Leveraging social media to enhance telecom customer experience

Mastering social media insights can enable telcos to deepen customer understanding and intimacy

Executive Summary

In recent years, leading Internet/online content players have redefined the customer experience (CX) game by familiarizing customers with a differentiating experience and intimacy, achieved primarily through an increased level of product/service simplicity, agility/efficiency of operations, and user personalization. Telecom operators (telcos) in general have traditionally lagged in providing a differentiated CX given the monopolistic (e.g., high barriers to entry due to licenses, CAPEX) and product-centric (e.g., fixed, mobile) nature of their business.

Within the rapidly transforming paradigm of the telecom industry over the past decade with increasing market saturation and fierce competition from Internet/content players, telcos have been focusing on CX within their corporate strategies. While some players such as Orange, Virgin Mobile, and Vodafone are leading the CX race among telcos, they have a long way to go when it comes to meeting customer expectations, let alone aspiring to redefine it.

Social media platforms have risen steadily in prominence (even more so with the global COVID-19 pandemic) and offer telcos an opportunity to create the next level of customer engagement and impact through unique capabilities that come from their wide reach and personalization options, rich advertising solutions, innovative business platforms, and powerful measurement and insights. We estimate that working with social media players can lead to a medium to high impact on most of the telcos’ customer lifecycle touchpoints for both B2C and B2B. This report aims to demonstrate that social media platforms, often considered as “frenemies” at best, can prove to be critical trusted partners for telcos as business models and CX synergies evolve. However, in order to design and implement these mutually win-win propositions, both parties need to take steps toward each other — from addressing current concerns to customizing systems and processes — to effectively realize the planned synergies.

Social media platforms need to perform constant scrutiny of content to ensure information validity and take prompt actions in cases of non-adherence to the established terms. They need to install adequate measures to address data management and cybersecurity concerns. Additionally, social media platforms can develop dedicated API platforms and analytics engines specifically for telecom-specific needs.

On the telco organizations’ part, deploying these models would require a shift in structures, processes, systems, resources, and cultures, many of which are already underway given their wider digitalization programs. Also, given the race for “direct-to-customer” across organizations, which has accelerated due to the COVID-19 pandemic, there is a need for telcos to identify that optimum level up to which they can complement their own digital and other channels with the ease and access that social media platforms provide.

Social media, the next level of telco customer engagement and impact

While CX has been a strategic priority for telcos globally in the past decade, most of them are still failing to transform it into sustainable competitive differentiation. Digital CX success stories from leading Internet/content players, as well as frontrunners from other industries, mean customers are increasingly accustomed to higher levels of engagement and intimacy.

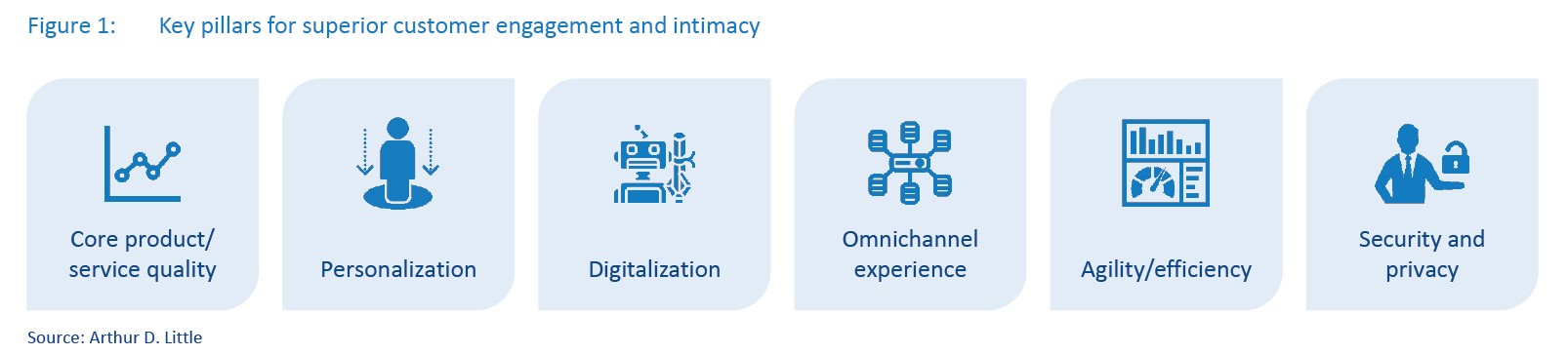

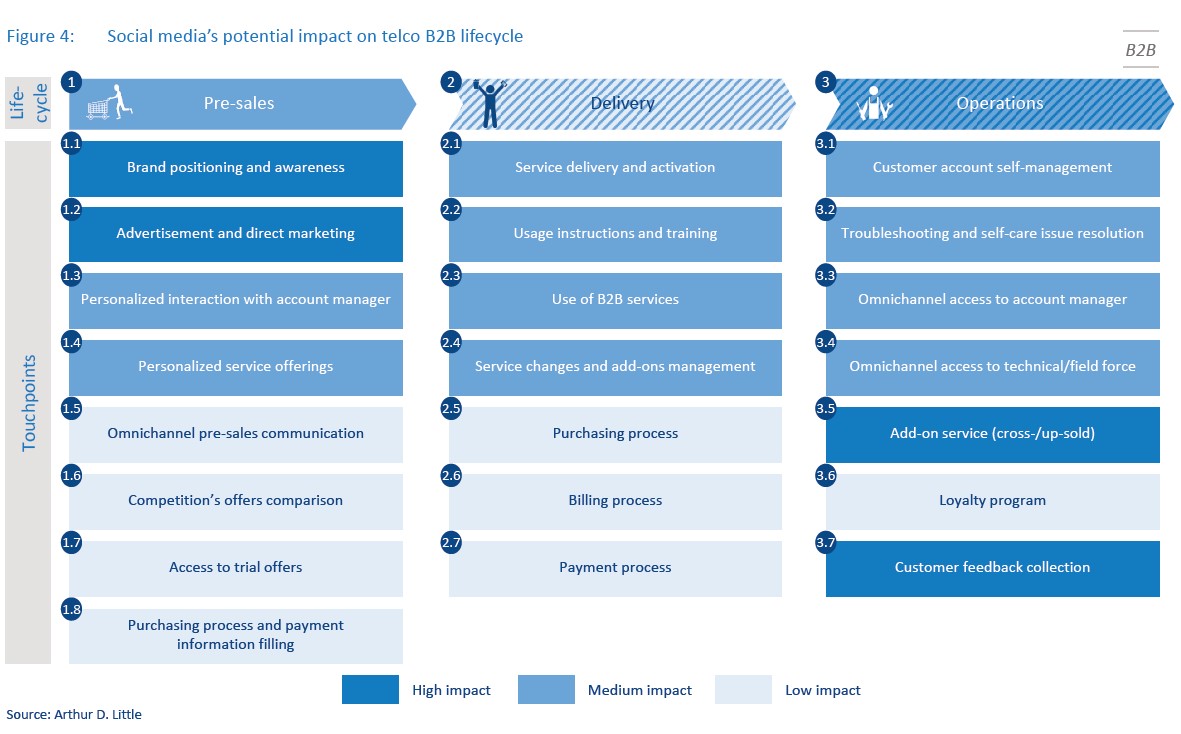

Key pillars for superior customer engagement and intimacy

Learning from CX leaders, we have identified six key building blocks at the foundation of a superior telco CX (see Figure 1). These building blocks have a critical place within the overall approach that telcos should ideally follow to design and implement their CX, and even broader digitalization strategies.

Core product/service quality. Telcos must develop products/ services that provide them with clear differentiation vis-à-vis competitors. Rather than a one-time activity, this requires effective innovation engines within organizations to gather ongoing feedback/insights from internal marketing functions and directly from customers to constantly upgrade products/services quality accordingly.

Personalization. Telcos should leverage the extensive customer data available to them to develop elaborate personas aligned with customers’ motivations and concerns. These personas can enrich both the sales achieved as well as the product/service experience delivered.

Digitalization. Telcos should digitalize customer interfaces as well as their operations/backends through the application of more open architectures.

Omnichannel experience. Telcos should enable an integrated customer lifecycle across multiple channels/mediums for delivering a seamless omnichannel experience.

Agility/efficiency. Telcos must continue becoming more Agile/ efficient in their processes and systems by leveraging latest technologies such as robotic process automation (RPA).

Security and privacy. Telcos must constantly adhere to robust cybersecurity protocols to protect the increasing amount of customer data they are managing.

Our experience with several telco operators around designing/ implementing CX strategies demonstrates a strong need for consistency, since CX works only when it all works, and it all works exactly the same way each time. This consistency is typically achieved through effectively deploying the comprehensive/holistic approach indicated above within the telco organization. Interactions/partnerships with social media players can provide support to telcos in designing and implementing each of the six CX pillars and in applying the strength/capabilities of the customer bases and the engines that large social media players (e.g., Facebook, Twitter, WeChat) have already developed. Additionally, telcos that leverage these interactions/partnerships well can even reach beyond the standard CX pillars to deliver building blocks/pillars that are more specific to their organizations and that reinforce their brand/ competitive advantage over competitors.

What makes social media players valuable to telcos

Social media players are witnessing steady growth in the number of users as well as in the relative importance these platforms play in users’ daily lives. With Internet availability continuing to grow and now reaching more than 5 billion people, this trend is expected to continue. Some leading social media players already have billions of users, representing existing customers as well as an attractive pool of potential new ones for businesses.

There is strong evidence that social media adoption is increasing in businesses across sectors, including telcos. According to a 2020 study from eMarketer the overall relative weight of digital ad spending has been rising steadily, up from 50% of total ad spend globally in 2019 to nearly 54% in 2020, and 91% of US businesses are already using or planning to use social media for customer services and are increasingly favoring this medium to enhance CX. There is a strong rationale to move to social media platforms given they have clear advantages over traditional CX channels, for example:

- Social media is the preferred customer support channel for those under 25, with 32.3% respondents picking social media as their top choice.

