11 min read • Energy, Utilities & Resources, Electric Power & Energy Grids

Small modular reactors

The missing piece in the energy transition puzzle?

Small modular reactor (SMR) technology has been attractive on paper, but difficult to realize in practice. Despite high investments into SMR development, no SMRs are yet in commercial operation. However, as the world struggles with the immense challenges of transitioning away from fossil fuels, a resurgence of interest has appeared across the globe.

Are SMRs finally reaching the stage at which they could become a key part of the energy solution? In this article we look at the background of SMRs, their benefits and challenges, and why now could be the right time to build an effective ecosystem to help move them from paper to reality.

DEAD IN THE WATER?

Originally, nuclear energy was seen as cheap, “clean,” and stable. However, disasters such as Three-Mile Island, Chernobyl, and Fukushima understandably led governments and the public to reconsider. The serious consequences of these accidents led to rapid decisions to decommission nuclear programs before their expected lifespan. Anti-nuclear sentiment led to a decline in nuclear’s share of global energy production, from 17 percent in the mid-1990s to approximately 10 percent today.

In addition to this, the tale of nuclear energy in recent years has been messy and troublesome, with difficult issues regarding waste disposal, security threats arising from nuclear energy as a potential target for terrorist attacks, and, most visibly, huge cost overruns and significant delays. For example, the construction of two large modern reactors (EPR-1600s) at Hinkley Point C in the UK was originally estimated to cost GBP16bn and commence commercial operations by 2025.

In February 2023, EDF announced that its cost was likely to increase to GBP32.7bn and completion would be delayed to September 2028 at the earliest – an astonishing approximate 100 percent cost overrun and a three-year delay. Some observers have concluded that the safety and economic risks of large-scale nuclear power generation are simply too great to take on.

THE ATTRACTIONS OF SMRS

Small reactors date back to the early years of the nuclear power industry. Built in the USSR, the US, and European countries during the 1950s to 1970s, these early small reactors were originally used for military purposes in submarines and aircraft carriers. Small reactors generally suffer from poor economies of scale versus large nuclear power plants (LNPPs), which are generally at least 700MW – enough to power a city the size of Madrid. However, SMRs can circumvent the economic disadvantages by utilizing modularity to reduce capital investment. Furthermore, streamlined production and certification in factory environments can significantly reduce construction and deployment timelines.

SMR deployment is significantly more flexible than that of legacy reactors. LNPPs in the US have an 800 km2 emergency planning zone (approximately the size of San Diego), and SMR developers argue that their safety zones will be equal to that of the site boundaries. Additionally, the small capacity of SMRs facilitates off-grid deployments, which unlocks new use cases, such as on-site power generation for industry.

From an investor perspective, SMRs have substantially lower upfront investment requirements, which opens a new proposition for nuclear energy for smaller investors. This increases the total capital pool for nuclear, putting less strain on local governments and municipalities, and increasing adoption further. Additionally, lower project complexity and shorter deployment timelines can alleviate cost and schedule risks of nuclear new-build projects.

While for some, the perceived safety, security, and environmental risks of nuclear fission power of any sort remain unacceptable, for many others, including many governments around the world, SMRs appear to offer an effective way to help meet the needs of baseload power generation without the downsides of constructing and operating LNPPs.

WHY AREN’T SMRS ALREADY DEVELOPED?

Given the appeal and long history of small reactors, questioning why no SMRs are in operation is reasonable. In fact, SMRs are not expected to begin commercial operation until the end of this decade, with currently only a few technologies nearing commercialization. Most SMRs are still in the conceptual stage, making it difficult to assess their commercial viability without further development, testing, and deployment. As Admiral Hyman Rickover, a pioneer of the US nuclear industry, told the members of Congress in 1957: “Any plant you haven’t built yet is always more efficient than the one you have built. This is obvious. They are all efficient when you haven’t done anything on them, in the talking stage. Then they are all efficient, they are all cheap. They are all easy to build, and none have any problems.”

The slow development of SMRs can be attributed to several challenges faced by the nuclear energy industry. Over the years, the operating costs of LNPPs have increased, while new projects have encountered delays and cost overruns. The costly process of uranium mining and lack of a viable nuclear waste storage solution have added complexity. A dwindling workforce due to long gaps between reactor builds, as well as rising interest rates impacting financing, have also led to under-prioritization and undermined development efforts in nuclear energy.

