The increasing number of satellites, the growing variety of earth observation (EO) sensors, and the adoption of new analytics techniques are driving the growth of the satellite-based EO analytics industry. Over the next decade a wide number of sectors will further leverage EO to enhance their decision-making and operational processes. However, as of today, EO analytics is a fragmented, niche industry, with several players evolving their value chain positioning and business models. In light of this, Arthur D. Little foresees two possible scenarios for the evolution of this industry and identifies the key questions for executives willing to unleash the value creation potential of EO analytics.

Why the EO analytics industry is taking off?

Three concurrent technological innovations are enhancing the value creation potential of satellite-enabled EO applications: the increasing volume of satellites, the growing variety of EO sensors, and the emergence of enhanced analytics technologies (both hardware and software). In fact, the global EO value-added services market is expected to reach USD5.7bn by 2027, from USD3.2bn in 20171 (6 percent CAGR).

Increasing volume of satellites

The increasing volume of EO satellites is the result of three market drivers: investments in EO satellites from a growing number of government agencies, lower satellite manufacturing cost, and a decrease in the cost of launch.

Firstly, there is a growing demand for EO satellites from governments and military agencies from both developed and emerging countries, with the aim of enhancing their military intelligence capabilities. Over the last 10 years more than 16 countries have launched satellites (versus 10 during the previous decade).

Secondly, the cost of satellite manufacturing has drastically decreased with the adoption of nanosatellites, enabled by commercial off-the-shelf components and higher degrees of miniaturization and standardization. Between 2013 and 2018 the cost of manufacturing non-geostationary satellites halved2 . This cost reduction resulted in a significant increase in the number of companies investing in satellite infrastructure.

Finally, the cost of launch services decreased with the adoption of smaller and reusable rockets, as well as the entrance of new launchers, such as SpaceX, Blue Origin and Rocket Labs, which increased the level of competition.

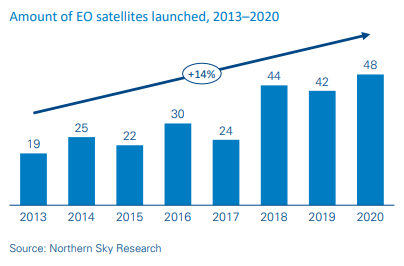

As a result, private investors and entrepreneurs have started investing in EO satellite constellation ventures, and the volume of EO satellites launched every year is increasing, with a CAGR of 14 percent between 2013 and 2020 (See above figure).

Increasing performance and variety of EO sensors

EO market demand is shifting towards higher-resolution images and lower revisit times to provide ubiquitous, near-real-time EO monitoring. This is enabled by the development of constellations of small, low-cost satellites and the growing variety and performance of sensor technologies.

Historically, optical technologies have been the most widely adopted sensors in the EO industry. They have dramatically improved in performance over time, today reaching very high spatial resolutions (up to a few tens of centimeters). The data generated by optical sensors can be easily interpreted by humans; however, it is dependent on cloud coverage in given areas being monitored. Synthetic aperture radar (SAR) systems have emerged to complement optical ones, which allows capture of images in all weather conditions and building of precise 3D profiles of the earth’s surface called digital elevation models. The main drawbacks of SAR systems have historically been the larger sizes of the satellite payloads and higher complexity of data analysis. Recent miniaturization of SAR payloads, as well as improvement of analytics techniques, should significantly improve the adoption of this technology over the coming decade.

On top of optical and radar, additional sensor technologies are emerging and being deployed on board satellites. Examples are hyperspectral sensors, which allow analysis of the chemical composition of the earth’s surface, and GNSS reflectometry, which enables monitoring of wind speed and direction, humidity, ice-layer density, and even moving targets.

Advanced analytics techniques

The volume of available satellite earth observation data is increasing steadily, driven by the growing number of satellites, higher resolution of sensors and higher on-board capacity. For example, DigitalGlobe’s satellite fleet currently generates 80TB per day of images, including approximately 1.3m square kilometers per day at a very high spatial resolution (30 cm). With the launch of its Legion constellation in 2021, DigitalGlobe will double the amount of very high-resolution data generated by its satellites, exceeding 2.5m square kilometers per day.