- Seventy-one percent of consumers are more likely to purchase a service or a product when referred through social media.

- Half of the customers globally feel more connected to a brand when they can message it directly.

- Forty-five percent of consumers share bad customer service experiences via social media.

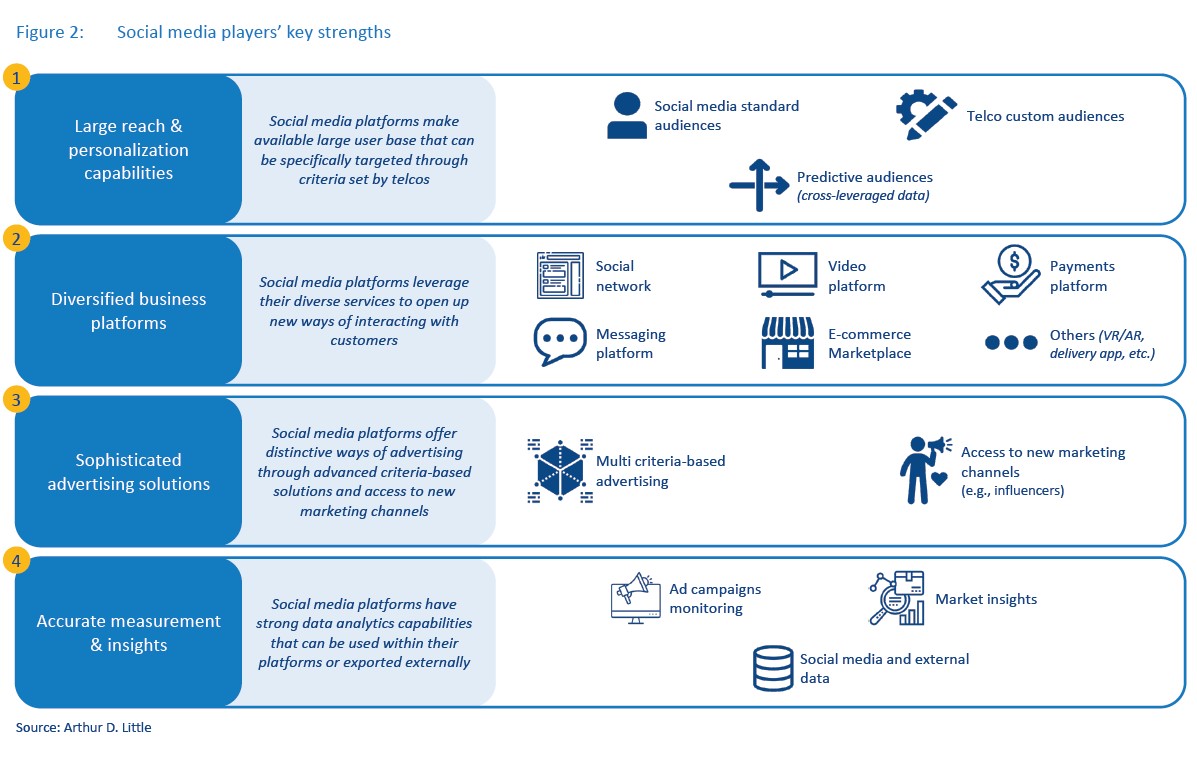

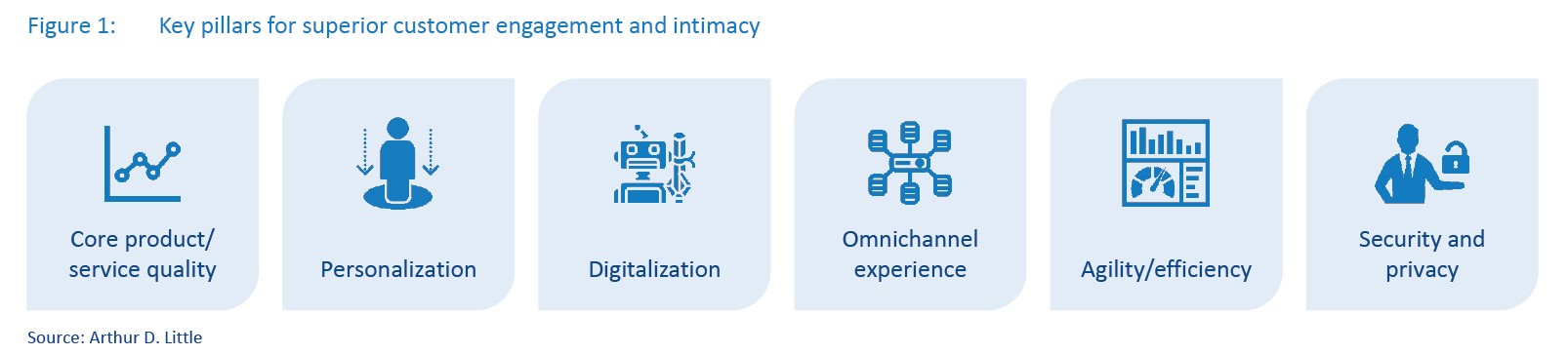

Telcos have long used social media for community building. For example, French telecom Orange boasts 28 million Facebook “fans” who willingly show their appreciation of the brand and subscribe to community communication. Additionally, community pages can now be boosted with the integration of chatbots, which, according to a survey by TM Forum are considered to be an important element of CX for more than 80% of telcos’ decision makers. However, social media platforms have over time built diverse CX offerings that go well beyond community building. These range from personalized and creative advertisements to advanced analytics and payments. Four main strengths of social media platforms make them highly relevant for telcos (see Figure 2):

1. Large reach and personalization capabilities. Social media players offer an unmatched reach to personalized audiences. Given their growing customer bases and their constantly expanding data analytics capabilities, social media players can enable telcos to tap into most of the audiences they want to target. Using platform data, users can be segmented by demographics, interests, and behaviors, creating audiences with strong precision. To cite a specific example, using social media data, telcos can target 18- to 25-year-old gamers using a 3+ year-old phone with less than a 10 MB/s data connection. Telcos can also plug in their own (hashed) data gathered from their websites, applications, CRM, and so on, to target specific audiences. Cross-leveraging both sources of data, social media players can offer powerful predictive audiences by scanning for look-alike custom audiences and thus identify and target non-customer users such as existing high-value customers for telcos.

2. Diversified business platforms. The reach discussed above can be engaged through a growing spectrum of business platforms offering messaging, videos, payments, e-commerce, and even latest technologies such as virtual reality (VR), offered by social media players as communication channels. The integrated model of social media, strongly exemplified by WeChat, provides customers with multiple daily interactions across all their devices, creating supplementary data that enables additional subsequent analyses. The diversification of social media giants into new platforms (e.g., Instagram Shopping, Facebook’s stake in Jio Platforms in India) will continue to reinforce this pillar in the future.

3. Sophisticated advertising solutions. Social media players’ advertising solutions offer diverse models of marketing delivery for telcos. Ads on most social media platforms are sold on an auction basis, which typically integrates several factors such as quality of the ad, the campaign objective, and target audiences, in addition to just the price. The ever-growing sophistication of ad algorithms implies that telcos can get more value for their money as accuracy of the auction system increases. New capabilities also imply that ads are increasingly interactive, lifting click-through rate and ad recall. Additionally, some social media platforms, such as WeChat, can act as intermediaries between telcos and influencers as the latter become ever more critical to marketing strategies. Enhanced ad relevance and performance translate into optimization of marketing expenditures and increased contribution to commercial objectives.

4. Accurate measurements and insights. At the core of the social media platforms’ business model lies its strong expertise in measurements and insights, providing accurate views of the results achieved from social media marketing campaigns. Some social media players go further and provide their insightgeneration capability for use by other parties (e.g., running their proprietary machine learning algorithms on CRM data from telcos). Services such as media mix, attribution, and lift modeling are often available. For telcos, measurements and insights can even go beyond marketing, as some social media players propose omnichannel and connectivity analytics.

To directly benefit from leveraging the power of data and analytics, several telcos are investing in adtech with the intention of developing their own capabilities to run personalized advertisements that could rival social media platforms. This is prompted by a bid to monetize and unleash the value of their rich customer data. Venturing into digital advertising could allow telcos to become enablers for other ecosystem players and give telcos the ability to influence the market. Although their number is currently limited, the telcos that have done this are now competing for “eyeballs” with social media players. The broader objective for telcos, however, is often to enhance the visibility of local companies to strengthen the local ecosystem by offering alternatives to social media giants.

