DOWNLOAD

DATE

Contact

Global aluminum consumption is on a path to reach 124 million tons by 2030, but growth comes at an environmental cost. Production of the silvery white element is energy-intensive, pumping out more CO2 than most other metals. In the context of decarbonization pledges, the onus is on the aluminum industry to build a greener future. This Viewpoint examines the many facets of green aluminum with a focus on the Gulf Cooperation Council (GCC) and its potential to lead the change.

Aluminum is a core component of the world around us. From construction and industrials to transport and consumer goods, it functions as an electricity transmitter, an engine part, a smartphone’s casing, the cans we drink from, and more. This lightweight metal is nothing if not versatile, and global demand is rising. Industry players welcome the news, but growing demand doesn’t just bring financial gain; it also brings responsibility.

A decade ago, the term “net zero” had barely made any monumental waves. Today it’s mainstream, pushing stakeholders across the value chain to turn the silvery white element a shade of green.

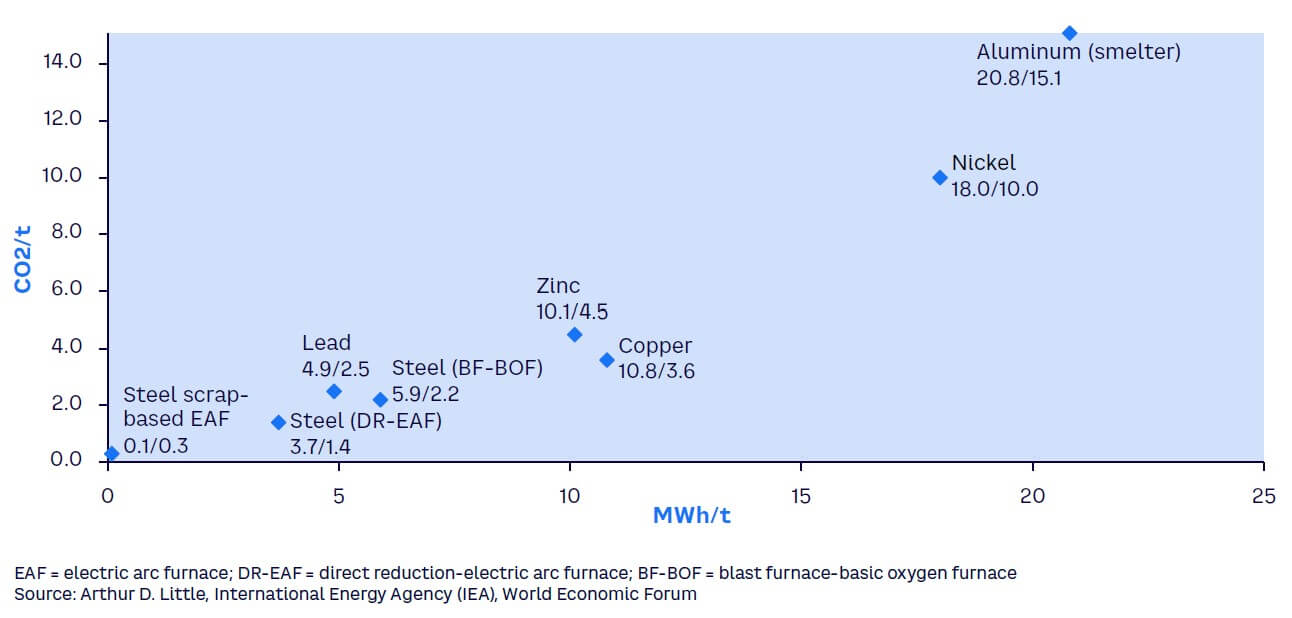

Growth in global aluminum consumption over the next decade is expected to exceed 3% per year, according to CRU, from 100 million tons this year to 124 million tons by 2030, with transportation, electrical, and consumer durables driving demand. However, growth comes at an environmental cost: aluminum is the most energy-intensive of all metals, generating the highest CO2 emissions at around 15 tons per ton, according to Arthur D. Little (ADL) analysis (see Figure 1).

