Luxury hospitality has experienced a period of prosperity given the rising growth in the world’s affluent population and that segment’s desire for exclusive experiences. This trend, coupled with a limited supply in premium locations, is driving investor interest in luxury hotels. Personalized luxury experiences, new wellness offerings, sustainable practices, unique culinary ventures, and a culture of excellence are commanding daily rates of US $3,000 or more. This Viewpoint explores these trends and the levers for success.

LUXURY SECTOR GAINING MOMENTUM

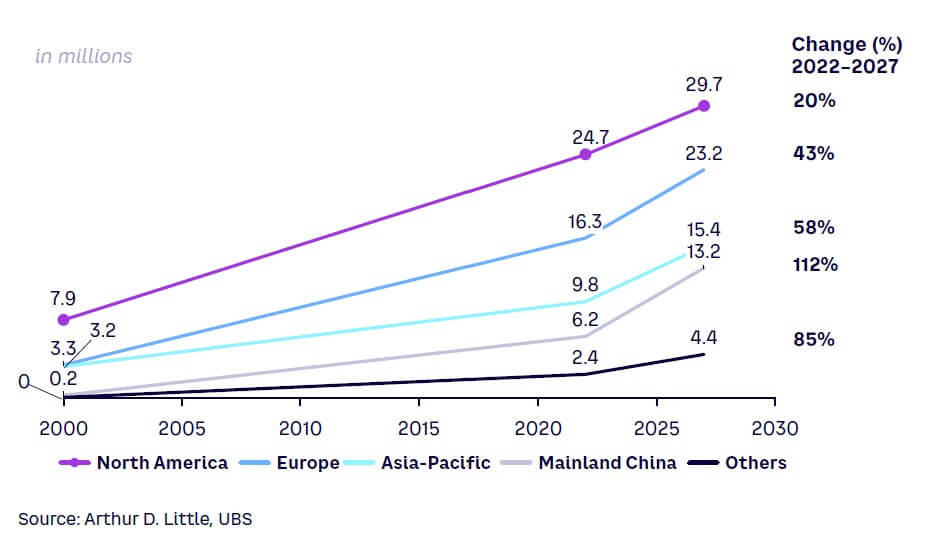

Several factors are driving the growth of the luxury market, including an increase in the number of millionaires worldwide, the strong restart of China’s luxury market, and evolving consumer preferences toward luxury goods and exclusive experiences. According to UBS, there will be more than 85 million millionaires in 2027 (see Figure 1), a rise of 26 million from today and 71 million from the beginning of the century. In 2022, 42% of this segment was concentrated in North America and 27% in Europe, but China expects to reach 13 million millionaires in 2027, a 112% growth for the 2022–2207 period.