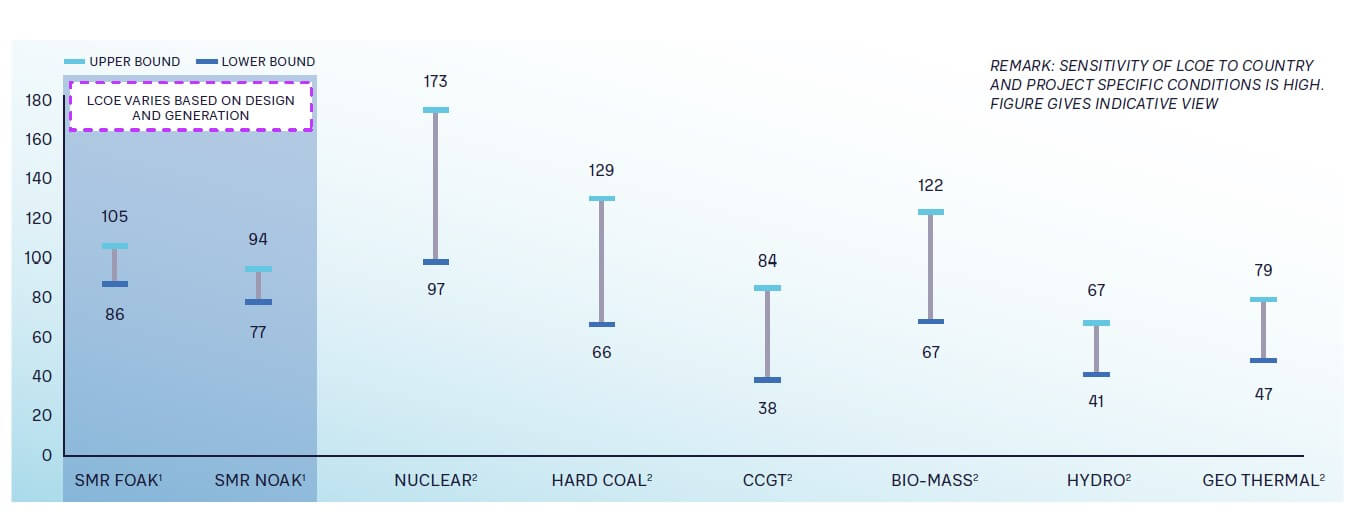

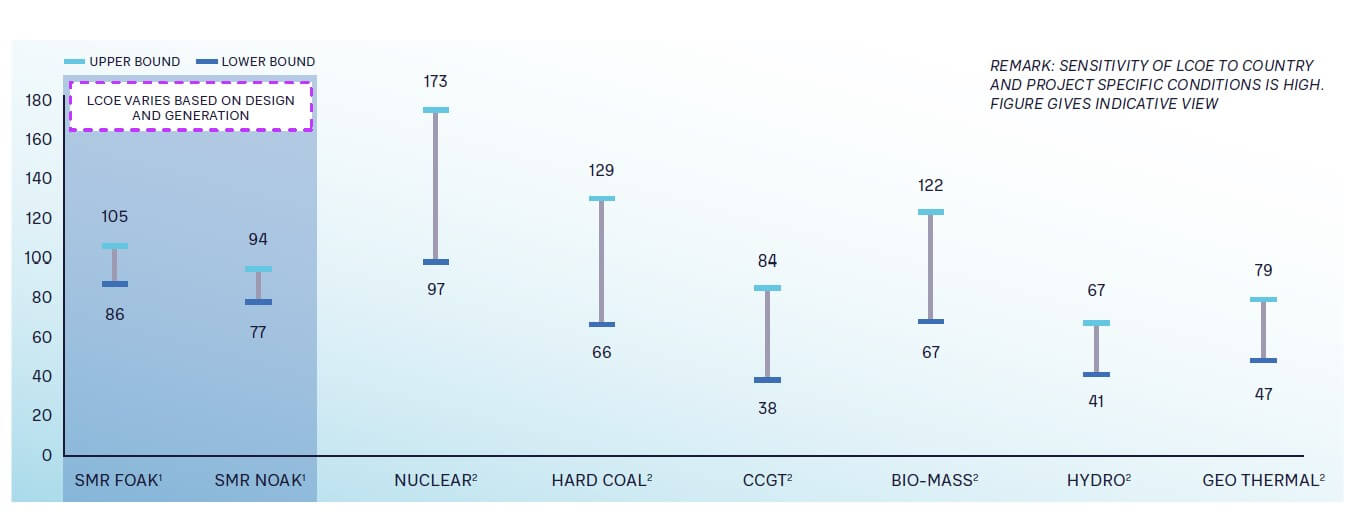

Additionally, the sheer complexity of SMR technology development has been a hurdle for developers and vendors alike. To make an SMR cost-effective requires breakthrough innovation in reducing capex and opex to obtain a reasonable levelized cost of electricity (LCOE). In their current state of development, SMRs do not yet represent a commercially competitive energy source. However, when we look at the power generation technologies that offer similar reliability to that of SMRs, the competitiveness becomes more apparent (Figure 1).[1, 2]

WHY SMRS ARE A HOT TOPIC NOW

Today’s global energy markets are facing a disruption of Schumpeterian proportions as the gale of decarbonization upends the status quo of fossil fuel power generation. Dismissing nuclear was easier in the post-Fukushima years, when many attractive alternatives were available. Renewables were growing fast and becoming more affordable, while natural gas was clean enough and readily available. However, increasing prices in recent years, combined with a strong emphasis on security of supply and stable electricity provision, have transformed the outlook. Moreover, the intermittent nature of energy being generated through renewable sources, combined with issues such as land use efficiency, network costs, and grid efficiency, means other energy sources are also needed to accelerate the green shift further. Nuclear remains one of the few options available for stable baseload power.

