DOWNLOAD

DATE

Contact

Financial institutions in the Middle East have adopted environmental, social, and governance (ESG) as a key strategic element in their commitment to going green. As more reporting requirements become mandatory, and stakeholders determine the need for a comprehensive approach to ESG, these institutions have responded by shifting their focus from defining an ESG strategy to implementing it, with data governance playing a key role. In this Viewpoint, we offer a two-part scalable solution for complex data to enable banks to efficiently manage ESG information.

Many financial institutions in the Middle East have designed comprehensive ESG strategies that open the door to new pathways to top-line growth, business opportunities, cost reductions, regulatory compliance, and employee satisfaction. With new reporting requirements taking effect, banks are facing an urgent need to kick-start their strategies and execute concepts throughout their organizations. In implementing their ESG strategies, banks are finding that the complexity of ESG data has not been entirely captured and addressed by current data governance frameworks, leaving these banks to resort to ad hoc solutions for collecting, managing, and governing ESG data.

The challenge of maintaining data transparency and high standards of quality is amplified in the context of ESG, as requirements are often not yet fully standardized or detailed by regulators. In addition, certain ESG data use cases that existed prior to the strategy need to be incorporated within the new initiatives to ensure consistent reporting while accounting for different forms, purposes, and requirements of each application.

Considering the challenge above creates the need to govern data and to guide ESG implementation while reworking the process to make it more efficient. Arthur D. Little (ADL) has proposed a comprehensive, efficient, and scalable framework to ensure the transparency and quality of ESG data, which will allow banks to address challenges in ESG implementation proactively.

ESG’S LONG-TERM IMPACT ON GLOBAL FINANCE

ESG has become the new normal for financial institutions. Perhaps the most significant sign of this remains in the products and services being offered by banks, which reflect their sustainable ambitions. The volume of global sustainable debt instruments reached a staggering US $1.47 trillion in 2021, which is more than double the 2020 amount; green bonds alone brought in more than $480 billion. A 2021 report from Bloomberg Analysis noted that the ESG market is on track to exceed $50 trillion by 2025. This growing trend demonstrates the momentum that ESG is gathering in financial institutions, as the world’s banks increasingly emphasize ESG and infuse it into their business models. An examination of strategy implementation shows banks at both ends of the spectrum: some banks are found lacking, whereas others are well underway.

Green issuances from countries in the Middle East and North Africa (MENA) are not standing still, but are in fact outpacing global growth. An impressive $24.55 billion in green and sustainable finance was generated by the MENA region in 2021, an increase from 3.8 billion in 2020, achieving an extraordinary 532% year-over-year (YoY) growth. Qatar, home to the MENA region’s biggest bank, has enacted a series of initiatives to make at least $75 billion available for sustainable investments, as explained in Invest Qatar’s ESG report. Led by UAE’s First Abu Dhabi Bank, Majid Al Futtaim’s fundraiser gathered $1.25 billion in 2022 as the credit facility linked to the company’s ESG goals. The National Bank of Bahrain, another prominent bank going green, has been actively working to embed ESG principles into its business model and culture; the majority of its workforce has attended at least one ESG training as of this writing.

