18 min read • Private equity

The Insight: State of the European private equity industry

Green shoots visible as AI rises rapidly

INTRODUCTION

The appetite to look outward at new opportunities points to the private equity (PE) industry expecting a brighter near-term future. Invest Europe’s H1 2024 data shows that fundraising, investment, and exit activity have been challenging. However, divestments are showing signs of picking up, which could unlock fundraising and investment, reviving the virtuous PE cycle again. Furthermore, both general partners (GPs) and limited partners (LPs) of PE firms are predicting higher levels of activity in the next 12 months — supported by LPs’ demands for distributions and GPs’ record levels of dry powder — as interest rates fall and the broader macroeconomic climate becomes more predictable.

Risks and opportunities presented by environmental, social, and governance (ESG) were previously prominent in partners’ minds and shaped the direction of GP initiatives, funds, and investments. Today, the focus is clearly on AI and all the ways it can impact the industry — both positively and negatively.

The fact that AI rose so rapidly up the agenda in terms of GP investment focus, internal priorities, and due diligence requirements is testament to managers’ reaction speed. Many are looking to participate in investment opportunities as AI leaders emerge in Europe. A large number are exploring the potential to integrate AI at portfolio companies, seeking new value-creation levers and productivity drivers. Others are turning the technology on their own operations, such as deal origination and analysis, looking for differentiation and an edge in competitive markets. And most are extending their due diligence to cover AI, analyzing the opportunities and the risks it may mean for companies and markets.

Of course, ESG hasn’t completely fallen out of favor. Attention to ESG issues and compliance with sustainability-related regulations remain top priorities for both GPs and LPs. In parallel, adopting ESG best practices and securing ESG expertise (either in-house or external) are increasingly the norm. As such, it is less a future priority than just a few years ago.

There are ever-present risks, including conflict and geopolitical tensions. The threat of cyberattack is considerable, particularly in industries embracing digitalization. And new and evolving regulation places a sizeable burden on PE and VC firms.

The takeaway from this year’s survey should be one of green shoots. After two challenging years, capping a rollercoaster period from the onset of the pandemic, PE and VC firms and their investors are looking at 2025 with increasing optimism, ready to move forward and capture new opportunities.

“AI has moved up as a hot topic among both PE firms and their investors. It can help portfolio companies to find operational efficiency opportunities, but it is important to ensure a proper and safe adoption of AI and implement policies around it. We are also applying AI in our own firm to help inform decisions and improve back-end processes.”

Henrik Johansson, General Counsel,

Nordic Capital Advisors

“ESG is still an important topic for us, but as most firms are up to speed on it, there are other areas now that are relatively more important.”

Michel Galeazzi, cofounder and Partner,

Evoco AG

1

FUNDRAISING REMAINS WEAK, ALTHOUGH EXPECTATIONS IMPROVE

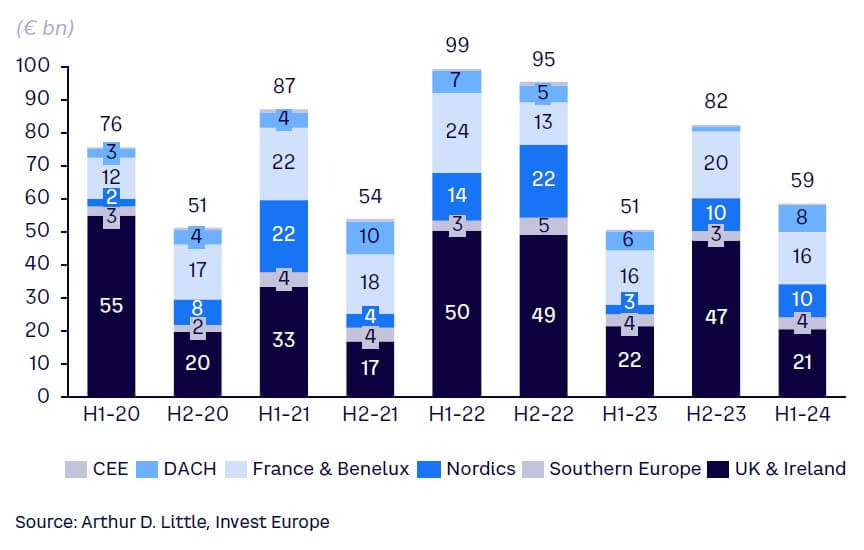

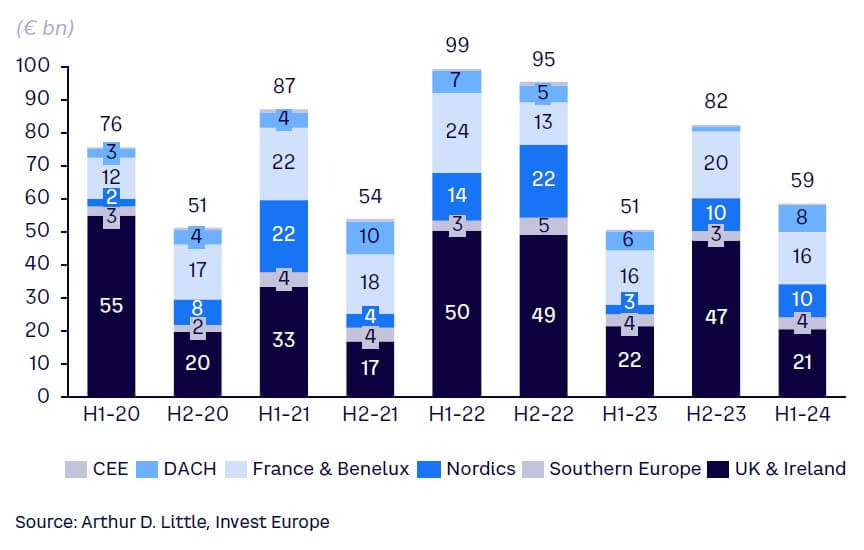

PE fundraising was challenging in the first half of 2024. Although the volume of capital raised increased by 15% year-on-year to €59 billion, it was 28% below the amount raised in the second half of 2023. The reality of the European market is that fundraising is uneven, cyclical, and increasingly polarized between mega-funds and small country- or sector-focused funds. This can lead to sizeable swings from year to year and half to half.

The year-on-year increase was almost entirely driven by a sharp improvement in fundraising in the Nordics, as capital raised in the region more than tripled to €10 billion. Across other regions, fundraising was largely in line with the first half of 2023. When looking at amounts compared to the previous half, the decline was almost entirely due to a fall in fundraising for funds based in the UK and Ireland (see Figure 1).

The UK remains the European hub for many large PE managers and thus the biggest region for fundraising, but it is also more volatile. Meanwhile, France and Benelux, as the second-largest region, perform more consistently due to a wider spread of medium-sized funds across constituent countries.

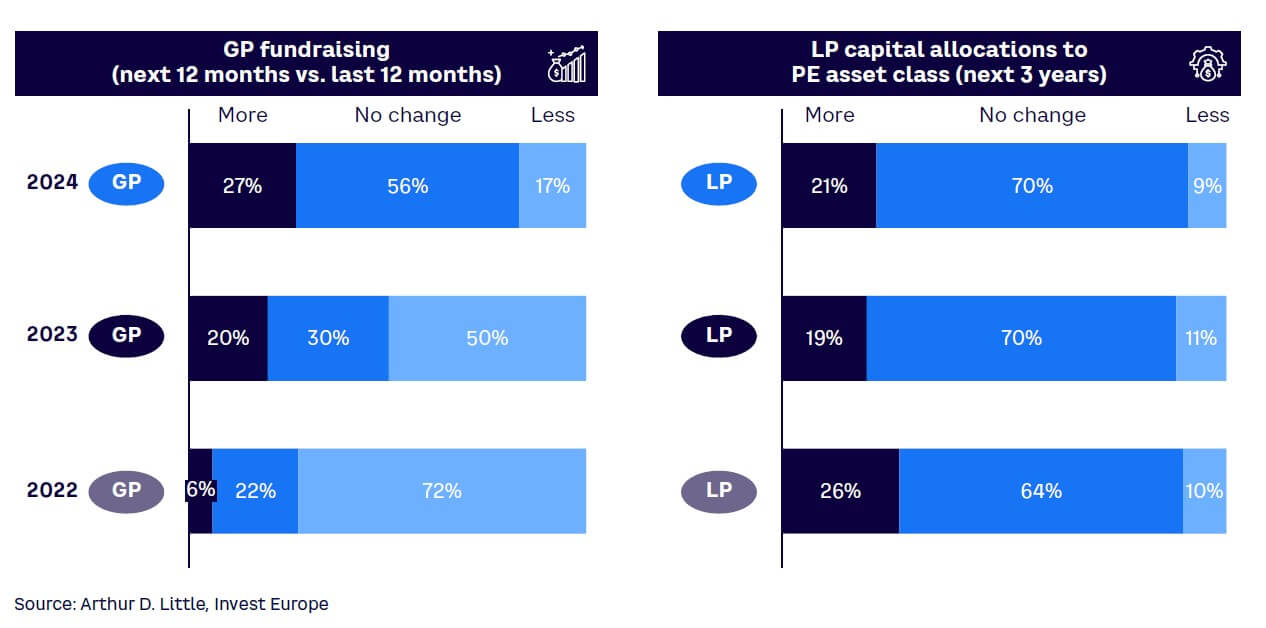

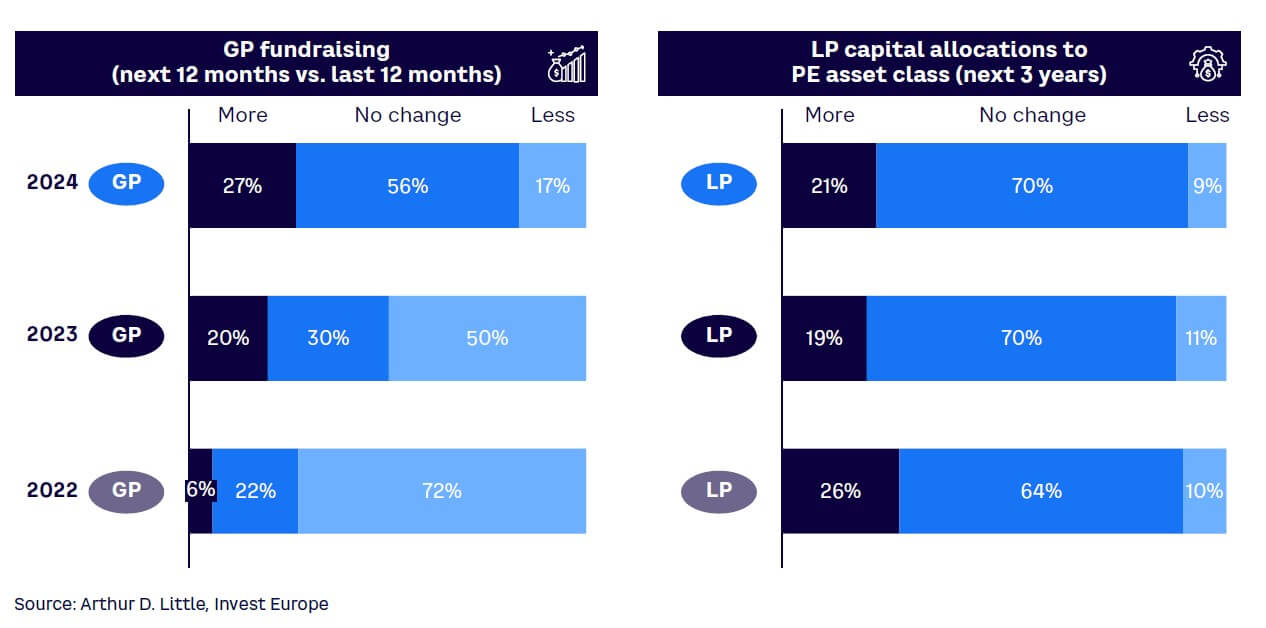

After a challenging period, the improving macro backdrop is causing a modest but noticeable boost in fundraising expectation. As shown in Figure 2, 27% of GPs expect fundraising to increase over the next 12 months versus the last 12 months, compared with 20% last year and just 6% the prior year.

More notably, fewer than one in five (17%) expect less capital to flow into the asset class compared with half of those surveyed last year.

Interestingly, while GP views have varied and improved, LP expectations of capital allocations have changed only modestly. Around a fifth expect an increase in allocations, over two-thirds expect no change, and less than 10% believe that capital committed to PE will fall. All figures are largely in line with the past two years and indicate a steady increase in the overall amount of capital flowing into PE. Ultimately, the vast majority of LPs continue to believe in the asset class’s potential to deliver strong returns amid ongoing uncertainty.

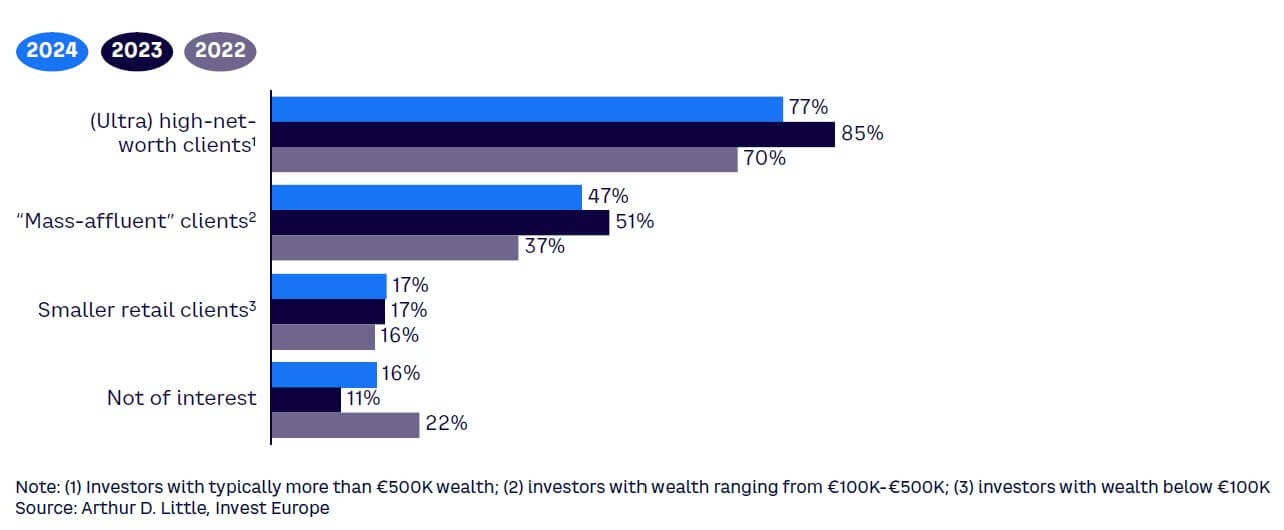

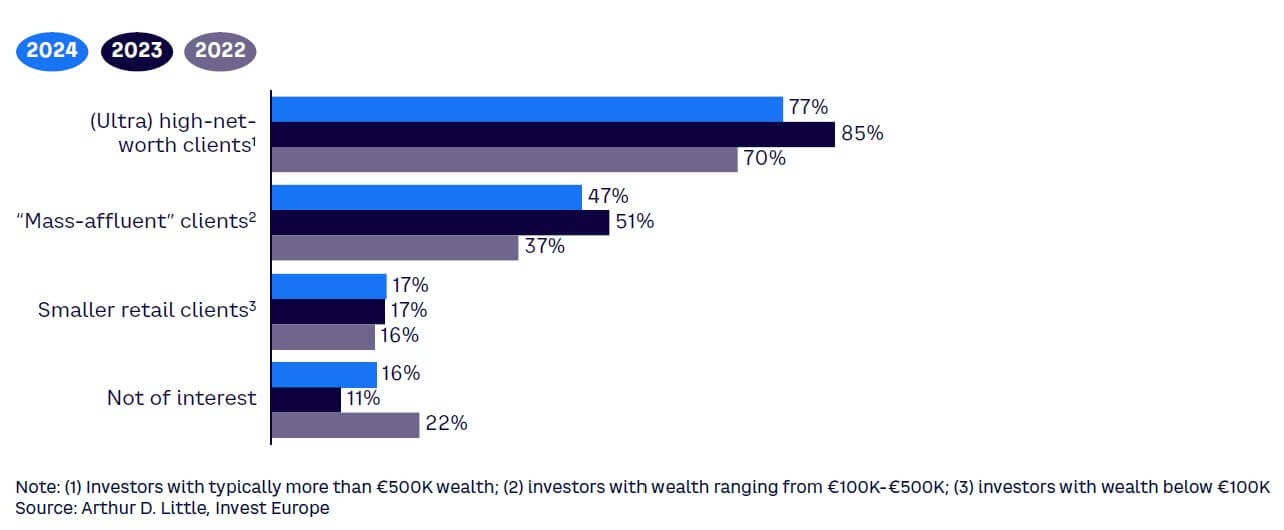

Opinions about the democratization potential of PE remain strong, although attention is focused on the wealthier brackets of individuals. More than three-quarters of GPs see potential in raising capital from (ultra) high-net-worth clients, the smallest in number but the most sophisticated and most likely to have sizeable pools of capital to deploy (see Figure 3).

