The marine-fuel sector is facing lower-sulfur-content specifications, with the major change taking place in January 2020. Both petroleum refiners and ship owners could contribute to close the supply-demand gap, but all players’ contributions will depend on each other’s, in both impact and timing.

A new schedule for sulfur content

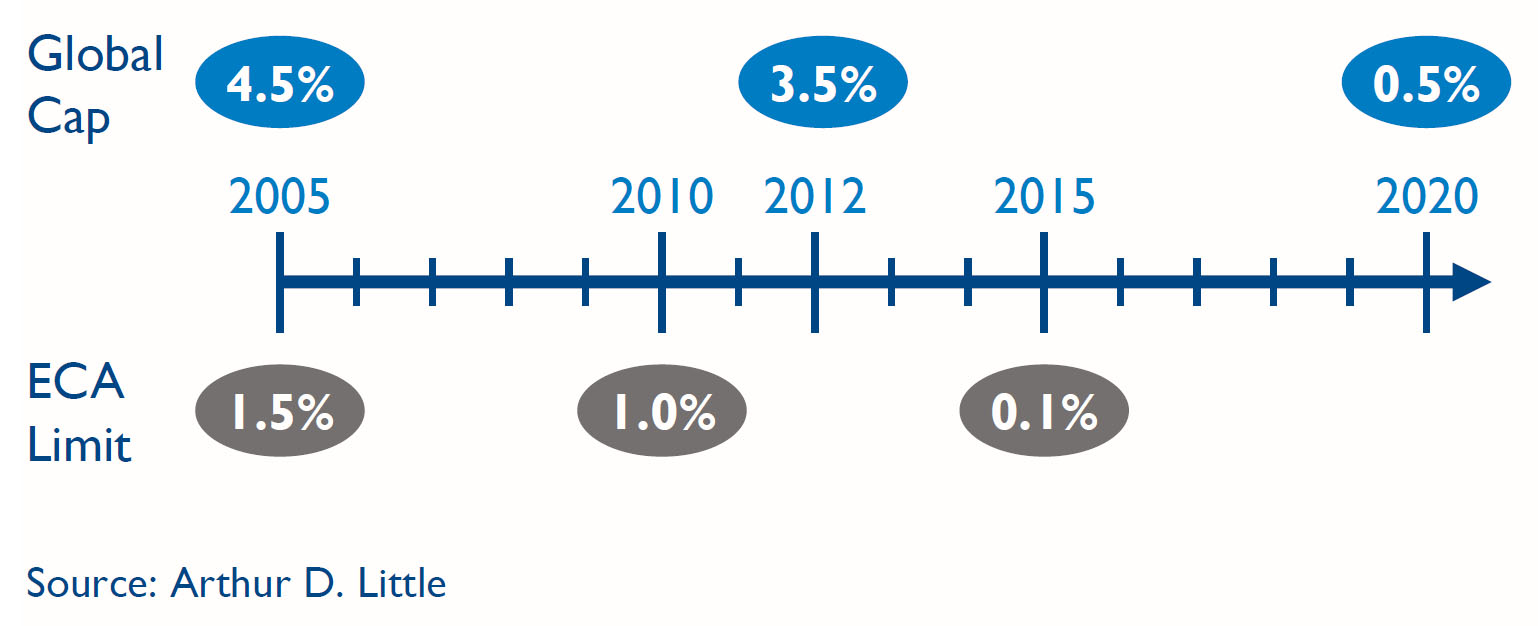

In October 2016 the International Marine Organization (IMO) committee set January 1st, 2020 as the starting date for the new MARPOL1 regulation. The regulation caps sulfur marinefuel emissions, limiting sulfur levels to of 0.5 percent (mass over mass) in marine fuels outside of the already-much-stricter emission-control areas (ECAs). Current marine-fuel regulation demands a maximum of 0.1 percent sulfur content inside ECAs and 3.5 percent outside them.

Marine-fuel sulfur-content limit – % m/m

Dealing with stricter fuel specs

From 2010 on, the most viable solution for vessels navigating through ECAs has been to run on marine diesel oil (MDO) or low-/ultra-low-sulfur fuel oil (LSFO/ULSFO) for as short a time as possible through these areas and switch to high-sulfur fuel oil outside them. This approach will no longer be possible after 2020, when higher-than-0.5-percent-sulfur-content fuels will no longer be an option on their own.

Upcoming regulations will negatively impact high-sulfur residualfuel demand, and the price penalty it incurs against lighter and cleaner fuels will increase. Non-compliant refineries and most of the current shipping fleet will face negative economic impact if the supply-demand imbalance expected for 2020 is not closed.

The answer may not come as a unique choice, but as a combination of approaches. Marine fuels will have to be desulfurized or blended with lower-sulfur components to enable them to meet the new specifications, but the incorporation of new shipping technology will play its role as well, especially exhaust-gas scrubbers and built-in liquefied natural gas (LNG) systems.

Marine refined products’ supply-demand imbalance

Fuel oil has been centrally involved in marine propulsion since the early 20th century, and its application is now being challenged. In the last years, more than 40 percent of total fuel-oil production has been absorbed in supplying marine-fuel demand, which may no longer be the case eyond 2020. Demand for refined products and crude refining throughput will continue growing and, consequently, so will fuel-oil production. Since the majority of current fuel oil does not meet the 2020 standards, low-sulfur fuel oil and other distillates, such as MDO, will see demand increased.