18 min read • Energy, Utilities & Resources, Strategy

Energy retailers: Facing the toughest transition in the energy sector

Energy retailers in Europe need to leverage an increasingly open energy ecosystem to differentiate and stay competitive

Executive Summary

Power and gas selling is commoditizing at lightning speed in an open market in which competition is hyper-agile and creative with retail add-on services. As a result, increasing customer switching rates and thinner margins directly impact traditional incumbent retailers. A key question is if and how these companies can shift their business models to break free from traditional positions to capitalize on the opportunities created by an ever-growing energy ecosystem.

In this paper, we offer a view of the challenges energy retailers face, and which strategic moves they need to consider to reinvent themselves and stay relevant in the future. Guided by their sense of purpose, retailers need to consider where in the ecosystem they want to focus and with which partners, as well as how to transform their organizations to anticipate innovation and create services that adapt to changing consumer behaviors.

1

Challenges faced by energy retailers in Europe

Energy retail profitability is at its lowest in years, while customer-churn levels and new-entrant numbers are at their highest

Almost two decades after the liberalization of energy markets in the developed world, the cards have been thoroughly reshuffled, with many new cards added and nearly all rules redefined. Traditional utilities have seen the entry of new players across the energy value chain. Further fueled by the megatrends of decentralization, digitization and decarbonization, their businesses have been disrupted significantly, which has resulted in many challenges. In this section we outline the main challenges and underlying drivers. In the next section, we explore ways forward for a better future.

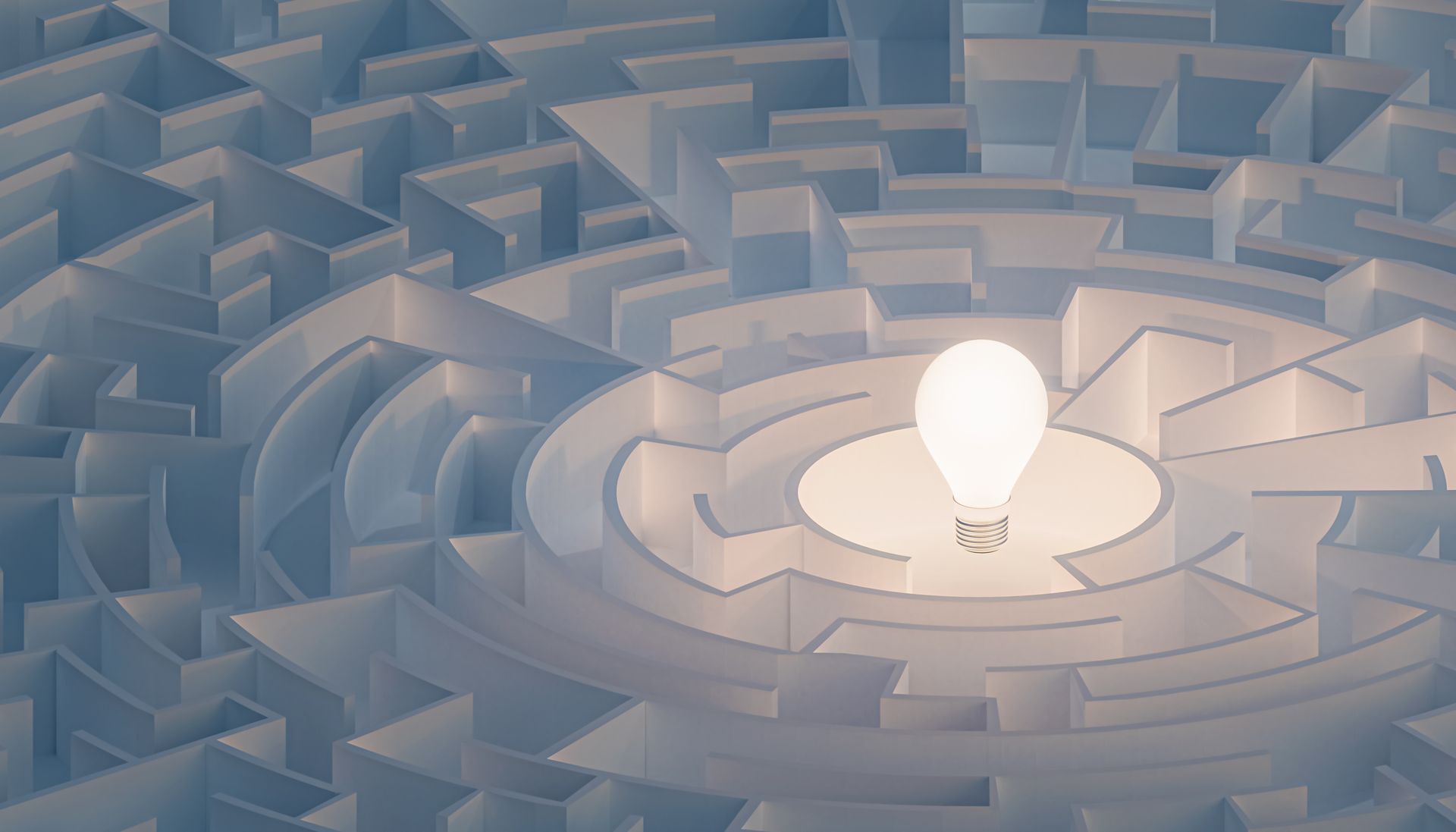

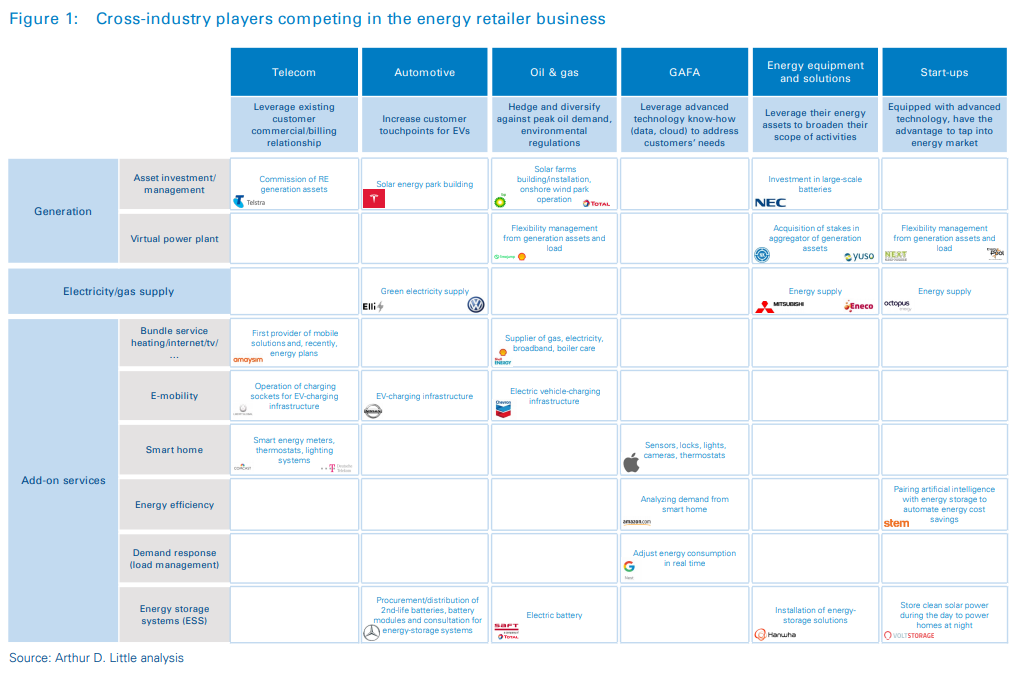

1. A whole lot of new competitors

Non-energy leaders throughout various industries have entered the power and gas sector, leveraging their existing capabilities, customer relationships and other value-chain positions (such as hardware and services) to enter energy retail. Among them, we find those that are new to the energy sector, such as car manufacturers, GAFA (“Google, Apple, Facebook, Amazon”) and telecom operators. In addition, others are broadening their scope of activities towards energy retail, building on positions in the extended energy value chain (such as equipment firms and service providers). Finally, a range of start-ups are also entering, some from the energy sector and others from outside (see Figure 1). Many see the energy sector as an opportunity to develop new revenue streams and expand the number of touchpoints with their existing customer bases.