Just under half see the potential of marketing funds to the “mass-affluent” category: individuals with investible wealth ranging from €100K to €500K. The attraction of smaller retail clients remains muted, although not negligible, with just under one in five interested in the category.

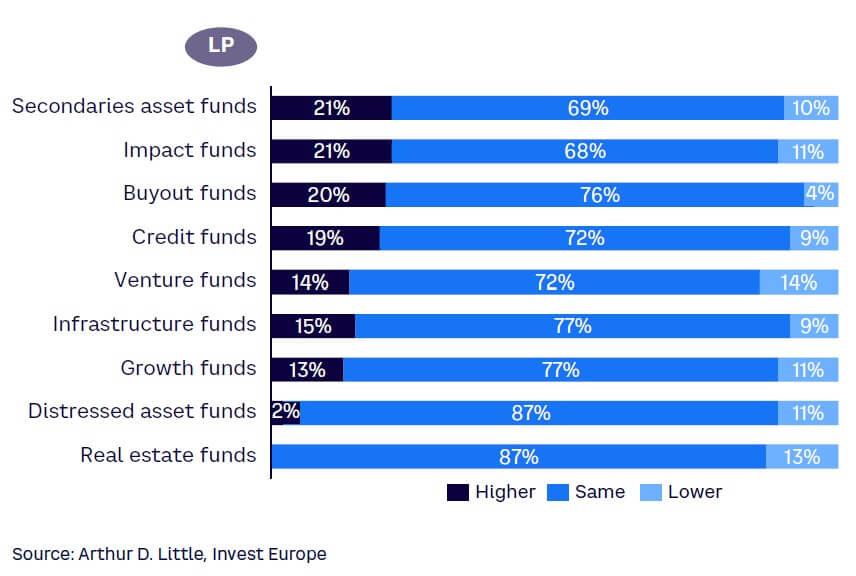

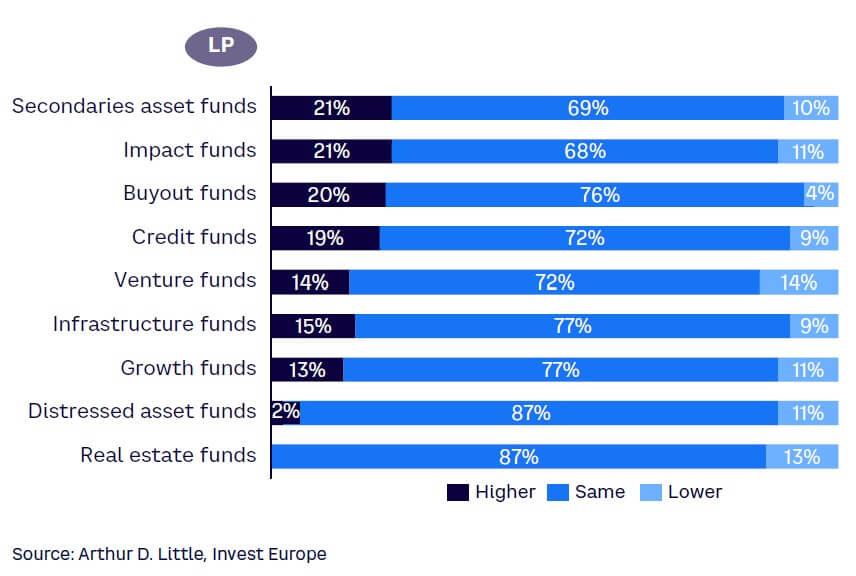

Investor appetite across all fund types remains consistent. Similar allocation levels are anticipated across secondaries, impact, buyouts, and credit, with around a fifth of respondents expecting to increase commitments to funds in those categories (see Figure 4). Although impact clearly remains an investment priority, the rush to commit to the segment appears to be cooling from last year, when 30% of LPs expected to allocate more.

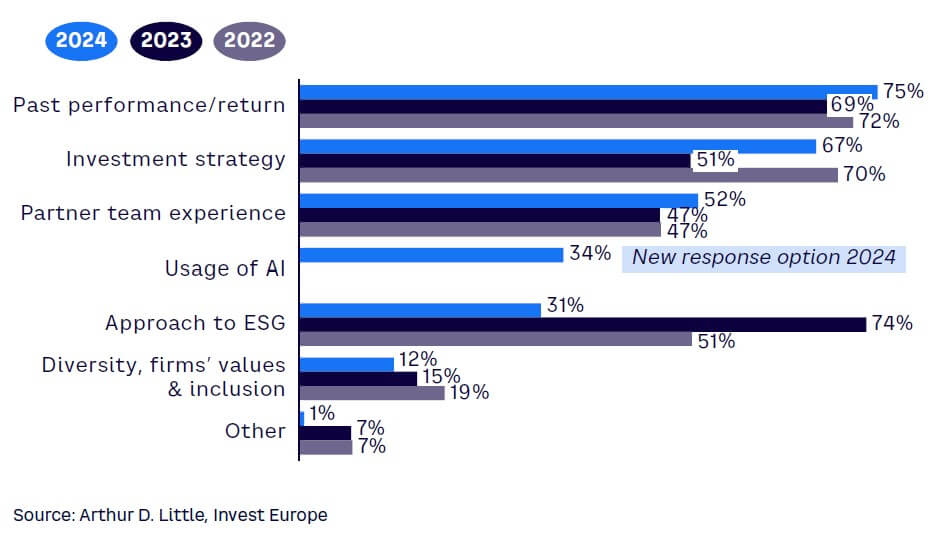

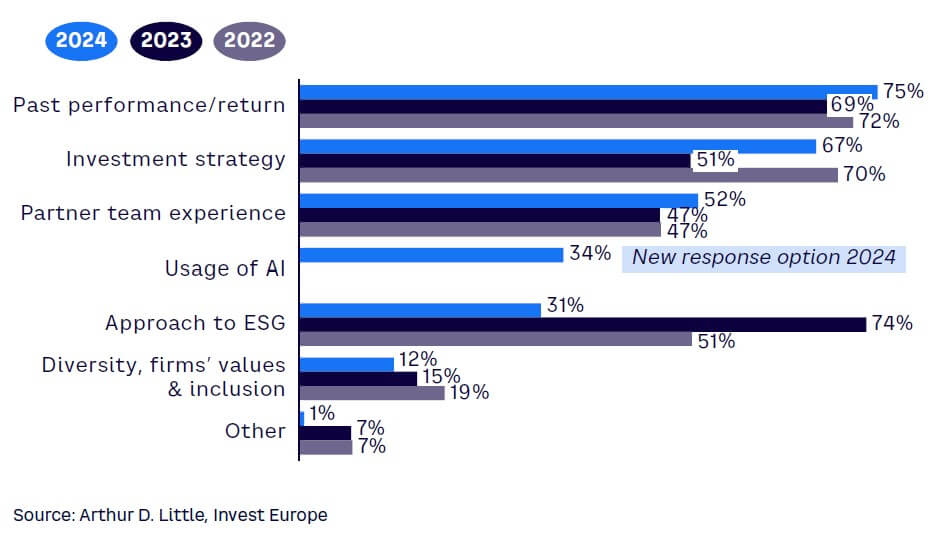

Past performance and returns continue to be the most important differentiating factor for managers in a competitive fundraising environment, cited by three-quarters of GPs (see Figure 5). The fund’s investment strategy is seen as another important differentiator, increasing in importance from last year, reflecting the development of sub-themes within increasingly established segments, such as secondaries and credit, as well as refinements of strategies within large segments such as buyouts.

About a third of GPs see use of AI as a differentiator, as many embrace the technology at portfolio companies and within their own operations, even as others arguably lag with their adoption. One of the most notable changes is the sharp decline in the relative importance of ESG as a differentiating factor — from three-quarters of respondents last year to just under a third this year. This is not necessarily a sign that ESG initiatives have fallen out of favor, but rather that strong ESG credentials have increasingly become the norm, and that both GPs and LPs now face growing EU sustainability regulatory requirements. This trend is a signpost to the future of AI, as its potential to make GPs stand out from the crowd increases before it ultimately becomes industry standard.

2

AS INVESTMENT PRESSURES PERSIST, SENTIMENT TURNS MORE POSITIVE

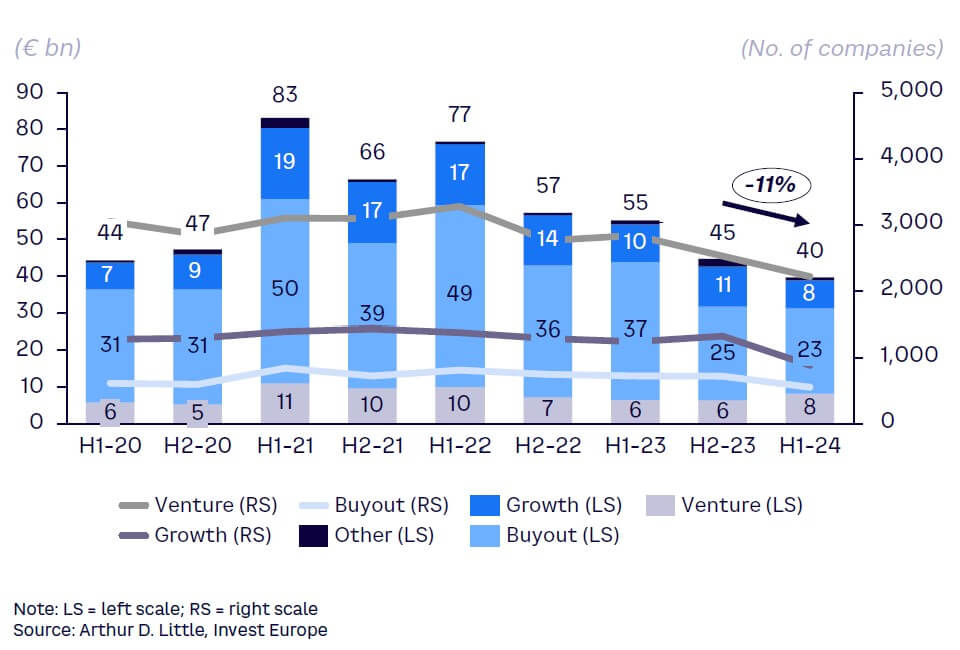

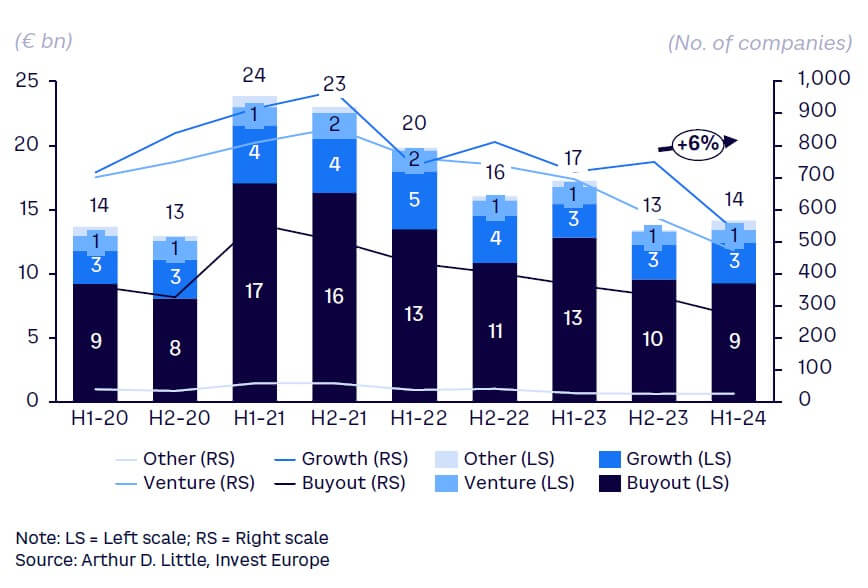

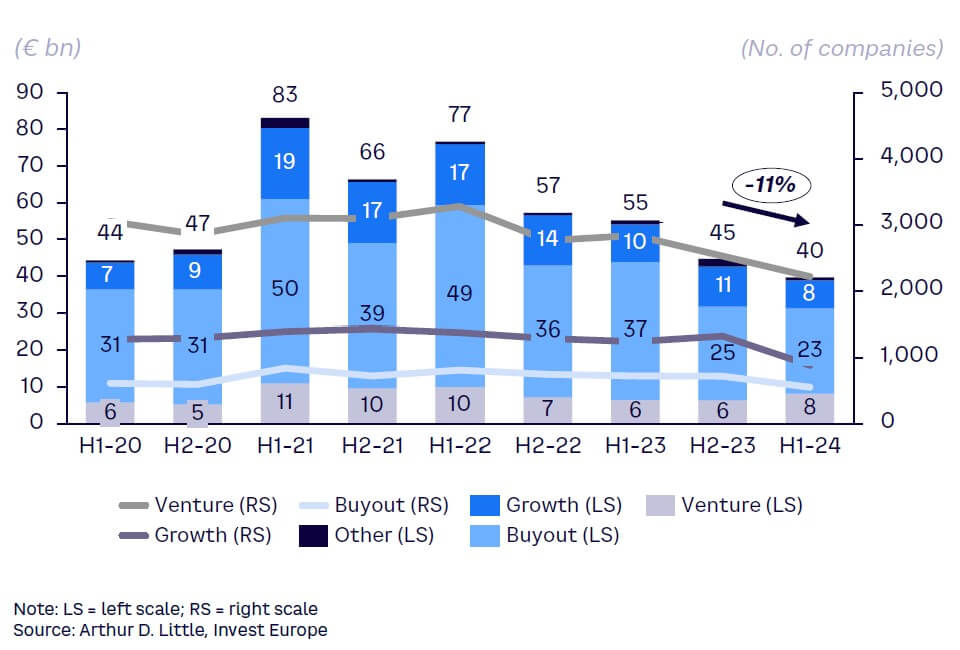

European PE investments continued to decline in the first half of 2024, down €5 billion (11%) to €40 billion compared with the second half of 2023 (see Figure 6). Growth investments continued to fall, while the rate of decline in buyouts softened more modestly, potentially pointing to a bottoming of deal activity, as the reduction in interest rates amid cooling inflation begins to provide greater certainty and availability of financing. Already turning a corner, VC investment picked up by 28% (€2 billion) fueled in part by investments in fields such as AI and deep tech.

Across segments, the number of deals declined. However, the average deal size is increasing slightly, indicating that GPs may focus more on larger transactions as they look to deploy their reserves of dry powder into more stable opportunities to compensate for higher risks.

