118 min read • Travel & transportation

The future of mobility 5.0

Changing gear in the journey toward sustainable mobility

Foreword

We live in uncertain and unpredictable times, yet looking into the future remains a key component of leadership. What trends and challenges are affecting the evolution of our mobility systems? What new solutions should we be aware of, and which ones are actually able to deliver on their promises? How can public and private sector initiatives come together and mutually reinforce each other? What will change the game in the years to come?

This Report is the fifth in a series of comprehensive reports on the future of mobility since Arthur D. Little (ADL) originally set up its Future of Mobility Lab in 2010. It aims to shed light on what key stakeholders — transport authorities at local, regional, and national levels; public and private mobility services providers; transport sector suppliers; and investors — should do to shift gear and accelerate the transition toward more sustainable, resilient, safe, inclusive, efficient, and human-centric mobility systems (hereafter referred to as “virtuous mobility systems”).

The primary audience for this study includes mobility leaders and decision makers from around the globe, including political decision makers, C-level executives, and management, as well as policy advisors. Given the breadth of our target audience, it is anticipated that some content may be familiar to certain readers while serving as new information to others. This diversity of knowledge is intentional, as the study aims to provide a holistic view of the critical components necessary for a virtuous mobility future. It also seeks to uncover common blind spots, encouraging a broader perspective that transcends familiar viewpoints.

For this edition, we joined forces with POLIS, Europe’s leading network of local and regional authorities advancing sustainable mobility through transport innovation. Over the past months, we talked to many global private and public sector stakeholders, engaged with POLIS members in focus groups, launched a worldwide survey to collect insights from leaders in the mobility world, drew conclusions, and formulated recommendations.

The study adopts a 360-degree perspective on mobility matters, from local to supra-regional levels. After taking stock of current mobility performance and trends, we dive more deeply into eight solutions currently at the forefront, aiming to demystify and critically evaluate them. We also reflect on their likely overall impact if they were collectively implemented and identify 10 game changers that we believe are critical for mobility systems players to shift gear and accelerate progress.

We hope you enjoy reading the Report and that it will be informative for your further mobility endeavors.

Sincerely,

Francois-Joseph Van Audenhove

Managing Partner,

Head of Travel & Transportation

Arthur D. Little

Karen Vancluysen

Secretary General

POLIS

EXECUTIVE SUMMARY

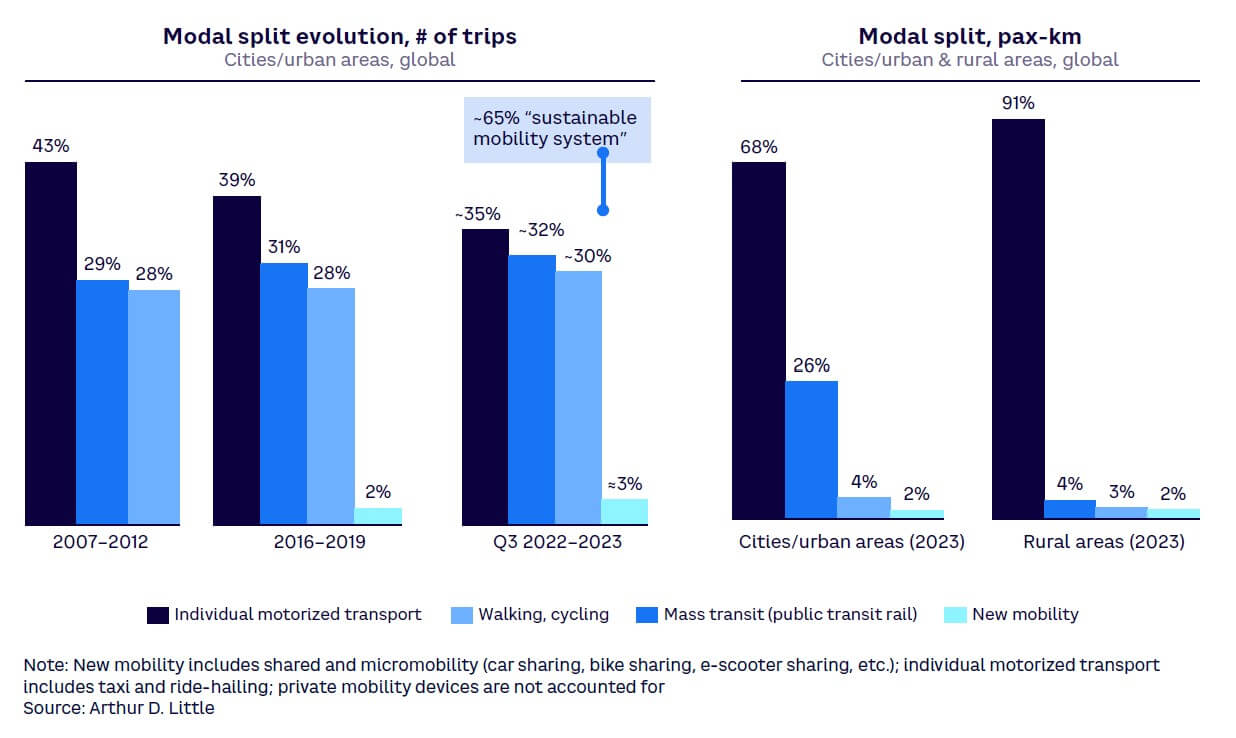

Progress toward the goal of more sustainable, resilient, safe, inclusive, efficient, and human-centric mobility systems in our cities has been slower than was expected a decade ago. While there has been some progress in the growth of public transport (PT) and active mobility (walking and cycling) — and new mobility devices and shared mobility services have been introduced — over the last 15 years the growth of these modes has been less than 10% globally, and individual cars still represent 70% of passenger-km (pax-km) in urban areas and 90% in rural areas. On a worldwide basis, transport still accounts for around 25%-40% of national carbon dioxide (CO2) emissions, the only sector with a steady increase since 1990.

On a more optimistic note, ADL’s latest “Future of Automotive Mobility” global end-user study[1] found that between 42% and 72% of inhabitants in large cities of more than 250,000 persons would “perhaps” be willing to give up at least one of their cars if sufficient mobility alternatives were made available to them. Of course, there is often a significant gap between declared intention and actually taking action.

Over the last decades, the convergence of global trends has led to the development of new mobility services and business models with the promise of improving our mobility systems. These include personal mobility devices (e.g., e-scooters and other micromobility devices), shared mobility models, and autonomous mobility, as well as active mobility and the need for more integrated mobility services and information. To explore the impact of these trends, the challenges hindering their progress, and recommendations for overcoming them, the study undertook eight deep dives into promising solutions, including concepts, policies, and services (see Figure A).

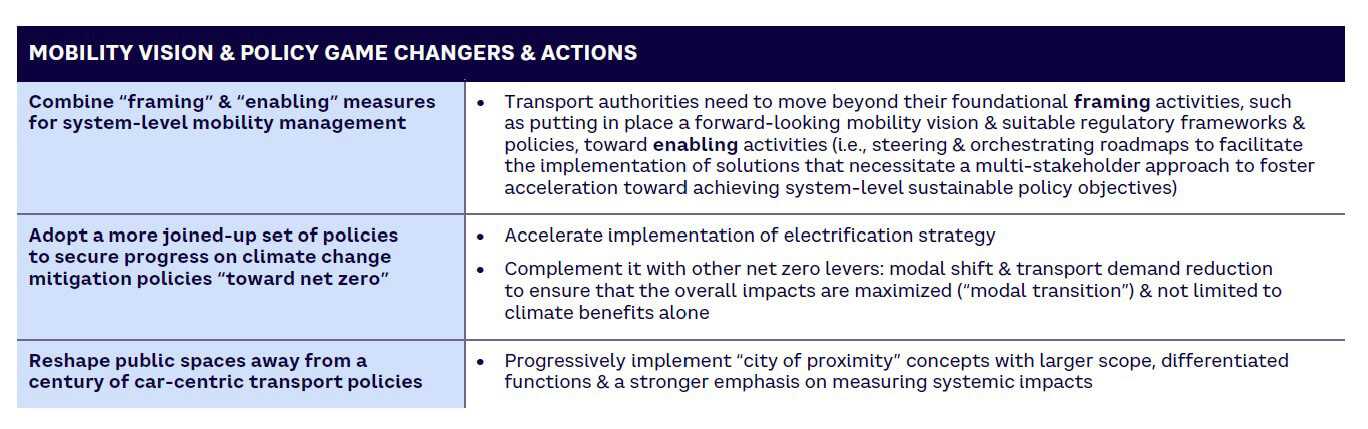

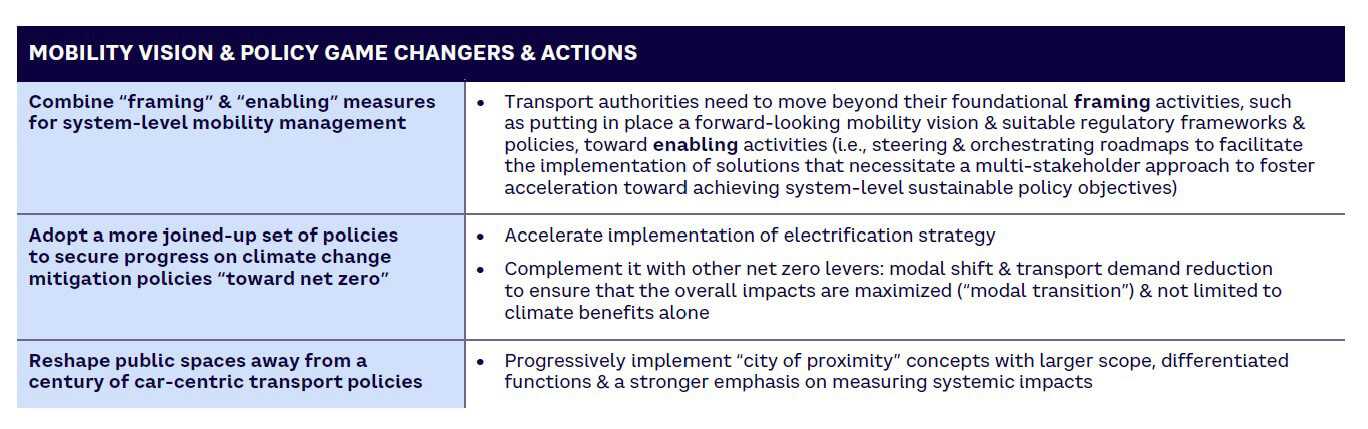

Beginning with mobility visions and policies, there are still difficulties in adopting long-term, adequately integrated policies to secure real progress on climate change mitigation and the move toward net zero is still challenging. Mitigating climate change’s impact requires a more joined-up policy approach, whereby electrification is complemented by a modal shift away from the private car to more sustainable modes as well as by transport demand reduction.

Reshaping mobility behaviors also requires reshaping public spaces away from a century of car-centric transport policies and urban planning. Overall, the concept of the “city of proximity” has great potential to contribute to sustainable mobility. Going forward, city authorities should pursue efforts to deploy the concept but at a larger scale, with possible adaptations to cater to how digitalization has changed citizens’ needs for proximity, and with a stronger emphasis on measuring systemic impacts.

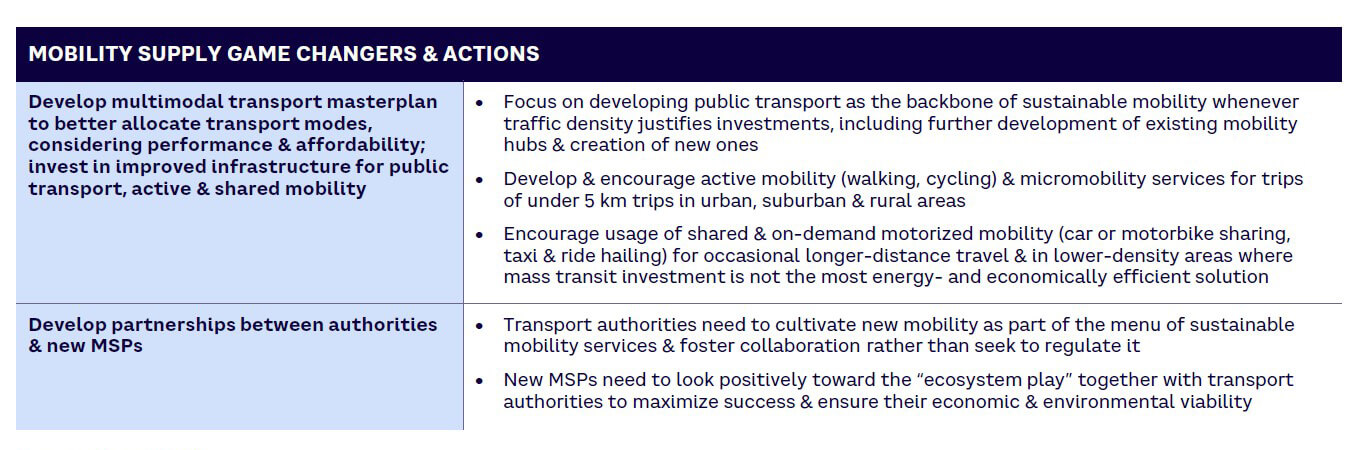

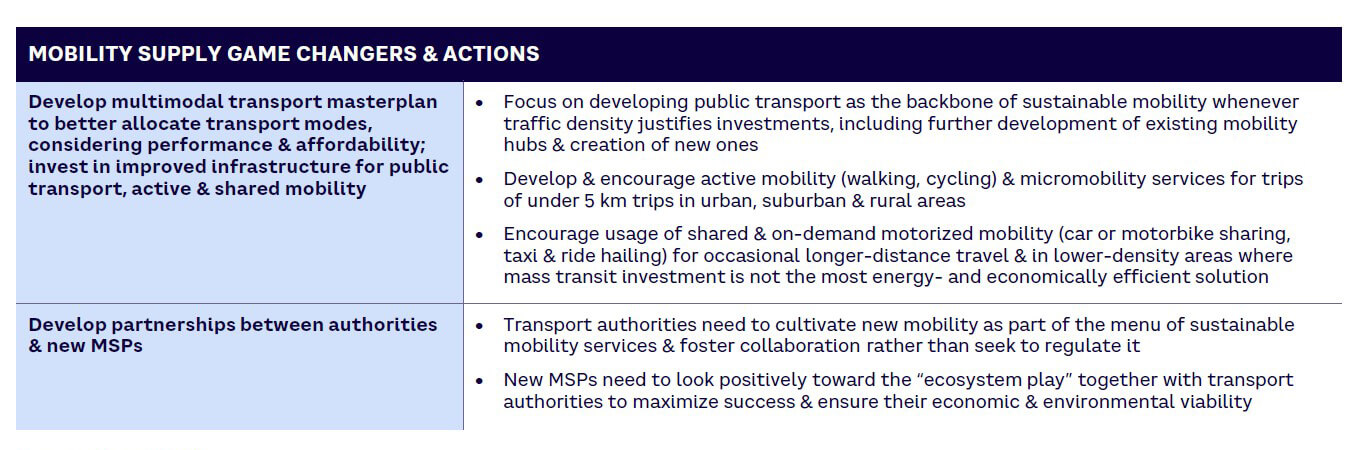

Looking at mobility supply, authorities should become smarter with transport mode allocation through the development of multimodal transport masterplans that prioritize transport services according to their performance and affordability, including supporting the development of mass transit in its key role as the “backbone” of sustainable mobility as well as encouraging complementarity with other sustainable modes where these can be more efficient, convenient, and equitable. Authorities need to cultivate new mobility as part of the menu and foster partnerships with new mobility service providers (MSPs), rather than merely seek to regulate them. This also means that new MSPs need to take a greater interest in improving the ecosystem to maximize success and improve their economic and environmental viability.

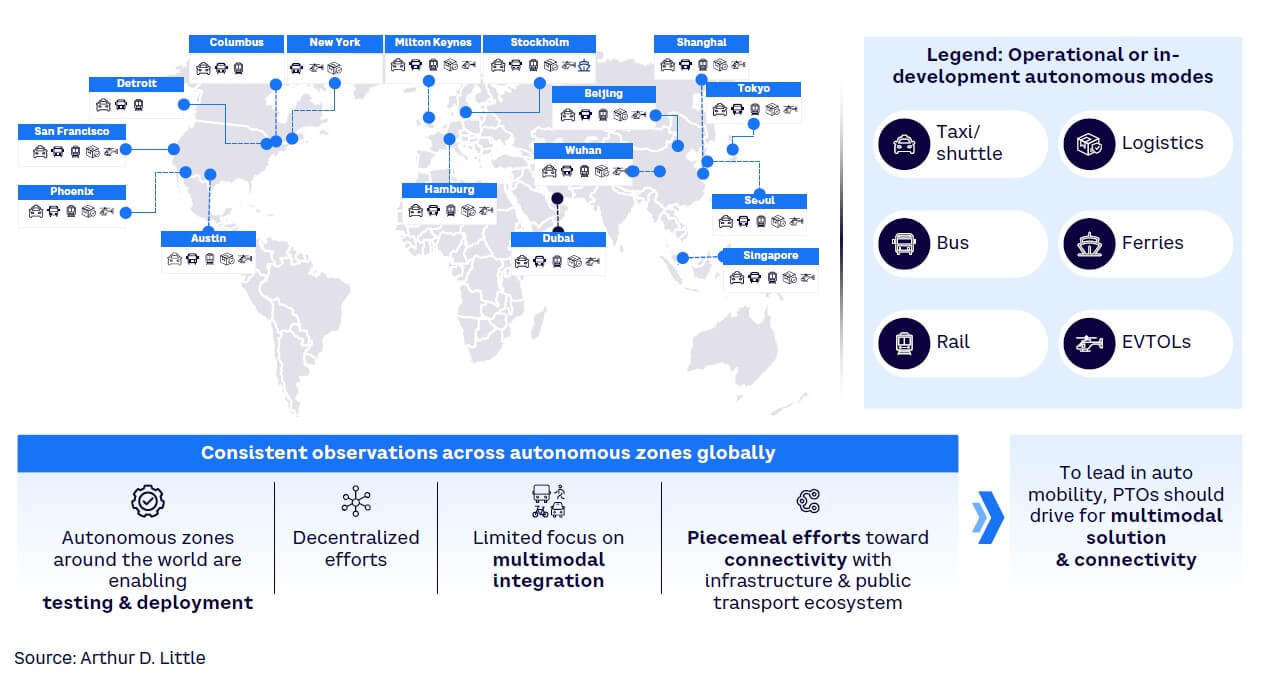

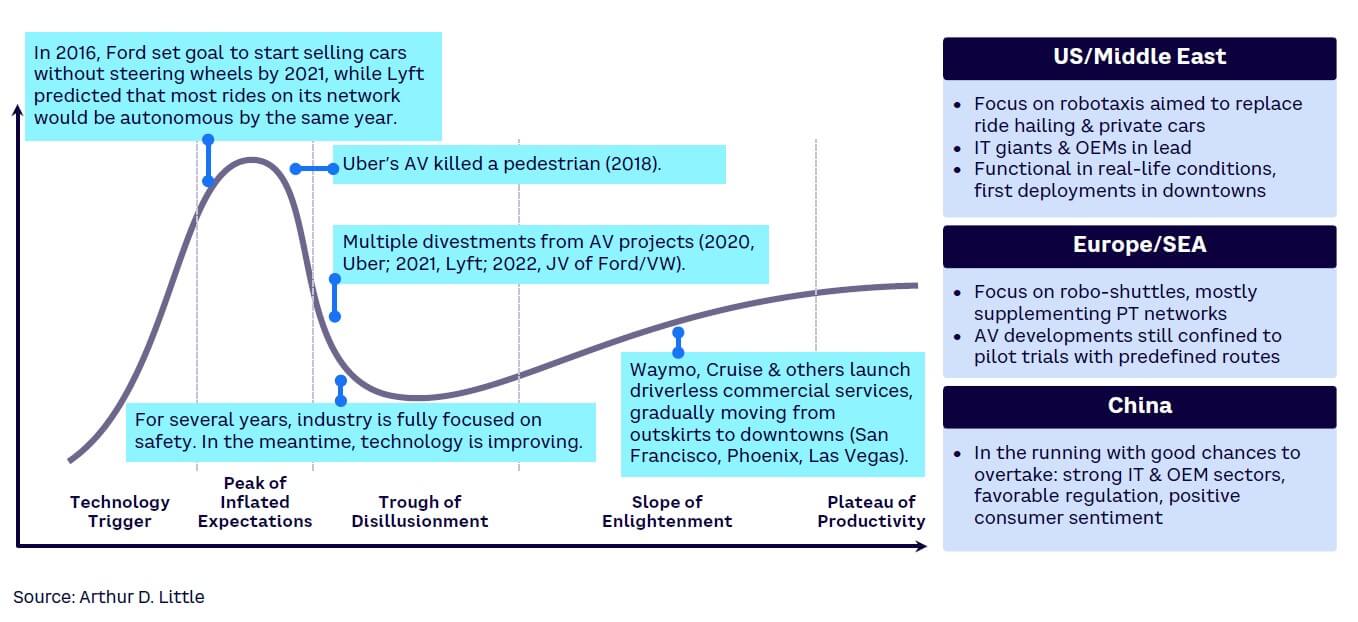

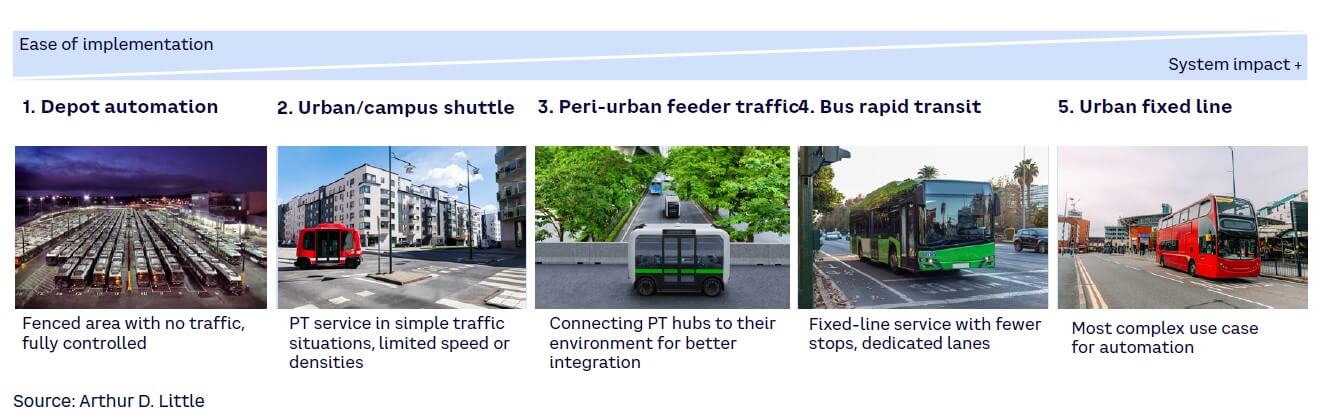

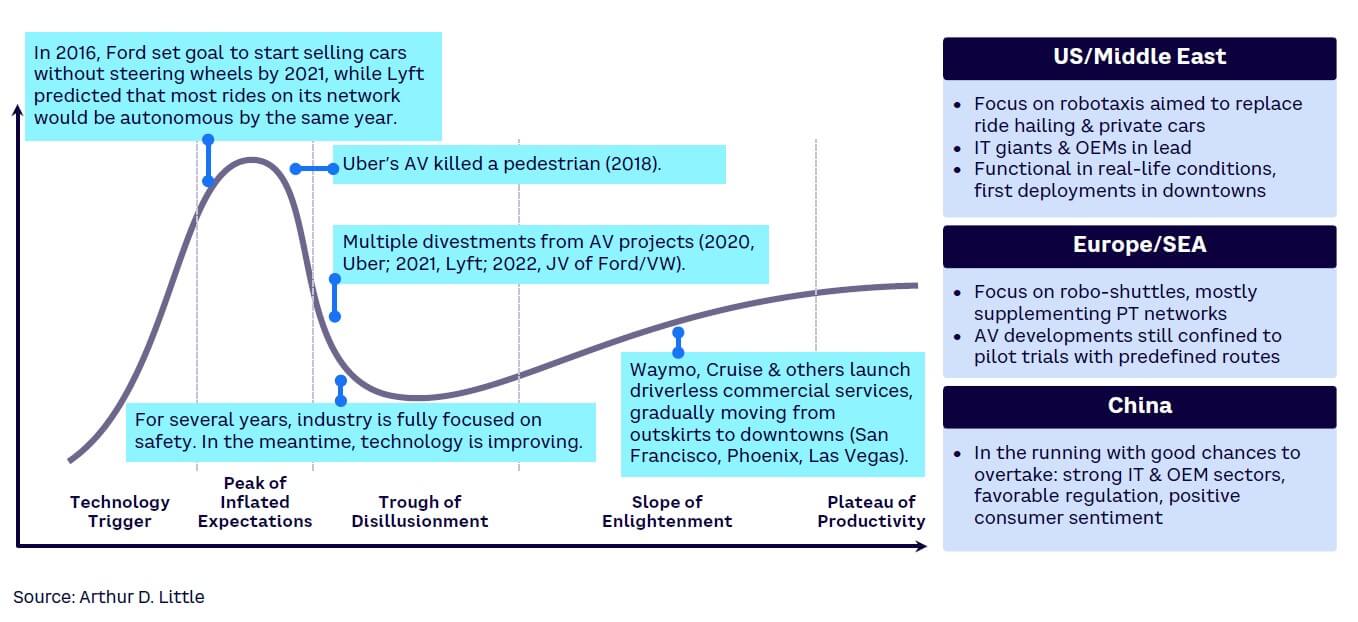

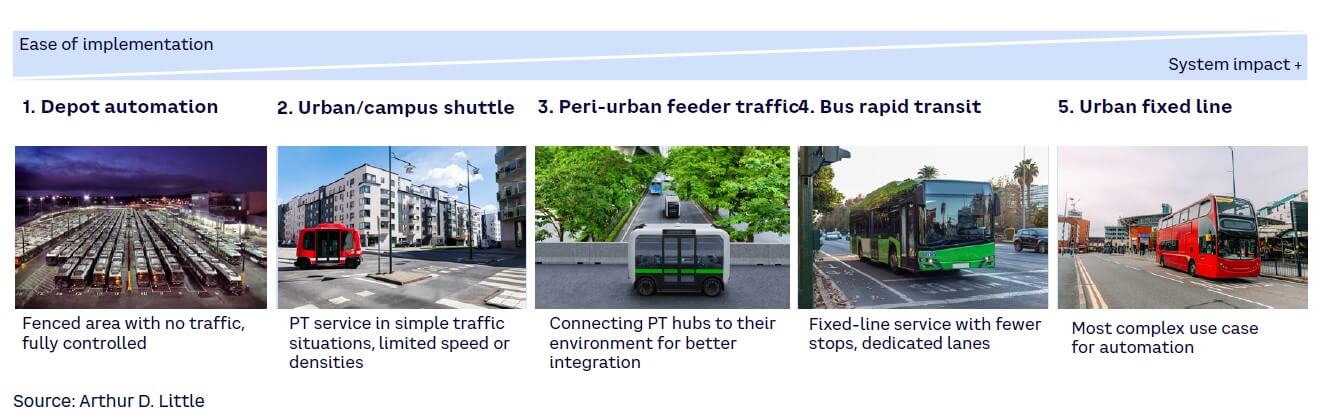

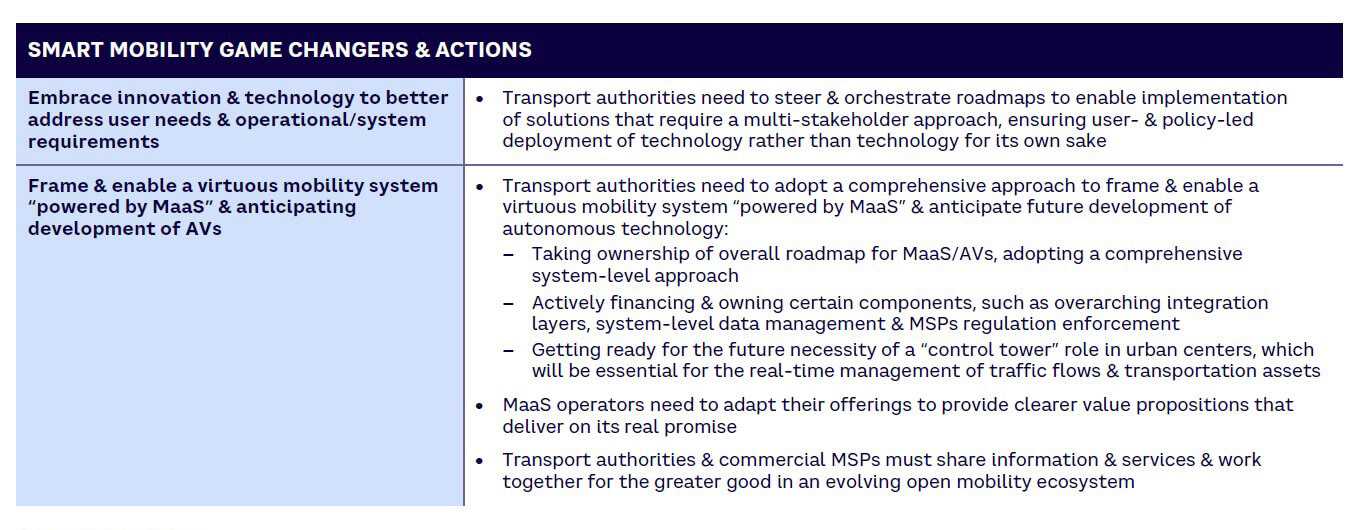

In terms of smart mobility, mobility as a service (MaaS) needs to offer more added value functionalities beyond merely serving as an “umbrella” app for existing services. In the long run, we expect the benefits of autonomous mobility are not realized through individual automated vehicles, but rather through connected and mostly shared vehicles in smart traffic systems. In the meantime, the focus should be more on feasible use cases and applications, such as automated bus rapid transit (BRT) systems and automated bus driving in depots, rather than going directly to the moonshot of autonomous vehicles (AVs) in mixed traffic.