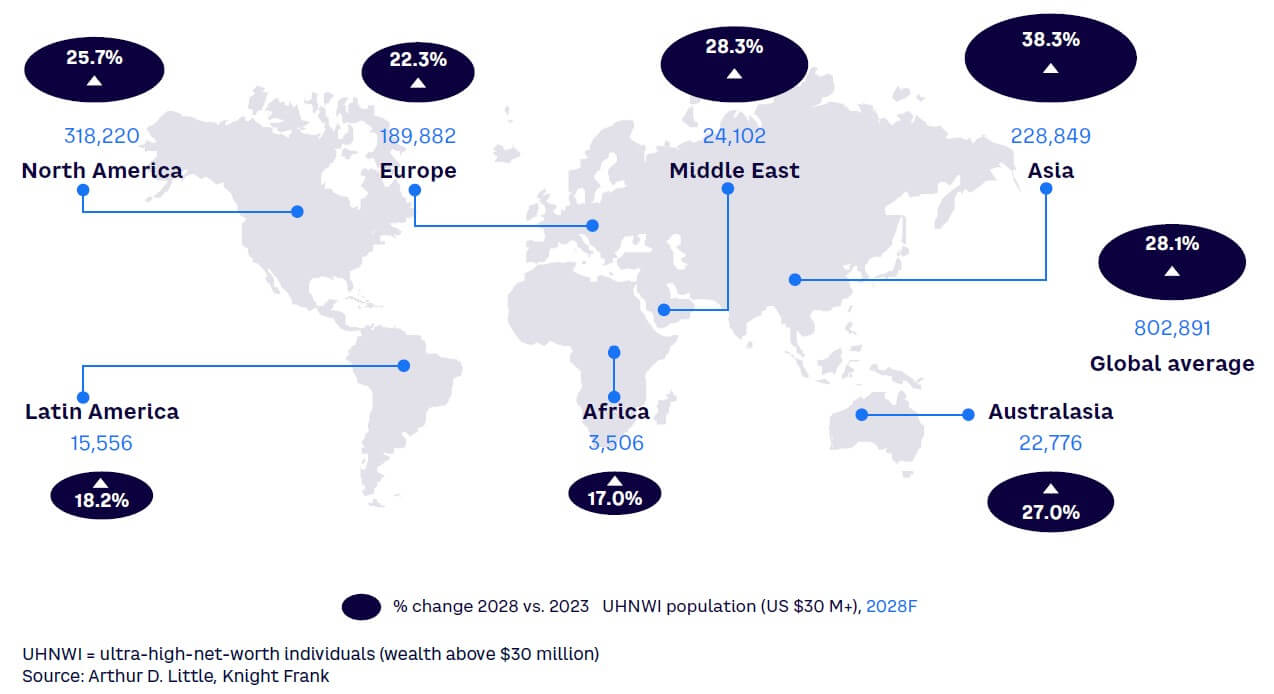

According to a recent Knight Frank wealth report ultra-high-net-worth individuals (UHNWIs, with wealth above $30 million), rose globally by 4.2% to 626,619, with North America (7.2%) and the Middle East (6.2%) being the main drivers (see Figure 2). This wealth creation was supported by global economic growth and the upside of key investment sectors: the equities markets surged on the back of enthusiasm surrounding AI (S&P Global 100 delivered a 25.4% annual increase in 2023), residential capital values grew 3.1% across the world’s leading markets in 2023, and gold (up 15%) and Bitcoin (up 155%) delivered positive results. The number of UHNWIs is expected to rise by 28% in the next five years (to 2028), with Asia (38%) and the Middle East (28%) experiencing the highest growth.

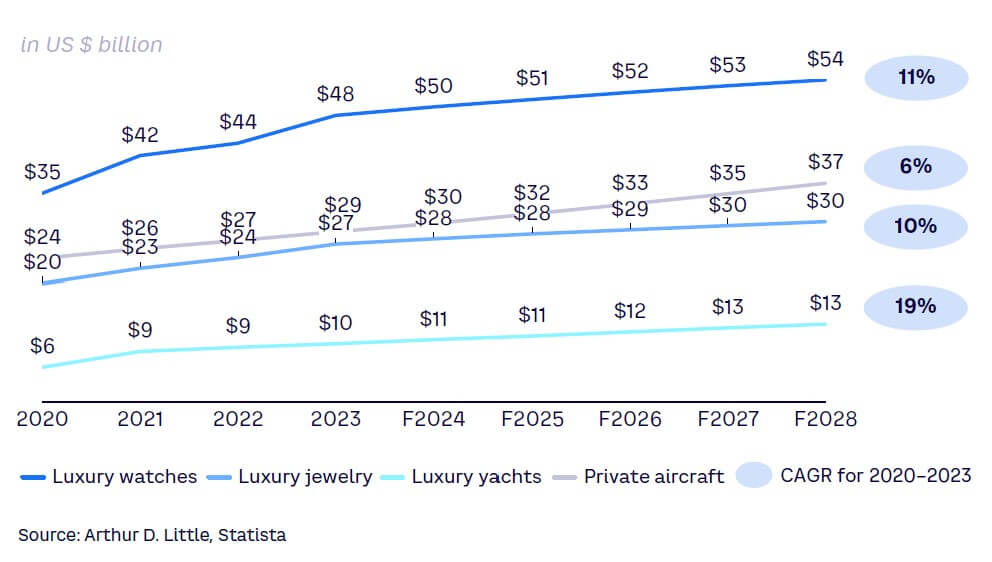

This increase is driving the growth of the luxury sector worldwide. For example, average prices in the secondhand market for top watch models from the three largest luxury brands (Rolex, Patek Philippe, and Audemars Piguet) rose at an annual rate of 20% between 2018 and 2023. The luxury yacht sector is forecasted to reach $13.2 billion in 2028 (a 19% increase for the 2020–2023 period), while the luxury watches market is expected to reach $54 billion in 2028 (an 11% annual increase for the 2020–2023 period) — see Figure 3. In the luxury car market, iconic brands have experienced significant growth. In 2023, Lamborghini sold more cars than ever, breaking the 10,000 units barrier — the first time in the brand's 60-year history that it has broken into five figures.