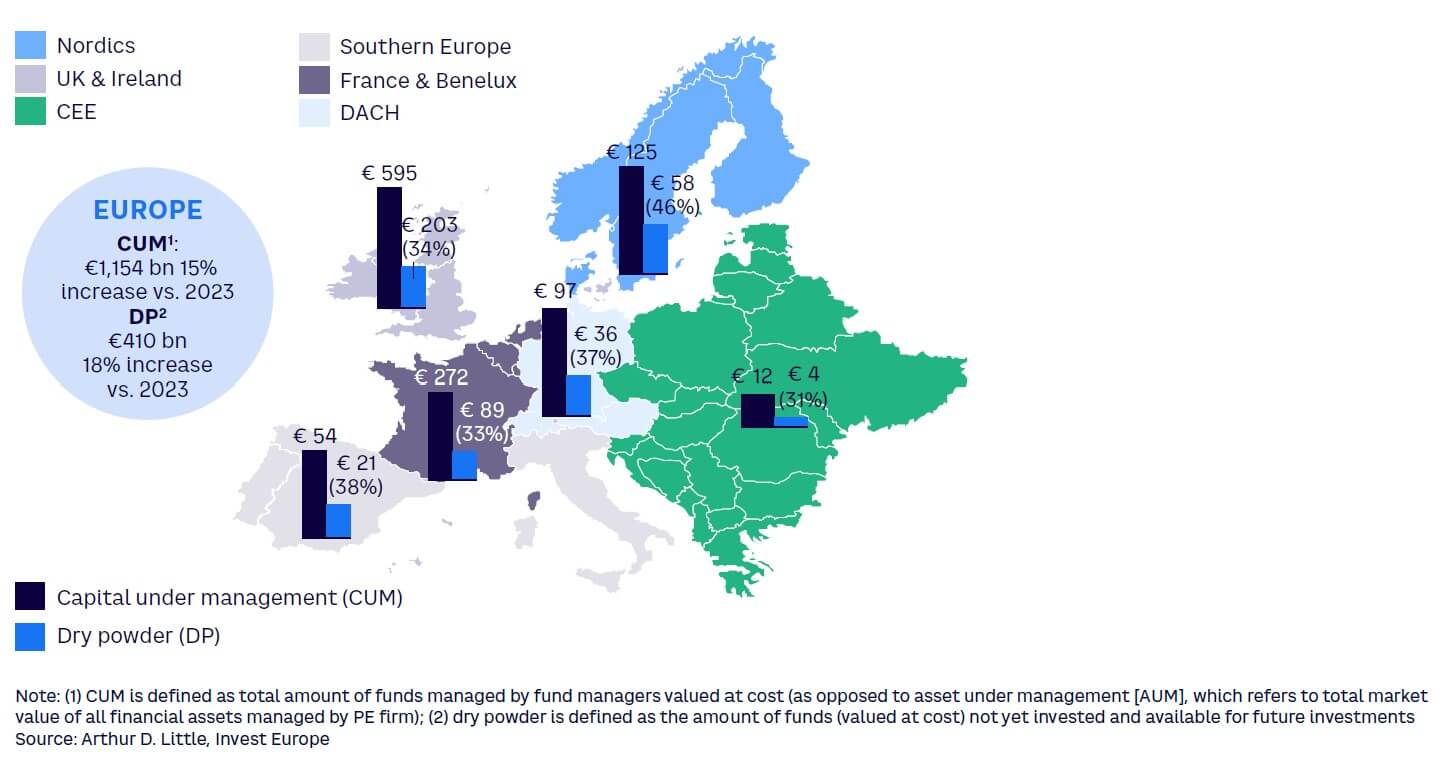

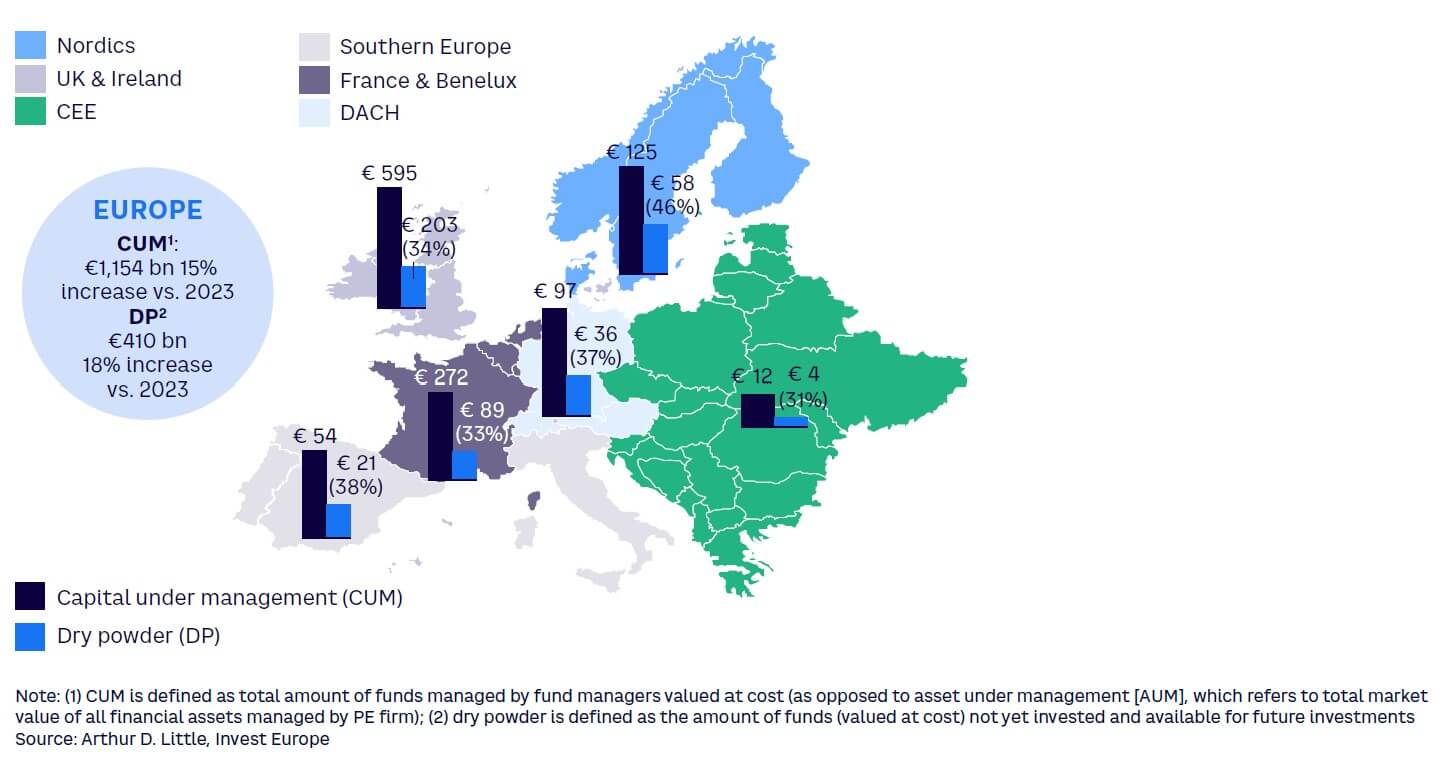

Overall capital under management and dry powder grew by 15% and 18%, respectively, in 2023, demonstrating the step-up in scale and reach of Europe’s PE industry (see Figure 7). Dry powder totaled €410 billion at the end of 2023. That equates to three to four years of investment capacity, slightly ahead of prior norms. However, as we saw during the immediate recovery from the pandemic, dealmaking can step up quickly and significantly across the board, including for mega-buyouts that can move the needle for overall investment totals.

Secondary buyouts are anticipated to be a major source of new deal flow in the coming 12 months, with more than two-thirds of respondents expecting activity to pick up (see Figure 8). Given increased LP pressure on incumbent PE owners to dispose of assets and return capital, the expected pickup is not surprising.

However, seller price (and return) expectations, as well as the return of other potential routes to liquidity, including dividend recapitalizations, may reduce the actual deal flow potential.

Primary transactions, spinoffs, and public-to-private deals are also expected to offer the same or better investment potential as the past year.

![AUM], which refers to total market value of all financial assets managed by PE firm); (2) dry powder is defined a](/sites/default/files/inline-images/Figure%208%20State%20of%20European%20private%20equity%202024_0.jpg)

3

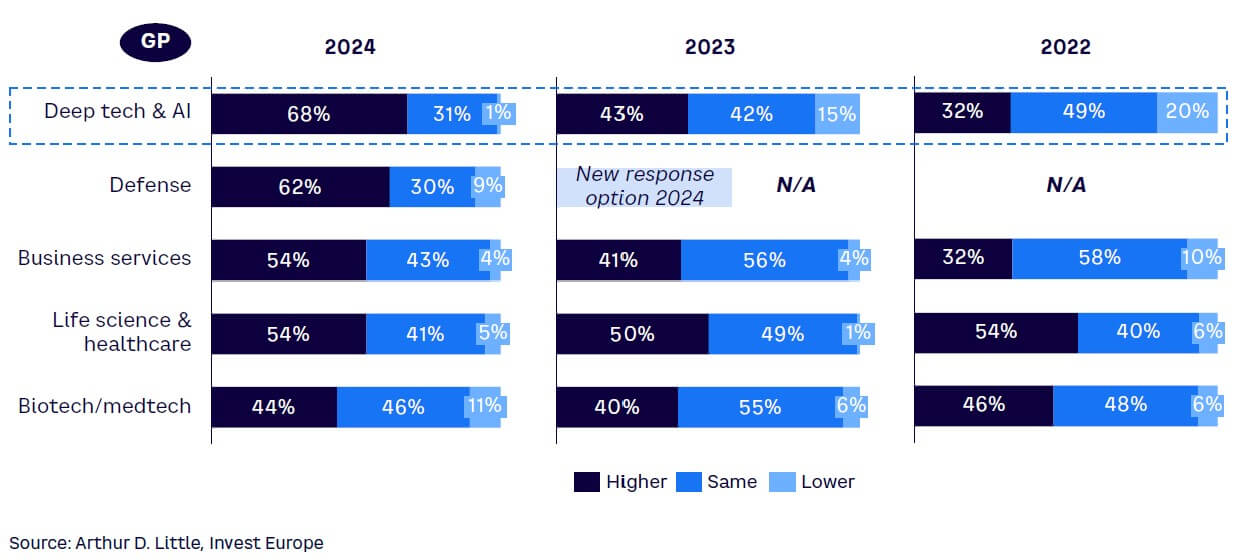

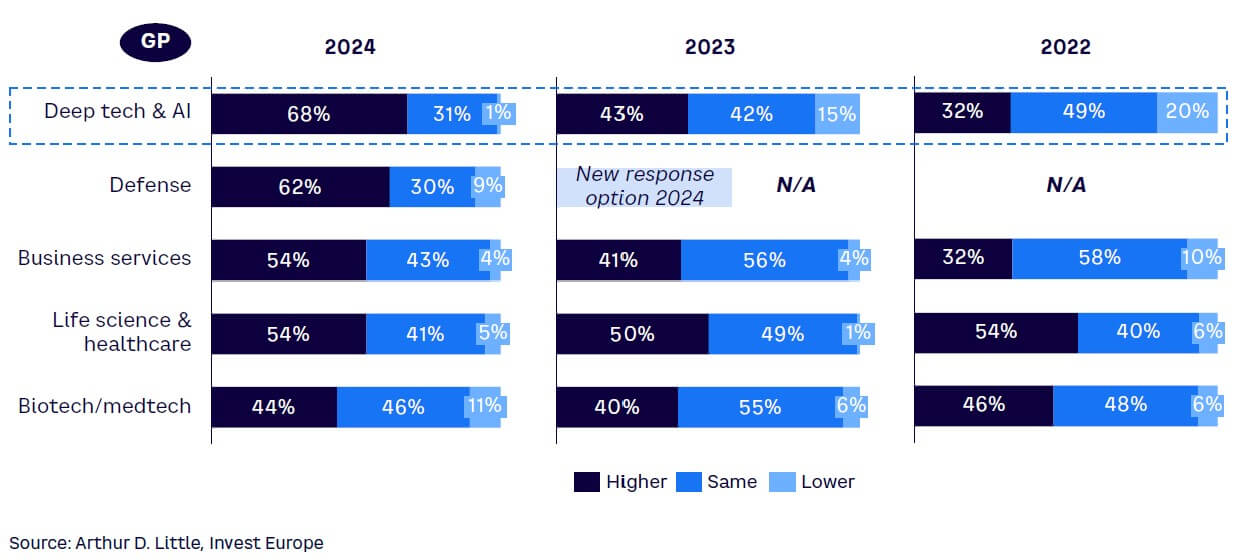

AI & DEFENSE MOVE UP GP TARGET LISTS, RENEWABLES DROP DOWN

Advances in technology and the uncertain geopolitical landscape are exerting influence on the sectors that GPs view as most attractive. Deep tech and AI has moved up and now leads the list of target sectors, favored by more than two-thirds of GPs (see Figure 9). It is closely followed by defense (a new entry), as ongoing international conflicts and geopolitical tensions drive government spending in the sector, with a particular focus on technologies that can serve both civilian and military applications. Life sciences and other health or medical investments remain in focus but are less important as the legacy of COVID-19 diminishes.

Deep tech/AI and business services have both gained more attention over the past two years. This is likely a reflection of a growing demand for technology and services that can boost productivity and efficiency, as well as GPs’ focus on emerging technologies that may deliver strong growth and high returns. It is also notable that the renewables sector has dropped out of the top five.

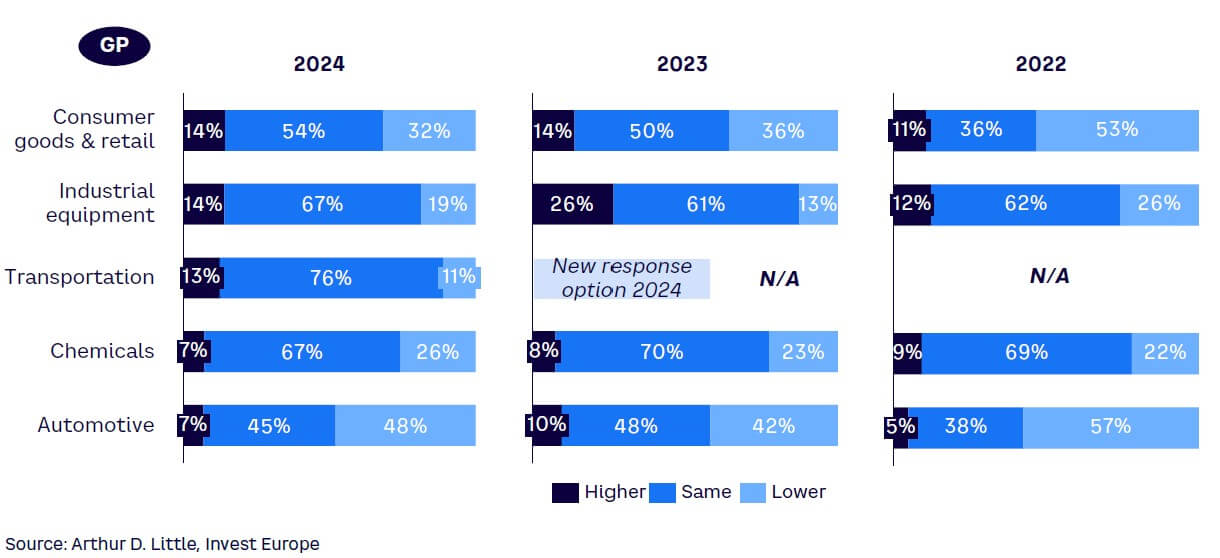

At the other end of the spectrum, industrial and manufacturing industries, as well as those tied to squeezed consumer spending, remain relatively low on GP investment-priority lists. Only a small number of managers see greater investment in any sector in the bottom five, in most cases well behind the proportion that anticipate less investment.

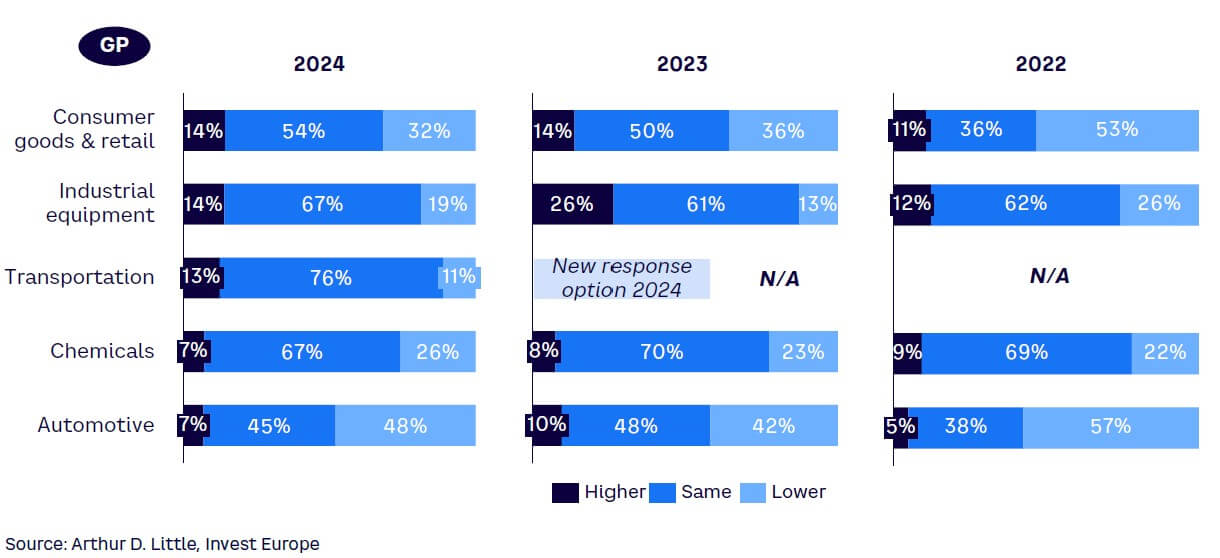

Roughly half of GPs envisage less investment in the automotive sector, and around a third expect less investment in consumer goods and retail, a much higher proportion than the 14% who see more activity in the space (see Figure 10). Transportation is a new entry into the bottom five, so it’s not a surprise that only 13% expect increased investment, although over three-quarters expect the same levels of deployment as last year and only about one in 10 expect a decrease.

