18 min read • Energy, Utilities & Resources

Distributed flexibility: The next pool of value

Enabled by easier energy market access and simpler end-user solutions, distributed flexibility is the next pool of value for energy players

Executive Summary

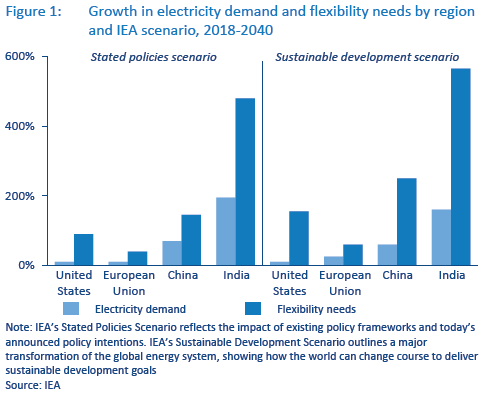

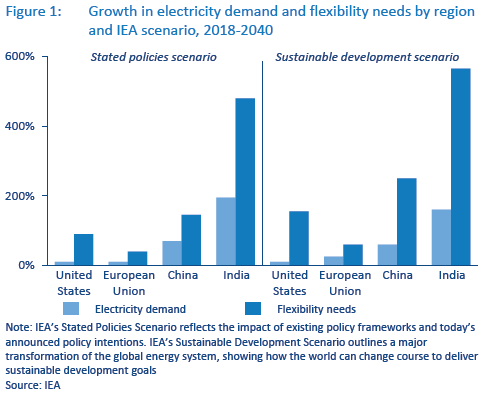

A shift in the energy mix due to increasing intermittent generation assets requires system operators to source more flexibility every year to ensure security of supply. In some regions of the world, like India, the International Energy Agency (IEA) predicts growth in flexibility need up to almost 600% by 2040 compared to 2018 needs. To date, large and traditional generation assets have provided most of the flexibility supply to network operators. Although this will extend in the coming years, distributed assets (not only generation-side) are now entering the game.

With the continued decrease in cost curves for distributed assets, such as solar power and batteries, a further rise of those assets is expected to occur, representing important resources of flexibility for network operators, which are opening their markets and “balancing products” to aggregators and any new technology capable of providing flexibility. In that context, behind-the-meter (BtM) batteries, electric vehicles (EVs) and heating ventilation and air conditioning (HVAC) systems can play a crucial role in providing grid stability, considering their forecasted penetration in the next two decades.

Energy market actors have understood this trend and the value in sourcing flexibility from distributed assets. Energy suppliers, independent aggregators, software providers and asset manufacturers are preparing themselves for two things at the same time:

- Being technically capable to get access to the flexibility that these distributed assets can provide.

- Adapting their value propositions to engage the customer in a complex technical process where the end user’s credo is simplicity.

Although technical and marketing parameters seem to be more or less under control, one remains challenging: profit!

As competition grows and the supply of flexibility rises year after year, there will likely be a decline of some revenues, such as those for ancillaries. This makes the business case very complex for the virtual power plant (VPP) owners that will have to search for additional revenue streams and will need to continue investing in their aggregation platform in order to get access to those increasingly fragmented revenue sources. Among successful aggregators, some provide a software-as-a-service (SaaS) solution, allowing them to access more and stable sources of revenue.

The situation is much more complex for independent aggregators than for retailers, given their lack of access to the client base. Nevertheless, retailers will need to unlock extra budget to imagine new routes to get access and convince end consumers to participate in this market. This is one of the reasons why many independent aggregators were acquired by large retailers (e.g., Restore by Centrica, Enernoc by Enel and Limejump by Shell) as they themselves were not agile enough to quickly set up or continuously adapt their own VPP technical solution internally.

From a customer point of view, at first sight, avoided costs on the monthly bill due to the provision of flexibility can appear very limited, so the question is, “Why bother?” Therefore, many players are working on new partnership models where aggregators and equipment manufacturers work together to provide either a discount on the value of an asset (e.g., electric boiler) in exchange for flexibility and/or offer a discount on the annual energy bill.

We offer the following key takeaways for executives:

- Since flexibility as a standalone activity is not very lucrative, independent aggregators are struggling, and most have been acquired by large retailers that have searched for cross-selling potential for their existing client base.

- In this “new normal,” the next battle is about getting access to end-user flexibility – via new retailer/aggregator combinations; such client access may appear easy, but the complexity to make it happen remains high, requiring creative and transparent business models.

- Some flexibility value must be “returned to the customer.” Required margin sharing will be needed to activate end consumers in the flexibility pool, which will likely stress the business case, at least during ramp-up of this new business model. Customers need to be seduced!

1

Increasing decentralized capacity for a growing need of flexibility

In its continuous transformation journey, the energy sector, and more specifically grid operators, face challenges stemming from increasing electrification and the rising penetration of renewables in the generation mix. These trends call for more power on the grid to respond to increasing demand as well as for alternative capacity that is capable of managing the intermittency of renewable sources of energy. In other words, flexibility is required to support network operators in their role of balancing supply and demand in real time. The International Energy Agency (IEA) anticipates an increasing need of flexibility in all regions of the world by 2040 (see Figure 1). Some markets will be more attractive than others, depending on many variables, including capacity mix, market design and regulatory enablement of flexibility, incentives available for renewable generation and distribution assets, price of electricity and so forth.

Although conventional generation assets can typically provide the required flexibility, new forms of decentralized flexibility are on the rise, both on the supply and demand sides. This changing energy mix has been incentivized by governmental subsidies and decreasing asset costs, while governments in some regions of the world such as Europe have decided to progressively shut down some traditional types of generation assets such as coal.

