DOWNLOAD

DATE

Contact

National Oil Companies (NOCs) are spending more and more on R&D. But this has not yet had much of an impact. With the oil price currently well below the break-even point of their nations’ budgets, they are still behind Independent Oil Companies (IOCs) in terms of R&D effectiveness. IOCs have been shown to adjust faster to a new baseline price. Arthur D. Little (ADL)’s framework for E&P Technology management suggests that better focus on delivering the corporate strategy through active portfolio management, and an organizational form that links technology with projects or operations and embeds deployment in budgetary planning, can help.

The continued rise of NOCs in technology development

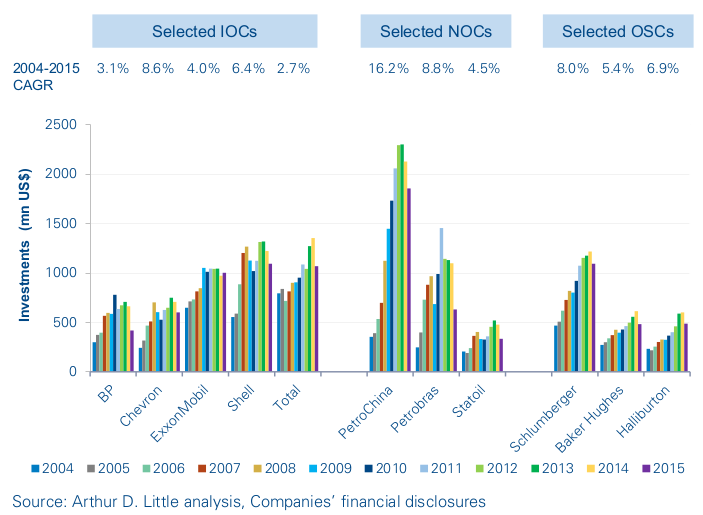

Five years ago, ADL observed a shift, with some NOCs notably increasing their R&D expenditures. 1 With energy demand rising at home and resource nationalism increasing, NOCs began to realize the importance of mastering technology leadership in facing the challenges posed domestically and in their international operations. Since then, some NOCs have raised their technical capabilities and gained confidence in “going it alone” without IOC expertise, while often relying on support from Oil Field Service (OFS) companies. At the same time, IOCs pledged significant investments in new projects for the next five years, partly in an attempt to maintain their technical capabilities. However, the rate of growth for their R&D investment has averaged 5.0% since 2004, whilst leading NOCs have grown at 9.9% and that of leading service companies at 6.8%.

Over this time period, some NOCs (e.g. PetroChina, Petrobras, and Saudi Aramco 2 ) invested more than IOCs and OFS companies in R&D. The technology lead of IOCs has been partially eroded. While some NOCs have established clear leadership in areas of particular significance to them (e.g. Petrobras in deep water and Statoil in arctic environment), others have partnered with peers for access to their resources (e.g. PetroChina with Petrobras).

Figure 1: 2004-2015 R&D spending for selected IOCs, NOCs and OFS companies

R&D spending by NOCs has allowed them to become credible partners to other resource-holding NOCs. Leading NOCs have become more sophisticated buyers, understand better what IOCs and OFS companies can bring, and have developed strategies for technology development of their own.