DOWNLOAD

DATE

Contact

Much is unclear about the future of non-fungible tokens (NFTs), but one thing remains certain: studios that fail to explore the possibilities of NFTs will miss opportunities for growth, relevance, and engagement. In this Viewpoint, we explore some burning questions: Why are NFTs exploding? Are they a fad, a bubble, or a burgeoning market? What are the risks? What should studios do? What industry-specific applications of NFTs will generate long-term value?

Eight years ago, artist Kevin McCoy created a pulsating, multicolored digital image of an octagon, which he called Quantum. In the grand scheme of art, it was unremarkable — except for one key fact: McCoy minted the image, which means he secured its code, as an NFT. From that moment, the code behind the artwork, and the rights to that code, were unique, protected, and purportedly not replicable: unforgeable, immutable art. Gone were concerns over dubious provenance and forgeries; a new form of art, a new art market, and technology that could revolutionize not just digital art, but all creative work, were born. Last year, Quantum sold at a Sotheby’s auction for US $1.5 million. And that is only a fraction of $40 billion in NFT sales for 2021, a figure that had been matched by May 2022.

Arthur D. Little’s (ADL’s) experience with major studios has shown that, while elusive, a winning NFT strategy is both possible and necessary for sustainable growth in the world of Web3. This Viewpoint will highlight this necessity by citing past mistakes made during Web 2.0; describing NFT opportunities that have proven valuable for studios; and maintaining a sober recognition of pitfalls, risks, and dead ends. We consider how studios can best implement an NFT strategy, suggesting the possibility of a studio-specific storefront as opposed to launching NFTs on open exchanges, which is currently the more popular choice. In summary, studios should capitalize on this moment to secure a foothold, as not all territory has yet been claimed but enough has been learned from first movers to avoid their pitfalls. Significant benefits await those who move smartly during this next wave of NFT proliferation.

NFT MARKET EXPANSION

NFTs are digital assets representing a wide range of unique tangible and intangible items, from digital art by individual artists to innovative collaborations from multiple creators. NFTs are minted to derive assets generated from larger works, such as still frames and GIFs from Hollywood content.

NFT trading has grown across many industries; the total volume traded by NFTs currently stands at more than $50 billion — a 220% increase from January 2022, according to Blockchain News. While the NFT market has fallen significantly from its fad-driven peak last year, the number of buyers and sellers continues to grow, indicating a sustainable business.

The ownership model for NFTs is also innovative: NFTs may be owned in shares, meaning groups of people can share joint ownership of a single NFT. For example, an artwork called The Merge has been sold to 30,000 buyers for $91.8 million.

While digital artwork comprises a major visible segment of the NFT world (about 14% by some estimates), NFTs exist in other segments as well, such as ticketing, gaming, real estate, financial services, insurance, and the largest of all: collectibles. Not only are there digital versions of analog tangible collectibles (e.g., trading cards), but there are also innovative NFTs of intangibles, such as a plot of land in a video game, or the idea for a yet-to-be-made 3D sculpture.

The high-end collectible and art markets are likeliest to make headlines. However, studios should think of NFTs as a pyramid, with rare collectibles and art at the top (most visible and most expensive), and a very broad, if yet unrealized, mass market at the bottom, generating the bulk of engagement and revenues.

So what does this mean for Hollywood? For TV and movie studios, NFTs will likely become a critical new component of content collection and distribution, providing notable benefits such as direct relationships and increased engagement with fans, and new revenue streams.

THE OPPORTUNITIES OF WEB3

Many TV and movie studios failed to capitalize on Web 1.0 and 2.0 opportunities — they failed to jump on the streaming bandwagon early enough and are suffering the consequences. Nevertheless, now studios need to establish themselves at the forefront of Web3, which has the potential to solve several endemic issues for Hollywood.

