The Indian automotive industry is witnessing shifts in customer preferences toward different body types (BT), such as sport utility vehicles (SUVs), premium hatchbacks, and crossovers, as well as features enabling driving experience and safety. These changes are creating cost pressures for automakers in an already price-sensitive market. Imminent emission regulations, including Corporate Average Fuel Economy (CAFE) 3, are expected to further increase compliance costs. In this complex environment, automakers face the challenge of reimagining their product portfolio strategies.

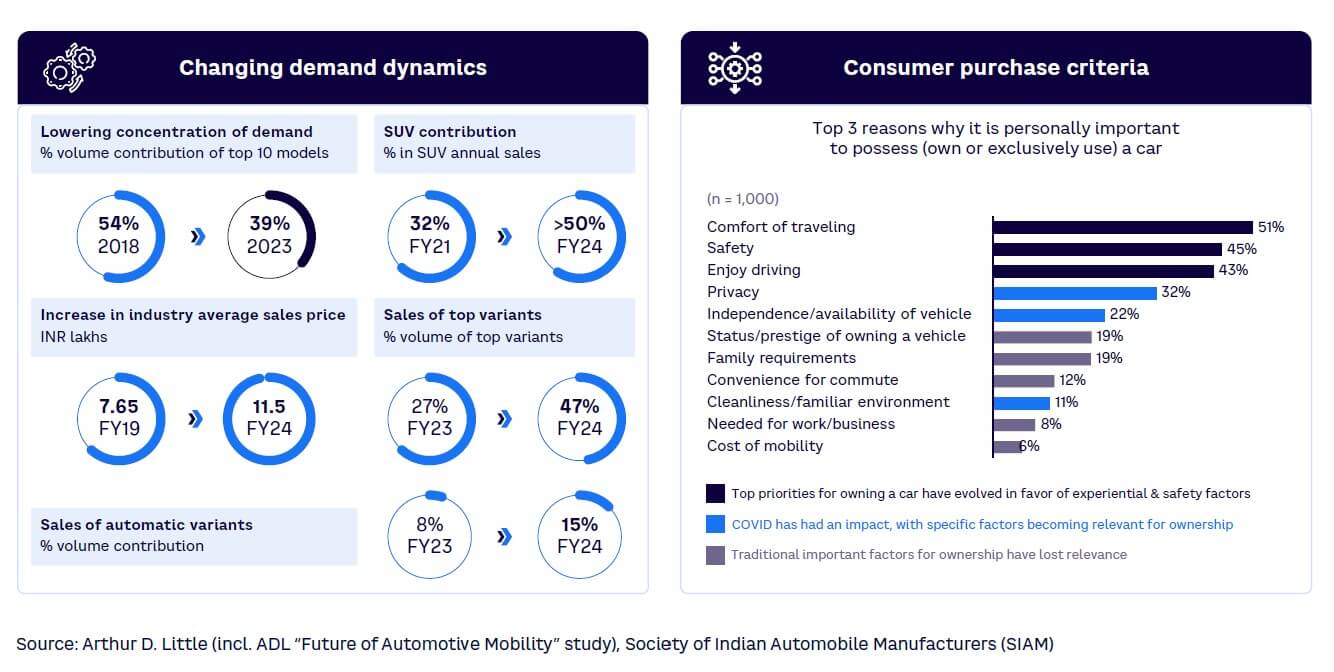

The Indian passenger vehicle (PV) market will likely undergo structural shifts by 2030 and beyond. Indian consumers have rapidly evolved, as shown by the evolution of the sales mix across product types. The changes in demand dynamics are visible across multiple indicators — including lowering concentrations of demand among top models, growing contribution of SUVs to annual sales, an increase in industry selling price, and growing sales of top models — and are a coherent representation of the purchase criteria for consumers (see Figure 1).

As an example, the traditional “value for money” orientation of an Indian automotive consumer is finding new meaning. In the past, the dominant traits associated with value included lower up-front cost of acquisition, mileage, and status or prestige. Increasingly, consumers are associating value with comfort, safety, and driving experience — including the availability of new features, such as automatic transmissions, sunroofs, connected infotainment, large wheel sizes, and so on.

OEMs are expected to address the expectations around this expanded “value for money” definition while also managing the cost pressure emerging from increasing bill of materials costs associated with new technology and new materials integration as well as the amortization necessitated by design and development spending to meet the multifaceted standards of safety and emissions from CAFE norms, Bharat Stage (BS) VII standards, and the like.

To illustrate, consider the following trends and their impact on OEMs:

- Growing adoption of automatic transmissions in an emission-regulated environment is pushing OEMs to absorb costly technologies like CVT (continuously variable transmission) or AMT (automated manual transmission).

- Preference for SUVs, which are typically less fuel efficient than sedans, puts pressure on emission compliance.

- Preference for new features (e.g., sunroofs, automatic transmissions) add to the curb weight of a vehicle, putting further pressure on emission compliance.

- The emergence of multiple powertrain (PT) choices enhances the complexity of establishing portfolios that guarantee future success.