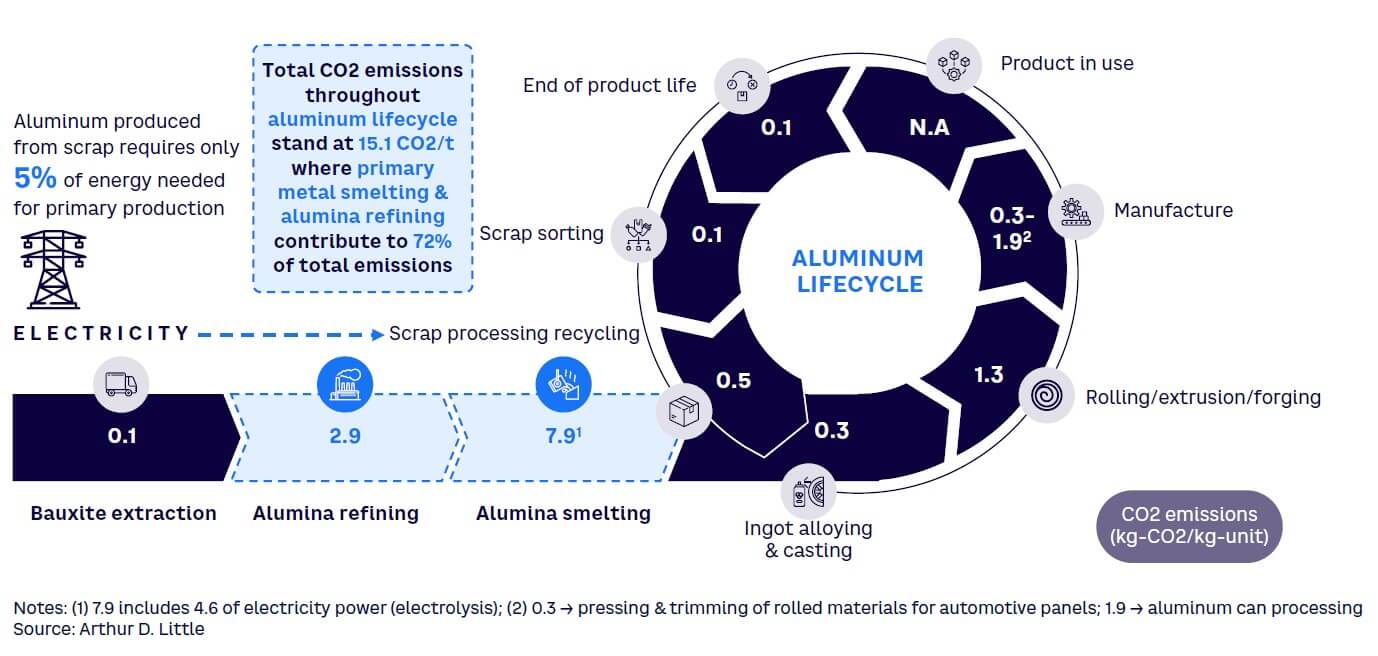

The majority of energy consumption and emissions in the bauxite-to-aluminum value chain originates from the aluminum-smelting process, followed by alumina refining (see Figure 2). Consequently, most technological advancements targeting decarbonization in the industry concentrate on these two stages of production.

The call to action is clear: growing consumer demand for green alternatives is compelling stakeholders to collaborate and innovate for a sustainable future. Gains will proliferate, not just for the planet, but for businesses and the economies of tomorrow.

THE CASE FOR LOW-CARBON ALUMINUM

Over the next decade, 16 million tons of additional green aluminum demand is expected globally, with hybrid and electric vehicles (EVs) driving approximately 70% of the total. Aluminum’s unique characteristics underpin this demand: it is lightweight, conductive, and resistant to corrosion, making it valuable and useful in a range of use cases across multiple industries. It is also infinitely recyclable and among the few metals with a clear, achievable pathway to zero-carbon emissions.