The Russian invasion of Ukraine and consequent massive supply-side disturbance have underlined the message for world leaders that energy security is of ever-increasing importance in a volatile geo-political environment. Traditional, non-renewable energy sources such as coal, oil, and gas still account for the majority of the world’s energy consumption. For non-producing countries, this entails heavy reliance on imports, as stockpiling these types of fuels for more than a few months of consumption far exceeds total storage capacity.

Stable and well-functioning supply chains are thus paramount to ensure dependable energy access, and the shortcomings of excessive reliance on imports have become apparent with recent developments. As nations around the world are realizing the need for reduced dependency on energy imports in order to hedge against sudden supply shocks, nuclear energy is starting to become more attractive as a potential alternative. The energy density of nuclear fuel is far superior to that of other sources, with one uranium fuel pellet (the size of a fingertip) containing as much energy as 1 ton of coal, 3.5 barrels of oil, or 4,800 cubic meters of natural gas.[3] For a 1,000MWe nuclear power plant, daily consumption of fuel is just over 3 kgs. In comparison, a coal-fired power plant with similar capacity burns around 10,000 tons per day.

As nuclear becomes somewhat more palatable for a public faced with increasing energy prices and governments looking to secure energy autonomy, SMRs are increasingly being considered as an attractive alternative over traditional nuclear, either in themselves or as a bridge towards the next generation of nuclear reactors.