Consequently, it is more important than ever for OEMs to take a strategic view of portfolio choices to ensure a balance of mid-to-long-term capital investments.

AUTOMAKERS AT A CROSSROADS

Arthur D. Little (ADL) has identified a set of key emerging questions for India’s OEMs:

- What key demand-side contours are likely to shape India’s passenger vehicle industry?

- What scenarios are likely to evolve for alternative PT adoption, especially internal combustion engine (ICE) 2.0 and battery electric vehicles (BEVs)?

- What body types will become more relevant in the future for different markets?

- How will emission regulations, especially CAFE, impact competitive intensity?

- What are the possible pathways to evaluate in a long-term portfolio strategy?

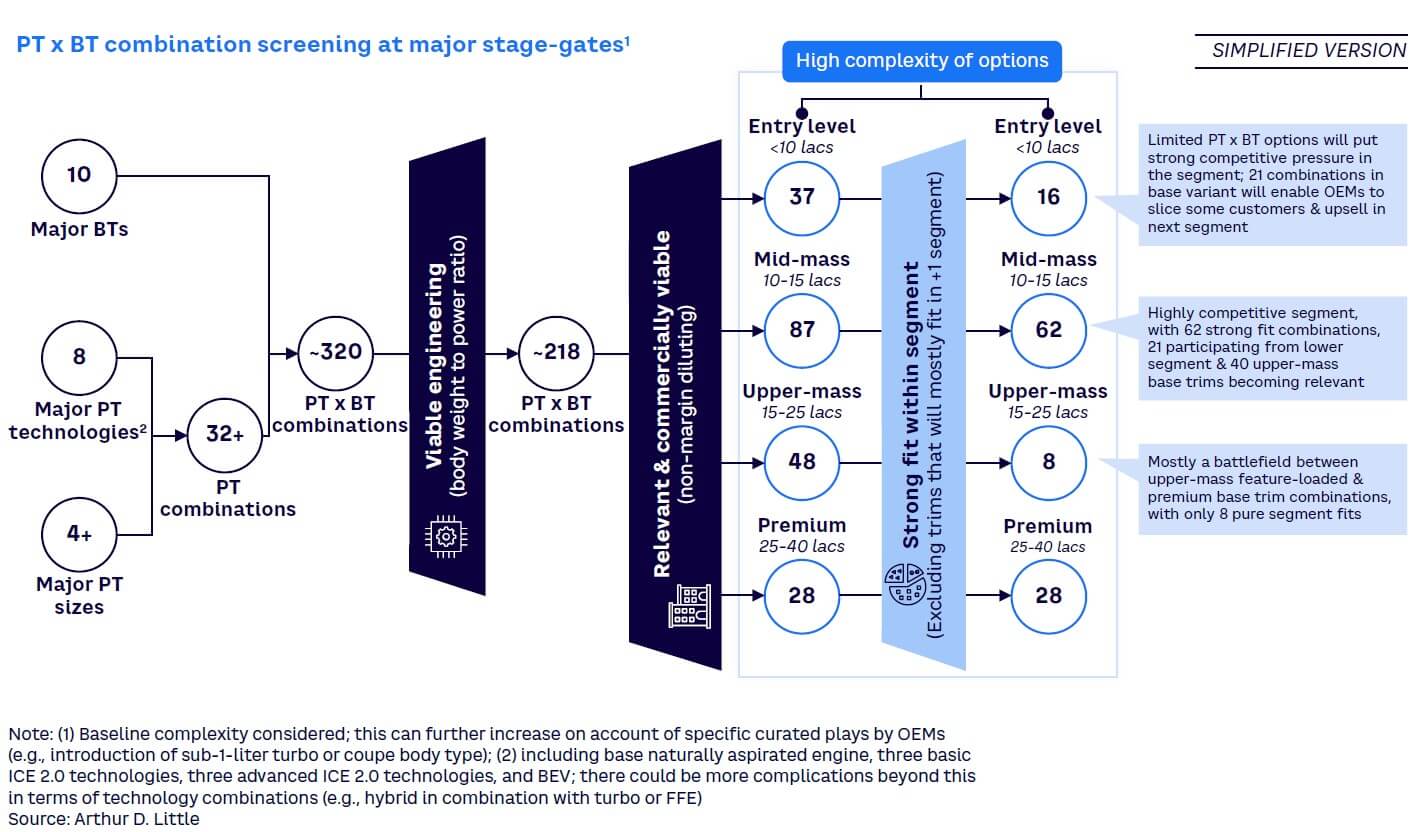

To address these questions, OEMs must make well-assessed choices across different PTs and BTs to inform their mid-to-long-term portfolio plans. To illustrate the extent of the complexity, Figure 2 illustrates ADL’s detailed modeling of the Indian market.

