As vehicles become connected, autonomous, shared, and electric (aka the CASE evolution), incumbent insurers and new entrants are experiencing myriad threats and opportunities. Simultaneously, industry-wide digitization (driven by customer expectations aligned with other sectors) is intensifying competition. This Viewpoint details key aspects of the shift caused by CASE, including business model implications and clear opportunities for key market participants.

CHANGING COMPETITIVE ADVANTAGES

For decades, insurers had an exclusive advantage. Risk transfer consisted of three capabilities: (1) understanding customer needs, (2) accurately assessing and pricing risk, and (3) having access to abundant, cost-effective capital (to hold risk). Insurers had easy access to customers via captive agents and intermediaries, a strong understanding of their clients’ risk environments, plenty of actuarial and risk assessment expertise, and a diversified risk portfolio that allowed a cost-effective way of holding risk.

These advantages are gradually becoming accessible to other industry players (see Figure 1). For example, automotive OEMs have broadened the scope and depth of user interaction through in-car/online/offline experiences, maintaining exclusive control over various driver behaviors and vehicle data. OEMs are now equipped with capabilities that translate into higher underwriting profit and investment return through existing access to vehicle data and internal capital.

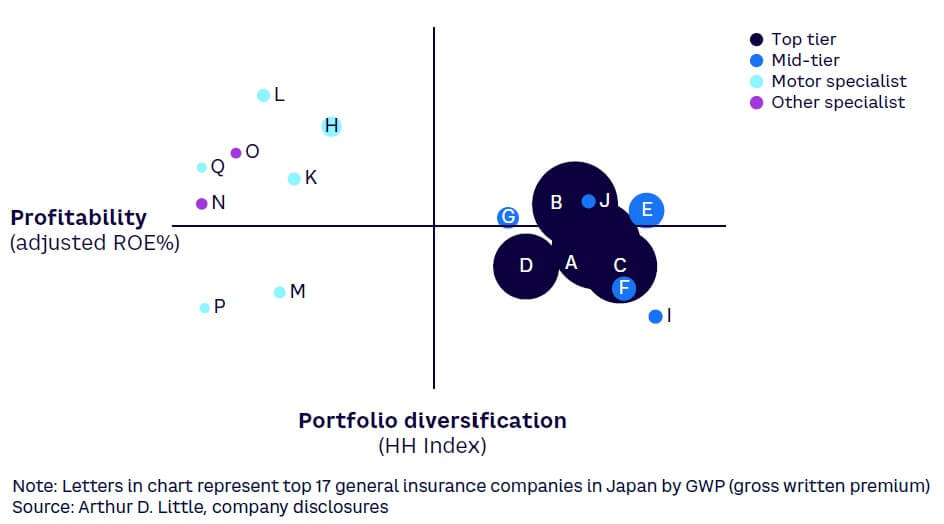

Other examples include digital insurers focused on auto and digital brokers (typically price-comparison websites) that create new ways to access customers. In Japan’s P&C market, nimble motor-specialist insurers can succeed in favorable risk segments, potentially leading to higher profitability compared to monolithic all-line carriers. OEMs’ advanced capabilities in assessing driver-behavior data and identifying more favorable risk segments could give them an advantage over incumbent players, despite their less diversified risk portfolio (see Figure 2).

CASE IMPLICATIONS

The CASE evolution is fundamentally reshaping transportation. Figure 3 shows how vehicles are becoming more connected to digital networks, more autonomous via augmentation and replacement of human operations and decisions, shared through mobility services, and electrified (changing vehicle structure and the energy supply chain).

Although the timeline for reaching certain CASE evolution milestones will vary across markets, we expect the following trends to emerge (see Figure 4):

-

Fewer vehicles owned by individuals. Vehicle ownership will decline due to increases in car sharing and ownership models such as renting and leasing.

-

Higher utilization of vehicles. The rise of car sharing as a business platform will create demand for local transportation and increase individual vehicle use.

-

Fewer motor risks. The shift of driving operations and decisions from human to artificial intelligence will reduce risks related to human error.