WHO IS LEADING THE WAY

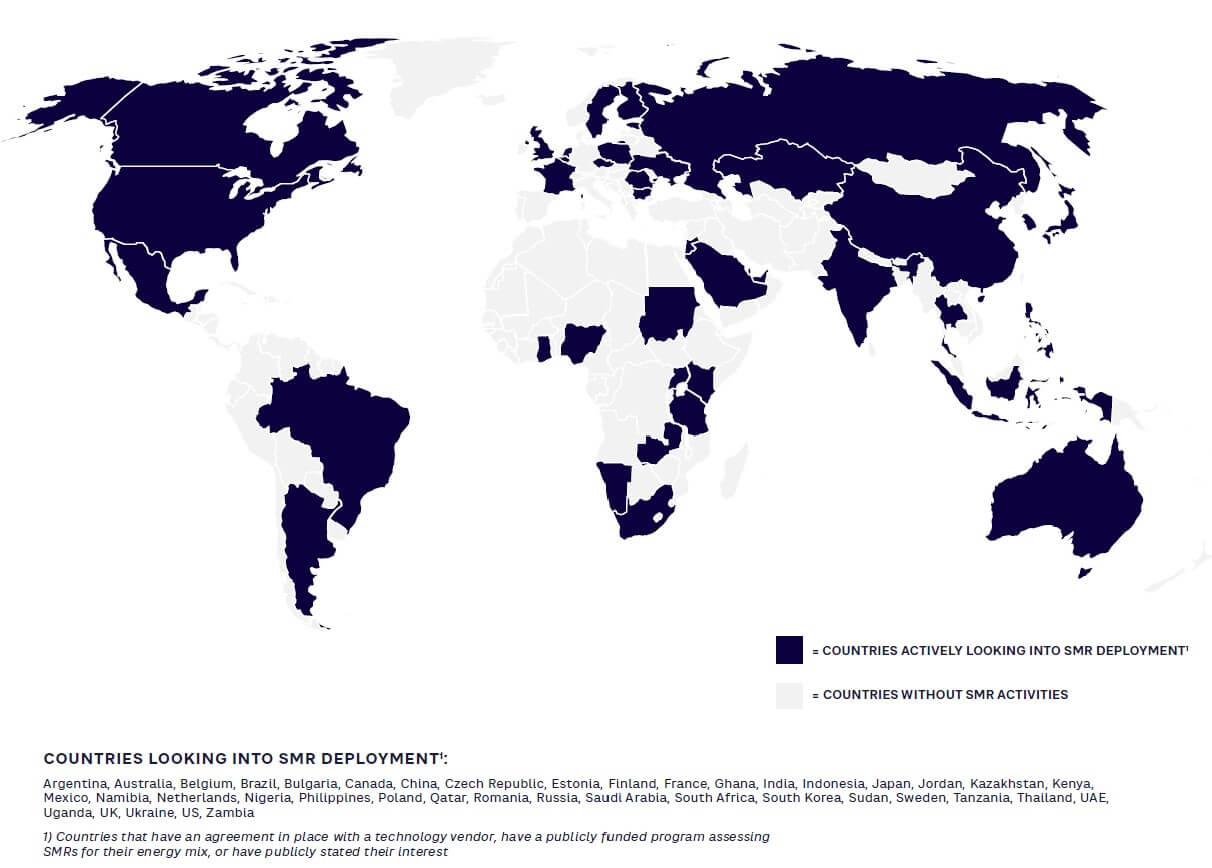

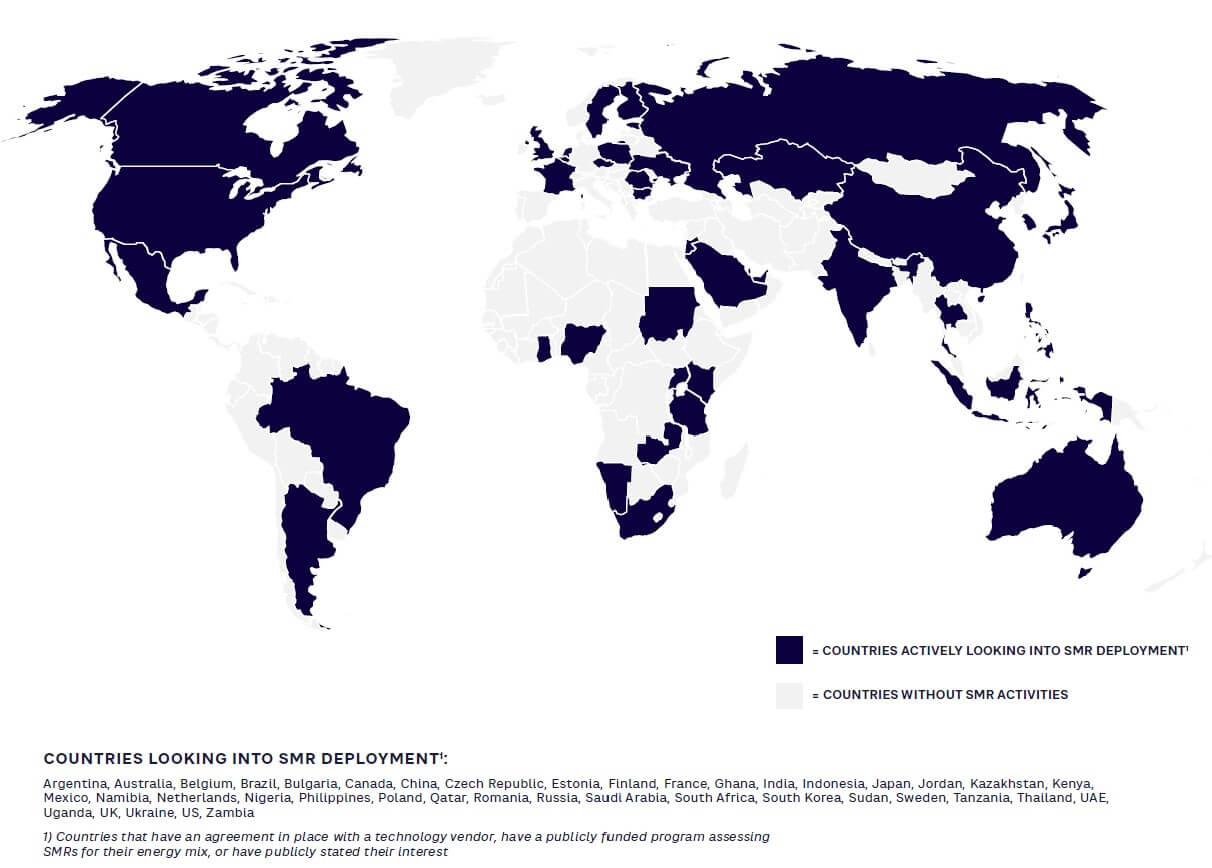

The number of countries publicly expressing their intent to deploy SMRs in the near- to mid-term has been increasing steadily. Currently, more than 30 countries have a vested interest in SMRs, either through development or potential deployment of the technology. Unsurprisingly, countries with the most nuclear experience are leading the way in SMR deployment. However, even countries that have no nuclear experience are turning their attention to SMRs, such as Poland, Saudi Arabia, and Estonia.

The SMR space is crowded with more than 80 different technologies under development, each with its own unique features. As the industry evolves, a large number of these technologies will fail, and a few leaders will prevail. Some common characteristics are associated with success:

-

Governmental support: Financial support from governmental institutions is a key success factor for a technology vendor, as the R&D phase of an SMR design is cash intensive. Vendors in countries with predictable and experienced policy makers, such as the NRC in the US, the CNSC in Canada, and the ONR in the UK, will also have an advantage.

-

First-mover advantages: First-of-a-kind (FOAK) reactors are often considered to be riskier and more troublesome than Nth-of-a-kind reactors (NOAK). Hence, vendors that have successfully deployed their technologies are likely to receive more business than those that come later to the market.

-

Traditional versus experimental technologies: The market consensus is that customers, especially utilities, prefer traditional and tested technologies (light-water reactors) over experimental technologies that require policy changes.

-

Vendor robustness: The perceived robustness of the vendor will be an important factor. Companies with established nuclear and engineering backgrounds are likely to have a natural advantage (such as GE Hitachi, Holtec International, and others).

-

Supply chain robustness: Having an established supply chain with strong nuclear manufacturing experience will be important to build customer confidence, given the previous history of cost overruns and delays.