As a consequence, we have assisted with a wave of consolidation among different types of players.

Many retailers have acquired aggregators: Centrica of REstore, Shell of Limejump, Engie of majority stakes in KiWi Power, Enel of EnerNOC, etc. This trend is also true for electric mobility charging-station providers: Engie acquired EV-Box, Shell bought NewMotion, and EDF group acquired Pivot Power.

In a very dominated market, incumbents typically are the ones acquiring the new players, as was the case in the Netherlands with the first wave of new entrants in 2004. Vattenfall bought Nuon in 2009 and Delta in 2019, and Eneco bought new entrant Oxxio in 2011. However, nowadays, we note a reverse trend. The perfect example is Ovo Energy, which was established in the UK in 2009. Ten years later it acquired SSE, one of the UK’s top six energy providers (known as the “Big Six”). Ovo Energy’s share of the electricity market increased from 0 percent in 2013 to 5 percent by the end of 2018, while the Big Six, in contrast, all lost market share (from 100 percent in 2010 to 73 percent in 2018). Other beneficiaries of this decreasing trend are Octopus Energy and Bulb, both of which entered the market in 2015.

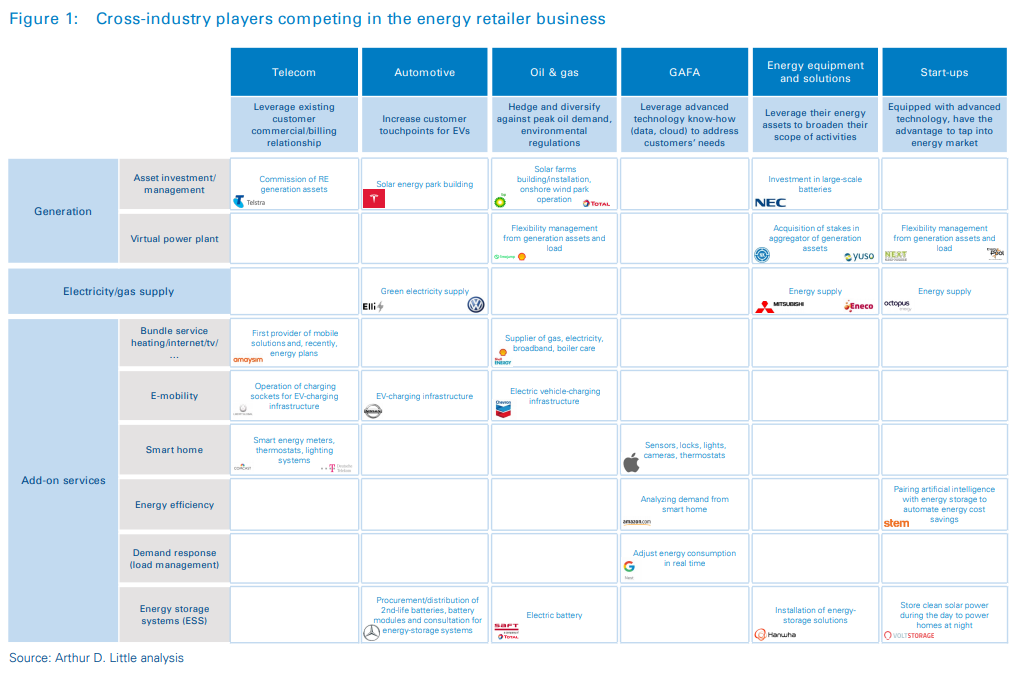

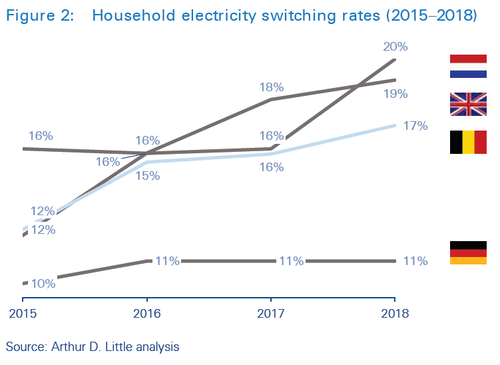

2. Sky-high switching rates

In some mature EU markets, external1 household switching rates for electricity reach 10–20 percent (see Figure 2) , although in some markets, such as Germany, switching rates remain stable. On the commercial and industrial (C&I) front, switching is intensifying as well. In Italy, for example, the switching rate for non-residential electricity customers increased from 12 to 17 percent between 2010 and 2018. In the UK, the number of renegotiated contracts increased over a three-year period (2015–2018), from 70 to 73 percent on the electricity side and 70 to 76 percent on the gas side. Not only are energy consumers becoming more active in terms of switching, but it is often the first step to becoming more active in managing their energy consumption and procurement. (For a more extensive overview of future energy consumers’ behavior, see “Getting ready for the energy consumer of the future” in ADL’s second Prism issue of 2019.)

3. Rigidity of the incumbent

Incumbent players are structurally less agile due to their heritage. They typically rely on older infrastructures and systems, and use more staff to run operations. In contrast, successful new entrants will benefit from the latest technologies in that they are more agile and rely on nimble, optimized back-end systems for client operations and energy procurement during their start-up phases. Once they climb the growth curve, a higher number of clients can be efficiently handled with less full-time equivalents (FTEs) than for traditional players. Not only does the effectiveness of operations impact their costs, but the lack of smooth client processes is a trigger for customers to churn, looking for better experiences.

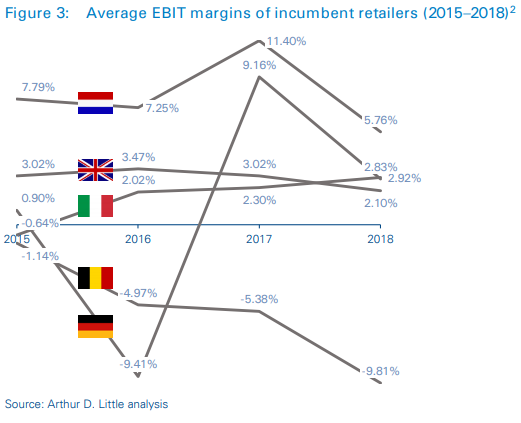

4. Low profitability

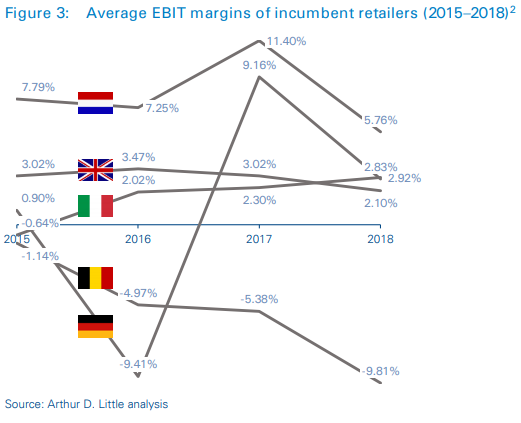

New competitors, higher switching rates and lack of internal agility result in low profitability for incumbent retailers. The lowest levels of EBIT margins recorded in years are shown in Figure 3. Retailers typically make money on loyal customers (referred to as “sleeper” contracts) once they have earned back the acquisition costs related to that customer, which often runs to €150+ (in the form of cash-backs, gifts, commissions, etc.). Therefore, higher switching rates mean suppliers are not just facing higher retention costs or failing to capitalize on their investments into those customers.

5. Changing and evolving regulation

Besides these main challenges, and like they do for other activities in the energy value chain, regulators are making up (and changing) their minds on a wide range of topics – most of the time in favor of customers and often with potentially high impact for retailers. As an illustration, capacity markets are halted or reinstated, markets deregulated, climate goals sharpened, etc. Another illustration with consequences for 2020 is the updated EU Directive 2019/944, which obliges suppliers of EU member states to offer at least one dynamic pricing tariff by December. Aside from affecting their operations, those changes could have a negative impact on the end-customer bill, which would include added environmental charges from suppliers being passed through to customers.

Although the last decade has been challenging for energy retailers, we believe these times can be equally exciting, as industries are converging and energy consumers are pulling attention towards them. Both trends can represent a new pool of value for retailers that will be agile enough to grab the related opportunities. In this rapidly evolving environment, what can energy retailers do to thrive?