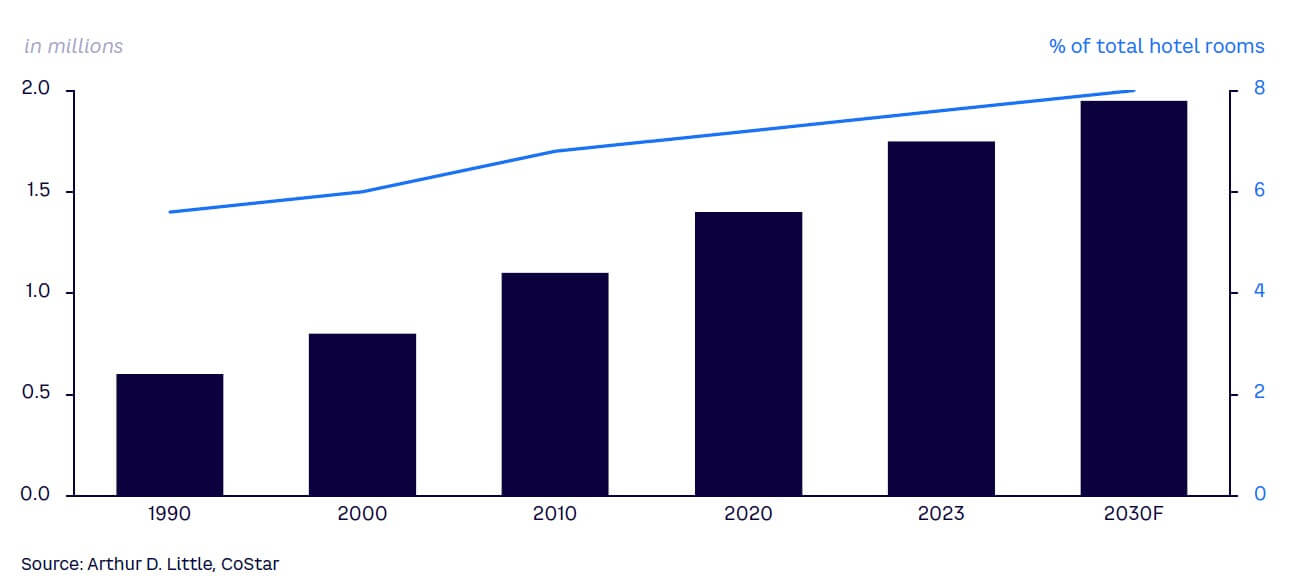

Not surprisingly, the luxury hotel sector is also on the rise. According to specialist real estate information company CoStar, the number of available global luxury rooms could reach 1.9 million in 2030, up from 1.6 million in 2023 (see Figure 4). Despite growth in available supply, hotel chains are struggling to meet demand, which stems from an increase in both affluent travelers and the aspirational segment of the middle class who desire to more frequently travel through unique experiences for birthdays, destination weddings, honeymoons, and so forth. Business travel is pushing demand for luxury rooms as well: mid-level and senior managers are splurging on plush retreats as a way to reinforce corporate culture and reward employees.

THE RISE OF LUXURY DESTINATIONS & OPERATORS

In the past few years, luxury tourist destinations like the Maldives began diversifying beyond honeymooners to families and groups. This broader demographic will support higher occupancy and room rates in the coming years while increasing the average length of stay (which in the Maldives was 6.3 days in 2019 and 7.6 days in 2023).

