The used car market is likely to reach approximately US $80 billion in the next five years and is witnessing increased formalization, with technological advancements reducing traditional friction points along the value chain. There is noteworthy market potential, as estimated transactions are expected to double during this period. In this Viewpoint, we explore five key reasons OEMs should reinvigorate their efforts in the used car space and explore ways OEMs can revisit their strategy to win in the used car market.

THE GROWTH CONTEXT

Globally, the used car market stood at more than $900 billion in 2023 and is expected to grow at ~9% CAGR to ~$1,500 billion by 2028 (according to estimates by Indian Blue Book [IBB]). In comparison, while the nascent Indian used car market is only ~$34 billion (i.e., 3% of the global market), Arthur D. Little (ADL) modeling predicts that the anticipated 17%+ CAGR over the next few years will drive it to an estimated ~$80 billion by 2028.

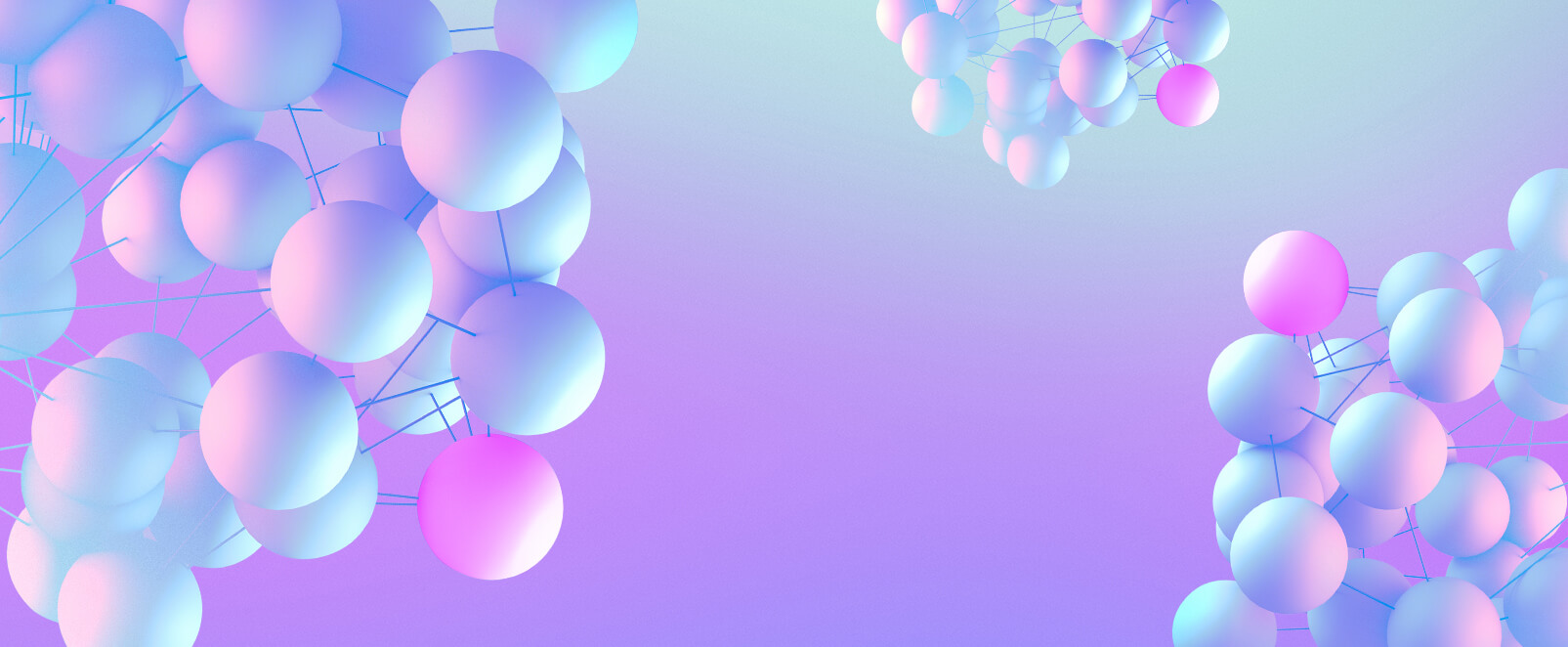

As Figure 1 illustrates, markets such as the UK, France, and the US have seen high used car sales (with used car transactions at three to four times those of new cars) with continued organized play enabling a decrease in peer-to-peer transactions. With their national scale and brand, OEMs are able to source high-quality, newer used cars, thus creating a strategic moat for themselves. Younger “new-age” players, on the other hand, are well funded and have disrupted the market with multi-brand supermarkets and pure digital channels.

The Indian market is facing some of the same tailwinds: continually decreasing used car age, improved quality of used car offerings, rise of organized players, reduction in information asymmetry through digital channels, and so forth. Coupled with the rapid price increases in new cars due to regulations and consumer shifts, this has opened a compelling value proposition for used cars in India across price segments.

Three main trends are defining the dynamics of the used car industry in India:

-

Increasing formalization

-

Value pool shifts

-

Disruptions by new players

Increasing formalization