There are 10+ major BTs (e.g., hatches, crossovers, sedans, premium sedans, SUVs, MPVs [multipurpose vehicles]), 8+ PT technologies, and 4+ PT sizes. Theoretically, these give OEMs a minimum of 218 technologically viable combinations to offer in the market today. These are further narrowed down by applying the constraints of commercial viability and customer requirements across four market price segments — entry-level (< INR 10 lacs), mid-mass (INR 10-15 lacs), upper-mass (INR 15-25 lacs), and premium (INR 25-40 lacs) — to arrive at the real combination of choices by different PV price segments.

The ADL model suggests that the market will see intense competition shifting toward the mid-mass segment where the possibilities of offerings will be highest in terms of PT and BT options — especially since many BEV and ICE 2.0 offerings become viable in this price bracket.

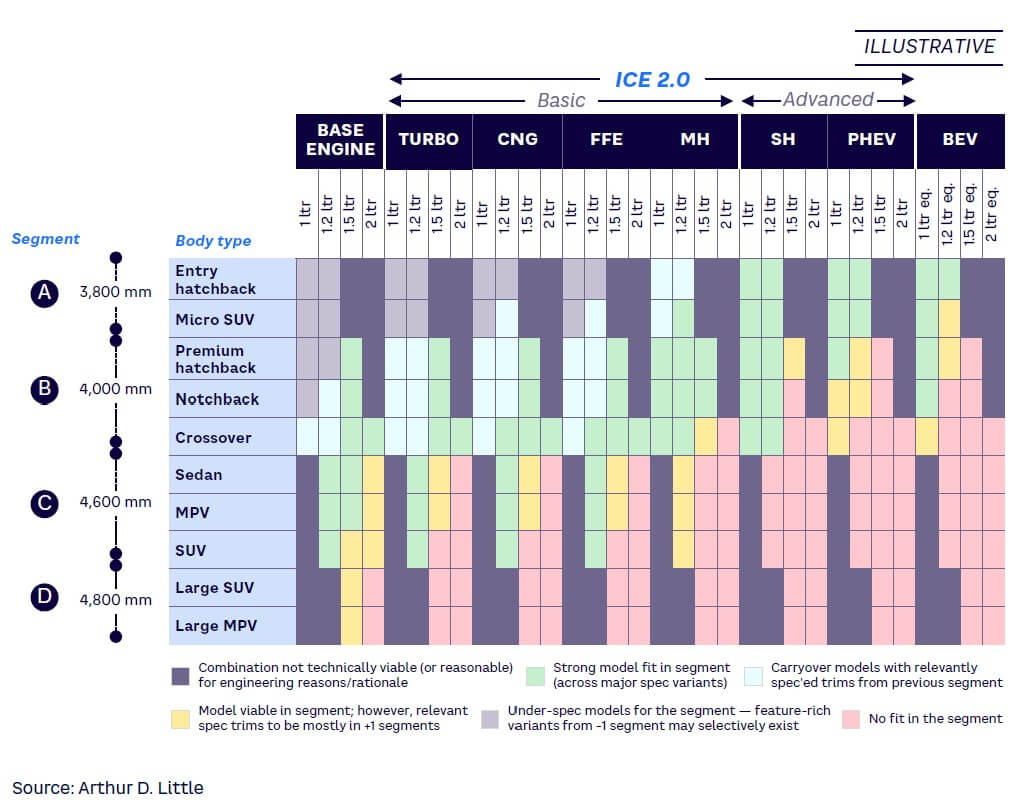

To illustrate the magnitude of complexity, consider the potential choices for the mid-mass segment (INR 10-15 lacs) shown in Figure 3. There are 62 potential options across powertrain types, powertrain sizes, and body types that have a strong fit for the mid-mass segment. Similar complexity exists across all four price segments of the market. To address the intricacy of dealing with so many possible combinations, OEMs would need to examine the combination of PT and BT choices through the lens of two factors: (1) commercial implications and (2) regulatory implications.