Social media’s potential impact on telco customer lifecycles

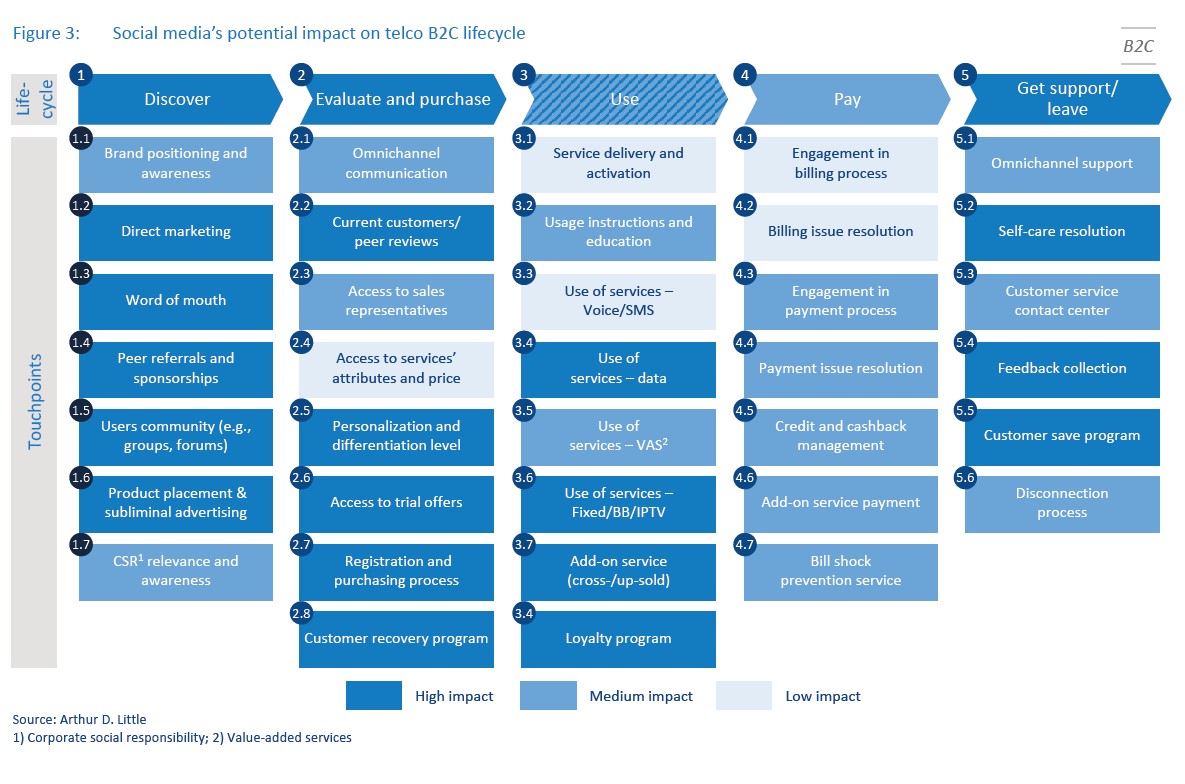

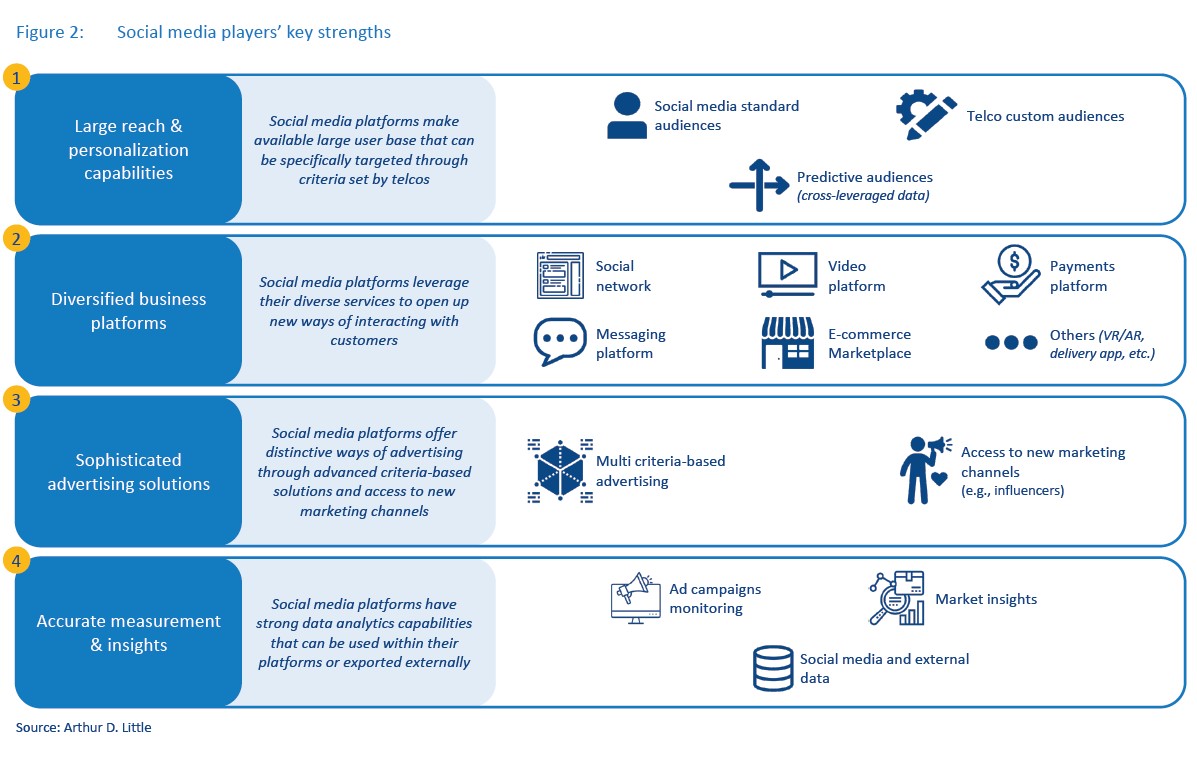

Overall, our assessment indicates that social media players can provide a high to medium impact for telcos, supporting them with delivery of their aspired CX to B2C segments (see Figure 3).

Along the discovery phase, the core social media use cases are gaining relevance as social media platforms further develop their advertisement competences. Thus, for telcos keen on running a massive campaign, social media platforms offer a credible alternative to offline media. For example, Zain KSA used Snapchat to run a 5G campaign including specific tools (e.g., interactive filters) and could reach 10.2 unique users in just four days, increasing 5G leads by 270% in the same period. Additionally, the diversification of the telco product/service mix beyond the idea of one-size-fits-all reinforces the need for accurate and granular customer segmentation. Social media platforms’ capabilities in audience targeting come extremely handy as, through their use, personalized bundles and new services can be offered directly to target potential customers. For example, Vodafone used TikTok in Ireland to promote an e-learning platform free for all 18- to 25-year-olds as part of its Vodafone X offer targeted at Irish youth, delivering 1.7 impressions and an impressive click-through rate of 21%. In addition to lead generation, targeted advertisement can lead to a positive impact on brand equity. To cite a case in point, an Ooredoo campaign run on Facebook and Instagram in Kuwait led to a seven-point increase in brand awareness and an 80% improvement in people’s perception of Ooredoo’s Internet experience. Social media platforms’ interactive nature can also be leveraged to generate new leads through instant messaging. For example, Globe Telecom used a Messenger bot to engage with target audiences, leading to a 300% increase in leads, at half the cost of traditional advertisement channels.

Along the evaluation and purchase phase, social media platforms can provide a strong medium for positive differentiation. Monitoring and managing existing customer reviews is essential, as peer assessment plays a key role in telco product/service evaluation. With customers’ requirements for personalization and differentiation of offers rising, leveraging social media advertisement and analytics solutions becomes more essential. For instance, a Norway ICE telecom ad campaign on Facebook and Instagram that targeted very specific audiences, such as parents of small children, boosted mobile subscription sales by more than 9%. Social media platforms can also reduce conversion pain points such as the form-filling requirements for registrations to services or trial offers. Leveraging Facebook retargeting and campaign optimization, STC Pay ran a campaign in Saudi Arabia that boosted the filling-up of KYC forms required for full use of one of its e-wallet applications by 280%.

Along the use phase, the relevance of social media platforms is increasing as telcos propose even more add-on services and applications to their core offerings. Telcos can also, via inplatform interactions, facilitate users’ experience in managing their services, avoiding tedious processes for customers (e.g., call centers, Internet websites) and reducing costs for telcos. For example, social media platforms can identify customers who do not use self-service apps and nudge them into installation — a solution used by Zain in Saudi Arabia, with a 53% increase in app launches. Telcos can also engage with customers via social media platforms — a solution used by MTN; whose customers can use MTN Chat on WhatsApp to manage their accounts.

Along the pay phase, social media platforms so far have not delivered a strong impact, as they have so far been unable to offer an integrated transactional experience for customers, although this is changing quickly. Some early integrated platforms, such as WeChat in China, have led the way and encouraged other platforms to emulate embedded payment experiences. For telcos, integrated payment services are a great way to address one of the biggest pain points within their CX. A low-hanging fruit in this area is communicating transactional data back to customers via social media platforms. Where enabled by platforms and regulations, customers can sometimes pay directly within the social media apps (as through the South African MTN Chat described above).

As social media platforms develop competence in handling payments through diversification into e-commerce, fully embedded payment experiences will materialize. Moreover, leveraging new social media transactional data can help telcos optimize their payment handling, for instance through the targeted bill shock prevention services. As the diversification of social media players into e-commerce enhances their experience in handling payments, data processed from these transactions can further reinforce social media offerings that enhance CX by offering even more tailored offers (e.g., offers in line with customers’ spending habits).

Along the support phase, social media platforms have an important role to play as they are increasingly used as a prime source of information.1 In particular, Twitter has become a top-of-mind medium of information during times of crisis, both global and telco-specific (e.g., during pandemics or network outages). Even in normal times, adverse experiences during issue resolutions can negate any prior positive CX, for both the customers as well as their peers, when such requests are made on public forums. Having an efficient private resolution mechanism, through direct messaging for example, can help avert/reduce the negative brand impact of mismanaged public resolution before the request goes public. For example, in UAE, telecom du has set up an AI-powered customer care bot, which now resolves upwards of 50% customer enquiries, leading to significant cost reduction for the company and stronger customer satisfaction. A reported 80% of customers prefer to resolve their enquiries via WhatsApp. Successful automation of customer support can result in up to a 70% reduction in related OPEX, with social media providing a strong hook toward increasing acceptance and habituating users to automated services. Predictive analytics can also help telcos resolve issues and reduce churn before it happens. Social media data, such as negative reviews or conversation keywords, can be proactively scanned to identify potential churners and enabling timely and targeted customer support.

