46 min read • Oil, Gas & Other Natural Resources

Nord Stream 2 Economic Impact on Europe

Follow-up analysis of effects on job creation and GDP during the construction phase

Executive Summary

Introduction

Due to its size and relevance to the European energy sector, Nord Stream 2 constitutes a major European infrastructure investment that receives a great deal of attention. In July 2017, Nord Stream 2 commissioned Arthur D. Little to evaluate the economic impact of the activities and investments related to the Nord Stream 2 project, on countries that were either directly involved in the project or had contributed materials or services. The first report was carried out in the summer of 2017, at the height of the procurement phase, when only part of the budgeted funds (€4,400 million) had been committed, and assumptions had to be made due to ongoing tenders.

The overall objective of the report is to perform an assessment and to provide a transparent and fair description of economic benefits in terms of job creation and the GDP impact of Nord Stream 2. In addition to the previously published report, the plan is to expand this early analysis with a follow up report during the construction phase. Further analysis following project completion could provide valuable insight into the longer term economic effects of the new infrastructure during operations.

This current follow-up report is conducted at the height of the construction phase, at a time when almost all funds have been either spent or committed (€8,000 million, as of December 2018).

The scope only covers investments in the pipeline itself until operations begin. Wider economic implications of the availability of this new infrastructure to the European energy market were not considered in this study, and neither were the political implications scrutinized.

The methodology used for the assessment is an Economic Impact Analysis, which analyzes how an initial investment creates value in the economy via subsequent spending in interconnected value chains.

The Economic Impact Analysis is complemented by a number of supplier interviews.

