The future of banking looks increasingly different, with new business models emerging on the back of digitalization, interconnectivity, and the availability and use of rich data. In this Viewpoint, we focus on “beyond banking,” compare it to other open banking–based business models, and point out possible engagement opportunities. We share examples and potential strategies and conclude with questions to help determine the right approach for your institution.

THE FUTURE OF BANKING: DIFFERENT FIELD, SAME PLAYERS

In recent years, technology, connectivity, and data have driven fundamental change in the delivery of financial services and will continue to do so. Fintechs have established themselves as important providers of financial services and play an integral role in the wider ecosystem, while digital banks provide more convenient and democratic access to banking services.

New business models are emerging, spurred by digitalization, interconnectivity, and rich data. These models have introduced many new concepts, such as open banking, embedded finance, platforms, ecosystems, and beyond banking.

We believe that these new business models, which we classify as open banking–based business models, will continue to change the industry in the future. However, we think a dramatic shift in the players’ landscape is unlikely. Instead, incumbent banks will adapt and leverage their large customer base, capital base, and systemic significance to remain prominent and relevant.

Incumbent banks seeking to transform themselves by adopting open banking–based business models, or that simply want to ramp up their organization’s overall digitalization, now have a window of opportunity:

-

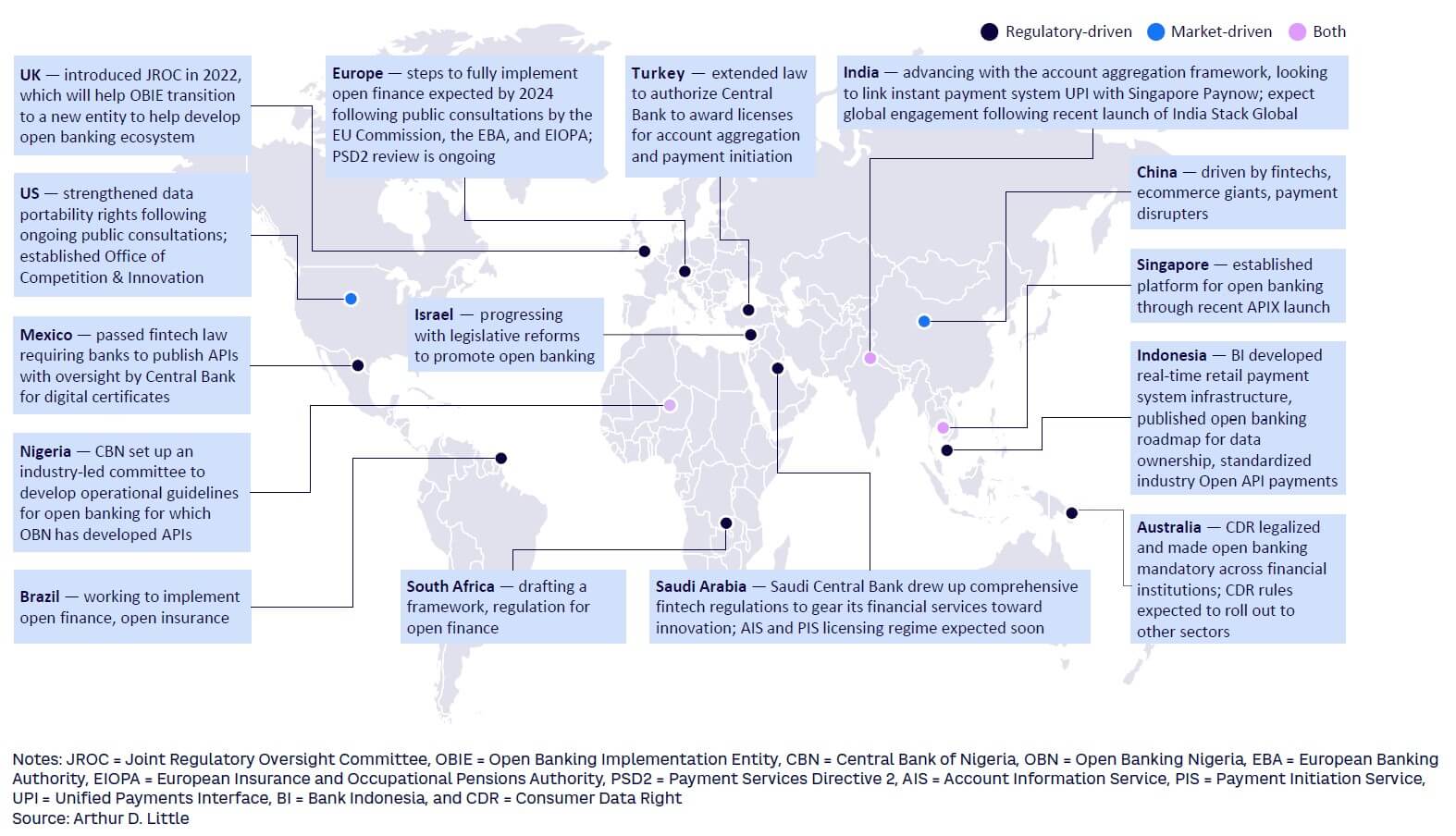

Emerging regulation around data, open banking, and open finance have created an opening for banks to extend their business into new products and services beyond banking. As shown in Figure 1, open banking and open finance regulations are being issued in several markets across the globe, establishing regulatory clarity for the business and enabling it. In other markets (e.g., the US and Switzerland), the push is led more by the industry. There are also markets with a hybrid approach, with both regulators and market participants in the driver seat. As open banking and open finance mature, the borders are blurring between regulatory versus market-driven and open banking versus open finance.

-

The current funding drought and decline in fintech valuations have led to an opportunity for incumbents to leapfrog their own digital transformation by strategically investing in fintech and digital partners. Previously, this was only possible at relatively high prices, which makes the current environment attractive for incumbent banks with sufficient investment capital.

Incumbent banks willing to invest and engage beyond their classic business models will establish themselves as leaders. They will be able to leverage their position to capture the emerging monetization potential from near-term and longer-term trends in consumer behavior, the introduction of nonfinancial services players to financial services, and the increasing depth and breadth of technology.