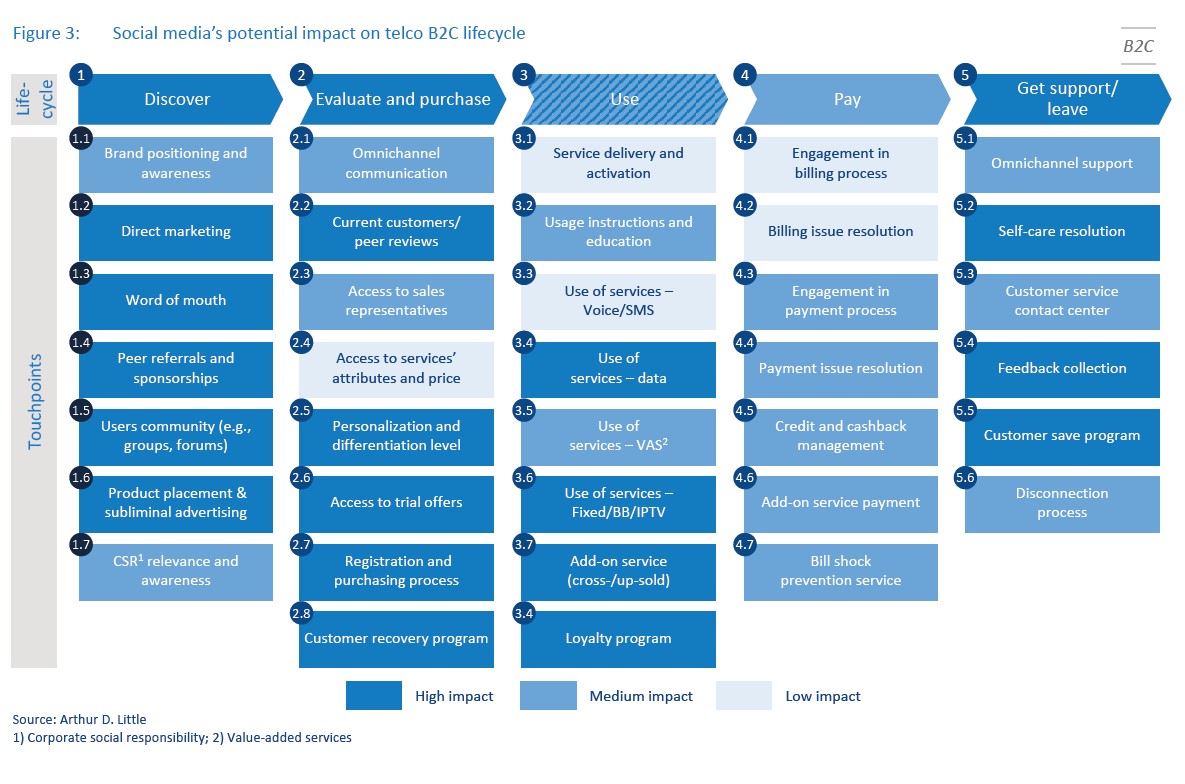

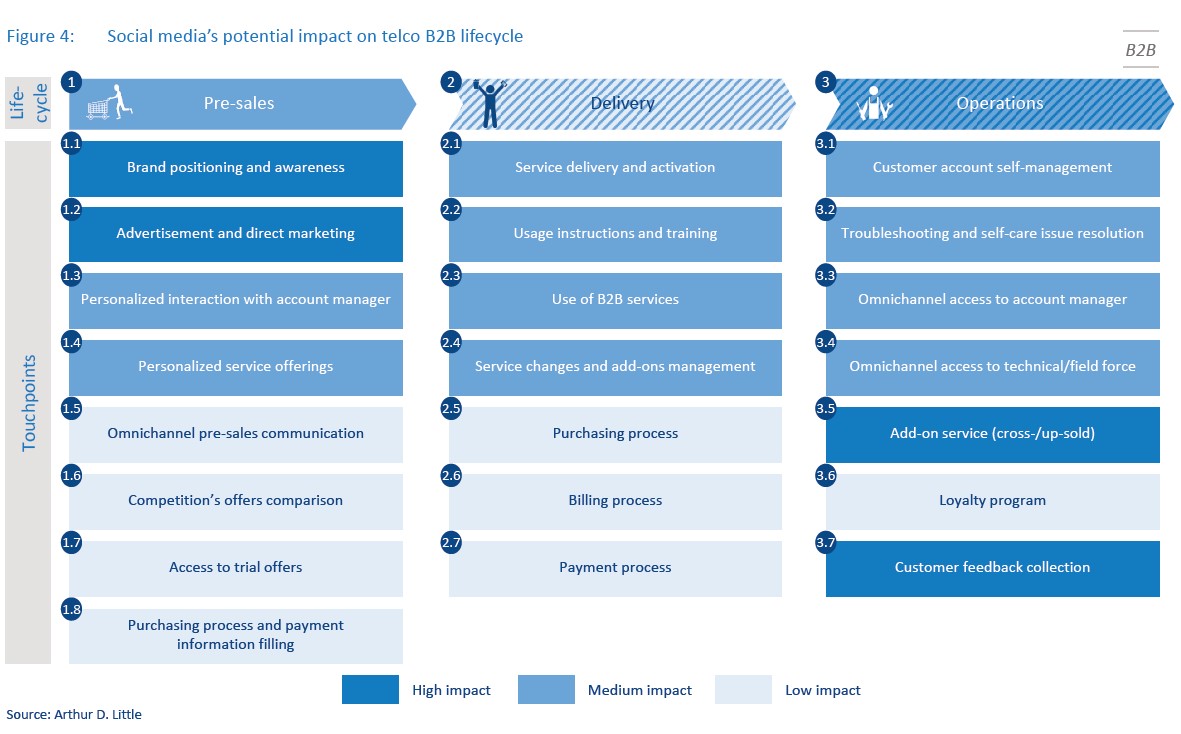

Compared to B2C, the potential impact of social media on the B2B lifecycle for telcos is relatively less pronounced. However, in absolute terms this impact is quite high, making social media platforms an effective tool for telcos for delivering the B2B CX they aspire to (see Figure 4).

Along the pre-sales phase, social media presence — particularly on professional networks such as LinkedIn — can boost brand equity, especially for small and medium enterprises (SMEs) with limited procurement capabilities. Peer reviews on social media are an important source of evaluation data for companies, highlighting the need for telcos to be proactive/responsive on these platforms. Thus, it is important to be able to reply and follow up on leads emerging on social media platforms by engaging account managers in serving potential clients. The impact of social media platforms on the pre-sales phase in B2B, while still nascent compared to that found in B2C, is bound to increase as telcos shift their product mix toward high-value niche markets. Social media platforms can help identify businesses that engage in these niche markets and evolve along with their needs, paving the way for personalized direct marketing. For example, Telstra designed a LinkedIn advertisement campaign for a niche B2B audience segment in Australia, leading to a 145% higher click-through rate and a 60% higher conversation rate compared to benchmarks. As businesses, including SMEs, continue to boost their online presence, social media platforms’ reach becomes even more potent, making them a privileged medium to boost B2B brand equity. For instance, Verizon generated a 100% brand sentiment through a Twitter campaign that raised funds for small businesses affected by the COVID-19 crisis and became the first trending topic on Twitter in the US.

In addition, telcos can benefit from direct touchpoints with decision makers within companies, whom they can identify on social media platforms through analyzing decisions such as the creation or the maintenance of a business page.

Along the delivery phase, social media platforms’ impact is mostly limited to enhanced education on the use of telco services, which can be delivered to B2B customers through ads, posts, and even training. Several platforms have developed integrated video/VR capabilities to meet these needs. For example, telcos can leverage the LinkedIn Learning platform to deliver training engagements they may contract with their B2B customers.

Along the operations phase, telcos can leverage social media platforms to propose a new channel for issue resolution to their B2B customers. Additionally, in line with data processed from the social media platform activity of their B2B customers, telcos can propose more targeted up-selling and cross-selling opportunities.

In summary, while the use of social media platforms for B2B CX remains limited in comparison to that for B2C CX, the growth in professional networks provides an increasing pool of usable data for telcos to leverage. More promisingly, social media platforms allow advanced segmenting, which can support telcos in designing unique CX for specific markets and extending it to otherwise difficult-to-access niche market players.

Given that social media players can influence/deliver on most touchpoints along the telco customer lifecycles, they now aspire to go beyond the plain customer-vendor transactional relationship toward forging deeper relationships, which could also be a win-win proposition for telcos once any corresponding concerns can be effectively addressed.

1 For instance, social media has become the primary source of information for 40% of Arabs and 24% of under-25 British adults

Telco-social media engagement models

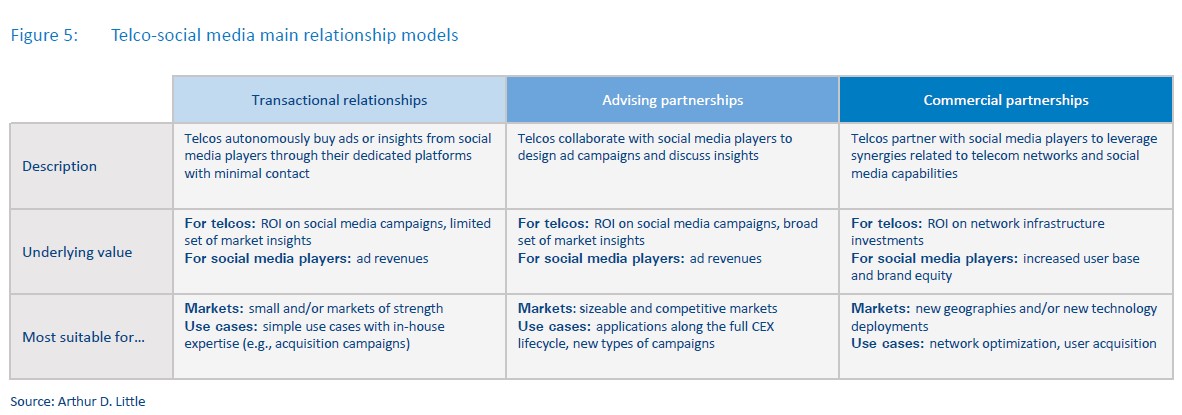

As illustrated in Figure 5, telcos can engage with social media players through multiple models, varying in the extent of interaction:

Transactional relationships (a quick and easy way to capitalize on established social media use cases). Social media players have democratized the accessibility of their advertisement services. Telcos can buy and configure ads in a self-service environment, using internal resources to design and monitor the campaigns delivered through social media platforms. In this model, social media platforms are considered as just one channel among others (e.g., telcos’ own digital and other channels). The value capture by the social media platforms is limited to their direct fees, while telcos benefit from a return on their investment when they achieve their intended objectives (e.g., incremental sales, additional app downloads). Although easy to implement, this relationship model might not be the most optimal for telcos given it does not leverage the full value that can be unlocked from customizing these platform features for the telco’s specific context. While building in-house social media expertise can enable telcos to tap into some of this value, it will remain costlier and restricted unless telcos can establish deeper relationships with social media players through partnerships. Transactional relationships can best serve telcos that are keen to test/experiment with the impact of social media platforms or in markets that are too small to warrant social media players’ interest in forging closer partnerships.