2

Four strategic focus areas to succeed

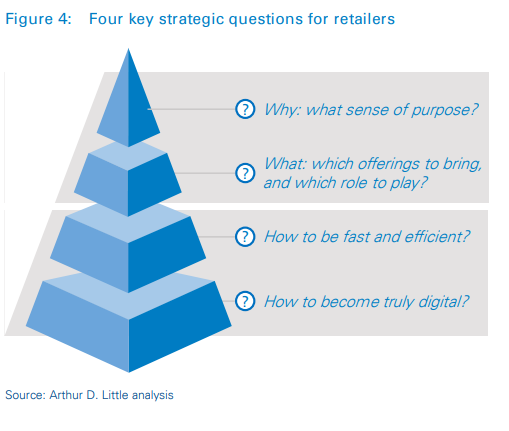

Helping energy retailers to reinvent themselves through four fundamental questions

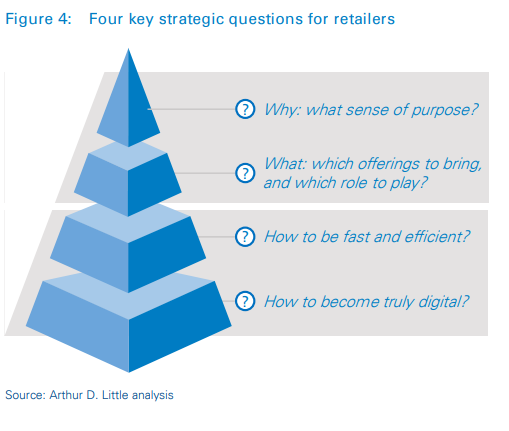

Today’s energy-retailer CXOs are confronted by challenges that cover the increasingly broad space in which their businesses exist, with much shorter times to act and react. (See ADL article: The CEO – Lost in space and time?) In this new “extended space, accelerated time” environment, CXOs must answer four strategic questions with the objective of building sustainable competitive advantage and outperforming competitors in tomorrow’s environment. Answering those questions will help CXOs navigate the challenging times. It will guide them in their search for differentiating value propositions that fit with customer expectations, while helping them reflect on their operating models to improve their outcomes.

1. What is our sense of purpose? WHY is our company in this world?

Given the more volatile, uncertain and complex business environment, companies need a resilient sense of purpose that will be the key to bringing value to their clients and staff, as well as society at large.

In the past, energy-retail incumbents (backed by large amounts of self-owned generation assets) did not have to fear competition, but the situation has drastically changed. Not only has the scope of their activities extended, but consumers’ awareness of green and energy-efficient products and tailored and complete offerings puts pressure on retailers to become “sustainable one-stop shops”.

It is therefore paramount that retailers review or even seek their purpose in order to give customers a reason to advocate for them and employees a monument to build. It is this purpose that defines what the company brings to the world, and therefore, what customers and employees contribute to. Simply providing power (and/or gas) does not suffice.

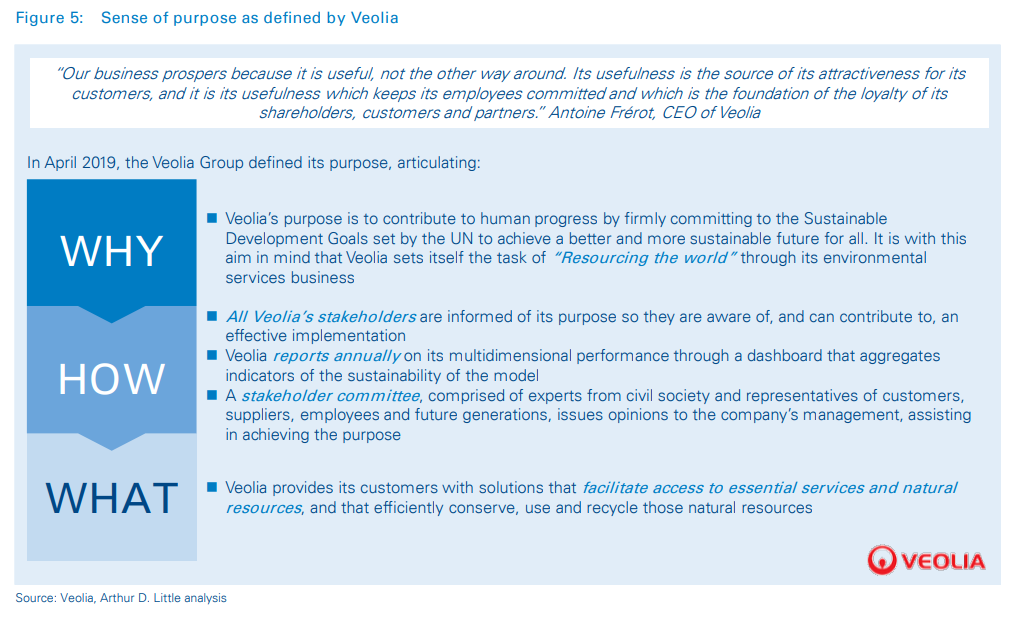

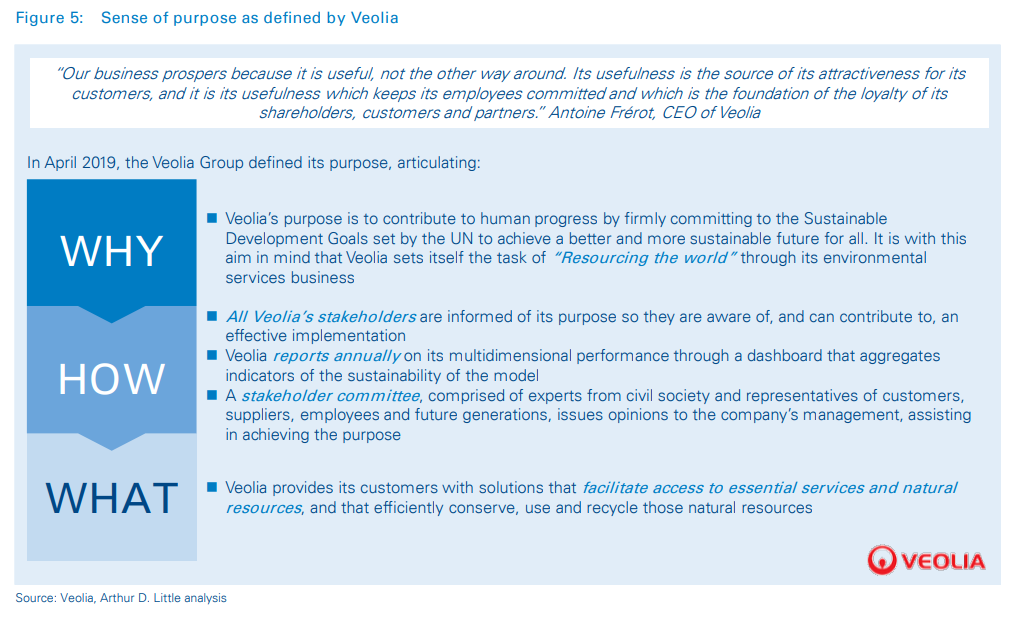

Having a well-thought-out sense of purpose will enable retailers to ensure consistency and aid in decision-making about where in the value chain and ecosystem they can contribute. Good crossindustry examples are Veolia and Michelin, which understand the importance of this sense of purpose and take the time to define and communicate it. In April 2019, the Veolia Group defined its Purpose articulating the “why”, the “what” and the “how”, as illustrated in Figure 5.

Not only is it key to reflect on and define the sense of purpose as a reminder of the company’s differentiators and sources of value creation, but it is also indispensable to communicate about it internally to employees eager to contribute to a better society. They must also embed it in their culture, as well as externally, aiming to reach customers assessing the company’s legitimacy to operate.

We have met many companies that claimed to have worked on their sense of purpose, but that neglected the need to communicate about it; this has led to limited impact in terms of the brand perception and emotional link that the sense of purpose is supposed to create.