RESPONDING TO TIGHTER REPORTING REQUIREMENTS

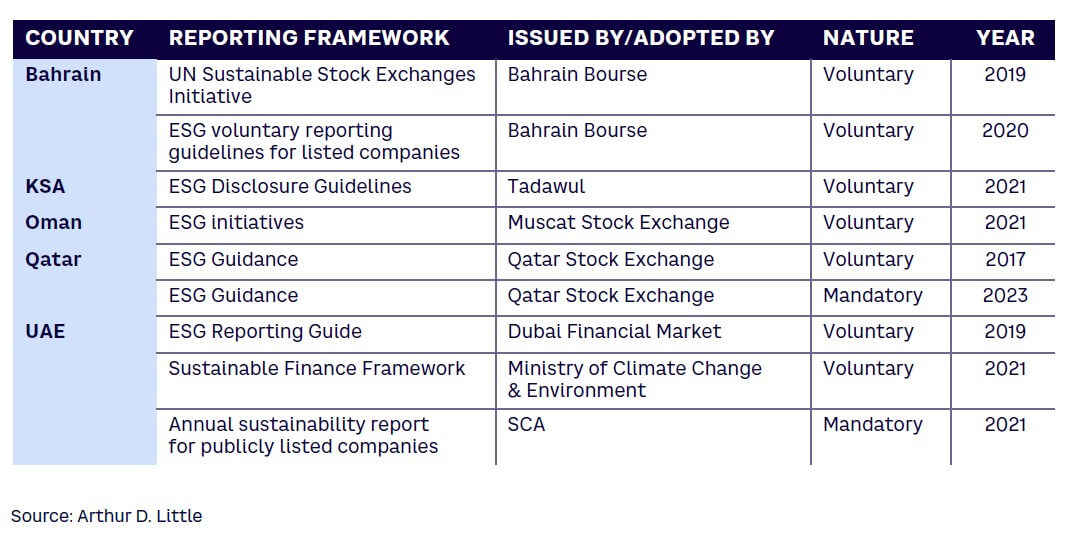

In recent years, regulators across the world have strived to adopt earlier regulatory requirements and frameworks and issue new ones, particularly within ESG. International regulatory bodies, such as the widely adopted GRI framework and International Financial Reporting Standards S1 and S2 are expected this year. Similarly, the Middle East has witnessed a rise in ESG awareness through specific reporting requirements and frameworks for banks, which are increasingly moving from voluntary to mandatory reporting.

The United Arab Emirates (UAE) and the Kingdom of Saudi Arabia (KSA) have led, enacting rules back in 2021; Qatar is looking to make ESG reporting mandatory some time in 2023. The region’s dynamic regulatory environment is summarized in Table 1.

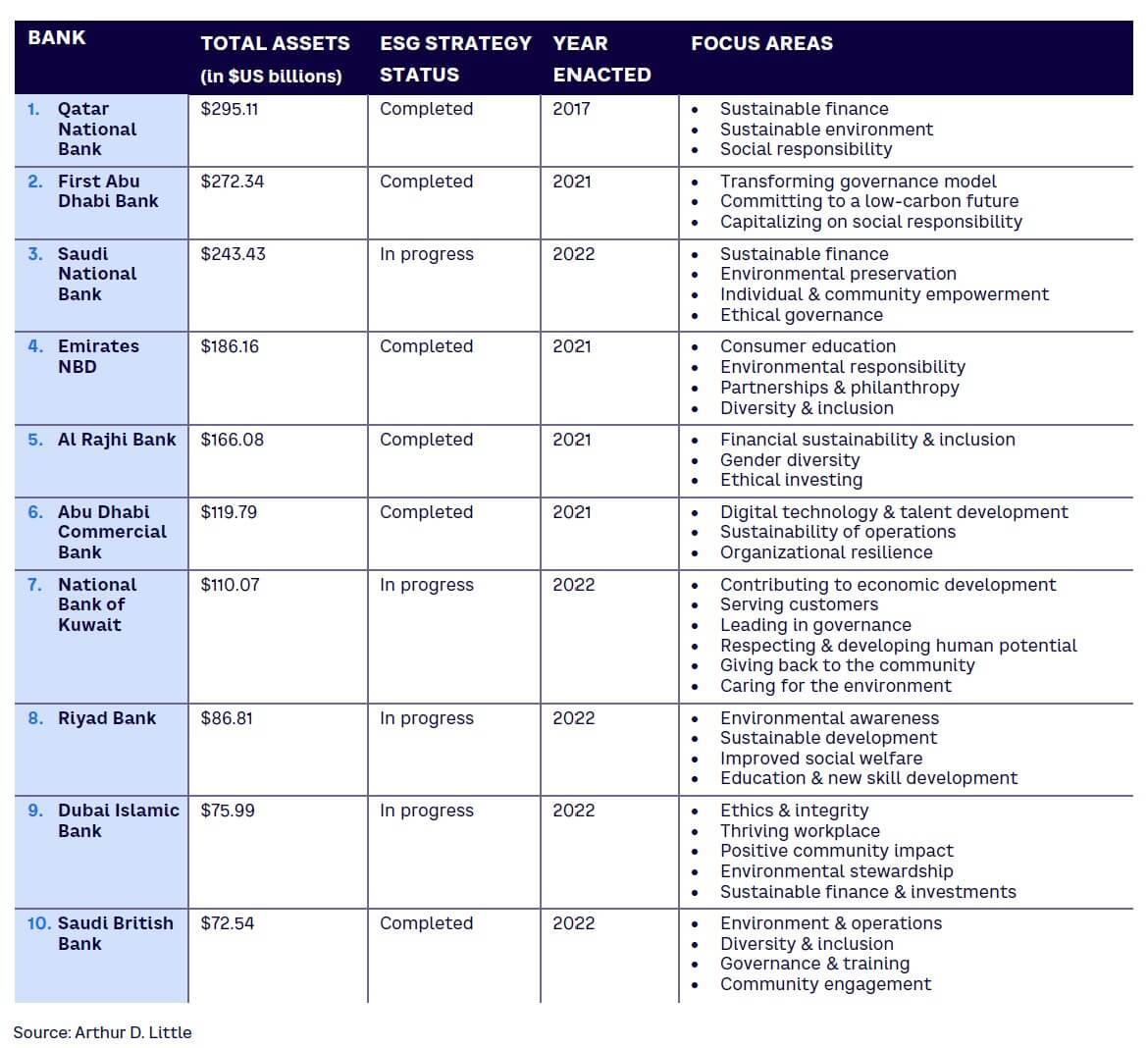

Though most reporting requirements remain voluntary, there is a clear trend toward mandating external reporting in the future. Financial institutions in the Middle East must design comprehensive strategies to cover the spectrum of ESG applications and comply with stronger reporting requirements. Table 2 details an examination of the region’s largest 10 banks by assets in 2021, using information from each bank’s official website and provides an overview of ESG strategy implementation in the Middle East. An “in progress” status signifies a strategy is in place but is not yet comprehensive.