Commercial implications: PT x BT choices

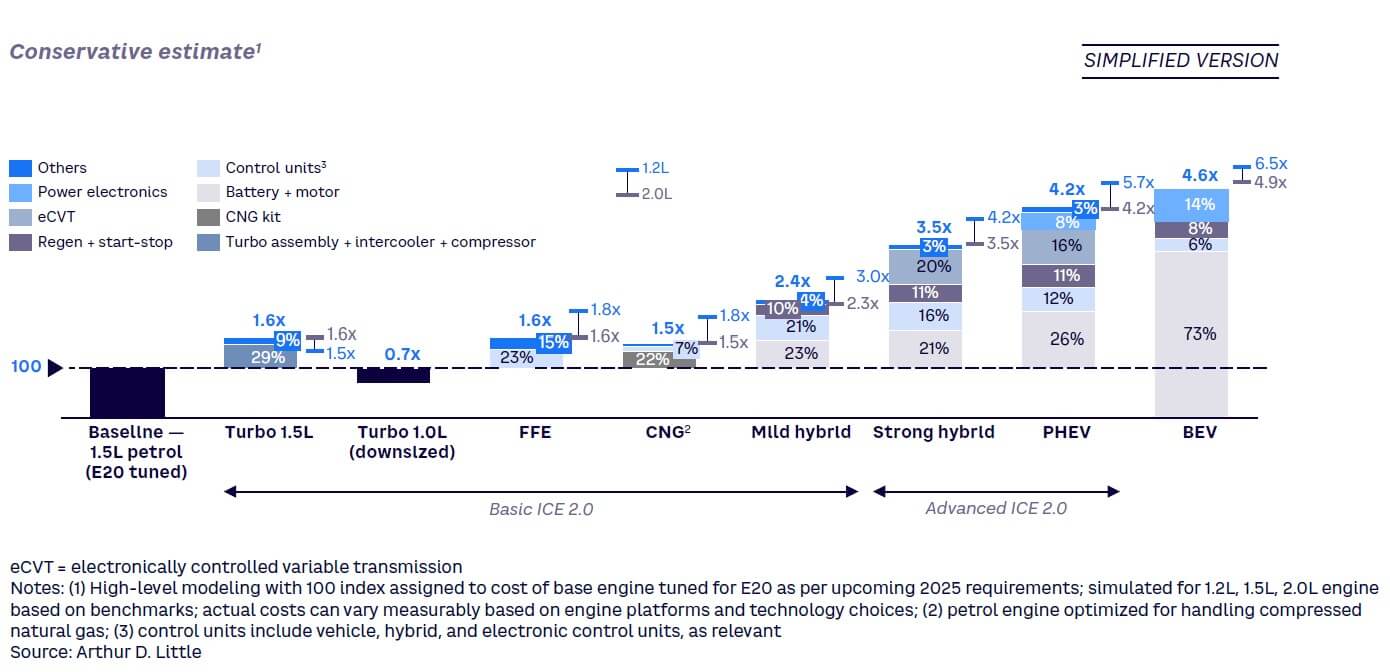

Based on our detailed cost benchmarks for the Indian market, the stark difference in the cost of absorbing different PT technologies becomes evident and has direct implications on the ability to offer ICE 2.0 and BEV technologies across different price brackets.

Compared to a base engine (see Figure 4), basic ICE 2.0 technologies (turbo, flex-fuel engine [FFE], CNG, and mild hybrids [MH]) can be around one and a half to three times more expensive, depending on the size of the engine, while advanced ICE 2.0 (full hybrids, PHEVs [plug-in hybrids]) and BEVs can reach more than three and a half to six and a half times the cost. For example, for a 1.5-liter petrol base engine tuned for E20 fuel, we estimate that a comparable BEV powertrain will be more than four times costlier while the cost of producing a PHEV powertrain is slightly lower versus BEVs. The “downsized” turbo 1-liter engine with similar power specifications will be at a cost advantage of roughly 30% versus the 1.5-liter base engine, thus reflecting the relevance of higher potential usage of turbo engines in the future.

Key takeaways for PT choices

- The mid-mass market (INR 10-15 lacs) is a sweet entry spot for multiple ICE 2.0 offerings (although limited by engine size and BT), BEVs, and C segment (length of 4.0-4.6 m) offerings (sedans, SUVs, MPVs).

- BEVs only become commercially viable in the mid-mass market and above. Any OEM play at the entry level (<10 lacs) is currently a margin-diluting play and is potentially intended to capitalize on the future BEV push with customers. Future cost decreases in BEV components, however, may affect these dynamics.

- Strong hybrids (SH) can become viable as early as mid-mass market (in small engine sizes up to 1.2 liters); however, larger engine sizes can only exist in segments of INR 15 lacs and above. On the other hand, PHEVs in larger engine sizes only become viable among premium PVs (INR 25-40 lacs).

- Turbo is a step jump between naturally aspirated base engines and advanced ICE 2.0/BEV offerings and offers early viability given similar power-to-weight ratios in a smaller engine size.

In comparison to PT choices, the cost curves for BT choices are less steep, with a maximum cost difference of approximately 13%-21% (excluding the costs of engines and powertrains) within product price segments.

To summarize, powertrain offerings are the most influential cost header (and are decisive for commercial viability) as OEMs try to balance emission requirements. The intersection of powertrain and body types (PT x BT) creates a template for OEMs to gauge viable offerings. Automakers will have to understand the ever-evolving customer requirements while balancing those with regulatory viability (in terms of adherence to CAFE 3 and CAFE 4 requirements) to create a long-term portfolio strategy.

Regulatory implications: PT x BT choices

Emission regulations for automakers in India are affecting PT choices in a variety of ways, including:

- Beyond the impact of tax structure (goods and services tax treatment by engine size), additional regulations on Real Driving Emissions (RDE) and upcoming BSVII norms will require the reimagining of baseline ICE engines.

- The baseline requirement of flex-fuel is also shifting, with BSVI Phase II already necessitating E20 fuel compatibility in 2023. E20-tuned engines are likely to become mandatory in 2025. Recently, CNG has seen increasing traction as OEMs in mass market plays reinvigorate their product lines, especially for rural markets.

- Hybrids (mild to plug-in) have just begun to play a role in the market; however, there has been an increasing curiosity about their relevance.

