32 min read • Energy, Utilities & Resources

Powering India’s energy vision 2030

An integrated transformation blueprint for energy independence

FOREWORD

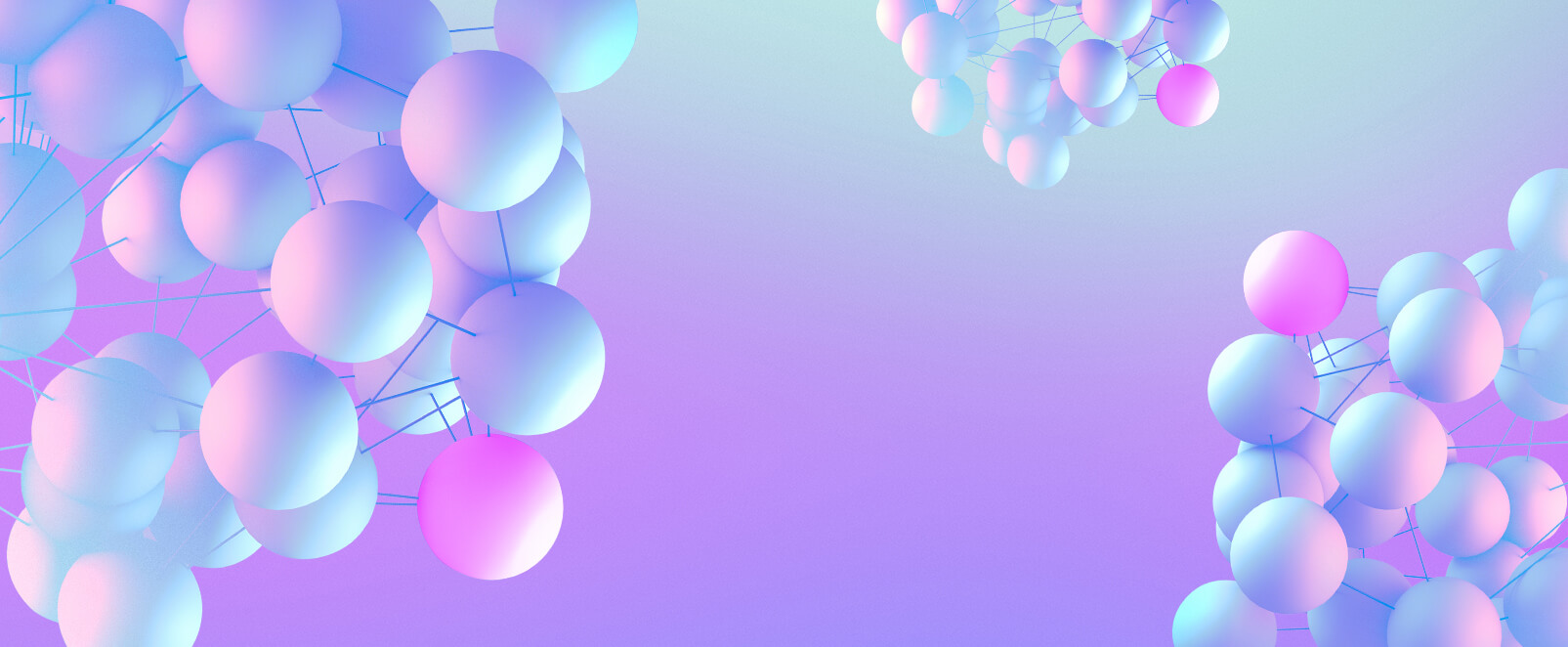

India aspires to be energy independent by 2047, as announced by Prime Minister Narendra Modi in August 2021. Changing dynamics in the industry, including the drastic increase in the cost of power generation due to skyrocketing coal prices, underperformance of state electricity boards, a shift toward renewable energy, the necessity to abide by environmental sustainability measures, the need for digitization to leverage the power of data, and reforms in buying/selling arrangements with the advent of power exchange markets all herald the need for transformation within the sector.

Overall, this Report envisions the future of India’s power sector to take a giant step forward in improving efficiency, reliability, digitalization, and sustainability. India is on the cusp of attaining self-sufficiency in energy, and for such a culturally and politically diverse nation, this is a remarkable achievement.

In fact, India is positioned to be a major player in green energy generation and aspires not only to attain energy security but also to begin supplying renewable power to neighboring nations. As the big conglomerates foray into green hydrogen and other renewable energy generation, associated industries such as energy transmission and distribution also need significant transformation. The Report presents an integrated blueprint for India to achieve its true potential in the power sector.

- Barnik Chitran Maitra, Managing Partner, ADL India & South Asia

- Michael Kruse, Managing Partner & Global Lead, Energy & Utilities

EXECUTIVE SUMMARY

Nations worldwide have undertaken the path toward energy independence to eliminate reliance on imports, enhance savings, create employment opportunities, and lay the roots for a clean energy ecosystem. To be truly energy independent, India needs to produce excess energy and generate it through sustainable methods as well as minimize losses during transmission, distribution, and consumption.

PROPELLING SELF-SUSTENANCE IN POWER GENERATION

After examining India’s power sector at a glance and reviewing some government initiatives, the Report moves on to an initial set of 10 key imperatives that will guide India in achieving its energy vision. First up is a look at the power generation sector and how it has its own set of challenges that must be prioritized for India to attain self-reliance. For example, it is increasingly difficult to meet rapidly growing energy demand with insufficient and perishable power resources, and the scarce availability of coal has pushed up the price to produce power. At the same time, carbon emissions from power generation must be mitigated to achieve the dream of net zero. To overcome these setbacks, highlighted in Chapter 3, the sector must consider the following three key imperatives:

-

Scaling up green energy’s contribution for an affordable and cleaner energy mix — by introducing reforms to improve investors’ confidence, removing entry barriers such as difficulty in land acquisition, boosting domestic manufacturing of photovoltaic (PV) cells and wind equipment, and incentivizing adoption of rooftop solar. The industry should emphasize baseload technologies like offshore wind and nuclear generation, increasing nuclear energy production by establishing scalable small modular reactors (SMRs), utilizing locally available thorium, and building a regulatory environment conducive to these alternatives.

-

Promoting green hydrogen as a carbon-neutral energy storage solution — by increasing the use of green hydrogen as a carbon-neutral energy storage solution through financial incentives for stakeholders and by ensuring self-sufficiency in electrolyzer production. Readily available biomass can generate green hydrogen as long as robust logistics are in place to support it.

-

Accelerating carbon capture, utilization, and storage (CCUS) adoption for decarbonization — by accelerating adoption of CCUS for decarbonization via introducing financing channels for CCUS implementers, investing in R&D to identify cost-effective mechanisms, establishing a start-to-end governance framework for CCUS management, and participating in global forums to leverage recent developments.

MAKING NATIONAL POWER TRANSMISSION FUTURE READY

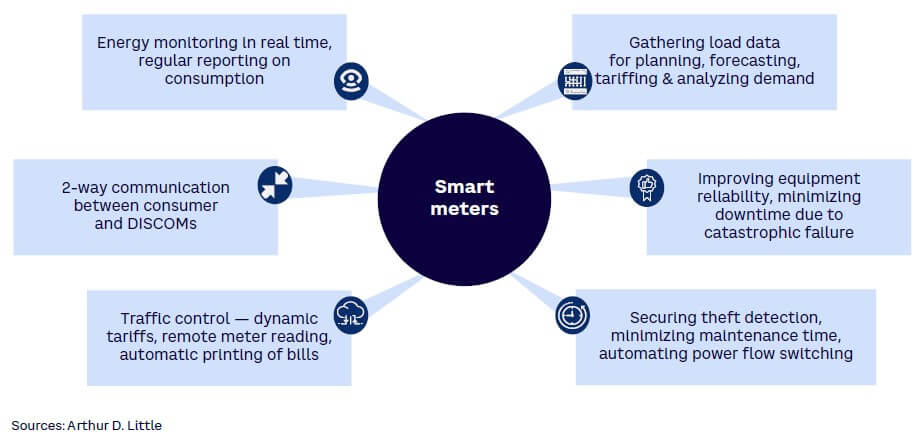

As we explore in Chapter 4, the transmission sector in the value chain needs to be future ready to accommodate changing dynamics within the industry. Transmission in India bears a technical loss of 3.6%,[1] which is high compared to other nations. The digitalization of distribution companies (DISCOMs) using smart meters provides the opportunity to digitalize the main grid. The following four key imperatives are necessary to mitigate these technical issues:

-

Enhancing infrastructure development and capacity augmentation — by improving infrastructure through deployment of anti-theft and anti-oxidation cables to reduce theft and technical losses, shifting toward high-voltage direct current (HVDC) lines for long-distance transmission, imposing stricter penalties for transmission network developers upon default, and expediting development of interstate transmission lines.

-

Securing future of national smart grid — by designing and implementing a strategy for a smart grid that emphasizes efficient data collection by installing smart meters at nodal points, securing data communications by using narrow broadband technologies such as RF-2.4 GHz, building data concentrator units, and piloting dedicated systems like smart grid control centers (SGCCs) and outage management systems (OMSs).

-

Creating opportune deployment of microgrids — by deploying microgrids in coordination with local operators while retaining the possibility of complete integration into the national grid in the future.

-

Establishing world-class grid congestion management — by acknowledging that more efficient use of available network capacity will become a necessity with an increasing share of renewable energy. Unnecessary grid investments and ineffective grid operations must be avoided through the deployment of direct control methods (e.g., peak shaving), market-based methods, or a combination of both.

DRIVING DISCOMS’ PROFITABILITY

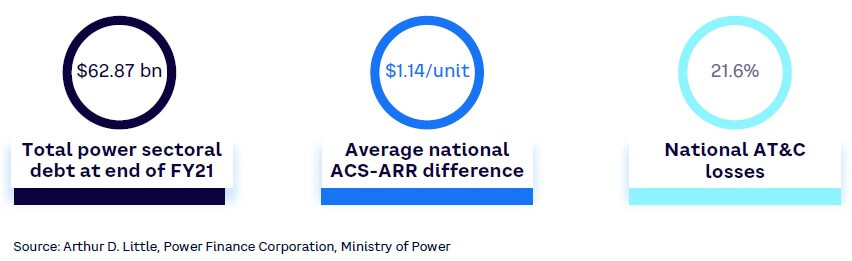

As we highlight in Chapter 5, the distribution of power is the most troubled sector across the value chain. Of late, the state DISCOMs have been characterized by negative net worth (US -$4.49 billion) and high debt (US $62.87 billion),[2] along with operational inefficiencies (aggregate technical and commercial [AT&C] losses of 21.6%).[3] There is an urgent need for transformation within the distribution sector, and India should leverage the following three key imperatives:

-

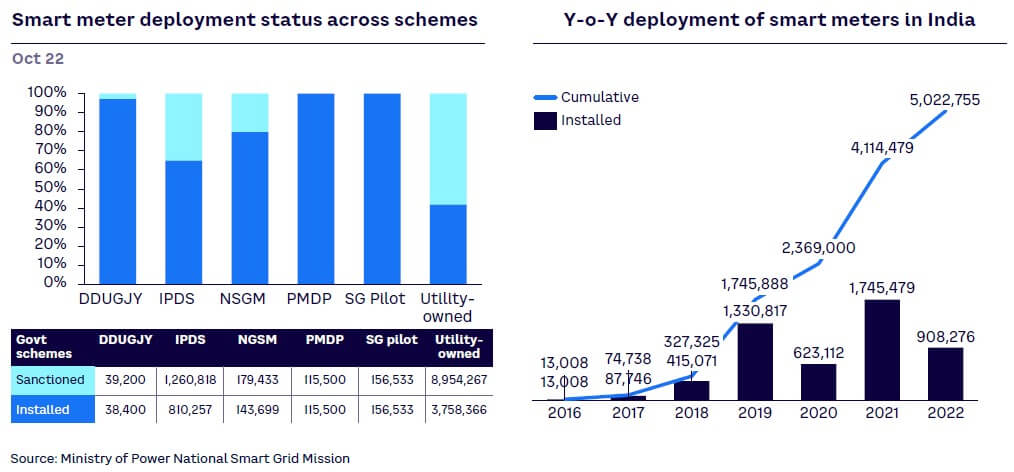

Harnessing digital transition of power distribution through smart meters — by developing digital infrastructure like smart meters to transform energy distribution via designing consumer-centric engagement strategies, phasing in nationwide deployment with constant feedback collection, and investing in a multilevel data security system using concepts like root of trust (RoT) and public key infrastructure (PKI).