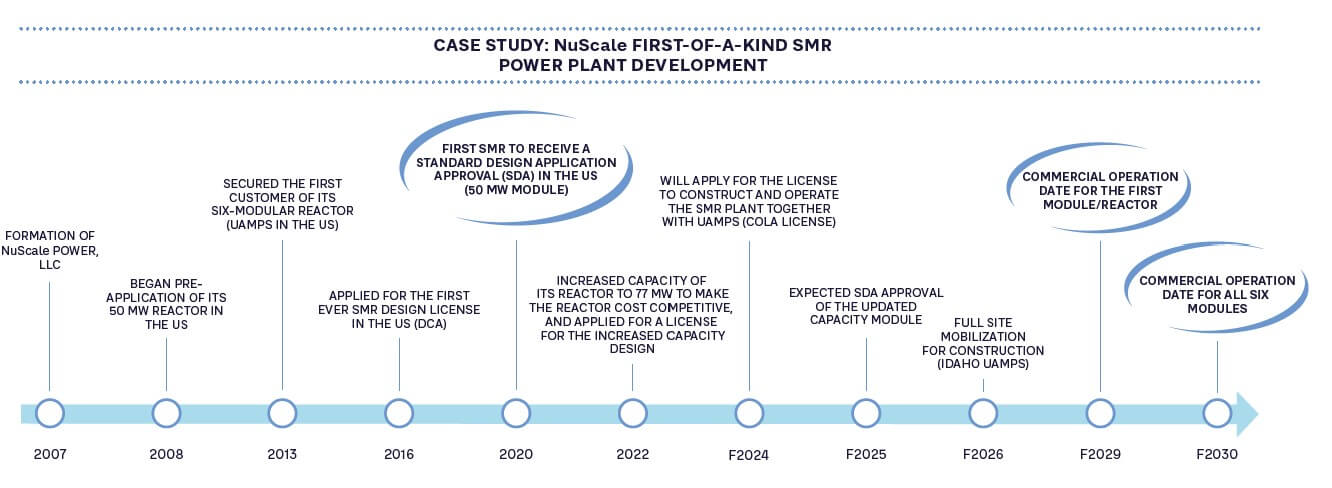

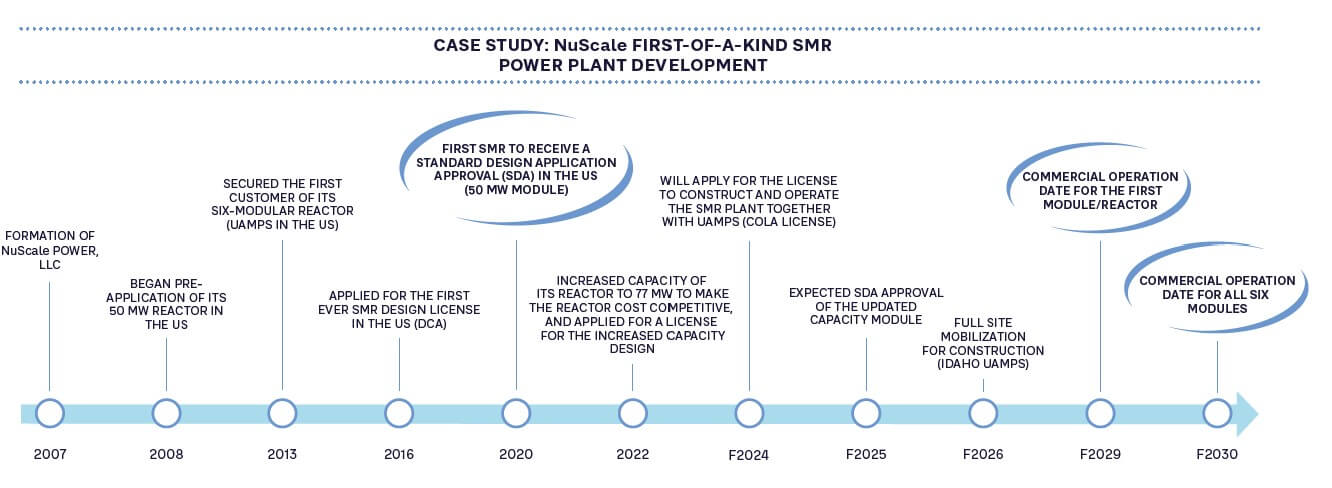

One of the possible contenders for first SMR to market is, however, NuScale, originally established in 2007 in Oregon, which is predicting its first commercial operation in 2029 (Figure 3).

THE IMPORTANCE OF BUILDING THE ECOSYSTEM

To enable SMRs to overcome development challenges and fulfill their potential in the energy transition, creating the right environment is crucial. In the 20th century, the nuclear industry thrived on standardization and regulation. However, today’s workforce lacks the necessary experience, and existing regulations focus on large-scale plants.