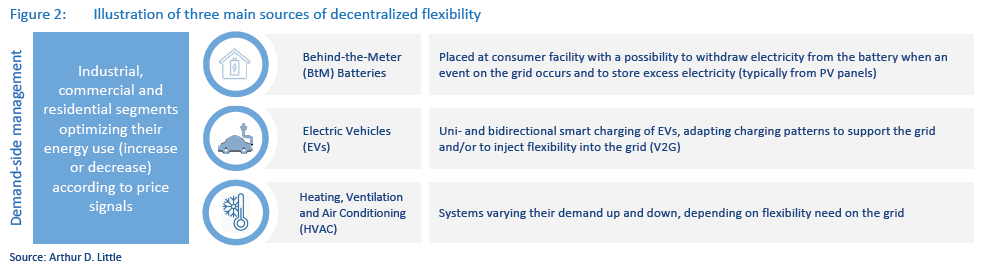

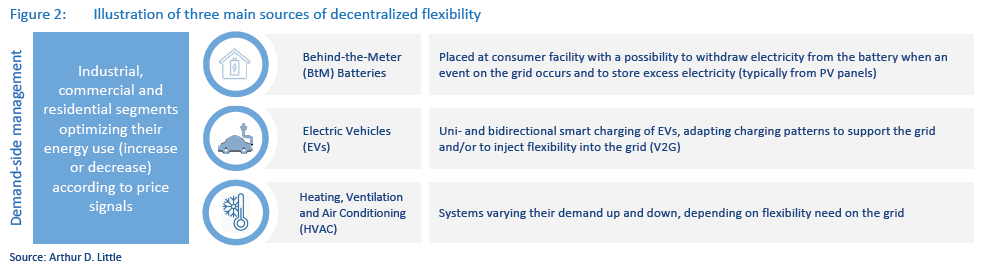

We identify three main sources of decentralized assets as promising for sourcing flexibility, given their expected growth in the coming years: (1) behind-the-meter (BtM) batteries, (2) electric vehicles (EVs) and (3) heating ventilation and air conditioning (HVAC) systems, including heat pump assets (see Figure 2). These can represent great value to network operators.

Indeed, some grid companies are in the process of designing the flexibility market in such a way as to enable both industrial and residential load in order to actively participate in the provision of flexibility.

As an illustration, UK Power Networks (UKPN), one of the UK’s largest distribution network operators, awarded contracts for 123MW of flexible power for a value of €15m in June 2020. The contracted flexibility comes from distributed generation and batteries as well as domestic flexibility from virtual power plants (VPP) aggregating heat pumps, household batteries and EVs.

Behind-the-meter batteries

Installed at industrial and commercial sites or in households, BtM batteries are typically used to optimize past or future investment in renewable generation assets and get access to cheaper electricity when market prices are high, or to store electricity during negative prices periods.

Although the majority of storage capacity will be utility-scale by the mid-2030s, BtM applications are expected to overtake in volume terms by 2040.

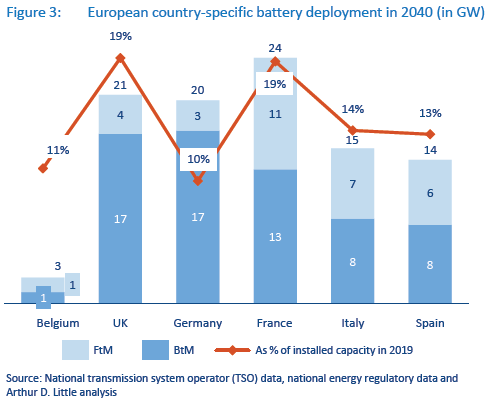

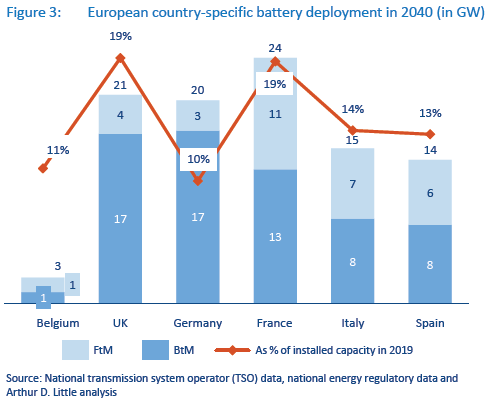

While China and the US will clearly lead the trend, some markets in Europe will also be very active in battery deployment. The UK and German markets, for example, will heavily invest in BtM batteries, while the Italian and Spanish markets plan to equally invest in BtM and front-of-the-meter (FtM) batteries.

In all geographies represented in Figure 3, it is interesting to note that in 2040 battery capacity will represent, at minimum, 10% of the total 2019 installed power capacity

Electric vehicles

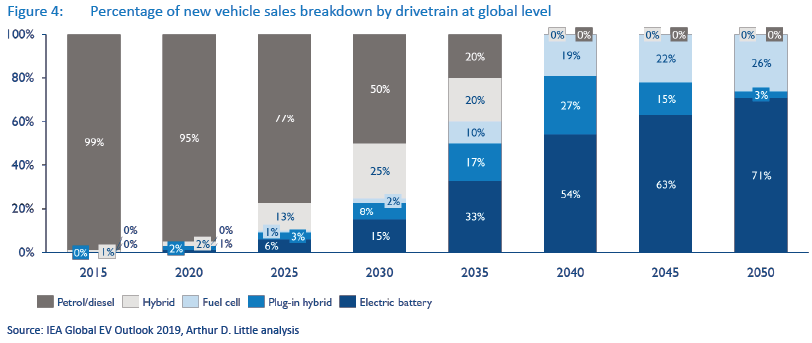

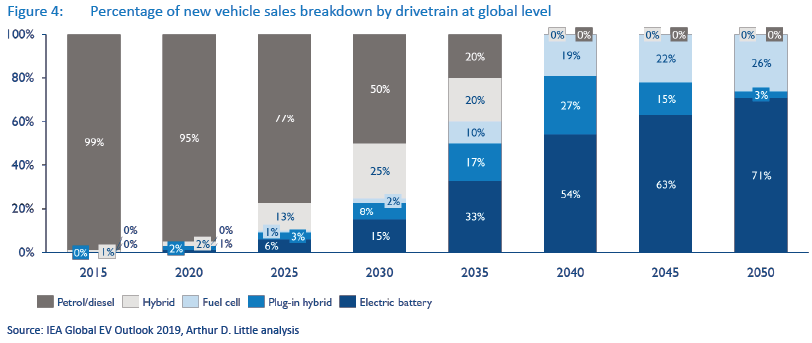

Used in the same way as a stationary battery, will see its owners incentivized to release power onto the grid when the grid needs it (vehicle-to-grid [V2G]), or (not) to charge their vehicle at specific times of the day. Notably, IEA expects e-mobility to expand at a rapid pace with an overall shift to EVs, accelerating from 2025 onwards (see Figure 4).

