The global loyalty management market is forecast to continue growing rapidly at more than 20% CAGR to the end of the decade. Still, consumer attitudes are constantly changing, requiring ever more sophisticated approaches. Embedded loyalty, in which rewards are integrated into daily experiences and transactions, is an increasingly prevalent solution. In this Viewpoint, we look at what embedded loyalty is all about and how companies can go about introducing it.

HOW LOYALTY PROGRAMS ARE EVOLVING

Traditional card-based loyalty programs have been around for many decades. According to Statista, the global loyalty management market was around US $5.6 billion in 2022 and is forecast to grow at a CAGR of more than 20% to around $24 billion by the end of the decade. In increasingly competitive customer environments, building brand loyalty makes obvious sense for companies, as well as offering savings and other types of benefit to customers. Loyalty programs seek to increase customer lifetime value (CLV), a key metric that measures the profit generated by customers over their entire relationship with a company, taking into account the frequency of purchases, average transaction values, customer-acquisition cost, and customer-retention rate. Through CLV, companies can identify their most valuable customers and target marketing efforts, while using data analytics to reduce churn, provide customer insights, and identify upsell and cross-sell opportunities. The net benefit of a loyalty program can be assessed by comparing all these incremental benefits with the incremental running costs.

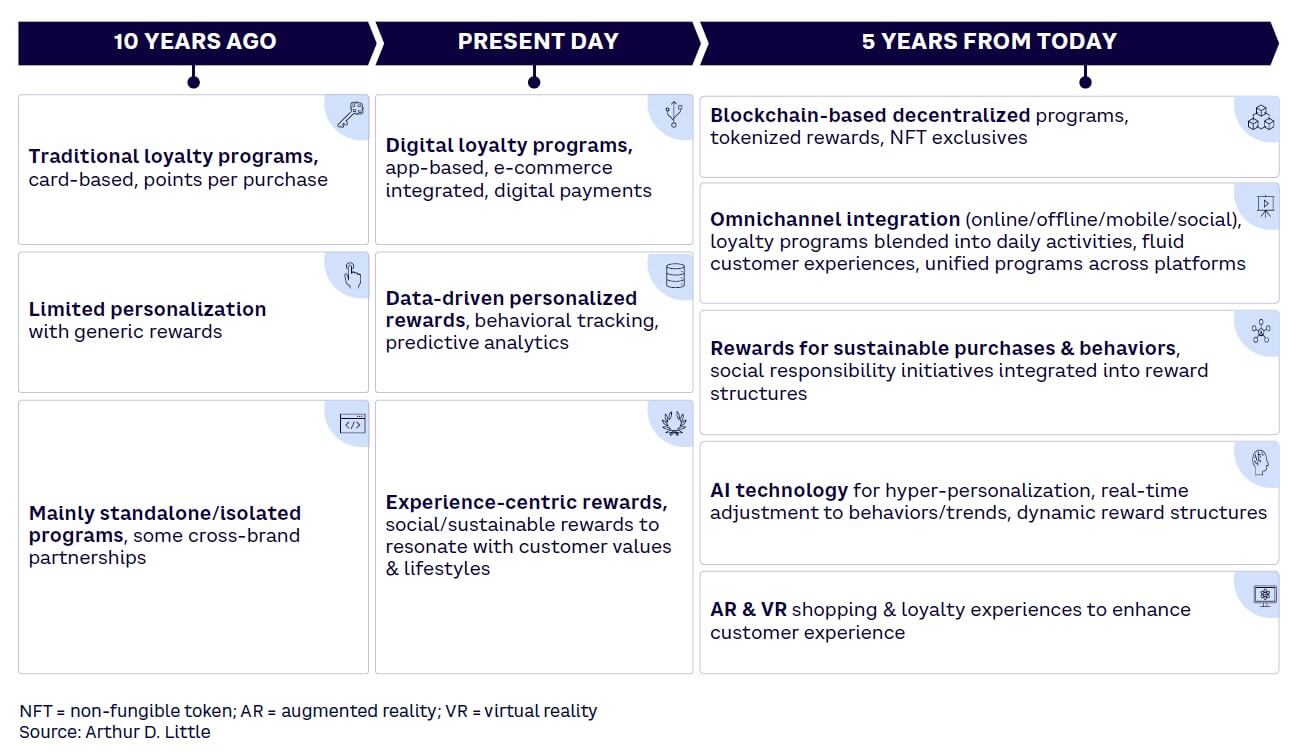

There are also some strong technological drivers for growth of loyalty programs. Digitalization has greatly enhanced customer convenience and experience, while providing richer customer data for companies. In the coming years, we can expect to see further advances through technologies such as blockchain, augmented reality/virtual reality, omnichannel integration and, of course, artificial intelligence (AI) — see Figure 1.

However, at the same time, customer attitudes and buying behaviors are shifting significantly. For example, recent studies from Zendesk and Hubspot have shown that while 77% of people say they stick with brands that offer loyalty programs, 55% of US and UK consumers indicate that their brand loyalty is beginning to decline. Looking ahead, according to Statista, 60% of US Gen Z online shoppers report diminished brand loyalty.

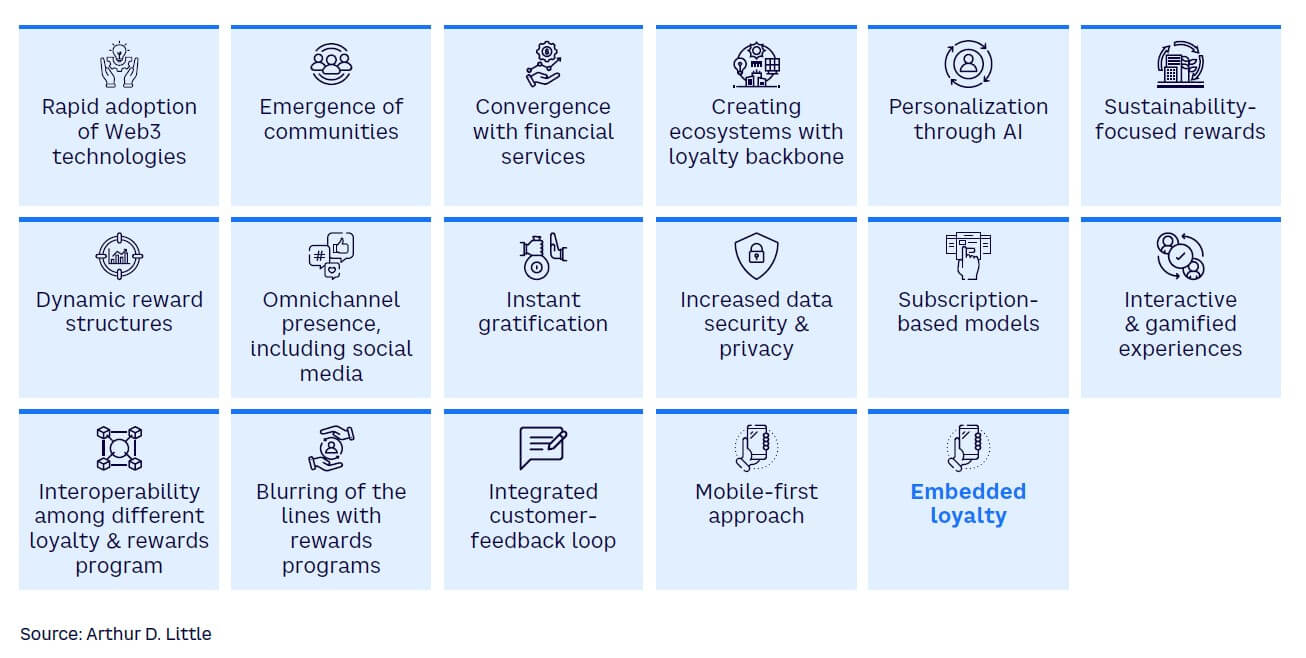

In general, customers are increasingly looking for customization. They are vastly aware of social trends and want to be part of a group where they feel they belong. They also expect to have their opinions heard. Consequently, brands need to provide them with benefits and experiences that make them feel special and keep them interested — directly and indirectly. Customers also want to feel like they are contributing and benefiting from the success of a particular brand. Figure 2 summarizes these and other trends shaping the future of loyalty schemes.