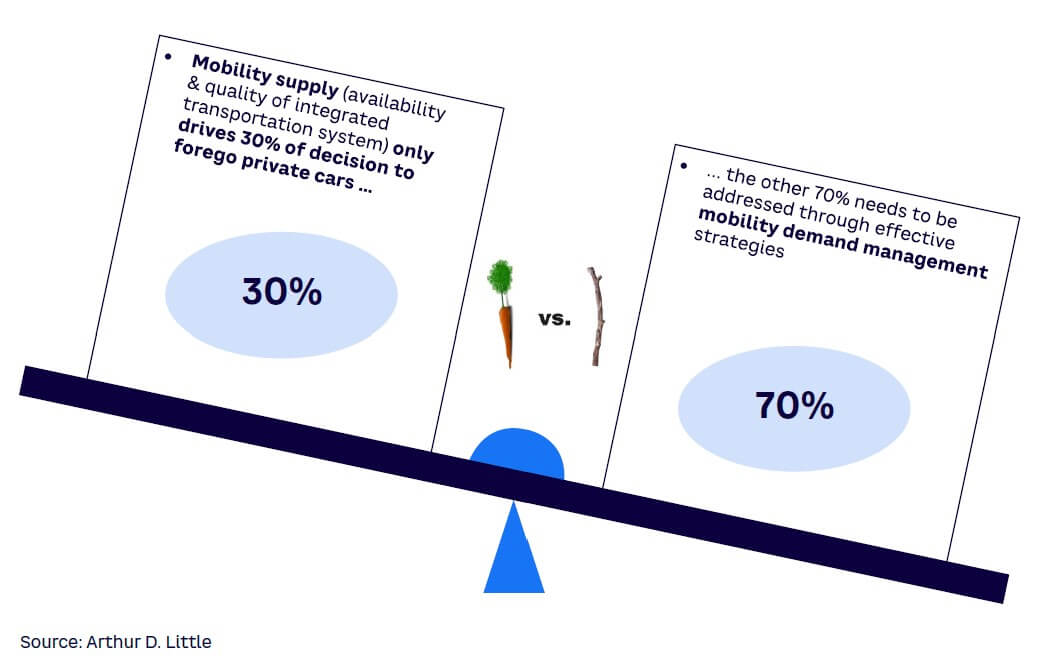

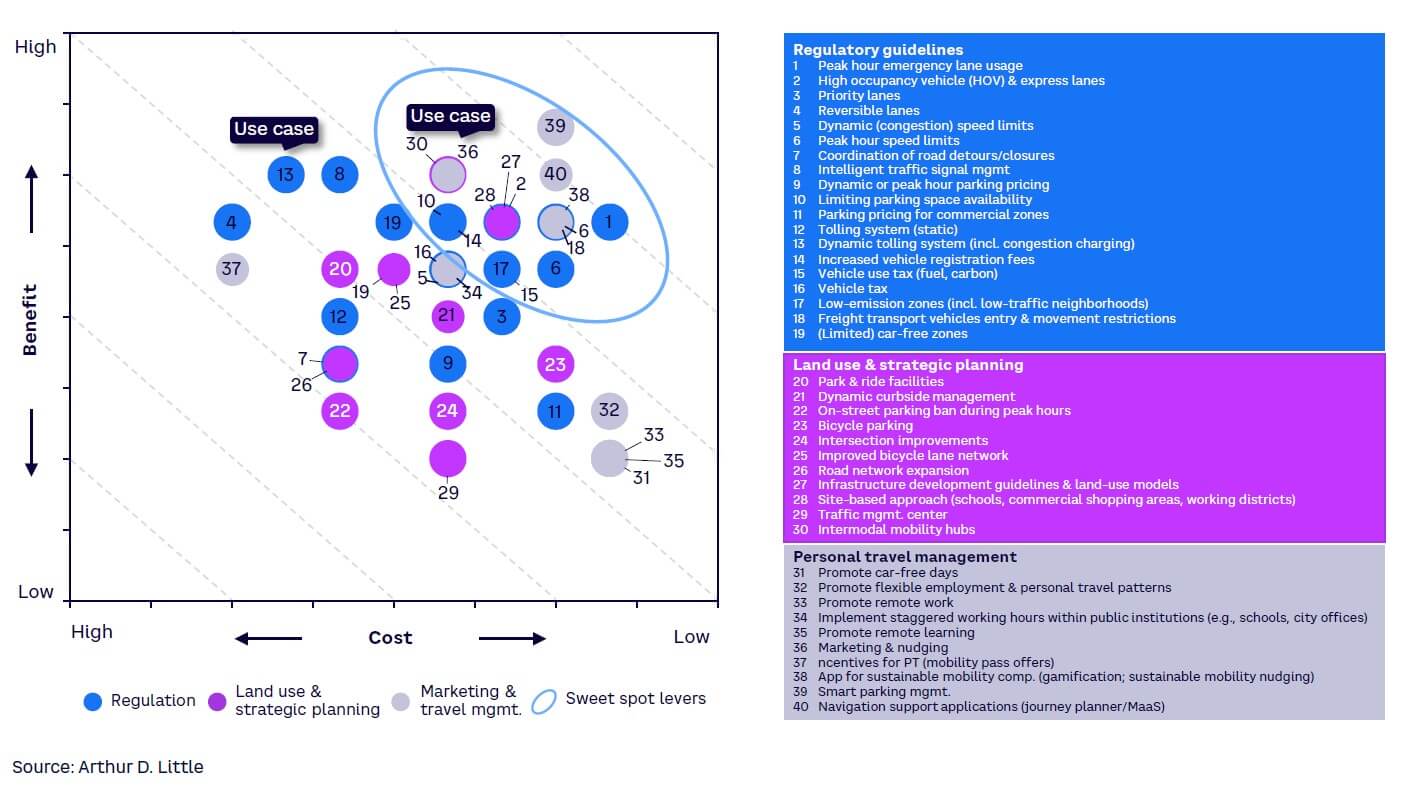

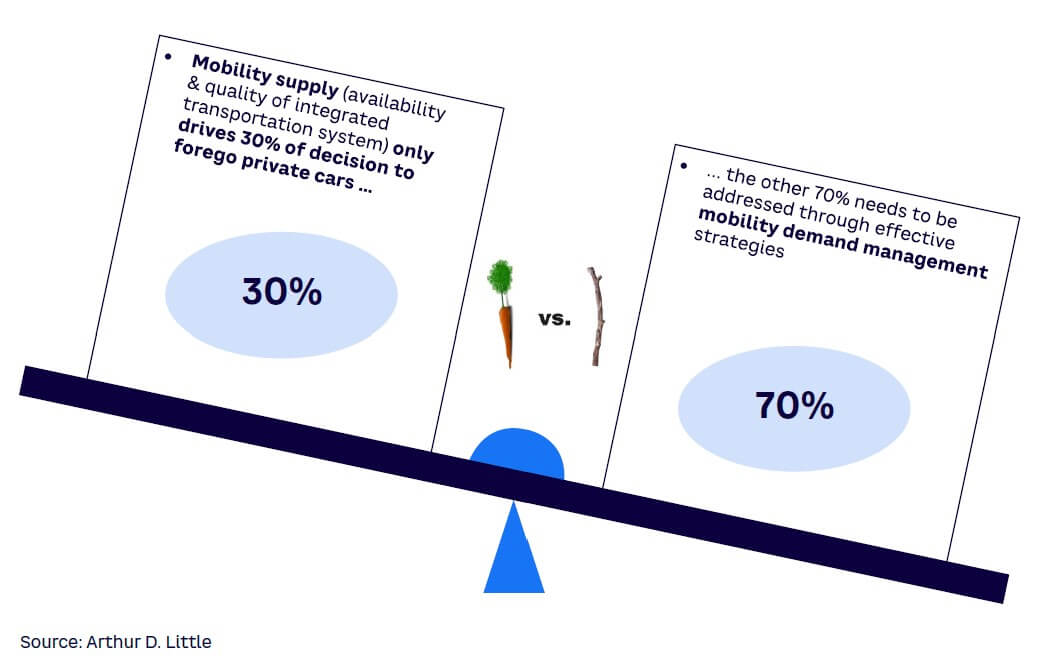

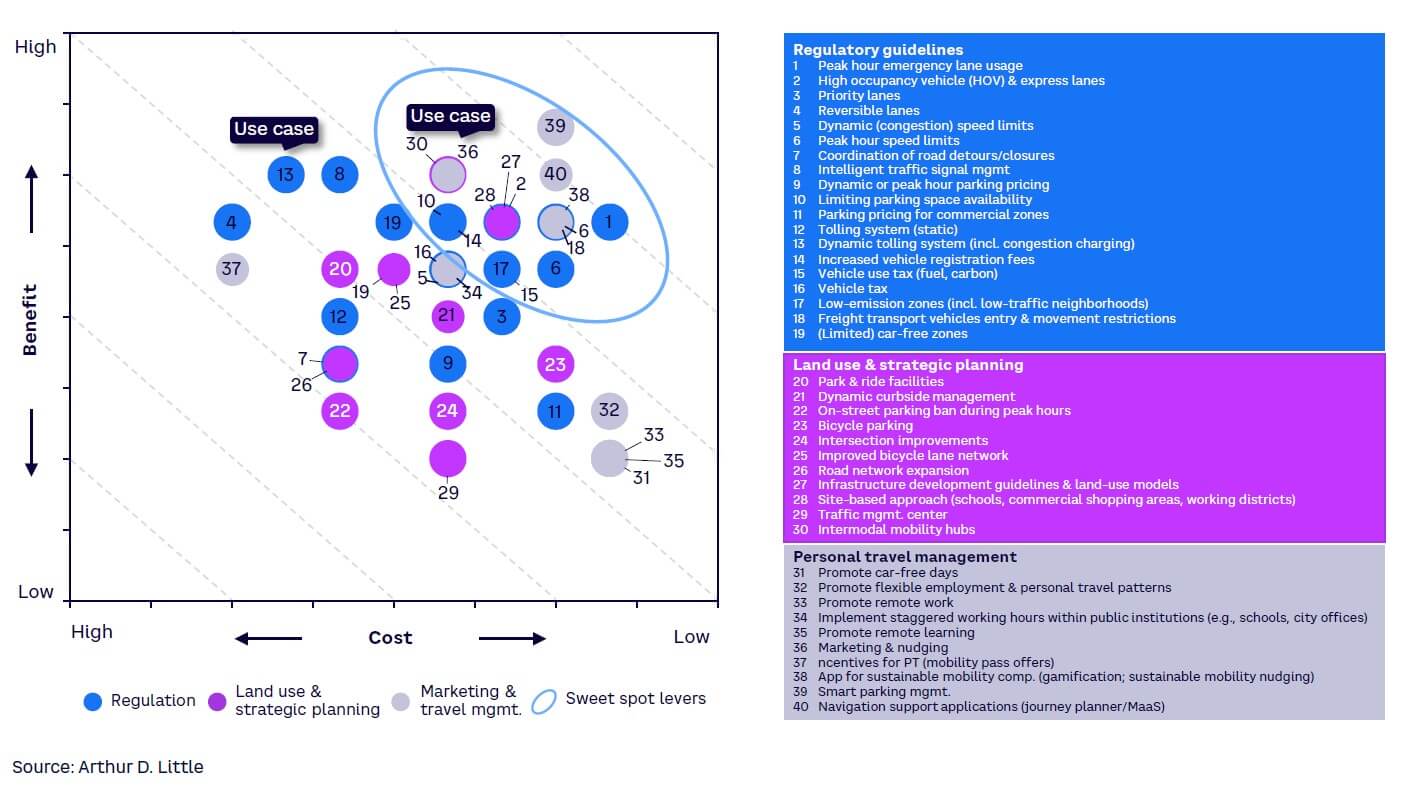

Mobility demand management (MDM) is crucial to enabling modal shift away from private cars. We identified some “sweet spots” among many possible demand management measures, including urban vehicle access regulations, specific infrastructure initiatives like intermodal mobility hubs, personal travel management measures such as smart parking solutions and MaaS apps, and marketing strategies that promote sustainable mobility.