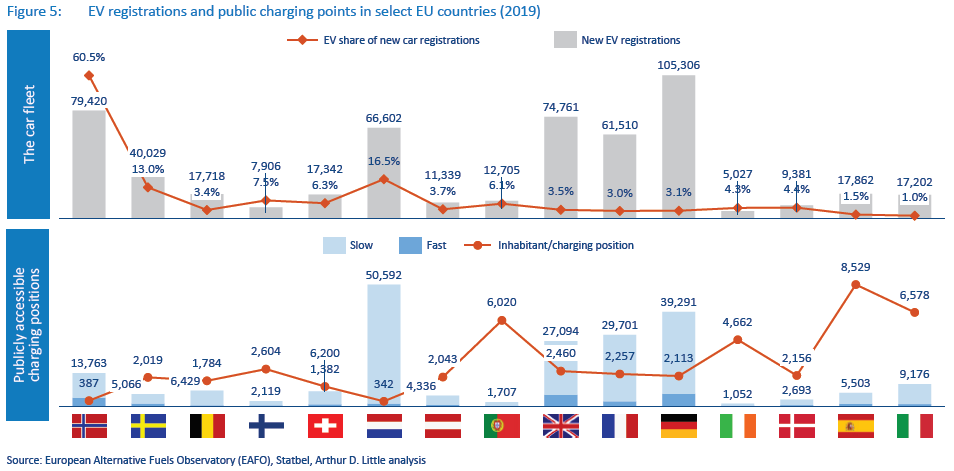

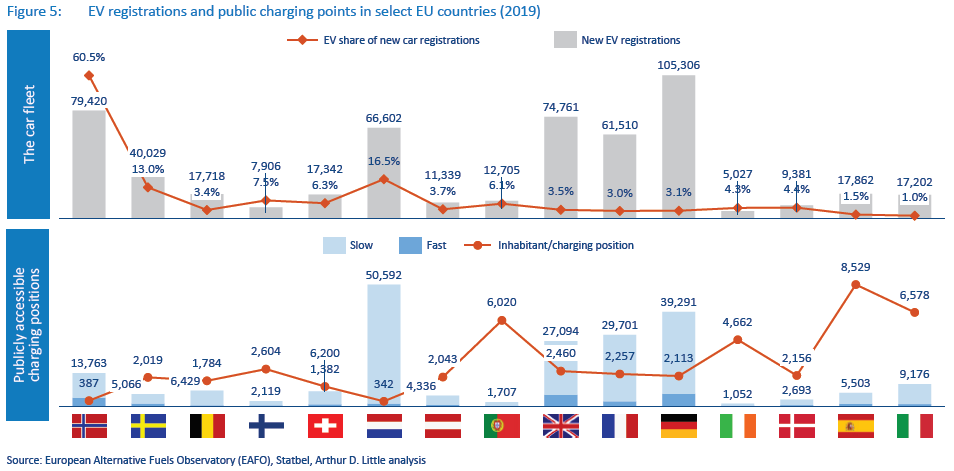

Although EV penetration will rise in all regions of the world, as shown in Figure 5, some countries are more or less on the forefront in the deployment of charging stations and in support to EVs. In Europe specifically, Norway, the Netherlands and Sweden are currently the countries where EV share of new car registrations is the highest, while the opposite is true for countries such as Belgium, Germany, France, Spain and Italy (all below 3.5 percent of EV share of new car registrations in 2019). Those differences in Europe are mainly explained by the attractiveness of incentives and/or subsidies (not) put in place by some markets.

Implications of local authorities is key in the development of charging stations. In the US, in particular, California is the state with the lowest number of people per charging point, which is explained by the commitment of different California cities to provide the best infrastructure as a way to increase the use of zero-emission cars.

Since EV penetration is growing, the main energy players are currently setting forth plans to have an active role in e-mobility, which includes developing smart charging solutions. Some players have embarked on joint venture (JV) opportunities. For example, French energy group EDF has established a JV with Californian startup NUVVE called DREEV.

The objective is clear: become a leader in the smart charging market, enable the charge/discharge of EVs and regulate the speed of charging remotely according to network tensions. Although many of these initiatives are in pilot mode, others are quite well developed. Vandebron in the Netherlands, for instance, stops and restarts the charging stations of some clients to provide automatic frequency restoration reserve to electricity transmission system operator TenneT.

Heating, ventilation and air conditioning systems

Controlled to shift energy consumption to off-peak times, HVAC systems are expected to grow by 4 percent CAGR between 2020 and 2030 according to PSMarket research, driven by the megatrends of urbanization and the emergence of energyefficient HVAC systems. Another major factor creating more demand is climate change and the increasing unpredictable climatic conditions and extreme temperatures.

HVAC will be, next to EVs, one of the top drivers for global electricity demand and in reducing carbon emissions in the next few decades. Already today, according to the IEA, air conditioning and electric cooling fans account for nearly 20 percent of electricity used in the world’s buildings and is one of the most critical blind spots in today’s energy debate.

HVAC and, by extension, other electrical appliances can, and are, used in demand-side response (DSR) programs to maintain stability in the grid and save energy for their owners. Enrolling these devices into DSR programs is already standard practice in the industrial and commercial (I&C) sector. Take, for example, the US, where according to the 2018 Smart Electric Power Alliance survey, two-thirds of I&C demand response came from deferring loads from lighting, HVAC and pumps, totaling 8GW of capacity deferred. Note that these are customer-initiated programs. In more recent years, we have seen a surge in automated smart control.

What about the residential sector? Homeowners are often more difficult to educate and convince of the benefits of letting third parties take control over their HVAC or heat pump installations. Hence, this segment knows a lower participation in DSR activity. The rise of Wi-Fi–connected smart thermostats, pioneered by Nest in 2013 and followed by players such as Honeywell and Ecobee, however, have lowered the barriers significantly for residential consumers to sign up with DSR programs. Not only do smart devices allow automated control by third parties, it also gives customers a greater sense of control over their use of energy through mobile access to data (e.g., apps, text message alerts). They value alerts that provide information about high energy use or demand response events. Moreover, the utilities themselves are bringing more awareness to customers, launching programs such as “Bring Your Own Thermostat (BYOT)” (e.g., EnergyHub, SRP), “Smart Therm” (SoCalGas) and many others, under which customers receive immediate cashbacks upon installing smart thermostats and allowing the utility to either use switch-based or fully automated control.

The smart devices revolution pays off; for example, in the US – where in 2018 over 5 million consumers were enrolled in a DSR program, either through traditional switch-based DSR (utility deciding to switch the device on/off) or through behavioral programs – giving customers cues to reduce their consumption. Consequently, just shy of 5GW of capacity was enrolled in DSR programs according to EUCI, which starts to represent a significant share in total DSR-enrolled capacity in the US.

Other markets are sure to follow. With the proliferation of the middle class in China, already the largest HVAC market in the world, it will be just a matter of years before market reform fully enables DSR in the residential sector.