OPEN BANKING–BASED BUSINESS MODELS: AN OVERVIEW

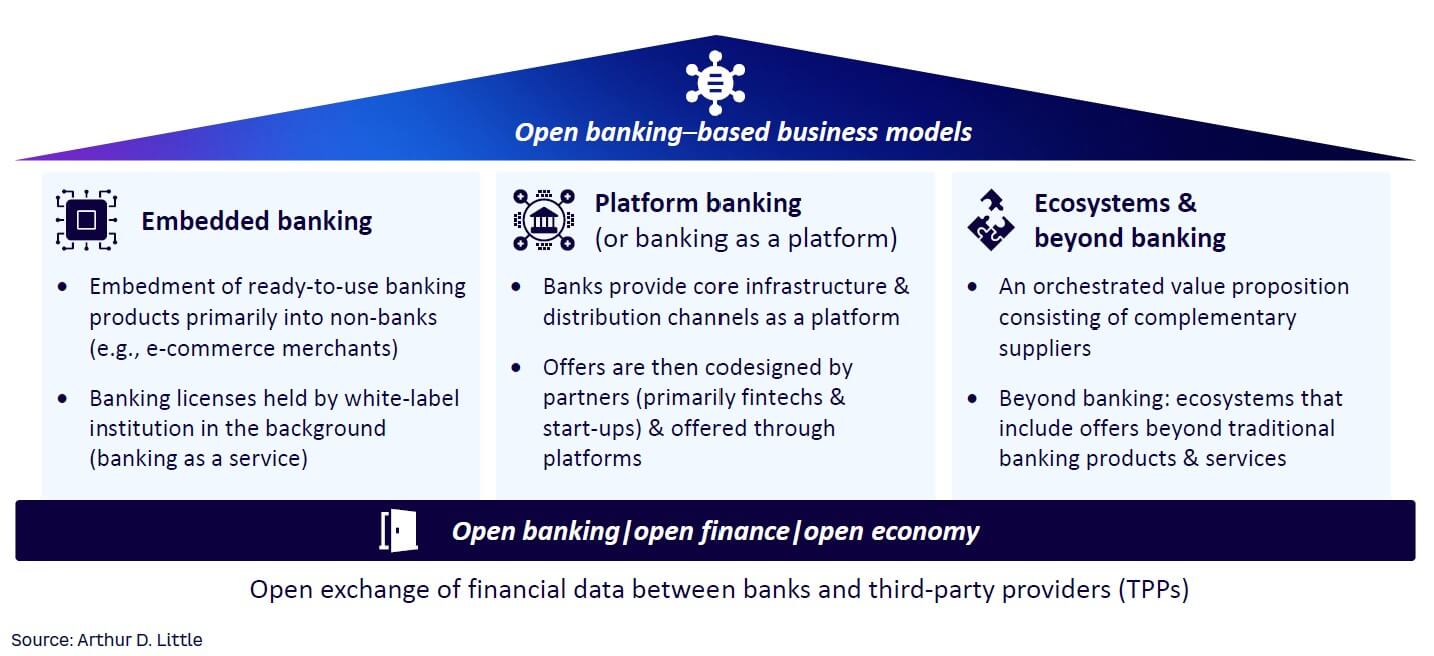

Before diving deeper into beyond banking and what it entails, we want to define the different open banking–based business models, as we believe the terms are often ambiguously and vaguely used.

Figure 2 provides an overview of these models and shows beyond banking’s position within this field. The models share some commonalities, including a new level of interconnectivity and the distribution of products and services across institutions, which are enabled primarily by application programming interface (API) technology and the open exchange of data:

-

Open banking provides an overall basis for these new methods of banking. At its core, open banking is the exchange of financial data between banking institutions and third-party providers (TPPs). The EU’s Second Payment Services Directive regulation (PSD2) has been a key driver, requiring banks to provide account information and payment initiation services to TPPs requiring only client consent. The terms “open finance” and “open economy” expand to applications such as lending (e.g., flow-based lending) and then to broader data sharing and capabilities across industries.

-

Embedded banking, which is one type of embedded finance, refers to the practice of folding banking products and services into other customer transactions, such as e-commerce (think of buy-now-pay-later (BNPL), a type of short-term financing for purchases as an example). Customers benefit from a more seamless experience when the financial service is almost invisibly built into the journey. Banking as a service (BaaS) is a slightly more specific type of embedded banking, where the bank is in the background and invisible to the end customer, typically offering its license, balance sheet, and white-labeled products to the integrating business B2BC business. Arthur D. Little’s (ADL’s) “Banking as a Service” Viewpoint provides a deep dive on this topic.

-

Platform banking has become an integral business model in both financial services and the overall economy. It is important to differentiate among two types of platforms — the latter reflects the purpose applied in this Viewpoint:

-

Transaction platforms, such as eBay, are exchange platforms where buyers and sellers meet. The platform’s value is inferred from the transaction itself. There are several examples of banks engaging with or hosting these types of platforms, specifically for mortgages (e.g. the Interhyp platform by ING in Germany or key4 by UBS in Switzerland).

-

Product platforms (platform banking or banking as a platform). The bank, with its license, tech stack, distribution channels, and client base, serves as a place where third parties can connect to and enrich the offering for the end customer. For example, Starling Bank launched a marketplace for financial products (which can already be argued to be an ecosystem).

-

-

Ecosystems. Working with partners, ecosystems orchestrate offerings to achieve new, upgraded value propositions that are superior to and more comprehensive than what the bank can offer alone. Ecosystems are guided by a target value proposition and are usually built around a theme such as housing. The main difference between an ecosystem and platform banking is that the former is more strongly steered by a target value proposition. Therefore, an ecosystem has a more selective choice of partners that are typically more tightly integrated, make strong contributions, and have a distinct voice in the partnership.