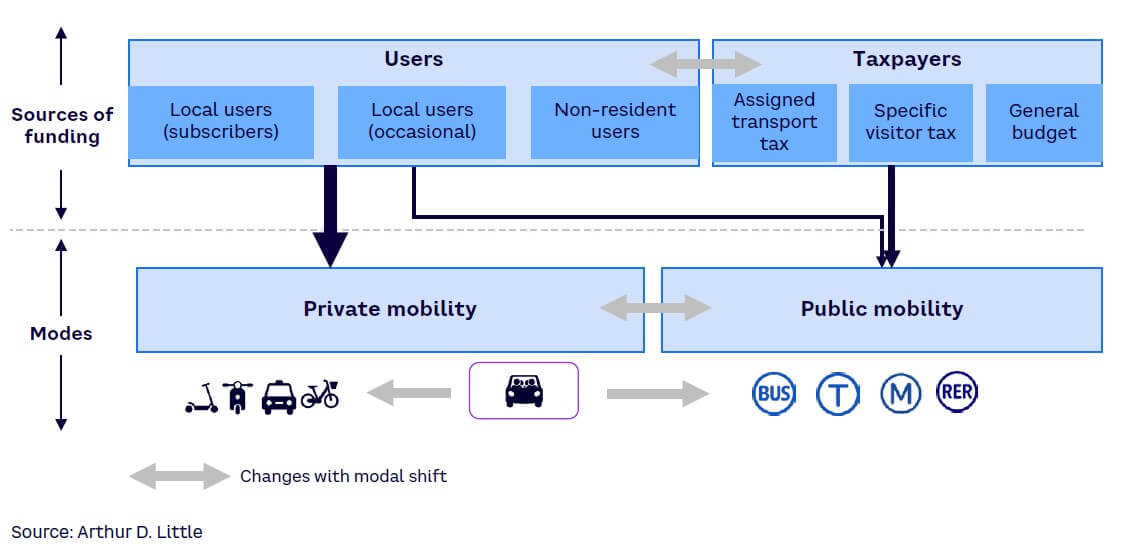

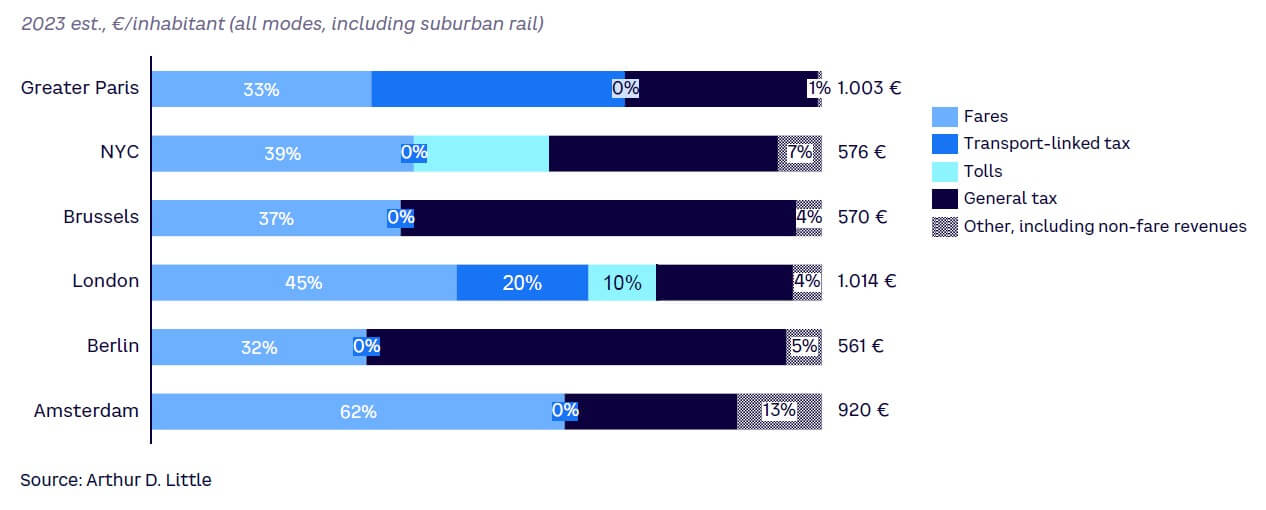

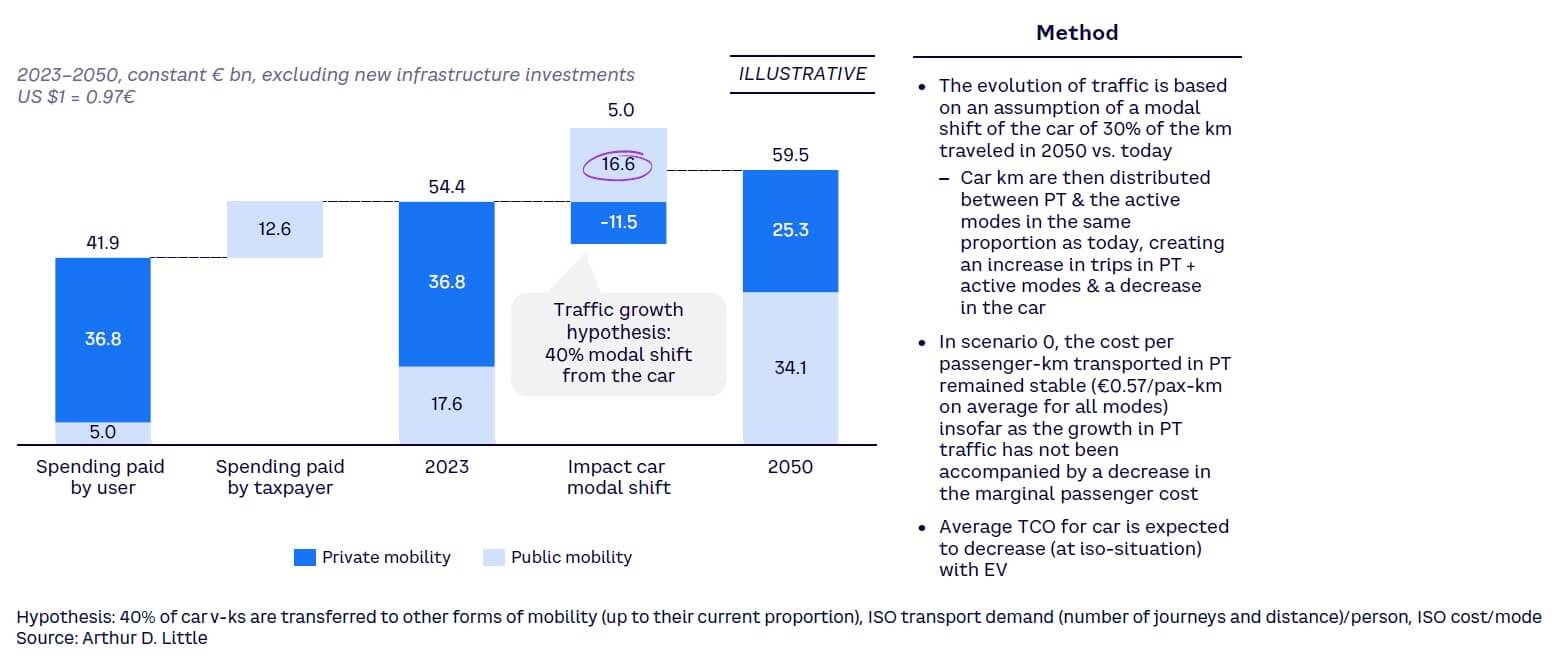

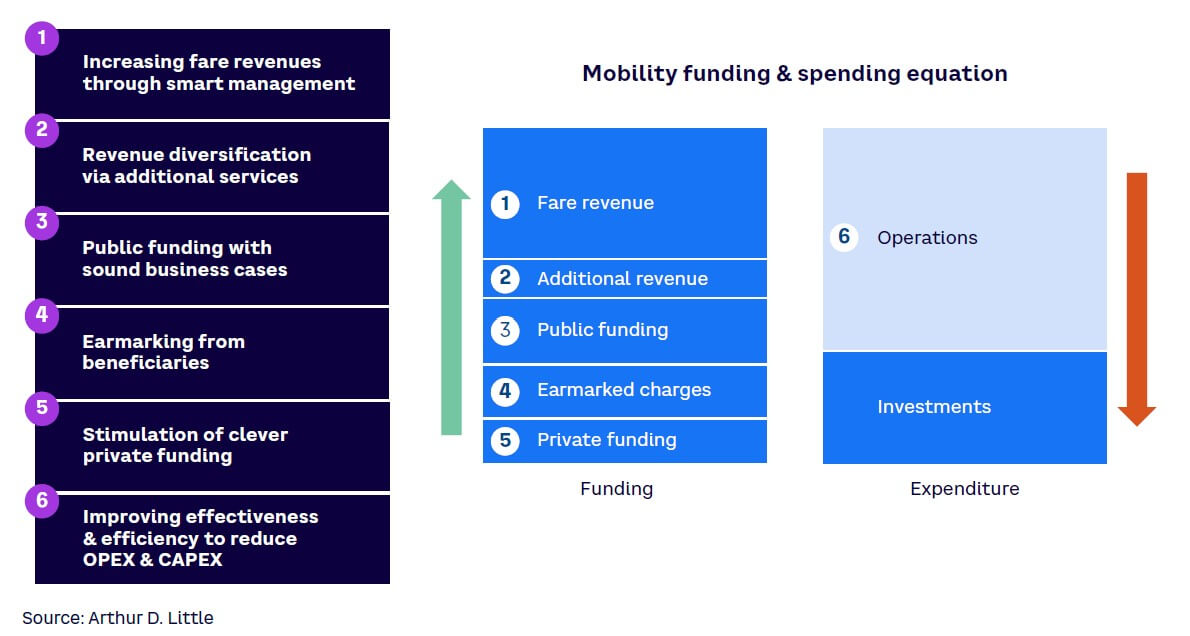

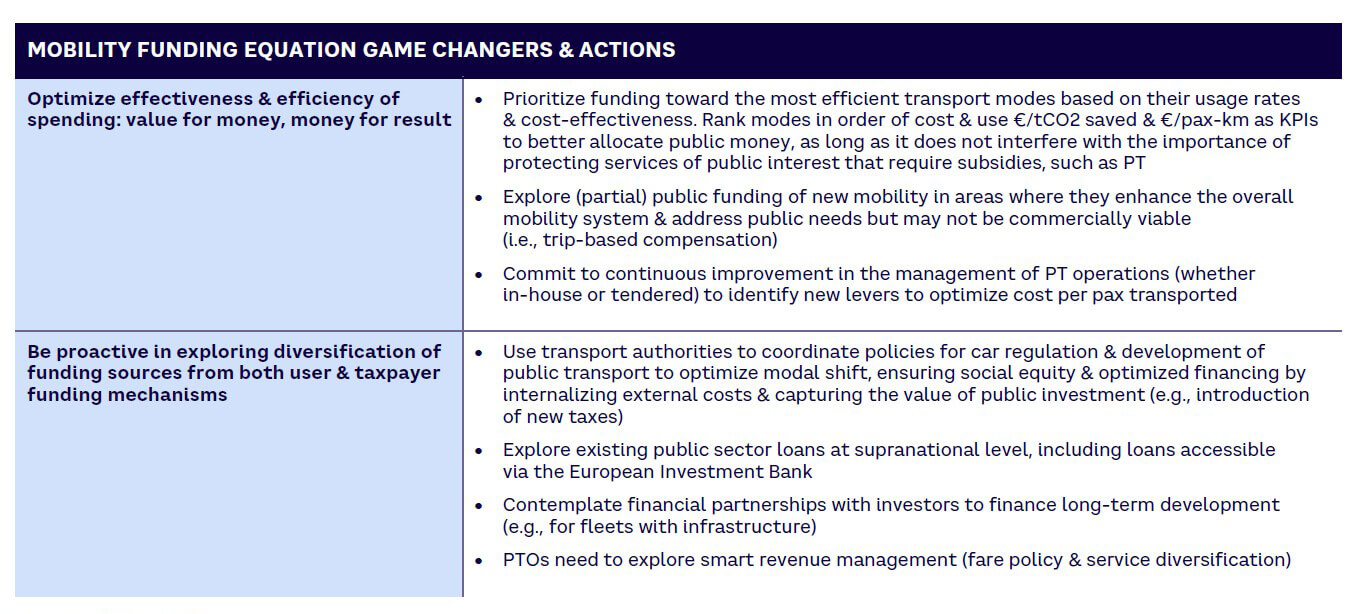

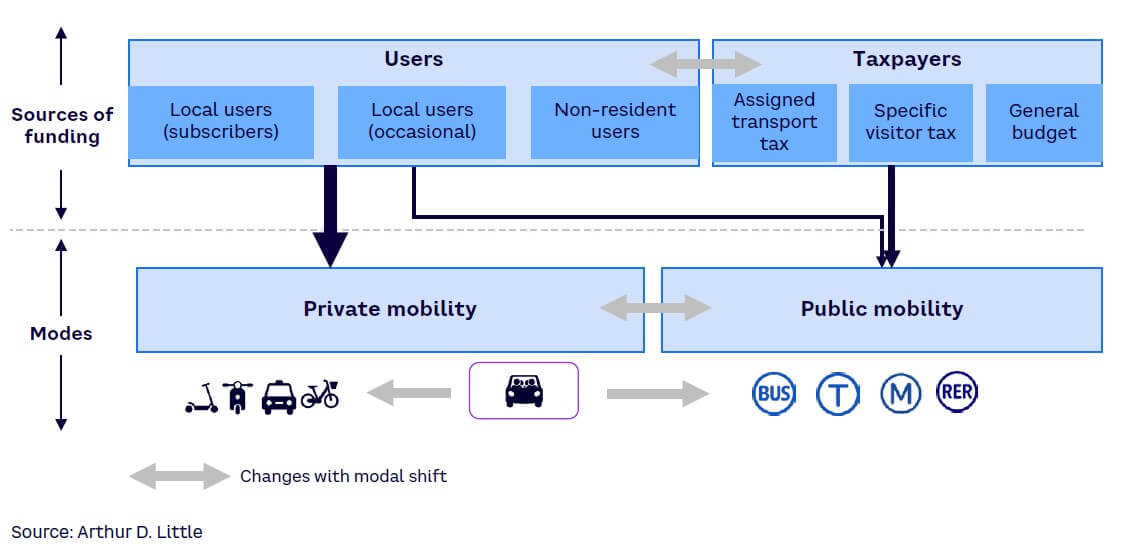

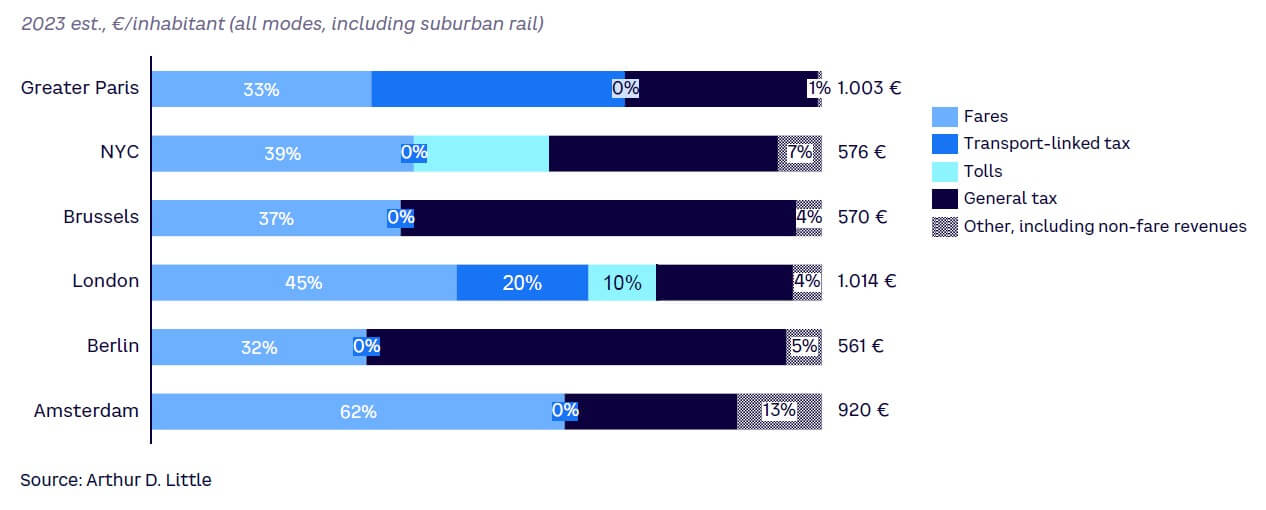

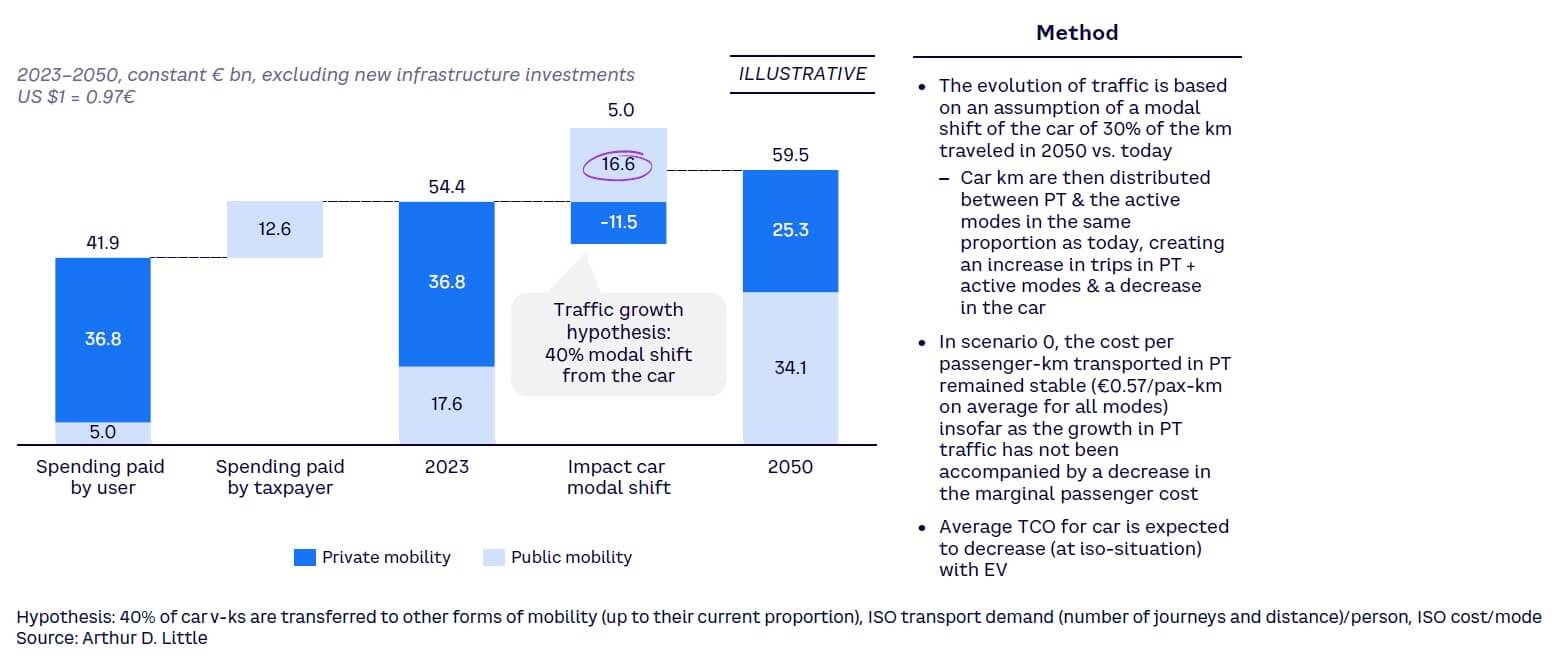

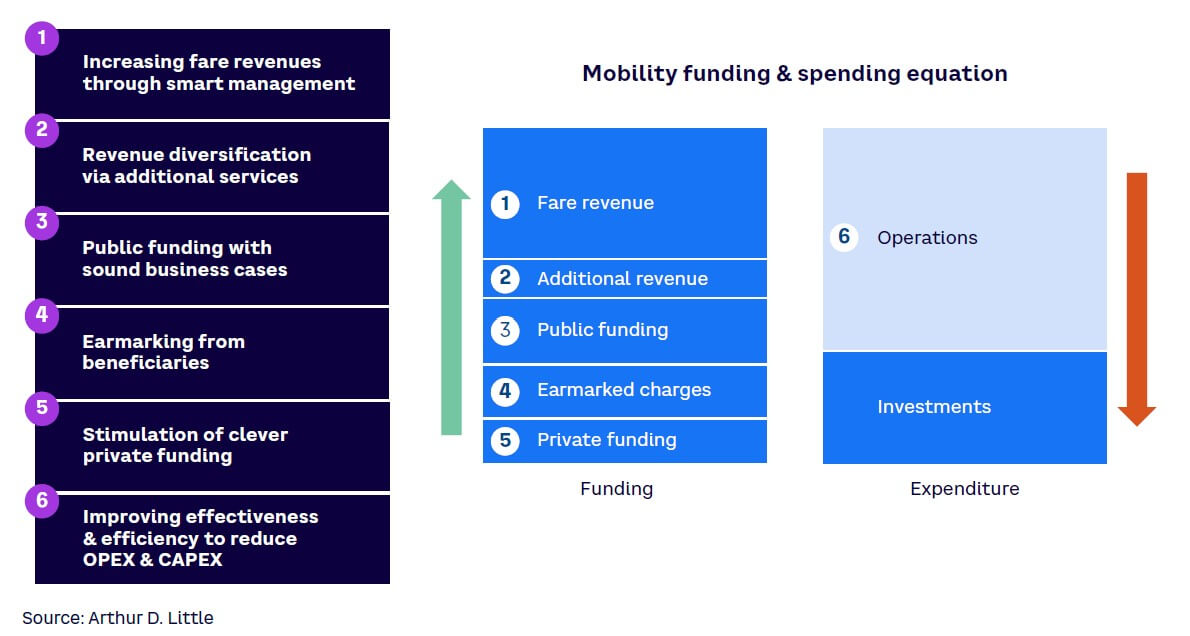

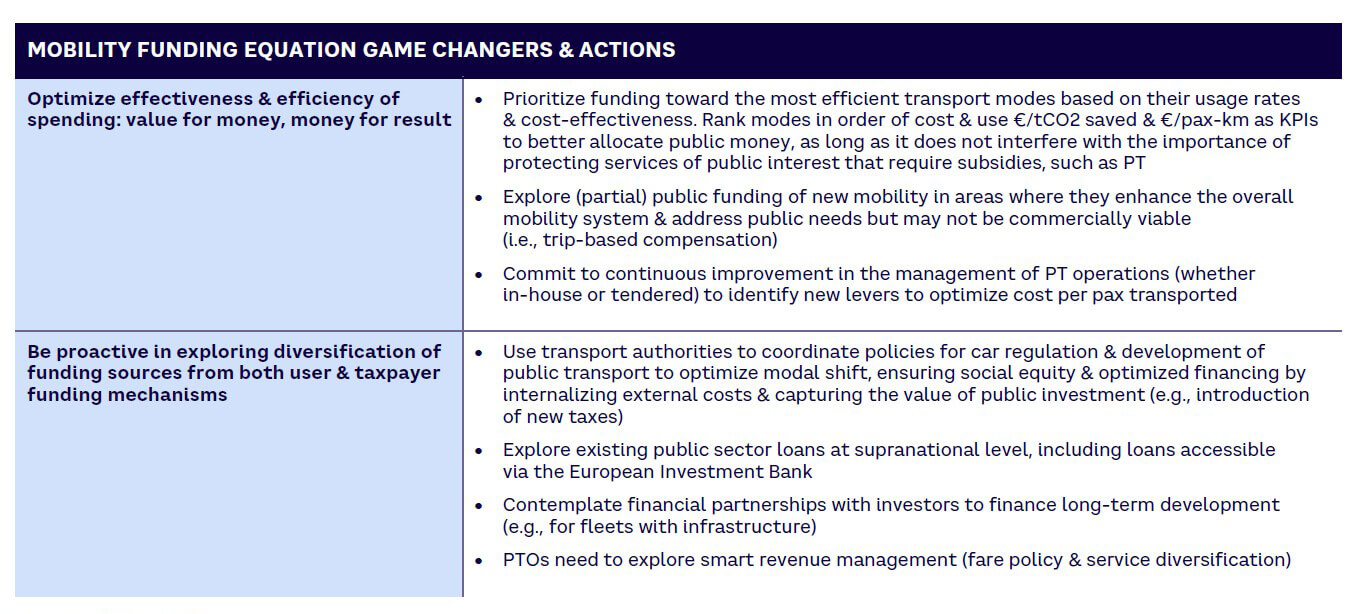

Finally, all measures mentioned above need significant additional mobility financing. Closing the funding gap will require more effective revenue management (e.g., through fare policies and subscription models), improving the attractiveness of public transport, and diversifying to secure new funding sources. On the expenditure side, transport authorities will need to better maximize the cost-effectiveness of capital investments and improve operational efficiency.

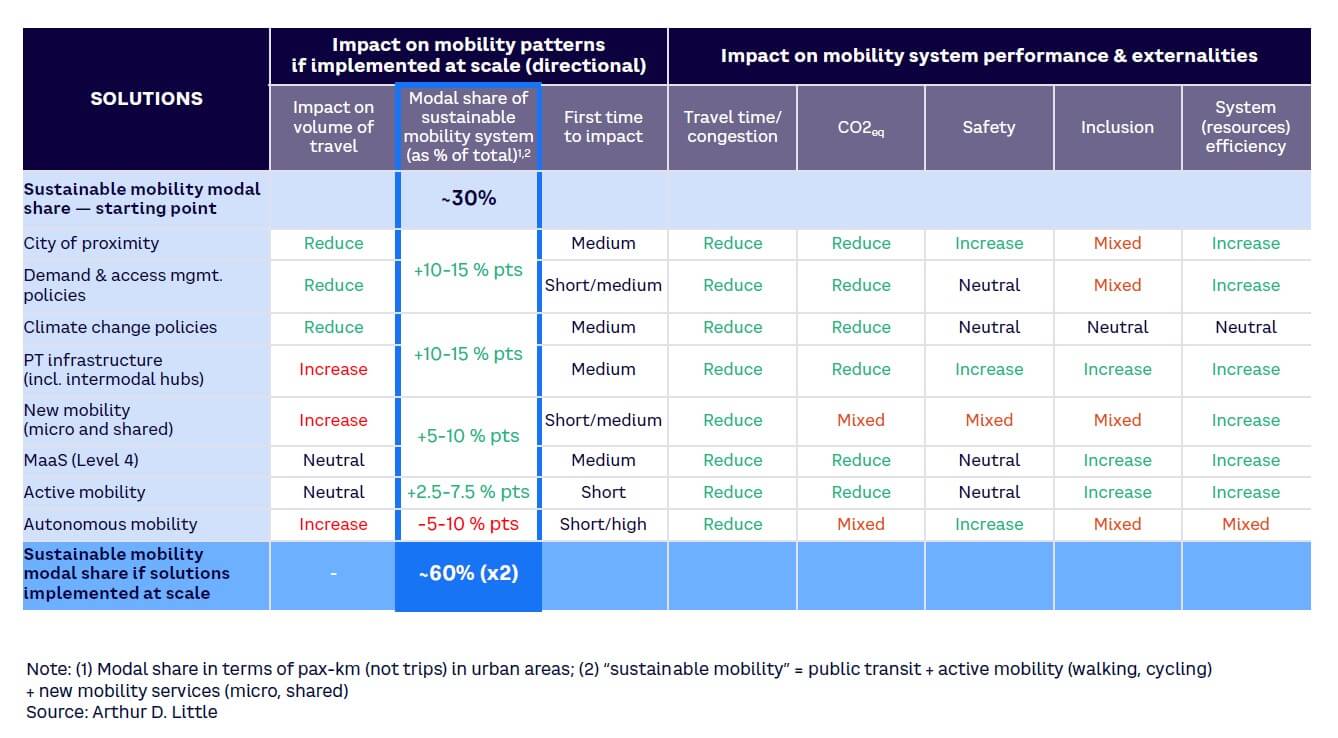

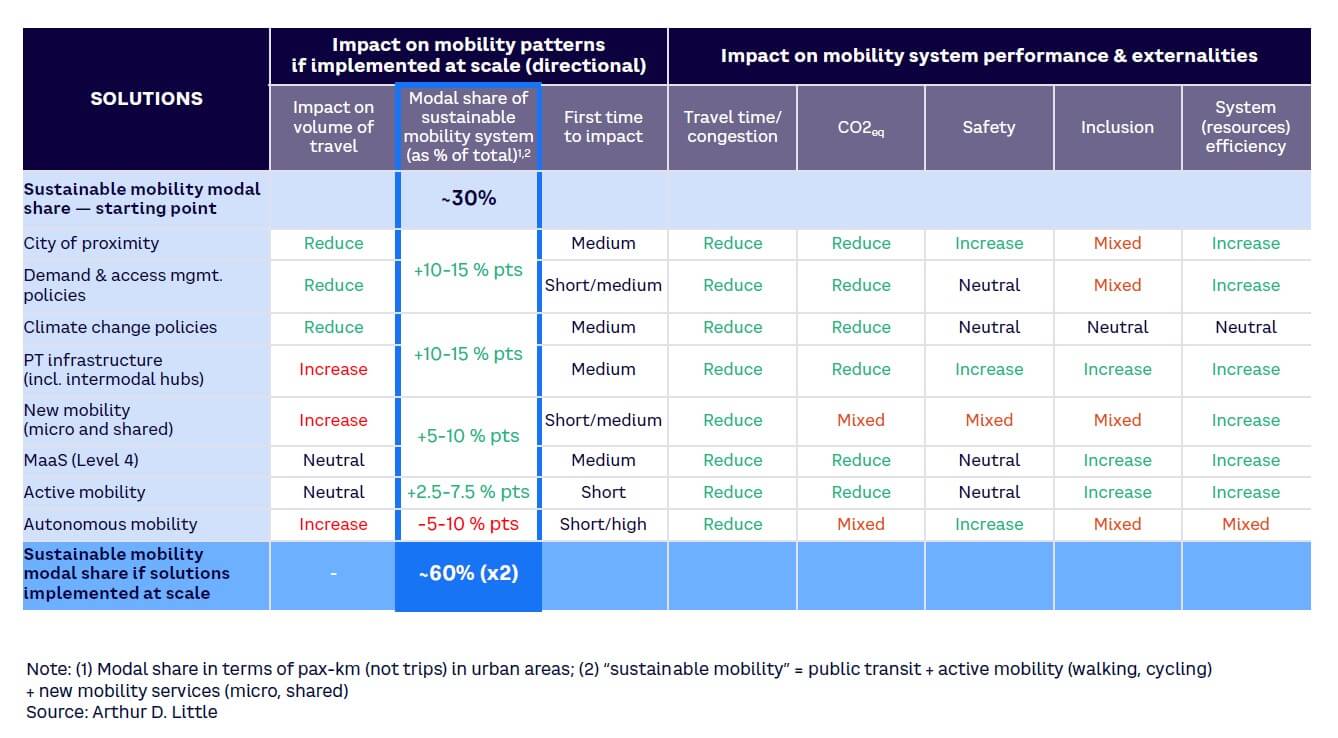

Our analysis leads us to conclude that, with comprehensive implementation, appropriate funding, and robust governance at the system level, the high-impact solutions we have reviewed could potentially double the global share of sustainable mobility from approximately 30% to 60% of pax-km within the next decade. However, none of the individual solutions has an impact of more than around 15%, so there are no shortcuts.

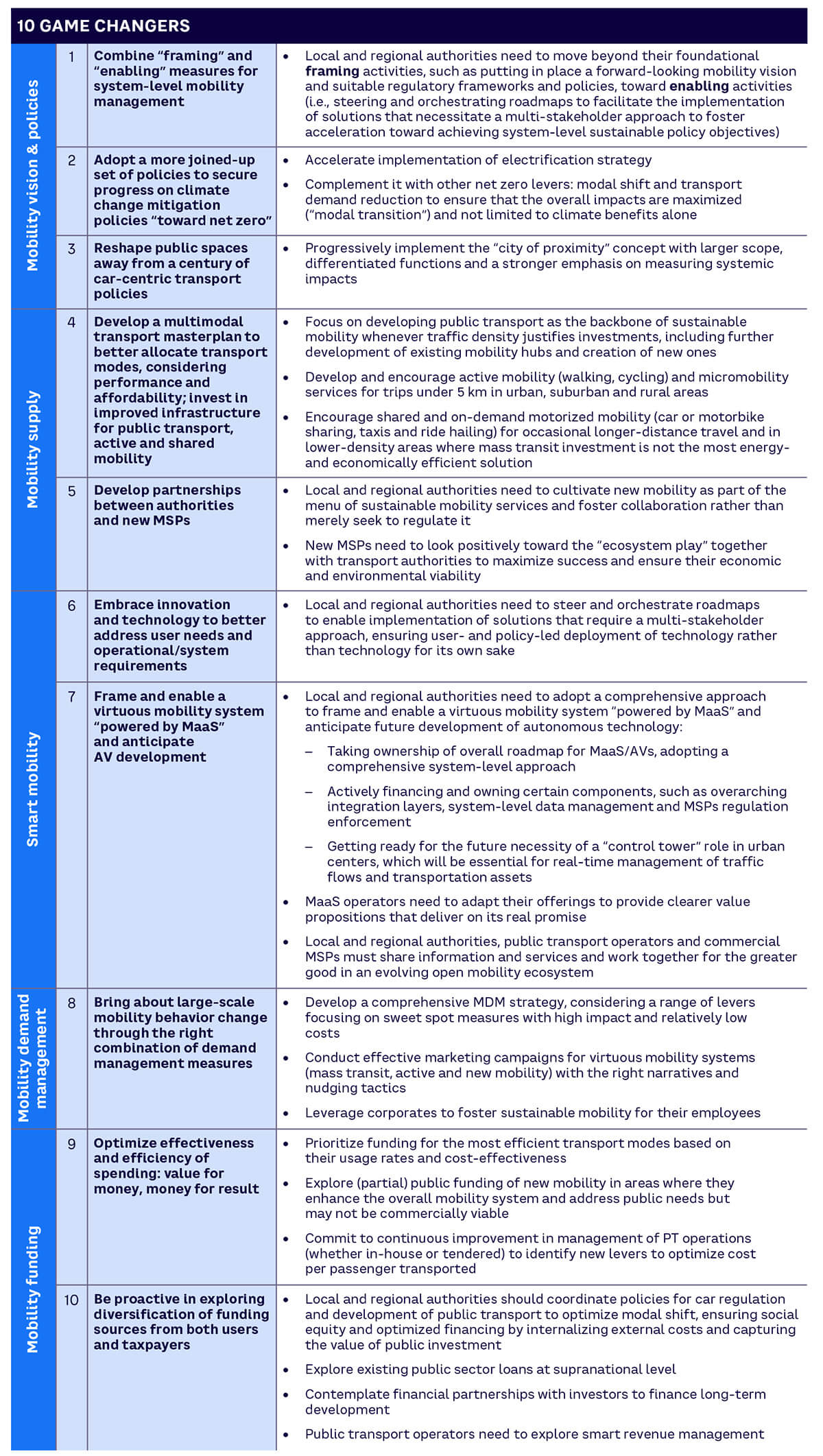

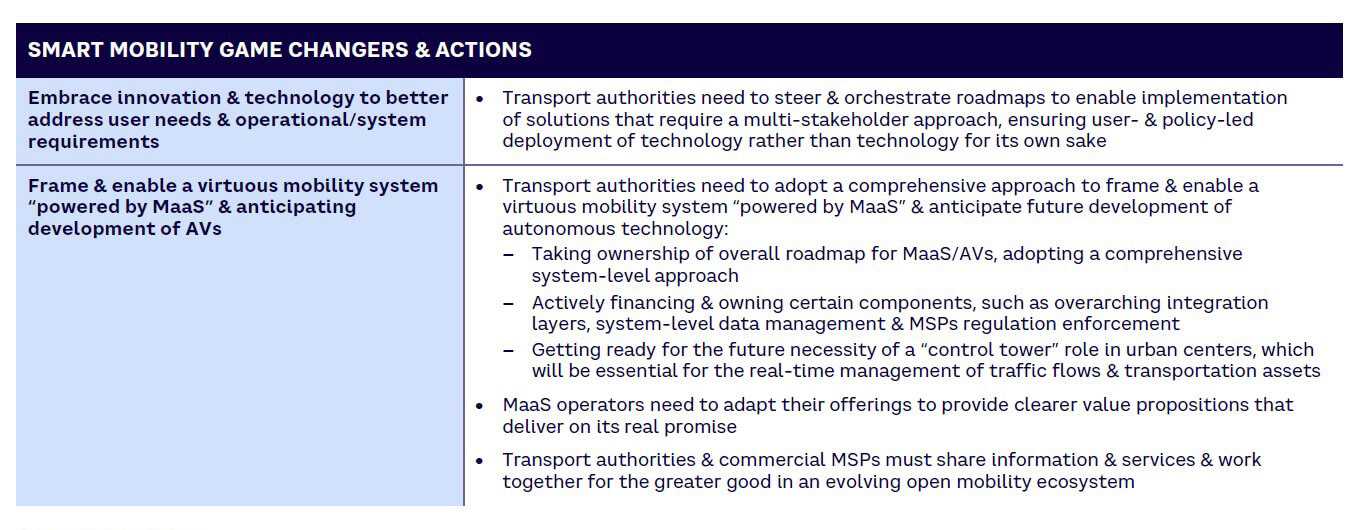

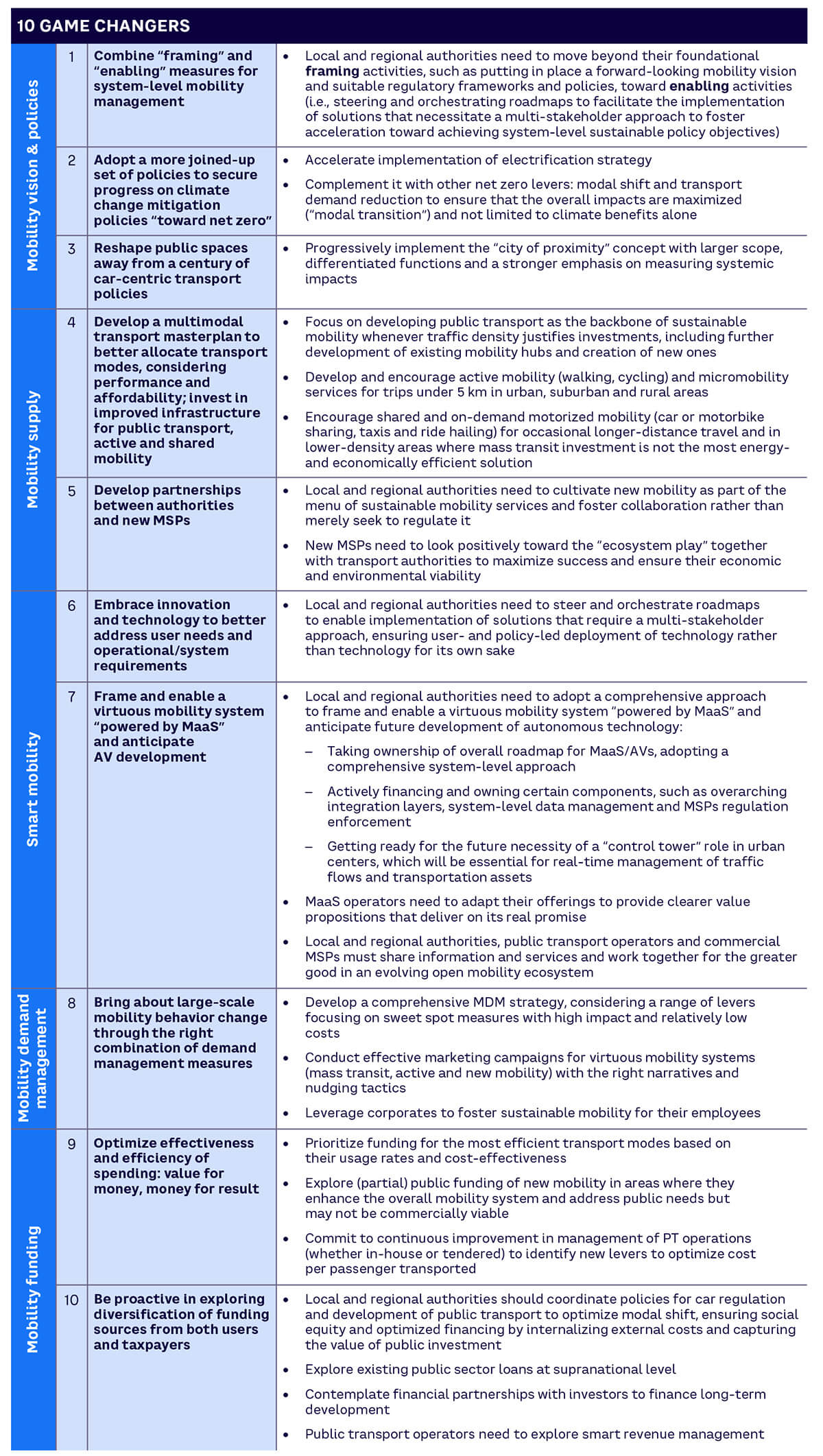

The solutions necessary for a transformative shift toward a more virtuous mobility future are already within our grasp. However, while the potential for transformation is evident, the real challenge lies in putting them into action. We identified 10 game changers that we believe are critical for mobility systems players to accelerate the transition (see Table 1).

Making change happen will demand political and organizational capacity as well as courage to change direction and determination to keep a steady course. Increased collaboration among public and private stakeholders within the extended mobility ecosystem is key. Transport authorities in cities and regions, in particular, play a crucial role in accelerating the shift.

1

EXAMINATION OF CURRENT STATE OF MOBILITY SYSTEMS

1.1 SETTING THE SCENE

When we first set up the Future of Mobility Lab in 2010, there was much optimism that by now we would have moved a long way toward the goal of more sustainable, resilient, safe, efficient, and human-centric mobility systems in our cities and regions. Technological developments — particularly in digitalization, connectivity, and automation — promised the ability to deliver tailored, diverse, and convenient mobility solutions that would be attractive enough to prompt a major shift away from private cars as the default mode.

Fourteen years on, things haven’t happened the way many expected, though there has been some progress. In today’s city centers, we have seen growth in public transport, active mobility (walking and cycling), and “new mobility” solutions, including shared and owned micromobility devices (e-bikes and e-scooters), car sharing, ride hailing, and electric-powered personal mobility devices (PMDs).

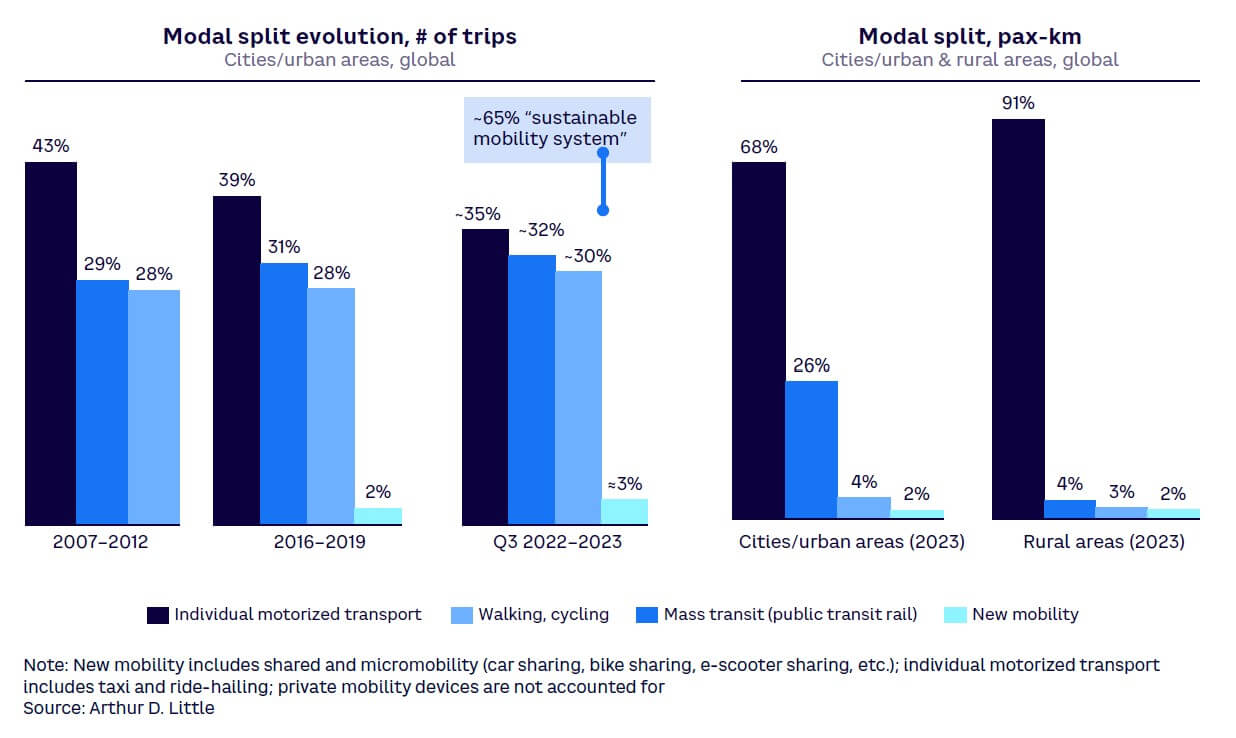

However, the bigger picture is less rosy. If we consider mass transit, walking/cycling, and shared mobility modes as collectively “sustainable,” over the 15 years leading up to 2023, the share of these modes (in terms of trips) has only grown from 57% to around 65% globally, while the remaining 35% of trips are still made by private car. And if we look at pax-km instead of trips, we see that private cars still represent about 70% in urban areas and 90% in rural areas (see Figure 1), with strong discrepancies between Europe and Southeast Asia that have a stronger share of PT in the modal split on one hand, and North America and the Middle East where private cars is even more dominant.