2

Proliferation of VPPs mostly eased by market conditions

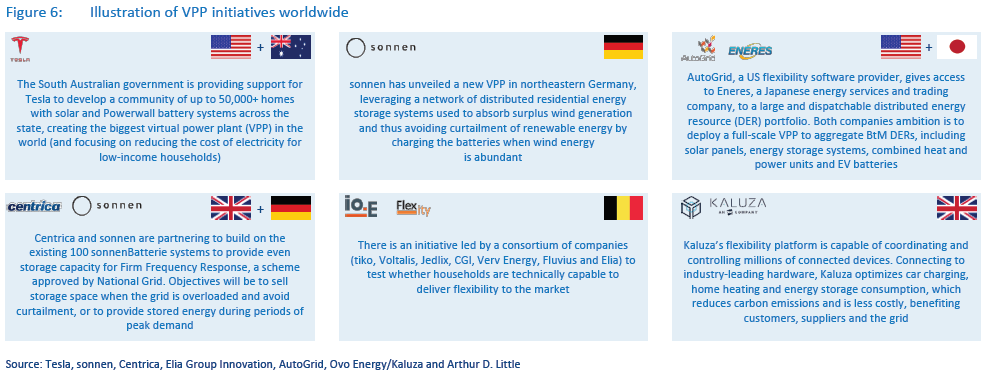

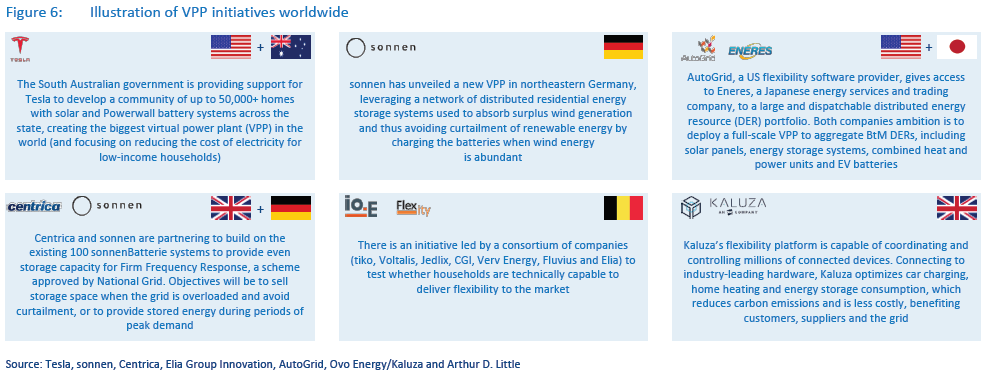

While most of the flexibility has been traditionally provided by conventional generation assets, forecasted evolution of distributed generation assets will undeniably favor the development of VPPs at residential, commercial and industrial levels (see Figure 6). Indeed, millions of assets will be required for aggregation in order to be technically and commercially able to provide flexibility to the grid. Some initiatives worldwide have already been developed to anticipate the volume of flexibility that soon will be available in large volumes.

While in the past it was quite challenging for aggregators to get access to the wholesale, ancillary and balancing markets due to a number of market design constraints,2 conditions of participation for aggregators are improving. This is facilitated by the emergence of new flexibility platforms led, for example, by distribution network operators. As an illustration, UKPN’s most recent tender was offering longer-term contracts to flexibility providers than the previous tenders, enabling them to have better visibility on their expected revenues and therefore on the viability of their model.

Although there is, of course, still plenty of room to improve market conditions for industrial and domestic flexibility, many markets are taking actions proactively to review their market design. Italy’s transmission system operator Terna, for instance, has undertaken pilots to diversify and increase sources of flexibility on the supply and demand sides to stimulate and create this market proactively

One critical element here is the uncertainty related to market design and regulation evolution. A simple change can prevent aggregators getting access to revenues they were relying on. A perfect illustration is the temporary suspension of the capacity market in the UK. Many flexibility providers were suddenly deprived from revenues that made their business viable. That’s why hedging strategies and aggregation solutions flexible enough to access multiple revenue streams are paramount to secure a sustainable business.

Simplicity for end consumers

Proactively managing energy consumption can seem counterintuitive for households. On top of educating the end consumer on the flexibility market and the benefits it can bring, trust needs to be established between the consumer and the aggregator or supplier to allow access to user devices and personal consumption data. Having to deal with those challenges, some suppliers, aggregators and equipment manufacturers are partnering to offer more consumer-adapted solutions that require minimum efforts from their clients. REstore, an aggregator acquired by Centrica, established a partnership with a Dutch electric boiler and heat pump manufacturer, Itho Daalderop, to install REstore’s control chip in their products. Through this partnership, household appliances can be connected to REstore’s FlexPond platform on a large scale through an Internet of Things (IoT) network without requiring any action from the end user. This logic is applicable to many other types of assets, such as batteries.

Regarding the economic benefits, here again the model needs to be simple in order to get consumers on board. Customers can get access to up-front discounts on the cost of assets (e.g., the purchase price of the boiler) or pay a fixed energy price over the year, taking into account the real consumption and the flexibility provided to the supplier and/or aggregator.

Adapted value propositions

Offerings and pricing models on the utility side need to evolve in order to engage the end user in the DSR journey.

Among the required evolutions is the need for time-of-use tariffs suited to distributed generation assets, associated with the installation of advanced metering infrastructure (AMI). Although static and dynamic time-of-use tariffs are already well developed in some markets, customized pricing structures according to customer behaviors is still nascent, especially at the residential level. With the emergence of new usages, retailers will have to be more and more creative in the design of their offerings. For instance, Centrica/British Gas has launched a new smart time-ofuse tariff that offers homeowners cheaper electricity overnight to charge their car.

Next to the need for attractive tailored offerings, up-front investment for distributed generation assets can represent an important cost for end users and therefore discouraging. Here again, creativeness can be a differentiator. Corporate power purchase agreements (PPAs) with advantageous terms for the end user, leasing models, renting of rooftops/fields by consumers to asset providers, sharing of usage of the asset with distribution of flexibility revenues and so forth are all forms of business models that can look more affordable to the client.

3

Nice but … can you make money!?

Although monetizing industrial and residential flexibility is nowadays technically and regulatory possible, the business case is not often obvious, neither for the VPP nor the end consumer.