- BEVs have shown initial momentum, both in terms of product offerings and adoption, although adoption is slow compared to that seen globally. Lowering government subsidies will likely act as a headwind for BEVs.

We believe that CAFE norms are likely to emerge as the biggest influencer on PT choices. Given the stringent targets proposed for CAFE 3 (~20% reduction at 91g/km CO2 in 2027–2032) and CAFE 4 (~38% reduction at 70g/km CO2 in 2032–2037) — and further pronounced with the shift from MIDC (modified Indian drive cycle) to WLTP (Worldwide Harmonized Light Vehicle Test Procedure) standards — strong volume mixes between full hybrids/plug-in hybrids and BEVs are an imperative for the industry.

Key takeaways for PT choices

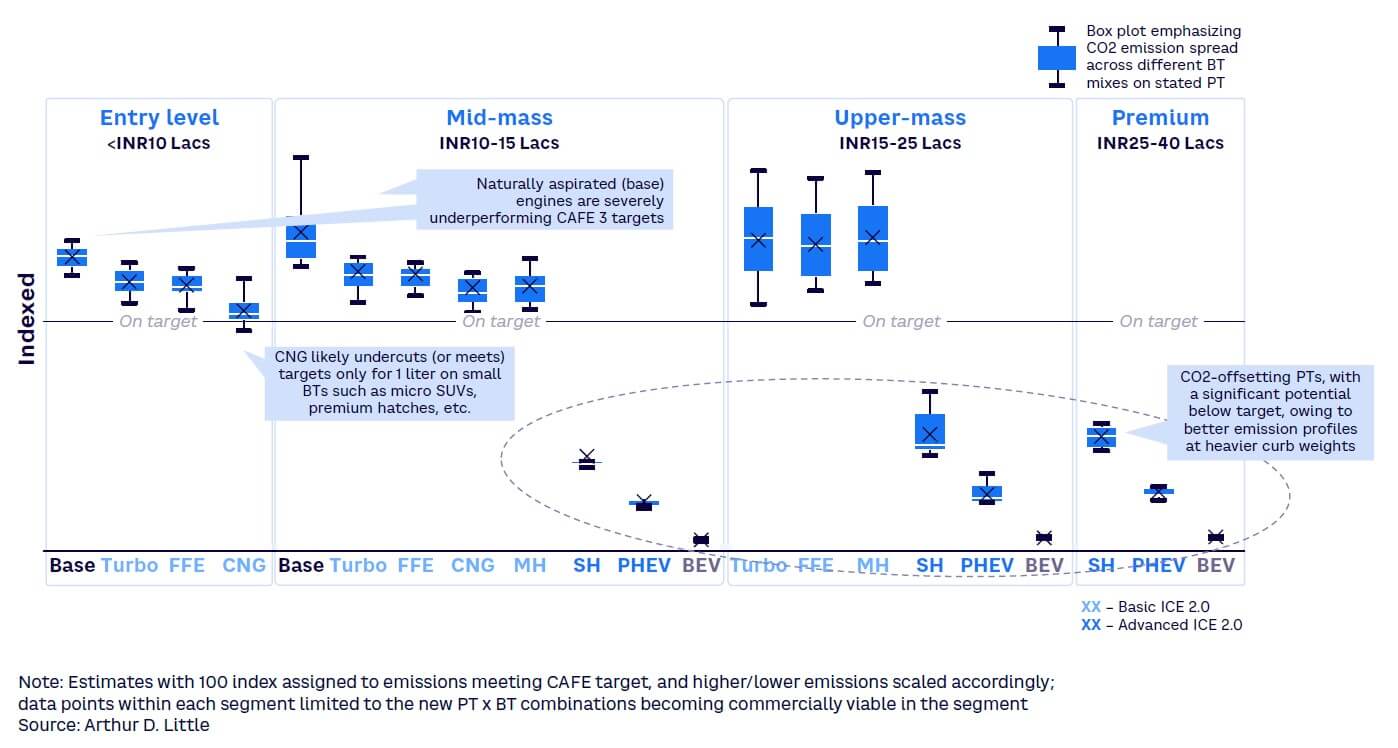

The penalties imposed for nonadherence to CAFE 2 norms in India are already impacting the portfolio choices that some OEMs are making. As these norms enter Phase III, the challenges will intensify. To understand the potential impact of CAFE 3 norms on various PT options, ADL analysis reveals that:

- Base engines (naturally aspirated) will severely underperform against CAFE 3 targets (see Figure 5).

- CNG can potentially meet the target for small (1-liter) engines with small BT designs.

- In mid- and upper-mass segments, full hybrids, PHEVs, and BEV combinations will be necessary for offsetting CO2 emissions.

- Basic ICE 2.0 PTs on their own will not suffice in achieving CAFE 3 norms.

