Accelerating the financing of sustainable transport fuels

How to achieve lift-off

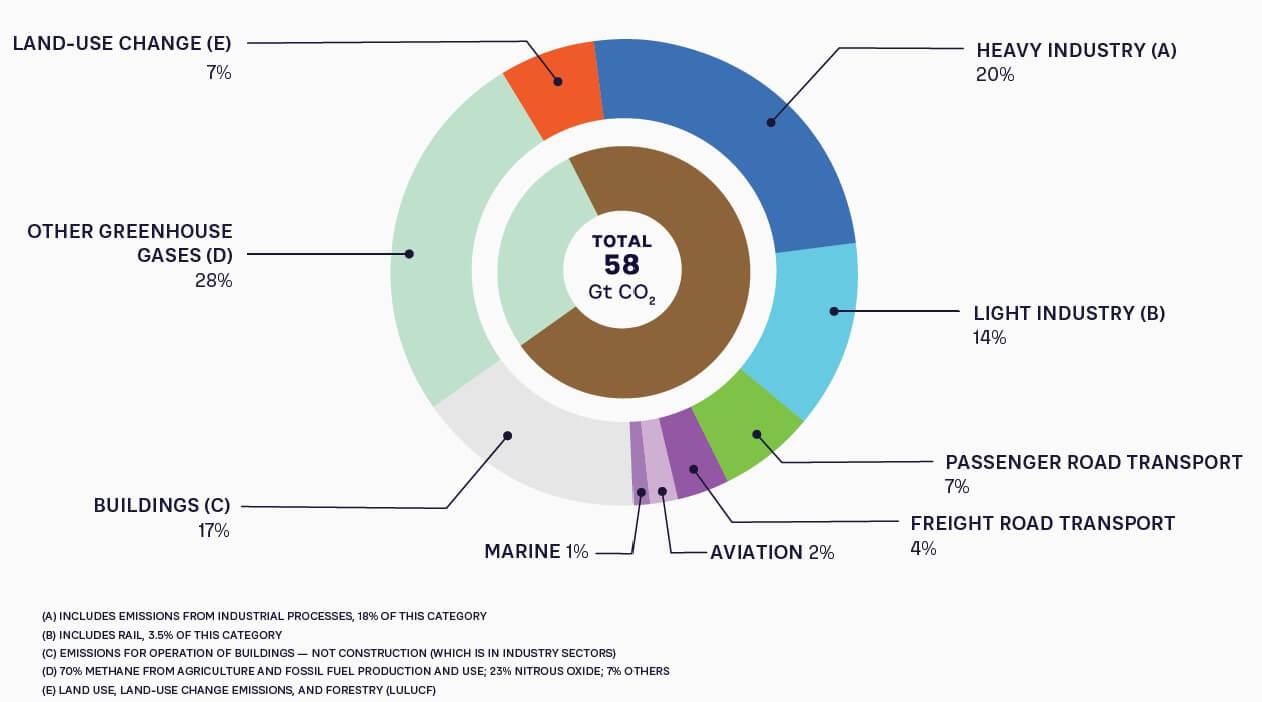

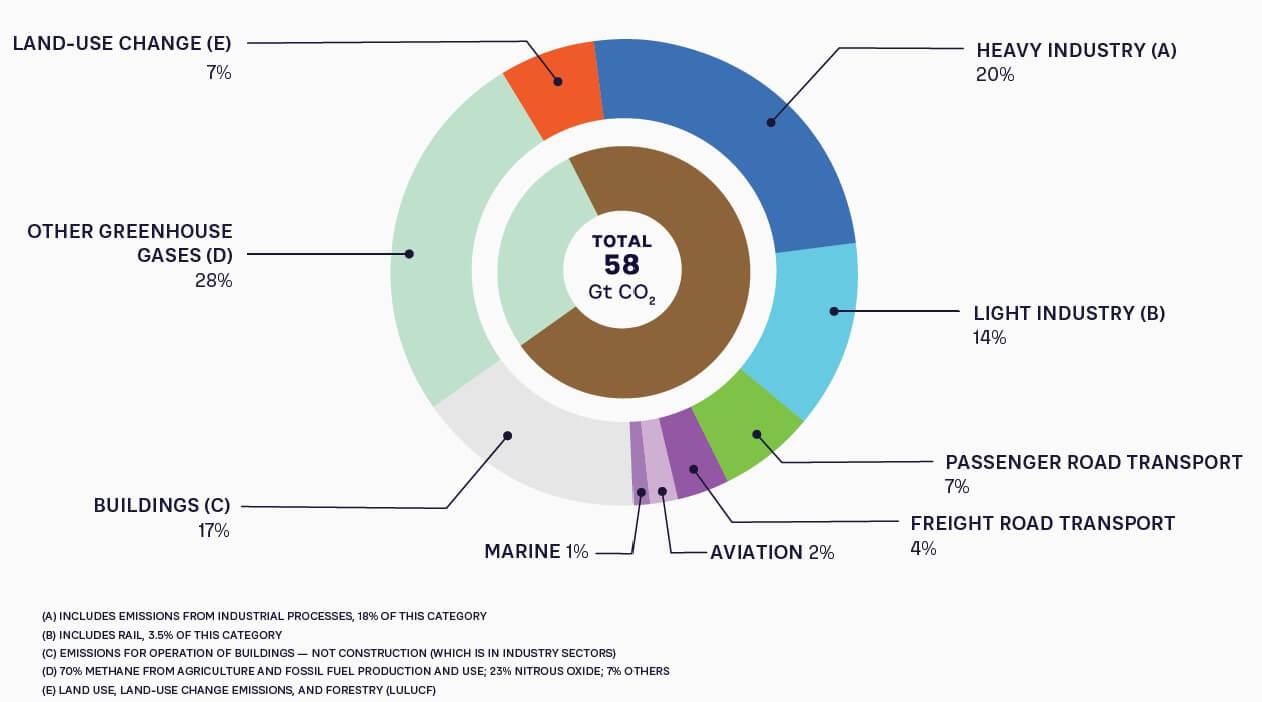

Transport was responsible for 14% of global greenhouse gas (GHG) emissions in 2023. While electrification is the most efficient way to decarbonize road transport, inland/nearshore shipping, and even short-haul flights, it does not cover every use case. That means different approaches will be needed for areas such as long-haul flights (2% of GHG emissions) and shipping (1% of GHG emissions).

Sustainable, low-carbon fuels are the only way to fully decarbonize long-haul flights and shipping. The potential within each market is enormous. For aviation alone, rising numbers of flights mean a cumulative 11,600 million tons of fossil jet kerosene will have to be decarbonized, and 9,500 million tons of fossil fuel will have to be replaced for maritime, both by 2050. These sectors are growing and face regulatory imperatives to shift away from fossil fuels.

This should mean sustainable fuels present a great investment opportunity for private capital. Institutional and infrastructure investors have abundant capital available, the latter of which can deploy approximately $50 billion of fresh investment every year.