Economic case for VPPs

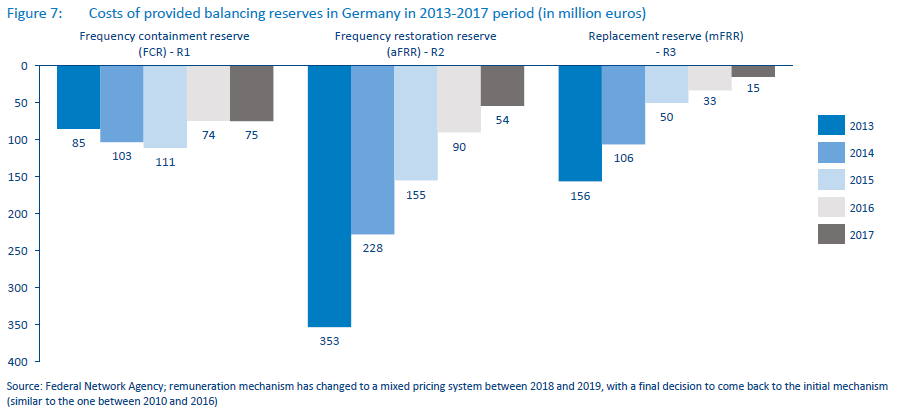

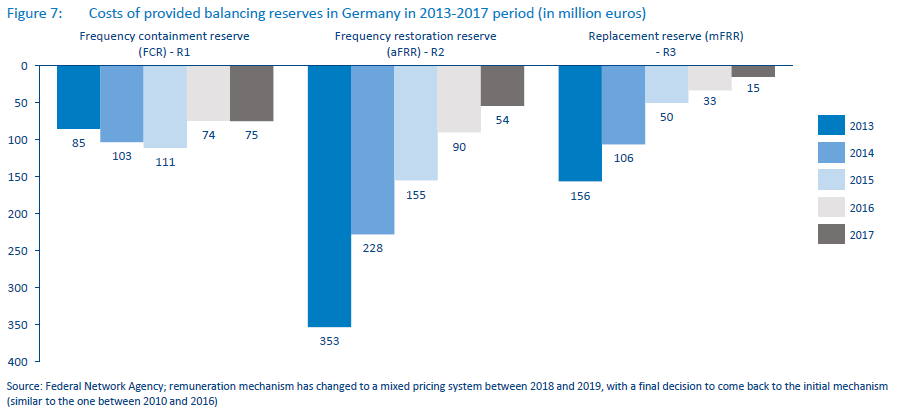

Although frequency regulation has historically been one of the most lucrative ancillary services, mature markets such as the UK, Germany and California have seen the value of such services decline over time, as illustrated by Figure 7. This is mainly explained by faster increased offerings of flexibility compared to demand. This phenomenon leads also to a split of the needed volume of flexibility across assets, diluting the value expected when making the business case.

In California, PA Consulting predicts that for a battery entering into service in 2021, a decline in ancillary service revenues is expected from over US $70/kW-year in 2021, to just over $10/ kW-year by 2027, as California’s regulation and reserve markets will become saturated with new investments.

Aggregators are therefore investigating additional sources of value, namely in wholesale markets, capacity market and balancing mechanisms, to stack revenues by leveraging flexibility from assets for multiple purposes. In December 2019, the UK Balancing Mechanism (BM) opened its doors to independent aggregators called, in that context, virtual lead parties (VLPs), without the need to be affiliated to a licensed energy supplier.

This means that smaller and distributed individual generation assets and aggregated loads can now access the BM directly, opening up a €1.2 billion market for DSR and flexible technologies. Flexitricity, a UK aggregator that entered the BM, has stated that on rare occasions, prices can reach €2,700/ MWh, compared to around €54/MWh in wholesale markets.

New sources of revenues are also expected from European scale projects such as the TERRE pan-European reserve market. More than 10 TSOs are participating in this market with the ambition to harmonize products and dispatch them by the end of 2020. This will lower the local need for flexibility by providing it cross-border, with the side effect that it will enable aggregators/ VPPs to tap into a far larger market.

These broader and new variety of revenue sources are necessary, considering the setup and baseline costs of the aggregation business in combination with the expected decline in value of the initial attractive sources of revenues. However, a diversified portfolio of distributed assets is also required, whose characteristics in terms of time of response, capacity and so forth will help in responding to the different natures of events on the grid.

SaaS: Source of stable revenues

Next to aggregating multiple sources of flexibility, some players also provide their VPP technical solutions under the SaaS model. Next Kraftwerke, sonnen, EnerNOC and Demand Energy (both owned by Enel), AutoGrid, Enbala, REstore (owned by Centrica) and tiko (owned by ENGIE) are all examples of players monetizing their solutions (rental or pay-per-use model) in order to generate stable and sustainable revenues. Tesla has just been granted an electricity generation license in the UK with the objective to develop VPPs in using its real-time trading and control platform, Autobidder. This will enable independent power producers and utilities to monetize their distributed assets, including batteries.

From an economical point of view, it seems that large retailers, most of whom acquired independent aggregators, will clearly have an advantage compared to the rest of the market. Besides the fact that customers are used to “discussing” energy matters with their retailers, independent aggregators need to spend a heavy budget in sales capabilities. Getting access to the end user on such technical topics is clearly not obvious. Many of these independent aggregators understood that challenge and accepted the synergy potential with larger retailers to complement their capabilities. We have assisted in a wave of consolidations in prior years, where companies such as Centrica, Enel, Shell, ENGIE, EDF and so forth made acquisitions of aggregators and their VPP platform. It seems clear that the aggregation business needs to be complementary to other types of services, such as energy supply, trading services and so on, and struggles to survive as a standalone business.

Benefits for end users

Costs savings and additional revenues for end users (i.e., industrial and commercial companies, households) will vary according to the inherent power reduction potential. Large industrials will be able to achieve notable cost savings. Next to cost savings, industries will also reduce their carbon emissions, with an additional positive impact on costs and brand.

For the household segment, reaching benefits seems a little bit more complex due to the costly up-front distributed asset investment, the lack of awareness of the DSR market and the smaller nominal cost savings to be achieved (i.e., limited flexibility volume). Incentives for households should therefore not solely consist of the potential for cost savings in the energy invoice. Instead, as mentioned earlier, equipment manufacturers (for boilers, heat pumps, whitegoods and so forth), the aggregator and/or the retailer should propose a joint investment in the asset or equipment. Such a value proposition could look more attractive to the end users and ensure a certainty for the aggregator to dispose of the equipment under certain conditions. For example, Portland General Electric (PGE) launched a pilot whose objective is to test the impact on the grid of connecting a large concentration of battery assets on one single substation. As part of the pilot, PGE installs 525 residential energy storage batteries to form a 4MW VPP. PGE incentivizes its end users by proposing an instant rebate on the cost of the battery, topped with a monthly bill credit of US $40 or $20.

What is clear is that aggregators will have to accept renouncing part of their margin and sharing it with the end consumers who will expect a much more significant return in exchange of flexibility, flexible behaviors and private data. After all this, a second wave of end users will need to be seduced to join the game.

4

What investors, independent aggregators and retailers need to keep in mind

- Markets and regulation are opening to distributed assets but are also changing fast, requiring excellent hedging strategies and flexible VPP solutions to adapt to new mechanisms and new geographies in order to deal with the fragmented growth in the market.

- Diversification of sources of revenues is key. The VPP portfolio of assets should therefore be diversified in order to access as many sources of revenues as possible from wholesale markets to capacity markets to ancillary services to BM – not only at the local level, but at a regional level across markets.