HANDLING COMPLEX DATA: FROM STRATEGY TO IMPLEMENTATION

Banks in the Middle East have embraced the importance of a well-defined ESG strategy. During the next step, implementation, frameworks such as data governance are vitally necessary. The shift from strategy to implementation is complex and detail oriented. Different use cases of ESG have different data requirements and multiple stakeholders who add to the complexity. Thus, there is no standard “one size fits all” in regards to ESG data. Banks face three key challenges on the path to implement their strategies:

-

Dynamic ESG data requirements. The nature of ESG, with its constantly evolving and increasing requirements, complicates matters for external ESG reporting. In addition to external reporting, ESG use cases include applications such as internal reporting, risk control, and addressing business needs. Each use case has its own requirements, including internal and external applications, reporting or business need uses, and forward- or backward-looking scenarios.

-

Lack of data availability and transparency. A lack of transparency currently surrounds which data already exists within an organization and which use cases it is applied to. Some ESG data points already exist within a particular bank, while others need to be sourced externally from clients or vendors or developed internally from existing data points. When data exists within existing databases, it may be on different platforms and sometimes under different names or metrics. Even a centralized ESG department may struggle with a lack of clarity and find itself unable to find, sort, and use existing data.

-

Inconsistent data quality. ESG covers a range of applications across an organization and requires expertise from various sources. Ensuring data quality is a significant challenge when responsibilities are not clearly assigned. This is even more true because typically there is no preexisting framework for new ESG data that is not yet sourced or procured by banks. As a result, data is often wrongly interpreted or used inconsistently across use cases.

ENSURING TRANSPARENCY & QUALITY: A TWO-PART APPROACH

ADL recommends a two-part scalable solution to resolve the difficulties of complex data and enable banks to properly and efficiently manage ESG information. During the first step, an ESG data catalog is created to ensure transparency through a nondisruptive and easy-to-incorporate layer. Setting up a governance framework to ensure quality control in a scalable, structured approach is the second step.

Making data transparent with ESG data catalog

The data catalog acts as a centralized repository that logs all the ESG-related data points. A data catalog should not be confused with a database; the catalog does not store specific data. Rather, the catalog contains data points that refer to the stored data. In other words, it acts as a catalog of data clusters — a tool to provide clarity on where data resides, who is responsible for it, and what it is used for. Our suggested approach offers data transparency without disrupting the existing data landscape of the bank because all catalog users can view which use cases exist for a cluster.

Prioritizing use cases is a key aspect of ADL’s approach to developing the ESG data catalog, which allows for a targeted and efficient approach. We suggest using the following three characteristics/elements to determine prioritization:

-

Nature of the reporting requirement — can be either external or internal; data used for external reporting receives priority.

-

Reporting due date — serves as a deadline for gathering and structuring data; priority assigned to the soonest due date.

-

Use case history — distinguishes between new use cases and existing ones, and prioritizes accordingly. It’s crucial for users to fully grasp the meaning of the data they seek, its location, its use cases, and its importance.