-

Beyond banking grows from an ecosystem that contains offerings that expand from traditional banking products and services and addresses areas such as real estate, transportation, travel, healthcare, and shopping. This definition of beyond banking, while narrow, helps differentiate between the assorted models. But you must view beyond banking comprehensively or you’ll miss the point: a bank’s ultimate goal should be facilitating the purchase of non-banking products and services to make the transaction smooth and easy for customers — regardless of where they buy it, which may not necessarily be through the bank’s own app.

Banks therefore need to take a holistic view of beyond banking by engaging with all the relevant industries and by engaging in embedded banking and its large monetization potential through BaaS and partnerships with players outside the financial sphere.

BEYOND BANKING: BENEFITS & OPPORTUNITIES

We see three primary benefits for incumbent banks that elect to go beyond banking:

-

Holistic value propositions, customer loyalty, and value per customer. Financial and lifestyle services continue to converge, with financial products embedded into customer lifestyle journeys. Using non-banking products to enrich a bank’s existing offerings can create a better, more holistic value proposition that helps them build deeper and more valuable relationships with customers.

-

New customer-acquisition opportunities. Customer acquisition is becoming increasingly difficult as the digital space becomes more “cookie-less,” which reduces access to valuable customer data. Banks must reassess standard digital marketing methods that build on cookies to generate new leads and grow their customer base. Beyond banking products can attract new, non-banking customers to the ecosystem.

-

New revenue streams. Beyond banking is advantageous to traditional banks, as their ecosystem partners will open new revenue streams for them.

Banks are especially well-positioned to co-orchestrate a beyond banking offering with a telco or retailer. Banks benefit from customer trust, rich data, and the core services they offer customers. In particular, a bank’s access to transaction data, which allows them to infer consumer behavior, is a solid unique selling proposition.

A survey performed by ADL in the Middle East and presented in “Beyond Banking: Is There an Opportunity for Banks to Go Beyond Banking in the UAE?” confirms banks’ strong starting position: a vast majority (61%) of bank customers are ready to turn to their primary bank for a beyond banking proposition. If their primary bank did not meet their needs, then respondents would opt for beyond banking offerings from either retailers or tech companies.

BIG MOVES FOR SOME BIG NAMES — BUT NOT ALL

Compared to other regions, European banks are behind the curve. A look at the global market shows a number of strong beyond banking case studies featuring well-known incumbents making bold moves. In particular, JPMorgan Chase & Co.’s plan to set up its own full-service travel service has caused quite a stir in the market. The company’s Connected Commerce unit is driving the plan, the overarching goal of which is to “serve customers with digital experiences beyond the core financial product.” During the first phase, JPMorgan bought a booking system, a luxury travel agency, and a restaurant review company. The bank believes it can capture enough bookings to put it in third place among travel companies in the US by 2025. JPMorgan aims to control the entire buying journey and better position its banking products within it, perhaps following with automobiles and homes soon. Similarly, Capital One Financial Corporation set up its own travel booking service, Capital One Travel.

In Asia, DBS Bank is a leading example of leveraging its wide reach of small- and medium-sized enterprises (SMEs) and retail customers and building a marketplace for them. Originally starting around cars (buying, selling, financing, insuring, and value-added services such as roadside assistance), the marketplace now also includes education, home and living, health, property, and travel and leisure. DBS acts as orchestrator, offering a one-stop solution for its customers’ needs.