ADL estimates that the used car market’s organized retail sector will grow from 30% currently to 50% by 2030, driven by the digital revolution, streamlined market access, transparent buying and selling processes, and regulatory push, such as goods and services tax (GST) rate rationalization to reduce rates, proposed used car dealer licenses, and so on. Multiple factors contribute to the formalization of the used car business, including:

-

Rise of organized players. The share of organized players increases every year (~30% in FY23 per ADL estimates), with dealers offering streamlined services throughout the used car user journey, both for selling and buying.

-

Reduction in information asymmetry through digital platforms. Digital platforms are helping customers with price discovery, specification checks, and vehicle comparison. Organized players are offering websites and apps for their services.

-

Decreasing age of used cars. The average age of replaced cars continues to decline (from around six years in FY11 to around four years in FY23).

-

Better quality of used car supply. Platforms offering 140-200 checkpoints provide certified vehicles through third parties or company-owned inspection services.

-

Shift in preference from motorbikes to used cars in nonmetropolitan areas. Nonmetropolitan regions accounted for 65% of demand (a shift from 55% over the last five years), due to rising disposable income and easily available financing options (with new nonbank financial companies).

-

Increasingly favorable regulations. Bharat Stage emissions standards (BS-VI) norms and scrappage policy will induce higher used car demand, while the Indian government GST rationalization from 24% to 12%-18% will contribute to positive conditions as well. Proposed used car dealer licenses (for accountability) will push for further formalization.

Value pool shifts

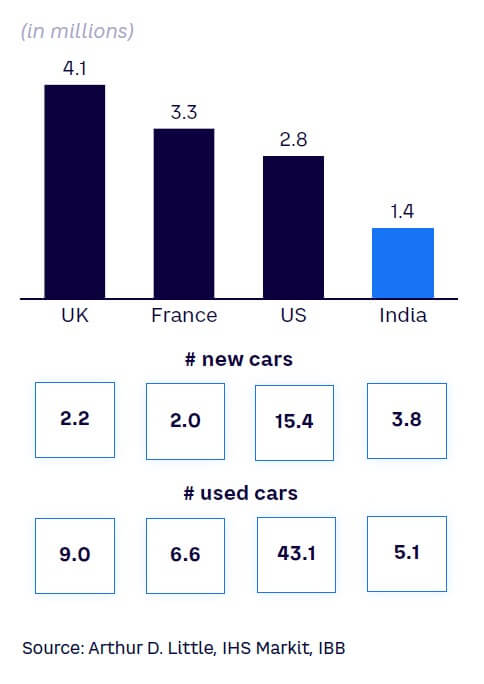

With used car transactions expected to reach nearly 10 million by 2028, the value pool is expected to reach approximately $78 billion across blocks beyond retail transactions, including supply and demand services (see Figure 2). Bolt-on demand services (e.g., warranty and finance) will witness the biggest growth, at nearly 30%. In supply-side services, innovation in digital is generating significant activity by increasing online inspections and accelerating auction platform procurement, for example.