-

Shift in liability from driver to manufacturer. Increased dependency on autonomous driving will increase the liability of vehicle manufacturers in accident cases and gradually impact the need for insurance coverage.

-

Improved data flow. With cars becoming more connected, insurers can use data from vehicles to assess driver behavior and tailor insurance premiums accordingly. This will promote safe driving and risk reduction, leading to lower premiums. We already see this development through usage-based insurance (UBI) and pay-as-you-drive tariffs leveraging telematics devices or apps.

-

Changes in vehicle manufacturing, repair, and maintenance cost structure. Electric vehicles (EVs) have simpler transmissions and cooling and fewer moving parts. However, battery manufacture and maintenance will affect cost structures and tow assistance (e.g., new needs such as battery recharge).

-

New risks. Risks (e.g., cyber threats) will emerge as vehicles integrate into external platforms. Specialized insurance products for EVs, autonomous vehicles, and shared mobility providers will come forth to cover the unique risks associated with these technologies.

-

Increase in new mobility platforms. We will see a rise in sharing service providers that connect mobility demand to vehicle supply.

-

New laws. Regulators will adapt to this landscape with laws and regulations pertaining to autonomous driving, data privacy, and insurance.

-

Increased customer engagement. This will increase as a result of added risk management services.

IMPACT ON INSURANCE

Contracting traditional motor risks

The CASE evolution will cause the motor insurance market to contract significantly over time. Because motor insurance in many developed nations is an established and highly competitive market, further contraction of risk demand could put pressure on margins and eventually crowd out incumbent players.

In many cases, vehicle ownership will change from individuals to businesses, with insurance embedded through car-sharing services. Sharing platforms will be the policyholders, aggregating end-customer access, and insurance products will be distributed via these platforms, requiring insurers to embed products in (and integrate with) customer-access platforms. These developments imply a shift of traditional motor insurance from retail to fleet and commercial insurance. In the retail sector, we expect an ongoing increase of on-demand and pay-per-use insurance models with coverage provided only when a vehicle is in use.

The frequency and severity of accidents will decline as autonomous driving replaces human-led driving behavior. Improvements in advanced safety devices will lessen impact and damage when clashes do occur. However, EV repair costs are higher than internal combustion engine (ICE) vehicles. Batteries are a critical EV component, and repairing the battery while salvaging the remainder of the vehicle increases repair costs. Anecdotally, we are learning that removing damaged batteries is difficult when they are tightly integrated into the vehicle body (to achieve production efficiency and maximize in-car space). In some cases, battery damage results in a total loss, creating a higher premium of ~20% for EVs compared to similar class ICE vehicles.

Emerging risks

As the traditional motor insurance market declines, new risks will emerge linked to the connected and shared nature of vehicles in the future. For example, connected vehicle features integrate with out-of-car services via networks, exposing them to any cyber risks the networks themselves face. Vehicle malfunctions caused by hacking or malware will trigger manufacturer product liability.

Mobility services have the potential to go beyond land transportation in the future. For example, Japan is looking to commercialize flying-car services in time for the 2025 Osaka Expo, transporting visitors to various expo sites in electric vertical take-off and landing (eVTOL) vehicles. A consortium consisting of an insurer, travel agency, bank, and trading house will be on-site to demonstrate the commercial feasibility of eVTOL vehicles, including new forms of aircraft insurance.

OPPORTUNITIES

For insurers

There are several ways insurers can build competitive advantage and grow their business, despite the predicted decline in traditional motor risk:

-

Understand and manage EV battery risks. Higher EV premiums stem mainly from higher repair costs, especially of battery components. Given the relatively unknown nature of EV batteries compared to ICE components, insurers are hesitant to take on any risk related to fixing or salvaging EV batteries. A better understanding of battery technology and the EV battery value chain will help insurers manage risks and increase repairability, leading to lower claim costs and competitive EV premiums. A recent example of such a move is Tokio Marine Kiln’s partnership with battery-focused insurance technology firm Altelium.

