suppliers they already know and trust, others will be actively looking for new partners that can offer them maximum value, service and confidence. Pricing and offering are key weapons in every company’s armory for generating demand from both existing and new customers, not just in the shortterm but in the post-COVID-19 mid-term as well.