- Engaging the end user in the DSR journey starts when purchasing the distributed asset or equipment (e.g., electric boiler). For that reason, partnerships along the entire value chain (e.g., with equipment manufacturers) seems paramount to be technically capable to access flexibility from this equipment and to secure contact with end customers.

- Committing on a fixed cost saving will convince end users, who are typically not well educated to the flexibility market, to indirectly participate.

- The most suited player in the energy value chain to get access to the end user is definitely the energy retailer. However, although the end-user relationship is present, retailers may lack the technology to make it happen and thus need to resort to an acquisition to enter the market.

DOWNLOAD THE FULL REPORT

18 min read • Energy, Utilities & Resources

Distributed flexibility: The next pool of value

Enabled by easier energy market access and simpler end-user solutions, distributed flexibility is the next pool of value for energy players

DATE

Executive Summary

A shift in the energy mix due to increasing intermittent generation assets requires system operators to source more flexibility every year to ensure security of supply. In some regions of the world, like India, the International Energy Agency (IEA) predicts growth in flexibility need up to almost 600% by 2040 compared to 2018 needs. To date, large and traditional generation assets have provided most of the flexibility supply to network operators. Although this will extend in the coming years, distributed assets (not only generation-side) are now entering the game.

With the continued decrease in cost curves for distributed assets, such as solar power and batteries, a further rise of those assets is expected to occur, representing important resources of flexibility for network operators, which are opening their markets and “balancing products” to aggregators and any new technology capable of providing flexibility. In that context, behind-the-meter (BtM) batteries, electric vehicles (EVs) and heating ventilation and air conditioning (HVAC) systems can play a crucial role in providing grid stability, considering their forecasted penetration in the next two decades.

Energy market actors have understood this trend and the value in sourcing flexibility from distributed assets. Energy suppliers, independent aggregators, software providers and asset manufacturers are preparing themselves for two things at the same time:

- Being technically capable to get access to the flexibility that these distributed assets can provide.

- Adapting their value propositions to engage the customer in a complex technical process where the end user’s credo is simplicity.

Although technical and marketing parameters seem to be more or less under control, one remains challenging: profit!

As competition grows and the supply of flexibility rises year after year, there will likely be a decline of some revenues, such as those for ancillaries. This makes the business case very complex for the virtual power plant (VPP) owners that will have to search for additional revenue streams and will need to continue investing in their aggregation platform in order to get access to those increasingly fragmented revenue sources. Among successful aggregators, some provide a software-as-a-service (SaaS) solution, allowing them to access more and stable sources of revenue.

The situation is much more complex for independent aggregators than for retailers, given their lack of access to the client base. Nevertheless, retailers will need to unlock extra budget to imagine new routes to get access and convince end consumers to participate in this market. This is one of the reasons why many independent aggregators were acquired by large retailers (e.g., Restore by Centrica, Enernoc by Enel and Limejump by Shell) as they themselves were not agile enough to quickly set up or continuously adapt their own VPP technical solution internally.

From a customer point of view, at first sight, avoided costs on the monthly bill due to the provision of flexibility can appear very limited, so the question is, “Why bother?” Therefore, many players are working on new partnership models where aggregators and equipment manufacturers work together to provide either a discount on the value of an asset (e.g., electric boiler) in exchange for flexibility and/or offer a discount on the annual energy bill.

We offer the following key takeaways for executives:

- Since flexibility as a standalone activity is not very lucrative, independent aggregators are struggling, and most have been acquired by large retailers that have searched for cross-selling potential for their existing client base.

- In this “new normal,” the next battle is about getting access to end-user flexibility – via new retailer/aggregator combinations; such client access may appear easy, but the complexity to make it happen remains high, requiring creative and transparent business models.

- Some flexibility value must be “returned to the customer.” Required margin sharing will be needed to activate end consumers in the flexibility pool, which will likely stress the business case, at least during ramp-up of this new business model. Customers need to be seduced!

1

Increasing decentralized capacity for a growing need of flexibility

In its continuous transformation journey, the energy sector, and more specifically grid operators, face challenges stemming from increasing electrification and the rising penetration of renewables in the generation mix. These trends call for more power on the grid to respond to increasing demand as well as for alternative capacity that is capable of managing the intermittency of renewable sources of energy. In other words, flexibility is required to support network operators in their role of balancing supply and demand in real time. The International Energy Agency (IEA) anticipates an increasing need of flexibility in all regions of the world by 2040 (see Figure 1). Some markets will be more attractive than others, depending on many variables, including capacity mix, market design and regulatory enablement of flexibility, incentives available for renewable generation and distribution assets, price of electricity and so forth.

Although conventional generation assets can typically provide the required flexibility, new forms of decentralized flexibility are on the rise, both on the supply and demand sides. This changing energy mix has been incentivized by governmental subsidies and decreasing asset costs, while governments in some regions of the world such as Europe have decided to progressively shut down some traditional types of generation assets such as coal.

We identify three main sources of decentralized assets as promising for sourcing flexibility, given their expected growth in the coming years: (1) behind-the-meter (BtM) batteries, (2) electric vehicles (EVs) and (3) heating ventilation and air conditioning (HVAC) systems, including heat pump assets (see Figure 2). These can represent great value to network operators.

Indeed, some grid companies are in the process of designing the flexibility market in such a way as to enable both industrial and residential load in order to actively participate in the provision of flexibility.

As an illustration, UK Power Networks (UKPN), one of the UK’s largest distribution network operators, awarded contracts for 123MW of flexible power for a value of €15m in June 2020. The contracted flexibility comes from distributed generation and batteries as well as domestic flexibility from virtual power plants (VPP) aggregating heat pumps, household batteries and EVs.

Behind-the-meter batteries

Installed at industrial and commercial sites or in households, BtM batteries are typically used to optimize past or future investment in renewable generation assets and get access to cheaper electricity when market prices are high, or to store electricity during negative prices periods.

Although the majority of storage capacity will be utility-scale by the mid-2030s, BtM applications are expected to overtake in volume terms by 2040.

While China and the US will clearly lead the trend, some markets in Europe will also be very active in battery deployment. The UK and German markets, for example, will heavily invest in BtM batteries, while the Italian and Spanish markets plan to equally invest in BtM and front-of-the-meter (FtM) batteries.

In all geographies represented in Figure 3, it is interesting to note that in 2040 battery capacity will represent, at minimum, 10% of the total 2019 installed power capacity

Electric vehicles

Used in the same way as a stationary battery, will see its owners incentivized to release power onto the grid when the grid needs it (vehicle-to-grid [V2G]), or (not) to charge their vehicle at specific times of the day. Notably, IEA expects e-mobility to expand at a rapid pace with an overall shift to EVs, accelerating from 2025 onwards (see Figure 4).