Advising partnerships (another step toward efficient social media driven CX). Social media players, as a part of their existing propositions for large advertisers (this typically includes telcos), offer privileged services with expert advice at their core. Through these partnerships, telcos have the opportunity to increase the efficiency of their expenditures via more customized/targeted use cases. Social media players usually do not expect advisory fees; rather, they anticipate new revenues as they showcase attractive use cases to telcos. Trusting their solutions to boost their clients’ ROI, social media players are typically remunerated for their advising services only by the prospect of subsequent increased account sales. In summary, the depth of telco-social media engagement is defined mostly by the extent of telcos’ spending on social media platforms. Strong partnerships can be realized through joint business plans, with collaboratively defined goals/targets along with corresponding requirements (e.g., resources, teams, partners, solutions) from both sides. An example of an advanced advising partnership can be found in the relationship between Verizonbacked virtual carrier Visible and Snapchat, where the two players collaborated to launch the Visible brand and business in 2018 through ads and interactive communication content on the Snapchat platform.

Commercial partnerships (another source of shared value). Although majority engagements between telcos and social media players are based on advertising investments from telcos, some social media players offer alternate models as well. For instance, Facebook — through its Advanced Network Planning, Actionable Insights tools, Telecom Infra Project, and Express Wi-Fi initiatives — proposes speed measures and planning algorithms to assist telcos with their network planning. The underlying value exchange materializes through mutually beneficial connectivity gains; that is, a telco can increase its customer base and usage experience while social media platforms, as over-the-top service providers, get access to new users. Taken a step further, wherever permissible with respect to the net neutrality stipulations, these partnerships can include privileged traffic for social media platforms on the telco’s network. One example of such a partnership can be found in Malaysia, where Facebook is assisting Time dotCom to reinforce its Internet infrastructure in exchange for a future privileged status for Facebook’s family of apps.

Another field of collaboration between telcos and social media is innovation, especially as the roll-out of 5G opens a new world of digital capabilities. For telcos wishing to demonstrate the possibilities of their new network, social media platforms can be partners of choice, especially as several players have been investing in augmented reality (AR)/VR experiences that depend on fast speed and high bandwidth. Verizon and Snapchat’s innovation partnership announced in 2019 exemplifies the potential synergies to be found as the two players now work together to develop AR experiences showcasing the benefits of 5G on Snapchat. In addition, while Snapchat provides premium sponsorship placements for Verizon, Verizon preinstalls the Snapchat application on some of its 5G phones. These types of partnerships can lead to win-win outcomes as both players can grow their customer base simultaneously.

Success factors for social media-driven customer engagement

The benefits to telcos from engaging with social media platforms are clear, yet increased reliance on social media-led CX management will not be fully risk-free for telcos, and they will have to address both generic and specific issues related to data privacy, as well as reputation.

Throughout the CX lifecycle and at any of the touchpoints, campaigns can backfire. While this is true for other channels as well, social media campaigns carry a heightened amount of risk as their management is mostly relegated to algorithms, and campaigns appear differently (customized) for each user. One of the most flagrant risks is the association to negative content (e.g., no advertiser wants its ads to be perceived as violent or discriminatory). Although social media players increasingly monitor the content on their platforms for any impermissible items, inappropriate content can still manage to creep in and remain for certain time durations depending on platforms’ policies and execution. In favor of advertisers though, direct control on where the ads appear is increasingly available to them, even in the transactional model. More pervasive is the risk of ad campaign irrelevance. Social media players’ algorithms can sometimes be at blame; however, this issue is mostly a controller issue where advertisers can feed unpersuasive ads, incorrect instructions, or imprecise data to social media platforms. This risk can be greatly alleviated through closer relationships with social media players, which can provide insights, advice, and tools to design better campaigns.

A key typical concern for entities using social media platforms has been data management. Instances of data breaches have been prominent in the last decade, and new regulations such as the European Union’s General Data Protection Regulation (GDPR) have increased compliance risks in some markets while raising reputational risks in others. Telcos can have legitimate concerns when it comes to sharing data with social media platforms to enable custom audience targeting.

By using platforms that are not their own, telco lose the opportunity to have detailed customer insights about their own customer base in the event negative campaigns are targeted at them, and about their potential customers in case campaigns are targeted at the wider addressable market. With these detailed insights, social media platforms continue to further their strength while potentially also creating the risk of the social media platform running campaigns for similar propositions from a telco’s competitors. Additionally, in line with the wider industry trend of structural separation, where telcos are carving their assets out into separate entities, the barriers to entry on the services layers are diminishing, creating the possibility for social media platforms themselves to start providing their own services directly and competing with the telcos. In such a scenario, availability of these deep insights with the social media platforms can serve to be a disadvantage for telcos.

Despite the above highlighted risks, there are steps that both parties (telcos and social media platforms) can take toward each other in order to design and implement mutually win-win propositions and effectively realize the planned synergies. Out of the three relationship models, we find that closer partnerships (e.g., advising partnerships) are more efficient in mitigating these risks and alleviating such concerns for the telcos.

Updates required to the telco organization

Even though there is a strong rationale to encourage deeper partnerships between telcos and social media players, to realize maximum value from these, telcos must make a few updates to their organizations across all key aspects of structures, processes, systems, resources, and cultures. Many of these are already underway given the wider digitalization programs that most telcos currently undertake.

A wider organization culture transformation, led from the top

Many telcos still only have a limited understanding of the opportunities available to them through social media platforms. The evolution and diversification of social media beyond a community engagement channel to a more comprehensive CX channel is yet to be widely accepted. Additionally, the direct competition social media players pose to telcos through VoIP and messaging does not favor telco-social media partnerships in general given the threat to core telco revenue streams. Telcos have constantly been digitalizing and diversifying themselves and will continue to do so in the post-COVID-19 world, toward being technology players rather than just connectivity providers. This telco evolution is also highly aligned with the CX enhancement opportunities social media platforms provide. A telco-social media player partnership thus should start at the top with strong buy-in and communication from the CxO-level, cascading down to all levels within the organization. In fact, this is well aligned with the ongoing broader shift toward adding CX into staff performance scorecards at all levels that is happening at multiple leading telcos globally.

Repositioning responsibility for social media strategy within the telco organizational structure

The increased pressure to leverage social media platforms to achieve improved CX must be clearly communicated and linked to specific responsible units in the telco organization. Within telcos, social media platforms have moved from being managed by public relations and communications teams historically to marketing teams more recently. However, a wealth of emerging use cases along the entire CX lifecycle is impacting new functions, such as customer care, customer value management, digital, and IT. Adopting more sophisticated use cases and partnership models requires breaking the siloed usage of social media by marketing teams and extending the same to other teams in commercial, operations, strategy, and IT units as well. A close integration with digital units within telco organizations is critical to fully leverage the social media advantage.

Updated processes for agility

Social media CX campaigns are different from traditional touchpoints in the sense that data and feedback can be collected in real time with utmost precision. Telcos must develop in-house capabilities and leverage the social media partners’ support to monitor ad campaigns and continue to adapt them as more data becomes available. Processes must be agile to allow for quicker updates. Additionally, governance of these processes must be aligned with the structural changes implemented within the telco organization.

Systems support for digital and omnichannel journeys

Social media campaigns must redirect both current and potential customers to user-friendly landing pages and associated websites or applications. A functional and aesthetic Web and app experience is vital to retain targeted audiences beyond click-throughs. Omnichannel consistency is a must to leverage interactive touchpoints on social media, particularly with sales or support teams. A request initiated on a messaging channel could be seamlessly picked up elsewhere; for example, a contact made through a WhatsApp chat could be followed up by a call with an agent. Telcos’ systems should be ready for integration with social media tools to bolster the efficiency of data processing. Last, the systems should provide insights on key metrics such as interaction success rate, engagement duration & quality, costs to serve, revenue generated, customer satisfaction scores, and so on.

Dedicated capabilities acquired through recruitment and/or outsourcing

Digital capabilities are key to engaging efficiently with social media platforms. Developing such capabilities requires both capital and investment in human resources. In fact, these capabilities should already be part of telcos’ overall digital transformation and can be leveraged in ways beyond the social media engagement. From a human resource perspective, telcos will need to hire specific expertise around managing social media CX touchpoints to optimize impact from their social media engagements. Additionally, recruitment of these workers must be accompanied by training for existing personnel to ensure seamless workflows. Complementarily, outsourcing can be an attractive option for telcos keen on stepping up quickly, especially on labor-intensive use cases such as in-person sales and/or support on social media platforms.

Updates required to social media platforms

Constant scrutiny of content to ensure information validity

With more content being posted on social media platforms with each day, social media players must constantly up their game on monitoring it for inappropriateness and must be decisive about prompt actions in cases of non-adherence to the established terms and conditions. This focus is critical for reputation management, especially for telcos that intend to be regular users of these social media platforms.