These trends are interconnected, and many are mutually reinforcing. Collectively, they could lead to no less than a complete redefinition of what customer engagement is all about.

WHY EMBEDDED LOYALTY IS INCREASINGLY IMPORTANT

Embedded loyalty is a powerful concept that some believe will be the future of all loyalty schemes. It refers to seamlessly incorporating rewards and experiences into daily experiences and transactions rather than treating them separately. A bank may, for instance, reward customers using its mobile banking app, or retailers may reward customers who purchase products with specific payment methods.

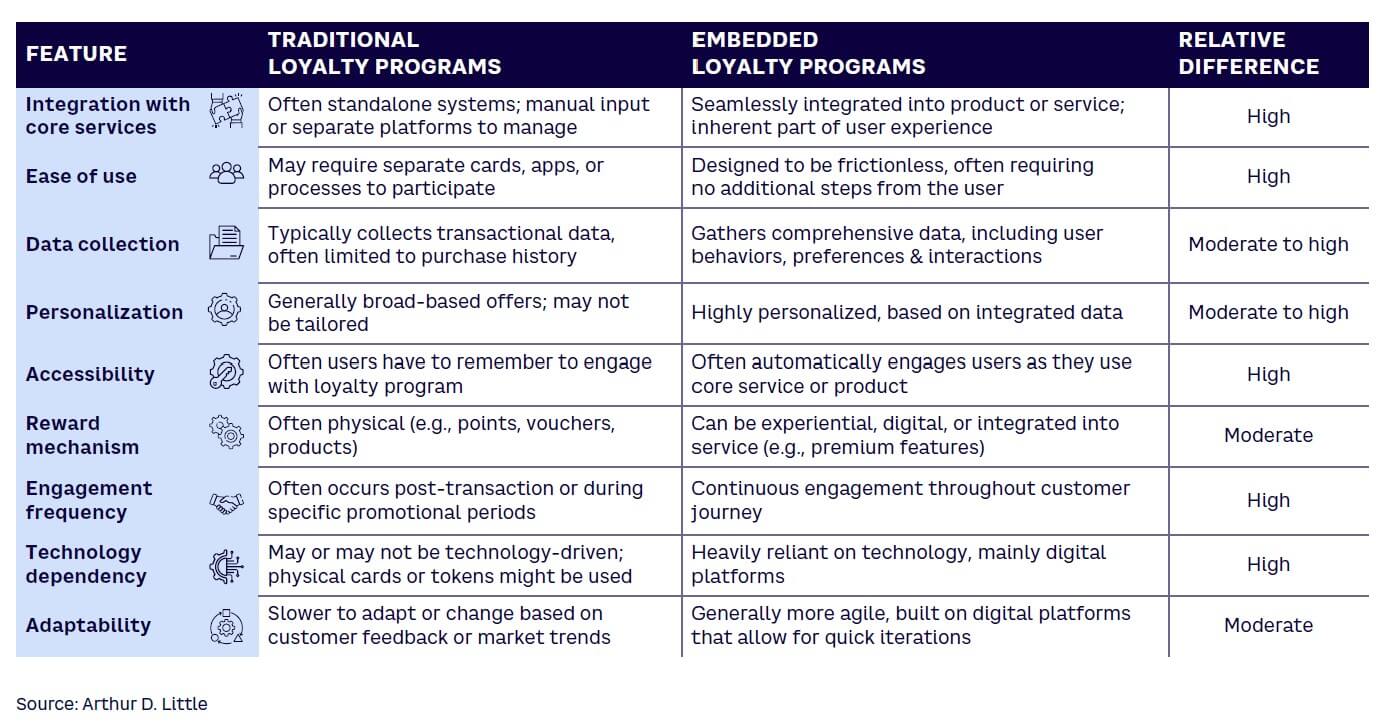

The main distinction between traditional loyalty programs and embedded loyalty is that the customer data collected can enhance personalizing rewards. Traditional loyalty programs often require customers to manually track points before redeeming them, whereas with embedded loyalty, this process becomes streamlined and effortless for both companies and customers. This is in contrast to traditional loyalty programs, which are often standalone systems that require separate registration, tracking, and redemption processes. Table 1 summarizes the differences between embedded loyalty and traditional loyalty schemes.