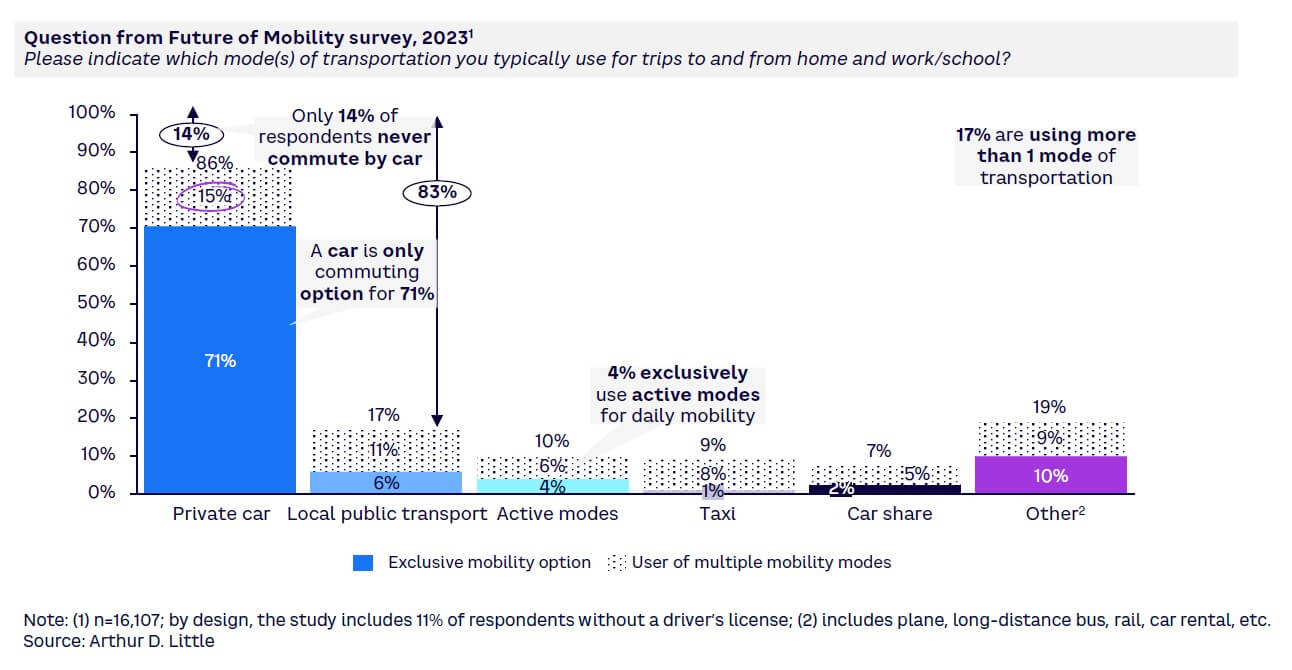

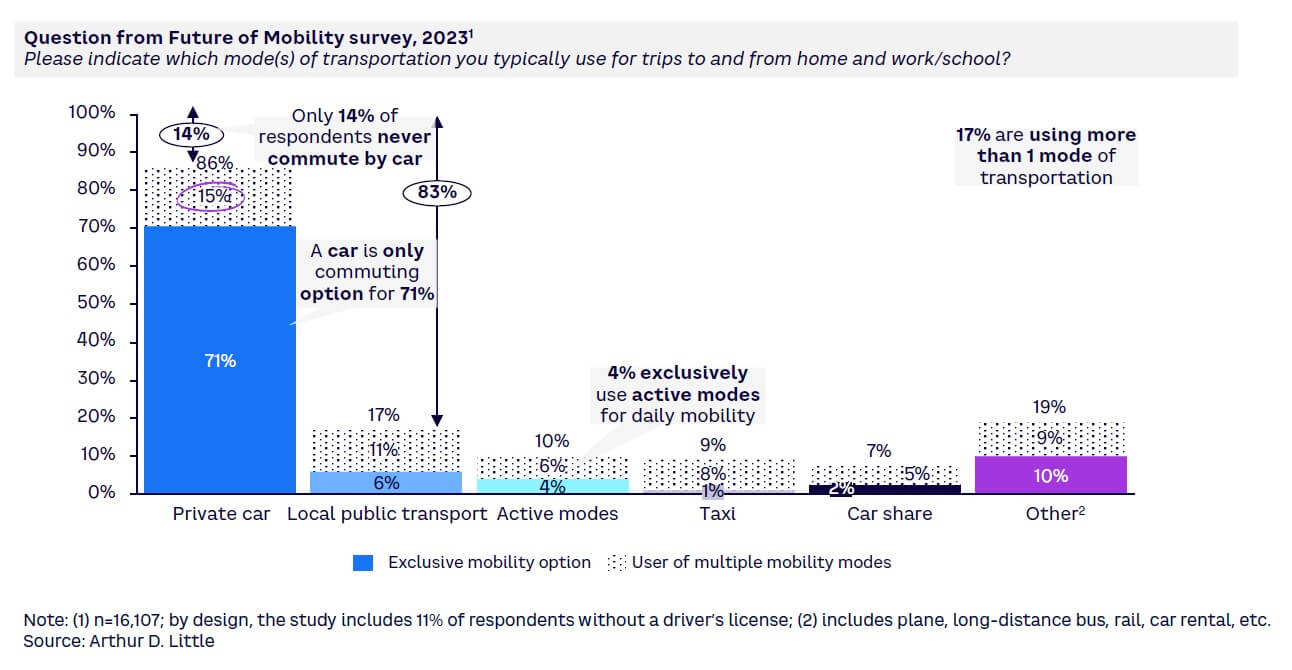

If we look at commuting to work and school, it is clear that the private car is still hugely dominant. Our latest “Future of Mobility” survey of more than 16,200 respondents globally[2] confirms the trend: more than 70% of citizens only use private cars for their daily commute, with only 14% never using a car (see Figure 2).

Figure 2 also shows that the share of respondents who exclusively use other modes is very small, with 6% using local public transport, 4% using active modes, 1% using taxis, 2% using car shares, and 10% selecting “other.” Moreover, the proportion of commuters who typically use modes of transportation other than private cars (including users of multiple mobility modes) ranges between 7% (for car sharing) and 17% (for local public transport).

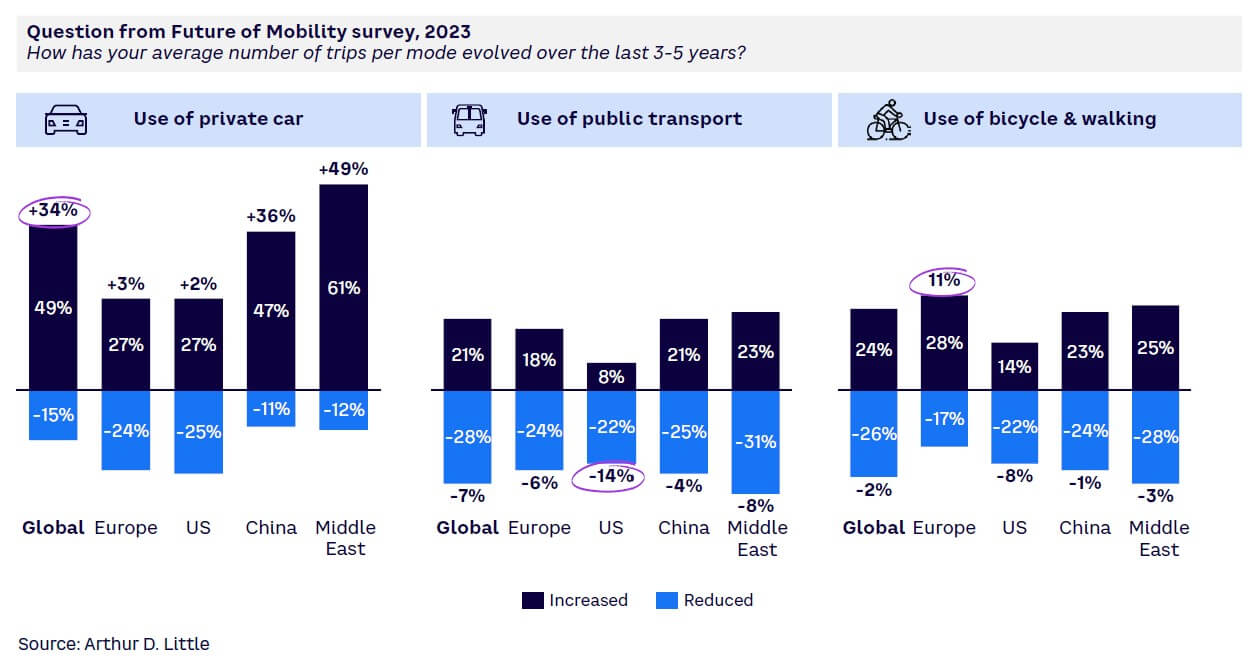

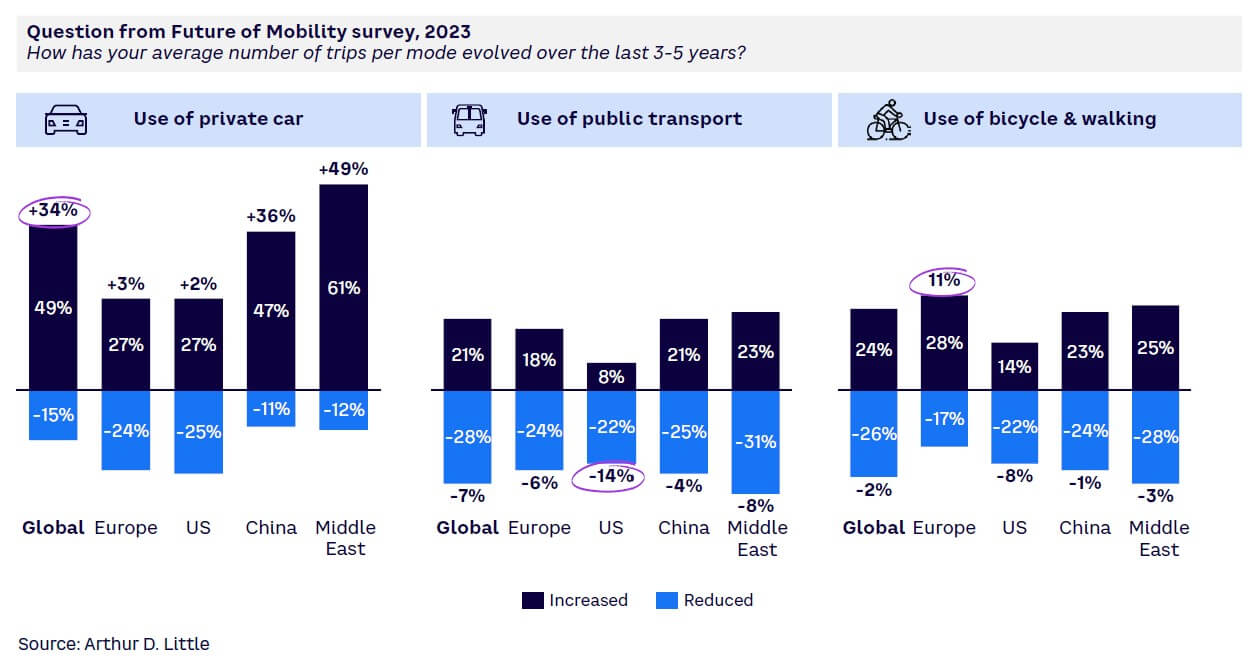

If we look at how this varies between global regions (see Figure 3), there is even more individual car usage in the US (78%), but somewhat less in China (61%). China also has more use of local public transport, with 27% using public transport together with at least one other mode. Over the last three to five years, globally the number of individual car trips increased by 34% according to our survey, propelled especially by fast-growing economies (e.g., India, Vietnam, Thailand, and Mexico).

In the meantime, the global use of public transport showed a small decrease of a few percentage points. The use of active modes was stable globally, although it showed an increase of more than 10% in Europe.

The lack of progress in terms of modal shift toward sustainable transport modes has negative impacts on transport:

-

On a worldwide basis, transport still accounts for about 25%-40% of national CO2 emissions, the only sector with a steady increase since 1990, according to the International Energy Agency (IEA).

-

According to the International Transport Forum, transport still leads to a large number of casualties in cities: from 8 fatalities per 100,000 inhabitants in Stockholm to 7.4 in Bologna and 15 in New York City, with little to no change over past years.

-

Despite less post-COVID traffic congestion, driven by increased working from home, levels have been growing again since 2023, and the average commuting time to work has not improved. In Europe, average time spent in traffic per year has risen from around 65 hours in 2019 to 90 hours in 2022, a rise of nearly 40%.

In other words, at best we can talk of an evolution toward more sustainable mobility but certainly not a revolution.

1.2 THE EVOLUTION OF MOBILITY PATTERNS

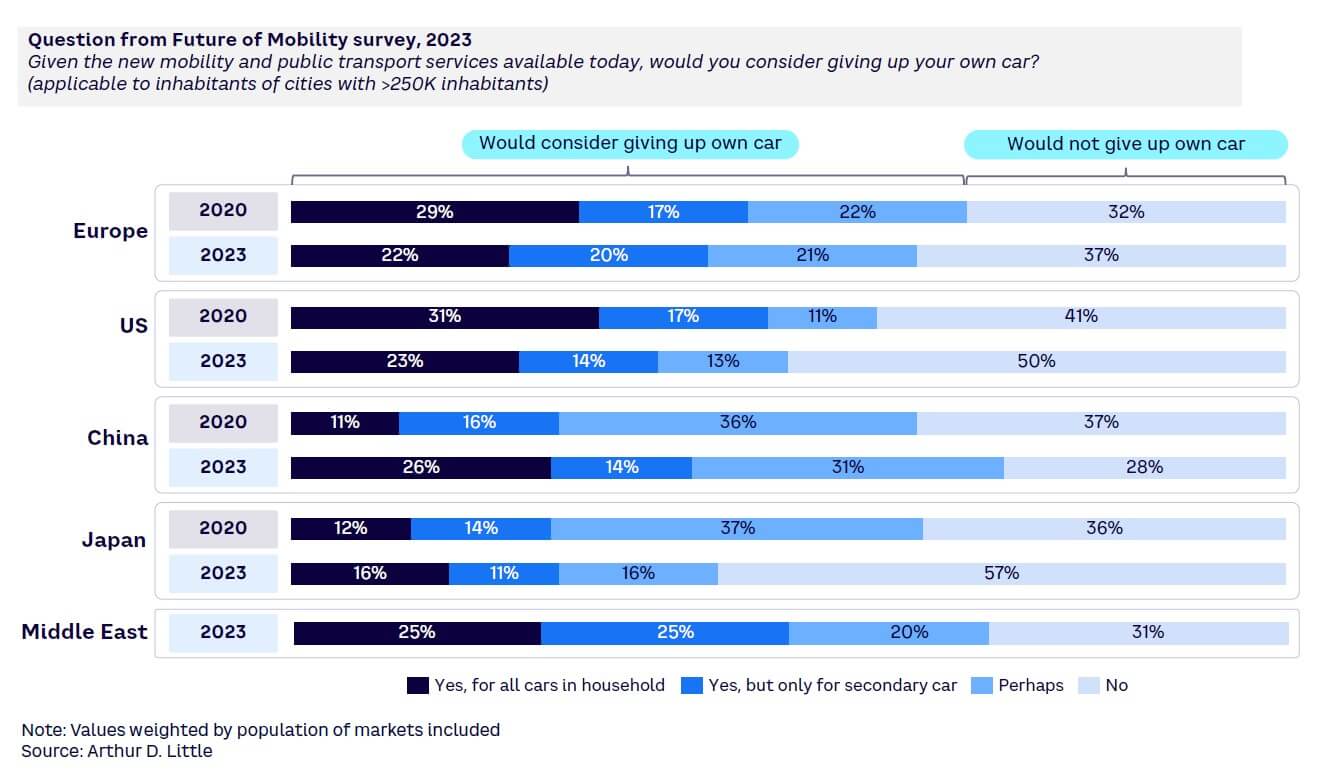

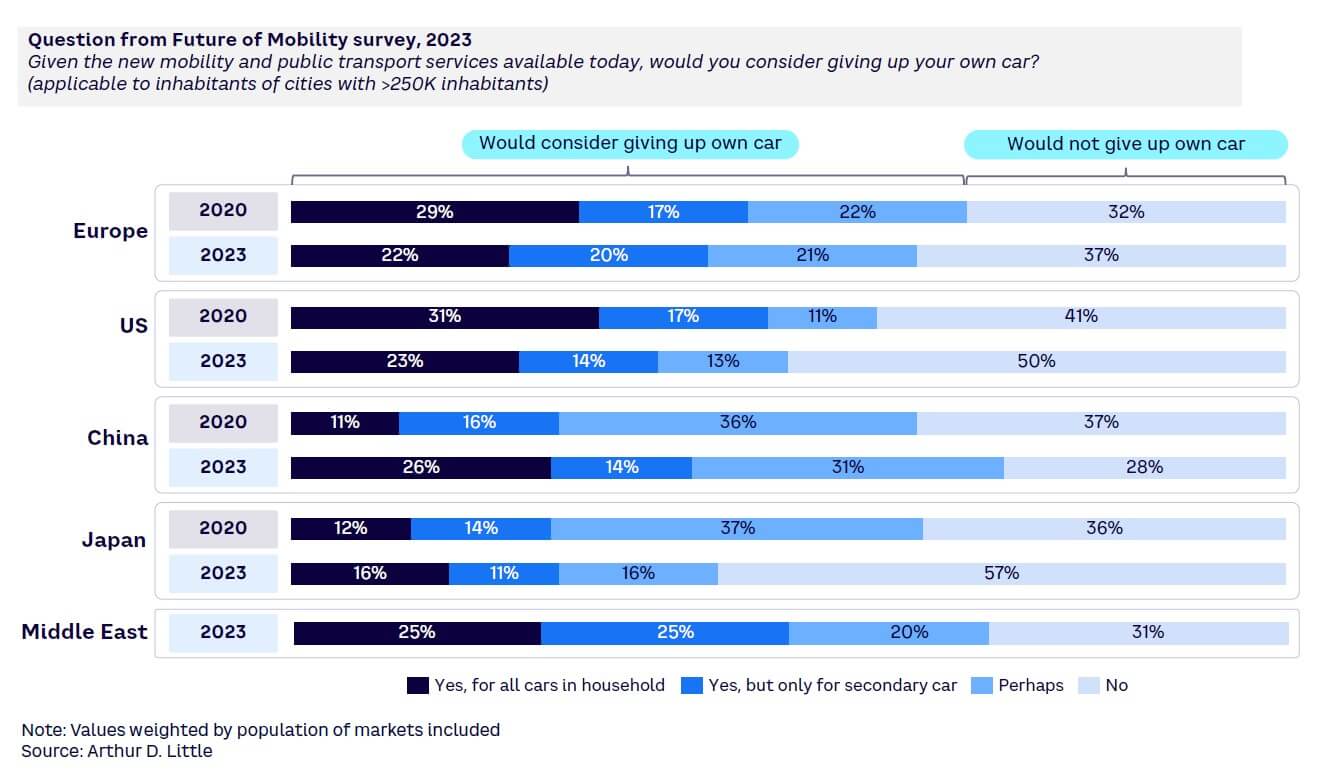

While many aspects of mobility evolution can be reasonably seen as disappointing, there are positive indicators. Regarding individual car usage, a significant proportion of citizens would consider foregoing at least one private car if sufficient mobility alternatives were available. Figure 4 shows that between 27% and 50% of inhabitants in large cities of more than 250,000 would be willing to give up at least one car based on new mobility and PT services. A further 13%-31% would “perhaps” give them up. This is a high number, although clearly there is a large gap between declaring an intention and taking action.

The geographical variation is also noteworthy: Asian and Middle East countries have a large share of citizens that may consider de-motorizing (e.g., 72% in China and 70% in Middle East), and this share is growing in Asia. In Europe, it accounts for about 63% and less than 50% in the US and Japan. One worrying trend is that willingness showed a decline between 2020 and 2023 in Europe and the US. There could be multiple explanations, but it can reflect a lack of confidence on the ability of mobility system to propose alternative services. It may also reveal that some people in developed economies who were willing to give up their secondary vehicle have already done so and are not ready to abandon the primary one.

The mobility providers themselves have an interesting perception. In a 2024 survey of 211 mobility leaders[3] (85% European) conducted by the BVA Family, ADL, and POLIS,[4] while 74% rated recent progress toward sustainable mobility as at least “fairly satisfactory,” the majority of them recognize the inability of those actions to deliver a sustainable modal shift, with 42% judging the impact on modal shift to be “poor” or “very poor” and only 4% rating the dynamics of the modal shift as “strong.” On the positive side, looking forward, 73% expected modal shift to increase either “moderately” or “strongly” in the next three years, reflecting some optimism within the industry. So, while there is little satisfaction with modal shift during past years, there is a widely shared belief within mobility CxOs that this will improve significantly in the coming years.

1.3 TRENDS & DEVELOPMENTS

We have seen a confluence of global trends that have been reshaping mobility systems over the last decades.

Global trends

-

Urbanization. Approximately 55% of the world’s population live in urban areas, which is expected to further rise to 68% by 2050,[5] in conjunction with growing urban-rural polarization.

-

Digitalization. Around two-thirds of the world’s population is now online, with over 50 countries having adoption rates above 90%.[6]

-

Individualization. Data ubiquity and digitalization of services have enabled increasing personalization of services, fueled even more by the advent of effective AI.

-

Sustainability. Sustainability imperatives are now at the heart of public policy and corporate strategy, with inclusiveness and social responsibility also becoming imperatives. Issues such as emissions, air quality, noise, quality of public space, and safety are increasingly critical.

Behavioral trends influencing demand

-

“Everything as a service.” Often referred to specifically in relation to IT service provision, the broader trend away from goods to services has been ongoing for perhaps two decades. Consumers increasingly expect on-demand services such as e-commerce, which has a huge impact on urban logistics.

-

Shared economy. There is continued growth in the involvement of consumers in crowd-based, peer-to-peer, collaborative, and/or community-based economies, often enabled by digitalization.

-

Green and healthy. Consumer awareness of the need to behave in ways perceived as less environmentally damaging and better for personal health and well-being has increased, at least in developed economies.

-

Changing lifestyles. Consumers, especially white-collar workers, are evolving their expectations around lifestyles and quality of life (e.g., work/life balance and flexibility).

Technology/market trends influencing supply

-

Connectivity. Connectivity advances have continued to enable mobility service provisions, especially in relation to connected vehicles, consumer interfaces, and overall mobility system management (i.e., the mobility system “control tower” concept).

-

New sources of energy. Electrification of mobility continues to meet sustainability requirements.

-

AI and autonomous vehicles. Now and in the future, AI has significant potential to help solve many critical transportation and mobility challenges, improving effectiveness and efficiency and optimizing mobility performances at a system level.[7] We will also witness continuous progress toward the availability of AVs, albeit slower than initially announced by the main developers.

-

Speed. There have been several attempts to develop innovative solutions to reduce travel time, make more efficient use of time while traveling, or avoid traveling altogether.

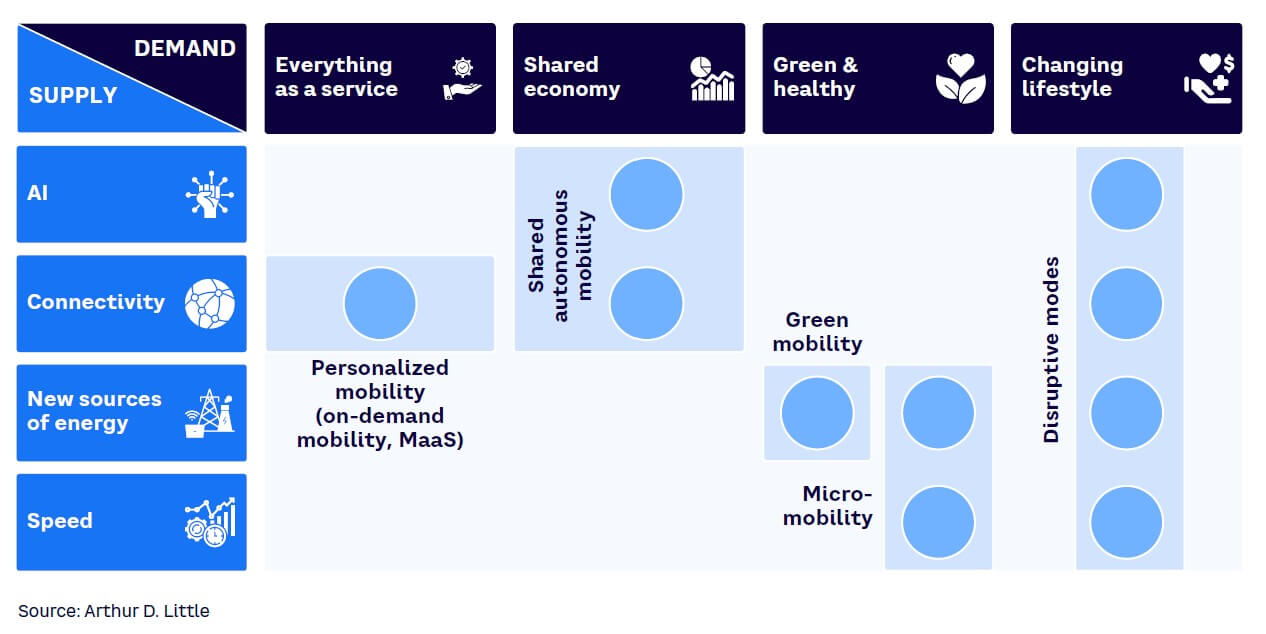

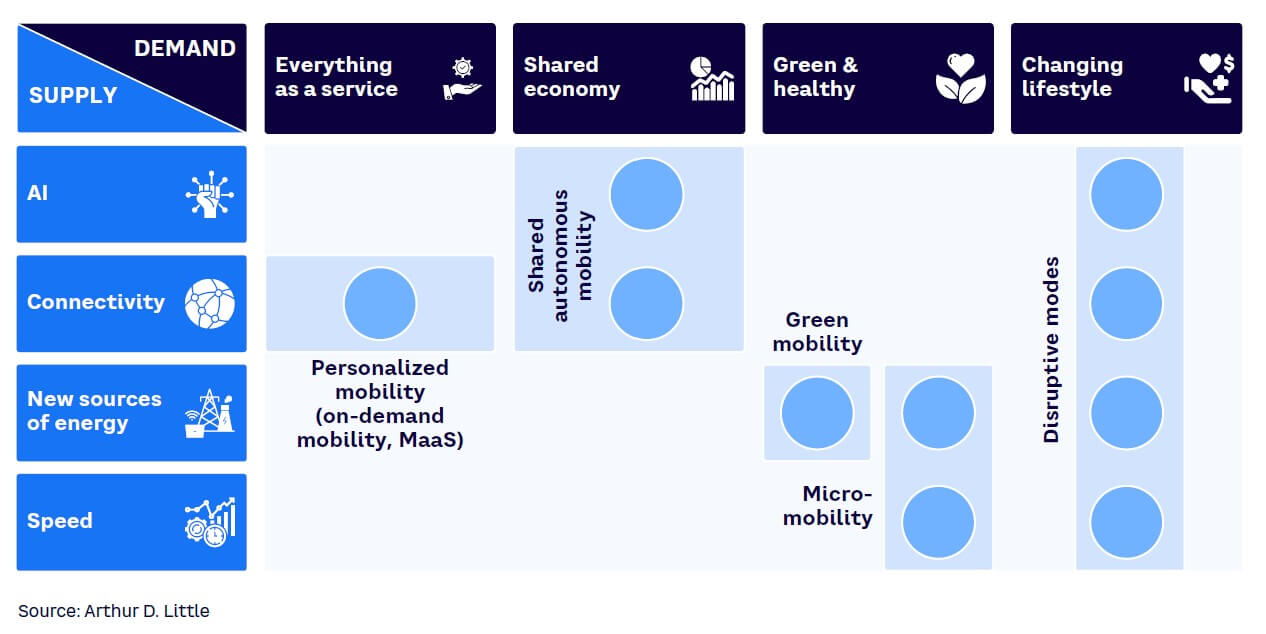

The convergence of these trends has been reshaping mobility systems, leading to the development of new mobility services and business models that aim to improve the sustainability, resilience, safety, efficiency, inclusiveness, and human-centricity of mobility systems (see Figure 5).

For example, the convergence of demand for “everything as a service” and the availability of rapidly improving connectivity has driven the growth of personalized mobility services, such as on-demand mobility (ride-haling, ride-pooling) and MaaS. The willingness of consumers to engage in the shared economy has enabled shared mobility models, such as car sharing or carpooling, and is expected to also enable, later on, autonomous shuttles and robotaxis. Demand for green and healthy mobility along with the availability of new energy sources creates opportunities for active mobility devices as well as micromobility (e.g., bicycle, e-scooters, e-bikes, and other micromobility sharing). Finally, the combined availability of several of those solutions fuels the need for more integrated mobility services and information.

To summarize, today we see a mobility picture characterized by the increasing availability of new mobility solutions with a range of strong drivers both on the supply and demand sides. Yet, in terms of adoption, the progress has been significantly slower than was expected a decade ago, and modal shift away from private cars has been very limited. We are a long way from the goal of virtuous mobility system adoption.

1.4 IMPACT & UNCERTAINTIES OF EXISTING SOLUTIONS

The lack of a “strong enough” business case is a key challenge for several of the new mobility solutions (micromobility, shared mobility, and integrated mobility). This is sometimes driven by a lack of market demand but also by increased regulations, which may be well justified but also incur additional costs for operators. Often, reliance on 100% private funding means the solution is not viable. In fact, the aforementioned CxO mobility survey also confirmed the perceived slow pace of progress and the lower-than-expected impact of micromobility and shared mobility on mobility system performance. However, the survey also showed increasing awareness of the need for change, triggered by both climate change and a growing realization of the need for the public sector and the private sector to work together.

Needless to say, there are no easy shortcuts to overcome these challenges. But what solutions have the potential to accelerate the move toward virtuous mobility systems, and from those, which ones can actually be delivered at scale?

In the remainder of this Report, we further explore the barriers, challenges, and strategies to accelerate progress.