What’s more, aluminum is the only metal expected to have a high impact on future green demand and can crosscut most new clean technologies. Its usage in solar photovoltaics, concentrated solar power, EVs/battery storage, and electricity networks is particularly high. It is also used widely in the wind, hydro, bioenergy, electricity networks, and hydrogen arenas.

Despite aluminum’s many advantages and use cases, numerous trends focus on replacing it. Examples include the development of new fiber-based barrier technologies for Tetra Pak packaging, environmentally friendly alternatives to aluminum foil, and the use of magnesium alloys in manufacturing, which offer greater specific strength and energy absorption. Additionally, fiberglass is surfacing as a potential structural alternative to metals. Conversely, the substitution of steel with aluminum in construction is rising, as is the broader application of aluminum alloys.

Because demand for the metal is still high, removing hydrocarbons from power generation will be the main challenge to the green aluminum ecosystem. Smelters powered by fossil fuels are relatively new and have few options for power sources. As a result, coal powers around half of aluminum production — a reality that the industry must address through a combination of innovation, advanced technology, and commitment from stakeholders.

THE PATH AHEAD

The GCC has the cheapest gas-based power in the world. With energy accounting for 50% of aluminum costs, it can produce aluminum in large volumes, at low prices, and with fewer emissions than coal-based production. There is also an increasing trend of using solar power for aluminum production, and the region has sunshine in abundance. Plus, the GCC has a strong supply base when it comes to raw materials like bauxite.

Outside of China, the GCC is the largest growing aluminum-producing region in the world, churning out more than 6 million tons in 2023, according to the International Aluminium Institute. Along with a reputation for innovation, vast energy supplies, and strong global links, the region is a prime location for the green aluminum industry to take root and thrive — and given the climate crisis, the need has never been greater.

Thanks to greater demand and wide-ranging use cases in green tech, aluminum can play a major role in building a sustainable future. China is by far the biggest player in the aluminum domain, producing more than 41.6 million tons last year, but when it comes to the rest of the world, the Gulf states are well placed to drive green momentum across the ecosystem:

- Volume. The GCC’s five established smelters produced around 6 million tons of aluminum in 2023, ahead of Asia (except China) with 4.67 tons, Russia and Eastern Europe (approximately 4 million tons), and North America (approximately 3.9 tons). The GCC was also the only region in the world to increase its global share last year (+1.4%) despite increased supply from Asia.

- Strong links. Over time, the GCC has forged strong links with both European and Asian players in the aluminum industry, opening a wealth of opportunities for partnership, investment, and technology development. Notably, the region has ties to sophisticated consumer markets that are driving technological innovation in areas such as new alloys and semi-fabricated materials, while its proximity to both the East and West gives it a logistical advantage.

- Innovation and experience. The GCC has significant resources at its disposal to channel into technological innovation and pioneering experimentation. Meanwhile, the region’s oil and gas legacy offers valuable and transferable experience as well as opportunities for technology and knowledge exchanges that can accelerate progress toward decarbonization in aluminum production.