2. Where should our company play a role in the ecosystem, and how?

Convergence of industries has brought (electric) mobility, smart devices, telecom services, and even financial services and construction to the retailer’s doorstep. Aside from that, the traditional linear energy value chain has been disrupted by new types of players (such as energy service companies and aggregators) and new forms of generation (decentralized generation), which represent both a threat and an opportunity to broaden their offers. This makes retailers question their positioning in the value chain, as well as broadly in the energy ecosystem and beyond.

Given the increasing number of new players and convergence of industries within the energy value chain, retailers are facing existential questions on where and how to position themselves in this new ecosystem of interconnected actors to provide their own parts of a solution. Indeed, retailers have understood they will not win through single products, services or solutions. Rather, it will be about providing a range of solutions, supported by the right capabilities which will unlock a new pool of value (that was inaccessible in the past, given the challenge to invest in so many capabilities). It will also be about leveraging platforms and partnering with others to create innovative business models.

In that context, the retailer of the future will exploit opportunities created by an ecosystem-driven world of collaboration and specialization. It will also leverage its own core capabilities and blend them with those of partners to offer a unique value proposition to the market. Nissan and EDF Group have signed a cooperation agreement to deliver electric mobility together, each leveraging the capability of the other to accelerate their development in this area. While Nissan is responsible for the sale of vehicle-to-grid (V2G)-compatible electric vehicles, EDF Group is in charge of V2G charging solutions and related services.

Similarly, Enel X, Nissan and RSE have launched the first testing program in Italy for the development and demonstration of vehicle-to-grid (V2G) technology, which enables electric vehicles (EV) to store and deliver electricity to help stabilize the electricity grid. The project involves the use of two Enel X bi-directional recharging systems, installed in the experimental RSE microgrid, which, using a specific control platform, enables the use of Nissan LEAFs for grid stabilization.

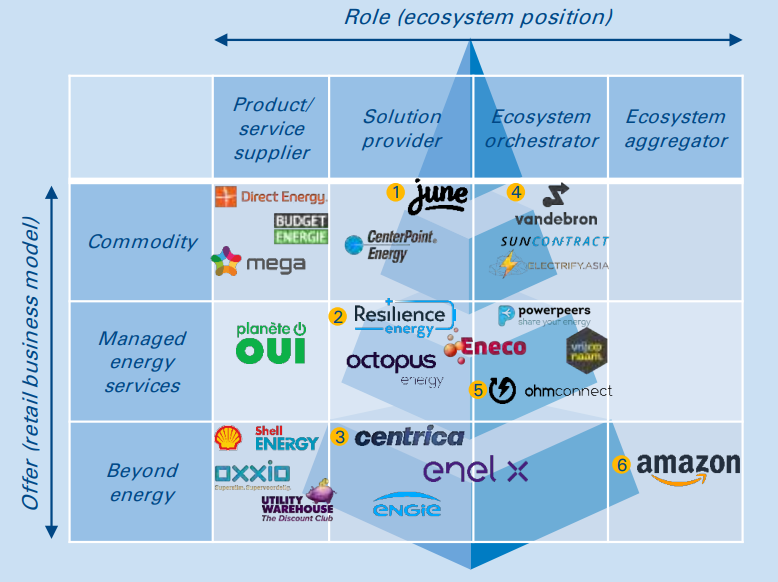

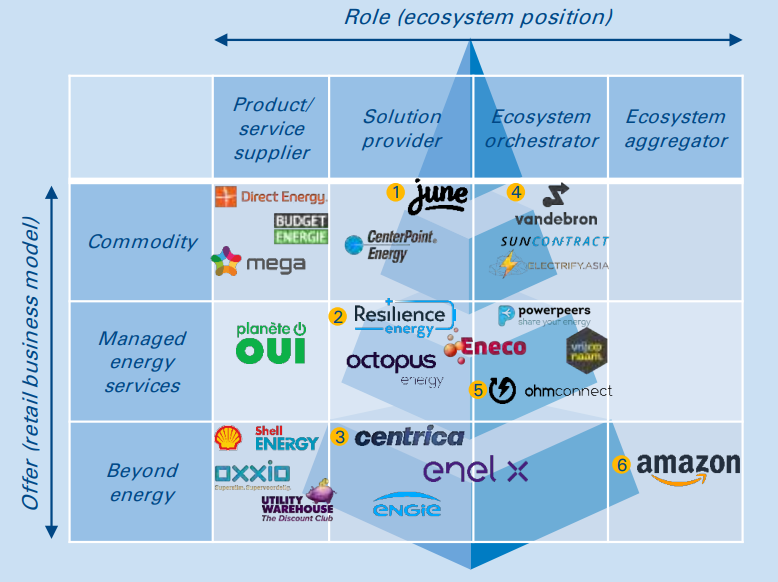

As such, retailers will clearly need to decide what offers they want to propose, and what roles they will take:

- “Commodity energy suppliers” focus on providing the commodity product itself (power, gas, or both). These suppliers typically do not provide any extra products or services. Nowadays, with active customers and a heightened sense of purpose, differentiation is still possible, in terms of, for example, targeted offerings (young and digital consumers, green and sustainable preferences, housing corporation tenants, seniors, etc.).

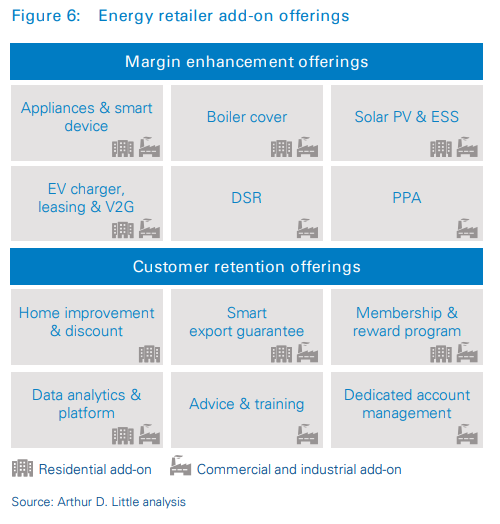

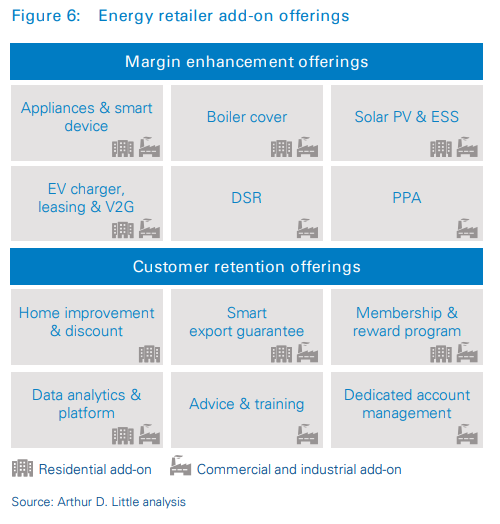

- “Managed energy services” have core energy offerings, plus a range of add-on products and services to position them as holistic “one-stop shops”. Example add-ons for both residential and C&I (commercial and industrial) segments include PV and/or energy storage system (ESS) installation and management services, EV charging-point installation and V2G services. Example add-ons specifically for C&I are ESCO-type services and aggregation, as well as DSR-type services. We see add-on services, as displayed in Figure 6, which can be segmented according to whether they predominantly lead to increased customer retention or increased margins. Together with dynamic pricing schemes, the integrated “energy offering” can become truly tailored towards the consumer and related add-on products.

- “Beyond energy service providers” goes beyond the scope of energy to offer a broader portfolio. Products and services might relate to telecommunications, smart home devices, financial services, leasing, etc.

Following another dimension, the retailers of the future will take up their roles in the energy ecosystem, which will range from bare-bones product and service providers to more innovative positions as ecosystem orchestrators and aggregators.

- Product/service suppliers offer no more than the simple product or service to one actor in the ecosystem. In the case of energy retailers, the actors are most often consumers, suppliers and system operators. They compete on price and technology.

- Solution providers combine products and services into entire solutions, for which the added value is higher than the sum of the parts.

- Ecosystem orchestrators leverage existing assets and solutions by orchestrating platforms to create network effects between actors.

- Ecosystem aggregators maximize customer lock-in by aggregating different ecosystems.

In recent years, we have seen many start-ups filling the empty roles in the ecosystem, and incumbent utilities and retailers shifting their businesses to capitalize on these emerging revenue opportunities.