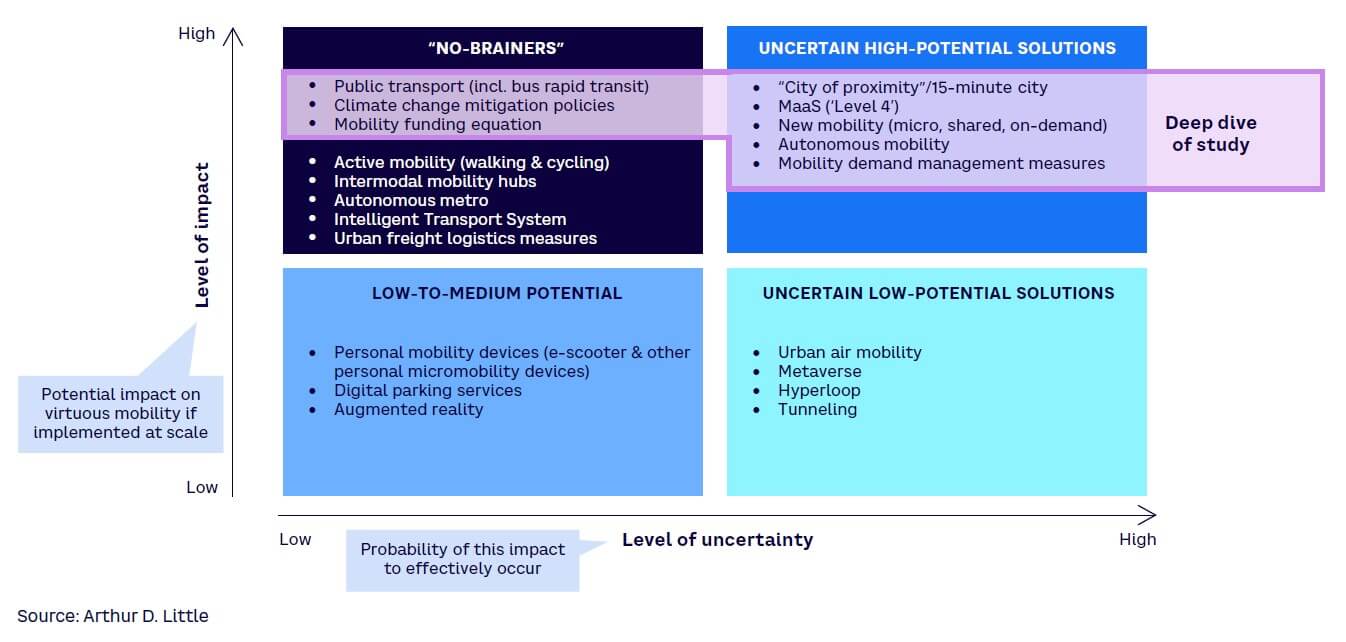

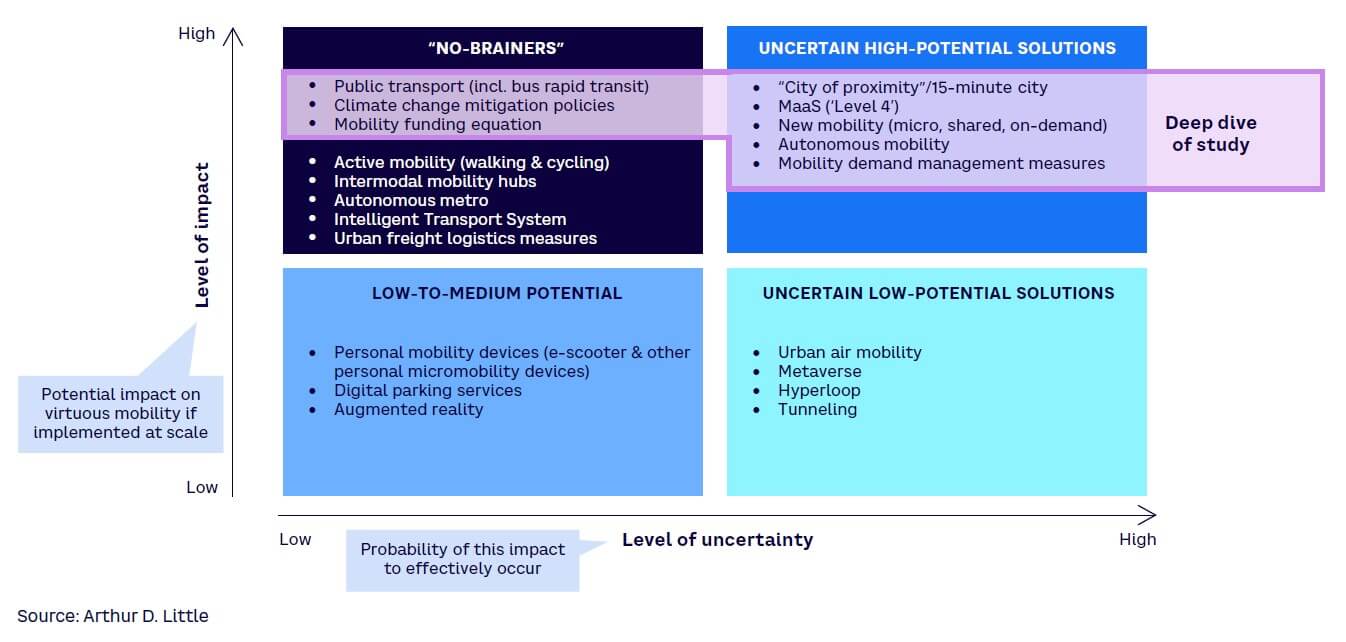

Looking across the full range of mobility solutions (concepts, policies, and services), we see that some have proven high-impact and others less so. We also see that some solutions are subject to more uncertainty than others in terms of how and whether they will be able to deliver an impact if they are implemented at scale (see Figure 6).

The bottom-left quadrant cites specific solutions that are fairly certain to be available, but their impact is limited relative to others, such as PMDs, digital parking services, charging infrastructure availability, and the use of augmented reality to assist the mobility journey.

Other solutions, which have relatively lower impact (often due to lack of scalability) and are more uncertain technically due to lack of maturity, include urban air mobility devices, metaverse applications, the hyperloop, and tunneling (bottom-right quadrant).

Looking at higher-impact solutions with lower levels of uncertainty (top-left quadrant) we see a range of “no-brainer” solutions that are key for the future, such as public transport, climate change mitigation policies, intermodal mobility hubs, active mobility, autonomous metros, intelligent transport systems (ITS), and urban logistics solutions. The major challenge of dealing with the mobility funding equation also falls under this category.

The top-right quadrant (high impact, high uncertainty) is especially important to gain a perspective on and better understand where we go from here. These solutions include demand and access management measures, city of proximity concepts, MaaS, new mobility (micromobility, shared mobility, and on-demand mobility services), and autonomous mobility.

1.5 MOBILITY SOLUTIONS REVIEWED IN THIS STUDY

As part of the study, we undertook eight deep dives on promising solutions (concepts, policies, or services) to demystify and critically evaluate them, draw conclusions, and formulate recommendations. We have focused on three of the “no-brainer” solutions, namely public transport, for which there is still an open question regarding the extent of its future development, climate change mitigation policies, due to their importance and the difficult challenges of implementing them, and the mobility funding equation, which is a critical issue underpinning and enabling the ability to bring about change. The remainder of this Report focuses on the solutions in the top-right quadrant: city of proximity, new mobility (micro, shared, and on-demand), mobility as a service, autonomous mobility, and demand and access management measures.

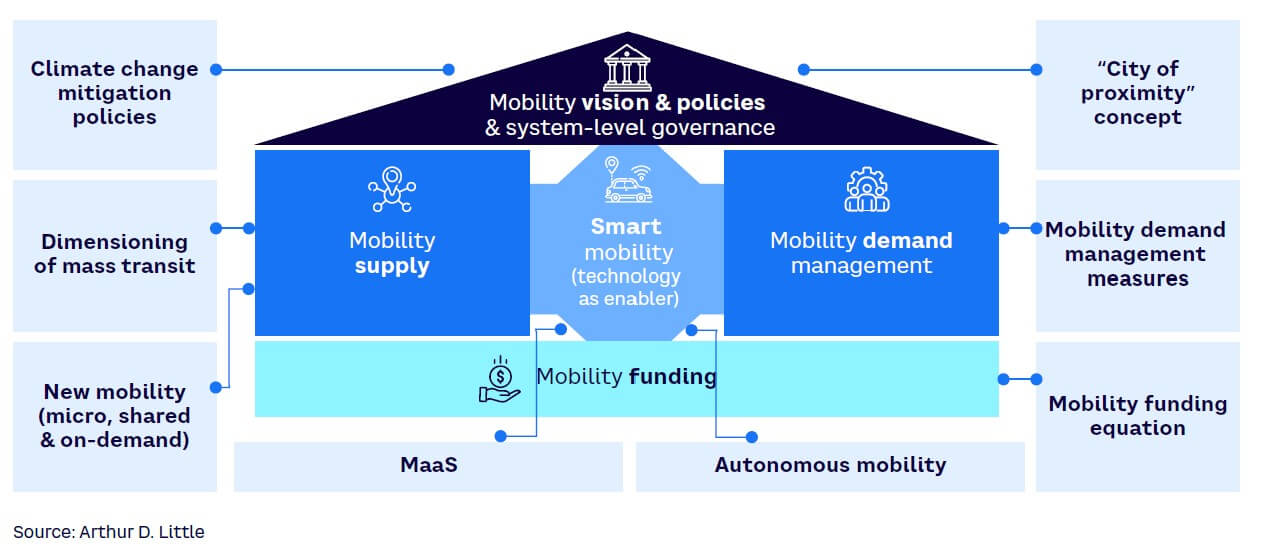

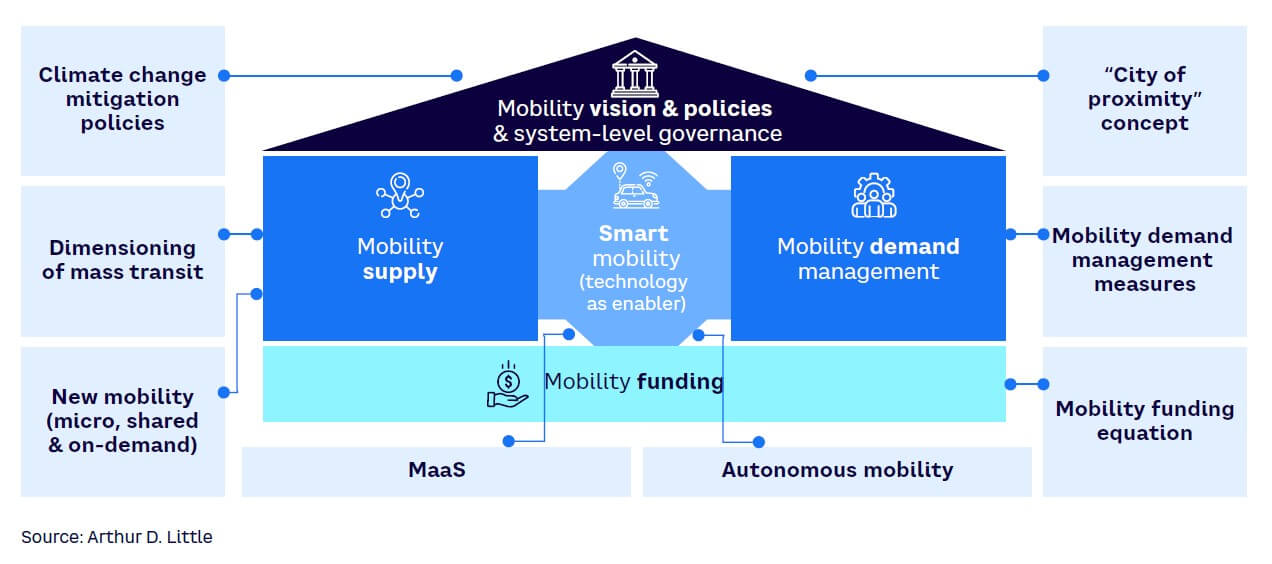

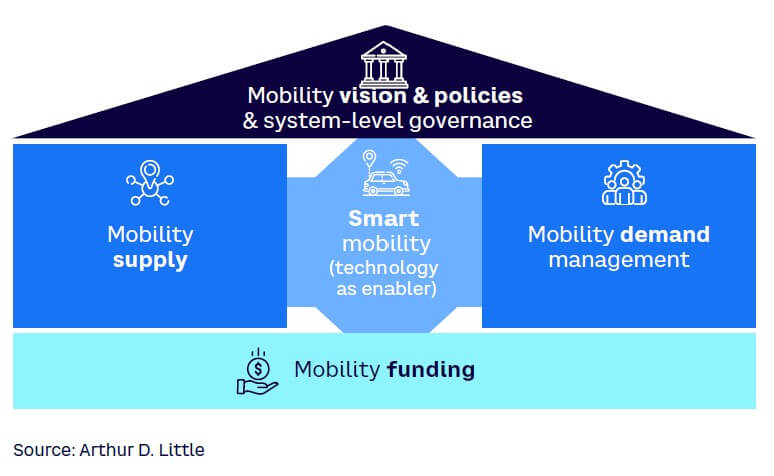

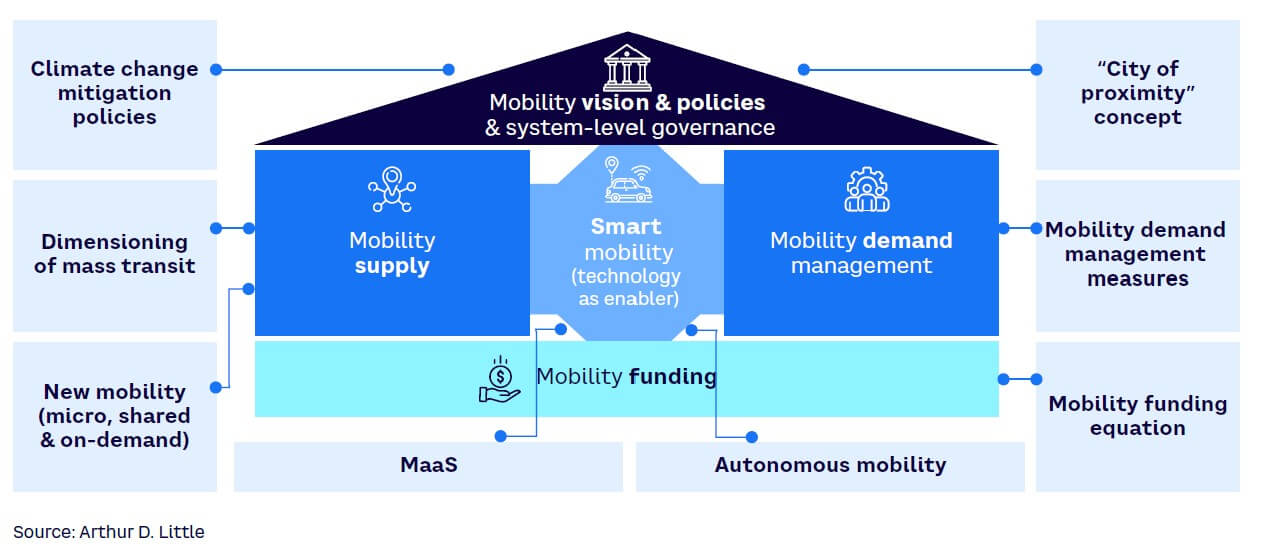

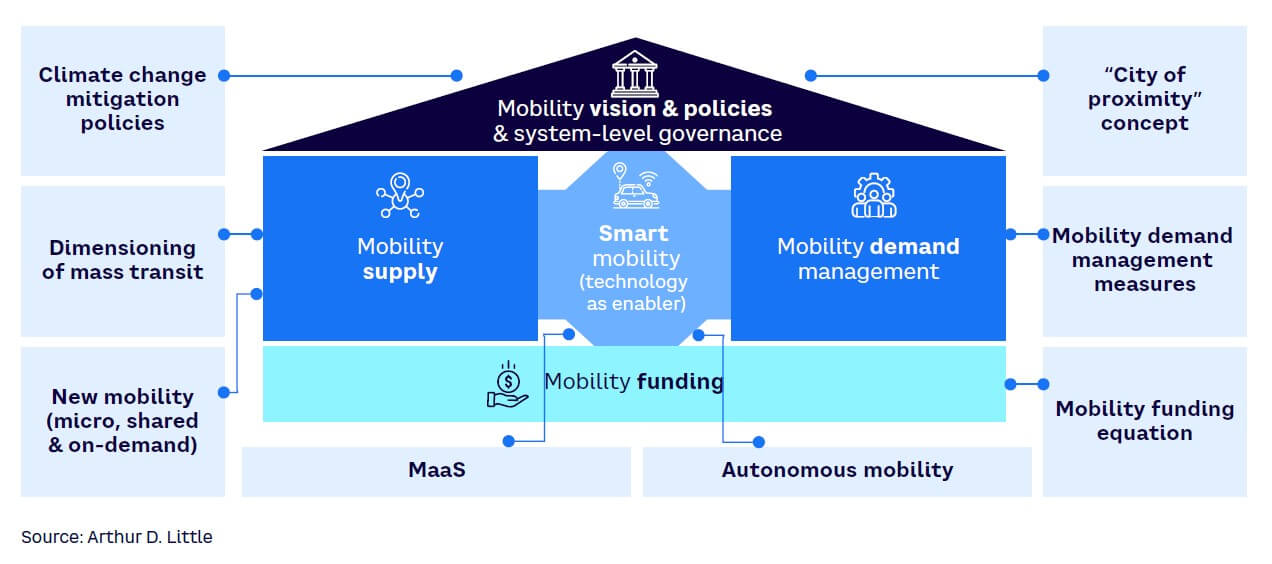

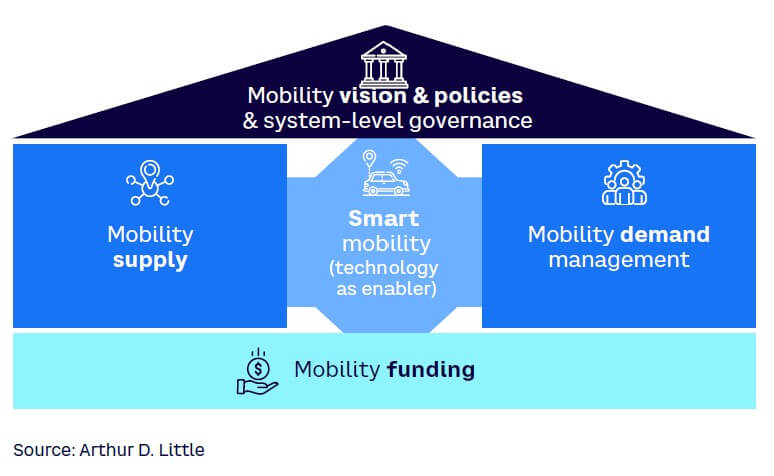

This gives us eight solutions, which have been mapped against the five-dimensional framework we traditionally use at ADL to describe the key building blocks of a virtuous mobility system[8] (see Figure 7). In this framework, the mobility system is guided by vision, policies, and governance. Supply and demand are both actively managed. Smart mobility acts as an enabler for the system, and adequate funding is made available through a range of mechanisms.

2

DEEP DIVES ON MOBILITY SOLUTIONS

2.1 CLIMATE CHANGE MITIGATION POLICIES IN TRANSPORT

Context

As part of the world’s essential infrastructure, mobility systems are deeply affected by climate change. Not only do mobility systems have to mitigate their impact by reducing greenhouse gas emissions, they also need to build resilience to adapt to new climate futures involving more extreme weather events and rising sea levels. In this chapter, we focus mainly on mitigation, although reference is also made to adaptation.

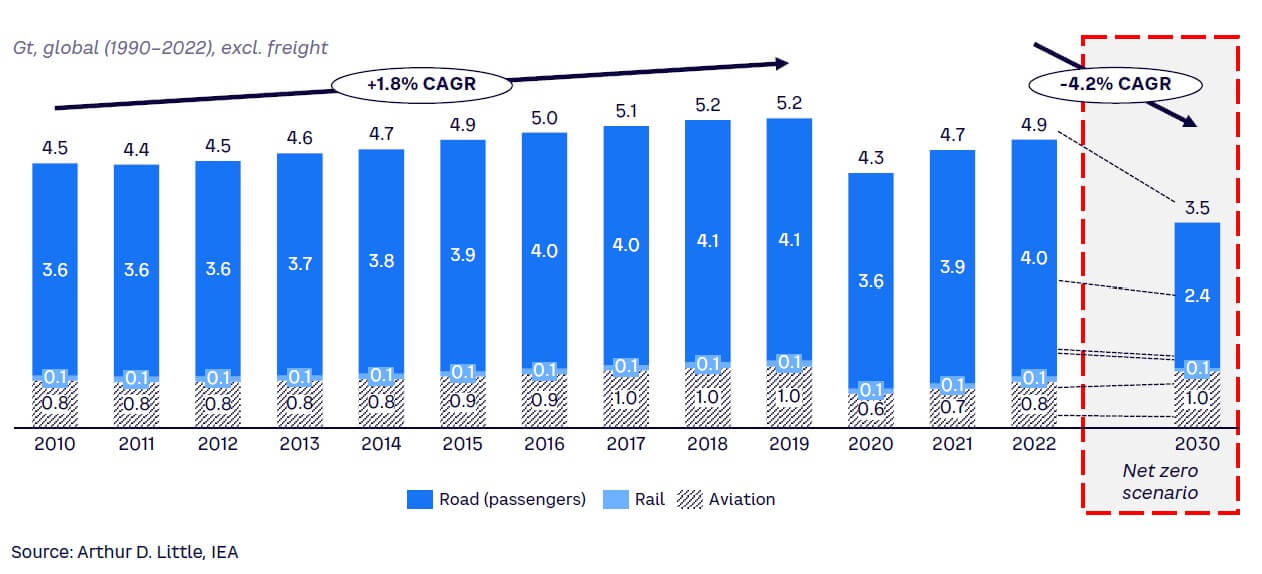

Inland mobility (i.e., excluding international road, air, and maritime mobility) accounts for more than a third of global CO2 emissions (according to IEA), a share that has been stable over at least the past 25 years.

In more than 80% of inland mobility, CO2 emissions[9] are related to road transport. However, the geographical pattern is highly variable. For example, in Europe, transport emissions have stabilized in most countries, including Germany, Spain, Italy, and the UK, while they are still increasing in countries within and beyond Europe, such as France, Poland, the US, China, India, and many others.

Several countries have set transport emission-reduction targets to achieve net zero by 2030, supported by legal frameworks and financial resources, but achieving the required reduction is likely to be difficult or impossible in most cases.

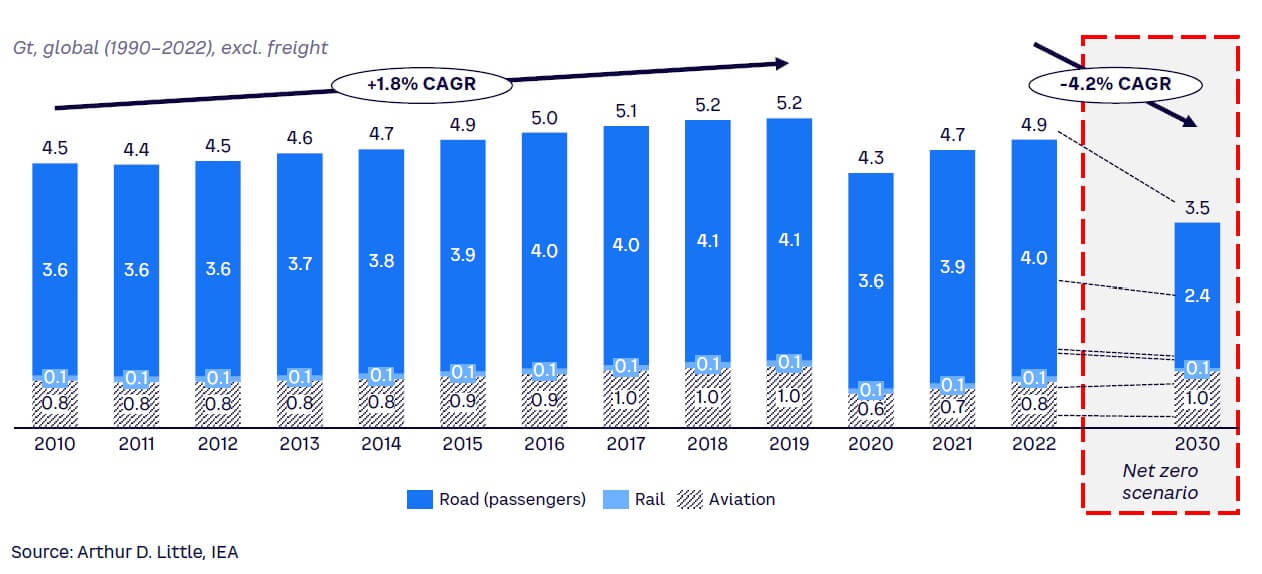

With regard to global emission-reduction targets, such as the achievement of net zero, transport is one of the only sectors where emissions have not decreased since 1990 (see Figure 8).

Challenges

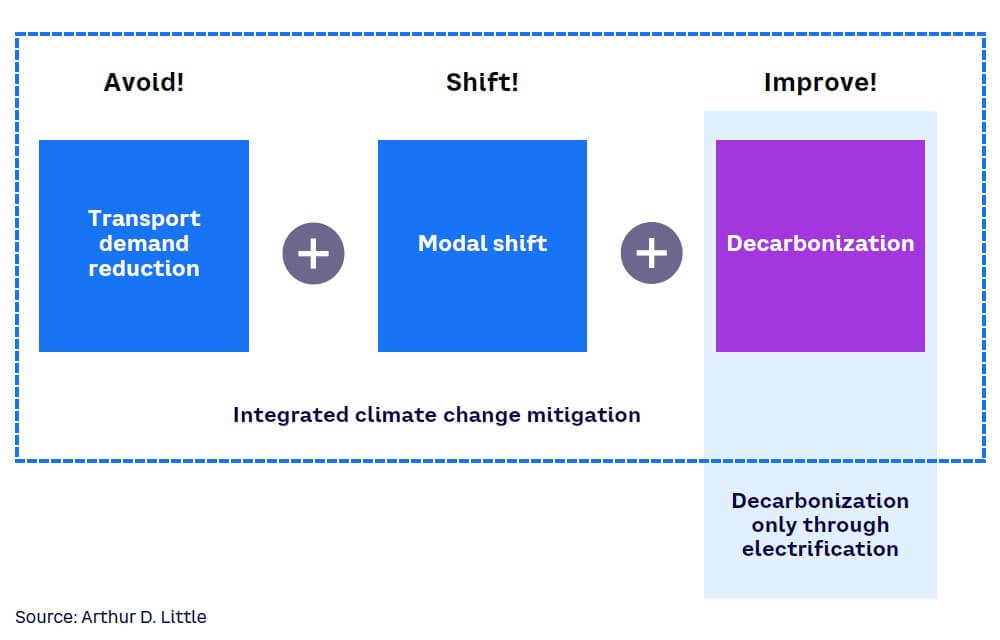

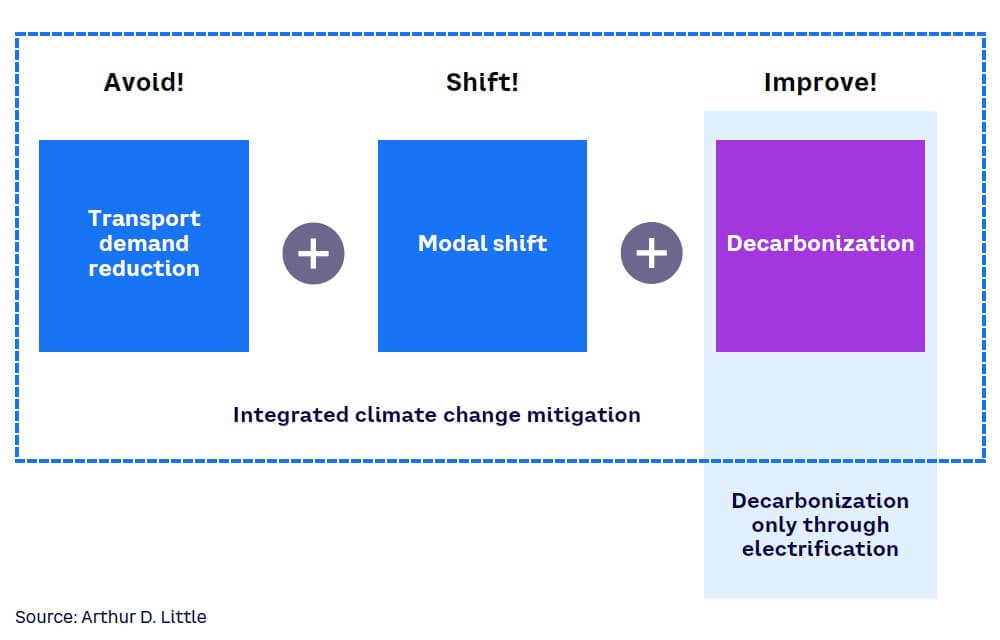

Mitigation of climate change impact requires a more joined-up policy approach, whereby electrification is complemented by other key levers, in particular modal shift and transport demand reduction to ensure that the overall impacts are maximized (see Figure 9).

As shown in Figure 9, an effective transport emission strategy needs to focus on three levers (in order of avoid-shift-improve).

-

Transport demand reduction. Historically, the surge in car usage has been a primary contributor to increased emissions. However, the COVID-19 period demonstrated that significant changes are achievable with sufficient determination. Reducing demand can be accomplished by eliminating unnecessary trips, shortening travel distances, and employing behavioral change strategies. Restrictive measures for solo car driving can also be considered where other competitive options are available to expand the vehicle occupancy rate, which has been flat for around 40 years in Organisation for Economic Co-operation and Development (OECD) countries (e.g., in Europe, the vehicle occupancy rate has been 1.6 people per vehicle for many years).

-

Modal shift. This is about promoting a shift to less energy-intensive mobility modes by means of push and pull measures, away from private cars toward public mass transport, active mobility, and new mobility modes such as micromobility, shared mobility, and on-demand mobility. As individual car usage trends made clear, making progress has been difficult.

-

Decarbonization through electrification. This approach aims to achieve lower CO2 emissions thanks to electricity sourced from low-carbon sources (kg CO2/kWh), as well as better energy efficiency per km traveled (kWh/km). This can be only partially achieved over the short term with better internal combustion engine (ICE) fuel efficiency and use of alternative fuels including biofuels, as long as the potential negative impacts of crop-based biofuels (land use and food price increases, among others) are minimized.