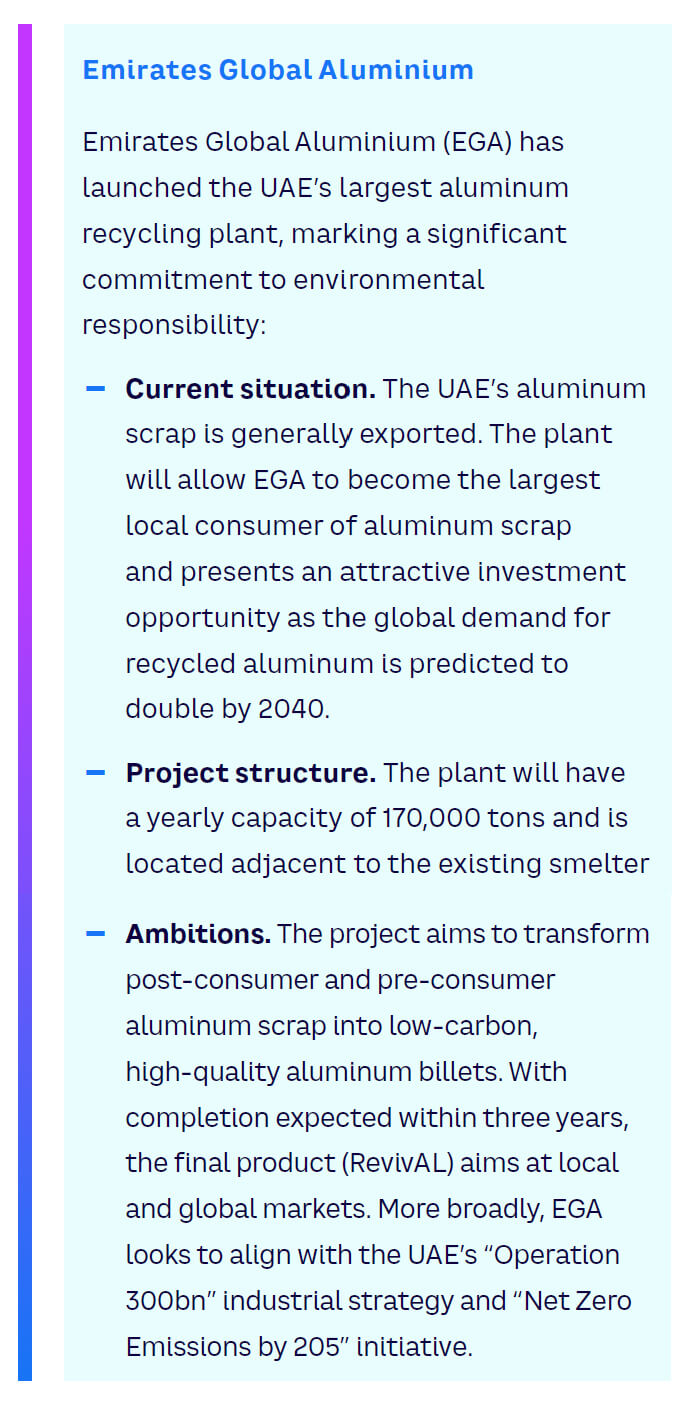

- Circularity. Bans and/or high tariffs on scrap aluminum exporting have made the GCC countries home to huge scrap markets that can be harnessed to develop a thriving circular economy and related infrastructure, including scrap-based smelters (see sidebar “Emirates Global Aluminium”).

GUIDING THE WAY

To support the energy transitions of the GCC’s aluminum industry, ADL has identified four key pillars that can shape the path to green: (1) reducing CO2 emissions, (2) developing new technologies, (3) creating a circular economy, and (4) maximizing green market potential.

Pillar 1: Reducing CO2 emissions

Leading multinational corporations are strategically refocusing their efforts to reduce their carbon emissions and meet ambitious environmental goals. Aluminum companies across the GCC region can gain actionable insights from the efforts and initiatives already underway to boost the green aluminum industry on the global stage.

Pledges

- US-based Alcoa Corporation, the world’s eighth-largest aluminum producer, committed to reducing greenhouse gas (GHG) emission intensity for Scope 1 and 2 by 30% by 2025 and 50% by 2030, from a 2015 baseline.

- Norway-based Norsk Hydro ASA aims to slash GHG emissions by 30% by 2030.

- British-Australian giant Rio Tinto intends to reach net zero by 2050.

- GFG Alliance’s Advance Group plans to achieve carbon neutrality by 2030.

- EN+ Group/RUSAL has signed up to the Science Based Targets initiative (SPTi) to limit global warming to 1.5°C.

Products

In recent years, leading international companies with access to renewable power have launched innovative low-carbon aluminum products. Austrian aluminum processor HAI was a first mover, launching SustainAl 2.0 in 2021 — a product it claims can produce less than 4 tons of CO2/ton.