-

Pushing for increased private player participation to improve efficacy — by increasing private player participation with the help of supporting regulatory frameworks as well as financial support in terms of subsidies and rebates for private entities.

-

Scaling up adoption of power exchanges — by enhancing power exchange markets via introducing a market-coupling operator to discover a common market clearing price (MCP) across exchanges, initiating energy derivative markets with regulatory frameworks that support fair price determination and shorter credit lines, and considering a market-based economic dispatch model to prevent complete replacement of power purchase agreements (PPAs).

Energy independence is of growing importance to leading nations. India could fast-track its self-reliance goals by leveraging these 10 key imperatives toward strategy-driven reform. With some directed momentum, India can achieve its aspiration of becoming an energy-independent nation.

1

INDIA’S POWER SECTOR AT A GLANCE

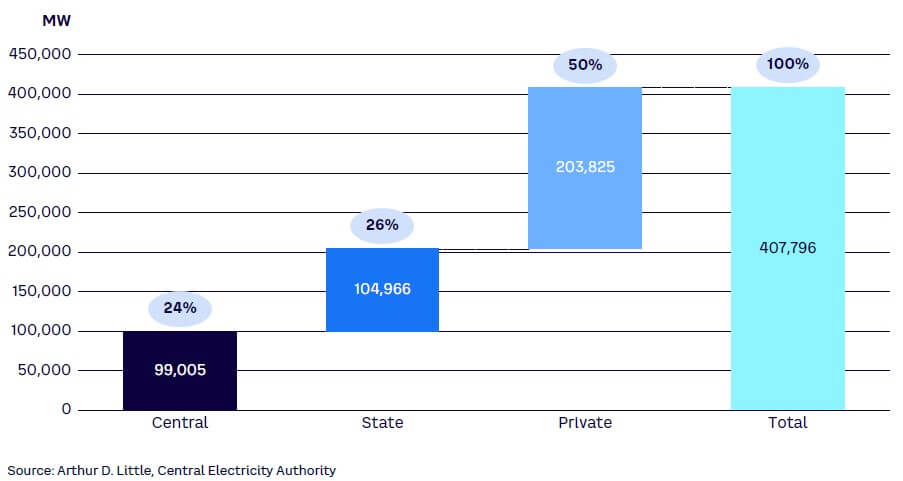

With about 405 GW (gigawatts) installed power capacity, India is the third-largest producer and the second-largest consumer of electricity in the world and has reliable energy-generation processes, according to the Central Electricity Authority of India (CEA), with power generated by conventional and nonconventional resources. India is the fourth-largest producer of wind power and the fifth-largest in solar power.

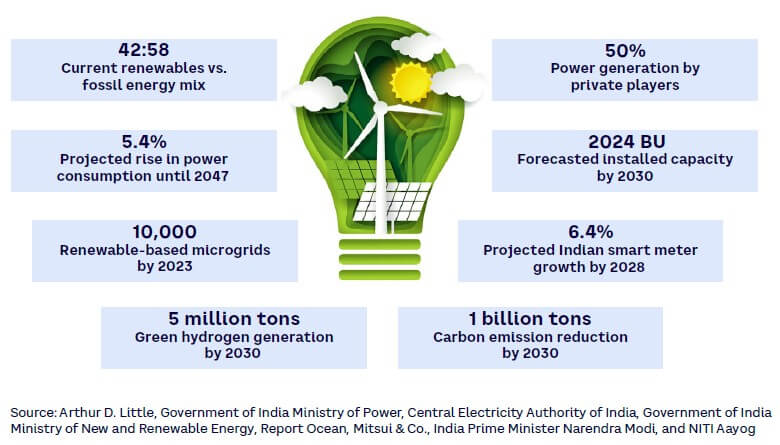

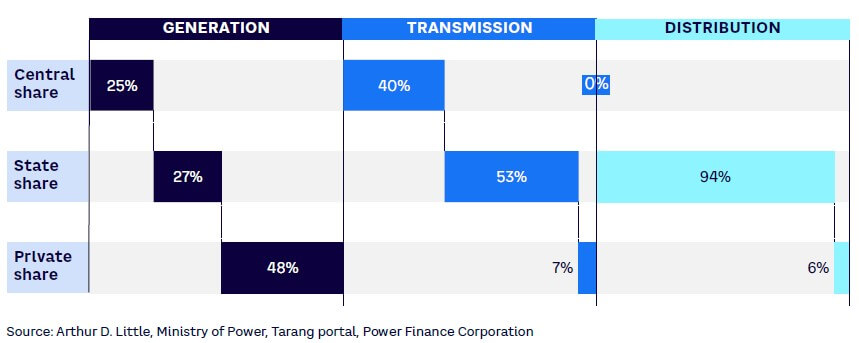

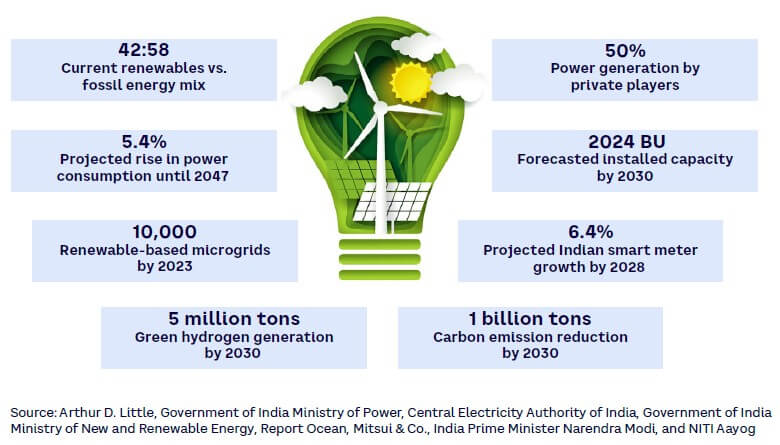

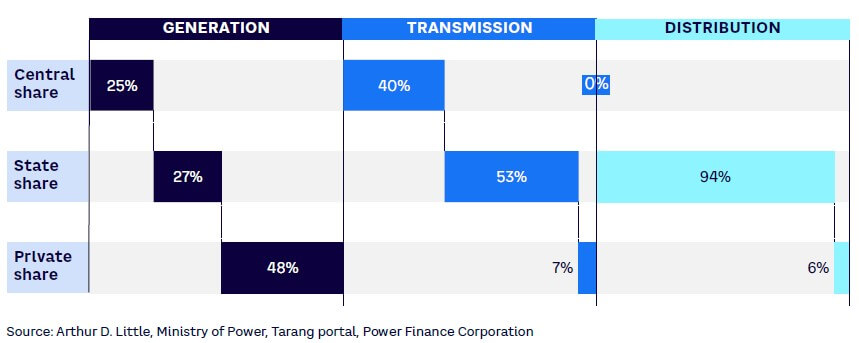

Over the last few decades, the demand for electricity has increased exponentially, driven by industrialization, digitization, and technological advancements. The increased share of renewable power generation has helped bridge the demand-supply gap. India’s Electricity (Supply) Act, 1948, was amended to encourage private player participation in power generation; half the power consumed in the nation today is generated by private players (see Figure 1).

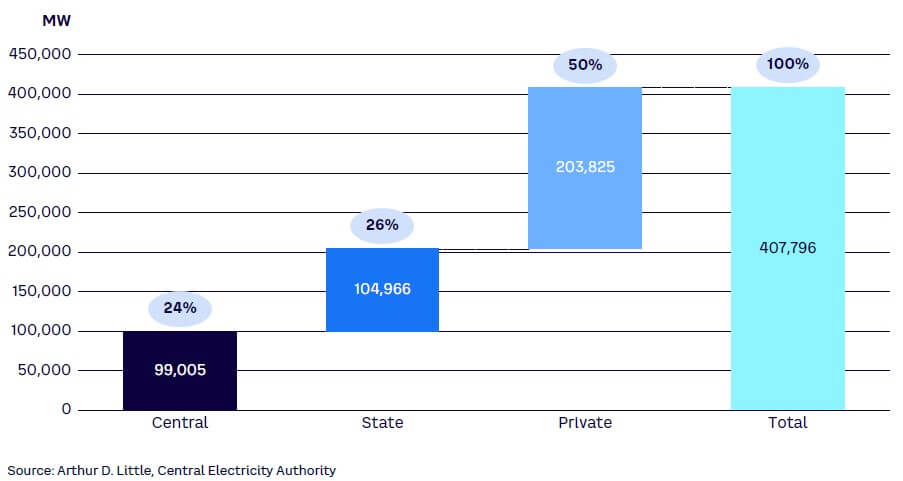

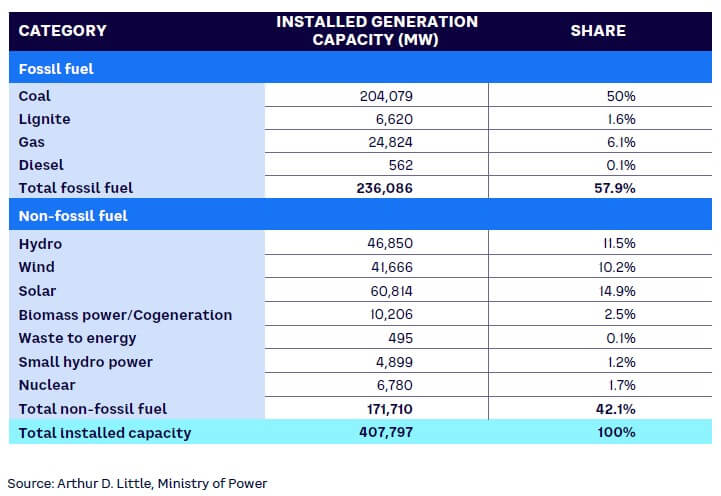

From 2010 to 2022, India’s generation capacity, including renewables, has grown by 85%. Table 1 illustrates the share of generation capacity estimated by India’s Ministry of Power (MoP), according to fuel type as of late September 2022. The share of power generated from non-fossil fuels has doubled to 42% in 2022, from 21% in 2021.

Conducive policy frameworks through subsidies and tax rebates have improved the attractiveness for investments to achieve a balanced energy mix.

The transmission infrastructure in India is robust, spanning around 450,000 circuit kilometers (ckm), according to MoP. Power Grid Corporation of India (POWERGRID) continues to convey 50% of the total energy generated in the country through its efficient transmission network.

The distribution sector has 7% participation from private players, while the remaining 93% is under state and central government utilities. However, the presence of large private players like Adani Power, Tata Power, JSW Energy, Torrent Power, and Reliance Power has increased significantly over the last few years and is expected to expand.