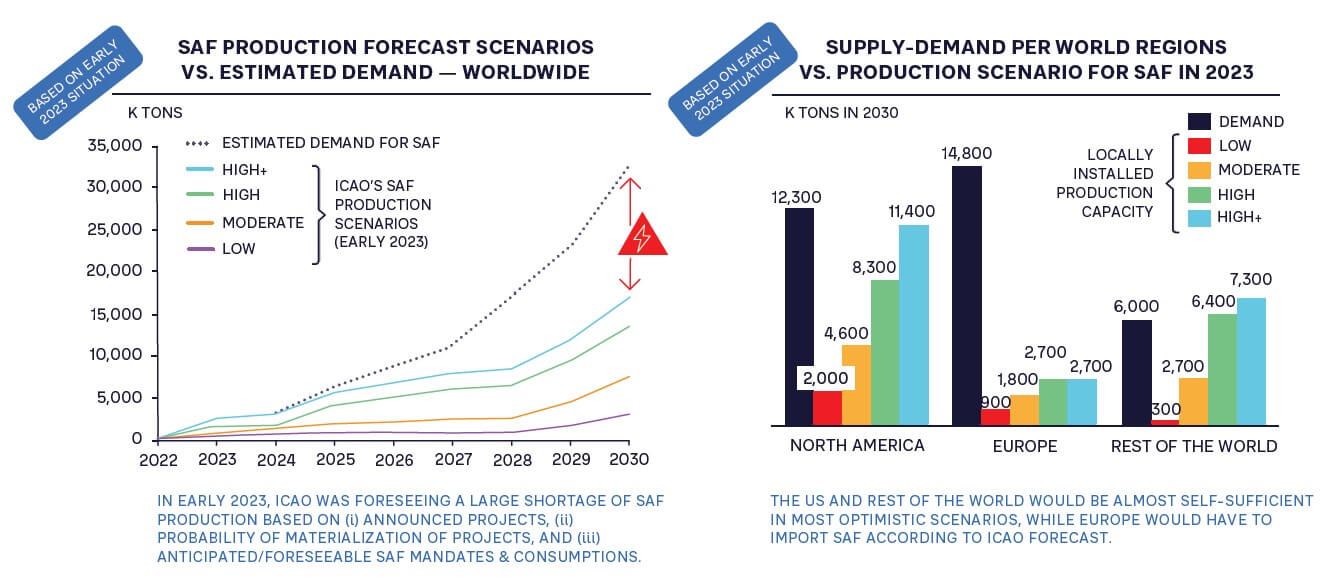

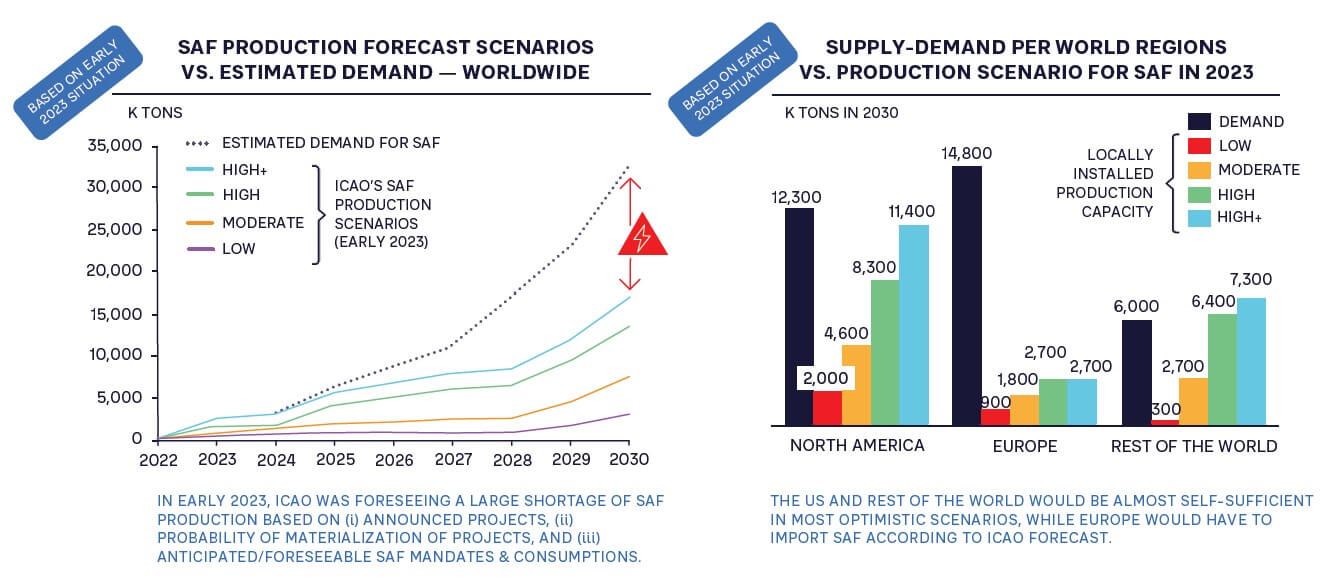

Despite this, demand-supply scenarios for sustainable fuel by 2030 show an enormous, worrying imbalance. For example, the International Civil Aviation Organization (ICAO) predicts a gap of over 15,000 kilotons between available supply and demand by 2030, based on projects announced before the end of 2023. A large-scale shortage of sustainable fuels will hamper efforts to decarbonize, even though the aviation and maritime industries are keen to invest in moving to net zero. The problem is critical and likely to worsen — demand for sustainable fuels will rise even faster post-2035, driven by 2050 CO2 net zero ambitions, as opposed to the seven years required to get a new production facility up and running.

To address this mismatch between supply and demand, this article looks at how the growth of the sustainable fuels market can be accelerated to drive decarbonization and reduce emissions.

THE NEED FOR SUSTAINABLE FUELS

Meeting pressures to decarbonize transport

As a major GHG emitter, the transport sector is under regulatory, financial, and consumer pressure to decarbonize. Passenger and freight road transport account for the lion’s share of current emissions (see Figure 1). However, electrification of road transport via battery-electric vehicles is progressing.

By contrast, electrification is not a viable option for the maritime and air transport sectors because of journey distance and weight constraints. Both of these hard-to-decarbonize sectors are seeing significant growth, meaning emissions will only rise further if left unchecked. Together, they are expected to hit annual emissions of approximately 1.8 billion metric tons of CO2 equivalent by 2030.

Given the size of the issue, regulators, customers, and maritime/air transport companies themselves are looking to take action.

- An increasing number of governments and regulatory bodies have set deadlines for decarbonization. For example, the International Maritime Organization (IMO) has set targets for the maritime industry to decrease its GHG emissions by at least 50% before 2050 and lower the carbon intensity of operations by 40% by 2030 and a further 70% by 2050. The EU has set out mandated targets for using sustainable fuels in aviation through the Refuel EU regulation.

- Customers are demanding decarbonization, particularly in the maritime sector. The coZEV initiative, which includes major shipping users such as Target, Philips, Amazon, and Electrolux, has set a target of 2040 for its freight to be carried by vessels powered by zero-carbon fuels.