These three routes to emissions reduction reveal two main difficulties impeding progress:

-

There has been little real progress on transport demand reduction, which is closely linked to economic growth and social cohesion, both of which are key political objectives.

-

Current policy frameworks for transport emission mitigation tend to follow two partly conflicting paths. One path is “decarbonization only through electrification,” focusing mostly on improvement involving conversion of transport modes to renewable sources, such as cars and buses to battery electric vehicles (BEVs), trucks, trains, and planes to hydrogen, electricity, or biofuels, but with limited policies encouraging new mobility patterns. The other path is “integrated climate change mitigation” involving all three levers (“avoid,” “shift,” and “improve”) to promote modal shifts away from cars.

These two policy approaches are increasingly in competition. Local and regional authorities are very sensitive to issues such as congestion and are keen to push the modal transition strategy; for example, large cities like London, New York, Madrid, Rome, Berlin, Amsterdam, and Stockholm all want to reduce private cars in urban mobility. Apart from reducing congestion and emissions, modal shift also provides opportunities to address other unwanted outcomes such as road crash fatalities and urban sprawl.

On the other hand, national governments are more divided on the strategy to follow, sometimes strongly favoring “decarbonization only,” as cars provide significant economic benefits, in particular via tax revenues (fuel and road use taxes). Automotive may also be an important domestic industry that provides employment. But this is a narrow perspective; transport by private cars generates significant negative externalities, which come with an economic cost often not factored in, and the monopoly car transport holds on the space allocated to circulation and parking is blocking the emergence, consolidation, and growth of other transport solutions, which will also generate new business and create jobs. At the global level, modal shift has hardly made any progress. Cars remain by far the preferred mode due to convenience and practicality, especially in peri-urban and rural areas.

Analysis, insights & conclusions

Given the scale and number of these challenges, what are the right policies and priorities going forward to ensure that the world’s mobility systems can get on track to rapidly decrease emissions and increase climate resilience? Based on ADL research and experience gained from POLIS, we offer the following insights into what should be done:

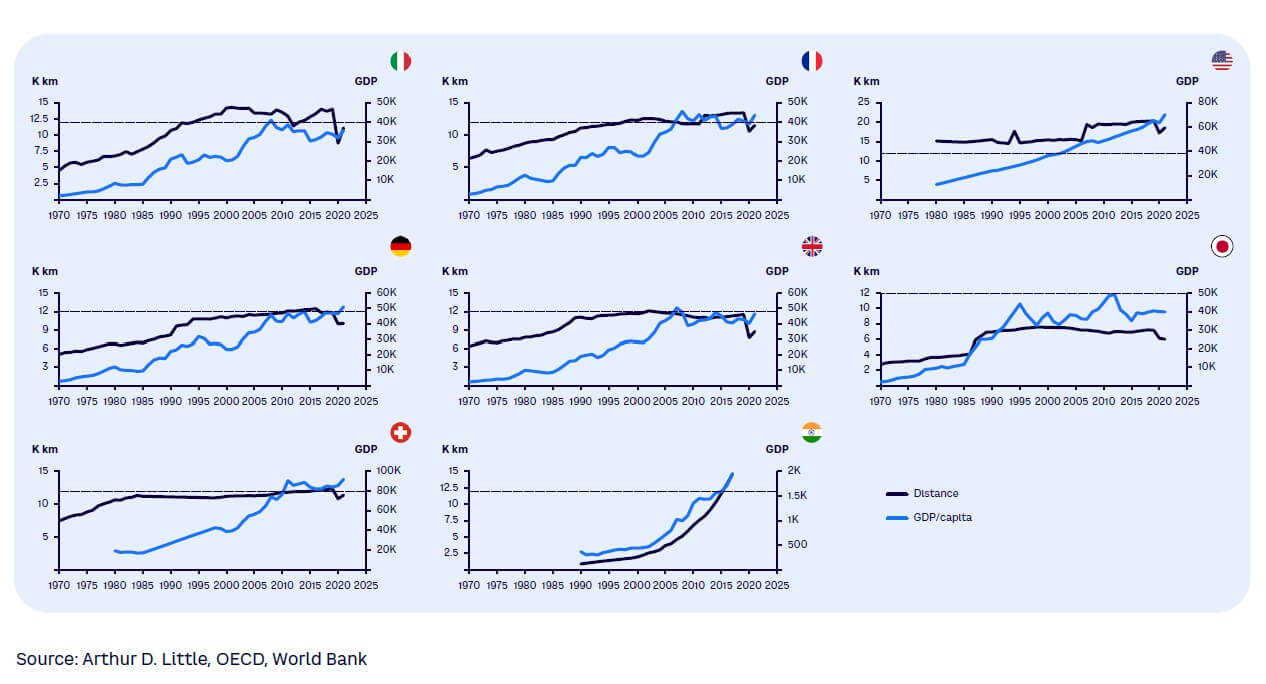

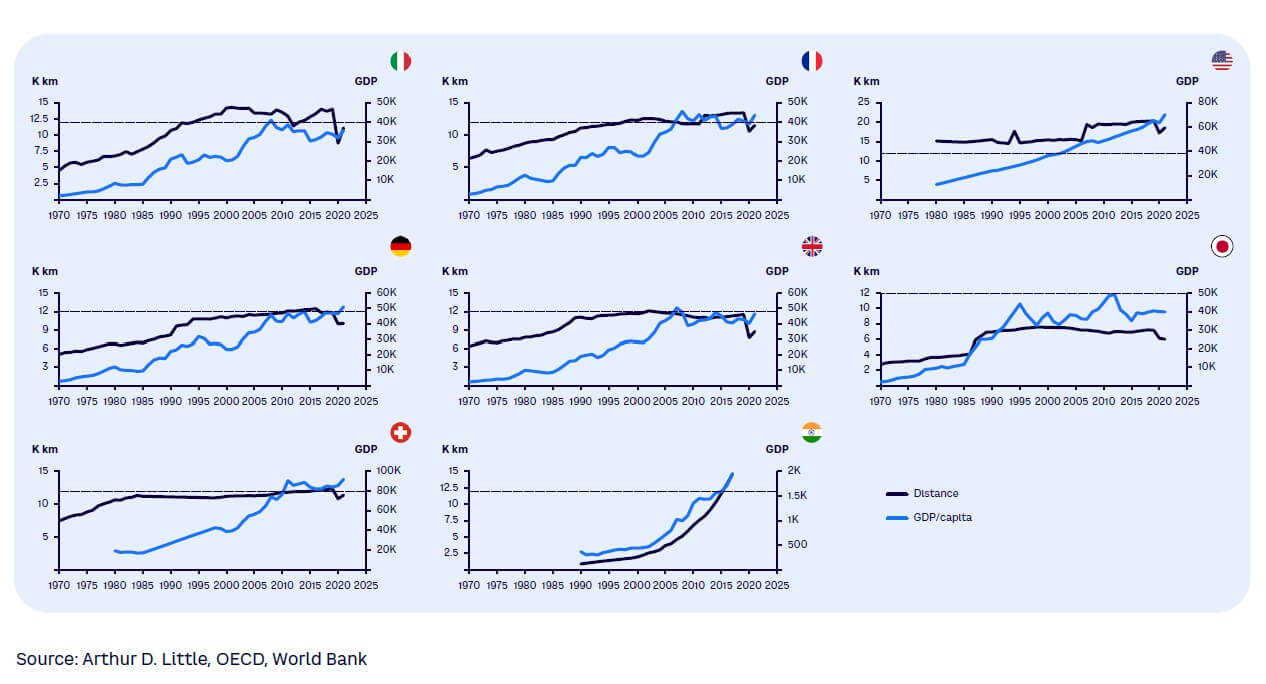

-

Almost no progress has been made in recent years to reduce overall transport demand. Looking specifically at road transport demand in terms of total km traveled shows a correlation with social integration and economic development.[10] Hence, while the time assigned for daily mobility has remained stable over the last decades (45 minutes to 1 hour), the distance traveled has increased over the same period. This is due to two factors: (1) increased motorization of households due to wage growth and easier access to credit and (2) increased average car speed, in particular due to new motorways, peripheral streets, and ring roads.

While road transport demand highly correlates to GDP per capita, our analysis revealed one fortunate trend: across major cities worldwide, it seems that we are now coming to a point where the annual average distance traveled per inhabitant has reached a ceiling of around 12,000 km (see Figure 10).

The same 12,000 km ceiling is evident across most European countries. In larger countries such as the US, the ceiling is higher (around 18,000 km), but there are also signs of stabilization. If we are comfortable that neither the motorization rate per household nor average car speeds are expected to increase further, then in fact, a flattening curve is to be expected given a stable travel time.

Policies aimed at further reducing demand for road transport and distance traveled by private cars should thus focus on reducing the need to travel (to decrease the number of trips), shortening ride distances (to foster shorter trips), and limiting travel speed (to increase travel time) to reduce the attractiveness of road transport versus other mobility options while enhancing safety. Further progress on limiting car traffic could also be made through increased vehicle occupancy rates. This can be achieved by penalizing or restricting solo car driving and encouraging solutions such as carpooling or ride sourcing. While these solutions have not grown significantly over the last few years, there are good opportunities, especially in low-density areas for medium-size trips, for which the additional time associated with picking up an extra passenger is acceptable.

Some cities and regions have demonstrated success by applying constraints on car traffic, such as via urban tolls, limited traffic zones, higher parking fees, and fewer parking spaces. However, those constraints are inefficient without proper alternatives (e.g., better public transit networks) with both greater capacity and frequency, along with new mobility services (see Sections 2.3 and 2.4) and good active travel infrastructure.

-

Only limited progress is being made globally on modal shift. At the country level, individual cars represent almost 80% of pax-km. In peri-urban and rural areas, the car remains by far the preferred mode for daily transportation, but only for those who can afford it, often creating what research has designated “forced car ownership,” which includes extreme vulnerability to energy price fluctuations.

Modal shift will improve only through a policy mix of constraints on cars and enhanced PT infrastructure and new mobility services (see Sections 2.3 and 2.4).

-

Good progress has been made on decarbonization through electrification. However, the journey is long. For example, vehicle propulsion has benefited both from more effective ICEs and the adoption of other clean fuels, such as gas and hydrogen. In parallel, there are ambitious goals for the development of EV charging infrastructure and for incentivizing BEVs. The transition is also underway for PT emissions. On urban buses, transport authorities are benefiting from the need for tender renewal to ask operators to introduce new green fleets, while a long-term strategy has been adopted in some networks. Nevertheless, in Europe, on interurban and scholar coach services, less than 5% of the fleet is electric, mostly due to a lack of suitable offers from non-Asian vehicle OEMs, while public transit authorities (PTAs) often see public procurement as a lever to support local industry.

Some issues are limiting the impact of electrification. First, the transition is slow due to replacement cycles (often, cars have a lifetime of 10-15 years). Second, the up-front costs of shifting to EVs for households and companies are still high, and there is limited willingness to pay the premium, especially given the uneven rollout of charging infrastructure and the perceived complexity of its use, as well as range anxiety associated with BEVs. Electric cars themselves also have an important carbon footprint due to the need to import critical raw materials used for battery production and non-repairable batteries, and some of the benefits are offset by the automotive industry’s marketing preference for heavier vehicles, such as SUVs, which have reached 1 billion tons CO2 worldwide in 2023.[11]

With regard to charging infrastructure, challenges also arise from the grid capacity needed to support an increasing number of BEVs. Strengthening the resilience of electricity distribution systems, promoting efficiency, and facilitating the integration of clean and renewable energy are critical. In this context, solutions like smart charging and vehicle-to-grid (V2G/V2x) technologies will be crucial. However, strategic planning and collaborative efforts among public authorities, charge point operators, and grid operators are essential to address these challenges effectively.

Recommendations

Given the extent of what needs to be done, prioritizing actions and investment is critical to maximize the impact of mitigation strategies. This requires defining short- and medium-term goals per type of journey (urban, peri-urban, radial), using results-oriented approaches and constantly measuring progress.

-

Local and regional authorities should clarify their climate change mitigation ambition and strategy for citizens; for example:

-

Do we want an electrification strategy only or a modal transition strategy, or a combination?

-

What are the ambitions and budgets that policymakers, and ultimately citizens, have agreed to?

-

-

Accelerate electrification as a key driver for decarbonization:

-

Incentivize electrification of private cars, company fleets, and shared mobility, especially in areas where sustainable alternative options are defaulting.

-

Subsidize public transport operators (PTOs) in order to accelerate the pace of fleet electrification while concurrently growing their fleets and improving their services.

-

-

Introduce targeted measures to accelerate modal shift and reduce road transport demand:

-

Leverage the city-of-proximity concept (see Section 2.2).

-

Improve PT attractiveness to trigger a modal shift (e.g., commercial speed) in suburban and peri-urban areas, where public transport competes with individual cars.

-

Introduce constraint-based policies to reduce the speed of motorized traffic, particularly passenger cars, and limit travel speed for car users, which will lengthen travel time, thereby reducing the attractiveness of private cars and fostering modal shift (see Section 2.7).

-

Restrict solo car driving within urban areas where other competitive options are available.

-

Introduce targeted subsidies to support sustainable modal shift. Many possible subsidy options can be considered. Using effective KPIs such as “cost of CO2 avoidance” can help to prioritize options.

-

Given the trend toward SUVs and heavy vehicles, use energy consumption (kWh/km traveled), vehicle size, and vehicle weight as additional metrics to encourage smaller personal vehicles, and avoid direct or indirect subsidization of heavier, more expensive, more dangerous, and less energy-efficient SUVs and other higher-end hybrid and electric passenger cars.

-

Invest in marketing and communications tools to boost modal transition, through nudging or communicating the impacts of mobility on health.

-

Climate change adaptation & resilience building

Transport infrastructures worldwide are suffering increasingly frequent and severe impacts from extreme weather events, which can have significant consequences, particularly in poorer and less developed regions. Hundreds of billions in financial losses are being attributed to flooding, extreme temperatures, and high winds. In 2023, Hong Kong’s modern and highly reliable metro system suffered unprecedented flooding following record rainfall that the surrounding urban drainage systems were unable to accommodate, despite existing anti-flooding design features. In January 2024, major storms caused flooding in 200 subway stations in New York City, which represented nearly half the stations throughout the system. In comparison, only 88 stations were impacted by flooding in 2023. In the UK, the railways set blanket speed restrictions to mitigate the impacts of heavy rain and gale-force winds, leading to significant and frequent disruption to journeys.

High summer temperatures are increasingly causing disruptions as railheads weaken or deform, a noted risk in Sweden, Canada, and China. Rolling stock is often not designed to deal with excessive summer temperatures.

Hot conditions are especially difficult for underground metros; many trains and buses lack air-conditioning. The key challenge for mobility systems is strengthening the resilience of their infrastructures, which is essential to maintaining economic and social well-being in a climate-changing world.

Many transport system networks were simply not built to cope with current weather conditions. The costs to upgrade are typically billions at a national level. For example, in the UK, Network Rail has earmarked £2.8 billion over five years but recognizes that this may be the tip of the iceberg. Lisbon’s drainage master plan, covering the years 2016–2030, with a total value of investment of €250 million over 15 years, is another example of the costs associated with climate adaptation policies at a local level.

Incorporating resilience into newly built systems is also costly, and it can be difficult to decide specifically what is needed and how far to go with hardening the infrastructure. Possibilities include high-/low-temperature resilience, flood prevention, vegetation management, overhead power line systems, ground works, sea defenses, and so on.

National governments have a substantial role to play here, as usually the market will not be able to support the investments needed. The EU recently introduced the Resilience of Critical Entities directive (2022/2557), which requires all EU member states to have strategies to enhance the resilience of their critical entities. The directive, which transposes into a law across all the member states in October 2024, was pushed by the EU Commission in response to a growing set of challenges, including extreme weather, and its impact on the lifespan of infrastructure and critical assets.

Technology also plays a key role in improving operational resilience. Together with the deployment of Internet of Things sensors for asset conditions, AI provides the opportunity to manage risks dynamically, enabling better prioritization of investment, better prediction of disruptions, and faster response. In Hong Kong, successful pilot trials have been conducted to enable better prediction of where severe climate events are most likely to cause disruption, through AI-based real-time analysis of weather data and tracking conditions. The UK has produced a risk-based tool that provides the railway with the ability to make better decisions about setting speed restrictions to optimize the impacts of disruption with safety risk.

Note

[1] GUSTO Project, developed by Network Rail Wales & Western in collaboration with Arthur D. Little. This project was recently awarded a Railway Innovation Award by Modern Railways.

2.2 THE CITY OF PROXIMITY CONCEPT

Context

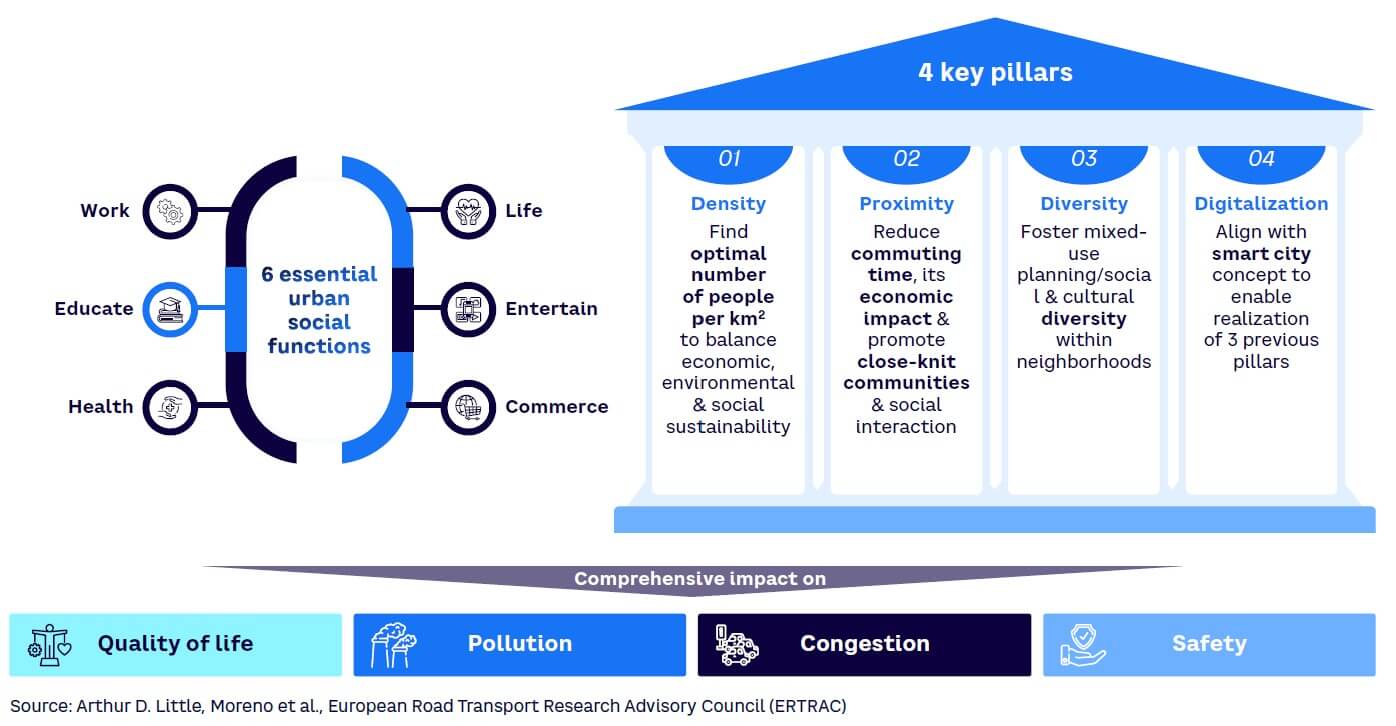

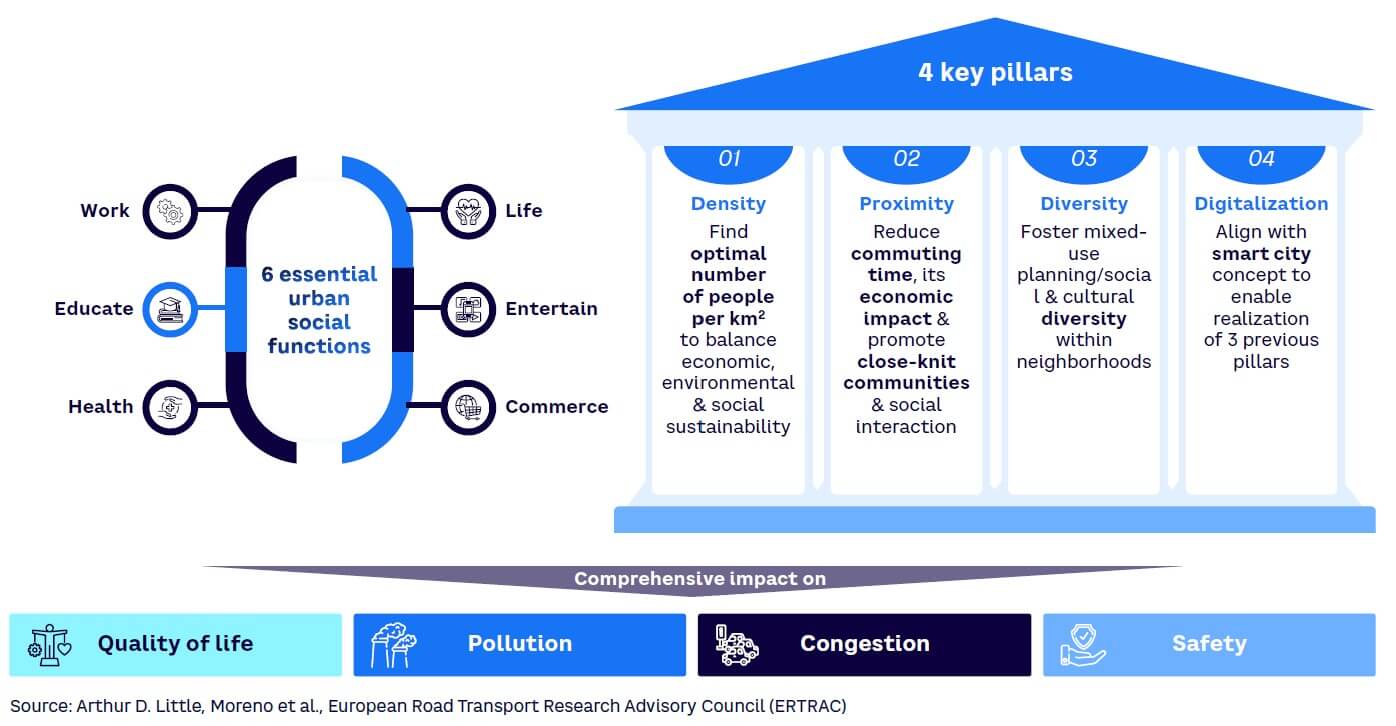

The city of proximity concept is an urban planning model that aims for more sustainable, livable, and healthier cities, by considering the closeness of services needed. Originating from the 1970s, when it started to replace “functional modernism” (i.e., building design should be based solely on purpose or function), the city of proximity concept has been increasing in importance, especially in the last decade. In 2016, French-Columbian researcher Carlos Moreno coined a new name for the idea, the “15-minute city,” defining it as “an urban setup where locals can access all their essentials at distances that would not take them more than 15 minutes by foot or by bicycle.” The concept is based around six essential social functions and four key design pillars (see Figure 11).

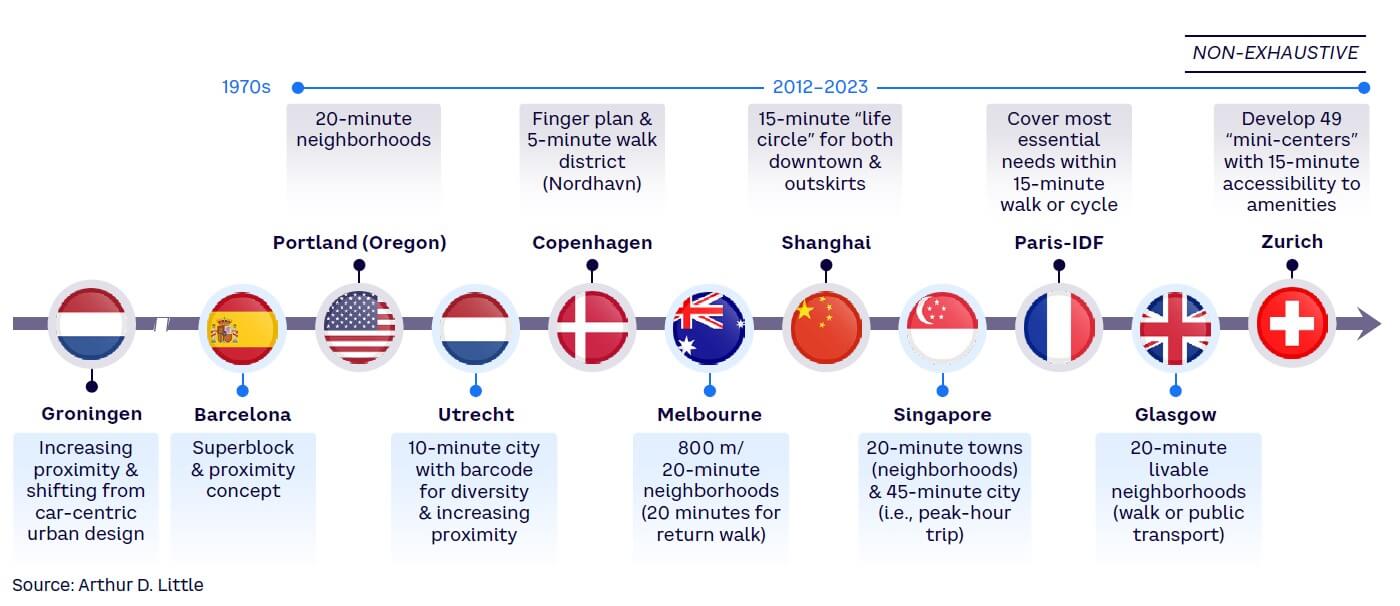

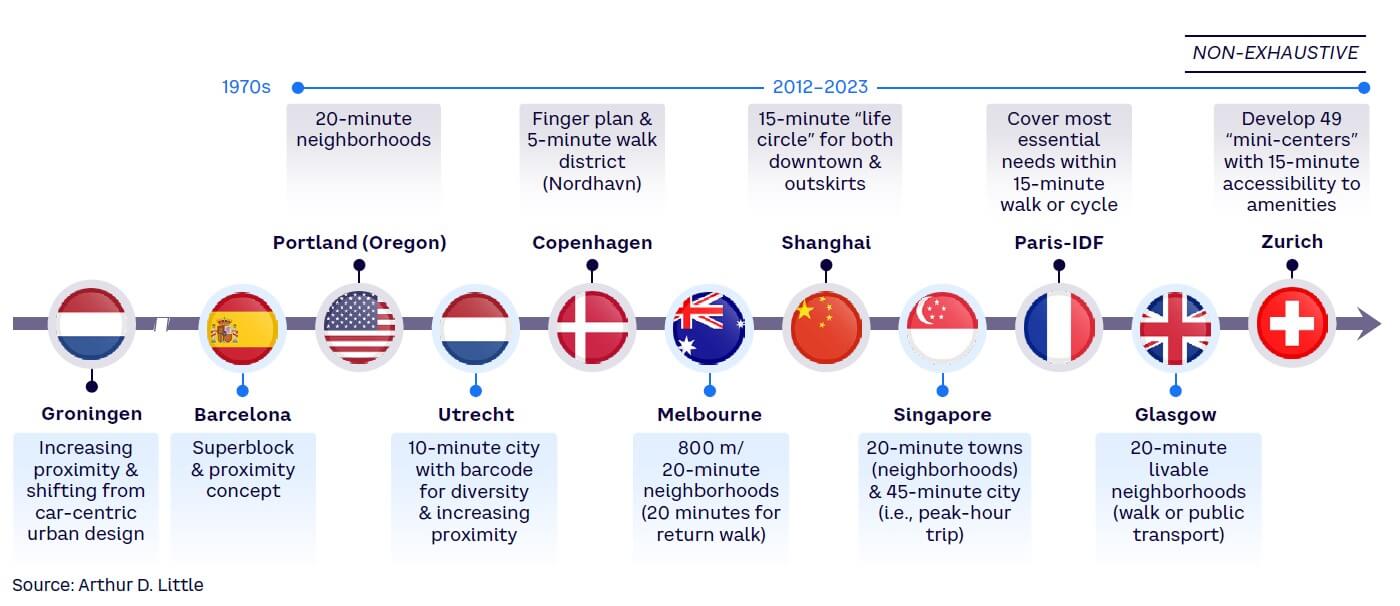

Multiple cities worldwide started giving a time reference to their city of proximity initiatives; for example, “20-minute neighborhoods” (Portland, Melbourne, Glasgow), “5-minute walk districts” (Copenhagen), “15-minute life circle” (Shanghai), and “ville du quart d’heure” (Paris). Beyond acting as a time reference, these cities aim to improve livability by ensuring the urban environment can respond to people’s needs without the burden of lengthy trips and displacements. Today, the city of proximity concept is gaining increasing traction internationally (see Figure 12):

-

The UN Intergovernmental Panel on Climate Change (IPCC) 2023 “AR6 Synthesis Report” considers “compact urban form” as one of the key opportunities for scaling up climate action.

-

In 2022, the European research and innovation hub JPI Urban Europe started the “Driving Urban Transition” program, adopting “the 15-minute city transition pathway” as one of three key levers to tackle modern urban challenges.

-

Also in 2022, C40 Cities, a global network of mayors of the world’s leading cities created to fight the climate crisis, formed a partnership with UN-Habitat, real estate company Nrep, and Carlos Moreno and launched a new “Green and Thriving Neighborhoods program” to deliver proof of concept for 15-minute city policies.