Secure data management

Several national and international regulators have already flagged data management as a key concern relating to social media platforms. These regulations have led to an increased onus on these platforms to install measures that adequately ensure the required privacy for all subjects (individuals, enterprises, and governments) and enhance transparency and communication around the same. While this topic mostly comes up in the context of extensive use of personal data by these social media platforms, it should also be extended beyond to aspects such as following robust security incident response processes and ensuring physical security of data centers.

Dedicated API platform for telcos

Superior customer value management remains a key focus of digitalization strategies for telcos across the world. While many such initiatives have been increasingly successful, the technology architectures for other operators remain in spaghetti form. Telcos rely on strong API ecosystems provided by the digital service players for enabling telco customers to access new products and services to increase profitability and enhance CX. Social media platforms are quite advanced in these APIs, and they are currently being leveraged by marketing managers in companies across different industries. Given certain requirements specific to telcos (such as ensuring data privacy, maintaining legacy systems, serving large customer bases, and operating in saturated markets), the technology teams at social media players must define unique API interfaces dedicated for telcos. Additionally, possibility of the mobile number serving as a unique customer identifier should be further explored in telcosocial media platform partnerships. APIs should be designed around leveraging this potential for wider customer engagement through services such as authentication, billing, and payments.

Enhanced dedicated analytics for telcos

Telecom analytics employ large databases of customer and network information. Given the near-utility nature of the business, telecom analytics’ success depends on quick identification of deep insights to up-sell/cross-sell new products and services to customers. In addition to static push ads and reports generation, social media platforms can assist with recommending products and services in real time. For example, roaming package advertisements can be pushed on social media platforms to customers travelling internationally, and package upgrades can be suggested to customers dealing with poor network quality. Analytics firms increasingly work on leveraging social media platforms to deliver such novel applications. The social media platforms should ensure that these requirements can be implemented technically at reasonable costs.

Conclusion

Since the beginning of the COVID-19 pandemic, social media platforms have become even more prominent, with more engaged customer bases dispersed over larger areas. Telcos can successfully work with these platforms to create the next level of customer engagement and impact, leveraging the unique and powerful capabilities that these platforms have been able to develop. Our estimates suggest that working with social media players can lead to a medium to high impact on most of the telcos’ customer lifecycle touchpoints for both B2C and B2B.

While there are certain risks that telcos need to consider and mitigate in advance, and while some telcos are keen to build their own adtech capabilities, there is still a strong opportunity to design and implement mutually win-win propositions. To achieve value, both parties must take steps toward each other — from addressing current concerns to customizing systems and processes to effectively realize the planned synergies.

Additionally, to address the most fundamental risk of losing their control or even customers to these social media platforms, which is a potential result when providing telecom/ICT services directly to telcos’ customers, telcos need to identify the extent to which they can complement their own digital and other channels with the quick access and ease that social media platforms provide. Robust models that can estimate and compare the benefit and cost per instance for each of the various channels available can help telcos identify the optimum level of social media usage for each task, without cannibalizing their own digitalization plans. Ideally, these models should be easy to update and use.

Given the dynamism of an ever-changing external world — including evolving customer preferences, increasing competitive intensity, new technological advances, and rapid enhancement in social media platform capabilities — telcos must constantly strive to remain close to this shifting optimal point that keeps the telco-social media engagement mutually symbiotic.

DOWNLOAD THE FULL REPORT

Leveraging social media to enhance telecom customer experience

Mastering social media insights can enable telcos to deepen customer understanding and intimacy

DATE

Executive Summary

In recent years, leading Internet/online content players have redefined the customer experience (CX) game by familiarizing customers with a differentiating experience and intimacy, achieved primarily through an increased level of product/service simplicity, agility/efficiency of operations, and user personalization. Telecom operators (telcos) in general have traditionally lagged in providing a differentiated CX given the monopolistic (e.g., high barriers to entry due to licenses, CAPEX) and product-centric (e.g., fixed, mobile) nature of their business.

Within the rapidly transforming paradigm of the telecom industry over the past decade with increasing market saturation and fierce competition from Internet/content players, telcos have been focusing on CX within their corporate strategies. While some players such as Orange, Virgin Mobile, and Vodafone are leading the CX race among telcos, they have a long way to go when it comes to meeting customer expectations, let alone aspiring to redefine it.

Social media platforms have risen steadily in prominence (even more so with the global COVID-19 pandemic) and offer telcos an opportunity to create the next level of customer engagement and impact through unique capabilities that come from their wide reach and personalization options, rich advertising solutions, innovative business platforms, and powerful measurement and insights. We estimate that working with social media players can lead to a medium to high impact on most of the telcos’ customer lifecycle touchpoints for both B2C and B2B. This report aims to demonstrate that social media platforms, often considered as “frenemies” at best, can prove to be critical trusted partners for telcos as business models and CX synergies evolve. However, in order to design and implement these mutually win-win propositions, both parties need to take steps toward each other — from addressing current concerns to customizing systems and processes — to effectively realize the planned synergies.

Social media platforms need to perform constant scrutiny of content to ensure information validity and take prompt actions in cases of non-adherence to the established terms. They need to install adequate measures to address data management and cybersecurity concerns. Additionally, social media platforms can develop dedicated API platforms and analytics engines specifically for telecom-specific needs.

On the telco organizations’ part, deploying these models would require a shift in structures, processes, systems, resources, and cultures, many of which are already underway given their wider digitalization programs. Also, given the race for “direct-to-customer” across organizations, which has accelerated due to the COVID-19 pandemic, there is a need for telcos to identify that optimum level up to which they can complement their own digital and other channels with the ease and access that social media platforms provide.

Social media, the next level of telco customer engagement and impact

While CX has been a strategic priority for telcos globally in the past decade, most of them are still failing to transform it into sustainable competitive differentiation. Digital CX success stories from leading Internet/content players, as well as frontrunners from other industries, mean customers are increasingly accustomed to higher levels of engagement and intimacy.

Key pillars for superior customer engagement and intimacy

Learning from CX leaders, we have identified six key building blocks at the foundation of a superior telco CX (see Figure 1). These building blocks have a critical place within the overall approach that telcos should ideally follow to design and implement their CX, and even broader digitalization strategies.

Core product/service quality. Telcos must develop products/ services that provide them with clear differentiation vis-à-vis competitors. Rather than a one-time activity, this requires effective innovation engines within organizations to gather ongoing feedback/insights from internal marketing functions and directly from customers to constantly upgrade products/services quality accordingly.

Personalization. Telcos should leverage the extensive customer data available to them to develop elaborate personas aligned with customers’ motivations and concerns. These personas can enrich both the sales achieved as well as the product/service experience delivered.

Digitalization. Telcos should digitalize customer interfaces as well as their operations/backends through the application of more open architectures.

Omnichannel experience. Telcos should enable an integrated customer lifecycle across multiple channels/mediums for delivering a seamless omnichannel experience.

Agility/efficiency. Telcos must continue becoming more Agile/ efficient in their processes and systems by leveraging latest technologies such as robotic process automation (RPA).

Security and privacy. Telcos must constantly adhere to robust cybersecurity protocols to protect the increasing amount of customer data they are managing.

Our experience with several telco operators around designing/ implementing CX strategies demonstrates a strong need for consistency, since CX works only when it all works, and it all works exactly the same way each time. This consistency is typically achieved through effectively deploying the comprehensive/holistic approach indicated above within the telco organization. Interactions/partnerships with social media players can provide support to telcos in designing and implementing each of the six CX pillars and in applying the strength/capabilities of the customer bases and the engines that large social media players (e.g., Facebook, Twitter, WeChat) have already developed. Additionally, telcos that leverage these interactions/partnerships well can even reach beyond the standard CX pillars to deliver building blocks/pillars that are more specific to their organizations and that reinforce their brand/ competitive advantage over competitors.

What makes social media players valuable to telcos

Social media players are witnessing steady growth in the number of users as well as in the relative importance these platforms play in users’ daily lives. With Internet availability continuing to grow and now reaching more than 5 billion people, this trend is expected to continue. Some leading social media players already have billions of users, representing existing customers as well as an attractive pool of potential new ones for businesses.

There is strong evidence that social media adoption is increasing in businesses across sectors, including telcos. According to a 2020 study from eMarketer the overall relative weight of digital ad spending has been rising steadily, up from 50% of total ad spend globally in 2019 to nearly 54% in 2020, and 91% of US businesses are already using or planning to use social media for customer services and are increasingly favoring this medium to enhance CX. There is a strong rationale to move to social media platforms given they have clear advantages over traditional CX channels, for example:

- Social media is the preferred customer support channel for those under 25, with 32.3% respondents picking social media as their top choice.

- Seventy-one percent of consumers are more likely to purchase a service or a product when referred through social media.

- Half of the customers globally feel more connected to a brand when they can message it directly.

- Forty-five percent of consumers share bad customer service experiences via social media.

Telcos have long used social media for community building. For example, French telecom Orange boasts 28 million Facebook “fans” who willingly show their appreciation of the brand and subscribe to community communication. Additionally, community pages can now be boosted with the integration of chatbots, which, according to a survey by TM Forum are considered to be an important element of CX for more than 80% of telcos’ decision makers. However, social media platforms have over time built diverse CX offerings that go well beyond community building. These range from personalized and creative advertisements to advanced analytics and payments. Four main strengths of social media platforms make them highly relevant for telcos (see Figure 2):

1. Large reach and personalization capabilities. Social media players offer an unmatched reach to personalized audiences. Given their growing customer bases and their constantly expanding data analytics capabilities, social media players can enable telcos to tap into most of the audiences they want to target. Using platform data, users can be segmented by demographics, interests, and behaviors, creating audiences with strong precision. To cite a specific example, using social media data, telcos can target 18- to 25-year-old gamers using a 3+ year-old phone with less than a 10 MB/s data connection. Telcos can also plug in their own (hashed) data gathered from their websites, applications, CRM, and so on, to target specific audiences. Cross-leveraging both sources of data, social media players can offer powerful predictive audiences by scanning for look-alike custom audiences and thus identify and target non-customer users such as existing high-value customers for telcos.