- Shipping and aviation companies have committed to reaching net zero. For example, Maersk aims to do so by 2040.

This need can only be met through sustainable fuels. These are drop-in replacements for existing fossil fuels, with oil and gas replaced as feedstock by available biological substitutes (such as biomass or alcohol) or hydrogen/carbon dioxide (so-called e-fuels).

THE CHALLENGES TO FUNDING THE CHANGE

A clear market need for sustainable fuels has emerged, which requires production to scale up. Therefore, project-finance investments from banks and infrastructure funds, among others, will be crucial.

However, despite the fact that many clean fuel production technology pathways, particularly around sustainable aviation fuel (SAF), are mature and technically ready for large-scale production, a number of risks currently hamper clean fuel growth, making some off-takers (customers) reluctant to sign up to binding long-term agreements. This is a vicious circle, with investors unwilling to commit to funding new facilities without customer contracts in place to demonstrate demand and future revenues.

On top of this, inflationary pressures and high interest rates make investment in high-CAPEX projects, such as SAF, particularly challenging, as it will take time for such projects to earn revenues and start to repay funding costs. The challenges to unlocking funding fall into four key areas:

1. TECHNOLOGY READINESS

Multiple maturing technology pathways lead to the production of clean fuels, with around 20 currently being pursued. Regarding SAF, oil-to-jet fuel conversion (HEFA) is technically ready for commercialization, with a technology-readiness level (TRL) of 9. Demonstrating this, US producer World Energy and others, such as TotalEnergies, already produce SAF by converting used cooking oil and waste animal fat into a fully usable aviation fuel. Among other flights powered by SAF, a Virgin Atlantic Boeing 787 has successfully flown from London to New York on 100% SAF.

Many technology pathways will have TRLs of over 7–8 by 2030, among which are alcohol-to-jet, power-to-liquid (e-SAF), and methanol-to-jet. Lanza Jet, one of the market leaders, recently commissioned the first large-scale pilot plant in Georgia, US, to explore alcohol-to-jet. e-SAF, although not yet proven on a pilot scale, is being actively developed and will be crucial to full decarbonization of the aviation sector. Consequently, investors should understand that technology immaturity risks are reducing year-on-year.