Conclusions

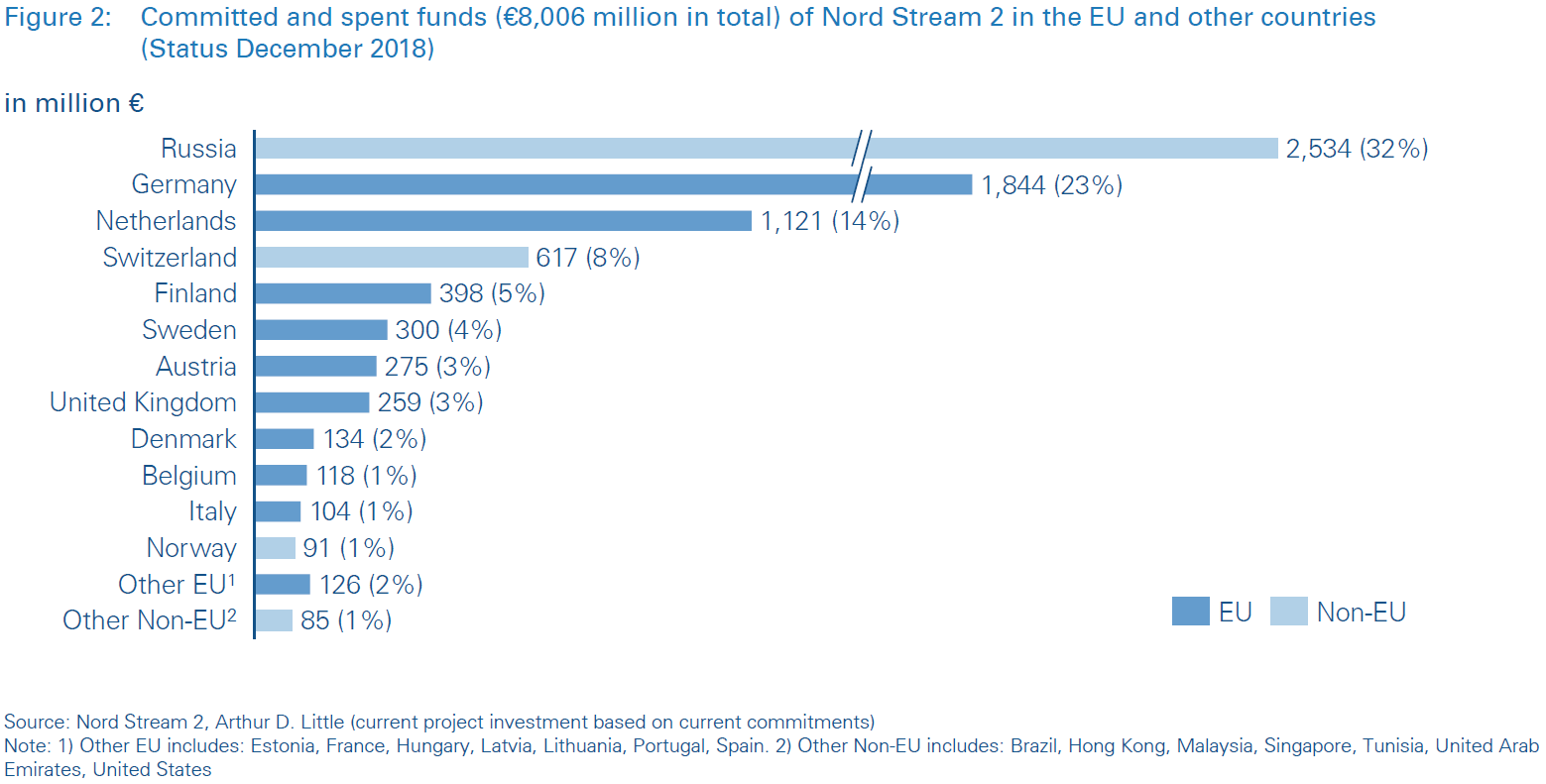

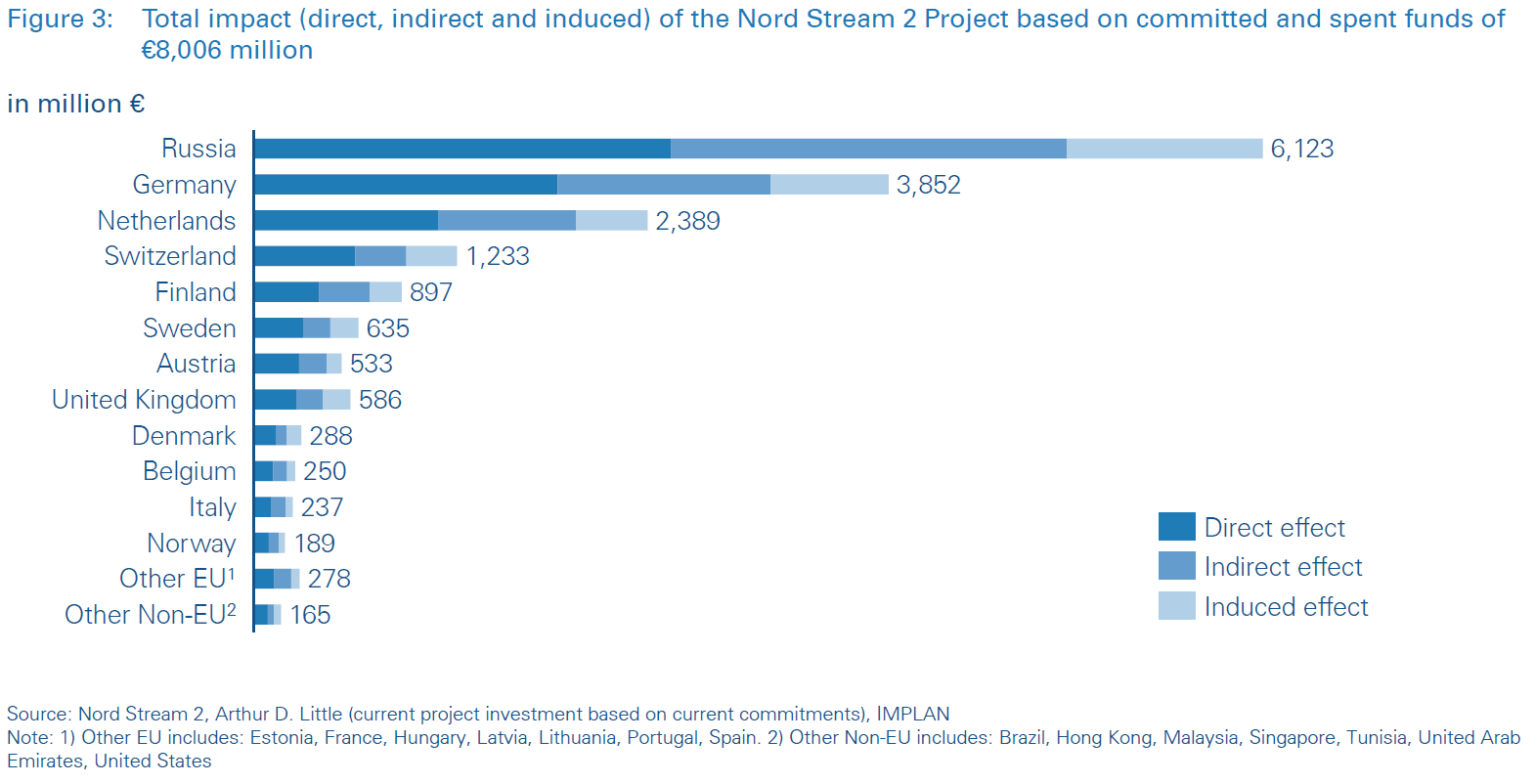

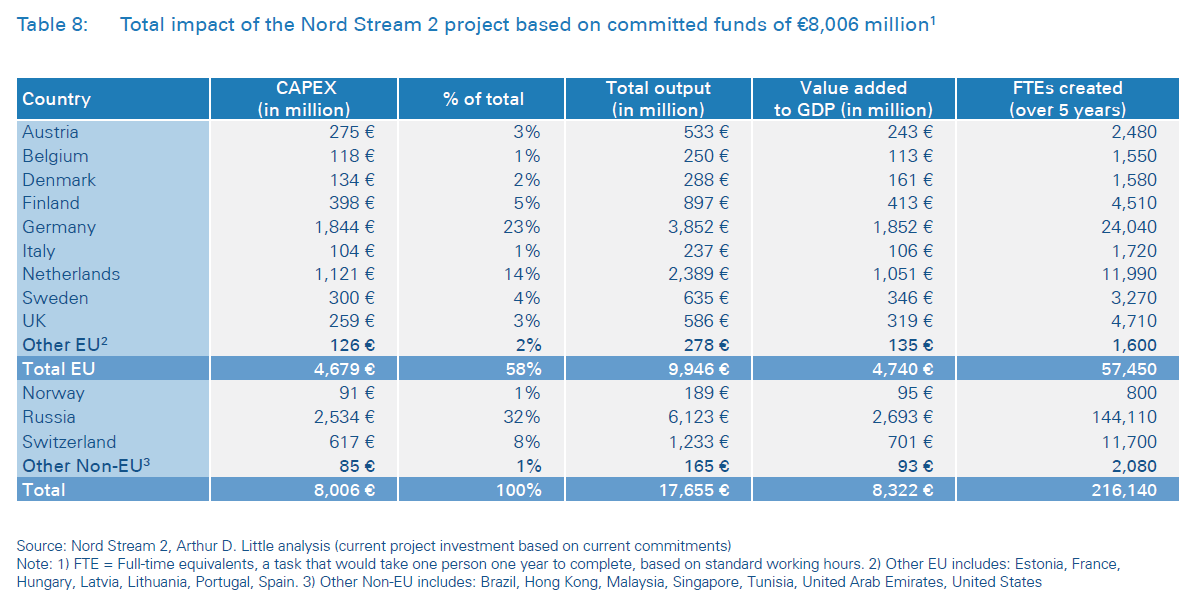

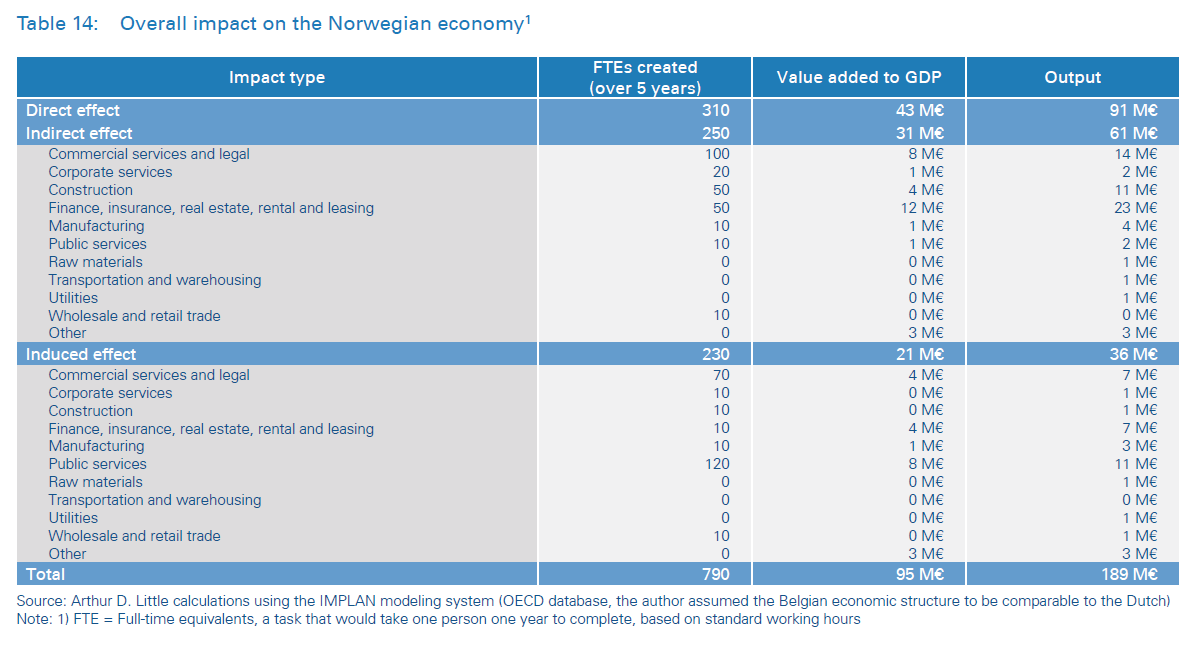

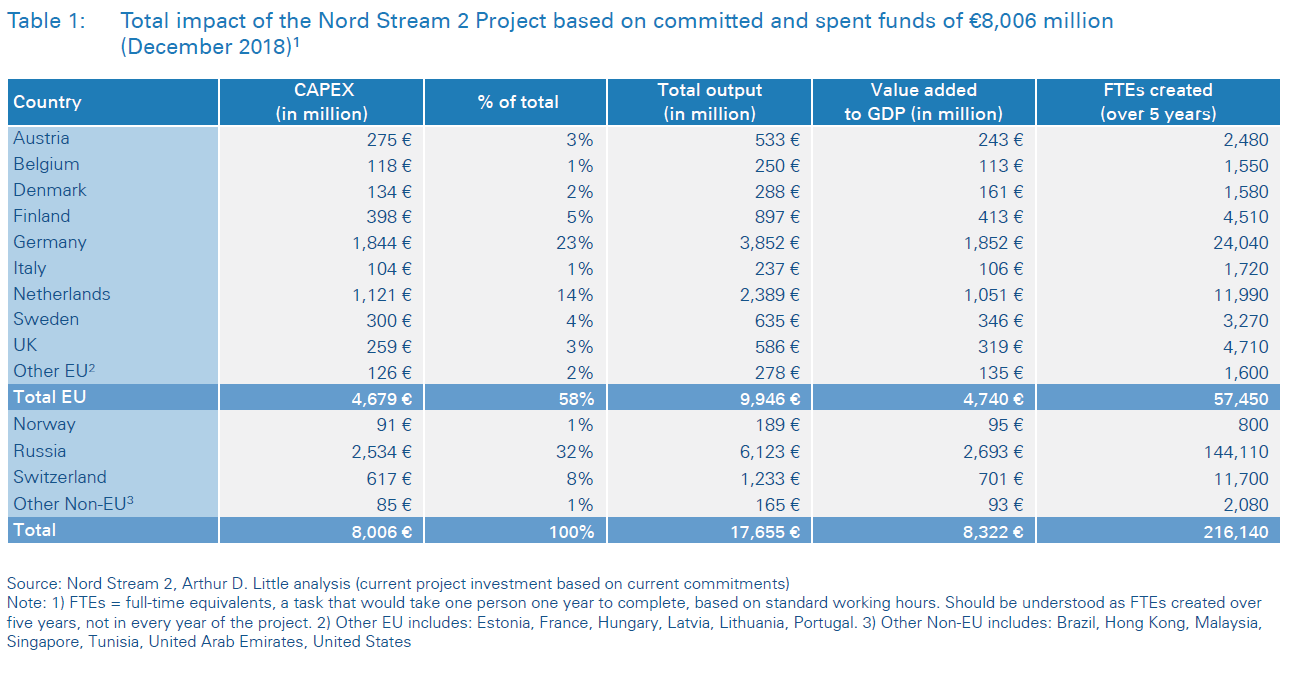

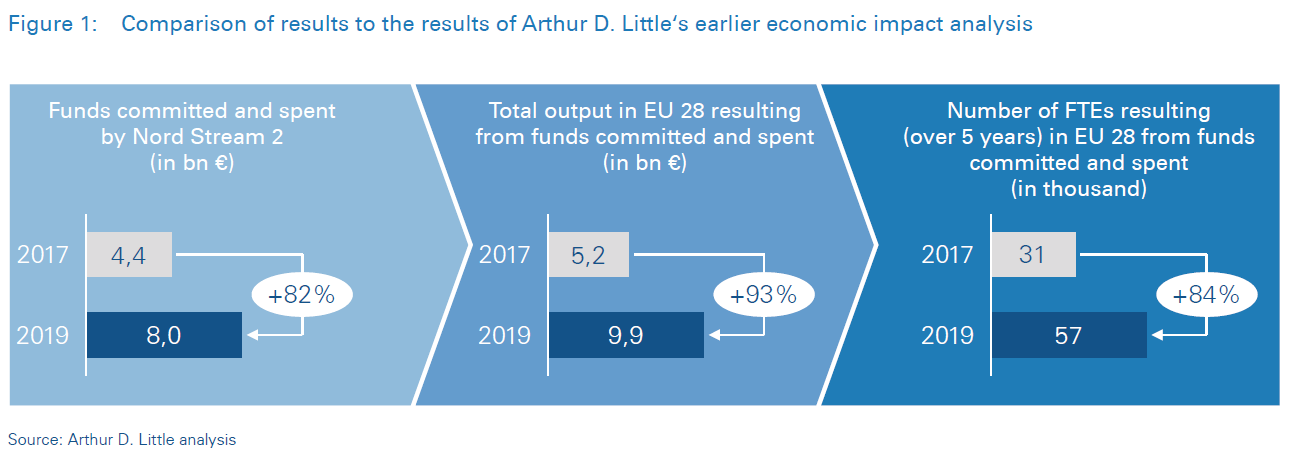

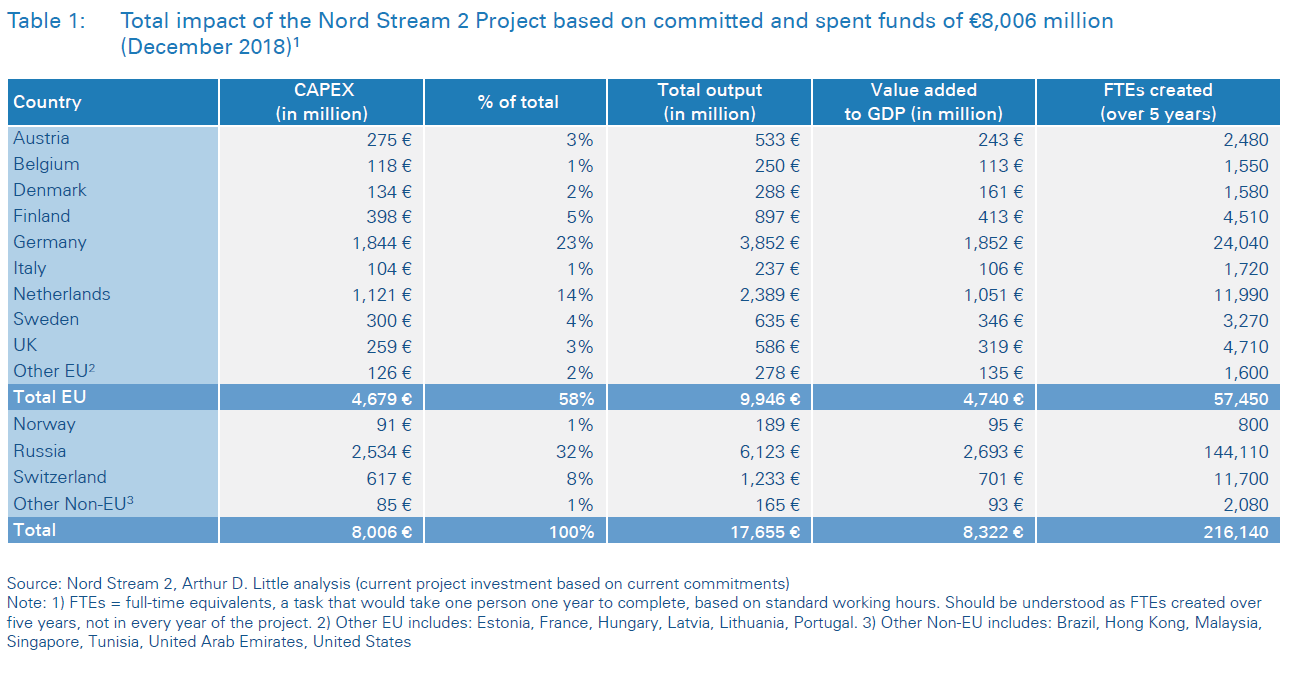

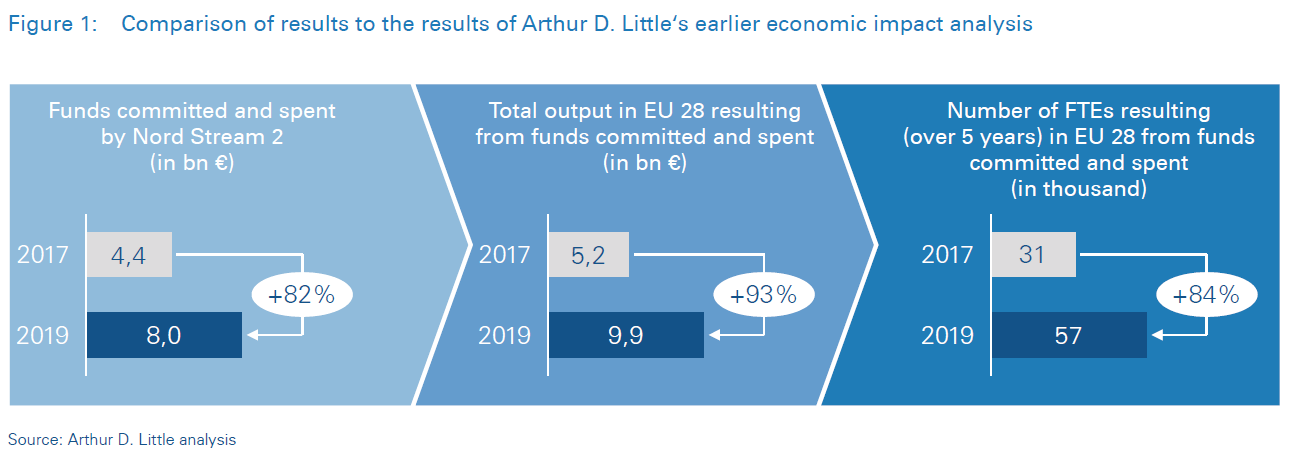

The overall results of the assessment show that the total economic benefit created as of December 2018 for the European Union, which is receiving 58 1 percent of total investments, is over €9,900 million. This has created 57’450 full-time equivalents 2 , and added €4,740 million in GDP (see Table 1). Since we conducted the first economic impact analysis, the committed and spent funds have increased by 82 percent. The impact on the European Union in terms of both financial output and FTEs created has increased accordingly (see Figure 1).

The project has a wide range of effects on many different countries and economic sectors. The analysis covers all the countries that have contributed, with special emphasis on the EU and Russia.

As can be expected, the most pronounced effects are seen in:

- countries where major

- project-related manufacturing activities take place (RU, DE, FI, SE, DK);

- countries traditionally associated with the offshore oil and gas industry that host themajority of service providers (NL, UK, NO, IT);

- headquarters of major international service providers;

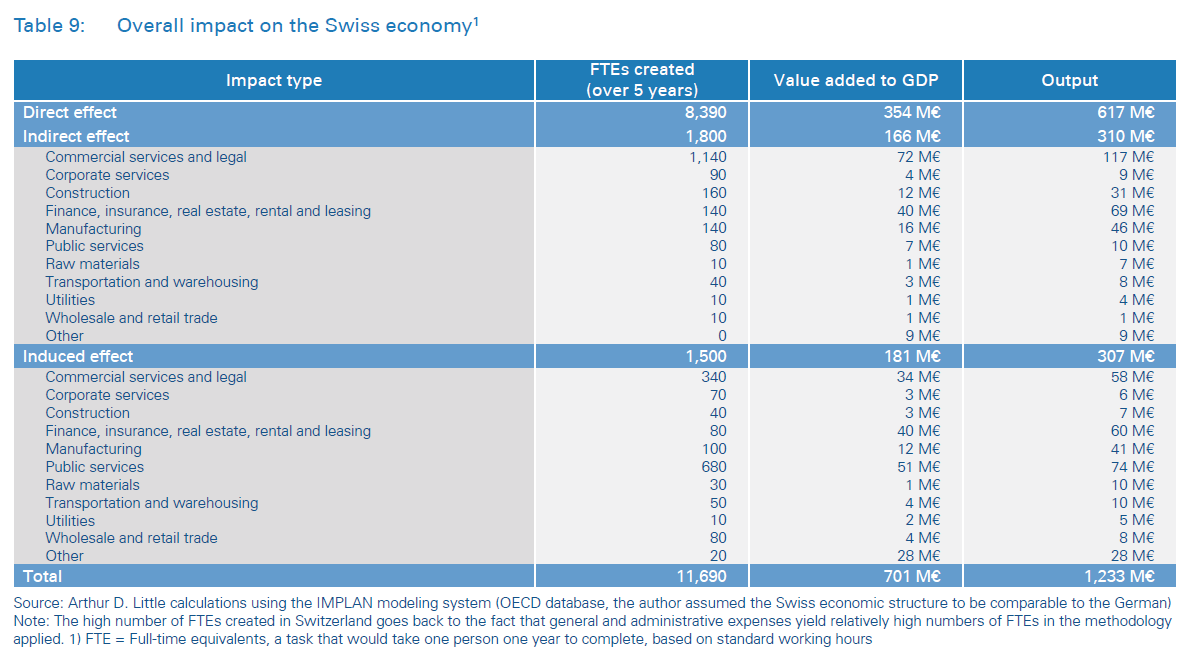

- Switzerland, where the headquarters of Nord Stream 2 are located, and from where, for instance, various professional services, technical and IT support are provided.

The analysis of full-time equivalent jobs created by the project is in line with expectations from other, similar large-scale infrastructure projects.

In comparison to the previous study, the effects by country are similar, but larger, since in the meantime, additional funds have been spent and committed.

The analysis in this study is limited by the boundaries of the Nord Stream 2 project, but further related economic effects are likely, for example, in connecting infrastructure in Germany, the Czech Republic and Russia.

Additional economic benefits are likely to arise from the presence of more competitively priced gas to the European economy as well as lower decarbonization costs as a result of lower gas prices competing with oil and coal. This could be the subject of separate studies further on.

The impact varies between countries because of:

- types of work created (white collar or blue collar);

- economic structure of the country;

- differences in labour cost.

A difference in the cost of labour would mean that an equally sized investment would have a larger impact in a country with lower wage and salary levels. An investment in engineering services will create more value than an investment in materials. An investment in a country with a large network of sectors contributing will have a larger effect than in a country that needs to import required goods or services from elsewhere. The impact of the investment is significant for the European Union as a whole, but also for individual Member States, as it is, of course, also for other contributing nations.

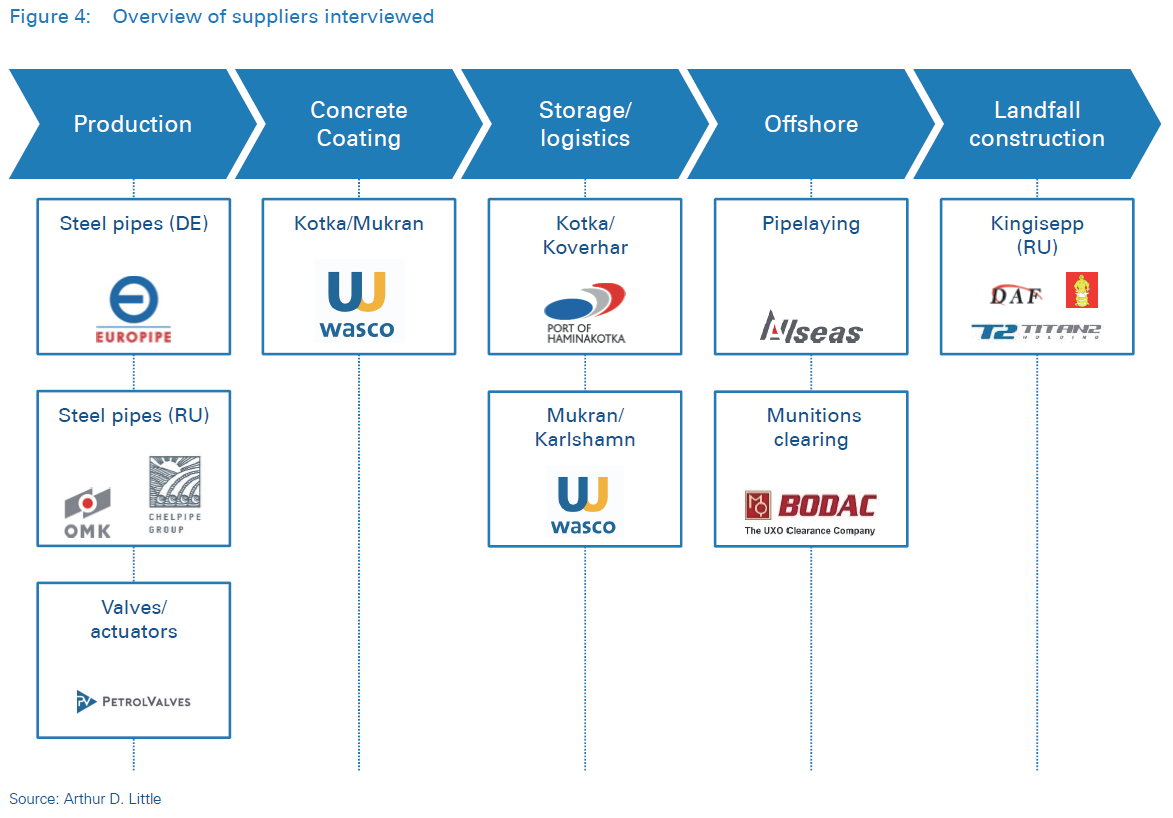

3 - Overview of suppliers interviewed

In order to create a more detailed picture of some of the key activities required to build the pipeline, as well as contractors involved in delivering products and services, we have included snapshot descriptions of some of the companies, spread out in this report, based on short interviews with key staff. It should be noted that this is not the full list of contributing companies, only a small subset. They were chosen to reflect a broad spectrum of activities and based on availability at the time of report preparation. In the chart below, we illustrate where the companies covered have been contributing across the value chain. They include (see Figure 4):

- The three pipemills: EUROPIPE, OMK, Chelpipe.

- A key supplier of critical components -- PetrolValves.

- A contractor engaged in weight coating and logistics operations -- Wasco.

- One of the strategic ports selected for the project -- the port of HaminaKotka.

- An offshore pipeline construction company -- Allseas.

- A company involved in mitigation measures and munition clearance -- Bodac.

- Plus some of the subcontractors engaged on various scopes and as well as various contractors on construction of on- shore facilities in Russia: Metallostroy, MSU-90, and DAF (subcontracted via Russian Dredging & Marine Contractors, as well as through Kvaerner).

4 - Many companies shared their experiences

By reliably suppling large quantities of quality pipe over such a long period and at such a tight schedule we have achieved a new milestone.

– Dr. Andreas Liessem, Managing Director and

Armin Klein, Marketing, Special Projects and Market Analysis

Successful participation in Nord Stream 2 has become an important reference for our subsea products.

– Eduard Stepantsov

Head of Commercial Department

The project participation gave us international recognition. We can proudly say that our processes and products correspond to the highest standards and stringent product requirements.

– Golodyagin Alexandr Sergeevitch

Head of Strategic Partnerships Department

Nord Stream 2 was strategically important for us as it came in a period of recession in oil and gas. Nord Stream 2 allowed PetrolValves to retain staff and invest to support project execution.

– Filippo Rinaldi

Director, UK

We firmly believe that this project will help us going forward to develop our business in Europe and globally because in our industry it has received global attention.

– Rik Nugteren

Project Director,Coatings Europe

Nord Stream 2 is an important employer here in the region and gives a lot of jobs to the local people.

– Dr. Kimmo Naski

CEO

On a very big project like this - you have the luxury of getting better at it month by month. You really have time to improve in every aspect.

– Edward Heerema

President

Bodac made a significant difference by using a mine disposal system that is safe and efficient but uses less explosives.

– Auke van der Velde

Explosive Ordinance Disposal Manager

Participation in this large project led to 70% utilization of both facilities and staff, and a significant increase in staff motivation.

– Djavad Djavadov

Deputy Director

The project allowed us to enter a new sector, gain international experience and adapt to higher safety standards.

– Dmitry Martinov

Deputy Chief Engineer

The project, as one of the five largest in our history, is strategically important for us.

– Dmitry Platonov

Chief Engineer

EUROPIPE – supplier of coated steel pipes

Products/services

EUROPIPE supplied about 1,100 km of steel pipe for Nord Stream 2 at a speed of up to a maximum of 90 km per month. The pipes were then transported by rail to Mukran on the Baltic Sea coast and by ship to Kotka for weight coating. In addition, bends and buckle arrestors were delivered for the onshore facilities in Germany and Russia. The order made up about 50-70 percent of capacity over the project duration, so it was very significant.

Key challenges

The delivery schedule was very challenging. Some 2,000 workers have been involved in the project since 2016, in various different staff categories. Additional working shifts had to be introduced at the factory, as well as at the coating yard to meet the deadlines. Significant investments into the quality control system were also made. At the same time, an induction coil system was added at the coating yard to accelerate the coating process (coating was applied to internal and external surfaces of the pipe) and increase overall production speed.

Main benefits

Reliably supplying large quantities of top quality pipe in the time required by the ambitious schedule of Nord Stream 2 is one of EUROPIPE’s strengths, and we were able to live up to the expectations. But doing it for so long, and at the same time handling the logistics to bring the pipes to the coating plant in Mukran was a challenge. It was a landmark project for us.

OMK – supplier of pipes

Products/services

OMK was one of three suppliers of steel pipe, providing some 730 km for the project, as well as pipe fittings for the compressor station on the Russian side of the pipeline. It was the largest one-off pipe-supply contract in the history of our company.

Key challenges

Production facilities were renovated and modernized, and technology upgraded for the Nord Stream 2 project. The safety requirements stipulated in the contract also led to an upgrade of industrial safety at the plant, including adoption of a new standard for incident reporting, installation of automatic sensors and an almost-complete phaseout of manual operations.

Main benefits

OMK was able to prove that we can compete globally, meeting the most stringent international standards and fulfilling the terms and conditions of a demanding contract. As a result of the Nord Stream 2 project, the plant has been modernized, safety upgraded and corporate social responsibility objectives introduced. Successful participation in Nord Stream 2 has become an important reference for the company’s subsea products. It also enabled OMK to actively improve the local urban environment in Vyksa through contributions to cultural projects, industrial tourism, sports, and charity

Chelpipe – supplier of pipes

Products/services

Chelpipe supplied large diameter pipes, including concrete-covered pipes (CWC), transition pieces, buckle arrestors and low-temperature pipes. About 200 km of pipes were coated by PCT (Pipe Coating Technilogies) at a plant in Volzhsky, the rest were shipped by rail to Kotka and Mukran for coating. The total amount of pipes supplied is 611,000 tons, or 640 km, and Chelpipe’s annual production capacity is 1,000,000 tons.