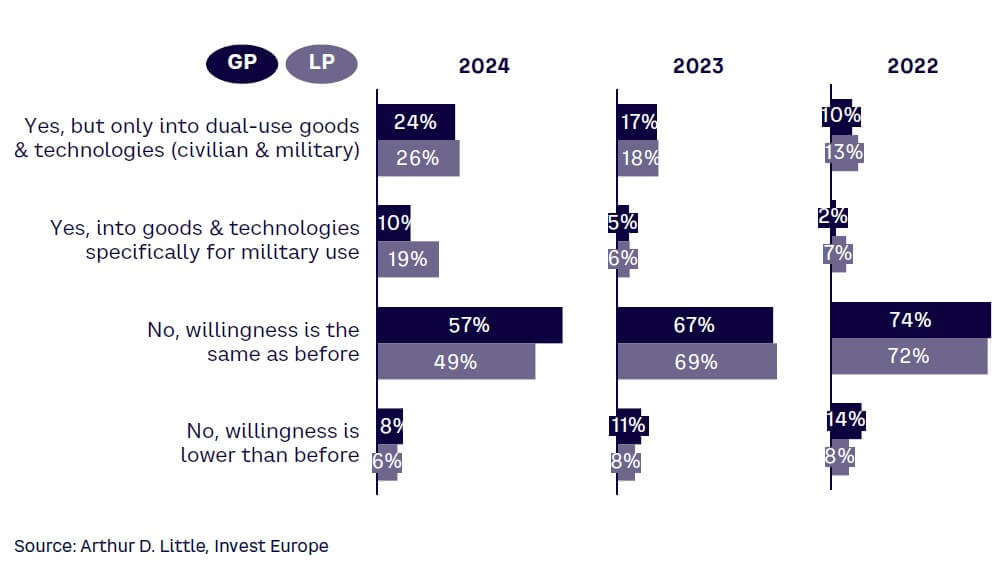

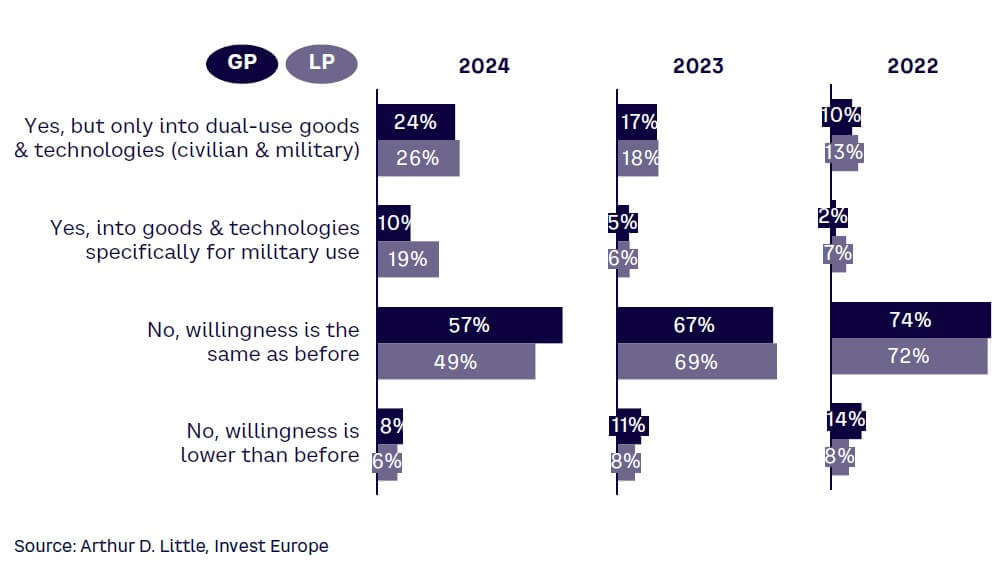

Although the largest proportion of GPs and LPs still express no change in willingness to invest in defense or military investments, there is a clear, steady shift in sentiment. This is most likely driven by an escalation of international conflicts and increased geopolitical tensions, most notably within Europe’s neighborhood (see Figure 11). About a quarter of GPs and LPs have seen increased willingness to invest in technology that has both military and civilian applications, up from about a tenth two years ago. However, challenges remain. The defense industry is often opaque due to national security concerns. Additionally, many defense projects do not align with ESG criteria, which are important to investors and can negatively influence investment decisions.

There has been a marked increase in acceptance of investment in military-only goods and technologies. This is particularly notable among LPs, with one in five now seeing increased willingness to back military-only investments, a three-fold increase over last year. This demonstrates how investor approaches to ESG have evolved and how the narrative around defense has shifted from one of aggression to one of protection.

4

DIVESTMENT ROUTES CHANGING AS EXIT ACTIVITY & CONFIDENCE INCREASE

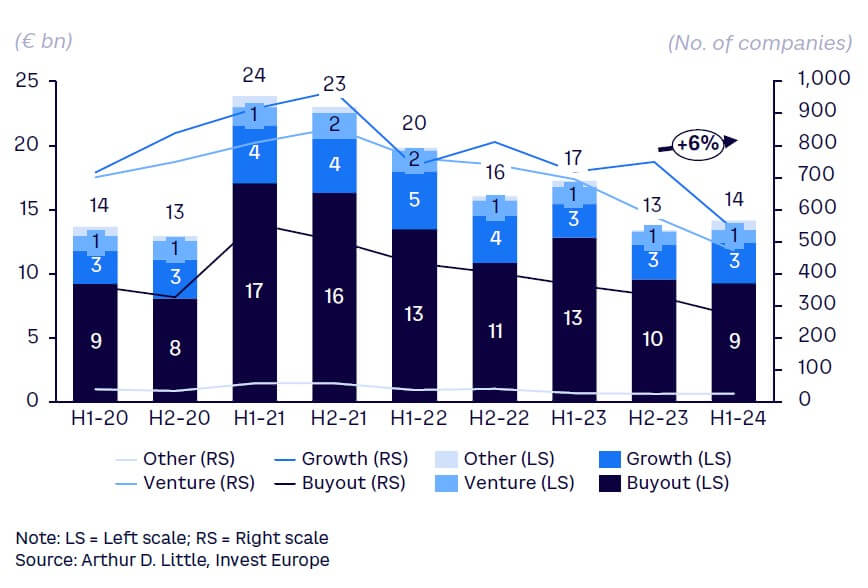

Divestment activity in the first half of 2024 highlighted some green shoots returning to the market, as well as ongoing challenges. Divestments (at cost) recovered by 6% to €14 billion from the second half of 2023, although exits declined by 22% (see Figure 12). Most likely, larger companies are achieving exits, due to trend toward larger but fewer PE investments.

Markets are signaling that exits are highly dependent on valuations, and valuations are highly dependent on asset quality. In other words, improving market conditions are enabling PE firms to exit investments that have performed strongly through the period of high inflation and interest rates. However, many exit processes continue to be interrupted or delayed by market volatility, with managers opting to hold assets for longer until markets recover more broadly.

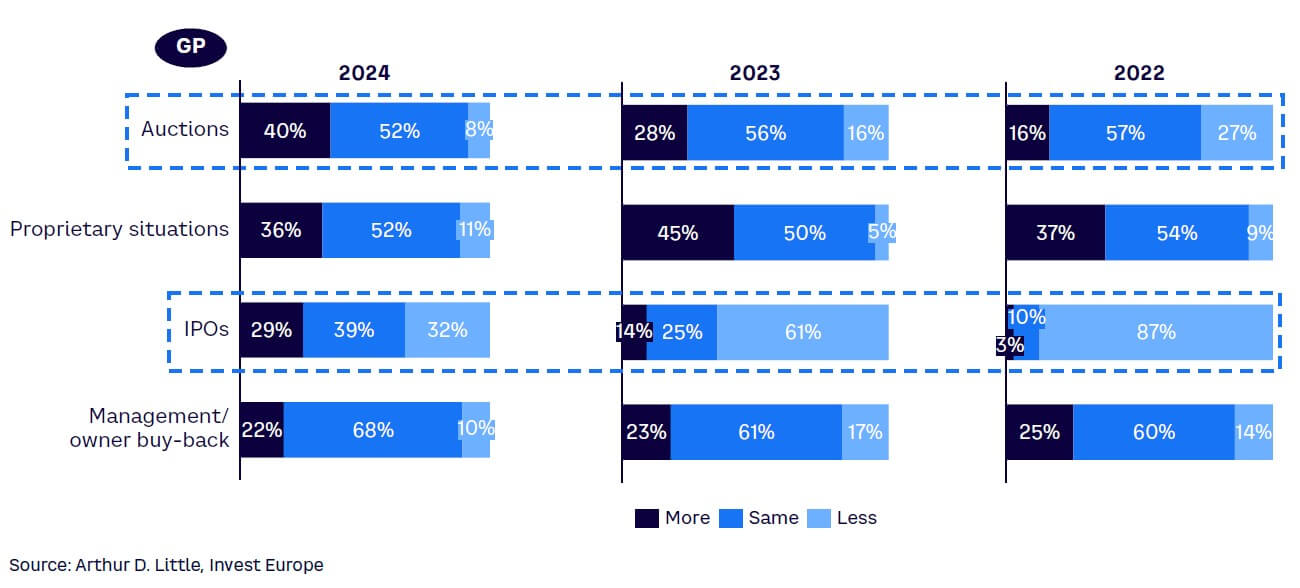

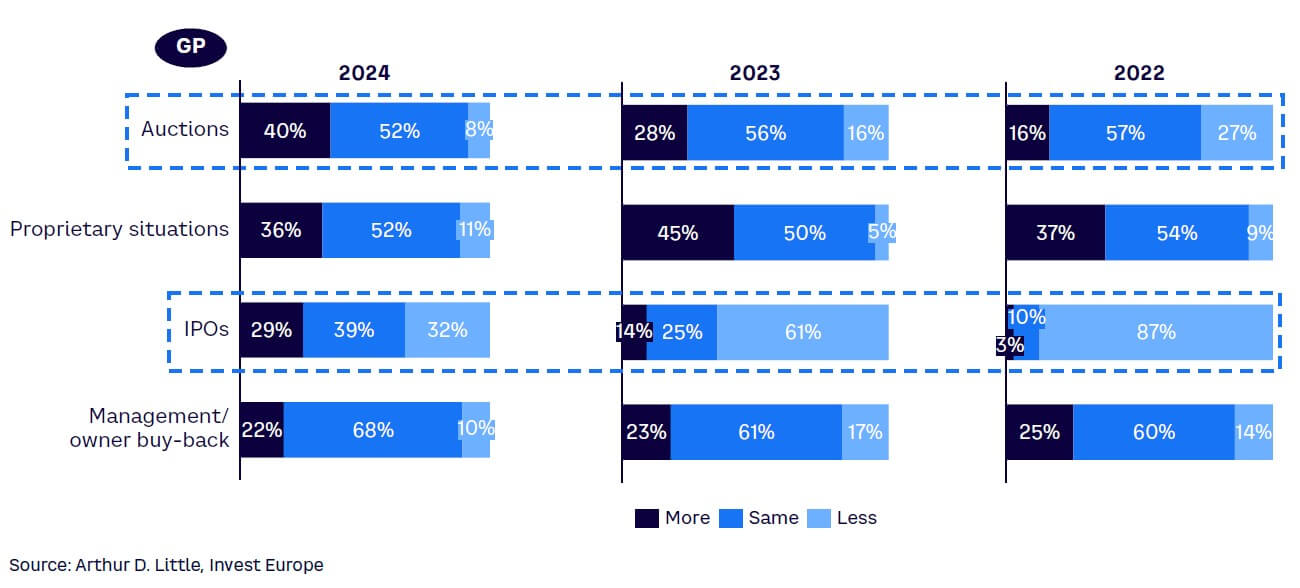

Expectations around exits appear to be improving, driven in part by improving confidence and reopening markets, as well as the ever-pressing need to return capital to LPs. Auctions are expected to increase, with 40% of GPs seeing better exit potential via intermediated processes to PE peers and cash-rich strategics (see Figure 13). More notable is the expected recovery of IPOs following some positive results for new European listings in the first half of 2024. Almost three in 10 GPs expect more IPOs, compared with three in 100 just two years ago.

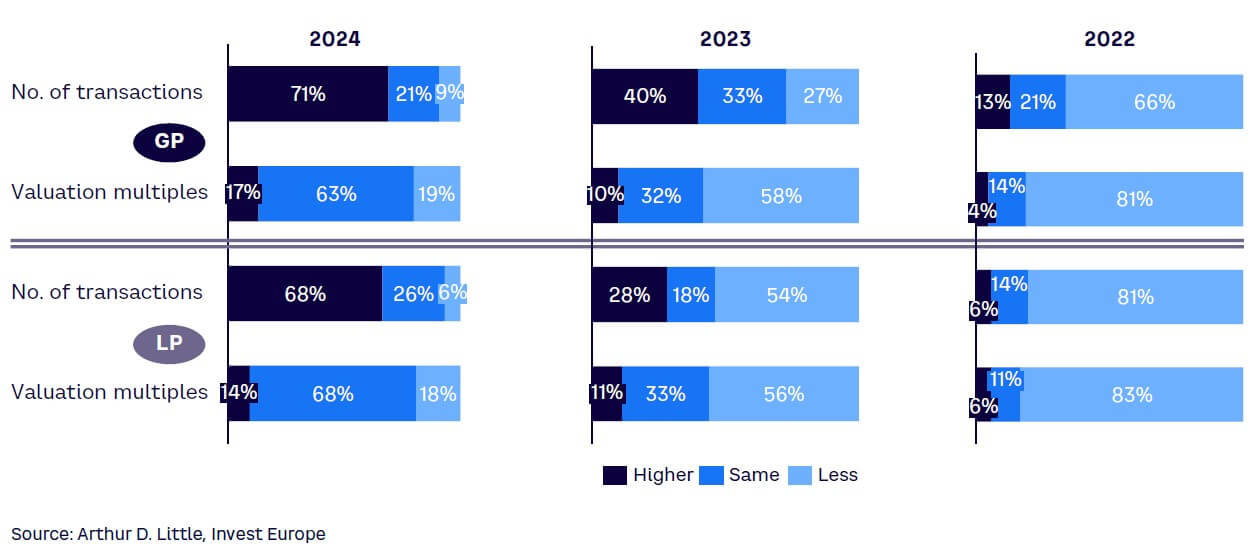

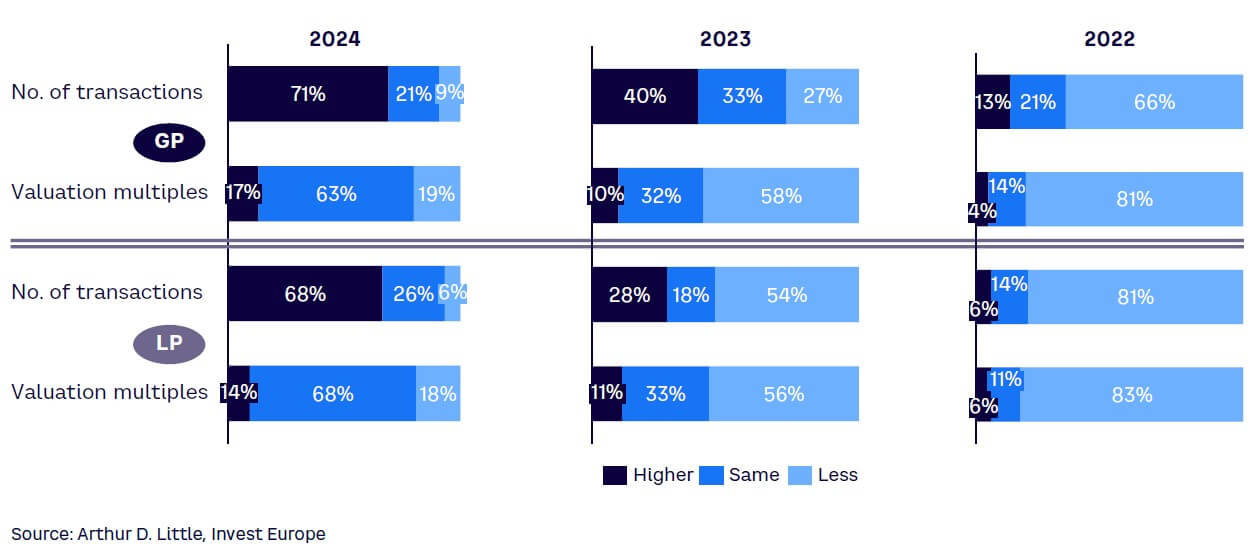

Well over two-thirds of GPs and LPs anticipate more transactions over the 12 coming months compared with much lower expectations two years ago, when supply chain shocks, rising inflation, and interest rates were a larger concern (see Figure 14).

Similarly, though to a lesser extent, much higher numbers of GPs and LPs see increased valuation levels for assets as interest rates decline and financing availability improves. Valuations will also be driven by company performance and improving public market comparables, with the MSCI Europe benchmark up some 8% for 2024 by the end of the third quarter — more than 30% from its mid-2022 lows.

“We expect divestments to increase gradually over the next six to 12 months, as a large part of our invested funds are overdue or at the end of their time commitment.”

