13 min read • Energy, Utilities & Resources

Case study: A new era in building offshore grid connections

TSO TenneT builds partnerships to unleash supply market growth

INTRODUCTION

As the need intensifies to build an energy infrastructure that helps meet increasingly ambitious targets on our way to net zero, companies in the sector are having to look afresh at how they deliver these complex and capital-intensive projects. Consequently, electricity infrastructure companies must reinvent their relationships with suppliers. Sourcing strategies are being revamped to push toward more long-term contract security. This goes along with standardizing technical components, procurement methods, and approaches to project delivery.

This report presents a case study of the Netherlands-based transmission system operator (TSO) TenneT and its approach to delivering a network infrastructure to bring power from offshore wind farms to shore in a rapidly expanding offshore wind market.

1

EUROPE’S TRANSFORMING ENERGY LANDSCAPE

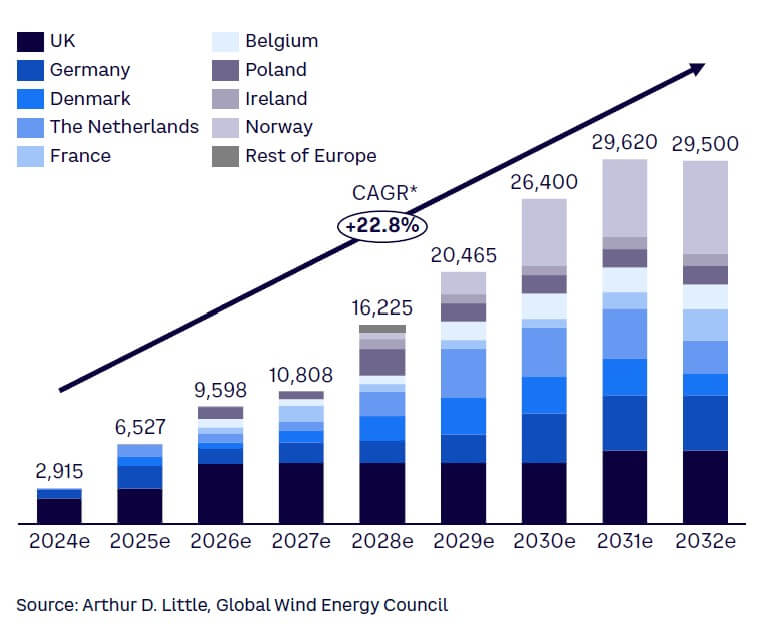

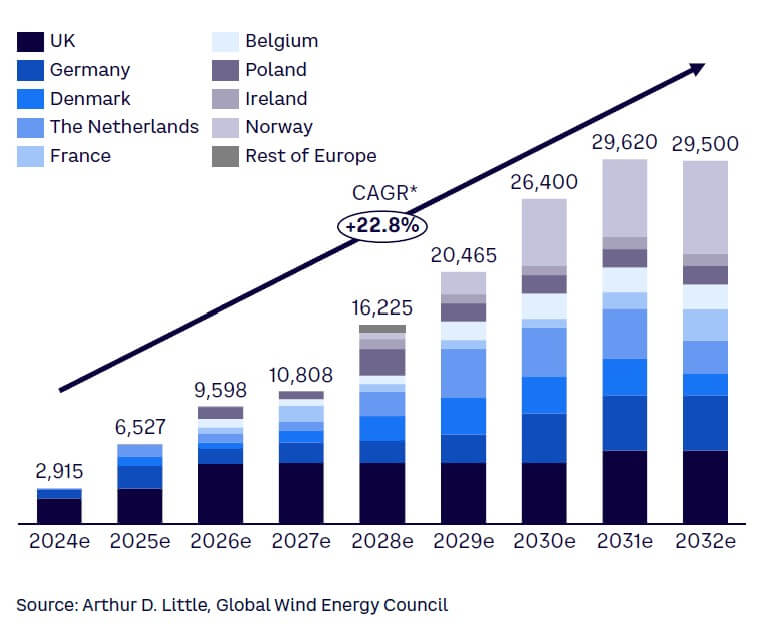

The energy landscape in Europe is undergoing a profound transformation, driven by the growing need to decarbonize and a desire for greater energy independence. For example, nine North Sea countries have committed to transform the region into a green powerhouse by harnessing offshore wind energy, as set out in the Esbjerg Declaration signed by Germany, Belgium, Denmark, and the Netherlands in May 2022. Under this pivotal agreement, the region will increase its offshore wind capacity to at least 150 GW per year by 2050. This requires a significant ramp-up in European offshore wind installations (see Figure 1), from ~5 GW per year in 2023 to more than 25 GW by 2030.

The Netherlands-based transmissions system operator (TSO) TenneT is among the organizations responsible for bringing this offshore power to land. As one of Europe’s largest grid operators, TenneT serves 43 million customers in the Netherlands and Germany within a 25,000 km network.

Like all TSOs, TenneT’s role requires it to ensure existing assets can meet energy needs in the short term (energy system operation and balancing) while planning and investing in infrastructure to meet future energy requirements (transmission capacity). So central is their role in ensuring reliable, efficient electricity transmission across power grids that TSOs often are referred to as the heart and veins of the energy industry.

However, increasingly ambitious net-zero targets are testing every European TSO’s ability to deliver the complex, CAPEX-intensive, technically challenging infrastructure needed.

This is especially true for grid connection systems that bring power from offshore wind farms to shore, which are experiencing compressed timelines and expectations of increased GW and numbers of offshore turbines being installed, many aiming at the same target year of 2030. In essence, a vast amount of projects is expected to be built much sooner than previously expected.