To ensure a safe and publicly acceptable SMR-based nuclear energy solution, a new ecosystem with a supply chain, developers, operators, and maintenance providers has to be created, alongside a regulatory environment that is fit for purpose.

Firstly, the industry and regulators must collaborate to establish standards and enable technology benefits. Modularity and factory fabrication simplify the supply chain and construction, requiring new regulatory rules that support them. A new regulatory paradigm is necessary to streamline certification and design modifications. Harmonized licensing frameworks can enhance nuclear power’s appeal and ensure consistent risk management across borders, positively impacting policy makers and the public.

Secondly, the critical parts of the supply chain need to be identified and addressed. This may include assessing the technical risks in the supply chain, as well as availability. One key area that needs urgent solutions is the development of a skilled workforce. While it is relatively straightforward to put up factories, these need to be filled and operated with nuclear, mechanical, electrical, and civil engineers. Personnel with experience in nuclear power are currently lacking, and need to be established over time.

Finally, if large numbers of SMRs are to be built and operated in the coming decades, it requires state-of-the art O&M concepts, including Industry 4.0 solutions such as digital twins and predictive maintenance, assisted by AI and machine learning.

INSIGHTS FOR THE EXECUTIVE

SMRs are likely to be increasingly important as a key part of the future energy mix. Executives would do well to include SMRs in their considerations about future energy supplies.

-

Keep track of nuclear developments: Businesses need to stay up-to-date on developments in the nuclear industry and emerging technologies. This includes keeping track of regulatory changes, industry trends, and new innovations, as well as how this may affect their operations.

-

Reconsider nuclear as a part of the energy mix: Companies should consider how the emergence of SMRs may involve new potential benefits from nuclear power in their energy strategies, including its low carbon footprint, reliability, scalability, and new use cases.

-

Build partnerships with nuclear industry leaders: Businesses can benefit from building partnerships with nuclear industry leaders, which can provide access to knowledge, expertise, and technology. These partnerships can also help to build credibility and trust with stakeholders, including customers and investors.

-

Assess nuclear risks and opportunities: Businesses should assess the potential risks involved with nuclear energy as a whole (e.g., regulatory, public approval, safety, and waste disposal) and the associated costs, as well as SMR-specific considerations such as not reaching full potential or immaturity of the technology itself. Conversely, executives should have a full overview of the opportunities presented by new nuclear technologies and the potential for cost savings.

-

Invest in nuclear education and workforce development: Utilities and industry can play a critical role in promoting the development of the nuclear workforce. This includes supporting education and training programs for workers, as well as investing in research and development to advance the field. This can help to ensure a skilled workforce for the future and build a strong foundation for the nuclear industry.

Notes

[1] Arthur D. Little analysis (bottom-up)

[2] Lazard (2021), Arthur D. Little analysis (bottom-up); FOAK: first-of-a-kind; NOAK: Nth-of-a-kind; CCGT: combined cycle gas turbine; average exchange rate USD–EUR for 2021 applied to LCOE data from Lazard study

[3] According to the Nuclear Energy Institute

11 min read • Energy, Utilities & Resources, Electric Power & Energy Grids

Small modular reactors

The missing piece in the energy transition puzzle?

DATE

Small modular reactor (SMR) technology has been attractive on paper, but difficult to realize in practice. Despite high investments into SMR development, no SMRs are yet in commercial operation. However, as the world struggles with the immense challenges of transitioning away from fossil fuels, a resurgence of interest has appeared across the globe.

Are SMRs finally reaching the stage at which they could become a key part of the energy solution? In this article we look at the background of SMRs, their benefits and challenges, and why now could be the right time to build an effective ecosystem to help move them from paper to reality.

DEAD IN THE WATER?

Originally, nuclear energy was seen as cheap, “clean,” and stable. However, disasters such as Three-Mile Island, Chernobyl, and Fukushima understandably led governments and the public to reconsider. The serious consequences of these accidents led to rapid decisions to decommission nuclear programs before their expected lifespan. Anti-nuclear sentiment led to a decline in nuclear’s share of global energy production, from 17 percent in the mid-1990s to approximately 10 percent today.

In addition to this, the tale of nuclear energy in recent years has been messy and troublesome, with difficult issues regarding waste disposal, security threats arising from nuclear energy as a potential target for terrorist attacks, and, most visibly, huge cost overruns and significant delays. For example, the construction of two large modern reactors (EPR-1600s) at Hinkley Point C in the UK was originally estimated to cost GBP16bn and commence commercial operations by 2025.

In February 2023, EDF announced that its cost was likely to increase to GBP32.7bn and completion would be delayed to September 2028 at the earliest – an astonishing approximate 100 percent cost overrun and a three-year delay. Some observers have concluded that the safety and economic risks of large-scale nuclear power generation are simply too great to take on.

THE ATTRACTIONS OF SMRS

Small reactors date back to the early years of the nuclear power industry. Built in the USSR, the US, and European countries during the 1950s to 1970s, these early small reactors were originally used for military purposes in submarines and aircraft carriers. Small reactors generally suffer from poor economies of scale versus large nuclear power plants (LNPPs), which are generally at least 700MW – enough to power a city the size of Madrid. However, SMRs can circumvent the economic disadvantages by utilizing modularity to reduce capital investment. Furthermore, streamlined production and certification in factory environments can significantly reduce construction and deployment timelines.