Frank Amberg, Managing Director, Head of Infrastructure Germany, AltamarCAM Partners

5

EXITS BECOME THE PRIORITY FOR PE, AI DOMINATES NEW WORKING PRACTICES

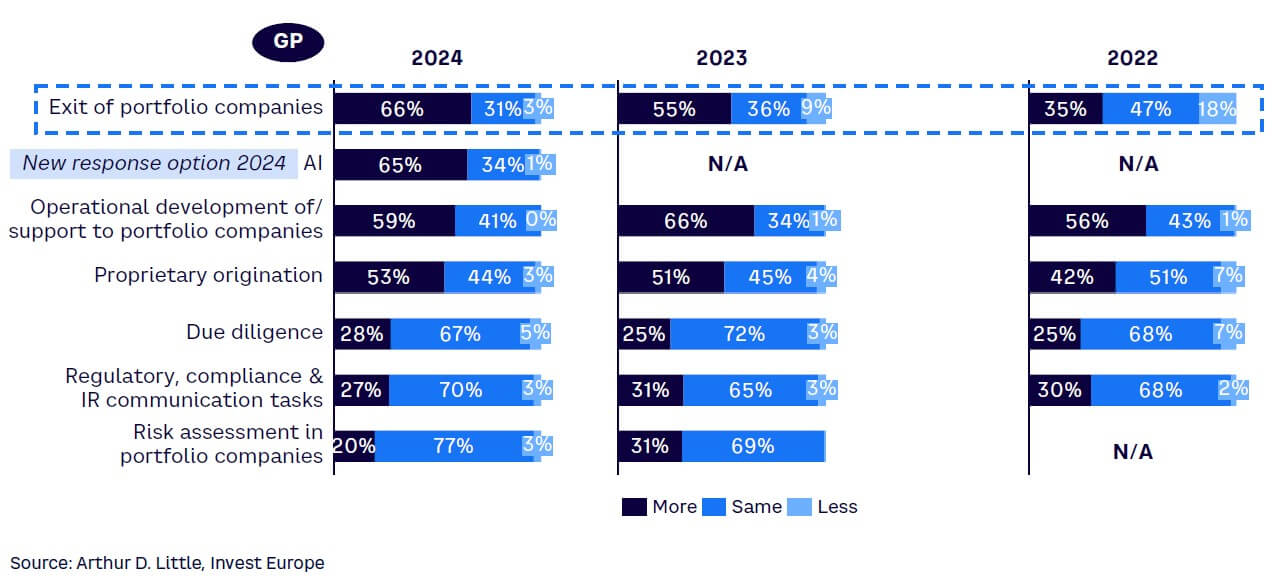

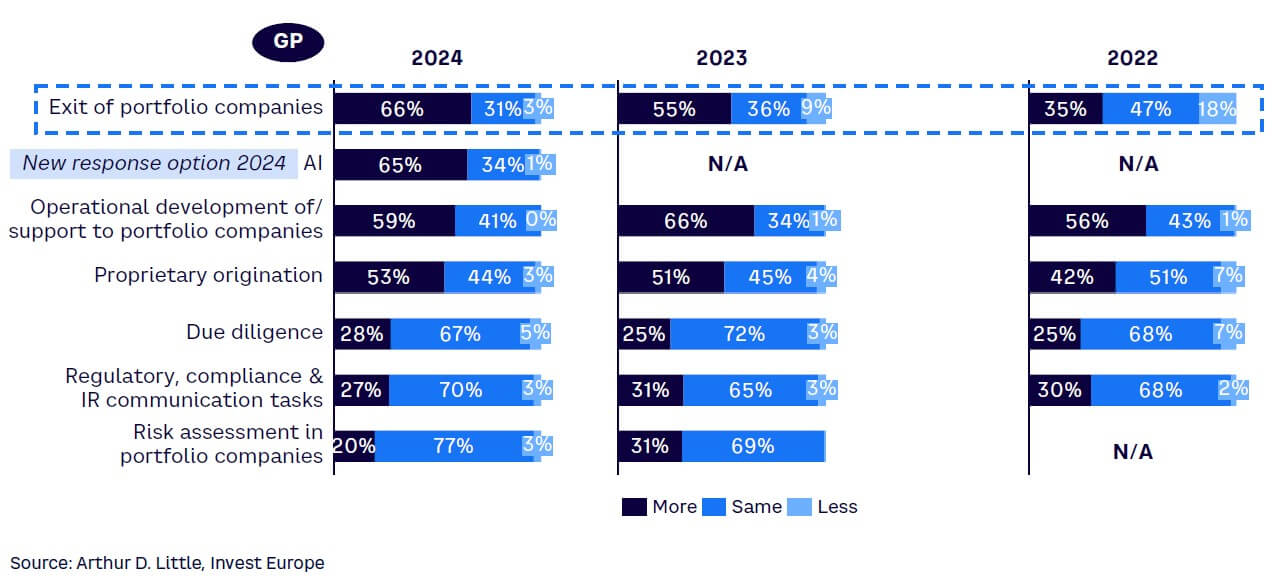

Exiting portfolio companies has become the most important future activity for PEs. Two-thirds of GPs expect it to be the main focus of their teams over the next 12 months, a sharp rise from just a third two years ago (see Figure 15). Although returning capital to investors is seen as a pressing priority, most GPs are still focused on activities that can further boost their portfolio companies. Some 59% see operational development and support of their businesses as a main focus, while 65% view AI as a key area of activity.

Risk assessment at portfolio companies ranks at the bottom of the list of priorities, reflecting the expected easing of interest rates and inflation, and some degree of comfort with company performance through the volatile market conditions of the last two years.

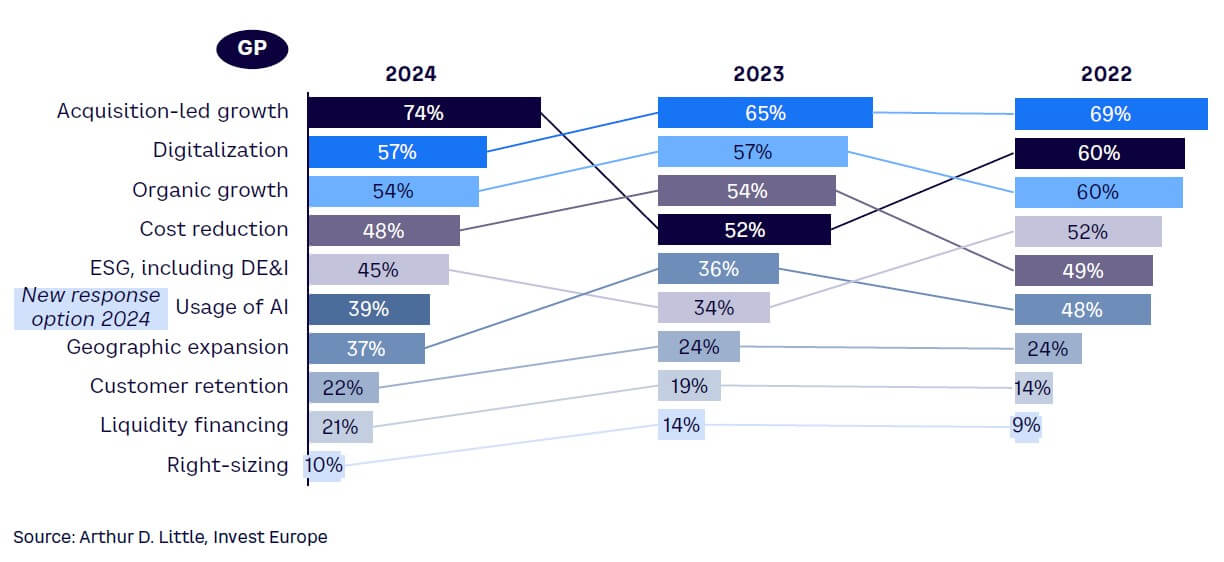

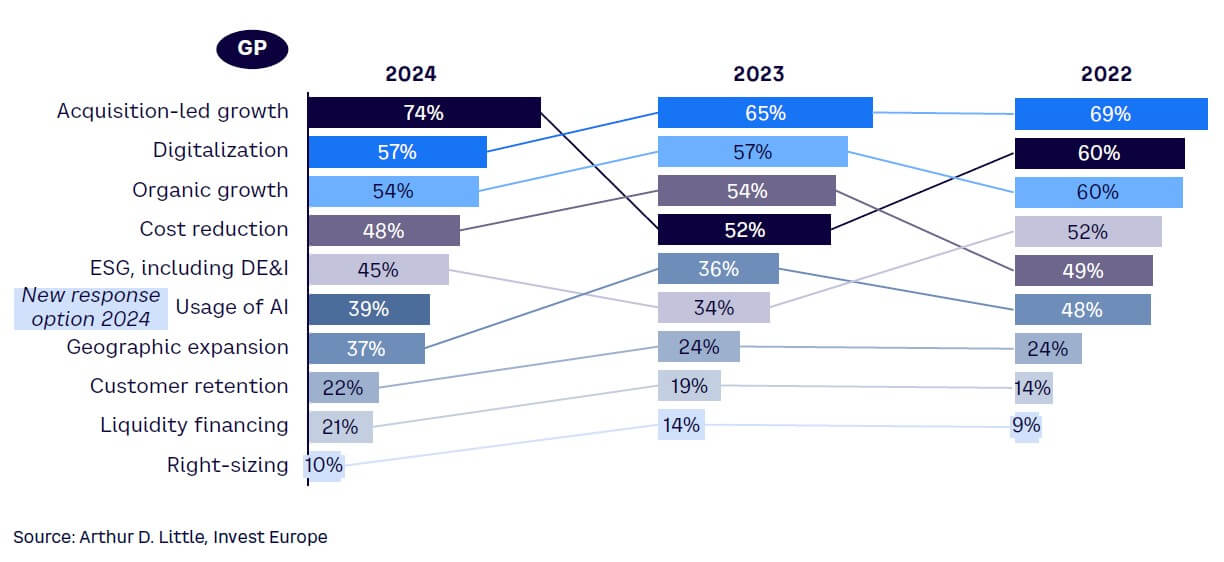

At the portfolio level, measures to drive growth against an improving market backdrop are clearly the highest priority, with acquisition-led expansion the most important initiative, selected by around three-quarters of GPs (see Figure 16).

Digitalization remains an important focus as firms continue to incorporate technologies such as big data analytics and cloud infrastructure. However, it is steadily declining in importance, underlining that this is a one-off operational lever that will become less relevant over time as more companies adopt the technology.

AI usage is a new initiative cited by a large minority (39%) of GPs. Given their expectations and current exploration of potential AI uses across firms, this is likely to become a more important initiative for GPs at portfolio companies.

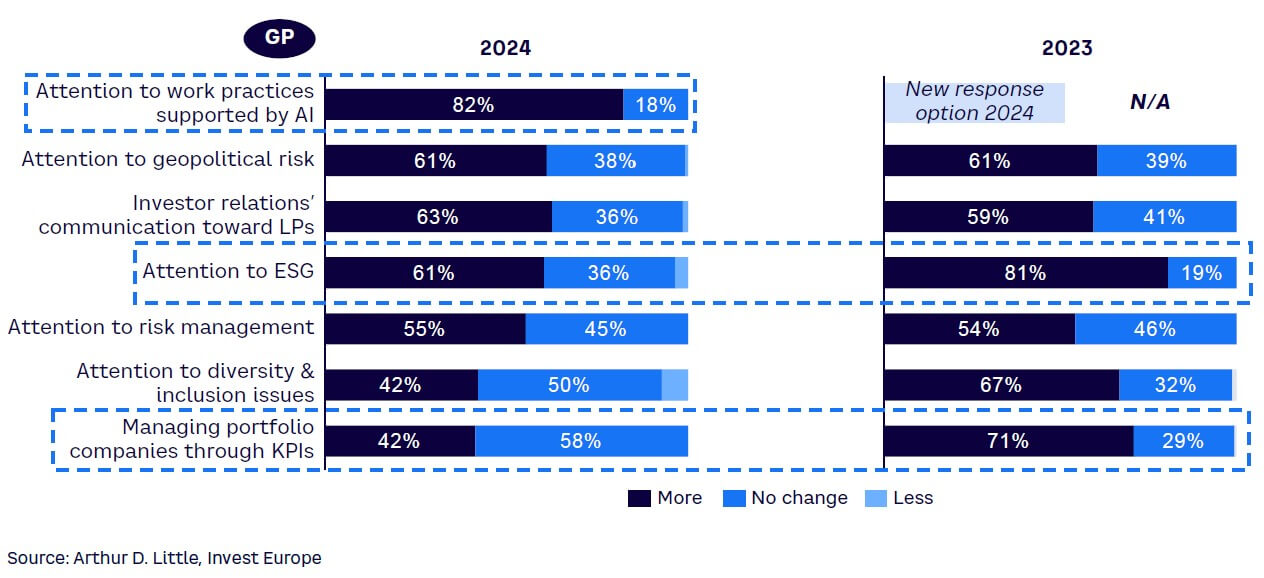

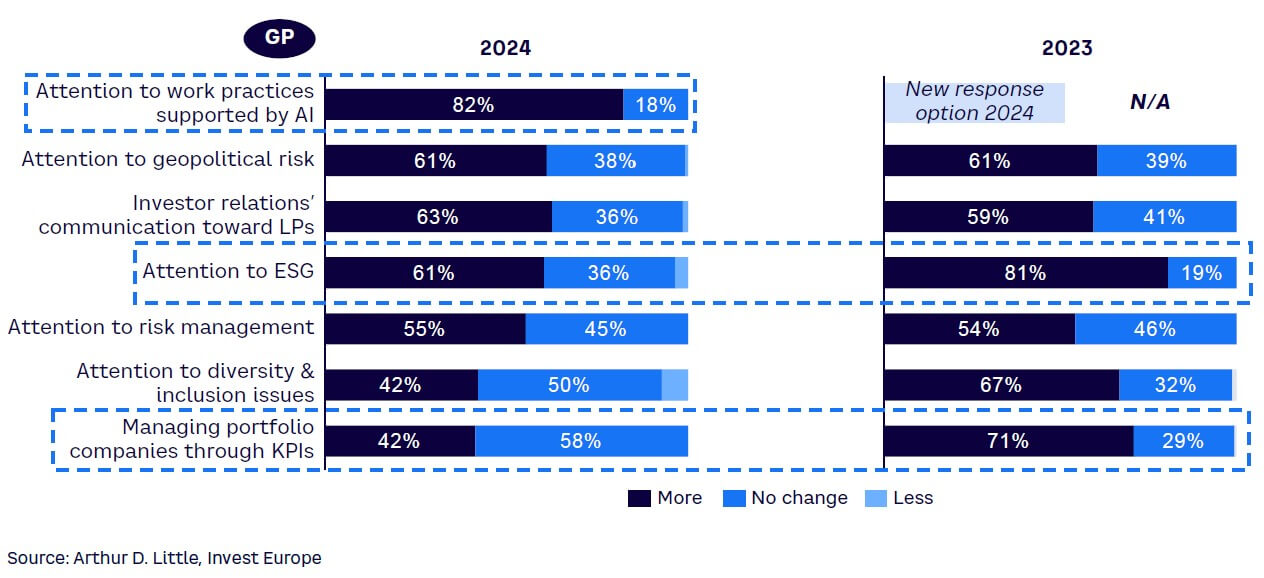

When looking at expected future focuses, we see that more than 80% of firms, including those that have not yet adopted AI, are eyeing its potential (see Figure 17). More than eight in 10 respondents believe the technology will have an impact on their operations in the near future, signaling the likelihood that most managers will incorporate AI into areas such as deal origination, due diligence, or reporting. Other issues driven by current trends include geopolitical risk, cited by over 60% of GPs. Investor relations toward LPs are also expected to have an impact by the majority of GPs, reflecting ongoing challenges in the exit and fundraising markets.

Although still important to a large numbers of GPs, attention to ESG, diversity and inclusion, and managing portfolio companies through KPIs have declined in importance since last year.

