In recent years, energy solutions have become part of energy utilities’ product portfolios but contribute little to revenues and profits. Companies that dedicate themselves to renewable energy solutions, such as solar photovoltaics, energy storage systems, heat pumps, or charging infrastructure, have been more successful. Demand and legislation to support renewable electricity generation and to decarbonize heat and mobility currently provide an unprecedented foundation for building a successful solutions business. In this Viewpoint, we argue that any energy company can leverage its established customer base to benefit from the thriving energy solutions market.

FAVORABLE CONDITIONS FOR NEW ENERGY

The demand for cleaner, more sustainable energy solutions, such as renewables and technology-supported energy services, is on the rise. Growing awareness of environmental issues has pushed national legislation on decarbonization and an increase in energy efficiency, while global geopolitical instability underscores the necessity of energy independence. Market dynamics and legal requirements have created the optimal conditions for developing new energy solutions into an additional earnings pillar (see Figure 1).

Arthur D. Little (ADL) surveyed approximately 80 German energy companies to assess their progress on the development and business impact of the energy solutions business. More than half of the companies we interviewed currently consider their customers’ evolving needs and are adapting their product portfolio accordingly, while only 8% do not yet provide any new solutions.

EVOLVING MARKET DYNAMICS

Changing market dynamics have been reflected by an increase in merger and acquisition (M&A) deals, with rapid growth toward decentralized and decarbonized energy solutions. Although 82% of companies interviewed doubt the achievability of climate goals for 2030, they still see strong increasing market potential for new energy solutions. The increasing M&A deal dynamics of the EU and its member states at the global level support this outlook. The number of clean energy–related deals within the Schengen region, which includes most EU members and four nonmembers, has grown steadily:

- UK-based Octopus Energy acquired French green energy supplier Plüm.

- US investor Energy Impact Partners (EIP) led a Series C funding round of €100 million (about US $1.1 million) for the German start-up Zolar.

- In 2019, Swiss private equity firm Partners Group acquired CapeOmega, a Norwegian infrastructure company, for €1.2 billion (about US $1.3 billion).

- In April 2023, BayWa sold a photovoltaic portfolio of three solar plants in Spain to the L&G NTR Clean Power Fund, accelerating the development of local renewable infrastructure. Additional deals are expected, such as UK-based Shell’s sale of German battery producer Sonnen, which was valued at more than €1 billion after only four years.

More than 80% of the surveyed German energy companies see tremendous potential in new energy solutions. Infrastructure and renewable energy are the two sectors with the highest growth and earning potential. In Germany alone, the energy solutions business is predicted to grow by at least 6% per annum until 2025. After Germany, the largest markets are France (€3.9 billion, 7.7% growth per annum), Italy (€4.4 billion, 6.4% growth per annum), and the UK (€3.9 billion, 6.5% growth per annum). Eastern European countries show higher growth rates but on a low absolute level (e.g., the Czech Republic has a growth rate of 10.8% and a market of approximately half a billion dollars).

Overall, with an average growth rate of 7% and an expected €37 billion market in 2025, Europe offers great growth opportunities to energy players to position themselves in decarbonization.

NEW ENERGY SOLUTIONS FOSTER PERFORMANCE

Energy players that already offer new energy solutions to their customers are performing better than others. Four-fifths of the energy players we interviewed believe energy solutions are relevant to their business and have observed an increased, specific demand from their customers. This is based on tangible advantages associated with the new energy solutions business:

- Inherent risk to a company is reduced by incorporating new energy solutions, including the reliance on fossil fuels unavailable locally, while regulatory incentives and support help lower costs.

- New energy solutions compensate for decreasing margin contributors in commodity business, especially gas.

- Energy players that concentrate on an environmentally conscious energy portfolio demonstrate enhanced customer satisfaction, increase profits, and convey a more favorable brand image.

A FAVORABLE FOUNDATION

The current political landscape and technology readiness provide an unprecedented favorable foundation for the establishment of new energy solutions. Strong regulatory incentives and governmental support have been implemented since the 2020 launch of the European Green Deal, which is pushing the transition toward new energy solutions. Climate-friendly initiatives within individual nations and across the EU have been promoting energy efficiency, infrastructure, and renewable energies. For instance, governments have taken various initiatives to set stronger energy standards and granted various financial support mechanisms to support related projects:

- In Spain, EHE-08 allows the use of recycled concrete aggregates.

- The German Buildings Energy Act/Gebäudeenergiegesetz (GEG) establishes standards for energy-efficient construction and refurbishment.

- The objective of RE2020 in France is to make the construction industry carbon-neutral by 2050.