Key challenges

Pipes had to be produced in line with Det Norske Veritas standard and in accordance with additional project-specific requirements. Chelpipe mastered production of all pipe sizes, including pipes with WT 41 mm. Buckle arrestors were produced for the first time in the territory of the Russian Federation. Multi-pass welding process for low- temperature pipes was developed and introduced in a short time. The steel was supplied by Magnitogorsky Metallurgical plant (MMK) Russia and Dillinger (Germany).

Main benefits

Around 1,300 people have been involved in various capacities during the 2 years of Chelpipe’s participation. We can proudly say that our manufacturing process and products correspond to the highest standards and stringent product requirements. We have delivered pipes of the highest quality, manufactured to strict client specifications, and without any delays, according to the tough schedule set out by Nord Stream 2. In addition, we were able to triple our tax contributions to the local Chelyabinsk community.

The Nord Stream 2 pipeline – status report

In our first report 5 , we provided a detailed background description of the project, and its history, market context, rationale and activities to date. In this report, we will focus on updating this context with developments in the past two years, in terms of demand and supply, general gas infrastructure additions and Nord Stream 2 project developments.

The objective of the Nord Stream 2 project is to provide additional means for safe and secure deliveries of gas to Europe. Europe’s import dependency and supply gap is growing, due to growing consumption, depletion of indigenous reserves, and phasing out of nuclear and coal-fired power generation capacity. In our first report, we provided forecasts of both demand and supply to illustrate this point. Renewable energies alone are not available in sufficient quantities to bridge this gap.

The addition of more pipeline capacity to Europe provides an option for buyers of gas to import competitively priced supplies from Russia if they wish to. It does not prevent anyone from buying gas from other sources, if preferred.

Market developments

Demand

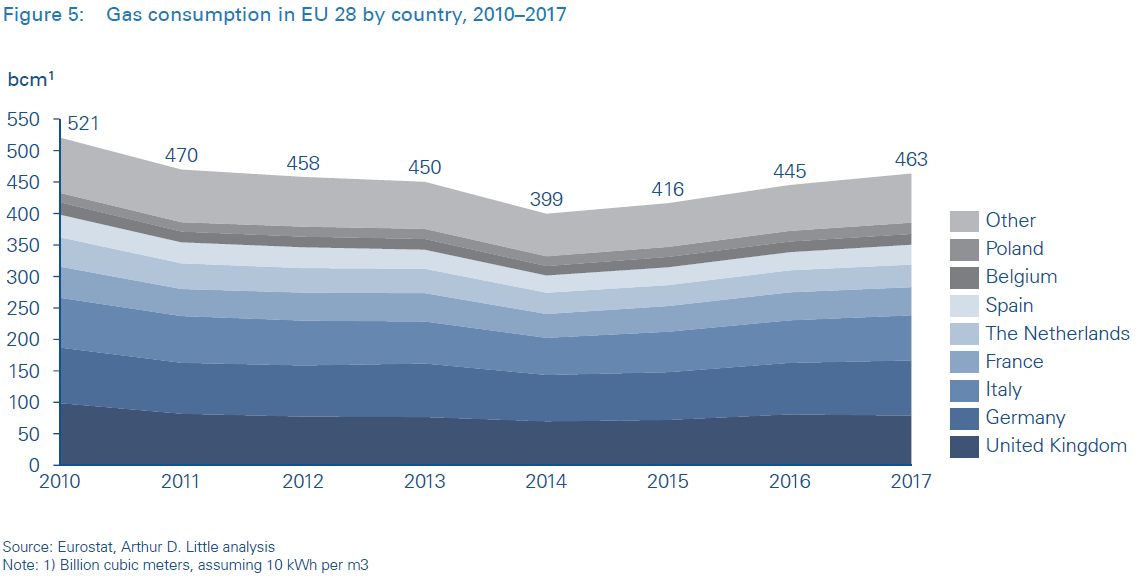

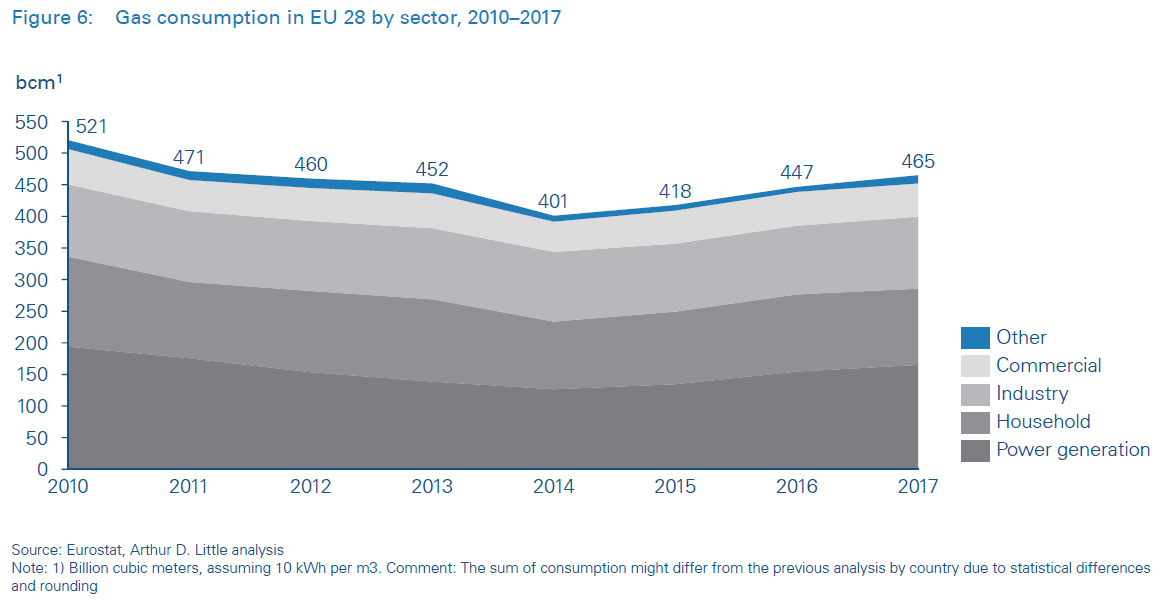

European gas demand has recovered since 2014, after its decline following the financial crisis in the early part of the decade. During this period, the European gas market has become increasingly competitive; 70 percent of wholesale gas sales are now based on traded gas market prices such as the NBP 6 and TTF 7 , while those volumes that are still indexed to oil have to compete with the traded gas price via discounts and rebates to remain competitive. Gas demand has grown in all countries and all sectors (see Figures 5 and 6).

Following a recent proposal by the German WSB 8 Commission, tasked with developing a plan for the phase-out of coal and lignite, Germany could close 8.6 GWe (20 percent) of hard coal- and lignite-fired power generation capacity by 2022 - and all of it by 2038. This would occur at the same time as the exit from nuclear power, presenting an additional challenge in closing the gap. It is anticipated that as a result, German gas consumption used for power and heat production could potentially double by 2023. This would require large new imports, which in the short term could be met by a combination of LNG and new import capacity from Russia (Nord Stream 2).

For a comprehensive review of forecast gas demand and the sources available to close the import gap, we would like to refer the reader to our first report.

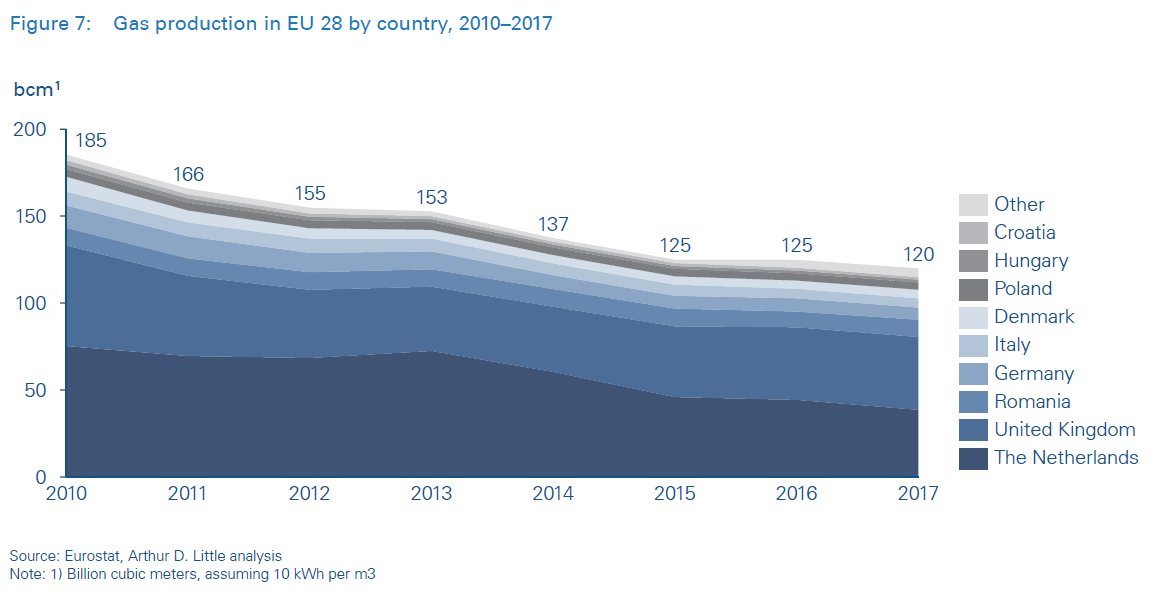

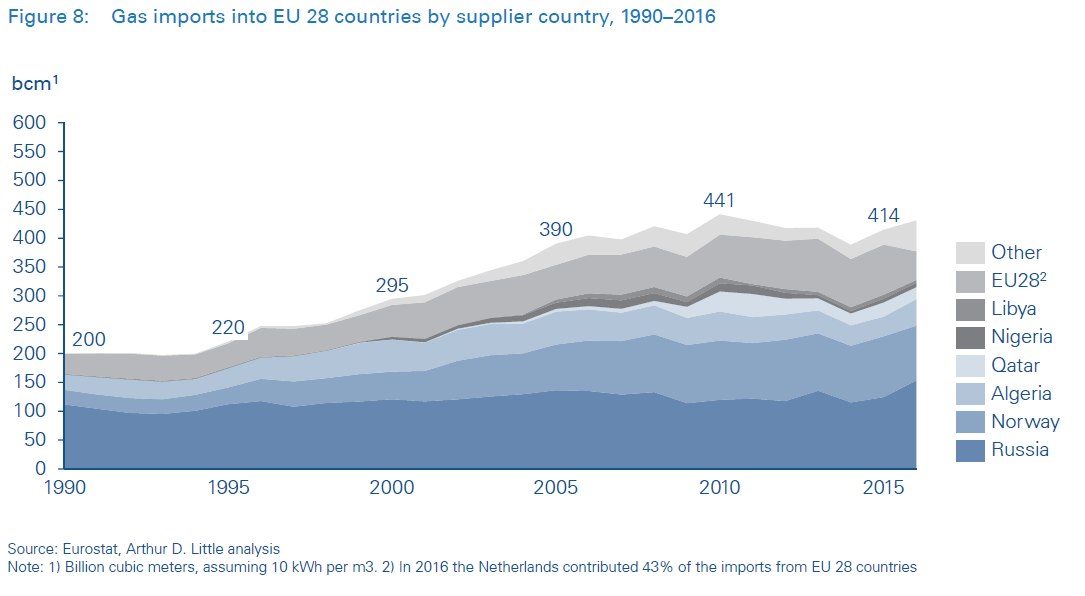

Supply

European imports have also grown in the past two years. Indigenous production in the Netherlands, the UK, Denmark and Germany has peaked and is declining. Norwegian gas production is not expected to increase from current levels. New import sources such as Nigeria have emerged, in addition to Russian LNG (see Figures 7 and 8).

Prices

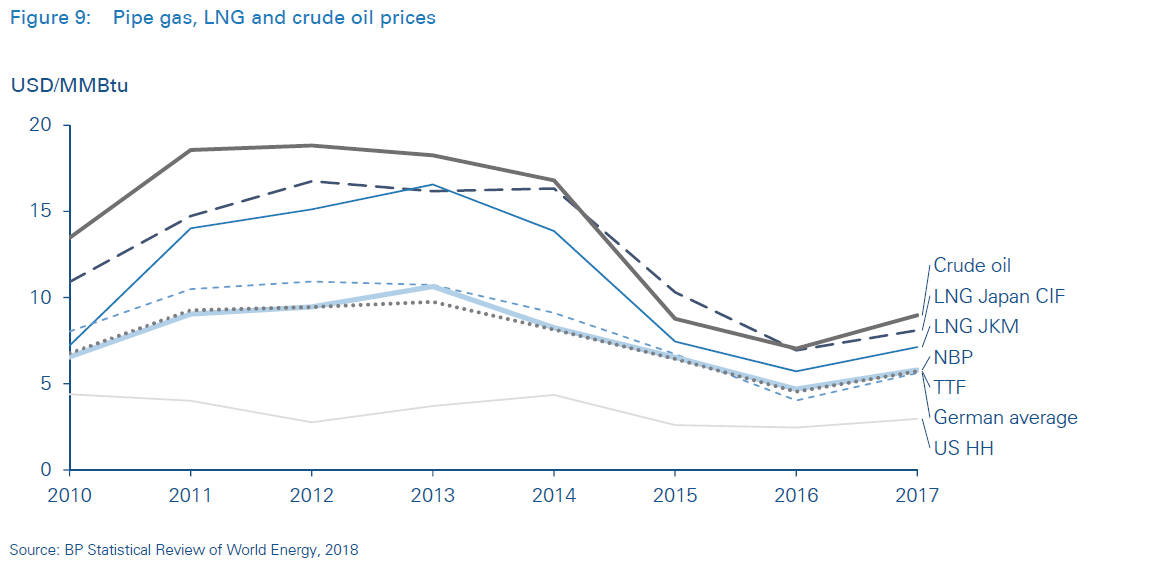

The period has been characterized by falling oil prices, while gas prices in Europe have remained more stable, which has reflected the fall in demand and gradual (although not yet universal) decoupling from oil prices (see Figure 9).

During the winter of 2018/19, the profit margin for LNG delivered to Asia compared to deliveries to Europe has decreased, due to higher shipping costs and additional LNG supply. As a result, more cargoes of LNG produced in the Atlantic Basin have gone to Europe instead. This illustrates that LNG very much acts as a swing supplier, and Europe as a residual market for LNG. It also shows how competitive and well-working the European gas market has become. At times when LNG is priced attractively, European buyers only take the minimum under the remaining long-term take-or-pay pipeline contracts, and fill the gap with LNG. At other times, when LNG is expensive, pipeline gas supplies are maximized. This benefits European buyers. However, a growing reliance on LNG to meet the supply gap developing in the longer term could serve to put upward pressure on European market prices. Although LNG supply is expected to increase, LNG demand is also increasing significantly and European buyers will have to compete with buyers from other regions such as Asia.

Infrastructure development9

Apart from the Nord Stream 2 project, several other European gas infrastructure projects are making progress.

TAP/TANAP

The Trans-Anatolian Pipeline (TANAP, 16 bcma), from Azerbaijan to Turkey, was inaugurated in June 2018. A few months later (November 2018), it was connected with the TAP pipeline on the Greek/Turkish border, now under construction, with commissioning expected in 2020. As a result, gas from the Shah Deniz 2 field in Azerbaijan will be brought to European markets along what is called the Southern Gas Corridor.

TurkStream

The TurkStream pipeline connects Russia with Turkey across the Black Sea. Offshore construction was completed in 2018, and the two string pipeline has a capacity of 31.5 bcma. There are plans to construct connecting capacity to bring some of the gas via this route to several south-east European markets.

Baltic Pipe

A final investment decision (FID) for this project, which aims to connect Norwegian gas infrastructure with that of Denmark and Poland, was made in November 2018. The project is now in the planning/permitting stage. Commissioning is planned for October 2022.

EastMed

In November 2018, the energy ministers of Italy, Greece, Cyprus and Israel agreed to build a pipeline from fields offshore of Israel and Cyprus to Greece and Italy. It will be the world’s longest and deepest offshore pipeline, is expected to cost €7,000 million, and take five to six years to complete. A pre-feasibility study has been made, financed by the EU. A final investment decision (FID) has yet to be made.

EUGAL

The EUGAL pipeline runs from the Baltic Sea coast through eastern Germany to the Czech border (in parallel to OPAL). It will be 480 km long and have a design capacity of 55 bcma. All permits are in place. Construction is proceeding as planned.

Projects in the Czech Republic

Czech TSO Net4Gas is currently undertaking and planning several projects to strengthen the existing infrastructure in order to facilitate market integration and security of supply not only in the Czech Republic but also in neighboring member states (Austria, Poland, Slovakia and Hungary). These include for example:

- Capacity4Gas – Strengthening capacity at the German/Czech border station in the north at Sayda (new compressor station and a new parallel pipeline) and connecting EUGAL with the Waidhaus border station in the southwest. It will make it possible to supply southern Germany with gas via existing infrastructure such as MEGAL. This project is ongoing in two stages, and scheduled for completion in 2019/2021.

- Czech/Polish interconnector STORK – a project to build bidirectional transmission capacity between Poland and the Czech Republic to integrate markets and improve security of supply. Construction is planned for 2020 to 2022. The project has been granted PCI 10 status by the EU, but a final investment decision has yet to be taken.

- Austrian/Czech interconnection BACI – connecting the Central European Gas Hub at Baumgarten (close to the Hungarian border) with the Czech transmission network via a new bidirectional pipeline going north to Breclav/Breslau via the Austrian city of Rheintal on the Austrian/Czech border. This project too has received PCI status but an investment decision has not yet been made.

LNG Germany

Currently, there are three ongoing German LNG projects: Wilhelmshafen (10 bcma), Brunsbüttel (5 to 8 bcma, and Stade (5 to 8 bcma). Of the three, Brunsbüttel currently seems to be in the lead for receiving state support, and could be completed in late 2022.

LNG Poland

The Polish LNG terminal at Swinoujscie is planning for expansion from the current 5 bcma to 7.5 bcma, with pipeline installation completed in steps between 2021 and 2023.