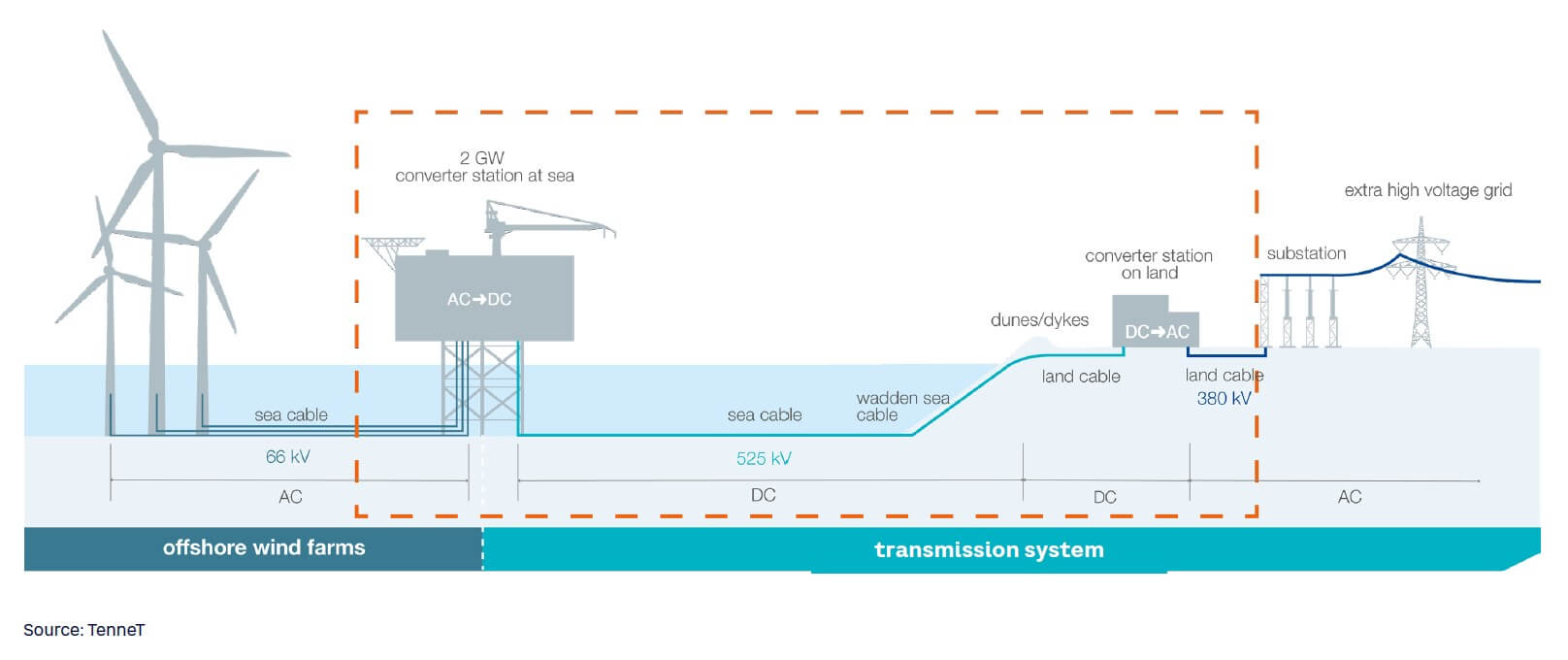

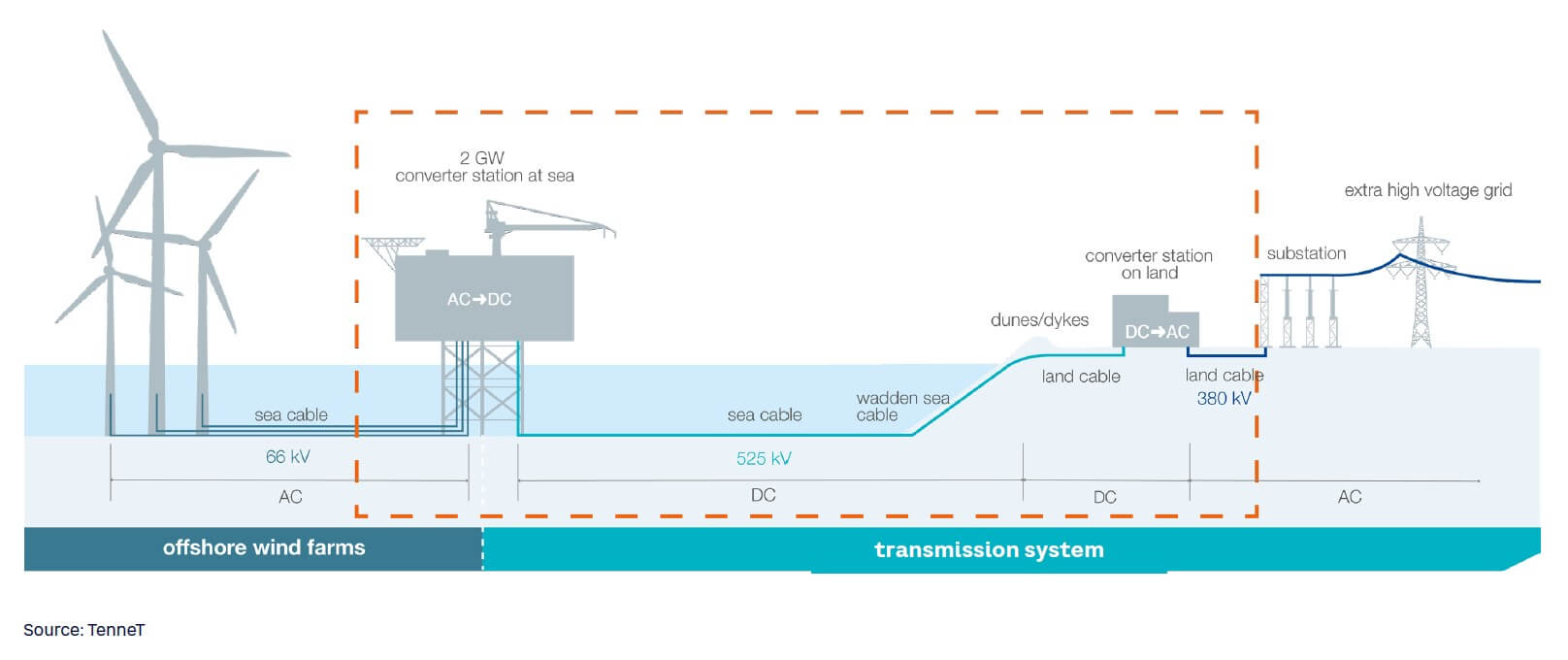

This has created considerable pressure in multiple areas, including financing, planning and permits, technology, supply chains, backup infrastructure, and energy storage. In TenneT’s case, it means increasing the number and size of offshore grid connection systems that it builds every year while keeping optimal total expenditure in mind. Between 2023 and 2031, TenneT plans to build and commission 14 offshore wind grid connection systems, increasing its newly connected offshore wind power from an average of 1 GW per year to ~8 GW per year by 2030. Figure 2 illustrates a schematic of TenneT’s offshore grid connection system.

2

DESIGN ONE, BUILD MANY

The acceleration in offshore wind generation described in Chapter 1 gave rise to TenneT’s 2GW Program, aimed at developing offshore grid connection systems with a capacity of 2 GW each, based on a 525 kV high voltage direct current (HVDC) system voltage. The program that began in 2018–2020, anticipated the growing need for grid connection systems long before the exact projects were announced. The larger size (previous DC systems were 900 MW and AC systems were 700 MW) was designed to reduce the number of systems needed to address the growing complexity of accommodating and permitting offshore cable routes.

Throughout, TenneT leveraged its experience in delivering offshore grid connection systems by (1) engaging in an engineering partnership with suppliers for both cables and converter stations, and (2) developing a prequalification system for cables. Standardization of offshore grid connections to ensure consistency and efficiency across its offshore projects was central to the successful implementation of the 2GW Program. TenneT calls this its “1 Platform, 1 Cable, 1 Contract” design.

This approach streamlines engineering processes, fosters replicability, and simplifies project management. Standardized is also the contract design — in the wind industry, International Federation of Consulting Engineers (FIDIC) contracts are standard. Using this industry standard contract design helps create a cohesive and comprehensive framework for collaboration with suppliers across tiers. By standardizing key aspects of its operations, TenneT created a foundation for a more resilient, adaptable, and collaborative energy infrastructure that aligns with the goals of the energy transition.

Using a standardized approach, each project can be delivered in the same structured way, and learnings can be passed on from one project to another. This type of continuous improvement leads to greater process efficiency and helps TenneT make the best use of scarce resources.