2. Diversified business platforms. The reach discussed above can be engaged through a growing spectrum of business platforms offering messaging, videos, payments, e-commerce, and even latest technologies such as virtual reality (VR), offered by social media players as communication channels. The integrated model of social media, strongly exemplified by WeChat, provides customers with multiple daily interactions across all their devices, creating supplementary data that enables additional subsequent analyses. The diversification of social media giants into new platforms (e.g., Instagram Shopping, Facebook’s stake in Jio Platforms in India) will continue to reinforce this pillar in the future.

3. Sophisticated advertising solutions. Social media players’ advertising solutions offer diverse models of marketing delivery for telcos. Ads on most social media platforms are sold on an auction basis, which typically integrates several factors such as quality of the ad, the campaign objective, and target audiences, in addition to just the price. The ever-growing sophistication of ad algorithms implies that telcos can get more value for their money as accuracy of the auction system increases. New capabilities also imply that ads are increasingly interactive, lifting click-through rate and ad recall. Additionally, some social media platforms, such as WeChat, can act as intermediaries between telcos and influencers as the latter become ever more critical to marketing strategies. Enhanced ad relevance and performance translate into optimization of marketing expenditures and increased contribution to commercial objectives.

4. Accurate measurements and insights. At the core of the social media platforms’ business model lies its strong expertise in measurements and insights, providing accurate views of the results achieved from social media marketing campaigns. Some social media players go further and provide their insightgeneration capability for use by other parties (e.g., running their proprietary machine learning algorithms on CRM data from telcos). Services such as media mix, attribution, and lift modeling are often available. For telcos, measurements and insights can even go beyond marketing, as some social media players propose omnichannel and connectivity analytics.

To directly benefit from leveraging the power of data and analytics, several telcos are investing in adtech with the intention of developing their own capabilities to run personalized advertisements that could rival social media platforms. This is prompted by a bid to monetize and unleash the value of their rich customer data. Venturing into digital advertising could allow telcos to become enablers for other ecosystem players and give telcos the ability to influence the market. Although their number is currently limited, the telcos that have done this are now competing for “eyeballs” with social media players. The broader objective for telcos, however, is often to enhance the visibility of local companies to strengthen the local ecosystem by offering alternatives to social media giants.

Social media’s potential impact on telco customer lifecycles

Overall, our assessment indicates that social media players can provide a high to medium impact for telcos, supporting them with delivery of their aspired CX to B2C segments (see Figure 3).

Along the discovery phase, the core social media use cases are gaining relevance as social media platforms further develop their advertisement competences. Thus, for telcos keen on running a massive campaign, social media platforms offer a credible alternative to offline media. For example, Zain KSA used Snapchat to run a 5G campaign including specific tools (e.g., interactive filters) and could reach 10.2 unique users in just four days, increasing 5G leads by 270% in the same period. Additionally, the diversification of the telco product/service mix beyond the idea of one-size-fits-all reinforces the need for accurate and granular customer segmentation. Social media platforms’ capabilities in audience targeting come extremely handy as, through their use, personalized bundles and new services can be offered directly to target potential customers. For example, Vodafone used TikTok in Ireland to promote an e-learning platform free for all 18- to 25-year-olds as part of its Vodafone X offer targeted at Irish youth, delivering 1.7 impressions and an impressive click-through rate of 21%. In addition to lead generation, targeted advertisement can lead to a positive impact on brand equity. To cite a case in point, an Ooredoo campaign run on Facebook and Instagram in Kuwait led to a seven-point increase in brand awareness and an 80% improvement in people’s perception of Ooredoo’s Internet experience. Social media platforms’ interactive nature can also be leveraged to generate new leads through instant messaging. For example, Globe Telecom used a Messenger bot to engage with target audiences, leading to a 300% increase in leads, at half the cost of traditional advertisement channels.

Along the evaluation and purchase phase, social media platforms can provide a strong medium for positive differentiation. Monitoring and managing existing customer reviews is essential, as peer assessment plays a key role in telco product/service evaluation. With customers’ requirements for personalization and differentiation of offers rising, leveraging social media advertisement and analytics solutions becomes more essential. For instance, a Norway ICE telecom ad campaign on Facebook and Instagram that targeted very specific audiences, such as parents of small children, boosted mobile subscription sales by more than 9%. Social media platforms can also reduce conversion pain points such as the form-filling requirements for registrations to services or trial offers. Leveraging Facebook retargeting and campaign optimization, STC Pay ran a campaign in Saudi Arabia that boosted the filling-up of KYC forms required for full use of one of its e-wallet applications by 280%.

Along the use phase, the relevance of social media platforms is increasing as telcos propose even more add-on services and applications to their core offerings. Telcos can also, via inplatform interactions, facilitate users’ experience in managing their services, avoiding tedious processes for customers (e.g., call centers, Internet websites) and reducing costs for telcos. For example, social media platforms can identify customers who do not use self-service apps and nudge them into installation — a solution used by Zain in Saudi Arabia, with a 53% increase in app launches. Telcos can also engage with customers via social media platforms — a solution used by MTN; whose customers can use MTN Chat on WhatsApp to manage their accounts.

Along the pay phase, social media platforms so far have not delivered a strong impact, as they have so far been unable to offer an integrated transactional experience for customers, although this is changing quickly. Some early integrated platforms, such as WeChat in China, have led the way and encouraged other platforms to emulate embedded payment experiences. For telcos, integrated payment services are a great way to address one of the biggest pain points within their CX. A low-hanging fruit in this area is communicating transactional data back to customers via social media platforms. Where enabled by platforms and regulations, customers can sometimes pay directly within the social media apps (as through the South African MTN Chat described above).

As social media platforms develop competence in handling payments through diversification into e-commerce, fully embedded payment experiences will materialize. Moreover, leveraging new social media transactional data can help telcos optimize their payment handling, for instance through the targeted bill shock prevention services. As the diversification of social media players into e-commerce enhances their experience in handling payments, data processed from these transactions can further reinforce social media offerings that enhance CX by offering even more tailored offers (e.g., offers in line with customers’ spending habits).

Along the support phase, social media platforms have an important role to play as they are increasingly used as a prime source of information.1 In particular, Twitter has become a top-of-mind medium of information during times of crisis, both global and telco-specific (e.g., during pandemics or network outages). Even in normal times, adverse experiences during issue resolutions can negate any prior positive CX, for both the customers as well as their peers, when such requests are made on public forums. Having an efficient private resolution mechanism, through direct messaging for example, can help avert/reduce the negative brand impact of mismanaged public resolution before the request goes public. For example, in UAE, telecom du has set up an AI-powered customer care bot, which now resolves upwards of 50% customer enquiries, leading to significant cost reduction for the company and stronger customer satisfaction. A reported 80% of customers prefer to resolve their enquiries via WhatsApp. Successful automation of customer support can result in up to a 70% reduction in related OPEX, with social media providing a strong hook toward increasing acceptance and habituating users to automated services. Predictive analytics can also help telcos resolve issues and reduce churn before it happens. Social media data, such as negative reviews or conversation keywords, can be proactively scanned to identify potential churners and enabling timely and targeted customer support.

Compared to B2C, the potential impact of social media on the B2B lifecycle for telcos is relatively less pronounced. However, in absolute terms this impact is quite high, making social media platforms an effective tool for telcos for delivering the B2B CX they aspire to (see Figure 4).

Along the pre-sales phase, social media presence — particularly on professional networks such as LinkedIn — can boost brand equity, especially for small and medium enterprises (SMEs) with limited procurement capabilities. Peer reviews on social media are an important source of evaluation data for companies, highlighting the need for telcos to be proactive/responsive on these platforms. Thus, it is important to be able to reply and follow up on leads emerging on social media platforms by engaging account managers in serving potential clients. The impact of social media platforms on the pre-sales phase in B2B, while still nascent compared to that found in B2C, is bound to increase as telcos shift their product mix toward high-value niche markets. Social media platforms can help identify businesses that engage in these niche markets and evolve along with their needs, paving the way for personalized direct marketing. For example, Telstra designed a LinkedIn advertisement campaign for a niche B2B audience segment in Australia, leading to a 145% higher click-through rate and a 60% higher conversation rate compared to benchmarks. As businesses, including SMEs, continue to boost their online presence, social media platforms’ reach becomes even more potent, making them a privileged medium to boost B2B brand equity. For instance, Verizon generated a 100% brand sentiment through a Twitter campaign that raised funds for small businesses affected by the COVID-19 crisis and became the first trending topic on Twitter in the US.

In addition, telcos can benefit from direct touchpoints with decision makers within companies, whom they can identify on social media platforms through analyzing decisions such as the creation or the maintenance of a business page.

Along the delivery phase, social media platforms’ impact is mostly limited to enhanced education on the use of telco services, which can be delivered to B2B customers through ads, posts, and even training. Several platforms have developed integrated video/VR capabilities to meet these needs. For example, telcos can leverage the LinkedIn Learning platform to deliver training engagements they may contract with their B2B customers.

Along the operations phase, telcos can leverage social media platforms to propose a new channel for issue resolution to their B2B customers. Additionally, in line with data processed from the social media platform activity of their B2B customers, telcos can propose more targeted up-selling and cross-selling opportunities.

In summary, while the use of social media platforms for B2B CX remains limited in comparison to that for B2C CX, the growth in professional networks provides an increasing pool of usable data for telcos to leverage. More promisingly, social media platforms allow advanced segmenting, which can support telcos in designing unique CX for specific markets and extending it to otherwise difficult-to-access niche market players.

Given that social media players can influence/deliver on most touchpoints along the telco customer lifecycles, they now aspire to go beyond the plain customer-vendor transactional relationship toward forging deeper relationships, which could also be a win-win proposition for telcos once any corresponding concerns can be effectively addressed.