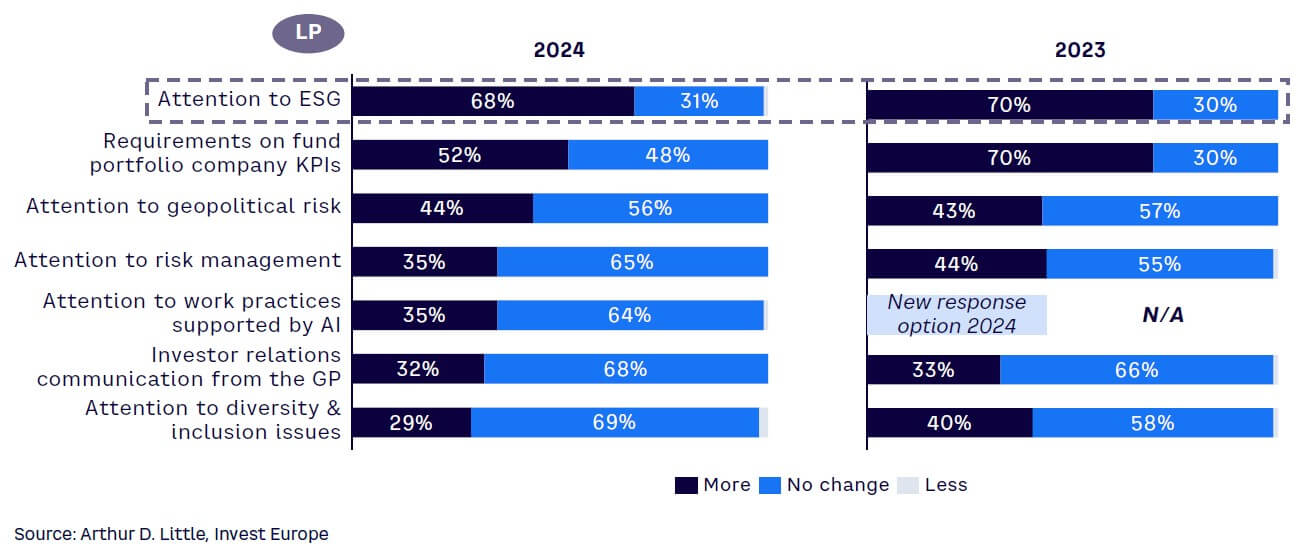

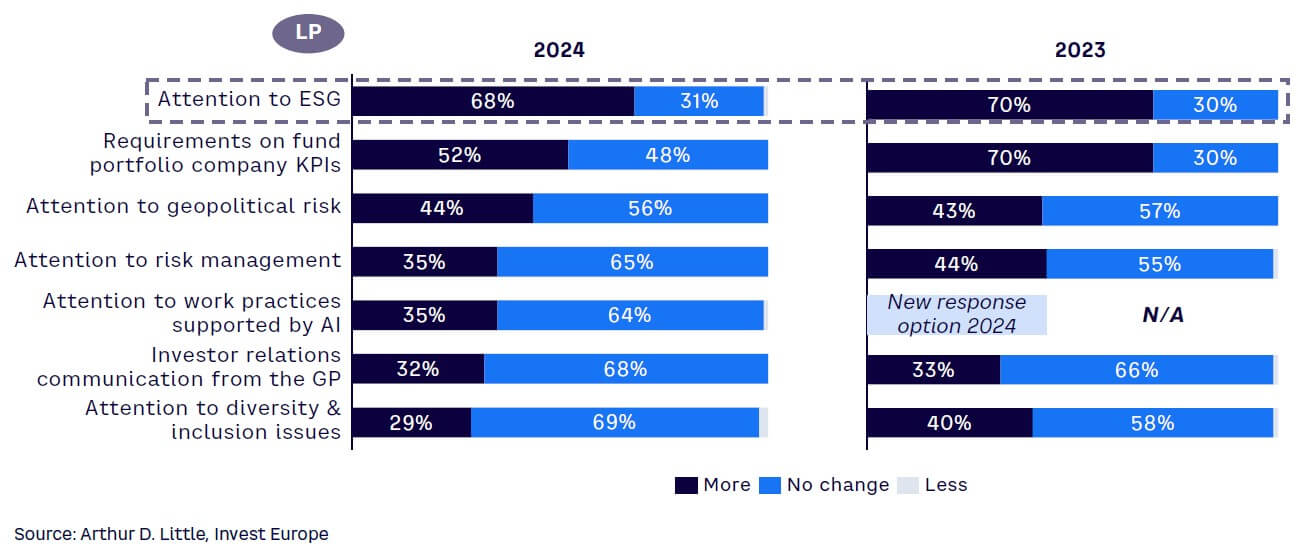

This may be a signal that, as a result of investor demand and regulation, many GPs have already adopted new approaches and standards on these issues and that best practices are increasingly ingrained industrywide. Investors continue to see attention to ESG issues as the most important factor for PE in the near future, cited by more than two-thirds of LPs (see Figure 18). Although this is significantly higher than for GPs, it reflects the perspective of LPs who back a number of firms and may still need to work with a diminishing number of GPs who have yet to fully embrace ESG best practices.

Conversely, attention to work practices supported by AI is of lower importance — and relevance — to many investors, demonstrating how adoption of the technology is more of an internal factor for GPs seeking efficiency and an edge in investment processes than one with significant impact on LP-facing activities.

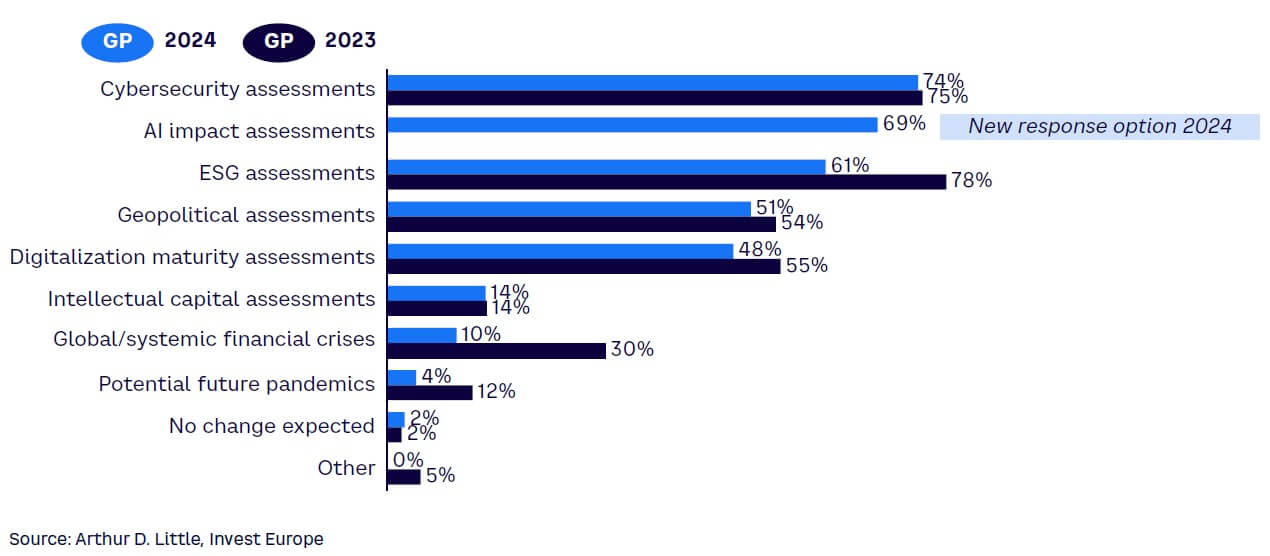

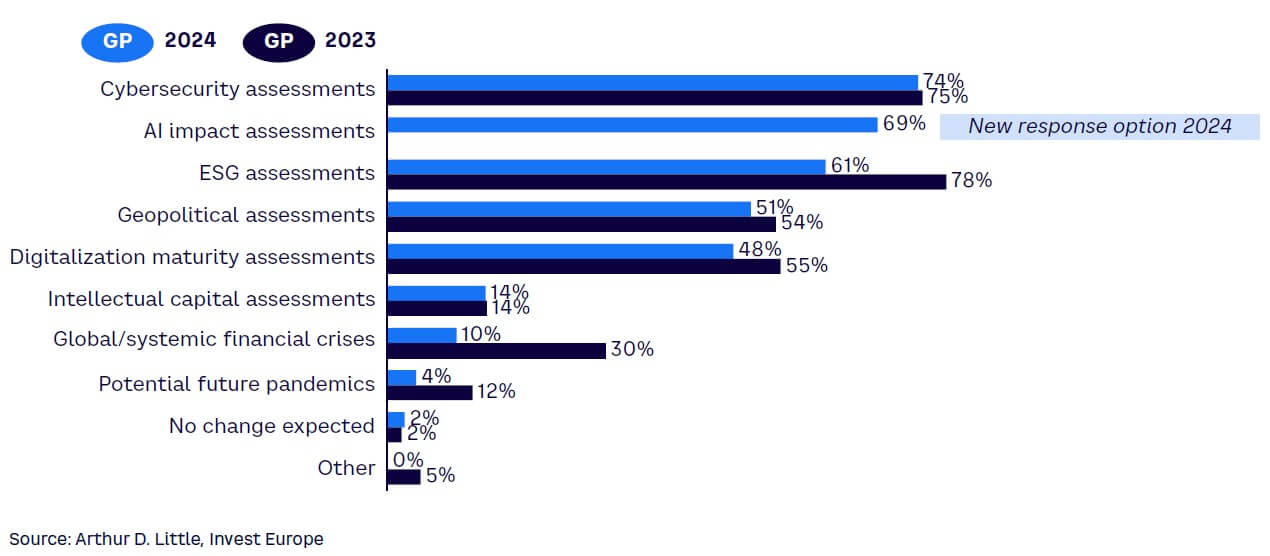

Cyber threats remain the largest issue for GPs, with about three-quarters expecting cybersecurity assessments to influence their future due diligence processes (see Figure 19). AI assessments have entered high on the list, with almost 70% expecting increased due diligence as GPs come to grips with the opportunities and risks posed by the technology.

Almost two-thirds of GPs expect ESG to remain an area of increased focus, despite it being the top priority for managers last year. Again, this does not necessarily mean ESG has become less important compared to other issues or previous years. Rather, it suggests that more GPs now see ESG as an integral part of their due diligence or feel their ESG due diligence processes are up to standard, aided by best practice resources such as Invest Europe’s GP ESG Due Diligence Guide, which includes a comprehensive ESG Due Diligence Questionnaire.

The risks posed by financial crises and pandemics are also expected to be less of a focus for the vast majority. Geopolitical assessments, in contrast, are expected to continue to receive increased due diligence attention from more than half of GPs, as the effects of international conflicts continue to ripple through markets.

6

SUSTAINABILITY REGULATION HAS SIGNIFICANT IMPACT ON FUNDS & REQUIRES RESOURCES

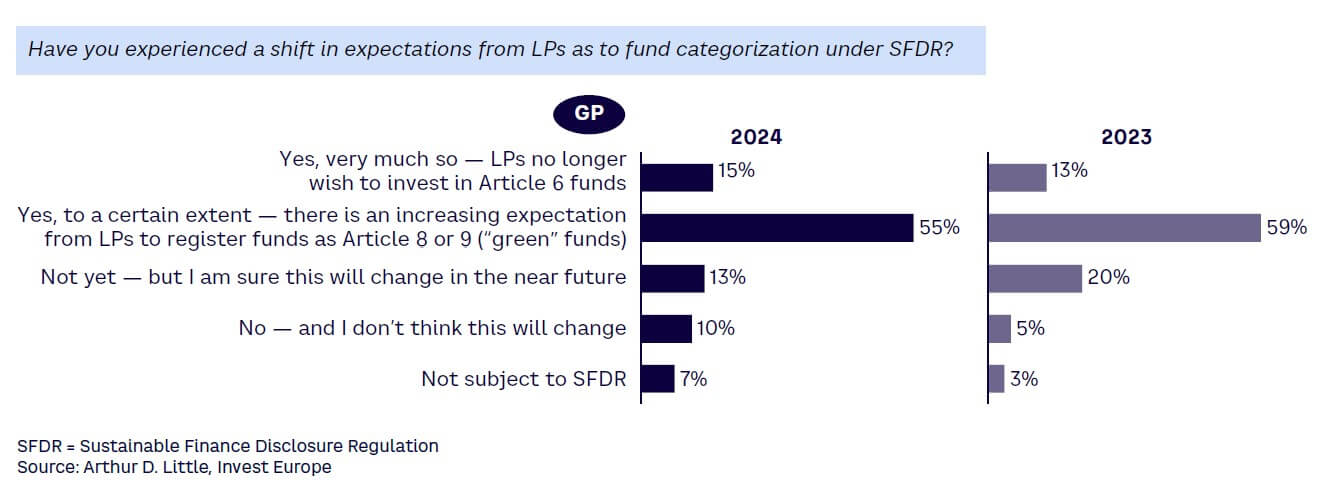

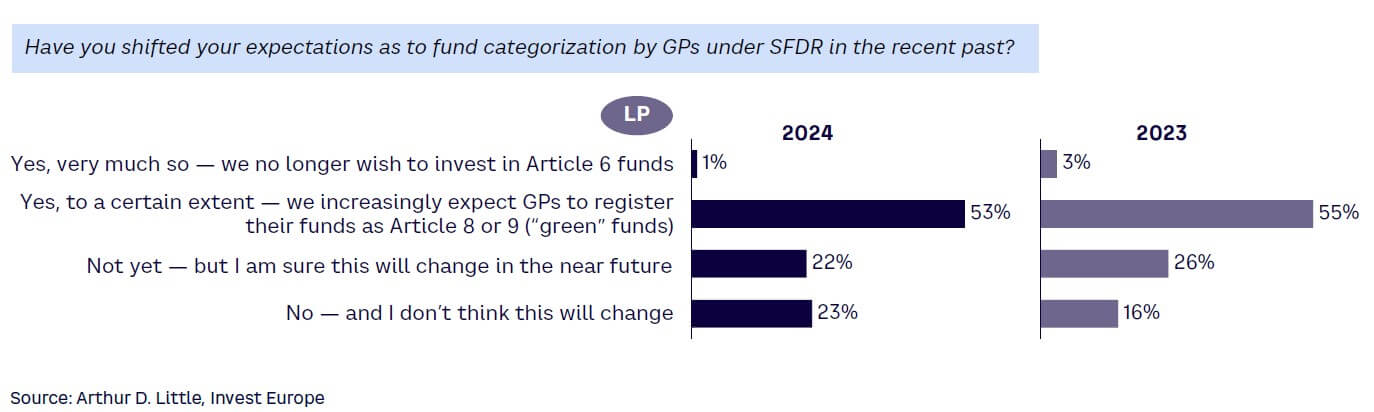

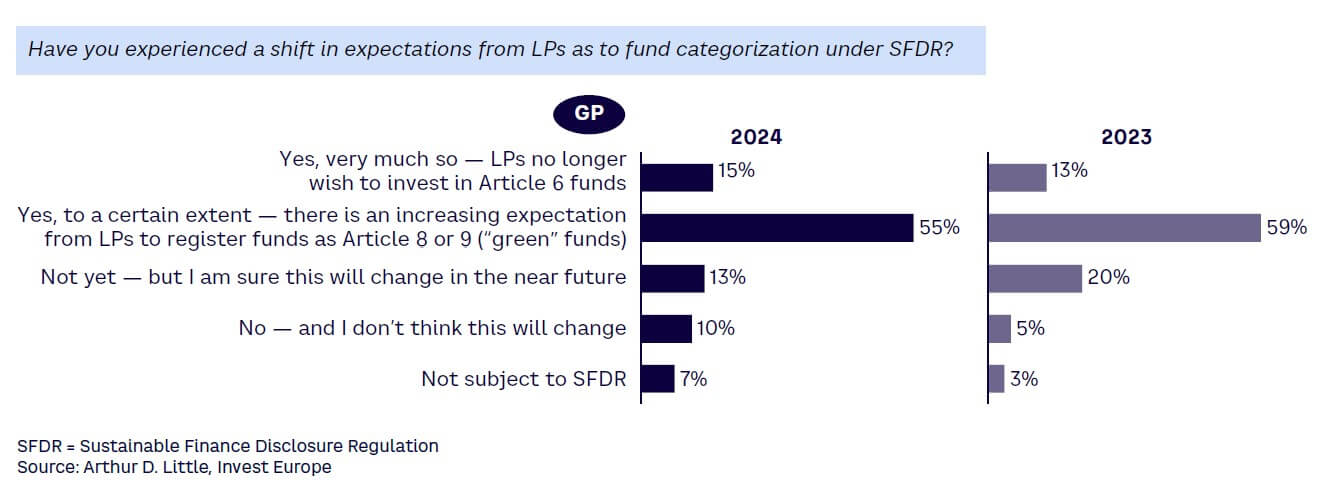

The majority of GPs expect the EU’s Sustainable Finance Disclosure Regulation (SFDR) to continue to shape fund focus and categorization (see Figure 20). An important minority perceive that LPs no longer want to invest in Article 6 funds that have less of a sustainability focus, and another 55% and 13%, respectively, perceive that LPs require or will require funds to comply with Article 8 or Article 9 rules, effectively meaning that 83% of GPs perceive they need to have a strong focus on ESG objectives or position themselves as “impact” funds.