2

GOVERNMENT INITIATIVES

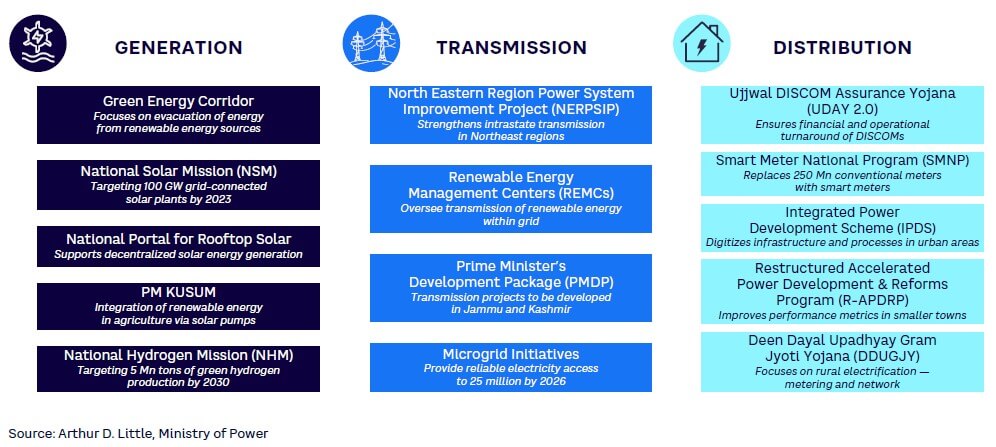

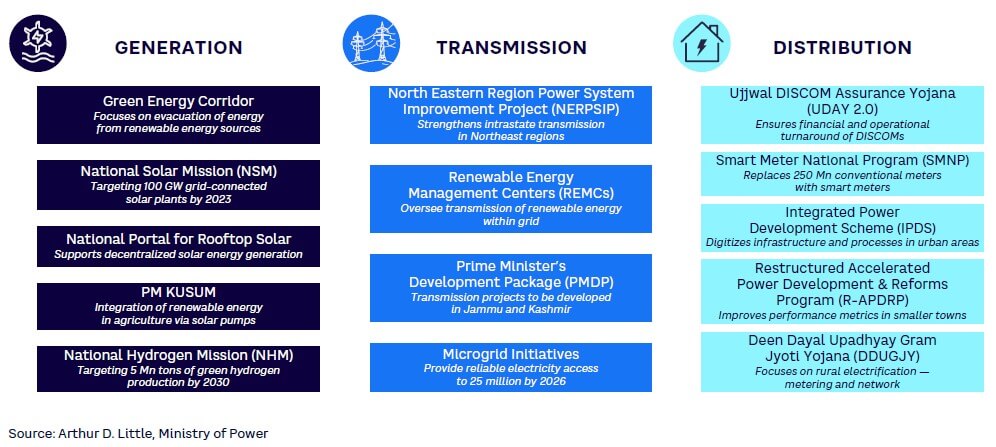

India has formulated many policy schemes to reinforce its goal of energy independence by supporting various reforms across the value chain (see Figure 2).

Recently, Prime Minister Modi outlined a five-point plan for India (“panchamrit”) during the 2021 United Nations (UN) Climate Change Conference (COP26), with the following goals for the country:

-

Expand non-fossil fuel–based energy capacity to 500 GW by 2030.

-

Provide 50% of India’s energy needs using renewable energy sources by 2030.

-

Reduce carbon emissions by 1 billion tons by 2030.

-

Cut the economy’s carbon intensity by less than 45% by 2030.

-

Achieve net zero emissions by 2070.

To achieve these ambitious goals, India needs to accelerate its transformation across the value chain. To do so, the country must drastically reduce its dependence on fossil fuels for power generation.

India should also adopt the latest technologies, including CCUS and green hydrogen, to decarbonize thermal power generation. In addition, the high AT&C losses (21.6%) that currently exist should be minimized with digital interventions in billing and metering.

TRANSFORMATION BLUEPRINT FOR ENERGY INDEPENDENCE

Globally, nations like the US, China, and Russia have embarked on journeys of energy self-reliance. Following in their footsteps, Prime Minister Modi has pledged that India will become energy independent by 2047. Currently, India spends US $160 billion on energy imports; hence, it is far from self-sufficient. Therefore, it is crucial for India to engage in a dramatic transformation across its entire energy value chain for the nation to realize its dream of energy independence. The remainder of this Report proposes an integrated transformation blueprint to accelerate India’s journey toward energy independence.

3

PROPELLING SELF-SUSTENANCE IN POWER GENERATION

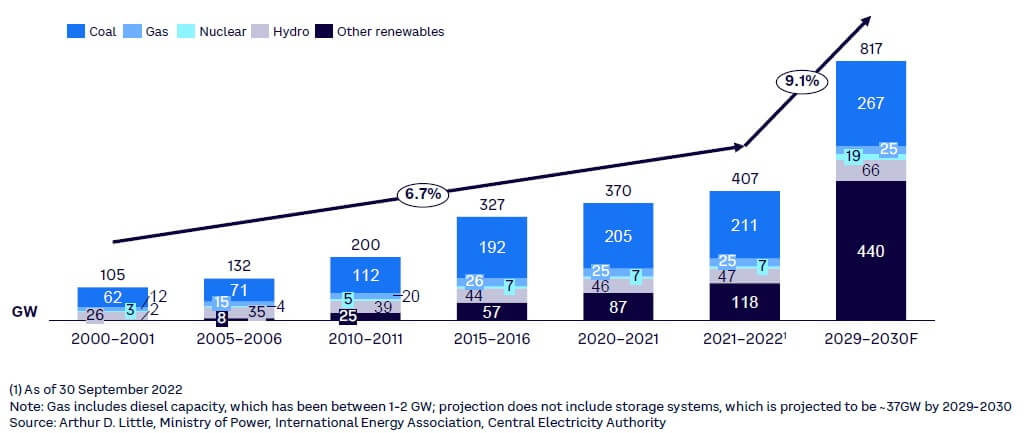

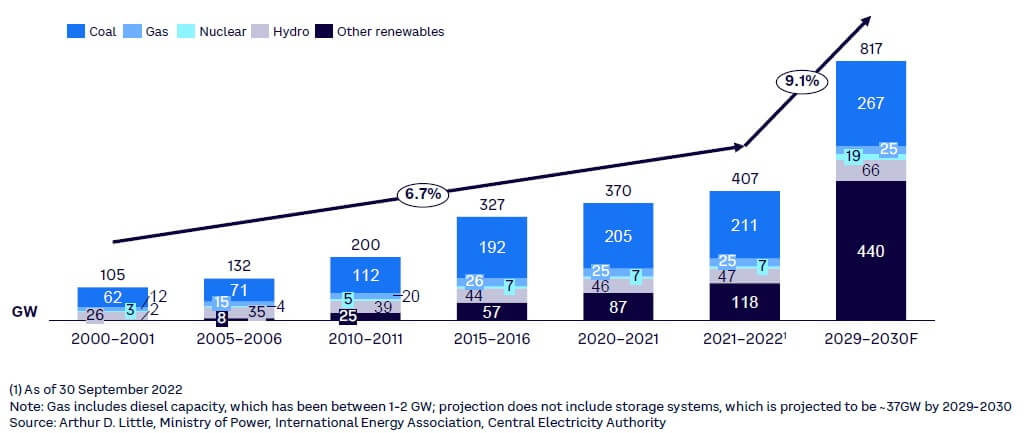

India’s electricity consumption is expected to grow at a rate of 5.4% by 2047,[4] creating the need for India to double its generating capacity in the next decade. Furthermore, the power generation capacity is forecasted to increase by 9.1% by 2030, as indicated in Figure 3.

Currently, Coal India meets only 65% of coal demand,[5] forcing India to rely on imports from other countries. Moreover, the coal crisis in India has meant drastic increases in the cost of power production. In fact, the price of electricity in exchange markets surged in March 2022 to an average of US $.10/kWh from its previous rate of US $.04/kWh — an 85% increase.[6] Along with these economic challenges, the emissions released are detrimental to India’s environment. India produces around 2.5 billion tons of carbon dioxide (CO2) each year (growing at an annual rate of 6%), of which 52% is contributed by the power sector itself.[7]

In this chapter, we highlight three key imperatives to tackle these challenges: (1) scaling up green energy’s contribution for an affordable and cleaner energy mix; (2) promoting green hydrogen as a carbon-neutral energy storage solution; and (3) accelerating CCUS adoption for decarbonization.

SCALING UP GREEN ENERGY CONTRIBUTION

India has the potential to generate a combined total of 1,700 GW of energy using renewable sources.[8] Tapping into this opportunity would not only eliminate India’s dependence on energy imports but would also establish it as a global leader in energy exports. The green nature of these sources helps India move closer to achieving its ambitious COP26 targets.

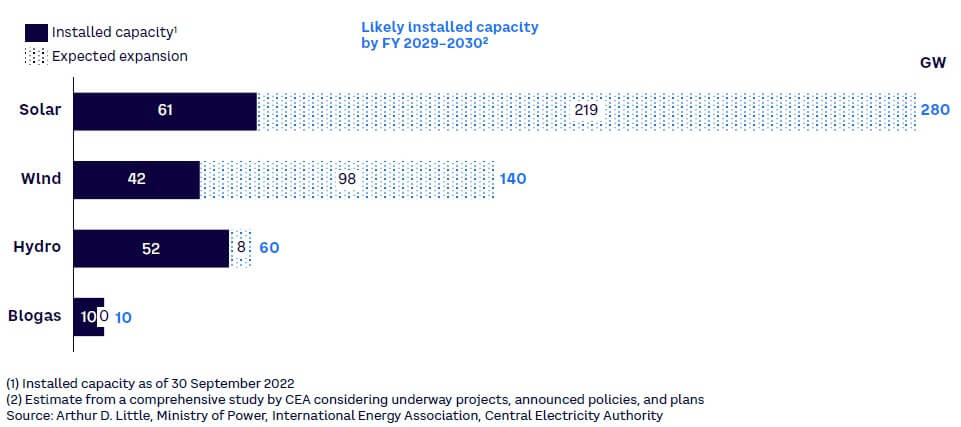

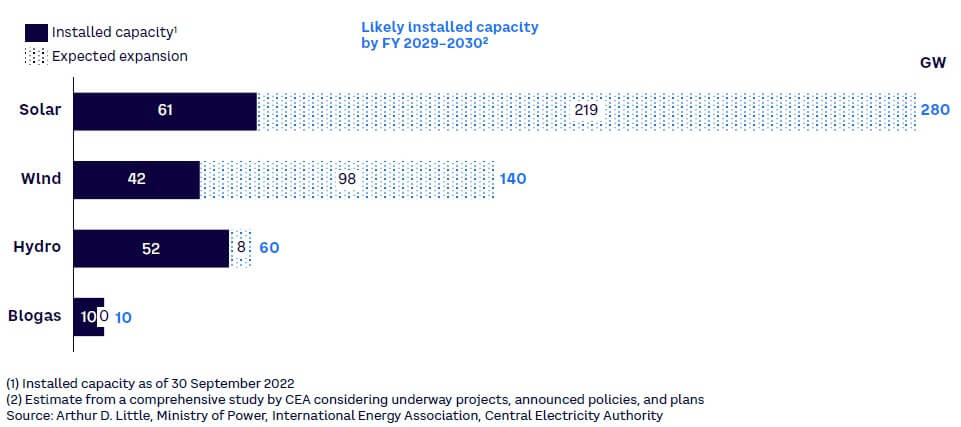

India is on the right trajectory to meet a nationally determined contribution (NDC) target of clean energy capacity of 500 GW by 2030, with 165 GW generation capacity already in place (see Figure 4). For a country like India where about 50% of power is generated through coal, it is not possible to reach net zero based only on onshore wind and solar. Instead, the country must rely on heavy investments into baseload technologies like nuclear power generation and offshore wind generation. Currently, according to MoP, just 1.7% of India’s power generation is contributed by nuclear sources. This is almost negligible compared to that of other nations.

To further accelerate adoption, we recommend that India focus on developing green energy generation capacities by focusing on:

-

Improving investor confidence. The government must introduce policy reforms to facilitate a smoother and faster transition to a market-based model from the existing PPA model for buying electricity. It should also initiate stricter policies to define and improve contractual structures as well as policies on curtailment of risk and compensation. And it should deploy a robust regulatory framework to compensate renewable energy generators in the event of payment defaults by DISCOMs.

-

Removing barriers to entry of greenfield projects. India should facilitate an easier land acquisition process by developing a one-stop solution for developers to apply for necessary permissions from the local, state, and central entities after land allocation. The country can also implement judicial reforms targeting expedited conflict resolution processes regarding land ownership and possession.

-

Increasing domestic equipment production. The manufacturing sector should focus on the entire value chain of solar PV cells and modules manufacturing by leveraging association with organizations such as the International Solar Alliance (ISA) to garner support and establish capabilities. The government should introduce policy reforms focused on accelerating mineral imports and developing a conducive manufacturing environment to attract investors riding on China +1 developments. Long-term trade negotiations with other countries can also ensure a stable supply of the supporting minerals required for solar and wind equipment manufacturing. Finally, India should invest in R&D to identify the manufacturing technologies suited for India based on mineral resources availability.