India’s largest aluminum producer, Vedanta, followed with the launch of Restora in February 2022, making similar claims regarding the product’s capabilities. Since then, Norsk Hydro and French-Spanish producer Aludium have each introduced products — CIRCAL and Aludium ECO 2.0, respectively — that reportedly have the potential to drive down emissions to 2 tons of CO2/ton.

These lower-carbon products are more costly to produce than conventional aluminum, but consumer appetite for sustainable offerings is rising. Many buyers are still reluctant to pay the premium attached, but that is beginning to change. In particular, B2C players are demonstrating increasing interest in low-carbon aluminum and will gradually require suppliers to submit lifecycle assessment data in response to the environmental concerns of their customers.

Among the international companies embracing greener aluminum is Belgian-Brazilian drinks multinational AB InBev, which has launched low-carbon cans. Jaguar Land Rover now requires all new vehicle designs to include upcycled aluminum, and Apple uses low-carbon aluminum across its devices. The iPhone maker’s green commitment goes even further; in July 2020, it announced its commitment to reach carbon neutrality across its supply chain and products by 2030 by reducing emissions by 75%. Apple also supports carbon removal through its sustainability initiatives, such as collaborating with aluminum suppliers to develop the first-ever direct (Scope 1) carbon-free aluminum-smelting process.

Coalitions

In addition to individual companies, entire industries are responding to consumer sentiment by forming coalitions dedicated to decarbonization:

- In aviation, the Oneworld initiative intends to achieve net zero carbon emissions by 2050, while CORSIA (Carbon Offsetting and Reduction Scheme for International Aviation), which includes the 192 countries within the United Nations International Civil Aviation Organisation (ICAO), aims to make all growth in international flights carbon-neutral post-2020.

- In the transport sector, the Decarbonizing Transport Initiative seeks to provide tools for carbon emission–mitigation efforts.

- In construction, the Global Alliance for Business and Construction (GlobalABC) includes more than 130 members from across sectors and is working to meet the Paris Agreement’s climate goals.

Investing, finance & ESG

Corporate and industry initiatives are driven not only by consumer demand but also by the environmental, social, and governance (ESG) agenda. Greater scrutiny across the aluminum supply chain is driving companies to reduce their carbon footprint and seek greener raw materials. In recent years, demand signals from metals buyers have triggered changes in the trading landscape.

In June 2020, the London Metal Exchange (LME) announced the future creation of a spot trading platform for low-carbon aluminum. In September 2020, Singapore-based commodity trading company Trafigura established a low-carbon aluminum-financing platform.

In addition to creating positive environmental change, the aluminum industry’s ESG obligations can also yield results. Since 2013, companies with consistently high ratings for ESG performance have outperformed their peers, enjoying operating margins 4.7 times higher than low-ESG performers, according to Financial Times. Companies with a strong approach to ESG also demonstrated greater resilience during the COVID-19 pandemic.

GCC focus

To reduce CO2 emissions, GCC aluminum players can factor the above into their strategic thinking, from setting carbon-reduction targets and innovating low-carbon products to forming industry-wide coalitions and developing tools and platforms to facilitate green aluminum growth.

Interest in a regional metals exchange is growing, with a market study currently underway in Saudi Arabia. If viable, an exchange could potentially be a pioneer in low-carbon aluminum trading due to its progress away from coal while reflecting the specific characteristics of the Gulf market.

Pillar 2: Developing new technologies

Several of the GCC’s major cities are built on a foundation of innovative design, technology, and forward-thinking. In the case of aluminum, this appetite for advancement and experimentation and the region’s strengths make the GCC nations well equipped to embrace frontier technologies to decarbonize production.

In particular, major local aluminum producers have formed joint ventures with major global players and technology providers. Partnerships exist between Ma’aden and Alcoa across the aluminum value chain in Saudi Arabia and between Qatar Aluminium, a joint venture of QAMCO and Hydro in Qatar.