-

Excel in “embeddability.” The shift from vehicle ownership to vehicle sharing/subscription will change the primary touch point with end customers when it comes to insurance distribution/maintenance and typical terms of coverage. Fleet businesses managing shared mobility services will be the primary platform to connect with customers and deliver services. Insurers that can embed quoting/binding/policy maintenance capabilities into mobility platforms and provide risk-related value-add services will have a competitive advantage.

-

Expand into new classes of mobility risks. As mentioned, the mobility domain will expand from land transportation to air mobility. Although air mobility may be covered by a modification of aviation insurance, it presents different risks, and tailored products will be needed. Insurers are actively partnering with (and investing in) mobility service developers. For example, MS&AD Insurance Group Holdings invested in Volocoptor with the aim of understanding risks surrounding eVTOL operations and developing insurance products.

For OEMs

OEMs can leverage existing strengths to build competitive advantage in the changing insurance landscape:

-

Calibrate EV value chain from an insurance perspective. The high cost of EV insurance claims comes from high parts costs (due to more sophisticated/advanced technologies and lower number of parts used in a vehicle) and lower repairability of damaged components. While incumbent insurers are building battery expertise through partnerships to optimize the cost of claims, OEMs can maximize repairability and salvageability and reduce claims cost by better understanding battery risks and reflecting crash data into vehicle design.

-

Deliver integrated vehicle/insurance-purchase experience. OEMs are already innovating the vehicle-purchase experience, especially in EV sales. To cater to digital native/tech-savvy segments, the EV sales experience focuses on an optimal balance between online and offline experiences. Using native customer data/interaction data, OEMs can offer tailored, integrated insurance products as part of the vehicle-purchase experience.

-

Take a lead role in CASE-driven insurance. With the rise of driverless cars, liability will shift from drivers to OEMs. Accidents caused by vehicle malfunctions could be attributable to system hacking, failed software upgrade/fixes, navigation system malfunction due to satellite outage, malfunctions of autonomous driving software, and failure to use manual override to avoid an accident.

-

The role of OEMs as partners of insurers will likely shift from distribution partners to product partners. The vast amount of data generated by connected vehicles (e.g., car performance, driver behavior, maintenance needs) can help create better UBI products along with innovative products tightly integrated with the respective vehicle’s technology or simply monetarized by OEMs in the form of data analytics services offered to insurers to better assess (and price) risks.

CASE FUTURE VARIABLES

The CASE evolution will lead to significant advances in technologies and applications. It will also greatly influence the way insurers add value to customers and society. CASE concepts will eventually come to fruition, whether it is autonomous driving, flying taxis, or car sharing as the primary mode of car usage. However, the timelines for CASE milestones will be unique across geographies, and there are differing views about these milestones within each market. Since success in new market opportunities requires a shift in strategy and investment, both insurers and OEMs will need to consider several scenarios to determine strategic options (see Figure 5).

Conclusion

MAXIMIZING THE INSURER-OEM PARTNERSHIP

The CASE evolution will widen our definition of mobility. In many cases, resulting technologies and data will reduce market inefficiencies. Both insurers and OEMs will come across opportunities that can be maximized by collaboration and efforts to overcome each other’s shortcomings. What first appears as intensified competition resulting from the changing mobility environment can become an opportunity for partnership, eventually benefiting customers in the form of lower insurance costs, adequate coverage, and greater convenience. Insurers and OEMs should:

-

Understand each party’s core strengths in relation to changing competitive advantages and identify opportunities to complement each other’s strengths and shortcomings (e.g., OEMs can leverage their “always-on” customer access through vehicles while insurers can offer balance sheet strength to diversify risks).

-

Build an incentive system that rewards both parties for collaborating on a common goal (e.g., setting up a joint venture between an insurer and OEM to underwrite OEM customers’ risks and comanage loss).

-

Leverage each other’s proprietary data to identify opportunities to reduce risks and minimize claim cost (e.g., identifying high-risk driving behavior to prevent loss, incorporating accident data into vehicle-safety design, and sharing accident data to identify further salvage opportunities).