Challenge 1: Intermediation between fans & studios

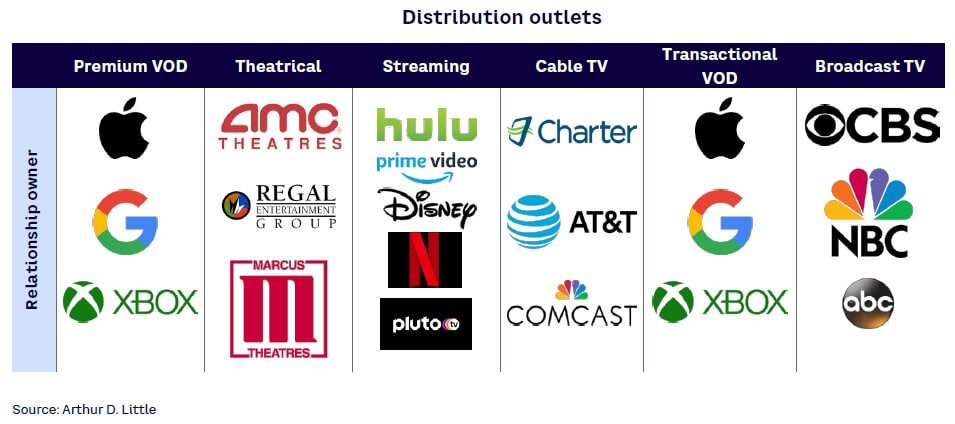

Studios historically lacked direct-to-consumer (D2C) offerings and missed the initial D2C opportunity created by streaming video and its robust consumer data. As shown in Figure 1, studios have not had a direct relationship with fans because of various intermediaries within each content window. Now, several studios are playing catch-up, building their own streaming offerings, as their licensing deals with Netflix and others expire. Other studios have opted out of D2C streaming, having missed the window or deciding the traditional licensing business model across content windows will be more profitable.

But D2C offerings hold the potential for better control and insights. Netflix’s rise to success illustrates a prime example. Media companies saw a new option for monetizing their intellectual property and licensed their content to third parties, giving digital streaming rights to many of their movies to Netflix and others. Netflix then created a low-price streaming subscription product with 24/7 access to a range of premium content, which devalued other content windows. Studios attempted to recover from this catastrophe in 2011 by creating Ultraviolet, a cloud-based digital rights platform for films and television programs. However, Ultraviolet shut down in July 2019, due to its inability to compete, technical difficulties, and customer dissatisfaction.

Most major studios have been trying to catch up with Netflix. Bob Iger, former Disney chair and CEO, made the launch of a suite of D2C services his most important priority of 2019. Studios should remember that their willingness to continue disintermediating themselves from fans in Web 2.0 and streaming was not the best move and reduced shareholder value.

Challenge 2: Old content falls short of fan desires

TV and movie studios are under pressure to use technological progress to provide real value and more ancillary content. According to Statista, the number of “cord-cutters” and “cord-nevers” in the US has steadily increased and is forecast to continue. More than 150 million people in the US will not have access to traditional pay TV services by the end of 2026. Human-centered design is anticipated to dominate the media landscape of 2025 with the technology systems integrating with the consumers’ tech ecosystems: mobile, voice, and augmented or virtual reality. We are also entering the “Golden Age of Fandom” with one in five consumers willing to pay for exclusive content, and the same percentage being more apt to join a community that brings them closer to entertainment. Media companies must adapt to this changing landscape by finding out-of-the-box ways to meet consumers’ preferences. The same old content shown in the same old ways is failing to be a compelling status quo for inflated consumer expectations of content variety and availability.

Challenge 3: Inflexible pricing

Until recently, one piece of content or one subscription offered for one price was the modus operandi for studios. Their options were either advertising-based video on demand (AVOD) or subscription video on demand (SVOD), with fixed ad loads or fixed prices. As consumers reconcile their subscription spending and experiment with mixed models of AVOD and SVOD, studios and networks must experiment with their approaches to pricing and ad loads. Additionally, studios need to rethink how they bundle (with multiple services, other perks, or third-party products). With NFTs, studios can experiment with existing or new pricing models, such as bundling a subscription with access to an event or memorabilia that could entice consumers.