Details of some of these players, as well as other examples, can be found below.

Illustration of players active in the energy retail ecosystem

01| June – Automatic switching of supplier with lowest price and highest promotion

Solution providers combine products and services into entire solutions, for which the added value is higher than just the sum of the parts – this is in contrast with barebones product/service providers, which typically supply just the energy commodity.

June goes beyond traditional price comparison websites by offering a smart dongle and application that measure power and gas consumption. Based on the consumption profile, June continuously looks for better energy contracts on the market and switches the customer automatically. On average, June switches contracts two to three times per year, saving the customer up to €300 annually.

This solution is an example of how a start-up, founded in 2016, revolutionized interactions between retailers and customers while still creating value for the customer based on the commodity only.

02| Resilience – Providing prosumers with hardware, software and contracts to produce, store and sell

UK start-up Resilience aims to convert UK homes into personal power stations. By choosing one of the packages, the customer receives a 2–4kW PV installation, a 4–12kWh battery installation, and access to the application. The added value lies in its optimized savings by learning the usage behavior of the consumer and storing or selling energy back to the grid to maximize arbitrage.

This area knows the most activity, as utilities are increasingly moving into the solution space, trying to lock the customer in by bundling multiple products and services.

03| Centrica – Shifting from a “gentailer” to a solutionand service-oriented retailer/aggregator

The large traditional utility Centrica is shifting its focus towards service-oriented business, most notably in its Centrica Business Solutions and British Gas brands. The first offers a complete portfolio of ESCO services to businesses, while the latter offers energy, home services and smart home solutions in the residential sector. To achieve this positioning, Centrica has acquired multiple companies, which span from smart home devices (AlertME, FlowGem, Hive, etc.) to aggregation (REstore).

Centrica is one of few examples of dominant utilities making large shifts in their business models through acquisitions to focus on service solutions. As an illustration, Centrica has sold several of its centralized generation assets.

04| Vandebron – A peer-to-peer marketplace for green energy

Ecosystem orchestrators take their inspiration from the platform economy. They develop platforms that can create and orchestrate ecosystems to produce network effects using the actors’ assets.

The Dutch supplier Vandebron is such a platform creator. It gained rapid success by offering a platform on which consumers could select one or more sources of green energy, often prosumers or small independent power producers (IPPs). Consumers benefit by having a greater sense of control over the sources of their energy, whereas IPPs, and especially small prosumers, benefit by having an alternative route to market. In November 2019, Vandebron was acquired by incumbent Essent, but it will remain a separate brand and entity. Similarly, several start-ups, such as SunContract and Electrify, have created peer-to-peer markets using blockchain technology to facilitate trading of renewable energy among communities.

05| OhmConnect – Bringing the power of DSR to households

Californian start-up OhmConnect notifies household consumers with smart meters when consumption is expected to peak. If, during the notification period (which lasts one hour), the consumer lowers their consumption, they are remunerated. The process is similar to traditional large-scale demand-side response (DSR), in that OhmConnect works together with the transmission system operator and utilities by offering them flexibility.

This is just one of many examples of recent platform-like business models. Traditional aggregators of generation and DSR fall under this category. Other examples include companies that create platforms to facilitate crowdfunding of renewable assets. Consumers that invest typically receive part of the generation of the asset, while the asset itself is owned and operated by the company.

In Europe, with the impending obligation to offer at least one dynamic pricing tariff, we suspect many new solution-oriented business models will flourish.

06| Amazon – The usual suspect setting foot in the world of energy through smart home devices

To date, there is no clear player taking the role of ecosystem aggregator that includes energy as part of the ecosystem. Several voices in energy markets claim that big tech players are well placed to launch such efforts in the near future, for the following reasons. Firstly, customer centricity, the main pain point traditional utilities fail to cover, is in their DNA. Not only are their customer-facing platforms optimized and trusted by millions, but the amount of data and knowledge they have about their customers would be of huge help in creating supplier businesses. Secondly, as entities in the public spotlight, many big tech companies committed to climate initiative the RE100, which means they aim to source energy from 100 percent renewable generation by 2025. In their efforts, Apple, Facebook, Google and Microsoft are getting involved with power-purchase agreements (PPAs) and even acquiring their own generation assets. Through this they are gaining experience and could set up assets for future retail activities. Lastly, the widespread offerings in smart home devices are already used as a first entry point in the energy ecosystem.

Amazon’s smart home assistant, Alexa, is already marketed together with British Gas’s Hive offering, Enel X’s HomiX smart home solution, Octopus Energy’s Agile offering, and many others. It is speculated that the big tech companies will experiment more in the energy ecosystem once energy markets are deregulated more in the US, their home field.

3. How to build an organization that combines scale and productivity with speed and creativity?

Given a retailer’s sense of purpose and targeted role in the ecosystem, a key question is how it will reach that state in the future. Although many retailers almost exclusively focus on “scale and efficiency”, today they must seek growth in innovation, creativity, and collaboration — or risk failing to get to their envisioned ecosystem positioning.

Ambidextrous companies are those that excel at finding this fine balance between “scale and efficiency” and “speed and creativity” – and they are few and far between. However, we are seeing more and more large retailers attempt to become ambidextrous, often through acquiring successful new market entrants that carry “speed and creativity” in their DNA (for example, the acquisition of REstore by Centrica).