Nord Stream 2 project developments

Manufacturing of steel pipe began in 2016, coating in 2017, followed by construction activities (dredging, pipelaying, etc.) in 2018. Pipes were produced in Germany by EUROPIPE, and in Russia by OMK and Chelpipe, and transported by rail and ship to the two coating plants in Kotka (Finland) and Mukran (Germany). The project schedule foresees that pipelaying will continue through 2019, with commissioning planned for the fourth quarter of that year. Below is a detailed description of these activities to date.

Construction and pipelaying activities

More than 2,400 km of steel pipe is concrete weight coated in two of four logistics hubs in Baltic Sea harbors close to the pipeline route (coating plants at Kotka and Mukran, additional storage at Koverhar, (Finland) and Karlshamn, (Sweden)); and distributed across the four ports for storage. Coated pipes are then fed from these four hubs to the moving construction site, aboard the pipelay vessel, along the different sections of the planned pipeline route. Wasco and Blue Water Shipping, the logistics partners, work closely with Nord Stream 2 and local suppliers in the harbors to prepare the pipes and deliver them to the right places, at the right times, at each stage of the project – right up until pipes have been shipped to the pipelay vessel, welded together and placed on the seabed.

Concrete weight coating

Pipes are concrete weight coated to double their weight; add stability and protect the pipes from external damage. In total, 4.8 million tons of materials will come through the coating plants – half in steel pipes, half in weighting materials. In addition to coating at Mukran and Kotka, some pipes were also coated by PCT (Pipe Coating Technologies) in Volzhsky in Russia.

Storage

Concrete weight coated pipes are stored right outside the coating plants in the harbors of Kotka in Finland and Mukran in Germany, which are located close to the starting and ending points of the planned pipelines. About half of the coated pipes are trans-shipped to two interim storage yards in the harbors of Karlshamn in Sweden and Hanko in Finland, which are located closer to the middle section of the pipeline route. Four hundred seventy-five shipments are needed to distribute the concrete weight coated pipes to the storage yards in Hanko and Karlshamn. In total, 200,000 concrete weight coated pipes needed for the two pipelines will be rolled, quality tested, coated and eventually stored.

Pipe delivery to pipelay vessel

Pipes are brought to the quays in each harbor and loaded onto pipe-carrier vessels that deliver them to the construction vessels out at sea. Some three hundred pipes are delivered to each of the pipelay vessels every day.

Pipelay vessel

Aboard the pipelay vessel, the pipes are welded together and the pipeline string is gradually lowered to the seabed at a rate of about three kilometers per day.

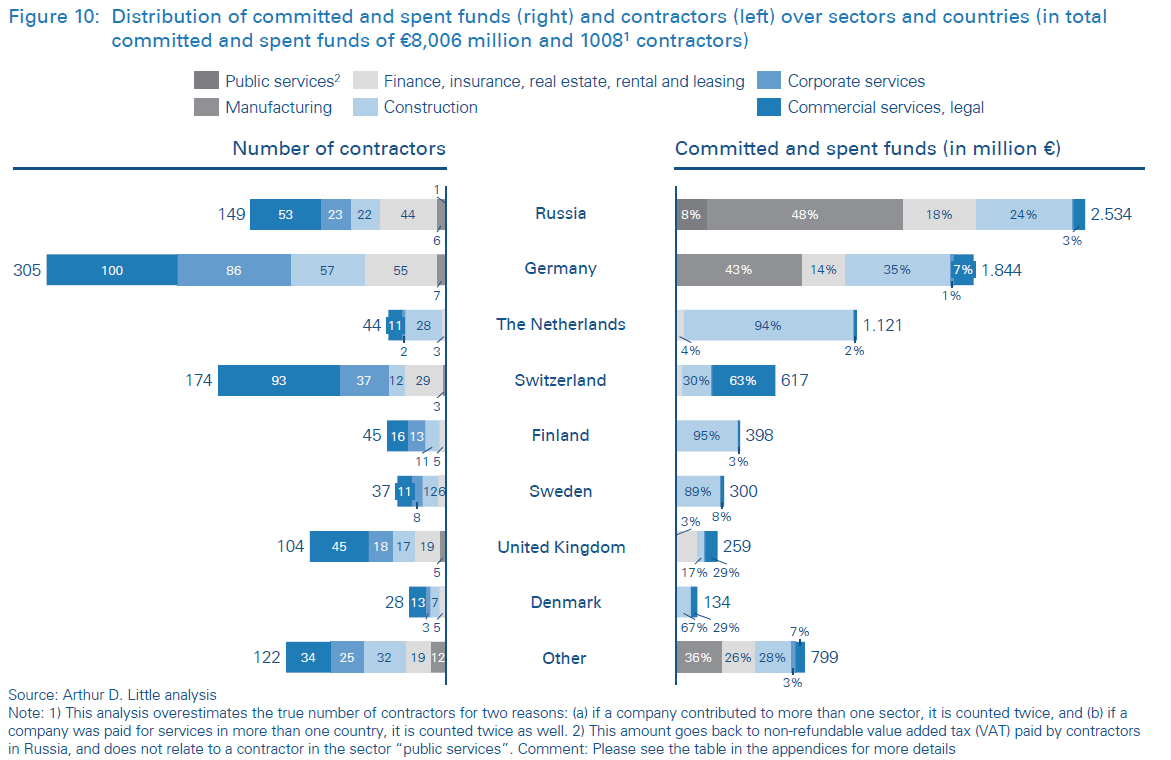

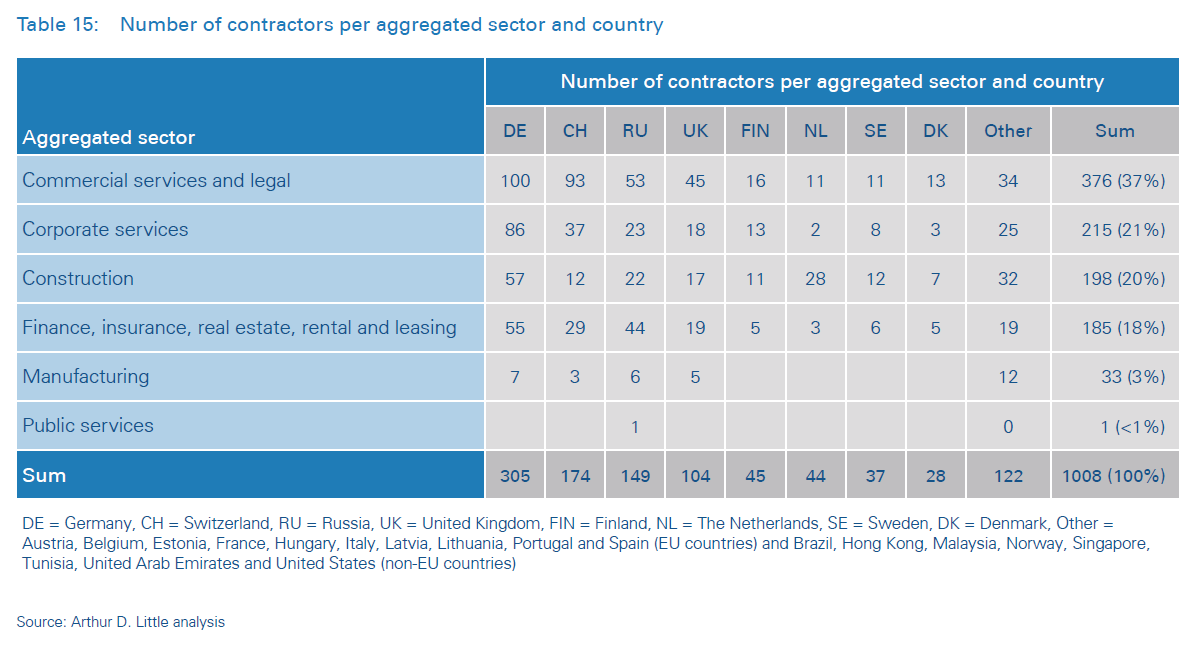

Contributing suppliers

Overall, some 1,000 different contractors are involved in the project, from large international industrial conglomerates that are capable of producing thousands of pipes to one-man firms providing a variety of expert services. Many contractors are small to medium-sized enterprises. In Figure 10 below we show the spread of contractors and funds spent over different sectors and countries. The affected number of companies, however, goes well beyond those listed below as there is a variety of additional subcontractors contributing indirectly to the project.

PetrolValves – supplier of valves

Products/services

PetrolValves delivered top entry ball valves to Nord Stream 2 with electric and electro-hydraulic actuators, designed for onshore installation at the two landfall areas. The valves are high-criticality components required for emergency shutdown, protection from overpressure, and isolation of pipeline sections for maintenance. The valves production demands particular attention in all phases of design, manufacturing, assembly, testing, installation and commissioning. Some types of valves manu-factured for the project are very large, with the 48 inch valve unit weighing some 100 tons each. The design for the valves and actuators had already been developed for the first Nord Stream project, and its reliability had been proven by 8 years of safe operation.

Key challenges

Many challenges, including long-distance transportation, have been handled efficiently and successfully, thanks to great teamwork and strong inter-functional cooperation. All functions and staff at PetrolValves were involved in the project. The total order contributed almost 30 percent to earnings in 2018. PetrolValves is well known for its ability to push technological boundaries, and yet deliver extremely reliable products.

Main benefits

The project was strategically important since it came in 2016, when the oil and gas sector was in recession, and many other projects were cancelled or delayed. Nord Stream 2 allowed PetrolValves to retain staff, and invest to support project execution. Many subcontractors, including foundries, specialty welders, tool and machinery suppliers and coaters, also benefitted from the project. The relationship with Nord Stream 2 is expected to continue after the project has been completed, with PetrolValves’ further involvement during maintenance, for shutdowns, repairs and similar activities.

Wasco – coating and logistics

Products/services

Wasco was responsible for concrete weight coating of the finished steel pipes supplied by EUROPIPE, OMK and Chelpipe and for handling the logistics of the project together with logistic partner Blue Water Shipping. Two coating plants were used for the project: one in Mukran (Germany), and one in Kotka (Finland). Pipes were stored both in the vicinity of the plants, and at two additional storage sites in Karlshamn (Sweden), and Koverhar (Finland). The concrete coated pipes from all four locations are loaded onto carrier ships that bring the pipes directly to the pipe laying vessels out at sea.

Key challenges

One of the main challenges were the cold weather conditions in the Baltic Sea region during winter. Sometimes, the pipes to be loaded would be covered with ice and snow. Together with sub-contractors and Nord Stream 2, Wasco developed a highly automated system for removing it, using robot arms for the inside of the pipes. Additionally, the logistics concept handling was one of the key learnings during the project. It has been the largest project the company has handled so far and the experience gained will support Wasco’s future business.

Main benefits

Nord Stream 2 is the largest offshore pipeline project that has ever been executed, globally, and as such is key strategic importance for Wasco. At each of the coating plants, some 400 people were employed and additional 100 people at each of the two storage sites (1,000 in total).

Most people were employed locally. It was a very significant project for Wasco. Especially in Kotka, this has made a huge difference to the economic development of the region. Wasco already has plans for alternative uses for the plant capacity in the Baltic region after completion of the Nord Stream 2 project.

Port of HaminaKotka

Products/services

The port of HaminaKotka fulfilled two functions for the Nord Stream 2 project. Firstly, it hosts a coating plant, where the pipes were concrete weight coated and stored at the interim storage yard. Secondly, it serves as a logistics hub for the supply vessels, delivering pipes and other necessities to the pipe laying vessels.

Key challenges

A very large area (60 ha) was cleared for the storage yard and equipped with lanes and lighting. The lanes are prepared for the heavy machinery that is required for lifting the pipes. This area will be used also in future – plans are already being developed for this.

Main benefits

The traffic at the port has increased by 10 percent during the project, a welcome contribution to revenues. We have been able to prove that our capacity and knowledge of handling large projects is really excellent. In addition, the employment provided and experience gained both in the port and at the coating plant is very beneficial for the region, as are the opportunities it provides for other subcontractors and service providers locally.

Economic benefits by country

Analyzing the economic benefits of the Nord Stream 2 project – methodology and approach

Any economic activity, such as setting up a business, making a capital investment or purchasing a service from established providers, will create an impact on the local economy and business eco-system. In this case, the aim is to understand the economic effects of the investments made by Nord Stream 2 to build the two new pipelines through the Baltic Sea. To do this, Arthur D. Little has applied a concept called economic impact analysis.

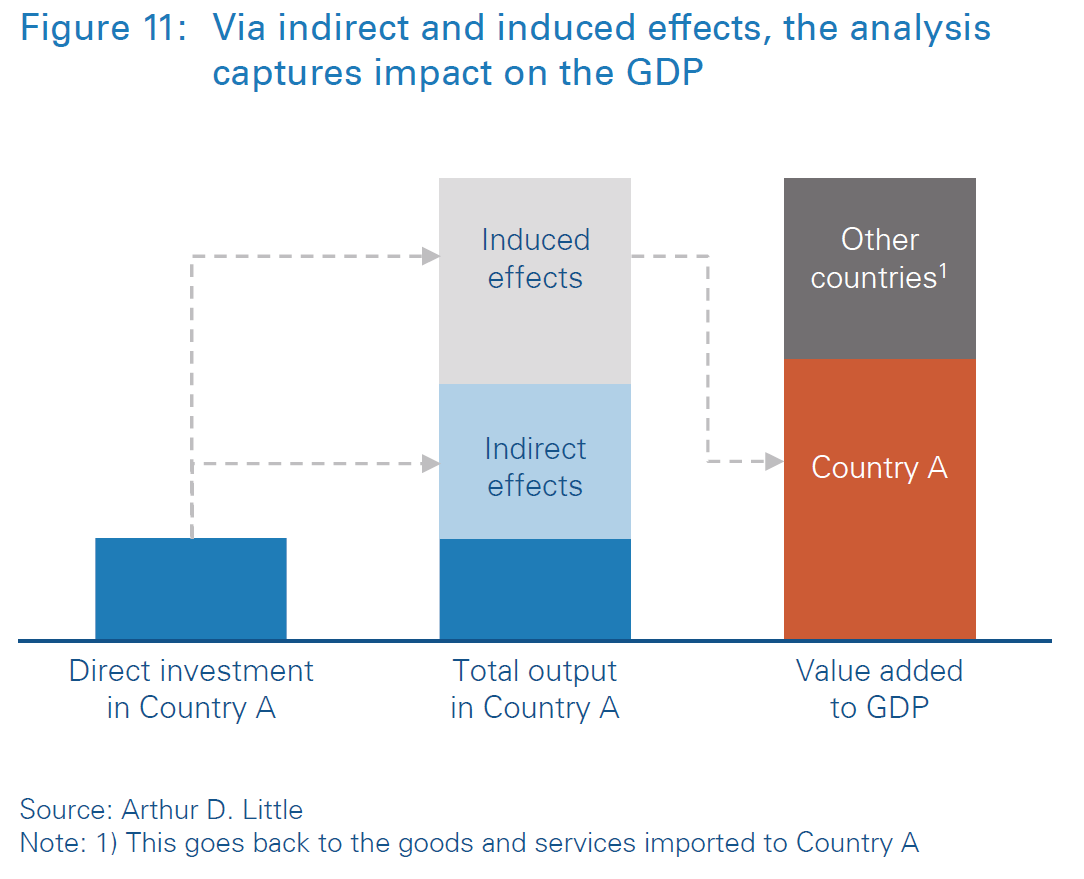

Economic impact analysis examines the effect of an economic event on the economy in a specified area. It studies these effects in terms of wealth creation (total economic output, GDP, or Value added) and number of employment opportunities generated, including the value of wages and salaries earned. In addition, it measures the value of government tax revenues (not considered in this report). In this case, the focus will be on the value of GDP added and employment opportunities created, by using full-time equivalents as a proxy.

GDP, or gross domestic product, is defined as the monetary value of all finished goods and services produced within a country’s borders in a specific time period. It consists of consumer spending, government spending, and investments (capital spending by businesses), plus net exports (exports minus imports), see Figure 11 for illustration. Full-time equivalents is a unit indicating the workload of an employed person or a specific task. If the year has 8,760 hours in total, only 1,760 of those are working hours (52 less six weeks of vacation and 10 public holidays, times 40). A full-time equivalent thus consists of 1,760 working hours, or 220 days.

Typically, the economic impact methodology measures the impact of an event as the difference between two scenarios: one in which the event does occur, and one in which it does not. Only the difference between the two scenarios is of interest. It is a well-established and widely recognized methodology for quantification, for example, of the benefits of proposed policies, action programs or large-scale investments, public or private.

The foundation of the analysis is a model of the country’s total economy, detailing flows of resources through different industry sectors and other areas of consumption and production.

These are so-called input-output models. Input-output models measure and keep track of the value of all economic resources that enter the economy, and how these are converted into economic value through various activities producing goods and services. The models are based on statistical data (in this case, provided by the OECD 11 ) about the economy as well as how different sectors are connected and interact with each other, including how they purchase products and services from one another.

This information, which consists of static historical data, is used to create so-called multipliers. The purpose of the multipliers is to allow prediction of economic impact by understanding the relative sizes generated by previous investment flows of similar activities.

The multipliers are based on actual transactions occurring between sectors as well as knowledge about the operating requirements of the activity in question, in relation to size. So, for example, an investment in a public school will necessitate purchase of classroom furniture. The cost of that furniture can be estimated based on typical prices paid times the number of pupils the school is designed for. This cost, if put in relation to the size of the school and investment, and compared with data of actual transactions between sectors, can be converted into a multiplier that allows us to estimate the cost of classroom furniture for any school investment.