Disruptions by new players

New-age players are well funded (~$3.5 billion invested as of 2023, according to data from Tracxn) and operate across a wide range of value blocks (see Figure 3). Parallel consolidations have also been seen in the space, with new-age players acquiring start-ups with specialized capabilities (e.g., inspection platforms, connected services platforms) to go deeper into the value pool. Unlike traditional automotive retail, new-age players have tested, pivoted, acquired, and scaled at the same time.

THE EMERGING CASE FOR OEMs: WHY NOW?

India’s used car market continues to differ from the Western matured markets on both the demand and supply side — with no big auction houses (e.g., the British Car Auctions [BCA] in the UK) and a very small leasing market with a handful of organized players, respectively. However, as we have emphasized, many factors have converged concurrently to enable fundamental corrections in the market. Well-funded new-age players have disrupted the market with their “phygital” play in a market infamous for information asymmetry and lack of trust among customers.

However, the dual-pronged challenge of managing acquisition costs while scaling up makes it difficult for new-age players to work out profitable unit economics. On a unit level, TheKredible estimates that new-age players in India spent approximately 1.22 rupees to earn just a rupee of operating revenue in FY23. As a result, this could be an opportune time for OEMs to revisit the used car market and contextualize the importance of this fast-growing value pool for themselves. The play may also enable OEMs seeking downstream opportunities for both expansion (new customers across a wider geography — including rural markets, international markets such as Africa, etc.) and for profitability improvement (services portfolio for financing, connected car packages, etc.).

We see five key aspects to propel OEMs to evaluate a focused used car play:

-

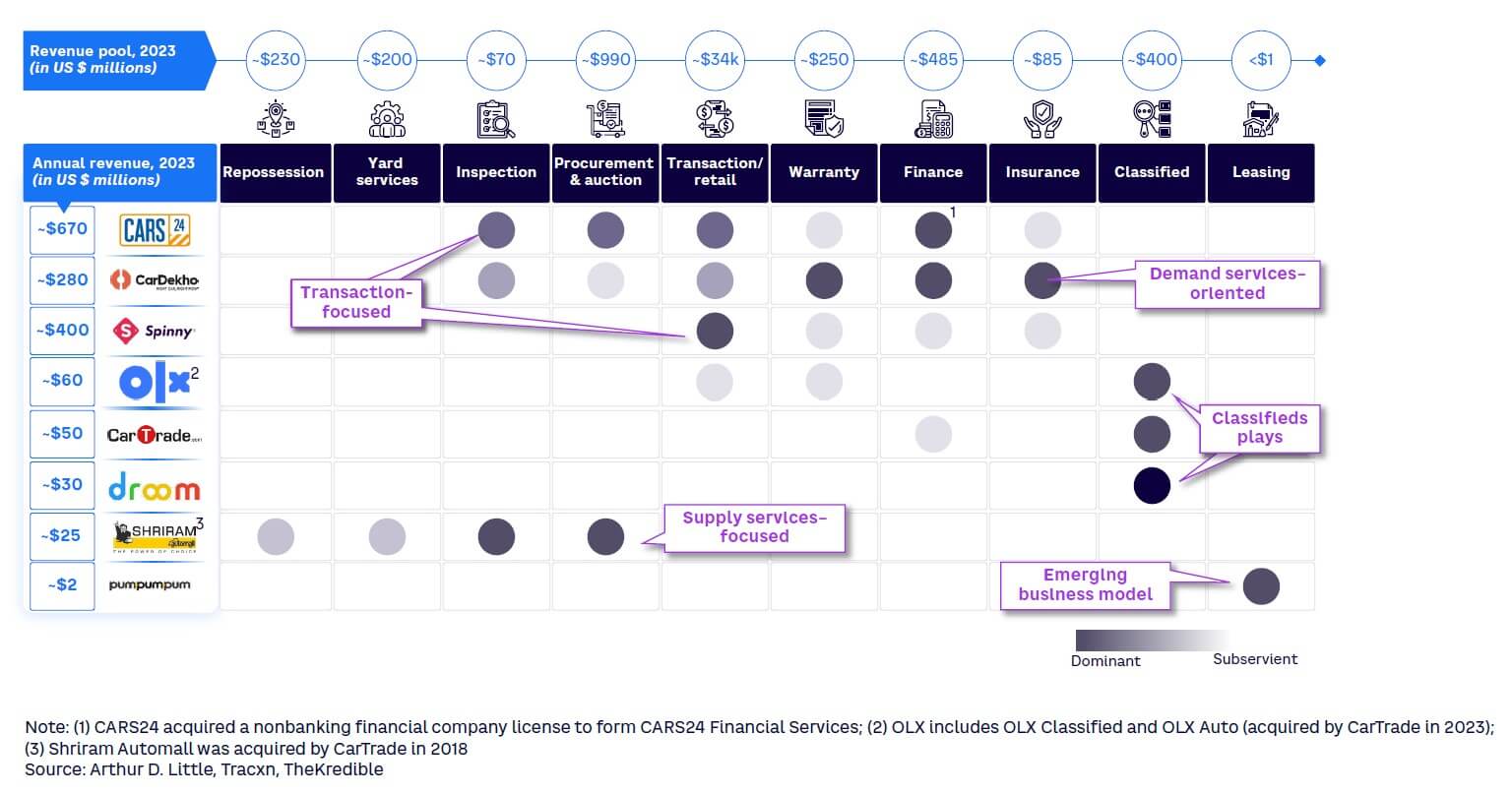

Early targeting of new car potentials. A polarization is emerging for used cars. On one side is the marked increase in prices of entry-level new car portfolios which has enabled used cars to detract first-time buyers typically focused on affordability (especially those graduating from two-wheelers). On the other side is a growing demand for used cars in the mid-range and premium car segments, driven by customers prioritizing product experience over affordability (see Figure 4). According to IBB, more than 70% of used car customers look for the right MMV (model-make-variant) when making a purchase, providing an opportunity for OEMs to build a customer-targeted used car play as an enabler to their new car portfolio. OEMs could potentially leverage their used car portfolios to create a larger lead funnel while also potentially creating a brush-off effect of their product experience to drive a stronger new car conversion over a customer’s lifecycle.