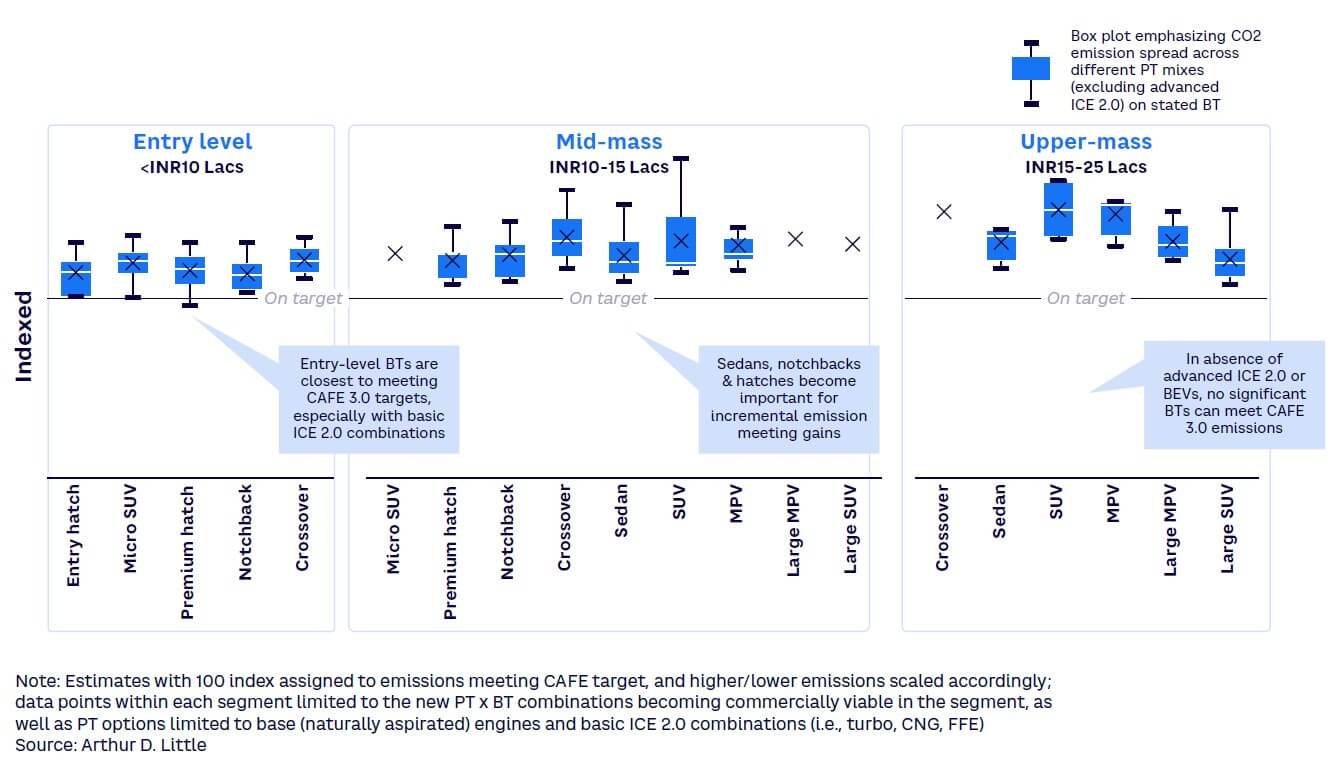

Key takeaways for BT choices

Regarding body type, the two most crucial factors from a regulatory perspective are length and curb weight. Taxes charged on cars (goods and services tax) have a direct impact on body length (with very low rates for cars less than 4,000 mm in length). However, curb weights increasingly are becoming decisive choices for portfolios to meet emission standards. Following are the key findings based on our modeling to estimate CO2 emissions under CAFE 3 norms for different body types (see Figure 6):

- Among entry-level PVs, smaller BT with specific basic ICE 2.0 powertrains can meet CAFE 3 targets.

- In the mass-market segment, sedans, premium hatchbacks, and notchback BT will come closest to meeting CAFE 3 norms with specific basic ICE 2.0 configuration, although advanced ICE 2.0 will be necessary to go beyond recommended targets. Thus, we expect sedans and hatchbacks to see a resurgence in the market in the future.

- Within the upper-mass segment, no body type will support adherence to norms without introducing advanced ICE 2.0 or BEVs as part of the portfolio.

To summarize, automakers must consider ever-evolving customer requirements as well as evaluate the optimal combinations of PT and BT through commercial viability and regulatory viability in terms of adherence to CAFE 3 and CAFE 4 requirements.