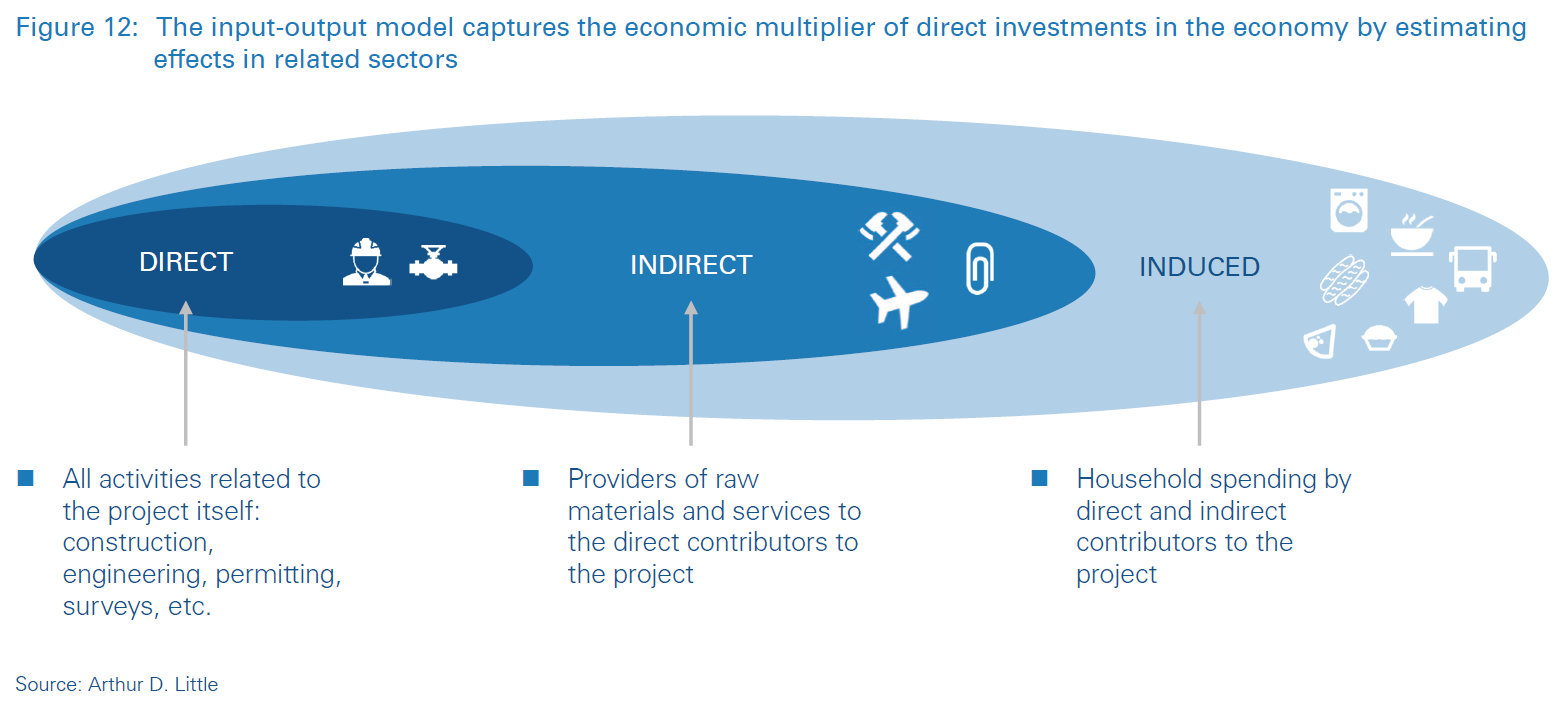

Multipliers are applied to the economic event in question to simulate the ripple-effect it will have throughout the economy. This ripple effect can be illustrated by another example. Consider the construction of a one-family house. Building the house itself will create contracts for an architect, a construction company, and interior decorators. These will, in turn, employ professional staff and workers to build and furnish the house. These are the direct effects of the investment, the firms and the people covered by the direct investment of the purchaser of the house. They will also have to rely on others to supply the goods and services to the undertaking. Building materials and electrical and plumbing services may be provided by third parties under contract. In addition, office supplies and IT equipment are needed for administration and business services. Transport services have to be hired to bring materials to the construction site, and so on. These are the indirect effects of the investment.

The impact of the event does not stop there, as illustrated in Figure 12. Workers and staff are compensated in wages and salaries, which they use for personal spending and upkeep. This is called the induced effect of the investment. They have to pay rent on their accommodation, buy food and clothing, and acquire leisure products and services, as well as capital goods such as cars and washing machines. A euro paid for the investment in the house thus keeps multiplying in value as it is spent again and again throughout the interconnected network of the economy.

Because of the fact that multiple value chains are involved, where each step is adding to the value of the original activity or re-spent on new activities, the original investment thus creates a ripple effect. For every sector affected by a specific activity, such as the investment in a bridge or new plants, there will be several multipliers, sometimes in sequential steps, triggering value creation in other sectors.

To summarize and bring us back to Nord Stream 2, the study analyses:

- Direct effects, which include all activities directly related to the event in question, in this case the investment in the Nord Stream 2 pipelines (planning, permitting, engineering, construction, etc.);

- Indirect effects, which include all suppliers of goods and services to the direct activities (raw materials, transportation, office supplies, etc.);

- Induced effects, which consist of the household spending that results from the salaries and wages earned in the first two categories.

In this study, a commercially available economic modelling tool (IMPLAN) was used to undertake the analysis. It is provided by the IMPLAN company of Huntersville, North Carolina (www.implan.com). Originally, the model was developed by the US Department of Agriculture in the 1970s, and used to measure economic impacts in forestry. Since then, it has been expanded and improved and is now available to measure economic impacts in sectors across the whole economy, not only for the US but across the world (currently covering the US, Canada, the EU and the OECD, based on different statistical databases). It is used not only by government, research and academia but also by financial institutes, consultancies and others interested in understanding the broader impact on the economy of a single economic event, for example, a change in economic policy, a major investment in a hospital or a decision to close down a public facility such as an airport base.

The input to the model in this case, consists of the value streams, i.e., the monetary flows from the project to the different countries and industry sectors that provide the products and services required to realize it. These value streams were determined together with Nord Stream 2, analyzing individual contracts and investments. The IMPLAN modelling software then, based on underlying OECD data for each affected country, calculates direct, indirect and induced effects in terms of value added and employment created in each country.

Value added, in this context, refers to the additional value created at a particular stage of production. It is a measure of the overall importance of an industry within the national economy and represents the industry’s share of gross domestic product (GDP). So, for example, in the context of Nord Stream 2 and the economic benefit created in a particular country, it describes how large a share of the total output value is attributable to the activities performed in that country, and is thus available locally for new and other purposes, including both consumption and investment. Value added consists of: employee compensation, proprietors’ income, income to capital owners from property, and indirect business taxes (including excise taxes, property taxes, fees, licenses, and sales taxes paid by businesses). Expressed differently, value added is equal to total output of the economic activity (direct, indirect and induced), less the value of imported goods and services that flow out of the economy.

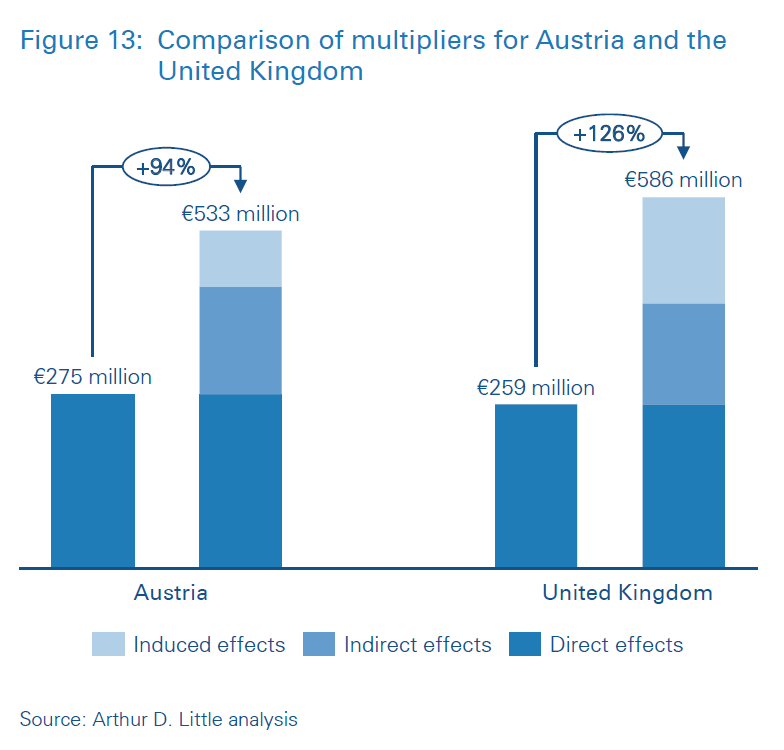

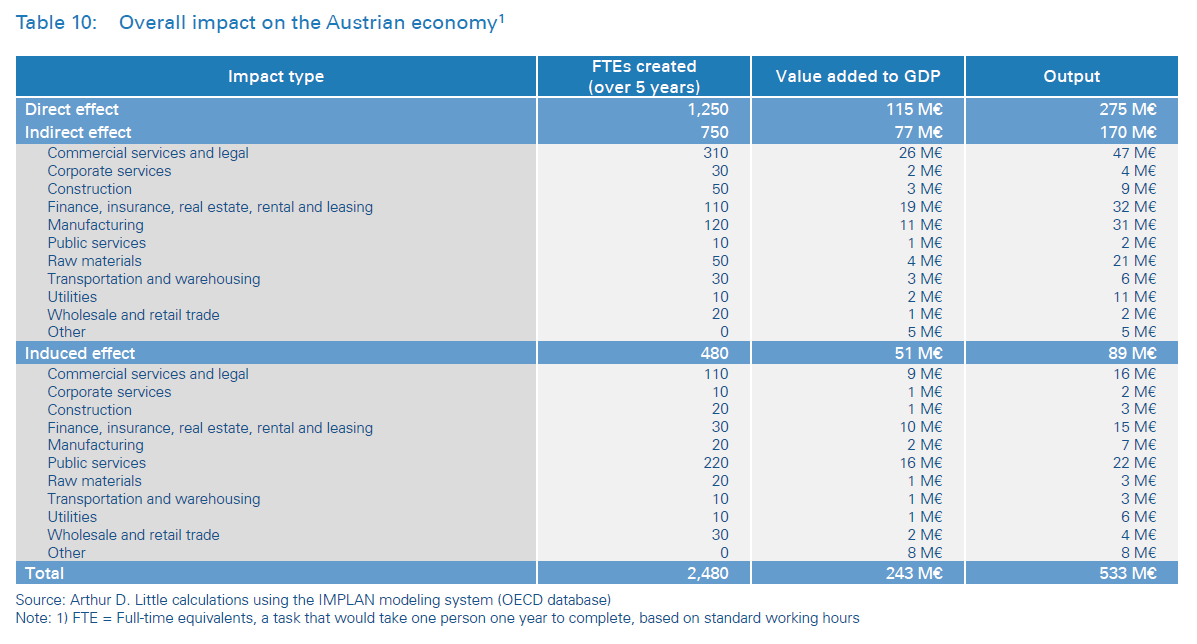

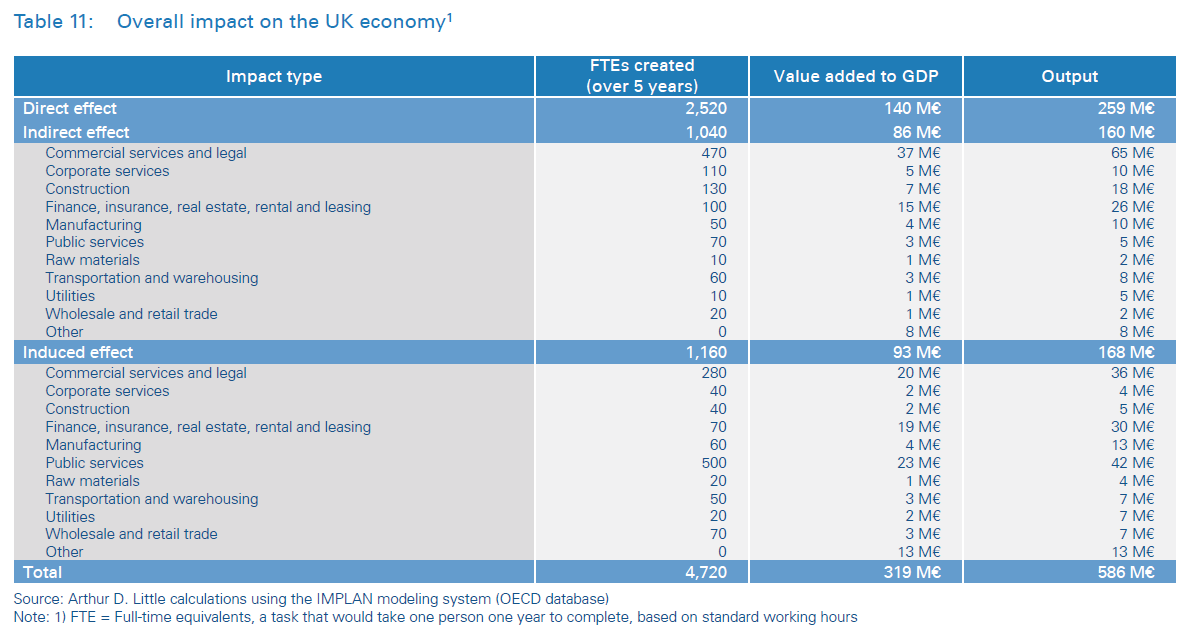

The difference between countries can be illustrated by looking at two examples with similar investments but different outcomes. The investment in the UK is €259 million, generating a total output of €586 million (adding a value of €319 million, or +123 percent), i.e. a multiplier of 2.26. In Austria, the investment is €275 million, generating a total output of €533 million (adding a value of €243 million, or +88 percent), i.e. a multiplier of 1.93.

Why does the investment in the UK generate a higher output than that in Austria? The answer lies in the sectors involved – Austria mainly supplies materials (blue-collar jobs with lower compensation), whereas the UK supplies engineering and consultancy services, for which higher salaries are paid. Compared to Austrian blue-collar workers, higher-paid UK engineers can consume more goods which manifests in higher induced effects in the UK (see Figure 13). This explains why multipliers are not the same – they depend on the economic structure of the country and the sectors involved.

For practical reasons, it was assumed that the investment took place over one year, in order to illustrate the total effect on the country’s economy. In reality, it is spread over five years, with activities taking place at different times during the project. Full time equivalents should be understood as a temporary effect on the labour market created by the investment. For example – five full-time equivalents can provide one full-time job opportunity for five years.

That is not to say that full-time equivalents are not able to support the creation of permanent jobs.

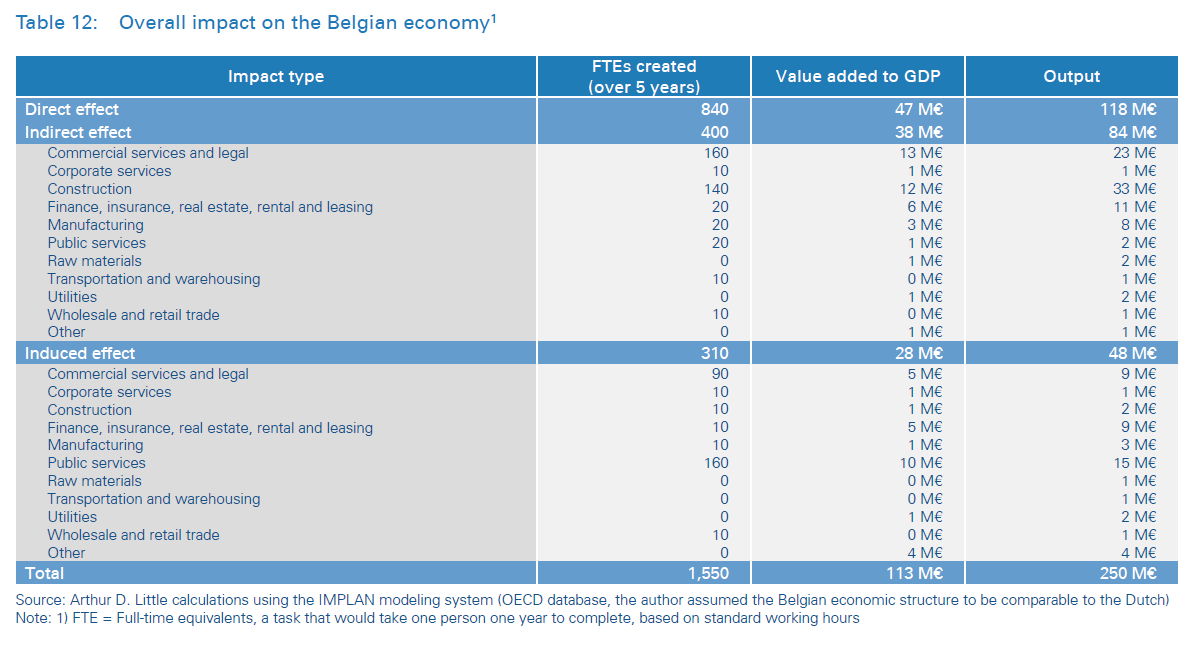

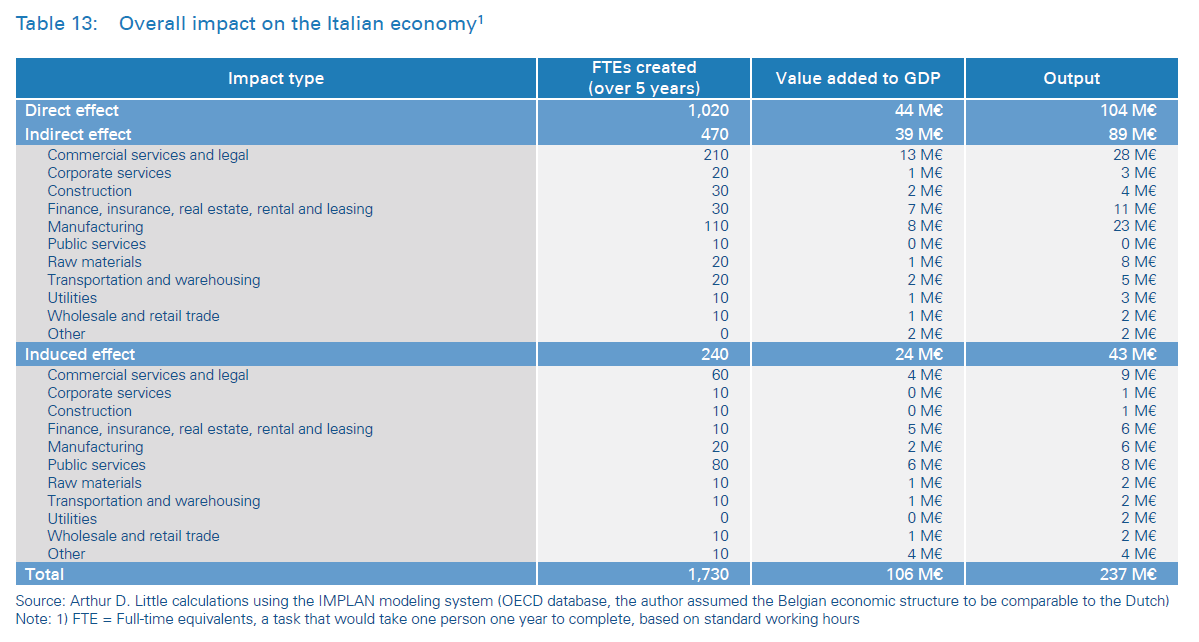

Results of economic impact analysis

The spent and committed funds to date have been allocated by country and type of activity, as indicated in Table 1. This represents the flow of investment from the project to each country. The totals have been used to model the economic impact for the top 12 countries affected – Russia, Germany, the Netherlands, Finland, Switzerland, Sweden, Austria, the United Kingdom, Denmark, Belgium, Italy, and Norway. Committed and spent funds in these 12 countries make up 97 percent of the total funds committed in the long-term business plan as of December 2018.