2. ECONOMIC RISKS — HIGH UNCERTAINTY AROUND PRODUCTION COSTS

Many green technologies are still immature — or require large-scale change from customers to incorporate them into their operations. This is less of an issue with many of the technology pathways to produce clean fuels, which have already reached high maturity levels.

While technology pathways are generally proven, concerns remain around the availability of sufficient feedstock. For example, SAF is created from used cooking oil and animal fats, and collecting significant volumes can be expensive for producers. At the same time, bio-based feedstock faces challenges in three main areas:

- “Fuel versus food”: Worries that prime agricultural land is being used to produce feedstock for clean fuels at the expense of feeding local people have led many governments to regulate in this area, such as banning the use of crops for feedstock and reducing supply.

- Adverse environmental effects: Booming demand for biofuel feedstock (such as palm oil) has created concerns around deforestation and consequent environmental (and reputational) damage, hence the need to regulate and foster “Gen 2” biofuel feedstock.

- Bio-based sustainable fuel plants: These require large volumes of feedstock, but to be economically viable, this has to come from a relatively small collection area, typically within a radius of 150–300 km. It increases the bargaining power of feedstock producers, pushing up prices.

Considering the high (and rising) demand for bio-based feedstock, suppliers are not ready to commit to long-term contracts, which leads to price volatility. The market is not yet sufficiently developed to have any transparent price mechanisms in place.

E-sustainable fuels/e-biofuels rely on green hydrogen, which makes up 70% of the fuel’s total production costs. In turn, this hydrogen requires green electricity for electrolysis, which makes up around 70% of green hydrogen production costs. Added together, this means green electricity is around 50% of the total production cost for e-fuels. Given current demands on renewable energy sources and their inherent intermittent nature, green electricity prices are extremely volatile, making securing sufficient supplies at reasonable, known prices difficult. This creates uncertainty around sustainable fuel investment cases.