-

Scaling up deployment of rooftop solar and wind projects. Improving visibility and accessibility of rooftop solar via state and DISCOM regulations is critical and is possible with the appointment of a publicly available, distributed solar registry platform for DISCOMs. India could also update net metering laws or regulatory policies to incentivize prosumers of solar panels based on their contribution in reducing peak electricity demand. Separately, the government could create a composite of land-based and offshore wind capacity to attain a better capacity utilization factor. Offshore wind has great potential along coastal regions, and HVDC lines could be utilized to transmit this energy inland.

-

Increasing nuclear energy generation. India should support establishing SMRs in a standard manner and scaling them according to demand. The country is one of just a few (similar to China or the US) that has the size to localize SMR design and build economies with scale. This can be done by attracting investments and facilitating international partnerships with UK, US, or even Russian SMRs. Since India already has a nuclear infrastructure, the incremental cost is estimated to be low. The high cost of importing uranium can be brought down by instead using thorium, a largely underutilized resource for nuclear power generation. To tackle risks associated with nuclear generation, the government must provide guarantees of security and returns, which might also attract private investments. Creating robust policy debates will benefit India’s energy development as a whole by pushing local industries to start participating in India’s nuclear expansion.

PROMOTING GREEN HYDROGEN

Leveraging renewable energy sources to meet total electricity demand is not possible without developing additional storage solutions. Green hydrogen is emerging as the go-to option in areas that require high power density storage and have space/weight constraints.

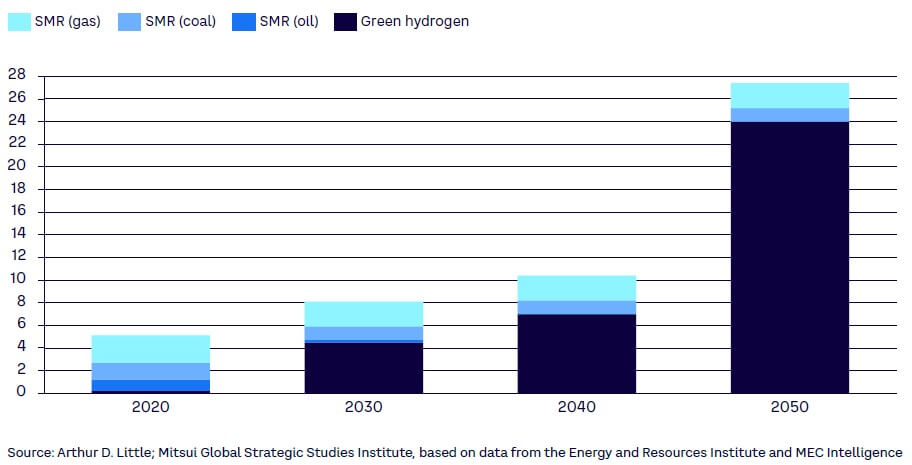

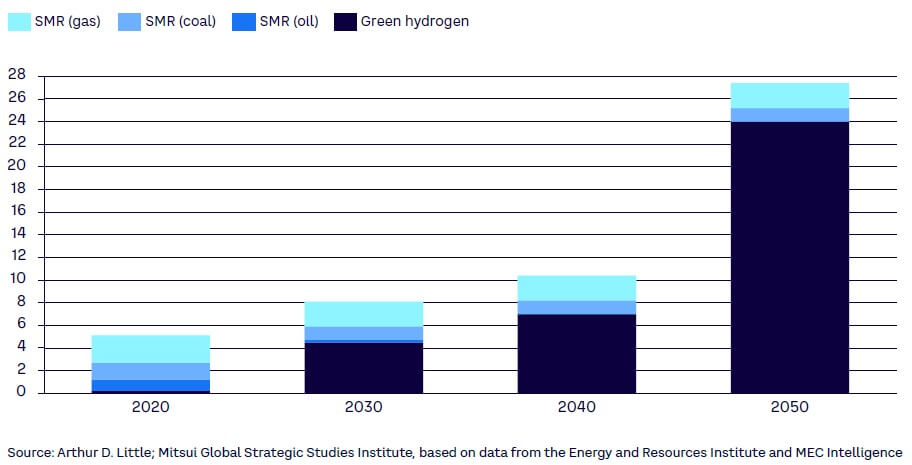

It is expected that India will produce 5 million tons of green hydrogen by 2030 and nearly 25 million tons by 2050 using surplus renewable capacity (see Figure 5). The storage reserve can be converted into energy with almost 100% efficiency using fuel cells. To optimally leverage this technology, it is important that India focus on reforming the following:

-

Utilizing biomass for green hydrogen generation. Generating green hydrogen using biomass can augment the electrolysis process and helps in recycling carbon waste. Industry players should push for efficient logistics mechanisms to collect the existing waste and convert it into green hydrogen.

-

Incentivizing stakeholders. The government should provide financial subsidies and monetary benefits to incentivize renewable energy generators with significant surplus peak capacity to set up green hydrogen systems, helping to catalyze capacity creation.

-

Promoting self-sufficient production. India can introduce policies promoting research collaborations and knowledge sharing with foreign companies to promote self-production of electrolyzers and fuel cells with better efficiencies in line with the aim of Prime Minister Modi’s “Atmanirbhar Bharat” (or “self-reliant India”).

ACCELERATING CCUS ADOPTION

To meet the net-zero emission target, India should also look at CCUS technology. This technology for carbon removal can complement and supplement nature-based solutions, such as afforestation and reforestation. The cost of carbon capture can be partially offset by carbon utilization efforts. CO2 is used to produce fertilizers, assist in enhanced oil recovery, as well as for food and beverage production, cooling, and water treatment.

India currently has four CCUS facilities with a negligible capacity of 0.003 million tons of CO2 per year. India’s carbon storage potential varies from 5 to 400 billion tons of CO2, located mainly in geological formations such as coal fields, oil and gas fields, sedimentary basins, and saline aquifers. To achieve its ambitious net zero goals by 2070, CCUS technology will play a critical role for India and support the following functions:

-

Introducing financing channels. India can introduce various financing mechanisms that make for a stronger economic case using CCUS technology in emission-intensive industries. These mechanisms include tax credits, enforcement of stringent carbon pricing protocols, incentives for early adoption, funding support for pilot programs, and other market-based financing models.

-

Focusing on CCUS-related R&D. The government can create an ecosystem that enables more research and innovation on CCUS and other carbon-mitigation technologies that can help in reducing costs, overcoming technical and logistics issues in the deployment of CCUS, and facilitating feasibility studies and pilot programs.

-

Developing policy, regulation, and governance systems. India can start developing various policy frameworks and regulations around the use and potential of CCUS, its risk management, and governance.

-

Participating in global forums. Government and private sector representatives can participate in global discussions around CCUS technology and its applications across industries, collaborate with global players and other nations, and strive to be a part of industrial hubs and other shared CCUS infrastructure.

4

MAKING NATIONAL POWER TRANSMISSION FUTURE READY

In 2018, India achieved the milestone of complete rural electrification. To support these lines, substations with a capacity of 119,256 megavolt-amperes (MVA) already exist across the country and another 321,433 MVA substations are under construction. India still faces a plethora of issues in transmission. As reported by Grid Controller of India, the transmission of technical losses average out to about 3.6% in 2022. Additionally, as distances over which power is transferred increase, wheeling charges have grown. Furthermore, many interstate and interregional connections are inadequate due to neglected grid monitoring and maintenance in a transmission infrastructure that is 30 to 40 years old.

Moreover, the new renewable power generation facilities face the problem of insufficient grid availability for power injection at plant locations. With the increasing pace of energy transition, transmission system operators are likely to face capacity bottlenecks.

Traditionally, the grid traffic was managed by reinforcing the physical grid, which required huge financial investments. Such methods are proving to be ineffective in current dynamics given the intermittent nature of renewables.

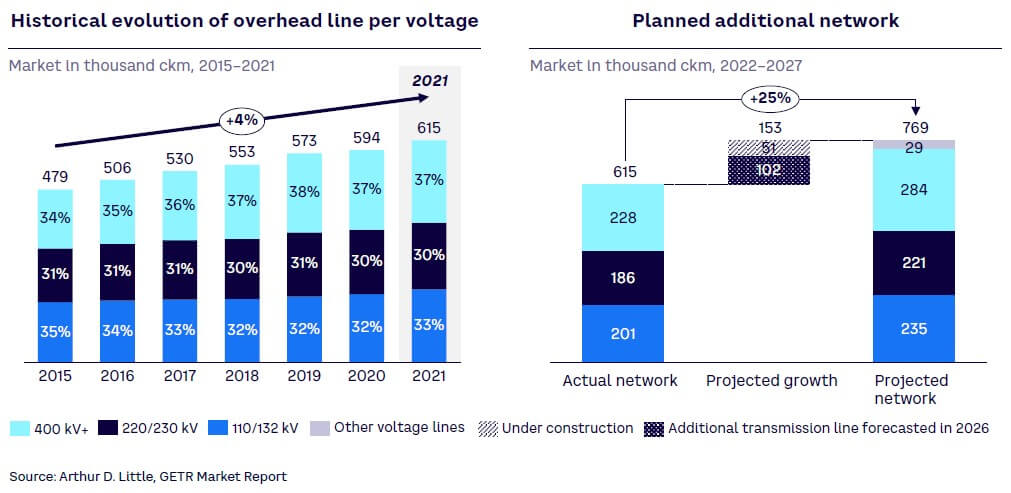

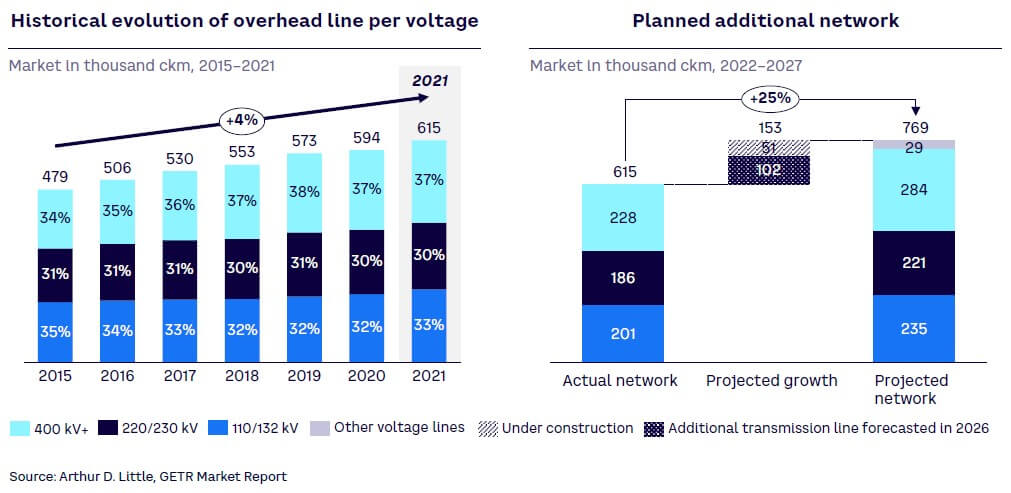

There has been tremendous growth in the transmission network (see Figure 6), but there is still a need for improving the interstate and interregional transmission infrastructure. As per data published on MoP’s Tarang portal, in 2022, only about 115 ckm of interstate lines were laid. This is extremely low when compared to the new intrastate transmission connections of 1,426 ckm. According to MoP, construction of 19,869 ckm of interstate transmission system is underway, with 16% close to or already completed.

CHANGING DYNAMICS DEMANDS ADAPTING TRANSMISSION NETWORK

With both technology and consumption patterns evolving at such a fast pace, it is important that the grid is future proof. While there are a host of reasons to ensure the grid is up to the task, some demands in particular should be the focus areas:

-

Geographical nonuniformity in renewable energy generation. Due to high dependence on natural resources, the availability of power is not uniform across the nation. Thus, the idea of open access becomes extremely relevant, as it allows an easy system for both the producers and consumers of power to reach one another.