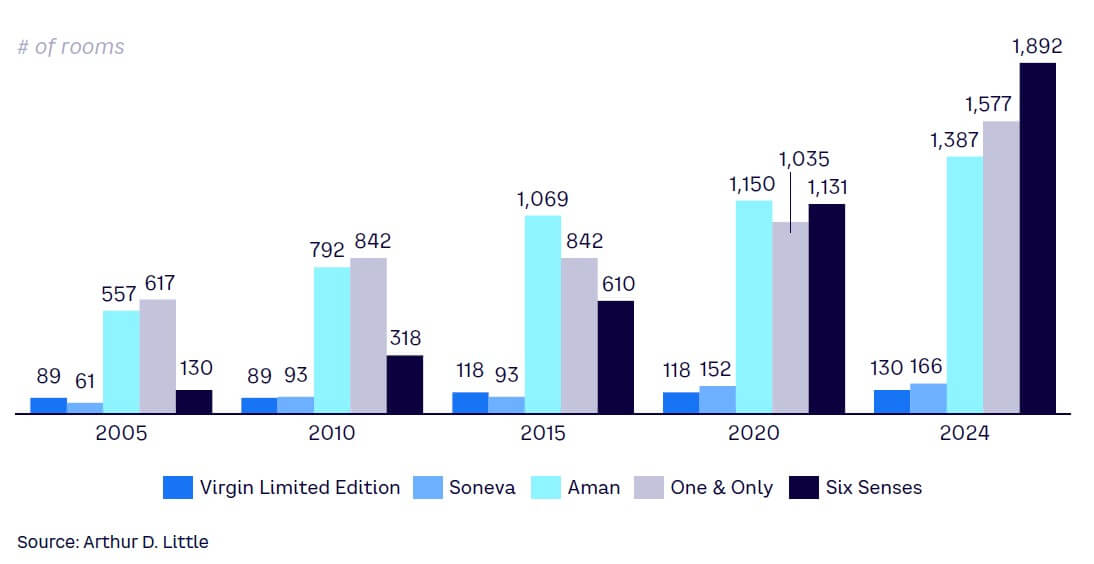

Luxury hotel expansion is driven in part by specialized operators; Six Senses, for example, shows annual growth of more than 14% since 2005 (see Figure 5); other brands like Aman Hotels with almost 1,400 rooms in 2024 and an annual growth of 5% for the same period also stand out. Smaller firms experienced more moderate growth; Virgin Limited Edition and Soneva had annual growth of 2% and 5%, respectively.

This growth is attracting new investors such as property developers and buy-out barons, attracted by the sector’s profitability. According to specialized real estate firm JLL, the annual rate of return on such properties exceeded 6% in 2022, the highest in a decade.

For example, Aman Group received more than $1 billion from investors, including Saudi Arabia’s Public Investment Fund (PIF), which, in December 2023, also paid $1.8 billion for a 49% stake in Rocco Forte, a British boutique firm that owns Brown’s Hotel in London, UK, and Hotel de Russie in Rome, Italy.