3. EXECUTION RISK: THE NEED TO SHORTEN DEPLOYMENT TIMES

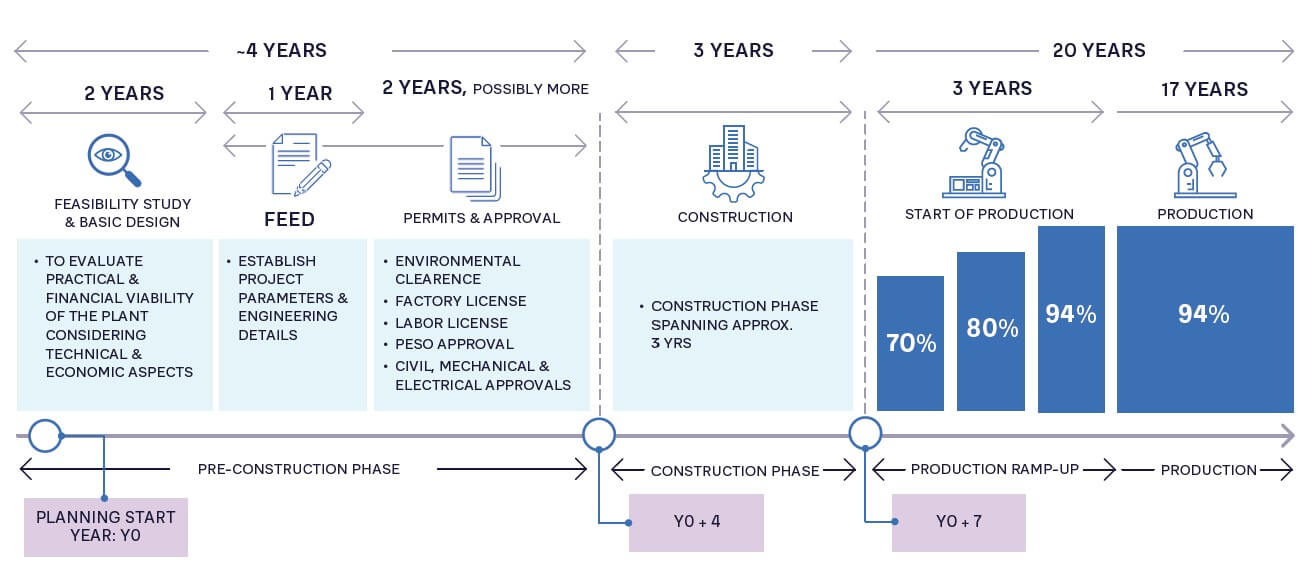

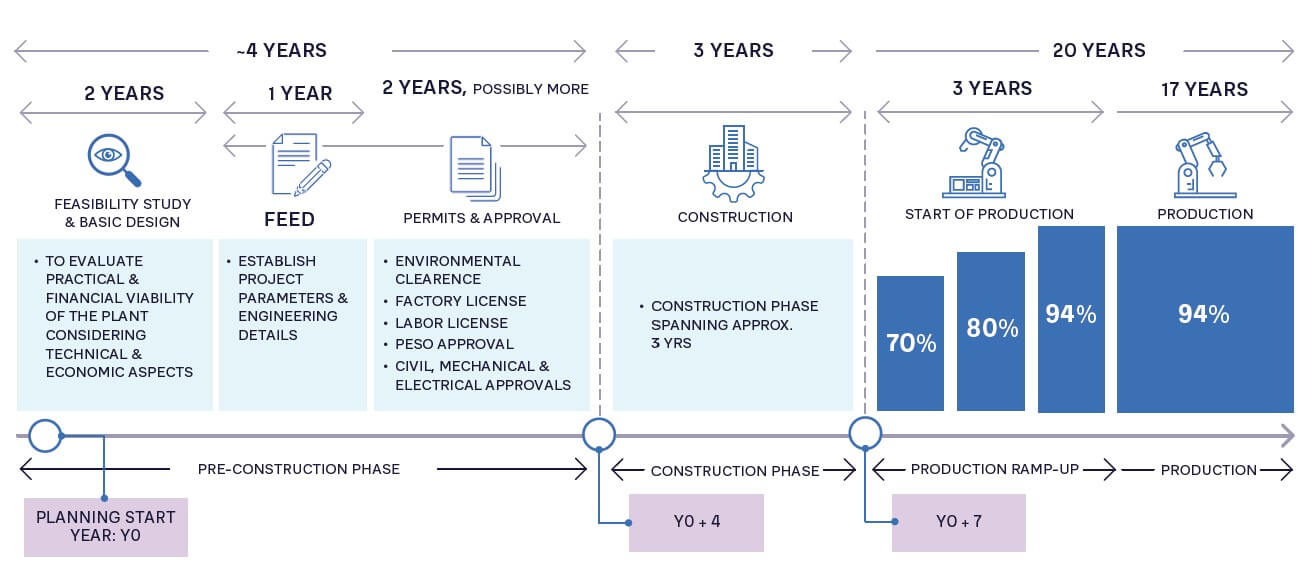

In many countries, from Europe to India, it takes up to seven years from the inception of a sustainable fuel production facility to the first drop. This covers feasibility studies, front-end engineering design (FEED), and permitting (four years total), as well as construction itself (a further three years). This elongated time frame means execution risks are large, while CAPEX costs can also increase considerably because of external economic factors over this period (see Figure 2).

Alongside planning and constructing production facilities, producers need to create supply chains to guarantee feedstock availability. Production/collection ecosystems must be built from scratch, with producers competing with other users who may offer higher prices if the feedstock has other, more lucrative uses.

4. CLIENTS ARE WILLING TO BUY BUT REGULATION IS UNCERTAIN

Policies and regulations to support the adoption of sustainable fuels are growing around the world, lowering investment risks every day. For example:

- The EU and the UK have introduced fuel-blending mandates with sub-mandates for bioSAF and e-SAF.

- Japan has mandated that fuels used on international flights to and from the country contain 10% SAF by 2030, while Singapore aims for 5% by the same date.

- The US and Qatar have not yet introduced any blending mandates but have stated ambitions to reach 10% adaptation by 2030 via voluntary blending of SAF, while aiming for full carbon neutrality by 2050.

However, policies and supporting incentives are not set in stone, leading to uncertainty, particularly if governments change. For example, in the United States, SAF blending was supposed to be supported by federal and state-level incentives, which would have significantly reduced the SAF premium over the price of conventional jet fuels, making it attractive for off-takers. Uncertainty about the duration of federal tax credits (part of the Inflation Reduction Act) and volatility of federal and state certificates (such as RIN prices and the California Low Carbon Fuel system) make it difficult to incorporate this revenue into bankable business cases with 100% certainty.

Despite this regulatory uncertainty, investors understand that end-client off-takers (airlines and maritime shipping lines) are committed to decarbonizing their operations, under pressure from both public opinion and their B2C and B2B clients, creating large-scale pull demand, as shown in Figure 3.

5. THE NEED TO EDUCATE AND LOWER THE COST OF CAPITAL

Based on market conversations, the largest investors do not seem fully familiar with the risk/reward profile of investing in sustainable fuels. The market is still educating itself and just starting to assess this investment opportunity.

Consequently, the cost of equity to fund sustainable fuels remains in the high teens, meaning only transformation or impact funds are set to invest in what are seen as riskier projects. Given the market demand and technology maturity, sustainable fuel projects have a much lower risk profile and should instead be compared to other infrastructure-like investments (such as battery storage or solar farms) when making investment decisions. Sustainable fuels should then benefit from a lower-teen/high-single-digit cost of equity and also higher debt leverage.

Additionally, a persistent belief holds that SAF costs will come down massively in the next decade. This leads to reluctance from off-takers and investors to step in now and make the necessary long-term commitments, as they feel waiting will deliver a better deal. While analysis shows that this belief is incorrect, it still impacts market sentiment and decision-making, deterring first movers from scaling projects significantly.

BREAKING THE VICIOUS CIRCLE AND MAKING SUSTAINABLE FUEL PRODUCTION A CLEAR INVESTMENT OPPORTUNITY

Looking at the challenges above, action clearly needs to be taken now to prevent avoidable shortages of sustainable fuels in the near future, with the negative impacts on decarbonization that such supply chain issues would bring. Breaking this vicious circle requires action from both governments and the private sector.

The need for government support

Governments hold many of the necessary keys to unlock market growth — and often, these keys are not about subsidies or financial support, although the latter will be crucial. At a country and regional level, governments should look to:

- Introduce clear blending mandates, with set timelines for the percentage of sustainable fuels to be included within existing fossil fuels, increasing this over time. This powerful solution provides visibility to all stakeholders around the market direction and delivers security around future demand.

- Overcome uncertain economics for sustainable fuel production by:

- Implementing harsher CO2 taxes that would reduce the price gap in favor of sustainable fuels. For instance, in aviation, the EU’s ETS CO2 system will likely reduce the price gap between SAF and existing fossil-based fuels by 20%. This would also bring in additional tax revenues that can potentially be reinvested in other sustainability initiatives.