BENEFITS OF SMART NFT STRATEGY

Increased fan engagement & loyalty

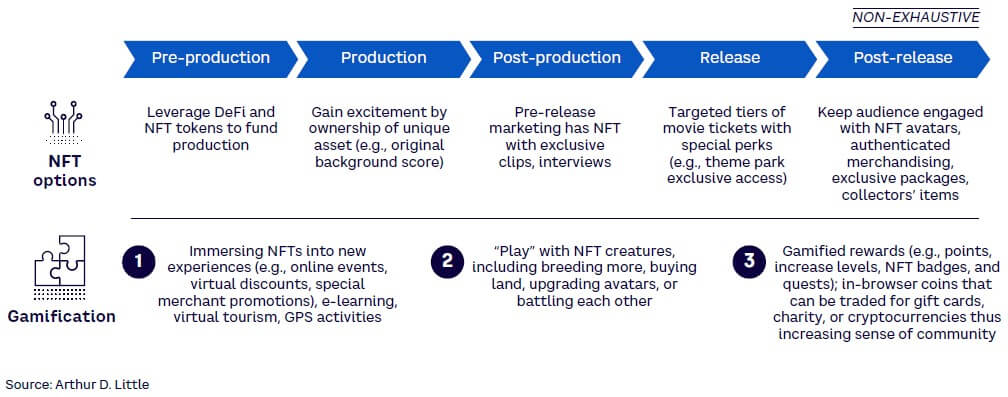

Despite concerns regarding the NFT market, premium content assets and IP that studios possess should maintain consumer interest and value if properly staged and merchandized. An NFT platform will allow studios to connect with both younger and existing audiences. Gen Z is becoming increasingly accustomed to Web3 — shopping, playing, and socializing with friends in the Metaverse. For instance, Roblox, an online game creation system and platform, is present in over 50% of US households, with its core audience between 9 and 15 years of age. In addition, existing audiences can find nostalgia from former moments they hold close to their hearts. Vault by CNN sells NFTs of significant moments from history. These moments include presidential elections, space and travel, and world history. As Figure 2 shows, studios can adopt a similar approach to audience engagement and loyalty, leveraging their array of items and moments to garner the attention of new and existing audiences.

New revenue streams

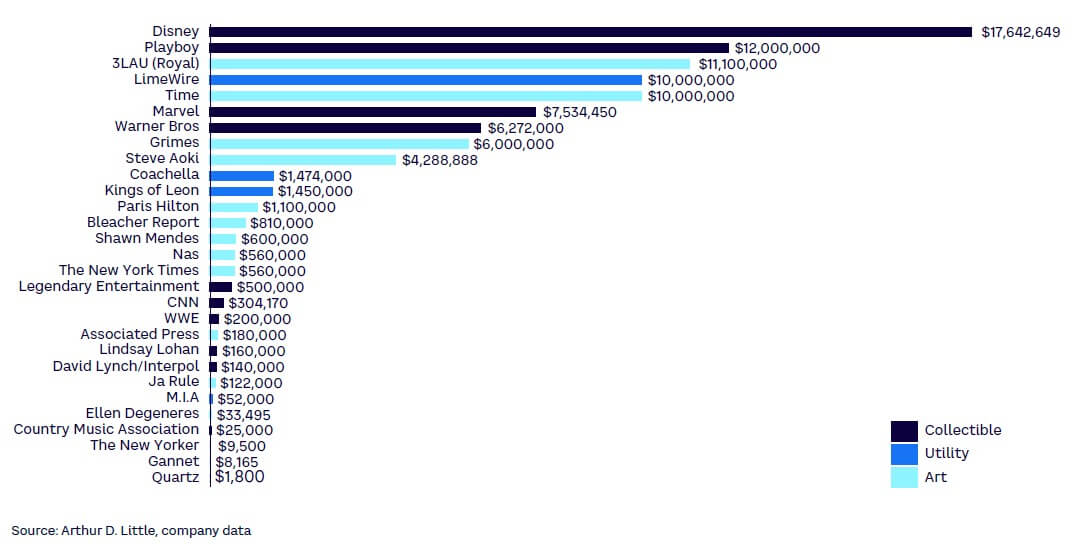

TV and movie studios have many opportunities to generate enormous profit through NFTs. For example, actor Mila Kunis sold NFTs associated with Stoner Cats, an animated series. The sale included over 10,000 NFTs, which can be sold on secondary markets. The NFTs sold out in under 35 minutes and raised a total of $8.4 million. Figure 3 shows revenue and type of NFT content for several companies and individuals in media and entertainment.

Studios can also leverage their TV and movie characters to gain new revenue streams. In March 2022, Pixar launched Pixar Pals, an NFT collection featuring animated characters from movies like Toy Story, Cars, The Incredibles, Monsters University, Coco, and Ratatouille. Pixar dropped the collection on VeVe, with a set floor price of $60. The Pixar Pals NFT collection grossed $3 million within 24 hours of its release. These examples reflect the initial economic success and ongoing potential NFTs offer studios.