1 For instance, social media has become the primary source of information for 40% of Arabs and 24% of under-25 British adults

Telco-social media engagement models

As illustrated in Figure 5, telcos can engage with social media players through multiple models, varying in the extent of interaction:

Transactional relationships (a quick and easy way to capitalize on established social media use cases). Social media players have democratized the accessibility of their advertisement services. Telcos can buy and configure ads in a self-service environment, using internal resources to design and monitor the campaigns delivered through social media platforms. In this model, social media platforms are considered as just one channel among others (e.g., telcos’ own digital and other channels). The value capture by the social media platforms is limited to their direct fees, while telcos benefit from a return on their investment when they achieve their intended objectives (e.g., incremental sales, additional app downloads). Although easy to implement, this relationship model might not be the most optimal for telcos given it does not leverage the full value that can be unlocked from customizing these platform features for the telco’s specific context. While building in-house social media expertise can enable telcos to tap into some of this value, it will remain costlier and restricted unless telcos can establish deeper relationships with social media players through partnerships. Transactional relationships can best serve telcos that are keen to test/experiment with the impact of social media platforms or in markets that are too small to warrant social media players’ interest in forging closer partnerships.

Advising partnerships (another step toward efficient social media driven CX). Social media players, as a part of their existing propositions for large advertisers (this typically includes telcos), offer privileged services with expert advice at their core. Through these partnerships, telcos have the opportunity to increase the efficiency of their expenditures via more customized/targeted use cases. Social media players usually do not expect advisory fees; rather, they anticipate new revenues as they showcase attractive use cases to telcos. Trusting their solutions to boost their clients’ ROI, social media players are typically remunerated for their advising services only by the prospect of subsequent increased account sales. In summary, the depth of telco-social media engagement is defined mostly by the extent of telcos’ spending on social media platforms. Strong partnerships can be realized through joint business plans, with collaboratively defined goals/targets along with corresponding requirements (e.g., resources, teams, partners, solutions) from both sides. An example of an advanced advising partnership can be found in the relationship between Verizonbacked virtual carrier Visible and Snapchat, where the two players collaborated to launch the Visible brand and business in 2018 through ads and interactive communication content on the Snapchat platform.

Commercial partnerships (another source of shared value). Although majority engagements between telcos and social media players are based on advertising investments from telcos, some social media players offer alternate models as well. For instance, Facebook — through its Advanced Network Planning, Actionable Insights tools, Telecom Infra Project, and Express Wi-Fi initiatives — proposes speed measures and planning algorithms to assist telcos with their network planning. The underlying value exchange materializes through mutually beneficial connectivity gains; that is, a telco can increase its customer base and usage experience while social media platforms, as over-the-top service providers, get access to new users. Taken a step further, wherever permissible with respect to the net neutrality stipulations, these partnerships can include privileged traffic for social media platforms on the telco’s network. One example of such a partnership can be found in Malaysia, where Facebook is assisting Time dotCom to reinforce its Internet infrastructure in exchange for a future privileged status for Facebook’s family of apps.

Another field of collaboration between telcos and social media is innovation, especially as the roll-out of 5G opens a new world of digital capabilities. For telcos wishing to demonstrate the possibilities of their new network, social media platforms can be partners of choice, especially as several players have been investing in augmented reality (AR)/VR experiences that depend on fast speed and high bandwidth. Verizon and Snapchat’s innovation partnership announced in 2019 exemplifies the potential synergies to be found as the two players now work together to develop AR experiences showcasing the benefits of 5G on Snapchat. In addition, while Snapchat provides premium sponsorship placements for Verizon, Verizon preinstalls the Snapchat application on some of its 5G phones. These types of partnerships can lead to win-win outcomes as both players can grow their customer base simultaneously.

Success factors for social media-driven customer engagement

The benefits to telcos from engaging with social media platforms are clear, yet increased reliance on social media-led CX management will not be fully risk-free for telcos, and they will have to address both generic and specific issues related to data privacy, as well as reputation.

Throughout the CX lifecycle and at any of the touchpoints, campaigns can backfire. While this is true for other channels as well, social media campaigns carry a heightened amount of risk as their management is mostly relegated to algorithms, and campaigns appear differently (customized) for each user. One of the most flagrant risks is the association to negative content (e.g., no advertiser wants its ads to be perceived as violent or discriminatory). Although social media players increasingly monitor the content on their platforms for any impermissible items, inappropriate content can still manage to creep in and remain for certain time durations depending on platforms’ policies and execution. In favor of advertisers though, direct control on where the ads appear is increasingly available to them, even in the transactional model. More pervasive is the risk of ad campaign irrelevance. Social media players’ algorithms can sometimes be at blame; however, this issue is mostly a controller issue where advertisers can feed unpersuasive ads, incorrect instructions, or imprecise data to social media platforms. This risk can be greatly alleviated through closer relationships with social media players, which can provide insights, advice, and tools to design better campaigns.

A key typical concern for entities using social media platforms has been data management. Instances of data breaches have been prominent in the last decade, and new regulations such as the European Union’s General Data Protection Regulation (GDPR) have increased compliance risks in some markets while raising reputational risks in others. Telcos can have legitimate concerns when it comes to sharing data with social media platforms to enable custom audience targeting.

By using platforms that are not their own, telco lose the opportunity to have detailed customer insights about their own customer base in the event negative campaigns are targeted at them, and about their potential customers in case campaigns are targeted at the wider addressable market. With these detailed insights, social media platforms continue to further their strength while potentially also creating the risk of the social media platform running campaigns for similar propositions from a telco’s competitors. Additionally, in line with the wider industry trend of structural separation, where telcos are carving their assets out into separate entities, the barriers to entry on the services layers are diminishing, creating the possibility for social media platforms themselves to start providing their own services directly and competing with the telcos. In such a scenario, availability of these deep insights with the social media platforms can serve to be a disadvantage for telcos.

Despite the above highlighted risks, there are steps that both parties (telcos and social media platforms) can take toward each other in order to design and implement mutually win-win propositions and effectively realize the planned synergies. Out of the three relationship models, we find that closer partnerships (e.g., advising partnerships) are more efficient in mitigating these risks and alleviating such concerns for the telcos.

Updates required to the telco organization

Even though there is a strong rationale to encourage deeper partnerships between telcos and social media players, to realize maximum value from these, telcos must make a few updates to their organizations across all key aspects of structures, processes, systems, resources, and cultures. Many of these are already underway given the wider digitalization programs that most telcos currently undertake.

A wider organization culture transformation, led from the top

Many telcos still only have a limited understanding of the opportunities available to them through social media platforms. The evolution and diversification of social media beyond a community engagement channel to a more comprehensive CX channel is yet to be widely accepted. Additionally, the direct competition social media players pose to telcos through VoIP and messaging does not favor telco-social media partnerships in general given the threat to core telco revenue streams. Telcos have constantly been digitalizing and diversifying themselves and will continue to do so in the post-COVID-19 world, toward being technology players rather than just connectivity providers. This telco evolution is also highly aligned with the CX enhancement opportunities social media platforms provide. A telco-social media player partnership thus should start at the top with strong buy-in and communication from the CxO-level, cascading down to all levels within the organization. In fact, this is well aligned with the ongoing broader shift toward adding CX into staff performance scorecards at all levels that is happening at multiple leading telcos globally.

Repositioning responsibility for social media strategy within the telco organizational structure

The increased pressure to leverage social media platforms to achieve improved CX must be clearly communicated and linked to specific responsible units in the telco organization. Within telcos, social media platforms have moved from being managed by public relations and communications teams historically to marketing teams more recently. However, a wealth of emerging use cases along the entire CX lifecycle is impacting new functions, such as customer care, customer value management, digital, and IT. Adopting more sophisticated use cases and partnership models requires breaking the siloed usage of social media by marketing teams and extending the same to other teams in commercial, operations, strategy, and IT units as well. A close integration with digital units within telco organizations is critical to fully leverage the social media advantage.

Updated processes for agility

Social media CX campaigns are different from traditional touchpoints in the sense that data and feedback can be collected in real time with utmost precision. Telcos must develop in-house capabilities and leverage the social media partners’ support to monitor ad campaigns and continue to adapt them as more data becomes available. Processes must be agile to allow for quicker updates. Additionally, governance of these processes must be aligned with the structural changes implemented within the telco organization.

Systems support for digital and omnichannel journeys

Social media campaigns must redirect both current and potential customers to user-friendly landing pages and associated websites or applications. A functional and aesthetic Web and app experience is vital to retain targeted audiences beyond click-throughs. Omnichannel consistency is a must to leverage interactive touchpoints on social media, particularly with sales or support teams. A request initiated on a messaging channel could be seamlessly picked up elsewhere; for example, a contact made through a WhatsApp chat could be followed up by a call with an agent. Telcos’ systems should be ready for integration with social media tools to bolster the efficiency of data processing. Last, the systems should provide insights on key metrics such as interaction success rate, engagement duration & quality, costs to serve, revenue generated, customer satisfaction scores, and so on.

Dedicated capabilities acquired through recruitment and/or outsourcing

Digital capabilities are key to engaging efficiently with social media platforms. Developing such capabilities requires both capital and investment in human resources. In fact, these capabilities should already be part of telcos’ overall digital transformation and can be leveraged in ways beyond the social media engagement. From a human resource perspective, telcos will need to hire specific expertise around managing social media CX touchpoints to optimize impact from their social media engagements. Additionally, recruitment of these workers must be accompanied by training for existing personnel to ensure seamless workflows. Complementarily, outsourcing can be an attractive option for telcos keen on stepping up quickly, especially on labor-intensive use cases such as in-person sales and/or support on social media platforms.

Updates required to social media platforms

Constant scrutiny of content to ensure information validity

With more content being posted on social media platforms with each day, social media players must constantly up their game on monitoring it for inappropriateness and must be decisive about prompt actions in cases of non-adherence to the established terms and conditions. This focus is critical for reputation management, especially for telcos that intend to be regular users of these social media platforms.

Secure data management