-

Intermittent nature of renewable energy. Due to the intermittent nature of renewable energy generation, it is not possible to match generation pattern directly to consumption pattern. The existence of a robust grid that can handle these variations in power generation on a large scale is essential.

-

Support for electric vehicle (EV) infrastructure. As EV adoption in India rises, the supporting infrastructure of charging stations must grow as well. These stations are high-load entities that have the capacity to alter the energy consumption pattern drastically. The transmission system must be ready to support the desired growth in the EV space.

All these challenges require dramatic corrections in the current growth trajectory and can be assisted through the following four key imperatives: (1) enhancing infrastructure development and capacity augmentation, (2) securing future of national smart grid; (3) creating opportune deployment of microgrids; and (4) establishing world-class grid congestion management.

INFRASTRUCTURE DEVELOPMENT & CAPACITY AUGMENTATION

Having a well-maintained and robust grid that spans the nation and is future ready can create a healthy power sector, with the following kept top of mind:

-

Shifting to state-of-the-art technology for old and new infrastructure. The government should prioritize replacing old, decayed cables with anti-theft and anti-oxidation cables by providing financial stimulus to manufacturers. Using HVDC lines for long-distance transmission is key to minimizing loss. As an additional impetus, there could be stricter penalties for developers that fail to build the allocated transmission network in due time.

-

Increasing interstate and interregional transmission lines. This should happen by starting with connecting regions that have low in-house production to nearby regions with surplus renewable capacity via green corridors. To accelerate the process, policy reforms should target increased coordination between various state and central transmission utilities.

FUTURE NATIONAL SMART GRID

With technological advances in system management and data handling, a new concept of smart grid has emerged. Using enhanced data acquisition and mining techniques, a smart grid can handle more complex demand-supply patterns and grid fluctuations. In addition, a smart grid can handle demand fulfillment automatically by forecasting production and demand of power at various locations across the grid.

Smart grid solutions can increase grid reliability, reduce transmission and distribution losses, optimize demand-side management, support renewable integration, improve self-healing capacity, and ensure optimal grid usage through the following actions:

-

Ensuring efficient data collection. The first step in setting up a smart grid is to have data collection equipment at all nodal locations. This includes metering at injection and drawing points, substations, transformers, and point of use.

-

Securing data transmission and communication. Once data has been generated, it needs to be transferred for storage and analysis. Here, the technology developers can implement the right technologies — like narrow band and broadband power line communication (PLC,) RF-2.4 GHz, RF-865 MHz, or GPRS.

-

Enabling real-time data storage and insight generation. Next, data operators must set up data management centers and data concentrator units to store the data generated and provide advanced real-time analytics services.

-

Piloting grid management and insight implementation. Finally, once real-time insights are possible, utilizing them for efficient management of the power network will require dedicated systems, such as SGCCs, OMSs, fault passage indicators, and so on.

OPPORTUNE DEPLOYMENT OF MICROGRIDS

A microgrid is a localized electricity generation and consumption ecosystem that might or might not be connected to the national grid. To promote microgrids in India, the government has proposed policies to set up at least 10,000 renewable energy–based mini- and microgrids. In a nation as vast as India, where stable electrification across the country has been a challenge, microgrids present the following opportunities:

-

Renewables adoption. With new projects based on renewable-based energy, India can move a step closer to COP26 targets by leveraging the abundant green energy potential.

-

Rural electrification. A substantial number of villages in India only have bare-minimum electricity coverage. With irregular load shedding adding to their woes, these areas can really benefit from a local microgrid.

-

Energy security. Eradicating the constant fear of blackouts due to grid instability, these microgrid regions can be self-reliant by having a local generation house and storage capabilities.

-

Grid stability. Multiple pockets of microgrids will reduce peak load on the grid. A microgrid connected to the national grid also enables injection of surplus energy into the larger grid.

-

Technology integration. Since most microgrids will be newly set up and based on renewable energy, there is a good opportunity to incorporate smart meters and implement time of use (ToU) tariffs. This will reduce dependency on storage solutions and other sources of energy.

Some actions required in this regard are:

-

Involving local operators. Government should include local operators in grid operations, as their market understanding would make the bill collection and maintenance process faster and more efficient.

-

Promoting a hybrid model. The microgrid should be connected to the national grid to deal with any supply shortages and ensure round-the-clock supply. There should be dedicated reforms to define accountability of stakeholders responsible for this connectivity.

-

Scaling up capacity augmentation and national integration. Due to ever-growing electricity consumption, standalone microgrids will not be able to sustain the load in the long term. Thus, the government must phase out standalone microgrid deployment and drive complete integration into the national grid.

WORLD-CLASS GRID CONGESTION MANAGEMENT

Energy supply is becoming more irregular, unpredictable, and decentralized, increasing the need for congestion control. Congestion control can take the form of direct control, like cutting off excess renewable energy, or it can take the shape of a market-based method, such as using price signals to encourage grid parties to change supply or demand. Rather than conventional management techniques like first-come/first-served methods, market splitting, and load curtailment methods, a couple newer techniques that have been proven to improve quality of service include:

-

Demand-side management by peak shaving. Peak shaving is the proactive management of overall demand to remove temporary demand spikes that raise the peak. These peaks are leveled out by commercial and industrial consumers by either temporarily reducing production, turning on an on-site power generation system, or using a battery. Peak loads are lowered and smoothed out as a result of this process, which lowers the total cost of demand charges.

-

Supply-side management by generator rescheduling. One way to ease congestion is to reschedule the generator outputs when the network reaches its threshold. Due to variations in market settlements, the generation must be rescheduled due to congestion in the pool market. It is estimated that generation rescheduling increases the system’s running costs, since out-of-merit generators are more involved than scheduled generators. The generators should be rescheduled in such a way that they minimize any departure from the pool market’s financial arrangements. These techniques can be used in combination by the transmission company for better results.

5

DRIVING DISCOMS’ PROFITABILITY

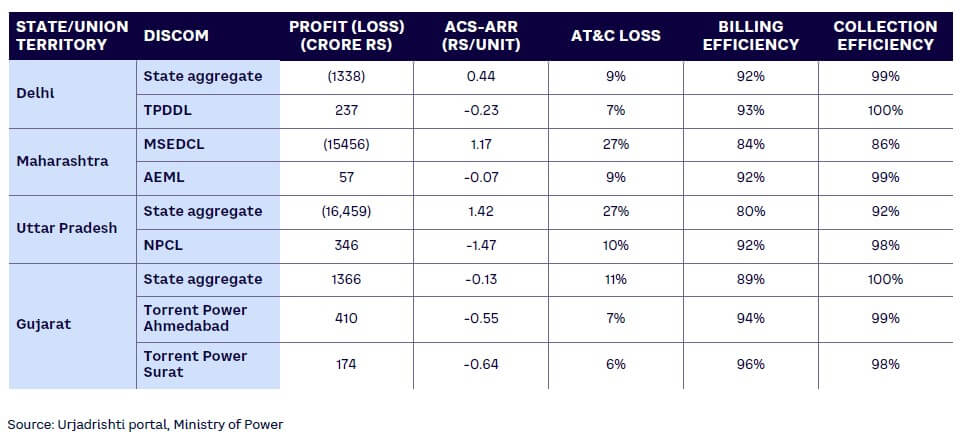

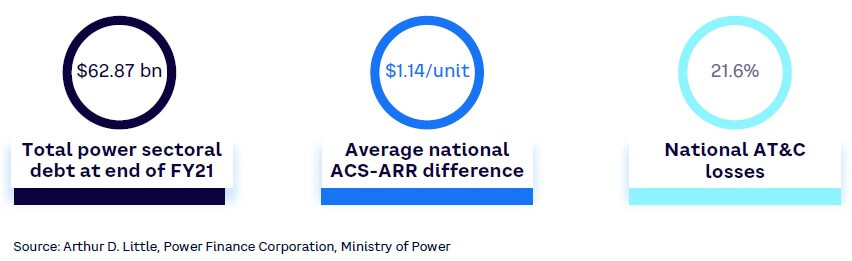

Distribution is arguably the most distressed category in the Indian power value chain. DISCOMs have been underperforming for a long time. Distribution utilities’ net worth continues to be US -$4.49 billion; at the end of fiscal year 2021, the net sectoral debt stood at a staggering US $62.87 billion (see Figure 7). The difference between average cost of supply (ACS) per unit and average revenue recovered (ARR) per unit (ACS-ARR) stands at approximately 0.93 Rs/unit. The AT&C loss stands at 21.6%, which is still significantly higher than the 15% target set in 2015 at the launch of the India’s Ujwal DISCOM Assurance Yojana (UDAY) scheme.

The Indian government has had to bail DISCOMs out of crisis on multiple occasions, with the latest being a US $10.91 billion bailout package declared by the central government in May 2022 to enable DISCOMs to pay back most of the US $11.76 billion of dues they owed to the independent and renewable power producers. DISCOMs’ inefficiencies have been attributed to a host of reasons, such as manual metering and billing processes, long-term arrangement of PPAs that were noncompetitive, and the incompetent management of state-owned public utilities.

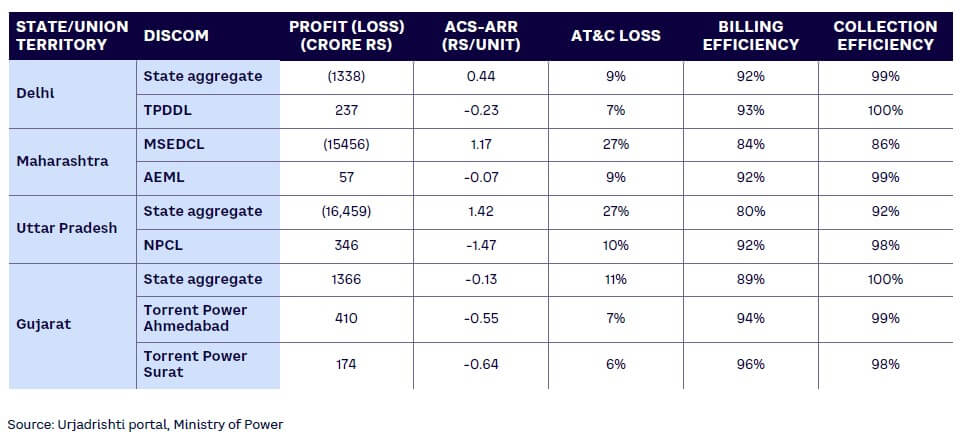

As reported by PFC, current billing and collection efficiencies stand at 84% and 92%, respectively, which are low compared to other leading nations.

The billing and metering losses are attributed to willful and unintended electricity theft, inadequate infrastructure, incorrect and improper billing, consumer profiling, a frequent need for manual intervention, corrupt practices in load determination, and defaults in bill payments.

Long-term bilateral PPAs are the main way of buying and selling electricity in India, covering 90% of generation in 2019.[9] The term of these PPAs is usually 20-25 years. Such long-term contracts are necessary due to the high capital and operational expenditure requirements of these projects. However, a surge in renewable energy in India is set to massively increase spot power trading, according to the country’s largest electricity exchange, Indian Energy Exchange (IEX). As a result, DISCOMs are locked in a situation where the buying price is fixed high due to PPA contracts, while cheaper renewable power is available.

To improve India’s distribution performance, the government must initiate the following three key imperatives: (1) harnessing digital transition of power distribution through smart meters; (2) pushing for increased private player participation to improve efficacy; and (3) scaling up adoption of power exchanges.