Notably, TenneT committed to the lowest overall cost (TOTEX), accepting higher CAPEX where OPEX savings outweighed the investment (taking into account the specificities of the connected offshore wind farms). For example, standardizing the operation and maintenance of platform cooling systems not only lowers costs, it also leads to improvements in occupational health and safety.

3

MAJOR CHALLENGES

TenneT has considerable experience in smaller offshore and onshore projects, but not all of this knowledge directly translates into the delivery of complex, CAPEX-intensive infrastructure being built in a technically challenging environment. For example, to get power to land in this region, offshore wind cables must negotiate sensitive, challenging areas like the Wadden Sea — the world’s largest expanse of tidal mudflats along the coasts of Denmark, Germany, and the Netherlands — and other morphologically dynamic areas.

With offshore projects being built further out to sea, energy losses are becoming a significant concern. Generally, many offshore wind projects use AC technology, but this is uneconomic over longer distances. This necessitates a switch to HVDC, a technology TenneT has already used in its German offshore projects. This switch to a less mature technology, particularly due to an increase in unprecedented size and voltage (2 GW and 525 kV), results in more pressure on already challenged supply chains.

Tendering is another concern. Historically, offshore projects were smaller, less frequent, and involved many “unknown unknowns,” making them high-risk ventures with unpredictable outcomes. Because these projects regularly experienced cost or time overruns, companies gained a great deal of knowledge about pricing and their own risk appetite.

These “old” risks are now better understood, but companies now face “new” risks; for example, trying to accurately evaluate projects that are not only larger and more complex, but potentially subject to an unusually volatile commercial market and changing political and regulatory environments. Unsurprisingly, many suppliers have little appetite for embarking on expensive and complex tendering processes to win contracts that ultimately may not prove profitable and could lead to lengthy claims and litigation procedures.

4

THE VALUE OF PREDICTABILITY

To reduce uncertainty for its suppliers, TenneT has moved away from tendering individual projects. Instead, it’s bundling them in portfolios being executed in convoys. The resulting high-volume orders, with contracts that can last between 10 and 14 years, give suppliers the certainty they need to more confidently invest in capital-intensive manufacturing and installation capacity. They know they will be able to justify their initial costs.