The city of proximity concept holds the potential to transform and enhance the utilization of urban public spaces by adopting a people-centered approach. This shift begins at the micro level, including street design and neighborhood planning, and extends its influence to broader aspects of urban and regional planning, such as land use, housing policies, environmental and climate strategies, and mobility systems. Each element, though small-scale, is interdependent and significantly impacts the larger urban framework.

Challenges

Although the city of proximity concept is appealing to many stakeholders, it is much more difficult to implement in some contexts than in others. For example, it may not work well in suburban areas, low-density developments, historically monofunctional neighborhoods, or in old cities with very limited space for improving street design. Moreover, it can be difficult to measure the overall city-wide impact of what are normally local or neighborhood initiatives.

The 15-minute city concept already has image problems in some cities, like Glasgow, where it has been accused of locking in pockets of prosperity, excluding certain parts of the population, and reinforcing local areas of deprivation, arising mainly from misconceptions and conspiracy theories as to the concept’s purpose.

The governance of city of proximity projects is often difficult, requiring extensive coordination among various stakeholders, including city authorities, transportation companies, real estate developers, local communities, commercial operators, and others.

Analysis, insights & conclusions

Given the current challenges, how sure are we that these increasingly popular city of proximity initiatives are really contributing to superior mobility system performance? To help answer the question, we studied eight cities currently implementing different variations of the concept: Barcelona, Groningen, Utrecht, Glasgow, Paris, Copenhagen, Singapore, and Portland. We gathered data through desktop research and interviews with representatives of urban planning and mobility authorities from several cities and engaged with a task force of academic researchers specializing in the topic. In particular, we focused on:

-

What results have been achieved so far, and have mobility externalities (i.e., congestion, pollution, quality of life, and safety) improved?

-

What are the key components of success?

-

What needs to be done by different stakeholders to further improve?

Overall, the analysis shows that the eight selected cities implementing the city of proximity concept are generally performing favorably in terms of mobility externalities versus averages, both locally and for the city as a whole; for example:

-

Quality of life. Based on an eight-criteria composite index,[12] quality of life ranks “very high” for five of the eight cities, with Barcelona and Singapore as “high” and Paris as “moderate.”

-

Pollution. Six of the eight cities had average fine particulate levels between 5 and 11 µg/m3, versus a European average of 14.9 µg/m3. Paris and Barcelona were 14.7 and 17 µg/m3, respectively. Air quality indicators of all the cities fall in the “good” category.

-

Congestion. With the exception of Paris, the selected cities perform well in terms of congestion, ranking between 98th and 273rd worst in the TomTom Traffic Index ranking, with average rush hour speeds between 27 and 38 km/hr. This may be compared with other cities like London and Milan, which are ranked 1st and 4th worst, with average speeds of 14 and 17 km/hours, respectively. Paris ranked 16th with an average speed of 18 km/hr.

Even the bigger cities in the selection that inevitably have greater issues to manage reported positive results at neighborhood levels: Barcelona reported a reduction in local vehicle use of 82% following the creation of its Sant Antoni “superblock” (although neighboring streets saw an increase of 22%) and decreases of 25% and 17% in NO2 and particulate levels, respectively. Paris had improved quality of life by promoting cycling, resulting in an increase of bicycle use of 54% in 2018–2019 and a reduction in car trips by 5% in 2020 versus 2010.

Analysis of actions taken by the selected cities versus the four key pillars in Figure 11 (density, diversity, proximity, and digitalization) shows that all four are being addressed. This seems to be a key component of success. However, today there is an imbalance in the relative levels of effort:

-

Priorities are shifting toward building diversity and proximity: 43% of all detected actions focused on reinforcing mixed land use, and 57% aimed to improve temporal proximity.

-

Only 15% of actions are dedicated to density, and only 12% leverage digitalization.

The progress still to be made on digitalization in an urban context provides opportunities to redefine what the city of proximity concept means. If we look at the six essential social functions of the 15-minute concept, digitalization has made them all easier to achieve remotely:

-

Work. Remote working has greatly increased post-COVID. For example, in the US more than 20% of the workforce will work remotely by 2025 according to Upwork. Even when employers require office attendance, it is frequently only for part of the week (e.g., three days instead of five).

-

Educate. In a 2023 Eurostat survey, 30% of Internet users in the EU (age 16-74) reported taking an online course or using online learning materials in the previous three months, with an increasing trend.

-

Life. Although physical space to live is always needed, increased working from home means that city center requirements for housing have changed.

-

Entertain. Remote entertainment is growing fast. For example, according to Forbes, in 2024, 99% of US households subscribe to at least one or more streaming services.

-

Health. More than 43% of primary medical care consultations were conducted via telehealth services in 2020 during the COVID-19 pandemic, and the global telehealth market size is predicted to grow at 24.3% CAGR between 2024 and 2030.

-

E-commerce. According to Shopify’s “Global E-Commerce Sales Growth Report,” annual global e-commerce sales are expected to increase by more than 60% from 2021 to 2027. Eurostat reports that nearly 70% of EU citizens aged 16-74 years bought or ordered goods or services online in 2023.

While the evolution of these functions may generally diminish the need to travel through cities, against this there are issues such as livability, inclusivity, and well-being that also need to be considered in deciding proximity needs. Moreover, the same trends act to increase urban logistics demands, which also need to be managed and accommodated proactively.

Recommendations

Based on the analysis, we propose three recommendations to improve the impact of the city of proximity concept on mobility system performance:

-

Improve measurement systems to better track the impact of the city of proximity on mobility externalities:

-

At the individual neighborhood level, monitor the pilot area and its surroundings to better understand the impacts beyond its boundaries.

-

Conduct 15-minute city pilots for the whole city, as opposed to just one or two neighborhoods. This will help test systemic impacts at a city level, which is important in selling the concept to citizens and businesses.

-

Consider the potential of tactical urbanism intervention (through quick-wins). In Barcelona, for example, the city started with punctual, small-scale interventions, such as changing street design in specific blocks (the superblocks) and greening inside block patios, already showing improvements and the potential for new social functions in those areas, then structured and framed this within the city’s broader mobility and urban planning, looking into the promotion of active modes and other sustainable mobility infrastructures and promoting an urban polycentric structure.

-

-

Make use of the concept in suburban areas by combining the ideas of city of proximity and transit-oriented development.[13] This means organizing 15-minute cities more closely around existing suburban public transport hubs (if this hasn’t happened yet) or, conversely, extending the public transport backbone to better serve areas with the potential to build a 15-minute city, leveraging on learnings from cities that implemented city of proximity concepts, such as Groningen, Paris-Ile-de-France, Singapore, Glasgow, Utrecht, and Barcelona.

Moreover, exploring how new mobility services and MaaS could be developed together with urban planning and design in suburban areas might generate new possibilities for urban morphologies that could respond to different mobility needs while not compromising environmental and climate ambitions. The concept can also be extended to different time-scales and areas (e.g., “30-minute territories”).

-

Embrace digitalization by developing more actively the “digital pillar” and, through this, improve digital accessibility to essentials to make the “x-minute city” easier to achieve and implement in practice; for example, this could include policies to support partial remote working, encourage e-commerce, and emphasize the digital component of social services such as health and education. While embracing digitalization, it is crucial to maintain a harmonious balance between digital and physical realms, acknowledging that certain facets of quality of life are inherently tied to the tangible world. Green and blue infrastructure, natural environments, and social interaction are vital to our well-being. It is essential to guard against an overemphasis on digitalization that could potentially eclipse these critical components of life quality, which should be afforded greater prominence in urban spaces.

Overall, the city of proximity concept is certainly a key contributor to mobility performance and is likely to remain an important aspect of urban development as long as its implementation challenges are properly addressed. The city of proximity should be considered from different scales (small-scale street level to large-scale region level) and reinforce the links of urban and mobility planning, where new and improved ways of allocating and designing public space are possible.

2.3 DIMENSIONING PUBLIC TRANSPORT

Context

Historically, public transport has been developed to address congestion generated by cars in dense urban areas. Cities and regions rely on five main PT service offerings:

-

Suburban rail (up to 1 million passengers/day)

-

Metro (more than 100,000 passengers/day)

-

Tram (20,000 passengers/day for modern trams)

-

Urban bus (approximately 2,000 passengers/day)

-

Bus rapid transit (15,000-80,000 passengers/day)

In large urban areas, PT systems rely on both a mass transit backbone (metro, tram, and suburban rail) together with lighter solutions such as buses. In addition, PT systems may be complemented by interurban coaches as well as more flexible solutions such as demand-responsive transit (DRT) services[14] to serve low-density areas.

Today globally, public transport accounts on average for 10% of km traveled at the national level, around 4% in rural areas, and 26% in large cities and urban areas. However, there are big differences in PT usage and modal share in different city contexts:

-

Public transport has a large modal share of more than 50% in inner cities (e.g., Singapore, Hong Kong, Paris, and London).

-

In outer cities, lower density restricts PT usage, hence the overall modal share for large cities is 25%-30%.

-

For commuting to and from work or school, PT usage is context-dependent. For example, the car is dominant in most medium-sized cities. In large cities, PT often has a larger share for commuting into the city (e.g., 74% for Paris) than for suburb-to-suburb commuting.

Commuting is at the heart of the value provided by public transport, often accounting for a large percentage of all trips. Yet public transport still has a fairly low modal share of commuting trips. The distance between home and the nearest PT stop appears to be the biggest driver of usage.

Challenges

There are several challenges to increasing the share of public transport in the modal split:

-

There are often constraints on how and where the PT backbone infrastructure can be developed (physical integration in densely built environment, costs, etc.), especially in city centers.

-

As cities grow radially, there is a growing need for better PT coverage in suburban and rural outskirts to provide alternative options to individual car usage for commuting. Yet, as we have seen, PT usage is highly dependent on the distance between home/destination and the nearest stop or station, which is typically increasing as we move further away from the city center.

-

Public transport is not always the preferred customer choice, even when available.

-

Traditional PT cannot be considered as the only option for virtuous mobility. Increasing usage of sustainable mobility therefore depends on intermodal and multimodal considerations as well.

Analysis, insights & conclusions

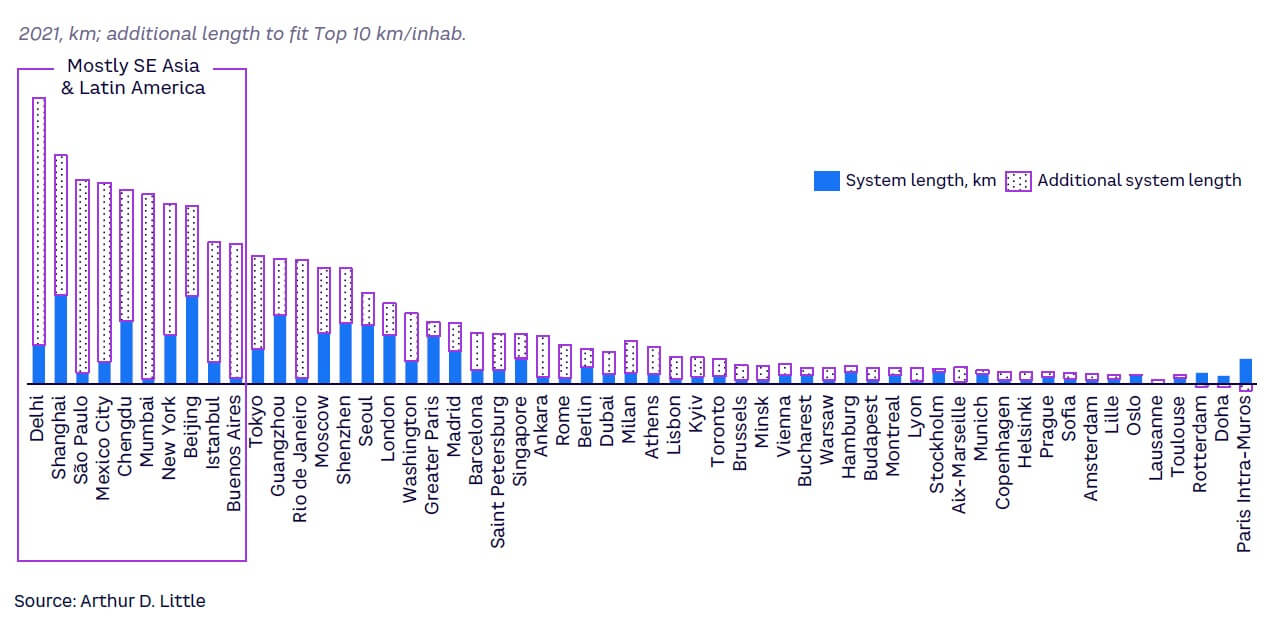

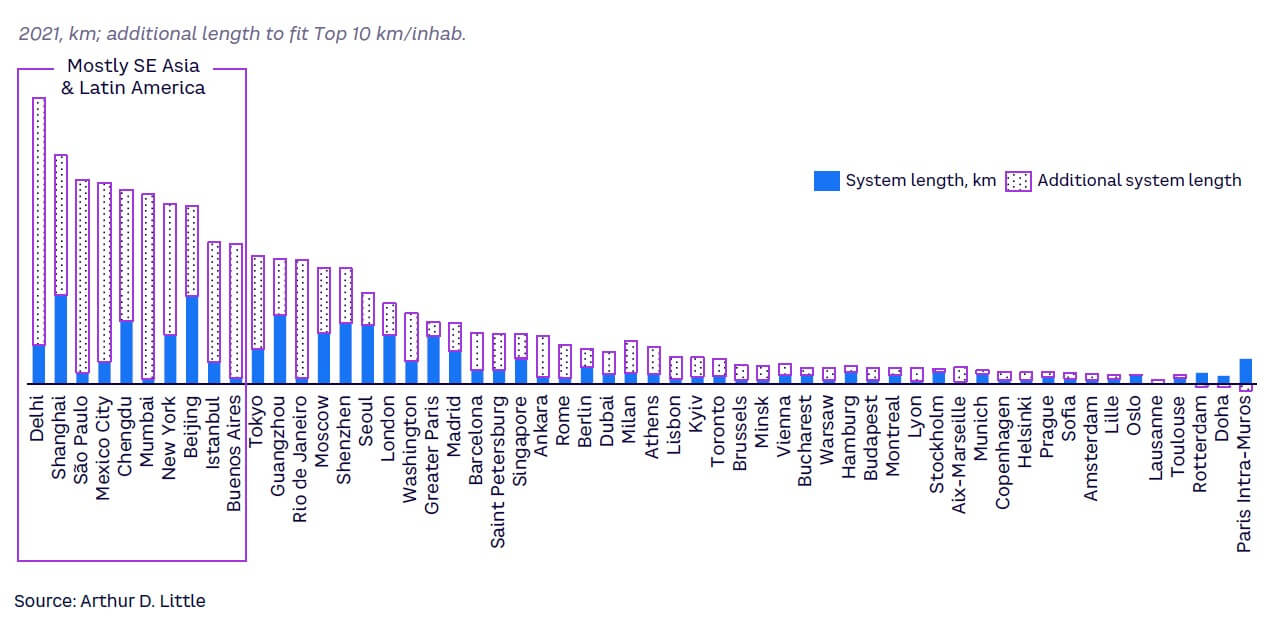

With regard to developing the backbone PT infrastructure in cities, we explored the density of metro line coverage across the 80 cities that had metro networks in 2023. What is striking is that there is a huge variation in the metro network line length divided by the number of inhabitants, with mainly European cities such as Paris, Munich, and Rotterdam having the greatest infrastructure density. If we consider this an indication of the metro network length that could be theoretically added to bring cities to the same density levels, then the sky is the limit for some cities that could add hundreds of km of additional system length to their network (see Figure 13).

In theory, provided there is funding and political will, ample opportunities exist to extend the PT backbone in most cities. The Elizabeth Line in London and the Grand Paris Express in Paris are high-profile examples. Even if constraints are placed on the addition of new network length, there are substantial opportunities to improve metro capacity through technology, especially via full automation using communications-based train control (CBTC) systems.

Several different aspects need to be considered with regard to better suburban and rural coverage by public transport. Increasing PT traffic from suburbs to the center of urban areas is one challenge. Our analysis suggests that while the density of train stations is already high in some areas, there is much variability. For example, in Europe, Switzerland has 19.5 per 1,000 km2, Germany has 15.1, and France has 5.44. Therefore, as with metro networks, there is, in theory, still potential to build new stations to widen rail suburb-to-center coverage. Aside from heavy infrastructure development, BRT and DRT systems can also be favorable options.

The integration with other mobility modes is another key driver for increased PT usage in suburban and rural areas. This includes integration with bikes (e.g., in the Netherlands, 29% of rail traffic was combined with the use of bike parking in 2023); integration with “new mobility” services, such as micromobility, shared mobility, and on-demand mobility; as well as integration with private cars through the creation of park-and-ride (P+R) schemes.

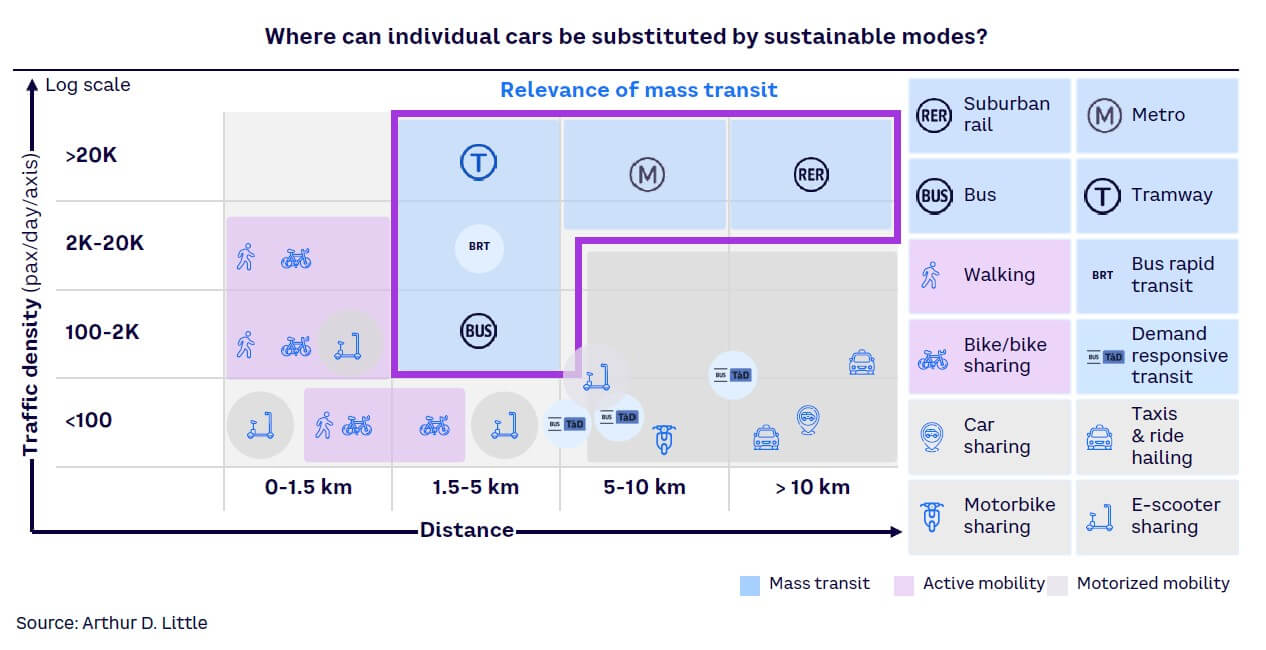

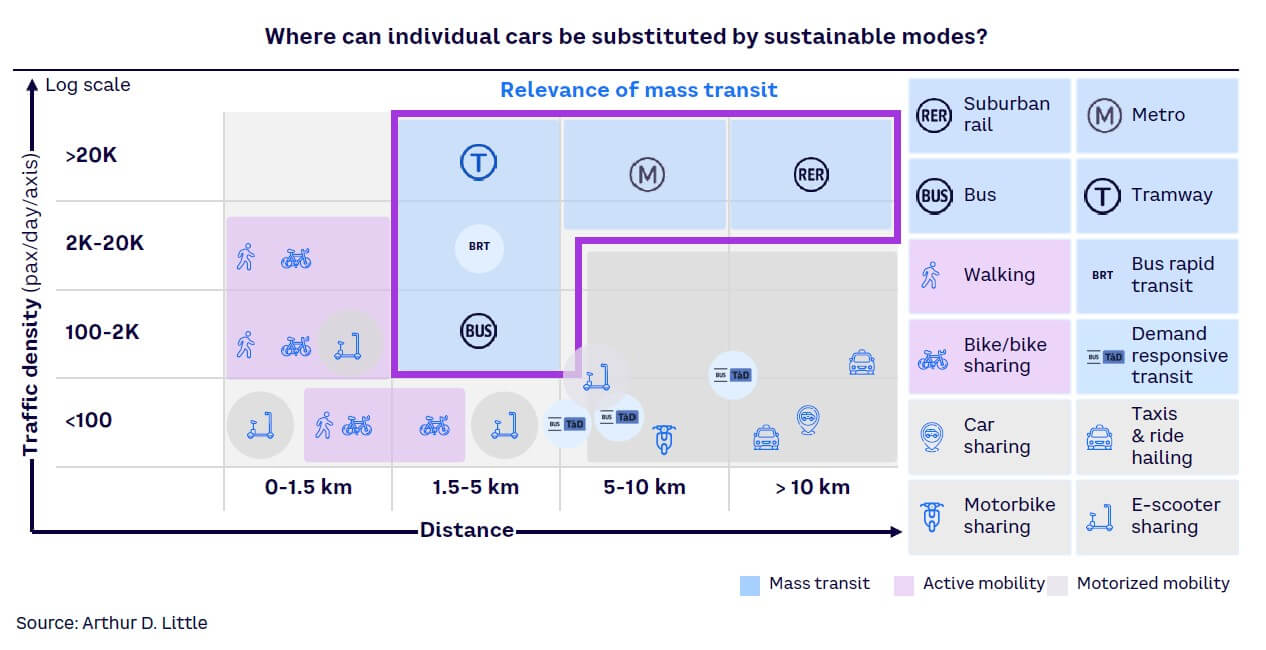

Because public transport is not always the best mobility solution on its own, one important approach to improving the adoption of sustainable mobility modes is to be smarter with transport mode allocation. This can be accomplished through the development of multimodal transport masterplans, prioritizing transport services according to their performance and affordability, and better fostering complementarity and usage of different services within the transport system via intermodality (“intermodal trip”) or multimodality (“multimodal life”).

All prioritization strategies need to rely on a tailored analysis of the number of potential travelers as well as cost/pax-km, prioritizing the cheapest and most accessible mode to cover the maximum possible traffic and then going on to the next mode. The cheapest relevant mode will depend on various criteria, such as traffic density, traffic volume, and number of trips per class of distance. For example, while tram or metro could be the cheapest option in euros per pax-km for the core network in large cities, bus or bus-responsive transit will be better solutions in less dense cities. Similarly, as micromobility has a higher cost per passenger than public transport in dense areas, it is better suited for complementing PT in sparsely populated areas where it is less available or as a first- and last-mile solution combined with PT but not as a core solution in the city center.

Recognizing and accommodating the diverse needs of all users is also important, including providing paratransit options for individuals with disabilities, despite the potentially higher cost per passenger compared to standard solutions. It is crucial to ensure that the transport system is inclusive and accessible to everyone, reflecting the commitment to serve the entire community equitably.

As shown in Figure 14, in practice this means refocusing public transport as the backbone of the virtuous mobility system whenever traffic density justifies the investments (i.e., on longer journeys of more than, say, 5 km) and encouraging the usage of active and micromobility services for trips less than 5 km. This can help increase the load factor on buses/metros at almost the same cost. In this way, bike and walking infrastructure can be a key ally for public transport in the modal transition, enlarging PT coverage by reallocating capacity in the suburbs and cutting peak hour coverage. For the same reason, the usage of shared and on-demand motorized mobility like car sharing, taxi, and ride hailing should be encouraged for longer distance travel and in lower-density areas where investment in mass transit is not justified.

Recommendations

We offer the following recommendations for transport authorities and PTOs.

For local & regional authorities

-

Choose the right transport mode allocation:

-

Upgrade the PT network with a primary focus on the backbone infrastructure and securing investment in mass transit to accompany urban development, ensuring that public transit networks can support growing populations and changing mobility patterns.

-

Then consider expanding surface modes (e.g., trams, buses, and BRT), focusing specifically on improving travel times and frequency.

-

Rely on active mobility where possible (depending on traffic, distance, and trip purpose) to enable reallocation of bus capacity outside of the city center.

-

Focus on trips to and from the suburbs with rail and urban transit integration.

-

-

Consider various strategies when extending coverage beyond the city center. Expanding regular PT lines is a crucial approach but presents several challenges, including a lower pooling rate, which consequently increases the average cost per passenger across the entire network. Local and regional authorities should select the most effective options to mitigate high costs per pax-km.

-

Develop multimodal transport master plans at city, regional, and even national levels to optimize infrastructure and transport solutions usage via system logic and increase ease of use of the various networks collectively.

-

In that context, carefully investigate the pros and cons of subsidized DRT, shared mobility services, and private mobility devices (e.g., bikes and e-scooters).

-

When geographically expanding regular PT services, it is imperative to focus on enhancing the attractiveness of these services as part of the expansion strategy.

-

-

Foster integration of modes:

-

Prioritize integration of fares, ticketing, passenger information, bike parking, and P+R.

-

Provide direction, guidance, and support to PTOs to open and integrate more toward new mobility solutions (see Section 2.7 on MaaS for more details on data openness and integration).

-

For PTOs

-

Maintain focus on quality of service to maximize attractiveness of PT as a viable option:

-

Consider all aspects of quality of service, including service robustness, punctuality, accessibility, comfort, and simplicity of the customer journey (including passenger information, ticketing), as well as travel time competitiveness versus private cars.

-

-

Enhance multimodal (physical and digital) integration and intermodality:

-

Address pain points associated with mode switching and developing mobility hubs to facilitate seamless transitions between different modes of transport.

-

Allow selective usage of PT infrastructure by new MSPs.

-

Integrate with new mobility services within MaaS (see Section 2.5).

-

2.4 NEW MOBILITY SERVICES: MICROMOBILITY, SHARED & ON-DEMAND

Context

New mobility is a diverse category that includes micromobility rental services (mostly bikes, e-bikes, or e-scooters), shared mobility rental services (car sharing and car pooling), and on-demand mobility services, including ride hailing and ride sharing).

It is important to distinguish between personally owned mobility devices and shared vehicles belonging to an MSP, which are the focus of our analysis in this Report. Whichever segmentation is used, the boundaries are constantly shifting as new services and vehicles are introduced, such as cargo bikes, micro-cars, mono-wheels, and e-skateboards.

Demand for micromobility and shared mobility continues to grow. For example, ridership in Europe increased by about 15% in 2023 versus 2022, with growth especially in sectors like bike sharing (54% for dockless bikes and 13% for station-based bikes) and free-floating car sharing (54%), taking over the e-scooter market (growth of 3% only in 2023 while it led the market in 2019-22).[15] However, the share is still very small, representing less than 3% of trips in the modal split. It is noteworthy that services represent only a fraction of total micromobility trips and assets, with ownership gaining in popularity. For example, sharing services in France operate about 40,000 e-scooters, while an estimated 2.5 million belong to citizens. Sharing services are also often considered a gateway to ownership of personal mobility devices.

The industry landscape is evolving but in a largely predictable way. For example, the shared micromobility landscape is highly fragmented, with US-based companies playing a dominant role. Consolidation is already ongoing with multiple partnerships, mergers, and acquisitions making the headlines, such as Bird’s acquisition of Spin (before ultimately filing for bankruptcy) and TIER’s merger with Dott. This trend is not limited to two-wheelers with ShareNow and Free2Move joining forces in the car-sharing segment.

Ride hailing and car sharing have already reached a fairly high degree of customer acceptance and are probably at the “early majority” stage. However, some two-wheeler services, especially e-scooter sharing, are still in between the early adopter and early majority stages. It could be argued that this format, used mainly by young men, may be stuck at this stage and may ultimately be replaced with other, yet-to-be-launched formats. In any case, effort is still required to extend micromobility usage to broader categories of users.

Shared micromobility services benefit from a relatively high demand and willingness to pay and are often used together with public transport to cater to door-to-door use cases (recently, several micromobility providers reported that more than 25% of their trips were intermodal with public transport).

There also is a demand for car-sharing and ride-hailing mobility services to support multimodal life use cases, which involve using different modes for different journeys and needs, both within and outside of cities. While some ride-hailing services seem to have reached a level of profitability, car sharing today generates low yield compared to ride hailing and micromobility, as it suffers from having a level of user willingness to pay that is not much higher than for micromobility and higher operational costs (e.g., maintenance, insurance, parking).[16]

Challenges

One of the key challenges of micromobility and shared mobility is that they are difficult to regulate compared to traditional mobility segments such as PT, cars, and bikes. Typically, micromobility and shared mobility developers and operators are entrepreneurial and technology-driven. They need, above all, to ensure financial viability, which often restricts their ability to prioritize societal concerns regarding the overall mobility system and urban planning. Moreover, the legacy of car domination makes new mobility regulation difficult. For example, scooters park on pavements because cars monopolize parking space, and scooters run on sidewalks because cars have a speed monopoly on roads. Car sharing and new delivery services are also constrained by the same legacy. Early on, this led transport authorities to focus too much on a “pest control” regulatory philosophy, rather than one that is strategic, proactive, and enabling for the overall mobility system, although this is already changing (see below). Another key concern is the economic viability of operators, with only a handful showing profitability. Excessive regulation increases operational complexity and cost for new mobility providers.

The safety of micromobility modes is a key issue for many, although, according to data from the International Transport Forum (ITF),[17] the situation is improving. The risk of casualties involving shared e-scooters in Europe is decreasing as their use grows more rapidly than injury reports. Up to 70% of total reported casualties are minor. Severe injuries account for a small fraction of total reported casualties, and fatal injuries from reported micromobility crashes constitute a relatively small percentage, up to 1% of total reported casualties. On the other hand, the overall safety of new mobility modes should always be a concern and requires transport authorities to set clear boundaries to mitigate risks.