SMR deployment is significantly more flexible than that of legacy reactors. LNPPs in the US have an 800 km2 emergency planning zone (approximately the size of San Diego), and SMR developers argue that their safety zones will be equal to that of the site boundaries. Additionally, the small capacity of SMRs facilitates off-grid deployments, which unlocks new use cases, such as on-site power generation for industry.

From an investor perspective, SMRs have substantially lower upfront investment requirements, which opens a new proposition for nuclear energy for smaller investors. This increases the total capital pool for nuclear, putting less strain on local governments and municipalities, and increasing adoption further. Additionally, lower project complexity and shorter deployment timelines can alleviate cost and schedule risks of nuclear new-build projects.

While for some, the perceived safety, security, and environmental risks of nuclear fission power of any sort remain unacceptable, for many others, including many governments around the world, SMRs appear to offer an effective way to help meet the needs of baseload power generation without the downsides of constructing and operating LNPPs.

WHY AREN’T SMRS ALREADY DEVELOPED?

Given the appeal and long history of small reactors, questioning why no SMRs are in operation is reasonable. In fact, SMRs are not expected to begin commercial operation until the end of this decade, with currently only a few technologies nearing commercialization. Most SMRs are still in the conceptual stage, making it difficult to assess their commercial viability without further development, testing, and deployment. As Admiral Hyman Rickover, a pioneer of the US nuclear industry, told the members of Congress in 1957: “Any plant you haven’t built yet is always more efficient than the one you have built. This is obvious. They are all efficient when you haven’t done anything on them, in the talking stage. Then they are all efficient, they are all cheap. They are all easy to build, and none have any problems.”

The slow development of SMRs can be attributed to several challenges faced by the nuclear energy industry. Over the years, the operating costs of LNPPs have increased, while new projects have encountered delays and cost overruns. The costly process of uranium mining and lack of a viable nuclear waste storage solution have added complexity. A dwindling workforce due to long gaps between reactor builds, as well as rising interest rates impacting financing, have also led to under-prioritization and undermined development efforts in nuclear energy.

Additionally, the sheer complexity of SMR technology development has been a hurdle for developers and vendors alike. To make an SMR cost-effective requires breakthrough innovation in reducing capex and opex to obtain a reasonable levelized cost of electricity (LCOE). In their current state of development, SMRs do not yet represent a commercially competitive energy source. However, when we look at the power generation technologies that offer similar reliability to that of SMRs, the competitiveness becomes more apparent (Figure 1).[1, 2]

WHY SMRS ARE A HOT TOPIC NOW

Today’s global energy markets are facing a disruption of Schumpeterian proportions as the gale of decarbonization upends the status quo of fossil fuel power generation. Dismissing nuclear was easier in the post-Fukushima years, when many attractive alternatives were available. Renewables were growing fast and becoming more affordable, while natural gas was clean enough and readily available. However, increasing prices in recent years, combined with a strong emphasis on security of supply and stable electricity provision, have transformed the outlook. Moreover, the intermittent nature of energy being generated through renewable sources, combined with issues such as land use efficiency, network costs, and grid efficiency, means other energy sources are also needed to accelerate the green shift further. Nuclear remains one of the few options available for stable baseload power.

The Russian invasion of Ukraine and consequent massive supply-side disturbance have underlined the message for world leaders that energy security is of ever-increasing importance in a volatile geo-political environment. Traditional, non-renewable energy sources such as coal, oil, and gas still account for the majority of the world’s energy consumption. For non-producing countries, this entails heavy reliance on imports, as stockpiling these types of fuels for more than a few months of consumption far exceeds total storage capacity.

Stable and well-functioning supply chains are thus paramount to ensure dependable energy access, and the shortcomings of excessive reliance on imports have become apparent with recent developments. As nations around the world are realizing the need for reduced dependency on energy imports in order to hedge against sudden supply shocks, nuclear energy is starting to become more attractive as a potential alternative. The energy density of nuclear fuel is far superior to that of other sources, with one uranium fuel pellet (the size of a fingertip) containing as much energy as 1 ton of coal, 3.5 barrels of oil, or 4,800 cubic meters of natural gas.[3] For a 1,000MWe nuclear power plant, daily consumption of fuel is just over 3 kgs. In comparison, a coal-fired power plant with similar capacity burns around 10,000 tons per day.

As nuclear becomes somewhat more palatable for a public faced with increasing energy prices and governments looking to secure energy autonomy, SMRs are increasingly being considered as an attractive alternative over traditional nuclear, either in themselves or as a bridge towards the next generation of nuclear reactors.