- In the UK, the 2025 Future Homes Standard (FHS) mandates the construction of more energy-efficient buildings.

Moreover, technological readiness and support for digital solutions and/or AI play a crucial role in establishing new energy solutions. Digital solutions and AI have improved weather and energy demand forecasting in the context of energy trading, optimized integration of renewables to the grid network, and enabled predictive maintenance. To this aim, some energy players are concentrating on developing AI-supported software in-house, such as watsonx, IBM’s commercial generative AI and scientific data platform, and the Siemens Xcelerator. EnBW (Enpulse) has also developed its own solution, the spin-off Levl, which uses AI-based software to make battery storage capacities tradable on the electricity exchange.

Other energy companies have actively sought to acquire state-of-the-art software solutions corresponding to their needs. For example, the recent acquisition of tech start-up Kwest by Octopus Energy’s tech arm Kraken helps the energy company boost operational efficiency for heat pumps, smart meters, and solar installations across Europe. Finally, these services can be externalized to independent companies, following the US model of the cleantech company AutoGrid (acquired by Schneider Electric in 2022 with Uplight planning to acquire it next). Its software solutions enable prediction, optimization, and real-time control of energy assets in virtual power plants and can be used by any energy player, be it industrial power generation or utility-scale.

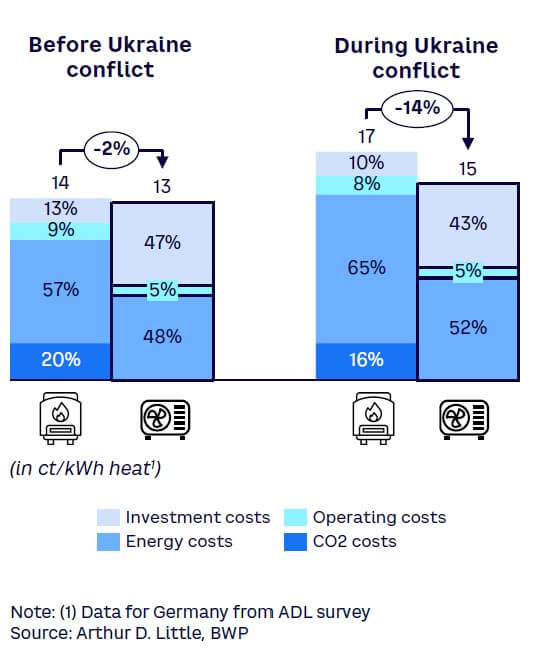

Furthermore, the pricing crisis among traditional energy sources has increased fuel costs and customer sensitivity toward potential changes in formerly stable prices. This resulted in, for example, more attractive individual business cases for electricity-driven heat pumps (see Figure 2). The partial or full withdrawal of former subsidies on conventional technology across most European countries and the introduction of CO2 pricing have made new energy solutions more cost-effective and attractive.

THE WINNING TRIUMVIRATE: COMMITMENT, FOCUS & ADAPTED MANAGEMENT

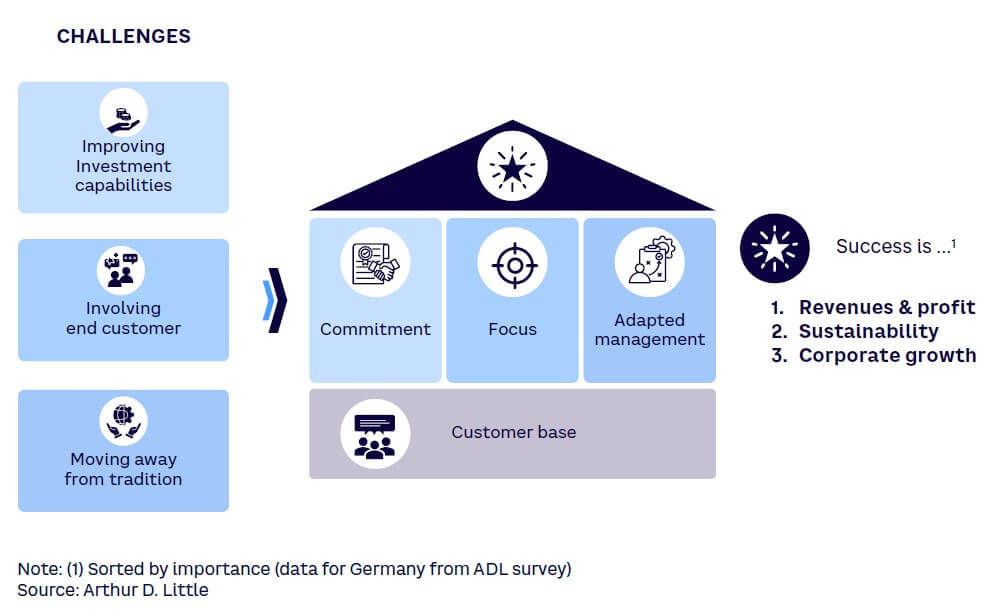

While the new energy solutions business seems highly promising, a successful business requires a series of widespread changes (see Figure 3).