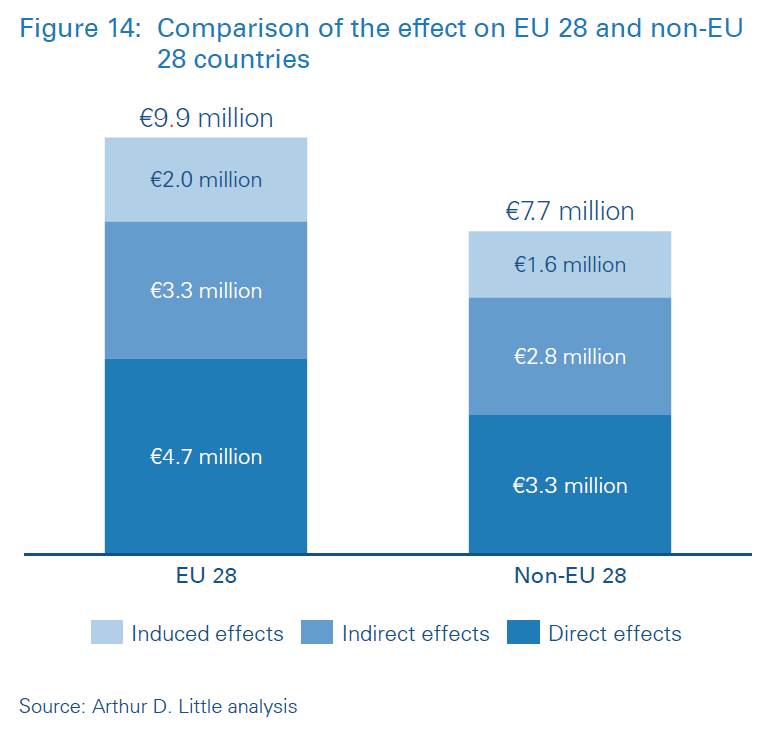

Figure 14 shows that EU Member Members states and non Member States – mainly Russia and Switzerland – are affected similarly.

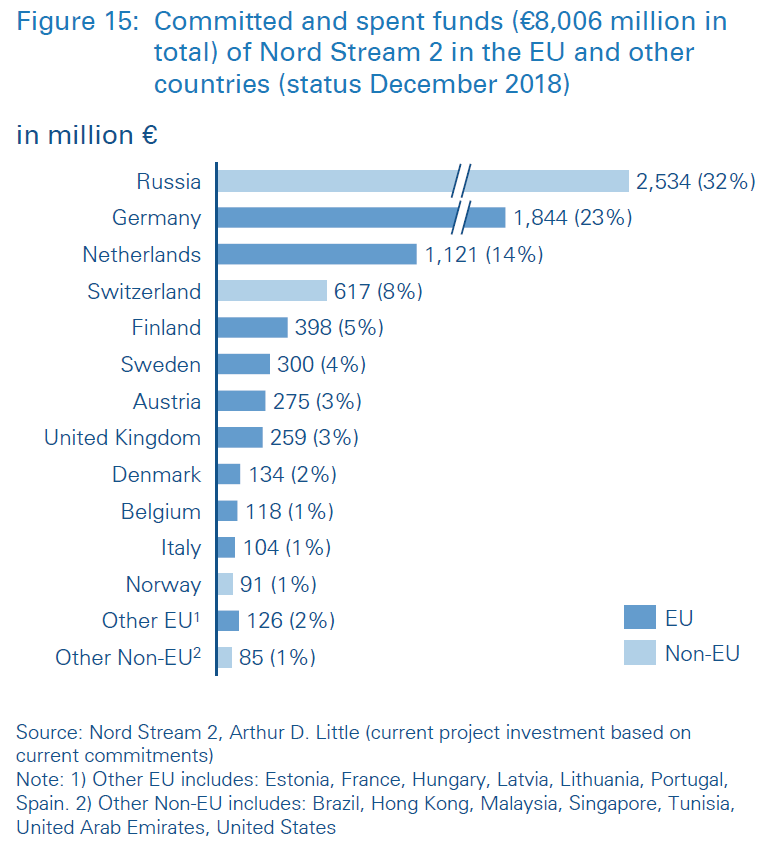

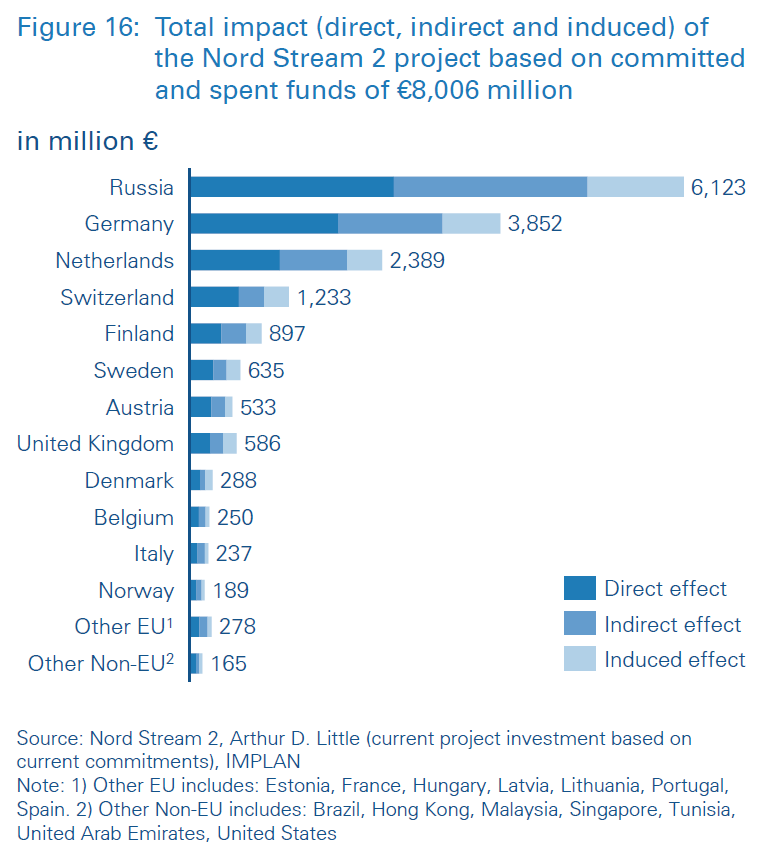

Figures 15 and 16 show an overview of the distribution of funds spent by country and total results by country, indicating that Russia and Germany are the two main contributors, followed by the Netherlands and Switzerland.

It should be noted that the effects are different depending on the economic/industrial structure of the country in question and the relative cost of labour. For example within the EU, any investment will have a larger impact in Spain (which has a lower relative labour cost), than in Germany. Equally, the results in Russia can be expected to be larger due to the differences in labour cost and economic structure.

Denmark

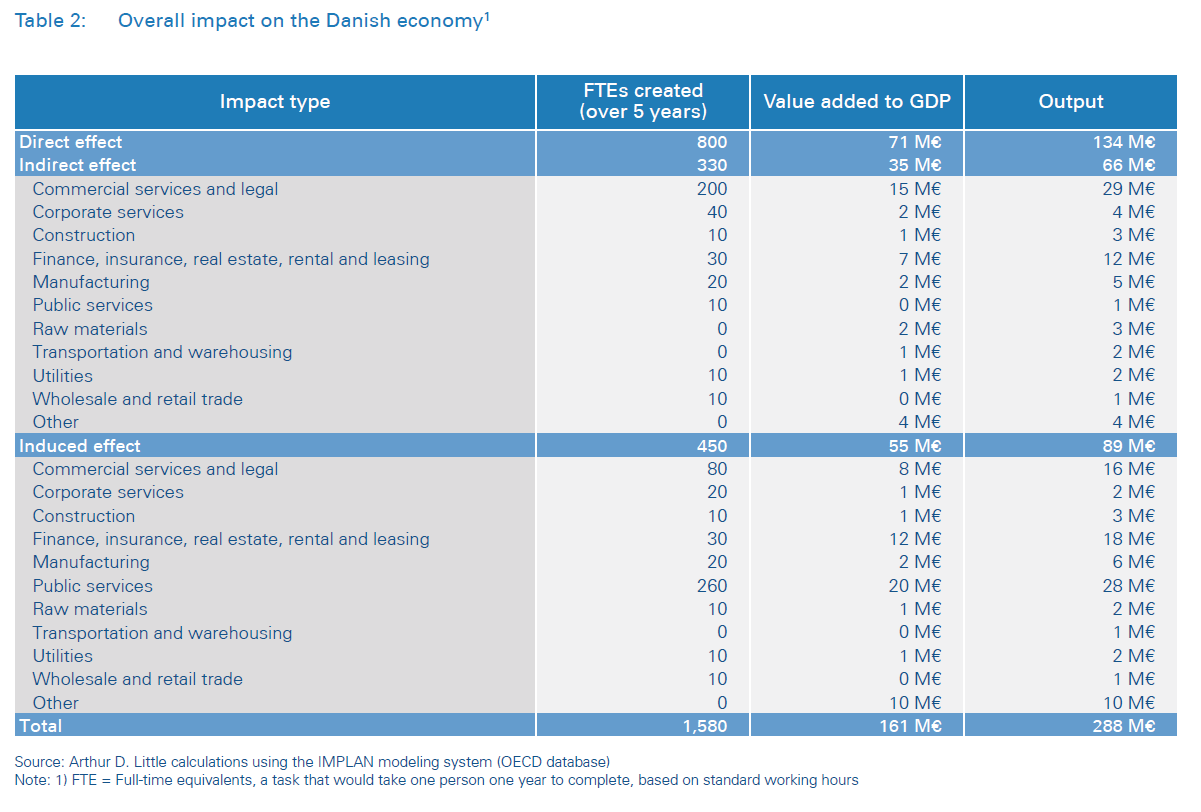

The direct impact on the Danish economy of the currently committed CAPEX investments is €134 million. This is equivalent to roughly 2 percent of the total committed investment expenditure to date. This amount has been entered into the IMPLAN model to calculate the indirect and induced impact on the total economy.

The overall impact on the Danish economy is equivalent to an economic output of nearly €300 million, adding €160 million to GDP and creating 1,580 full-time equivalents, spread over many different sectors (Table 2).

Finland

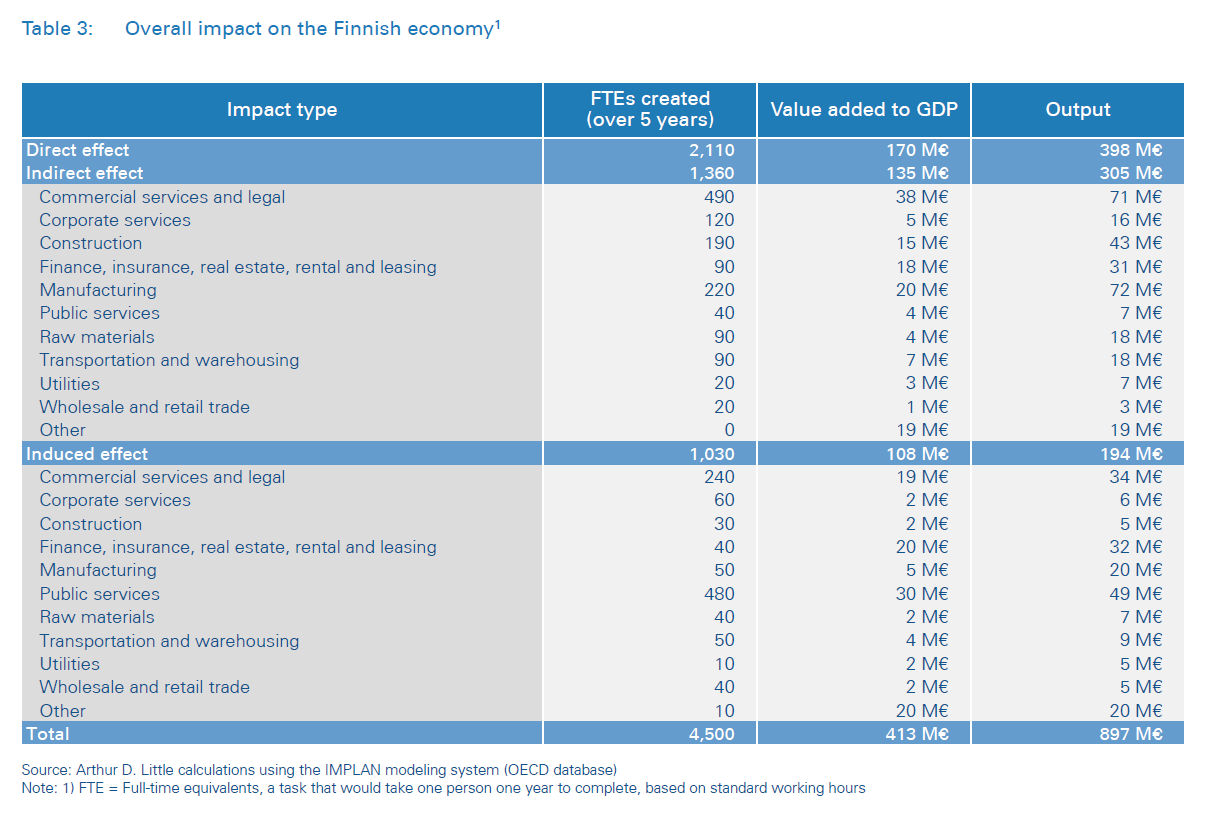

The direct impact on the Finnish economy of the currently committed CAPEX investments is nearly €400 million. This is equivalent to 5 percent of the total committed investment expenditure to date. This amount has been entered into the IMPLAN model to calculate the indirect and induced impact on the total economy.

The overall impact on the Finnish economy is equivalent to an economic output of nearly €900 million, adding more than €410 million to GDP and creating 4,500 full-time equivalent jobs, spread over many different sectors (Table 3).

Germany

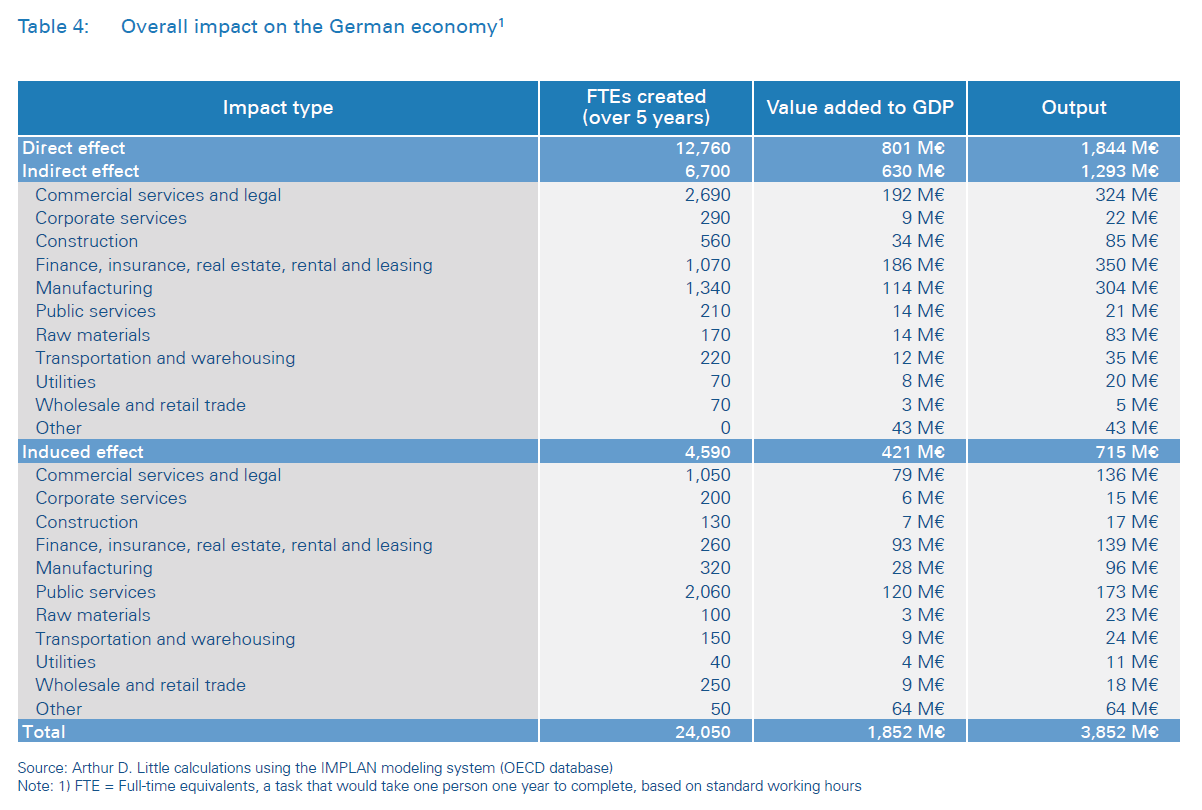

The direct impact on the German economy of the currently committed CAPEX investments is €1,844 million. This is equivalent to 23 percent of the total committed investment expenditure to date. This amount has been entered into the IMPLAN model to calculate the indirect and induced impact on the total economy.