- Capping or at least regulating the price for bio-feedstock, particularly agricultural and forestry residues used for bioSAF. This reduces the challenge of local monopoly providers charging extortionate prices.

- Mitigate execution risks by simplifying and shortening the permitting phase for sustainable production projects.

- Provide government financing to lower the cost of capital or at least encourage the creation of large venture capital funds via incentives or lowering some regulatory risk management constraints for investors. This is a powerful lever to boost the IRR of sustainable fuel production projects and lower the final price for clean fuels, thus accelerating their adoption.

The need for private sector action

Producers, investors, and customers should also change their investment strategies around sustainable fuel production to drive market growth and secure first-mover opportunities:

Producers:

- Mitigate risk and balance portfolios by exploring and investing in different technology pathways, such as by looking beyond SAF-HEFA in aviation. They should invest in multiple projects across various regions and technology pathways. This maximizes the chances of success and limits the risk of failure.

- Consider vertical upstream integration into the sustainable fuel production value chain, or at least secure consistent OPEX via long-term power purchase agreements. Controlling the sources of production inputs (bio-based feedstock, green hydrogen, renewable power, and CO2) is a powerful lever to secure their availability and fix costs reasonably.

Investors:

- Educate themselves about the market opportunity, particularly around rising demand and the consequent lowering of risk around investments.

- Follow a balanced approach to investing, looking at a range of technologies, projects, and regions.

Customers (transport companies):

- Understand the market need and reputational benefits of switching to sustainable fuels early and sign contracts to guarantee sufficient supplies.

- Communicate plans to demonstrate commitment to sustainable fuel to end customers (passengers, users of shipping), regulators, and investors, helping drive the sector forward.

INSIGHTS FOR THE EXECUTIVE

Sustainable fuels represent a very attractive investment class: market and technology risk is decreasing every year, while economic returns are comparable to or higher than those of other infrastructure investments.

Sustainable fuels provide an opportunity for transport players to invest in the sector and diversify or re-insource some key operating costs.

Investors in sustainable fuels should ensure that they can secure sufficient volumes of feedstock and lower the cost of capital. They could potentially co-invest to reach the very high bar of required CAPEX while sharing risks.

Finally, all key private stakeholders within the sustainable fuel ecosystem (feedstock suppliers, producers, off-takers, and investors) should create a compelling “equity story” for governments, helping them design the right incentives and locate financing for the industry.

Coordinated efforts between agriculture, green electricity generators, H2- and CO2-producers, and transportation off-takers would demonstrate the market’s full potential and, therefore, unleash wider financing of sustainable fuel projects.

Accelerating the financing of sustainable transport fuels

How to achieve lift-off

DATE

Transport was responsible for 14% of global greenhouse gas (GHG) emissions in 2023. While electrification is the most efficient way to decarbonize road transport, inland/nearshore shipping, and even short-haul flights, it does not cover every use case. That means different approaches will be needed for areas such as long-haul flights (2% of GHG emissions) and shipping (1% of GHG emissions).

Sustainable, low-carbon fuels are the only way to fully decarbonize long-haul flights and shipping. The potential within each market is enormous. For aviation alone, rising numbers of flights mean a cumulative 11,600 million tons of fossil jet kerosene will have to be decarbonized, and 9,500 million tons of fossil fuel will have to be replaced for maritime, both by 2050. These sectors are growing and face regulatory imperatives to shift away from fossil fuels.

This should mean sustainable fuels present a great investment opportunity for private capital. Institutional and infrastructure investors have abundant capital available, the latter of which can deploy approximately $50 billion of fresh investment every year.

Despite this, demand-supply scenarios for sustainable fuel by 2030 show an enormous, worrying imbalance. For example, the International Civil Aviation Organization (ICAO) predicts a gap of over 15,000 kilotons between available supply and demand by 2030, based on projects announced before the end of 2023. A large-scale shortage of sustainable fuels will hamper efforts to decarbonize, even though the aviation and maritime industries are keen to invest in moving to net zero. The problem is critical and likely to worsen — demand for sustainable fuels will rise even faster post-2035, driven by 2050 CO2 net zero ambitions, as opposed to the seven years required to get a new production facility up and running.

To address this mismatch between supply and demand, this article looks at how the growth of the sustainable fuels market can be accelerated to drive decarbonization and reduce emissions.

THE NEED FOR SUSTAINABLE FUELS

Meeting pressures to decarbonize transport

As a major GHG emitter, the transport sector is under regulatory, financial, and consumer pressure to decarbonize. Passenger and freight road transport account for the lion’s share of current emissions (see Figure 1). However, electrification of road transport via battery-electric vehicles is progressing.

By contrast, electrification is not a viable option for the maritime and air transport sectors because of journey distance and weight constraints. Both of these hard-to-decarbonize sectors are seeing significant growth, meaning emissions will only rise further if left unchecked. Together, they are expected to hit annual emissions of approximately 1.8 billion metric tons of CO2 equivalent by 2030.

Given the size of the issue, regulators, customers, and maritime/air transport companies themselves are looking to take action.

- An increasing number of governments and regulatory bodies have set deadlines for decarbonization. For example, the International Maritime Organization (IMO) has set targets for the maritime industry to decrease its GHG emissions by at least 50% before 2050 and lower the carbon intensity of operations by 40% by 2030 and a further 70% by 2050. The EU has set out mandated targets for using sustainable fuels in aviation through the Refuel EU regulation.