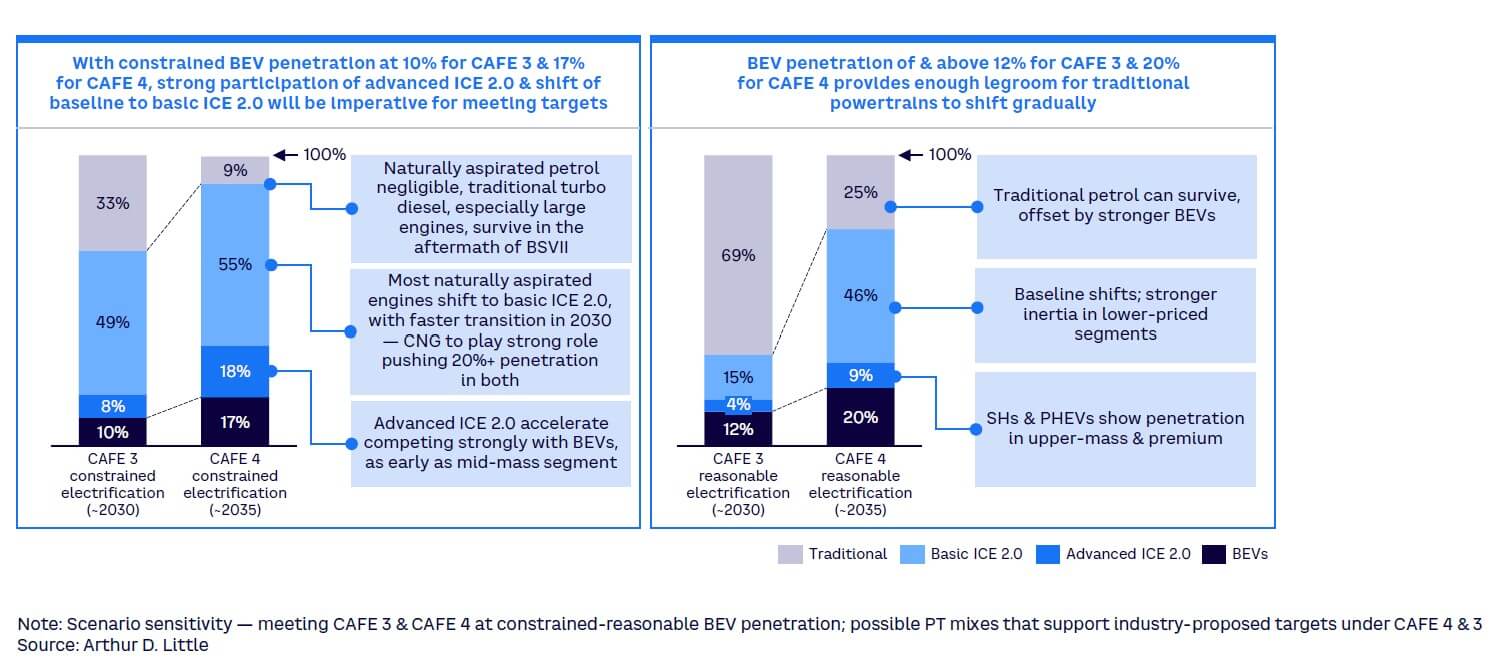

INDUSTRY OUTLOOK ON PORTFOLIO MIX

To meet the stringent proposed guidelines for CAFE 3 and beyond, automakers’ focus is likely to shift to advanced ICE 2.0 and BEVs. As BEVs have a high carbon offsetting advantage, the extent of BEV penetration will have a direct correlation to the need to drive the adoption of other powertrains to meet industry targets. Based on ADL’s modeling, BEV penetration scenarios at 12%+ for CAFE 3 and ~20%+ for CAFE 4 will give a higher flexibility to the industry in terms of ICE 2.0 plays (see right side of Figure 7). Lower adoption of BEVs would require a stronger and accelerated push from OEMs looking at ICE 2.0 offerings (see left side of Figure 7).

Considering BT changes, we expect a lesser quantum shift in both high and moderate BEV penetration. Thus, a BT strategy in isolation will not be enough to meet industry targets. As a result, a few fundamental shifts will become pertinent in the industry:

- ICE variant strategies

- Turbo engines will increasingly become a norm in base models, including conceptualizing smaller turbo engines to cater to the entry-level market.

- In the hybrid lineup, strong hybrid (or even PHEV) options in top variants supported with mild hybrids in base models will start making inroads as early as the mid-mass segment.

- The entry-level and mid-mass markets will continue to see variant complexity, with basic ICE 2.0 technologies such as CNG and FFE and higher constrained by availability and reach of fuel grades.

- The PT dilemma

- The ongoing dilemma between hybrids and BEVs will become more pronounced, and OEMs will have to focus on one of the two.

- Hybrids and BEVs both have lower CO2 emissions at higher curb weights, which has double benefits in CAFE accounting, but from a long-term perspective, BEVs are likely to become must-haves — especially given the increasing preferential treatment to BEVs in CAFE, with hydrogen tech competing only from a regulatory standpoint.

- BT examination

- Given the strong play of aerodynamic drag and its impact on SUV body forms, OEMS will continually need to reexamine the importance of SUVs as a demand driver.

- Hatchbacks and sedans across different segments can drive incremental advantage when combined with PT mix strategy, providing an opportunity for different body types around SUV styling, which is already being seen in launches.

- Platform twinning

- OEMs will increasingly need to drive CO2-offsetting products to balance traditional plays, requiring a twinning platform mindset. For example, every strong hybrid sold in the mid-mass segment has the potential to offset four or more vehicles on basic ICE 2.0, and this number increases with BEVs.