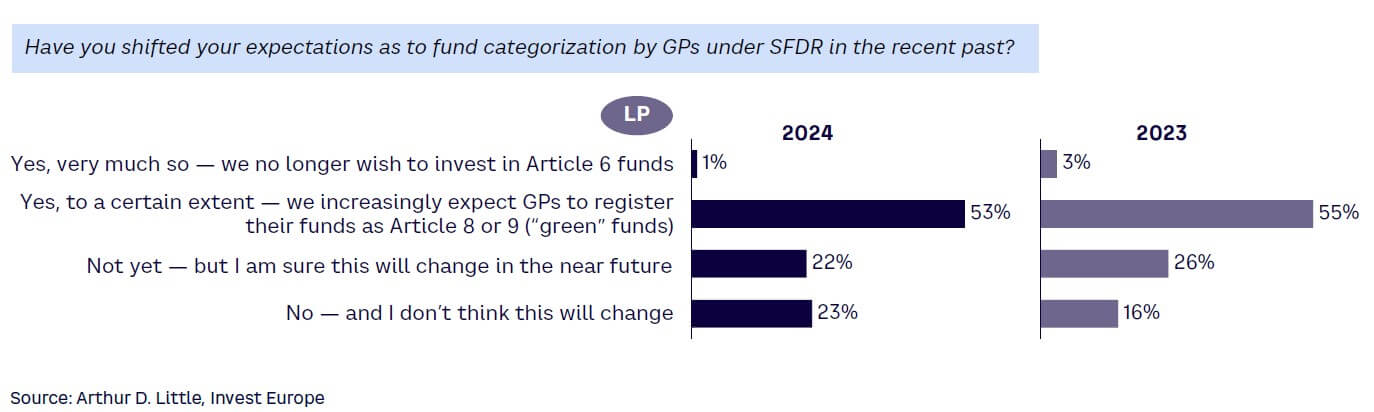

LP views on the impact of SFDR are slightly less progressive than those of GPs (see Figure 21). Only 1% say they no longer want to invest in Article 6 funds, and more than half (53% and 22%, respectively) expect GPs to register their funds as Article 8 or Article 9 now or in the near future. Still, around a quarter of LPs expect no change in fund categorization among GPs.

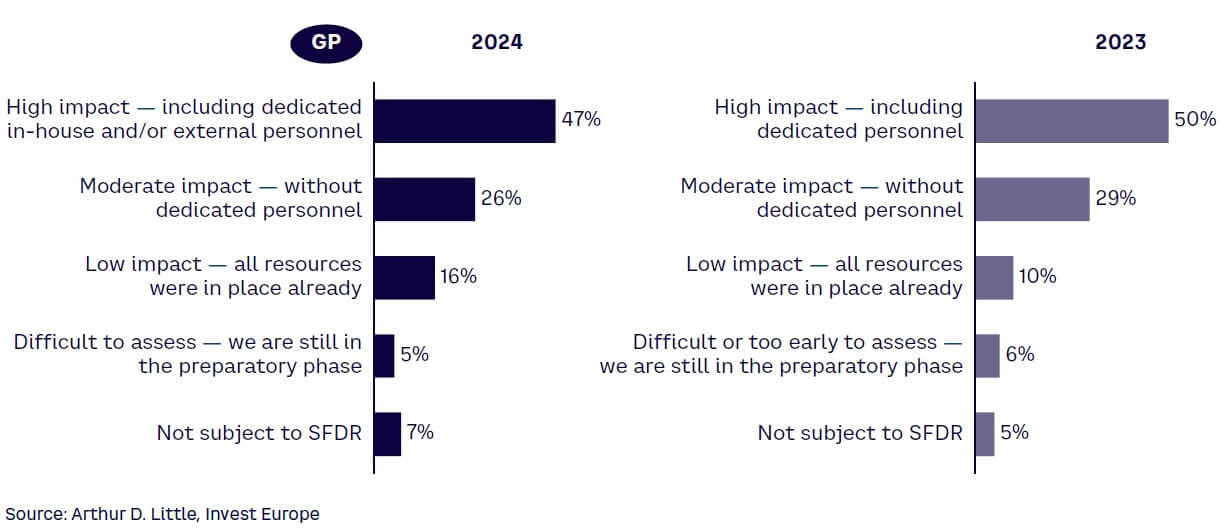

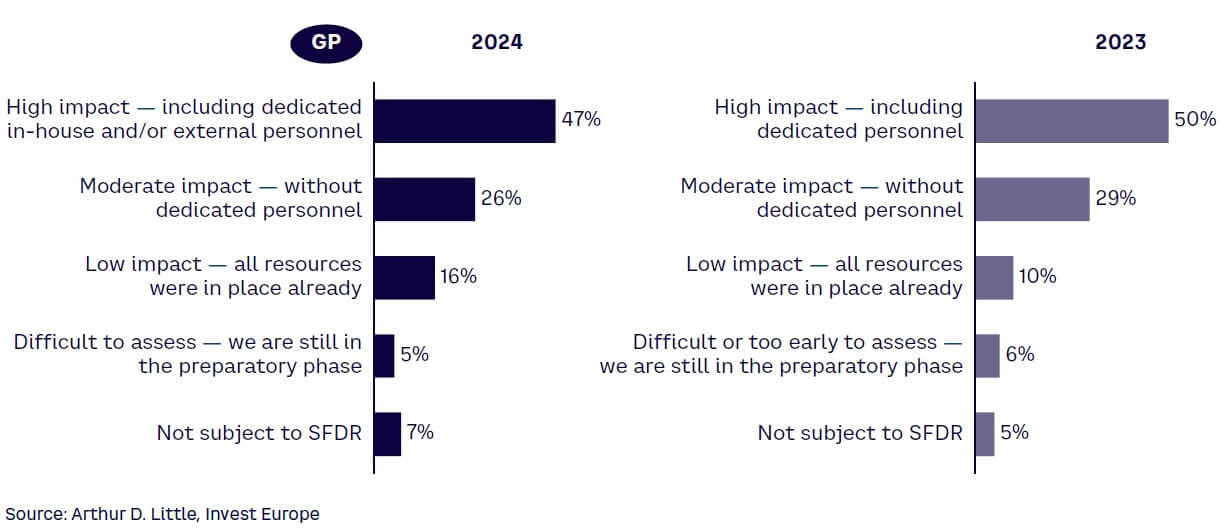

The vast majority of GPs envisage some form of impact on their resources and internal operations from SFDR, although, again, that impact is softening at the margins (see Figure 22). Almost half of respondents see a high impact, requiring dedicated in-house personnel or external consultants, a modest reduction on last year. Around a quarter see a moderate impact that does not require dedicated resources, again slightly lower than last year. And some 16% expect very low impact from the regulation, already having all the necessary staff and processes in place.

As more GPs register their funds as Article 8 or 9, the impact of the regulation may lessen, since having dedicated ESG professionals (or at least ESG experience across existing teams) will become the industry norm. It is also likely that a growing knowledge about how to apply the regulation in practice will lead to a higher effectiveness of its application over time.

The expansion of the EU sustainability regulatory regime via the creation and implementation of the Corporate Sustainability Reporting Directive (CSRD) adds a layer of ESG compliance to PE. Depending on the size of the firm and the assets it invests in, CSRD can require reporting both from the GP and its portfolio companies. Unsurprisingly, the vast majority see some form of impact, with around half expecting high impact that requires dedicated resources, echoing expectations around SFDR (see Figure 23). A small minority see limited impact, while around one in 10 are still in the preparatory phase.

As a directive, CSRD requires transposition into member state law. The deadline for such national legislation was July 2024, yet some countries have not fully transposed the directive, and others chose to enhance the rules with additional requirements. Although this adds complexity (on top of the ongoing uncertainties around CSRD’s scope and boundaries of application), CSRD may primarily be a domestic compliance requirement at the portfolio company level. Some GPs may choose to support their companies in preparing for and meeting the directive; others may take a less interventionist approach, limiting their efforts to creating awareness of the obligations under CSRD and corresponding timelines.

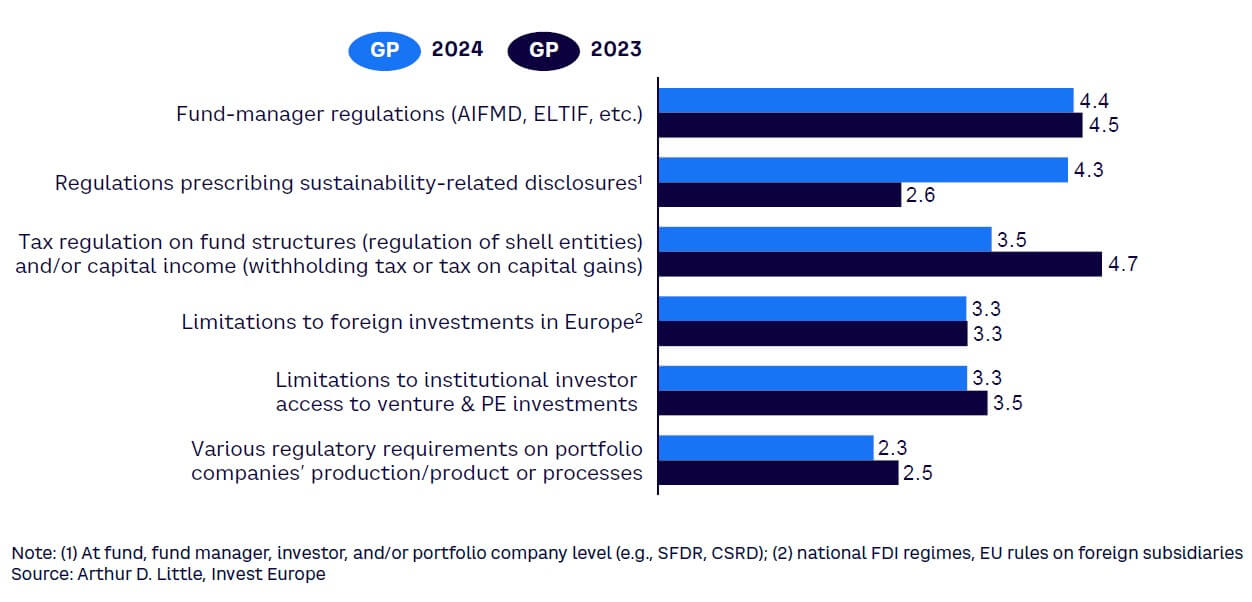

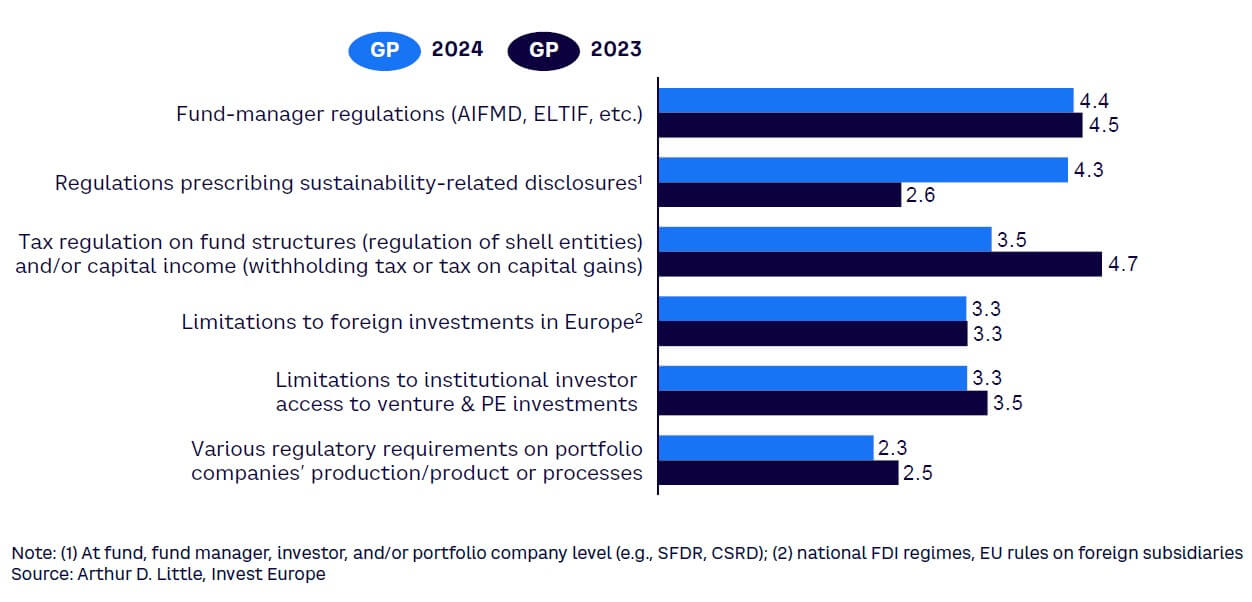

The negative impacts of sustainability-related disclosures feature prominently on the list of regulatory issues for GPs and have become much more important over the past year (see Figure 24).

Fund manager-focused regulations, including AIFMD and ELTIF, are still perceived as the most negative, given their direct impact on GP operations. However, given the increased adoption of ELTIF 2.0 vehicles by a wide range of managers following updated rules in January 2024, such regulated assets can be viewed as an opportunity to broaden the reach and appeal of PE to investors.

Conclusion

The macro backdrop at last appears to be improving, and that is having a positive impact on sentiment in the European PE and VC industry. Stabilization in inflation and falling interest rates are feeding green shoots.

Modest increases in exits in the first half are expected to accelerate, and bottoming fundraising and investment activity are expected to rise. VC investment has turned a corner, with buyouts and growth increasingly seeing headwinds easing and tailwinds strengthening. As we saw in the rebound from the effects of COVID-19, that recovery could be significant, particularly given the twin drivers of LPs’ demands for distributions and GPs’ record levels of dry powder. Add new opportunities in AI and defense to existing technology, health, and business services, and more pieces of the puzzle begin to fall into place.

Volatility and uncertainty are never far away, however. Escalating conflict in the Middle East could have global implications, including on already volatile energy prices and supply.

A new US administration could reignite trade wars with Beijing and even Europe. These risks are highly unpredictable but should not be underestimated.

Shocks and surprises tend to be relatively short term — or at least shorter than the average PE cycle. Moreover, GPs are focused on secular themes that will reshape the economy and society over the long term, rather than sectors that are excessively exposed to consumer spending and cyclical industries. This is very much in line with investor priorities and the EU’s drive to become more competitive. Europe’s digital future, green transitions, and growth require far more investment than public coffers have available. Private capital is not only needed but welcomed, even if it comes with increased regulation.

The coming 12 months point to a recovery in activity, and the longer-term trajectory for the industry remains strongly positive.

DOWNLOAD THE FULL REPORT

18 min read • Private equity

The Insight: State of the European private equity industry

Green shoots visible as AI rises rapidly

DATE

INTRODUCTION

The appetite to look outward at new opportunities points to the private equity (PE) industry expecting a brighter near-term future. Invest Europe’s H1 2024 data shows that fundraising, investment, and exit activity have been challenging. However, divestments are showing signs of picking up, which could unlock fundraising and investment, reviving the virtuous PE cycle again. Furthermore, both general partners (GPs) and limited partners (LPs) of PE firms are predicting higher levels of activity in the next 12 months — supported by LPs’ demands for distributions and GPs’ record levels of dry powder — as interest rates fall and the broader macroeconomic climate becomes more predictable.

Risks and opportunities presented by environmental, social, and governance (ESG) were previously prominent in partners’ minds and shaped the direction of GP initiatives, funds, and investments. Today, the focus is clearly on AI and all the ways it can impact the industry — both positively and negatively.

The fact that AI rose so rapidly up the agenda in terms of GP investment focus, internal priorities, and due diligence requirements is testament to managers’ reaction speed. Many are looking to participate in investment opportunities as AI leaders emerge in Europe. A large number are exploring the potential to integrate AI at portfolio companies, seeking new value-creation levers and productivity drivers. Others are turning the technology on their own operations, such as deal origination and analysis, looking for differentiation and an edge in competitive markets. And most are extending their due diligence to cover AI, analyzing the opportunities and the risks it may mean for companies and markets.

Of course, ESG hasn’t completely fallen out of favor. Attention to ESG issues and compliance with sustainability-related regulations remain top priorities for both GPs and LPs. In parallel, adopting ESG best practices and securing ESG expertise (either in-house or external) are increasingly the norm. As such, it is less a future priority than just a few years ago.

There are ever-present risks, including conflict and geopolitical tensions. The threat of cyberattack is considerable, particularly in industries embracing digitalization. And new and evolving regulation places a sizeable burden on PE and VC firms.

The takeaway from this year’s survey should be one of green shoots. After two challenging years, capping a rollercoaster period from the onset of the pandemic, PE and VC firms and their investors are looking at 2025 with increasing optimism, ready to move forward and capture new opportunities.

“AI has moved up as a hot topic among both PE firms and their investors. It can help portfolio companies to find operational efficiency opportunities, but it is important to ensure a proper and safe adoption of AI and implement policies around it. We are also applying AI in our own firm to help inform decisions and improve back-end processes.”

Henrik Johansson, General Counsel,

Nordic Capital Advisors

“ESG is still an important topic for us, but as most firms are up to speed on it, there are other areas now that are relatively more important.”

Michel Galeazzi, cofounder and Partner,

Evoco AG

1

FUNDRAISING REMAINS WEAK, ALTHOUGH EXPECTATIONS IMPROVE

PE fundraising was challenging in the first half of 2024. Although the volume of capital raised increased by 15% year-on-year to €59 billion, it was 28% below the amount raised in the second half of 2023. The reality of the European market is that fundraising is uneven, cyclical, and increasingly polarized between mega-funds and small country- or sector-focused funds. This can lead to sizeable swings from year to year and half to half.