Increased share of minds & time

An NFT strategy can help studios engage with customers in new and innovative ways, which will make them more competitive. Studios should take note of the multifaceted nature of NFTs and use them to compete for shares of viewers’ time. Some examples include:

- Fox Entertainment will launch an NFT and blockchain subsidiary for its new animated series Krapopolis, fronted by Dan Harmon, one of the creators of Rick and Morty. This will be the first animated series curated entirely on blockchain.

- In November 2021, Wolf Entertainment launched WolfSociety — a membership-based society where users can take part in detective games and purchase NFTs that contain clues to a case they can work to solve. WolfSociety members can also trade, buy, and sell the NFTs with other members to obtain more clues.

- In January 2022, Nukebox Studios, the developers of SpongeBob: Krusty Cookoff, Food Truck Chef, and Room Flip, announced plans to launch free-to-play games related to the Metaverse, and hinted at the use of NFTs.

- In March 2022, Amobear Studio released HeroSeri, the first NFT multiverse game. The series includes three games that guide players through an in-depth story line with characters who remain consistent throughout each game.

Boosting new content launches

NFTs have proven a great tool for driving excitement and anticipation around project releases. In September 2021, VUELE released 11 NFT copies of its debut experimental film Zero Contact. The NFTs included the feature-length film as well as sought-after content including a signed digital poster, behind-the-scenes footage, and exclusive character trading cards. The drop resulted in $100,000 in sales. A few months later, Grindstone Entertainment announced its acquisition of US rights to the film, with plans for a May 2022 release. The success led to subsequent drops, and two movie sequels are being created. As the frenzy around NFTs continues, it gives studios an opportunity to spark excitement around their project releases.

Increased valuation

NFT and blockchain companies not only garner attention; they’ve continued to receive huge valuations. Blockchain companies like Coinbase are valued at over $10 billion. Vancouver-based Dapper Labs was valued at $7.6 billion in April 2021, while just a few weeks earlier the company was valued at $2.6 billion following a funding round. Given the current environment, NFTs can add to studios’ valuations. Undoubtedly, there is a risk associated with the longevity of these valuations and no guarantee they will increase. Nevertheless, investors continue to target new customers and revenue streams associated with NFTs.

ADVANTAGES OF STUDIO-SPECIFIC STOREFRONT

A number of open NFT marketplaces have emerged, looking to get valuable content from studios to build their own audiences and increase underlying valuations. Studios have already begun experimenting with NFTs on these open marketplaces, willingly giving up their content as they did in the Web 2.0 era; for example:

- In March 2022, Warner Bros. created 6 million DC Comics-inspired physical trading cards as NFTs.

- In September 2021, Marvel released Spider-Man NFTs in partnership with VeVe.

- In December 2021, Atom Tickets, Marvel, and Fox Filmed Entertainment released a series of exclusive NFTs for the feature film Deadpool 2 for people who had purchased a movie ticket.

Warner Bros. has also been selling Matrix-inspired NFTs on OpenSea to coincide with the release of Matrix 4. OpenSea takes 2.5% of every transaction; this seems like a small amount, but the losses are enormous for studios when considering the number of transactions and the price many of their NFTs can sell for.

In contrast, sports leagues are launching their own NFT storefronts, where they “own” the relationships with fans and make millions of dollars in incremental revenue. The National Basketball Association (NBA), for example, entered a deal with Dapper Labs, the fastest-growing NFT marketplace in the world, to launch its NBA Top Shot product back in 2019. Similarly, Dapper Labs and the Ultimate Fighting Championship (UFC) launched the UFC Strike NFT platform in January 2022, featuring video collectibles that can be traded in the secondary marketplace. Major League Baseball’s Internet NFT game was launched in July 2022 in association with SoftBank-upheld NFT organization Sorare. Launching their own NFT storefronts allows sports leagues to save on fees while establishing D2C relationships, accessing fan data and analytics, and facilitating better marketing and business insights. This NFT strategy provides an inspiring comparison for what is possible for studios if they adopt a similar model.