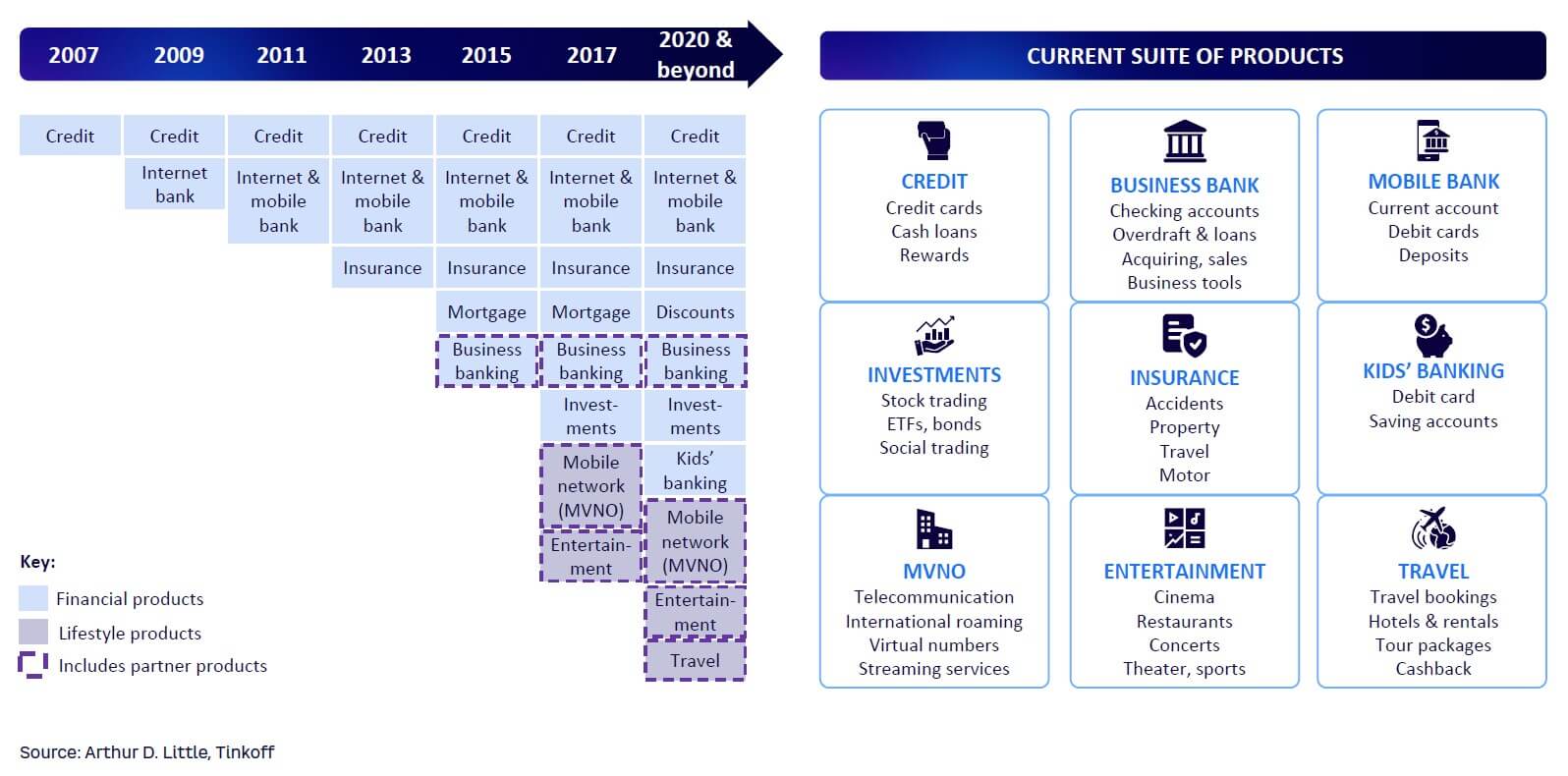

Only a few financial institutions, however, have managed to create genuine super apps that include beyond banking offerings. New super apps have emerged from four potential specialties: ride hailing, delivery, telcos, and marketplaces. In our view, Tinkoff and Alipay are prime examples. Tinkoff sells non-banking products in its super app, as shown in Figure 3. It has transitioned from being a lender to offering a wide range of lifestyle and financial services for business and individuals through its Web interface and mobile app. Note that this was a multiyear evolution for Tinkoff.

There are a number of reasons Europe is lagging behind its peers:

-

Reliance on old practices. Incumbent banks are characterized by a focus on in-house development and a high level of confidentiality; the ecosystem paradigm requires collaboration and data sharing across players and a move away from the practice of doing everything in-house.

-

Inadequate tech capabilities. Legacy IT infrastructure does not always support the construction and co-orchestration of an ecosystem; modernizing the tech stack and specifically upgrading the connectivity capabilities is often necessary and requires high financial investments.

-

Focus on near banking. Many banking ecosystems products are currently in the “near banking” stage (i.e., banks offer additional products that are near to their core offering, such as insurances).