The year-on-year increase was almost entirely driven by a sharp improvement in fundraising in the Nordics, as capital raised in the region more than tripled to €10 billion. Across other regions, fundraising was largely in line with the first half of 2023. When looking at amounts compared to the previous half, the decline was almost entirely due to a fall in fundraising for funds based in the UK and Ireland (see Figure 1).

The UK remains the European hub for many large PE managers and thus the biggest region for fundraising, but it is also more volatile. Meanwhile, France and Benelux, as the second-largest region, perform more consistently due to a wider spread of medium-sized funds across constituent countries.

After a challenging period, the improving macro backdrop is causing a modest but noticeable boost in fundraising expectation. As shown in Figure 2, 27% of GPs expect fundraising to increase over the next 12 months versus the last 12 months, compared with 20% last year and just 6% the prior year.

More notably, fewer than one in five (17%) expect less capital to flow into the asset class compared with half of those surveyed last year.

Interestingly, while GP views have varied and improved, LP expectations of capital allocations have changed only modestly. Around a fifth expect an increase in allocations, over two-thirds expect no change, and less than 10% believe that capital committed to PE will fall. All figures are largely in line with the past two years and indicate a steady increase in the overall amount of capital flowing into PE. Ultimately, the vast majority of LPs continue to believe in the asset class’s potential to deliver strong returns amid ongoing uncertainty.

Opinions about the democratization potential of PE remain strong, although attention is focused on the wealthier brackets of individuals. More than three-quarters of GPs see potential in raising capital from (ultra) high-net-worth clients, the smallest in number but the most sophisticated and most likely to have sizeable pools of capital to deploy (see Figure 3).

Just under half see the potential of marketing funds to the “mass-affluent” category: individuals with investible wealth ranging from €100K to €500K. The attraction of smaller retail clients remains muted, although not negligible, with just under one in five interested in the category.

Investor appetite across all fund types remains consistent. Similar allocation levels are anticipated across secondaries, impact, buyouts, and credit, with around a fifth of respondents expecting to increase commitments to funds in those categories (see Figure 4). Although impact clearly remains an investment priority, the rush to commit to the segment appears to be cooling from last year, when 30% of LPs expected to allocate more.

Past performance and returns continue to be the most important differentiating factor for managers in a competitive fundraising environment, cited by three-quarters of GPs (see Figure 5). The fund’s investment strategy is seen as another important differentiator, increasing in importance from last year, reflecting the development of sub-themes within increasingly established segments, such as secondaries and credit, as well as refinements of strategies within large segments such as buyouts.

About a third of GPs see use of AI as a differentiator, as many embrace the technology at portfolio companies and within their own operations, even as others arguably lag with their adoption. One of the most notable changes is the sharp decline in the relative importance of ESG as a differentiating factor — from three-quarters of respondents last year to just under a third this year. This is not necessarily a sign that ESG initiatives have fallen out of favor, but rather that strong ESG credentials have increasingly become the norm, and that both GPs and LPs now face growing EU sustainability regulatory requirements. This trend is a signpost to the future of AI, as its potential to make GPs stand out from the crowd increases before it ultimately becomes industry standard.

2

AS INVESTMENT PRESSURES PERSIST, SENTIMENT TURNS MORE POSITIVE

European PE investments continued to decline in the first half of 2024, down €5 billion (11%) to €40 billion compared with the second half of 2023 (see Figure 6). Growth investments continued to fall, while the rate of decline in buyouts softened more modestly, potentially pointing to a bottoming of deal activity, as the reduction in interest rates amid cooling inflation begins to provide greater certainty and availability of financing. Already turning a corner, VC investment picked up by 28% (€2 billion) fueled in part by investments in fields such as AI and deep tech.

Across segments, the number of deals declined. However, the average deal size is increasing slightly, indicating that GPs may focus more on larger transactions as they look to deploy their reserves of dry powder into more stable opportunities to compensate for higher risks.

Overall capital under management and dry powder grew by 15% and 18%, respectively, in 2023, demonstrating the step-up in scale and reach of Europe’s PE industry (see Figure 7). Dry powder totaled €410 billion at the end of 2023. That equates to three to four years of investment capacity, slightly ahead of prior norms. However, as we saw during the immediate recovery from the pandemic, dealmaking can step up quickly and significantly across the board, including for mega-buyouts that can move the needle for overall investment totals.

Secondary buyouts are anticipated to be a major source of new deal flow in the coming 12 months, with more than two-thirds of respondents expecting activity to pick up (see Figure 8). Given increased LP pressure on incumbent PE owners to dispose of assets and return capital, the expected pickup is not surprising.

However, seller price (and return) expectations, as well as the return of other potential routes to liquidity, including dividend recapitalizations, may reduce the actual deal flow potential.

Primary transactions, spinoffs, and public-to-private deals are also expected to offer the same or better investment potential as the past year.

![AUM], which refers to total market value of all financial assets managed by PE firm); (2) dry powder is defined a](/sites/default/files/inline-images/Figure%208%20State%20of%20European%20private%20equity%202024_0.jpg)

3

AI & DEFENSE MOVE UP GP TARGET LISTS, RENEWABLES DROP DOWN

Advances in technology and the uncertain geopolitical landscape are exerting influence on the sectors that GPs view as most attractive. Deep tech and AI has moved up and now leads the list of target sectors, favored by more than two-thirds of GPs (see Figure 9). It is closely followed by defense (a new entry), as ongoing international conflicts and geopolitical tensions drive government spending in the sector, with a particular focus on technologies that can serve both civilian and military applications. Life sciences and other health or medical investments remain in focus but are less important as the legacy of COVID-19 diminishes.

Deep tech/AI and business services have both gained more attention over the past two years. This is likely a reflection of a growing demand for technology and services that can boost productivity and efficiency, as well as GPs’ focus on emerging technologies that may deliver strong growth and high returns. It is also notable that the renewables sector has dropped out of the top five.

At the other end of the spectrum, industrial and manufacturing industries, as well as those tied to squeezed consumer spending, remain relatively low on GP investment-priority lists. Only a small number of managers see greater investment in any sector in the bottom five, in most cases well behind the proportion that anticipate less investment.

Roughly half of GPs envisage less investment in the automotive sector, and around a third expect less investment in consumer goods and retail, a much higher proportion than the 14% who see more activity in the space (see Figure 10). Transportation is a new entry into the bottom five, so it’s not a surprise that only 13% expect increased investment, although over three-quarters expect the same levels of deployment as last year and only about one in 10 expect a decrease.

Although the largest proportion of GPs and LPs still express no change in willingness to invest in defense or military investments, there is a clear, steady shift in sentiment. This is most likely driven by an escalation of international conflicts and increased geopolitical tensions, most notably within Europe’s neighborhood (see Figure 11). About a quarter of GPs and LPs have seen increased willingness to invest in technology that has both military and civilian applications, up from about a tenth two years ago. However, challenges remain. The defense industry is often opaque due to national security concerns. Additionally, many defense projects do not align with ESG criteria, which are important to investors and can negatively influence investment decisions.

There has been a marked increase in acceptance of investment in military-only goods and technologies. This is particularly notable among LPs, with one in five now seeing increased willingness to back military-only investments, a three-fold increase over last year. This demonstrates how investor approaches to ESG have evolved and how the narrative around defense has shifted from one of aggression to one of protection.

4

DIVESTMENT ROUTES CHANGING AS EXIT ACTIVITY & CONFIDENCE INCREASE

Divestment activity in the first half of 2024 highlighted some green shoots returning to the market, as well as ongoing challenges. Divestments (at cost) recovered by 6% to €14 billion from the second half of 2023, although exits declined by 22% (see Figure 12). Most likely, larger companies are achieving exits, due to trend toward larger but fewer PE investments.

Markets are signaling that exits are highly dependent on valuations, and valuations are highly dependent on asset quality. In other words, improving market conditions are enabling PE firms to exit investments that have performed strongly through the period of high inflation and interest rates. However, many exit processes continue to be interrupted or delayed by market volatility, with managers opting to hold assets for longer until markets recover more broadly.

Expectations around exits appear to be improving, driven in part by improving confidence and reopening markets, as well as the ever-pressing need to return capital to LPs. Auctions are expected to increase, with 40% of GPs seeing better exit potential via intermediated processes to PE peers and cash-rich strategics (see Figure 13). More notable is the expected recovery of IPOs following some positive results for new European listings in the first half of 2024. Almost three in 10 GPs expect more IPOs, compared with three in 100 just two years ago.

Well over two-thirds of GPs and LPs anticipate more transactions over the 12 coming months compared with much lower expectations two years ago, when supply chain shocks, rising inflation, and interest rates were a larger concern (see Figure 14).

Similarly, though to a lesser extent, much higher numbers of GPs and LPs see increased valuation levels for assets as interest rates decline and financing availability improves. Valuations will also be driven by company performance and improving public market comparables, with the MSCI Europe benchmark up some 8% for 2024 by the end of the third quarter — more than 30% from its mid-2022 lows.

“We expect divestments to increase gradually over the next six to 12 months, as a large part of our invested funds are overdue or at the end of their time commitment.”

Frank Amberg, Managing Director, Head of Infrastructure Germany, AltamarCAM Partners

5

EXITS BECOME THE PRIORITY FOR PE, AI DOMINATES NEW WORKING PRACTICES

Exiting portfolio companies has become the most important future activity for PEs. Two-thirds of GPs expect it to be the main focus of their teams over the next 12 months, a sharp rise from just a third two years ago (see Figure 15). Although returning capital to investors is seen as a pressing priority, most GPs are still focused on activities that can further boost their portfolio companies. Some 59% see operational development and support of their businesses as a main focus, while 65% view AI as a key area of activity.

Risk assessment at portfolio companies ranks at the bottom of the list of priorities, reflecting the expected easing of interest rates and inflation, and some degree of comfort with company performance through the volatile market conditions of the last two years.

At the portfolio level, measures to drive growth against an improving market backdrop are clearly the highest priority, with acquisition-led expansion the most important initiative, selected by around three-quarters of GPs (see Figure 16).

Digitalization remains an important focus as firms continue to incorporate technologies such as big data analytics and cloud infrastructure. However, it is steadily declining in importance, underlining that this is a one-off operational lever that will become less relevant over time as more companies adopt the technology.

AI usage is a new initiative cited by a large minority (39%) of GPs. Given their expectations and current exploration of potential AI uses across firms, this is likely to become a more important initiative for GPs at portfolio companies.

When looking at expected future focuses, we see that more than 80% of firms, including those that have not yet adopted AI, are eyeing its potential (see Figure 17). More than eight in 10 respondents believe the technology will have an impact on their operations in the near future, signaling the likelihood that most managers will incorporate AI into areas such as deal origination, due diligence, or reporting. Other issues driven by current trends include geopolitical risk, cited by over 60% of GPs. Investor relations toward LPs are also expected to have an impact by the majority of GPs, reflecting ongoing challenges in the exit and fundraising markets.

Although still important to a large numbers of GPs, attention to ESG, diversity and inclusion, and managing portfolio companies through KPIs have declined in importance since last year.

This may be a signal that, as a result of investor demand and regulation, many GPs have already adopted new approaches and standards on these issues and that best practices are increasingly ingrained industrywide. Investors continue to see attention to ESG issues as the most important factor for PE in the near future, cited by more than two-thirds of LPs (see Figure 18). Although this is significantly higher than for GPs, it reflects the perspective of LPs who back a number of firms and may still need to work with a diminishing number of GPs who have yet to fully embrace ESG best practices.

Conversely, attention to work practices supported by AI is of lower importance — and relevance — to many investors, demonstrating how adoption of the technology is more of an internal factor for GPs seeking efficiency and an edge in investment processes than one with significant impact on LP-facing activities.

Cyber threats remain the largest issue for GPs, with about three-quarters expecting cybersecurity assessments to influence their future due diligence processes (see Figure 19). AI assessments have entered high on the list, with almost 70% expecting increased due diligence as GPs come to grips with the opportunities and risks posed by the technology.

Almost two-thirds of GPs expect ESG to remain an area of increased focus, despite it being the top priority for managers last year. Again, this does not necessarily mean ESG has become less important compared to other issues or previous years. Rather, it suggests that more GPs now see ESG as an integral part of their due diligence or feel their ESG due diligence processes are up to standard, aided by best practice resources such as Invest Europe’s GP ESG Due Diligence Guide, which includes a comprehensive ESG Due Diligence Questionnaire.

The risks posed by financial crises and pandemics are also expected to be less of a focus for the vast majority. Geopolitical assessments, in contrast, are expected to continue to receive increased due diligence attention from more than half of GPs, as the effects of international conflicts continue to ripple through markets.

6

SUSTAINABILITY REGULATION HAS SIGNIFICANT IMPACT ON FUNDS & REQUIRES RESOURCES

The majority of GPs expect the EU’s Sustainable Finance Disclosure Regulation (SFDR) to continue to shape fund focus and categorization (see Figure 20). An important minority perceive that LPs no longer want to invest in Article 6 funds that have less of a sustainability focus, and another 55% and 13%, respectively, perceive that LPs require or will require funds to comply with Article 8 or Article 9 rules, effectively meaning that 83% of GPs perceive they need to have a strong focus on ESG objectives or position themselves as “impact” funds.

LP views on the impact of SFDR are slightly less progressive than those of GPs (see Figure 21). Only 1% say they no longer want to invest in Article 6 funds, and more than half (53% and 22%, respectively) expect GPs to register their funds as Article 8 or Article 9 now or in the near future. Still, around a quarter of LPs expect no change in fund categorization among GPs.

The vast majority of GPs envisage some form of impact on their resources and internal operations from SFDR, although, again, that impact is softening at the margins (see Figure 22). Almost half of respondents see a high impact, requiring dedicated in-house personnel or external consultants, a modest reduction on last year. Around a quarter see a moderate impact that does not require dedicated resources, again slightly lower than last year. And some 16% expect very low impact from the regulation, already having all the necessary staff and processes in place.

As more GPs register their funds as Article 8 or 9, the impact of the regulation may lessen, since having dedicated ESG professionals (or at least ESG experience across existing teams) will become the industry norm. It is also likely that a growing knowledge about how to apply the regulation in practice will lead to a higher effectiveness of its application over time.

The expansion of the EU sustainability regulatory regime via the creation and implementation of the Corporate Sustainability Reporting Directive (CSRD) adds a layer of ESG compliance to PE. Depending on the size of the firm and the assets it invests in, CSRD can require reporting both from the GP and its portfolio companies. Unsurprisingly, the vast majority see some form of impact, with around half expecting high impact that requires dedicated resources, echoing expectations around SFDR (see Figure 23). A small minority see limited impact, while around one in 10 are still in the preparatory phase.

As a directive, CSRD requires transposition into member state law. The deadline for such national legislation was July 2024, yet some countries have not fully transposed the directive, and others chose to enhance the rules with additional requirements. Although this adds complexity (on top of the ongoing uncertainties around CSRD’s scope and boundaries of application), CSRD may primarily be a domestic compliance requirement at the portfolio company level. Some GPs may choose to support their companies in preparing for and meeting the directive; others may take a less interventionist approach, limiting their efforts to creating awareness of the obligations under CSRD and corresponding timelines.

The negative impacts of sustainability-related disclosures feature prominently on the list of regulatory issues for GPs and have become much more important over the past year (see Figure 24).

Fund manager-focused regulations, including AIFMD and ELTIF, are still perceived as the most negative, given their direct impact on GP operations. However, given the increased adoption of ELTIF 2.0 vehicles by a wide range of managers following updated rules in January 2024, such regulated assets can be viewed as an opportunity to broaden the reach and appeal of PE to investors.

Conclusion

The macro backdrop at last appears to be improving, and that is having a positive impact on sentiment in the European PE and VC industry. Stabilization in inflation and falling interest rates are feeding green shoots.

Modest increases in exits in the first half are expected to accelerate, and bottoming fundraising and investment activity are expected to rise. VC investment has turned a corner, with buyouts and growth increasingly seeing headwinds easing and tailwinds strengthening. As we saw in the rebound from the effects of COVID-19, that recovery could be significant, particularly given the twin drivers of LPs’ demands for distributions and GPs’ record levels of dry powder. Add new opportunities in AI and defense to existing technology, health, and business services, and more pieces of the puzzle begin to fall into place.

Volatility and uncertainty are never far away, however. Escalating conflict in the Middle East could have global implications, including on already volatile energy prices and supply.

A new US administration could reignite trade wars with Beijing and even Europe. These risks are highly unpredictable but should not be underestimated.

Shocks and surprises tend to be relatively short term — or at least shorter than the average PE cycle. Moreover, GPs are focused on secular themes that will reshape the economy and society over the long term, rather than sectors that are excessively exposed to consumer spending and cyclical industries. This is very much in line with investor priorities and the EU’s drive to become more competitive. Europe’s digital future, green transitions, and growth require far more investment than public coffers have available. Private capital is not only needed but welcomed, even if it comes with increased regulation.

The coming 12 months point to a recovery in activity, and the longer-term trajectory for the industry remains strongly positive.

DOWNLOAD THE FULL REPORT