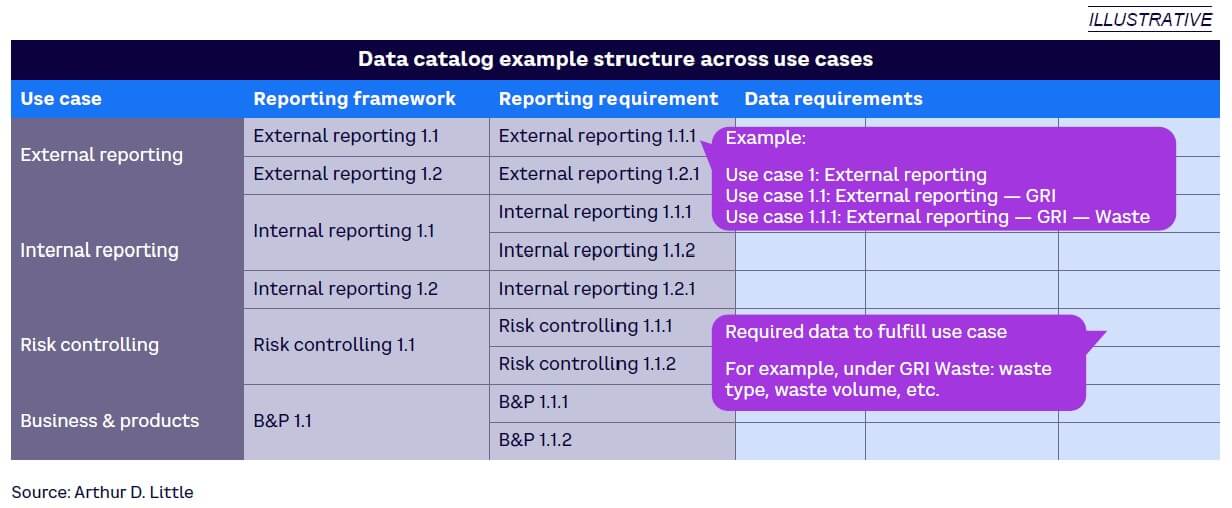

The ESG data catalog uses a top-down structure, with data clustered into use cases (see Figure 1). This fosters a targeted approach to identifying and structuring data points from requirement to application while ensuring that prioritized ESG use cases are completed first. This creates a stepwise approach to expand the ESG data catalogs application in the future.

Quality control in data governance framework

As data goes through its lifecycle — creation, storage, usage, archival, quality control, and destruction — it needs a process to designate clear alignment of responsibility and ensure quality across the ESG use cases. Identifying the ESG data owner is key to our recommended approach. The data owner serves as a manager who is responsible for quality control of specific data points as they are being used for the different ESG use cases.

To ensure the framework’s future success, we have defined three necessary attributes for the development of a data governance framework:

-

Scalable. The framework should be built around comprehensive dimensions that can expand and adapt to the bank’s structure and requirements. As ESG data requirements continue to evolve, the dimensions should keep the future in mind and be designed around the types and sources of data, rather than specific ESG applications, ensuring the framework can be applied into the future.

-

Tailored. The framework should be tailored to the specific bank’s structure and ESG requirements, accounting for the existing organizational and ESG governance structures currently or recently put in place.

-

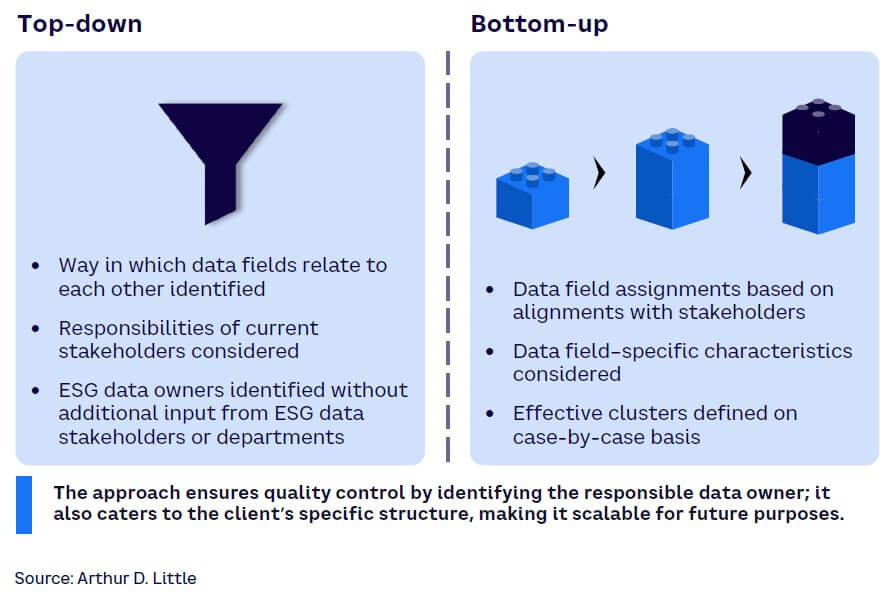

Flexible. The dimensions should not be mandated but instead used as an initial draft of the bank’s assignment of responsibilities. A combined top-down, bottom-up approach (see Figure 2) can ensure the actual skills are taken into account as ESG applications continue to be implemented.

Conclusion

BENEFITS OF COMPREHENSIVE STRATEGY

Banks encounter unique challenges as they put their ESG strategies into action. A comprehensive ESG strategy covers a range of external and internal applications and can help financial institutions move toward the sustainable future they seek. Because data governance is central to a fully developed strategy, we propose a framework built around an ESG data catalog with the following three features:

-

Emphasis on data transparency and quality that does not disrupt existing data landscape.

-

Anticipation of future ESG-related needs.

-

Support for handling complex data requirements in an ever-evolving regulatory environment.

Overall, financial institutions have embraced ESG, which is gaining momentum and wide-reaching acceptance. A well-developed, thoughtful approach that considers the framework outlined in this Viewpoint can create the conditions for future success.