- Platform twinning requires rethinking product margin profiles and finding the right balance between ICE 2.0 and BEV offerings while factoring in associated CAFE fines. High-margin vehicles that exceed emissions targets can help offset the lower margins of cleaner, more expensive vehicles, allowing OEMs to maintain overall profitability. Such an approach will allow OEMs to drive competitive pricing for carbon offsetting options, ensuring the right balance they require to push ICE 2.0 and BEV offerings.

EMERGING PATHWAYS

Faced with multiple options, OEMs will need to address their unique set of challenges and consider different pathways. We have defined OEMs in three distinct archetypes to cluster major headwinds and potential pathway considerations for each archetype:

- Mass-market dominators — OEMs that have a compelling mass market proposition, multiple variant options, and increasingly stay relevant by leveraging feature additions

- SUV shapers — OEMs that achieved dominance in the SUV market and increasingly look at a cross-segment SUV/crossover portfolio as a future option for growth

- Electric disruptors — OEMs that are leveraging BEVs and increasingly become key disruptors in a traditionally ICE-dominated market

Mass-market dominators

Headwinds to conquer

- Upcoming emission regulations (BSVII, CAFE 3, CAFE 4):

- Base engines (naturally aspirated) designed for BSVII may not be able to meet CAFE 3 targets even for smaller engine sizes (e.g., 1 liter) in low curb weight. CNG and turbo only effectively meet/offset the CAFE 3 targets.

- From a long-term perspective (CAFE 4 and beyond), none of the powertrains (including CNG and turbo engines) will be able to meet the target requirements.

- BEVs and strong hybrids in the entry-level segment will be commercially unviable, adding to the complexity of portfolio choices for mass-market players.

- Competitive intensity in the mid-mass segment will grow due to overall market shifts and the imminent viability of the offerings across ICE 2.0, BEVs, and BT.

Pathway considerations

- Maximize the share of turbo and CNG in the entry-level portfolio, evaluating more options for turbo engines across segment offerings.

- Plan for end-of-life decisions on small (especially 1-liter) naturally aspirated engines, accounting for limitations posed by the stringent CAFE 4 norms.

- Leapfrog beyond basic ICE 2.0 to plan for a play in advanced ICE 2.0 (or hybrid) offerings stretching to upper-mass segments. When doing this, rethink the emergence of the sedan BT.

- Prepare for a highly competitive mid-mass market segment; cost and price pressures will make it challenging.

- Plan for more lightweighting options to optimize emissions through better body weight-to-power ratio.

- Plan for BEV offerings for the mid-mass segment. Leverage the better weight-to-CO2 ratio from BEVs to offset CAFE targets.

SUV shapers

Headwinds to conquer

- The challenge of existing portfolios in meeting CAFE 3 and beyond norms is only expected to become more pronounced.

- The possibility of adopting other body types in the mid-mass and upper-mass segments will intensify competition.

- In the upper-mass segment, all basic ICE 2.0 offerings significantly overcut the target requirements, with mild hybrids staying within 20% of targets. This will require a reexamination of carbon targets.

- Diesel PTs, already muted, will be further constrained to specific use cases/model categories beyond BSVII.

Pathway considerations

- Leverage current SUV demand to establish a position in the mid-mass markets and reduce the portfolio skew toward higher curb weights and consequently higher emissions.

- Plan for a selective ICE 2.0 play in the existing portfolio and in the lower portions of the market.

- Evaluate limiting exposure to SUVs in the long term, and create strategic positioning in other body types emerging in the market.

- Develop BEV variants and create stronger BEV pull on existing platforms.

- Evaluate pricing/bundling options and carbon offsetting options to avoid fines for breaching CAFE targets.

Electric disruptors

Headwinds to conquer

- Electric disruptors have already moved in a direction that is meaningful from a long-term portfolio-alignment context. However, there is an increasing midterm pressure on EV adoption.

- The emergence of strong hybrids and PHEVs may further impact the adoption rates for BEVs.

Pathway considerations

- Evaluate ICE 2.0 options in alignment with BEV offerings.

- Anchor BEV solutioning for the Indian context, reimagining a strong BEV 3.0 (third-generation BEV development focused on innovative cost-reducing levers) and challenging the current cost mix in BEVs.

- Expand play beyond India. This will require product engineering modifications to meet global standards.

Conclusion

THE TIME TO ACT IS NOW!

The Indian automotive industry is facing significant shifts in consumer preferences, increasing cost pressures in an already price-sensitive market. Upcoming emission regulations will further raise compliance costs. To navigate this landscape, automakers must innovate their portfolios by focusing on four key areas:

- Contextualize current and future growth headwinds. Future portfolio pathways will be heavily influenced by an automaker’s starting position.

- Anticipate customer demands for body types and features. While the customer is at the center of the portfolio strategy, not all trends will play out in perpetuity.

- Closely watch BEV and ICE 2.0 trends. Adoption rates for ICE 2.0 and BEVs will significantly impact portfolio choices. Build agility into portfolio planning.

- Adopt a portfolio-wide approach. Target profit-accretive scenarios while maximizing carbon offsetting opportunities.