Among the most impactful and far-reaching advances are: (1) the transition to renewable energy; (2) the implementation of carbon capture, utilization, and storage (CCUS); and (3) hydrogen — all of which affect the entire aluminum value chain, from mining and refinery to smelting, casting, and recycling.

Technology in action

Other frontier technologies with fewer, yet valuable, use cases include inert anode technology, mechanical vapor recompression, scrap recycling, and bauxite residues processing. To varying degrees, global market leaders have started adopting and implementing these technologies in their production facilities, as exemplified below:

- Transition to renewable energy. In China, state sanctions on coal usage are compelling industries to find low- or zero-emission alternatives to conventional coal-fired power plants. In this context, aluminum company Hongqiao Group has begun production at a new hydro-powered aluminum smelter in the Chinese province of Yunnan. This is the first of several projects to relocate Chinese aluminum production close to hydropower sources to support the country’s decarbonization targets.

- Hydrogen. Rio Tinto has partnered with the Australian Renewable Energy Agency (ARENA) to evaluate hydrogen’s use as an alternative to natural gas in alumina refineries. This feasibility study will see natural gas replaced with green hydrogen during calcination at the Yarwun alumina refinery in Queensland, Australia. Norwegian aluminum company Norsk Hydro is also using its expertise in renewable power to evaluate green hydrogen as an alternative to natural gas for its operations while exploring an additional revenue stream based on hydrogen’s increasing role in the green economy. This transition could reduce Hydro’s CO2 emissions by as much as 30% by 2030.

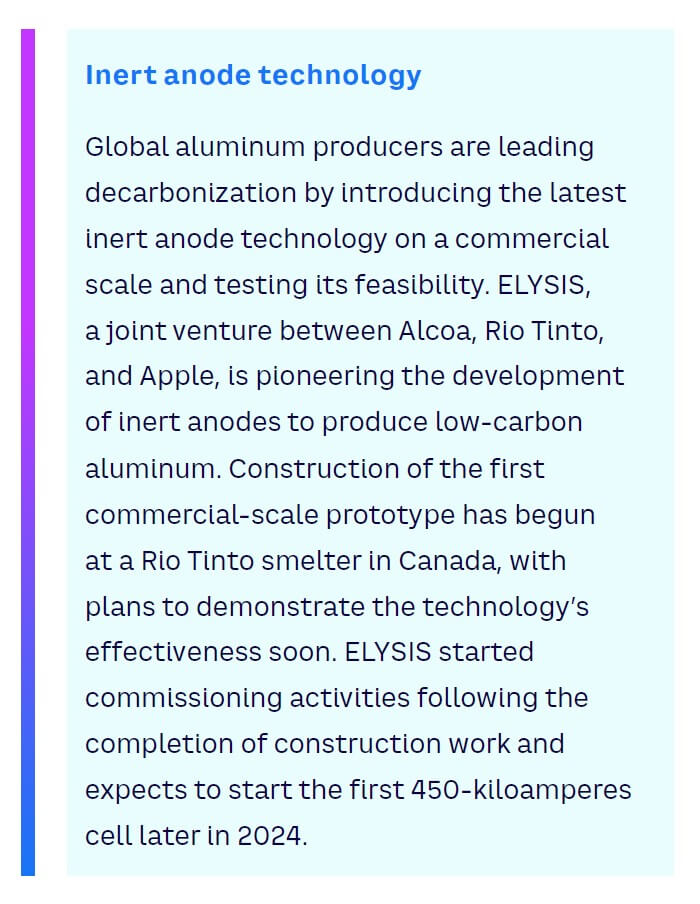

- Inert anodes. Replacing carbon anodes with inert anodes is considered the most powerful way to significantly reduce GHG emissions originating from the smelting process. ELYSIS, a partnership between Rio Tinto and Acloa, is leading the way (see sidebar “Inert anode technology”). RUSAL has produced over 1,500 tons of aluminum with exceptionally low-carbon emissions using inert anode technology and renewable energy. Their new electrolytic cells reduce emissions and produce oxygen equivalent to 70 hectares of forest. Arctus Aluminium R&D, in collaboration with the Innovation Centre Iceland, has created high-purity (99.9%), low-carbon aluminum using vertical inert anodes and wetted cathodes in a low-temperature electrolyte.