Embedded loyalty is growing rapidly for several reasons:

-

Digital technologies and tools have enabled greatly improved capabilities to collect and analyze customer information, allowing businesses to provide more targeted, customized rewards to customers, increasing retention and engagement and opening up the possibility of using the data to generate new revenue streams.

-

Customers appreciate the convenience offered by a seamless, integrated loyalty scheme, without the need to enroll or manually redeem rewards.

-

Embedded finance opens up the potential for new, mutually beneficial partnerships between product/service providers, loyalty service specialists, and financial services firms.

Building on the third point, embedded finance (i.e., the integration of financial services into nonfinancial platforms, products, or processes) is already a popular and growing service with customers and embedders alike. Deep integration of loyalty programs with financial products — going beyond just superficial integration such as cobranded credit cards — offers major benefits, for example:

-

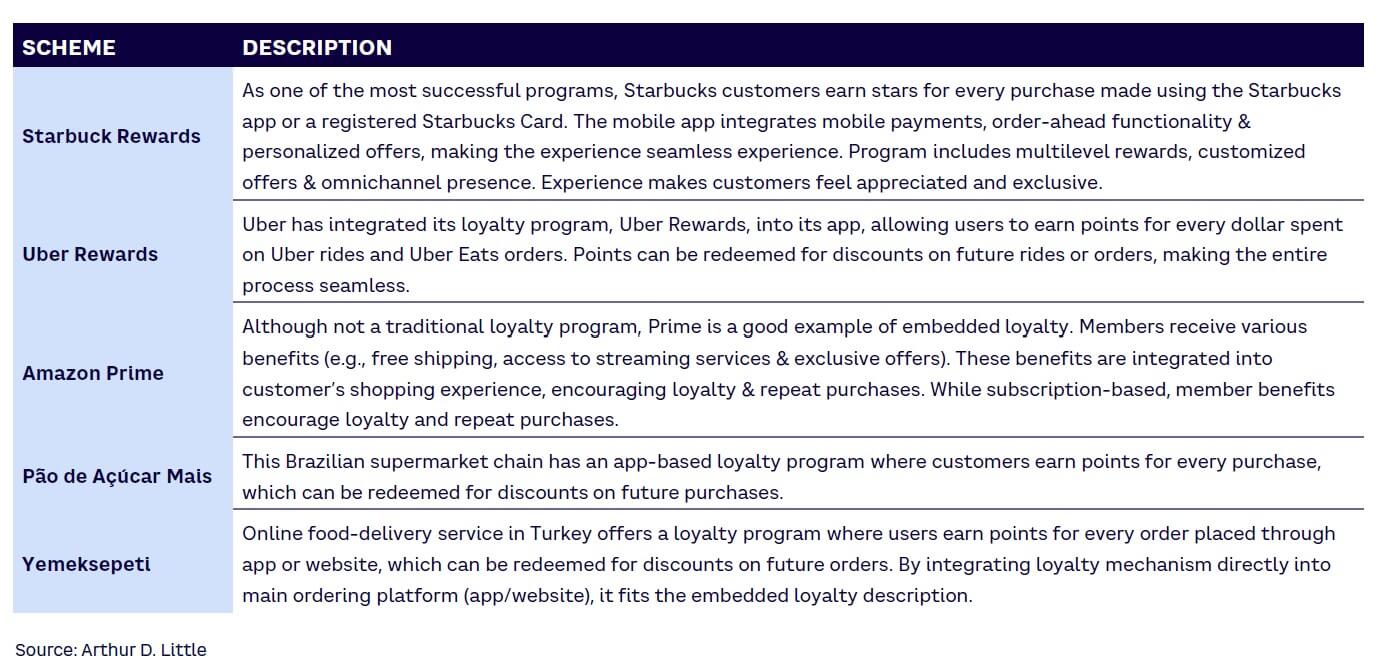

Improved customer experience. Companies that incorporate loyalty programs directly into financial products can offer instantaneous rewards for users and create a frictionless experience for them. Starbucks’s mobile app, for example, combines digital wallet and loyalty program functionality so users can load funds onto it, earn points, and then redeem those rewards within one app environment.

-

Increased stickiness. For example, Uber Cash’s digital wallet provides bonus amounts for pre-deposits, encouraging customers to regularly utilize this financial product and extend its daily relevance. As more customers utilize both services simultaneously, Uber sees retention increase.

-

Tailored offers. By merging financial transaction data with loyalty data, businesses can develop tailored offers. One such example is Apple Card’s seamless integration into Apple Wallet and Apple Pay and tiered rewards on purchases within Apple products and services — encouraging spending within its ecosystem and rewarding users who stay within it.

-

New monetization channels. Merging loyalty with financial services opens up many monetization channels. Grab, an original ride-hailing app, made the leap into financial services via GrabPay, its mobile wallet service that offers loyalty points when bill payments and mobile recharge payments are made using it, creating an ecosystem where users can both spend and pay within one platform.

-

Increased ecosystem engagement. Users become more engaged when they can access an array of services under one loyalty umbrella, like Paytm (an Indian digital payment platform) that offers banking, digital wallets, and shopping. Loyalty points earned can then be spent across this ecosystem, providing one-stop shopping for the financial and retail needs of its users.