DIGITAL TRANSITION OF POWER DISTRIBUTION THROUGH SMART METERS

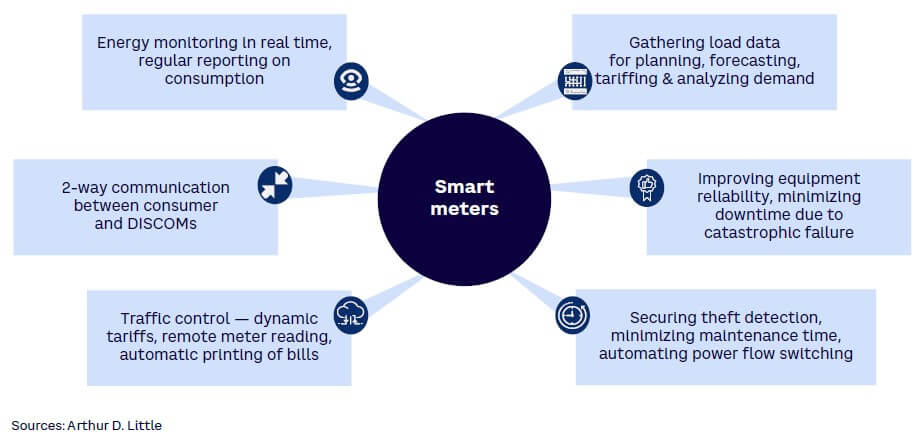

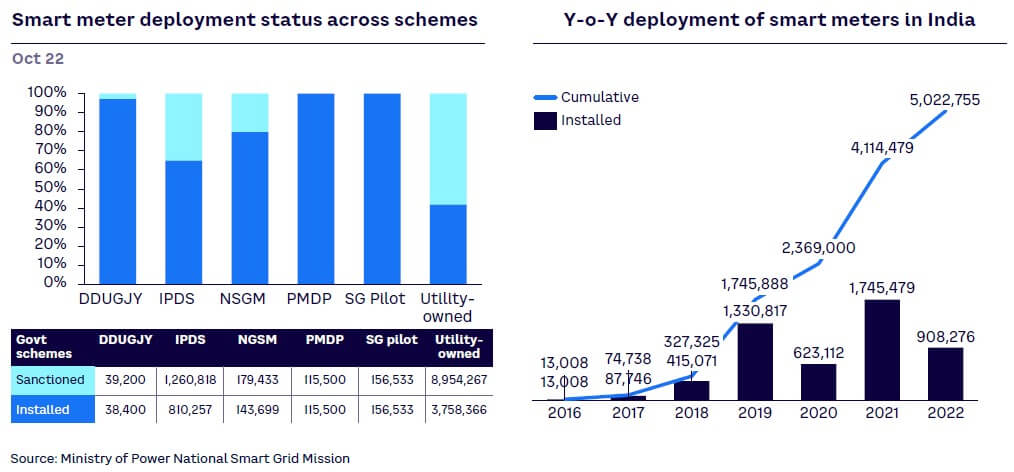

Smart meters capable of two-way communication, real-time data gathering can alleviate collection challenges by increasing billing and collection efficiency, offering insights into consumption patterns, reducing transmission and distribution losses, and enhancing possibilities for adding new revenue streams while providing a foundation for smart grids and smart cities (see Figure 8).

Currently, the government has sanctioned around 10.7 million smart meters across the country, with about 5 million installed, according to MoP. Additionally, about 1.21 million prepaid smart meters have been installed (see Figure 9 for a breakdown by scheme).

Some necessities to ensure successful deployment of smart meters include:

-

Improving consumer engagement to fast-track adoption. To accelerate the deployment process of smart meters, it is crucial to address factors that inhibit customers from adopting them. Most Indians are not aware of smart meters’ advantages. And because the introduction of smart meters compels users to pay for every unit of power utilized, changing consumer behavior and making them realize that power is no longer free will be a challenging task. Developing a common platform for consumer engagement focused on awareness, participation, and grievance redress is critical. Such an initiative should be supported by a nation-wide awareness campaign highlighting the cost benefits of developments such as ToU tariffs. It is vital to educate customers to create the pull for new-age smart meters.

-

Undertaking staged deployment for effective management. The industry lacks the capacity to drive mass deployment at one go. Instead, it would be wise first to implement pilot programs to observe ground-level installation nuances, consumer product acceptance, and data integration complications. India needs to discover scalable solutions to the issues identified and then implement them in the coming pilot programs until all hitches are resolved. It could then take a staged deployment approach based on priority and available infrastructure. With every stage of deployment, the scale could be increased — working toward the final stages of deployment by 2030. The drastic shift in meter, billing, and collection processes with the advent of smart meters demands restructuring and the skilling up of the human resources pool. A staged deployment provides enough experience and time for efficient restructuring.

-

Developing an unparalleled, multilevel data security system. With the power of data comes the responsibility to use it wisely and protect it from breaches. Data security is thus an additional challenge in the monitoring of smart meters. DISCOMs will now have the additional responsibility of supervising data security and preventing misuse by external third parties. Consumers are apprehensive about sharing household sensitive information. Thus, the network should be secure enough to avert hacks during billing modifications, prevent personal data breaches, perform consumption pattern analysis, and so on. To ensure smart meter security, it is vital to safeguard the entire lifecycle, from manufacturing and onboarding to regular use.

At the head node, the meter manufacturers should adopt factory provisioning to inject security certificates. RoT is the latest technology that ensures reliability with increasing scale by injecting all credentials onto a single device. In addition, the sector should make trusted connections with the transmission grid during deployment using PKIs. The two-way communication between the meter and the cloud needs to be encrypted to ensure end-to-end communication security. It is equally vital to safeguard software updates that roll out post-deployment through authentications technology.

PRIVATE PLAYER PARTICIPATION TO IMPROVE EFFICACY

A successful strategy for improvement of sector performance requires increased participation of private players. While the generation market is dominated by private players (at 48%), transmission and distribution see just 7% and 6% private participation, respectively (see Figure 10). Thus, there is an enormous potential for private players to enter and transform performance in these two areas.

In the distribution space, private DISCOMs have consistently performed well (see Table 2). As per MoP’s “10th Annual Integrated Rating & Ranking” report for power distribution utilities, six of the 12 A+ rated DISCOMs are privately held and none of the privately held DISCOMs have been rated below B- (except for Orissa DISCOM, which was set up only two years ago).

As shown in Table 2, irrespective of the state’s aggregate performance, private DISCOMs are making profits in all states. For example, Noida Power Company Limited (NPCL) has achieved an ACS-ARR gap of -1.47 Rs/unit, while the state of Uttar Pradesh as an aggregate has an ACS-ARR gap of 1.42 Rs/unit. This means that NPCL can make a profit of Rs 1.47/unit of electricity it supplies, while the state of Uttar Pradesh as a whole loses Rs 1.42/unit of electricity supplied.

Even in Gujarat, where the aggregate state DISCOM performance is impressive, private DISCOMs beat the state on all fronts, including ACS-ARR gap and AT&C loss.

All the evidence suggests that private-player participation has the capacity to add new life to the nation’s power sector.

The government of India has also made its intent of enabling private participation clear through multiple steps, including the Electricity (Amendment) Bill 2022 and the recent bid to give the control of eight Union Territory DISCOMs to private operators.

To increase private player participation, the government is embarking on some action items, including:

-

Encouraging public-private partnerships. The regulatory policy framework must be amended to encourage public-private partnerships. Government policies to enable entry of the private players in the distribution and transmission sector are needed to leverage the improved technical capabilities they have to offer. The distressed public power entities must also be incentivized to seek help and emulate the performance of successful private parties. Utilities can be enticed with longer moratorium periods and minimal-interest loans when partnered with private entities.

-

Providing financial support for private entities. Private firms looking to enter the distribution sector need to be provided financial aid, such as subsidies, tax rebates, and conducive loan structures. They could also be allowed higher equity returns for innovative capital investments, which could result in improved distribution performance.

SCALING UP ADOPTION OF POWER EXCHANGES

As a result of the introduction of open access in the Electricity Act, 2003, India has three power exchanges in its ecosystem. While IEX and Power Exchange India Limited (PXIL) were established in 2008, Hindustan Power Exchange (HPX) is in its nascent stages. The buyers comprise DISCOMs, traders, and industrial consumers, whereas the sellers range from central and state-generating stations to independent power producers. In India, the Central Electricity Regulatory Commission (CERC) regulates and guides the power exchanges. Volumes traded through power exchanges in India have steadily grown, with CAGR of 19.8% over the last five years, reaching 101 business units in 2021–2022.[10] With the power exchange market still in its early stages, now is the time to implement and experiment with some reforms to tailor a suitable system for India:

-

Introduce a market coupling operator. A market coupling operator can be introduced to decide a common MCP for all exchanges and undertake the responsibility of allocating transmission loads. Along with this, the operator can fix the maximum of fees exchanges can charge. While these changes would be relevant for the day ahead and real-time markets, other markets can be given more freedom to foster competition and innovation in products.

-

Encourage the open energy derivatives market. The Indian energy exchange market is at the optimal stage to incorporate derivatives trading. The government must implement reforms targeting quick settlement of transactions and stricter penalties, as barring defaulters from the platform still leave their dues unpaid. A regulatory framework is also needed to ensure that large players do not control the prices. Key learnings from developed energy derivatives markets such as the European Energy Exchange (EEX) can also be used to devise a suitable model for India.

-

Incentivize renewable transactions. The government can implement policy reforms and provide financial support that incentivizes renewable energy transactions only via power exchanges. This would enable efficient price discovery and ensure higher plant load factors for developers. Innovative frameworks like Market-Based Economic Dispatch (MBED), which provides a platform to include PPA transactions, can assist in onboarding larger numbers of users.

CONCLUSION

10 KEY IMPERATIVES TO ACHIEVE INDIA’S ENERGY VISION

Countries across the globe are actively working toward attaining energy self-sufficiency and trying hard to meet their own energy needs in the presence of changing world dynamics. In India, the need for transformation within the industry is signaled by shifting dynamics in the market, including the sharp rise in power generation costs due to skyrocketing coal prices, the underperformance of state electricity boards, a move toward renewable energy, the requirement to adhere to environmental sustainability measures, the need for digitization to harness the power of data, and various reforms in buying/selling arrangements with the advent of power exchange markets. Achieving energy independence, given the current industry challenges, requires an integrated transformation blueprint across all components of the value chain. In this Report, we have described the steps India must take via 10 key imperatives to ensure the country meets its true potential in the power sector.

To reach the goal of net zero, India must reduce carbon emissions from electricity generation through the following key imperatives:

As highlighted in this Report, India’s transmission segment has had a significant technical loss compared to that of other countries. Smart meters’ digitalization of distribution companies opens the possibility for digitalizing the primary grid. The following key imperatives will prove essential in reducing transmission problems:

Power distribution is the value chain’s most problematic area within the distribution industry. There is a pressing need for transformation in this area through the following key imperatives:

- Scaling up green energy’s contributions for an affordable and cleaner energy mix by:

-

Improving investor confidence.

-

Increasing domestic equipment production.

-

Removing entry barriers.

-

Scaling up rooftop solar and offshore wind generation.

-

Expanding nuclear power generation.

-

- Promoting green hydrogen as a carbon-neutral energy storage solution by:

-

Leveraging biomass as an alternative for water electrolysis.

-

Providing financial incentives for stakeholders.

-

Promoting self-sufficient production.

-

- Accelerating CCUS adoption for decarbonization by:

-

Introducing financial channels.

-

Investing in R&D

-

Improvizing regulatory frameworks.

-

Participating in global forums.

-

- Enhancing infrastructure development and capacity augmentation through:

-

Introducing state-of-the-art technology in old and new infrastructure.

-

Expanding interstate transmission capabilities.

-

- Securing future of smart grid by emphasizing:

-

Efficient data collection by implementing smart meters.

-

Secure data communications using latest narrow broadband technologies.

-

Real-time data storage and insight generation using analytical services.

-

Grid management and insight implementation by piloting dedicated systems like SGCCs, OMSs, and so on.

-

- Creating opportune deployment of microgrids by:

-

Involving local operators with market understanding.

-

Encouraging a hybrid model for reliable integration of microgrids with main grids.

-

Integrating all microgrids with the main grid in the long run.

-

- Establishing world-class congestion management using techniques like:

-

Demand-side management through peak shaving.

-

Supply-side management by rescheduling generators.

-

- Harnessing digital transition of power distribution through smart meters by:

-

Designing consumer engagement strategies focused on awareness, participation, and grievance redress to design a pull-oriented approach.