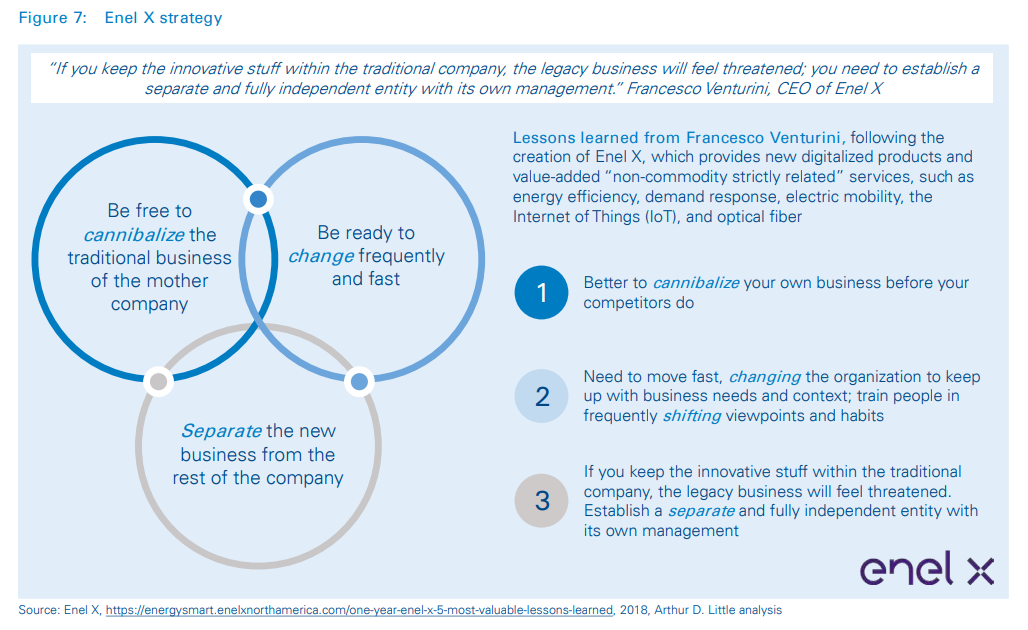

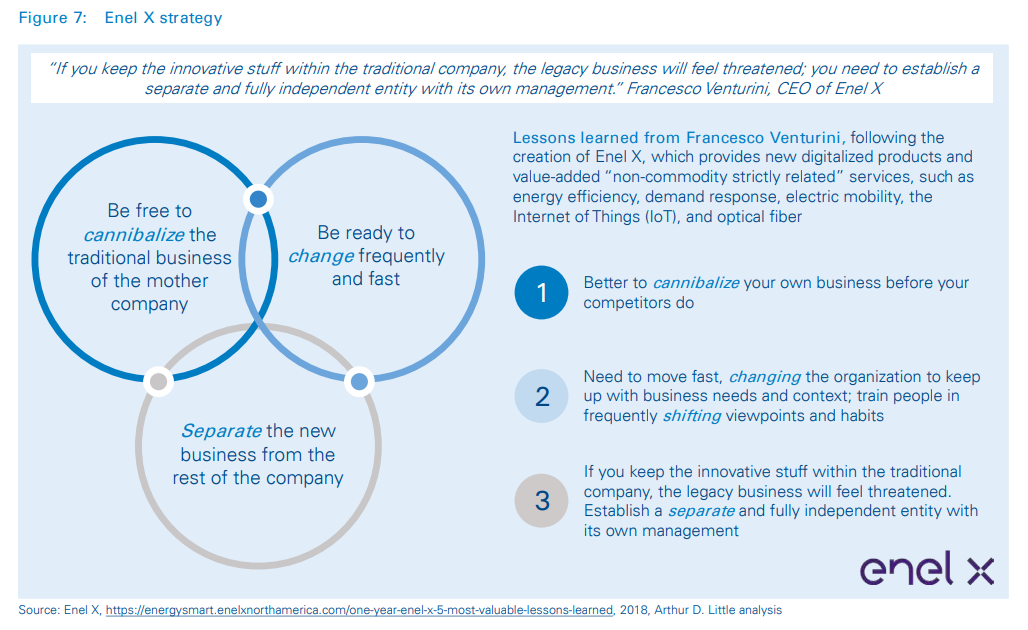

From our experience, it’s important to give the newly acquired or created business its own distinct governance and incentives and allow it to cannibalize the traditional business of the mother company. This is exemplified by Enel X, which developed an all-new digitalized offering by establishing a separate, fully independent entity with its own separate management team.

4. How do we become truly digital and tap the potential to improve operations efficiency and increase revenue? What should our priorities be?

Multiple business implications are driven by the emergence of digitalization within the energy industry.

New product offerings – New products and services, enabled by an innovative digital ecosystem and technologies, are emerging to create new revenue streams and compensate for stagnating core businesses.

Operations optimization – Digitalization of operations and processes has enabled some players, mostly new entrants, to achieve operational excellence through implementation of cutting-edge, scalable back ends that can combine forecasting, procurement and customer-handling, as well as to optimize costs, which leads to competitive pricing.

Customer engagement – Developing innovative offerings and ensuring customer-friendly and efficient processes and operations are essential steps to convince, acquire and retain customers. Digitalization plays a paramount role in seamless customer journeys if leveraged to the fullest.

Players such as Octopus, OVO Energy and Opus, active in the UK retail market, have developed their business models based on AI and digitalization, capitalizing on data to improve customer experience and internal processes. In less than four years, Octopus Energy grew its customer base from nothing to 1 million customers, mixing organic and inorganic growth through differentiated positioning and excellent customer experience. This tech-savvy retailer with smart tariffs proposes a smooth experience through AI systems, which allows it to interact with customers via different channels (web, mobile, smart meters). Aside from obvious internal benefits from an operational perspective, Octopus Energy has generated extra revenue by leveraging its “Kraken platform”. Marks & Spencer, a white-label brand, recently chose Octopus’ energy over the usual incumbent for its energy operations, mentioning that the technology platform was a key decisive factor. Good Energy has also announced using the Kraken platform as of 2020 for its customer service and billing. It is the first time a retailer has used a rival’s back end in the UK.

Incumbents need to reflect on their digitalization journeys to (1) expand their offerings toward increasingly demanding customers who desire personalized services, and therefore pursue new growth opportunities (such as through creation of a 100 percent online brand), (2) improve their operations to reduce costs and (3) improve customer experience. To determine where their focus should be, retail organizations need to assess their maturity on those three fronts.

3

Key recommendations

Relying on ecosystems and digitalization to access new pools of value, reduce costs and improve operations and customer experience

The traditional dominance of incumbent energy retailers is under pressure as challengers across industries grab market share with disruptive services. While new entrants’ business models mainly rest on digitalized and innovative operating models and services, traditional players struggle to transform and think outside their core businesses.

Considering their profitability levels nowadays and the increasing intensity of competition, energy retailers should, on one side, focus on making sure they have the right partnerships to unlock new pools of value that require new capabilities. On the other side, they should seek to leverage digital and artificial intelligence to reduce costs, create new sources of revenues through new offerings and improve customer experience.

In this dynamic environment where many industries converge, Energy retail CEOs should re-define and leverage their sense of purpose to guide them in their investment and partnership decisions while respecting the long term commitment of the company towards the society, giving employees and customers confidence in the company for the values it represents.

DOWNLOAD THE FULL REPORT

18 min read • Energy, Utilities & Resources, Strategy

Energy retailers: Facing the toughest transition in the energy sector

Energy retailers in Europe need to leverage an increasingly open energy ecosystem to differentiate and stay competitive

DATE

Executive Summary

Power and gas selling is commoditizing at lightning speed in an open market in which competition is hyper-agile and creative with retail add-on services. As a result, increasing customer switching rates and thinner margins directly impact traditional incumbent retailers. A key question is if and how these companies can shift their business models to break free from traditional positions to capitalize on the opportunities created by an ever-growing energy ecosystem.

In this paper, we offer a view of the challenges energy retailers face, and which strategic moves they need to consider to reinvent themselves and stay relevant in the future. Guided by their sense of purpose, retailers need to consider where in the ecosystem they want to focus and with which partners, as well as how to transform their organizations to anticipate innovation and create services that adapt to changing consumer behaviors.

1

Challenges faced by energy retailers in Europe

Energy retail profitability is at its lowest in years, while customer-churn levels and new-entrant numbers are at their highest

Almost two decades after the liberalization of energy markets in the developed world, the cards have been thoroughly reshuffled, with many new cards added and nearly all rules redefined. Traditional utilities have seen the entry of new players across the energy value chain. Further fueled by the megatrends of decentralization, digitization and decarbonization, their businesses have been disrupted significantly, which has resulted in many challenges. In this section we outline the main challenges and underlying drivers. In the next section, we explore ways forward for a better future.

1. A whole lot of new competitors

Non-energy leaders throughout various industries have entered the power and gas sector, leveraging their existing capabilities, customer relationships and other value-chain positions (such as hardware and services) to enter energy retail. Among them, we find those that are new to the energy sector, such as car manufacturers, GAFA (“Google, Apple, Facebook, Amazon”) and telecom operators. In addition, others are broadening their scope of activities towards energy retail, building on positions in the extended energy value chain (such as equipment firms and service providers). Finally, a range of start-ups are also entering, some from the energy sector and others from outside (see Figure 1). Many see the energy sector as an opportunity to develop new revenue streams and expand the number of touchpoints with their existing customer bases.

As a consequence, we have assisted with a wave of consolidation among different types of players.

Many retailers have acquired aggregators: Centrica of REstore, Shell of Limejump, Engie of majority stakes in KiWi Power, Enel of EnerNOC, etc. This trend is also true for electric mobility charging-station providers: Engie acquired EV-Box, Shell bought NewMotion, and EDF group acquired Pivot Power.

In a very dominated market, incumbents typically are the ones acquiring the new players, as was the case in the Netherlands with the first wave of new entrants in 2004. Vattenfall bought Nuon in 2009 and Delta in 2019, and Eneco bought new entrant Oxxio in 2011. However, nowadays, we note a reverse trend. The perfect example is Ovo Energy, which was established in the UK in 2009. Ten years later it acquired SSE, one of the UK’s top six energy providers (known as the “Big Six”). Ovo Energy’s share of the electricity market increased from 0 percent in 2013 to 5 percent by the end of 2018, while the Big Six, in contrast, all lost market share (from 100 percent in 2010 to 73 percent in 2018). Other beneficiaries of this decreasing trend are Octopus Energy and Bulb, both of which entered the market in 2015.

2. Sky-high switching rates

In some mature EU markets, external1 household switching rates for electricity reach 10–20 percent (see Figure 2) , although in some markets, such as Germany, switching rates remain stable. On the commercial and industrial (C&I) front, switching is intensifying as well. In Italy, for example, the switching rate for non-residential electricity customers increased from 12 to 17 percent between 2010 and 2018. In the UK, the number of renegotiated contracts increased over a three-year period (2015–2018), from 70 to 73 percent on the electricity side and 70 to 76 percent on the gas side. Not only are energy consumers becoming more active in terms of switching, but it is often the first step to becoming more active in managing their energy consumption and procurement. (For a more extensive overview of future energy consumers’ behavior, see “Getting ready for the energy consumer of the future” in ADL’s second Prism issue of 2019.)