Such a vast quantity of data never could have been analyzed and stored just a decade ago. It is only with the advent of advanced analytics techniques enabled by new optimized hardware (e.g., GPUs), as well as the ability to purchase huge amounts of computing power and data storage in a “pay as you go” model, that it is now economically viable to extract value from these large amounts of data.

These two trends are reducing the entry barriers to development of new analytics. As a result, more players are providing EO services, and the business model is shifting from selling raw data to selling higher-value information.

Which sectors will get the most out of EO over the next decade?

Despite the favorable conditions, the EO satellite industry is still at an early stage overall, applied by a wide range of vertical markets with different degrees of maturity. On the one hand, industries such as infrastructure, defense and environmental monitoring have already adopted EO in their operations. For example, the military industry was an early adopter of EO technologies and now accounts for more than 60 percent of the EO data market . In fact, between 1998 and 2008 the number of satellites launched for military EO applications was only 34, compared to more than 118 launched in the last 10 years. Moreover, the number of governments investing in EO satellites grew from 10 to 16 in the last decade compared to the previous one, which highlights increasing recognition of satellites as a key asset to support intelligence activity, environmental monitoring and weather forecasting.

On the other hand, industries such as insurance and agriculture are at an early stage, and the full potential of EO still needs to be unleashed. In particular agriculture applications include mapping of soil types for agricultural planning, monitoring the health of crops to guide farming (e.g., fertilization and irrigation) in more precise and sustainable ways, and forecasting yields in support of agricultural commodity trading activities. In fact, even when considering an advanced agricultural market such as France, the potential of satellite EO is still largely untapped. Farmstar, a collaboration between Airbus, Arvalis Institut du vegetal and Terres Inovia, was launched in 2002 to offer EO-based precision farming applications. Its services, which target soft wheat cultures, today serve approximately 700k hectares (roughly 10 percent of the total soft wheat cultures in France). Farmstar recently widened its portfolio with services addressing colza and maize cultures, which further increased its potential market. As the worldwide population grows, a key challenge for the agricultural sector is to increase yield in a sustainable way. This is where EO satellite-based technologies can make the difference, for example, by reducing the use of fertilizer and pesticides and optimizing that of water.

Finally, insurance, infrastructure, finance and disaster monitoring are additional examples of market verticals in which EO satellitebased technologies are starting to deliver tangible benefits and create value.

How is the EO value chain evolving?

The EO value chain is rapidly evolving, driven by the three technological innovations described earlier. First, hardware manufacturers and satellite operators are transitioning from capturing images to selling value-added services to better differentiate and stimulate demand from early adopters. Second, digital giants such as Google and Amazon are entering the EO market ecosystem, offering their massive computing capabilities and investing in satellites (Google) and ground infrastructure (Amazon). Finally, a growing number of independent geospatial analytics service providers, such as Orbital Insight and Descartes Labs, are emerging, aiming to extract valuable insight from the growing volumes of available data.

Commercial satellite operators invest in acquisition & processing and selected analytics capabilities to differentiate

Incumbent satellite operators have gradually moved towards the data acquisition and processing steps of the value chain to capture higher shares of value and dramatically simplify the way their clients can purchase and leverage EO data.

These players have enhanced their presence in specific markets along the value chain and invested in analytics. For example, Airbus has invested in the development of Farmstar since the early 2000s to address the agricultural market, and DigitalGlobe has acquired Radiant Group to strengthen its presence across the US intelligence community.

New-entrant EO satellite operators are also aiming to expand their processing and geospatial analytics capabilities to differentiate and increase the value of their data. Planet, the operator of the largest EO constellation, with more than 300 nanosatellites launched since 2013 (of which approximately 150 are active today), aims to offer a set of basic analytics functionalities, such as object classification and change detection, to allow its customers to extract information from its data easily

Cloud computing and storage providers expand their services to gather higher volumes of data on their infrastructure

Digital giants such as Amazon AWS and Google Cloud see the EO market as a fast-growing volume of data to be stored and processed on their infrastructure. They offer cloud computing and storage services to all the players along the value chain and invest in additional services and functionalities to differentiate and gather higher volumes of data. Both Amazon and Google have partnered with ESRI, the leading provider of mapping and analytics software tools, in order develop combined offerings.