The investment does not cover the connecting infrastructure nor the compressor stations required after landfall – these will be undertaken by separate organizations and are not included in the Nord Stream 2 project. These additional investments will have further economic beneficial effects on the German economy that are not reflected in this calculation.

The overall impact on the German economy is equivalent to an economic output of more than €3,850 million, adding roughly €1,850 million to GDP and creating roughly 24,000 full-time equivalents, spread over many different sectors (Table 4).

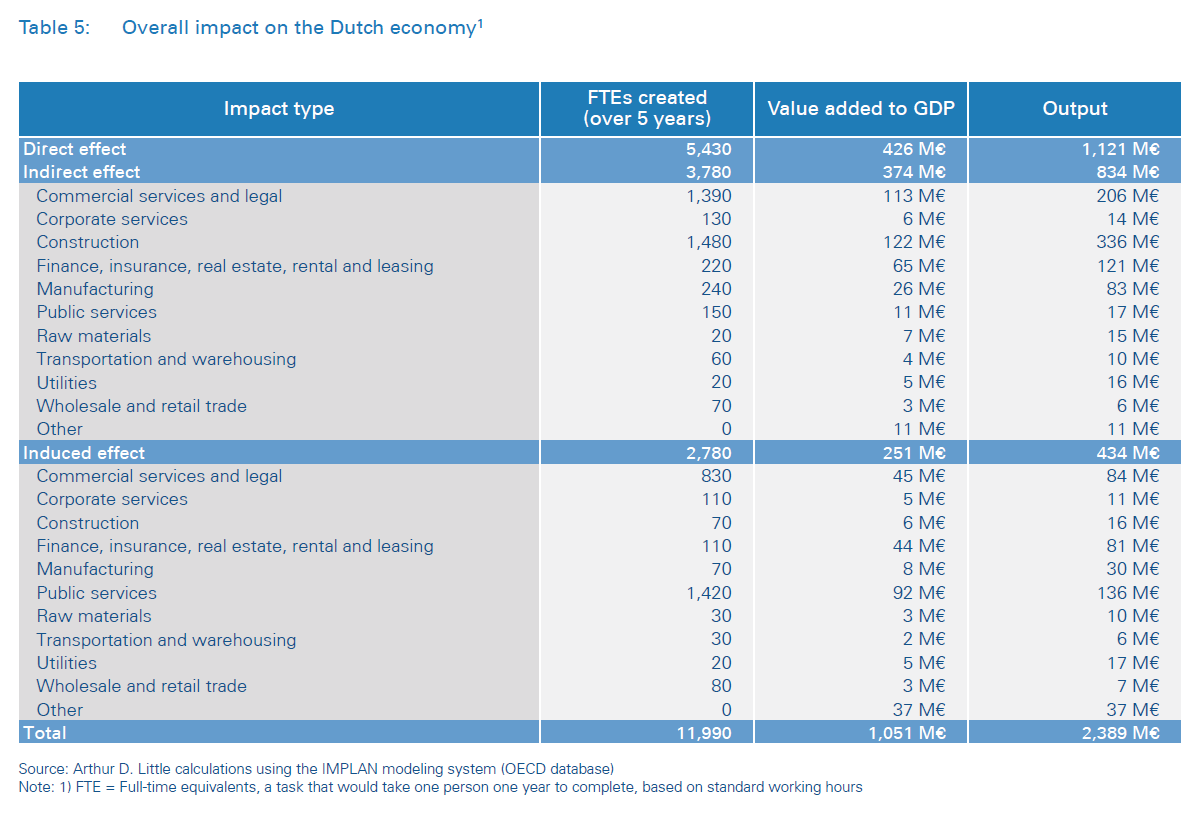

The Netherlands

As shown in the table below, the direct impact on the economy of the Netherlands of the currently committed CAPEX investments amounts to some €1,121 million. This is equivalent to 14 percent of the total committed expenditure in December 2018. This amount has been entered into the IMPLAN model to calculate the indirect and induced impact on the total economy.

The overall impact on the Dutch economy is equivalent to an economic output of €2,389 million, adding roughly €1,050 million to GDP and creating 11,990 full-time equivalents, spread over many different sectors (Table 5).

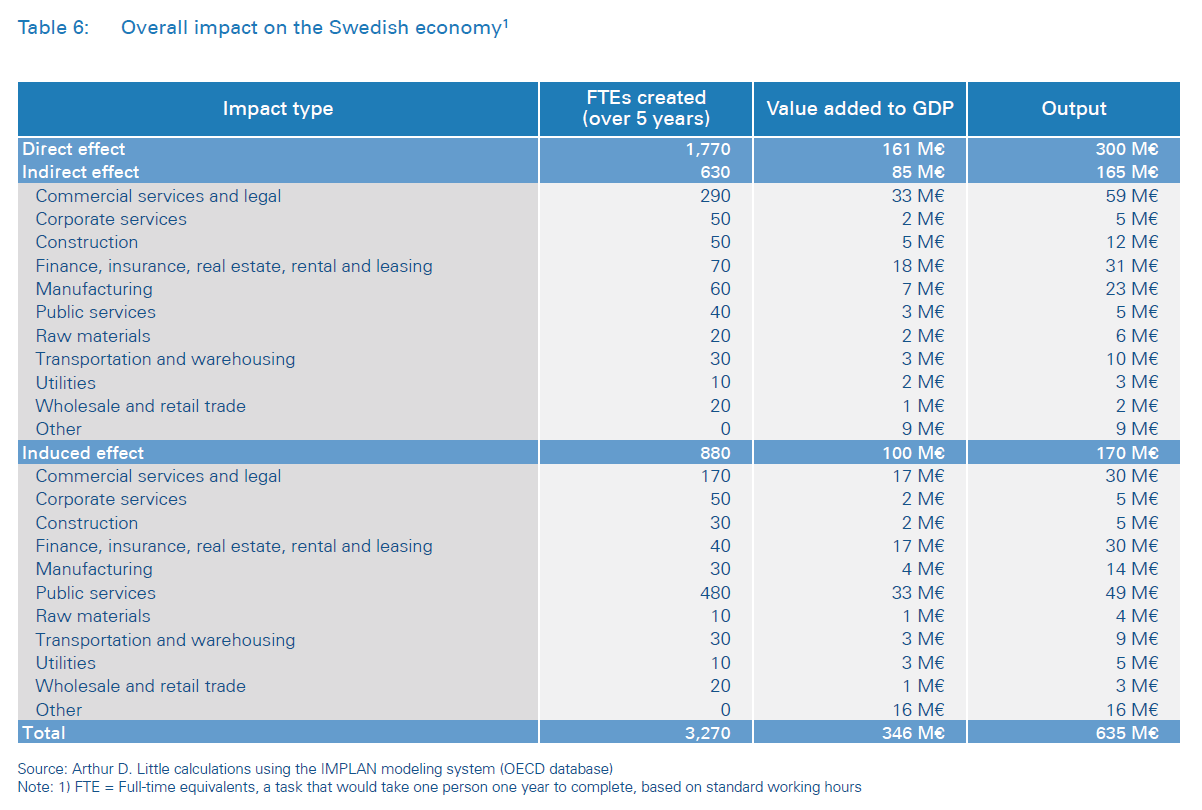

Sweden

The direct impact on the Swedish economy of the currently committed CAPEX investments is €300 million. This is equivalent to roughly 4 percent of the total committed investment expenditure to date. This amount has been entered into the IMPLAN model to calculate the indirect and induced impact on the total economy.

The overall impact on the Swedish economy is equivalent to an economic output of €635 million, adding nearly €350 million to GDP and creating 3,270 full-time equivalents, spread over many different sectors (Table 6).

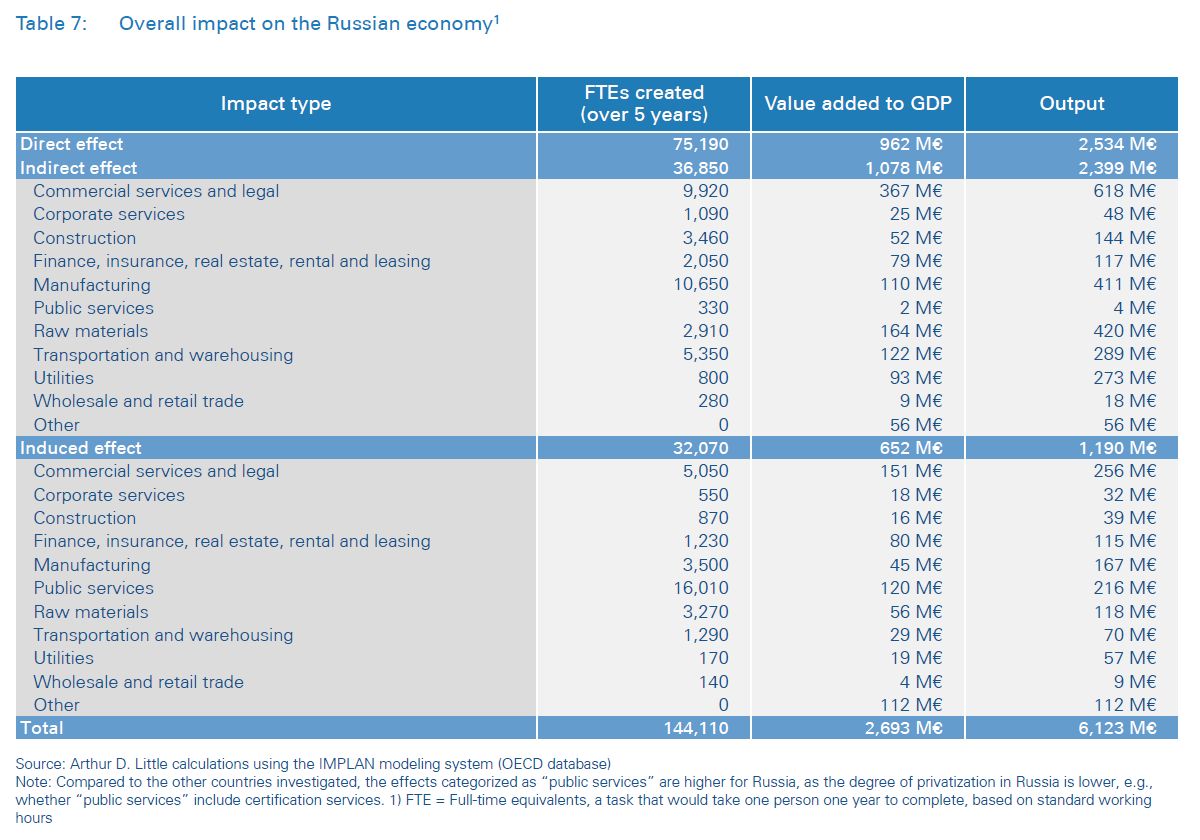

Russia

The direct impact on the Russian economy of the currentlycommitted CAPEX investments is over €2,500 million, the largest single allocation, both relative and absolute, to any country so far. It is equivalent to 32 percent of the total committed investment expenditure to date. This amount has been entered into the IMPLAN model to calculate the indirect and induced impact on the total economy.

The investment does not cover the connecting infrastructure or the compressor stations required – these will be undertaken by separate organizations and are not included in the Nord Stream 2 project. They will have additional economic beneficial effects on the Russian economy that are not reflected in this calculation. The overall impact on the Russian economy from Nord Stream 2 is equivalent to an economic output of more than €6,100 million, adding nearly €2,700 million to GDP and creating more than 144,000 full-time equivalents, spread over many different sectors (Table 7).

It should be noted that the multiplier impact on Russia is far higher than for EU countries, primarily due to the difference in labour cost. This means that every euro spent in investment will create three times more full-time equivalents in Russia than in, for example, Germany.

Total results

Results for the remaining EU countries and the main five analyzed above have been summarized in the table below. The total economic benefit created for the European Union, receiving 58 percent of investments, is nearly €10,000 million, creating roughly 57,000 full-time equivalent jobs, and adding nearly €5,000 million in GDP (Table 8).

Allseas – pipelaying

Products/services

Allseas provided pipeline installation services for Nord Stream 2. This included pre-lay surveys of the route, pre-lay seabed preparations (including installation of mattresses), pipe haul from the marshalling yards and associated logistics, installation of 2,300 km of 48-inch pipe (for the two pipelines of some 1,230 km each), and as-laid survey.

Key challenges

It has been the largest single pipeline project in Allseas’ history, simply because there has not been a larger project before, or one more rapidly executed. About 2,000 of the company’s staff contributed over the whole project (one year). The schedule was very ambitious and challenging. Some upgrades had to be made to the fleet to meet the requirement for local operation conditions (some shallow waters), and to satisfy top speed and weight requirements. All the equipment had to be in top shape for everything to work smoothly and efficiently, because a very high rate of production is required. All suppliers involved cooperated well and were well prepared, another key condition for smooth operations.

Main benefits

A project of this size and of this length is a good opportunity for everyone involved to learn and improve, from project management to technical staff. We have very high safety standards that help to reduce risk and avoid accidents. If the work is organized well and everybody does their job systematically and in the best possible way, it results in high productivity as well as high safety rates.

Bodac – munitions clearing

Products/services

There is a large amount of left-over explosives (explosive ordnance, or explosive remnants of war) at the bottom of the Baltic Sea. Bodac was involved in the clearing of unexploded ordnance (UXO) along the pipeline route. Together with other contractors, the company cleared away a total of 74 devices in Finland alone, either by exploding them on site, or removing them safely to shore for disposal.

Key challenges

Nord Stream 2 wanted this done in the most environmentally friendly manner possible, including minimum impact on marine life. A very precise plan was developed for each ordnance to be cleared, and the utmost care taken not to disturb fish or mammals. Both were scanned for extensively. If detected, fish were scared away, and if mammals were found, the operation had to be postponed. In addition, bubble curtains were used to absorb the sound of the explosion. It was the largest job in the industry for years.

Main benefits

Great care was taken to remove any remaining debris after the explosion, and also to use a minimum amount of explosives to do the job. This required precise placement of the charges to trigger the device. This was the largest project in the industry for years, and contributed some 25 percent to Bodac’s annual turnover.

Subcontractors engaged on various scopes

Metallostroy – provider of trenchboxes

Products/services

Metallostroy supplies trench boxes, top boxes, struts and wailings for offshore and onshore sheet pile walls, sheet piles, slider systems for compartment walls, and various other steel items.

Key challenges

Nord Stream 2 provided utilization for some 70 percent of both staff and facilities over the course of the project, so was a significant undertaking.

Main benefits

Participation in such a large and ambitious project led to an increase in staff motivation. In addition, a majority of the employees enjoyed increased wages due to high utilization and overtime.

Djavad Djavadov

Deputy Director

MSU-90/Titan 2 – metal works

Products/services

MSU-90 (Titan 2) is involved in the installation of sheet pile walls at the Russian landfall in the Kingisepp area. The company’s core business is installation of technical equipment, pipelines and metalwork as well as welding of any complexity.

Key challenges

Historically, the company has been focused on the nuclear sector, so Nord Stream 2 represents a new market segment for MSU-90, to gain the required experience and skills to expand further. It is also an opportunity to gain new experience by participating in a large international project, as well as meeting safety standards far above those required by domestic regulations.

Main benefits

Some 350 people were employed locally in Kingisepp, 80 percent of whom came from the Leningrad region. 30 percent of the jobs require high skills, such as engineers or economists. About 450 of MSU-90’s and Titan 2’s existing staff from various functions were also employed by the project. Some materials, such as metal structures and concrete, were sourced locally.

Dmitry Martinov

Deputy Chief Engineer

DAF – ground preparation and road construction

Products/services

DAF is a road construction company. It prepared the terrain at the Russian landfall for use by heavy equipment in and around the site of the area for storage and offices. It also constructed the access road in Kingisepp. The period of active participation in the Nord Stream 2 project was about six months, from July 2018 to January 2019.

Key challenges

The project is strategically important for DAF, since it is one of the five largest projects in the company’s history. Participation in such projects improves reputation and brings new opportunities for the company, which is medium-sized.

Main benefits

About 90 percent of all the materials required for the project were purchased locally: sand from the Kingisepp area; stone and sand mixture, geotextiles and geogrid from the Vyborg area; and woodpiles from the Lomonosov area.

Dmitry Platonov

Chief Engineer

Pioneering industry solutions

Nord Stream 2 is constructed with state-of-the-art technology. Due to the special conditions and sensitive environment at the two landfalls, several innovative solutions to specific challenges had to be found. These will no doubt benefit other,similar projects in the future. In this section, we have described four such solutions.

This chapter is not exhaustive. Other new solutions were found in other areas of construction, materials production and data management.

Trench boxes at the Russian landfall

The two pipelines enter the Baltic Sea in a sensitive nature reserve, the Kurgalsky peninsula in Narva Bay. The onshore section of the pipes cross 3.7 km of this protected area, which consists of coastal forest, sand dunes, and swampland. In order to minimize the impact of the construction activities, a special technology was developed that required less invasion of the soil and use of heavy machinery along the path of the pipe. Several alternative technologies were evaluated, but only the chosen trench box solution was found to be acceptable. The technology involves using boxes to create vertical trench walls, thus minimizing the soil that needs to be removed for the pipe. Conventional trenching would have required a corridor width of 85 meters; now only 30 meters are needed, and 70 percent less soil needs to be removed. The boxes are filled with water, which reduces the need to dewater the area during construction, thus preserving ground water tables. Welding takes place on the lay-barge and at the gas inlet facility. Instead of laying the pipeline gradually and welding it in the trench, the welded pipe is pulled through the water-filled trenches by a linear winch. Thus, no heavy machinery is required. After construction is finished, the trench boxes are removed, and the ground restored with original soil.