Although EV penetration will rise in all regions of the world, as shown in Figure 5, some countries are more or less on the forefront in the deployment of charging stations and in support to EVs. In Europe specifically, Norway, the Netherlands and Sweden are currently the countries where EV share of new car registrations is the highest, while the opposite is true for countries such as Belgium, Germany, France, Spain and Italy (all below 3.5 percent of EV share of new car registrations in 2019). Those differences in Europe are mainly explained by the attractiveness of incentives and/or subsidies (not) put in place by some markets.

Implications of local authorities is key in the development of charging stations. In the US, in particular, California is the state with the lowest number of people per charging point, which is explained by the commitment of different California cities to provide the best infrastructure as a way to increase the use of zero-emission cars.

Since EV penetration is growing, the main energy players are currently setting forth plans to have an active role in e-mobility, which includes developing smart charging solutions. Some players have embarked on joint venture (JV) opportunities. For example, French energy group EDF has established a JV with Californian startup NUVVE called DREEV.

The objective is clear: become a leader in the smart charging market, enable the charge/discharge of EVs and regulate the speed of charging remotely according to network tensions. Although many of these initiatives are in pilot mode, others are quite well developed. Vandebron in the Netherlands, for instance, stops and restarts the charging stations of some clients to provide automatic frequency restoration reserve to electricity transmission system operator TenneT.

Heating, ventilation and air conditioning systems

Controlled to shift energy consumption to off-peak times, HVAC systems are expected to grow by 4 percent CAGR between 2020 and 2030 according to PSMarket research, driven by the megatrends of urbanization and the emergence of energyefficient HVAC systems. Another major factor creating more demand is climate change and the increasing unpredictable climatic conditions and extreme temperatures.

HVAC will be, next to EVs, one of the top drivers for global electricity demand and in reducing carbon emissions in the next few decades. Already today, according to the IEA, air conditioning and electric cooling fans account for nearly 20 percent of electricity used in the world’s buildings and is one of the most critical blind spots in today’s energy debate.

HVAC and, by extension, other electrical appliances can, and are, used in demand-side response (DSR) programs to maintain stability in the grid and save energy for their owners. Enrolling these devices into DSR programs is already standard practice in the industrial and commercial (I&C) sector. Take, for example, the US, where according to the 2018 Smart Electric Power Alliance survey, two-thirds of I&C demand response came from deferring loads from lighting, HVAC and pumps, totaling 8GW of capacity deferred. Note that these are customer-initiated programs. In more recent years, we have seen a surge in automated smart control.

What about the residential sector? Homeowners are often more difficult to educate and convince of the benefits of letting third parties take control over their HVAC or heat pump installations. Hence, this segment knows a lower participation in DSR activity. The rise of Wi-Fi–connected smart thermostats, pioneered by Nest in 2013 and followed by players such as Honeywell and Ecobee, however, have lowered the barriers significantly for residential consumers to sign up with DSR programs. Not only do smart devices allow automated control by third parties, it also gives customers a greater sense of control over their use of energy through mobile access to data (e.g., apps, text message alerts). They value alerts that provide information about high energy use or demand response events. Moreover, the utilities themselves are bringing more awareness to customers, launching programs such as “Bring Your Own Thermostat (BYOT)” (e.g., EnergyHub, SRP), “Smart Therm” (SoCalGas) and many others, under which customers receive immediate cashbacks upon installing smart thermostats and allowing the utility to either use switch-based or fully automated control.

The smart devices revolution pays off; for example, in the US – where in 2018 over 5 million consumers were enrolled in a DSR program, either through traditional switch-based DSR (utility deciding to switch the device on/off) or through behavioral programs – giving customers cues to reduce their consumption. Consequently, just shy of 5GW of capacity was enrolled in DSR programs according to EUCI, which starts to represent a significant share in total DSR-enrolled capacity in the US.

Other markets are sure to follow. With the proliferation of the middle class in China, already the largest HVAC market in the world, it will be just a matter of years before market reform fully enables DSR in the residential sector.

2

Proliferation of VPPs mostly eased by market conditions

While most of the flexibility has been traditionally provided by conventional generation assets, forecasted evolution of distributed generation assets will undeniably favor the development of VPPs at residential, commercial and industrial levels (see Figure 6). Indeed, millions of assets will be required for aggregation in order to be technically and commercially able to provide flexibility to the grid. Some initiatives worldwide have already been developed to anticipate the volume of flexibility that soon will be available in large volumes.

While in the past it was quite challenging for aggregators to get access to the wholesale, ancillary and balancing markets due to a number of market design constraints,2 conditions of participation for aggregators are improving. This is facilitated by the emergence of new flexibility platforms led, for example, by distribution network operators. As an illustration, UKPN’s most recent tender was offering longer-term contracts to flexibility providers than the previous tenders, enabling them to have better visibility on their expected revenues and therefore on the viability of their model.

Although there is, of course, still plenty of room to improve market conditions for industrial and domestic flexibility, many markets are taking actions proactively to review their market design. Italy’s transmission system operator Terna, for instance, has undertaken pilots to diversify and increase sources of flexibility on the supply and demand sides to stimulate and create this market proactively

One critical element here is the uncertainty related to market design and regulation evolution. A simple change can prevent aggregators getting access to revenues they were relying on. A perfect illustration is the temporary suspension of the capacity market in the UK. Many flexibility providers were suddenly deprived from revenues that made their business viable. That’s why hedging strategies and aggregation solutions flexible enough to access multiple revenue streams are paramount to secure a sustainable business.

Simplicity for end consumers

Proactively managing energy consumption can seem counterintuitive for households. On top of educating the end consumer on the flexibility market and the benefits it can bring, trust needs to be established between the consumer and the aggregator or supplier to allow access to user devices and personal consumption data. Having to deal with those challenges, some suppliers, aggregators and equipment manufacturers are partnering to offer more consumer-adapted solutions that require minimum efforts from their clients. REstore, an aggregator acquired by Centrica, established a partnership with a Dutch electric boiler and heat pump manufacturer, Itho Daalderop, to install REstore’s control chip in their products. Through this partnership, household appliances can be connected to REstore’s FlexPond platform on a large scale through an Internet of Things (IoT) network without requiring any action from the end user. This logic is applicable to many other types of assets, such as batteries.

Regarding the economic benefits, here again the model needs to be simple in order to get consumers on board. Customers can get access to up-front discounts on the cost of assets (e.g., the purchase price of the boiler) or pay a fixed energy price over the year, taking into account the real consumption and the flexibility provided to the supplier and/or aggregator.

Adapted value propositions

Offerings and pricing models on the utility side need to evolve in order to engage the end user in the DSR journey.