- Customers are demanding decarbonization, particularly in the maritime sector. The coZEV initiative, which includes major shipping users such as Target, Philips, Amazon, and Electrolux, has set a target of 2040 for its freight to be carried by vessels powered by zero-carbon fuels.

- Shipping and aviation companies have committed to reaching net zero. For example, Maersk aims to do so by 2040.

This need can only be met through sustainable fuels. These are drop-in replacements for existing fossil fuels, with oil and gas replaced as feedstock by available biological substitutes (such as biomass or alcohol) or hydrogen/carbon dioxide (so-called e-fuels).

THE CHALLENGES TO FUNDING THE CHANGE

A clear market need for sustainable fuels has emerged, which requires production to scale up. Therefore, project-finance investments from banks and infrastructure funds, among others, will be crucial.

However, despite the fact that many clean fuel production technology pathways, particularly around sustainable aviation fuel (SAF), are mature and technically ready for large-scale production, a number of risks currently hamper clean fuel growth, making some off-takers (customers) reluctant to sign up to binding long-term agreements. This is a vicious circle, with investors unwilling to commit to funding new facilities without customer contracts in place to demonstrate demand and future revenues.

On top of this, inflationary pressures and high interest rates make investment in high-CAPEX projects, such as SAF, particularly challenging, as it will take time for such projects to earn revenues and start to repay funding costs. The challenges to unlocking funding fall into four key areas:

1. TECHNOLOGY READINESS

Multiple maturing technology pathways lead to the production of clean fuels, with around 20 currently being pursued. Regarding SAF, oil-to-jet fuel conversion (HEFA) is technically ready for commercialization, with a technology-readiness level (TRL) of 9. Demonstrating this, US producer World Energy and others, such as TotalEnergies, already produce SAF by converting used cooking oil and waste animal fat into a fully usable aviation fuel. Among other flights powered by SAF, a Virgin Atlantic Boeing 787 has successfully flown from London to New York on 100% SAF.

Many technology pathways will have TRLs of over 7–8 by 2030, among which are alcohol-to-jet, power-to-liquid (e-SAF), and methanol-to-jet. Lanza Jet, one of the market leaders, recently commissioned the first large-scale pilot plant in Georgia, US, to explore alcohol-to-jet. e-SAF, although not yet proven on a pilot scale, is being actively developed and will be crucial to full decarbonization of the aviation sector. Consequently, investors should understand that technology immaturity risks are reducing year-on-year.

2. ECONOMIC RISKS — HIGH UNCERTAINTY AROUND PRODUCTION COSTS

Many green technologies are still immature — or require large-scale change from customers to incorporate them into their operations. This is less of an issue with many of the technology pathways to produce clean fuels, which have already reached high maturity levels.

While technology pathways are generally proven, concerns remain around the availability of sufficient feedstock. For example, SAF is created from used cooking oil and animal fats, and collecting significant volumes can be expensive for producers. At the same time, bio-based feedstock faces challenges in three main areas:

- “Fuel versus food”: Worries that prime agricultural land is being used to produce feedstock for clean fuels at the expense of feeding local people have led many governments to regulate in this area, such as banning the use of crops for feedstock and reducing supply.

- Adverse environmental effects: Booming demand for biofuel feedstock (such as palm oil) has created concerns around deforestation and consequent environmental (and reputational) damage, hence the need to regulate and foster “Gen 2” biofuel feedstock.

- Bio-based sustainable fuel plants: These require large volumes of feedstock, but to be economically viable, this has to come from a relatively small collection area, typically within a radius of 150–300 km. It increases the bargaining power of feedstock producers, pushing up prices.

Considering the high (and rising) demand for bio-based feedstock, suppliers are not ready to commit to long-term contracts, which leads to price volatility. The market is not yet sufficiently developed to have any transparent price mechanisms in place.

E-sustainable fuels/e-biofuels rely on green hydrogen, which makes up 70% of the fuel’s total production costs. In turn, this hydrogen requires green electricity for electrolysis, which makes up around 70% of green hydrogen production costs. Added together, this means green electricity is around 50% of the total production cost for e-fuels. Given current demands on renewable energy sources and their inherent intermittent nature, green electricity prices are extremely volatile, making securing sufficient supplies at reasonable, known prices difficult. This creates uncertainty around sustainable fuel investment cases.

3. EXECUTION RISK: THE NEED TO SHORTEN DEPLOYMENT TIMES

In many countries, from Europe to India, it takes up to seven years from the inception of a sustainable fuel production facility to the first drop. This covers feasibility studies, front-end engineering design (FEED), and permitting (four years total), as well as construction itself (a further three years). This elongated time frame means execution risks are large, while CAPEX costs can also increase considerably because of external economic factors over this period (see Figure 2).

Alongside planning and constructing production facilities, producers need to create supply chains to guarantee feedstock availability. Production/collection ecosystems must be built from scratch, with producers competing with other users who may offer higher prices if the feedstock has other, more lucrative uses.

4. CLIENTS ARE WILLING TO BUY BUT REGULATION IS UNCERTAIN

Policies and regulations to support the adoption of sustainable fuels are growing around the world, lowering investment risks every day. For example:

- The EU and the UK have introduced fuel-blending mandates with sub-mandates for bioSAF and e-SAF.

- Japan has mandated that fuels used on international flights to and from the country contain 10% SAF by 2030, while Singapore aims for 5% by the same date.

- The US and Qatar have not yet introduced any blending mandates but have stated ambitions to reach 10% adaptation by 2030 via voluntary blending of SAF, while aiming for full carbon neutrality by 2050.