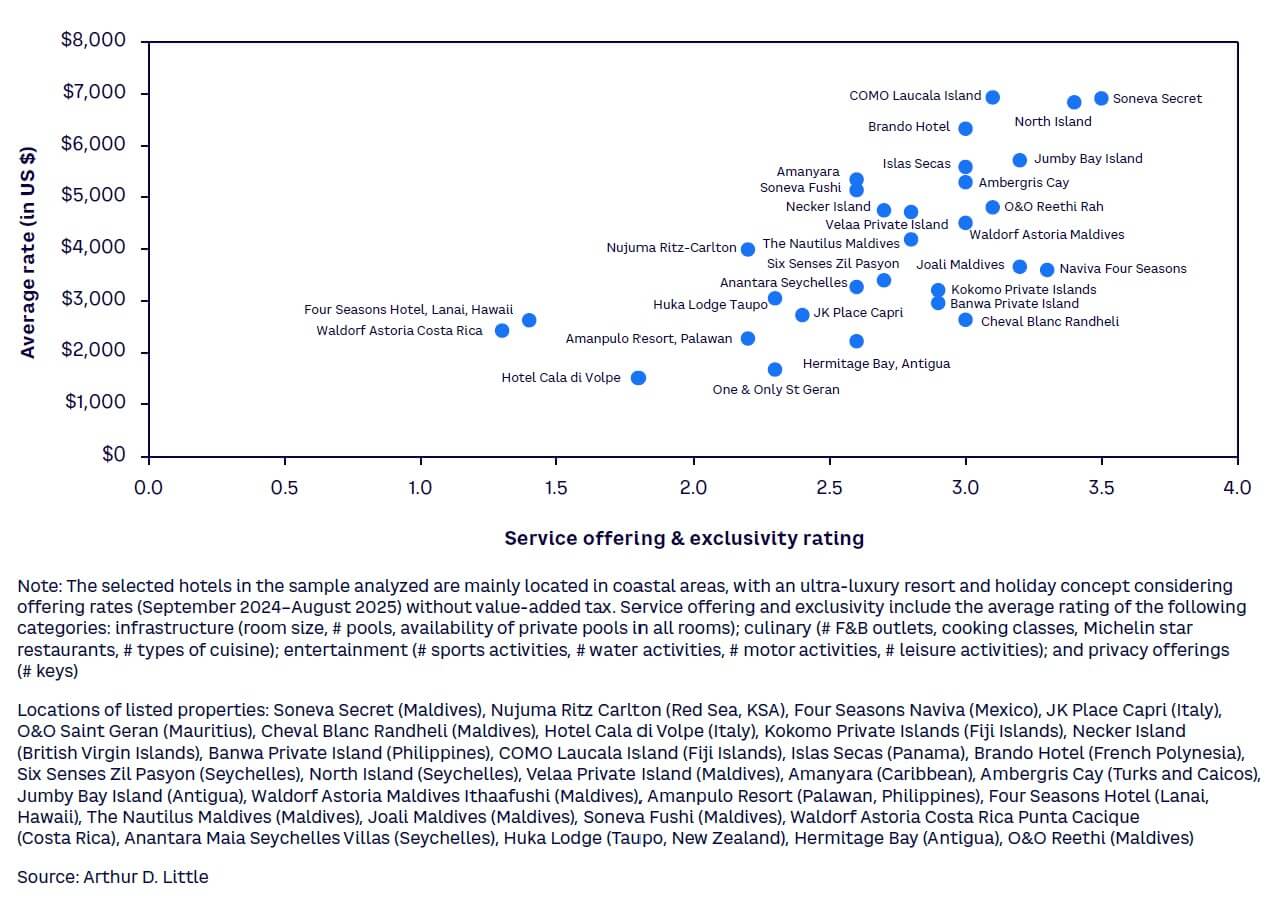

Luxury hotels are increasing their range of exclusive services, reinforcing their culinary offerings, and expanding their wellness and well-being experiences. They also offer privacy and exclusivity, with a limited number of rooms (some hotels have less than 20) and remote locations, including private islands.

These factors, combined with bespoke service, high levels of comfort and convenience, and sustainable and ecologically responsible facilities, allow luxury hotels to achieve average room rates of about $3,000 or more per night (see Figure 6).

5 KEY DIFFERENTIATORS

The meaning of luxury hospitality is shifting. Affluent customers increasingly value unique experiences over huge rooms and vibrant atmospheres over opulent formality. Our analysis of consumer-spending data substantiates the idea that interest in recreational educative and immersive experiences is rising, while interest in nonessential goods is subsiding. Luxury hotels are embracing their surroundings and offering curated cultural immersion experiences (e.g., indigenous traditions and crafts), connecting guests with the essence of their destination and enriching their travel experience. Based on our experience in the luxury hospitality sector, we identify the following five differentiators:

1. Personalized exclusive experiences

With the prevalence of social media, visitors are better anticipating their travel experiences, making it more difficult to surprise guests with memorable stays. The recent opening of Soneva Secret in the Maldives illustrates this effort. With just 14 villas, the exclusive resort features accommodations with roofs that open to the stars, dedicated assistants (a “barefoot guardian,” a “barefoot assistant,” and a private chef for each villa), and a staff-to-room ratio well above average for the luxury hotel sector. The level of privacy is also unique: the resort is built on a remote, mostly untouched atoll, where dolphins and whales often swim by. When snorkeling or scuba diving, guests can be among the first to discover the reefs, far away from crowded sites elsewhere in the Maldives.

Luxury boutique hotels also focus on customized, authentic experiences. For example, a chef comes at breakfast time and asks what you would like for dinner, then sends you photos of fresh fish at the market or invites you to join him or her.