-

Undertaking staged deployments in a planned schedule for effective management of limited resources.

-

Developing an unparalleled multilevel data security system using the latest concepts, such as RoT, PKIs, and so forth.

-

- Pushing for increased private player participation to improve efficacy by:

-

Supporting regulatory frameworks for public-private partnerships.

-

Providing financial support in terms of subsidies, rebates for private entities.

-

- Scaling up adoption of power exchanges markets (and replacing long-term PPA arrangements) by:

-

Enabling market coupling operators to act as intermediaries for MCP determination and transmission load allocation.

-

Opening an energy derivative market with regulatory frameworks supporting fair price determination and shorter credit lines.

-

Following market-based economic dispatch models to prevent complete replacement of PPAs.

With a concerted approach, energy independence is not a distant dream for India. By making the necessary reforms in policy framework, stakeholder management, infrastructure development, and technological advancements, India can be on track to achieve self-reliance by 2047.

Notes

[1] “Transmission Losses — 2021-22.” Grid Controller of India, accessed December 2022.

[2] “Report on Performance of Power Utilities 2019-20.” Power Finance Corporation (PFC), August 2021.

[3] “10th Annual Integrated Rating & Ranking: Power Distribution Utilities.” Government of India Ministry of Power (MoP), August 2022.

[4] “Energizing India.” NITI Aayog and the Institute of Energy Economics (IEE), Japan, June 2017.

[5] “Coal Demand Continues to Far Outstrip the Domestic Production in September 2021.” CARE Ratings, Industry Research Outlook, 7 October 2021.

[6] Karthikeyan, Suchitra. “Explained: Why India Is Facing Coal Shortage and How It Affects Power Supply? ” India.com, 1 May 2022.

[7] “India CO2 Emissions.” Worldometer, accessed December 2022.

[8] Sundar Parira, Anindya et al. “India Taps into Renewable Energy Potential.” T&D World, 27 June 2022.

[9] “Leading India’s Energy Transformation: Annual Report.” Indian Energy Exchange (IEA), 2021.

[10] Gupta, Nikita. “Deepening the Market.” PowerLine, 8 September 2002.

DOWNLOAD THE FULL REPORT

32 min read • Energy, Utilities & Resources

Powering India’s energy vision 2030

An integrated transformation blueprint for energy independence

DATE

FOREWORD

India aspires to be energy independent by 2047, as announced by Prime Minister Narendra Modi in August 2021. Changing dynamics in the industry, including the drastic increase in the cost of power generation due to skyrocketing coal prices, underperformance of state electricity boards, a shift toward renewable energy, the necessity to abide by environmental sustainability measures, the need for digitization to leverage the power of data, and reforms in buying/selling arrangements with the advent of power exchange markets all herald the need for transformation within the sector.

Overall, this Report envisions the future of India’s power sector to take a giant step forward in improving efficiency, reliability, digitalization, and sustainability. India is on the cusp of attaining self-sufficiency in energy, and for such a culturally and politically diverse nation, this is a remarkable achievement.

In fact, India is positioned to be a major player in green energy generation and aspires not only to attain energy security but also to begin supplying renewable power to neighboring nations. As the big conglomerates foray into green hydrogen and other renewable energy generation, associated industries such as energy transmission and distribution also need significant transformation. The Report presents an integrated blueprint for India to achieve its true potential in the power sector.

- Barnik Chitran Maitra, Managing Partner, ADL India & South Asia

- Michael Kruse, Managing Partner & Global Lead, Energy & Utilities

EXECUTIVE SUMMARY

Nations worldwide have undertaken the path toward energy independence to eliminate reliance on imports, enhance savings, create employment opportunities, and lay the roots for a clean energy ecosystem. To be truly energy independent, India needs to produce excess energy and generate it through sustainable methods as well as minimize losses during transmission, distribution, and consumption.

PROPELLING SELF-SUSTENANCE IN POWER GENERATION

After examining India’s power sector at a glance and reviewing some government initiatives, the Report moves on to an initial set of 10 key imperatives that will guide India in achieving its energy vision. First up is a look at the power generation sector and how it has its own set of challenges that must be prioritized for India to attain self-reliance. For example, it is increasingly difficult to meet rapidly growing energy demand with insufficient and perishable power resources, and the scarce availability of coal has pushed up the price to produce power. At the same time, carbon emissions from power generation must be mitigated to achieve the dream of net zero. To overcome these setbacks, highlighted in Chapter 3, the sector must consider the following three key imperatives:

-

Scaling up green energy’s contribution for an affordable and cleaner energy mix — by introducing reforms to improve investors’ confidence, removing entry barriers such as difficulty in land acquisition, boosting domestic manufacturing of photovoltaic (PV) cells and wind equipment, and incentivizing adoption of rooftop solar. The industry should emphasize baseload technologies like offshore wind and nuclear generation, increasing nuclear energy production by establishing scalable small modular reactors (SMRs), utilizing locally available thorium, and building a regulatory environment conducive to these alternatives.

-

Promoting green hydrogen as a carbon-neutral energy storage solution — by increasing the use of green hydrogen as a carbon-neutral energy storage solution through financial incentives for stakeholders and by ensuring self-sufficiency in electrolyzer production. Readily available biomass can generate green hydrogen as long as robust logistics are in place to support it.

-

Accelerating carbon capture, utilization, and storage (CCUS) adoption for decarbonization — by accelerating adoption of CCUS for decarbonization via introducing financing channels for CCUS implementers, investing in R&D to identify cost-effective mechanisms, establishing a start-to-end governance framework for CCUS management, and participating in global forums to leverage recent developments.

MAKING NATIONAL POWER TRANSMISSION FUTURE READY

As we explore in Chapter 4, the transmission sector in the value chain needs to be future ready to accommodate changing dynamics within the industry. Transmission in India bears a technical loss of 3.6%,[1] which is high compared to other nations. The digitalization of distribution companies (DISCOMs) using smart meters provides the opportunity to digitalize the main grid. The following four key imperatives are necessary to mitigate these technical issues:

-

Enhancing infrastructure development and capacity augmentation — by improving infrastructure through deployment of anti-theft and anti-oxidation cables to reduce theft and technical losses, shifting toward high-voltage direct current (HVDC) lines for long-distance transmission, imposing stricter penalties for transmission network developers upon default, and expediting development of interstate transmission lines.

-

Securing future of national smart grid — by designing and implementing a strategy for a smart grid that emphasizes efficient data collection by installing smart meters at nodal points, securing data communications by using narrow broadband technologies such as RF-2.4 GHz, building data concentrator units, and piloting dedicated systems like smart grid control centers (SGCCs) and outage management systems (OMSs).

-

Creating opportune deployment of microgrids — by deploying microgrids in coordination with local operators while retaining the possibility of complete integration into the national grid in the future.

-

Establishing world-class grid congestion management — by acknowledging that more efficient use of available network capacity will become a necessity with an increasing share of renewable energy. Unnecessary grid investments and ineffective grid operations must be avoided through the deployment of direct control methods (e.g., peak shaving), market-based methods, or a combination of both.

DRIVING DISCOMS’ PROFITABILITY

As we highlight in Chapter 5, the distribution of power is the most troubled sector across the value chain. Of late, the state DISCOMs have been characterized by negative net worth (US -$4.49 billion) and high debt (US $62.87 billion),[2] along with operational inefficiencies (aggregate technical and commercial [AT&C] losses of 21.6%).[3] There is an urgent need for transformation within the distribution sector, and India should leverage the following three key imperatives:

-

Harnessing digital transition of power distribution through smart meters — by developing digital infrastructure like smart meters to transform energy distribution via designing consumer-centric engagement strategies, phasing in nationwide deployment with constant feedback collection, and investing in a multilevel data security system using concepts like root of trust (RoT) and public key infrastructure (PKI).

-

Pushing for increased private player participation to improve efficacy — by increasing private player participation with the help of supporting regulatory frameworks as well as financial support in terms of subsidies and rebates for private entities.

-

Scaling up adoption of power exchanges — by enhancing power exchange markets via introducing a market-coupling operator to discover a common market clearing price (MCP) across exchanges, initiating energy derivative markets with regulatory frameworks that support fair price determination and shorter credit lines, and considering a market-based economic dispatch model to prevent complete replacement of power purchase agreements (PPAs).

Energy independence is of growing importance to leading nations. India could fast-track its self-reliance goals by leveraging these 10 key imperatives toward strategy-driven reform. With some directed momentum, India can achieve its aspiration of becoming an energy-independent nation.

1

INDIA’S POWER SECTOR AT A GLANCE

With about 405 GW (gigawatts) installed power capacity, India is the third-largest producer and the second-largest consumer of electricity in the world and has reliable energy-generation processes, according to the Central Electricity Authority of India (CEA), with power generated by conventional and nonconventional resources. India is the fourth-largest producer of wind power and the fifth-largest in solar power.

Over the last few decades, the demand for electricity has increased exponentially, driven by industrialization, digitization, and technological advancements. The increased share of renewable power generation has helped bridge the demand-supply gap. India’s Electricity (Supply) Act, 1948, was amended to encourage private player participation in power generation; half the power consumed in the nation today is generated by private players (see Figure 1).

From 2010 to 2022, India’s generation capacity, including renewables, has grown by 85%. Table 1 illustrates the share of generation capacity estimated by India’s Ministry of Power (MoP), according to fuel type as of late September 2022. The share of power generated from non-fossil fuels has doubled to 42% in 2022, from 21% in 2021.

Conducive policy frameworks through subsidies and tax rebates have improved the attractiveness for investments to achieve a balanced energy mix.

The transmission infrastructure in India is robust, spanning around 450,000 circuit kilometers (ckm), according to MoP. Power Grid Corporation of India (POWERGRID) continues to convey 50% of the total energy generated in the country through its efficient transmission network.

The distribution sector has 7% participation from private players, while the remaining 93% is under state and central government utilities. However, the presence of large private players like Adani Power, Tata Power, JSW Energy, Torrent Power, and Reliance Power has increased significantly over the last few years and is expected to expand.

2

GOVERNMENT INITIATIVES

India has formulated many policy schemes to reinforce its goal of energy independence by supporting various reforms across the value chain (see Figure 2).

Recently, Prime Minister Modi outlined a five-point plan for India (“panchamrit”) during the 2021 United Nations (UN) Climate Change Conference (COP26), with the following goals for the country:

-

Expand non-fossil fuel–based energy capacity to 500 GW by 2030.

-

Provide 50% of India’s energy needs using renewable energy sources by 2030.

-

Reduce carbon emissions by 1 billion tons by 2030.

-

Cut the economy’s carbon intensity by less than 45% by 2030.

-

Achieve net zero emissions by 2070.

To achieve these ambitious goals, India needs to accelerate its transformation across the value chain. To do so, the country must drastically reduce its dependence on fossil fuels for power generation.

India should also adopt the latest technologies, including CCUS and green hydrogen, to decarbonize thermal power generation. In addition, the high AT&C losses (21.6%) that currently exist should be minimized with digital interventions in billing and metering.

TRANSFORMATION BLUEPRINT FOR ENERGY INDEPENDENCE

Globally, nations like the US, China, and Russia have embarked on journeys of energy self-reliance. Following in their footsteps, Prime Minister Modi has pledged that India will become energy independent by 2047. Currently, India spends US $160 billion on energy imports; hence, it is far from self-sufficient. Therefore, it is crucial for India to engage in a dramatic transformation across its entire energy value chain for the nation to realize its dream of energy independence. The remainder of this Report proposes an integrated transformation blueprint to accelerate India’s journey toward energy independence.

3

PROPELLING SELF-SUSTENANCE IN POWER GENERATION

India’s electricity consumption is expected to grow at a rate of 5.4% by 2047,[4] creating the need for India to double its generating capacity in the next decade. Furthermore, the power generation capacity is forecasted to increase by 9.1% by 2030, as indicated in Figure 3.