Energy players often underestimate the challenges they face; most companies that took part in our survey prefer a continuous, slow adaptation rather than the disruptive, potentially high-risk-bearing introduction of new operating models and new products. With this in mind, most energy companies believe in leveraging their current customer base as their main success factor; they can build upon the established trust and relationship, and channels are already in place to introduce new products and limit their investment needs. While building on these assets is certainly a crucial foundation for success, we would like to underline the importance of the three additional guiding principles: commitment, focus, and adapted management:

- Commitment is one of the most critical success factors. Companies developing their energy solutions business should:

- Have a common ambitious goal to support full growth potential, encouraging a CO2-free strategy rather than undertaking cost-cutting measures. In our survey, only a few energy players mentioned environmental protection as a success indicator; most prefer to focus on revenues and profits. However, we encourage companies to commit to a more sustainable business, in alignment with current and future European directives, based on the European Green Deal and the associated Corporate Sustainability Reporting Directive (CSRD).

- Build and retain new, necessary capabilities and resources. The success of financial investments must be measured by adapted indicators, including environmental impact, and a longer ROI should be expected.

- Target specific companies active in the energy solutions business and hire relevant experts and personnel.

- Identify motivated and qualified employees early and invest in their upskilling and re-skilling toward altered and partially new competence profiles.

- Prepare and embrace change by adapting delivery models, modifying the supply chain, and strengthening positions with specialized partners.

- Accept a certain amount of risk that comes with this ambitious goal.

- Focus on a specific technology or service line for a key target group. This depends on intrinsic factors for each company and may include its size and actual financial health. Using these factors, the company should:

- Consider which energy solutions are relevant and which aren’t.

- Decide on the key target customer groups.

- Evaluate the depth of its own value chain for the chosen focus and develop a business development plan accordingly.

- Adapt the management approach. Success requires a different setup than traditional commodity businesses:

- If possible, manage an independent setup to focus on the development of this particular business and ensure independence regarding group policy to avoid additional complexity and allow more agile decision-making processes.

- Develop a tailored governance approach (which will differ from commodity sales) with specific key performance indicators (KPIs).

To date, only a few energy companies understand how to benefit from new energy solutions and have managed to tackle the associated challenges. Building on the know-how of energy markets is a plus when establishing a new business. Nevertheless, required customer-centricity and capabilities differ to a large extent, compared to traditional commodities businesses. Building on established processes, roles, and organizational structures can become a “false friend.” Our survey identified three factors that help successfully build and grow a new energy solutions business:

- Move away from tradition. Energy companies have focused on commodities for a long time, developing their capabilities and company culture accordingly. Companies know that this traditional positioning is not suitable for new energy solutions and that innovative, deep changes to culture and management are necessary to succeed in this new sector. The energy companies that participated in our survey recognize that decentralized solutions require decentralized implementation for practical reasons. The installation on-site of such solutions for each end customer, however, constitutes a huge challenge for traditional energy businesses. Furthermore, the new competitor landscape involves numerous smaller players, including highly specialized and agile start-ups. This results in a homogeneous distribution of small market shares with no established big players.

- Improve investment capability. The new energy solutions market is volatile and not yet mature, with unprecedented business models. Therefore, flows of capital must be invested with the expectation of slower and potentially lower returns, especially at the start and if infrastructure solutions are involved. At least two-thirds of the interviewed companies acknowledge that investing decisions are highly challenging.

- Actively involve the end customer as early as possible. Understanding this new market and the corresponding opportunities is a challenge for traditional energy companies, which lack adequate customer feedback mechanisms and standardized delivery models. More than half of the energy players we interviewed view this aspect with moderate concern.

Conclusion

CREATING A NEW ENERGY FUTURE

While traditional commodity businesses are losing traction, and current regulations encourage alternative solutions, energy players have the chance to build a sustainable and long-term profitable business. Leveraging their established customer base for cross-selling complementary solutions will build the foundation. Furthermore, there needs to be a strong commitment to invest and embrace change. Business development benefits from a product-specific deep focus, ambitious targets, and an adapted management system to steer a young business. Successfully meeting these challenges is a sustainable investment in the future — both in potential new core revenue carries within energy players’ portfolios and in our planet’s health.