With the pace, size, and complexity of new projects making individual tendering more challenging, neither suppliers nor TSOs want to face expensive, time-consuming and resource-intensive tendering processes several times a year. Eliminating this frees up much needed resources that can be used in project delivery.

Bundling also lets suppliers use a convoy approach to manufacturing, in which new assets are installed sequentially. Here, TenneT was inspired by the oil and gas industry, where studies suggest that standardization can lead to savings of more than 20%, and increase delivery probability by 15%, provided at least four orders are completed the exact same way. Market scarcity, in combination with very large portfolios, could make realizing such cost reductions difficult, however.

Although bundling gives suppliers greater certainty on whether or not to invest, it introduces risks related to projects beginning more than five years into the future. Large orders are also more difficult to finance for suppliers, both internally and externally, as bonds and guarantees may be needed to offset the risk of unsatisfactory performance or business continuity. The sheer size of portfolios, and even single projects, leads to a heightened risk of default and added financial risk to contractors and their supply chains.

Suppliers must balance their customer portfolio between the certainty of working with large, familiar customers and the risk of becoming dependent. For example, bundling increases risks related to buyer-side problems such as projects being cancelled because of internal issues or external events such as changes in the political or legislative environment.

Conversely, once all portfolios in a large tender are allocated, there is a danger that TSOs will lock out certain suppliers for years to come, damaging relationships that had been fostered over many years. Hence, large bundles increase mutual dependency and create the need for new ways of cooperation.

5

SUPPLY CHAIN SCARCITIES

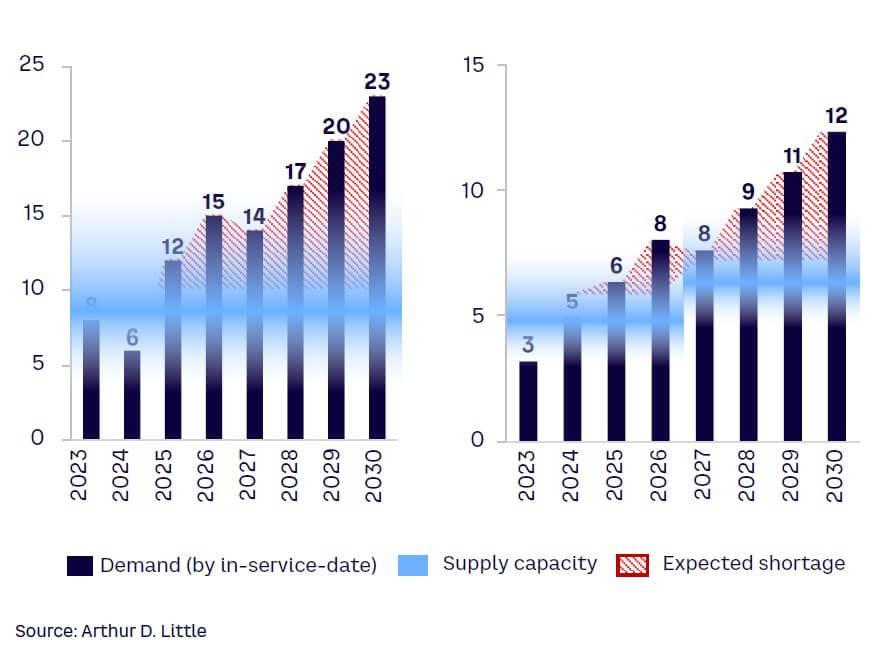

There are only six manufacturers of 525 kV HVDC cable technology (Prysmian, NKT, Nexans, LS Cable, Sumitomo, and Hellenic) and only three Western manufacturers of HVDC converters (Siemens Energy, Hitachi, and GE). Considering current manufacturing capacities, supply shortages can be expected as soon as 2025/2026.

Such shortages reflect a wider problem that infrastructure companies are becoming familiar with: having to compete with the demand needs of other infrastructure-building companies for the services of a small number of companies that are both willing and can actually do the work because they have the right mix of qualified employees and the equipment required to complete a project (or are prepared to invest in it). Substantial growth is needed in the supply market, but suppliers find it difficult to invest in new capacity due to the significant amounts of up-front CAPEX needed and a lack of qualified personnel (a problem across Europe and the Americas).

This means there are product and personnel scarcities all along the supply chain, from HVDC cables and offshore platforms to transport, installation, civil engineering, and construction.

We can expect to see a supply shortage of HVDC platforms globally beginning this year. Europe’s energy transition is in danger of being held back unless new capacity is somehow created, either by fresh players coming into the market or incumbents being able to invest in new capacity.

