With Chinese regulators’ stimulation policy, a number of EV start-up companies have been set up since 2015. Many of them aim to launch EV products with high levels of artificial intelligence, connectivity and autonomous driving technology. In this viewpoint, Arthur D. Little reviews major players’ product offerings, highlighting sales and aftersales services, market performance, major challenges and implications for the future.

Stimulated by the government’s NEV policy, a number of EV start-ups have emerged in the Chinese market

Since 2015, the new energy vehicle (NEV) market in China has been growing rapidly.

By 2019, approximately 500 EV start-ups had been registered in China and more than 60 had unveiled their concept vehicles. Many addressed the trends of artificial intelligence (AI), connectivity and autonomous driving (AD).

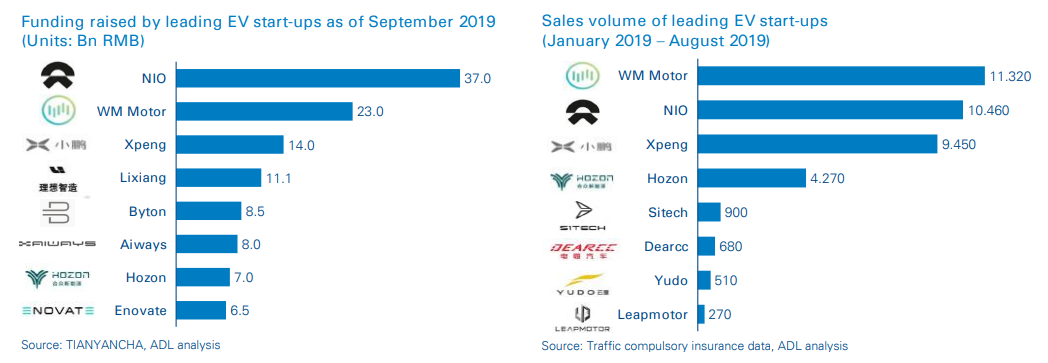

NIO, WM Motor and Xpeng are the top three EV start-ups in terms of total financing and sales volume. Lixiang, Byton, Aiways and Enovate have attracted 6.5–11 billion RMB from the capital market, although they have not completed SOP yet. Many of the founders of these start-ups have shining resumes.

They either have successful internet entrepreneur backgrounds, as do the founders of NIO (Li Bin), Lixiang (Li Xiang) and Xpeng (He Xiaopeng); or hold track-records as senior leaders of major OEMs, as is the case for the founders of WM motor (Shen Hui, ex-SVP of Geely Group), Aiways (Fu Qiang, ex-senior executive of SVW and Audi) and Enovate (Zhang Hailiang, ex-SVP of SVW and SAIC Group), and the co-founders of Byton (Daniel Kirchert and Carsten Breitfield, ex-VPs of BMW).

The sales volumes of EV start-ups in 2019 show sharp contrast. WM Motor, NIO and Xpeng ranked top three due to relatively high intelligence and connectivity design, premium after-sales service (NIO) and good product value (Xpeng and WM). Hozon’s sales performance ranked at four; however, the majority of its sales volume comes from B2B, such as car-sharing and e-hailing companies.

Dearcc and Sitech focus on the low-end market (60,000– 100,000 RMB after subsidies). They have seen their sales volumes plunging since 2019, mainly because most of their consumers are in T3/4 cities and demand for low-priced EVs is decreasing due to reduced subsidies. The chairman/owner of Dearcc has launched a higher-positioned product under the brand “Enovate” (see below).

Product offerings from major EV start-ups

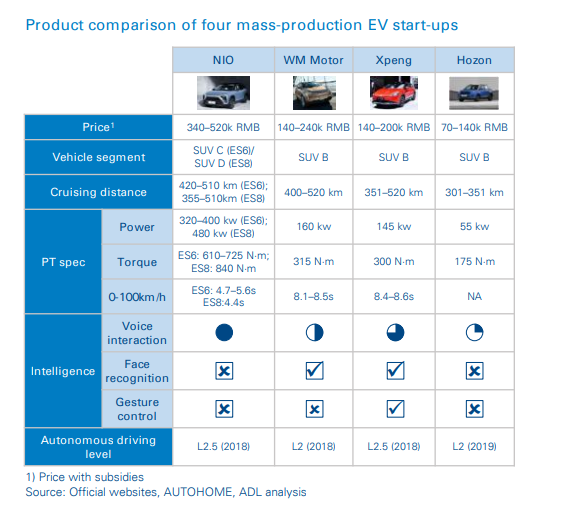

Benchmarking against Tesla, NIO focuses on the premium EV market, pricing 320,000–400,000 RMB after its subsidy. Features include: active air suspension and aluminum body, cruising distance reaching 510km, and 0–100km/h acceleration in 4.4 seconds (ES8). AI is a highlight of the NIO product. Incar AI robot NOMI offers a high level of voice interaction with passengers. For instance, it can control the degree to which windows can open based on speakers’ demands and spray fragrance according to drivers’ moods. Three hundred sixtydegree after-sales service is a major differentiator for NIO among EV start-ups. NIO ES8 offers a free whole-life warranty for the vehicle and its battery pack, free pick-up service from home, whole-life free SOS aid, and free connectivity (8GB per month).