-

Lack of long-term focus. Building and independently managing an ecosystem without a partner requires substantial up-front investments, which can take several years to recoup and thus calls for unwavering attention and a sufficiently long planning horizon. The possibility of failure is always present and creates uncertainty.

BEYOND BANKING IN THE METAVERSE

It would be short-sighted not to look outside the current perimeter for beyond banking opportunities. In fact, we see as much demand for beyond banking in the Metaverse as in the real world.

According to Precedence Research, the global Metaverse market was valued at around US $40 billion in 2021 and is projected to grow at a CAGR of 50.74% from 2022 to around $1.6 trillion by 2030. In their article “Banks Compounding Their Interest in the Metaverse,” Sanjeev Kumar and WhiteSight describe the widespread desire across industries to sit front row, but fear of missing out is certainly also a driving force for some players.

Banks are among the industries expanding into the Metaverse. Since 2021, there has been an influx of incumbent banks into this new world, starting with JPMorgan and its opening of Onyx, a blockchain platform. HSBC, Standard Chartered, Union Bank of India, Commercial Bank International (CBI), and many others have also started searching for entry points to the Metaverse.

The need for innovative forms of money in this evolving sphere means that banking and the wider financial services sector will be critical to the viability of the new space. And the Metaverse, in return, will offer financial institutions an array of new and traditional ways to expand their operations (e.g., exchanging currencies between different worlds, converting virtual or real-world assets, providing mortgages to buy virtual real estate) for their classic banking products and beyond.

Consider that whatever we do and need in the real-world economy will be replicated in the Metaverse. There will be additional use cases, accompanied by an opportunity and a need to do things differently. Opportunities will not be limited to one type of financial player; organizations of all shapes and sizes will be able to carve out a piece of the Metaverse for themselves.

