DOWNLOAD

DATE

Contact

An increasing number of CEOs see innovation as a key lever for growth and critical to achieving sustained competitive advantage across the oil and gas sector. To be more innovative, firms increasingly complement their internal innovation capabilities with solutions, ideas, and technologies from external partners such as suppliers and service providers. It is critical to appraise the contract’s potential in order to foster innovation and understand the conditions under which this potential can be fully exploited, given the increased use of outsourcing and external partners in the oil and gas sector and their importance in driving innovation in outsourced service delivery.

Most recently, oil and gas companies have started using performance-based contracts (PBCs). PBCs underline the output, outcome and quality of the product/service rather than prescribing how it is delivered or which resources to use, and may tie at least a portion of the external partner’s payment to its accomplishment. An important element in PBCs is therefore the clear separation between the buyer’s expectations (i.e., performance goal) and the external partner’s implementation (i.e., how it is achieved). PBCs are typically characterized by a relatively low degree of contractual detail, as the focus is on the external partner’s outcome and a high degree of partner rewards are linked to its performance. Hence, the organization is dependent on the provider and has interest in choosing the “right” external partner.

In PBCs, the overall compensation to the external partner, consisting of the base price and an incentive, may be higher, because the risk has shifted to the partner and premium is explicit rather than absorbed into the owner’s operating expenditures. The main benefit of a PBC is that it allows freedom for the external partner to deliver the product/service as it sees best. This results in more freedom for the external partner to engage in innovative activities as the partner is stimulated to lower its costs. In addition, this contract requires little information and knowledge on the inputs and processes required to deliver the product/service. However, it is extremely important to detail and measure the outcome/performance of the external partner. To successfully implement such collaborative contractual frameworks, oil and gas companies should emphasize three important stages of engaging with external partners when they want to stimulate innovation: the partner selection phase, the contract design phase, and the contract execution phase.

1. Importance of innovation is increasing, but few oil and gas companies focus on it

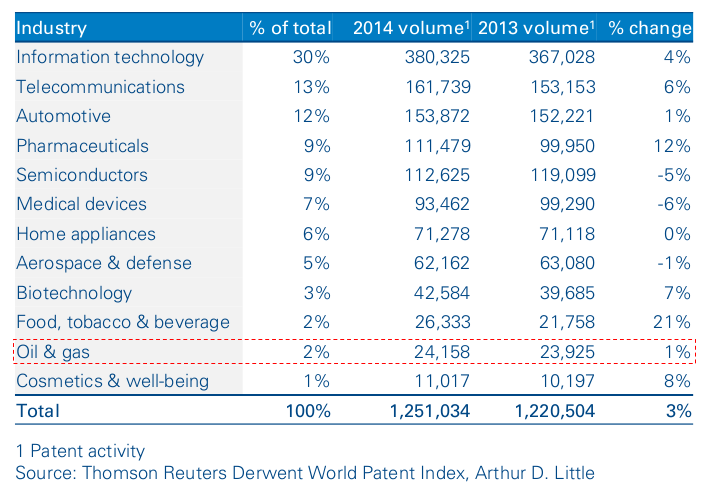

“Innovate or die” has become a well-known urge for large and small corporations regardless of the industry, as innovation in products and services – whether radical or incremental – is critical for companies’ sustained competitive advantage and long-term survival. For firms in the oil and gas sector this could not be more true; as the overall business structure changes, it is crucial to stay ahead of the curve through innovations. Innovation in the oil and gas sector plays a key role in reducing production costs, increasing production efficiency, supporting exploration, and ensuring that decommissioning activities are carried out effectively. Nevertheless, the oil and gas sector lags behind in developing innovative capabilities, commercializing inventions and benefiting from technological inventions from other industries. Figure 1 shows that the oil and gas sector is ranked only 12th (out of 13 industries) when it comes to being innovative.

Figure 1: Innovation in different industries

Firms can engage in innovation through internal innovation practices (e.g., internal development, R&D and corporate entrepreneurship). However, closed innovation activities, in which innovation is initiated based on the firm’s own resources and technologies, limit the firm in responding to changing environments. Internally, firms do not have all the necessary resources to succeed in complex environments and face difficulties when trying to capture the value of their resources. As a result, the full value potential often remains

underexploited. Furthermore, internal innovation practices, such as R&D, may not fit the current needs of organizations as they are characterized by high costs and risks, slow time to market and inflexibility. To be more innovative, firms increasingly complement their internal innovation capabilities with solutions, ideas, and technologies from external partners such as suppliers and service providers (in the oil and gas sector this could be, e.g., maintenance providers of refineries or oilfield and drilling services providers). External partners enhance and drive innovation in products and services, as well as service outsourcing contexts in which providers innovate to improve and optimize the daily operations performed for the buyer. Innovation may occur with external partners as result of mutual learning, complementary resources and knowledge sharing. External relationships may, however, suffer from opportunistic behavior or coordination failures that may inhibit good performance and innovation activities. Inefficiencies working with external partners often lead to project delays. Bonuses or penalties for contracted work cannot mitigate delays or the entire project risk because they are proportional to and limited by the scope of the outsourced work. Oil and gas producers use contractual frameworks to manage intercompany relationships, improve efficiencies, and mitigate project delays. Traditional frameworks used by oil and gas companies are procuring material supply and oilfield services on a primarily transactional basis, with services performed or material procured at predetermined prices, rather than performance bases under which the service provider takes a greater share of both risk and reward.

Appraising the contract’s potential to foster innovation and understanding the conditions under which this potential can be fully exploited are critical, given the importance of outsourcing and external partners in the oil and gas sector and their importance in driving innovation in outsourced service delivery. This viewpoint aims to increase our understanding of the nature and form of contract types in the oil and gas sector which have the potential to improve performance and stimulate innovation.