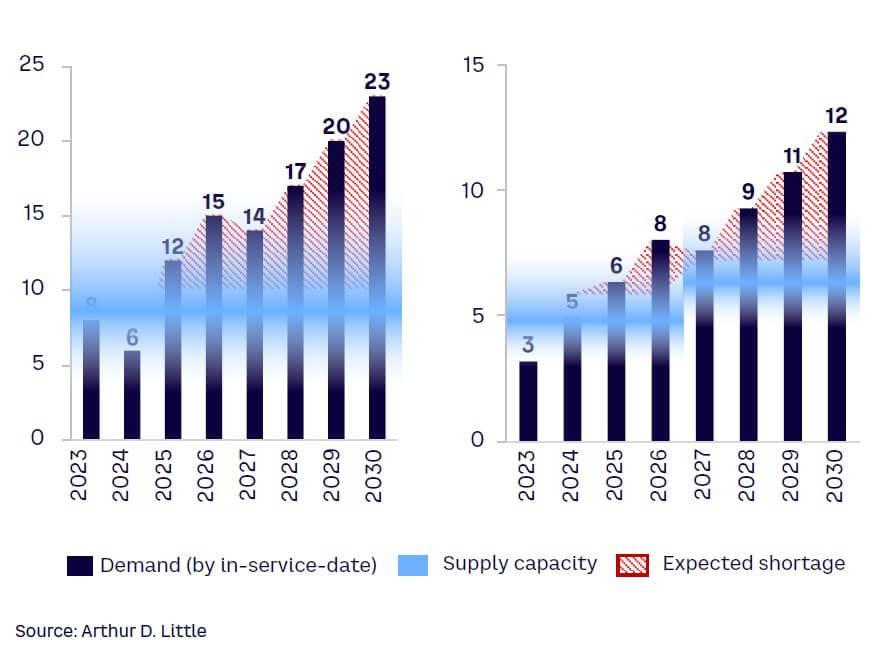

In 2021, having made steady progress in setting up its 2GW Program and on the verge of publishing several multi-billion-euro tenders, TenneT found itself in a tough spot. Comparing the size of its own portfolio alongside the demands of other players with existing capacity in the supply markets, the market shortage became clear and TenneT was at risk of not being able to secure enough capacity for the grid connection system projects it had planned up to 2031 (see Figure 3).

As a key enabler of the energy transition, TenneT was also mindful of not locking up all existing capacities — this would leave other TSOs and buyers unable to secure their needs and likely hold back investment in offshore wind, slowing the energy transition.

TenneT was faced with continuing its approach and risking not being able to secure capacities or attempting to outcompete other buyers for capacity, risking impeding progress in offshore wind and possibly incurring reputational damage.

Even if it chose the latter, the size of TenneT’s portfolio might have become a drawback (when supply markets are constrained and only a limited number of suppliers can take part in a tender, large orders are not necessarily preferred over small ones).

6

CREATING MEANINGFUL PARTNERSHIPS

For TenneT, the key to addressing these challenges was building closer relationships with its suppliers, moving beyond transactional relationships in which buyers focus on achieving the lowest price and ensuring contracts are followed to the letter. Instead, it aims to establish partnerships, encouraging open discussions from the beginning that lead to a mutual understanding of each organization’s objectives, challenges, and risk perceptions.

This type of early engagement allows TenneT to create project combinations that either appeal to specific suppliers or are attractive enough to appeal to a range of suppliers. This creates competition and encourages bidding, even for projects technically difficult or uncertain. These portfolios can be flexibly redefined before or during the tendering process to account for potential interest.

TenneT sets up its contracts as full partnerships in which the relationships between both the organizations and the people in charge are as important as traditional contractual mechanisms. Once the contract is signed, a partnership board is established to ensure TenneT and its suppliers are aligned at all levels, including the C-suite. The board convenes regularly to provide a frequent 360-degree review of the relationship’s performance. Potential risks are identified so they can be addressed and prevented throughout the contract’s duration, avoiding lengthy claims and litigation processes that add to the cost of contract management.

At the core of the collaborative contracts are risk-sharing mechanisms, including price adjustment. Agreements to work jointly on R&D projects, share engineering resources, undertake collaborative investment in new ventures, and set up cooperative programs with academic institutions aimed at growing capacity long-term and closing skills gaps may also be included. The long-term cooperation also allows realizing nonmonetary benefits in areas such as health/safety/environment and corporate social responsibility. The contractual mechanisms then need to be anchored in the organization and culture, as shown in Figure 4.

This approach helps create a reservoir of knowledge that all parties can access, fostering innovation throughout the value chain, reducing costs from duplication, and encouraging problems to be seen as joint challenges. For example, close collaboration between engineering teams reduces the need for feedback loops so synergies can be realized more quickly.

When innovative solutions are required for future offshore wind farm connections and country-to-country interconnector cables, rather than being treated as separate engineering projects, they can be tackled jointly by partners from conceptualization to initial testing. This creates stability along the supply chain, just what contractors need to see before making capital-intensive investments. Buyers that offer these benefits are seen as attractive partners to sell to, a crucial advantage in a market characterized by constrained supply chains. There is also a trickle-down effect, with learnings spread to sub-suppliers, workforces, and financing entities.

This approach, in which suppliers and buyers collaborate to positively impact the wider ecosystem (dubbed “ecosystem thinking”), recognizes the growing financial risks and commercial stresses associated with major energy projects and fits neatly with TenneT’s wider role of engaging with industry associations and international organizations like ENTSO-E and ACER, as well as developing international technical and environmental standards within the industry, and with national and international authorities and regulators.

7

WIN OR LOSE TOGETHER

Moving away from transactional contract dynamics will involve a significant cultural change. New governance bodies, joint initiatives, and shared goals could help, encouraging players to prioritize long-term benefits for all over short-term advantages for some. The pandemic, the war in Ukraine, and the recent energy crisis were certainly not on anyone’s radar, but with relational contracts in place, unexpected events can be dealt with more fluidly and without the need for litigation so characteristic of transactional relationships.

TenneT’s approach has already been shown to benefit not only the company but also other TSOs and buyers. In 2023, TenneT successfully awarded partnership contracts to suppliers, installers, and consortia to deliver 14 offshore wind grid connection systems until 2031, the culmination of a program that began in 2018 and required multiple contributing resources in many departments along the way. Moreover, the 2GW Program standard has positively impacted other TSO projects in Germany and beyond, both onshore and offshore.