EMBEDDED, NEAR-EMBEDDED EXAMPLES

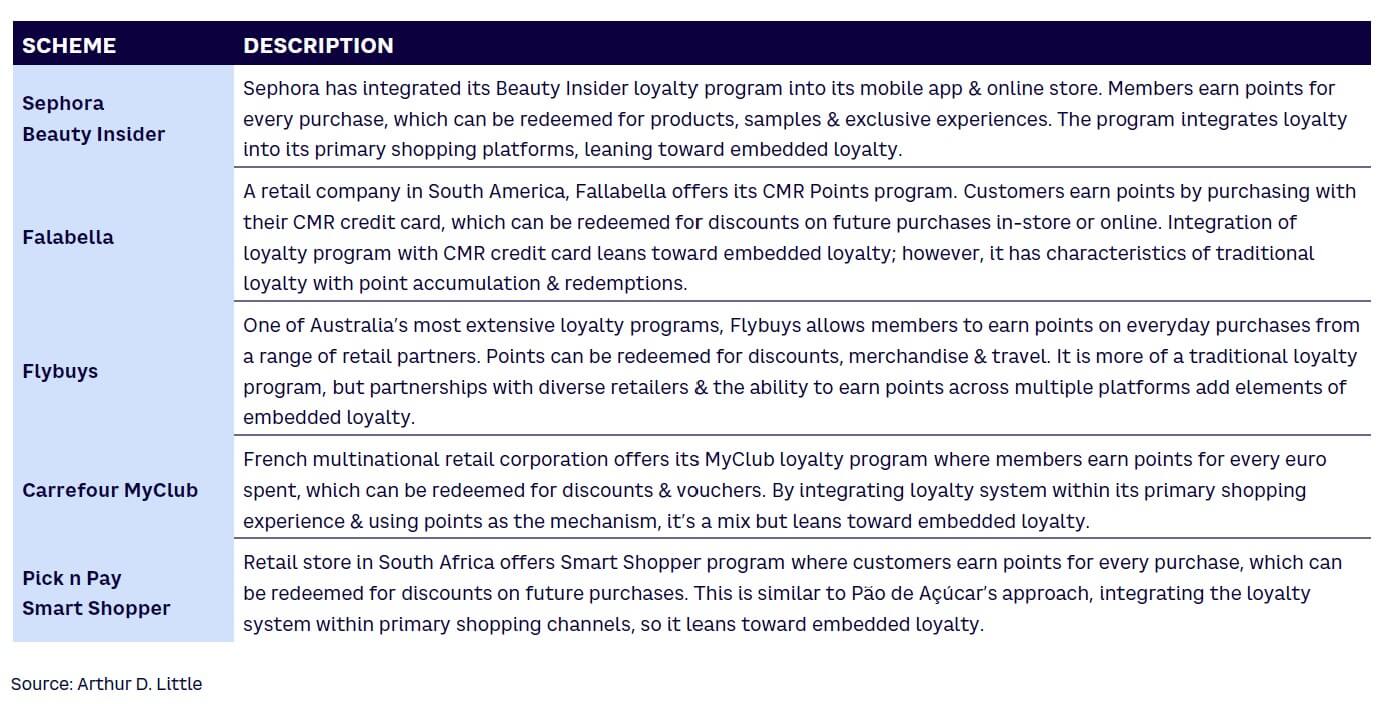

Embedded loyalty is growing across multiple sectors from coffee shops to airlines to retailers. The degree of embeddedness varies, but the direction of travel is toward increasing integration. Tables 2 and 3 provide some illustrative current examples, distinguishing between embedded and what we call “near-embedded” loyalty programs.

BUILDING AN EMBEDDED LOYALTY PROGRAM

Building and executing an embedded loyalty program requires a strategic approach. Businesses should consider the following key building blocks:

-

Robust data analytics infrastructure. An effective data analytics infrastructure is essential to collect, analyze, and utilize customer data for greater insight into customers’ needs, preferences and behaviors, as well as provide tailored rewards with personalized experiences for their customers.

-

Strength in partnerships. Forging strategic alliances with other businesses, financial services providers, and vendors is integral to offering customers additional rewards and benefits from loyalty programs. Doing this can increase their appeal among customers while making programs even more valuable to the bottom line.

-

Integration into customer experience. Delivering an outstanding customer experience across both online and offline channels is of utmost importance, which includes seamlessly incorporating loyalty programs into daily transactions and interactions to reduce friction.

-

Integrating mobile and digital platforms. Integrating mobile and digital platforms like mobile apps, online stores, and payment platforms into loyalty programs is vital to making them accessible and user-friendly for customers.

-

Personalization. Advanced data analytics and/or AI algorithms should be adopted to enable personalization strategies with rewards and incentives tailored specifically for each customer’s preferences and behaviors.