WM Motor and Xpeng target the mass market (140,000– 240,000 RMB after their subsidies) and position themselves to offer good “value for money”, with cruising distances of greater than 500 km. Their products also feature AI with face recognition (log-in with face ID) and voice interaction, although their voice interaction is not as sensitive as NIO’s.

Xpeng and NIO have the highest autonomous driving levels of the launched EV products: L2 plus an automatic parking function in 2019. NIO aims to offer L4 by 2022. NIO and Xpeng also have the strongest R&D capabilities of all the EV start-ups (approximately 3,000 staff) and have been investing heavily in AD technology development (approximately 1,000 R&D staff).

Compared with Tesla, the AD technology of the leading Chinese EV start-ups is still lagging. However, their AI and connectivity capabilities are stronger, including voice recognition and verbal commands, as well as better understanding of local customer demand. They offer various elements such as recommending the best local restaurants and entertainment centers and using popular local super stars’ voices for AI communication.

The quality and reliability of NIO’s, Xpeng’s, and WM Motor’s products have met the standards of Chinese OEMs such as Geely and Changan, according to the consensus of market feedback. Their high scores in five-star C-NCAP assessments (a Chinese vehicle crash test) is one of the proofs. In order to launch the vehicles into the market and seize market share, these EV start-ups are trying to shorten their product development processes. For instance, Xpeng takes 32 months for product development, versus 42–48 months for traditional OEMs. Concept design, detailed structure design and manufacturing preparation processes are compressed. As a consequence, they have to pay extra to accelerate development cycles. For instance, the first and second rounds of PV testing are overlapped, which wastes tooling.

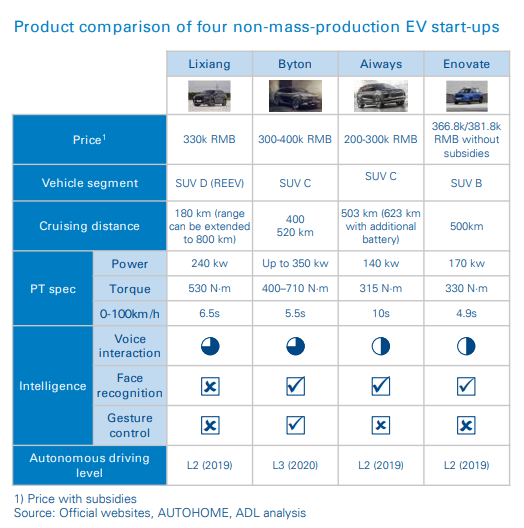

Lixiang, Byton and Enovate focus on the premium EV market (300,000–400,000 RMB with subsidies). Lixiang is the only EV start-up to develop range-extended electric vehicles (REEVs) instead of battery-electric vehicles (BEVs) in order to solve range anxiety for consumers.

In terms of AI, all of these start-ups offer voice interaction. Byton allows users to shop online via its 48-inch screen and voice interaction. It also features a hand-gesture control function.

Byton claims that it will reach autonomous driving level 3 by 2020. However, this target could be challenging, given that the company has only 500 R&D staff in the US dedicated to AD and human machine interface (HMI) development. This number significantly decreased through Byton’s layoff plan, which was caused by a shortage of funding and increasing cost pressure.

EV batteries and charging solutions

Safety, cruise range and convenience of charging are the major concerns for EV end customers.

Major EV start-ups currently use NCM Lithium ion batteries and procure battery cells from Chinese suppliers such as CATL and BAK Power. The leaders have achieved 600km of range under New European Driving Cycle (NEDC) conditions. To address range anxiety in customers, Lixiang’s REEV product can achieve a range of 800 km. To solve safety issues and pursue higher energy density and longer ranges, NIO, WM Motor, Enovate and Aiways are developing solid-state batteries in collaboration with suppliers such as ProLogium.

NIO provides innovative, value-added charging solutions. Instead of charging batteries, consumers can swap their batteries within three minutes at NIO’s power stations. The company also provides battery charging services that can come to EVs. These mobile charging stations can give EVs an extra 100 km of driving distance in 10 minutes. These services are included with others, such as free repair and maintenance of vehicles and batteries for their whole life cycles, as well as free SOS support, in NIO’s after-sales service package. This package is superior to those of all other EV start-ups, and even traditional premium OEMs such as BMW, Daimler and Audi. However, whether such a service model can support profitability and be sustainable in the long term is still questionable.

NIO and Aiways can provide battery-leasing solutions for consumers. For example, NIO allows consumers to buy EVs without paying for battery packs, and then finance these over five years.