WHO IS LEADING THE WAY

The number of countries publicly expressing their intent to deploy SMRs in the near- to mid-term has been increasing steadily. Currently, more than 30 countries have a vested interest in SMRs, either through development or potential deployment of the technology. Unsurprisingly, countries with the most nuclear experience are leading the way in SMR deployment. However, even countries that have no nuclear experience are turning their attention to SMRs, such as Poland, Saudi Arabia, and Estonia.

The SMR space is crowded with more than 80 different technologies under development, each with its own unique features. As the industry evolves, a large number of these technologies will fail, and a few leaders will prevail. Some common characteristics are associated with success:

-

Governmental support: Financial support from governmental institutions is a key success factor for a technology vendor, as the R&D phase of an SMR design is cash intensive. Vendors in countries with predictable and experienced policy makers, such as the NRC in the US, the CNSC in Canada, and the ONR in the UK, will also have an advantage.

-

First-mover advantages: First-of-a-kind (FOAK) reactors are often considered to be riskier and more troublesome than Nth-of-a-kind reactors (NOAK). Hence, vendors that have successfully deployed their technologies are likely to receive more business than those that come later to the market.

-

Traditional versus experimental technologies: The market consensus is that customers, especially utilities, prefer traditional and tested technologies (light-water reactors) over experimental technologies that require policy changes.

-

Vendor robustness: The perceived robustness of the vendor will be an important factor. Companies with established nuclear and engineering backgrounds are likely to have a natural advantage (such as GE Hitachi, Holtec International, and others).

-

Supply chain robustness: Having an established supply chain with strong nuclear manufacturing experience will be important to build customer confidence, given the previous history of cost overruns and delays.

One of the possible contenders for first SMR to market is, however, NuScale, originally established in 2007 in Oregon, which is predicting its first commercial operation in 2029 (Figure 3).

THE IMPORTANCE OF BUILDING THE ECOSYSTEM

To enable SMRs to overcome development challenges and fulfill their potential in the energy transition, creating the right environment is crucial. In the 20th century, the nuclear industry thrived on standardization and regulation. However, today’s workforce lacks the necessary experience, and existing regulations focus on large-scale plants.

To ensure a safe and publicly acceptable SMR-based nuclear energy solution, a new ecosystem with a supply chain, developers, operators, and maintenance providers has to be created, alongside a regulatory environment that is fit for purpose.

Firstly, the industry and regulators must collaborate to establish standards and enable technology benefits. Modularity and factory fabrication simplify the supply chain and construction, requiring new regulatory rules that support them. A new regulatory paradigm is necessary to streamline certification and design modifications. Harmonized licensing frameworks can enhance nuclear power’s appeal and ensure consistent risk management across borders, positively impacting policy makers and the public.

Secondly, the critical parts of the supply chain need to be identified and addressed. This may include assessing the technical risks in the supply chain, as well as availability. One key area that needs urgent solutions is the development of a skilled workforce. While it is relatively straightforward to put up factories, these need to be filled and operated with nuclear, mechanical, electrical, and civil engineers. Personnel with experience in nuclear power are currently lacking, and need to be established over time.

Finally, if large numbers of SMRs are to be built and operated in the coming decades, it requires state-of-the art O&M concepts, including Industry 4.0 solutions such as digital twins and predictive maintenance, assisted by AI and machine learning.

INSIGHTS FOR THE EXECUTIVE

SMRs are likely to be increasingly important as a key part of the future energy mix. Executives would do well to include SMRs in their considerations about future energy supplies.

-

Keep track of nuclear developments: Businesses need to stay up-to-date on developments in the nuclear industry and emerging technologies. This includes keeping track of regulatory changes, industry trends, and new innovations, as well as how this may affect their operations.

-

Reconsider nuclear as a part of the energy mix: Companies should consider how the emergence of SMRs may involve new potential benefits from nuclear power in their energy strategies, including its low carbon footprint, reliability, scalability, and new use cases.

-

Build partnerships with nuclear industry leaders: Businesses can benefit from building partnerships with nuclear industry leaders, which can provide access to knowledge, expertise, and technology. These partnerships can also help to build credibility and trust with stakeholders, including customers and investors.

-

Assess nuclear risks and opportunities: Businesses should assess the potential risks involved with nuclear energy as a whole (e.g., regulatory, public approval, safety, and waste disposal) and the associated costs, as well as SMR-specific considerations such as not reaching full potential or immaturity of the technology itself. Conversely, executives should have a full overview of the opportunities presented by new nuclear technologies and the potential for cost savings.

-

Invest in nuclear education and workforce development: Utilities and industry can play a critical role in promoting the development of the nuclear workforce. This includes supporting education and training programs for workers, as well as investing in research and development to advance the field. This can help to ensure a skilled workforce for the future and build a strong foundation for the nuclear industry.

Notes

[1] Arthur D. Little analysis (bottom-up)

[2] Lazard (2021), Arthur D. Little analysis (bottom-up); FOAK: first-of-a-kind; NOAK: Nth-of-a-kind; CCGT: combined cycle gas turbine; average exchange rate USD–EUR for 2021 applied to LCOE data from Lazard study

[3] According to the Nuclear Energy Institute