Micro-tunneling at the German landfall

At the German landfall in Lubmin, the twin pipes are connected to the pig trap area at the receiving terminal, close to Lubmin harbor. The land between the station and the waterfront consists of sandy forests and a narrow beach area. Due to the geological conditions, and to minimize the environmental footprint, micro-tunneling was the preferred technology to bury the two pipes in the ground. Micro-tunneling is an existing and proven technology. It essentially means that the concrete pipes forming the walls of the tunnel are pushed through the ground using hydraulic jacks to apply the required pressure, while a tunnel-boring machine (TBM) up front is used to excavate the soil. Each tunnel has a length of 700 meters and is 2.5 meters in diameter. They consist of 200 concrete pipe sections, each three meters long with a wall thickness of 225 mm. The tunnels are placed below ground water level, and exit the ground under the sea at a depth of ca two meters.

Deployment of trench boxes

Micro-tunneling

Munitions clearance with bubble curtain

After the two World Wars, mine lines were abandoned and numerous munitions were dumped in the Baltic Sea. Nord Stream 2 has carried out extensive and detailed surveys to verify that the seabed is safe for the construction and operation of the pipeline.

Nord Stream 2 has optimized the pipeline route to avoid munitions objects wherever feasible. Conventional munitions that cannot be avoided through localized rerouting have been cleared on location, if these measures could be consistent with safe practice and in agreement with the relevant authorities. The data and experience gained from the previous project were utilized for planning the clearance methods, mitigation measures and monitoring of the environmental impacts according to the highest standards.

Nord Stream 2 contracted international munitions clearance experts to perform the operations. Extensive mitigation measures were used to reduce potential impact onto the environment. The basic principles of the munitions clearance method involved placing a small charge next to the identified object on the seabed using a remotely operated vehicle (ROV) or divers. These charges were then detonated from a surface support ship located at a safe distance from the target. In the Finnish Exclusive Economic Zone (EEZ), munitions were cleared using ROVs, thus limiting the risk for the personnel onboard the vessels involved in the munitions clearance. In shallower waters in Germany, divers were also used.

In Finland, N-Sea/Bodac and MMT/Ramora performed the clearance activities. A detailed munition-by-munition clearance plan was developed for each individual object. The companies used four vessels, with two vessels working simultaneously on one munition: a main disposal vessel and a bubble curtain vessel that mitigated the noise impact of underwater explosions on marine life. Bubble curtain equipment was deployed and operated by the support vessel and is designed to be laid around the unexploded munitions target. Compressors carried onboard were activated, feeding the compressed air into the bubble curtain hose to create a wall of bubbles which significantly dampened the acoustic shock during detonation.

In Germany, some 79 UXO (unexploded objects) were identified and cleared, with assistance from the local authorities. Denmark’s preferred route section has been planned to avoid any conventional or chemical munitions. In the Swedish EEZ, the route has been locally re-routed to avoid the finds, whereas in the Finnish EEZ, a total of 74 munitions were cleared. In Russian waters, the Baltic Fleet carried out the required clearance.

Creation of portal for management of survey data

Since the start of the Nord Stream 2 project, a number of different and increasingly detailed surveys have been carried out to select the optimal pipeline route. This includes identifying objects to avoid (wreckage or munition dumps), getting a detailed image of the topography and composition of the seabed and taking into account protected or restricted areas. These surveys have resulted in very large amount of information, with the help of which the entire seabed along the route has been mapped. To enable all users, even non-survey specialists, to access this information quickly and efficiently, the geographical information system department (GIS) at Nord Stream 2 have created a browser-based portal which connects the different data-bases and the document control system. This allows easy searches for information on practically any question that may arise, whether about the conditions of the seabed, or the pipe itself. For example, for a specific location along the pipeline route, it is possible to see exactly when the latest survey was made and what the results were. It will also be possible, once the pipe has been laid, to check the status of individual joints and anodes on the pipes, and, for instance, to filter them to locate which ones are damaged or show anomalous values. Users can also use the portal to create their own maps. The data collected is of geographical and topographical value only. It is useful for project implementation and, in future, during maintenance, with potential also for various scientific applications.

Bubble curtain

3D map of the seabed

Conclusions

- The results of the analysis show a wide range of effects of this large infrastructure investment, affecting many different countries and economic sectors.

- It clearly demonstrates that this is an international project impacting many more countries than those directly involved at the two landfalls of the pipeline.

- As can be reasonably expected, a large share of the effect is

- in countries where major project-related construction activities take place (RU, DE, FI, SE, DK);

- in countries traditionally associated with the offshore oil and gas industry, which host the majority of service providers (NL, UK, NO, IT);

- at the headquarters of major international service providers;

- at the Swiss headquarters of Nord Stream 2.

- The data also shows that raw materials and services are today sourced internationally from around the world, depending on price/quality considerations.

- The creation of over 57,000 FTEs (full time equivalents over five years) in the EU alone shows that a project of this magnitude has the capacity to contribute significantly to local economies and GDP. Please note – an FTE is equivalent to full-time work for one person over one year, and these 57,000 are spread over a period of five years. It does not mean that 57,000 employment opportunities have been created.

- Additional economic benefits are also likely to arise from the presence of additional competitively priced gas, and lower decarbonization costs as a result of lower gas prices competing with oil and coal – these could be the subject of separate studies further on.

- Interviews with contributing suppliers confirm the view that in addition to directly benefitting those companies economically, sometimes in times of economic downturn, Nord Stream 2 has also had positive effects on competitiveness, innovation and corporate development. Sub-contractors and materials providers in earlier stages of value chains have also benefitted in similar fashion.

- The project has generated a number of innovations and novel solutions, in technology, operations and organization. Some of these have been highlighted and described in the report.

DOWNLOAD THE FULL REPORT

46 min read • Oil, Gas & Other Natural Resources

Nord Stream 2 Economic Impact on Europe

Follow-up analysis of effects on job creation and GDP during the construction phase

DATE

Executive Summary

Introduction

Due to its size and relevance to the European energy sector, Nord Stream 2 constitutes a major European infrastructure investment that receives a great deal of attention. In July 2017, Nord Stream 2 commissioned Arthur D. Little to evaluate the economic impact of the activities and investments related to the Nord Stream 2 project, on countries that were either directly involved in the project or had contributed materials or services. The first report was carried out in the summer of 2017, at the height of the procurement phase, when only part of the budgeted funds (€4,400 million) had been committed, and assumptions had to be made due to ongoing tenders.

The overall objective of the report is to perform an assessment and to provide a transparent and fair description of economic benefits in terms of job creation and the GDP impact of Nord Stream 2. In addition to the previously published report, the plan is to expand this early analysis with a follow up report during the construction phase. Further analysis following project completion could provide valuable insight into the longer term economic effects of the new infrastructure during operations.

This current follow-up report is conducted at the height of the construction phase, at a time when almost all funds have been either spent or committed (€8,000 million, as of December 2018).

The scope only covers investments in the pipeline itself until operations begin. Wider economic implications of the availability of this new infrastructure to the European energy market were not considered in this study, and neither were the political implications scrutinized.

The methodology used for the assessment is an Economic Impact Analysis, which analyzes how an initial investment creates value in the economy via subsequent spending in interconnected value chains.

The Economic Impact Analysis is complemented by a number of supplier interviews.

Conclusions

The overall results of the assessment show that the total economic benefit created as of December 2018 for the European Union, which is receiving 58 1 percent of total investments, is over €9,900 million. This has created 57’450 full-time equivalents 2 , and added €4,740 million in GDP (see Table 1). Since we conducted the first economic impact analysis, the committed and spent funds have increased by 82 percent. The impact on the European Union in terms of both financial output and FTEs created has increased accordingly (see Figure 1).

The project has a wide range of effects on many different countries and economic sectors. The analysis covers all the countries that have contributed, with special emphasis on the EU and Russia.

As can be expected, the most pronounced effects are seen in:

- countries where major

- project-related manufacturing activities take place (RU, DE, FI, SE, DK);

- countries traditionally associated with the offshore oil and gas industry that host themajority of service providers (NL, UK, NO, IT);

- headquarters of major international service providers;

- Switzerland, where the headquarters of Nord Stream 2 are located, and from where, for instance, various professional services, technical and IT support are provided.

The analysis of full-time equivalent jobs created by the project is in line with expectations from other, similar large-scale infrastructure projects.

In comparison to the previous study, the effects by country are similar, but larger, since in the meantime, additional funds have been spent and committed.

The analysis in this study is limited by the boundaries of the Nord Stream 2 project, but further related economic effects are likely, for example, in connecting infrastructure in Germany, the Czech Republic and Russia.

Additional economic benefits are likely to arise from the presence of more competitively priced gas to the European economy as well as lower decarbonization costs as a result of lower gas prices competing with oil and coal. This could be the subject of separate studies further on.

The impact varies between countries because of:

- types of work created (white collar or blue collar);

- economic structure of the country;

- differences in labour cost.

A difference in the cost of labour would mean that an equally sized investment would have a larger impact in a country with lower wage and salary levels. An investment in engineering services will create more value than an investment in materials. An investment in a country with a large network of sectors contributing will have a larger effect than in a country that needs to import required goods or services from elsewhere. The impact of the investment is significant for the European Union as a whole, but also for individual Member States, as it is, of course, also for other contributing nations.

3 - Overview of suppliers interviewed

In order to create a more detailed picture of some of the key activities required to build the pipeline, as well as contractors involved in delivering products and services, we have included snapshot descriptions of some of the companies, spread out in this report, based on short interviews with key staff. It should be noted that this is not the full list of contributing companies, only a small subset. They were chosen to reflect a broad spectrum of activities and based on availability at the time of report preparation. In the chart below, we illustrate where the companies covered have been contributing across the value chain. They include (see Figure 4):

- The three pipemills: EUROPIPE, OMK, Chelpipe.

- A key supplier of critical components -- PetrolValves.

- A contractor engaged in weight coating and logistics operations -- Wasco.

- One of the strategic ports selected for the project -- the port of HaminaKotka.

- An offshore pipeline construction company -- Allseas.

- A company involved in mitigation measures and munition clearance -- Bodac.

- Plus some of the subcontractors engaged on various scopes and as well as various contractors on construction of on- shore facilities in Russia: Metallostroy, MSU-90, and DAF (subcontracted via Russian Dredging & Marine Contractors, as well as through Kvaerner).

4 - Many companies shared their experiences

By reliably suppling large quantities of quality pipe over such a long period and at such a tight schedule we have achieved a new milestone.

– Dr. Andreas Liessem, Managing Director and

Armin Klein, Marketing, Special Projects and Market Analysis

Successful participation in Nord Stream 2 has become an important reference for our subsea products.

– Eduard Stepantsov

Head of Commercial Department

The project participation gave us international recognition. We can proudly say that our processes and products correspond to the highest standards and stringent product requirements.

– Golodyagin Alexandr Sergeevitch

Head of Strategic Partnerships Department

Nord Stream 2 was strategically important for us as it came in a period of recession in oil and gas. Nord Stream 2 allowed PetrolValves to retain staff and invest to support project execution.

– Filippo Rinaldi

Director, UK

We firmly believe that this project will help us going forward to develop our business in Europe and globally because in our industry it has received global attention.

– Rik Nugteren

Project Director,Coatings Europe

Nord Stream 2 is an important employer here in the region and gives a lot of jobs to the local people.

– Dr. Kimmo Naski

CEO

On a very big project like this - you have the luxury of getting better at it month by month. You really have time to improve in every aspect.

– Edward Heerema

President

Bodac made a significant difference by using a mine disposal system that is safe and efficient but uses less explosives.

– Auke van der Velde

Explosive Ordinance Disposal Manager

Participation in this large project led to 70% utilization of both facilities and staff, and a significant increase in staff motivation.

– Djavad Djavadov

Deputy Director

The project allowed us to enter a new sector, gain international experience and adapt to higher safety standards.

– Dmitry Martinov

Deputy Chief Engineer

The project, as one of the five largest in our history, is strategically important for us.

– Dmitry Platonov

Chief Engineer

EUROPIPE – supplier of coated steel pipes

Products/services

EUROPIPE supplied about 1,100 km of steel pipe for Nord Stream 2 at a speed of up to a maximum of 90 km per month. The pipes were then transported by rail to Mukran on the Baltic Sea coast and by ship to Kotka for weight coating. In addition, bends and buckle arrestors were delivered for the onshore facilities in Germany and Russia. The order made up about 50-70 percent of capacity over the project duration, so it was very significant.

Key challenges

The delivery schedule was very challenging. Some 2,000 workers have been involved in the project since 2016, in various different staff categories. Additional working shifts had to be introduced at the factory, as well as at the coating yard to meet the deadlines. Significant investments into the quality control system were also made. At the same time, an induction coil system was added at the coating yard to accelerate the coating process (coating was applied to internal and external surfaces of the pipe) and increase overall production speed.

Main benefits

Reliably supplying large quantities of top quality pipe in the time required by the ambitious schedule of Nord Stream 2 is one of EUROPIPE’s strengths, and we were able to live up to the expectations. But doing it for so long, and at the same time handling the logistics to bring the pipes to the coating plant in Mukran was a challenge. It was a landmark project for us.

OMK – supplier of pipes

Products/services

OMK was one of three suppliers of steel pipe, providing some 730 km for the project, as well as pipe fittings for the compressor station on the Russian side of the pipeline. It was the largest one-off pipe-supply contract in the history of our company.

Key challenges

Production facilities were renovated and modernized, and technology upgraded for the Nord Stream 2 project. The safety requirements stipulated in the contract also led to an upgrade of industrial safety at the plant, including adoption of a new standard for incident reporting, installation of automatic sensors and an almost-complete phaseout of manual operations.

Main benefits

OMK was able to prove that we can compete globally, meeting the most stringent international standards and fulfilling the terms and conditions of a demanding contract. As a result of the Nord Stream 2 project, the plant has been modernized, safety upgraded and corporate social responsibility objectives introduced. Successful participation in Nord Stream 2 has become an important reference for the company’s subsea products. It also enabled OMK to actively improve the local urban environment in Vyksa through contributions to cultural projects, industrial tourism, sports, and charity

Chelpipe – supplier of pipes

Products/services

Chelpipe supplied large diameter pipes, including concrete-covered pipes (CWC), transition pieces, buckle arrestors and low-temperature pipes. About 200 km of pipes were coated by PCT (Pipe Coating Technilogies) at a plant in Volzhsky, the rest were shipped by rail to Kotka and Mukran for coating. The total amount of pipes supplied is 611,000 tons, or 640 km, and Chelpipe’s annual production capacity is 1,000,000 tons.

Key challenges

Pipes had to be produced in line with Det Norske Veritas standard and in accordance with additional project-specific requirements. Chelpipe mastered production of all pipe sizes, including pipes with WT 41 mm. Buckle arrestors were produced for the first time in the territory of the Russian Federation. Multi-pass welding process for low- temperature pipes was developed and introduced in a short time. The steel was supplied by Magnitogorsky Metallurgical plant (MMK) Russia and Dillinger (Germany).

Main benefits

Around 1,300 people have been involved in various capacities during the 2 years of Chelpipe’s participation. We can proudly say that our manufacturing process and products correspond to the highest standards and stringent product requirements. We have delivered pipes of the highest quality, manufactured to strict client specifications, and without any delays, according to the tough schedule set out by Nord Stream 2. In addition, we were able to triple our tax contributions to the local Chelyabinsk community.

The Nord Stream 2 pipeline – status report

In our first report 5 , we provided a detailed background description of the project, and its history, market context, rationale and activities to date. In this report, we will focus on updating this context with developments in the past two years, in terms of demand and supply, general gas infrastructure additions and Nord Stream 2 project developments.

The objective of the Nord Stream 2 project is to provide additional means for safe and secure deliveries of gas to Europe. Europe’s import dependency and supply gap is growing, due to growing consumption, depletion of indigenous reserves, and phasing out of nuclear and coal-fired power generation capacity. In our first report, we provided forecasts of both demand and supply to illustrate this point. Renewable energies alone are not available in sufficient quantities to bridge this gap.

The addition of more pipeline capacity to Europe provides an option for buyers of gas to import competitively priced supplies from Russia if they wish to. It does not prevent anyone from buying gas from other sources, if preferred.

Market developments

Demand

European gas demand has recovered since 2014, after its decline following the financial crisis in the early part of the decade. During this period, the European gas market has become increasingly competitive; 70 percent of wholesale gas sales are now based on traded gas market prices such as the NBP 6 and TTF 7 , while those volumes that are still indexed to oil have to compete with the traded gas price via discounts and rebates to remain competitive. Gas demand has grown in all countries and all sectors (see Figures 5 and 6).

Following a recent proposal by the German WSB 8 Commission, tasked with developing a plan for the phase-out of coal and lignite, Germany could close 8.6 GWe (20 percent) of hard coal- and lignite-fired power generation capacity by 2022 - and all of it by 2038. This would occur at the same time as the exit from nuclear power, presenting an additional challenge in closing the gap. It is anticipated that as a result, German gas consumption used for power and heat production could potentially double by 2023. This would require large new imports, which in the short term could be met by a combination of LNG and new import capacity from Russia (Nord Stream 2).

For a comprehensive review of forecast gas demand and the sources available to close the import gap, we would like to refer the reader to our first report.

Supply

European imports have also grown in the past two years. Indigenous production in the Netherlands, the UK, Denmark and Germany has peaked and is declining. Norwegian gas production is not expected to increase from current levels. New import sources such as Nigeria have emerged, in addition to Russian LNG (see Figures 7 and 8).

Prices

The period has been characterized by falling oil prices, while gas prices in Europe have remained more stable, which has reflected the fall in demand and gradual (although not yet universal) decoupling from oil prices (see Figure 9).

During the winter of 2018/19, the profit margin for LNG delivered to Asia compared to deliveries to Europe has decreased, due to higher shipping costs and additional LNG supply. As a result, more cargoes of LNG produced in the Atlantic Basin have gone to Europe instead. This illustrates that LNG very much acts as a swing supplier, and Europe as a residual market for LNG. It also shows how competitive and well-working the European gas market has become. At times when LNG is priced attractively, European buyers only take the minimum under the remaining long-term take-or-pay pipeline contracts, and fill the gap with LNG. At other times, when LNG is expensive, pipeline gas supplies are maximized. This benefits European buyers. However, a growing reliance on LNG to meet the supply gap developing in the longer term could serve to put upward pressure on European market prices. Although LNG supply is expected to increase, LNG demand is also increasing significantly and European buyers will have to compete with buyers from other regions such as Asia.

Infrastructure development9

Apart from the Nord Stream 2 project, several other European gas infrastructure projects are making progress.

TAP/TANAP