- CCUS. Alvance British Aluminium, part of a consortium alongside German aluminum manufacturer Trimet, Fives Group, and Rio Tinto’s research center LRF, is evaluating the most economical way to capture carbon in aluminum smelters. The initiative looks at mine technology to determine the feasibility of capturing flue gases directly versus the need to concentrate the CO2. Alvance is framing a pilot to launch by the end of 2024 to capture up to 70% of emissions from the smelting process. In 2021, Alcoa announced the implementation of a CO2 sequestration process using bauxite residue at its Kwinana Alumina Refinery in Western Australia, with savings of 70,000 tons of CO2 annually.

- Bauxite reuse. Initiatives are also underway to convert bauxite residues into nutrient-rich soil mineral products. The R&D departments at major international institutions such as Canada-based Geomega and Emirates Global Aluminium (EGA) have developed cutting-edge technology with a target of 80% bauxite reuse. This goal exceeds the industry standard set by the International Aluminium Institute and is expected to facilitate the extraction and isolation of bulk metals.

Industry 4.0

In addition to the emergence of frontier technologies in the decarbonization of aluminum production, Industry 4.0 (4IR) has the potential to make a profound impact. In the aluminum industry, the application of 4IR is expected to become critical over time, due to its potential to boost productivity and quality and significantly reduce costs. There are currently several 4IR within the aluminum domain:

- Tracking. 4IR technologies can track the qualities of different bauxite deposits at different locations and monitor the health of equipment used in activities such as digestion, precipitation, calcination, and electrolysis. It can also track the settings used, production process status, and material and product data.

- Modeling. 4IR can create virtual models of ore bodies in bauxite mines and of the array of aluminum products that a company is looking to manufacture.

- Linking. Technologies associated with 4IR can link information flow from upstream to downstream (e.g., bauxite mine → alumina smelter → electrolysis → casting) to allow changes to downstream settings in real time.

- Predicting. Based on data analysis, 4IR can plan, run, steer, and correct equipment predictively rather than reactively while controlling the quality of the product.

The benefits of these applications to aluminum players include fewer incidents in bauxite mines and aluminum smelters, fewer unplanned plant shutdowns, improved production quality and accuracy, reduced costs, and less waste of raw materials, energy, and machine time.

GCC focus

The experiences of global aluminum heavyweights can inform the strategic thinking of industry leaders in the GCC as they continue to explore and expand use cases for hydrogen, CCUS, bauxite, and the wider energy transition. Lessons from global aluminum giants can also help the region’s players avoid mistakes and leapfrog innovations. The commitment of GCC government leaders to building the digital economies of the future makes 4IR particularly relevant, as much of the required tech infrastructure is in the making or already in place.

Pillar 3: Creating a circular economy

Like all elements, aluminum is pure and cannot be broken down, which raises environmental and lifecycle concerns. However, scrap recycling has advanced significantly in recent years, promoting sustainable practices while meeting high-quality demands of the market. New primary capacity will still be necessary to balance market needs, but 50% of aluminum production is projected to come from recycling by 2050, marking a milestone in sustainable manufacturing, which currently stands at around 30%.

The GCC region is ready to ramp up its scrap recycling efforts, with a combination of strong technology and innovation capabilities and a large supply of scrap aluminum resulting from export and import restrictions. Maximizing that potential and progressing toward full circularity is critical to the sustainability of the industry, which entails a hierarchy of basic principles relating to aluminum production, design, lifespan, and application of materials.

The hierarchy of principles

Smarter aluminum production, design, and use centers on the principles of refuse, rethink, and reduce:

- Refuse. Growth in aluminum demand may be controlled by enhancing system efficiencies, introducing new technologies, and expanding the use of alternative materials, such as magnesium alloys, stainless steel, fiberglass, carbon fiber, and other fiber-reinforced polymers.