TAKING YOUR BANKING STRATEGY BEYOND

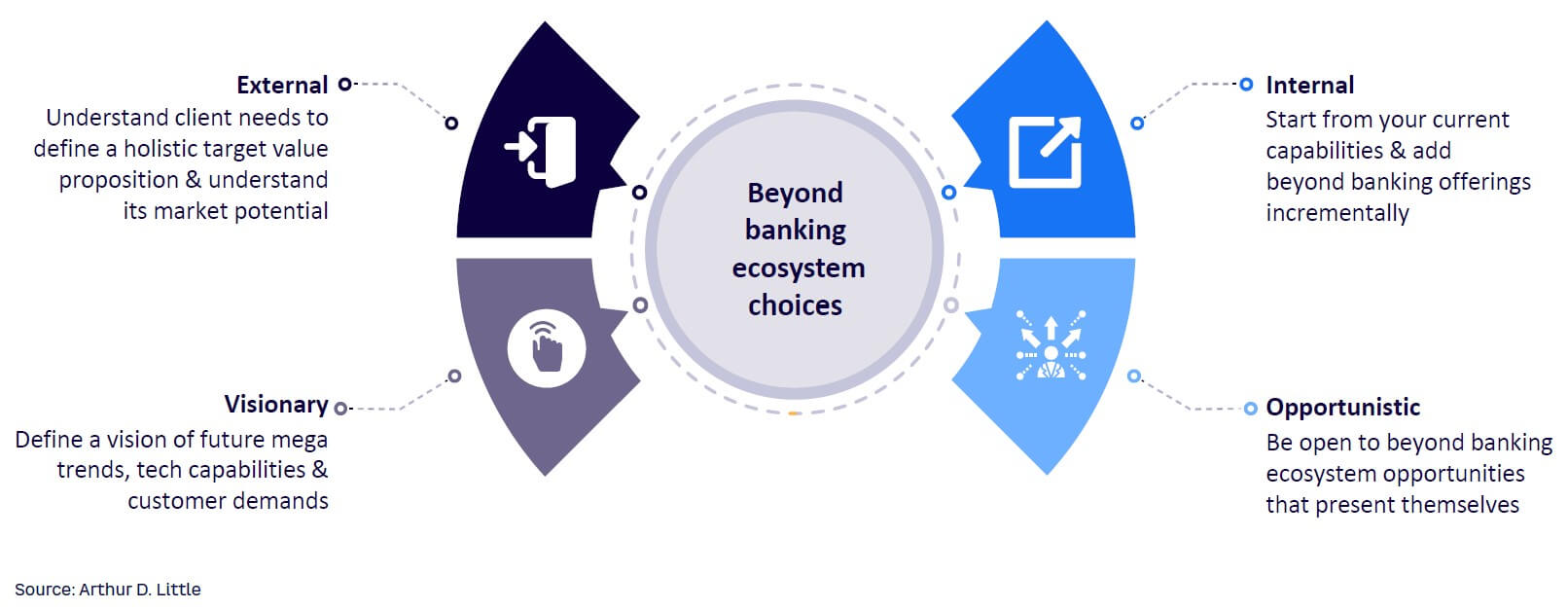

We suggest that four perspectives, which interact with each other, should guide and inform the development of a beyond banking strategy (see Figure 4).

The four perspectives can be viewed as poles that are not mutually exclusive. Each one needs to converge in a manner that finds the ideal conditions for you. Note that a purely client-driven view with visionary thinking will fail, as it does not consider current realities, while an incremental view with an opportunistic approach will also fail as it lacks the courage and innovation needed to achieve breakthroughs:

-

External perspective. Develop a clear view of customer demands. Which of those needs are currently not served well? Build a target value proposition to close these gaps. This target value proposition will then guide your beyond banking products and services. Consideration of your own strengths should be kept to a minimum, as they will be examined during the next perspective.