There are still risks, of course, and the potential benefits will not materialize without changes to priorities and behaviors at TenneT and the industry in general. There will undoubtedly be unforeseen issues, potentially resulting in project delays, but the success of the offshore wind rollout in Europe is dependent on this new way of working.

Key takeaways:

- Supply shortages and contractor reluctance may impede the pace of the energy transition.

- Contractors are reluctant to tender for complex offshore wind projects because it’s difficult to accurately evaluate risks.

- Earlier underpricing and financial losses contribute to contractor hesitancy in engaging in an expensive, complex tendering process.

- TenneT has revamped its procurement approach to make projects more attractive for suppliers by offering longer-duration, higher-volume orders and combining projects into bundles that appeal to a range of suppliers.

- Bundling enables greater standardization and the use of a convoy approach to capacity building that has delivered savings of more than 20% for the oil and gas industry.

- This approach brings a more standardized, systems engineering approach to project delivery and eliminates the need for repetitive, expensive, time-consuming tendering processes on a project-by-project basis.

- Managing timelines and costs does not end with a successful award. Continued effort is needed to avoid more significant cost increases and delays. The cost of offshore grid connection systems is substantial, and without a strategic sourcing approach and excellence in delivery, delivering large numbers of mega-projects would either be prohibitively expensive or impossible.

- Substantial increases in investment in the grid that require supply chains to be stimulated need predictability from all stakeholders, including TSOs, governments, regulators and permitting authorities.

DOWNLOAD THE FULL REPORT

13 min read • Energy, Utilities & Resources

Case study: A new era in building offshore grid connections

TSO TenneT builds partnerships to unleash supply market growth

DATE

INTRODUCTION

As the need intensifies to build an energy infrastructure that helps meet increasingly ambitious targets on our way to net zero, companies in the sector are having to look afresh at how they deliver these complex and capital-intensive projects. Consequently, electricity infrastructure companies must reinvent their relationships with suppliers. Sourcing strategies are being revamped to push toward more long-term contract security. This goes along with standardizing technical components, procurement methods, and approaches to project delivery.

This report presents a case study of the Netherlands-based transmission system operator (TSO) TenneT and its approach to delivering a network infrastructure to bring power from offshore wind farms to shore in a rapidly expanding offshore wind market.

1

EUROPE’S TRANSFORMING ENERGY LANDSCAPE

The energy landscape in Europe is undergoing a profound transformation, driven by the growing need to decarbonize and a desire for greater energy independence. For example, nine North Sea countries have committed to transform the region into a green powerhouse by harnessing offshore wind energy, as set out in the Esbjerg Declaration signed by Germany, Belgium, Denmark, and the Netherlands in May 2022. Under this pivotal agreement, the region will increase its offshore wind capacity to at least 150 GW per year by 2050. This requires a significant ramp-up in European offshore wind installations (see Figure 1), from ~5 GW per year in 2023 to more than 25 GW by 2030.

The Netherlands-based transmissions system operator (TSO) TenneT is among the organizations responsible for bringing this offshore power to land. As one of Europe’s largest grid operators, TenneT serves 43 million customers in the Netherlands and Germany within a 25,000 km network.

Like all TSOs, TenneT’s role requires it to ensure existing assets can meet energy needs in the short term (energy system operation and balancing) while planning and investing in infrastructure to meet future energy requirements (transmission capacity). So central is their role in ensuring reliable, efficient electricity transmission across power grids that TSOs often are referred to as the heart and veins of the energy industry.

However, increasingly ambitious net-zero targets are testing every European TSO’s ability to deliver the complex, CAPEX-intensive, technically challenging infrastructure needed.

This is especially true for grid connection systems that bring power from offshore wind farms to shore, which are experiencing compressed timelines and expectations of increased GW and numbers of offshore turbines being installed, many aiming at the same target year of 2030. In essence, a vast amount of projects is expected to be built much sooner than previously expected.

This has created considerable pressure in multiple areas, including financing, planning and permits, technology, supply chains, backup infrastructure, and energy storage. In TenneT’s case, it means increasing the number and size of offshore grid connection systems that it builds every year while keeping optimal total expenditure in mind. Between 2023 and 2031, TenneT plans to build and commission 14 offshore wind grid connection systems, increasing its newly connected offshore wind power from an average of 1 GW per year to ~8 GW per year by 2030. Figure 2 illustrates a schematic of TenneT’s offshore grid connection system.

2

DESIGN ONE, BUILD MANY

The acceleration in offshore wind generation described in Chapter 1 gave rise to TenneT’s 2GW Program, aimed at developing offshore grid connection systems with a capacity of 2 GW each, based on a 525 kV high voltage direct current (HVDC) system voltage. The program that began in 2018–2020, anticipated the growing need for grid connection systems long before the exact projects were announced. The larger size (previous DC systems were 900 MW and AC systems were 700 MW) was designed to reduce the number of systems needed to address the growing complexity of accommodating and permitting offshore cable routes.

Throughout, TenneT leveraged its experience in delivering offshore grid connection systems by (1) engaging in an engineering partnership with suppliers for both cables and converter stations, and (2) developing a prequalification system for cables. Standardization of offshore grid connections to ensure consistency and efficiency across its offshore projects was central to the successful implementation of the 2GW Program. TenneT calls this its “1 Platform, 1 Cable, 1 Contract” design.

This approach streamlines engineering processes, fosters replicability, and simplifies project management. Standardized is also the contract design — in the wind industry, International Federation of Consulting Engineers (FIDIC) contracts are standard. Using this industry standard contract design helps create a cohesive and comprehensive framework for collaboration with suppliers across tiers. By standardizing key aspects of its operations, TenneT created a foundation for a more resilient, adaptable, and collaborative energy infrastructure that aligns with the goals of the energy transition.