3. Rigidity of the incumbent

Incumbent players are structurally less agile due to their heritage. They typically rely on older infrastructures and systems, and use more staff to run operations. In contrast, successful new entrants will benefit from the latest technologies in that they are more agile and rely on nimble, optimized back-end systems for client operations and energy procurement during their start-up phases. Once they climb the growth curve, a higher number of clients can be efficiently handled with less full-time equivalents (FTEs) than for traditional players. Not only does the effectiveness of operations impact their costs, but the lack of smooth client processes is a trigger for customers to churn, looking for better experiences.

4. Low profitability

New competitors, higher switching rates and lack of internal agility result in low profitability for incumbent retailers. The lowest levels of EBIT margins recorded in years are shown in Figure 3. Retailers typically make money on loyal customers (referred to as “sleeper” contracts) once they have earned back the acquisition costs related to that customer, which often runs to €150+ (in the form of cash-backs, gifts, commissions, etc.). Therefore, higher switching rates mean suppliers are not just facing higher retention costs or failing to capitalize on their investments into those customers.

5. Changing and evolving regulation

Besides these main challenges, and like they do for other activities in the energy value chain, regulators are making up (and changing) their minds on a wide range of topics – most of the time in favor of customers and often with potentially high impact for retailers. As an illustration, capacity markets are halted or reinstated, markets deregulated, climate goals sharpened, etc. Another illustration with consequences for 2020 is the updated EU Directive 2019/944, which obliges suppliers of EU member states to offer at least one dynamic pricing tariff by December. Aside from affecting their operations, those changes could have a negative impact on the end-customer bill, which would include added environmental charges from suppliers being passed through to customers.

Although the last decade has been challenging for energy retailers, we believe these times can be equally exciting, as industries are converging and energy consumers are pulling attention towards them. Both trends can represent a new pool of value for retailers that will be agile enough to grab the related opportunities. In this rapidly evolving environment, what can energy retailers do to thrive?

2

Four strategic focus areas to succeed

Helping energy retailers to reinvent themselves through four fundamental questions

Today’s energy-retailer CXOs are confronted by challenges that cover the increasingly broad space in which their businesses exist, with much shorter times to act and react. (See ADL article: The CEO – Lost in space and time?) In this new “extended space, accelerated time” environment, CXOs must answer four strategic questions with the objective of building sustainable competitive advantage and outperforming competitors in tomorrow’s environment. Answering those questions will help CXOs navigate the challenging times. It will guide them in their search for differentiating value propositions that fit with customer expectations, while helping them reflect on their operating models to improve their outcomes.

1. What is our sense of purpose? WHY is our company in this world?

Given the more volatile, uncertain and complex business environment, companies need a resilient sense of purpose that will be the key to bringing value to their clients and staff, as well as society at large.

In the past, energy-retail incumbents (backed by large amounts of self-owned generation assets) did not have to fear competition, but the situation has drastically changed. Not only has the scope of their activities extended, but consumers’ awareness of green and energy-efficient products and tailored and complete offerings puts pressure on retailers to become “sustainable one-stop shops”.

It is therefore paramount that retailers review or even seek their purpose in order to give customers a reason to advocate for them and employees a monument to build. It is this purpose that defines what the company brings to the world, and therefore, what customers and employees contribute to. Simply providing power (and/or gas) does not suffice.

Having a well-thought-out sense of purpose will enable retailers to ensure consistency and aid in decision-making about where in the value chain and ecosystem they can contribute. Good crossindustry examples are Veolia and Michelin, which understand the importance of this sense of purpose and take the time to define and communicate it. In April 2019, the Veolia Group defined its Purpose articulating the “why”, the “what” and the “how”, as illustrated in Figure 5.

Not only is it key to reflect on and define the sense of purpose as a reminder of the company’s differentiators and sources of value creation, but it is also indispensable to communicate about it internally to employees eager to contribute to a better society. They must also embed it in their culture, as well as externally, aiming to reach customers assessing the company’s legitimacy to operate.

We have met many companies that claimed to have worked on their sense of purpose, but that neglected the need to communicate about it; this has led to limited impact in terms of the brand perception and emotional link that the sense of purpose is supposed to create.

2. Where should our company play a role in the ecosystem, and how?

Convergence of industries has brought (electric) mobility, smart devices, telecom services, and even financial services and construction to the retailer’s doorstep. Aside from that, the traditional linear energy value chain has been disrupted by new types of players (such as energy service companies and aggregators) and new forms of generation (decentralized generation), which represent both a threat and an opportunity to broaden their offers. This makes retailers question their positioning in the value chain, as well as broadly in the energy ecosystem and beyond.

Given the increasing number of new players and convergence of industries within the energy value chain, retailers are facing existential questions on where and how to position themselves in this new ecosystem of interconnected actors to provide their own parts of a solution. Indeed, retailers have understood they will not win through single products, services or solutions. Rather, it will be about providing a range of solutions, supported by the right capabilities which will unlock a new pool of value (that was inaccessible in the past, given the challenge to invest in so many capabilities). It will also be about leveraging platforms and partnering with others to create innovative business models.

In that context, the retailer of the future will exploit opportunities created by an ecosystem-driven world of collaboration and specialization. It will also leverage its own core capabilities and blend them with those of partners to offer a unique value proposition to the market. Nissan and EDF Group have signed a cooperation agreement to deliver electric mobility together, each leveraging the capability of the other to accelerate their development in this area. While Nissan is responsible for the sale of vehicle-to-grid (V2G)-compatible electric vehicles, EDF Group is in charge of V2G charging solutions and related services.

Similarly, Enel X, Nissan and RSE have launched the first testing program in Italy for the development and demonstration of vehicle-to-grid (V2G) technology, which enables electric vehicles (EV) to store and deliver electricity to help stabilize the electricity grid. The project involves the use of two Enel X bi-directional recharging systems, installed in the experimental RSE microgrid, which, using a specific control platform, enables the use of Nissan LEAFs for grid stabilization.

As such, retailers will clearly need to decide what offers they want to propose, and what roles they will take:

- “Commodity energy suppliers” focus on providing the commodity product itself (power, gas, or both). These suppliers typically do not provide any extra products or services. Nowadays, with active customers and a heightened sense of purpose, differentiation is still possible, in terms of, for example, targeted offerings (young and digital consumers, green and sustainable preferences, housing corporation tenants, seniors, etc.).

- “Managed energy services” have core energy offerings, plus a range of add-on products and services to position them as holistic “one-stop shops”. Example add-ons for both residential and C&I (commercial and industrial) segments include PV and/or energy storage system (ESS) installation and management services, EV charging-point installation and V2G services. Example add-ons specifically for C&I are ESCO-type services and aggregation, as well as DSR-type services. We see add-on services, as displayed in Figure 6, which can be segmented according to whether they predominantly lead to increased customer retention or increased margins. Together with dynamic pricing schemes, the integrated “energy offering” can become truly tailored towards the consumer and related add-on products.

- “Beyond energy service providers” goes beyond the scope of energy to offer a broader portfolio. Products and services might relate to telecommunications, smart home devices, financial services, leasing, etc.

Following another dimension, the retailers of the future will take up their roles in the energy ecosystem, which will range from bare-bones product and service providers to more innovative positions as ecosystem orchestrators and aggregators.

- Product/service suppliers offer no more than the simple product or service to one actor in the ecosystem. In the case of energy retailers, the actors are most often consumers, suppliers and system operators. They compete on price and technology.

- Solution providers combine products and services into entire solutions, for which the added value is higher than the sum of the parts.

- Ecosystem orchestrators leverage existing assets and solutions by orchestrating platforms to create network effects between actors.

- Ecosystem aggregators maximize customer lock-in by aggregating different ecosystems.

In recent years, we have seen many start-ups filling the empty roles in the ecosystem, and incumbent utilities and retailers shifting their businesses to capitalize on these emerging revenue opportunities.

Details of some of these players, as well as other examples, can be found below.