In addition, luxury hospitality and brands are working together to engage customers in personal and memorable ways — Four Seasons has started including luxury watches and bags that guests can borrow during their stay, and Mandarin Oriental Jumeira has reintroduced the Vacheron Constantin Suite in Dubai.

2. Ultimate wellness & well-being offerings

Luxury travelers are paying more attention to their health and well-being, a trend fueled by the pandemic and the explosion in wearable fitness technology. Luxury hotels are responding with a range of innovative solutions to enhance guest wellness, including exclusive yoga retreats, advanced sleep offerings (e.g., smart beds, sleep trackers to adjust body temperature, and smart curtains connected to an alarm clock), and new spa treatments like hyperbaric chambers and cryotherapy.

Ultra-luxury wellness retreat Sensei Porcupine Creek in Palm Springs, California, USA, organizes an exclusive three-night tennis program for guests in partnership with the Indian Wells Tennis Garden. The program, with rates beginning at $8,950 per guest, is led by Tommy Haas, who competed on the Association of Tennis Professionals Tour for more than 20 years and earned 15 titles. Program guests have access to Sensei’s world-class wellness and tennis offerings, paired with specialty experiences such as court time with Haas. They also enjoy exclusive behind-the-scenes access at the renowned Indian Wells Tennis Garden and a chance to play where the pros play (the 16,100-seat Stadium 1). Luxury brands such as Dior have expanded their chain of branded spas in luxury hotels worldwide, allowing guests to experience “Dioriginel” beauty rituals, which bring to life the brand’s stories and values.

3. Sustainable offerings

Sustainable luxury hotels are carving out a welcome niche in the hospitality industry, striking a balance between elegance and responsibility. They prioritize reducing their environmental impact with fine linens made from organic cotton and farm-to-table dining options using locally sourced ingredients. Hotels like the Six Senses Southern Dunes in Saudia Arabia and the Four Seasons Maui at Wailea (Hawaii) offer ecotourism packages and regenerative tourism so guests can immerse themselves in local customs and contribute to environmental-preservation efforts.

Sustainable luxury hotels focus on preserving the environment and local culture and/or reducing their carbon footprint by using renewable energy sources and effective waste management systems tailored to their locations. For example, Soneva Fushi in the Maldives uses solar power and turns waste into valuable resources; 1 Hotel Central Park in New York City combined responsible construction with an environmentally friendly design that uses reclaimed woods and recycled materials; and the Lefay Resort & Spa Lago di Garda in Italy used thoughtful construction as part of its clear commitment to preserve the natural beauty of Lake Garda.

4. Unique culinary journeys

The range of dining experiences in ultra-luxury hotels is enormous. You can have a bespoke lunch created by your private chef in your villa or anywhere around the atoll. Or perhaps you prefer to dine barefoot on a virgin beach or picnic on a deserted shore. Other luxury hotels work to surprise guests with totally unexpected culinary experiences. For instance, Badrutt’s Palace Hotel, a legendary hotel in the heart of St. Moritz, offers a Peruvian restaurant to guests despite outside winter temperatures of -15 degrees Celsius. Badrutt’s is known for inviting in Michelin-starred chefs and creating pop-up food and beverage concepts, in addition to its existing deluxe food menus.

5. Culture of excellence

A culture of excellence has become the most powerful differentiator in the luxury hotel sector. This is powered by staff that anticipate customers’ moods and needs, seek to exceed expectations, and help create cherished memories. Guests say the top factor influencing customer loyalty is “an experience worth paying more for.” In other words, the experience, not the product, is most important in the luxury segment. Every touchpoint with the guest is relevant, no matter how insignificant. For example, doormen are crucial to creating an impression, since they are the first people guests interact with when they arrive and the last people they see when they leave.

Setting the scene is fundamental to creating unforgettable experiences for guests. Staff understand that they are “on stage” and that whenever they are near a guest, it is “show time.” Employees must also expect the unexpected: since luxury hotels are a “home away from home” for guests, they should be able to change their minds and preferences without the level of service being affected.