-

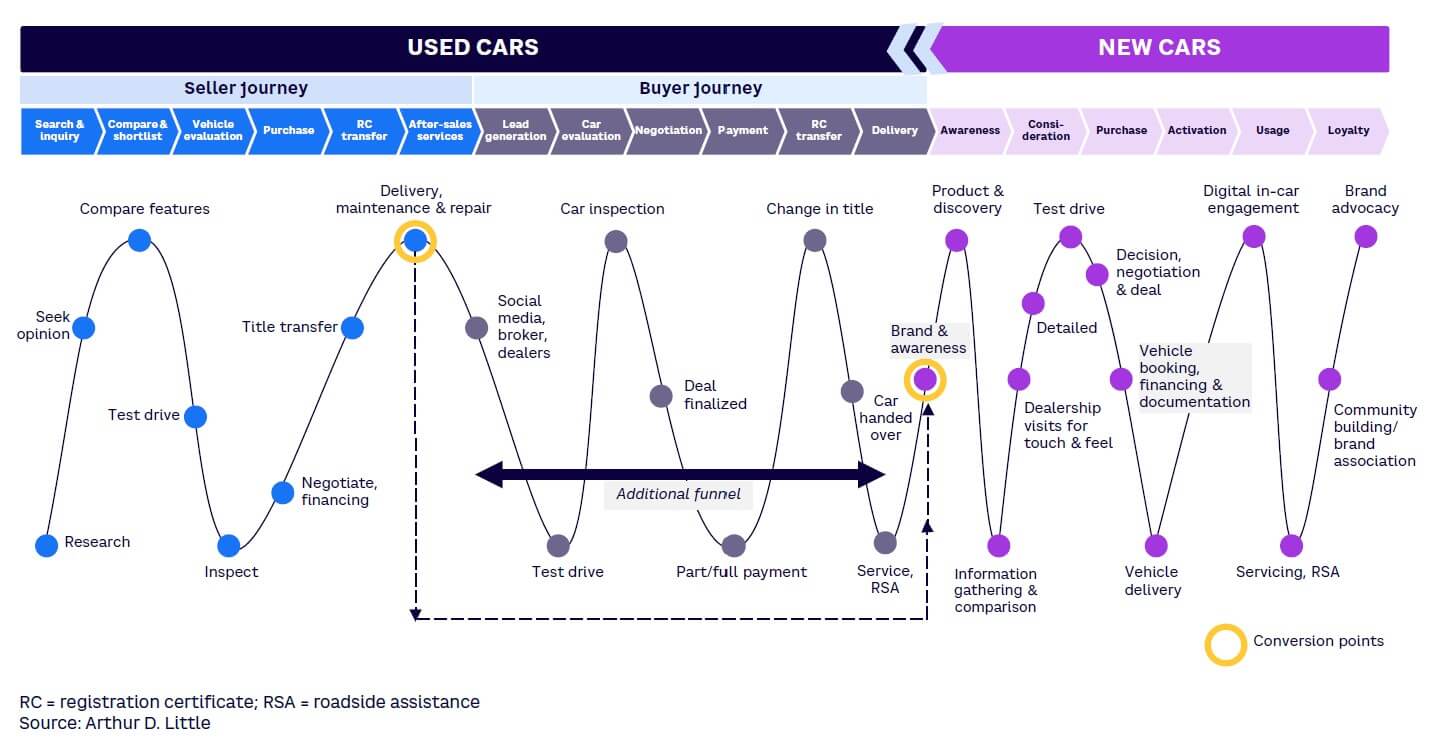

Expanded view of customer journey beyond new vehicle purchase. Another advantage that OEMs stand to gain from used car play is expanded visibility into the customer journey, especially for customers who are not yet “walking in” for new car purchases. Compared to new vehicles, the used car customer journey has two additional phases: the “seller” phase and the “buyer” phase, which contain multiple touchpoints (see Figure 5). An effectively integrated customer relationship management strategy between used cars and new cars will result in an organic customer base ripe for upselling and further monetization. For instance, OEMs could expand their lead funnels for new car sales and hook customers from their used car pool. OEMs can use customer data to build interventions that will generate long-term value for the firm and communicate to shareholders the impact of those investments on customer lifetime value and other long-term metrics. Parenting synergies can also drive business, with deeper penetration and imagining “art of the possible” use cases for other arms of the business, such as financing, insurance, and associated services.

-

Additional revenue streams with a profitable downstream proposition. Used car average selling prices have shot up (to more than INR 5 lakh today, expanding 1.3x within the last two years, according to IBB) and are expected to continue to grow, driven by two main factors. The first is the increasingly better quality (with high-end features) of young used cars available in the market. A second factor is the market’s indexation with new car prices, which have seen a 2x jump over the last five years, and which are in effect driving car owners (on the supply side) to derive a lucrative value from existing cars and urging them to evaluate replacement sooner than traditionally imagined. Increasingly, high-margin value-added services such as warranties are becoming market norms and are often included in sticker prices.