Direct sales models and sales channel strategies

In contrast to traditional OEMs, leading EV start-ups sell their vehicles directly to consumers for better control of pricing and direct communication with customers. This allows them to collect feedback and solve problems. On the other hand, distribution channel strategies differ among the three players. NIO and Xpeng mainly open fully owned, directly managed stores in order to get closer to consumers, provide better service and optimize customers’ perceptions. WM Motor, similar to traditional OEMs, depends heavily on franchise stores to capture market share quickly while keeping costs low. Due to cost pressure, Xpeng is also planning to open franchise stores to expand into more cities.

Major challenges for EV start-ups

In September 2019, NIO’s stock price dropped to 1.53 USD, which has decreased by 77 percent from the initial public offering (IPO) price. This represents major difficulties among EV start-ups in China.

Stricter government control of production licenses

In order to better control overcapacity in the automotive and EV industry, the Chinese government has put stricter rules on approving investments for new plants. For instance, among the top three players, only WM motor has its own plant. NIO originally planned to build a plant in Shanghai, however, the government didn’t approve this after it had approved Tesla’s plant. This left NIO no other choice but to keep outsourcing its production to JAC. Xpeng didn’t get approval from the government either and has been outsourcing production to Haima. Both JAC and Haima are local Chinese OEMs that mainly focus on low-end vehicles, and hence, this has raised concerns about quality control and upgrading capabilities to meet higher production standards.

Low sales volumes due to relatively limited brand recognition and product competence

Compared with Tesla and traditional OEMs, EV start-ups lag behind in terms of brand power and core competence. The sales volumes of the top three start-ups, NIO, WM motor and Xpeng, reached 2,000 per month in H1 2019. However, this is still not comparable with the performances of traditional OEMs such as BYD and BAIC, whose sales volumes of NEV models reached 9,000–20,000 per month, on average, in H1 2019. Tesla also sold 150,000 in H1 2019 worldwide.

With their subsidies heavily reduced, major traditional OEMs such as BYD and BAIC plan to keep their EV prices the same levels as before, as they are able to draw upon their existing technology with cheaper batteries (e.g., LFP), mature sales networks, and large scale. This has led to high pricing pressure on EV start-ups. If their prices can’t be competitive after subsidies are removed, consumers will choose traditional OEMs’ EV products or even ICE vehicles.

Profitability is in the red and unable to break even

Due to low sales volumes, EV start-ups still heavily rely on external funding for a few years after launching products. For instance, NIO had negative profitability of 23.5 Bil RMB in 2018 and 5.9 Bil RMB in H1 2019. To achieve breakeven, Xpeng, for example, requires annual cash flow of around 2–3 billion RMB to cover R&D costs (payroll, testing, etc.) and selling, general, and administrative expenses. Its gross margin per car is approximately 20,000 RMB. This means the company needs to sell 100,000 to 150,000 vehicles to cover the above costs. However, its sales volume in H1 2019 was only 1,000–2,000 per month.

More pressure from fundraising and cost control

Due to the unsatisfactory performances of EV start-ups, investors have become more cautious about continued investing. Intensive consolidation will be seen among EV startups, investors will focus more on leading players, and other players will experience major difficulties in raising money.

Cost control becomes crucial. At the beginning, the key focus of EV start-ups was product development and launching decent vehicles into the market. What’s more, in order to achieve premium brand perceptions, players such as NIO, Byton, and Lixiang are sparing no money or effort in building the “premium” sense and feel. For instance, in T1 cities such as Beijing and Shanghai, NIO rents showrooms in the most expensive city centers that are full of luxurious brands. The rental of a showroom can be as high as 30 mil RMB per year. In addition, NIO, Xpeng and Byton have all set up global R&D centers in the US. In order to attract top R&D and autonomous driving talent, they will have to pay much higher salaries than their previous packages and offer major promotions. Sometimes the purpose of this is more to attract attention from the media to raise funding from investors than to improve R&D capabilities.

Due to cost pressure, NIO has sold its Formula E racing team and begun to reduce its head count from the original 9,000 to 7,500. Byton also laid off heavily among its R&D team in the US and gave up its autonomous driving L4 development.

Conclusion

NEVs represent the future of the auto industry. Although EV start-ups are facing various challenges, their emergence has brought new vigor and vitality into the Chinese automotive market. Since 2018, the growth of the auto industry in China has slowed down, and negative growth was seen for the first time in nearly 30 years. The whole China auto industry is facing major challenges and needs to undergo transformation. It’s too soon to say whether Chinese EV start-ups have a promising future because their market performance has not been satisfactory. However, in order to win out eventually, EV start-ups must ensure they build product core competence, consider where to differentiate from competition, and achieve economy of scale, significant cost reduction and operations excellence. Only if they manage this, can they realize sustainable profitability and prosperity in the end.