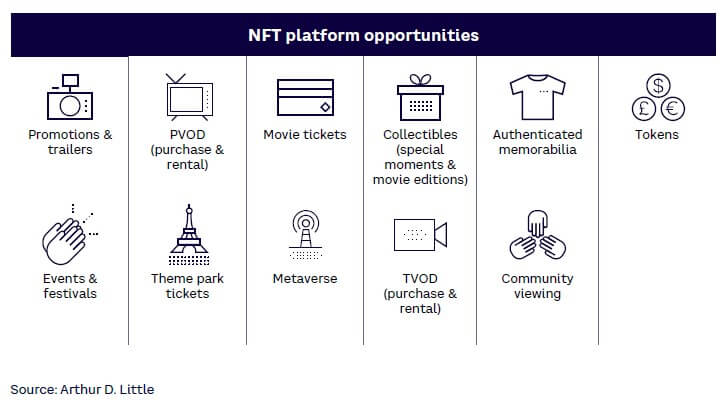

ADL believes that select TV and movie studios should create their own NFT storefronts to build direct relationships with fans, instead of dropping their NFTs on other exchanges. In Web3, the Web is decentralized and based on blockchain principles (outlined in ADL Viewpoint, “Web3 basics for telecoms & media”); there is an opportunity to establish a direct link between content creators and content viewers, independent of distributor. This powerful disruptor will help studios establish D2C links, potentially resulting in increased relevance, audiences, revenue, and valuation. Additionally, studios will benefit from providing this new content type and platform, satisfying the increasingly divergent tastes of consumers who crave novel ways of engaging with their favorite universes and characters. Finally, with flexible pricing, bundling, and ownership options (including resale marketplaces), studios can address fans’ proclivity for experimenting with different pricing and ownership models. Web3 — and a successful approach to proprietary NFT platforms — can address otherwise stagnant aspects of the current studio experience. Figure 4 shows different products studios can market to their fans.

EXECUTION, RISKS & MITIGATION FACTORS

While numerous benefits are associated with NFTs, and first movers have shared valuable lessons, studios must be aware of current risks and issues in the ecosystem. Managing these risks thoughtfully will be the difference between a winning NFT strategy and a dead-on-arrival launch. Some key points to consider:

-

Content strategy and demand planning. Launching NFTs provides no guarantee of fan interest. Flops in the NFT space are as visible as any blockbuster gone nowhere. A strong strategy must include thoughtful consideration of customer needs, which NFTs to mint and of what content, how to price them, how many to offer, how to bundle them with other items (e.g., tickets, exclusive content), how to showcase and merchandise them, and how to time the drop.

-

Product design and marketing. The non-technological capabilities, such as product design, marketing, community management, and business development for partnerships, require much thought.

-

Enforcing legalities. IP and general rights will need management. Brands must clarify ownership of content rights and related distributions. Although blockchain is no longer new, quite a few of its applications are and may require legal or regulatory clarification. Studios should develop smart contracts, which are self-executing programs that store all metadata of every NFT, assign ownership, and manage transferability.

-

Blockchain and token selection. Studios must select the right blockchain, and consider several elements, including transaction and development costs, and smart contract support. Each blockchain also comes with a different NFT token standard, which determines which wallet will be compatible (e.g., Ethereum NFT token standard is ETH-721). Therefore, studios must determine the most suitable token for their platform.

-

Cost structure. Several types of fees are associated with creating, minting, and trading NFTs, like transaction fees, marketplace fees, and infrastructure costs. Brands will need to define a contractual framework around these fees for primary and secondary sales.

-

Security and reliability. Testing and deploying the NFT marketplace is necessary because content, usability, security, reliability, productivity, and content should be tested in various scenarios.

-

Scalability and sustainability. Depending on the use case and requirements for transaction speed, blockchain selection is critical to ensure scalability of the desired solution. In terms of sustainability concerns, major blockchains deploy a consensus method (i.e., proof of work) that is very energy-intensive, which could be a concern for an enterprise’s sustainability aspirations.

Conclusion

IMPERATIVES FOR THE INDUSTRY

TV and movie studios cannot afford to miss out on the multitude of opportunities NFTs present. Successful implementation can increase fan engagement, relevance, revenues, valuations, and reinforcement of a studio’s non-NFT assets and programming. These benefits can help studios overcome current challenges, most notably the intermediation between fans and studios. Studios and networks can learn from mistakes made in the streaming era and use that knowledge to thoughtfully create proprietary solutions in the NFT world, designing end-to-end products that fully consider content, design, cost, performance, scalability, security, and sustainability.