-

Flexible and attractive reward offerings. Customers should be offered flexible rewards that appeal to a broad customer base (e.g., discounts, cashback offers, merchandise sales, or experiences).

-

Merging loyalty, rewards, and financial services. Embedded loyalty creates greater convergence between loyalty, rewards, and financial services for customers. By capitalizing on existing relationships and data to provide additional value-added services — such as offering mobile app users embedded loyalty incentives when taking out loans or opening savings accounts — embedded loyalty increases customer engagement while simultaneously creating new revenue streams for any business.

-

Adopting cutting-edge technologies like Web3, AI, and others. Leveraging cutting-edge technologies can enable loyalty programs to become more adaptive, responsive, and tailored toward individual customer needs, improving engagement and retention rates.

Conclusion

MAKE THE MOVE TOWARD EMBEDDED LOYALTY

It is true that loyalty programs on their own cannot change the fortunes of any brand in isolation, with many factors contributing to building brand strength. However, loyalty programs do have a key part to play. They are growing rapidly — and also becoming more competitive as customer trends and behaviors shift. Moving toward embedded loyalty is therefore increasingly important for businesses. To make the move, businesses need to put in place strong data analytics infrastructures and embrace the potential of partnerships with other companies such as financial services providers. In doing so, they can greatly enhance customer experience, improve engagement, build greater loyalty, and generate new revenue streams. If loyalty and reward programs are not an integral part of an organization’s customer engagement strategy, they are merely glorified discount programs.