- Rethink. Changes can be made to industrial models and critical infrastructure to unlock the power of alternative technologies to meet aluminum production demand.

- Reduce. Electricity efficiency using low-carbon grids can increase aluminum manufacturing efficiency.

Extending the lifespan of products is based on several principles guiding the reuse and repurposing of aluminum:

- Reuse. If products are in good condition and fulfill their original function, continuous reuse of aluminum products by multiple consumers should be encouraged.

- Repair and refurbish. Aluminum-based products should be repaired and maintained to extend their use and to restore functioning products to their original condition.

- Remanufacture. Aluminum goods can be remade to their original specifications using parts from discarded products.

- Repurpose. Discarded aluminum-based products (or parts) can be repurposed to create a new product with a different function.

Useful application of aluminum materials involves two main principles (recycle and recover):

- Recycle. Materials can be processed to obtain the same (high-grade) or lower-quality (low-grade) products.

- Recover. Aluminum can be extracted from waste or byproducts, and incineration can be utilized for energy recovery.

Harnessing these principles can set organizations on course for successful aluminum recycling — but the task is not straightforward. It requires a focused yet holistic approach throughout the value chain, including scrap sourcing and partnering, scrap shredding and sorting, product segments, and market development.

Meanwhile, closing the global aluminum circularity loop requires international trade throughout aluminum value chains, from waste and scrap recovery to R&D and digital. While restrictions on aluminum exports and imports create large domestic asset bases, they also represent a significant roadblock for the circular economy. Circularity policies for aluminum should be developed and implemented in accordance with international trade law principles. Efforts must also be made to uphold safeguards that ensure aluminum trade for circularity does not pose risks to human health or the environment.

GCC focus

Countries across the GCC are pursuing ambitious national visions that blend economic growth with sustainability and digital technologies. For example, clean energy, innovation, and responsible production are central components of the UAE’s Operation 300bn strategy, which aims to develop the country’s industrial sector and enhance its role in stimulating the national economy. The region’s aluminum companies have the power to make an impact on all these fronts while doing their part to reduce the industry’s carbon footprint.

Pillar 4: Maximizing green market potential

In an external context of market fluctuations and geopolitical unrest, the global aluminum market is expected to shine as a solid investment frontier and reliable hedging instrument, with the element showcasing remarkable resilience and low pricing volatility, compared to other key metal commodities.

Despite a global push for developing the green aluminum value chain and concerted efforts of industry leaders and government initiatives, the financial returns on green aluminum remain modest, restricting the ability of producers to recoup the cost of decarbonization. According to market participants, green premiums currently hover around 1% of the LME price — a sign that consumers are not yet ready to pay more. There is optimism that these premiums could rise significantly, potentially reaching between 5% and 10% in the future, but for now, significant challenges remain. Alongside customer reticence over costs, producer alliances are not powerful enough to push their agendas globally. Discussions about green aluminum pricing have continued for years without significant progress.

GCC focus

As the region looks to diversify its economies away from fossil fuels, consumer demand for aluminum and its solid investment potential are encouraging signs and make a clear case for continued efforts to decarbonize the industry. Consumers may not yet be prepared to pay the premium associated with green aluminum, but this will likely change; thus, the GCC’s key players should prepare to meet future demand. The prospect of a GCC metals exchange is particularly exciting and could foster interest in green aluminum from the trading and investment communities.

Conclusion

A LOW-CARBON FUTURE IS WITHIN REACH

Aluminum is an integral part of the world around us — a vitally important material to multiple industries and a key component in numerous products. As the biggest aluminum producer outside of China and a global champion of innovation, the GCC is in a prime position to pave the way to a sustainable future by:

- Doubling down on efforts to reduce carbon emissions

- Embracing new technologies

- Ramping up recycling capabilities

- Nurturing a market ripe for investment