Among the required evolutions is the need for time-of-use tariffs suited to distributed generation assets, associated with the installation of advanced metering infrastructure (AMI). Although static and dynamic time-of-use tariffs are already well developed in some markets, customized pricing structures according to customer behaviors is still nascent, especially at the residential level. With the emergence of new usages, retailers will have to be more and more creative in the design of their offerings. For instance, Centrica/British Gas has launched a new smart time-ofuse tariff that offers homeowners cheaper electricity overnight to charge their car.

Next to the need for attractive tailored offerings, up-front investment for distributed generation assets can represent an important cost for end users and therefore discouraging. Here again, creativeness can be a differentiator. Corporate power purchase agreements (PPAs) with advantageous terms for the end user, leasing models, renting of rooftops/fields by consumers to asset providers, sharing of usage of the asset with distribution of flexibility revenues and so forth are all forms of business models that can look more affordable to the client.

3

Nice but … can you make money!?

Although monetizing industrial and residential flexibility is nowadays technically and regulatory possible, the business case is not often obvious, neither for the VPP nor the end consumer.

Economic case for VPPs

Although frequency regulation has historically been one of the most lucrative ancillary services, mature markets such as the UK, Germany and California have seen the value of such services decline over time, as illustrated by Figure 7. This is mainly explained by faster increased offerings of flexibility compared to demand. This phenomenon leads also to a split of the needed volume of flexibility across assets, diluting the value expected when making the business case.

In California, PA Consulting predicts that for a battery entering into service in 2021, a decline in ancillary service revenues is expected from over US $70/kW-year in 2021, to just over $10/ kW-year by 2027, as California’s regulation and reserve markets will become saturated with new investments.

Aggregators are therefore investigating additional sources of value, namely in wholesale markets, capacity market and balancing mechanisms, to stack revenues by leveraging flexibility from assets for multiple purposes. In December 2019, the UK Balancing Mechanism (BM) opened its doors to independent aggregators called, in that context, virtual lead parties (VLPs), without the need to be affiliated to a licensed energy supplier.

This means that smaller and distributed individual generation assets and aggregated loads can now access the BM directly, opening up a €1.2 billion market for DSR and flexible technologies. Flexitricity, a UK aggregator that entered the BM, has stated that on rare occasions, prices can reach €2,700/ MWh, compared to around €54/MWh in wholesale markets.

New sources of revenues are also expected from European scale projects such as the TERRE pan-European reserve market. More than 10 TSOs are participating in this market with the ambition to harmonize products and dispatch them by the end of 2020. This will lower the local need for flexibility by providing it cross-border, with the side effect that it will enable aggregators/ VPPs to tap into a far larger market.

These broader and new variety of revenue sources are necessary, considering the setup and baseline costs of the aggregation business in combination with the expected decline in value of the initial attractive sources of revenues. However, a diversified portfolio of distributed assets is also required, whose characteristics in terms of time of response, capacity and so forth will help in responding to the different natures of events on the grid.

SaaS: Source of stable revenues

Next to aggregating multiple sources of flexibility, some players also provide their VPP technical solutions under the SaaS model. Next Kraftwerke, sonnen, EnerNOC and Demand Energy (both owned by Enel), AutoGrid, Enbala, REstore (owned by Centrica) and tiko (owned by ENGIE) are all examples of players monetizing their solutions (rental or pay-per-use model) in order to generate stable and sustainable revenues. Tesla has just been granted an electricity generation license in the UK with the objective to develop VPPs in using its real-time trading and control platform, Autobidder. This will enable independent power producers and utilities to monetize their distributed assets, including batteries.

From an economical point of view, it seems that large retailers, most of whom acquired independent aggregators, will clearly have an advantage compared to the rest of the market. Besides the fact that customers are used to “discussing” energy matters with their retailers, independent aggregators need to spend a heavy budget in sales capabilities. Getting access to the end user on such technical topics is clearly not obvious. Many of these independent aggregators understood that challenge and accepted the synergy potential with larger retailers to complement their capabilities. We have assisted in a wave of consolidations in prior years, where companies such as Centrica, Enel, Shell, ENGIE, EDF and so forth made acquisitions of aggregators and their VPP platform. It seems clear that the aggregation business needs to be complementary to other types of services, such as energy supply, trading services and so on, and struggles to survive as a standalone business.

Benefits for end users

Costs savings and additional revenues for end users (i.e., industrial and commercial companies, households) will vary according to the inherent power reduction potential. Large industrials will be able to achieve notable cost savings. Next to cost savings, industries will also reduce their carbon emissions, with an additional positive impact on costs and brand.

For the household segment, reaching benefits seems a little bit more complex due to the costly up-front distributed asset investment, the lack of awareness of the DSR market and the smaller nominal cost savings to be achieved (i.e., limited flexibility volume). Incentives for households should therefore not solely consist of the potential for cost savings in the energy invoice. Instead, as mentioned earlier, equipment manufacturers (for boilers, heat pumps, whitegoods and so forth), the aggregator and/or the retailer should propose a joint investment in the asset or equipment. Such a value proposition could look more attractive to the end users and ensure a certainty for the aggregator to dispose of the equipment under certain conditions. For example, Portland General Electric (PGE) launched a pilot whose objective is to test the impact on the grid of connecting a large concentration of battery assets on one single substation. As part of the pilot, PGE installs 525 residential energy storage batteries to form a 4MW VPP. PGE incentivizes its end users by proposing an instant rebate on the cost of the battery, topped with a monthly bill credit of US $40 or $20.

What is clear is that aggregators will have to accept renouncing part of their margin and sharing it with the end consumers who will expect a much more significant return in exchange of flexibility, flexible behaviors and private data. After all this, a second wave of end users will need to be seduced to join the game.

4

What investors, independent aggregators and retailers need to keep in mind

- Markets and regulation are opening to distributed assets but are also changing fast, requiring excellent hedging strategies and flexible VPP solutions to adapt to new mechanisms and new geographies in order to deal with the fragmented growth in the market.

- Diversification of sources of revenues is key. The VPP portfolio of assets should therefore be diversified in order to access as many sources of revenues as possible from wholesale markets to capacity markets to ancillary services to BM – not only at the local level, but at a regional level across markets.

- Engaging the end user in the DSR journey starts when purchasing the distributed asset or equipment (e.g., electric boiler). For that reason, partnerships along the entire value chain (e.g., with equipment manufacturers) seems paramount to be technically capable to access flexibility from this equipment and to secure contact with end customers.

- Committing on a fixed cost saving will convince end users, who are typically not well educated to the flexibility market, to indirectly participate.

- The most suited player in the energy value chain to get access to the end user is definitely the energy retailer. However, although the end-user relationship is present, retailers may lack the technology to make it happen and thus need to resort to an acquisition to enter the market.

DOWNLOAD THE FULL REPORT