Amazon has launched a ground station-as-a-service offering for its clients, which has further simplified the acquisition of satellite EO data to add more volumes to its cloud. Google acquired an equity stake in Planet, which operates a constellation of earthimaging satellites, as part of the sale of Terra Bella (formerly Skybox Imaging) to Planet. Google also signed a multi-year contract to purchase earth-imaging data from Planet to feed its services (e.g., Google Maps).

Geospatial analytics providers maximize their access to data and invest in market-specific analytics capabilities

The availability of data supplied by numerous EO satellites, as well as the computing power offered by AWS and Google, have enabled a growing number of new players to enter the market. For example, Orbital Insight has raised more than $70m since its creation in 2013 to develop advanced analytic techniques to extract information from high-resolution images. The company focuses on the retail, finance/insurance and defense markets, and has partnered with all major satellite operators to access their large data archives.

We estimate that today there are more than 300 EO geospatial analytics players active around the world. These players often focus on small numbers of market verticals, developing highly specialized algorithms side-by-side with their clients.

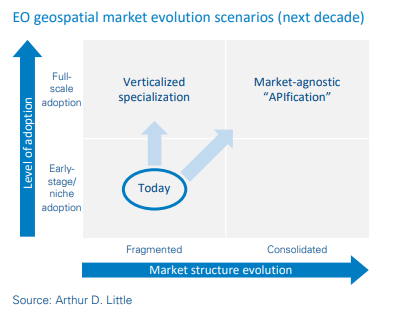

What are the potential market development scenarios?

We expect that the increase in volume and variety of EO data, as well as the shift towards cloud-based storage and processing infrastructure, will continue, further stimulating the development of new applications.

In this environment, we see two different business models emerging as sustainable and scalable in the long run.

Business model 1: Verticalized specialization

In multiple vertical markets, such as oil & gas, agriculture and environmental monitoring, development and commercialization of geospatial analytics services requires deep understanding of market specifics, as well as working closely with clients to integrate analytics services into their complex operational models. In such markets geospatial analytics service providers must leverage deep vertical expertise and customer intimacy as their key success factors.

Business model 2: Market-agnostic “APIfication”

A wide range of simpler analytics functionalities, such as change detection and identification of objects, allows provision of services across a wide range of markets. Examples of such services are counting cars in parking lots to deliver business intelligence to retail companies and detecting damages to buildings to validate insurance claims. The Airbus platform OneAtlas already allows access to EO images through APIs, including thematic services such as Verde, which provides detailed crop analytics.

For these types of services, we foresee the emergence over the coming decade of generalist players addressing a wide range of markets with highly automated analytics. These players will offer fully digitalized interfaces, which will allow their clients to seamlessly integrate these services into their own digital processes. In this model, the key success factor for analytics service providers will be scale: their ability to aggregate large volumes of demand and invest in best-in-class digital capabilities.

We believe these two business models will be able to coexist in the future EO analytics markets, as they address different markets and requirements. Verticalized EO specialists will capture and develop the demand of high-value, complex industries, while the market-agnostic “APIfied” players will further reduce the barriers to EO adoption in high-volume markets, which will fuel demand for data along the entire value chain.

Conclusion

As we have highlighted throughout this viewpoint, the EO data analytics market is rapidly growing, driven by major technological innovations, and we see two business models emerging and coexisting in the market of geospatial analytics.

These evolutions raise key strategic questions for companies willing to invest in EO analytics for value creation:

- What are the benefits and value creation potential of EO for our activity today and over the next decade?

- How do we define a future-proof strategy to fully maximize such value?

- What are the critical assets and skills we should develop inhouse? Which are the key suppliers and partners?

- How do we integrate such capability into our organization and operational model to capture sustainable benefits?

Executives willing to address these questions need to build robust understanding of EO analytics industry evolution, its underlying drivers, and the specific implication for their companies’ business and operational models.