Analysis, insights & conclusions

Against this background, we conducted research and analysis to address the key question: to what extent are micromobility and shared mobility solutions contributing to improving the mobility system? Within this framework, we aimed to assess the current impact of new mobility on modal shift, the biggest pain points for new mobility service providers today, and what needs to be done by different stakeholders to further improve their positive impact toward more sustainable urban mobility systems. The work was based on quantitative and statistical analysis, desktop research, focus groups with mobility experts, and a primary survey of the mobility patterns of people around the world, involving some 15,600 respondents.[18]

Trends in modal shift away from cars were covered in Chapter 1. Looking specifically at new mobility services on willingness to forego personal car ownership, we found they do have an impact. Our regression analysis of the survey results showed that regular usage of multiple new mobility modes positively impacts readiness to give up car ownership. For example, if a person uses four different new mobility modes on a regular basis (i.e., more than two or three times a month), he or she is more likely to give up a personal car than a person using only two new mobility services.

-

On an individual mode level, we found that car-sharing and ride-sharing services, as well as the use of MaaS solutions, are more likely to impact readiness to forego car ownership than other services, such as two-wheeler sharing and ride hailing; a statistically significant association between usage of the mode and readiness to abandon a private vehicle is confirmed only for the first three modes and isn’t confirmed for the last two.

-

This is likely due to the fact that car sharing and ride sharing both cater to the typical use cases of car users, such as doing errands, picking up goods and/or people, and traveling to and from city centers. These use cases are not well served by two-wheeler and ride-hailing services.

Turning to new mobility operators’ pain points, these are to a large extent related to the challenges of moving from the “rapid growth” to “maturity” stages. In particular:

-

Raising funding is difficult. Venture capital (VC) investment has been instrumental to the rapid launch, spread, and expansion of new mobility services, though the outcomes have been mixed. High expectations, regulatory hurdles, operational challenges, and the impact of the COVID-19 pandemic led to a drying up of VC funds, causing investors to shift their focus. Despite some disappointments, this period underscored the significant role private investment plays in advancing sustainable mobility. Expanding the sustainable mobility offering, particularly through shared mobility and DRT in wide suburban areas necessitates private investment. For investors to realize stable and substantial returns, they must exhibit reliability and a willingness to engage over the long haul. In parallel, it is imperative for local and regional authorities to develop strategies that attract these investors and provide the necessary oversight and assistance to ensure that investments are directed effectively (see Section 2.8).

-

Complexity and costs are growing. In 2023, the number of permitted new mobility operators and vehicles was reduced in Berlin, Rome, Brussels, and many other markets, with Paris banning shared e-scooters altogether. At the same time, authorities are establishing rules and conditions that generate costs and constraints for mobility service providers. Issues such as parking restrictions, crime, vandalism, and difficulties with integration into broader MaaS solutions have added to the complexity and cost burden.

Consequently, only a handful of operators have showed signs of profitability so far, such as Lime and Ryde in 2022. Meanwhile, Bird’s US branch filed for bankruptcy, Superpedestrian shut down its US operations and is exploring the sale of its EU branch, and Dott and TIER sold nextbike after their merger. Late last year, Micromobility.com delisted from the Nasdaq due to its low share price, and several players have laid off employees. Economic viability is therefore uncertain, and in the medium term, it may even be necessary to consider public subsidies in order to keep new mobility services as part of the menu.

Recommendations

Our analysis confirms that usage of multiple new mobility services positively impacts readiness to give up the use of private car by default for all trips, and that micromobility, shared mobility, and on-demand mobility services have an important role to play in improving the modal split within our mobility systems. They are especially valuable in encouraging modal shift and, with the possibility of increased service diversity, quality, and reliability, creating a virtuous circle. Transport authorities, PTOs, and new MSPs thus have a shared interest in bringing about the shift away from private cars. But there are some significant challenges to be overcome to ensure new mobility services can remain part of the equation.

Transport authorities should cultivate new mobility as part of their menu and foster partnerships with new MSPs to ensure a positive contribution to sustainable mobility, rather than merely seeking to regulate them:

-

Adopting a balanced policy toward new mobility, where supply management is complemented by demand management. In addition to improving supply of alternatives, a balanced mix of other measures, also on the demand side, is necessary to effect change. Further details on demand management, including nudging and communications policies, are provided in Section 2.7.

-

Carefully calibrating support structures fordifferent mobility options. More attention is needed to promote solutions with greater potential to shift citizens away from private cars, such as car sharing, in addition to continuing to promote bike lanes and bike sharing.

-

Taking a greater interest in “ecosystem plays” to maximize success and help improve the economic viability of new mobility players.

Operators should position themselves as team players in the mobility ecosystem:

-

Integrating as much as possible with public transport and other transportation modes, both physically (intermodal mobility hubs, interchanges) and digitally (MaaS).

-

Collaborating with transport authorities to codesign innovative support mechanisms such as micro-subsidies. These can be positioned as benefits to both sides: the operators can secure better margins, while the authorities can benefit from being able to influence how and where new mobility services are provided (e.g., low-density areas, disadvantaged user groups, and off-peak times).

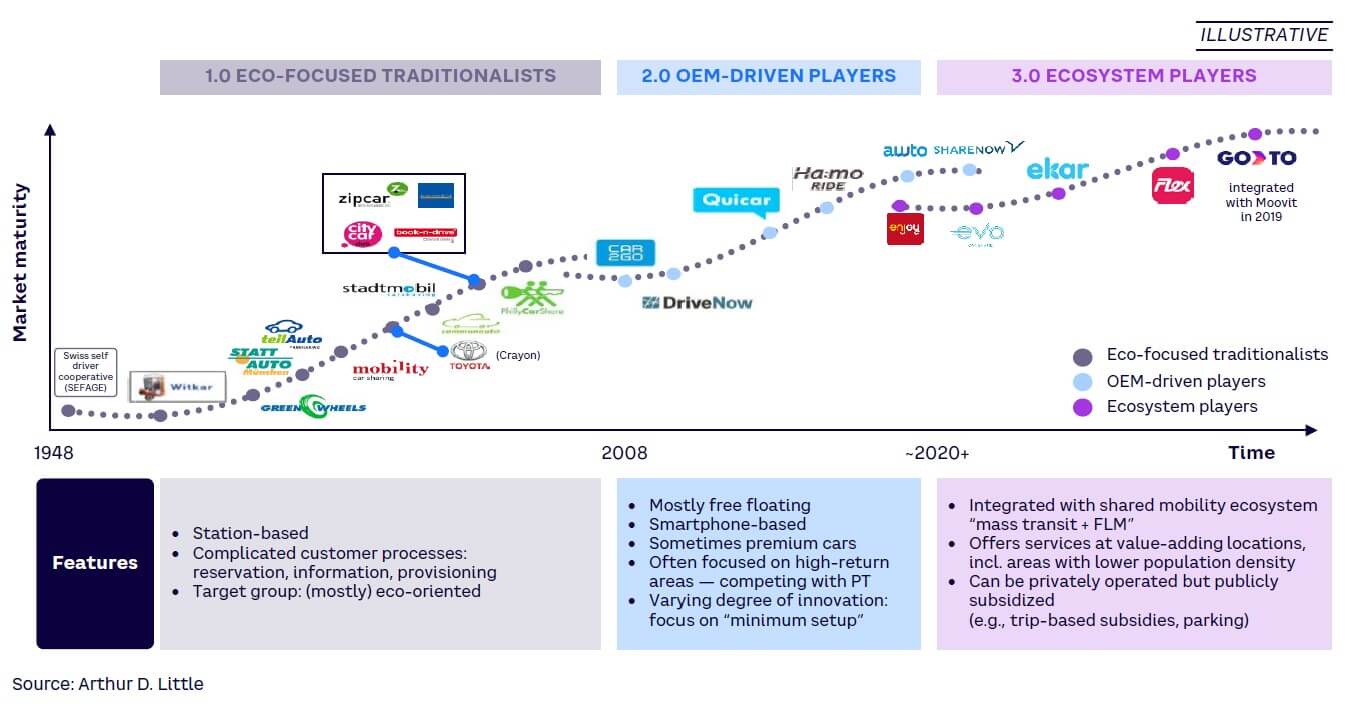

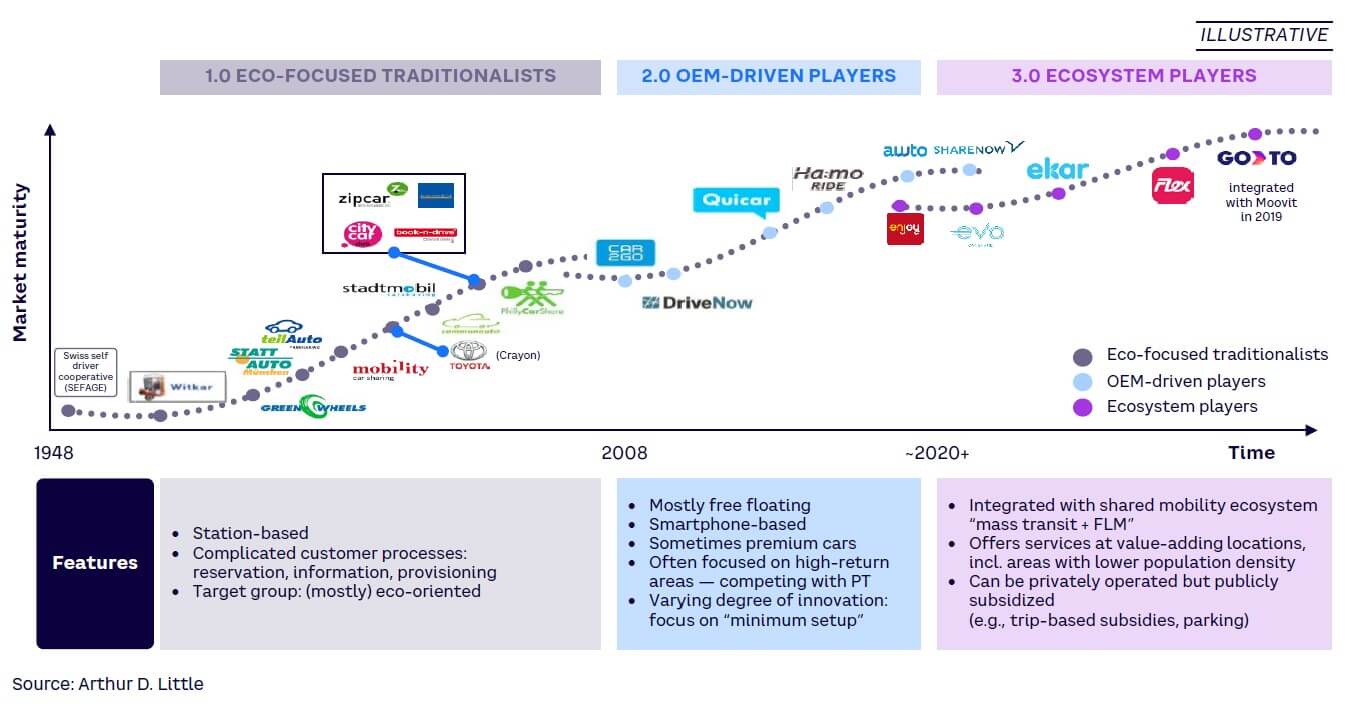

Figure 15 is an illustration of the application of the ecosystem play concept to car-sharing service providers, as detailed in the ADL Report published earlier this year in collaboration with movmi, a shared mobility tech company, and the Mobility Cooperative.[19]

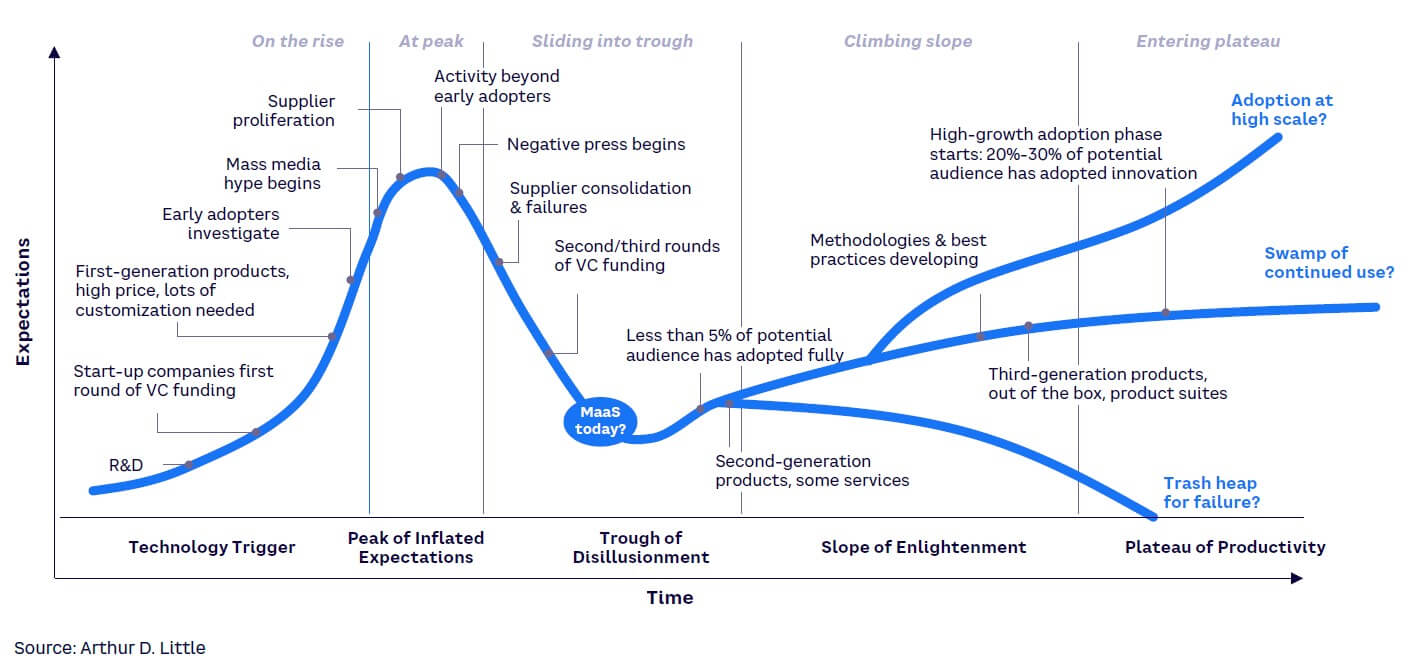

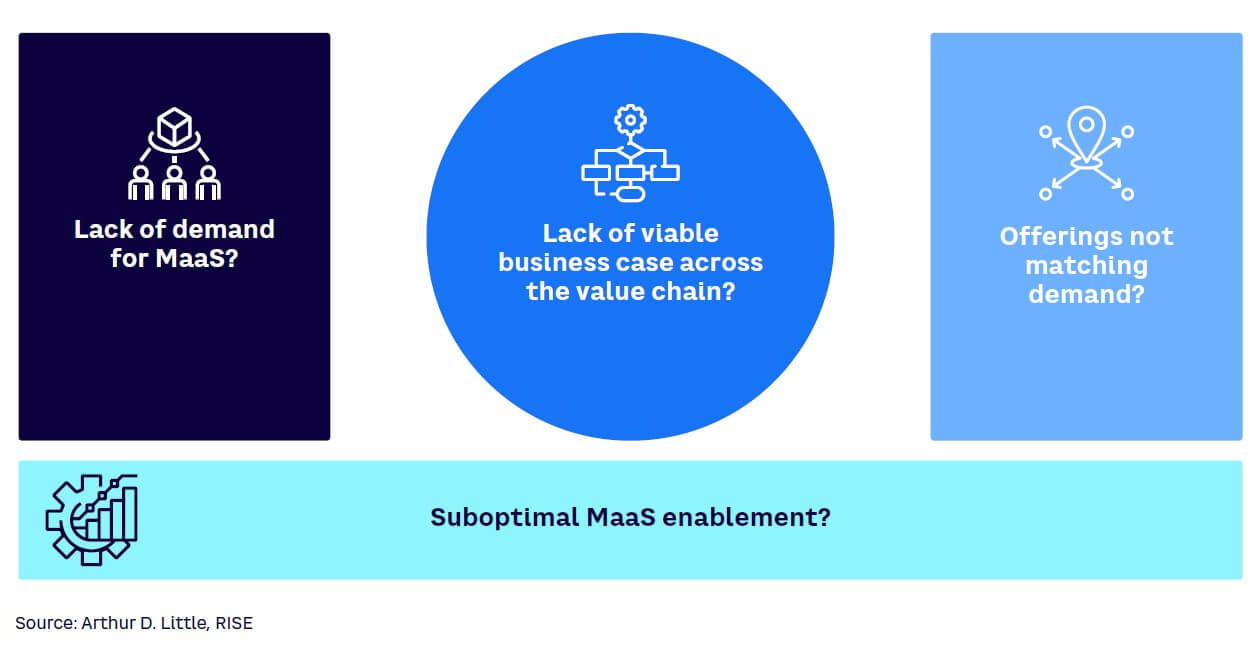

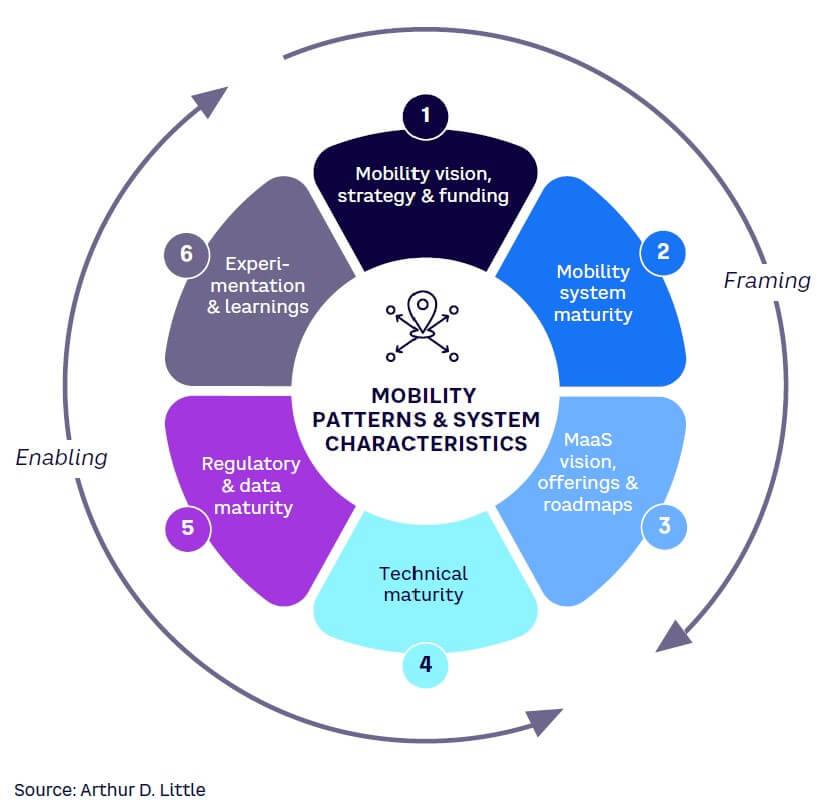

2.5 MOBILITY AS A SERVICE

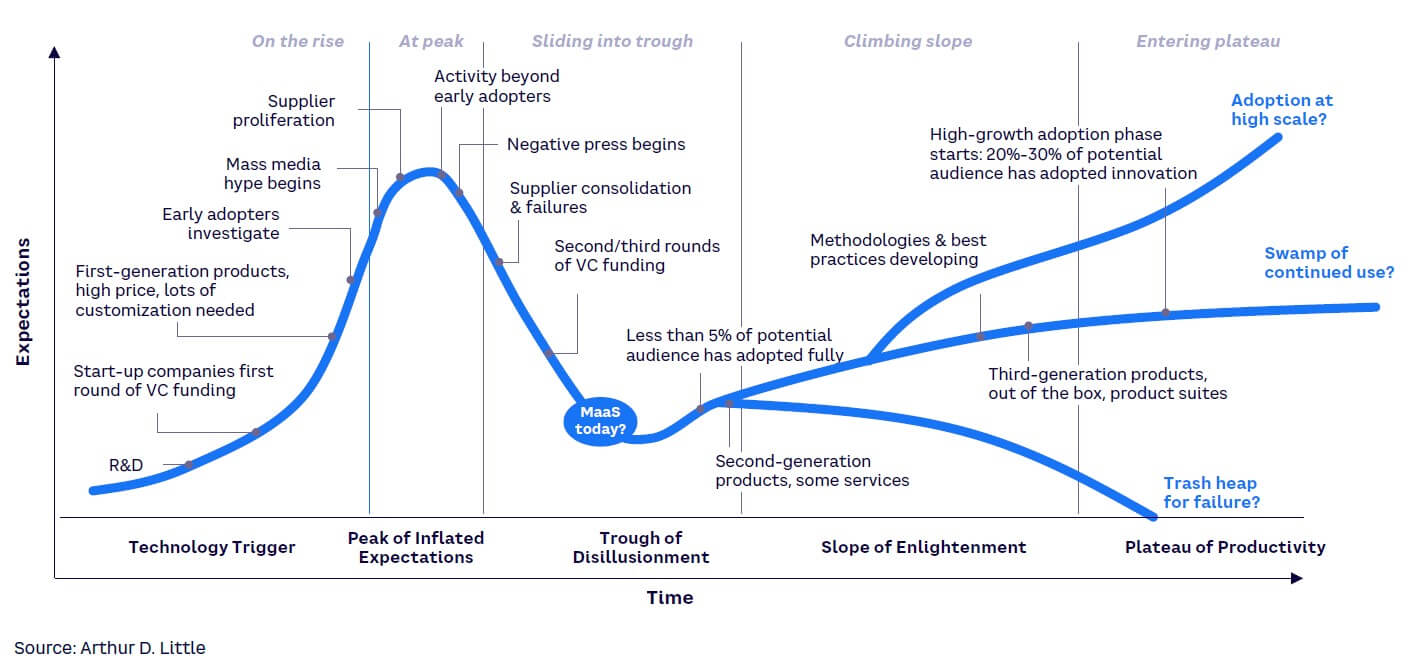

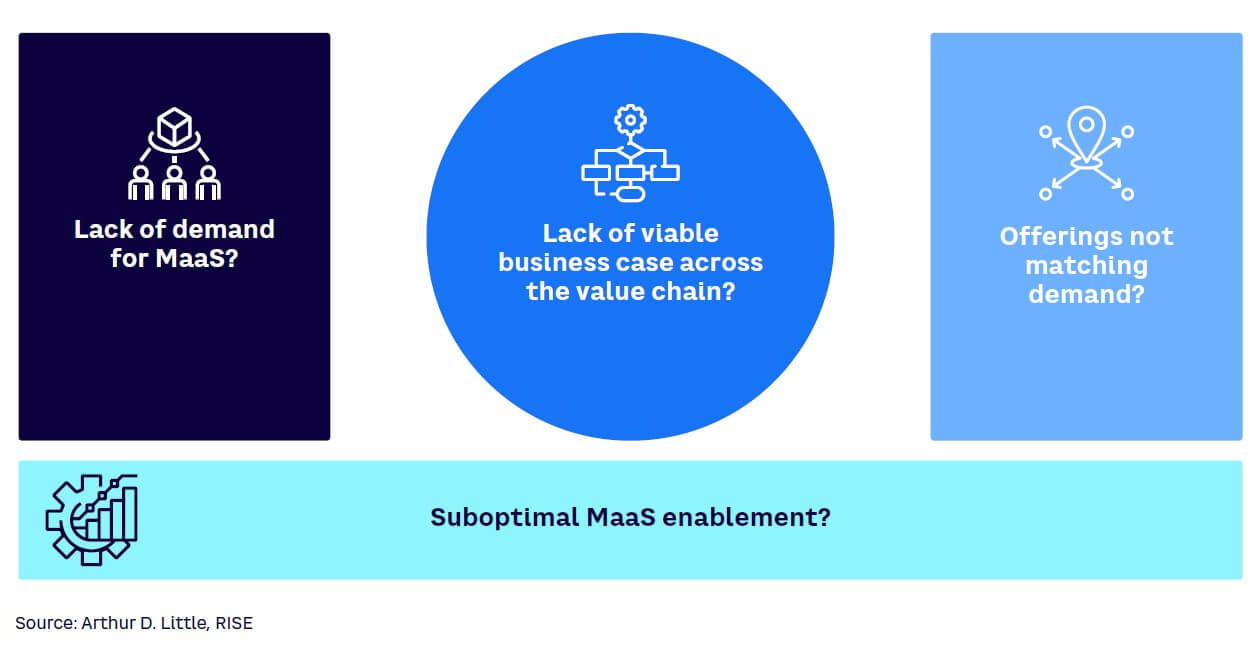

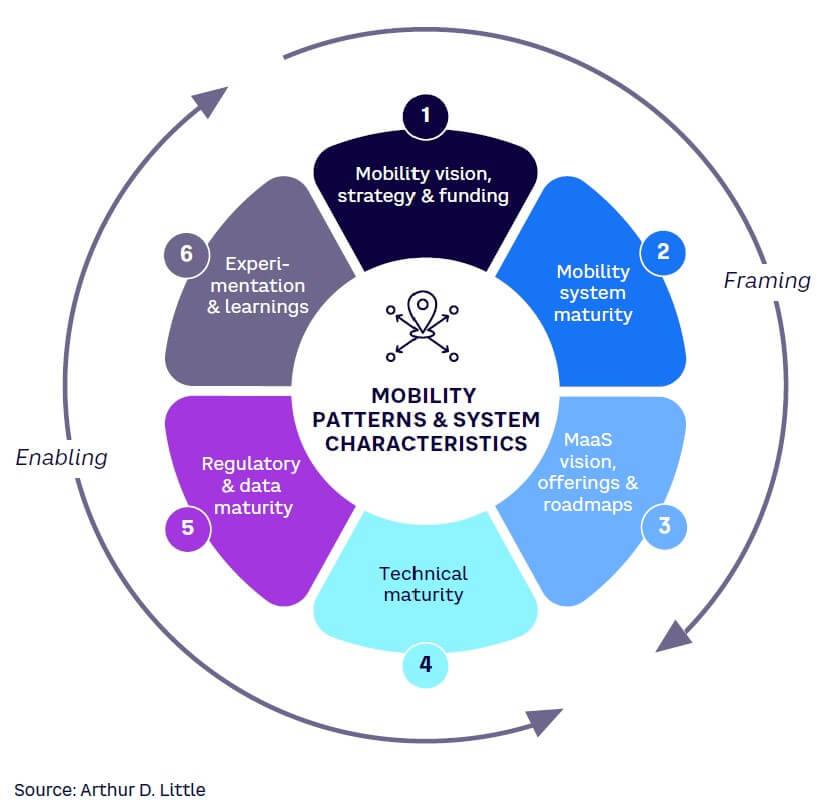

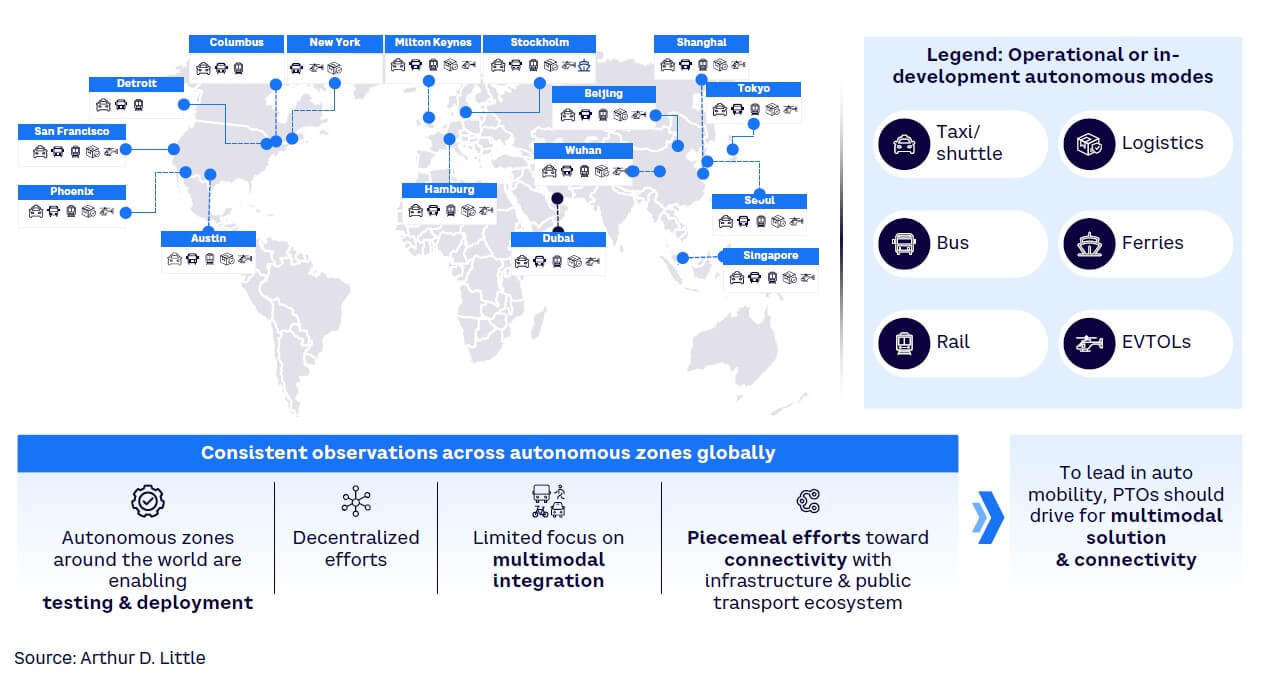

Context