Luxury hotels excel in the art of anticipation, leaving no stone unturned to ensure a seamless and delightful guest experience. From arranging chauffeur-driven transfers and providing personal butlers to preselecting preferred room amenities, they strive to anticipate guests’ needs before guests articulate them. Some hotels even bring the standard of excellence to the next level; the GM of a luxury hotel once shared with us that when a guest lost her wedding ring while swimming, he hired a metal detector service to look for it, returning the ring to the client at dinner — creating unique memories for their guests.

This type of service only happens when staffers have a deep understand of who they are serving. Customer relationship management systems with large volumes of data can help track repeat customers’ preferences and distribute this information to staff in a timely, efficient manner, setting the stage for an extraordinary hotel stay.

KEY LEVERS FOR SUCCESS

Key levers for success include compelling marketing, well-trained workforce, a shift in financial mindset, and a strong focus on data:

-

A compelling marketing and communication strategy. Hoteliers must be able to tell a story that demonstrates what sets them apart and makes the experiences they offer unique. This goes beyond providing guests with general information explaining the hotel’s facilities to developing an emotional connection between the brand and the guest, including an aspirational narrative. Visual storytelling with powerful words and strong imagery (including video) is a must-have to effectively market to Gen Z. Promoting wellness and well-being offerings and highlighting the benefits of a sustainable hotel are also important — these are in high demand with affluent travelers, and they may result in higher room rates.

-

A well-trained, motivated workforce. Hoteliers must implement exhaustive recruiting processes for staff to ensure they have the skills and capabilities required to perform daily duties at an extremely high level, constantly exceeding expectations. To consistently provide a high level of customer service in the demanding luxury market, staffers need a comprehensive training plan that includes upskilling and re-skilling as needed, as well as detailed action protocols to help them handle unexpected situations involving guests. Luxury hotels must also create as close to an ideal work environment as possible, with new-employee retention strategies, employee satisfaction programs, and well-being initiatives. Some luxury brands are going a step further by developing ambitious career pathways, including departmental rotations, sponsored courses, and community involvement programs. A cohesive, well-trained team is essential to creating memorable, personalized moments for guests.

-

A shift in financial mindset. In this sector, some departments may not be highly profitable and some may even lose money, but they are necessary to enable the services and products demanded by luxury travelers. This includes some state-of the-art wellness/well-being treatments, costly sustainability designs, and/or bespoke culinary offerings. Hoteliers must anticipate this and take a cross-departmental view of the bottom line, instead of working to make each department profitable. Investors must be aware that, in many cases, luxury hotels involve a higher terminal value of the asset and its surroundings due to the attractiveness of the area for other luxury retail brands or well-renowned chefs.

-

A strong data focus. Data helps hoteliers more accurately predict and anticipate customer needs, including suggestions about dining, spa treatments, trips to local attractions, and more based on deep knowledge about guest preferences. The rise of the luxury hotel sector is being fueled by technological advancement designed to enhance the guest experience.

Everything from online booking and mobile check-in to mobile apps, personalized concierge services, and in-room automation is revolutionizing how guests interact with hotels. Although AI is still in an early stage, it is already being used to enrich guest experience. For example, hotels can use computer vision (a technology that analyzes what is happening in a CCTV video and transforms it into actionable insights) to determine in real time when guests are lined up at the front desk and automatically alert a manager that more staff is needed. Renaissance Hotels, part of Marriott Group, recently announced a pilot program for a new virtual concierge service. Powered by human expertise and AI, it aims to provide guests with instant access to local recommendations for dining, attractions, and more directly from their smartphones.

Conclusion

The moment for luxury hospitality

Driven by the increase in the number and wealth of affluent travelers with a strong desire for unique experiences, the luxury hotel sector has experienced significant growth. Affluent travelers are willing to pay higher room rates for extraordinary execution of the following differentiators:

-

Personalized exclusive experiences

-

Ultimate wellness and well-being services

-

Sustainable offerings

-

Unique culinary journeys

-

Culture of excellence

Regardless of the luxury market’s outlook, it’s clear that creating innovation and value along the five differentiators will command higher prices. Moreover, implementing these differentiators well will require compelling marketing and communications, enhanced workforce training, a shift in financial mindset, and a strong data focus — all tools hoteliers can use to successfully enhance their offerings.