Using a standardized approach, each project can be delivered in the same structured way, and learnings can be passed on from one project to another. This type of continuous improvement leads to greater process efficiency and helps TenneT make the best use of scarce resources.

Notably, TenneT committed to the lowest overall cost (TOTEX), accepting higher CAPEX where OPEX savings outweighed the investment (taking into account the specificities of the connected offshore wind farms). For example, standardizing the operation and maintenance of platform cooling systems not only lowers costs, it also leads to improvements in occupational health and safety.

3

MAJOR CHALLENGES

TenneT has considerable experience in smaller offshore and onshore projects, but not all of this knowledge directly translates into the delivery of complex, CAPEX-intensive infrastructure being built in a technically challenging environment. For example, to get power to land in this region, offshore wind cables must negotiate sensitive, challenging areas like the Wadden Sea — the world’s largest expanse of tidal mudflats along the coasts of Denmark, Germany, and the Netherlands — and other morphologically dynamic areas.

With offshore projects being built further out to sea, energy losses are becoming a significant concern. Generally, many offshore wind projects use AC technology, but this is uneconomic over longer distances. This necessitates a switch to HVDC, a technology TenneT has already used in its German offshore projects. This switch to a less mature technology, particularly due to an increase in unprecedented size and voltage (2 GW and 525 kV), results in more pressure on already challenged supply chains.

Tendering is another concern. Historically, offshore projects were smaller, less frequent, and involved many “unknown unknowns,” making them high-risk ventures with unpredictable outcomes. Because these projects regularly experienced cost or time overruns, companies gained a great deal of knowledge about pricing and their own risk appetite.

These “old” risks are now better understood, but companies now face “new” risks; for example, trying to accurately evaluate projects that are not only larger and more complex, but potentially subject to an unusually volatile commercial market and changing political and regulatory environments. Unsurprisingly, many suppliers have little appetite for embarking on expensive and complex tendering processes to win contracts that ultimately may not prove profitable and could lead to lengthy claims and litigation procedures.

4

THE VALUE OF PREDICTABILITY

To reduce uncertainty for its suppliers, TenneT has moved away from tendering individual projects. Instead, it’s bundling them in portfolios being executed in convoys. The resulting high-volume orders, with contracts that can last between 10 and 14 years, give suppliers the certainty they need to more confidently invest in capital-intensive manufacturing and installation capacity. They know they will be able to justify their initial costs.

With the pace, size, and complexity of new projects making individual tendering more challenging, neither suppliers nor TSOs want to face expensive, time-consuming and resource-intensive tendering processes several times a year. Eliminating this frees up much needed resources that can be used in project delivery.

Bundling also lets suppliers use a convoy approach to manufacturing, in which new assets are installed sequentially. Here, TenneT was inspired by the oil and gas industry, where studies suggest that standardization can lead to savings of more than 20%, and increase delivery probability by 15%, provided at least four orders are completed the exact same way. Market scarcity, in combination with very large portfolios, could make realizing such cost reductions difficult, however.

Although bundling gives suppliers greater certainty on whether or not to invest, it introduces risks related to projects beginning more than five years into the future. Large orders are also more difficult to finance for suppliers, both internally and externally, as bonds and guarantees may be needed to offset the risk of unsatisfactory performance or business continuity. The sheer size of portfolios, and even single projects, leads to a heightened risk of default and added financial risk to contractors and their supply chains.

Suppliers must balance their customer portfolio between the certainty of working with large, familiar customers and the risk of becoming dependent. For example, bundling increases risks related to buyer-side problems such as projects being cancelled because of internal issues or external events such as changes in the political or legislative environment.

Conversely, once all portfolios in a large tender are allocated, there is a danger that TSOs will lock out certain suppliers for years to come, damaging relationships that had been fostered over many years. Hence, large bundles increase mutual dependency and create the need for new ways of cooperation.

5

SUPPLY CHAIN SCARCITIES

There are only six manufacturers of 525 kV HVDC cable technology (Prysmian, NKT, Nexans, LS Cable, Sumitomo, and Hellenic) and only three Western manufacturers of HVDC converters (Siemens Energy, Hitachi, and GE). Considering current manufacturing capacities, supply shortages can be expected as soon as 2025/2026.

Such shortages reflect a wider problem that infrastructure companies are becoming familiar with: having to compete with the demand needs of other infrastructure-building companies for the services of a small number of companies that are both willing and can actually do the work because they have the right mix of qualified employees and the equipment required to complete a project (or are prepared to invest in it). Substantial growth is needed in the supply market, but suppliers find it difficult to invest in new capacity due to the significant amounts of up-front CAPEX needed and a lack of qualified personnel (a problem across Europe and the Americas).

This means there are product and personnel scarcities all along the supply chain, from HVDC cables and offshore platforms to transport, installation, civil engineering, and construction.

We can expect to see a supply shortage of HVDC platforms globally beginning this year. Europe’s energy transition is in danger of being held back unless new capacity is somehow created, either by fresh players coming into the market or incumbents being able to invest in new capacity.

In 2021, having made steady progress in setting up its 2GW Program and on the verge of publishing several multi-billion-euro tenders, TenneT found itself in a tough spot. Comparing the size of its own portfolio alongside the demands of other players with existing capacity in the supply markets, the market shortage became clear and TenneT was at risk of not being able to secure enough capacity for the grid connection system projects it had planned up to 2031 (see Figure 3).