Another consideration is the rising operating costs for dealers (rentals, manpower, etc.) in metros/Tier 1 cities. Especially in a market that is likely to continue with a traditional retail format rather than agency models, dealer viability continues to be an important factor for OEMs. Rising costs prompt dealers to look toward other opportunities for incremental growth (e.g., satellite towns, Tier 2+ cities). The unique nature of the Indian used car market (where supply and demand pockets are fragmented) offers these opportunities to dealers while also driving better controls over trade-in inventories.

-

Hedging disruptions to new car business. With the increasingly attractive value pool due to factors we have discussed, the time is ripe for OEMs to reconsider the used car business as a “new horizon” opportunity. New horizon businesses can often hedge against disruptions to the core business (e.g., lost sales due to chip shortage or post-COVID demand shifts). Used car opportunities could also help take advantage of shifting business boundaries in new markets, such as market entry to Africa with used car exports or even experimenting with mobility models. At the same time, these changes will require OEMs to shift their mindsets and build a different set of capabilities beyond new car business. For instance, dealers will need to adapt to a portfolio approach to sales and focus on inventory turns. OEMs also will need to brand differently (even more so in the case of multi-brand retail) and start working with a different set of target customers.

-

Meaningfully closing the loop on sustainability. A play in used cars also allows OEMs to interface with the vehicle parc nearing the end of their lifecycle. Especially for the cars from their own stable, OEMs are positioned to provide best possible salvage values given awareness of the materials used, potential platform failures, and service records. Cross-linking this with trade-in-based replacements, pushing customers for more dealer services (driving salvage values), and so on, can be a closed-loop strategy to evaluate. While doing this, OEMs also show their commitment on sustainability and can position themselves on environmental, social, and governance criteria.

WHAT IS THE “RIGHT TO WIN” FOR OEMs?

While OEMs have long understood the links between new and used car markets, they have typically exercised only indirect control beyond first transactions. Moving forward, the key competitive weapon for OEMs remains on the supply side, with privileged access to a ready supply of high-quality, young, used vehicles through trade-ins and consistent coverage of touchpoints during the customer ownership journey. New-age retailers and independent dealers must rely heavily on the expensive “home inspections” or “auctions” routes (lower conversion rates), which typically entail higher refurbishment or documentation costs for retailers.

On demand, OEMs already have established scope through existing dealer channels. This is one of the key foundations for scaling up profitably given the multi-city volume aggregation required in used cars. This is where new-age players will continue to face challenges as they expand into the space. OEMs stand to gain an advantage with their large-scale distribution network.

There are OEMs in both the Indian and the global markets that have chosen already to capitalize on the trends and grow their used car businesses — either by building it under the parent umbrella brand (e.g., Audi Approved Plus and Maruti Suzuki True Value) or by carving out different multi-brand businesses (e.g., Aramis Group and Heycar). Global OEMs are further investing to build used car marketplaces (e.g., GM and Ford) and expand into new geographies (e.g., Stellantis with Auto24).

Conclusion

WHAT’S NEXT? REVISIT YOUR PLAYFIELD IN USED CAR BUSINESS

The accelerated formalization in the used car business provides OEMs with opportunities to strategize ways to take advantage of this business. Given the unique starting points of different OEMs, the following strategic questions need to be answered:

-

OEMs already participating in the used car business. Is there a need for imagining a used car strategy given the upcoming wave of growth? What other strategic levers can be unlocked from a used car play, especially core business?

-

OEMs outside used car play or entering/revisiting the Indian market. Are competitive disadvantages likely to emerge by not participating in the used car business? Which value blocks will render the maximum impact? What is the optimal entry mode to this market — fully owned versus partnership?

-

OEMs pushing strategy toward new energy vehicles. Can participation enable an increased value pool for new energy vehicles? Could used car play provide OEMs with a strategic advantage with battery electric vehicles and software-defined vehicles in the future for their new car play?