However, policies and supporting incentives are not set in stone, leading to uncertainty, particularly if governments change. For example, in the United States, SAF blending was supposed to be supported by federal and state-level incentives, which would have significantly reduced the SAF premium over the price of conventional jet fuels, making it attractive for off-takers. Uncertainty about the duration of federal tax credits (part of the Inflation Reduction Act) and volatility of federal and state certificates (such as RIN prices and the California Low Carbon Fuel system) make it difficult to incorporate this revenue into bankable business cases with 100% certainty.

Despite this regulatory uncertainty, investors understand that end-client off-takers (airlines and maritime shipping lines) are committed to decarbonizing their operations, under pressure from both public opinion and their B2C and B2B clients, creating large-scale pull demand, as shown in Figure 3.

5. THE NEED TO EDUCATE AND LOWER THE COST OF CAPITAL

Based on market conversations, the largest investors do not seem fully familiar with the risk/reward profile of investing in sustainable fuels. The market is still educating itself and just starting to assess this investment opportunity.

Consequently, the cost of equity to fund sustainable fuels remains in the high teens, meaning only transformation or impact funds are set to invest in what are seen as riskier projects. Given the market demand and technology maturity, sustainable fuel projects have a much lower risk profile and should instead be compared to other infrastructure-like investments (such as battery storage or solar farms) when making investment decisions. Sustainable fuels should then benefit from a lower-teen/high-single-digit cost of equity and also higher debt leverage.

Additionally, a persistent belief holds that SAF costs will come down massively in the next decade. This leads to reluctance from off-takers and investors to step in now and make the necessary long-term commitments, as they feel waiting will deliver a better deal. While analysis shows that this belief is incorrect, it still impacts market sentiment and decision-making, deterring first movers from scaling projects significantly.

BREAKING THE VICIOUS CIRCLE AND MAKING SUSTAINABLE FUEL PRODUCTION A CLEAR INVESTMENT OPPORTUNITY

Looking at the challenges above, action clearly needs to be taken now to prevent avoidable shortages of sustainable fuels in the near future, with the negative impacts on decarbonization that such supply chain issues would bring. Breaking this vicious circle requires action from both governments and the private sector.

The need for government support

Governments hold many of the necessary keys to unlock market growth — and often, these keys are not about subsidies or financial support, although the latter will be crucial. At a country and regional level, governments should look to:

- Introduce clear blending mandates, with set timelines for the percentage of sustainable fuels to be included within existing fossil fuels, increasing this over time. This powerful solution provides visibility to all stakeholders around the market direction and delivers security around future demand.

- Overcome uncertain economics for sustainable fuel production by:

- Implementing harsher CO2 taxes that would reduce the price gap in favor of sustainable fuels. For instance, in aviation, the EU’s ETS CO2 system will likely reduce the price gap between SAF and existing fossil-based fuels by 20%. This would also bring in additional tax revenues that can potentially be reinvested in other sustainability initiatives.

- Capping or at least regulating the price for bio-feedstock, particularly agricultural and forestry residues used for bioSAF. This reduces the challenge of local monopoly providers charging extortionate prices.

- Mitigate execution risks by simplifying and shortening the permitting phase for sustainable production projects.

- Provide government financing to lower the cost of capital or at least encourage the creation of large venture capital funds via incentives or lowering some regulatory risk management constraints for investors. This is a powerful lever to boost the IRR of sustainable fuel production projects and lower the final price for clean fuels, thus accelerating their adoption.

The need for private sector action

Producers, investors, and customers should also change their investment strategies around sustainable fuel production to drive market growth and secure first-mover opportunities:

Producers:

- Mitigate risk and balance portfolios by exploring and investing in different technology pathways, such as by looking beyond SAF-HEFA in aviation. They should invest in multiple projects across various regions and technology pathways. This maximizes the chances of success and limits the risk of failure.

- Consider vertical upstream integration into the sustainable fuel production value chain, or at least secure consistent OPEX via long-term power purchase agreements. Controlling the sources of production inputs (bio-based feedstock, green hydrogen, renewable power, and CO2) is a powerful lever to secure their availability and fix costs reasonably.

Investors:

- Educate themselves about the market opportunity, particularly around rising demand and the consequent lowering of risk around investments.

- Follow a balanced approach to investing, looking at a range of technologies, projects, and regions.

Customers (transport companies):

- Understand the market need and reputational benefits of switching to sustainable fuels early and sign contracts to guarantee sufficient supplies.

- Communicate plans to demonstrate commitment to sustainable fuel to end customers (passengers, users of shipping), regulators, and investors, helping drive the sector forward.

INSIGHTS FOR THE EXECUTIVE

Sustainable fuels represent a very attractive investment class: market and technology risk is decreasing every year, while economic returns are comparable to or higher than those of other infrastructure investments.

Sustainable fuels provide an opportunity for transport players to invest in the sector and diversify or re-insource some key operating costs.

Investors in sustainable fuels should ensure that they can secure sufficient volumes of feedstock and lower the cost of capital. They could potentially co-invest to reach the very high bar of required CAPEX while sharing risks.

Finally, all key private stakeholders within the sustainable fuel ecosystem (feedstock suppliers, producers, off-takers, and investors) should create a compelling “equity story” for governments, helping them design the right incentives and locate financing for the industry.

Coordinated efforts between agriculture, green electricity generators, H2- and CO2-producers, and transportation off-takers would demonstrate the market’s full potential and, therefore, unleash wider financing of sustainable fuel projects.