-

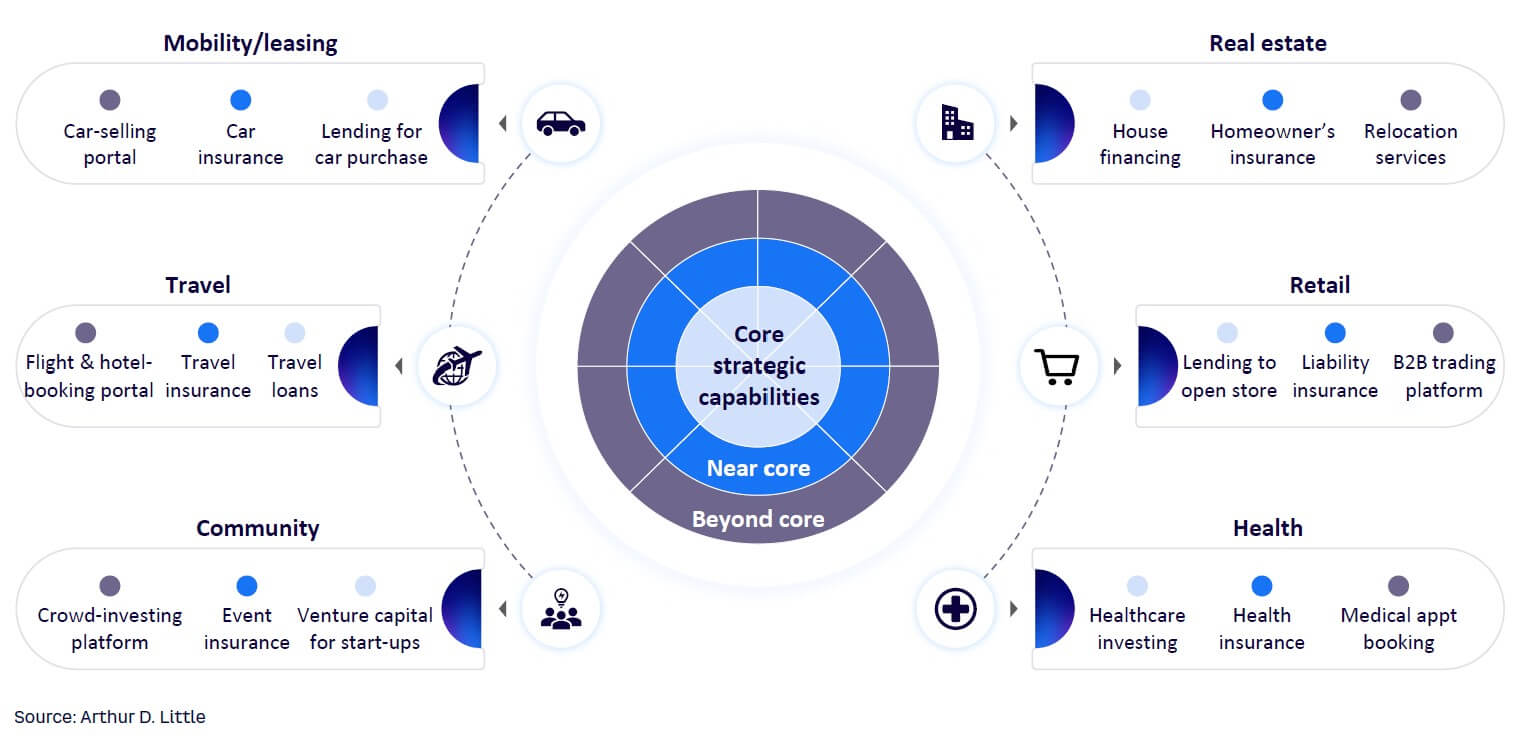

Internal perspective. Start from your focus customer segments (e.g., retail or SME), core offerings, and strengths, and determine which additional beyond banking products and services can be attached to those. We advise thinking in terms of a core offering, a near-core, and a beyond core offering (see Figure 5).

-

Visionary perspective. Define a future “out of the box” target value proposition and challenge yourself to fulfill it, based on your expectations of medium-term future mega trends, technological capabilities, and customer demands. Remember, clients do not always know what they want until they see it.

-

Opportunistic perspective. The target value proposition offers guidance and a vision. At the same time, be aware that some opportunities may present themselves to you, and you should remain flexible, seriously review them, and adjust your approach if a sufficiently convincing prospect appears.

Ideally, you should build the business case to validate your financial strategy as soon as possible after you define the first strategic imperatives for your beyond banking strategy. While the future revenue potential is important, the necessary investments to build the ecosystem can be significant, depending on current infrastructure capabilities.

Instead of partnering with providers, a bank can manage its own non-banking offerings in-house. However, this will force the bank to continue its usual operations while trying to manage a product or business unit that encompasses areas outside its core expertise.

A HARMONIOUS ECOSYSTEM

Orchestrating an ecosystem has the advantage of maintaining the client relationship and reaping the largest share of the ecosystem’s financial benefits. It is a challenging task, especially for incumbent banks, and will require significant up-front investment. A conservative bank might decide to build an ecosystem in a separate legal entity to better establish the open and change culture and capabilities required for this exercise.