Illustration of players active in the energy retail ecosystem

01| June – Automatic switching of supplier with lowest price and highest promotion

Solution providers combine products and services into entire solutions, for which the added value is higher than just the sum of the parts – this is in contrast with barebones product/service providers, which typically supply just the energy commodity.

June goes beyond traditional price comparison websites by offering a smart dongle and application that measure power and gas consumption. Based on the consumption profile, June continuously looks for better energy contracts on the market and switches the customer automatically. On average, June switches contracts two to three times per year, saving the customer up to €300 annually.

This solution is an example of how a start-up, founded in 2016, revolutionized interactions between retailers and customers while still creating value for the customer based on the commodity only.

02| Resilience – Providing prosumers with hardware, software and contracts to produce, store and sell

UK start-up Resilience aims to convert UK homes into personal power stations. By choosing one of the packages, the customer receives a 2–4kW PV installation, a 4–12kWh battery installation, and access to the application. The added value lies in its optimized savings by learning the usage behavior of the consumer and storing or selling energy back to the grid to maximize arbitrage.

This area knows the most activity, as utilities are increasingly moving into the solution space, trying to lock the customer in by bundling multiple products and services.

03| Centrica – Shifting from a “gentailer” to a solutionand service-oriented retailer/aggregator

The large traditional utility Centrica is shifting its focus towards service-oriented business, most notably in its Centrica Business Solutions and British Gas brands. The first offers a complete portfolio of ESCO services to businesses, while the latter offers energy, home services and smart home solutions in the residential sector. To achieve this positioning, Centrica has acquired multiple companies, which span from smart home devices (AlertME, FlowGem, Hive, etc.) to aggregation (REstore).

Centrica is one of few examples of dominant utilities making large shifts in their business models through acquisitions to focus on service solutions. As an illustration, Centrica has sold several of its centralized generation assets.

04| Vandebron – A peer-to-peer marketplace for green energy

Ecosystem orchestrators take their inspiration from the platform economy. They develop platforms that can create and orchestrate ecosystems to produce network effects using the actors’ assets.

The Dutch supplier Vandebron is such a platform creator. It gained rapid success by offering a platform on which consumers could select one or more sources of green energy, often prosumers or small independent power producers (IPPs). Consumers benefit by having a greater sense of control over the sources of their energy, whereas IPPs, and especially small prosumers, benefit by having an alternative route to market. In November 2019, Vandebron was acquired by incumbent Essent, but it will remain a separate brand and entity. Similarly, several start-ups, such as SunContract and Electrify, have created peer-to-peer markets using blockchain technology to facilitate trading of renewable energy among communities.

05| OhmConnect – Bringing the power of DSR to households

Californian start-up OhmConnect notifies household consumers with smart meters when consumption is expected to peak. If, during the notification period (which lasts one hour), the consumer lowers their consumption, they are remunerated. The process is similar to traditional large-scale demand-side response (DSR), in that OhmConnect works together with the transmission system operator and utilities by offering them flexibility.

This is just one of many examples of recent platform-like business models. Traditional aggregators of generation and DSR fall under this category. Other examples include companies that create platforms to facilitate crowdfunding of renewable assets. Consumers that invest typically receive part of the generation of the asset, while the asset itself is owned and operated by the company.

In Europe, with the impending obligation to offer at least one dynamic pricing tariff, we suspect many new solution-oriented business models will flourish.

06| Amazon – The usual suspect setting foot in the world of energy through smart home devices

To date, there is no clear player taking the role of ecosystem aggregator that includes energy as part of the ecosystem. Several voices in energy markets claim that big tech players are well placed to launch such efforts in the near future, for the following reasons. Firstly, customer centricity, the main pain point traditional utilities fail to cover, is in their DNA. Not only are their customer-facing platforms optimized and trusted by millions, but the amount of data and knowledge they have about their customers would be of huge help in creating supplier businesses. Secondly, as entities in the public spotlight, many big tech companies committed to climate initiative the RE100, which means they aim to source energy from 100 percent renewable generation by 2025. In their efforts, Apple, Facebook, Google and Microsoft are getting involved with power-purchase agreements (PPAs) and even acquiring their own generation assets. Through this they are gaining experience and could set up assets for future retail activities. Lastly, the widespread offerings in smart home devices are already used as a first entry point in the energy ecosystem.

Amazon’s smart home assistant, Alexa, is already marketed together with British Gas’s Hive offering, Enel X’s HomiX smart home solution, Octopus Energy’s Agile offering, and many others. It is speculated that the big tech companies will experiment more in the energy ecosystem once energy markets are deregulated more in the US, their home field.

3. How to build an organization that combines scale and productivity with speed and creativity?

Given a retailer’s sense of purpose and targeted role in the ecosystem, a key question is how it will reach that state in the future. Although many retailers almost exclusively focus on “scale and efficiency”, today they must seek growth in innovation, creativity, and collaboration — or risk failing to get to their envisioned ecosystem positioning.

Ambidextrous companies are those that excel at finding this fine balance between “scale and efficiency” and “speed and creativity” – and they are few and far between. However, we are seeing more and more large retailers attempt to become ambidextrous, often through acquiring successful new market entrants that carry “speed and creativity” in their DNA (for example, the acquisition of REstore by Centrica).

From our experience, it’s important to give the newly acquired or created business its own distinct governance and incentives and allow it to cannibalize the traditional business of the mother company. This is exemplified by Enel X, which developed an all-new digitalized offering by establishing a separate, fully independent entity with its own separate management team.

4. How do we become truly digital and tap the potential to improve operations efficiency and increase revenue? What should our priorities be?

Multiple business implications are driven by the emergence of digitalization within the energy industry.

New product offerings – New products and services, enabled by an innovative digital ecosystem and technologies, are emerging to create new revenue streams and compensate for stagnating core businesses.

Operations optimization – Digitalization of operations and processes has enabled some players, mostly new entrants, to achieve operational excellence through implementation of cutting-edge, scalable back ends that can combine forecasting, procurement and customer-handling, as well as to optimize costs, which leads to competitive pricing.

Customer engagement – Developing innovative offerings and ensuring customer-friendly and efficient processes and operations are essential steps to convince, acquire and retain customers. Digitalization plays a paramount role in seamless customer journeys if leveraged to the fullest.

Players such as Octopus, OVO Energy and Opus, active in the UK retail market, have developed their business models based on AI and digitalization, capitalizing on data to improve customer experience and internal processes. In less than four years, Octopus Energy grew its customer base from nothing to 1 million customers, mixing organic and inorganic growth through differentiated positioning and excellent customer experience. This tech-savvy retailer with smart tariffs proposes a smooth experience through AI systems, which allows it to interact with customers via different channels (web, mobile, smart meters). Aside from obvious internal benefits from an operational perspective, Octopus Energy has generated extra revenue by leveraging its “Kraken platform”. Marks & Spencer, a white-label brand, recently chose Octopus’ energy over the usual incumbent for its energy operations, mentioning that the technology platform was a key decisive factor. Good Energy has also announced using the Kraken platform as of 2020 for its customer service and billing. It is the first time a retailer has used a rival’s back end in the UK.

Incumbents need to reflect on their digitalization journeys to (1) expand their offerings toward increasingly demanding customers who desire personalized services, and therefore pursue new growth opportunities (such as through creation of a 100 percent online brand), (2) improve their operations to reduce costs and (3) improve customer experience. To determine where their focus should be, retail organizations need to assess their maturity on those three fronts.

3

Key recommendations

Relying on ecosystems and digitalization to access new pools of value, reduce costs and improve operations and customer experience

The traditional dominance of incumbent energy retailers is under pressure as challengers across industries grab market share with disruptive services. While new entrants’ business models mainly rest on digitalized and innovative operating models and services, traditional players struggle to transform and think outside their core businesses.

Considering their profitability levels nowadays and the increasing intensity of competition, energy retailers should, on one side, focus on making sure they have the right partnerships to unlock new pools of value that require new capabilities. On the other side, they should seek to leverage digital and artificial intelligence to reduce costs, create new sources of revenues through new offerings and improve customer experience.

In this dynamic environment where many industries converge, Energy retail CEOs should re-define and leverage their sense of purpose to guide them in their investment and partnership decisions while respecting the long term commitment of the company towards the society, giving employees and customers confidence in the company for the values it represents.

DOWNLOAD THE FULL REPORT