Currently, Coal India meets only 65% of coal demand,[5] forcing India to rely on imports from other countries. Moreover, the coal crisis in India has meant drastic increases in the cost of power production. In fact, the price of electricity in exchange markets surged in March 2022 to an average of US $.10/kWh from its previous rate of US $.04/kWh — an 85% increase.[6] Along with these economic challenges, the emissions released are detrimental to India’s environment. India produces around 2.5 billion tons of carbon dioxide (CO2) each year (growing at an annual rate of 6%), of which 52% is contributed by the power sector itself.[7]

In this chapter, we highlight three key imperatives to tackle these challenges: (1) scaling up green energy’s contribution for an affordable and cleaner energy mix; (2) promoting green hydrogen as a carbon-neutral energy storage solution; and (3) accelerating CCUS adoption for decarbonization.

SCALING UP GREEN ENERGY CONTRIBUTION

India has the potential to generate a combined total of 1,700 GW of energy using renewable sources.[8] Tapping into this opportunity would not only eliminate India’s dependence on energy imports but would also establish it as a global leader in energy exports. The green nature of these sources helps India move closer to achieving its ambitious COP26 targets.

India is on the right trajectory to meet a nationally determined contribution (NDC) target of clean energy capacity of 500 GW by 2030, with 165 GW generation capacity already in place (see Figure 4). For a country like India where about 50% of power is generated through coal, it is not possible to reach net zero based only on onshore wind and solar. Instead, the country must rely on heavy investments into baseload technologies like nuclear power generation and offshore wind generation. Currently, according to MoP, just 1.7% of India’s power generation is contributed by nuclear sources. This is almost negligible compared to that of other nations.

To further accelerate adoption, we recommend that India focus on developing green energy generation capacities by focusing on:

-

Improving investor confidence. The government must introduce policy reforms to facilitate a smoother and faster transition to a market-based model from the existing PPA model for buying electricity. It should also initiate stricter policies to define and improve contractual structures as well as policies on curtailment of risk and compensation. And it should deploy a robust regulatory framework to compensate renewable energy generators in the event of payment defaults by DISCOMs.

-

Removing barriers to entry of greenfield projects. India should facilitate an easier land acquisition process by developing a one-stop solution for developers to apply for necessary permissions from the local, state, and central entities after land allocation. The country can also implement judicial reforms targeting expedited conflict resolution processes regarding land ownership and possession.

-

Increasing domestic equipment production. The manufacturing sector should focus on the entire value chain of solar PV cells and modules manufacturing by leveraging association with organizations such as the International Solar Alliance (ISA) to garner support and establish capabilities. The government should introduce policy reforms focused on accelerating mineral imports and developing a conducive manufacturing environment to attract investors riding on China +1 developments. Long-term trade negotiations with other countries can also ensure a stable supply of the supporting minerals required for solar and wind equipment manufacturing. Finally, India should invest in R&D to identify the manufacturing technologies suited for India based on mineral resources availability.

-

Scaling up deployment of rooftop solar and wind projects. Improving visibility and accessibility of rooftop solar via state and DISCOM regulations is critical and is possible with the appointment of a publicly available, distributed solar registry platform for DISCOMs. India could also update net metering laws or regulatory policies to incentivize prosumers of solar panels based on their contribution in reducing peak electricity demand. Separately, the government could create a composite of land-based and offshore wind capacity to attain a better capacity utilization factor. Offshore wind has great potential along coastal regions, and HVDC lines could be utilized to transmit this energy inland.

-

Increasing nuclear energy generation. India should support establishing SMRs in a standard manner and scaling them according to demand. The country is one of just a few (similar to China or the US) that has the size to localize SMR design and build economies with scale. This can be done by attracting investments and facilitating international partnerships with UK, US, or even Russian SMRs. Since India already has a nuclear infrastructure, the incremental cost is estimated to be low. The high cost of importing uranium can be brought down by instead using thorium, a largely underutilized resource for nuclear power generation. To tackle risks associated with nuclear generation, the government must provide guarantees of security and returns, which might also attract private investments. Creating robust policy debates will benefit India’s energy development as a whole by pushing local industries to start participating in India’s nuclear expansion.

PROMOTING GREEN HYDROGEN

Leveraging renewable energy sources to meet total electricity demand is not possible without developing additional storage solutions. Green hydrogen is emerging as the go-to option in areas that require high power density storage and have space/weight constraints.

It is expected that India will produce 5 million tons of green hydrogen by 2030 and nearly 25 million tons by 2050 using surplus renewable capacity (see Figure 5). The storage reserve can be converted into energy with almost 100% efficiency using fuel cells. To optimally leverage this technology, it is important that India focus on reforming the following:

-

Utilizing biomass for green hydrogen generation. Generating green hydrogen using biomass can augment the electrolysis process and helps in recycling carbon waste. Industry players should push for efficient logistics mechanisms to collect the existing waste and convert it into green hydrogen.

-

Incentivizing stakeholders. The government should provide financial subsidies and monetary benefits to incentivize renewable energy generators with significant surplus peak capacity to set up green hydrogen systems, helping to catalyze capacity creation.

-

Promoting self-sufficient production. India can introduce policies promoting research collaborations and knowledge sharing with foreign companies to promote self-production of electrolyzers and fuel cells with better efficiencies in line with the aim of Prime Minister Modi’s “Atmanirbhar Bharat” (or “self-reliant India”).

ACCELERATING CCUS ADOPTION

To meet the net-zero emission target, India should also look at CCUS technology. This technology for carbon removal can complement and supplement nature-based solutions, such as afforestation and reforestation. The cost of carbon capture can be partially offset by carbon utilization efforts. CO2 is used to produce fertilizers, assist in enhanced oil recovery, as well as for food and beverage production, cooling, and water treatment.

India currently has four CCUS facilities with a negligible capacity of 0.003 million tons of CO2 per year. India’s carbon storage potential varies from 5 to 400 billion tons of CO2, located mainly in geological formations such as coal fields, oil and gas fields, sedimentary basins, and saline aquifers. To achieve its ambitious net zero goals by 2070, CCUS technology will play a critical role for India and support the following functions:

-

Introducing financing channels. India can introduce various financing mechanisms that make for a stronger economic case using CCUS technology in emission-intensive industries. These mechanisms include tax credits, enforcement of stringent carbon pricing protocols, incentives for early adoption, funding support for pilot programs, and other market-based financing models.

-

Focusing on CCUS-related R&D. The government can create an ecosystem that enables more research and innovation on CCUS and other carbon-mitigation technologies that can help in reducing costs, overcoming technical and logistics issues in the deployment of CCUS, and facilitating feasibility studies and pilot programs.

-

Developing policy, regulation, and governance systems. India can start developing various policy frameworks and regulations around the use and potential of CCUS, its risk management, and governance.

-

Participating in global forums. Government and private sector representatives can participate in global discussions around CCUS technology and its applications across industries, collaborate with global players and other nations, and strive to be a part of industrial hubs and other shared CCUS infrastructure.

4

MAKING NATIONAL POWER TRANSMISSION FUTURE READY

In 2018, India achieved the milestone of complete rural electrification. To support these lines, substations with a capacity of 119,256 megavolt-amperes (MVA) already exist across the country and another 321,433 MVA substations are under construction. India still faces a plethora of issues in transmission. As reported by Grid Controller of India, the transmission of technical losses average out to about 3.6% in 2022. Additionally, as distances over which power is transferred increase, wheeling charges have grown. Furthermore, many interstate and interregional connections are inadequate due to neglected grid monitoring and maintenance in a transmission infrastructure that is 30 to 40 years old.

Moreover, the new renewable power generation facilities face the problem of insufficient grid availability for power injection at plant locations. With the increasing pace of energy transition, transmission system operators are likely to face capacity bottlenecks.

Traditionally, the grid traffic was managed by reinforcing the physical grid, which required huge financial investments. Such methods are proving to be ineffective in current dynamics given the intermittent nature of renewables.

There has been tremendous growth in the transmission network (see Figure 6), but there is still a need for improving the interstate and interregional transmission infrastructure. As per data published on MoP’s Tarang portal, in 2022, only about 115 ckm of interstate lines were laid. This is extremely low when compared to the new intrastate transmission connections of 1,426 ckm. According to MoP, construction of 19,869 ckm of interstate transmission system is underway, with 16% close to or already completed.

CHANGING DYNAMICS DEMANDS ADAPTING TRANSMISSION NETWORK

With both technology and consumption patterns evolving at such a fast pace, it is important that the grid is future proof. While there are a host of reasons to ensure the grid is up to the task, some demands in particular should be the focus areas:

-

Geographical nonuniformity in renewable energy generation. Due to high dependence on natural resources, the availability of power is not uniform across the nation. Thus, the idea of open access becomes extremely relevant, as it allows an easy system for both the producers and consumers of power to reach one another.

-

Intermittent nature of renewable energy. Due to the intermittent nature of renewable energy generation, it is not possible to match generation pattern directly to consumption pattern. The existence of a robust grid that can handle these variations in power generation on a large scale is essential.

-

Support for electric vehicle (EV) infrastructure. As EV adoption in India rises, the supporting infrastructure of charging stations must grow as well. These stations are high-load entities that have the capacity to alter the energy consumption pattern drastically. The transmission system must be ready to support the desired growth in the EV space.

All these challenges require dramatic corrections in the current growth trajectory and can be assisted through the following four key imperatives: (1) enhancing infrastructure development and capacity augmentation, (2) securing future of national smart grid; (3) creating opportune deployment of microgrids; and (4) establishing world-class grid congestion management.

INFRASTRUCTURE DEVELOPMENT & CAPACITY AUGMENTATION

Having a well-maintained and robust grid that spans the nation and is future ready can create a healthy power sector, with the following kept top of mind:

-

Shifting to state-of-the-art technology for old and new infrastructure. The government should prioritize replacing old, decayed cables with anti-theft and anti-oxidation cables by providing financial stimulus to manufacturers. Using HVDC lines for long-distance transmission is key to minimizing loss. As an additional impetus, there could be stricter penalties for developers that fail to build the allocated transmission network in due time.

-

Increasing interstate and interregional transmission lines. This should happen by starting with connecting regions that have low in-house production to nearby regions with surplus renewable capacity via green corridors. To accelerate the process, policy reforms should target increased coordination between various state and central transmission utilities.

FUTURE NATIONAL SMART GRID

With technological advances in system management and data handling, a new concept of smart grid has emerged. Using enhanced data acquisition and mining techniques, a smart grid can handle more complex demand-supply patterns and grid fluctuations. In addition, a smart grid can handle demand fulfillment automatically by forecasting production and demand of power at various locations across the grid.

Smart grid solutions can increase grid reliability, reduce transmission and distribution losses, optimize demand-side management, support renewable integration, improve self-healing capacity, and ensure optimal grid usage through the following actions:

-

Ensuring efficient data collection. The first step in setting up a smart grid is to have data collection equipment at all nodal locations. This includes metering at injection and drawing points, substations, transformers, and point of use.

-

Securing data transmission and communication. Once data has been generated, it needs to be transferred for storage and analysis. Here, the technology developers can implement the right technologies — like narrow band and broadband power line communication (PLC,) RF-2.4 GHz, RF-865 MHz, or GPRS.

-

Enabling real-time data storage and insight generation. Next, data operators must set up data management centers and data concentrator units to store the data generated and provide advanced real-time analytics services.

-

Piloting grid management and insight implementation. Finally, once real-time insights are possible, utilizing them for efficient management of the power network will require dedicated systems, such as SGCCs, OMSs, fault passage indicators, and so on.

OPPORTUNE DEPLOYMENT OF MICROGRIDS

A microgrid is a localized electricity generation and consumption ecosystem that might or might not be connected to the national grid. To promote microgrids in India, the government has proposed policies to set up at least 10,000 renewable energy–based mini- and microgrids. In a nation as vast as India, where stable electrification across the country has been a challenge, microgrids present the following opportunities:

-

Renewables adoption. With new projects based on renewable-based energy, India can move a step closer to COP26 targets by leveraging the abundant green energy potential.

-

Rural electrification. A substantial number of villages in India only have bare-minimum electricity coverage. With irregular load shedding adding to their woes, these areas can really benefit from a local microgrid.

-