In our view, independent orchestration is generally too risky for a bank to undertake. Tech giants, telecom providers, and retailers (IKEA has its own bank and is, in fact, an ecosystem orchestrator), which are often already in the middle of peoples’ lives, may have an easier time. Therefore, banks are typically well-advised to consider teaming up with players from other industries, which means working with a telecommunication provider, for example, to organize their ecosystems.

Before attempting to orchestrate, participating in an ecosystem first to collect experience and learn to navigate its economy typically increases the probability of success for the co-orchestrator. Participation in one ecosystem can even be continued once you launch another one; these roles are not mutually exclusive.

Conclusion

USE QUESTIONS TO BUILD A STRATEGY

There is no one-size-fits-all beyond banking strategy. While certain advice applies to all, your best approach depends on your starting position, context, and goals. Answering the questions below can determine your ideal beyond banking strategy:

-

What customer segments are your focus?

-

What are your customers’ biggest pain points?

-

What are your core offerings and strengths?

-

What beyond banking themes should you pursue?

-

Will you work with outside partners or procure the capabilities in-house?

-

Do you already have a connection with potential partners?

-

Do you have experience establishing partnerships?

-

Do you want to orchestrate or co-orchestrate a beyond banking ecosystem?

-

Is your tech stack adequate, or will it require upgrades?

-

Can your core institution support beyond banking or is a separate entity better?