As a key enabler of the energy transition, TenneT was also mindful of not locking up all existing capacities — this would leave other TSOs and buyers unable to secure their needs and likely hold back investment in offshore wind, slowing the energy transition.

TenneT was faced with continuing its approach and risking not being able to secure capacities or attempting to outcompete other buyers for capacity, risking impeding progress in offshore wind and possibly incurring reputational damage.

Even if it chose the latter, the size of TenneT’s portfolio might have become a drawback (when supply markets are constrained and only a limited number of suppliers can take part in a tender, large orders are not necessarily preferred over small ones).

6

CREATING MEANINGFUL PARTNERSHIPS

For TenneT, the key to addressing these challenges was building closer relationships with its suppliers, moving beyond transactional relationships in which buyers focus on achieving the lowest price and ensuring contracts are followed to the letter. Instead, it aims to establish partnerships, encouraging open discussions from the beginning that lead to a mutual understanding of each organization’s objectives, challenges, and risk perceptions.

This type of early engagement allows TenneT to create project combinations that either appeal to specific suppliers or are attractive enough to appeal to a range of suppliers. This creates competition and encourages bidding, even for projects technically difficult or uncertain. These portfolios can be flexibly redefined before or during the tendering process to account for potential interest.

TenneT sets up its contracts as full partnerships in which the relationships between both the organizations and the people in charge are as important as traditional contractual mechanisms. Once the contract is signed, a partnership board is established to ensure TenneT and its suppliers are aligned at all levels, including the C-suite. The board convenes regularly to provide a frequent 360-degree review of the relationship’s performance. Potential risks are identified so they can be addressed and prevented throughout the contract’s duration, avoiding lengthy claims and litigation processes that add to the cost of contract management.

At the core of the collaborative contracts are risk-sharing mechanisms, including price adjustment. Agreements to work jointly on R&D projects, share engineering resources, undertake collaborative investment in new ventures, and set up cooperative programs with academic institutions aimed at growing capacity long-term and closing skills gaps may also be included. The long-term cooperation also allows realizing nonmonetary benefits in areas such as health/safety/environment and corporate social responsibility. The contractual mechanisms then need to be anchored in the organization and culture, as shown in Figure 4.

This approach helps create a reservoir of knowledge that all parties can access, fostering innovation throughout the value chain, reducing costs from duplication, and encouraging problems to be seen as joint challenges. For example, close collaboration between engineering teams reduces the need for feedback loops so synergies can be realized more quickly.

When innovative solutions are required for future offshore wind farm connections and country-to-country interconnector cables, rather than being treated as separate engineering projects, they can be tackled jointly by partners from conceptualization to initial testing. This creates stability along the supply chain, just what contractors need to see before making capital-intensive investments. Buyers that offer these benefits are seen as attractive partners to sell to, a crucial advantage in a market characterized by constrained supply chains. There is also a trickle-down effect, with learnings spread to sub-suppliers, workforces, and financing entities.

This approach, in which suppliers and buyers collaborate to positively impact the wider ecosystem (dubbed “ecosystem thinking”), recognizes the growing financial risks and commercial stresses associated with major energy projects and fits neatly with TenneT’s wider role of engaging with industry associations and international organizations like ENTSO-E and ACER, as well as developing international technical and environmental standards within the industry, and with national and international authorities and regulators.

7

WIN OR LOSE TOGETHER

Moving away from transactional contract dynamics will involve a significant cultural change. New governance bodies, joint initiatives, and shared goals could help, encouraging players to prioritize long-term benefits for all over short-term advantages for some. The pandemic, the war in Ukraine, and the recent energy crisis were certainly not on anyone’s radar, but with relational contracts in place, unexpected events can be dealt with more fluidly and without the need for litigation so characteristic of transactional relationships.

TenneT’s approach has already been shown to benefit not only the company but also other TSOs and buyers. In 2023, TenneT successfully awarded partnership contracts to suppliers, installers, and consortia to deliver 14 offshore wind grid connection systems until 2031, the culmination of a program that began in 2018 and required multiple contributing resources in many departments along the way. Moreover, the 2GW Program standard has positively impacted other TSO projects in Germany and beyond, both onshore and offshore.

There are still risks, of course, and the potential benefits will not materialize without changes to priorities and behaviors at TenneT and the industry in general. There will undoubtedly be unforeseen issues, potentially resulting in project delays, but the success of the offshore wind rollout in Europe is dependent on this new way of working.

Key takeaways:

- Supply shortages and contractor reluctance may impede the pace of the energy transition.

- Contractors are reluctant to tender for complex offshore wind projects because it’s difficult to accurately evaluate risks.

- Earlier underpricing and financial losses contribute to contractor hesitancy in engaging in an expensive, complex tendering process.

- TenneT has revamped its procurement approach to make projects more attractive for suppliers by offering longer-duration, higher-volume orders and combining projects into bundles that appeal to a range of suppliers.

- Bundling enables greater standardization and the use of a convoy approach to capacity building that has delivered savings of more than 20% for the oil and gas industry.

- This approach brings a more standardized, systems engineering approach to project delivery and eliminates the need for repetitive, expensive, time-consuming tendering processes on a project-by-project basis.

- Managing timelines and costs does not end with a successful award. Continued effort is needed to avoid more significant cost increases and delays. The cost of offshore grid connection systems is substantial, and without a strategic sourcing approach and excellence in delivery, delivering large numbers of mega-projects would either be prohibitively expensive or impossible.

- Substantial increases in investment in the grid that require supply chains to be stimulated need predictability from all stakeholders, including TSOs, governments, regulators and permitting authorities.

DOWNLOAD THE FULL REPORT